#funded trader programs london

Explore tagged Tumblr posts

Link

funded trader programs london | traderfundingprogram.com

Funded trader programs in London.Learn more here https://traderfundingprogram.com/uk-london

0 notes

Text

Day Trading Firm

Lux Trading Firm is a trusted prop trading firm, Forex Proprietary Trading Firms in the UK. Select the evaluation funded trading accounts program to trade in any trading style.

Day Trading Firm

About Company :- We are a leading proprietary trading firm based in London (UK), specializing in supporting experienced prop traders.Our commitment is to help traders excel and provide the tools and capital they need to compete in a marketplace defined by change and disruption.We are focused on seeking out trading and investment opportunities to grow our capital in the global financial markets.

Click Here For More Info.:- https://luxtradingfirm.com/

0 notes

Text

Best Prop Trading Firms in the UK for Aspiring Traders

The UK is a leading global hub for finance and trading, offering abundant opportunities for those aspiring to make their mark in proprietary trading (prop trading). The prop trading in United Kingdom is thriving, with numerous firms providing capital to skilled traders, allowing them to trade the markets and share profits while minimizing personal risk. Here’s an overview of some of the best prop trading companies in United Kingdom that cater to ambitious traders.

FTMO: FTMO is widely regarded as one of the top trading prop firms in united kingdom and internationally. It has a structured evaluation program designed to identify talented traders. Once traders pass the evaluation, they gain access to futures funding in united kingdom, enabling them to trade a wide range of financial instruments, including forex, commodities, and indices.

This firm emphasizes discipline and performance consistency, offering traders tools and insights to optimize their strategies and achieve success in volatile markets.

The5ers: The5ers is a prop firm in united kingdom dedicated to nurturing forex traders. It provides instant funding to traders who meet its selection criteria, enabling them to start trading immediately. The firm also focuses heavily on risk management and offers resources to help traders refine their strategies in a supportive and controlled environment.

Its streamlined approach and commitment to developing consistent performers make The5ers a popular choice for forex-focused traders.

City Traders Imperium (CTI)

City Traders Imperium is a London-based firm that combines funding with education and mentorship. CTI’s mission is to develop disciplined, long-term traders through tailored training programs and psychological support.

This firm’s flexibility allows traders to explore futures trading in united kingdom and various markets, making it a versatile option for those looking to expand their skill set. Its focus on trader development ensures a strong foundation for future growth.

Audacity Capital

Audacity Capital is another prominent name among prop trading companies in united kingdom, specializing in forex trading. It provides traders with funded accounts and does not require lengthy evaluation processes for experienced traders.

This firm’s transparent funding model and supportive trading environment attract both new and seasoned traders. Audacity Capital emphasizes growth and profitability, offering resources to help traders succeed in competitive markets.

BluFX

BluFX takes a unique approach to the prop trading in united kingdom with its subscription-based funding model. This system eliminates the need for profit-sharing, allowing traders to retain their full earnings. BluFX is especially appealing to forex traders seeking straightforward access to capital without extensive evaluations.

The firm’s flexible and transparent structure makes it a great option for those who value simplicity and control over their trading outcomes.

Tips for Choosing the Best Prop Trading Firm

When selecting a prop firm in united kingdom, aspiring traders should consider the following factors:

Funding Models: Assess the capital offered, profit-sharing arrangements, and any upfront costs.

Evaluation Processes: Determine whether the firm requires rigorous testing or offers instant funding.

Training and Support: Look for firms that provide educational resources, mentorship, and trading tools.

Market Access: Ensure the firm aligns with your trading preferences, such as forex, commodities, or indices.

Conclusion

The UK is home to some of the world’s leading trading prop firms in United Kingdom, each offering unique opportunities for aspiring traders. Firms like FTMO, The5ers, City Traders Imperium, Audacity Capital, and BluFX provide access to capital, resources, and platforms for traders to excel in futures trading in United Kingdom.

By carefully evaluating your goals and preferences, you can choose a firm that aligns with your ambitions and supports your growth as a trader. With options such as funded trader program in united kingdom, apex trader funding in united kingdom, and even atf trader in united kingdom, you’ll find ample opportunities to thrive. With the right firm and perhaps even atf funded in united kingdom, you’ll be well-equipped to navigate the fast-paced and rewarding world of proprietary trading.

#the prop trading in united kingdom#prop trading companies in united kingdom#prop firm in united kingdom#trading prop firms in united kingdom#futures trading in united kingdom#futures funding in united kingdom#funded trader program in united kingdom#atf trader in united kingdom#atf funded in united kingdom#apex trader funding in united kingdom

0 notes

Text

Forex Funded Trader Program

Lux Trading Firm is a trusted prop trading firm, Forex Proprietary Trading Firms in the UK. Select the evaluation funded trading accounts program to trade in any trading style.

Forex Funded Trader Program

About Company :- We are a leading proprietary trading firm based in London (UK), specializing in supporting experienced prop traders.

Our commitment is to help traders excel and provide the tools and capital they need to compete in a marketplace defined by change and disruption.

We are focused on seeking out trading and investment opportunities to grow our capital in the global financial markets.

Click Here For More Info.:- https://luxtradingfirm.com/

Social Media Profile Links-

https://twitter.com/FirmLux

https://www.instagram.com/luxtradingfirm/

https://www.youtube.com/@LuxTradingFirm/featured

0 notes

Text

GMI Edge Broker Review ( Legit Or Scam?)

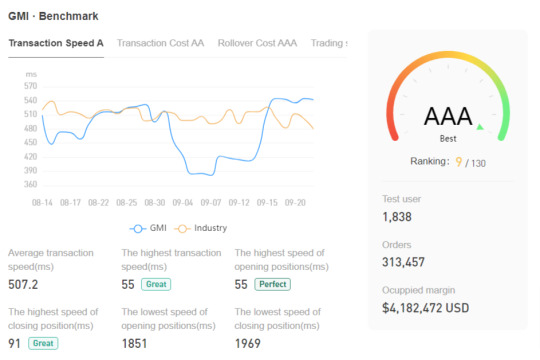

GMI Edge - Global Market Index (GMI) Review: Your Gateway to Advanced Forex Trading

In this comprehensive review, we'll delve into the features, offerings, and reputation of GMI Edge Broker - Global Market Index (GMI), also known as Global Market Index Limited. With over a decade of experience in the financial markets, GMI has become a prominent player in the forex trading industry. Let's explore the key aspects that make GMI stand out in the crowded world of forex brokers.

Introduction to GMI:

GMI Edge , established in 2009, has earned its place as a respected forex broker. It strongly emphasizes delivering lightning-fast and stable order execution through modern technology. GMI provides a wide range of tradable assets, including currency pairs, precious metals like gold and silver, crude oil, and global indices. With a presence in over 30 countries and a user base of more than 1 million traders, GMI Edge operates through seven trading centers worldwide, making it a truly global brokerage.

Copy Trading Service:

One notable feature of GMI Edge is its copy trading service, allowing both novice and busy traders to replicate successful trading strategies and check top trading performance in GMI. This feature opens the door for traders to potentially boost their profitability by learning from experts in the field.

Awards and Recognitions:

GMI Edge has received industry awards, including recognition as the Best Liquidity Provider Platform, Best Broker Support for Traders, Best Trading Platform for Traders, and Best Trading Environment for Traders. These accolades reflect GMI's commitment to excellence in serving its clients and maintaining high standards in the industry.

Apart from the retail traders offering, the GMI Edge brings an advanced proprietary software that includes MT4 and MT5 bridges, tailored partnership programs for Institutional Trader, Money Managers, White Label and APIs via FIX connectivity network.Indeed, it is obvious that the main pro of GMI is a technology and software, which also was recognized by many awards received for special achievements within the industry and overall ratings.

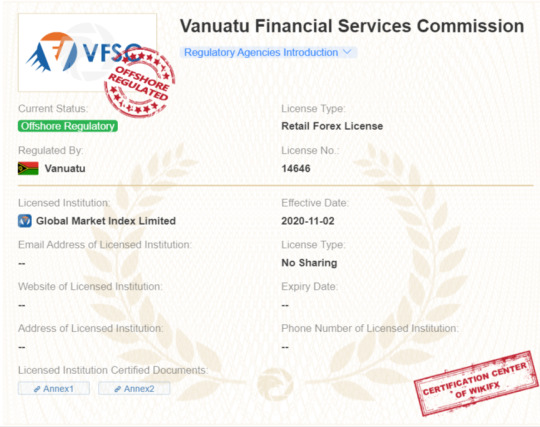

GMI Edge Regulatory Oversight:

Global Market Index Limited operates under various regulatory bodies and entities across the globe. Notably, GMIUK, based in London, is authorized by the Financial Conduct Authority (FCA). Additionally, GMINZ is registered in New Zealand, authorized by VFSC, and GMIVN operates in Vanuatu. The GMI Group also includes entities registered in Hong Kong, further enhancing its global reach.

GMI Trading Platforms:

GMI Edge broker offers a diverse range of trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are renowned for their user-friendly interfaces and advanced trading tools. GMI's technology-driven approach ensures ultra-low latency and FIX API connectivity, making it a preferred choice for active traders seeking rapid order execution.

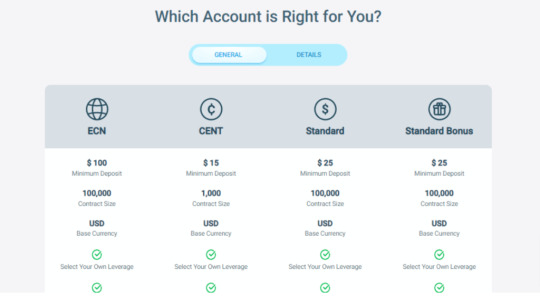

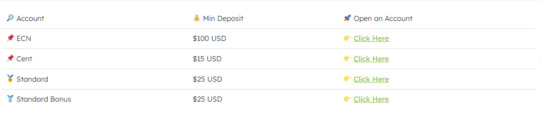

Account Types and Sign-Up Bonus:

GMI caters to various trader profiles by offering different account types, including ECN, Cent, Standard, Standard Bonus, and Risk-Free Demo accounts. The minimum deposit required to open a GMI Professional live trading account is just $15 USD. Additionally, GMI offers a deposit bonus of up to 30% on initial deposits, providing an extra edge to traders.

Safety and Security:

The safety and security of traders' funds are paramount at GMI. The brokerage operates under the umbrella of Global Market Index Limited (GMI), a group of companies registered in several jurisdictions. Each entity complies with the regulatory requirements of its respective jurisdiction, ensuring a high level of security and transparency.

Conclusion: Is GMI Edge Right for You?

In conclusion, GMI is a technology-driven brokerage solution that offers transparent pricing, advanced systems, multiple customer support options, and an array of software proposals. Its diverse range of trading instruments, including Forex, Indices, Cryptocurrencies, and CFDs, appeals to traders seeking variety in their portfolios. However, it's worth noting that GMI may be better suited for professional and active traders rather than beginners due to its highly developed technology and advanced features. The broker's commitment to regulatory compliance, awards, and global presence make it attractive for those looking for a trusted partner in the forex trading world. Whether you're an experienced trader seeking rapid execution or a newcomer looking to learn from the best through copy trading, GMI offers a comprehensive solution to meet your trading needs. Our GMI review highlights a well-regulated firm with a global presence in key financial hubs, known for its transparent trading conditions and advanced technological connectivity. However, a few drawbacks include limited information on the website, the absence of educational support, and a relatively high initial deposit requirement of $2,000. On a positive note, GMI impresses with its extensive range of diverse trading platforms, catering to the needs of traders across the spectrum, from beginners to experienced professionals, both institutional and retail. Read the full article

0 notes

Text

Advocacy and Life Outside North Korea

Founder of group No Chain, Jung Gwang-il explains how drones have delivered contraband to North KOrea since 2015. This contraband includes SD cards and USB flash drives containing Western and SK films and music , as well as internet free access to Wikipedia. No Chain and the Human Rights Foundation have quietly delivered more than 1,000 SD cards and flash drives to the communist country via hexacopter drones, they said. These drones can carry up to several pounds of SD cards. The whereabouts of where these drones are launched has been declined to be revealed due to security reasons. Drones have proven more effective as balloons would often drift off course into the sea or back into SK. The large size of the balloons also made them obvious and easy to track. Traders and activists have also relied on hired smugglers to carry goods across, but this is extremely dangerous. It is said that the desire for these contrabands are not initiated just by traders, but also people within Nk who want to know what is outside NK. A USB costs a months wage for a NK. Human Rights Foundation funded the drones and after months of testing in secret, made their mission public to encourage others to take advantage of drones.

Oslo Freedom Forum

The Oslo Freedom Forum is an organisation that hosts speakers who survived oppressive regimes.

"Each year, OFF amplifies the voices of courageous dissidents and exposes the threats to liberal democracy and the day’s most pressing human rights issues".

Past events have held speakers from NK, such as Kang Chol-hwan, who survived ten years in North Korea's Gulags. In the talk he explains that although the South Korean government and various international aid organizations have supplied an enormous amount of money and food, most of it has been used by the North Korean dictatorship to feed the People’s Army, the fourth largest standing army in the world.

youtube

Human Rights Foundation

A non-profit organisation, the HRF gives a platform to activists and creates innovative solutions to combat human rights violations. HRF has a singular focus on authoritiation regimes and estimates that 4 billion people live under tyranny-54% of the world population in 95 countries.

Art In Protest HRF

Art in Protest seeks to elevate artists whose work is connected to their struggle for democracy and human rights.

Song Byeok was a state propaganda artist in NK until he escaped after famine killed his family. Since 2002, he has been making paintings that stylistically echo his propaganda work to satirize the regime. Song was awarded the 2018 Global Artist Award for his work concerning the North Korean human rights crisis.

SONG BYEOK- OUR GENERALISSIMO, 2018

Protest Art HRF

This running collection, curated by HRF’s Art in Protest program, reminds us of the power of art to expose the deception and social bankruptcy of tyranny. Observing the artworks, I liked Joanne Liu's simplistic, naive approach to design. She is an illustrator from Hong Kong and criticises the Chinese government. The illustrations touch on the contradictory and hypocritical ruling of the government and this is done through the power of language.

I also liked the stylistic choice of artist Lilia Kvatsabaya, a digital artist from Belarus. She uses silhouettes and block colours to portray her ideas. The use of silhouettes appeal to me as I am not a strong drawer when it comes to bodily anatomy, and silhouettes allow a bit of leeway in this aspect.

https://www.independent.co.uk/arts-entertainment/photography/north-korea-defectors-london-traces-left-behind-catherine-hyland-new-malden-a9333311.html

Inside London's Community of North Korean Defectors

600 North Koreans live in the London suburb of New Malden, making it the largest NK community in Europe. Photographer Catherine Hyland spent three years visiting church services and kpop competitions before she took a single photograph. The photographs named 'The Traces Left Behind' allowed for her subjects to express themselves through their own cultural language.

"The disparity between the media [portrayal of the community] and reality is vast"-Hyland.

The collection looks at how companionshiop can help resolve trauma. Her collaboration with the Korean Senior Citizens Society dance group and choir allowed for participants to share their story. The presentation subverts from NK's controlled photo releases. One defector, Lee-Sook Sung, a 77 year old in the dance group, revealed how three of her sons starved to death before escaping to China with her husband and three remaining children. She explains how the community has helped her "remain young", especially with the healthcare and quality of life found in New Malden.

Open Doors UK

Open Doors is an organization that fights to combat persecution of Christians worldwide. North Korea is number 1 on the Open Doors World Watch List 2018. Open Doors provides aid by giving workers in secret networks in China rice and other foods to give to refugees. They also provide shelter and discipleship training for NK refugees at safe houses in China. There is thought to be as many as 400,000 Christians in NK. NK has recently introduced the Anti-reactionary Thought Law, which dictates the possession of a bible as a serious crime.

Connect North Korea UK

Connect aims to enable every defector to jral, grow and live the life they chose. Their holistic support programmes enable detectors to overcome barrier that prevent them from building new lives. Language barriers, lack of qualifications and mental health problems all contribute to refugees becoming trapped in low paid work where finding time to study or improve the situation is non existent. Connect Connect enables refugees to develop new skills, giving them a choice to take a certain job, to travel and to make new friends. The Enabling Freedom programme provides educational, wellbeing and financial support needed to gain recognised qualifications. Enabling Resilience programme supports refugees with the recovery of their mental health. Enabling Freedom Network is a social leadership and scholarship scheme designed to enhance the education of refugees.

Humanity and Inclusion UK

This orgsaiton helps residents from inside North Korea. Their goal is to to support the inclusion of children with disabilities in education, provide access to rehabilitation and orthopaedic fitting services, and promote the rights of people with disabilities.

Life in other countries:

South Korea:

33,000 refugees have resettled here as of Dec 2020

Most popular destination

The South Korean government offers generous resettlement benefits to help North Koreans integrate into South Korean society, which include the 12-week adaptation training at Hanawon, $6,000 – $32,400 in settlement benefits, $13,300 –$19,100 in housing subsidy, and free education in public schools and universities, to name the few.

The Hana Foundation’s annual survey of North Korean refugees reported the lowest rate of discrimination experienced at 17 percent in 2019, but one psychiatrist shared in a Yonhap News article also published in 2019, that "eight or nine of 10 North Korean defectors think that they are discriminated in the South and looked down on as 'second-class' citizens, though they do not talk about those issues publicly."

China:

Considers North Koreans illegal migrants

Women are victimised by trafficking

Estimated 200,000 hiding in China

Some stay in China to act as brokers

North Korean defector, Kim Yong-mi, who acquired Chinese citizenship upon marrying a Korean-Chinese husband said in an interview that it was “better to live well in China than to live poorly in South Korea”.

Chinese husbands attempt to secure their North Korean wives’ legal standing in China by paying expensive bribes to authorities

North Koreans who choose to work in China long-term regularly send money back to their family in North Korea and intend to return to their homeland after earning enough.

Japan:

The migration process became challenging when the interests of East Asian countries grew complicated and relations between China and Japan deteriorated in 2010 during the Senkaku/Diaoyu Islands dispute.

Due to discrimination and other social concerns experienced by ethnic Koreans (which had led to the resettlement programme of Japanese-Korean residents between 1959 to 1984), all the North Korean refugees who had escaped to Japan had later settled in South Korea.

Europe and UK:

EU’s statistics office stated in a report that a total of 820 North Koreans settled and obtained citizenships in the EU between 2007 and 2016, with nearly 90 percent of them residing in Germany and the UK

North Koreans’ asylum claims are often denied because EU countries such as the UK, France, Belgium, and the Netherlands view North Koreans as South Korean citizens.

UK rejected 30 out of 40 asylum applications made by North Korean defectors in 2013.

In NK, they are taught that UK is the best democracy in the world and so remains a popular destination for refugees.

USA:

170 North Korean refugees have settled in the US as of 2014.

Refugees often urged by religious representatives to escape to US or have family already settled there

A 33-year-old female who left North Korea in 2004 and arrived in the US in 2006 said that “I learned through the internet that [North Korean] people in South Korea were living difficult lives because of discrimination… So I thought I would rather go to America".

An estimated 200 North Koreans have entered illegally and settled in Los Angeles as of 2016.

Canada:

As of 2016, an estimated 970 North Koreans reside in Canada

those who applied for asylum in Canada feared discrimination in South Korea.

Taegun Kim who had spent 5 years living in South Korea said in an interview with the news outlet Global News, that “[South Koreans] treat us like garbage...even though we work harder than them, the payment for us is lower than the payment for foreigners… I feel we are accepted here [in Canada] because of the political and legal support for multiculturalism”.

Although their policy is to hear every case based on its own merits, Canada is reluctant to grant permanent residency as NK's are unlikely to face death or torture in SK.

0 notes

Text

Best Prop Trading Firms

Lux Trading Firm is a trusted prop trading firm, Forex Proprietary Trading Firms in the UK. Select the evaluation funded trading accounts program to trade in any trading style.

We are a leading proprietary trading firm based in London (UK), specializing in supporting experienced prop traders.

Best Prop Trading Firms

#proptradingfirms#tradingfirms#proprietytradingfirms#fundedtradingaccount#freeproptradingfirms#fundedtradingaccounts#tradingpropfirms#bestproptradingfirms#onlineproptradingfirms#fundedaccounts#forextradingfirm#tradingpropfirm#proptradingcompanies#proprietarytradingfirmsforbeginners#forextradingpropfirms

1 note

·

View note

Text

Neteller.com Product Review

Trying to conveniently and securely gamble at online casinos or trade currencies on the foreign exchange market can be challenging. Neteller is a virtual wallet that is widely accepting at online casinos and Forex trading sites. Active gamblers, traders and shoppers continually battle with credit card fees especially when dealing with foreign countries. Neteller makes fees consistent.

About Neteller

The money transfer business opened in 1999 in Canada. The company now services customers in more than 200 countries. Currently operating from the Isle of Man, the service is listed with the United Kingdom government's Financial Conduct Authority. The FCA protects consumers and financial markets as well as promoting competition. Neteller is owned by the Paysafe Group, which is a public company. The Paysafe stock symbol is PAYS. It is traded on the London Stock Exchange.

Net+ card is part of the Neteller account. Members will receive a physical card in the mail after they deposit at least $20 in their Neteller account. There is no credit check for the Net+ card because it's not a credit card. Users can only spend what is on the card. The card balance limit is $10,000.

U.S. residents can fund their Net+ prepaid card through the following methods

MasterCard Debit

Visa Debit

MasterCard Credit

Visa Credit

The Neteller website lists Maestro and Visa Electron, but those cards are not available to U.S. residents.

Online gamblers oftentimes have trouble retrieving payouts from casinos because they won't send money to a credit card account. Neteller users have far less trouble. There is no waiting for a printed check or a transfer to a Western Union office. Most online casinos in the U.S. do not accept PayPal, but Neteller is very popular.

There is no U.S. federal law against online gambling in general. Gamblers can access U.S. casino websites such as the Golden Nugget and use Neteller for deposits and withdrawals.

There is a federal law that prohibits U.S. web sites from taking sportsbook bets, but that law involves banks. Users in the United States do not connect their bank accounts to the Neteller e-wallet service.

Certain U.S. states have laws against online gambling. U.S. gamblers can access international sportsbook casinos such as BetOnline.ag and fund their accounts using Neteller. BetOnline.ag's physical location is in Panama.

Neteller offers apps for Android and iPhone.

Many Forex trading websites seem to be accessible to most countries except the U.S. Other Forex web sites exclude all EU countries. It may be difficult for U.S. residents to find a Forex broker they can use and that accepts Neteller. Traders should be careful to use brokers that are regulated by an independent organization such as the FCA. Non-regulated brokers are notorious for charging hidden fees.

Top Features

Members in the U.S. can fund their Neteller account with major credit cards or debit cards with a MasterCard or Visa logo unlike some other e-wallet providers that require a bank account transfer.

The Net+ card carries the MasterCard logo, so cardholders can use it wherever MasterCard is accepted. These transactions do not incur a fee unless they involve foreign currency, just like a regular credit card or debit card.

For those wishing to deposit to or withdrawal from their account in a foreign currency, there is a foreign exchange fee calculator in the account menu on the website.

Neteller offers instant money transfers even to people who do not have an account. Recipients without an account will receive an email telling them to open a free account. The transfer is free if both parties use the same currency.

The Neteller VIP program has five levels. VIP status comes with fee discounts, higher ATM withdraw limits and loyalty points. There is a dedicated VIP manager to answer member questions.

VIP members have an option to open multiple accounts. Users can designate different currencies for each account to save on foreign exchange fees. Features improve as members ascend to higher VIP levels. To reach a level, members must pass a specific amount in the form of transfers to merchants per year. Transfer thresholds are as follows

Bronze – $10,000

Silver – $50,000

Gold – $100,000

Platinum – $500,000

Diamond – $2 million

The bank transfer / withdrawals feature is only for UK residents.

If Neteller members link their account to eWallet-Optimizer.com, they will quickly achieve the silver level and other benefits. Members must email a scan of their ID card to complete registration. The eWO account is free because the German company makes money through its partnership with Neteller.

Neteller offers a few affiliate programs. Websites can join the Neteller Affiliate program to earn 20 percent commissions on transfer to fees. They also can join the Net+ Card Affiliate program to earn $5 every time a new customer opens an account.

Members also can sign up to be ambassadors and receive a 20 percent revenue share from referrals on all their future transactions to merchants.

Businesses that want to offer Neteller as a payment option to their customers can fill out a form on the Neteller website to contact the sales department. Neteller even offers a joint affiliate program.

Neteller Fees

Members do not incur a fee when using Net+ prepaid card to to pay in shops, restaurants or online. There is a 3.39 percent fee for foreign currency exchanges. Making a withdrawal at an ATM will incur a fee of 1.75 percent. There is a monthly administration fee of $2.99. A paper statement costs $3. Replacing a lost card costs $5.

Members can make two withdrawals every 24 hours for a total of $500. The minimum withdrawal is $10. For U.S. residents, there is a 2.5 percent fee for deposits from credit and debit cards.

Those members who have a balance on their account but do not use Neteller for 14 months will be charged a $30 inactivity fee. The company will email the member one month before it charges the fee. To close an account, members must call.

Neteller is quite transparent about account fees on its website. This is in contrast to other e-wallet companies. PayPal Prepaid MasterCard users will need to find and download the cardholder agreement then search through the 23-page document to find the fee schedule. PayPal charges cardholders a $4.95 administrative fee every month.

Considering users have to fund their PayPal card via a bank account or their regular PayPal account, a bank debit card with a MasterCard logo would be a better deal. About the only thing more ridiculous than a PayPal debit card is a 401(k) debit card.

Neteller Security

To set up an account, members will need to enter their personal information including a full Social Security number. Other security measures include

Account ID number

Secure ID number

3 security questions

Two-step authentication

Automatic account timeout

The two-step authentication works with Android, iPhone and Blackberry devices. Users will have to install the Google authenticator and a barcode reader.

Often, gamblers and shoppers visit websites that may not appear to be completely reputable. By using a Neteller account, users avoid exposing their credit cards and bank accounts. Online gamblers sometimes visit new casino sites after being drawn in by the promise of bonuses, skip research and just type in their credit card number. Neteller accounts create an extra layer of security between personal financial information and vendors.

There are websites that curate lists of casinos with the best bonuses. Often, the promotions are temporary, so having a Neteller account can allow gamblers a convenient way to hop from casino to casino and quickly grab bonuses. Recently, the Silver Oak Casino offered a first-deposit bonus of $1,000 plus a 555 percent match bonus.

Criticism of Neteller

U.S. residents have to pay a 3.39 percent fee to buy things abroad. By comparison, American Express Blue Cash Everyday credit cardholders only pay a 2.7 percent foreign transaction fee.

In the U.S., bank transfers (ACH) are not allowed for funding a Neteller account. A bank debit card with a Visa or MasterCard logo can get around this, but there is a fee.

There seems to be only one way to withdrawl money from Neteller for U.S. residents, and that is to use the Net+ at an ATM. Thrifty consumers will want to search for fee-free ATMs in their area.

Those who do a lot of traveling may run into problems using their Neteller account while in non-serviced countries and banned countries. Banned countries include Iraq and Syria.

Customer Support

Neteller has 24/7 live customer support. Because of the company's extensive security features, customers can get locked out of their account. If this happens, they can call the support line and present identification.

There is an extensive and searchable frequently asked questions section on the website. Customers also can email member support.

Conclusion

Consumers who don't have credit cards and don't trust debit cards when shopping online at offshore vendors, Neteller can be a convenient alternative. The main markets for Neteller in the U.S. are online casinos and non-U.S. Forex trading sites. Neteller offers exceptional security for consumers and merchants.

0 notes

Text

imited is officially registered

ContactSite: medcofinance.com; Email: [email protected], [email protected]; Phone: +442030978900; Office location: London (UK).

General information

Medco Finance Limited attracts beginners with special bonus offers up to 50% of the deposit. In addition, users are offered a thorough analysis and favorable conditions for cooperation. The company provides 24/5 multilingual support in 20 different languages. To contact the support there are phone numbers and email.

Medco Finance Limited is officially registered in the UK (Document No. 07317157). Scanned copies of the certificate of incorporation and platform licenses. However, the site has a legal address. All documents must be checked independently.

Among the main advantages of Medco Finance Limited notes the following:effective trading technologies; low commission rates; a large selection of payment methods; professional market analysis; transparent trading conditions.

Medco Finance Limited has a reviews section on its website. All feedback is positive. However, on independent forums there are different reviews. How to make money with Medco Finance Limited?

Medco Finance Limited offers trading on Native Mobile App, MetaTrader4, MetaTrader5 and Webtrader. After registering, you need to decide on the tariff plan and replenish your account. After that, you will be able to access 17,000+ markets.

There are several types of accounts. The main features are:minimum deposit – from 100 euros; personal account manager; insured trades (from 3 to 15 risk-free trades); fixed/floating spreads; some types of accounts have micro-lot trading, bonuses, insurance and lending, access to a reserve fund, and personal analytics services.

To replenish your account and withdraw funds, you can use Visa, Mastercard, CashU or bank transfer. For additional earnings, you can join the affiliate program. To find out the detailed conditions, you need to contact the project managers on an individual basis. Summing up

Medco Finance Limited is a brokerage organization based in the UK. We did not find legal confirmation of legality. Reviews are different, traders could not agree. Have you already cooperated with this broker and are ready to share your personal experience? Post reviews and tell the truth. folder_openTags: Medco Finance Limited, Medco Finance Limited review, Medco Finance Limited scam Post navigation Previous post Previous post Nadex CFD(nadexcfd.com): Reviews-SCAM Next post Next post Doto(doto.com): Reviews-SCAM 1 CommentP Pete FRAUD! In one word! They promise you millions and will tell you “how does the future millionaire feel”. Just to deposit more money! To withdraw money from your Medco account, you need to deposit the same value into your account, e.g. Revo… (this is one of the withdrawal options) to make a “mirror money transfer” (after talking to Revo… this method of transfer is considered money laundering” So once you’ve deposited all your savings into your Medco finance limited uk account (and that’s what hungry experts are asking you to do), you’ll have nothing on your account and you want to withdraw the money you’ve earned, you won’t be able to afford to withdraw it! !! Such a millionaire you will be! And the next two withdrawal options are a parody! Bank of Cyp… for each amount withdrawn you have to pay about 33% of the value from your pocket. So if you have £10k-11% commission on your account, simple calculation! almost 50% of your deposit! So if you would like to withdraw your deposit the next day for any reason, you have already lost 44% of your money! as tax fraud! No control over the money you earn! Because the payment must be approved by an expert and an accountant. You can’t just withdraw your money whenever you want! you have to ask for it! The third option is to pay tax, which the accountant does not recommend for obvious reasons like tax fraud, so they only give you 2 options. There is one more thing worth mentioning, namely the “webinar for the poor”, in which the host urges the “poor” to take a loan! Then the expert suggests you take 30-50k£ and if you are wondering because you are not sure it starts to rule! “And he says that you are wasting his precious time” just like Mr. Markus my expert! The account is billed once a year! If you would like to withdraw from Medco services earlier, even if you paid £ 100, it costs £ 500 to close your account and if you do not pay, they will threaten you with special services, court and I was threatened with deportation!!! after which they will ignore your emails and any contact attempts (great experts won’t tell you about this when you create an account, they are only interested in the money you have!). If you would like to start with a small investment and work your way up, you are not profitable for a hungry expert and Medco. Your money, savings, loan from which you were persuaded and more in my eyes forced is not safe in their hands. In the end, it will turn out that you are a tax fraudster and you launder dirty money. The only winning earner millionaire will be Medco and you will be left with a loan to pay off. So learn from someone else’s mistakes and don’t let yourself be DECEIVED!

Below we will explain to you why you should not open an account with this broker. Blacklands Finance Limited is not a regulated broker. This means that it is not licensed to provide financial services in any country. Unlicensed brokers are not supervised by government bodies therefore they are not trustworthy. So you better stay away from this broker because it is anonymous and can disappear with your money at any time. We also checked online forums and found only negative comments from users who were unhappy with this broker. Users have complained that they cannot withdraw money. Based on these user reviews, it looks like Blacklands Finance Limited is a broker that is trying to scam people out of money, which is why we once again warn against investing through their brokerage platform. How do such brokers work?

Usually they call clients and persuade them to make a deposit. They are really good at this - promising unrealistic investment returns just to get you to deposit money. If they succeed in getting you to make your first deposit they will then call you all the time and ask you to deposit more money. Do not believe anything they say it is all a lie. Such brokers employ several people, usually foreigners, to make it cheaper. They obtain the phone numbers of potential victims and then the employees have the task of calling as many people as possible. They swindle them out of their money and then disappear without a trace. They cannot be contacted by phone, email or chat. Often the broker's website also stops working after some time.

If you want to start investing, we recommend that you open an account with a legitimate broker. You can check the list of regulated brokers here. Best Brokers 2023

One of these regulated brokers is RoboForex which is licensed to provide financial services in the European Union. Here is why you should choose RoboForex broker:ECN Broker 20+ Industry Awards 12000+ Trading Instruments CFDs on Stocks - Over 11700 companies Licensed and Regulated Broker Tight Spreads as Low as 0 Pips No extra fees apply Minimum deposit - $10 Leverage up to 1:2000 Bonus $30 / 120% Negative balance protection Fast withdrawals with no extra fees 99% of orders executed in less than 1 sec. Over 800000 clients from 169 countries Over 500000000 trades executed with zero requotes or rejections, ever Retail client funds are insured up to €20,000 by the Investor Compensation Fund Social trading - CopyFX system gives copiers the option to copy all of the currently open trades of the copied trader

For example, brokers regulated in the European Union are required to provide all clients with protection against negative balance and keep their money in segregated accounts. They should also regularly report open and closed trades to the relevant financial regulators. But most importantly, clients are covered by compensation funds - so even if a licensed firm becomes insolvent, its clients can claim compensation - usually up to €20,000 per person. How can you get your money back?

If you have already deposited some money with Blacklands Finance Limited, you should request a withdrawal immediately. However, it may turn out that the broker will not want to return your money to you. Don't worry, if you made your deposit with a Visa or Mastercard there is still hope. Credit cards provide you with the option of a refund, or chargeback. For example, Visa and Mastercard allow chargebacks within 540 days of a deposit to people who have been victims of investment fraud. Chargeback is a complaint procedure initiated by the bank upon receipt of a report from a payment card customer. So if you want your money back you should contact your bank as soon as possible. The same applies to transfers of money via online payment systems. Some of them allow chargebacks and some do not. Regardless of which online payment system you used to make your deposit, you should contact customer support immediately and ask if there is a possibility of refund. If you have made a bank transfer there is no possibility to make a chargeback. All you can do is write an email to Blacklands Finance Limited making it clear that if they don't refund your money you will go to the police. There is a chance that they will get scared and you will get your funds back. You can also write a complaint to the government agency that regulates financial institutions and brokers. They will take appropriate action. We also warn against paying in cryptocurrencies. Firstly, your payment will remain largely anonymous - you never know exactly who you're sending cash to, but more importantly, your transaction will be final - once you've made your payment, there's no going back. Conclusion

Blacklands Finance Limited is not a broker we can recommend because they are not licensed to provide financial services. We also found some negative comments on internet forums. Your money is not safe so it is better to stay away from this broker. Remember to always check reviews and comments about a company before you send money to someone, no matter if it is a forex broker, cryptocurrency exchange or any other company.

If you have been scammed leave a negative comment below to warn other users against investing with this broker.

Read our Empire Swiss review to see why we do not recommend this broker for trading. Just to clear doubts, this is an empireswiss.com review. If you have any questions or need advice about the withdrawal process, feel free to contact us at [email protected].

Who are they?

After taking a look at their website, it shows that they do not fall under any regulating agency. That is a MAJOR RED FLAG!! That should be enough for you NOT to invest with them. And they also work with websites that offer “Automated trading software” which is another red flag, as these kinds of websites are notoriously famous for scamming schemes.

So Empire Swiss is just another unregulated forex broker, which means the customers are not protected, and it is highly likely they will get away with your hard-earned money and there will be no regulating agency to hold them responsible.

In today’s forex market flooded with scam brokers, traders must tread every online financial trading company carefully. You must be particularly aware of shady brokerage firms like Empire Swiss that are anonymous, do not hold any trading credentials, and provide poor services based on deception.

If you have come across the Empire Swiss broker, you will soon realize how fraudulent this company is. So, continue with our Empire Swiss review for more information about this investment scam.

On top of that, we seriously recommend you not invest in the fake brokers BCH Advance, iToroStocks, and WiseFXPro. Do not trade with these unlicensed brokers if you want to save your money! Broker status: Unregulated Broker Regulated by: Unlicensed Scam Brokerage Blacklisted as a Scam by: N/A Owned by: N/A Headquarters Country: Australia Foundation year: 2022 Supported Platforms: Web Trader Minimum Deposit: 2,500 USD Cryptocurrencies: Yes (Bitcoin, Litecoin, Ripple) Types of Assets: Cryptocurrencies, Forex Maximum Leverage: 1:100 Free Demo Account: No Accepts US clients: No

How does it work?

Usually, unregulated forex brokers work in the following way. They will call people to persuade them to make the initial minimum deposit while trying any conceivable method in order to make that happen. They will offer deals that sound too good to be true like we will double your initial deposit or you will make $100 per day easily. Please don’t fall for anything they say!!! It is a SCAM! After making the initial deposit, people get transferred to a smarter scammer, called a “retention agent”, who will try to get more money out of you.

Withdrawing funds

You should submit a withdrawal request ASAP because your funds are never safe with an unregulated broker. And here is when things get tricky.

If you want to withdraw your money and it does not matter if you have profits or not, they will delay the withdrawal process for months. If they delay it for six months, you won’t be able to file a chargeback anymore and your money is gone for good. It does not matter how often you remind them or insist on withdrawing your money, you will NOT get them back. And if you signed the Managed Account Agreement or MAA, which is basically authorizing them to do anything they want on your account, they will lose all your funds so there won’t be anything to request anymore.

How to get your money back?

If you already deposited your money with them and they refuse to give your money back, which is very likely to happen, don’t worry, it might be a way or two to get your money back.

First of all, you need to keep the emails as proof that you have been requesting the money back from them but they don’t give it to you, or they delay the process for too long, with the intention of not refunding your money.

The first thing you should do is perform a chargeback! And you should do this right away! Contact your bank or credit card provider and explain how you were deceived into depositing for a trading company that is not regulated and refuses to give your money back. This is the simplest way of getting your money back and is also the way that hurts them the most. Because if there are many chargebacks performed, it will destroy their relationship with the payment service providers. If you haven’t done this before or you are not sure where to start or how to present your case to your bank or credit card company, we can assist you in preparing your chargeback case. Contact us at [email protected] but do not let your broker know if you have read this article or are in contact with us.

What about wires?

If you sent them a wire, there is no way to perform a chargeback on a wire. For this step, you need to raise the fight to a different level. Tell them that you will go to the authorities and file a complaint against them. That will get them to rethink the refund possibility. Another thing you can do is prepare a letter or email for the regulating agencies. Depending on the country where you live, you can search on google to find the regulating agency for Forex brokers in that country. After that, you can prepare a letter or an email describing how you got deceived by them. Make sure you show this letter or email to them and tell them you will send it to the regulating agency if they don’t refund your money. If you do not know where to start, reach us at [email protected] and we will help you with this step as well. Is Empire Swiss a Licensed Forex Broker?

Forex trading is a heavily controlled industry by financial regulatory agencies closely cooperating with governments and ensuring that every broker complies with relevant legislation.

When a phony broker like Empire Swiss doesn’t state its headquarters or any information about the company’s registration, it is hard to determine its jurisdiction. This is done with the purpose to cover up the fact that it is an unlicensed and unregulated business.

The only info about Empire Swiss available on its website is a telephone number, which is an Australian phone number according to the dialing code. That brings us to the assumption that this broker might be based in Australia, which is one of the most stringent jurisdictions.

If it is the case, it is impossible to be a legitimate broker without being authorized by the Australian financial authority, ASIC. Not unexpectedly, Empire Swiss is not licensed under this or any other financial market regulatory agency. Why Is Trading On a Licensed Broker’s Platform Preferable?

Unlike unauthorized brokers, certified companies can be trusted with money since they adhere to a strict code of conduct – especially forex providers regulated by top-level supervisory bodies like the Australian ASIC, British FCA, and German BaFin. For example, ASIC’s eligibility conditions stipulate a broker maintain a minimum operating capital of 1M AUD and keep its and traders’ money separated (segregation of funds).

Additionally, traders of licensed brokers are protected by indemnification programs run by supervisory agencies. For example, ASIC covers traders with a 100,000 AUD indemnification in the event of a broker’s bankruptcy. On top of that, legitimate companies implement a range of risk management measures to mitigate trading risks, such as offering negative balance protection (a trader can lose more than deposited), cooperating with first-rate banks, providing reliable trading platforms, and ensuring propitious trading conditions. So Is Empire Swiss a Decent Broker or a Scam?

Empire Swiss is an anonymous and unregulated broker running online trading scams and cheating traders from the UK, Canada, Australia, the US, and Sweden. What Trading Software Does Empire Swiss Offer?

Speaking of the Empire Swiss portal, a trading platform available here, it is a web trader with limited functionality. This unscrupulous broker claims that its web trader fits the needs of both beginners and experienced traders. However, we are dubious about that since it has generic functions that can’t ensure profitable trading.

As far as that is concerned, your best option is the latest trading programs – MetaTrader 4, MetaTrader 5, cTrader, and Sirix – providing advanced tools such as expert advisors, stop loss, fast execution, unlimited pending orders, copy trading, and more.

Make sure you leave reviews about Empire Swiss on other sites

Another way to hurt them and save other people from falling victims is to leave bad reviews on other sites, and describe shortly what happened. If you have fallen victim please leave a review and a comment on this site in the comment section. Also, when these people change their website they tend to call the old clients, so if they call you from a new website please write it down on the comment or let us know by contacting us. That would be really appreciated by us and families all over the world. Also if you get phone calls from other companies please put the name of these companies also in the comment or send it to us. We will expose them too.

Empire Swiss Review Conclusions

Making the Empire Swiss review is actually a pleasure for us, and we hope to save as many people as possible from losing their hard-earned money. A good rule of thumb is to carefully review all the Forex companies and any other company for that matter before you perform any transaction. We hope that our Empire Swiss review has been helpful to you. If you have any questions or you need advice about the withdrawing process, feel free to contact us at [email protected].

If you like to trade please do it with a trustworthy, regulated broker, by choosing one of the brokers listed below.

Warning: Low score, please stay away!

It has been verified that this broker currently has no valid regulations, please be aware of the risk!

Empire Swiss unconvincingly claims to be a “world-leading broker” with years of experience and numerous awards. The low quality of the website, the conflicting information and the missing credentials suggest that these boasts cannot be true. Fact-checking quickly reveals that Empire Swiss is indeed just another scam website trying to cash in on the hype around cryptocurrencies and the general public’s ignorance about financial markets. Broker name Empire Swiss TRUSTED? UNREGULATED SCAM BROKER 100% Regulation No Minimum Deposit $1 Leverage 1:200 Trading platforms web Available assets forex, indices, shares, bonds, energies

CUSTOMER REVIEW – Identity Hidden Empire Swiss is a scam broker, I have deposited 8500 USD and made a profit of 4000 USD in a day. this scam broker is not giving me a withdrawal and today dated 27.04.2021 they have blown my account intentionally so cannot ask for a withdrawal. this totally B Book broker without liquidity bridging( there is no bank with this broker) How to get your money back?

If you already deposited your money with them and they refuse to give your money back, which is very likely to happen, don’t worry, it might be a way or two to get your money back. First of all, you need to keep the emails as proof that you have been requesting the money back from them but they don’t give it to you, or they delay the process for too long, with the intention of not refunding your money.

The first thing you should do is perform a chargeback! And you should do this right away! Contact your bank or credit card provider and explain how you were deceived into depositing for a trading company that is not regulated and refuses to give your money back. This is the simplest way of getting your money back and is also the way that hurts them the most. Because if there are many chargebacks performed, it will destroy their relationship with the payment service providers. If you haven’t done this before or you are not sure where to start or how to present your case to your bank or credit card company, we can assist you in preparing your chargeback case. Just contact us at [email protected] but do not let your broker know they you read this article or that you are in contact with us. HOW DOES THE SCAM WORK

The idea of passive income is increasingly attractive to more and more people. The Internet gives the impression that making money through investments in the financial markets is more accessible than ever to non-experts. But the online space is full of scammers who lure inexperienced wannabe traders through flashy advertisements and fake testimonials from satisfied clients. However, these fake brokers don’t really invest the money you give them – even though they very confidently assure you that you are generating great profits and should invest even more.

But when you try to withdraw some of your supposed winnings or deposit, it turns out to be impossible. Scammers will tell you that a sudden change in the market has wiped out all your money, or point you to vague clauses in the Terms and Conditions that require a huge minimum volume traded. The victim of such a scam may also be surprised by hidden fees and taxes amounting to tens of percentages of their funds.

Holding fraudsters accountable is difficult because they operate through uncontrolled and unregulated offshore companies. In addition, scammers require that you provide them with a copy of your ID and proof of address so that they can claim that all transactions were voluntary and agreed upon by both parties.

REASONS WHY Empire Swiss is a completely Fake, Unreliable and scam forex broker?

A guarantee of success and/or large profits – Empire Swiss scam broker

Nothing about the market, specifically the forex market, can be guaranteed. This market is influenced by too many factors that can change at any moment. So if someone is boasting of guaranteed profits or specific results, they are peddling a scam.

No substantial proof or background information on Empire Swiss

It’s very easy to come across pictures of charts showing profits. Scammers are savvy and they will only show profits and not losses within a period of time. In worse cases, they may even show charts from demo trading accounts that aren’t even a reflection of real trading. Do not base your decision to work with someone or purchase a product based on this or any other limited information. Ask for background information and full disclosure of the profits and losses. If they refuse or remain vague, it’s probably a scam.

Unsolicited marketing techniques

Unsolicited and persistent marketing is typically a sign of fraudulent behaviour. If you find yourself being pushed to purchase a product or service with little information and time, it may be an attempt to scam you. Be particularly cautious if they begin to ask for personal information that can be used for things like identity theft. If it feels uncomfortable and pushy, avoid it.

Empire Swiss Review Conclusions

Making the Empire Swiss review is actually a pleasure for us, and we hope to save as many people as possible from losing their hard-earned money. A good rule of thumb is to carefully review all the Forex companies and any other company for that matter before you perform any transaction. We hope that our Empire Swiss review has been helpful to you. If you have any questions or you need advice about the withdrawal process, feel free to contact us at [email protected].

EmpireSwiss.com is an unregulated broker which targets innocent traders and steals the money they deposit. They also resort to using fake DMCA takedowns in order to hide negative posts and review them. As a trader, I strongly recommend anyone avoid EmpireSwiss.com at all costs. If they have to resort to such cheap and ugly tactics for creating a fake reputation, then they definitely can’t be trusted with your money. How EmpireSwiss.com Scams People

This post will expose exactly how the Empire Swiss scam works and why you should not open an account with this broker. They are not regulated by any financial authority in the world. In simpler terms, they are not licensed to provide any financial services in any country on the face of the planet.

Unlicensed brokers are not permitted to operate legally, thus they cannot be trusted. YOu should stay away from them as they can disappear from the internet at any moment and run away with your money. See also Joshua Twelftree: Forcing Himself On Bumble Date?

There are also no details about the owners and executives behind EmpireSwiss.com, this is a big red flag because essentially gives the actual owners immunity from being held accountable by their victims.

On online forums I found only negative press on EmpireSwiss.com, users complain about not being able to withdraw their funds and struggling with bugs on the website.

EmpireSwiss.com usually call potential victims and promises them big returns of investments on their investments. All they want is for the target to deposit money into their platform. Once that happens they keep upselling the victim until they leech the most amount of money possible. They even show a fake increase in value but when the victim tries to withdraw their money, they are shown an error.

Brokers who scam masses often swindle their victims and disappear without a trace. You cannot contact them via phone or email once they run away with your money as all these lines of communication are shut down by teh scammers. See also Paramveer Singh

I’ve lost a lot of money to these scammers and I hope no one else falls victim to their heinous scam. Fake Reviews On TrustPilot & SiteJabber

These scammers have made dummy accounts on Trustpilot and Sitejabber in order to scam more people. They posted fake 5 star reviews on these platforms and are blatantly abusing them.

They use these reviews as social proof to scam actual people. The victims don’t realize that these reviews have been written by the scammers themselves and get fooled.

Do not trust their ratings on Trustpilot and Sitejabber.

Read our Empire Swiss review to see why we do not recommend this broker for trading. Just to clear doubts, this is an Empireswiss.com review. If you have any questions or you need advice about the withdrawal process, feel free to contact us at [email protected].

Who are they?

After taking a look at their website, it shows that they do not fall under any regulating agency. That is a MAJOR RED FLAG!! That should be enough for you NOT to invest with them. And they also work with websites that offer “Automated trading software” which is another red flag, as these kinds of websites are notoriously famous for scamming schemes.

So Empire Swiss is just another unregulated forex broker, which means the customers are not protected, and it is highly likely they will get away with your hard-earned money and there will be no regulating agency to hold them responsible.

How does it work?

Usually, unregulated forex brokers work in the following way. They will call people to persuade them to make the initial minimum deposit while trying any conceivable method in order to make that happen. They will offer deals that sound too good to be true like we will double your initial deposit or you will make $100 per day easily. Please don’t fall for anything they say!!! It is a SCAM! After making the initial deposit, people get transferred to a smarter scammer, called a “retention agent”, who will try to get more money out of you.

Withdrawing funds

You should submit a withdrawal request ASAP, because your funds are never safe with an unregulated broker. And here is when things get tricky.

If you want to withdraw your money and it does not matter if you have profits or not, they will delay the withdrawing process for months. If they delay it for six months, you won’t be able to file a chargeback anymore and your money is gone for good. It does not matter how often you remind them or insist on withdrawing your money, you will NOT get them back. And if you signed the Managed Account Agreement or MAA, which is basically authorizing them to do anything they want on your account, they will lose all your funds so there won’t be anything to request anymore.

How to get your money back?

If you already deposited your money with them and they refuse to give your money back, which is very likely to happen, don’t worry, it might be a way or two to get your money back.

First of all, you need to keep the emails as proof that you have been requesting the money back from them but they don’t give it to you, or they delay the process for too long, with the intention of not refunding your money.

The first thing you should do is perform a chargeback! And you should do this right away! Contact your bank or credit card provider and explain how you were deceived into depositing for a trading company that is not regulated and refuses to give your money back. This is the simplest way of getting your money back and is also the way that hurts them the most. Because if there are many chargebacks performed, it will destroy their relationship with the payment service providers. If you haven’t done this before or you are not sure where to start or how to present your case to your bank or credit card company, we can assist you in preparing your chargeback case. Contact us at [email protected] but do not let your broker know if you have read this article or are in contact with us.

What about wires?

If you sent them a wire, there is no way to perform a chargeback on a wire. For this step, you need to raise the fight to a different level. Tell them that you will go to the authorities and file a complaint against them. That will get them to rethink the refund possibility. Another thing you can do is prepare a letter or email for the regulating agencies. Depending on the country where you live, you can search on google to find the regulating agency for Forex brokers in that country. After that, you can prepare a letter or an email describing how you got deceived by them. Make sure you show this letter or email to them and tell them you will send it to the regulating agency if they don’t refund your money. If you do not know where to start, reach us at [email protected] and we will help you with this step as well.

Make sure you leave reviews about Empire Swiss on other sites

Another way to hurt them and save other

1 note

·

View note

Photo

funded trader programs london | traderfundingprogram.com

Funded trader programs in London.Learn more here https://traderfundingprogram.com/uk-london

0 notes

Text

Fully Funded Trading Account

Lux Trading Firm is a trusted prop trading firm, Forex Proprietary Trading Firms in the UK. Select the evaluation funded trading accounts program to trade in any trading style.

Fully Funded Trading Account

About Company :- We are a leading proprietary trading firm based in London (UK), specializing in supporting experienced prop traders.Our commitment is to help traders excel and provide the tools and capital they need to compete in a marketplace defined by change and disruption.We are focused on seeking out trading and investment opportunities to grow our capital in the global financial markets.

Click Here For More Info.:- https://luxtradingfirm.com/

0 notes

Link

Figure out how to move toward specialized investigation with the best online trading course to turn out to be more reliable in your trading. Visit now to acquire a strong comprehension of the center standards and afterward apply that information to gauge its future course.

#online trading course#forex trading course london#financial trading online#online forex trading course#forex trading course#learn to trade forex london#best funded trader programs#learn forex trading online#forex trading courses uk#forex learn online trading#learn to trade uk#forex trading lessons

0 notes

Text

Free Funded Trader Program

Lux Trading Firm is a trusted prop trading firm, Forex Proprietary Trading Firms in the UK. Select the evaluation funded trading accounts program to trade in any trading style.

Free Funded Trader Program

About Company :- We are a leading proprietary trading firm based in London (UK), specializing in supporting experienced prop traders.

Our commitment is to help traders excel and provide the tools and capital they need to compete in a marketplace defined by change and disruption.

We are focused on seeking out trading and investment opportunities to grow our capital in the global financial markets.

Click Here For More Info.:- https://luxtradingfirm.com/

Social Media Profile Links-

https://twitter.com/FirmLux

https://www.instagram.com/luxtradingfirm/

https://www.youtube.com/@LuxTradingFirm/featured

0 notes

Text

I Found an Old Goals List...

...and it made me chuckle...

by each of the "Want to Be"s, I put who I knew was currently in that role...some names, I don't even recognize...How I feel today is in red...

Want to Be

Fundraiser

Owner of Microfinancing Philanthropist

Financial Infrastructure Engineer

Data Scientist

Product Director

Trader on Wall Street

Enterprise Saleswoman

App Owner/Business Owner/Entrepreneur/Mogul

Professor

Teacher

Author

Investment Banker

Fantasy

Actress

Dancer

DJ (Hannah Bronfman)

TV Host (Desus & Mero)

Tour Manager

Don’t Want to Be

Attorney

Real Estate Agent

Rapper

Singer

Scientist

Fitness Coach

Event Planner

Office Manager

Financial Advisor

Financial Analyst

5 Year Plan – 2017 - 2021 – 24 - 28 YO (6/13 complete)

Establish connections, gain industry experience (happened)

Complete my 1st Marathon – 2017 (happened)

Raise & Promotion @ L – 2017 (happened 2018)

Leave L – 2018 (happened 2022)

Visit Cuba - 2018 (didn't happen, lost my passport and fought w/my mom pretty badly over this one...)

Join Netflix w/ 6 figure salary – 2018 (hahahah)

Complete UC Berkeley data science program – 2018 (no longer a desire)

Make 1st trade on NYSE - 2018 (happened 2019)

Visit KT in Bangkok/Bhutan/Charles in Singapore – 2019

Visit Japan - 2020 (happened 2018)

Become Mid-level Finance Manager – 2021 (ahahhaah)

Earn CFA - 2021 (not a desire)

Visit Switzerland - 2021 (not a desire)

10 Year Plan – 2022 - 2026 – 29 - 33 YO

Visit Capetown - 2022 (2023...2022 is over this week, I don't think this finna happen...)

Return to work in NYC on Wall Street as Financial Infrastructure Manager – 2022 (no, but I did work in NYC in 2021...)

Finish the NYC Marathon - 2022 (don't care to anymore)

Learn basic conversational and reading in Japanese – 2022 (I tried in 2021...but other things were prioritized)

Visit Hong Kong - 2022 (with that air pollution & covid?? nahhh)

Harvard Business School funded by employer – 2023 (could happen...)

Visit Dubai/UAE/Mecca - 2023 (I don't care to go there anymore...human rights reasons...)

Work abroad in Italy, South Africa, Japan or London – 2024 (could happen...)

Visit Brazil – 2024

Visit Australia – 2025

Visit Tahiti – 2026

First child with natural birth – 2026 (yikes...unless my future husband has 8 figures, miss me with this one...)

Own NYC loft - 2026 (we shooting big here!...can happen...)

Get hired at T4 or T5 SWE position at my top choice company - 2023

Get a $180k+ base salary - 2023

Start dating a guy a like and who likes me - 2023

Move to a 1 bedroom in Manhattan or Brooklyn, New York - 2023

Master all the topics I want to before June 2023 - June 2023

Look like Tamara Prichett, Melanie Alcantara, Jade Cargill, or Massy Arias - 2024

Update my app to be on React - 2024

Mentor an intern engineer - 2024

Get a promotion - 2024

Staff engineer - 2025

Visit friends in Milan - 2023

15 Year Plan – 2027 - 2031 – 34 - 38 YO

Visit the Amazon – 2027 (don't really care to do this anymore)

Fundraise for my own app – 2027 (2028)

Go public with my company – 2031 (2037, MAYBE)

Get married to a really rich man (2026)

Move back in with grandparents to code for my app full time or live off of my really rich husband - 2027

35 Year Plan – 2032 – 2050 – 39 – 58 YO

Grow company

Tech Invest - 2040

Own home in NJ or NY - 2040

Retire – 2050

40 Year Plan – 2051 – 2055 – 59 – 63 YO

Become teacher in LA – 2051

41 Year Plan – 2056 - 2060 – 64 - 68 YO

Become USC Trustee

It could happen...I have to believe and work hard...

#follow your dreams#pray#Youtube#tech#software engineering#software engineer#check in#black in tech#black in the bay#san francisco#silicon valley#engineer#python#black women in tech#women in tech#startup#layoff#100 days of python#100 days of code#programming#coding#pytest#systems engineer#goals#marriage

1 note

·

View note

Text

Thank you-FTP - AudaCity Capital - London - Proprietary Trading Firm - Funded Trader Program - Hidden Talents Program - Funding for forex traders.

3 notes

·

View notes

Text

BullPerks

BullPerks - The fairest and most community dedicated decentralized VC and multi chain launchpad.

#bullperks #bsc #crypto

I'm Jadon Sancho here will explain more about the project Bullperks

About BullPerks

The Ultimate and most fair platform for retail buyers to get access to private sale allocations to the most sought after crypto projects just like crypto funds do

Who is behind this?

The BullPerks team and advisors have been around for a while and have over 20 years of combined crypto experience. Each member has managed tons of projects in the crypto space.

A mix of talented individuals at the top of their fields is here to build a unique skill set to have a fun and successful journey from crypto start-up ideation to execution.

What's unique about Bullperks?

The majority of decentralized VCs and launchpads have become private member clubs after their token price increased. With a set tier system based on the token amount you hold, only early investors have access to those tiers and share in the deals.

BullPerks, with its adaptive tier system, is the fairest and most community-dedicated platform giving access to early-stage deals.

BullPerks — The All-Inclusive Decentralized VC That Can’t be Tamed

As a proud crypto bull, you know this is an exciting time to invest in a wide range of cutting-edge blockchain technologies that show great potential to revolutionize an industry or service. However, having access to those groundfloor investments with typical VCs presents its challenges because of the exclusivity that comes with getting in early. This results in missed opportunities and keeps you on the sidelines as great projects turn into great companies.

At BullPerks we intend to disrupt this pattern and provide stakeholders with even modest starting capital the chance to buy into projects they feel align with their vision of a healthy crypto/blockchain portfolio.

The Team Behind the Bull

The experts that make up our BullPerks team are entrepreneurs, advisors, investors, marketing professionals, and VC fundraisers. We are at the top of our respective fields with a long list of projects to their credit and over two decades of experience in the crypto space. The wealth of knowledge our team possesses allows for us to present you with projects that will bring new blockchain technology to the forefront of the business world.

Where To Get Started

Investors are encouraged to contact BullPerks through our website info page and join our Telegram group. It’s important to purchase BLP tokens and establish which allocation tier you fall into. This will also allow you to see which projects are available to you.

We also understand that from time to time, you may come across a project that does not resonate with you; and this leads to one of the many “perks’’ of joining Bullperks. Your investment is your choice, which means you have the freedom to buy into or pass on any project you see fit. You simply select the “pass” option on the BullPerks platform and you will maintain your place in the queue.

Support For Your Project

As a founder of a project, the BullPerks team will pool their extensive experience and resources to help raise funds, develop an effective marketing strategy, and advise you on a wide range of procedures and opportunities that may include potential partnerships with other successful projects.

What Sets Bullperks Apart?

BullPerks acts as a VC/fund that offers traders access to seed and private rounds which are otherwise known as “exclusive” allocations. It is well known that to partake in these types of investments, an individual or organization must have access to a high-profile network and must also provide very large sums of capital. Being able to participate in these types of exclusive sales is one of the most coveted opportunities in the crypto space and something typically far out of reach for the average joe.

Experience and Focus That Equals

The various skill sets of our team of crypto and blockchain experts help every project we bring to market reach its full potential. As a trader or project founder, you will have the support you need as you join a community of like-minded people with years of experience and a proven track record of success. Contact us at BullPerks today to get more information on how you can get started on our platform.

Tokenomics

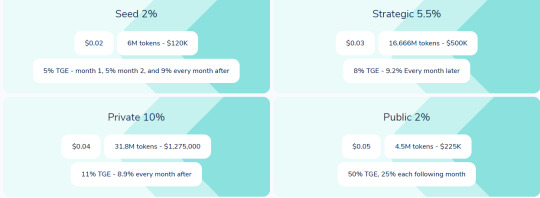

300M total tokens BLP

Token sale

Total raise: $2,120,000

Team: 1 year cliff and then 8.33% per month

Advisors: 8 months cliff and then 8.33% per month

Initial market cap on TGE - Seed + Strategic + Private + Public at $0.05

7.389M tokens = $369.5K

Buyback Program

The 3% fees on investment will go fully to buy backs!

All the profits from the sales of the NFT store

Using 10% of the profits of the company investments

Our Investment model and tiers

There are other platforms that offer so-called investing like VС’s, however in all of those only if you join early you win and really get allocation for projects

We will have deals and allocations for each group or fair mixes

Silver Bulls will be guaranteed to get some allocations on some deals.

Per every 4 deals:

Leadership

Eran Elhanani: Co-Founder

Constantin Kogan: Co-Founder

Team

Dmitry Chirun

CTO

Seasoned CTO with over 20 years of creating and managing remote teams in a variety of industries. Master’s in cryptography. Building engineering teams from concept to delivery. Ex-VP of Wargaming, USGold, advisor to various crypto projects and accelerators.

Sheynel Smith

Compliance Officer/Money Laundering Reporting Officer (MLRO)

Managing Director of Driftwood Advisory Services. An experienced crypto compliance professional with a Master's of Law specializing in Financial Crime. She is certified as a Crypto Currency Investigator (CCI), Anti-Money Laundering Specialist (ACAMS) and Financial Crimes Specialist (ACFCS).

Alex Man

Head of Business Development & Partnerships

Partner at Jun Capital, serial entrepreneur, futurist. A digital assets specialist primarily focused on early stage emerging technologies, startups and revolutionary DLT projects. Alex helps companies get access to strategic capital and builds bridges between global partners.

Dima Doroshenko

Project Manager

Calculated and strategic decision maker with 10 years of proven leadership, communication skills and a relentless drive to exceed expectations.

Nikita Drozdov

UX/UI, Graphic Designer