#forex trading xm

Explore tagged Tumblr posts

Text

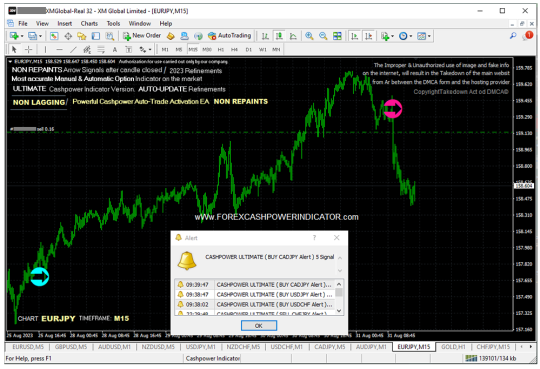

Forex #Metatrader4 EURJPY M15 Sell trade 0.16 lots. More Info about Non Repaint Trade system in Website.

. 🔥 wWw.ForexCashpowerIndicator.com . Cashpower Indicator is Lifetime license one-time fee with No Lag & Non Repaint buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones. . ✅ NO Monthly Fees ✅ * LIFETIME LICENSE * ✅ NON REPAINT / NON LAGGING ✅ Less Signs Greater Profits 🔔 Sound And Popup Notification ✅ Minimizes unprofitable/false signals 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account. .

#cashpowerindicator#forexindicator#forexindicators#forexsignals#forex#indicatorforex#forextradesystem#forexprofits#forexvolumeindicators#forexchartindicators#forex forum#forex baby pips#forexstation#how trade forex#what is forex#best forex brokers#xm forex broker

5 notes

·

View notes

Text

The Best Forex Broker agencies and IC market experts will attend Forex Expo Dubai 2024. At this event, they will share their insights with everyone.

0 notes

Text

The Ultimate Forex Brokers Comparison for South African Traders

Introduction:

The forex market in South Africa is one of the fastest-growing financial sectors, and selecting the right broker can make all the difference. In this Forex Brokers Comparison in South Africa, we will explore the best options available for traders in 2025. Whether you're just getting started or are looking for a more advanced trading experience, this guide will help you navigate your choices and make an informed decision.

Why Forex Trading in South Africa is Thriving:

Forex trading in South Africa has seen a steady rise in popularity over the past few years. This growth can be attributed to the country's stable financial regulations, mainly governed by the Financial Sector Conduct Authority (FSCA). With a secure regulatory framework, traders are assured of a safe trading environment. In addition, many brokers now offer dedicated services tailored for South African traders, including local deposit methods and customer support in native languages.

Key Features to Look for in a Forex Broker in South Africa:

When choosing a forex broker, several key factors should guide your decision:

Security and Regulation: Ensure your broker is regulated by the FSCA for a secure trading environment.

Trading Platforms: Popular platforms such as MT4 and MT5 offer robust features, but many brokers now offer proprietary platforms as well.

Low Spreads and Fees: Low trading costs are crucial to maximizing profits.

Customer Support: 24/7 support in the South African time zone can enhance your trading experience.

Account Types: Brokers offering diverse account types with local payment options can cater to a wide range of traders.

Top Forex Brokers for South African Traders in 2025:

Eightcap: Known for its low spreads, quick deposits, and intuitive platform, Eightcap is perfect for both beginners and seasoned traders.

IC Markets: With low spreads and fast execution, IC Markets is ideal for scalpers and day traders.

FP Markets: Offering excellent customer support and a user-friendly platform, FP Markets provides an outstanding trading experience.

Octa: Specializing in accounts suitable for South African traders, Octa stands out for its commitment to local customers.

BlackBull: If you're after low-cost trading with access to a wide range of assets, BlackBull is a top contender.

XM: XM’s global reach and local support make it a solid choice for traders looking for both global opportunities and local assistance.

FXPro: Known for its top-tier services and robust tools, FXPro is ideal for traders seeking a complete package.

FBS: FBS’s user-friendly interface and attractive promotions make it an appealing option for beginners.

Comparing Forex Brokers in South Africa: Which One is Right for You?

Choosing the right broker depends on your trading needs. For beginner traders, brokers with easy-to-use platforms and strong customer support, like FBS and Eightcap, might be the best fit. Experienced traders, however, may benefit from IC Markets or FP Markets, which offer advanced tools and low-cost trading. If you're focused on low spreads, BlackBull and Octa are excellent options.

The Future of Forex Trading in South Africa:

As we look toward 2025, the future of forex trading in South Africa appears promising. Technological advancements, such as AI-based trading tools and faster transaction systems, are set to make trading more efficient. Moreover, evolving regulations may offer even greater protection for traders. Staying informed about the latest trends and innovations will help traders maintain a competitive edge.

Conclusion:

In conclusion, choosing the right forex broker is critical for successful trading in South Africa. With the Forex Brokers Comparison in South Africa above, you are equipped with the knowledge to make an informed decision. Visit Top Forex Brokers Review for more in-depth insights and to explore detailed broker reviews

2 notes

·

View notes

Text

The Forex Brokers in Australia: Why You Should Choose Them?

Australia has earned a reputation as one of the most attractive destinations for forex traders worldwide. Known for their strong regulatory framework, advanced trading platforms, and excellent customer service, the best forex brokers in Australia continue to lead the market by offering an unparalleled trading experience. Whether you're a beginner or an experienced trader, the benefits of choosing a top-tier Australian broker are undeniable. In this article, we will explore why Australia-based forex brokers are so popular, what sets them apart, and which brokers, such as FP Markets, Blackbull Markets, EightCap, OctaFX, FXPro, IC Markets, FBS, XM, AXI, and Pepperstone, are the top contenders in the industry.

Why Australian Forex Brokers Are the Best Choice for Traders

Australia's forex trading environment stands out in the global market for a variety of reasons. Below are key factors that contribute to the rising popularity of Forex Brokers Review.

1. Regulation and Trust

Australia's financial markets are governed by the Australian Securities and Investments Commission (ASIC), one of the most respected regulatory bodies in the world. ASIC ensures that brokers adhere to stringent financial standards, offering a layer of security and trust that traders look for when selecting a forex broker. ASIC’s regulatory oversight ensures that brokers are transparent, operate with integrity, and prioritize the protection of their clients' funds.

2. Competitive Trading Conditions

One of the most attractive features of the best forex brokers in Australia is the competitive trading conditions they offer. These brokers typically provide low spreads, low commissions, and tight liquidity, which are essential for traders who want to maximize their profits. The competitive trading conditions are often coupled with a wide range of account types, including options suitable for scalpers, swing traders, and long-term investors.

youtube

3. Advanced Trading Platforms

Australian brokers are known for providing access to industry-leading trading platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and even their proprietary platforms. These platforms are known for their reliability, advanced charting tools, and sophisticated features like automated trading, backtesting, and technical analysis.

4. Fast Execution Speeds and Low Latency

Execution speed is a critical factor in forex trading, especially for active traders who rely on quick decision-making to capitalize on price movements. The best Australian brokers offer fast execution speeds and low latency, meaning that orders are processed quickly, reducing the risk of slippage.

6. Comprehensive Customer Support

Australian forex brokers are renowned for their exceptional customer service. Offering 24/5 support through various channels, such as live chat, email, and phone, these brokers are committed to helping traders solve problems, answer queries, and provide assistance whenever needed.

Leading Forex Brokers in Australia You Should Consider

Now that we’ve discussed the factors that make Australian forex brokers an excellent choice, let’s take a look at some of the leading brokers in Australia that offer top-tier services to traders:

1. FP Markets

With more than 15 years of experience, FP Markets is a leading forex broker in Australia. Regulated by ASIC, FP Markets offers low spreads, a wide range of trading instruments, and advanced platforms like MT4, MT5, and Iress. The broker’s commitment to providing fast execution, reliable customer support, and educational resources makes it a trusted choice for both novice and professional traders.

2. Blackbull Markets

Blackbull Markets is a well-known broker that caters to traders who want competitive spreads and fast execution speeds. Regulated by ASIC, Blackbull Markets offers access to MT4 and MT5, as well as ECN trading accounts, making it a favorite among scalpers and day traders.

3. EightCap

EightCap is another excellent Australian forex broker, known for offering low-cost trading and reliable execution speeds. With access to MT4 and MT5, EightCap supports a wide range of trading strategies and provides solid customer support, making it ideal for traders of all experience levels.

4. OctaFX

OctaFX offers a variety of account types with low spreads and excellent customer service. The broker’s educational resources, along with MT4 and MT5 platforms, make it a popular choice for Australian traders. OctaFX’s focus on transparency and user-friendly features has earned it a solid reputation in the industry.

5. FXPro

FXPro is a trusted global forex broker with a strong presence in Australia. Offering low spreads, fast execution, and access to MT4, MT5, and cTrader, FXPro is ideal for traders seeking robust trading tools. With a wide range of instruments and excellent customer support, FXPro continues to be one of the top brokers in Australia.

6. IC Markets

IC Markets is one of the largest forex brokers in Australia, offering a wide range of instruments, including forex, commodities, and cryptocurrencies. The broker offers access to MT4, MT5, and cTrader and is known for its low spreads and fast execution speeds, making it a favorite among active traders.

7. FBS

FBS provides competitive spreads and offers a variety of trading accounts, including ECN and STP accounts. FBS also offers a wide range of educational materials for both beginner and advanced traders, helping them improve their trading skills.

8. XM

XM offers a large variety of financial instruments and low spreads. The broker provides access to MT4 and MT5 and is known for its excellent customer support. XM is highly regarded for its educational resources and tools, making it a popular choice for both beginners and seasoned traders.

9. AXI

AXI is known for its tight spreads and high execution speeds. The broker offers access to MT4 and MT5 and is regulated by ASIC, ensuring a safe and secure trading environment for all traders.

10. Pepperstone

Pepperstone is a leading Australian forex broker known for its low spreads, fast execution speeds, and cutting-edge technology. Offering access to MT4, MT5, and cTrader, Pepperstone provides a comprehensive trading experience for both retail and institutional traders. Its excellent customer service and competitive pricing make it a top choice for Australian traders.

Conclusion

The best forex brokers in Australia are distinguished by their commitment to providing transparent, secure, and competitive trading environments for traders. With ASIC regulation, fast execution, low spreads, and outstanding customer support, these brokers offer the ideal conditions for traders of all experience levels. Whether you’re looking to start your forex trading journey or you’re a seasoned professional, brokers like FP Markets, Blackbull Markets, EightCap, OctaFX, FXPro, IC Markets, FBS, XM, AXI, and Pepperstone offer the perfect platforms to achieve your trading goals.

0 notes

Text

What is Best Online Forex Brokers

Best Online Forex Brokers are platforms that facilitate the buying and selling of currencies in the foreign exchange (forex) market. These brokers provide traders with the necessary tools, trading platforms, and resources to trade forex effectively. The best brokers are often defined by factors such as regulation, fees, spreads, customer support, platform features, and educational resources.

Here are some of the best online forex brokers in the industry, known for their reliability, strong regulatory frameworks, and competitive trading conditions:

1. IG Group

Overview: IG Group is one of the most established forex brokers, offering a variety of trading tools and platforms. It is highly regulated and provides access to a large number of currency pairs.

Key Features:

80+ currency pairs for trading

Low spreads starting from 0.6 pips

MetaTrader 4 (MT4) and IG Trading platform

Extensive market research and educational resources

Regulated by FCA, ASIC, and other top authorities

Ideal For: Traders looking for a trusted, highly regulated broker with extensive educational and research tools.

2. OANDA

Overview: OANDA is a reliable broker offering a user-friendly platform with low spreads and extensive research tools.

Key Features:

70+ currency pairs

Low spreads starting from 1.4 pips

Access to MT4, Proprietary Trading Platform, and mobile apps

Comprehensive market analysis tools

Regulated by CFTC, FCA, ASIC, and others

Ideal For: Traders looking for low spreads and a platform with advanced research tools.

3. eToro

Overview: eToro is best known for its social trading feature, which allows traders to copy the trades of others. It's a great platform for beginners.

Key Features:

50+ currency pairs

No commissions on forex trading

Copy Trading and social trading features

User-friendly interface with mobile app access

Regulated by FCA, ASIC, and others

Ideal For: Beginner traders or those interested in copy trading and social features.

4. XM

Overview: XM offers a wide range of currency pairs and trading platforms, with competitive pricing and educational tools.

Key Features:

55+ currency pairs

Leverage up to 888:1 (depending on country)

MT4 and MT5 platforms

Educational resources and webinars for traders

Regulated by CySEC, IFSC, and others

Ideal For: Traders looking for high leverage and educational resources.

5. Forex.com

Overview: Forex.com is a popular broker with an easy-to-use platform and access to global forex markets.

Key Features:

80+ currency pairs

Competitive spreads with no commission fees

MT4 integration and custom trading platform

Access to advanced charting tools and market research

Regulated by CFTC, FCA, and ASIC

Ideal For: Traders seeking a comprehensive and reliable broker with competitive pricing.

6. AvaTrade

Overview: AvaTrade offers a wide selection of trading platforms, including MetaTrader 4 (MT4), MT5, and its proprietary platform, AvaTradeGO.

Key Features:

Over 50+ currency pairs

Low spreads and competitive leverage

Platforms: MT4, MT5, and AvaTradeGO

Copy trading and automated trading tools

Regulated by FCA, ASIC, and other global authorities

Ideal For: Traders interested in copy trading, automated trading, and those seeking a variety of platforms.

7. Interactive Brokers

Overview: Known for its low commissions and robust trading platforms, Interactive Brokers offers forex trading with a wide selection of assets and tools.

Key Features:

70+ currency pairs

Commission-based pricing with low spreads

Platforms: Trader Workstation (TWS) and IBKR mobile app

Advanced charting tools and market research

Regulated by CFTC, SEC, FCA, and others

Ideal For: Experienced traders seeking low fees, advanced tools, and access to multiple asset classes.

8. Plus500

Overview: Plus500 is a user-friendly platform known for offering a wide range of forex pairs, CFDs, and other assets. It’s ideal for beginners.

Key Features:

60+ currency pairs

No commission fees—profit is made from the spread

Risk management tools like stop-loss and guaranteed stop

Highly regulated (FCA, ASIC)

Ideal For: Beginners who want an easy-to-use platform with no commission fees.

9. Saxo Bank

Overview: Saxo Bank offers a premium trading experience with high-end tools, research, and a robust trading platform.

Key Features:

Over 180 currency pairs and other assets

Premium platforms: SaxoTraderGO, SaxoTraderPRO

Comprehensive research tools and market insights

Low spreads with commission-based pricing

Regulated by FCA, ASIC, and other financial authorities

Ideal For: Professional traders seeking a premium trading experience and comprehensive research.

10. FXTM (ForexTime)

Overview: FXTM offers a range of services with competitive leverage and educational tools, making it suitable for both beginners and experienced traders.

Key Features:

Wide range of currency pairs

Leverage up to 1000:1

Platforms: MT4, MT5, FXTM Trader

Educational webinars, guides, and videos

Regulated by CySEC, FCA, and others

Ideal For: Traders seeking high leverage and strong educational support.

Key Factors to Consider When Choosing the Best Forex Broker:

Regulation: Ensure the broker is regulated by reputable authorities (e.g., FCA, ASIC, CFTC) for safety and security.

Spreads and Fees: Low spreads and no hidden fees help reduce your overall trading costs.

Leverage: Understand the leverage options available, as high leverage can amplify both potential profits and risks.

Platforms and Tools: Choose brokers that offer popular platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5) and provide charting and analysis tools.

Customer Support: A responsive customer support team ensures that any issues you encounter are addressed promptly.

Educational Resources: For beginner traders, brokers that provide comprehensive educational materials (webinars, guides, videos) are beneficial.

Conclusion:

The best online forex brokers offer a combination of reliable platforms, competitive pricing, strong regulation, and quality customer service. Brokers like IG Group, OANDA, eToro, and Forex.com provide excellent conditions for both beginners and experienced traders. Choose a broker based on your trading style, risk tolerance, and platform preference.

Contact Us WinProfx 1st Floor, The Sotheby Building, Rodney Bay, Gros-Islet, Saint Lucia P.O Box 838, Castries, Saint Lucia. +971 4 447 1894 [email protected] https://winprofx.com/ Find Us Online Facebook

0 notes

Text

XM Trading - xtradingforexs.com

Trading on XM provides access to forex, CFDs, stocks, and commodities with low spreads, lightning-fast execution, and advanced tools. Perfect for both beginners and experienced traders.

0 notes

Text

Discover the Best Trading Apps in UAE for 2025

The UAE is a rapidly growing financial hub, attracting investors from all over the globe. With advancements in technology, best online trading platforms in UAE, best trading platform in uae, and stock trading platforms in UAE have made trading accessible through mobile apps. Platforms like Apextrader Funding cater to traders by offering tools for enhanced performance. Whether you’re into stocks, forex, or cryptocurrencies, finding the right app can make a huge difference in your journey as a funded trader in UAE or exploring the prop trading in UAE.

Why Trading Apps Are Essential for Modern Investors

Trading apps provide a seamless platform for investors to trade anytime, anywhere. They offer real-time market updates, analytics tools, and secure payment gateways, making them the best trading apps in UAE. In the UAE, where innovation meets finance, these apps support instant funding prop firms in UAE and meet the unique demands of prop trading companies in UAE. Platforms like Apextrader Funding play a crucial role in enabling traders to access global markets through online trading platform in uae and best trading websites in UAE.

Features to Look for in a Trading App

When selecting an app, consider the following factors:

User-Friendly Interface: Ensure the app is easy to navigate, especially for beginners seeking the best trading websites in UAE.

Regulation and Security: Opt for apps regulated by UAE's financial authorities, such as those used by best prop trading firms in UAE.

Market Access: Look for apps offering a wide range of instruments, such as stock trading platforms in uae and forex trading.

Top Trading Apps in UAE for 2025

1. eToro

eToro is one of the best online trading platforms in UAE, popular for its user-friendly interface and innovative features. It’s ideal for users seeking the best trading app for beginners in UAE or instant funding prop firms in UAE.

2. Saxo Bank

Saxo Bank is a robust option for professional traders exploring the prop trading in uae. With access to a vast range of instruments, including stocks and forex, it’s a go-to for those seeking platform trading in uae. Many professional traders also integrate their experience with Apextrader Funding to enhance their strategies.

3. Interactive Brokers (IBKR)

IBKR is renowned as one of the best trading platforms in UAE, offering low fees and global market access. Whether you’re a funded trader in UAE or using online trading platforms in UAE, this app caters to diverse trading styles.

4. XM Trading

XM is one of the best trading apps in uae for forex enthusiasts. It’s especially favored by prop firms in UAE and beginners seeking low spreads and extensive educational resources. Partnering with services like Apextrader Funding can provide even greater leverage for traders.

5. Binance

For cryptocurrency enthusiasts, Binance is a top choice among prop trading companies in uae. With competitive fees and staking options, it’s one of the best online trading platforms in uae for crypto.

How to Get Started with a Trading App in UAE

Research: Compare the features and reviews of stock trading platforms in uae and online trading platforms in UAE.

Verify Regulation: Ensure the app is authorized by UAE’s financial bodies, like those used by best prop trading firms in UAE.

Open an Account: Register and complete KYC with the best trading websites in uae.

Conclusion

Choosing the best trading app in UAE for 2025 depends on your goals and experience level. Platforms like eToro and Saxo Bank serve as excellent stock trading platforms in uae, while Binance is perfect for prop trading companies in UAE. Whether you’re starting with the best trading app for beginners in uae or integrating with Apextrader Funding, these apps help you navigate the UAE’s dynamic financial landscape.

#instant funding prop firm in uae#best online trading platforms in uae#best trading platform in uae#stock trading platforms in uae#best trading app for beginners in uae#best trading websites in uae#platform trading in uae#best trading apps in uae#online trading platform in uae#trading website in uae#funded traderin uae#best prop trading firmsin uae#the prop trading in uae#prop trading companies in uae#prop firm in uae

0 notes

Text

Forex MT4 Plataform, #BUY SWING TRADE #US30Cash INDEX $4.100 Profits. Official Website to have access: wWw.ForexCashpowerIndicator.com . Forex Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell powerful Signals with Smart algorithms that emit signals in big trades volume zones. Works in all Charts inside your Broker MT4 Plataform and all timeframes . ✅ NO Monthly Fees ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notifications 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#US30Cash#forex index#usd30cash#us500cash#us30cash#best forex trade system#forex volume indicators#nt4 bollinger bands#mt4 fibonacci#metatrader4 fibonacci

3 notes

·

View notes

Text

free compotitions

December 01, 2024

Reasons to Participate in Free Demo Contests

Free Entry: Participation costs nothing.

Real Cash Prizes: Win real money without risking your capital.

Gain Experience: Hone your trading skills and test your strategies in a risk-free environment.

Observe Competitors: See how other traders operate and adapt their techniques.

Experiment Safely: Try out new strategies without fearing losing real money.

Compete and Improve: Measure your skills against other traders and identify areas for improvement.

Flexible Access: Trade anytime, anywhere, from a computer, tablet, or smartphone.

Learning Platforms: Download and explore trading platforms before committing to real funds.

Trusted Brokers: Many reputable brokers offer free demo contests to help you practice with

No Obligation: sign up and start trading risk-free.

Demo contests are a valuable way to boost your confidence, refine your strategies, and familiarize yourself with different trading environments. Here are three trustworthy brokers that run demo competitions that we suggest

eightcap

xm trading

Avatrade

for more information on how to start forex trading, visit trybuying.com

0 notes

Text

Top Forex Brokers in the UAE

Understanding the Forex Market in the UAE

The Forex market in the UAE is a vibrant and rapidly growing sector, attracting traders from around the world. Due to its strategic location and robust financial infrastructure, the UAE serves as a hub for Forex trading in the Middle East. Traders benefit from a diverse range of currency pairs and trading instruments, alongside a dynamic economic environment.

Moreover, the increasing interest in Forex trading has led to a proliferation of brokerage firms, providing various services tailored to both novice and experienced traders. Understanding the local market dynamics and economic indicators is crucial for making informed trading decisions.

Key Factors to Consider When Choosing a Forex Broker

When selecting a top forex broker in UAE, several key factors should be considered. First and foremost, regulatory compliance is essential; traders should choose brokers that are licensed and regulated by reputable authorities to ensure their funds are secure. Additionally, the trading platform offered by the broker should be user-friendly and equipped with the necessary tools and features to enhance the trading experience.

Other important factors include the range of currency pairs available, spreads and commissions, customer support, and educational resources. A broker that provides comprehensive learning materials and responsive customer service can significantly improve a trader's experience and success.

Top Forex Brokers in UAE

Several well-established Forex brokers operate in the UAE, catering to a diverse clientele. Among them, brokers like FXTM (Forex Time), IG Markets, and XM are popular choices, known for their competitive spreads and extensive trading platforms. Each of these brokers offers unique features that appeal to different trading styles, from scalping to long-term investment strategies.

Furthermore, many of these brokers provide demo accounts, allowing traders to practice without risking real money. This feature is particularly beneficial for beginners who are looking to familiarize themselves with the Forex market and develop their trading skills.

Regulatory Environment for Forex Trading in the UAE

The regulatory environment for Forex trading in the UAE is primarily governed by two entities: the Central Bank of the UAE and the Securities and Commodities Authority (SCA). The regulations are designed to protect traders and ensure fair trading practices. Brokers operating in the UAE must adhere to strict guidelines regarding capital requirements and client fund segregation.

This regulatory framework enhances the credibility of Forex trading in the region, providing traders with the confidence that their investments are safeguarded. Additionally, the UAE's commitment to maintaining a transparent and stable financial market makes it an attractive destination for Forex trading.

Tips for Successful Forex Trading in the UAE

To achieve success in Forex trading within the UAE, traders should adopt a well-structured approach. Firstly, developing a solid trading plan that includes clear goals, risk management strategies, and a disciplined approach to trading is essential. Traders should also stay informed about local and global economic news that can impact currency movements.

Moreover, leveraging technical and fundamental analysis can provide valuable insights into market trends. Continuous education and adaptation to market changes are vital for long-term success in the Forex market. Engaging with local trading communities or forums can also provide support and additional learning opportunities.

1 note

·

View note

Text

Forex Brokers in Canada: Your 2025 Guide to Choosing the Best

The forex trading market continues to expand across the globe, offering lucrative opportunities for traders of all levels. In Canada, the forex market is thriving, thanks to the country’s strong financial regulatory framework and increasing interest from investors. However, choosing the right broker is critical to ensure a secure, transparent, and profitable trading experience. With so many options available, selecting the most reliable and regulated Forex Brokers in Canada can be a daunting challenge. This guide will help you navigate the competitive forex broker landscape in Canada in 2025. We’ll highlight the top brokers—Eightcap, IC Markets, FP Markets, Octa, BlackBull, XM, FXPro, and FBS—and explain why they stand out. Whether you’re a beginner or an experienced trader, this guide will help you find the broker that matches your trading needs. For in-depth reviews and comparisons, don’t forget to visit Top Forex Brokers Review, your trusted source for evaluating brokers worldwide.

Why Regulation Matters for Canadian Forex Traders

The forex market operates 24/5, with trillions of dollars traded daily. While it offers huge opportunities, it also comes with risks, especially when working with unregulated brokers. In Canada, choosing a regulated broker is essential to ensure that your funds and data are secure.Canadian forex brokers are regulated by IIROC (Investment Industry Regulatory Organization of Canada), which enforces strict standards to protect traders. IIROC ensures brokers operate transparently, comply with financial rules, and segregate client funds to reduce the risk of fraud.However, some of the most popular brokers for Canadians are internationally regulated by reputable authorities like:

Australian Securities and Investments Commission (ASIC)

Financial Conduct Authority (FCA) in the UK

Cyprus Securities and Exchange Commission (CySEC)

Regulation is a key factor that ensures fairness, security, and transparency in your trading environment. By choosing a regulated broker, you can trade confidently, knowing your funds are protected and disputes will be handled fairly.

Top Forex Brokers in Canada for 2025

Here’s a detailed look at the most trusted Forex Brokers in Canada for 2025. These brokers are renowned for their reliability, transparency, and trader-focused features.

1. Eightcap

Eightcap has established itself as a favorite among Canadian traders, offering a seamless trading experience with access to a wide range of financial instruments. Regulated by ASIC, Eightcap is known for its straightforward platform and competitive pricing.

Why Choose Eightcap:

Tight spreads starting from 0.0 pips on major currency pairs.

Supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

Access to over 200 trading instruments, including forex, indices, and cryptocurrencies.

Fast trade execution designed for scalping and day trading.

Eightcap is an excellent choice for beginners and advanced traders alike, thanks to its user-friendly platforms and low-cost trading conditions.

2. IC Markets

IC Markets is one of the largest and most trusted forex brokers worldwide, known for its institutional-grade liquidity and ultra-fast execution speeds. This broker is regulated by ASIC and caters to Canadian traders who demand high transparency and reliability.

Why Choose IC Markets:

Offers raw spread accounts with spreads starting at 0.0 pips.

Compatible with MT4, MT5, and cTrader, providing flexibility for all trading styles.

Access to over 65 currency pairs, commodities, indices, and cryptocurrencies.

Ideal for automated and algorithmic trading strategies.

IC Markets is especially popular among professional traders, thanks to its advanced trading tools and low fees.

3. FP Markets

FP Markets is a well-established broker regulated by ASIC and CySEC, offering Canadian traders access to a diverse selection of assets. With over 15 years of experience, FP Markets is known for its reliability and excellent trading conditions.

Why Choose FP Markets:

Over 10,000 trading instruments, including forex, stocks, and commodities.

Competitive spreads as low as 0.1 pips.

Advanced trading platforms like MT4, MT5, and IRESS.

Multiple account types to suit different trading goals.

FP Markets caters to traders looking for variety and high-quality execution, making it a great option for diversifying your portfolio.

4. Octa

Octa is a globally recognized forex broker that has been gaining traction among Canadian traders. Regulated by CySEC, Octa is known for its beginner-friendly features and innovative tools.

Why Choose Octa:

Low minimum deposit requirements for easy account access.

A copy trading platform that allows new traders to mimic the strategies of expert traders.

Spreads starting from 0.4 pips and no hidden fees.

Educational tools and training resources for novice traders.

With its user-friendly interface and low-entry barriers, Octa is ideal for traders just starting their forex journey.

5. BlackBull Markets

BlackBull Markets is a New Zealand-based broker that has gained a strong reputation among Canadian traders. Known for its ECN trading model, BlackBull Markets provides tight spreads and professional-grade trading conditions.

Why Choose BlackBull Markets:

Leverage of up to 1:500 for experienced traders.

Tight spreads and fast trade execution through direct market access.

Supports MT4 and MT5 platforms with advanced charting tools.

Offers forex, CFDs, and commodities for diverse trading options.

BlackBull Markets is a great choice for traders who value speed, precision, and transparency.

6. XM

XM is a globally renowned forex broker trusted by millions of traders worldwide. With over 1,000 trading instruments, XM is known for its transparency, excellent customer support, and flexible account options.

Why Choose XM:

Negative balance protection for added security.

Free VPS services for eligible clients to enhance trading speeds.

No hidden fees or commissions.

Offers a wide range of trading assets, including stocks, forex, and commodities.

XM’s user-friendly platforms and low deposit requirements make it a top contender for beginners and experienced traders alike.

7. FXPro

FXPro has built a strong reputation as one of the most innovative forex brokers in the industry. Regulated by FCA and CySEC, FXPro provides Canadian traders with access to advanced tools and diverse trading instruments.

Why Choose FXPro:

Multiple platforms available, including MT4, MT5, and cTrader.

Offers fixed and floating spreads with competitive pricing.

Comprehensive research tools and market analysis.

No dealing desk intervention for transparent trading conditions.

FXPro is an excellent choice for traders who value flexibility and cutting-edge technology.

8. FBS

FBS is a popular broker among traders worldwide, offering attractive promotions and beginner-friendly features. Regulated by CySEC, FBS provides Canadian traders with low-risk account options and comprehensive educational tools.

Why Choose FBS:

Cent accounts for trading with minimal risk.

Bonus programs and trading contests to enhance opportunities.

Spreads starting as low as 0.5 pips.

Flexible leverage options to suit different trading preferences.

FBS is ideal for new traders looking to start small and gradually scale their trading activities.

How to Choose the Best Forex Broker in Canada

When selecting a forex broker in Canada, consider the following factors:

Regulation: Ensure the broker is regulated by a reputable authority like IIROC, ASIC, or CySEC.

Trading Platforms: Look for brokers offering robust platforms like MT4, MT5, or cTrader.

Fees and Spreads: Compare trading costs, including spreads, commission fees, and withdrawal charges.

Customer Support: Choose a broker with reliable and responsive support, especially if you're new to trading.

Account Options: Opt for brokers with flexible account types to match your trading style and experience level.

Educational Resources: For beginners, brokers with webinars, tutorials, and educational tools are invaluable.

Conclusion

Forex trading offers significant opportunities for Canadian traders, but success starts with choosing the right broker. The brokers mentioned in this guide—Eightcap, IC Markets, FP Markets, Octa, BlackBull Markets, XM, FXPro, and FBS—are some of the most trusted Forex Brokers in Canada for 2025. They provide secure environments, competitive trading conditions, and advanced tools to support traders of all experience levels. Whether you’re a beginner exploring the forex market or an experienced trader looking for a professional-grade platform, these brokers offer everything you need to trade confidently. For more in-depth reviews and comparisons, visit Top Forex Brokers Review, your ultimate resource for finding the right broker tailored to your needs.

0 notes

Text

Trade Safely: Why Trusted & Regulated Forex Brokers Win?

Forex trading is a highly lucrative but equally risky financial endeavor. To ensure a secure and profitable trading experience, traders must choose trusted & regulated forex brokers. Regulation in the forex market is crucial as it protects traders from fraudulent activities, ensures transparency, and provides a fair trading environment. With thousands of brokers available, selecting a reliable broker that complies with regulatory standards can make a significant difference in a trader’s success.

This article explores why trading with a trusted & regulated forex broker is the safest and most efficient choice. We will also highlight some of the top brokers in the industry, such as FP Markets, BlackBull, Eightcap, OctaFX, FX Pro, IC Markets, FBS, XM, AXI, and Pepperstone, all of which have proven to be secure and reliable choices for traders worldwide.

The Importance of Trading with a Trusted & Regulated Forex Broker

Regulation is the backbone of a transparent and trustworthy forex market. Regulatory bodies such as the Australian Securities and Investments Commission (ASIC), the Financial Conduct Authority (FCA), and the Cyprus Securities and Exchange Commission (CySEC) set strict guidelines to ensure Forex Brokers Review operate ethically and maintain financial stability.

Key advantages of regulated brokers:

Fund Protection: Segregation of client funds ensures that traders’ money is protected from misuse.

Fair Trading Environment: Brokers adhere to fair execution policies, ensuring traders get the best market prices.

Security Against Fraud: Regulated brokers operate under strict rules, reducing the risk of scams.

Reliable Dispute Resolution: Traders can seek assistance from regulatory bodies in case of conflicts with brokers.

Why Choose a Trusted & Regulated Forex Broker?

1. Enhanced Security and Fund Protection

One of the biggest concerns for forex traders is the safety of their funds. Regulated brokers ensure that traders’ funds are held in segregated accounts, preventing misuse and protecting them in case of financial difficulties. For instance, IC Markets and FP Markets store client funds in top-tier banks, providing additional security.

2. Fair and Transparent Trading Conditions

Regulated brokers offer real-time market execution with minimal slippage, tight spreads, and fair pricing. Brokers like Pepperstone and XM provide competitive spreads and superior execution speed, making them excellent choices for scalpers and day traders.

3. Protection from Fraudulent Activities

Unregulated brokers can manipulate market prices, delay order execution, or refuse withdrawals. Trusted & regulated forex brokers, such as FX Pro and Eightcap, follow strict ethical guidelines to ensure traders receive honest trading conditions.

4. Access to Advanced Trading Platforms and Tools

Top-tier forex brokers provide access to advanced trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These platforms offer powerful charting tools, automated trading options, and customizable indicators. BlackBull Markets and Eightcap offer traders sophisticated trading technology to enhance their strategies.

5. Educational Resources and Market Insights

Regulated brokers invest in trader education, offering comprehensive resources such as webinars, e-books, and market analysis. Brokers like FBS and AXI provide extensive educational content to help traders make informed decisions and improve their trading skills.

6. Fast and Transparent Withdrawals

Withdrawal delays are a common problem with unregulated brokers. Trusted & regulated forex brokers ensure smooth and fast withdrawals with clear policies. OctaFX and XM have built strong reputations for their transparent and efficient withdrawal processes.

Top Trusted & Regulated Forex Brokers

1. FP Markets

ASIC-regulated with deep liquidity.

Ultra-low spreads from 0.0 pips.

Multi-asset trading and high-speed execution.

2. BlackBull Markets

FMA and FSA regulated.

ECN pricing model with institutional-grade execution.

Suitable for both retail and professional traders.

3. Eightcap

ASIC and VFSC are regulated.

Specializes in forex, cryptocurrencies, and CFDs.

Competitive spreads and transparent pricing.

4. OctaFX

CySEC-regulated.

Offers negative balance protection.

Various trading bonuses and promotions.

5. FX Pro

FCA, CySEC, and SCB regulated.

Advanced cTrader and MT4/MT5 platforms.

Strong liquidity and reliable execution.

6. IC Markets

ASIC and CySEC regulated.

Ultra-low spreads and lightning-fast execution.

A top choice for scalpers and algorithmic traders.

7. FBS

Internationally regulated with multiple licenses.

Various account types, including zero-spread accounts.

User-friendly platform for beginners.

8. XM

FCA and CySEC regulated.

24/5 multilingual customer support.

Free forex education and daily market analysis.

9. AXI

ASIC and FCA regulated.

Institutional-grade trading conditions.

No minimum deposit is required.

10. Pepperstone

ASIC, FCA, and CySEC regulated.

Tight spreads and rapid trade execution.

Trusted by professional traders worldwide.

How to Choose the Best Trusted & Regulated Forex Broker

Selecting the right broker involves careful consideration of several factors:

Regulation & Licensing: Always verify if the broker is licensed by a reputable financial authority.

Trading Fees & Spreads: Look for brokers with tight spreads and low commissions to minimize costs.

youtube

Trading Platforms & Features: Ensure they provide MT4, MT5, or cTrader with powerful trading tools.

Customer Support: A reliable broker should offer responsive and professional support 24/7.

Deposit & Withdrawal Processes: Choose brokers with transparent and efficient transaction policies.

Leverage & Account Options: Assess different account types and leverage levels based on your risk appetite.

Conclusion

Forex trading requires careful planning and a strong risk management strategy, but the choice of broker is equally important. A trusted & regulated forex brokers ensures a secure, transparent, and fair trading environment. Brokers such as FP Markets, BlackBull, Eightcap, OctaFX, FX Pro, IC Markets, FBS, XM, AXI, and Pepperstone have established themselves as industry leaders, offering traders top-notch trading conditions, robust security, and professional support.By choosing a regulated broker, traders can trade with confidence, knowing that their funds are safe and their trading activities are protected. Always conduct thorough research before selecting a broker to ensure it aligns with your trading goals. With the right broker by your side, you can navigate the forex market successfully and achieve long-term profitability.

0 notes

Text

Top Forex Brokers Reviewed by WikiFX

Top Forex Brokers Reviewed by WikiFX The foreign exchange (forex) market is the largest financial market in the world, operating 24 hours a day, five days a week. With its vast size and continuous operation, choosing a reliable forex broker is crucial for traders. WikiFX, a trusted platform for forex broker reviews, has compiled a list of top forex brokers for 2024. This article provides an overview of some of the best brokers, highlighting their key features and benefits.To get more news about WikiFX, you can visit our official website.

1. FXCM Overview: FXCM is a well-established broker with over 20 years of experience in the forex market. It is regulated in Australia and offers a full license for global business operations.

Key Features:

Competitive spreads starting from 0 pips. Advanced trading platforms including MetaTrader 4 (MT4). Strong regulatory framework ensuring safety and reliability. 2. IC Markets Overview: IC Markets is another prominent broker regulated in Australia. It has been in operation for 15-20 years and is known for its tight spreads and robust trading infrastructure.

Key Features:

Tight spreads from 0.0 pips. Multiple trading platforms including MT4 and MetaTrader 5 (MT5). High liquidity and fast execution speeds. 3. XM Overview: XM is a globally recognized broker with 10-15 years of experience. It is regulated in Australia and offers a wide range of trading instruments.

Key Features:

Low spreads and no hidden fees. Comprehensive educational resources for traders. Multiple account types to suit different trading needs. 4. GO Markets Overview: GO Markets has been in the forex industry for over 20 years. It is regulated in Australia and provides a full license for global business operations.

Key Features:

Competitive pricing structure. Advanced trading tools and platforms. Strong customer support and educational resources. 5. FP Markets Overview: FP Markets is a well-regulated broker with 15-20 years of experience. It offers a full license for global business and is known for its transparency and reliability.

Key Features:

Tight spreads and low trading costs. Multiple trading platforms including MT4 and MT5. Extensive range of trading instruments. 6. FBS Overview: FBS is a relatively newer broker with 5-10 years of experience. It is regulated in Australia and offers a full license for global business operations.

Key Features:

Competitive spreads and low minimum deposit requirements. User-friendly trading platforms. Strong focus on customer education and support. Conclusion Choosing the right forex broker is essential for successful trading. The brokers reviewed by WikiFX, including FXCM, IC Markets, XM, GO Markets, FP Markets, and FBS, offer a range of features and benefits that cater to different trading needs. Whether you are a beginner or an experienced trader, these brokers provide the tools and resources necessary for a successful trading experience.

0 notes

Text

XM Open Account - xtradingforexs.com

Open an account on XM and access a trusted global trading platform. Trade forex, CFDs, stocks, and commodities with low spreads, fast execution, and advanced tools tailored to your needs.

0 notes

Text

Forex Là Gì? Hướng Dẫn Chi Tiết Về Thị Trường Ngoại Hối

1. Giới Thiệu Về Thị Trường Forex

Th��� trường ngoại hối, thường được biết đến với tên gọi Forex (viết tắt của "Foreign Exchange"), là thị trường tài chính lớn nhất và sôi động nhất trên thế giới. Với khối lượng giao dịch trung bình hàng ngày vượt quá 6,6 nghìn tỷ USD, Forex nổi bật nhờ tính thanh khoản cao, khả năng tiếp cận toàn cầu, và cơ hội kiếm lời đa dạng. Forex cho phép các nhà đầu tư, doanh nghiệp và các tổ chức tài chính giao dịch các cặp tiền tệ trên toàn cầu, từ đó thực hiện các chiến lược quản lý rủi ro và đầu cơ.

2. Cơ Chế Hoạt Động Của Thị Trường Forex

2.1. Cặp Tiền Tệ

Trong Forex, các loại tiền tệ được giao dịch theo cặp, ví dụ như EUR/USD (Euro/USD) hoặc GBP/JPY (Bảng Anh/Yên Nhật). Mỗi cặp tiền tệ biểu thị giá trị của một đồng tiền này so với đồng tiền khác. Giá trị của cặp tiền tệ thay đổi liên tục do tác động của các yếu tố kinh tế, chính trị và tâm lý thị trường.

2.2. Cách Thức Giao Dịch

Forex hoạt động 24 giờ một ngày, 5 ngày một tuần thông qua mạng lưới điện tử liên ngân hàng. Các trung tâm giao dịch chính bao gồm London, New York, Tokyo và Sydney, đảm bảo rằng thị trường luôn mở cửa ở một nơi nào đó trên thế giới.

2.3. Đòn Bẩy

Đòn bẩy là công cụ quan trọng trong giao dịch Forex, cho phép nhà đầu tư kiểm soát lượng tiền lớn hơn số vốn mà họ thực sự sở hữu. Ví dụ, với đòn bẩy 1:100, bạn có thể kiểm soát 100.000 USD chỉ với 1.000 USD vốn.

3. Lợi Ích Khi Tham Gia Thị Trường Forex

3.1. Thanh Khoản Cao

Thị trường Forex có thanh khoản rất cao, nghĩa là bạn có thể mua và bán nhanh chóng mà không lo bị thiếu người đối tác. Điều này giúp giảm thiểu rủi ro và chi phí giao dịch.

3.2. Khả Năng Tiếp Cận

Bạn có thể giao dịch Forex từ bất kỳ đâu chỉ cần có kết nối Internet và một thiết bị như máy tính hoặc điện thoại thông minh. Các nền tảng giao dịch hiện đại như MetaTrader 4 và MetaTrader 5 cung cấp các công cụ và biểu đồ phân tích mạnh mẽ.

3.3. Đa Dạng Chiến Lược

Forex cung cấp nhiều cơ hội cho các chiến lược giao dịch ngắn hạn và dài hạn. Bạn có thể thực hiện giao dịch trong ngày (day trading), giao dịch theo tin tức, hoặc giao dịch theo phân tích kỹ thuật.

4. Các Rủi Ro Trong Giao Dịch Forex

4.1. Biến Động Thị Trường

Thị trường Forex có thể rất biến động, với giá trị tiền tệ thay đổi nhanh chóng trong một khoảng thời gian ngắn. Điều này có thể tạo ra cơ hội lớn nhưng cũng tiềm ẩn rủi ro thua lỗ lớn.

4.2. Rủi Ro Đòn Bẩy

Mặc dù đòn bẩy có thể gia tăng lợi nhuận, nó cũng có thể làm tăng mức lỗ nếu thị trường đi ngược lại với dự đoán của bạn. Quản lý đòn bẩy một cách thận trọng là yếu tố quan trọng để giảm thiểu rủi ro.

4.3. Rủi Ro Thanh Khoản

Trong một số trường hợp, đặc biệt là khi giao dịch với các cặp tiền tệ ít ph�� biến, bạn có thể gặp khó khăn trong việc tìm đối tác giao dịch hoặc giá có thể thay đổi đáng kể khi cố gắng thực hiện lệnh lớn.

5. Cách Bắt Đầu Giao Dịch Forex

5.1. Chọn Sàn Giao Dịch Uy Tín

Để bắt đầu, bạn cần chọn một sàn giao dịch Forex uy tín. Các yếu tố cần xem xét bao gồm giấy phép và quản lý, mức đòn bẩy và spread, phương thức nạp rút tiền, và dịch vụ chăm sóc khách hàng. Một số sàn Forex uy tín như XM, Exness, IC Markets, và FXPro thường được khuyến nghị do tính minh bạch và chất lượng dịch vụ cao.

5.2. Mở Tài Khoản Giao Dịch

Sau khi chọn sàn, bạn cần mở tài khoản giao dịch. Quá trình này thường yêu cầu bạn cung cấp thông tin cá nhân và xác minh danh tính. Nhiều sàn giao dịch cung cấp tài khoản demo để bạn có thể làm quen với nền tảng trước khi giao dịch thực.

5.3. Nạp Tiền Vào Tài Khoản

Bạn có thể nạp tiền vào tài khoản qua nhiều phương thức khác nhau như chuyển khoản ngân hàng, thẻ tín dụng, hoặc ví điện tử. Hãy kiểm tra các quy định về nạp và rút tiền của sàn để đảm bảo rằng chúng phù hợp với yêu cầu của bạn.

5.4. Bắt Đầu Giao Dịch

Khi đã có tiền trong tài khoản, bạn có thể bắt đầu giao dịch bằng cách chọn cặp tiền tệ và thực hiện lệnh mua hoặc bán dựa trên phân tích thị trường của mình. Bạn có thể sử dụng các công cụ phân tích kỹ thuật và cơ bản để hỗ trợ quyết định giao dịch.

6. Các Công Cụ Hỗ Trợ Giao Dịch Forex

6.1. MetaTrader 4 và MetaTrader 5

MetaTrader 4 (MT4) và MetaTrader 5 (MT5) là hai nền tảng giao dịch phổ biến nhất hiện nay. Chúng cung cấp các công cụ phân tích kỹ thuật, biểu đồ nâng cao, và khả năng tự động hóa giao dịch thông qua các chiến lược Expert Advisors (EA).

6.2. Công Cụ Phân Tích Kỹ Thuật

Công cụ phân tích kỹ thuật như Moving Averages, RSI, MACD, và Fibonacci Retracement giúp bạn nhận diện xu hướng thị trường và đưa ra quyết định giao dịch chính xác hơn.

6.3. Tin Tức và Lịch Kinh Tế

Các sự kiện kinh tế và chính trị có thể ảnh hưởng mạnh đến thị trường Forex. Sử dụng lịch kinh tế và các nguồn tin tức đáng tin cậy để theo dõi các thông tin quan trọng có thể giúp bạn dự đoán và phản ứng kịp thời với các biến động thị trường.

7. Lời Khuyên Cho Người Mới Bắt Đầu

7.1. Học Tập và Nghiên Cứu

Hãy dành thời gian để học hỏi và nắm vững các khái niệm cơ bản về Forex. Sử dụng các tài liệu hướng dẫn, khóa học trực tuyến, và tài khoản demo để làm quen với thị trường trước khi giao dịch thực.

7.2. Quản Lý Rủi Ro

Luôn đặt các mức cắt lỗ (stop loss) và chốt lời (take profit) để bảo vệ vốn đầu tư của bạn. Đừng bao giờ đầu tư toàn bộ số vốn vào một giao dịch duy nhất.

7.3. Cập Nhật Liên Tục

Thị trường Forex thay đổi liên tục, vì vậy việc cập nhật kiến thức và thông tin mới nhất là rất quan trọng. Theo dõi các xu hướng thị trường và tin tức để có những quyết định giao dịch thông minh.

8. Kết Luận

Forex là một thị trường đầy cơ hội nhưng cũng tiềm ẩn nhiều rủi ro. Để thành công trong giao dịch Forex, bạn cần có kiến thức vững vàng, kỹ năng phân tích tốt, và một chiến lược quản lý rủi ro hợp lý. Bằng cách lựa chọn đúng sàn giao dịch, sử dụng các công cụ hỗ trợ hiệu quả, và duy trì kỷ luật trong giao dịch, bạn có thể tận dụng tối đa tiềm năng của thị trường Forex để đạt được các mục tiêu tài chính của mình. Hãy bắt đầu hành trình của bạn với sự tự tin và kiến thức để biến Forex thành một công cụ mạnh mẽ trong việc xây dựng tương lai tài chính của bạn.

1 note

·

View note