#forex 500 pips per day

Explore tagged Tumblr posts

Text

03. Forex Trading on a Budget: How Much Cash Do You Need to Start?

The Basics: Understanding Forex Trading

The amount of money needed to start trading forex is a common question among beginners. It’s important to understand that while forex trading can potentially be lucrative, it is not a get-rich-quick scheme. Success in the forex market requires dedication, hard work, and continuous learning.

Key Principle: Money Management

One of the key principles of trading forex is money management. Over-capitalization, which involves risking more money than one can afford to lose, should be avoided. Many individuals are lured into forex trading with the hope of achieving high returns, only to over-leverage and over-trade their accounts into significant losses.

Avoiding Under-Capitalization

On the other hand, under-capitalization, where a trader does not have sufficient funds to trade safely, can also lead to substantial losses. While some brokers offer minimum account deposits as low as $1 or $25, it is advisable to start with a more substantial amount. Beginning with a modest capital amount can help new traders effectively manage risks.

Safe Starting Amount

So, how much money do you need to start trading forex? It is generally considered safe to start with at least $300 and trade with 0.01 lot per trade. This approach allows for gradual account balance growth and helps avoid overleveraging and the risk of complete fund loss.

Effective Money Management

When it comes to money management, it is recommended to risk only 2% of your capital per trade. This means that if you have a $500 account, you should risk no more than $10 on a single trade. Additionally, it’s wise to trade only 2–3 currency pairs per day to balance risk management.

Risk and Reward Ratio

In terms of risk and reward, it’s essential to maintain a 1:3 risk to reward ratio. This means that for every 1 pip in your stop-loss, you should aim to gain 3 pips of profit. Trading in micro lots requires careful consideration of trade selection, focusing on high-probability trades with well-defined support and resistance criteria.

The Path to Success

Ultimately, achieving success in forex trading requires dedication, time, and continuous learning. While it is possible to generate significant returns from forex trading, it’s important to approach it with a realistic mindset and a focus on prudent risk management.

Conclusion

In conclusion, the amount of money needed to start trading forex is a critical consideration for beginners. By adhering to principles of money management, avoiding over-capitalization and under-capitalization, and focusing on risk management and realistic expectations, individuals can embark on their forex trading journey with a greater likelihood of success.

Free Forex Course

#finance#forex#stock market#learn forex trading#forex broker#forex education#forex trading#forexsignals#forex market#forextrading#technical analysis#investing

1 note

·

View note

Text

The Perils of Unrealistic Expectations in Forex Trading

In the world of forex trading, where fortunes can be made and lost in the blink of an eye, it's essential to have a clear understanding of what's realistic and what's not. This article explores two common but unrealistic expectations that novice traders often harbor and the potential pitfalls that come with them.

Mistake No. 1: Hoping to Transform a $500 Account into $10,000 in a Few Months

The allure of turning a small trading account into a substantial fortune in a short time is a dream many traders chase. The idea of taking a mere $500 and magically multiplying it into $10,000 within a few months seems tantalizingly achievable. While it's not impossible, the reality is far more sobering.

Here's the hypothetical scenario: You start with a $500 trading account, and you decide to risk your entire capital on a single trade. If, by some stroke of luck, the market moves in your favor with a 1:1 risk/reward ratio, you exit the trade with a doubled account—$1,000. Repeat this process a few times, and voilà, you have $10,000.

However, let's pause for a moment and consider the harsh truth. Less than 0.1% of traders will successfully pull off this feat. The reason? Excessive risk-taking. Trading isn't akin to gambling, and taking reckless risks with your hard-earned money is a recipe for disaster. The lure of quick riches often leads traders to ignore prudent risk management practices, which ultimately results in blowing up their trading accounts.

Here's a real-life anecdote to drive the point home. Imagine a college student with a starting capital of $10,000 who believes that making a consistent 20% monthly return is a realistic goal. If achieved, this would yield $2,000 a month, which seems more than sufficient to meet their needs. However, a wise decision prevailed. Instead of quitting school immediately, the student decided to give trading a few months. They set a condition: if they could achieve a 20% return for six consecutive months, then they would consider quitting school. Unsurprisingly, that day never arrived.

Mistake No. 2: Seeking to Make 10 Pips a Day, No Matter What

Another common unrealistic expectation in forex trading is the desire to make a fixed number of pips daily, regardless of market conditions. On the surface, this goal seems reasonable. Earning 10 pips a day may translate to $100 in profits (assuming 1 standard lot) and $2,000 per month (based on 20 trading days). However, this approach overlooks a critical aspect of trading—market dynamics.

Every trading strategy is tailored to specific market conditions. For instance, a trend trading strategy thrives in trending markets, while a range trading strategy excels in sideways or range-bound markets. The truth is, no trading strategy works effectively all the time because market conditions are in constant flux.

Aiming to make a fixed number of pips each day, regardless of market conditions, can lead to suboptimal decisions. Traders may resort to averaging into their losses, widening their stop losses, or impulsively chasing market moves. Such actions can result in significant losses and undermine the very foundation of a trading strategy.

The bottom line is this: instead of rigidly pursuing a set daily, weekly, or monthly pip target, traders should focus on aligning their strategies with prevailing market conditions. Flexibility and adaptability are essential in responding to the ever-changing dynamics of the forex market.

In conclusion, successful forex trading requires a realistic mindset and a deep understanding of market dynamics. Unrealistic expectations, such as rapidly multiplying a small account or fixating on daily pip targets, can lead to disappointment and financial losses. To thrive in forex trading, approach it with discipline, prudent risk management, and a willingness to adapt to changing market conditions.

For the best Forex VPS solutions, visit cheap-forex-vps.com to enhance your trading experience with top-notch virtual private servers tailored for forex trading.

#vpsforex#cheap forex#cheap vps forex#forex vps#forex trading servers#forex vps Malaysia#best trading vps#forex vps India#forex vps Italy#forex vps Nigeria#forex vps Latvia#forex vps Singapore#forex vps Australia#forex vps United Kingdom#forex vps USA#forex vps Canada

0 notes

Text

XM Broker Review 2023: A Comprehensive Analysis of Trading Fees and Services

XM Broker Review 2023 XM is a global forex and CFD broker regulated by Australia's ASIC, CySEC of Cyprus, and Belizean authority IFSC. XM has low stock CFD and withdrawal fees. Account opening is user-friendly and fast. You can use many educational tools, such as webinars and a demo account. On the other hand, XM has a limited product portfolio as it offers mainly CFDs and forex trading. Its forex and stock index CFD fees are average, and there is no investor protection for clients onboarded outside the EU. XM is a regulated broker, it is overseen by top-tier financial regulators in multiple countries . XM is also covered by investor protection in selected jurisdictions. XM Highlights 🗺️ Country of regulationCyprus, Australia, Belize, United Arab Emirates💰 Trading fees classAverage💰 Inactivity fee chargedYes💰 Withdrawal fee amount$0💰 Minimum deposit$5🕖 Time to open an account1 day💳 Deposit with bank cardAvailable👛 Depositing with electronic walletAvailable💱 Number of base currencies supported10🎮 Demo account providedYes🛍️ Products offeredForex, CFD, Real stocks for clients under Belize (IFSC) Visit Broker74.89% of retail CFD accounts lose money

Fees

XM has low trading fees for CFDs and charges no withdrawal fee. On the other hand, forex and stock index fees are only average, and there is a fee for inactivity. AssetsFee levelFee termsS&P 500 CFDLowThe fees are built into the spread, 0.4 points is the average spread cost during peak trading hours.Europe 50 CFDAverageThe fees are built into the spread, 2.5 points is the average spread cost during peak trading hours.EURUSDAverageWith Standard, Micro, and Ultra-Low accounts the fees are built into the spread. 1.7 pips is the Standard account's average spread cost during peak trading hours. With XM Zero accounts, there is a $3.5 commission per lot per trade and a small spread cost.Inactivity feeLow$15 one-off maintenance fee after one year of inactivity, followed by $5 per month fee if the account remains inactive XM trading fees XM trading fees are average. XM has many account types, which all differ in pricing. The Standard, Micro, and Ultra Low accounts charge higher spreads but there is no commission. The XM Zero account charges lower spreads, but there is a commission. The following calculations were made using the Standard account. We know it's hard to compare trading fees for CFD brokers. So how did we approach the problem of making their fees clear and comparable? We compared brokers by calculating all the fees of a typical trade for selected products. We chose popular instruments within each asset class: - Stock index CFDs: SPX and EUSTX50 - Stock CFDs: Apple and Vodafone - Forex: EURUSD, GBPUSD, AUDUSD, EURCHF and EURGBP A typical trade means buying a leveraged position, holding it for one week and then selling. For volume, we chose a $2,000 position for stock index and stock CFDs, and $20,000 for forex transactions. The leverage we used was: - 20:1 for stock index CFDs - 5:1 for stock CFDs - 30:1 for forex These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Let's see the verdict for XM fees. CFD fees XM has low stock CFD, while average stock index CFD fees. XMFxProAdmirals (Admiral Markets)S&P 500 index CFD fee$2.5$1.1$1.4Europe 50 index CFD fee$3.1$1.2$1.4Apple CFD fee$6.7$9.4$5.3Vodafone CFD fee$2.3$14.7$14.2 Visit Broker74.89% of retail CFD accounts lose money

Account opening

XM accepts customers from all over the world. There are a few exceptions though; among others, you can't open an account from the USA, Canada, China, Japan, New Zealand or Israel. What is the minimum deposit at XM? The required XM minimum deposit is $5 for two XM Account types (Micro, Standard), which is very low, and $100 for the XM Zero account. Account types XM offers many account types, which differ in pricing, base currencies, minimum deposit and contract size. MicroStandardXM ZeroShares AccountClient countryEEA Australia Other countriesEEA Australia Other countriesEAANon-EEA and non-Australian clientsPricingNo commission, but higher spreadNo commission, but higher spreadThere is a commission, but the spread is very lowMarket spread and commissionBase currenciesUSD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, SGD, ZARUSD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, SGD, ZARUSD, EUR, JPYUSDMinimum deposit$5$5$100$10,000Contract size1 Lot = 1,0001 Lot = 100,0001 Lot = 100,0001 share Islamic or swap-free accounts are also available. With Islamic accounts, a flat commission is charged if you hold your leveraged position overnight instead of the percentage-based financing rates. XM doesn't offer corporate accounts. If you sign up for a non-European entity, you will not be eligible for European client protection measures. How to open your account XM account opening is fully digital, fast and straightforward. You can fill out the online application form in 20 minutes. Our account was verified on the same day. You can select many languages other than English: ArabicBengaliChineseCzechDutchFilipinoFrenchGermanGreekHungarianIndonesianItalianKoreanMalayPolishPortugueseRussianSpanishSwedishThaiVietnamese To open an account at XM, you have to go through these steps: - Fill in your name, country of residence, email address and telephone number. - Select the trading platform (MT4 or MT5) and account type. - Add your personal information, such as your date of birth and address. - Select the base currency and the size of the leverage. - Provide your financial information and answer questions about your financial knowledge. - Verify your identity and residency. You can upload a copy of your national ID, passport or driver's license to verify your identity, while utility bills and bank statements are accepted as proof of residency. Visit Broker74.89% of retail CFD accounts lose money

Deposit and withdrawal

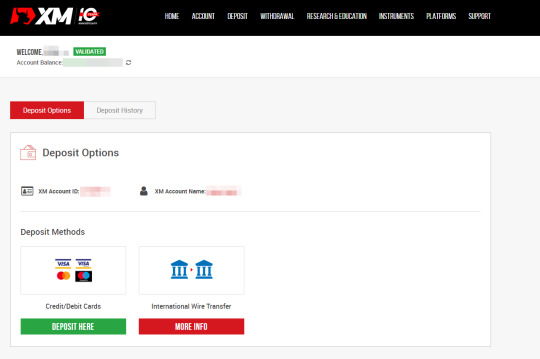

Account base currencies At XM, you can choose from 9 base currencies. The available base currencies are: EURUSDGBPCHFJPYAUDSGDPLNHUFZAR XMFxProAdmirals (Admiral Markets)Number of base currencies10811 Why does this matter? For two reasons. If you fund your trading account in the same currency as your bank account or you trade assets in the same currency as your trading account base currency, you don't have to pay a conversion fee. Deposit fees and options XM charges no deposit fees. You can use bank transfers and credit/debit cards for depositing funds. Clients onboarded under IFSC can also deposit using the SticPay electronic wallet. XMFxProAdmirals (Admiral Markets)Bank transferYesYesYesCredit/debit cardYesYesYesElectronic walletsYesYesYes A bank transfer can take several business days, while payment with a credit/debit card is instant. You can only deposit money from accounts that are in your name.

XM review - Deposit and withdrawal - Deposit XM withdrawal fees and options XM charges no withdrawal fees. The only exception is bank (wire) transfers below $200, which incur a $15 fee. XMFxProAdmirals (Admiral Markets)Bank transferYesYesYesCredit/debit cardYesYesYesElectronic walletsYesYesYesWithdrawal fee$0$0$0 For credit/debit cards and electronic wallets (Skrill, Neteller), the withdrawal amount cannot exceed the amount you deposited using the same instrument. This means that you can only withdraw your trading profits via bank transfer. How long does it take to withdraw money from XM? We tested debit card withdrawal and it took 2 business days. You can only withdraw money to accounts that are in your name. How do you withdraw money from XM? - Log in to your account - Go to 'Withdraw Funds' - Select the withdrawal method - Enter the withdrawal amount Visit Broker74.89% of retail CFD accounts lose money

Web trading platform

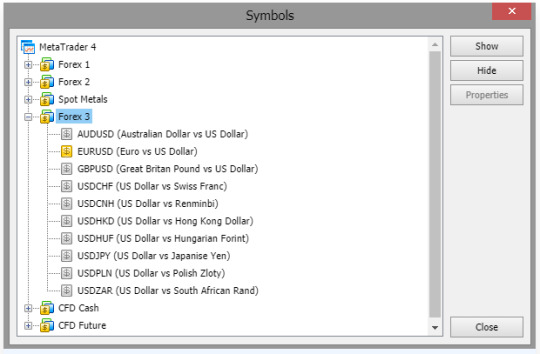

Trading platformScoreAvailableWeb2.8starsYesMobile3.8starsYesDesktop3.4starsYes XM does not have its own trading platform; instead, it uses third-party platforms: MetaTrader 4 and MetaTrader 5. These platforms are very similar to each other in functionality and design. One major difference is that you can't trade stock CFDs on MetaTrader 4, only on MetaTrader 5. We tested the MetaTrader 4 platform as it is more widely used. MetaTrader 4 is available in an exceptionally large number of languages. XM web trading platform languagesArabicBulgarianChineseCroatianCzechDanishDutchEnglishEstonianFinnishFrenchGermanGreekHebrewHindiHungarianIndonesianItalianJapaneseKoreanLatvianLithuanianMalayMongolianPersianPolishPortugueseRomanianRussianSerbianSlovakSlovenianSpanishSwedishTajikThaiTraditional ChineseTurkishUkrainianUzbekVietnamese Look and feel The XM web trading platform has great customizability. It is easy to change the size and the position of the tabs. However, the platform feels outdated and some features are hard to find. For example, it took us a while to figure out how to add an asset to the watchlist.

Visit Broker74.89% of retail CFD accounts lose money XM review - Web trading platform Login and security XM requires two-step authentication for the account login on the website where you can deposit and withdraw. The trading platform itself, however, doesn't have two-step authentication. Search functions The search functions are OK. You can find assets grouped into various categories. However, we missed the usual search function where you can type in the name of an asset manually.

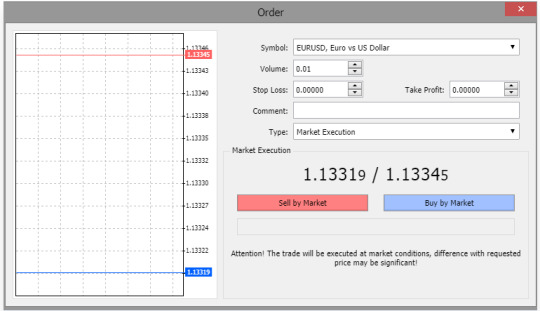

XM review - Web trading platform - Search Placing orders You can use all the basic order types. However, you won't find more sophisticated order types such as 'one-cancels-the-other'. The following order types are available: - Market - Limit - Stop - Trailing Stop Trailing Stop is available only in the MT4 desktop platform To get a better understanding of these terms, read this overview of order types. There are also order time limits you can use: - Good 'til canceled (GTC) - Good 'til time (GTT)

XM review - Web trading platform - Order panel Alerts and notifications You cannot set alerts and notifications on the XM web trading platform. This feature is available only on the desktop trading platform. Portfolio and fee reports XM has clear portfolio and fee reports. You can easily see your profit-loss balance and the commissions you paid. These reports can be found under the 'History' tab. We couldn't find a way to download them.

Mobile trading platform

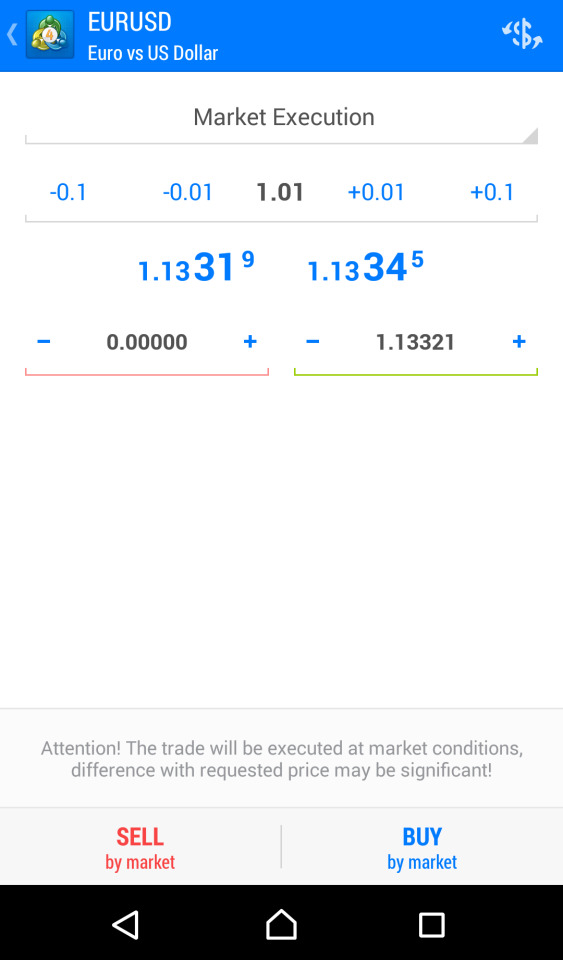

XM offers MetaTrader 4 and MetaTrader 5 mobile trading platforms. Similarly to the web trading platform, we tested the MetaTrader 4 platform on Android. Once you have downloaded the MT4 mobile trading platform, you should access the relevant XM server. Just like on the web trading platform, you can choose from many languages on the mobile trading platform as well. Changing the language is a bit tricky on Android devices, as you can do it only if you switch the default language of your mobile. XM mobile trading platform languagesArabicChinese (Simplified)Chinese (Traditional)CzechEnglishFrenchGermanGreekHindiIndonesianItalianJapaneseKoreanPolishPortuguesePortuguese (Brazil)RussianSpanishThaiTurkishUkrainianVietnamese Look and feel XM has a great mobile trading platform, we really liked its design and user-friendliness. It is easy to find all the features it provides.

XM review - Mobile trading platform Login and security XM requires only one-step login for the platform, but provides two-step account login to access deposit and withdrawal functions. A two-step login procedure for the trading platform would be safer. You can't use fingerprint or Face ID authentication. Offering this feature would be more convenient. Search functions The search functions are good. You can search by typing the name of the product or by navigating the category folders.

XM review - Mobile trading platform - Search Placing orders You can use the same order types and order time limits as on the web trading platform.

XM review - Mobile trading platform - Order panel Alerts and notifications You can set alerts and notifications for your mobile, although only through the desktop trading platform. It would be much easier if you could set these notifications on the mobile trading platform as well. Visit Broker74.89% of retail CFD accounts lose money

Desktop trading platform

For desktop trading too, you can use the MetaTrader 4 and 5 platforms; we tested MetaTrader 4. It has the same design, is available in the same languages, offers the same order types, has the same search functions, and offers the same portfolio and fee reports as the web trading platform. The desktop trading platform doesn't have two-step authentication; however, XM provides a two-step account login procedure on the website where you can deposit and withdraw funds. The major difference is that you can set alerts and notifications on the desktop trading platform in the form of mobile push and email notifications. To set these, you have to add your email address and mobile MetaQuotes ID (you can find it in the MT4 app's settings). You can add them if you go to 'Tools' and then 'Options'.

Markets and products

XM is a CFD and forex broker with a great number of currency pairs available for trading. However, the CFD selection is lower compared to some XM alternatives. Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74.89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. XMFxProAdmirals (Admiral Markets)Currency pairs (#)557047Stock index CFDs (#)242943Stock CFDs (#)1,2611,7003,252ETF CFDs (#)--372Commodity CFDs (#)152528Bond CFDs (#)--2Cryptos (#)*-3042 Cryptos are available for customers onboarded under XM Global Limited entity. You can't change the leverage levels of the products, which is a drawback. Changing the leverage manually is a very useful feature when you want to lower the risk of your trade. Be careful with forex and CFD trading, as the preset leverage levels may be high. Real stocks and ETFs XM provides real stocks for clients onboarded under XM's IFSC-regulated entity. You can trade stocks only using the Shares Account. It is a big addition compared to its competitors. XMFxProAdmirals (Admiral Markets)Stock markets (#)3-11ETFs (#)--192 Visit Broker74.89% of retail CFD accounts lose money

Research

Trading ideas XM provides trading ideas under the 'Trade Ideas' tab, where you can find various assets and their recent performances. Read the full article

3 notes

·

View notes

Text

Fp markets

#Fp markets pro

#Fp markets plus

#Fp markets plus

It will be automatically deleted after 30 days of inactivityįor stockbroking accounts it gets a lot higher, minimum $1000, plus the IRESS monthly fee If you want to expand your research, and evaluate some options similar to this broker, you can consult the alternatives to FP Markets. The table below helps chart some of the main pros and cons in key broker areas. This starts at a low point of $1,000 up to $50,000 depending on your account type so may not be feasible for more casual traders. The minimum deposit on a stockbroking account here is also very high. That would certainly discourage less-experienced traders. The monthly fee you will encounter here is also high at $55 per month to use the IRESS/Viewpoint platform. Starting with downsides of the broker, if you are looking to use the IRESS platform you will find this is only available to Australian traders. Though it is costly to manage, the IRESS service also provides great depth for more experienced traders at FP Markets. This extensive selection is supported by a great low-fee environment that is ideal for the casual trader with no inactivity fee charged at all. Pros and Cons ProsĪt FP Markets, one of the major positives is the fact you will have a wealth of assets to choose from in trading. They are further secured by offering negative balance protection, segregated accounts, and ICF insurance coverage to EU traders. When it comes to physical presence, they do only have two offices internationally but continue to offer great service worldwide including in Australia where, as a high volume stock trader you can benefit from specific accounts and features for stockbroking. You will also find a wide variety of account types here to fit every need. To back up their trusted reputation the broker has won more than 30 awards over the years. With more than 10,000 assets and different execution methods available, FP Markets is perfect for a range of traders. ( 74-89% of retail CFD accounts lose money)įP Markets is both an ECN/STP and DMA broker with spreads from 0 pips, regulated by both CySEC, and ASIC and very well known for its IRESS stockbroking service (not available outside Australia) and its wide range of assets. This can help you see exactly what they have to offer. With that in mind, you can take advantage of an excellent demo account offered by FP Markets. There are many things to consider when starting out with a broker. Very well-regulated by CySEC, ASIC, and SVG.In this FP Markets review, the expert InvestinGoal team has taken a closer look at all the key features of the broker including trading platforms, costs, minimum deposits, and more. Among traders, FP Markets is renowned for the lightning-fast execution speeds they offer. Regulatory oversight comes from some of the most respected bodies in the industry with CySEC, ASIC, and SVG all available. Founded in 2005 the broker is also very well-regulated. The company's outstanding 24/7 multilingual service has been recognized by Investment Trends as home to some of the most content clients in the industry, having been awarded 'The Highest Overall Client Satisfaction Award,' five years running from Investment Trends.įP Markets has been awarded as the ' Global Forex Value Broker' in three consecutive years (2019, 2020, 2021) at the Global Forex Awards.įP Markets has been awarded the " Best Forex Trading Experience in the EU" at the Global Forex Awards 2021.FP Markets is an experienced Australian ECN broker.

#Fp markets pro

FP Markets is an Australian Regulated global Forex Broker with more than 17 years of industry experience.įP Markets offers highly competitive interbank Forex spreads available from 0.0 pips and leverage up to 500:1 on its pro account.ĭownload FP Markets' Mobile App and trade on the go across several powerful online platforms like MetaTrader4, MetaTrader5, WebTrader, and Iress.

2 notes

·

View notes

Text

Honest Forex Broker Review - Fx Pro

Fx Pro Trading Brokerage Fully Reviewed

In this summary we are going to make a fully reviewed explanation of Fx Pro trading brokerage in some detail.

About FxPro

Founded in 2006, FxPro has executed more than 500 million orders since its inception and has serviced more than 1.8 million clients in over 173 countries. As of 2021, FxPro lists over $100m in Tier 1 Capital and has more than 200 employees across its 4 offices.

The FxPro brand holds regulatory licenses in the United Kingdom (UK) under FxPro UK Limited, Cyprus under FxPro Financial Services Limited, South Africa, and the Bahamas. Making Fx Pro a highly trusted broker by many retail & institutional traders.

FxPro competes among the top MetaTrader brokers, offering the full suite of MT4 and MT5 platforms with multiple accounts and execution methods. The only drawback to an otherwise balanced forex broker is pricing that is slightly higher than the industry average.

In the below table please take your time to view some of Fx Pro's features & benefits:

Start Trading Like A Pro With Fx Pro

Is FxPro Safe?

FxPro is considered very low-risk, with an overall Trust Score of 93 out of 99. FxPro is not publicly traded and does not operate a bank. FxPro is authorized by one tier-1 regulator (high trust), two tier-2 regulators (average trust), and one tier-3 regulator (low trust). FxPro is fully authorized & regulated by the following tier-1 regulators: Financial Conduct Authority (FCA). Fx Pro is extremely unlikely to be a scam broker. and has been tried & tested by Fx Brokers Empire.

Commissions and Fees FxPro's pricing is slightly higher than the industry average, putting it at a small disadvantage compared to its peers, such as Etoro or HF Markets, who both also offer the full MetaTrader and cTrader suites just like FxPro does. However what they lose in price is far outweighed with better options & service. Execution method: On FxPro MT4, you can choose either variable or fixed spreads. For the variable spread pricing, there are two types of execution-based pricing: instant and market. Instant execution is subject to requotes but no slippage, while market execution has the potential for slippage but without requotes. Commissions: FxPro offers its most competitive spreads on its cTrader platform, which uses commission-based pricing. FxPro's effective spread to trade EUR/USD is roughly 1.27 pips, based on 0.37 average spread + 0.9 pip commission equivalent on cTrader, using August 2020 data. Spreads: FxPro's floating rate model (variable spread) is available on both MT4 and MT5, with EUR/USD spreads of 1.57 pips for accounts on market execution (1.51 pips on MT5) and 1.71 for accounts with instant execution, as per August 2020 data from FxPro. Fixed pricing: On MT5, there is no fixed spread offering, and only market execution is available. Other platforms such as MT4 and web traders offer fixed pricing models. Active traders: FxPro offers an Active Trader program, & provides loyalty rewards for its longstanding traders. Executing large orders: Without question, FxPro's best feature is its ability to execute large trading orders, which can be placed with no minimum distance away from the current market price. A high liquidity broker which is important for high frequency & big money traders

Platforms and Tools Thanks to offering MetaTrader, cTrader, and its own in built proprietary FxPro Edge web platform, traders at FxPro have a diverse selection of platform options depending on their trading style. Both beginners & experts can enjoy trading and perform with there respective platforms. MetaTrader suite: FxPro offers the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platform for web and desktop. A notable add-on is available for MT4 which is the suite of trading tools from Trading Central that can be rather helpful. cTrader: The FxPro cTrader platform is available for web and desktop. The cAlgo platform can also be used to enable algorithmic trading when using cTrader at FxPro. Proprietary platform: FxPro Edge is a light web-based platform that has robust charts and a responsive design. There are a few default layouts, and users can drag and drop the modules to rearrange them and add new widgets. Overall, there is a good foundation established for the future, especially for such a new in built platform. There will definitely be more updated features to this platform to enhance traders performance. Research FxPro provides great daily market updates and analysis on its blog, along with content from third-party providers. Overall, we found the written articles from FxPro's in-house staff to be of a good quality. More Video content would help fill the gap in research, as FxPro's YouTube channel is mostly webinars, platform tutorials, and promotional videos. FxPro News blog: There are multiple articles per day available on FxPro's dedicated blog, including its 'Market Snapshots' series. These articles provide a daily outlook and are nicely organized, making it easy to consume, understand & apply in volatile market conditions. Traders dashboard: FxPro has a client portal where users can access sentiment data for various symbols and forex pairs, along with the trading session times and a summary of gainers and losers. There is also an integrated economic calendar. Adding trading capabilities to the client portal, or merging these features with the Edge platform, would help to centralize these resources in one place.Fx Pro Education FxPro has a general education section where it provides written materials, along with some educational videos on its website. Overall, FxPro has a good foundation of educational content. Expanding its coverage and adding other videos on some more advanced trading elements would balance out the FxPro educational offering.Written content: FxPro's educational section features mini cards with key information and short paragraphs explaining things like "what is a stop out" in less than six sentences. There are 36 cards in the Psychology section and four other areas, each with a collection of learning cards. There is even progress tracking, so you know which modules or chapters you have finished, which is a nice touch.

Mobile Trading

Alongside providing its proprietary FxPro Direct app for trading, account management, and basic market news, FxPro's mobile lineup is powered by the same third-party providers as its desktop and web-based platforms: MetaTrader (Meta Quotes) and cTrader (Spotware).

cTrader: FxPro's white-labeled version of cTrader is consistent with the web-based platform, offering traders a really friendly & easy to use trading experience with a variety of trading tools. As far as third-party mobile apps go, cTrader is very versatile.

MetaTrader: The mobile versions of the MT4 and MT5 platforms are presented as standard from the developer with default features. In 2021, FxPro is a Best in Class MetaTrader Broker due to a range on smart trading indicators & strong liquidity.

FxPro Direct: The FxPro Direct app is the broker's proprietary mobile app which supports trading for users that have a CFD account, but is mainly optimized for account management. With just a quotes, trades, and history tab, we found that the FxPro Direct app was not very ideal for trading, compared to FxPro's other available mobile platforms. Meanwhile, the FxPro Edge platform is not yet available for mobile.

While FxPro does not stand out for its pricing, FxPro is a well-capitalized, trustworthy broker that offers multiple platform options, multiple execution methods, and, for professionals, can cleanly execute large orders. Fx Pro Trust FxPro scores quite well when it comes to reputation and trustworthiness. Most importantly, they are regulated in the United Kingdom, which is reputedly safer than some regulators in the EU. FxPro also advertises that they have one of the highest counterparty credit ratings in the industry, scoring a whopping 95 on a hundred point scale, where a high score indicates a lower risk of default or bankruptcy. They also participate in the Financial Services Compensation Scheme (FSCS) that allows clients to claim compensation in the event FxPro were to become insolvent up to £80,000. They also offer clients negative balance protection under new EU guidelines that prevent clients from losing more money than they have deposited. So they are clearly not worried about liquidity issues as they have good insurances in place. One negative for FxPro is the absence of guaranteed stop‑loss orders. Some brokers offer this feature for a fee, but this is not offered by FxPro at all. Fx Pro Special Features FxPro offers traders algorithmic trading through cTrader, which is an advanced algo and technical indicator coding application that allows traders to create and build algorithmic trading strategies and custom indicators. This is a smart technological feature that is not offered by many brokers and definitely worth checking out. FxPro also offers a Virtual Private Server (VPS) that enables clients to upload and run MT4 Expert Advisors and algo bots, 24 hours a day, without needing to keep the trading terminal running. These applications also allow for back testing of trading strategies.

Fx Pro Customer Support FxPro prides itself on its "five‑star customer service," specifically its multilingual, 24‑hour Monday‑through‑Friday (24/5) customer service team. Their live phone support operates in several locations with a toll‑free number in the U.K., France, Germany, UAE, and Russia. Live chat is offered for both live trading clients and prospective clients. Unlike other brokers, they have a physical office in London with a reception desk that is open from 7:30 a.m. to 4:30 p.m. Some social media support is available on Twitter, but this is mainly news related rather than specifically for customer support.

Please Note: The FCA has a ban in place for the sale of crypto-derivatives to UK retail consumers as from 6th January 2021.

Fx Brokers Empire's Conclusion For Fx Pro

We recommend trading with this broker and find it to be a very trustworthy broker. Due to its popularity and multi tiered regulations, Fx Pro is extremely unlikely to be a scam. Fx Brokers Empire recommends using Fx Pro for its high liquidity & execution service. Along with outstanding customer support based on our own experiences & our client feedback. Using there run on line 'Trade Like A Pro' they definitely have weight in there words and offer some decent trading features. We further recommend not to start a investment account with Fx Pro in excess of £25,000 initially until you get used to the platform offered and all its features. Fx Pro is a highly popular trading choice & has a well branded name that delivers results for its traders, across Europe, Asia & most definitely in the UK as a trusted broker.

Fx Brokers Empire rates Fx Pro as a 4.5/5 star broker

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Start Trading Like A Pro With Fx Pro

#fx pro review#detailed fx pro review#fxpro#fxproreview#fxproreviewed#fx pro reviewed#fx pro best fca broker review

3 notes

·

View notes

Text

youtube

I want to get to deep details about the video

I uploaded about forex because its beyond

The impossible.

There are places to go beyond belief

The decision rest with you

and why it's very important to

To any body to see it

**

So let's start by explaining what it forex

Quickly and fast first.

Forex its trading very simple, you bet either

It will go up or down.

Now when the graph/line go up or down

Each move called tick/pip very simple.

In other words the line moved up 100

Ticks or pips.

When you trade you decide the value

Per tick/pip....which mean if the line

Moved 100 ticks/pips up And you chossed

That each pip/tick

Is equel to 5 usd

100 pips/ticks x 5 usd = 500 usd profit

If it go in your direction

This is how forex work very simple and nothing. more, but the beauty in forex is that this tool give

The possibility to get rich very fast and daily market cap is 5.1 trillion which is huge monster, a

The biggest monster in the world.

**

Now 99.99% lose, the last 1% is devided also

and

Basically .001% have more winnings then loses.

What I try to say here...which is very important to

Any body read this and see this video.

When your mind so something

Impossible and know its true

And not scammer

Its upgrade your all inner world

Confidence, creativity,....

Even you dont know how its done.

When you see something great or unique but not impossible....its different, then see something impossible.

Top traders in the world have every 15 trades 2..3 loses this is the statistics of the best, top traders

Imagine you enter the world of trading like any other complex industry and read and explore on the web about this...you find what the limits you can do per day from trading based on what the top traders do and other ..after you filter out the scammers for sure.....

But when you saw somebody do 500 trades without single loss and it's real.....even you dont know how....your mind is jump to huge level of confidence and creativity..compare to great things....its not easy to explain this...

But it help you in other complex industries and much more....you saw it live done...from true guy...not scammer....

If the top traders have every 15 trades 2..3 loses ...and you saw someone show 500 trades or 1000 trades all of them winnings,

Its beyond the word impossible

Its bring Magical emotions

Even you dont know your confidence jump to so. high level only by see it **

It's different then great traders or whatever the industry....you saw something which impossible by any means...period

When you see such things it shape your inner world from confidence to creativity....to get whatever you want....

Remember to do great things and to do the impossible, there is huge difference ...esapcilly seeing it....not in all industry's...

Forex market is the biggest monster in the world

.....

Who I am

Moses(zeev)

Magic man

Marlin

#developers & startups#love#futurism#love quotes#batman#x-story#dc comics#deadpool#documentary#design#art#magical story#magic the gathering#magick#magical#Youtube

2 notes

·

View notes

Text

eToro

Website The eToro website seems very sleek upon first view, there is a lot of information on the homepage and this brokerage is marketed in a different way to others in the way that it is marketed as a social trading site where traders can copy trades of other successful traders by simply mirroring them.

I do appreciate this website a lot, it is well designed and thought out and easy to use with a lot of graphics in order to help explain certain parts of how they work. The website is available in 20 different languages which makes it accessible to a larger audience around the globe. The Company eToro is a well known fin-tech company who started in Israel by three co founders. The company was formed in 2007 and trades under the eToro name. They have offices in the UK,Cyprus, Australia with their head office based in Israel. According to their website and after some research online I was able to confirm that they are regulated by CySEC, the FCA and ASIC. They are not listed on any stock exchange but they are a well known startup company which along with the fact that they are regulated reinforces their status as being a safer broker. Their Platform and Technical Information The platform has a variety of different assets to trade from, they primarily offer CFD’s but you can also choose from stocks and cryptocurrencies. One thing to note in regard to their stock trading is that it is commission free in the EU and if you are a non EU citizen it is 0.09% spread cost per side. The first negative I can find regarding the platform is that they seem to have a wide spread on the majority of the assets they have available to trade, for example the EURUSD pair at the time of writing had a 3 pip spread where normally you will find around a 1.5 pip spread on average amongst other reputable brokers. They offer a free demo account if needed and their live accounts are made simple by only having one live account type, with the minimum deposit being $200 for this account, although for US and Australian residents the minimum is $50 and for residents of Russia, China, Hong Kong, Taiwan, and Macau the minimum first time deposit is $500. It is easy and simple to open and there seem to be no complications when I opened an account to try. In terms of the platforms they have available to trade on it can only be done via their web trading platform or their mobile app, the app is available on iOS or Android.

The app is fairly easy to use and simple to navigate, it is a user friendly app and users will have no problem in trying to open and close trades or searching for different stocks or forex pairs. The web platform is also great, it has a nice modern feel and looks good on the eye. Again it is a user friendly experience and easy to navigate around and customers should have no problem when getting to grips with it. When it comes to deposits and withdrawals one thing that is important to note is that all accounts have to be in US dollars and so once your local currency is deposited into an eToro account it is then converted into US dollars. Deposits can be made via a variety of different ways including debit or credit card, bank wire, PayPal and many other online payment systems. In order to withdraw money the account holder will need to fill out a withdrawal form, they will in most cases authorise withdrawals back to the same account they were deposited from, they normally take five days to arrive in the clients account. Another important factor to note here is that there is a $25 withdrawal fee which is very high, not good eToro! Education eToro currently offer some educational tools for their traders, these seem to be in the form of live webinars. They do also offer a tool to copy other traders positions so in essence you can learn by understanding those other traders and how they take trades, as long as they are profitable! Customer Support eToro’s customer support is a 24/5 service available Monday through to Friday and they can be contacted via telephone or email and from past experience they seem to respond within two days.

So How Reliable Are They, What Have Clients Said? After having a look at some customer reviews it seems there are a mix of the majority being negative, some average and some positive. I have mentioned in an earlier review but this could be down to the fact that when traders lose money (especially new traders) they will tend to blame the markets or their brokers. There seems to be more complaints of stop losses not being hit or glitches in their system and failure of trades being copied from one trader to another. These seem like issues with their system to me and are things that can be fixed, there are some complaints of failures to withdraw which investors reading this should be aware of. I would say that eToro is a reliable company they are regulated by the FCA which is a well respect conduct authority in the UK and they are also regulated elsewhere so will be adhering to those rules which suggests to me that they are a broker that can be trusted. In Conclusion For me I feel that eToro are a reputable broker and although they may not be perfect for professional traders due to their large spreads, they are perfect for new investors who can copy trades from more experienced and profitable traders in order to help them increase their profits. The social feel to the eToro structure is a new take on trading and it is no wonder they seem to be leading the way in that sense as their user interface is very user friendly . All in all I would recommend this broker for the new less experienced traders out there. Read the full article

1 note

·

View note

Text

50.17 Percent Profits in 75 Trading Days: The Success Story of RvR Ventures!

Forex, also known as foreign exchange, FX or currency trading, is a decentralized global market where all the world's currencies trade. The forex market is the largest, most liquid market in the world with an average daily trading volume exceeding $5 trillion a day, which much more than the volume on the New York Stock Exchange.

Also, the most traded currency is the US dollar, which features in nearly 80% of all forex trades. Nearly 90% of forex trading is speculative trading. The majority of foreign exchange trades consist of spot transactions, forwards, foreign exchange swaps, currency swaps and options. However, as a leveraged product there is plenty of risk associated with Forex trades that can result in substantial losses.

Interestingly - challenging the risk-reward ratio & trading frequency of the biggest Forex Traders & Portfolio Managers in the world, RvR Ventures achieved 50.17% profits by trading on Real ECN Account of $ 1 Million. The traders of RvR ventures traded pairs like XAUUSD, EURUSD, GBPJPY, GBPUSD, EURGBP and other cross currency pairs on Real ECN accounts with 1:500 leverage through automated & manual mode of trading based on the algorithms developed by RvR Ventures & a Dubai Based Indian Cryptographer & Forex Trader.

As per the data verified by us on the Track Record Verified & Trading Privileges verified portfolios of RvR Ventures on MyFxBook.com: (Link: https://www.myfxbook.com/members/rvr005/2739956)

RvR Ventures achieved a total gain of 50.17% on their portfolio RvR005 with a daily gain of up to 0.39%, Monthly gain of 12.62% with a drawdown of 44.5% only. Total profit of $ 5,02,116 was booked in 75 Trading Days / 3 months (15 October, 2018 – 27 January, 2019) on a total portfolio size of 1,000,000$ with 83% accuracy on 2,067 trades with 20,876 lots executed during this span on their portfolio RvR005, a Real – ECN account with 1:500 leverage.

RvR Ventures achieved profit returns ranging from 68.44%- 5.78% on their various accounts. A total profit of $ 3,473,648.50 was booked with a daily gain of 0.30 % & monthly gain of 12.64% at an average trading accuracy of 71% on total 46,811 trades executed with 66.579 lots on their portfolio through manual & automated trading as seen in Image 2.

Q&A with Mr. Kevin Albuquerque, Chief Trading Officer - RvR Ventures.

How can a trader make profits safely in highly volatile & high-risk market?

"How much can I make as a trader"? This is one of the first questions that many people ask me followed by "How long will it take"? Each person is unique in their goals. Some traders want to make millions while others want to improve their financial situation and enjoy the flexibility of Forex trading. Forex Trading has unlimited possibilities. Hence one should not be greedy & should be patient enough to focus, calculate & mitigate the risk while booking / planning profits in highly volatile currencies in Forex Trading. We took less than 5% risk on the basis of our automated trading algorithm & achieved upto 68% profits in 75 trading days.

What is the trading strategy of RvR Ventures?

We at RvR Ventures focus on profits & work on profit sharing basis only without charging any handling charges, service charges, trading commissions or fund management charges. We started working on our algorithms in 2008, so that we can trade with maximum accuracy by minimizing the risk to achieve higher profits in any type of volatile markets & on any currency pair in Forex. Making our offering a win-win situation, our proposal is very simple: We earn only if you earn.

Explaining further with more insights, Mr. Kevin Albuquerque said, "The Forex is a highly leveraged market, with typical leverage ratios ranging from 1:100 to 1:1000. If you use the maximum available leverage, your account can be wiped out in a matter of seconds when the market moves against you. I generally prefer leverage of 1:400 - 1:500. In addition, I always make sure that total risk taken by me doesn't exceed more than 10% of total portfolio size in the very beginning. Once the profits in the first few trades are booked, we generally take calculated risk on the profits earned only, keeping the principal amount entirely safe. Most of the trades opened by us are closed the same day to minimize the risk on the principal/profit amount in case of sudden one directional volatility.”

Is Forex Trading A Gamble?

All trading appears as speculative as to be little more than legalized gambling. There are no guarantees and making a profit on the exchange seems a totally random matter. The reality is that successful Forex trading is a highly skilled business that is not like betting at all. A common misconception is that Forex is gambling, but I personally do not consider it gambling. If you want to be successful at trading currencies, you need to take a Forex related course, need to be actively updated regarding latest market trends, market conditions, political – economic current affairs, economic data & economy of various countries.

Does Forex Broker play an important role in Forex Trading?

Yes, definitely, the trading platform provider & Forex brokers play an important role in the same. The tight spreads, negligible slippage and timely execution of trades always boost the confidence & accuracy of a Forex Trader, hence we always & only work with Regulated Forex Brokers.

What do you prefer: Smaller Lots – Higher Profits or Bigger Lots – Smaller Profits?

Recently, we were able to book up to 2,100$ per trade’s profit on lot sizes of just 0.30 in sequence, repeatedly and on the other hand, we also booked 1,14,000$ profits in 48 trading hours by trading on lot sizes of up to 100.00 each. It doesn't matter whether a trader trades on big or small lots, what matters is how much profit he is able to book on the same & in how much time, without holding any floating losses.

Smaller the lots, lesser the risk, however, to book 20x or 30x profits on small lot sizes you need to have accurate and in-depth knowledge about markets, volumes, moving averages, pair range, market sentiments, pivot points, resistance & support of a particular pair on which you are trading. On the other hand to trade on higher lots ranging from 25.00 to 100.00 each to achieve higher profits in few minutes, you need to be more alert, very cautious & accurate on your strategy. A movement of 1000 pips can instantly make your account stand in a floating loss of 100,000$ in minutes!

What makes your automated trading more efficient & accurate?

We have integrated more than 132 parameters including OHLC, market sentiments, volumes, Live News based volatility factors, EMA, SMA, Pivot Point based volatility assumptions, Momentum, Summary of various successful indicators, Technical Analysis, Fundamental Analysis, RSI, Fibonacci Retracement, SL TP ratio, Session-Based Volatility Calculations, Ascending, Descending, Symmetrical - Triangle Strategy, Head & Shoulder Strategy & Dynamic support & resistance trackers in a single algorithm to achieve utmost efficiency, trading accuracy & right point of entry & exit in different pairs of currencies in Forex Trading through our automated Trading & Forex Trading Strategy Algorithm.

Do you also offer Training?

Yes, recently we have started training courses for the candidates who qualify for Forex Trading. We offer extensive technical & fundamental analysis based real-time training sessions on Real ECN accounts for more than 2500 trading hours. This prepares the candidates to trade with higher accuracy in highly volatile markets. In addition, we also offer the option to experience our automated trading strategy as a guide in the learning process.

What are your future expansion plans?

We are now planning to expand our Portfolio Management Business in different countries of the world, by offering the option to copy our trades on Social Trading of various regulated Forex brokers which will help beginners, experts & professional Forex Traders, to minimize the risk & maximize the opportunity of returns on investment in Forex Trading. We have no plans to sell or reveal our automated trading robots, strategy & trading algorithms to any party.

1 note

·

View note

Text

If you are looking for some professional assistance in the trading world, it is right time to get started with the BluePips platform. Here, you will find a variety of offers and services to get started with the healthy forex trading experience.

Beginners often seek some additional tools and guidelines to step ahead into the trading world. The latest software tools and techniques can help them to make fairer decisions to put buy and sell trades. Below we have highlighted some of the best trading packages offered by BluePips to lead your Forex Market. You can choose any of these to enjoy great returns.

Copy Trading or Mirror Trading:

Many beginners prefer to start with the copy trading experience where they can follow the trade patterns of some professional trader in the market. We offer this package with the payment of $99.99 per month so that beginners can enjoy great returns with low investment as well. Here you can get 1-5 signals per day with around 500 pips per week. This system ensures around 70 to 90 percent accuracy and the trades are transferred directly via MT4 account online.

BluePips Signals Package:

No trading decision is possible without the study of right signals in the Forex market. If you are searching for some reliable and trustworthy indicators, this BluePip signals packages is the right choice for you. With the payment of $49.99 per month only, you can gain access to 100% algorithm signals online. Our system can make a highly accurate analysis about entry and exit points to make your trades more profitable. In case if you are not interested in investingin the monthly package, the weekly package is more suitable for your needs. You can get this forex signals package by paying $13.99 per week only.

Algorithm Trading Software:

How can we forget to talk about the algorithm trading software that you can buy at $997 only a BluePip platform? It can provide you easy access to charts, strategies, and indicator files as well. We offer lifetime updates along with professional level mentoring with this algorithm.

Harmonic Software:

This harmonic indicator is available with the price tag of $297.99 only. It can help you understand the harmonic patterns in the Forex market that are quite helpful in making predictions about the future. Our tool provides universal pattern details so that you can make wise decisions to ensure higher profits in the market.

Other than this, you can also invest in Drip Trading Package to learn the effective Drip Trading strategy in the Forex Market.

1 note

·

View note

Photo

Understanding Forex - What is Forex? Part I FIRST HOPE FINANCIAL This is a series of articles about The Foreign Exchange Market. You will learn here what Forex is , how it works and how profitable it can be. The whole series contain the following articles . . . 1. What is Forex 2. Technical analysis 3. Fundamental analysis 4. Money management 5. Compound interest What is Forex? The word Forex is an acronym for The Forex Exchange Market. This is the most liquid market on the world where you can trade or exchange one currency for another. For example, if you think that the Euro will appreciate in value and you have US dollars, you can trade the dollars for the Euros. If you are right and the Euro appreciates in value in relationship with the dollars, then you can close the position realizing a profit. That's the basic idea behind the Spot Forex Market. This is an interbank system which means that it is not centralized. There is no central exchange where currencies are traded. It is a global market. You can trade Forex online 24 hours per day, 6 days per week. This market emerged at the beginning of the 70's decade. The reason was that currencies where not backed up by gold anymore. They began floating freely. Their value depended on forces of supply and demand due to economic factors, speculation, etc. This originated the Forex Market. You can trade Forex on the Internet as I said above. There are many brokers like www.oanda.com that allow you to open an account with just $300 to $500 and start trading online. You can also get a demo account first and trade with play money just to test the waters and see if you like this market or not. Demo accounts are free with most brokers. Some brokers offer demo accounts which expire within 30 days while others never expire. It is important to trade on paper, because you can test your strategies and see if they work or not. Trading Forex is risky, but it can be very profitable too. You can trade at anywhere from 20: 1 to 400: 1 leverage. This means that the broker will lend you more money than you have on the account to trade. For example, let's say that a broker allows you to trade at 100: 1 leverage. If you use all the leverage, for every dollar that you have on the account you can trade 100. Let's say that you have $1,000. With $1,000 at 100: 1 you can trade $100,000 worth of dollars in exchange for other currencies. You multiply your trading potential a lot. This allows you to realize bigger profits, but you also incur in bigger risks. Let me show you an example. Let's say that you have 100: 1 leverage on the account and you trade at full leverage with $1,000. The EUR/USD pair (Euro/US Dollar) is trading at 1.2500. So, you enter a position on this pair. Let's say that you are long. If the market moves in your favor by just one cent (1.2600), you will double your money and end up with $2,000 on the account. If the market moves against you by just one cent (1.2400), you will lose all the money that you have on the account or most of it depending on the broker you are trading with. This can happens really quick. The market can move this much in a matter of minutes or hours. This is what makes Forex very profitable, but also very volatile. I don't know if novice traders can understand the magnitude of what I am saying here. Many people get into Forex trading only seeing half of the truth. They get pulled into this market by all the hype flying around it. I do believe that no other market in the world offer the opportunity to make money like this market does. On the other hand, there are some risks involved. It is important for new traders to trade on paper first before compromising real capital. We learn doing. I didn't learn many basic concepts about this market until I started trading with a demo account. Now, let me explain other important facts. The Spot Forex Market is traded in currency pairs. Whenever you enter a position you trade one currency for another. For example if you buy EUR/USD you are buying Euros and selling US Dollars. If you sell EUR/USD you are selling Euros and buying US Dollars. When you enter a position, you can not trade other currency pairs unless you have additional funds on your account, but you can trade several currency pairs at the same time as long as you have enough margin/funds to trade. If you have never traded Forex before, you can see how all this works when you practice with a demo account. Another thing that you would like to know is that Forex is traded in pips. Your profit on every trade depends on many aspects. One of those aspects are pips. Another one is how much leverage you are using per trade. A pip is the minimum unit that the price of a currency pair can move. For example, in the case of the EUR/USD a pip is equal to 0.0001. If the price is at 1.2500 and it moves to 1.2501, it moved one pip. If it moves from 1.2500 to 1.2600 it moves 100 pips, like in the example above. Now, how much you make on every trade depends on how many pips you make and how much money you invested on that trade. Also, what is the leverage for that account. If you trade at full leverage with a 100: 1 leverage account and you trade $1,000, if the market moves 50 pips in your favor, then you will make $500. This can happen within just a few minutes after you enter your order. Most experienced traders wouldn't recommend you to trade this way though. The reason is that if the market moves against you, then you could lose everything within minutes. It is better to have lower profit goals for every single trade and compound your profits over time. Money management principles stay that it is better to never risk more than 1% - 3% of your capital, specially if you are an inexperienced trader. This is something that I will explain more under other article of this series. Well, I hope this information have been helpful to you. This was an introduction to the Forex Market. You can read more about Forex on my other articles. market strategies

0 notes

Text

101Investing review ✨ – Full Review (Features & Platforms)

101investing review - summary

Demo Account: Yes

Min. deposit: $250

Trading Platforms: Desktop, Web & Mobile

Assets: CFDs on Forex, Crypto, Indices, Stocks & Commodities

No commissions

Quick sign up

Visit 101investing

82% of retail investor accounts lose money when trading CFDs

When choosing an online broker for trading, especially CFDs, you may encounter misguiding information that can make the whole search complicated. 101investing is such a broker, and so we have prepared a review of the 101investing broker to make it easy for you to understand the platform.

In this 101investing broker review, we break down the platform’s features, account types, regulations and give you all the details you need to know about 101investing.

Sign up now to win a gift card –>

Our 101investing review: What is 101investing?

101investing is an online trading platform that provides complex financial derivatives (CFDs) on over 250 financial instruments. An investor can trade CFDs on shares, Forex, Cryptocurrencies, Commodities, Indices, and Precious Metals.

101investing firm was established in 2016 in Cyprus as part of the FXBFI Broker Financial Invest Ltd. Being in Cyprus, and the broker gets authorization and regulations from Cyprus Securities and Exchange Commission (CySEC). Like many other brokers regulated by CySEC, 101investing holds a membership position with Investor Compensation Fund (ICF), which means investors are guaranteed compensation if the broker collapses.

The broker offers several account types (Pro, Platinum, Gold, and Silver) and Islamic and demo accounts. In this review of the 101investing platform, we discuss the different trading platforms and each account’s features.

Things we like

Easy sign up

Innovative platform

Wide variety of markets

Things we don't like

High percentage of retails losing money

Trading Platforms

101investing broker offers its clients access to the powerful Meta Trader 4 (MT4) platform for trading both on the web and on downloadable software.

Meta Trader 4

The MT4 platform is rich with features that most traders love. It has a simple interface that can be easily customized to create a preferred trading environment to boost the trading experience.

The 101investing MT4 platform is downloadable from the 101investing website, both for Windows and Mac devices. You can sign up from the software or log in using your account details so that you can fully enjoy the platform.

Some of the features that you’ll find on the MT4 platform include:

9-time frames ranging from one minute to one month to allow you to set your trading time accordingly.

More than 30 in-built indicators such as RSI, Bollinger Bands, Moving Average, MACD, and many others to help you conduct comprehensive market analysis.

Complete trade history for reference and strategy testers for backtesting with the historical data.

Multiple market order types such as instant, pending, and limit orders and their execution modes.

One-click trading as well as automated trading with EAs (expert advisors).

Over 24 analytical tools such as Fibonacci and Gann tools, shapes, and arrows for easy market analysis.

MQL editor that helps you to create trading tools and customize them according to preference.

The user interface is fully customizable to suit the traders’ requirements.

Price alert notifications pop up on the trading platform or are sent to the email or show up as an SMS.

WebTrader

The WebTrader allows you to trade on the MT4 platform online without downloading the software. It’s the parent host for the 101investing trading platform.

With the WebTrader, you’ll have access to more than 250 financial assets, over 30 indicators, analytical tools, and many other features. Since it’s accessed on the internet browser, you’ll need to have a stable internet connection and a secured browser.

Sign up now to win a gift card –>

Markets and Trading Products

101investing offers many financial assets that you can trade as CFDs. They include:

Forex – There are over 45 currency pairs that you can trade on CFDs. The most popular currency pairs are EUR/USD, EUR/JPY, and AUD/USD.

Stocks – There are over 75 stocks (popular globally) on 101investing trading platform which are tradable on CFDs. The most-traded global stocks are Facebook, Sony, Microsoft, Intel, eBay, and Amex.

Cryptocurrencies – Popular cryptocurrencies like Bitcoin and Ethereum are available on 101investing. There are over 20 other cryptocurrencies on the platform and can be traded as CFDs.

Commodities – Both hard and soft commodities are available for CFD trading. Some of the popular commodities are gas, oil, silver, brent, coffee, corn, and gold.

Indices – You can trade the world’s most popular indices such as S&P 500, CAC 40, FTSE100, and DAX 30.

101investing Fees

Fees are charged as trading and non-trading fees. However, the broker charges no commissions on the trades, so investors can freely trade on any asset.

Trading Fees

On 101investing, the amount of trading fees varies depending on the type of account you’re holding and is commonly known as the spread.

Looking at each account type, you’ll realize that spreads start from 0.07 pips on a Silver account, 0.05 pips for a Gold account, and 0.03 pips for a Platinum account. Spreads also vary depending on the asset you’re trading on.

For example, spreads on indices start from 1.0 pip, 0.03 pips on commodities, and 0.7 pips on forex.

Non-trading Fees

Non-trading fees are charged in different ways. Such as:

Inactivity fees – an account is classified as inactive if no activity is done on the account for 60 days. After 60 days, a high inactive fee (about 160 EUR) is imposed on the account. The inactivity continues to be reviewed, and more charges are incurred after every 30 days. If the account balance is zero, the account is turned into a dormant account and can be reactivated if the investor contacts the company and funds the account again.

Deposit and withdrawal fee – 101investing does not charge a deposit or withdrawal fee. However, a small fee may apply if the amount withdrawn is less than €100.

Overnight fees – This is a fee charged on positions left open through the night. It’s also called Swap or Financing fee or Rollover fee.

How to Open an Account with 101investing

The process of opening an account with 101investing is quick and only takes a few minutes to complete. Here are five simple steps in opening a live trading account.

Step 1 – Go to the 101investing homepage and click on the “Open Account” button on the page.

Step 2 – Fill in the form requiring your details. You’ll be required to provide your valid email address and a working phone number in this form. You’ll then get a second form which will require more information like your residence address and birthday.

Step 3 – In the next step, you’ll be prompted to answer a few questions on your experience and economic profile, which will be helpful in customizing your account. The questions will be about your trading experience, your net worth, and your source of income.

Step 4 – Verify your 101investing account by providing documents showing your proof of identity and proof of address. Providing these documents is a requirement as per the KYC & AML regulations.

Step 5 – The last step is to fund your 101investing account with a minimum of $250 and start making trades. Before proceeding to this step, it’s important to carefully read through terms and conditions and understand them and continue with the process if you agree to them.

Sign up now to win a gift card –>

Deposit Methods

Deposits

On the 101investing trading platform, there are several payment options accepted from different regions, while others are universal. Some of these deposit methods include:

Traditional bank wire transfer.

Credit and debit cards

eWallets like Skrill, WorldPay, eMerchantPay, SafeCharge, Paydoo, and SolidPay.

All deposits are free and do not incur any broker deposit charges on 101investing. The minimum deposit is set at $250.

Withdrawals

Withdrawals on 101investing are initiated by sending a withdrawal request email to the support team or filling a request form available on the Client Portal. The request is processed within the same day or the following day, depending on the time the request was sent.

Whether you receive the cash on the same day or not depends on the payment method you’re using to receive the funds. Some like e-wallets receive payments instantly, while bank transfers can take up to 7 days.

Withdrawals are free for any amount. However, FXBFI Financial Broker Invest Ltd can charge a standard withdrawal fee of EUR 50 if the account had been left inactive or with little activity before requesting for withdrawal.

Account Types

On 101investing, you’re spoilt for choice when it comes to account types. The broker offers all clients access to a demo account, which they can use to familiarize themselves with the platform before trading on the live account.

Let’s look at the different account types.

Demo Account

The demo account allows any prospective user to test the MT4 platform and try out all available features. It’s customized to respond to real market movements and price fluctuations in real-time.

The demo account has access to virtual cash, which traders can use to practice in the demo account under real market conditions. The demo account’s risk-free nature allows new users to practice comfortably until they are familiar with the platform.

The demo account is not mandatory, so you can choose to use it or not. It’s only there for occasions when you need it. For example, you might need to test new indicators and trading strategies without risking your account balance so you can use the demo account.

Real Accounts

101investing has four account types, namely Silver, Gold, Pro, and Platinum. They all have different features that make each of them unique.

Silver Account

It allows a minimum deposit of $250.

The spreads start from 0.07 pips.

The maximum leverage is 1:30.

Trade over 250 financial assets.

No commissions.

Gold Account

Clients receive a 25% discount on overnight charges.

The spreads start at 0.05 pips.

The maximum leverage is 1:30.

Access to over 350 financial assets.

No commissions.

Platinum account

Clients receive a 50% discount on overnight charges.

The Forex spreads start from 0.03pips.

The maximum leverage is 1:400.

Access to over 250 financial assets.

No commissions.

All these three accounts have access to a dedicated account manager, free VPS, and news updates. Also, they allow hedging for both retail and professional clients.

Professional account

The professional account is exclusive and personalized for VIP clients. Such a client has to qualify by meeting any two of these requirements.

They should have a portfolio greater than $500,000 exclusive of property & cash.

Their trading history should show positions of the significant amount placed down to broker discretion.

They should have a work history as a professional trader.

Any client with proof of any two of these requirements qualifies as a professional trader, and all ESMA regulation restrictions are removed.

With the professional account, leverage goes up to 1:500 or more as they continue to trade.

Islamic Account

101investing accepts Shariah-abiding clients and thus creating an account for them which is compliant with the Shariah law. These traders enjoy swap-free trading services and can trade following their beliefs.

Sign up now to win a gift card –>

Leverage

The leverage varies depending on the account type, the financial asset being traded, and whether the client is retail or professional. The leverages are set in compliance with the ESMA standards as per the CySEC regulations.

Silver and gold account holders enjoy maximum leverages of 1:30, while platinum account holders enjoy leverages as high as 1:400. Retail clients have the leverages vary across assets as follows:

Forex – 1:30

Commodities and Indices – 1:20

Cryptocurrency – 1:2

Stocks – 1:5

Professional clients holding pro accounts enjoy higher leverages of 1:500 on some assets.

All clients (retail and professional) are warned of the risks involved when using leverage and encouraged to use risk management tools available on the 101investing platform.

Mobile Apps

The MT4 mobile app helps the trader experience all the powerful MT4 features right on the palm of their hands. With access to all the analytical tools and trading capabilities of the MT4 platform, traders can trade comfortably, just like with the desktop platform or the WebTrader.

The app can synch activities performed on the desktop or Webtrader and continue them on the app. For example, if you place a trade on the WebTrader, you can go on your business and later close the trade on the mobile app.

The app is compatible with Android and iOS operating systems. Once installed, clients have access to all features, including order types and their executions, charting tools, trading history, different time frames, and contact support right on the app.

Deals & Bonuses

101investing runs an affiliate program accompanied by high payouts up to $800 per successful referral. The payouts are determined by the number of trades a referral makes, VIP conditions, account upgrades, and high performance on the platform.

101investing operates under strict CySEC regulations and restrictions, which limit the offering of bonuses to the clients. Such bonuses like the first deposit bonus are not available on 101investing, even though some brokers offer it to their customers.

Such bonuses are meant to attract new clients and motivate registered members to invite others and help the platform grow. 101investing is way past that and thus focuses on quality clients and offering them quality services.

Sign up now to win a gift card –>

101investing Regulation

A well-regulated broker has to fulfill all compliance obligations and meet set financial standards and legal requirements for its operation in a designated region. 101investing as a part of the FXBFI Broker Financial Invest Ltd follows regulatory guidelines from CySEC and holds a license with the number 315/16.

The FXBFI Broker Financial Invest Ltd is licensed to offer both investment and ancillary services. The investment services include:

Receiving and transmitting orders placed on any financial instrument.

Executing the orders on behalf of the investors.

The ancillary services are:

Administering financial assets and keeping funds safe in services like custodianship.

Offering foreign exchange services and providing investment services.

The license is subject to the law as CySEC is a member of the European Securities and Markets Authority (ESMA). The law culminates with the EU regulation, MiFID II. It allows for the provision and operation of investment services as well as the operation of regulated financial markets to ensure high-level security for the investor and their investment.

Pros & Cons