#for the record peer rewards points are a super cool thing my company does where we can give each other points

Explore tagged Tumblr posts

Text

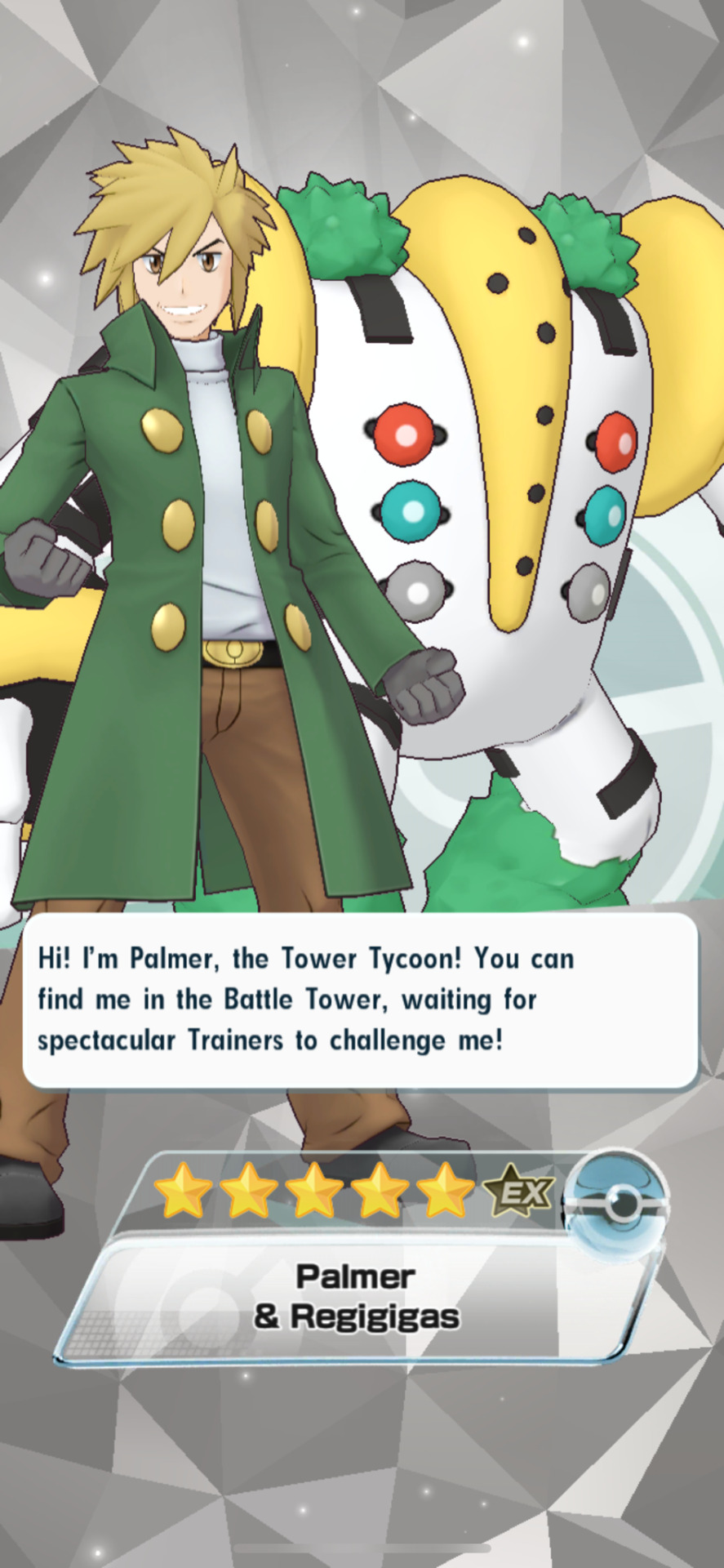

It knows I want green cause it gave me these two assholes, I have no interest in either of you. Let me have green!!

Also…. It’s a good thing I just got a bunch of peer rewards points at work cause I’m gonna need some spending money lmao

#pokemas#pokemon masters#like I know they’re prolly good#but I need all of bb boys alts okay#for the record peer rewards points are a super cool thing my company does where we can give each other points#and then turn them in for gift cards or PayPal#cool benefits that cost the company a shit ton of money every month lol#but also I just got a bunch for helping someone with something last minute so#gonna get an iTunes card

3 notes

·

View notes

Text

Bitcoin Halving, BUY NOW? WAIT? Price Breaking Out On News of HUGE INVESTOR’S BTC PLAY

VIDEO TRANSCRIPT

Today in crypto bitcoin blasts over ten thousand dollars as the bitcoin having Foma kicks into high gear, is now the right time to buy Bitcoin? Or should you wait until after the having? Well, mass accumulation is happening right now by key players in a massive and very respected hedge fund just announced there. Bitcoin play. This is heating up big time. Let the photo commence. The crypto lark. This is where you subscribe for all of the hottest and all of the latest happening out there in the wild, wildland of crypto. Also, for those of you who want to learn how to trade cryptocurrencies. Check out my course. Crypto Trading explained. It will take you through all of the basics and teach you how to use key indicators, identify important patterns, manage your risk and lock in your trading profits. There is a link Downbelow, where you can learn more. So let’s dig into the charts to get started off with. And the first thing that we have got to talk about is that the price of Bitcoin has finally broken above the line of weekly resistance that has been holding Bitcoin down for more than two years. This is incredibly bullish. Obviously, this candle does still need to confirm there’s a few days away until we actually do see that candle close. But definitely looking nice today, certainly heading in the right direction. Now, looking over on the daily, we have confirmed a candle above the downward trend line as well. However, even though we have peaked just above ten thousand dollars a few times in the last few hours, Bitcoin is having trouble holding this incredibly key line in the sand resistance. Around ten thousand dollars was definitely something to be expected. Now, watching Bitcoin and trying to break and hold above ten thousand dollars kind of feels like this. You shall not pass. If we can actually be crushed and a thousand dollars over the weekend, then the next big hurdle is ten thousand five hundred dollars. Crossing above that line would literally give us a new high for the year. But let’s see if we can actually confirm that we have flipped that line of resistance, that we just broke into a line of support around the 94 hundred dollar mark, approximately. If it doesn’t hold as a line of support, then eighty-four hundred dollars to be the next important one on the way down that you should be watching for. But the way that the market is moving right now, we are back on schedule for another golden cross to potentially hit in just a few days. If the markets continue like this, then we could actually hit that cross sometime late next week. Bitcoin market dominance has been raging today as well, almost hitting 69 percent of the total market, meaning that ALTE coin BTC pairs, they’re getting hit pretty hard at the moment. So be careful if you are out there trading old coins right now. I am personally waiting for the having madness to pass before I hop back into trading BTC pairs. A big thank you to Crypto Dot for sponsoring today’s episode. A reminder that the crypto dot com exchange is going to be hosting an insane sale for Bitcoin on May 12th. There will be one million buckaroos worth of Bitcoin up for grabs at a 50 percent discount. So you can buy up to two hundred dollars of that allocation with no S.R.O. tokens needing to be staked. And you can actually get a higher limit with S.R.O. tokens state. Sadly, U.S. traders are not eligible for this sale. So if you are keen, get over there, get registered on the exchange and get ready to score some of that cheap Bitcoin 50 percent off Bitcoin sale. You don’t find it very often. And big news for all those waiting for their debit cards over in the EU. The final stages of card deployment are moving ahead. And the current estimate is that cards are going to start shipping next week all across the European Union. Orsa. Also, as a reminder, these cards are currently available in the USA, New Zealand, Australia, the Philippines, the UK, of course, now shipping across the EU as well. Get yours today and start enjoying Krypto back rewards for every single swipe of your card. That’s two percent for the ruby red tier card and three percent for the J Green, which is. The card that I have here in my hand now, as well as getting those crypto back rewards, you will also get some sweet perks like free Netflix, free Spotify, an airport lounge access. And as an extra super special bonus, when you reserve a ruby red tier card or higher using the link Downbelow, you’ll get a 50 dollar bonus of free crypto. Very nice. So let’s go ahead and get into our question. Today is the time to buy Bitcoin now or is it not the time to make one? Well, it’s always time to buy Bitcoin, but the Bitcoin having is less than four days away at this point. A lot of people think the show, buy before or after having. And look, there remains a very good chance with all the macro factors that we have been discussing on the channel recently, that Bitcoin is going to be over twenty thousand dollars by the end of the year. I mean, just look at how crazy the recovery from this big crash has been. We are currently up around a hundred and sixty percent since Black Thursday. No other asset class has come near this. Also, a quick word of congratulations to all those people with the very strong hands that did not sell when the market got tough and that held through all of this craziness. But does that mean that you should buy now or wait for a dip after the bitcoin having? Well, let’s go over some different things that are happening right now in the market. And hopefully, you can answer this question for your self. There is a lot of expectation right now of a post having a dip. The last Bitcoin having we saw. Was quite significant. I must say, though, there are no guarantees that this will happen this time. Nothing is certain in markets. You can think. Maybe this will happen, but there is no guarantee that is what’s going to happen. Just because there is a big dip last time. It doesn’t mean it’s going to happen this time. But if there is a significant dip in the price of Bitcoin, I personally expect it to be short-lived and to be heavily bought unless some really just drastically bad economic news comes out worse than we’ve been getting in the past couple of weeks anyway. And of course, that would drag Bitcoin lower, potentially. But there is a good chance that we do see a buy the rumour, sell the news kind of scenario, play out in the coming week or two where everyone’s really excited and then it’s not that big an event like, oh, isn’t that exciting? So keep an eye out for that. The Bitcoin Fear and greed index has more than doubled in two weeks. The rise in greed in the market so quickly kind of has me short term suspicious of the continuation of this run after the having. But that being said, we are only about halfway up this meter. So there is an incredible amount of more greed that we can be experiencing in this market. Search trends for Bitcoin are also up big time. The term by Bitcoin is that high that we have not seen since the height of the twenty nineteen runs. And the term Bitcoin having, of course, is absolutely skyrocketing at the moment, making the 2016 interest in this particular search term just a small blip on the chart that you see on the screen here. Such parabolic interest spikes are usually followed by a cool-down period and less interest short term could mean less price action short term. But regardless of whether or not we hit a little bit of turbulence in the next week or two, coming out of the having almost every metric is showing that the big picture for Bitcoin is getting incredibly exciting. The Holder net position change chart has stayed positive during the market recovery of the past eight weeks, which is showing that there is a lot of optimistic sentiment in the market right now and that buyers have long term confidence in their holdings. Also, the number of active addresses has soared to levels not seen since the 2017 bull market, which is totally loco considering where we are price-wise and so has the number of new Bitcoin addresses that have also been soaring recently. We are seeing big increases in both new adopters and big increases in way accounts that have been accumulating more in the demand. It is soaring like crazy. Check out these crazy stats here. When we combine the buying of just cash app and just greyscale together, these two organizations bought the equivalent of half of the supply in quarter one of newly mined Bitcoin, meaning that post having if demand stayed the same. Then these two entities A. Own would consume all of the newly mined Bitcoin. But demand is not staying the same. Demand is rising big time right now. And I’m only talking about two companies here. We’re not accounting for all the other guys, like the ATC desks and Coinbase and finance and crypto dot com and all of the others that are offering people ways to buy up Bitcoin and of course, peer to peer exchanges like local bitcoins and others have seen record volumes in countries all around the world. This Bitcoin bull run, it is going to be crazy. And we got a big boost today from the world’s most respected investors and hedge fund managers. Paul Tudor Jones has announced that he is buying Bitcoin as a hedge against the inflationary forces being unleashed by central banks across the world and their relentless money printing insanity, telling his clients in a letter that Bitcoin right now reminds him of gold in the 1970s, particularly gold in the year 1976. What happens to gold in 1976? You might ask. Well, the price of gold started a run from around five hundred dollars up to over two thousand dollars just a couple of years later. One of the world’s top macro investors is betting that Bitcoin is about to pull a gun of this magnitude. 2021 is likely going to be a super crazy year for the crypto markets. Jones has been left shocked, of course, by the money printing madness that is going on, saying that we are witnessing the great monetary inflation and unprecedented expansion of every form of money, unlike anything the developed world has ever seen. And this is not his first time in the Bitcoin rodeo either. Healths made an epic long back in 2017 that he closed out around the twenty thousand dollar mark. So he’s not totally new to Bitcoin, but this is a new play for him because he’s been kind of quiet since back then. Now, in his recent statement, he said that Bitcoin is a store of value and decided that it passes the test based on four characteristics purchasing power, trustworthiness, liquidity and portability. The twenty-two billion dollars, two-door BVI fund has now been authorized to invest a low single-digit percentage of assets in BITT coin futures. Even one percent is two hundred and twenty million dollars. Four percent. That’s almost a billion dollars. This is big money that we’re talking about here. Now, sadly, they are not buying and holding Bitcoin directly. It’s also not clear whether the Tudeh or Fund will be trading cash, settled Bitcoin futures or physically settled Bitcoin futures that give them Bitcoin at the end. And to be fair, he didn’t only talk about Bitcoin in his letter to investors. In fact, he rated it as a store of value below that of gold. But his choice to buy derivatives instead of real bitcoin put aside here for a moment. The entry of Jones is still an incredibly bullish indicator for the crypto markets and is likely to pique the interest of a lot of older investors who follow and respect Jones since he is one of the most successful investors of the last few decades. And this will also be a big buy signal to other Wall Street types and to other fund managers. Billions of dollars are about to start flowing into Bitcoin in a massive, massive flood of new money coming in. This might just be the signal from the big boys. The perfect storm is here for crypto big funds. They are getting involved in a big way, retail mania. It is starting to set in. Governments are printing ungodly amounts of money. Honestly, Bitcoin has never been so strong. Going into a having the infrastructure and the awareness, they are bigger and better than ever before. So anyway, to answer the question, should you buy Bitcoin now or wait until after the having? I don’t know. I don’t know. No one really does. This is the thing. You have to make your own decisions, DIY or do your own research. We’re all just out here making educated guesses what we think might or might not happen in the markets. With the current surge in retail demand, institutional demand and the macroeconomic picture, I think that any dip that we do have will be short-lived, even if we get anything substantial happening at all. I know a lot of new people. They’re entering the space right now and they’re looking for answers to looking for someone to tell you what to do. That’s not how it works. There’s not gonna be someone out there telling you what to do. And if there is, you should be suspicious of that person. Dollar-cost averaging remains one of the most solid strategies for getting a position into Bitcoin that is buying a set dollar amount of Bitcoin every single week. Well, that’s 50 bucks, 100 bucks, whatever your number is, is one of the easiest wafers ways for investors to actually get access to Bitcoin going all in. Yeah, that can also be a big reward kind of situation, but it also can shake you if the market turns on you the next day and prices take a big debt and you think, what did I do? I’m losing all this money. Remember, no matter what you do, focus on that long term game. Bitcoin is highly limited in its supply and getting any portion of the supply into your hands in the coming years, that is going to be big. So if you do go all in today on Bitcoin, because I know some people will be doing that exact thing, just remember, we are right now at the start of a new massive cycle for crypto. There is a good chance that we could get over twenty thousand dollars by the end of this year and then within 18 months, we could be looking at new all-time highs, over one hundred thousand dollars. There’s going to be bumps on the way. Nothing goes straight up. So be aware of that. This is why we say stack Satz and chill, accumulate, relax, take the big picture him. So your question for today. What do you think? Will there be a big dump after the bitcoin having? And if so, what price point are you hoping to buy in it or do you think that there’s just way too much demand, way too much excitement? The stars are all aligning for Bitcoin and that is definitely be taking off to new highs as the year progresses. There won’t be any real significant dips coming in the short term after the having. Curious to know your thoughts, as always, down below in the comment section. Thank you so much. Watching today’s video. Daily reminder, you’re freaking awesome. So thank you so much for watching this video. You did enjoy it. Whack that thumbs up. Unsubscribe that young. You guys know the drill. Long live block, James. Then peace out till next time.

source https://www.cryptosharks.net/bitcoin-halving-price-breaking-out-news/ source https://cryptosharks1.blogspot.com/2020/05/bitcoin-halving-buy-now-wait-price.html

0 notes

Text

Bitcoin Halving, BUY NOW? WAIT? Price Breaking Out On News of HUGE INVESTOR’S BTC PLAY

VIDEO TRANSCRIPT

Today in crypto bitcoin blasts over ten thousand dollars as the bitcoin having Foma kicks into high gear, is now the right time to buy Bitcoin? Or should you wait until after the having? Well, mass accumulation is happening right now by key players in a massive and very respected hedge fund just announced there. Bitcoin play. This is heating up big time. Let the photo commence. The crypto lark. This is where you subscribe for all of the hottest and all of the latest happening out there in the wild, wildland of crypto. Also, for those of you who want to learn how to trade cryptocurrencies. Check out my course. Crypto Trading explained. It will take you through all of the basics and teach you how to use key indicators, identify important patterns, manage your risk and lock in your trading profits. There is a link Downbelow, where you can learn more. So let’s dig into the charts to get started off with. And the first thing that we have got to talk about is that the price of Bitcoin has finally broken above the line of weekly resistance that has been holding Bitcoin down for more than two years. This is incredibly bullish. Obviously, this candle does still need to confirm there’s a few days away until we actually do see that candle close. But definitely looking nice today, certainly heading in the right direction. Now, looking over on the daily, we have confirmed a candle above the downward trend line as well. However, even though we have peaked just above ten thousand dollars a few times in the last few hours, Bitcoin is having trouble holding this incredibly key line in the sand resistance. Around ten thousand dollars was definitely something to be expected. Now, watching Bitcoin and trying to break and hold above ten thousand dollars kind of feels like this. You shall not pass. If we can actually be crushed and a thousand dollars over the weekend, then the next big hurdle is ten thousand five hundred dollars. Crossing above that line would literally give us a new high for the year. But let’s see if we can actually confirm that we have flipped that line of resistance, that we just broke into a line of support around the 94 hundred dollar mark, approximately. If it doesn’t hold as a line of support, then eighty-four hundred dollars to be the next important one on the way down that you should be watching for. But the way that the market is moving right now, we are back on schedule for another golden cross to potentially hit in just a few days. If the markets continue like this, then we could actually hit that cross sometime late next week. Bitcoin market dominance has been raging today as well, almost hitting 69 percent of the total market, meaning that ALTE coin BTC pairs, they’re getting hit pretty hard at the moment. So be careful if you are out there trading old coins right now. I am personally waiting for the having madness to pass before I hop back into trading BTC pairs. A big thank you to Crypto Dot for sponsoring today’s episode. A reminder that the crypto dot com exchange is going to be hosting an insane sale for Bitcoin on May 12th. There will be one million buckaroos worth of Bitcoin up for grabs at a 50 percent discount. So you can buy up to two hundred dollars of that allocation with no S.R.O. tokens needing to be staked. And you can actually get a higher limit with S.R.O. tokens state. Sadly, U.S. traders are not eligible for this sale. So if you are keen, get over there, get registered on the exchange and get ready to score some of that cheap Bitcoin 50 percent off Bitcoin sale. You don’t find it very often. And big news for all those waiting for their debit cards over in the EU. The final stages of card deployment are moving ahead. And the current estimate is that cards are going to start shipping next week all across the European Union. Orsa. Also, as a reminder, these cards are currently available in the USA, New Zealand, Australia, the Philippines, the UK, of course, now shipping across the EU as well. Get yours today and start enjoying Krypto back rewards for every single swipe of your card. That’s two percent for the ruby red tier card and three percent for the J Green, which is. The card that I have here in my hand now, as well as getting those crypto back rewards, you will also get some sweet perks like free Netflix, free Spotify, an airport lounge access. And as an extra super special bonus, when you reserve a ruby red tier card or higher using the link Downbelow, you’ll get a 50 dollar bonus of free crypto. Very nice. So let’s go ahead and get into our question. Today is the time to buy Bitcoin now or is it not the time to make one? Well, it’s always time to buy Bitcoin, but the Bitcoin having is less than four days away at this point. A lot of people think the show, buy before or after having. And look, there remains a very good chance with all the macro factors that we have been discussing on the channel recently, that Bitcoin is going to be over twenty thousand dollars by the end of the year. I mean, just look at how crazy the recovery from this big crash has been. We are currently up around a hundred and sixty percent since Black Thursday. No other asset class has come near this. Also, a quick word of congratulations to all those people with the very strong hands that did not sell when the market got tough and that held through all of this craziness. But does that mean that you should buy now or wait for a dip after the bitcoin having? Well, let’s go over some different things that are happening right now in the market. And hopefully, you can answer this question for your self. There is a lot of expectation right now of a post having a dip. The last Bitcoin having we saw. Was quite significant. I must say, though, there are no guarantees that this will happen this time. Nothing is certain in markets. You can think. Maybe this will happen, but there is no guarantee that is what’s going to happen. Just because there is a big dip last time. It doesn’t mean it’s going to happen this time. But if there is a significant dip in the price of Bitcoin, I personally expect it to be short-lived and to be heavily bought unless some really just drastically bad economic news comes out worse than we’ve been getting in the past couple of weeks anyway. And of course, that would drag Bitcoin lower, potentially. But there is a good chance that we do see a buy the rumour, sell the news kind of scenario, play out in the coming week or two where everyone’s really excited and then it’s not that big an event like, oh, isn’t that exciting? So keep an eye out for that. The Bitcoin Fear and greed index has more than doubled in two weeks. The rise in greed in the market so quickly kind of has me short term suspicious of the continuation of this run after the having. But that being said, we are only about halfway up this meter. So there is an incredible amount of more greed that we can be experiencing in this market. Search trends for Bitcoin are also up big time. The term by Bitcoin is that high that we have not seen since the height of the twenty nineteen runs. And the term Bitcoin having, of course, is absolutely skyrocketing at the moment, making the 2016 interest in this particular search term just a small blip on the chart that you see on the screen here. Such parabolic interest spikes are usually followed by a cool-down period and less interest short term could mean less price action short term. But regardless of whether or not we hit a little bit of turbulence in the next week or two, coming out of the having almost every metric is showing that the big picture for Bitcoin is getting incredibly exciting. The Holder net position change chart has stayed positive during the market recovery of the past eight weeks, which is showing that there is a lot of optimistic sentiment in the market right now and that buyers have long term confidence in their holdings. Also, the number of active addresses has soared to levels not seen since the 2017 bull market, which is totally loco considering where we are price-wise and so has the number of new Bitcoin addresses that have also been soaring recently. We are seeing big increases in both new adopters and big increases in way accounts that have been accumulating more in the demand. It is soaring like crazy. Check out these crazy stats here. When we combine the buying of just cash app and just greyscale together, these two organizations bought the equivalent of half of the supply in quarter one of newly mined Bitcoin, meaning that post having if demand stayed the same. Then these two entities A. Own would consume all of the newly mined Bitcoin. But demand is not staying the same. Demand is rising big time right now. And I’m only talking about two companies here. We’re not accounting for all the other guys, like the ATC desks and Coinbase and finance and crypto dot com and all of the others that are offering people ways to buy up Bitcoin and of course, peer to peer exchanges like local bitcoins and others have seen record volumes in countries all around the world. This Bitcoin bull run, it is going to be crazy. And we got a big boost today from the world’s most respected investors and hedge fund managers. Paul Tudor Jones has announced that he is buying Bitcoin as a hedge against the inflationary forces being unleashed by central banks across the world and their relentless money printing insanity, telling his clients in a letter that Bitcoin right now reminds him of gold in the 1970s, particularly gold in the year 1976. What happens to gold in 1976? You might ask. Well, the price of gold started a run from around five hundred dollars up to over two thousand dollars just a couple of years later. One of the world’s top macro investors is betting that Bitcoin is about to pull a gun of this magnitude. 2021 is likely going to be a super crazy year for the crypto markets. Jones has been left shocked, of course, by the money printing madness that is going on, saying that we are witnessing the great monetary inflation and unprecedented expansion of every form of money, unlike anything the developed world has ever seen. And this is not his first time in the Bitcoin rodeo either. Healths made an epic long back in 2017 that he closed out around the twenty thousand dollar mark. So he’s not totally new to Bitcoin, but this is a new play for him because he’s been kind of quiet since back then. Now, in his recent statement, he said that Bitcoin is a store of value and decided that it passes the test based on four characteristics purchasing power, trustworthiness, liquidity and portability. The twenty-two billion dollars, two-door BVI fund has now been authorized to invest a low single-digit percentage of assets in BITT coin futures. Even one percent is two hundred and twenty million dollars. Four percent. That’s almost a billion dollars. This is big money that we’re talking about here. Now, sadly, they are not buying and holding Bitcoin directly. It’s also not clear whether the Tudeh or Fund will be trading cash, settled Bitcoin futures or physically settled Bitcoin futures that give them Bitcoin at the end. And to be fair, he didn’t only talk about Bitcoin in his letter to investors. In fact, he rated it as a store of value below that of gold. But his choice to buy derivatives instead of real bitcoin put aside here for a moment. The entry of Jones is still an incredibly bullish indicator for the crypto markets and is likely to pique the interest of a lot of older investors who follow and respect Jones since he is one of the most successful investors of the last few decades. And this will also be a big buy signal to other Wall Street types and to other fund managers. Billions of dollars are about to start flowing into Bitcoin in a massive, massive flood of new money coming in. This might just be the signal from the big boys. The perfect storm is here for crypto big funds. They are getting involved in a big way, retail mania. It is starting to set in. Governments are printing ungodly amounts of money. Honestly, Bitcoin has never been so strong. Going into a having the infrastructure and the awareness, they are bigger and better than ever before. So anyway, to answer the question, should you buy Bitcoin now or wait until after the having? I don’t know. I don’t know. No one really does. This is the thing. You have to make your own decisions, DIY or do your own research. We’re all just out here making educated guesses what we think might or might not happen in the markets. With the current surge in retail demand, institutional demand and the macroeconomic picture, I think that any dip that we do have will be short-lived, even if we get anything substantial happening at all. I know a lot of new people. They’re entering the space right now and they’re looking for answers to looking for someone to tell you what to do. That’s not how it works. There’s not gonna be someone out there telling you what to do. And if there is, you should be suspicious of that person. Dollar-cost averaging remains one of the most solid strategies for getting a position into Bitcoin that is buying a set dollar amount of Bitcoin every single week. Well, that’s 50 bucks, 100 bucks, whatever your number is, is one of the easiest wafers ways for investors to actually get access to Bitcoin going all in. Yeah, that can also be a big reward kind of situation, but it also can shake you if the market turns on you the next day and prices take a big debt and you think, what did I do? I’m losing all this money. Remember, no matter what you do, focus on that long term game. Bitcoin is highly limited in its supply and getting any portion of the supply into your hands in the coming years, that is going to be big. So if you do go all in today on Bitcoin, because I know some people will be doing that exact thing, just remember, we are right now at the start of a new massive cycle for crypto. There is a good chance that we could get over twenty thousand dollars by the end of this year and then within 18 months, we could be looking at new all-time highs, over one hundred thousand dollars. There’s going to be bumps on the way. Nothing goes straight up. So be aware of that. This is why we say stack Satz and chill, accumulate, relax, take the big picture him. So your question for today. What do you think? Will there be a big dump after the bitcoin having? And if so, what price point are you hoping to buy in it or do you think that there’s just way too much demand, way too much excitement? The stars are all aligning for Bitcoin and that is definitely be taking off to new highs as the year progresses. There won’t be any real significant dips coming in the short term after the having. Curious to know your thoughts, as always, down below in the comment section. Thank you so much. Watching today’s video. Daily reminder, you’re freaking awesome. So thank you so much for watching this video. You did enjoy it. Whack that thumbs up. Unsubscribe that young. You guys know the drill. Long live block, James. Then peace out till next time.

source https://www.cryptosharks.net/bitcoin-halving-price-breaking-out-news/ source https://cryptosharks1.tumblr.com/post/617823181427949568

0 notes

Text

Bitcoin Halving BUY NOW? WAIT? Price Breaking Out On News of HUGE INVESTORS BTC PLAY

VIDEO TRANSCRIPT

Today in crypto bitcoin blasts over ten thousand dollars as the bitcoin having Foma kicks into high gear, is now the right time to buy Bitcoin? Or should you wait until after the having? Well, mass accumulation is happening right now by key players in a massive and very respected hedge fund just announced there. Bitcoin play. This is heating up big time. Let the photo commence. The crypto lark. This is where you subscribe for all of the hottest and all of the latest happening out there in the wild, wildland of crypto. Also, for those of you who want to learn how to trade cryptocurrencies. Check out my course. Crypto Trading explained. It will take you through all of the basics and teach you how to use key indicators, identify important patterns, manage your risk and lock in your trading profits. There is a link Downbelow, where you can learn more. So let’s dig into the charts to get started off with. And the first thing that we have got to talk about is that the price of Bitcoin has finally broken above the line of weekly resistance that has been holding Bitcoin down for more than two years. This is incredibly bullish. Obviously, this candle does still need to confirm there’s a few days away until we actually do see that candle close. But definitely looking nice today, certainly heading in the right direction. Now, looking over on the daily, we have confirmed a candle above the downward trend line as well. However, even though we have peaked just above ten thousand dollars a few times in the last few hours, Bitcoin is having trouble holding this incredibly key line in the sand resistance. Around ten thousand dollars was definitely something to be expected. Now, watching Bitcoin and trying to break and hold above ten thousand dollars kind of feels like this. You shall not pass. If we can actually be crushed and a thousand dollars over the weekend, then the next big hurdle is ten thousand five hundred dollars. Crossing above that line would literally give us a new high for the year. But let’s see if we can actually confirm that we have flipped that line of resistance, that we just broke into a line of support around the 94 hundred dollar mark, approximately. If it doesn’t hold as a line of support, then eighty-four hundred dollars to be the next important one on the way down that you should be watching for. But the way that the market is moving right now, we are back on schedule for another golden cross to potentially hit in just a few days. If the markets continue like this, then we could actually hit that cross sometime late next week. Bitcoin market dominance has been raging today as well, almost hitting 69 percent of the total market, meaning that ALTE coin BTC pairs, they’re getting hit pretty hard at the moment. So be careful if you are out there trading old coins right now. I am personally waiting for the having madness to pass before I hop back into trading BTC pairs. A big thank you to Crypto Dot for sponsoring today’s episode. A reminder that the crypto dot com exchange is going to be hosting an insane sale for Bitcoin on May 12th. There will be one million buckaroos worth of Bitcoin up for grabs at a 50 percent discount. So you can buy up to two hundred dollars of that allocation with no S.R.O. tokens needing to be staked. And you can actually get a higher limit with S.R.O. tokens state. Sadly, U.S. traders are not eligible for this sale. So if you are keen, get over there, get registered on the exchange and get ready to score some of that cheap Bitcoin 50 percent off Bitcoin sale. You don’t find it very often. And big news for all those waiting for their debit cards over in the EU. The final stages of card deployment are moving ahead. And the current estimate is that cards are going to start shipping next week all across the European Union. Orsa. Also, as a reminder, these cards are currently available in the USA, New Zealand, Australia, the Philippines, the UK, of course, now shipping across the EU as well. Get yours today and start enjoying Krypto back rewards for every single swipe of your card. That’s two percent for the ruby red tier card and three percent for the J Green, which is. The card that I have here in my hand now, as well as getting those crypto back rewards, you will also get some sweet perks like free Netflix, free Spotify, an airport lounge access. And as an extra super special bonus, when you reserve a ruby red tier card or higher using the link Downbelow, you’ll get a 50 dollar bonus of free crypto. Very nice. So let’s go ahead and get into our question. Today is the time to buy Bitcoin now or is it not the time to make one? Well, it’s always time to buy Bitcoin, but the Bitcoin having is less than four days away at this point. A lot of people think the show, buy before or after having. And look, there remains a very good chance with all the macro factors that we have been discussing on the channel recently, that Bitcoin is going to be over twenty thousand dollars by the end of the year. I mean, just look at how crazy the recovery from this big crash has been. We are currently up around a hundred and sixty percent since Black Thursday. No other asset class has come near this. Also, a quick word of congratulations to all those people with the very strong hands that did not sell when the market got tough and that held through all of this craziness. But does that mean that you should buy now or wait for a dip after the bitcoin having? Well, let’s go over some different things that are happening right now in the market. And hopefully, you can answer this question for your self. There is a lot of expectation right now of a post having a dip. The last Bitcoin having we saw. Was quite significant. I must say, though, there are no guarantees that this will happen this time. Nothing is certain in markets. You can think. Maybe this will happen, but there is no guarantee that is what’s going to happen. Just because there is a big dip last time. It doesn’t mean it’s going to happen this time. But if there is a significant dip in the price of Bitcoin, I personally expect it to be short-lived and to be heavily bought unless some really just drastically bad economic news comes out worse than we’ve been getting in the past couple of weeks anyway. And of course, that would drag Bitcoin lower, potentially. But there is a good chance that we do see a buy the rumour, sell the news kind of scenario, play out in the coming week or two where everyone’s really excited and then it’s not that big an event like, oh, isn’t that exciting? So keep an eye out for that. The Bitcoin Fear and greed index has more than doubled in two weeks. The rise in greed in the market so quickly kind of has me short term suspicious of the continuation of this run after the having. But that being said, we are only about halfway up this meter. So there is an incredible amount of more greed that we can be experiencing in this market. Search trends for Bitcoin are also up big time. The term by Bitcoin is that high that we have not seen since the height of the twenty nineteen runs. And the term Bitcoin having, of course, is absolutely skyrocketing at the moment, making the 2016 interest in this particular search term just a small blip on the chart that you see on the screen here. Such parabolic interest spikes are usually followed by a cool-down period and less interest short term could mean less price action short term. But regardless of whether or not we hit a little bit of turbulence in the next week or two, coming out of the having almost every metric is showing that the big picture for Bitcoin is getting incredibly exciting. The Holder net position change chart has stayed positive during the market recovery of the past eight weeks, which is showing that there is a lot of optimistic sentiment in the market right now and that buyers have long term confidence in their holdings. Also, the number of active addresses has soared to levels not seen since the 2017 bull market, which is totally loco considering where we are price-wise and so has the number of new Bitcoin addresses that have also been soaring recently. We are seeing big increases in both new adopters and big increases in way accounts that have been accumulating more in the demand. It is soaring like crazy. Check out these crazy stats here. When we combine the buying of just cash app and just greyscale together, these two organizations bought the equivalent of half of the supply in quarter one of newly mined Bitcoin, meaning that post having if demand stayed the same. Then these two entities A. Own would consume all of the newly mined Bitcoin. But demand is not staying the same. Demand is rising big time right now. And I’m only talking about two companies here. We’re not accounting for all the other guys, like the ATC desks and Coinbase and finance and crypto dot com and all of the others that are offering people ways to buy up Bitcoin and of course, peer to peer exchanges like local bitcoins and others have seen record volumes in countries all around the world. This Bitcoin bull run, it is going to be crazy. And we got a big boost today from the world’s most respected investors and hedge fund managers. Paul Tudor Jones has announced that he is buying Bitcoin as a hedge against the inflationary forces being unleashed by central banks across the world and their relentless money printing insanity, telling his clients in a letter that Bitcoin right now reminds him of gold in the 1970s, particularly gold in the year 1976. What happens to gold in 1976? You might ask. Well, the price of gold started a run from around five hundred dollars up to over two thousand dollars just a couple of years later. One of the world’s top macro investors is betting that Bitcoin is about to pull a gun of this magnitude. 2021 is likely going to be a super crazy year for the crypto markets. Jones has been left shocked, of course, by the money printing madness that is going on, saying that we are witnessing the great monetary inflation and unprecedented expansion of every form of money, unlike anything the developed world has ever seen. And this is not his first time in the Bitcoin rodeo either. Healths made an epic long back in 2017 that he closed out around the twenty thousand dollar mark. So he’s not totally new to Bitcoin, but this is a new play for him because he’s been kind of quiet since back then. Now, in his recent statement, he said that Bitcoin is a store of value and decided that it passes the test based on four characteristics purchasing power, trustworthiness, liquidity and portability. The twenty-two billion dollars, two-door BVI fund has now been authorized to invest a low single-digit percentage of assets in BITT coin futures. Even one percent is two hundred and twenty million dollars. Four percent. That’s almost a billion dollars. This is big money that we’re talking about here. Now, sadly, they are not buying and holding Bitcoin directly. It’s also not clear whether the Tudeh or Fund will be trading cash, settled Bitcoin futures or physically settled Bitcoin futures that give them Bitcoin at the end. And to be fair, he didn’t only talk about Bitcoin in his letter to investors. In fact, he rated it as a store of value below that of gold. But his choice to buy derivatives instead of real bitcoin put aside here for a moment. The entry of Jones is still an incredibly bullish indicator for the crypto markets and is likely to pique the interest of a lot of older investors who follow and respect Jones since he is one of the most successful investors of the last few decades. And this will also be a big buy signal to other Wall Street types and to other fund managers. Billions of dollars are about to start flowing into Bitcoin in a massive, massive flood of new money coming in. This might just be the signal from the big boys. The perfect storm is here for crypto big funds. They are getting involved in a big way, retail mania. It is starting to set in. Governments are printing ungodly amounts of money. Honestly, Bitcoin has never been so strong. Going into a having the infrastructure and the awareness, they are bigger and better than ever before. So anyway, to answer the question, should you buy Bitcoin now or wait until after the having? I don’t know. I don’t know. No one really does. This is the thing. You have to make your own decisions, DIY or do your own research. We’re all just out here making educated guesses what we think might or might not happen in the markets. With the current surge in retail demand, institutional demand and the macroeconomic picture, I think that any dip that we do have will be short-lived, even if we get anything substantial happening at all. I know a lot of new people. They’re entering the space right now and they’re looking for answers to looking for someone to tell you what to do. That’s not how it works. There’s not gonna be someone out there telling you what to do. And if there is, you should be suspicious of that person. Dollar-cost averaging remains one of the most solid strategies for getting a position into Bitcoin that is buying a set dollar amount of Bitcoin every single week. Well, that’s 50 bucks, 100 bucks, whatever your number is, is one of the easiest wafers ways for investors to actually get access to Bitcoin going all in. Yeah, that can also be a big reward kind of situation, but it also can shake you if the market turns on you the next day and prices take a big debt and you think, what did I do? I’m losing all this money. Remember, no matter what you do, focus on that long term game. Bitcoin is highly limited in its supply and getting any portion of the supply into your hands in the coming years, that is going to be big. So if you do go all in today on Bitcoin, because I know some people will be doing that exact thing, just remember, we are right now at the start of a new massive cycle for crypto. There is a good chance that we could get over twenty thousand dollars by the end of this year and then within 18 months, we could be looking at new all-time highs, over one hundred thousand dollars. There’s going to be bumps on the way. Nothing goes straight up. So be aware of that. This is why we say stack Satz and chill, accumulate, relax, take the big picture him. So your question for today. What do you think? Will there be a big dump after the bitcoin having? And if so, what price point are you hoping to buy in it or do you think that there’s just way too much demand, way too much excitement? The stars are all aligning for Bitcoin and that is definitely be taking off to new highs as the year progresses. There won’t be any real significant dips coming in the short term after the having. Curious to know your thoughts, as always, down below in the comment section. Thank you so much. Watching today’s video. Daily reminder, you’re freaking awesome. So thank you so much for watching this video. You did enjoy it. Whack that thumbs up. Unsubscribe that young. You guys know the drill. Long live block, James. Then peace out till next time.

Via https://www.cryptosharks.net/bitcoin-halving-price-breaking-out-news/

source https://cryptosharks.weebly.com/blog/bitcoin-halving-buy-now-wait-price-breaking-out-on-news-of-huge-investors-btc-play

0 notes

Text

Bitcoin Halving, BUY NOW? WAIT? Price Breaking Out On News of HUGE INVESTOR’S BTC PLAY

VIDEO TRANSCRIPT

Today in crypto bitcoin blasts over ten thousand dollars as the bitcoin having Foma kicks into high gear, is now the right time to buy Bitcoin? Or should you wait until after the having? Well, mass accumulation is happening right now by key players in a massive and very respected hedge fund just announced there. Bitcoin play. This is heating up big time. Let the photo commence. The crypto lark. This is where you subscribe for all of the hottest and all of the latest happening out there in the wild, wildland of crypto. Also, for those of you who want to learn how to trade cryptocurrencies. Check out my course. Crypto Trading explained. It will take you through all of the basics and teach you how to use key indicators, identify important patterns, manage your risk and lock in your trading profits. There is a link Downbelow, where you can learn more. So let’s dig into the charts to get started off with. And the first thing that we have got to talk about is that the price of Bitcoin has finally broken above the line of weekly resistance that has been holding Bitcoin down for more than two years. This is incredibly bullish. Obviously, this candle does still need to confirm there’s a few days away until we actually do see that candle close. But definitely looking nice today, certainly heading in the right direction. Now, looking over on the daily, we have confirmed a candle above the downward trend line as well. However, even though we have peaked just above ten thousand dollars a few times in the last few hours, Bitcoin is having trouble holding this incredibly key line in the sand resistance. Around ten thousand dollars was definitely something to be expected. Now, watching Bitcoin and trying to break and hold above ten thousand dollars kind of feels like this. You shall not pass. If we can actually be crushed and a thousand dollars over the weekend, then the next big hurdle is ten thousand five hundred dollars. Crossing above that line would literally give us a new high for the year. But let’s see if we can actually confirm that we have flipped that line of resistance, that we just broke into a line of support around the 94 hundred dollar mark, approximately. If it doesn’t hold as a line of support, then eighty-four hundred dollars to be the next important one on the way down that you should be watching for. But the way that the market is moving right now, we are back on schedule for another golden cross to potentially hit in just a few days. If the markets continue like this, then we could actually hit that cross sometime late next week. Bitcoin market dominance has been raging today as well, almost hitting 69 percent of the total market, meaning that ALTE coin BTC pairs, they’re getting hit pretty hard at the moment. So be careful if you are out there trading old coins right now. I am personally waiting for the having madness to pass before I hop back into trading BTC pairs. A big thank you to Crypto Dot for sponsoring today’s episode. A reminder that the crypto dot com exchange is going to be hosting an insane sale for Bitcoin on May 12th. There will be one million buckaroos worth of Bitcoin up for grabs at a 50 percent discount. So you can buy up to two hundred dollars of that allocation with no S.R.O. tokens needing to be staked. And you can actually get a higher limit with S.R.O. tokens state. Sadly, U.S. traders are not eligible for this sale. So if you are keen, get over there, get registered on the exchange and get ready to score some of that cheap Bitcoin 50 percent off Bitcoin sale. You don’t find it very often. And big news for all those waiting for their debit cards over in the EU. The final stages of card deployment are moving ahead. And the current estimate is that cards are going to start shipping next week all across the European Union. Orsa. Also, as a reminder, these cards are currently available in the USA, New Zealand, Australia, the Philippines, the UK, of course, now shipping across the EU as well. Get yours today and start enjoying Krypto back rewards for every single swipe of your card. That’s two percent for the ruby red tier card and three percent for the J Green, which is. The card that I have here in my hand now, as well as getting those crypto back rewards, you will also get some sweet perks like free Netflix, free Spotify, an airport lounge access. And as an extra super special bonus, when you reserve a ruby red tier card or higher using the link Downbelow, you’ll get a 50 dollar bonus of free crypto. Very nice. So let’s go ahead and get into our question. Today is the time to buy Bitcoin now or is it not the time to make one? Well, it’s always time to buy Bitcoin, but the Bitcoin having is less than four days away at this point. A lot of people think the show, buy before or after having. And look, there remains a very good chance with all the macro factors that we have been discussing on the channel recently, that Bitcoin is going to be over twenty thousand dollars by the end of the year. I mean, just look at how crazy the recovery from this big crash has been. We are currently up around a hundred and sixty percent since Black Thursday. No other asset class has come near this. Also, a quick word of congratulations to all those people with the very strong hands that did not sell when the market got tough and that held through all of this craziness. But does that mean that you should buy now or wait for a dip after the bitcoin having? Well, let’s go over some different things that are happening right now in the market. And hopefully, you can answer this question for your self. There is a lot of expectation right now of a post having a dip. The last Bitcoin having we saw. Was quite significant. I must say, though, there are no guarantees that this will happen this time. Nothing is certain in markets. You can think. Maybe this will happen, but there is no guarantee that is what’s going to happen. Just because there is a big dip last time. It doesn’t mean it’s going to happen this time. But if there is a significant dip in the price of Bitcoin, I personally expect it to be short-lived and to be heavily bought unless some really just drastically bad economic news comes out worse than we’ve been getting in the past couple of weeks anyway. And of course, that would drag Bitcoin lower, potentially. But there is a good chance that we do see a buy the rumour, sell the news kind of scenario, play out in the coming week or two where everyone’s really excited and then it’s not that big an event like, oh, isn’t that exciting? So keep an eye out for that. The Bitcoin Fear and greed index has more than doubled in two weeks. The rise in greed in the market so quickly kind of has me short term suspicious of the continuation of this run after the having. But that being said, we are only about halfway up this meter. So there is an incredible amount of more greed that we can be experiencing in this market. Search trends for Bitcoin are also up big time. The term by Bitcoin is that high that we have not seen since the height of the twenty nineteen runs. And the term Bitcoin having, of course, is absolutely skyrocketing at the moment, making the 2016 interest in this particular search term just a small blip on the chart that you see on the screen here. Such parabolic interest spikes are usually followed by a cool-down period and less interest short term could mean less price action short term. But regardless of whether or not we hit a little bit of turbulence in the next week or two, coming out of the having almost every metric is showing that the big picture for Bitcoin is getting incredibly exciting. The Holder net position change chart has stayed positive during the market recovery of the past eight weeks, which is showing that there is a lot of optimistic sentiment in the market right now and that buyers have long term confidence in their holdings. Also, the number of active addresses has soared to levels not seen since the 2017 bull market, which is totally loco considering where we are price-wise and so has the number of new Bitcoin addresses that have also been soaring recently. We are seeing big increases in both new adopters and big increases in way accounts that have been accumulating more in the demand. It is soaring like crazy. Check out these crazy stats here. When we combine the buying of just cash app and just greyscale together, these two organizations bought the equivalent of half of the supply in quarter one of newly mined Bitcoin, meaning that post having if demand stayed the same. Then these two entities A. Own would consume all of the newly mined Bitcoin. But demand is not staying the same. Demand is rising big time right now. And I’m only talking about two companies here. We’re not accounting for all the other guys, like the ATC desks and Coinbase and finance and crypto dot com and all of the others that are offering people ways to buy up Bitcoin and of course, peer to peer exchanges like local bitcoins and others have seen record volumes in countries all around the world. This Bitcoin bull run, it is going to be crazy. And we got a big boost today from the world’s most respected investors and hedge fund managers. Paul Tudor Jones has announced that he is buying Bitcoin as a hedge against the inflationary forces being unleashed by central banks across the world and their relentless money printing insanity, telling his clients in a letter that Bitcoin right now reminds him of gold in the 1970s, particularly gold in the year 1976. What happens to gold in 1976? You might ask. Well, the price of gold started a run from around five hundred dollars up to over two thousand dollars just a couple of years later. One of the world’s top macro investors is betting that Bitcoin is about to pull a gun of this magnitude. 2021 is likely going to be a super crazy year for the crypto markets. Jones has been left shocked, of course, by the money printing madness that is going on, saying that we are witnessing the great monetary inflation and unprecedented expansion of every form of money, unlike anything the developed world has ever seen. And this is not his first time in the Bitcoin rodeo either. Healths made an epic long back in 2017 that he closed out around the twenty thousand dollar mark. So he’s not totally new to Bitcoin, but this is a new play for him because he’s been kind of quiet since back then. Now, in his recent statement, he said that Bitcoin is a store of value and decided that it passes the test based on four characteristics purchasing power, trustworthiness, liquidity and portability. The twenty-two billion dollars, two-door BVI fund has now been authorized to invest a low single-digit percentage of assets in BITT coin futures. Even one percent is two hundred and twenty million dollars. Four percent. That’s almost a billion dollars. This is big money that we’re talking about here. Now, sadly, they are not buying and holding Bitcoin directly. It’s also not clear whether the Tudeh or Fund will be trading cash, settled Bitcoin futures or physically settled Bitcoin futures that give them Bitcoin at the end. And to be fair, he didn’t only talk about Bitcoin in his letter to investors. In fact, he rated it as a store of value below that of gold. But his choice to buy derivatives instead of real bitcoin put aside here for a moment. The entry of Jones is still an incredibly bullish indicator for the crypto markets and is likely to pique the interest of a lot of older investors who follow and respect Jones since he is one of the most successful investors of the last few decades. And this will also be a big buy signal to other Wall Street types and to other fund managers. Billions of dollars are about to start flowing into Bitcoin in a massive, massive flood of new money coming in. This might just be the signal from the big boys. The perfect storm is here for crypto big funds. They are getting involved in a big way, retail mania. It is starting to set in. Governments are printing ungodly amounts of money. Honestly, Bitcoin has never been so strong. Going into a having the infrastructure and the awareness, they are bigger and better than ever before. So anyway, to answer the question, should you buy Bitcoin now or wait until after the having? I don’t know. I don’t know. No one really does. This is the thing. You have to make your own decisions, DIY or do your own research. We’re all just out here making educated guesses what we think might or might not happen in the markets. With the current surge in retail demand, institutional demand and the macroeconomic picture, I think that any dip that we do have will be short-lived, even if we get anything substantial happening at all. I know a lot of new people. They’re entering the space right now and they’re looking for answers to looking for someone to tell you what to do. That’s not how it works. There’s not gonna be someone out there telling you what to do. And if there is, you should be suspicious of that person. Dollar-cost averaging remains one of the most solid strategies for getting a position into Bitcoin that is buying a set dollar amount of Bitcoin every single week. Well, that’s 50 bucks, 100 bucks, whatever your number is, is one of the easiest wafers ways for investors to actually get access to Bitcoin going all in. Yeah, that can also be a big reward kind of situation, but it also can shake you if the market turns on you the next day and prices take a big debt and you think, what did I do? I’m losing all this money. Remember, no matter what you do, focus on that long term game. Bitcoin is highly limited in its supply and getting any portion of the supply into your hands in the coming years, that is going to be big. So if you do go all in today on Bitcoin, because I know some people will be doing that exact thing, just remember, we are right now at the start of a new massive cycle for crypto. There is a good chance that we could get over twenty thousand dollars by the end of this year and then within 18 months, we could be looking at new all-time highs, over one hundred thousand dollars. There’s going to be bumps on the way. Nothing goes straight up. So be aware of that. This is why we say stack Satz and chill, accumulate, relax, take the big picture him. So your question for today. What do you think? Will there be a big dump after the bitcoin having? And if so, what price point are you hoping to buy in it or do you think that there’s just way too much demand, way too much excitement? The stars are all aligning for Bitcoin and that is definitely be taking off to new highs as the year progresses. There won’t be any real significant dips coming in the short term after the having. Curious to know your thoughts, as always, down below in the comment section. Thank you so much. Watching today’s video. Daily reminder, you’re freaking awesome. So thank you so much for watching this video. You did enjoy it. Whack that thumbs up. Unsubscribe that young. You guys know the drill. Long live block, James. Then peace out till next time.

source https://www.cryptosharks.net/bitcoin-halving-price-breaking-out-news/

0 notes