#findahome

Explore tagged Tumblr posts

Text

House For Sale in Philippines

Real Estate Listing, Marketplace, Compare and book your site viewing appointment with the local experts and licensed agents. Why rent a house when you can have your own. For more information, visit https://realtor.krbooking.com/

#home#property#forsale#forrent#realestateforsale#newhome#dreamhome#househunting#apartmenthunting#justsold#homesforsale#justlisted#renovated#newlisting#buyerwishlist#realestatebuyers#virtualtour#relocation#findahome#makeahouseahome#bringyourbuyers#bringmebuyers#homesweethome#househunter#buyeragent#realestate#realtor#realestateagent#realtorlife#investment

2 notes

·

View notes

Text

What To Know About Closing Costs

Now that you’ve decided to buy a home and are ready to make it happen, it’s a good idea to plan ahead for the costs that are a typical part of the homebuying process. And while your down payment is probably the number one expense on your mind, don’t forget about closing costs. Here’s what you need to know.

What Are Closing Costs?

Simply put, your closing costs are the additional fees and payments you have to make at closing. And while they’ll vary based on the price of the home and how it’s being financed, every buyer has these, so they shouldn’t be a surprise. It’s just that some people forget to budget for them. According to Freddie Mac, this part of the homebuying process typically includes:

Application fees

Credit report fees

Loan origination fees

Appraisal fees

Home inspection fees

Title insurance

Homeowners Insurance

Survey fees

Attorney fees

Some of these are one-time expenses that are baked into your closing costs. Others, like homeowners’ insurance, are initial installment payments for ongoing responsibilities you’ll have once you take possession of the home.

How Much Are Closing Costs?

The same Freddie Mac article goes on to say:

“Closing costs vary greatly depending on your location and the price of your home. Typically, you should be prepared to pay between 2% and 5% of the home purchase price in closing fees.”

With that in mind, here’s how you can get an idea of what you’ll need to budget. Let’s say you find a home you want to purchase at today’s median price of $422,600. Based on the 2–5% Freddie Mac estimate, your closing fees could be between roughly $8,452 and $21,130.

But keep in mind, if you’re in the market for a home above or below this price range, your numbers will be higher or lower.

Tips To Reduce Your Closing Costs

If you’re wondering if there’s any way to inch that down a little bit, NerdWallet lists a few things that could help:

Negotiate with the Seller: Some sellers are willing to cover part or all of these expenses — especially since homes are staying on the market a bit longer now. Sellers may be more motivated to compromise, and you’ll find you have a bit more negotiation power. So don’t hesitate to ask them for concessions like paying for the home inspection or giving you a credit toward closing costs.

Shop Around for Home Insurance: Since rising home insurance is a challenge in many areas of the country right now, take the time to get a clear picture of all your options. Each insurance company offers their own policies and coverage, so get multiple quotes and see how they compare. Choosing a policy that provides reliable coverage at a competitive rate can make a difference.

Look into Closing Cost Assistance: Just like there are programs out there to help with your down payment, options exist to get support with closing costs too. While they’ll vary by area, there are programs for various income levels, certain professions, and specific towns or neighborhoods too. If you want to learn more, Experian says:

“Your real estate professional should be able to steer you toward applicable programs, and the U.S. Department of Housing and Urban Development (HUD) maintains a helpful resource for finding homebuying assistance programs in every state.”

Bottom Line

Planning for the fees and payments you’ll need to cover when you’re closing on your home is important — and it doesn’t have to be a big surprise. With the right experts on your side, you can make sure you’re prepared. Let’s connect with real estate agents from KM Realty Group LLC so you have someone you can go to for more tips and advice.

#buyahome#homebuying#homeowners#findahome#realestate#realestateagents#real estatebrokers#realestateagentstexas#bestrealtors#chicagorealtors#Chicagobrokers

0 notes

Text

🚀 Exciting times ahead for Gurugram! Our latest blog post delves into the transformative impact of the Dwarka Expressway on the city's landscape. From enhancing connectivity to boosting real estate, this major infrastructure project is set to redefine the way we live, work, and commute in Gurugram. Curious about what the future holds? Click the link below to explore how the Dwarka Expressway is shaping the future of this vibrant city! 🏙️ #Gurugram #DwarkaExpressway #UrbanDevelopment #Infrastructure #RealEstate #FutureCity

#realestate#realestateagent#realestateinvestor#realestatelife#property#realty#housingmarket#homedesign#realestatetips#homeownership#broker#investment#luxuryrealestate#makememove#mansion#interiordesign#architecture#firsttimehomebuyer#fixandflip#foreclosure#Real estate hashtags for buyers#buyeragent#homebuyer#dreamhome#findahome#househunter#makeahouseahome#newhome#realestatebuyers#relocation

0 notes

Text

Simplify your apartment search with our company's expert help. Consulting firms and legal support provide the tools you need for a successful and affordable move. https://www.hotels.com.bd/blog/how-to-find-cheap-apartments-for-rent-5-effortless-ways/ #BudgetRentals #ConsultingSupport #LegalHelp #FindAHome

0 notes

Text

OPEN HOUSE! Today 11am to 1pm. Join Me!

29 June

#homes #realtornearme #toprealtors #house #sellmyhome #vanessasellsctx #copperascovetx #fortcavazos #fortcavazosrealtor #moving #firsttimehomebuyers #luxurylistings #1031exchange #HomeValue #homeevaluation #equity #JustListed #NewListing #MillennialHome #BuyerWishlist #FindaHome #Relocation #VirtualTour #RenovatedHome #HouseHunting #RealtorLife #FSBO #LuxuryRealEstate #OpenHouse #FirstTimeHomeBuyer #FutureHomeowner #LoveWhereYouLive #Downtown #Uptown #MidCenturyModern #VictorianHome #petfriendly

0 notes

Photo

A Realtor's Vital Role: Navigating the Home Loan Process As a realtor, my job is to guide you through the many options available while finding the perfect home for your unique needs. I also act as a personal connection to help you navigate the financial aspects of home buying, specifically finding the right loan. While I personally don't handle the loan, I work alongside the mortgage lender to assist with paperwork for the underwriters. Purchasing a home can be a complicated process, but with my guidance, it can be a highly rewarding experience. Understanding the Different Home Loan Types One of my primary responsibilities is to help you choose the right home loan by understanding its specific requirements. It's important to note that each loan type has its own set of benefits and requirements. For example, a conventional loan may offer lower interest rates and greater flexibility when it comes to property selection, but it usually requires a higher down payment. On the other hand, an FHA loan may have more lenient down payment requirements, but come with higher interest rates and stricter property guidelines. Exploring Down Payment Assistance Programs There are several down payment assistance programs available to home buyers, but it's essential to research these programs carefully. Some may have income or credit score requirements and can result in higher fees or interest rates. As your realtor, I'm here to help you navigate these programs and find the best fit for your needs. Let Me Guide You Every Step of the Way Don't let the complexities of the home loan process hold you back from the rewards of homeownership. As your realtor, I'm here to help you understand and confidently navigate every step of the process. #danwood,#NRHrealtor, #texasrealestate, #txrealestate, #texasrealto, #txrealtor, #fortworrealtor, #fortworthrealestate, #ftwrealtor, #ftwrealestate,#buyerwishlist,#realestatebuyers,#virtualtour,#relocation,#findahome,#makeahouseahome,#bringyourbuyers,#bringmebuyers,#homesweethome,#househunter,#buyeragent, #realtor #dreamhomes #homebuyers #realestateagent #homesofinstagram #properties #homesearch #realestateinvesting #housingmarket #NRHRealtor

0 notes

Photo

This beauty perked up my snowy Friday night! A Victorian #sapphire and #diamond cruciform pendant from @woolleyandwallisjewellery I could find this a wonderful home ;) * * #vintagejewelry #fashion #antique#followme #antiquejewelry#jewelrygram #finejewelry #vintage#jotd #jewelryofinstagram #jewelryporn#jewelrylovers #jewelryaddict#inspiration #victorian #findahome#newhome #wishitwasmine#whatididntwear #lovegold https://www.instagram.com/p/B6BzPcblQ-X/?igshid=1kvgj7jx3nldq

#sapphire#diamond#vintagejewelry#fashion#antique#followme#antiquejewelry#jewelrygram#finejewelry#vintage#jotd#jewelryofinstagram#jewelryporn#jewelrylovers#jewelryaddict#inspiration#victorian#findahome#newhome#wishitwasmine#whatididntwear#lovegold

62 notes

·

View notes

Photo

Raw Land

If you are curious about active or potential real estate listings in the Cedar City area, then make Ben Batty - ERA Realty Center your first call. I have a constantly-updated database of all the raw land, commercial, and residential real estate sales available and am dedicated to helping you find the property that's right for your needs and budget. I know the area incredibly well and can help you make decisions about what would work best for you and your situation. For more information, or to learn about the current listings I have on file, contact Ben Batty - ERA Realty Center today!

https://www.cedarcitynewhomebuyers.com

#HomesforSale#Homes#NewHomeBuyers#CedarCityHomes#HousesforSale#PropertyBuying#RealEstateInvestment#MovingtoCedarCity#RealEstateSales#RealEstateAgent#FindAHome#RawLand

3 notes

·

View notes

Text

Moving to, Bangalore

Moving to a new city and getting accustomed can be easy or challenging, depending upon various factors. Here's my take on the transition to Bangalore.

Moving to a new city can be both exciting and daunting. Whether it’s for personal or professional reasons, relocating to a new place requires a lot of planning and effort. If you are moving to Bangalore, a bustling metropolis in the southern part of India, and you are from Kolkata, a city in eastern India, then you can expect some cultural differences between the two places. In this blog post, I…

View On WordPress

#Bangalore#blogging#communitylove_#culture#family#findahome#getaccustomed#goodvibes#heritage#housing#ideas#india#life#livelihood#lovelycity#lovethiscity#metropolis#nature#newcity#peakBengaluru#Photography#positivity#rent#scenery#SouthIndia#technology#touristing#walkingaround#wanderingaround#wordpress

0 notes

Photo

#WhosAfraid #VirginiaWoolf #TheLost #Books #Secondhand #JustForYou #Homeless #FindAHome #InMySoul #TakeMeHome #Random #CaughtMyEye #BestFriends https://www.instagram.com/p/CfNkUVdMVpO/?igshid=NGJjMDIxMWI=

#whosafraid#virginiawoolf#thelost#books#secondhand#justforyou#homeless#findahome#inmysoul#takemehome#random#caughtmyeye#bestfriends

0 notes

Photo

You can't find the perfect home without the perfect agent. That's where I come in! I'd love to help you find your forever home and represent you at the closing table. Let's talk soon! #HouseHunting #Agent #Representation #FindAHome #Tips #KnowYourAgent #Realtors #ForeverHome (at Markham, Ontario) https://www.instagram.com/p/CVu5B_TrXuu/?utm_medium=tumblr

0 notes

Text

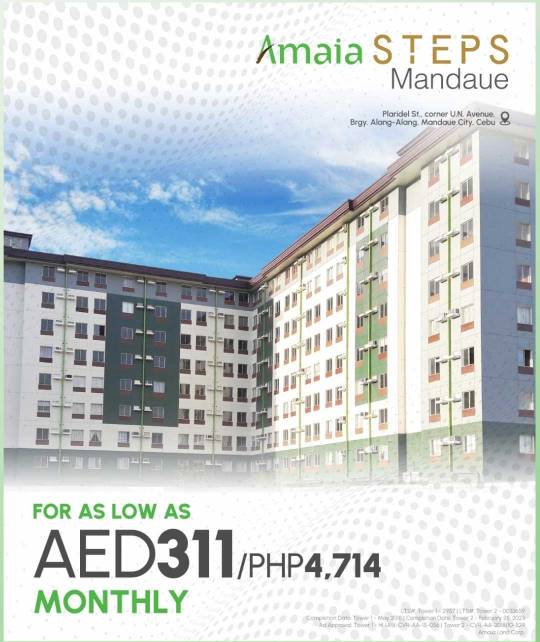

Apartment for sale in Cebu, Philippines

Real Estate Listing, Marketplace, Compare and book your site viewing appointment with the local experts and licensed agents. For more information, visit https://realtor.krbooking.com/

#home#property#forsale#forrent#realestateforsale#newhome#dreamhome#househunting#apartmenthunting#justsold#homesforsale#justlisted#renovated#newlisting#buyerwishlist#realestatebuyers#virtualtour#relocation#findahome#makeahouseahome#bringyourbuyers#bringmebuyers#homesweethome#househunter#buyeragent#realestate#realtor#realestateagent#realtorlife#investment

0 notes

Text

Today’s Biggest Housing Market Myths

Blog by KM Realty Group LLC, Chicago, Illinois

Have you ever heard the phrase: don’t believe everything you hear? That’s especially true if you’re thinking about buying or selling a home in today’s housing market. There’s a lot of misinformation out there. And right now, making sure you have someone you can go to for trustworthy information is extra important.

If you partner with a real estate agent, they can clear up some common misconceptions and reassure you by backing them up with research-driven facts. Here are just a few misconceptions they can help disprove.

1. I’ll Get a Better Deal Once Prices Crash

If you’ve heard home prices are going to come crashing down, it’s time to look at what’s actually happening. While prices vary by local market, there’s a lot of data out there from numerous sources that shows a crash is not going to happen. Back in 2008, there was a dramatic oversupply of homes that led to prices crashing. Across the board, there’s an undersupply of homes for sale today. That makes this market a whole different scenario (see chart below):

So, if you think waiting will score you a deal, know that data shows there’s not a crash on the horizon, and waiting isn’t going to pay off the way you’d hoped.

2. I Won’t Be Able To Find Anything To Buy

So, if you’re remembering all that media coverage about record-low supply during the pandemic, you can rest a bit easier. While the market isn’t back to normal just yet, inventory is moving in a healthier direction. And that means as your options improve, you can let go of this now outdated myth because finding a home to buy won’t feel quite so impossible anymore.

3. I Have To Wait Until I Have Enough for a 20% Down Payment

Many people still believe you need a 20% down payment to buy a home. To show just how widespread this myth is, Fannie Mae says:

“Approximately 90% of consumers overstate or don’t know the minimum required down payment for a typical mortgage.”

And if you look at the data from the National Association of Realtors (NAR), you can see the typical homeowner isn’t putting down as much as you might expect (see graph below):

First-time homebuyers are typically only putting down 6%. That’s far less than the 20% so many people think they need. And if you’re looking at that graph and you’re more focused on how the number for repeat buyers is closer to 20%, here’s what you need to realize. That’s only because they have so much equity built up in their current house that can be used to make a larger down payment for their next move.

This goes to show you don’t have to put 20% down, unless it’s specified by your loan type or lender. Many people put down a lot less. Not to mention, depending on the type of home loan you get, you may only need to put 3.5% or even 0% down. So, if you’re buying your first home, you likely don’t need nearly as much for your down payment as you may think.

An Agent’s Role in Fighting Misconceptions

If you put your move on pause because you heard one or more of these myths yourself, it’s time to talk to a trusted agent. An expert agent has more data and the facts, just like this, to reassure you and help break through any misconceptions that may be holding you back.

Bottom Line

If you have questions about what you’re hearing or reading, let’s connect with real estate agents from KM Realty Group LLC. You deserve to have someone you can trust to get the facts.

0 notes

Text

Looking for a smart investment in a city with deep cultural roots and bright future prospects? Ayodhya is offering exclusive residential plots in prime locations, perfect for building your dream home or making a wise investment.

Why Invest in Ayodhya?

Prime Location: Excellent access and infrastructure in a city on the rise.

Modern Living: Experience the perfect blend of heritage and contemporary lifestyle.

High Return Potential: As Ayodhya grows, so will your investment.

Take advantage of this rare opportunity. Discover more and take the first step today.

Explore Now

#realestate#realestateagent#realestateinvestor#realestatelife#property#realty#housingmarket#homedesign#realestatetips#homeownership#broker#investment#luxuryrealestate#makememove#mansion#interiordesign#architecture#firsttimehomebuyer#fixandflip#foreclosure#Real estate hashtags for buyers#buyeragent#homebuyer#dreamhome#findahome#househunter#makeahouseahome#newhome#realestatebuyers#relocation

0 notes

Video

instagram

#openhouse #thehaydonteam #dgsir #smithtown #yourwayforward🐳 #lovemyjob 😍 . . . #thehaydonteam #danielgalesir #danielgalesmithtown #yourwayforward #explorelongisland #longislandny #realestateagent #smithtown #realtor #longislandrealestate #realestate #findahome #hotmarket #homesforsale #buyingandselling #luxury

#dgsir#realestate#realestateagent#lovemyjob#explorelongisland#danielgalesmithtown#buyingandselling#findahome#homesforsale#thehaydonteam#danielgalesir#longislandny#smithtown#yourwayforward🐳#openhouse#yourwayforward#longislandrealestate#hotmarket#luxury#realtor

2 notes

·

View notes

Text

#homes #realtornearme #toprealtors #house #sellmyhome #vanessasellsctx #copperascovetx #fortcavazos #fortcavazosrealtor #moving #firsttimehomebuyers #luxurylistings #1031exchange #HomeValue #homeevaluation #equity #JustListed #NewListing #MillennialHome #BuyerWishlist #FindaHome #Relocation #VirtualTour #RenovatedHome #HouseHunting #RealtorLife #FSBO #LuxuryRealEstate #OpenHouse #FirstTimeHomeBuyer #FutureHomeowner #LoveWhereYouLive #Downtown #Uptown #MidCenturyModern #VictorianHome #PetFriendly

0 notes