#financialengineering

Explore tagged Tumblr posts

Photo

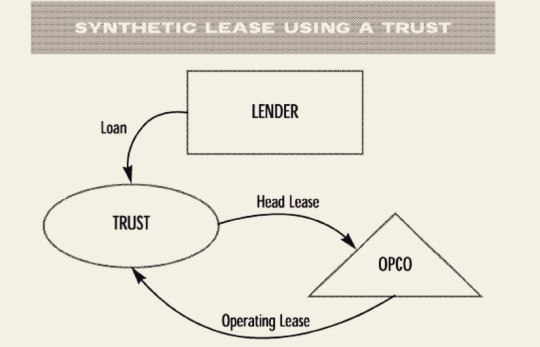

#trust #offbalancesheet #obs #offbalancesheetfinancing #trustee #specialpurpose #prose #prosocio #prosolido #finance #financialengineering #itsatrust #financebro #lease #REIT #fiscal #InGodWeTrust https://www.instagram.com/p/CpjlZAXNqbh/?igshid=NGJjMDIxMWI=

#trust#offbalancesheet#obs#offbalancesheetfinancing#trustee#specialpurpose#prose#prosocio#prosolido#finance#financialengineering#itsatrust#financebro#lease#reit#fiscal#ingodwetrust

0 notes

Photo

Global Islamic Fintech Summit 全球清真金融高峰会 #gifs #globalislamicfintechsummit #fintech #blockchain #mobilefinance #digitalfinance #digitalbank #financialengineering #fintechsummit #financialinclusion #清真 #回教金融 #清真金融 #区块链 #数码金融 #数码银行 (at Malaysian Global Innovation and Creativity Centre) https://www.instagram.com/p/B3Dp7R7AdJ4/?igshid=7tzq2g66ounl

#gifs#globalislamicfintechsummit#fintech#blockchain#mobilefinance#digitalfinance#digitalbank#financialengineering#fintechsummit#financialinclusion#清真#回教金融#清真金融#区块链#数码金融#数码银行

0 notes

Photo

#derivativesmodelling #financialengineering https://www.instagram.com/p/Bw3SSTQjhQ8BhToLBEvxr7h1z7JppC7lbtF77I0/?igshid=ra6grz5y7jtj

0 notes

Text

Budget deficit, a strong economy, and a strong currency

The Nigerian government projected a budget deficit of about two trillion Naira in the 'Consolidation' budget for 2018. While it is a wise move to stimulate economic growth by government spending, especially after a recession, it however begs the question of how to effectively use budget deficit as a tool for economic recovery. In this short post, I'm going to quickly show a method for how budget deficit leads to strong economy and then a strong currency. I'll also explore avenues to meet budget deficit, hopefully make a case for focusing first on having a strong economy than a strong currency. Before then though, I'll explain what these three concepts mean and how they operate. After which, I intend to take the Herculean task of successfully adapting these concepts and how they can work in the Nigerian situation (I wish to state here that I believe all human constructs, which includes plans, are fallible such that there could be factors I errorneously neglect. And that's why I have decided to stick to a level of abstraction that makes it flexible enough for future evolution). According to EconomicTimes, budgetary deficit is the sum of revenue account deficit and capital account deficit; revenue account deficit occuring when revenue expenses exceed revenue receipts while capital account deficit occurs when capital disbursements of the government exceed capital receipts (from sale of government assets, domestic and/or international debt). Strength denotes power or influence to either defend something or make something else happen. A strong economy will therefore be an economy that can defend the prosperity of those concerned with it during tough economic situations and also advance that prosperity, whether in the face or absence of opposing conditions. According to TheBalance, the GDP value (all personal consumption expenses plus business investment plus governement spending plus trade balance, i.e exports - imports) is mostly used to measure the strength of an economy. If you notice, savings in any form don't contribute to the GDP, implying that a strong economy is one that encourages; and people and businesses will only spend when they have confidence in the economy - either to give them good returns on the spending or to avail them access to jobs or credit urgently in the face of an existential crisis. This is the reason why he government must strive to be the biggest individual spender - as other stakeholders belief in the economy is dependent on the government's belief in the economy, as expressed in the posture and plan of the government. Budget deficit indicates that a government is, at least, in some way spending. A strong currency is a currency that is highly valued in the international market as stakeholders desire to hold it in reserve either for speculative reasons or for trade transactions, or for both reasons. This desire to hold a currency is usually initially backed by underlying fundamentals which support the currency rating (for example, if there's a lot of trade going on in that currency). However, as speculation increases, a trend develops and a divergence between the underlying fundamentals and prevailing trend appears. More speculative activities would mean a wider gap between underlying fundamentals and the currency value due to prevailing bias of speculators, in fact at this point all market participants become speculators until the currency can't keep up having become more dependent on the prevailing bias than on the underlying fundamentals. Strong currencies like this typically favor imports over exports in the local economy, and if this is left uncorrected it could erode GDP unless the government can understand this and keep spending big in order to sustain the prevailing bias, as we can see with the US economy. As you must observe by now, when market confidence is low - when people are afraid to spend because funds are relatively scarce; banks unwilling to give loans because employment is relatively low, therefore spending power is low as well making it less likely that the prospective debtors, whether individuals or businesses, will be able to service the debt obligations enough for the bank to recover the original sum; when businesses are afraid of making additional investments, expandion being a counter-intuitive move where there is low market confidence - when the market confidence id low, everyone is forced into a "savings" more and begin to cut down expenses. This situation is a recession. At such a point, the burden of responsibility lies on the government to use budget deficit to fund and support an aggressive development plan - build new industries and develop existing ones, finding strategic avenues to increase exports by spearheading an international coordination where every participating country wins (this may be easily guaranteed by currency pegging). This plan should be implemented after ensuring there's little room for leakage through corruption or redundancy in the government's operations. Then the government can select key industries which meet the needs of its international partners and those that also meet the needs of the local market (which is usually import-dependent before a recession), drive growth in these industries by policies and programs that make cheap loans readily available to entrepreneurs - driving employment growth, and more economic activities which will see the banks become more willing to give domestic loans resulting greater spending power and more money circulation in the economy. Remember that a strong economy is one that encourages spending. The government can source for capital receipts through domestic and international debt with an attractive moderate interest rate while keeping inflation rate high enough to discourage sitting on cash. The increased spending will contribute to GDP growth. Well, that's all I've got. In this post, I described budget deficit, what a strong economy and strong currency should mean, and finally an abstract model to recover an economy by making use of budget deficit. Cheers

0 notes

Video

Destination Weissman, 11.3.17: MFE Program at Baruch

0 notes

Text

A Solution Manual for: Statistics and Data Analysis for Financial Engineering by David Ruppert

A Solution Manual for: Statistics and Data Analysis for Financial Engineering by David Ruppert

A Solution Manual for: Statistics and Data Analysis for Financial Engineering by David Ruppert Weatherwax, John For anyone with interest in a career in financial engineering it extremely important to have a strong understanding ofthe mathematics that govern the movement of security prices. Ruppert’s book “Statistics and Data Analysis for FinancialEngineering” does an outstanding job of…

View On WordPress

0 notes

Link

"Most innovations in financial technology have revolved around new modalities — take something we’ve done for decades and just “put it on the internet”. The paper credit card statement begot the web credit card statement, which begot the mobile-app-with-your-statement-in-it [..] There’s no such thing as a free lunch, and in this case Point’s lunch comes in the form of capital appreciation [..] Point gets paid back after the bank, but before the homeowner, in the event of a sale."

0 notes

Photo

Dear second term, I am ready for you! #financialengineering #programming (la University of Reading) https://www.instagram.com/p/BtBd9-_j31tn_24eYnbctX-Qb_i-E3Cl5miymw0/?utm_source=ig_tumblr_share&igshid=1v0t2d37c5k85

0 notes

Link

The Berkeley Master of Financial Engineering program invites you to learn about career paths in finance for students with quantitative backgrounds. The Berkeley MFE Program, which was launched in 2000, has helped hundreds of students begin rewarding careers on Wall Street and inmany other financial centers around the world.

We will hold an information session in in Los Angeles on Monday, April 8. If you are interested in learning how your degree in engineering, physics, computer science, economics, statistics, mathematics, and related disciplines can to a career in finance, please join us. Please see below for details.

UPCOMING BERKELEY MFE INFO SESSIONS

Los Angeles/Westwood

Date: April 8, 2013

Time: 6:00-7:00 PM

Location: W Hotel Westwood, 930 Hilgard Avenue, Los Angeles; Studio 2

MFE Admissions Staff and alumna Lea Zhu will host the event. Executive Director Linda Kreitzman and admissions staff will participate via conference phone to discuss career paths and admissions details. Please upload your resume prior to the event for an on-the-spot career assessment. Refreshments served.

Please RSVP at bit.ly/10OGqcX

Can’t make it? Join us at one of our upcoming online info sessions, held biweekly. Upcoming online sessions:

March 20, 2013 at 2 PM Pacific time and April 3, 2013 at 10:00 AM Pacific time, berkeleymfe.webex.com.

Web conference session and Q& A with executive director Linda Kreitzman, current students and admissions staff.

Please register and upload your resume prior to the event for an on-the-spot background assessment.

Please register for all sessions at http://mfe.berkeley.edu/. All are welcome.

0 notes

Photo

All purchases qualify for #membership and #certification. mutualaid #legalaid #financialengineering #financialaid #dadhats #fundraiser #associationlibrary #legalinformation #legalinsurance #assetaccumulation #individual #development #account #individualdevelopmentaccount #exlibrisvelxenon #economicinclusion #collectiveeconomics #socioeconomic #newyork (at Brooklyn, New York) https://www.instagram.com/p/CRG_jGItJjV/?utm_medium=tumblr

#membership#certification#legalaid#financialengineering#financialaid#dadhats#fundraiser#associationlibrary#legalinformation#legalinsurance#assetaccumulation#individual#development#account#individualdevelopmentaccount#exlibrisvelxenon#economicinclusion#collectiveeconomics#socioeconomic#newyork

0 notes

Photo

Să râzi și să plângi #financialengineering #cadouldelamosu (at University of Reading)

0 notes

Photo

😲🤣❤️ #financialengineering (la ICMA Centre)

0 notes