#fastag login

Text

Paytm Hdfc Credit Card kaise banaye 2023

paytm hdfc credit card kaise banaye, paytm hdfc credit card customer care number, hdfc credit card login, how to activate paytm hdfc credit card, paytm credit card customer care, paytm credit card apply online, paytm hdfc credit card limit, paytm hdfc credit card verification process,

paytm hdfc credit card kaise banaye टॉपिक को इंटरनेट पर सर्च कर रहे हैं हम आपको इसके बारे में पूरी जानकारी देंगे इसलिए निवेदन है कि आर्टिकल को पूरा पढ़ें पूरी बात समझ में आ जाएगी

आज ऑनलाइन अगर आप कोई भी चीज करना चाहते हैं तो वहां पर आपको बिल पेमेंट करने के लिए क्रेडिट कार्ड का विकल्प जाता है कि कार्ड के माध्यम से आप घर बैठे कोई भी चीज ऑनलाइन से खरीद सकते हैं I

सबसे बड़ी बात है कि उसे आप अपने मुताबिक किस्तों में तब्दील भी कर सकते हैं ताकि आपको खरीदी गई चीज के पैसे चुकाने में आसानी हो

हम सभी लोग पेटीएम का इस्तेमाल करते हैं लेकिन आप क्या जानते हैं कि पेटीएम के द्वारा क्रेडिट कार्ड बनाने के ऑफर चलाए जाते हैं I ऐसे में आप पेटीएम एचडीएफसी बैंक क्रेडिट कार्ड बना सकते हैं कैसे बनाएंगे उसकी प्रक्रिया के बारे में अगर आप नहीं जानते हैं तो आर्टिकल को पूरा पढ़े ही जानते हैं

Paytm HDFC बैंक क्रेडिट कार्ड क्या है ?

Paytm hdfc credit card पेटीएम के द्वारा लांच किया गया क्रेडिट कार्ड इस कार्ड को पेटीएम कंपनी ने एचडीएफसी बैंक के साथ मिलकर लॉन्च किया है I इसके अलावा Paytm ने HDFC बैंक के साथ मिलकर अपने 5 क्रेडिट लॉन्च किए हैं इसका लाभ पेटीएम इस्तेमाल करने वाले कस्टमर उठा सकते हैं | इसे बनाने के लिए आपको अपने पेटीएम एप्स को ओपन करना होगा I

paytm hdfc credit card

Paytm hdfc credit card के प्रकार

कुल मिलाकर पांच प्रकार के कार्ड लांच किए गए हैं इसका विवरण हम आपको नीचे बिंदु अनुसार देंगे आइए जानते हैं

- Paytm HDFC बैंक क्रेडिट कार्ड

- Paytm HDFC बैंक मोबाइल क्रेडिट कार्ड

- Paytm HDFC बैंक सेलेक्ट क्रेडिट कार्ड

- Paytm HDFC बैंक बिज़नस क्रेडिट कार्ड

- Paytm HDFC बैंक सेलेक्ट बिज़नस क्रेडिट कार्ड

Paytm hdfc credit के फायदे

- इसके द्वारा आप मूवी अमोल जैसी जगह पर अगर पेमेंट करते हैं तो आपको 3% का कैशबैक मिलेगा

- यूटिलिटी बिल पेमेंट कर पाएंगे

- बैंक की तरफ से आपको जीरोकोड चला बेटी दी जाएगी या नहीं अगर आपका कार्ड कहीं खो जाता है तो आप कस्टमर सर्विस को तुरंत इसकी जानकारी दे आपका कार्ड वहां से ब्लॉक कर दिया जाएगा और कार्ड की जिम्मेदारी आपके ऊपर ही रहेगी

- फ्यूल (fuel) के खर्चों पर 1% लगने वाले फ्यूल सरचार्ज को नहीं लिया जाएगा | यदि आप ₹400 का फुल यहां पर मरवाते हैं तो आपको ₹250 का कैशबैक दिया जाएगा I

Paytm HDFC Credit Card charges and Fee

- मेम्बरशिप के तौर पर आपको – 49 रुपए + GST चार्ज देना होता है | 1 महीने के लिए

Paytm hdfc credit card बनाने की Paytm Hdfc Credit Card योग्यता

- 21 साल से ऊपर होना चाहिए

- पीएम का अकाउंट नंबर होना

- Paytm Payment Bank में Saving Account होना चाहिए

- क्रेडिट स्कोर अच्छा होना चाहिए

- Income source

- पैन कार्ड होना चाहिए

Paytm मे आधार कार्ड से Upi कैसे बनाये | Create Upi pin in Paytm Through Aadhar Card 2023

Fastag Recharge Online: Fastag Online रिचार्ज कैसे करें | Axis Bank, Bhim App, Paytm कैसे करें

Paytm Hdfc Credit Card

Paytm Credit Card अप्लाई करने के लिए डाक्यूमेंट्स?

- Ration Card, Passport, Voter ID, Aadhar Card. निवास प्रमाण पत्र के तौर पर

- Salary Slip, ITR Copy

- Driving Licence, Passport, Addhar Card पहचान पत्र के तौर पर

Paytm hdfc credit card बनाने की प्रक्रिया

- सबसे पहले आपको पेटीएम एप ओपन करना होगा और अगर आपके मोबाइल में नहीं है तो उसे डाउनलोड कर लीजिए

- इसके होमपेज पर पहुंच जाएंगे यहां पर आपको Loans and Credit Cards’ वाले ऑप्शन दिखाई देगा उस पर क्लिक करेंगे

- आपके सामने क्रेडिट कार्ड कार्ड वाला ऑप्शन आएगा उस पर आपको क्लिक करना है

- अब आपके सामने आवेदन पत्र ओपन होगा जहां से जो भी आवश्यक जानकारी पूरी जाएगी उसका विवरण देंगे और उसके बाद आपको ‘Terms & Condition’ Agree करने के ऑप्शन पर क्लिक करेंगे

- घर का पता और कितना पैसा महीने में कमाते हैं उसका यहां पर विवरण देंगे

- सभी डिटेल्स भर देंगे आपको ‘Submit’ वाले बटन पर क्लिक करना है।

- अब पेटीएम के अधिकारी योगिता की जांच करेंगे कि आप यहां पर लोन लेने के लिए योग्य है कि नहीं अगर है तो आपके मोबाइल में मैसेज आ जाएगा

- उसके बाद आपको apply now के बटन पर क्लिक करना है

- जिसके बाद आपके सामने एक नया पेज ओपन होगा जहां आप से कुछ आवश्यक चीजें मां की जाएंगे जिसका आपको सही ढंग से विवरण देना है

- अब आपको Terms & Condition” को accept करके ‘Submit’ पर क्लिक करना है।

- के बाद आपके स्किन पर एप्लीकेशन नंबर आएगा जिससे आपको कहीं पर लिख कर रखना है

- अब बैंक के अधिकारी आपके आवेदन पत्र का वेरिफिकेशन करेंगे

- जिसके बाद ही आपको क्रेडिट कार्ड मिल पाएगा

- इस प्रकार आप आसानी से पेटीएम एचडीएफसी बैंक क्रेडिट कार्ड बना सकते हैं

Paytm Credit Card का Status कैसे check करे?

Paytm HDFC Credit Card के स्थिति का विवरण चेक करना बिल्कुल आसान है इसके लिए आपको अपने पेटीएम एप के credit card के ऑप्शन में जाना होगा वहां पर आपको क्रेडिट कार्ड अप्लाई स्टेटस का ऑप्शन दिखाई पड़ेगा उस पर क्लिक करके आप जान पाएंगे अपने क्रेडिट कार्ड का इसके बाद भी अगर आपको मालूम नहीं चल रहा है तो आप बैंक ऑफिशल वेबसाइट पर जाकर के टायर के स्टेटस का पूरा विवरण चेक कर सकते हैं इसके अलावा कस्टमर सर्विस में भी फोन कर कर आप जान पाएंगे

Paytm hdfc क्रेडिट कार्ड की लिमिट कितनी होती है?

आप पेटीएम एचडीएफसी बैंक एटीएम कार्ड इस्तेमाल करेंगे तो हम आपको बता दें कि इसकी एक निश्चित लिमिट तय की गई है जायदा का खर्चा करते है तो आपको 2.5 प्रतिशत के दर से अतिरिक्त fine जो कि ₹600 होती है इसके अलावा और भी कई प्रकार की चीजें आपको ध्यान में रखनी होंगी ताकि आप fine देने बच सके I

Read the full article

2 notes

·

View notes

Text

IndusInd Bank FASTag Recharge: The Smart Way to Travel on Indian Highways

In today’s fast-paced world, time is of the essence, especially when it comes to travel. That’s where the IndusInd FASTag comes in as a game-changer for Indian motorists. Offering a seamless toll-paying experience, the IndusInd FASTag is more than just a convenience; it’s a necessity for the modern-day traveler.

Embracing the Future with IndusInd FASTag

Gone are the days of waiting in long queues at toll plazas. With IndusInd FASTag, your vehicle breezes through, saving you time and fuel. This electronic toll collection system, backed by the National Highways Authority of India (NHAI), is revolutionizing highway travel.

Easy Recharge Options

Recharging your IndusInd FASTag is a breeze. The ‘IndusInd FASTag recharge’ process is user-friendly, ensuring that you are always ready to hit the road without any delays. You can easily top up your FASTag through the ‘IndusInd FASTag login’ portal, using options like net banking, credit/debit card, or UPI. Additionally, the ‘IndusInd Bank FASTag recharge online’ feature lets you recharge from anywhere, anytime.

Keeping Track of Your Expenses

For those who love to keep a close eye on their expenses, ‘IndusInd FASTag balance check’ is a handy tool. It allows you to monitor your toll payments and manage your account effectively. This transparency is crucial for personal and professional fleet management.

How Does IndusInd FASTag Work?

The RFID (Radio-frequency Identification) technology at the heart of IndusInd FASTag makes toll payments directly from the prepaid or savings account linked to it. As you drive through the toll plaza, sensors read your tag, deduct the toll amount, and let you pass without stopping.

The Benefits of Using IndusInd FASTag

Reduced Travel Time: With automatic toll deductions, IndusInd FASTag cuts down your travel time significantly.

Cashless Transactions: Say goodbye to the hassle of carrying cash for toll payments.

Easy Recharge and Balance Check: With ‘fastag recharge IndusInd bank’ services, maintaining your FASTag balance is effortless.

Transaction History: Keep track of your toll payments with detailed statements available through ‘IndusInd FASTag login’.

Step-by-Step Guide to IndusInd FASTag Recharge

Recharging your IndusInd FASTag is a straightforward process:

Log in to the Park+ FASTag Recharge portal.

Enter your VRN (Vehicle Registration Number) in the FASTag Recharge section.

Choose the ‘Recharge’ option.

Select your preferred payment method.

Complete the transaction and your FASTag is recharged!

Tips for a Smooth IndusInd FASTag Experience

Regularly check your FASTag balance.

OPT for auto-recharge to avoid low balance situations.

Keep your registered mobile number updated to receive timely alerts.

Conclusion

The IndusInd FASTag is not just a tool for convenience; it is a testament to the evolving landscape of Indian roadways. With its easy recharge options, like ‘IndusInd bank FASTag recharge online’, and efficient balance tracking, it’s an essential gadget for every vehicle. As we embrace this technology, we contribute to a smoother, faster, and more efficient road network in India. Remember, every time you use your IndusInd FASTag, you’re choosing a smarter way to travel.

0 notes

Text

Appreciating the Mpassbook app and its uniqueness

Many times, the government tries new ways to make sure the people find it easier to pay some bills and also to ensure they experience some flexibility. If you live in India, then you will know by now that there are a lot of ways through which you can benefit from the way electronic systems have come to take over. This is why the Mpassbook is one that is winning over many hearts. With the fast-paced world we find ourselves in, it is common that you will want to make the right decisions and choices about your finances. Well, if that is the case then do so now.

What is the mpassbook about?

Well, this book is the online version of the normal passbook you are given in a bank. This online version need to be downloaded and installed on your phone or laptop. Its use is very easy and convenient. That is definitely one thing you need to be interested in. Most people do not know that making hasty decisions with online banking can kill their finances. Even if the Government of India has seen the value of using Fastag to collect tolls and it is regulated by the National Highway Authority of India, then you should know that the electronic world has come to stay. It is exciting to know that more and more people are accepting this way of spending, saving, and living. That helps a lot.

Why do you need this book?

Just as the government of India needs Fastag to collect its tolls perfectly, you need this book. This online version of the book has been designed to provide you with much flexibility to have access to your mini statements, transaction history, and details as well. All these can be made available for you on your mobile device which is indeed amazing. It is indeed exciting to benefit from such innovations. You will be required to register and use those info to have access to your account through the app. A lot of people keep using them and it has helped to simplify their life and their ability to verify important financial information online. That is how things should be.

Are there any time restrictions?

One good thing about this book is that, there is no time restriction. You can view details you need via the app at any time you wish to. Also, you do not need to have a mobile or internet banking account to be able to use this app. As long as you have a bank account linked to the specific bank that you are registering to the app with, that is it. You can view your account details to perfection. Some features include:

There is no need for you to keep long login details in your memory. This is due to the fact that the M-Pin is used for login.

It is possible to download and save details of your statement on your computer.

Conclusion

It is good to know that the process of paying tolls in India has been made simple. This brings many gains. Fastag will definitely be one of the best for the government. You should consider using the best digital book to ensure every detail you need is obtained accordingly.

1 note

·

View note

Text

Cars24 Financial Services Private Limited Loan Repayment

Just in case you have missed your online loan payment, we have just the right payment facilities to help you out with the same.

You can either pay through your bank account using Payrup’s fast payment gateway or you can utilize digital payment options like UPI, net banking, Razorpay, Bharat Billpay, etc. to clear your dues. Speaking of loans, it can be anything - a bank loan or any other loan payment online. When the world is thinking digital, so are you because it is just so much more convenient to do so. Clear all your loan repayment with quick loan payment facilities only on Payrup.

The digital mission for digital payments

Payrup is a very popular online digital partner for bill payments, recharges, ticketing, and much more. It is a brand for customers who prefer to get work done on the go!

We at Payrup, believe India is a market that requires facilities and facilities as these help digital India grow ahead day by day.

Why is it so easy to make loan repayment at Payrup? Making payments is now easier using various payment channels mentioned on our platform. Select the most suitable channel to clear your loan payment and within seconds it is done.

How is the payment done? Find out below in the next section

Just follow these simple steps to process your repayment:

Step - 1:

Login to your account on Payrup

Step - 2:

Click on loan repayment from the various modules listed on the website

Step - 3:

Select your loan repayment operator to proceed to pay the loan/overdue loan online

Step - 4:

Once you select the operator, a user must enter all the details needed for the loan payment, then hit the fetch bill button to get the actual loan amounts payable.

Step - 5:

“Proceed to Pay” the loan repayment once all the amounts are correct and verified

Pro hint! Always check the displayed details carefully to be sure that the payment is all correct before you proceed to the next step.

Step - 6:

Enter the amount and click on "Proceed to Pay" & Choose the desired payment option from the many available.

Step - 7:

Choose from the desired payment option, proceed to finish the payment

Step - 8:

Receive the online loan payment confirmation on your registered mobile and email id once you finish doing the payment. You can even download the invoice from the “My transactions” tab in your account.

Successful payment will reflect in your EMI loan account within 24 hours of successfully completing the payment.

So, this is how a loan/overdue payment is successfully completed in a few easy steps on Payrup. For many such simple payment facilities, we are always there for you 24*7.

Final Thoughts…

Popular bill payment facilities are available on Payrup!

Payrup has a host of facilities that can all be paid online using our platform.

Choose to make payments for mobile prepaid, mobile postpaid, dth, electricity, landline bills, piped gas, broadband bills, water bills, e-gift cards purchases, cable tv bills, credit card bills, health insurance purchases, housing society payments, life insurance premium purchases, loan repayments, hospital payments, subscriptions, education fees, fastag payments, LPG gas bills, municipal services, and municipal taxes’ payments Payrup has it all covered for our users under one roof. visit us : Cars24 Financial Services Private Limited Loan Repayment

0 notes

Text

[caption id="attachment_8801" align="alignnone" width="370"] ICICI Bank enables FASTag-based parking payment payment at Mumbai airport[/caption]

NEW DELHI: ICICI Bank on Thursday said it has enabled FASTag-based payment for parking at Terminal 2 of the Chhatrapati Shivaji Maharaj International Airport. The facility will allow users to pay parking charges digitally and in a contactless manner, resulting in quicker movement of vehicles through the parking zone.

“The scanners installed at the parking zone reads the FASTag affixed on the windscreen of the vehicle, records the entry/ exit time and deducts the parking charges automatically," the bank said in a statement.

Also Read - How to Register, Login and Transfer Funds Using HDFC Mobile Banking App?

“We are delighted to introduce FASTag based payment for parking at Terminal 2 of the Chhatrapati Shivaji Maharaj International Airport, one of the busiest airports in the world. We believe this facility will improve convenience of users by saving their time and dependency on cash,“ said Sudipta Roy, Head – Credit Cards, Payment Solutions & Merchant Ecosystem, ICICI Bank.

“We were the first bank in the country to launch FASTag on the Mumbai – Vadodara corridor in 2013. Since then, we have pioneered the usage of FASTag for payments at various national and state highway toll plazas and parking at airports, malls, business hubs and at tech parks across the country. In addition, we have introduced the facility at fuel stations so that users can avail the triple benefit of using one tag for payments for fuel, toll and parking,"

Also Read - IndusInd Bank to offer EV financing to Tata Motors dealers

ICICI Bank is the only bank to have introduced the FASTag-based parking payment facility at Mumbai airport. Till now, tags were used majorly to pay toll across highways in the country.

Click on Twitter, Facebook, Youtube links to subscribe to our social media pages.

0 notes

Text

SIMPLE STEPS TO REDUCE YOUR LANDLINE BILL PAYMENT BSNL

Bharat Sanchar Nigam Ltd commonly referred to as BSNL as we all know, is India's largest telephone service provider and also delivers mobile phone and internet service to millions of its customers. BSNL allows its customers to make their telephone bill payments online in a variety of ways. Payment of BSNL landline bills online in today’s times has become both a convenient and time-saving method of making telephone payments. Here are a few steps to pay BSNL telephone bills online.

Right now, in the telecom industry, BSNL landline packages are coming with new offers and innovative consumer-centric strategies to woo old and new customers alike. The state-led Bharat Sanchar Nigam Limited (BSNL) has also been proactive when it comes to rolling out new offers after its revival packages.

Ever since BSNL received relief from the government of India, it is putting more effort into the retention of its customers and adding new customers as well. One such new offer has been rolled out by BSNL for its landline or broadband subscribers as well. Today, many other telecom operators have been charging their subscribers quite a high rate compared to what BSNL is actually charging for the same type of scheme or plan to make the same calls. BSNL has made a flipside move on the same in the past few years.

Instead of charging customers for making calls, BSNL is giving customers cashback for making calls instead, sound surprising to you? Read ahead to find out more.

Moving further, have a look at how to pay your bsnl landline bill payment online in a few easy steps on Payrup.

Login to your account on Payrup

Select your landline operator to BSNL to pay the online landline bill payment

Enter the valid landline number for the right landline payment

Write in the amount as mentioned in the bill (or) you can fetch the bill accordingly

Press the “Proceed to Pay” button once all details are entered correctly

User can pay their landline bills on Payrup using internet banking, credit or debit cards, MyRupee wallets, other wallets, etc. as per their convenience.

After this, your BSNL landline bill payment is completed and to find the same you can find it in the transactions under your account details

Make quick BSNL landline bill payments a reality today only with Payrup.

Final Thoughts…

Popular bill payment facilities are available on Payrup!

Payrup has a host of facilities that can all be paid online using our platform.

Choose to make payments for mobile prepaid, mobile postpaid, dth, electricity, water bill, landline bills, piped gas, broadband bills, water bills, e-gift cards purchases, cable tv bills, credit card bills, health insurance purchases, housing society payments, life insurance premium purchases, loan repayments, hospital payments, subscriptions, education fees, fastag payments, LPG gas bills, municipal services, and municipal taxes’ payments Payrup has it all covered for our users under one roof.

0 notes

Text

Voter Id Search By Name Haryana

Voter Id Search By Name Near Haryana Voter Id Search By Name Haryana भारतीय मतदाता पहचान पत्र भारत के वयस्क अधिवासियों को भारत के ���िर्वाचन आयोग द्वारा जारी किया गया एक पहचान दस्तावेज है, जो 18 वर्ष की आयु तक पहुंच गया है, जो मुख्य रूप से देश के नगरपालिका, राज्य में अपना मतपत्र डालते समय भारतीय नागरिकों के लिए एक पहचान प्रमाण के रूप में कार्य करता है और राष्ट्रीय चुनाव।

Voter Id Search By Name Near Haryana

मतदाता सूची (आधिकारिक तौर पर मतदाता सूची के रूप में जानी जाती है) एक संकलित व्यापक सूची है, जिसमें किसी विशेष निर्वाचन क्षेत्र में मतदाताओं के नाम और अन्य विवरण शामिल होते हैं भारत निर्वाचन आयोग ने अपनी आधिकारिक वेबसाइट पर 2020 के लिए मतदाता सूची प्रकाशित की है।

ऑनलाइन प्रणाली की सुविधा के साथ, मतदाता सूची में अपना नाम खोजने के लिए अपने आईडी प्रूफ या अन्य आवश्यक दस्तावेजों के साथ बूथ पर जाने की आवश्यकता नहीं है हालांकि, यह चुनाव से कम से कम 10 दिन पहले करना होगा ताकि किसी भी प्रकार की त्रुटि को जल्द से जल्द ठीक किया जा सके। एक बार चुनाव शुरू होने के बाद, परिवर्तन की अनुमति नहीं है।

Voter Id Search By Name In Haryana

भारत में एक चुनाव में मतदान करने के योग्य होने के लिए एक मतदाता पहचान पत्र होना पर्याप्त नहीं है। चुनाव से पहले व्यक्ति को यह जांचना चाहिए कि उसका नाम मतदाता सूची में है या नहीं। अब, चुनाव आयोग ने किसी व्यक्ति के लिए मतदाता सूची में अपना नाम ऑनलाइन जांचना संभव बना दिया है। बस नीचे बताए गए चरणों का पालन करें:

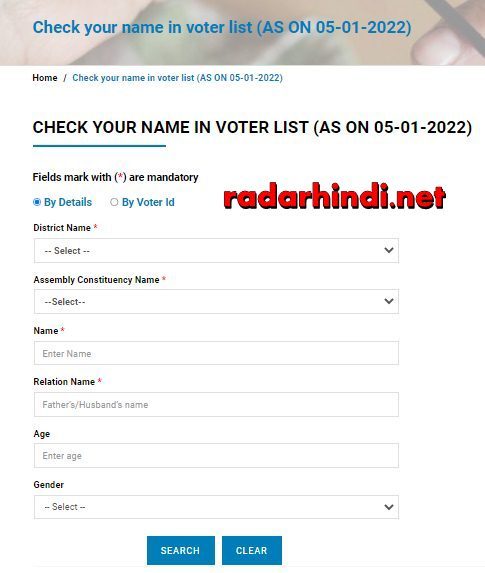

Voter Id Search By Name Haryana Step:- 1

दोस्तों आपको इस स्टेप में एक लिंक मिलेगा उस पर क्लीक करना है और क्लीक करने के बाद Image में दिखाए अनुसार आपके सामने विंडो ओपन होगी। Link :- haryana

Voter Id Search By Name Haryana Step:- 2

दोस्तों आपको दूसरे स्टेप में Image में दिखाए अनुसार सभी कॉलम को Fill करना है।

- 1 नंबर पर By Details पर टिक करना है।

- 2 नंबर पर आपको अपने ज़िले का नाम सेलेक्ट करना है।

- 3 नंबर पर आपको अपने असेंबली यानि की तहसील का नाम सेलेक्ट करना है।

- 4 नंबर पर नाम लिखना है।

- 5 नंबर पर अपने पिता जी का नाम लिखना है।

- 6 नंबर पर आपकी अपनी AGE भरनी है

- 7 नंबर पर आपको अपना लिंग सेलेक्ट करना है

- 8 नंबर पर SEARCH BUTTON पर टिक करना है।

Sketch Artist Kaise Bane – स्केच आर्टिस्ट कैसे बने

Social Media In Hindi Social Media Essay In Hindi

वोटर लिस्ट डाउनलोड वोटर लिस्ट ग्राम पंचायत Haryana के सिरसा जिले

Voter Id Search By Name In Haryana Step:- 3

दोस्तों आपको 2 स्टेप में सर्च बटन पर क्लीक करने के उपरांत आपके सामने ऐसी window ओपन होगी।

- 1 नंबर पर आपका वोटर कार्ड की इनफार्मेशन होगी।

- 2 नंबर पर आपकी सभी परिवार की इनफार्मेशन मिलेगी।

Voter Id Search By Name Near Haryana Step:- 4

Step :- 3 के चित्र में दिखाए अनुसार में 1 नंबर पर क्लीक करने के बाद Pop - Window ओपन होगी। जिसमे अपनी वोटर id की सभी जानकरी देख सकते है। और आपका वोट किस स्थान पर बना वो भी पता कर सकते है।

READ ALSO

Am Or Pm Full Form Am Or Pm Kab Hota Hai

Best Credit Cards In India Best Cashback Credit Cards In India

Axis Bank Fastag एक्सिस बैंक फास्टैग रिचार्ज Axis Bank Fastag Recharge

मेरे पास के किराये के मकान Mere Pass Ke Kiraye Ke Makan

चाँद धरती से कितना दूर है Ok Google Chand Dharti Se Kitna Dur Hai

How To Become A Psychiatrist – साइकिएट्रिस्ट कौन होता है क्या रेस्पॉन्सिबिलिटीज होती है?

10 Steps Doctor Kaise Bane डॉक्टर कैसे बने Doctor Kaise Bane in Hndi

YouTube versus Television टेलीविजन छोड़िये

जल है तो कल है R.O water V/S Normal Water सादा पानी के फायदे

Debit Card Meaning in Hindi डेबिट कार्ड क्या होता है? डेबिट कार्ड का मतलब क्या होता है?

फेसबुक का मालिक कौन है Facebook Ka Malik Kaun Hai

अच्छा बीएफ कैसे ढूंढे और अच्छे बीएफ की कैसे पहचान करें Hello Bf Bf Bf मुझे bf चाहिए

Instagram Reels A Guide to Mastering for Businesses & Creators इंस्टाग्राम के बारे में जानकारी

मूर्ति बनाने का सांचा कहां मिलता है मिट्टी की मूर्ति बनाने की विधि

लड़कियों से बात करने के टॉपिक्स – Ladkiyo Se Baat Karne Ke Topics Hindi

लूडो गेम से पैसे कैसे कमाए – Paise Kamane Wala Ludo Game – लूडो गेम खेलो और पैसे जीतो

Tafcop Dg Telecom Gov In – Tafcop Dg Telecom Gov In Login In Hindi

How Many Sim Card on My Name in India – How Can I Check How Many Sims on My Aadhar Card

20 Best Bf Se Baat Karne Ke Topics In Hindi – लड़कों से फोन पर कैसे बात करें

Password Ko Hindi Mein Kya Bolte Hain – पासवर्ड को हिंदी में क्या कहते हैं

Bf Download Aadhar Card – इ आधार कार्ड डाउनलोड – आधार कार्ड डाउनलोड करायचे

Google Meri Shaadi Kab hogi – Shadi Kab Karna Chahiye

Aaj kaun sa de hai – Google Aaj kaun sa din hai – आज कौन सा दिन है

Aaj ka Mousamआज का मौसम कैसा रहेगा – आने वाले कल का मौसम कैसा रहेगा

Thank You in Hindi | थैंक यू कब बोलना चाहिए

गूगल तुम्हारा नाम क्या है – Hello Google tumhara naam kya hai

- Types of marriage in sociology – जानिए विवाह के 8 प्रकार

Rummy Kaise Khelte Hain रम्मी गेम कैसे खेलेंते है? जानिए 3 महत्वपूर्ण चरण

- New Whatsapp Features 2022 GB Whatsapp Features

- Difference Between Gmail and Email In Hindi – Gmail और Email में क्या अंतर है

- Social Media In Hindi Social Media Essay In Hindi

दोस्तों आपको Voter Id Search By Name Haryana पोस्ट कैसी लगी। हमें comment करके अपने विचार दे। हमें बहुत ख़ुशी होगी और आपका 1 कमेंट हमें लिखने को प्रोत्साहित करता और हमारा जोश बढ़ाता है। इस पोस्ट को अपने दोस्तों के साथ Share ज़रूर करें। जानकारी को ज्यादा से ज्यादा शेयर करना न भूलें। आपके पास कोई लेख है तो आप हमें Send कर सकते है।

हमारी id:[email protected] पसंद आने पर हम उसे आपके नाम और फोटो के साथ यहाँ PUBLISH करेंगे। इसके साथ ही अगर स्वास्थ्य के बारे में अधिक जानने के लिए, कृपया हमारे फेसबुक पेज पर जाएँ। facebook page पर फॉलो कर ले और Right Side में जो Bell Show हो रही है उसे Subscribe कर ले ताकि आप को समय समय पर Update मिलता रहे।

Thanks For Reading

Read the full article

0 notes

Photo

Payulife is one of the best FASTAG Service Provider Company in India.

FASTAG service meaning- FASTAG is an electronic toll collection system in India, operated by the National Highway Authority of India (NHAI).FASTAG uses RFID technology where toll payments get directly debited from the account linked to it. Payulife gives you high commission on every transaction and best support.

#FASATAG#fastag service#fastag csc#fastag login#fastag service providers#fastag service near me#Fastag service center#b2c

0 notes

Link

Table of Contents What is FASTag? Things to know about FASTag What are the benefits of using FASTag? Cashless Payments Mobile Alerts through SMS Faster Moving.

1 note

·

View note

Text

FASTag

FASTag mandatory for all vehicles from December 1: Here's where you can buy activate it

#FASTag#hdfc fastag#icici fastag#fastag sbi#fastag login#fastag recharge#fastag online#get fastag#paytm fastag#how to get fastag#fastag online buy#fastag online sbi#fastag purchase

0 notes

Link

Make Toll Payments on national highways without stopping for the cash transaction. Login to FASTag now to pay toll online at HDFC Bank.

0 notes

Text

Axis Bank FASTag Login

Axis FASTag is a compact reloadable card, equipped with an RFID chip that enables automatic deduction of toll from your bank account linked with the FASTag on your vehicle.

Axis Bank offers you the most convenient and hassle-free FASTag service. Axis Bank’s FASTag service facilities include cashless transactions, easy online FASTag balance checks for Axis Bank, and much more.

Here are the steps following which you can log in to your Axis Bank FASTag account online through Axis Bank FASTag login:

Go to Axis Bank's online FASTag portal.

Choose retail login/corporate login as applicable.

If you are a first-time user, you will have to register online and set a password.

If you already have an account, you can log in with your registered mobile number/vehicle number/wallet ID.

Enter your password and the captcha code.

Then click ‘Login’.

0 notes

Text

Easy Steps For Making BSNL Landline Bill Payment At Payrup

Bharat Sanchar Nigam Limited - BSNL as we all know allows online transaction recharging towards landline, mobile, broadband, fiber optic internet (FTTH) before or after the due date and even after disconnection where we a user can do online payment transactions on Payrup.

The state-run telecom operator has been recognized for its range of services since its introduction in 2000 and today, we shall show you how to make BSNL landline bills online without getting out of your home.

Along with a good internet speed, you have multiple offers and packs where a landline bill can be coupled together. With so much advancement, you can pay the BSNL landline bill online with just a few simple steps. Make payments within minutes following the hassle-free procedure on the Payrup platform and complete your bill right from wherever you are.

Everything is now handy and more manageable in the comfort of your home and with a few simple steps on Payrup, your worries of standing in queues to pay landline bills, going to the BSNL office, or requesting someone to complete this task for you you are all sorted.

Find out how you can pay bsnl landline bill online pay for your BSNL landline bill on Payrup:

Login to your account on Payrup

Select BSNL landline operator to proceed to pay the BSNL landline bill payment

Enter your valid landline number for the landline bill payment

Enter the amount as mentioned in your generated bill (or) you can fetch the bill accordingly

Press the “Proceed to Pay” button once all details are entered correctly

Choose the bsnl landline bill payment offers accordingly for the bill before completing the payment

Proceed to pay the bill using internet banking, credit or debit cards, MyRupee wallets, other wallets, etc. as per your convenience.

On successful transaction, your landline bill payment is completed

Find your transaction in your account transactions under your account details

Make quick landline bill payments a reality today only with Payrup because paying online landline bills is the new thing - simple because it is simple and faster than all the other processes and you receive a load of offers on transacting on Payrup.

Final Thoughts…

Popular bill payment facilities are available on Payrup!

Payrup has a host of facilities that can all be paid online using our platform.

Choose to make payments for mobile prepaid, mobile postpaid, dth, electricity, landline bills, piped gas, broadband bills, water bills, e-gift cards purchases, cable tv bills, credit card bills, health insurance purchases, housing society payments, life insurance premium purchases, loan repayments, hospital payments, subscriptions, education fees, fastag payments, LPG gas bills, municipal services, and municipal taxes’

#fixedline bill payment Online#Corporate bsnl landline bill payment#financial services#payrup#bsnl landline bill pay#MTNL Mumbai Landline Bill Payment

0 notes

Text

The Kotak – 811 & Mobile Banking app

The Kotak – 811 & Mobile Banking app is an app that helps you stay in touch with all your banking needs on the go. With over 180 features, you can pay bills, shop, invest, manage your credit and debit cards, recharge your mobile and FASTag and do a lot more at any time, from anywhere. Go ahead and download the app today to experience the ease of mobile banking at your fingertips.

Why choose a Kotak 811 savings account?

Your Kotak 811 savings account comes with unlimited validity and unrestricted deposits and spends. With the Kotak app, you enjoy benefits like

• In-app virtual Kotak 811 debit card

• Zero balance account with no penalties for not maintaining a minimum balance

• Savings account with up to 4%* interest p.a.

• Free online Fund transfers (UPI, NEFT, IMPS, RTGS)

• Kotak 811 #DreamDifferent credit card with no joining and annual fee

What else can I do with my Kotak mobile app?

You can shop, pay bills, manage your credit and debit cards, invest and do a lot more with just a few taps on the Kotak app. There are 180+ features that you can enjoy on the Kotak App.

Here are a few of the 180+ features that you can enjoy:

• Check your savings account balance

• Get a Dream Different Debit Card or Image Debit Card

• Request a chequebook

• Open a term deposit

• Transfer funds using BHIM UPI

• Apply for a 811 #DreamDifferent Credit Card

• Regenerate PINs

• Switch credit/debit cards on or off

• Recharge mobile and DTH subscription

• Recharge FASTag

• Pay utility bills with BillPay

• Avail an instant personal loan

• Book train tickets, flights, hotel rooms, and cabs

• Shop at Kaymall (travel, shopping, grocery, electronic)

• Purchase and redeem mutual funds

• Avail a Kotak personal loan

• Use ‘Pay Your Contact’ to pay beneficiaries with just a phone number

• BharatQR 3(scan and pay)

• Keya chat boat

• Get insurance

• Apply for FASTag

Download the Kotak App today to discover a whole new exciting world of banking digitally with Kotak.

How to get started?

Completing your sign-up on the Kotak app is easy. All you need are a few bank account details such as your credit/debit card PIN and your Net Banking password. You will go through a one-time activation process as you login for the first time on the Kotak app.

How do I get my 811 #DreamDifferent Credit Card?

Want to get your very own 811 #DreamDifferent Credit Card? It’s really easy. Just follow these 3 quick steps –

Open a Kotak 811 savings account

Book a fixed deposit of a minimum amount of ₹10,000

Apply for free credit card against FD

That’s it!

Security

With the Kotak app, you do not have to worry about security. We place utmost importance on our customers’ privacy and security. We make sure that your data will never be shared with a third-party without your consent.

Permissions of Kotak banking app users

The Kotak app would require the following permissions from its users:

• Contacts: To permit access to mobile numbers for mobile / DTH recharge or sharing IFSC/MMID

• Location: For branch / ATM locator

• Photos / Media / Files / Camera: To access gallery and set images

• Phone: To contact customer service

• SMS: To auto activate the device during activation process (read SMS will be applicable for select customers and basis customer consent)

The Kotak app will access device level alternate data for credit risk assessment and make decisions for better product offering.

Giving Aadhaar details is voluntary.

Issuance of credit cards is at the sole discretion of Kotak Mahindra Bank Limited. All features and benefits are subject to Credit Card Terms and Conditions. Please read the Credit Card terms and conditions carefully provided on the bank website www.kotak.com

Mutual Fund investments are subject to market risks. Please read all documents carefully before investing.

Credit at sole discretion of Kotak Mahindra Bank Ltd. and subject to guidelines issued by RBI from time to time. Bank may engage the services of marketing agents for the purpose of sourcing loan assets.

#Kotak#india news#india business#india budget 2022: digital rupee and crypto tax announced cnn#mumbai indians#India#india

1 note

·

View note

Text

[caption id="attachment_8801" align="alignnone" width="370"] ICICI Bank enables FASTag-based parking payment payment at Mumbai airport[/caption]

NEW DELHI: ICICI Bank on Thursday said it has enabled FASTag-based payment for parking at Terminal 2 of the Chhatrapati Shivaji Maharaj International Airport. The facility will allow users to pay parking charges digitally and in a contactless manner, resulting in quicker movement of vehicles through the parking zone.

“The scanners installed at the parking zone reads the FASTag affixed on the windscreen of the vehicle, records the entry/ exit time and deducts the parking charges automatically," the bank said in a statement.

Also Read - How to Register, Login and Transfer Funds Using HDFC Mobile Banking App?

“We are delighted to introduce FASTag based payment for parking at Terminal 2 of the Chhatrapati Shivaji Maharaj International Airport, one of the busiest airports in the world. We believe this facility will improve convenience of users by saving their time and dependency on cash,“ said Sudipta Roy, Head – Credit Cards, Payment Solutions & Merchant Ecosystem, ICICI Bank.

“We were the first bank in the country to launch FASTag on the Mumbai – Vadodara corridor in 2013. Since then, we have pioneered the usage of FASTag for payments at various national and state highway toll plazas and parking at airports, malls, business hubs and at tech parks across the country. In addition, we have introduced the facility at fuel stations so that users can avail the triple benefit of using one tag for payments for fuel, toll and parking,"

Also Read - IndusInd Bank to offer EV financing to Tata Motors dealers

ICICI Bank is the only bank to have introduced the FASTag-based parking payment facility at Mumbai airport. Till now, tags were used majorly to pay toll across highways in the country.

Click on Twitter, Facebook, Youtube links to subscribe to our social media pages.

0 notes

Text

Easy Steps For Making BSNL Landline Bill Payment At Payrup

Bharat Sanchar Nigam Limited - BSNL as we all know allows online transaction recharging towards landline, mobile, broadband, fiber optic internet (FTTH) before or after the due date and even after disconnection where we a user can do online payment transactions on Payrup.

The state-run telecom operator has been recognized for its range of services since its introduction in 2000 and today, we shall show you how to make BSNL landline bills online without getting out of your home.

Along with a good internet speed, you have multiple offers and packs where a landline bill can be coupled together. With so much advancement, you can pay the BSNL landline bill online with just a few simple steps. Make payments within minutes following the hassle-free procedure on the Payrup platform and complete your bill right from wherever you are.

Everything is now handy and more manageable in the comfort of your home and with a few simple steps on Payrup, your worries of standing in queues to pay landline bills, going to the BSNL office, or requesting someone to complete this task for you you are all sorted.

Find out how you can pay bsnl landline bill online pay for your BSNL landline bill on Payrup:

Login to your account on Payrup

Select BSNL landline operator to proceed to pay the BSNL landline bill payment

Enter your valid landline number for the landline bill payment

Enter the amount as mentioned in your generated bill (or) you can fetch the bill accordingly

Press the “Proceed to Pay” button once all details are entered correctly

Choose the bsnl landline bill payment offers accordingly for the bill before completing the payment

Proceed to pay the bill using internet banking, credit or debit cards, MyRupee wallets, other wallets, etc. as per your convenience.

On successful transaction, your landline bill payment is completed

Find your transaction in your account transactions under your account details

Make quick landline bill payments a reality today only with Payrup because paying online landline bills is the new thing - simple because it is simple and faster than all the other processes and you receive a load of offers on transacting on Payrup.

Final Thoughts…

Popular bill payment facilities are available on Payrup!

Payrup has a host of facilities that can all be paid online using our platform.

Choose to make payments for mobile prepaid, mobile postpaid, dth, electricity, landline bills, piped gas, broadband bills, water bills, e-gift cards purchases, cable tv bills, credit card bills, health insurance purchases, housing society payments, life insurance premium purchases, loan repayments, hospital payments, subscriptions, education fees, fastag payments, LPG gas bills, municipal services, and municipal taxes’ payments Payrup has it all covered for our users under one roof.

0 notes