#failed zelle payment

Explore tagged Tumblr posts

Text

Understanding Why Your Zelle Payment Failed and How to Resolve It

Zelle has become a go-to payment solution for millions, allowing users to send and receive money quickly and easily. However, one common issue that frustrates many users is the dreaded "payment failed" message. Whether you're paying rent, splitting a dinner bill, or sending a gift, encountering a Zelle payment failed can be inconvenient and stressful. In this blog, we will delve into the reasons why a Zelle payment might fail, how to resolve these issues, and what steps you can take to prevent future failures.

Why did my Zelle Payment Failed?

When using any digital payment platform, occasional hiccups are expected. But when it comes to money, even minor issues can cause significant stress. Here are some common reasons why your Zelle payment failed:

Insufficient Funds: The most straightforward reason for a failed payment is adequate funds in your bank account. Zelle requires that you have enough money in your account to cover the payment amount and any associated fees.

Incorrect Recipient Information: Entering the wrong email address or phone number for the recipient can cause the payment to fail. Zelle uses this information to direct the payment, so accuracy is crucial.

Bank-Specific Issues: Sometimes, the issue may be with your bank or the recipient's bank. Each financial institution has its own set of rules and regulations, and a bank-specific issue can cause a payment to be declined.

Security Concerns: For security purposes, Zelle and your bank may flag or block transactions that appear suspicious. This could be due to an unusual transaction amount, a new recipient, or a location change.

Technical Problems: Like any other app or service, Zelle can experience technical difficulties. Server outages, software bugs, or maintenance work can lead to failed payments.

Zelle Daily Transfer Limits: Zelle has daily and monthly transfer limits. If you exceed these limits, your payment will be declined.

What Happens When a Zelle Payment Fails?

When a Zelle failed payment, the process usually stops, and you receive a notification explaining the failure. Here are some possible scenarios and steps to follow:

Funds Not Deducted: If the funds were not deducted from your account, you can attempt to resend the payment after correcting the issue.

Funds Deducted but Payment Failed: In some cases, you might see that Zelle payment failed but money taken. This can be particularly alarming but don't panic. Generally, the funds are returned to your account within a few business days. If not, you should contact your bank immediately.

How to Resolve Zelle Payment Failed?

Check Your Account Balance: Ensure that you have sufficient funds in your account to cover the payment.

Verify Recipient Information: Double-check that you have entered the correct email address or phone number for the recipient.

Contact Your Bank: If the issue persists, reach out to your bank's customer service. They can provide insights into whether there are any issues on their end.

Update Your App: Ensure that you are using the latest version of the Zelle app. Sometimes, outdated software can cause transaction failures.

Review Security Alerts: Check if your bank or Zelle has flagged the transaction for any security reasons. You should verify your identity or authorize the payment manually.

Wait and Retry: If the failure was due to a temporary technical glitch, waiting a few hours before trying again can sometimes resolve the issue.

Conclusion

While Zelle offers a convenient way to send and receive money, payment failures can occur for various reasons. By understanding the common causes and taking preventive measures, you can minimise the chances of encountering these issues. Always ensure you have sufficient funds, double-check recipient information, and stay updated with app versions. If you do experience a payment failure, follow the steps outlined above to resolve the issue promptly. By staying informed and proactive, you can make the most of Zelle's payment platform without the frustration of failed transactions.

FAQs About Zelle Payment Failures

1. What should I do if my Zelle payment fails but the money is taken from my account?

If your payment failed but the funds were deducted, typically, the money will be returned to your account within a few business days. If the funds do not return, contact your bank's customer service for assistance.

2. Why does my Zelle payment fail even though I have sufficient funds?

This could be due to incorrect recipient information, security concerns, or daily transfer limits. Double-check all details and contact your bank if the issue persists.

3. Can I cancel a failed Zelle payment?

If the payment shows as failed, it usually means the transaction did not go through, so there is no need to cancel it. However, if funds were deducted, they should be refunded automatically.

4. How can I prevent Zelle payment failures in the future?

Ensure you have sufficient funds, double-check recipient details, stay within transfer limits, and keep your app updated.

5. What happens if a Zelle payment fails due to technical issues?

If a payment fails due to technical issues, wait a few hours and try again. If the problem persists, contact your bank or Zelle support.

0 notes

Text

Why Zelle Unable to Process Transaction: Understanding the Issue

Introduction

In the realm of digital payments, Zelle has emerged as a popular choice for its promise of seamless transactions. However, users often encounter the frustrating issue of Zelle being unable to process their transactions. Let's delve into the reasons behind this phenomenon and explore potential solutions.

Technical Glitches: A Common Culprit

One of the primary reasons why Zelle fail to process transaction is due to technical glitches within the system. These glitches can range from server errors to software bugs, disrupting the smooth flow of transactions.

Recipient Bank Incompatibility

Another common issue is the incompatibility between Zelle and the recipient's bank. If the recipient's bank does not support Zelle or instant transfers, the transaction may fail to go through, leaving both parties in a state of confusion and inconvenience.

Insufficient Funds: A Barrier to Transactions

Zelle transactions may also fail if the sender does not have sufficient funds in their account to cover the transfer amount. In such cases, Zelle is unable to process the transaction until the sender's account is adequately funded.

Incorrect Recipient Information

Incorrect recipient information, such as an invalid email address or phone number, can also lead to transaction failed on Zelle. It is crucial for users to double-check the recipient's details before initiating a transfer to avoid such issues.

Fraud Prevention Measures

Zelle has robust fraud prevention measures in place to safeguard users' funds and prevent unauthorized transactions. However, these security protocols may occasionally flag legitimate transactions as fraudulent, resulting in transaction failure.

Network Connectivity Issues

Poor network connectivity or internet outages can also disrupt Zelle transactions, causing them to fail unexpectedly. It is essential for users to ensure they have a stable internet connection when using the Zelle app to avoid such issues.

Zelle's Response and Resolution

In response to transaction failure issues, Zelle continuously works to improve its service reliability and address underlying technical issues. Users experiencing transaction failures are encouraged to reach out to Zelle's customer support for assistance in resolving the issue promptly.

Preventing Transaction Failures: Best Practices

To minimize the risk of failed zelle payment, users should ensure they have sufficient funds in their account, verify recipient details, and maintain a stable internet connection. Following these best practices can help ensure smooth and successful transactions.

Conclusion

While Zelle offers a convenient and efficient way to send and receive money, transaction failures can still occur due to various reasons. Understanding the potential causes of Zelle payment failed and taking proactive measures can help users navigate these challenges effectively and enjoy a seamless payment experience with Zelle.

0 notes

Text

Troubleshooting Guide: How to Fix a Failed Zelle Payment

Zelle has revolutionised the way we transfer money, offering a convenient and swift platform for peer-to-peer transactions. However, encountering a failed payment can be frustrating and concerning. If you've experienced Zelle payment failed, there's no need to panic. Here's a comprehensive guide on how to troubleshoot and fix the issue.

Confirm Transaction Details: The first step is to double-check all the transaction details, including the recipient's information and the amount you're trying to send. Ensure that there are no typos or errors in the recipient's email address or phone number. Even a minor mistake can cause the payment to fail.

Check Account Balance: Insufficient funds are a common reason for payment failures. Verify that you have enough money in your account to cover the transaction, including any associated fees. If your account balance is low, consider transferring funds or depositing money before attempting the transaction again.

Verify Recipient Enrollment: Both the sender and the recipient must be enrolled in Zelle to send and receive payments. Ensure that the person you're trying to send money to has a registered Zelle account with their bank or credit union. If not, they won't be able to receive the payment.

Transaction Limits: Many banks impose limits on the amount of money you can send through Zelle in a single transaction or within a certain timeframe. Check your bank's policies regarding transaction limits and ensure that you're not exceeding them. If necessary, consider splitting the payment into smaller amounts.

Network Connectivity: A stable internet connection is essential for successful Zelle transactions. If you're experiencing network issues or a weak internet connection, it could disrupt the payment process. Make sure you're connected to a reliable network before attempting the transaction again.

Contact Customer Support: If you've tried all the above steps and are still unable to fix the issue, don't hesitate to contact Zelle's customer support for assistance. They can provide guidance and troubleshoot the problem further. Be prepared to provide details about the failed transaction, including the date, time, and amount.

Wait and Retry: Sometimes, payment failures are temporary and resolve on their own. If you encounter a failed Zelle payment, wait for a while and then try again later. It's possible that the issue was due to a temporary glitch or maintenance activity.

Check for Bank Restrictions: Certain banks have their own security measures in place to prevent fraudulent transactions. If your bank detects any suspicious activity or unauthorized access to your account, it may block Zelle payments. Contact your bank to verify if there are any restrictions affecting your account.

Update Zelle App: Ensure that you're using the latest version of the Zelle app or accessing Zelle through your bank's mobile banking app. Updates often include bug fixes and improvements that can address issues related to payment failures.

Consider Alternative Payment Methods: If you're unable to resolve the payment failure with Zelle, consider using alternative payment methods such as PayPal, Venmo, or traditional bank transfers.

In conclusion, encountering a failed Zelle payment can be frustrating, but it's not the end of the world. By following these troubleshooting steps, you can often resolve the issue and successfully complete your transaction. If you're still unable to fix the problem, don't hesitate to seek assistance from Zelle's customer support or your bank. With a bit of patience and persistence, you'll be back to sending money seamlessly in no time.

0 notes

Text

What happens when a Zelle payment failed?

Zelle is a convenient and widely used digital payment network that allows users to send and receive money directly from their bank accounts. Unlike other payment methods, Zelle offers near-instantaneous transactions, making it a preferred choice for many. However, despite its efficiency, users occasionally need help with successful transactions, which can lead to confusion and concern.

When a Zelle payment failed, it can be due to a variety of reasons ranging from technical glitches to user errors. Understanding the root cause of the failure is crucial in resolving the issue and ensuring seamless future transactions. In this blog, we will explore the common causes of why Zelle payment failed, provide troubleshooting tips, and answer frequently asked questions to help you navigate these challenges with ease.

Common Reasons Why Your Zelle Payment Failed

1. Incorrect Recipient Information

One of the most common reasons for a failed Zelle payment is entering incorrect recipient information. Zelle payments require the recipient's email address or mobile number linked to their Zelle account. If this information is incorrect or outdated, the payment will not go through.

Fix: Double-check the recipient’s details before sending the payment. Ensure that the email address or mobile number is correct and associated with a Zelle account. If you're unsure, confirm the details with the recipient.

2. Insufficient Funds

Zelle transactions draw funds directly from your linked bank account. If your account has insufficient funds to cover the payment, the transaction will fail.

Fix: Verify your account balance before initiating a Zelle payment. Ensure that you have enough funds in your account to complete the transaction. If necessary, transfer funds into your account before trying again.

3. Bank Restrictions

Some banks have restrictions or limits on the amount you can send via Zelle. These limits can vary based on your bank’s policies and your account type.

Fix: Check with your bank to understand the Zelle transaction limits. If you need to send a large amount, you may need to split the payment into smaller transactions or use an alternative payment method.

4. Network Issues

Occasionally, network or technical issues can cause Zelle payments to fail. This can be due to problems with Zelle’s servers, your bank’s servers, or your internet connection.

Fix: If you suspect a network issue, try again later. Ensure that you have a stable internet connection and that Zelle’s and your bank’s services are operational. You can check your bank’s website or contact their customer service for updates on any outages or technical problems.

5. Account Verification Problems

Zelle requires that both the sender and the recipient have verified accounts. If either party’s account is not properly verified, the payment will not go through.

Fix: Verify that both your account and the recipient’s account are set up correctly and fully verified. This typically involves confirming your email address or mobile number through a code sent by Zelle. Follow the verification steps provided by Zelle or your bank.

6. Security Concerns

For security reasons, Zelle and banks monitor transactions for unusual or potentially fraudulent activity. If a payment is flagged as suspicious, it may be blocked or delayed.

Fix: If your payment is flagged, you may need to confirm the transaction with your bank or Zelle. Contact your bank’s fraud department or Zelle customer support to verify your identity and the legitimacy of the transaction.

What to Do When Your Zelle Payment Fails but Money is Taken?

There are instances where your Zelle payment failed but money taken. This situation can be particularly stressful. Here’s what you should do:

Check Your Transaction History: Verify the transaction status in your bank account and Zelle activity log. Sometimes, failed transactions are automatically reversed, and the funds are returned to your account.

Contact Your Bank: If the money has been debited but the payment has failed, contact your bank’s customer service. Please provide them with the transaction details and request an investigation.

Reach Out to Zelle Support: You can also contact Zelle customer support for assistance. They can help you understand the issue and work with your bank to resolve it.

Wait for Automatic Reversal: In many cases, if a Zelle payment fails. Still, the money is taken, and the amount is usually credited back to your account within a few business days. Monitor your account for any updates.

FAQs

Q1: What happens when a Zelle payment fails?

When a Zelle payment failed, the transaction does not go through, and the money is not transferred to the recipient. You may receive an error message indicating the failure, and in some cases, the funds might be temporarily held or debited from your account.

Q2: Why did my Zelle payment fail, but the money was taken?

If see Zelle failed payment but the money is taken, it could be due to a processing error or technical glitch. The funds are usually credited back to your account within a few business days. Contact your bank and Zelle support for further assistance.

Q3: How can I prevent Zelle payment failures in the future?

To prevent Zelle payment failures, ensure that you have sufficient funds in your account, verify recipient information, check for bank transaction limits, and maintain a stable internet connection. Additionally, keep your account information up to date and promptly address any verification or security concerns.

Q4: Can I cancel a Zelle payment after it has been sent?

Once a Zelle payment is sent, it cannot be canceled if the recipient is already enrolled in Zelle. However, if the recipient is not enrolled, you can cancel the payment through your bank’s mobile app or online banking portal.

Q5: What should I do if my recipient hasn’t received the Zelle payment?

If your recipient hasn’t received the Zelle payment, ask them to check the email or mobile number associated with their Zelle account. Ensure that the details are correct. If the issue persists, contact Zelle support for assistance.

Conclusion

Experiencing a failed Zelle payment can be inconvenient, but understanding the common causes and solutions can help you quickly resolve the issue. By ensuring accurate recipient information, sufficient funds, and adherence to bank policies, you can minimize the chances of encountering payment failures. Always stay informed about your bank’s guidelines and keep your account details up to date. If problems arise, don’t hesitate to reach out to your bank and Zelle support for prompt resolution.

0 notes

Text

Why my Zelle Payment Failed (Get Immediate Solution)

Zelle is a mobile app for sending money without sharing your bank accounts, routing numbers, or personal information Zelle Payment Failed. It’s secure, easy to use, and available in the U.S., with many banks to come.

Zelle is a fast, easy way to send money to friends and family. Whether you’re paying a bill, splitting a check, or sending a friend a late-night coffee pick-me-up, sending is just as easy with Zelle. Choose the amount you want to send and Zelle will do the rest. It’s that simple! And when you need to get paid back for an online purchase or split up an unexpected bill, Zelle’s one-touch feature easily transfers money to the recipient without sharing bank account information or routing numbers.

Easy To Fix Zelle Payment Failed

If you are asking yourself, “why did my Zelle payment fail?”, we listed below a couple of reasons that might be the reasons.

· Server issues: Some customers have reported issues connecting to the Zelle servers on their average day.

· Blocked recipient’s account: If the recipient’s account is blocked, the payment will be failed.

· Entered the wrong credentials/information: If the entered recipient’s information might be incorrect, the payment will be failed.

How To Fix Zelle payment failed

If you identify with any of the above issues, the plausible act to do is to give you solutions. Here is how to fix or deal with failed Zelle payment issues.

1. Double-check recipient information: If you are sending a payment for the second time and it failed again, probably you have entered the wrong information. Double-check all of your recipient’s details before sending the money.

2. Try again later: In some cases, it is recommended to wait at least two hours or try again until the issue is fixed.

3. Contact Zelle customer service: If it still doesn’t work after following the solutions above, try contacting Zelle customer service by dialing and speaking to your bank’s representative if you choose to contact them via phone.

4. Try sending it again: If you are sending a payment for the second time and it failed again, probably your bank or financial institution is experiencing some issues that they’re working on resolving.

If a Zelle payment failed but money was taken, what must you do?

Here are the things you need to be aware of if your Zelle payment failed but money is taken from your account:

Zelle is an app that lets people send and receive money from their bank accounts. It’s been around for a few years now, and many people have used it to send payments. What happens if you use Zelle to send someone money, only to learn that the transaction failed? If you want to know what to do in this situation, then continue reading.

Nowadays, sending and receiving money with Zelle is very simple: it’s done through texts on your mobile phone. That said, sometimes transactions don’t go through correctly. Due to technical issues with the app, this can happen. Since Zelle isn’t available in every state, you should contact your bank or financial institution and ask them about the issue.

What happens when a Zelle payment failed

· Customers who are making their first transaction should wait for a few days until the Zelle server is fully deployed for them to receive their first transaction and the initial value of their Zelle account.

· Customers who are having issues with the incorrect connection should try clearing their browser cache and cookies to refresh the connections and try again.

· Customers with blocked recipient accounts can add that contact again to receive payments through Zelle.

How do you know if Zelle failed payment?

1. You sent a payment but the money was removed from your account.

2. Your recipient requested to have money from you and it was declined.

3. Your payment did not go through within the transaction window period specified by the recipient (if you set up a set period for the payment to go through).

4. It is hard to verify your Zelle’s request, such as if funds are needed immediately or limited deposit amounts or specific timing (which is not supported by Zelle).

5. You need to verify payment for over 60 seconds but there are no verification results on the screen, your phone or other devices from which your Zelle account can be accessed are not reachable or are otherwise unable to connect to the internet, and you cannot find someone else who can verify your request during that time frame (i.e., there’s no one else online).

Conclusion on Zelle failed payment

Zelle is a new way to send money to anyone in the U.S., whether they have a bank account or not. Zelle is typically used for smaller transactions, such as splitting a dinner check with friends or paying back a friend for buying your concert tickets. It’s similar to sending an instant message, except instead of chatting through technology, you’re sending messages through money. It’s that simple!

Zelle transfer failure is also helpful when paying bills each month or sending your roommate money for rent. This can be done directly from your bank or using the Zelle app on your phone.

Zelle’s payment is an innovative way to pay and transfer money using your smartphone or the Zelle App. It’s a secure, fast, and simple way to send money to family, friends, colleagues, and other acquaintances. You can also use it to send payments online or in-store.

FAQs About Zelle Payment Failed

Q. What is the minimum age to use Zelle?

As of 2018, the minimum age for Zelle is 18 years old. Before that, the age requirement was only 14 years old. Although it’s likely your recipient and you will be able to use Zelle regardless of your age, there have been some cases where the user has been turned down due to their age.

0 notes

Text

Tarot & Astrology Paid Services

Tarot Readings

Dipping Your Toes Into Your Psyche – $25

Step into the depths of your mind. In this reading, you ask one question, which I break down into three specific sub-questions. I pull a total of nine cards to reveal the insights your psyche is ready to uncover.

Craving More of Your Own Subconscious – $50

Go beyond the surface and explore the hidden corners of your subconscious. You ask two questions, which I break down into six targeted sub-questions. With 21 cards, I will reveal what your subconscious wants you to understand and integrate.

Dive Into Your Soul – $75

Immerse yourself fully in self-discovery. In this reading, you ask three deep questions, which I break down into 12 sub-questions. I pull 36 cards to unveil the wisdom, desires, and truths your soul is longing for you to see.

Astrology Readings

Empowerment Through Your Big 3 – $25

Unlock the essence of your Sun, Moon, and Rising signs. I’ll reveal your core values, the aura you naturally emit, and the deep desires of your soul. Then, we’ll explore the ego you carry, how you handle emotional volatility, and why people may either be drawn to or distanced from you.

Empowerment Through Your Big 6 – $50

A deeper dive into your Sun, Moon, Rising, Mercury, Venus, and Mars signs. I’ll uncover:

• Your core identity and the energy you radiate.

• The inner cravings of your soul and how they shape your life.

• Your ego and emotional reactivity, revealing why others may find you magnetic or distant.

• The intricate system of your mind, the way you process thoughts, and the communication patterns that either strengthen or sabotage your relationships.

• The flames of your desire—what arouses and ignites your passion in love.

• Your approach to intimacy, power, and impact, detailing the imprint you leave on the world.

Then, we’ll flip the script and uncover:

• Why your communication may be misunderstood.

• Why your relationships struggle or fail.

• How you may unconsciously create chaos and destruction in your own life.

Transformation & Evolution Through Your Chart – $100

A full natal chart reading designed to awaken, empower, and transform you. We will explore both the radiant and shadow aspects of your being:

• The beautiful, exciting, and alluring qualities that make you shine.

• The dark, unattractive, and challenging traits that hold you back.

• Your pain, trauma, insecurities, and weaknesses, as well as your strengths, resilience, and inner power.

This is a soul-deep analysis, offering profound insights into your journey of self-evolution.

Fated, Karmic, Soulmates, or Toxic? Unveiling Your Synastry – $120

Step into the portal of your heart and uncover the cosmic connection between you and another person. Whether it’s a crush, lover, or someone you can’t seem to let go of, this reading will break down the fated and karmic dynamics at play.

We’ll dissect:

• Why this person entered your life and what they mirror back to you.

• The emotional, mental, and physical chemistry between you both.

• The lessons, karmic ties, and possible future of this connection.

• Whether you should continue, seek healing, or walk away.

If you’re ready to peel back the layers of your subconscious, psyche, and soul, DM me to begin your journey.

I accept Zelle, PayPal, and CashApp, as payments.

#astro notes#astro observations#astroblr#astrology#astro placements#astro community#astrologer#tarotblr#tarot#paid readings#paid astrology#paid tarot reading

11 notes

·

View notes

Text

JPMorgan, Wells Fargo, BofA facing federal lawsuit over Zelle payment network fraud

A federal regulator sued JPMorgan Chase, Wells Fargo and Bank of America on Friday, claiming the banks failed to protect hundreds of thousands of consumers from rampant fraud on the popular payments network Zelle, in violation of consumer financial laws. In the federal civil complaint, the Consumer Financial Protection Bureau asserts that the banks rushed to get the peer-to-peer payments platform…

3 notes

·

View notes

Text

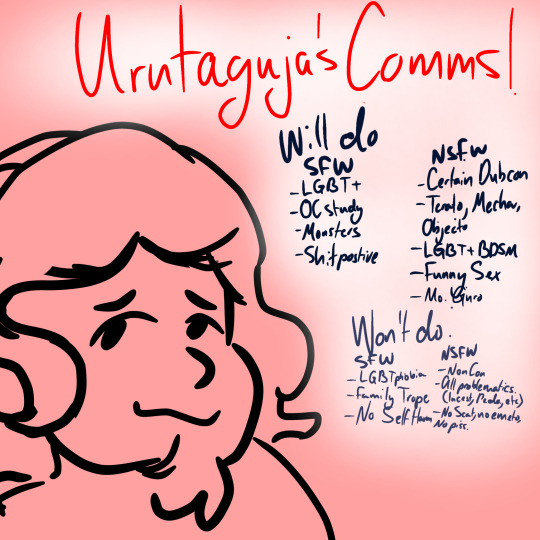

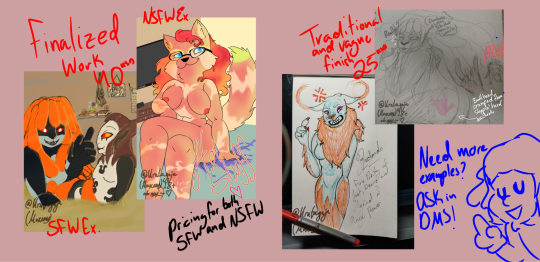

New Updated Commission's list!

Its about time I actually do something better and this time it is more simple.

For all kinds of Finalized work, SFW AND NSFW, they will be charged $40USD

For all kinds of Traditional work, whether it is vague ended or simply very detailed trad, they will be charged around $25USD

Traditional works are usually the fastest made and therefore should be expected in less than a day's worth, but I shall also let you know any updates regarding any delays.

I am open to discuss during the drawing process, please make sure to ask for any additions or small changes I can do. Once I color it in, I will not accept anything more. Be sure to make up your mind proper.

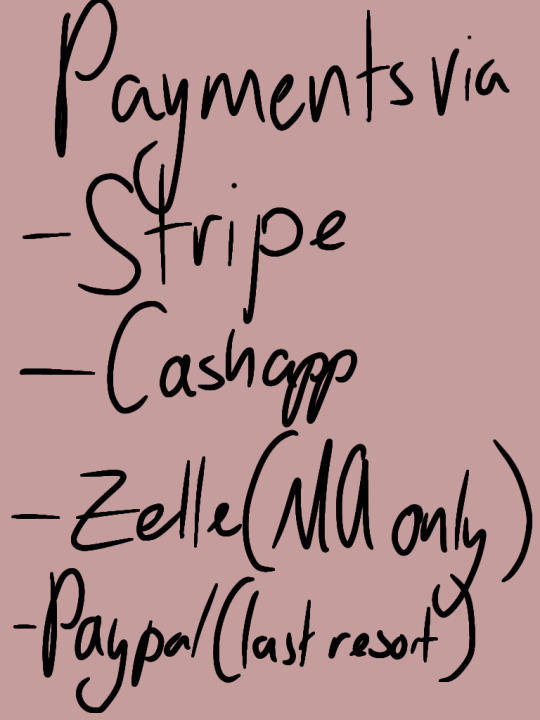

I will accept the payments by order of ease or options.

Stripe, Cashapp, Zelle for local MA and lastly, Paypal.

Please remember my boundaries. While asking for a commission in dms, I expect you to be realistically quick, do not delay!

If you ask for commissions and I answer, yet you take about two days to answer back, I'll call you off on a deal. I will not make your commissions by then unless your excuse is acceptable (be careful of how you pull it off).

If any questions, please ask me in dms and not in comments, I will not answer them unless my dms seem to fail you.

#comms open#considering making commissions#comms sheet#commision me#art commissions open#commission info#small artist#small art blog

36 notes

·

View notes

Text

How to Transfer Money from Cash App to Bank Account: A Complete Guide

Cash App is a popular peer-to-peer payment service that allows users to send, receive, and withdraw money conveniently. Whether you need to cash out to your bank, debit card, or even another payment service like PayPal or Venmo, understanding how to do it efficiently is essential.

In this guide, we’ll cover everything you need to know about transferring money from Cash App to your bank account, including fees, processing times, and potential issues.

1. How to Cash Out on the Cash App

Cashing out on Cash App simply means withdrawing your available balance to your bank account or debit card.

Steps to Cash Out:

Open the Cash App on your phone.

Tap on the Banking Tab (🏦 icon).

Select "Cash Out."

Enter the amount you want to withdraw.

Choose between Standard Deposit (1-3 business days) or Instant Deposit (within minutes, with a fee).

Confirm the transfer and wait for the funds to appear.

2. How to Send Money from Cash App to Bank Account

Transferring funds from Cash App to your bank account is simple and can be done manually or automatically.

Manual Transfer:

Go to the Banking Tab and select Cash Out.

Enter the amount to transfer.

Choose Standard or Instant Transfer.

Select your linked bank account and confirm the transfer.

Enable Automatic Bank Transfers:

Open Cash App.

Go to Settings > Deposits & Transfers.

Enable Auto Cash Out.

Choose between Daily, Weekly, or Monthly transfers.

3. How to Transfer Money from Cash App to Debit Card

Transferring money to a linked debit card is similar to a bank transfer, but it is faster.

Instant Deposit: Money is sent immediately, but a 1.5% fee applies.

Standard Deposit: Free, but takes 1-3 business days.

Steps to Transfer:

Tap Banking Tab > Cash Out.

Enter the amount.

Choose your debit card as the destination.

Select Instant or Standard Transfer and confirm.

4. Can You Send Money from Cash App to PayPal?

Cash App doesn’t have a direct PayPal transfer option, but you can use these methods:

Workaround Methods:

Transfer to Your Bank Account – Send funds from Cash App to your bank, then move them to PayPal.

Use a PayPal Cash Card – Add the PayPal Cash Card to Cash App and withdraw funds.

5. Can You Send Money from Cash App to Zelle?

Cash App and Zelle are not directly compatible.

Alternative Methods:

Withdraw to Your Bank – Move funds from Cash App to your bank, then send money using Zelle.

Use a Linked Debit Card – If your Zelle account is linked to the same debit card as Cash App, you can transfer funds between the two.

6. Can You Send Money from Cash App to Venmo?

Cash App and Venmo are separate platforms, but you can transfer money between them indirectly.

How to Do It:

Transfer to a Bank – Move funds from Cash App to your bank, then transfer to Venmo.

Use a Venmo Debit Card – Link the Venmo Card to Cash App and withdraw funds.

7. How to Send Money from Cash App to Apple Pay

Cash App allows users to send money to Apple Pay through a linked card.

Steps to Transfer:

Open Cash App.

Tap Cash Card > Add to Apple Pay.

Follow the on-screen instructions to link the card.

Use Apple Pay to make purchases with your Cash App balance.

FAQs

1. How long does it take to transfer money from Cash App to a bank?

Standard deposits take 1-3 business days.

Instant deposits happen within minutes (with a 1.5% fee).

2. What is the Cash App withdrawal limit?

Standard accounts can withdraw up to $1,000 in 30 days.

Verified accounts can increase limits to $7,500 per week.

3. Can I cancel a Cash App transfer?

No, once a transfer is initiated, it cannot be canceled.

4. What should I do if my Cash App transfer fails?

Ensure you have enough funds.

Check your internet connection.

Contact Cash App Support if the issue persists.

5. Does Cash App charge fees for bank transfers?

Standard deposits are free.

Instant deposits charge a 1.5% fee.

6. Can I use Cash App internationally?

No, Cash App is only available in the U.S. and U.K..

Conclusion

Transferring money from Cash App to your bank, debit card, or other services like PayPal and Venmo is easy if you follow the right steps. Whether you choose a standard or instant deposit, understanding the fees and limits will help you manage your funds efficiently.

0 notes

Text

Most frequent causes of a Zelle failed payment

In the realm of digital banking, Zelle stands out as a quick and convenient method of sending and receiving money. Despite its efficiency, users sometimes need help with payment failures. Understanding why a Zelle payment failed and how to resolve it swiftly can save time and prevent unnecessary stress. In this comprehensive guide, we'll explore common reasons behind Zelle payment failed and provide effective solutions that can resolve these issues in just two minutes.

Introduction

Zelle is designed to simplify money transfers between bank accounts, providing near-instantaneous transactions with a user-friendly interface. However, even the most reliable systems can experience hiccups. A failed Zelle payment can be particularly concerning, especially if the funds appear to have been deducted from your account. Knowing the underlying causes and quick fixes for these issues can make all the difference.

Whether you're transferring money to a friend, paying a bill, or receiving a payment, encountering a "payment failed" message can disrupt your plans. This blog aims to equip you with the knowledge to resolve such issues efficiently, ensuring smooth and hassle-free transactions. We'll delve into the most common reasons why Zelle payment failed and offer step-by-step solutions to fix them in no time.

Common Reasons Why Your Zelle Payment Failed

1. Incorrect Recipient Information

One of the most frequent causes of a Zelle failed payment is entering incorrect recipient information. Zelle transactions require the recipient's email address or mobile number linked to their Zelle account. If this information is inaccurate or outdated, the payment will not go through.

Solution:

Double-check the recipient’s details before sending the payment.

Ensure that the email address or mobile number is accurate and associated with a Zelle account.

Confirm these details with the recipient if necessary.

2. Insufficient Funds

Zelle transactions draw funds directly from your linked bank account. If your account has insufficient funds to cover the payment, the transaction will fail.

Solution:

Verify your account balance before initiating a Zelle payment.

Ensure that you have enough funds in your account to complete the transaction.

If necessary, transfer funds into your account before trying again.

3. Bank Restrictions

Some banks have restrictions or limits on the amount you can send via Zelle. These limits can vary based on your bank’s policies and your account type.

Solution: Check with your bank to understand the Zelle transaction limits. If you need to send a large amount, you may need to split the payment into smaller transactions or use an alternative payment method.

4. Network Issues

Occasionally, network or technical issues can cause Zelle payments to fail. This can be due to problems with Zelle’s servers, your bank’s servers, or your internet connection.

Solution: If you suspect a network issue, try again later. Ensure that you have a stable internet connection and that Zelle’s and your bank’s services are operational. You can check your bank’s website or contact their customer service for updates on any outages or technical problems.

5. Account Verification Problems

Zelle requires that both the sender and the recipient have verified accounts. If either party’s account is not correctly verified, the payment will not go through.

Solution: Verify that both your account and the recipient’s account are set up correctly and fully verified. This typically involves confirming your email address or mobile number through a code sent by Zelle. Follow the verification steps provided by Zelle or your bank.

6. Security Concerns

For security reasons, Zelle and banks monitor transactions for unusual or potentially fraudulent activity. If a payment is flagged as suspicious, it may be blocked or delayed.

Solution: If your payment is flagged, you may need to confirm the transaction with your bank or Zelle. Contact your bank’s fraud department or Zelle customer support to verify your identity and the legitimacy of the transaction.

Quick Fixes to Resolve Zelle Payment Failed Issues

Step 1: Double-Check Recipient Details

Before initiating any payment, make sure that the recipient's email address or mobile number is entered correctly. A minor typo can cause the transaction to fail. Confirm these details with the recipient to ensure accuracy.

Action: Go to the payment screen, verify the entered recipient information, and correct any mistakes.

Step 2: Verify Account Balance

Ensure that your bank account has sufficient funds to cover the payment. Check your account balance through your bank’s mobile app or online banking portal.

Action: Log into your bank account, check the balance, and transfer funds if necessary.

Step 3: Check for Bank Limits

Different banks have different limits on Zelle transactions. If you're trying to send a large amount, make sure it doesn't exceed your bank’s limit.

Action: Contact your bank or check their website for information on Zelle transaction limits.

Step 4: Confirm Account Verification

Both your and the recipient’s Zelle accounts need to be verified. Make sure that all required verification steps have been completed.

Action: Log into your Zelle account, navigate to the verification section, and follow the prompts to complete any pending verification steps.

Step 5: Resolve Network Issues

A stable internet connection is crucial for successful Zelle transactions. Ensure you have a reliable connection and that there are no outages with Zelle or your bank’s services.

Action: Switch to a different network if needed, restart your device, and attempt the transaction again.

Step 6: Address Security Flags

If your payment is flagged for security reasons, contact your bank’s fraud department or Zelle customer support to confirm the transaction’s legitimacy.

Action: Call your bank’s customer service or Zelle support, verify your identity, and provide details about the transaction.

FAQs

Q1: Why did my Zelle payment fail?

A Zelle failed payment for several reasons, including incorrect recipient information, insufficient funds, bank restrictions, network issues, account verification problems, or security concerns.

Q2: What should I do if my Zelle payment fails but the money is taken?

If your Zelle payment fails but the money is taken, check your transaction history and contact your bank’s customer service for assistance. You can also reach out to Zelle support for help. Typically, the funds are credited back to your account within a few business days.

Q3: How can I prevent Zelle payment failures?

To prevent Zelle payment failures, verify recipient information, maintain sufficient funds, understand your bank’s policies, stay informed about network status, complete account verification, and monitor for security alerts.

Q4: Can I cancel a Zelle payment after it has been sent?

Once a Zelle payment is sent, it cannot be canceled if the recipient is already enrolled in Zelle. However, if the recipient is not enrolled, you can cancel the payment through your bank’s mobile app or online banking portal.

Q5: Why does my Zelle payment keep failing even after multiple attempts?

Repeated payment failures could be due to persistent issues such as incorrect recipient information, insufficient funds, or unresolved verification problems. Contact your bank and Zelle support to investigate and resolve the underlying issue.

Q6: How long does it take for a failed Zelle payment to be refunded?

If a Zelle payment fails, the amount is usually credited back to your account within a few business days. Monitor your account and contact your bank if the refund takes longer than expected.

0 notes

Text

Why does Zelle keep saying payment failed?

Zelle has become synonymous with easy, instant money transfers in today's digital age. However, many users have encountered the frustrating issue of payment failure when using the platform. Let's delve into why Zelle keeps saying "payment failed" and explore possible solutions to this common problem.

How Zelle Works

Zelle operates as a peer-to-peer payment system, allowing users to send and receive money quickly and securely using their mobile devices. Its seamless interface and widespread adoption have made it a preferred choice for millions of users across the United States.

Understanding Zelle Payment Failure

Despite its convenience, Zelle is not immune to technical glitches and user errors that can lead to payment failure. Common reasons for payment failure include issues with recipient banks, insufficient funds, and incorrect recipient information.

Common Error Messages

When a Zelle payment failed, users may encounter various error messages, such as "payment failed" or "transaction unsuccessful." These messages often leave users feeling confused and frustrated, unsure of what went wrong with their transaction.

Recipient Issues

One common cause of payment failure on Zelle is when the recipient's bank does not support the platform or instant transfers. Additionally, errors in recipient information, such as misspelled names or incorrect account numbers, can also result in failed payments.

Sender Errors

On the sender's end, payment failure can occur due to insufficient funds in the account or mistakes in entering recipient details. Even a small typo in the recipient's email or phone number can lead to a failed transaction.

Zelle's Response

To address payment failure issues, Zelle has implemented measures to improve its service reliability. This includes enhancing security protocols and collaborating more closely with partner banks to ensure seamless transactions.

User Experience

Experiencing a payment failure on Zelle can be incredibly frustrating for users, especially when there's no clear explanation for the issue. Such incidents can erode trust and confidence in the platform, leading some users to seek alternative payment methods.

Resolving Payment Failure

If a payment fails on Zelle, users can take several steps to troubleshoot the issue. This includes double-checking recipient details, verifying account balances, and contacting Zelle's customer support for assistance.

Preventing Future Payment Failures

To minimize the risk of payment failure in the future, users should ensure they have sufficient funds in their accounts and accurately enter recipient information. Taking these precautionary measures can help prevent unnecessary disruptions to transactions.

Alternatives to Zelle

While Zelle offers convenience, users may also consider exploring alternative peer-to-peer payment options like Venmo or PayPal. Comparing features and reliability can help users make informed decisions about which platform best suits their needs.

User Feedback

Listening to user feedback is crucial for Zelle to improve its services and address common concerns related to payment failure. Sharing experiences and testimonials from satisfied users can also help build trust and credibility.

Zelle's Reliability

Despite occasional payment failures, Zelle remains a reliable and widely used payment platform for many users. Balancing convenience with the occasional technical hiccup is part of the evolving landscape of digital payments.

Future of Zelle

Looking ahead, Zelle is likely to continue evolving and improving its services to meet the changing needs of users. As digital payment technologies advance, Zelle will need to stay ahead of the curve to remain competitive in the market.

Conclusion

While Zelle failed payment can be frustrating, understanding the reasons behind it and taking proactive steps to resolve issues is key to ensuring a smooth experience on Zelle. By staying informed and vigilant, users can navigate potential challenges and continue to enjoy the convenience of peer-to-peer payments.

FAQs:

Why does Zelle sometimes say "payment failed"?

Zelle payments may fail due to various reasons, including technical glitches, recipient issues, or sender errors.

What should I do if my Zelle payment fails?

If your payment fails on Zelle, double-check recipient details, verify your account balance, and contact customer support for assistance.

Can Zelle payments be reversed after failing?

In most cases, Zelle payments cannot be reversed once they have failed. However, contacting customer support may help resolve the issue.

Are there alternatives to Zelle for peer-to-peer payments?

Yes, there are alternative platforms like Venmo and PayPal that offer similar peer-to-peer payment services.

Is Zelle a reliable payment platform despite occasional failures?

Despite occasional payment failures, Zelle remains a widely used and reliable payment platform for many users.

0 notes

Text

Why was my Zelle payment failed, but money was taken?

Zelle is a popular payment service used by millions of people to send and receive money quickly and securely. However, there are times when a payment may fail, even though the money has already been deducted from the sender's account. This can be frustrating and confusing for users, as they may wonder why their payment was not successful despite the funds being taken. There are several reasons why this may occur, and it is important to understand these factors to prevent it from happening in the future.

One common reason for a failed Zelle payment is incorrect recipient information. If the recipient's email or phone number is entered incorrectly, the payment will not go through. It is crucial to double-check the recipient's information before sending a payment to ensure accuracy. Additionally, the recipient must have an active Zelle account in order to receive the payment. If the recipient has not enrolled in Zelle, the payment will not be successful, even though the money has been deducted from the sender's account.

Another reason for a failed Zelle payment is insufficient funds in the sender's account. If the sender does not have enough money in their account to cover the payment, it will not go through. It is important to make sure that there are sufficient funds available before attempting to send a payment through Zelle. Additionally, some financial institutions have daily limits on the amount of money that can be sent through Zelle. If the payment exceeds this limit, it will not be successful.

Technical issues can also cause a Zelle payment failed. If there are network or server issues on the Zelle platform, payments may be delayed or unsuccessful. In these cases, it is best to wait and try again later when the technical issues have been resolved. It is also important to ensure that the sender's internet connection is stable and reliable when sending a payment through Zelle.

Finally, fraud or security concerns may lead to a failed Zelle payment. If there is suspicious activity on either the sender's or recipient's account, the payment may be blocked for security reasons. It is important to monitor account activity and report any unauthorized transactions to the financial institution immediately. By taking precautions to protect personal and financial information, users can help prevent fraud and ensure successful payments through Zelle.

In conclusion, there are several reasons why a Zelle payment failed, even though the money has been deducted from the sender's account. Incorrect recipient information, insufficient funds, technical issues, and fraud or security concerns are all factors that can lead to a failed payment. By understanding these potential issues and taking preventative measures, users can avoid failed payments and ensure a smooth and secure transaction process when using Zelle.

0 notes

Text

Resolving Confusion: Failed Zelle Payments But Money Taken?

In the digital age, peer-to-peer payment systems like Zelle have become integral to our daily transactions, offering the convenience of instant money transfers directly between bank accounts. However, despite its widespread use and reliability, users occasionally need help with issues such as Zelle failed payment, even when it appears that money was deducted from their account. This situation can cause not only confusion but also significant inconvenience.

This blog aims to unravel the mystery behind why Zelle payment failed while still appearing to take funds from your account. Understanding the reasons behind such discrepancies and knowing how to address them can help ensure a smoother experience with Zelle. We will explore the mechanics of Zelle's payment processing and common issues that can lead to payment failures and provide answers to frequently asked questions about Zelle transactions.

Understanding Zelle Payment Failures and Money Deductions

1. Payment Processing Delays

Zelle is designed for instant transfers, but there are instances when transactions are not processed immediately. If a payment fails due to issues like server downtime or maintenance, the funds might still be held temporarily by your bank, creating the appearance that money was taken. These funds are usually not transferred to the recipient but are instead pending.

2. Insufficient Funds After Initiation

At times, a payment is initially approved when there are sufficient funds in your account. However, if other transactions are processed before the Zelle transfer is completed and your account balance falls below the necessary amount, the Zelle payment might subsequently fail. Despite this, the initial hold on the funds may still show as if the money was taken.

3. Security Holds and Fraud Prevention

Banks continually monitor for unusual activity to prevent fraud. If your Zelle payment triggers a security alert, the bank might stop the transaction as a protective measure. Although the payment to the recipient is halted, your funds could still be temporarily frozen until the issue is resolved.

4. Technical Issues With Bank Integration

Zelle operates directly with banks, and sometimes, technical issues between Zelle and your bank's systems can lead to transaction errors. These can include synchronization lags where the money appears deducted because the bank has processed the withdrawal, but Zelle hasn't completed the transfer due to technical disruptions.

5. Recipient Issues

If the recipient's account isn't registered or frozen, Zelle might attempt to transfer the funds but then reverse the transaction. During this period, your account might show the funds as being taken even though the payment has failed.

How to Resolve Issues When Zelle Payments Fail

Step 1: Check Transaction Status

First, verify the transaction's status in your Zelle or bank app. If the status is pending, the funds have likely yet to be transferred, and the issue may resolve itself.

Step 2: Contact Your Bank

If there is no clear resolution or if the payment status shows as failed but your account balance is still affected, contact your bank to inquire about the specific details of the transaction. They can provide insights into why the payment was halted and help recover any held funds.

Step 3: Communicate With the Recipient

Ensure that the recipient's account is active and registered with Zelle. Confirming these details can prevent future payment issues.

Step 4: Wait for Automatic Refunds

In many cases, if a Zelle payment failed and funds are deducted, the money will be automatically refunded to your account within a few business days. If this does not happen, follow up with your bank.

Frequently Asked Questions (FAQs)

Why did my Zelle payment fail, but money was taken?

This typically happens due to processing delays, insufficient funds after transaction initiation, security holds, or recipient issues. Checking the transaction status and contacting your bank can clarify the specific reason.

What should I do if my Zelle payment fails but my account shows money deducted?

First, check the transaction status to see if it's pending or failed. If the payment has failed, contact your bank to trace the funds and understand the reason behind the deduction.

How long does it take for a failed Zelle payment to be refunded?

Refunds for failed Zelle payments typically take a few business days. If you are still waiting to receive a refund within this timeframe, contact your bank for further assistance.

By understanding the complexities behind Zelle payment processing and knowing the steps to take when issues arise, you can use Zelle more confidently and effectively. Remember, most payment failures and deductions are temporary and can be resolved by following the right procedures.

0 notes

Text

Why did My Zelle Payment Fail? What to do now?

If you have been wondering why Zelle payment failed, you're not alone. Many human beings were annoyed with their payments, and you need to realize what is causing this. There are some things that you may do to resolve this problem. First of all, make sure that the receiver has a registered account. This is crucial since if the recipient's account is not active, you'll be unable to receive payments.

If you see a message that asserts your payment failed Zelle, there are several reasons that you may have missed the payment. If the recipient doesn't have an account, they did not enroll. This means that their account credentials are incorrect. Try to find the recipient's bank internet site and test their email address. If they can't enroll, this may also be a problem with your application.

Often, the problem will be a server issue. In this case, you should contact Zelle support and get assistance. You should check the recipient's bank account details, enrollment, and account details to ensure that they are updated. If that doesn't work, try checking their bank's website for errors. If all else fails, you can contact Zelle support and ask them to send you the money again.

What Happens When a Zelle Payment Failed?

You've probably encountered an error message if you've attempted sending money to someone through Zelle. The purpose can be defective community connectivity or sluggish net. It may also be your account credentials or your net connection. Then, comply with the stairs underneath to remedy your hassle. If none of those answers work, contact Zelle support to get help. If the error persists, try reinstalling your application and contacting the supplier.

First, test your account credentials. If you are unsure of your recipient's account credentials, you could touch their customer support team.

Often, the problem is related to the recipient's account, which can be quickly resolved. In any case, be sure to test your account information. If you are unsure of your account's credentials, contact Zelle customer support. They'll help you fix the problem.

Another reason a Zelle failed payment is that your recipient's account now no longer has enough funds. If that is the case, you need to touch the person's bank to resolve the issue. Generally, the issue will be fixed within some hours.

However, if the problem continues, you should contact the provider. If they can't resolve the problem, you could also try using another payment platform. If that does not work, you can touch Zelle support.

How to Fix If a Zelle Payment Failed But Money Was Taken?

If you've ever experienced the frustration of a Zelle payment failing, however the cash was taken, you know that you're now no longer alone. Despite your best efforts to resolve the problem independently, the state of affairs may still arise at times. We've got you included whether or not you are experiencing a failed charge or have trouble making payments. Read on to discover ways to fix this problem and avoid it in the future.

The most common reason for a Zelle payment failed but money taken is a problem with your net connection or your provider's server. These issues regularly save you Zelle from moving price range to the recipient. If this takes place to you, your best bet is to contact Zelle's support team and ask for assistance. A consultant can be able to provide you with a step by step solution.

Another possible reason for a Zelle failed payment is a server issue. The recipient's account information may be incorrect, or the recipient's bank account may be unavailable. In such a situation, you should double-check your recipient's account details.

If you've followed those steps to the letter, the failure is most likely a server issue. If this is the case, you have to contact Zelle support immediately.

0 notes

Text

Block Settles for Up to $120 Million in Cash App Fraud Case

Source: pymnts.com

Block, the financial conglomerate led by Jack Dorsey, has agreed to a $175 million settlement with the Consumer Financial Protection Bureau (CFPB) following accusations that its payment service, Cash App, allowed widespread fraud while misleading its users. The settlement includes up to $120 million in refunds for affected customers.

Government Action and Company Response

The CFPB accused Cash App of failing to adequately investigate and resolve unauthorized transaction disputes, leading to significant customer harm. The agency alleged that Block violated its legal obligations by shifting the burden onto customers and local banks to reverse fraudulent transactions, which were often denied.

CFPB Director Rohit Chopra criticized Cash App’s handling of these issues, stating the company neglected its responsibilities and created burdens for banks with issues the platform caused.

In response, Block stated that Cash App’s core principle is to prioritize customer well-being. While the company disagreed with the CFPB’s claims, it chose to settle the matter to avoid prolonged litigation and refocus on serving its customers.

Background on Cash App and Its Rapid Growth

Launched in 2013, Cash App has become one of the most widely used digital wallets in the United States, competing with platforms like Venmo and Zelle. As of 2023, Cash App had over 56 million accounts and generated more than 50% of Block’s gross profit that year.

Block, formerly known as Square, initially started with point-of-sale systems in 2009 but expanded its portfolio to include Cash App, the Bitcoin hard wallet Bitkey, and the music streaming service Tidal, acquired in 2021. Jack Dorsey, previously the CEO of both Block and Twitter (now X), stepped down from the social media company in 2021.

Cash App’s Handling of Fraud and Customer Service Failures

While Cash App has become a significant profit driver for Block, it has also brought significant challenges due to its handling of fraudulent transactions. In 2023, short-seller Hindenburg Research alleged that Block misrepresented its user base and enabled illegal activity on the platform. Block dismissed these allegations as misleading.

The CFPB, however, determined that Cash App’s customer service practices were inadequate, leaving many users vulnerable to fraud. The agency accused the company of directing users to seek help from their banks instead of thoroughly investigating disputes themselves. Many claims were reportedly denied, with Cash App’s terms of service being used as justification.

Additionally, fraudsters exploited the lack of proper support by impersonating Cash App representatives and stealing customer information. The CFPB stated that Cash App’s platform allowed fraud to thrive due to poor support infrastructure.

Steps Block Will Take Under the Settlement

As part of the settlement, Block has agreed to take the following steps:

Provide up to $120 million in refunds to customers affected by fraud.

Establish a 24-hour customer service program to handle disputes more effectively.

Pay a $55 million fine imposed by the CFPB.

Block defended itself by highlighting the company’s growth during the pandemic and emphasizing recent investments in customer support improvements. The company stated that the issues cited in the settlement do not reflect the current state of Cash App’s service.

Additional Legal Challenges for Block

The CFPB’s action follows a joint enforcement effort earlier this week by 48 state financial regulatory agencies, which accused Block of money laundering violations. In that case, Block agreed to pay an $80 million penalty and hire a consultant to review its compliance with anti-money laundering regulations and the Bank Secrecy Act.

The CFPB’s recent enforcement actions have been part of an aggressive push for consumer protection during the Biden administration. The agency has faced criticism from Republican lawmakers since its creation under the Dodd-Frank banking reforms in 2011.

As leadership transitions with the incoming Trump administration, the CFPB has increased its scrutiny of major financial institutions. Just this week, the agency sued Capital One, alleging the bank cheated consumers out of over $2 billion in interest.

The settlement with Block serves as a reminder of the importance of consumer protection in the rapidly expanding digital payments sector, emphasizing the need for stronger safeguards and better accountability from financial service providers.

#paypal#cashappfriday#cashappme#cashappgiveaway#money#cash#cashappblessing#cashappmoney#bitcoin#cashappflipp#cashappready#cashappaccepted

1 note

·

View note

Text

Zelle and major banks face $870 million lawsuit over alleged fraud losses

The Consumer Financial Protection Bureau (CFPB) has filed a lawsuit against the peer-to-peer payment network Zelle and three US banks that conduct or facilitate transactions on the platform. The suit alleges that the defendants failed to investigate fraud complaints and provide proper reimbursement to victims.Read Entire Article…Read More

1 note

·

View note