#factoring for oilfield services

Explore tagged Tumblr posts

Text

Factoring for Oilfield: Enhancing Financial Stability

Factoring for oilfield businesses provides a vital solution to maintain consistent cash flow in an industry that often faces extended payment cycles. By converting accounts receivable into immediate cash, factoring allows companies to fund essential operations, invest in equipment, and manage unforeseen expenses without delay.

Factoring for Oilfield Services: Tailored Financial Support

Factoring for oilfield services is specifically designed to address the cash flow challenges unique to this sector. From equipment maintenance to payroll, oilfield service providers require consistent liquidity to meet operational demands. Factoring ensures that businesses can stay financially agile, even when clients delay payments.

Immediate Funding with Invoice Factoring for Oil Field

Invoice factoring for oil field operations is a straightforward process that transforms unpaid invoices into working capital. Rather than waiting for extended payment terms from clients, businesses can receive immediate funds, enabling them to manage ongoing expenses and seize new opportunities in a competitive industry.

Streamlining Cash Flow with Invoice Factoring for Oilfield

Invoice factoring for oilfield companies simplifies financial management by bridging cash flow gaps caused by delayed payments. This reliable funding option not only ensures timely payments but also reduces the administrative burden of chasing unpaid invoices, allowing companies to focus on operational efficiency and growth.

Oil Field Services Factoring: A Strategic Approach

Oil field services factoring provides businesses with the financial flexibility needed to thrive in a demanding sector. By leveraging this service, companies can maintain steady cash flow, invest in critical projects, and mitigate the impact of fluctuating oil prices, ensuring long-term sustainability.

Factoring Oilfield Services: Empowering Growth

Factoring oilfield services empowers companies to overcome financial obstacles by providing immediate access to funds. This solution helps businesses reduce dependence on traditional loans, improve financial health, and focus on delivering quality services to their clients without financial constraints holding them back.

#factoring for oilfield#factoring for oilfield services#invoice factoring for oil field#invoice factoring for oilfield#oil field services factoring#factoring oilfield services

0 notes

Text

Cutting-Edge Equipment for Pharmaceutical and Medical Research

HIMLABORREAKTIV is a leading company in Ukraine, offering comprehensive solutions for industry-specific laboratories. With years of experience, we specialize in providing high-quality equipment and services to meet the diverse needs of laboratories in a wide range of sectors, including pharmaceutical, medical, agricultural, food, chemical industries, as well as the mining and metallurgy, machine engineering, oil and gas, and quality control sectors.

At HIMLABORREAKTIV, we understand the importance of reliable and accurate laboratory instruments for industries that rely on precision and compliance. Whether you are involved in scientific research, product testing, or quality assurance, we offer everything your laboratory requires to operate efficiently and meet industry standards.

A Wide Range of Laboratory Solutions

Our product range is designed to cover all your laboratory needs across various industries. From high-tech testing equipment to everyday laboratory essentials, HIMLABORREAKTIV provides solutions for:

Pharmaceutical Laboratories: We offer a broad selection of pharmaceutical-grade equipment, reagents, and analytical instruments necessary for the production and quality control of medicines. These products are designed to help pharmaceutical laboratories maintain compliance with rigorous industry standards and regulations.

Medical Laboratories: From diagnostic equipment to clinical tools, we provide everything needed for medical laboratories to conduct precise tests and analyses, supporting accurate diagnosis and patient care.

Agricultural Laboratories: Our laboratory solutions for agriculture include soil and water testing equipment, plant analysis tools, and devices designed to optimize agricultural processes and promote sustainable farming practices.

Food Industry Laboratories: We offer testing equipment to ensure food safety and quality. Our products help monitor factors such as moisture content, texture, and microbiological safety, enabling food manufacturers to comply with regulatory standards.

Chemical Industry Laboratories: HIMLABORREAKTIV provides reliable instruments for testing chemical properties, including materials analysis, chemical reaction studies, and safe chemical handling.

Mining and Metallurgy Laboratories: Our mining and metallurgy laboratory equipment is designed for material testing, mineral analysis, and metal quality control, essential for maintaining high standards in these industries.

Machine Engineering Laboratories: We supply equipment for testing materials in machine engineering, such as hardness testers and stress analyzers, ensuring that machine components meet durability and performance requirements.

Oil and Gas Laboratories: HIMLABORREAKTIV offers specialized tools for testing petroleum, gas analysis, and monitoring oilfield operations, supporting safety and efficiency in the oil and gas industry.

Quality Control Laboratories: Our extensive range of laboratory tools and testing devices ensures that products meet industry-specific quality standards, allowing manufacturers to carry out thorough quality control and testing procedures.

Why Choose HIMLABORREAKTIV?

Comprehensive Selection: With a vast array of laboratory equipment from leading manufacturers, HIMLABORREAKTIV offers all the tools and solutions required for a variety of industries, all available in one convenient online store.

Largest Laboratory Equipment Supplier in Ukraine: As the largest supplier of laboratory equipment in Ukraine, we provide customers with access to the most advanced, reliable, and efficient solutions on the market.

Easy-to-Navigate Online Store: The HIMLABORREAKTIV website is designed to ensure a seamless shopping experience. Users can easily browse, select, and purchase products from the comfort of their offices or laboratories.

Top-Quality Products: Our commitment to providing only the highest quality laboratory equipment ensures that every product we offer meets the strictest industry standards, delivering reliable and accurate results for your lab.

Expert Support and Consultation: We offer professional consultation and customer support to guide you in choosing the right products for your laboratory’s specific needs. Our team is dedicated to ensuring your satisfaction and success.

Conclusion

HIMLABORREAKTIV is committed to providing comprehensive, industry-specific laboratory solutions to a wide range of sectors. Our online store, shop.hlr.ua, offers a vast selection of high-quality equipment for pharmaceutical, medical, agricultural, food, chemical, mining, metallurgy, machine engineering, oil and gas, and quality control laboratories.

Visit shop.hlr.ua today to find the best laboratory solutions that meet your industry's needs. With HIMLABORREAKTIV, you can be confident that your laboratory will be equipped with the latest technology and tools to ensure efficiency, accuracy, and compliance.

0 notes

Text

A Comprehensive Overview of Bioremediation Market Landscape

The global bioremediation market size is expected to reach USD 29.37 billion by 2030, registering to grow at a CAGR of 10.52% from 2025 to 2030 according to a new report by Grand View Research, Inc. Rapid growth in industrialization & increasing environmental deterioration, advancements in synthetic technologies, and increasing government support for bioremediation research and innovations are driving the market growth.Genome editing tools, such as CRISPR-Cas and TALEN, are facilitating metabolic engineering applications for the production of optimized enzymes and metabolic pathways that aid in the biodegradation process. Similarly, quorum sensing-based microbial interactions can be effectively used for designing gene circuits and microbial biosensors for the detection and degradation of persistent recalcitrant pollutants.

These factors can accelerate the adoption of bioremediation techniques and fuel market growth. Furthermore, synthetic biology also enables the designing of biological molecules with the desired chemical composition that can be used for the degradation of target contaminant molecules. Several enzyme modification approaches have been developed in this domain, such as enzyme immobilization, using magnetic nanoparticles, production of designer enzymes, and generation of single enzyme nanoparticles, among others. Therefore, the use of synthetic technology for utilizing the bio-degradative capabilities of enzymes is expected to drive the industry.In addition, government authorities are raising awareness about the implementation of bioremediation strategies to drive the adoption of the technique.

For instance, in June 2020, the Indian Government issued an advisory for the treatment and disposal of solid waste through the bioremediation process for reclamation of landfill sites. The advisory was directed toward Urban Local Bodies and signified the increasing attention drawn by bioremediation in the country.The COVID-19 pandemic has led to increased awareness about disinfection, sterilization, and remediation of contaminated areas in public spaces and homes. Furthermore, as the SARS-CoV-2 virus continues to undergo mutations, causing recurrent waves of infection cases around the globe, demand for bioremediation services for reducing the risk of contamination is expected to rise. Similarly, large quantities of Personal Protective Equipment (PPE) and face masks used have led to new challenges in the disposal and treatment of medical waste, which present new growth opportunities for bioremediation.

Gather more insights about the market drivers, restrains and growth of the Bioremediation Market

Bioremediation Market Report Highlights

• In situ bioremediation segment held the largest market share of 56.63% in 2024. The technique refers to treatment of contaminations at the original site without the need to excavate or pump out the contaminated materials.

• Phytoremediation segment held the largest market share of 32.05% in 2024. Demand for technology is fueled by its applications for removal of heavy metals, radionuclides, organic contaminants, and pesticides with help of plants.

• Soil remediation segment held the largest market share of 39.67% in 2024. The service involves removal of soil contaminants originating from sources such as dumping of chemicals, improper waste disposal, pipe leaks & spills, and others.

Bioremediation Market Segmentation

Grand View Research has segmented the global bioremediation market based on product, end-use, and region:

Bioremediation Type Outlook (Revenue, USD Million, 2018 - 2030)

• In Situ Bioremediation

• Ex Situ Bioremediation

Bioremediation Technology Outlook (Revenue, USD Million, 2018 - 2030)

• Biostimulation

• Phytoremediation

• Bioreactors

• Fungal Remediation

• Bioaugmentation

• Land-based Treatment

Bioremediation Service Outlook (Revenue, USD Million, 2018 - 2030)

• Soil Remediation

• Oilfield Remediation

• Wastewater Remediation

• Others

Bioremediation Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o UK

o Germany

o France

o Italy

o Spain

o Denmark

o Sweden

o Norway

• Asia Pacific

o Japan

o China

o India

o Australia

o Thailand

o South Korea

• Latin America

o Brazil

o Argentina

• Middle East and Africa

o South Africa

o Saudi Arabia

o UAE

o Kuwait

Order a free sample PDF of the Bioremediation Market Intelligence Study, published by Grand View Research.

#Bioremediation Market#Bioremediation Market Size#Bioremediation Market Share#Bioremediation Market Analysis#Bioremediation Market Growth

0 notes

Text

0 notes

Text

Maximizing Oilfield Operations: The Importance of Professional Services and Core Analysis

In the ever-evolving energy industry, companies are continually striving to increase efficiency, reduce costs, and improve decision-making processes. One crucial aspect that often gets overlooked is the need for specialized Oilfield Professional Services and expert insights derived from Core Analysis Services. These services play an indispensable role in enhancing the productivity of oilfields, optimizing extraction methods, and ensuring long-term operational success. Understanding the impact and value of these services can be the key to staying ahead in the competitive oil and gas sector.

The Growing Need for Professional Services in Oilfields

The oil and gas industry is a high-stakes environment where accuracy and precision are paramount. Oilfield Professional Services are designed to address these demands by providing expert solutions in various areas of field operations. Whether it is well completion, drilling optimization, or production enhancement, these services ensure that the operations are executed safely, efficiently, and in line with best practices. By leveraging the skills and knowledge of seasoned professionals, oilfield operators can optimize their resources, reduce downtime, and enhance overall field performance.

As the complexity of oilfield operations increases with the advent of advanced technologies and more challenging exploration environments, the need for these professional services becomes even more evident. With a wide range of services available—from geological assessments to reservoir management—oilfield companies can rely on these specialized teams to manage intricate tasks and ensure operations run smoothly. In an industry where margins are tight and risks are high, these services are indispensable.

Core Analysis: A Critical Component for Informed Decision-Making

The role of Core Analysis Services cannot be understated when it comes to extracting valuable insights from oil and gas reservoirs. Core analysis involves the study of rock and fluid samples extracted from beneath the surface, providing critical data on reservoir characteristics. This data is vital for creating accurate reservoir models and informing decisions related to drilling, completion, and production strategies. Without core analysis, companies would lack the depth of knowledge required to make informed, data-driven decisions in oilfield operations.

In addition to aiding exploration efforts, Core Analysis Services also help in assessing reservoir performance over time. By continuously analyzing core samples, companies can better predict future reservoir behavior, optimize recovery strategies, and reduce the risk of unforeseen complications. This makes core analysis an essential part of not only the exploration phase but also the production lifecycle. As such, the value of core analysis is deeply integrated into every step of oilfield development.

Unlocking Value Through Data-Driven Insights in Core Analysis

As the energy industry moves towards more data-driven practices, the importance of Core Analysis Services continues to grow. Modern technologies and sophisticated testing methods now allow companies to obtain highly detailed information from core samples. These insights can reveal everything from the porosity and permeability of reservoir rocks to the chemical composition of fluids trapped underground. This in-depth understanding helps in tailoring production techniques that maximize resource extraction and minimize environmental impact.

Core analysis also plays a pivotal role in reservoir management. With detailed data, companies can monitor reservoir health and adjust operations to improve recovery factors. Techniques such as enhanced oil recovery (EOR) can be employed based on the findings of core analysis, ensuring that companies are extracting as much resource as possible while maintaining cost-efficiency and sustainability.

Why These Services Are Essential for the Future of Oilfields

Looking ahead, it’s clear that both Oilfield Professional Services and Core Analysis Services will continue to be cornerstones in the development of efficient, effective oil and gas operations. These services provide the specialized knowledge and insights needed to navigate the complexities of modern oilfields. By partnering with the right service providers, companies can ensure that they are equipped with the latest technologies and expertise required to meet the challenges of an ever-demanding market.

In conclusion, for companies looking to succeed in today’s competitive and resource-intensive oil and gas industry, incorporating expert Oilfield Professional Services and leveraging advanced Core Analysis Services are essential. Visit alzare.com for more information on how these services can optimize your oilfield operations.

1 note

·

View note

Text

Invoice Factoring for Oilfield Services Companies: A Financial Lifeline

Invoice factoring for oilfield services companies is a critical tool for businesses operating in the energy sector. These companies often face extended payment cycles, which can disrupt cash flow. By leveraging invoice factoring, oilfield services companies can receive immediate funding for unpaid invoices, ensuring they have the liquidity required to maintain operations, pay employees, and invest in new projects.

Streamlining Cash Flow with Invoice Factoring for Oilfield Businesses

Invoice factoring for oilfield businesses provides a seamless solution for overcoming financial challenges. The process involves selling outstanding invoices to a factoring provider in exchange for immediate cash. This eliminates the wait associated with long payment terms and allows oilfield companies to focus on core business activities rather than chasing payments from clients.

Oilfield Invoice Factoring: The Key to Operational Stability

Oilfield invoice factoring offers financial stability in an industry known for its volatility. Factoring helps companies manage unpredictable revenue streams by converting receivables into working capital. With oilfield invoice factoring, businesses can cover essential costs like equipment maintenance, supplies, and employee wages without relying on traditional loans or lines of credit.

Maximizing Efficiency with Invoice Factoring Oilfield Solutions

Invoice factoring oilfield solutions are tailored to meet the unique needs of businesses in this demanding sector. Factoring providers understand the specific challenges faced by oilfield companies, such as fluctuating demand and extended payment terms. By offering flexible funding options, invoice factoring oilfield services ensure companies can maintain steady cash flow and operational efficiency.

Oilfield Factoring Services: Customized Financial Support

Oilfield factoring services are designed to address the cash flow gaps that arise from delayed payments. These services enable companies to access a percentage of their invoice value upfront, providing the funds necessary for immediate expenses. Oilfield factoring services also simplify accounts receivable management, allowing businesses to focus on growth and productivity.

Oilfield Factoring: A Reliable Financial Strategy

Oilfield factoring is a proven financial strategy that helps businesses navigate the complexities of the energy industry. Whether dealing with fluctuating commodity prices or extended client payment terms, factoring provides a steady cash flow that supports daily operations. This approach eliminates the need for traditional debt and ensures oilfield companies can remain competitive and financially resilient.

#invoice factoring for oilfield services companies#invoice factoring for oilfield#oilfield invoice factoring#invoice factoring oilfield#oilfield factoring services#oilfield factoring

0 notes

Text

0 notes

Text

Choosing the Right Oilfield Tubing Anchor for Your Operation

Oilfield operations are complex systems that demand reliable equipment to ensure safety, efficiency, and productivity. Among the critical components in these operations are oilfield tubing anchors—devices that provide stability to tubing strings in wells, preventing unnecessary movement and enhancing operational efficiency. Choosing the right tubing anchor is vital for optimizing well performance and minimizing maintenance costs. This article will guide you through the essential factors to consider when selecting the best tubing anchor for your oilfield operation.

Understanding Oilfield Tubing Anchors

An oilfield tubing anchor is designed to secure the tubing string, preventing vertical movement caused by pressure fluctuations during pumping or production activities. This stability reduces wear and tear on the tubing and associated components, extending their lifespan and improving well productivity.

Tubing anchors are commonly used in rod-pumped wells, where consistent stability is crucial for efficient operation. They are especially important in deviated or directional wells where tubing movement can pose additional challenges.

Benefits of Using Tubing Anchors

Reduced Wear and Tear: Tubing anchors minimize the movement of tubing, reducing friction and wear on the tubing and associated components.

Enhanced Pumping Efficiency: By stabilizing the tubing, anchors ensure more consistent pump strokes, improving efficiency and output.

Extended Equipment Life: Anchors reduce mechanical stress on well components, lowering maintenance costs and downtime.

Improved Well Control: Stability provided by tubing anchors enhances control over well operations, reducing risks associated with sudden pressure changes.

Key Factors to Consider When Choosing Oilfield Tubing Anchors

1. Well Conditions

The specific conditions of your well play a significant role in determining the type of tubing anchor you need. Factors such as depth, temperature, pressure, and fluid composition must be considered. For instance:

High-pressure wells may require anchors made from robust materials to withstand extreme conditions.

Wells with corrosive fluids demand anchors with corrosion-resistant coatings or materials.

2. Type of Well

Different types of wells—vertical, deviated, or horizontal—require specific anchor designs. For deviated or horizontal wells, anchors with enhanced gripping capabilities are essential to maintain stability.

3. Material and Durability

Oilfield tubing anchors are exposed to harsh environments, so durability is critical. Choose anchors made from high-quality materials such as alloy steels or those with protective coatings to resist corrosion and wear.

4. Anchor Setting Mechanism

Tubing anchors come with various setting mechanisms, including hydraulic, mechanical, or a combination of both. Hydraulic anchors are ideal for wells where mechanical setting is challenging, while mechanical anchors are more straightforward and require no additional hydraulic pressure.

5. Compatibility with Existing Equipment

Ensure the tubing anchor is compatible with your existing well equipment, including the tubing string and downhole pump. Mismatched equipment can lead to inefficiencies or even damage to the system.

6. Ease of Installation and Removal

Some tubing anchors are easier to install and remove than others. Consider the ease of handling, as this can impact downtime and operational efficiency.

7. Manufacturer and Support Services

Choose a reputable manufacturer with a proven track record of producing reliable oilfield tubing anchors. Ensure the manufacturer provides technical support and after-sales services to assist with installation and troubleshooting.

Types of Oilfield Tubing Anchors

Mechanical Tubing Anchors: These anchors rely on mechanical force to grip the tubing and hold it in place. They are simple, durable, and cost-effective.

Hydraulic Tubing Anchors: These use hydraulic pressure to secure the tubing. They are suitable for wells where high pressure or other conditions make mechanical anchors less effective.

Combination Anchors: These anchors combine mechanical and hydraulic elements for added reliability and performance.

Steps for Proper Anchor Selection

Assess Well Requirements: Begin by evaluating the specific needs and conditions of your well.

Consult Experts: Engage with manufacturers or industry professionals to understand the options available.

Perform Cost-Benefit Analysis: Consider the long-term benefits of investing in a high-quality tubing anchor against its initial cost.

Test Before Deployment: Whenever possible, test the anchor in similar well conditions to ensure compatibility and performance.

Conclusion

Choosing the right oilfield tubing anchors is a critical decision that can significantly impact the efficiency and longevity of your well operations. By considering factors such as well conditions, anchor type, material durability, and compatibility, you can make an informed choice that meets your operational needs. Investing in the right tubing anchor ensures stability, enhances production efficiency, and reduces maintenance costs, ultimately improving the overall profitability of your oilfield operations.

To learn more about the benefits of oilfield tubing anchors and explore reliable options for your operation, visit https://www.techtac.com/the-benefits-of-using-an-oilfield-tubing-anchor-with-a-rod-pump-system. Discover how the right equipment can transform your oilfield operations today!

0 notes

Text

Well Cementing Services Market Future Outlook: Analyzing Size, Share, Growth Patterns

The global well cementing services market is expected to reach USD 11.6 billion by 2030. The market is projected to grow at a CAGR of 4.1% from 2024 to 2030, according to a new report by Grand View Research, Inc. Rising drilling activities to recover unconventional hydrocarbons such as shale and tight gas coupled with rehabilitation activities in existing oil & gas fields is expected to remain a key driving factor for the global market.

Well Cementing Services Market Report Highlights

The primary type dominated the market with a global revenue share of 77.7% in 2023 and is projected to continue its dominance from 2024 to 2030.

The well cementing services market in North America secured 41.1% of the global revenue share in 2023. The development of untapped hydrocarbon reserves was a major driving force.

The Asia Pacific well cementing services market was significantly augmented owing to the strong growth in cement consumption, partially due to the reopening of the Chinese economy.

The global industry is dominated by various integrated players present across the value chain. Key companies operating in the well cementing service market include Schlumberger Ltd., Baker Hughes Inc., Halliburton, Weatherford & Gulf Energy Llc., and Calfrac Well Services Ltd.

For More Details or Sample Copy please visit link @: Well Cementing Services Market Report

A large number of unexplored reserves particularly in Brazil, Russia, and China, coupled with technological advancements in well cementing equipment and services provided by oil service providers is projected to have a positive impact on the market growth in the near future. Stringent environmental regulations coupled with low crude oil prices are expected to hinder market growth over the next eight years. Low crude oil prices are anticipated to support stronger economic growth, but it may hamper growth among energy-producing states.

Primary cementing was the leading service segment and accounted for over 75% of total market revenue in 2015. It is estimated to remain the largest segment over the next eight years owing to rising E&P to exploit unconventional hydrocarbon reserves. Remedial cementing is anticipated to emerge as the fastest-growing well cementing service market over the forecast period owing to increasing rehabilitation of oil & gas wells in both onshore and offshore activities.

List of major companies in the Well Cementing Services Market

Advanced Cementing Services Incorporated

Baker Hughes Company

Calfrac Well Services Ltd.

China Oilfield Services Limited

Gulf Energy SAOC

Halliburton Company

Magnum Cementing Services Ltd.

Sanjel Energy Services

Schlumberger Limited

For Customized reports or Special Pricing please visit @: Well Cementing Services Market Analysis Report

We have segmented the global well cementing services market on the basis of type, well type, deployment and region.

#WellCementing#OilfieldServices#EnergyIndustry#DrillingOperations#WellConstruction#CementingSolutions#PetroleumEngineering#OilAndGas#EnergyInnovation#SubsurfaceTech#WellIntegrity#ReservoirManagement#FieldDevelopment#IndustrialServices#EnergySector

0 notes

Text

MENA Oilfield Service Market: Unlocking Growth Opportunities & Trends in the Energy Sector - UnivDatos

The MENA (Middle East and North Africa) oilfield services market is a significant player in the global energy sector, valued at USD 40.7 billion in 2022 and expected to grow at a CAGR of 5.3% by 2030. The oilfield service market in MENA region is extensive and varied, offering a wide range of services to support exploration, drilling, production, and maintenance activities in the oil and gas sector. One of the key drivers of opportunities and growth in the oilfield service market in the MENA region is the increasing global demand for oil and gas. As economies continue to grow and industrialize, the need for energy, particularly oil and gas, is on the rise. This has led to an increase in exploration and production activities in the MENA region, creating a demand for oilfield services such as drilling, well completion, and production enhancements.

Request To Download Sample of This Strategic Report - https://univdatos.com/get-a-free-sample-form-php/?product_id=56510&utm_source=LinkSJ&utm_medium=Snehal&utm_campaign=Snehal&utm_id=snehal

This growth is fueled by several key factors:

Rising Global Energy Demand: As economies develop and industrialize, the demand for oil and gas continues to climb. This fuels exploration and production activities in the MENA region, creating a strong demand for oilfield services.

Market Segmentation and Trends:

Dominant Service: Drilling Drilling services hold the largest market share, driven by the vast oil reserves in the MENA region. Increased investments in oil and gas development necessitate more drilling activity.

Onshore Advantage: Onshore drilling dominates due to easier access and lower costs compared to offshore operations. The region's vast deserts offer ideal conditions for onshore drilling.

Regional Leader: Saudi Arabia Saudi Arabia leads the market due to government investments in oil and gas development, its strategic location, and a stable political environment.

Market Players:

Major players include Anton Oilfield Services, Baker Hughes, Halliburton, Schlumberger, and Weatherford.

Ask for Report Customization - https://univdatos.com/get-a-free-sample-form-php/?product_id=56510&utm_source=LinkSJ&utm_medium=Snehal&utm_campaign=Snehal&utm_id=snehal

Looking Ahead:

While the MENA oilfield services market presents a promising outlook, there are challenges to consider:

Fluctuating Oil Prices: Unstable oil prices can impact investments in exploration and production activities, hindering market growth.

Renewable Energy Shift: The growing focus on renewable energy sources could pose a long-term challenge to the oil and gas industry.

Despite these challenges, the MENA oilfield services market is expected to maintain steady growth in the coming years. Advancements in technology and a continued focus on resource extraction are likely to drive market expansion. This presents opportunities for oilfield service companies to invest in innovative solutions and solidify their positions in the MENA region.

0 notes

Text

Tesla Boosts Nasdaq, Oil Cuts Stir Forex Opportunities Markets on the Move: The Ups and Downs You Didn't See Coming Yesterday's markets offered just enough drama to keep things interesting, and, as usual, there were some hidden opportunities for those in the know. The Nasdaq 100 (+0.7%) surged ahead like a trader who's finally figured out how to read RSI, boosted by a sharp jump in Tesla's stock (TSLA, up a cool 5.7%). And while the headlines focused on Elon Musk's ever-fickle charisma, there's a more grounded story in the broader market that deserves your attention. But before we jump into that, imagine this: You're buying a new pair of shoes online. You order them, eagerly await their arrival, only to realize they're two sizes too big. That's kind of what most traders felt like yesterday if they were chasing after the Dow Jones, which slipped a bit (-0.13%)—definitely not the right fit if you were looking for gains. However, unlike shoes, you can pivot in trading, and that's where the hidden gems come in. Nasdaq's Underdog Rally: The Tesla Effect Tesla isn’t just about electric cars and self-driving tech anymore; it’s also about driving market gains. With a tidy 5.7% jump, Tesla’s ascent had the Nasdaq 100 feeling like it was cruising on autopilot. However, the real story isn't just about Tesla's post-election rally. The real secret sauce here lies in understanding how this impacts market sentiment in sectors that often get overshadowed. Emerging Trends: The Oil Ripple Crude oil markets had their own mini-adventure as Kazakhstan decided to hit the brakes on production at the Tengiz oilfield (600,000 barrels per day), slashing output by nearly 30%. Pair that with Equinor's Sverdrup field halting its 720,000 barrels per day, and you've got a recipe for a market that's tightening supply just as winter is preparing to make everyone in Europe nervously sip on their overpriced lattes. Why should you care? Because changes in oil production have a much broader impact than most traders give credit. Energy and Communication Services were the biggest winners across US sectors yesterday, meaning that this ripple effect has created some juicy, often-overlooked opportunities for Forex traders. Contrarian Moves: Sectors on the Up Energy and Communication Services were the stars, performing like they had been practicing for this moment. This is where savvy traders can pick up on moves others may overlook. The energy sector's gain wasn’t just about oil prices; it’s also reflective of underlying supply dynamics and how capital is shifting ahead of potential policy changes under a new administration. Consider this: Energy prices climbing may seem like an obvious signal to stay away from oil-heavy currencies, but sometimes the contrarian move is the smart one. When crude production dips, currencies like the CAD (Canadian Dollar) or NOK (Norwegian Krone) may actually benefit, as higher oil prices feed into GDP. While other traders may be cautious, those who see these hidden signals know there's an opportunity to ride the uptrend in currencies that are positively correlated to the commodity. Presidential Influence: Playing the Politics Card Meanwhile, in the political circus ring, we’ve got US President-elect Trump apparently pushing to get Matt Gaetz confirmed as Attorney General. Now, if you’re thinking, “Wait, what does this have to do with Forex?”—let me bring you in on the secret. Geopolitical instability, or even the mere hint of potential changes in leadership, sends ripples into the currency markets. Take note: if Gaetz’s nomination struggles, expect uncertainty. And what does uncertainty do? It weakens the dollar, which in turn could create opportunities for those looking to capitalize on pairs like EUR/USD or GBP/USD. Hidden Forces Driving the Forex Market Now, here’s the kicker—the move in US energy production and political shifts don’t just impact equity markets. These factors are like invisible hands adjusting the foreign exchange levers behind the scenes. The greenback’s ebb and flow against majors such as the EUR, GBP, and CAD is where traders should be focused. When you see political pressures and oil disruptions, you should be thinking about how the USD is going to play out on the currency stage. To make it practical, think of this as playing chess against an opponent who only looks at the big pieces. Most traders will focus on headline moves, like Tesla stock jumps, while ignoring the pawns—like oil disruptions and political drama—that set up those moves several turns ahead. That’s the difference between guessing the next market move and anticipating it with precision. How to Use This Information Today So what should you be looking at right now? Here’s a breakdown: - Energy Sector's Influence: With crude prices swinging and supply tightening, it’s worth looking at the CAD or NOK. Look for opportunities to trade these pairs when they dip, knowing there’s likely underlying support as oil prices rally. - Political Moves: Keep an eye on the ongoing developments in Washington. Political instability could be the key to spotting a weakness in the USD. Uncertainty is every trader's best friend when you’re looking for volatility. - Nasdaq's Boost: When you see tech on a rally, consider whether it’s going to be a multi-day trend. Pair that with a softer dollar and you might see opportunities to go long on tech-correlated pairs. Finding the Hidden Moves If there’s one thing to remember from yesterday, it’s this: the market's biggest opportunities often hide in the details. While everyone else is staring at the bright, shiny objects (like Tesla’s 5.7% pop), the real moves lie in understanding what's happening underneath—like oil output changes, political shifts, and sector-wide trends. That’s where the hidden gems live, and that’s where your edge as a Forex trader becomes apparent. Want to Get Ahead? Stay informed with our exclusive updates at StarseedFX Forex News and explore our in-depth Forex Courses. Join the StarseedFX Community for live trading insights, and let’s turn those hidden gems into strategic gains. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Bates Machine & Mfg. Texas Machine Shop

Bates Machine & Mfg. Texas Machine Shop

Machine shops perform a variety of tasks related to controlled material removal. They often use hand tools, power tools, and measuring instruments. They also use workholding devices and deburring tools. The quality of a shop can depend on many factors. Its organization and the level of compliance over safety practices may differ from one establishment to another.

Bates Oil Field Machine Shop

Texas machine shops can manufacture cost-effective oil field parts and BOP components according to blueprints. They offer a full range of

services including machining, cutting, milling, welding, and more. They also provide quality monitoring and traceability. The oil and gas industry operates in harsh environments. It needs specialized equipment to explore, drill, extract, refine, and transport natural resources. These machines must withstand extreme temperatures and corrosive chemicals. Black Diamond Oilfield Services provides pressure control equipment and drilling tools for the oil & gas industry. Their products include a patented In-Line Filtration Technology, Detritus Defender, and Thru-Tubing tools. Their rotary subs can be made to order for double-pin or double-box crossovers, lift subs, bitsubs, and top drive subs. Located in Farmersville, Texas, Bates Machine and Mfg. is your best source for oil field machine shop and cnc work. This company has excellent reviews from previous customers. Visit their website today to see what they have to offer!

CNC Work at Bates Machine & Mfg.

Whether working on complex machinery, precision parts for medical devices, or fabricated metal structures in the oil field, machine shops must meet strict standards of quality and accuracy. They use advanced technology like CNC (Computer Numerical Control) machines to automate the machining process, which saves time and reduces human error. These advances in technology make machining an efficient and cost-effective solution for bulk production orders. In addition to these specialized tools, a machine shop also utilizes cooling systems and sawing machines to cut raw materials into manageable sizes for the machining process. Additionally, the machine shop may have a warehouse or storage space for finished products. The methodology a machine shop uses to store its tools, equipment, and materials, as well as how stringently it adheres to safety protocols, can vary from one establishment to the next. For example, some machine shops keep their workspaces swept and cleaned regularly while others do not. Also, some shops require workers to wear personal protective equipment and adhere to established safety protocols while handling machinery.

Precision Machining

Precision machining is an essential part of manufacturing many products, especially ones where even the slightest error could be disastrous. Precision machining utilizes highly-trained machinists and advanced machinery to create a product with extremely tight tolerances. The machinists follow very specific blueprints made by CAD or CAM programs. The machinists then feed these exact instructions into the CNC machine, allowing the machine to cut and shape the metal or plastic as needed. The process is very quick, and the machines can work up to 24 hours a day. Using this process can save a company a lot of time and money. It can also help them meet the dimensional specifications they need for their products. This is an important factor in reducing waste and improving production efficiency. It can also reduce the amount of defective or unusable parts that get sent back to a company for scrap. Lastly, it can help improve the overall quality of the final product.

Metal Fabrication

A metal fabrication company is a great choice for creating parts for industrial projects, such as tanks and silos. The company’s skilled team will use a variety of methods, including welding, to create the desired products. They’ll also ensure that the materials are safe for the environment. Structural metal is a critical component of modern buildings, from fire escapes to catwalks and metal staircases. Without the processes of metal fabrication, these structures wouldn’t be as sturdy or safe for emergency use. The best metal fabricators have a wide range of technical capabilities and equipment, such as CNC machines. They’ll use these tools to cut, etch, grind, sand, and polish metals into different shapes. They’ll also have the expertise to provide insight and solutions for complex machining tasks. In addition, they’ll offer customer service that’s responsive to your needs. They’ll work with you to achieve the right results within your budget and timeline. Read the full article

0 notes

Text

Shipping Companies in India: Navigating the Future of Maritime Trade

India, with its extensive coastline and strategic location along key global shipping routes, has long been a hub for maritime trade. Shipping companies in India are integral to the country's international trade, supporting the export-import sector and contributing significantly to economic growth. From traditional shipping lines to modern maritime logistics providers, the industry has undergone significant evolution, driven by globalization, technological innovation, and government reforms.

The Role of Shipping in India's Economy

Shipping companies in India play a crucial role in connecting the country's economy to global markets. Over 90% of India's international trade by volume and about 70% by value is carried by sea. With a coastline of over 7,500 kilometers, India has 12 major and over 200 minor ports, making maritime trade a key enabler for various industries, including oil, textiles, automobiles, and consumer goods.

The growth of India’s shipping industry has been accelerated by the increasing demand for import-export services, coupled with rising industrialization. Indian shipping companies operate in various segments, including container shipping, bulk cargo, coastal shipping, and offshore services, supporting industries ranging from agriculture to energy.

Leading Shipping Companies in India

India’s shipping industry is served by several major players who manage a wide range of maritime logistics, including cargo transport, vessel chartering, and specialized services. Here are some of the prominent companies:

Shipping Corporation of India (SCI): A government-owned enterprise, SCI is the largest shipping company in India. It operates in multiple segments, including bulk carriers, tankers, and offshore services. SCI has a fleet that caters to the transportation of crude oil, gas, and bulk cargo for international and domestic routes.

Great Eastern Shipping Company: One of India’s oldest private shipping companies, Great Eastern Shipping provides services across the shipping and offshore oilfield services sectors. Its fleet includes crude oil tankers, dry bulk carriers, and offshore vessels.

Essar Shipping: A subsidiary of Essar Group, Essar Shipping operates a diversified fleet comprising crude oil and product tankers, bulk carriers, and offshore supply vessels. It is known for providing transportation and logistics services to industries like steel, energy, and power.

Allcargo Logistics: Known for its strong presence in the logistics sector, Allcargo also operates a fleet of vessels to support its multi-modal logistics services, which include containerized cargo, project cargo, and coastal shipping solutions.

Adani Ports and SEZ (APSEZ): Though primarily known for its port operations, APSEZ also runs shipping services, offering integrated logistics solutions that include ocean freight, terminal handling, and inland transport. Its comprehensive shipping services support its operations at some of India’s largest private ports.

Key Growth Drivers

Several factors have contributed to the growth of India’s shipping sector in recent years:

Increasing Trade Volumes: India’s expanding international trade, driven by its burgeoning manufacturing and agricultural sectors, has spurred demand for reliable and efficient maritime services. As the government focuses on reducing trade imbalances and boosting exports, shipping companies are poised to benefit from this growth.

Port Infrastructure Development: India has made significant investments in port infrastructure through the Sagarmala Project, a government initiative aimed at modernizing ports, enhancing connectivity, and improving logistics. This project is expected to reduce logistics costs and improve cargo handling capacity, benefiting shipping companies.

Coastal Shipping: The government’s push for coastal shipping as a means to decongest roads and railways has provided a boost to shipping companies. Coastal shipping is gaining momentum as an environmentally friendly and cost-effective mode of transportation, especially for bulk cargo like coal, cement, and iron ore.

Shipbuilding and Repair: The rise of shipbuilding and ship repair facilities in India, such as those at Cochin Shipyard, L&T Shipbuilding, and Goa Shipyard, is aiding the growth of the maritime industry. Domestic shipbuilding is encouraged by the "Make in India" initiative, and shipping companies can benefit from reduced maintenance costs and shorter lead times.

Offshore and Energy Sector: With India’s growing focus on energy security, shipping companies are playing a crucial role in transporting crude oil, liquefied natural gas (LNG), and offshore support for exploration activities. Companies like SCI and Great Eastern Shipping are key players in this segment, providing specialized services to the oil and gas industry.

Challenges Faced by Shipping Companies

Despite the positive outlook, shipping companies in India face several challenges:

High Operating Costs: The operational costs for Indian shipping companies are often higher compared to global counterparts due to factors such as rising fuel prices, port handling charges, and regulatory compliance costs.

Port Congestion: Despite improvements, congestion at key Indian ports remains a significant challenge, leading to delays in cargo handling and increased costs for shipping companies.

Global Competition: Indian shipping companies face stiff competition from global players, many of whom operate larger, more efficient fleets. This competition puts pressure on Indian companies to modernize their operations and improve efficiency.

Environmental Regulations: The global push for sustainability has led to stricter environmental regulations for the shipping industry. Indian companies must adapt by investing in cleaner technologies, such as energy-efficient ships and alternative fuels, which can be capital-intensive.

The Future of Shipping in India

The future of shipping in India is expected to be shaped by several emerging trends and innovations:

Digitalization: The adoption of digital technologies such as blockchain, IoT, and AI is transforming the shipping industry. Indian shipping companies are beginning to invest in digital platforms for real-time tracking, improved cargo management, and automation of port operations.

Green Shipping: With increasing pressure to reduce carbon emissions, shipping companies will need to adopt greener practices. This could include the use of alternative fuels, such as LNG and hydrogen, and the development of energy-efficient vessels.

Expanding Fleet Size: To remain competitive, Indian shipping companies are expected to invest in fleet expansion, especially in the container shipping and LNG sectors. This expansion will enable them to meet the growing demand for maritime services in India’s expanding economy.

Public-Private Partnerships: The government is encouraging greater collaboration between public and private sectors in port development and shipping operations. This will likely lead to increased investment in infrastructure and innovation in the shipping industry.

Conclusion

India’s shipping industry stands at a critical juncture, with opportunities for growth driven by the country's expanding trade, infrastructure development, and technological advancements. Despite challenges, Indian shipping companies are well-positioned to navigate the future of maritime trade, supported by government initiatives and global demand for sustainable shipping solutions. As India continues to strengthen its presence in global supply chains, its shipping sector will play an increasingly vital role in shaping the country's economic future.

This article explores the current state of shipping companies in India, focusing on the key drivers, challenges, and future trends shaping the industry.

0 notes

Text

Unités de réparation de puits hydrauliques, Prévisions de la Taille du Marché Mondial, Classement et Part de Marché des 13 Premières Entreprises

Selon le nouveau rapport d'étude de marché “Rapport sur le marché mondial de Unités de réparation de puits hydrauliques 2024-2030”, publié par QYResearch, la taille du marché mondial de Unités de réparation de puits hydrauliques devrait atteindre 2228 millions de dollars d'ici 2030, à un TCAC de 4.9% au cours de la période de prévision.

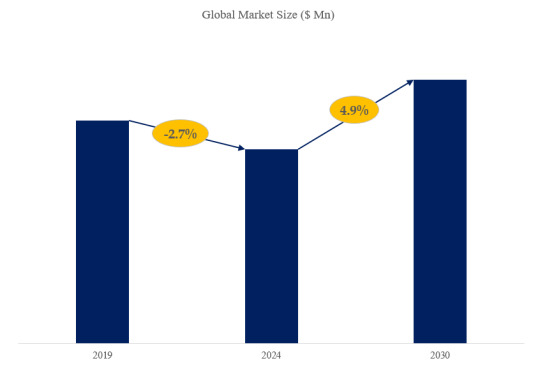

Figure 1. Taille du marché mondial de Unités de réparation de puits hydrauliques (en millions de dollars américains), 2019-2030

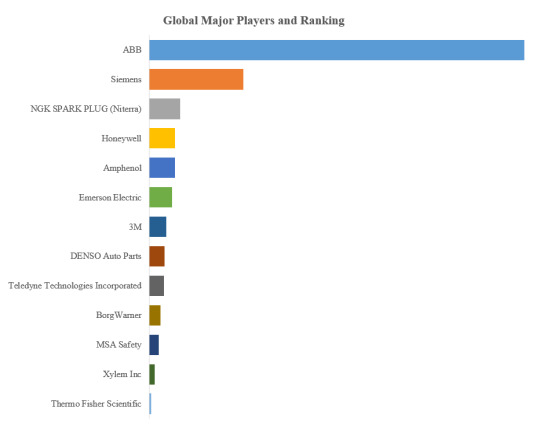

Selon QYResearch, les principaux fabricants mondiaux de Unités de réparation de puits hydrauliques comprennent ABB, Siemens, NGK SPARK PLUG (Niterra), Honeywell, Amphenol, Emerson Electric, 3M, DENSO Auto Parts, Teledyne Technologies Incorporated, BorgWarner, etc. En 2023, les cinq premiers acteurs mondiaux détenaient une part d'environ 62.0% en termes de chiffre d'affaires.

Figure 2. Classement et part de marché des 13 premiers acteurs mondiaux de Unités de réparation de puits hydrauliques (Le classement est basé sur le chiffre d'affaires de 2023, continuellement mis à jour)

The Hydraulic Workover Units (HWUs) market experiences growth due to several influential factors, reflecting the evolving needs of the oil and gas industry. Key drivers include:

: As global energy demand rises, exploration and production activities in both conventional and unconventional oil and gas fields are expanding. HWUs play a crucial role in these operations by facilitating workovers, completions, and interventions, which are necessary to maintain or enhance well productivity.

: Compared to conventional rig-based workover operations, HWUs offer a more efficient and cost-effective solution. They can perform tasks such as tubing/packer changeouts, stimulation, and repairs with minimal downtime, reducing overall operational expenses.

: The growth in shale gas and tight oil production has significantly increased the demand for hydraulic workover units. These resources require frequent stimulation and maintenance, making HWUs indispensable for their extraction processes.

: Offshore oil and gas fields pose unique challenges due to their remote locations and harsh environments. HWUs, with their compact size and mobility, are well-suited for offshore applications where space is limited and quick response times are critical.

: Technological advancements in HWUs, such as improved hydraulic systems, remote operation capabilities, and enhanced safety features, have increased their efficiency and operational flexibility, further driving market demand.

: With the focus on maximizing the output from existing wells, workover operations are becoming more frequent. HWUs enable operators to conduct interventions that extend well life and enhance recovery rates, making them a strategic investment.

: Stricter environmental regulations are pushing the industry towards less intrusive and more environmentally friendly methods of operation. HWUs, with their targeted and controlled intervention capabilities, align with these requirements.

: Many mature oilfields require retrofitting and upgrading to maintain production levels. HWUs are ideal for conducting such operations, including slot recovery, sand cleanouts, and installation of artificial lift systems.

: HWUs offer a wide range of applications beyond workovers, including well testing, coiled tubing operations, and snubbing services, making them a versatile asset for oilfield service companies.

: While the world transitions towards renewable energy sources, oil and gas companies are focusing on optimizing their existing assets to ensure profitability during the transition period. HWUs support these efforts by maintaining and enhancing well productivity.

These market drivers indicate a robust outlook for the Hydraulic Workover Units market, as they continue to be an essential tool in maintaining and enhancing oil and gas production efficiency in the face of complex operational challenges and evolving industry dynamics.

À propos de QYResearch

QYResearch a été fondée en 2007 en Californie aux États-Unis. C'est une société de conseil et d'étude de marché de premier plan à l'échelle mondiale. Avec plus de 17 ans d'expérience et une équipe de recherche professionnelle dans différentes villes du monde, QYResearch se concentre sur le conseil en gestion, les services de base de données et de séminaires, le conseil en IPO, la recherche de la chaîne industrielle et la recherche personnalisée. Nous société a pour objectif d’aider nos clients à réussir en leur fournissant un modèle de revenus non linéaire. Nous sommes mondialement reconnus pour notre vaste portefeuille de services, notre bonne citoyenneté d'entreprise et notre fort engagement envers la durabilité. Jusqu'à présent, nous avons coopéré avec plus de 60 000 clients sur les cinq continents. Coopérons et bâtissons ensemble un avenir prometteur et meilleur.

QYResearch est une société de conseil de grande envergure de renommée mondiale. Elle couvre divers segments de marché de la chaîne industrielle de haute technologie, notamment la chaîne industrielle des semi-conducteurs (équipements et pièces de semi-conducteurs, matériaux semi-conducteurs, circuits intégrés, fonderie, emballage et test, dispositifs discrets, capteurs, dispositifs optoélectroniques), la chaîne industrielle photovoltaïque (équipements, cellules, modules, supports de matériaux auxiliaires, onduleurs, terminaux de centrales électriques), la chaîne industrielle des véhicules électriques à énergie nouvelle (batteries et matériaux, pièces automobiles, batteries, moteurs, commande électronique, semi-conducteurs automobiles, etc.), la chaîne industrielle des communications (équipements de système de communication, équipements terminaux, composants électroniques, frontaux RF, modules optiques, 4G/5G/6G, large bande, IoT, économie numérique, IA), la chaîne industrielle des matériaux avancés (matériaux métalliques, polymères, céramiques, nano matériaux, etc.), la chaîne industrielle de fabrication de machines (machines-outils CNC, machines de construction, machines électriques, automatisation 3C, robots industriels, lasers, contrôle industriel, drones), l'alimentation, les boissons et les produits pharmaceutiques, l'équipement médical, l'agriculture, etc.

0 notes

Text

Utility Poles Market Poised for Steady Growth in the Future

Utility Poles Industry Overview

The global utility poles market size was estimated at USD 57.65 billion in 2023 and is expected to grow at a CAGR of 4.0% from 2024 to 2030. The market growth is driven by multiple factors such as rising electricity consumption, the increasing demand for efficient energy distribution and the subsequent construction of power transmission and distribution networks. The proliferation of smartphones, internet connectivity, and data-intensive applications has additionally contributed to the market growth by increasing the demand for efficient communication networks.

The shift toward smart grid technologies is driving the market owing to their ability to enable real-time monitoring of power usage, early detection of faults or damage, and optimization of maintenance schedules. These technologies enable real-time monitoring of power usage, early detection of faults or damage, and optimization of maintenance schedules, leading to improved reliability and efficiency in energy transmission and distribution, which in turn is expected to present lucrative growth opportunities for the market.

Gather more insights about the market drivers, restrains and growth of the Utility Poles Market

Companies operating in the market have adopted various strategies to enhance their market presence and meet the growing demand for utility poles. Many companies are focusing on developing innovative utility pole designs that offer improved strength, durability, and cost-effectiveness. In addition, companies are exploring new geographical markets to tap into emerging opportunities and increase their market share. This may involve strategic partnerships, acquisitions, or setting up manufacturing facilities in key regions to better serve local demand. For instance, in January 2024, Nippon Steel Corporation acquired a 20% interest in Elk Valley Resources, the steelmaking coal business partnership sold by Teck Resources Limited. The acquisition was aimed at securing stable procurement of high-quality steelmaking coal, which is vital for decarbonizing the manufacturing process of steel. Such strategies by key companies are expected to fuel market growth in the coming years.

Browse through Grand View Research's Communications Infrastructure Industry Research Reports.

The global rugged servers market size was estimated at USD 630.2 million in 2023 and is anticipated to grow at a CAGR of 6.7% from 2024 to 2030.

The global land mobile radio market size was estimated at USD 26.85 billion in 2023 and is expected to grow at a CAGR of 15.7% from 2024 to 2030.

Key Utility Poles Company Insights

Some of the key players operating in the market include Tata Power, Nov Inc, SAE Towers, Nippon Steel Corporation, KEC International Ltd.

Tata Steel's diverse product portfolio caters to multiple market segments. The company offers a wide range of steel products, including hot and cold rolled coils and sheets, galvanized sheets, tubes, wires, and construction rebars for various applications in the automotive, construction, consumer goods, and engineering industries, demonstrating the company's versatility in meeting global steel demands.

NOV Inc. (formerly known as National Oilwell Varco) provides equipment and components used in oil & gas drilling and production operations, oilfield services, and supply chain integration services to the upstream oil & gas industry. The company is committed to innovation and technological advancement. The company invests aggressively in research and development to improve the performance and durability of its products. The company’s commitment to sustainability and innovation is evident in its efforts to improve the environmental footprint of its products.

New Forests Company, Lishu Steel Co. Ltd, and Omega Company are some of the emerging market participants in the utility poles market.

New Forests Company specializes in the manufacturing and supply of transmission poles across East and Southern Africa. The company’s customer base includes national electricity utilities, government agencies, municipalities, and turnkey operators.

Lishu Steel Co.Ltd’s product portfolio showcases a diverse range of utility poles crafted from various materials, including steel, concrete, and innovative composite materials, thereby ensuring that the company can meet the specific needs of its global clientele, providing solutions that cater to different environmental conditions, load requirements, and aesthetic preferences.

Key Utility Poles Companies:

The following are the leading companies in the utility poles market. These companies collectively hold the largest market share and dictate industry trends.

Al-Babtain Power & Telecom

American Timber and Steel

Bell Lumber & Pole

Energya Steel-KSA

Europoles Middle East LLC

Frank R. Close & Son, Inc.

NATIONAL COMPANY FOR GALVANIZING AND STEEL POLES (GALVANCO)

George Scott (Geo Stott)

HAS Engineering LLC

Hidada

Metrosmart International Trading & Contracting W.L.L.

New Forests Company

NOV Inc.

Omega Company for Luminaries, Poles & Galvanizing

ORBIX INTERNATIONAL LLC

R&B Timber Group

Stella-Jones

Techno Pole Industries LLC

Valmont Industries, Inc.

SAE Towers

Skipper Limited

Nanjing Daji Tower Manufacturing Co., Ltd.

KEC International Inc.

Lishu Steel Co., Ltd

Nippon Steel Corporation

Qingdao Mingzhu Steel Structure Co., Ltd.

Jiangsu Guohua Tube Tower Manufacturer Co. Ltd.

Tata Steel

Kalpataru Projects International Ltd.

Jyoti Structures Limited

Sabre Industries, Inc.

Foresite Group LLC

Nanjing Tuopeng Construction Technology Co., Ltd

Recent Developments

In February 2024, Bell Lumber & Pole acquired a pole peeling facility and wood concentration yard located in Newport in the U.S. state of Maine from Prentiss & Carlisle, a forest resource management and timberland services company. The company’s customers in the Northeast region would enjoy even more direct access to local pole fiber as a result of the deal.

In February 2024, Skipper Limited received a contract worth USD 88.55 million (INR 7.37 billion) for the design, supply, and construction of a 765 kV Transmission Line Project for Power Grid Corporation of India Limited.

In January 2023, Nippon Steel Corporation collaborated with Mitsubishi Corporation and ExxonMobil Asia Pacific Pte. Ltd. to jointly study Carbon Capture and Storage (CCS) and establish potential CCS value chains in Asia Pacific.

Order a free sample PDF of the Utility Poles Market Intelligence Study, published by Grand View Research.

0 notes

Text

Global Geophysical Services Market Growth Analysis 2024 – Forecast Market Size And Key Factors Driving Growth

Overview and Scope The geophysical services specialize in locating and measuring the number of resources such as minerals, oil, and gas, assessing earthquake hazards, investigating the subsurface for engineering structures, investigating archaeological sites, and imaging the subsurface for environmental hazards. Sizing and Forecast The geophysical services market size has grown steadily in recent years. It will grow from $14.55 billion in 2023 to $15.01 billion in 2024 at a compound annual growth rate (CAGR) of 3.1%. The growth in the historic period can be attributed to oil and gas exploration, mining sector growth, infrastructure development, environmental studies and remediation, seismic exploration advancements, geothermal energy development. The geophysical services market size is expected to see steady growth in the next few years. It will grow to $16.97 billion in 2028 at a compound annual growth rate (CAGR) of 3.1%. The growth in the forecast period can be attributed to growing renewable energy expansion, mining exploration demand, environmental impact studies, hydrocarbon exploration, geothermal and alternative energy sources. Major trends in the forecast period include climate change studies, urban infrastructure mapping, multi-disciplinary approach, remote sensing and satellite technology, big data analytics integration. Order your report now for swift delivery, visit the link: https://www.thebusinessresearchcompany.com/report/geophysical-services-global-market-report Segmentation & Regional Insights The geophysical services market covered in this report is segmented – 1) By Survey Type: Land, Marine, Aerial 2) By Technology: Seismic, Magnetic, Gravity, Electromagnetic, Lidar, Ground Penetrating, Other Technologies 3) By Application: Road, Rail, Port, Airport, Pipeline, Other Applications 4) By End User: Agriculture, Environment, Minerals And Mining, Oil And Gas, Water Exploration, Other End Users North America was the largest region in the geophysical services market in 2023. Western Europe was the second largest region in the global geophysical services market share. The regions covered in the geophysical services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. Intrigued to explore the contents? Secure your hands-on a free sample copy of the report: https://www.thebusinessresearchcompany.com/sample.aspx?id=3693&type=smp Major Driver Impacting Market Growth Growing exploration activities are contributing to the growth of the geophysical services market. Mineral exploration aims to discover deposits of minerals and rocks that can be used to meet the resource needs of society, which could be fulfilled by geophysical services. Key Industry Players Major companies operating in the geophysical services market report are BGP Inc., Schlumberger Limited, Halliburton Company, Geotech Surveys International Limited, Sea Geo Surveys Pvt. Ltd., COSL China Oilfield Services Limited. The geophysical services market report table of contents includes: 1. Executive Summary 2. Market Characteristics 3. Market Trends And Strategies 4. Impact Of COVID-19 5. Market Size And Growth 6. Segmentation 7. Regional And Country Analysis . . . 27. Competitive Landscape And Company Profiles 28. Key Mergers And Acquisitions 29. Future Outlook and Potential Analysis Contact Us: The Business Research Company Europe: +44 207 1930 708 Asia: +91 88972 63534 Americas: +1 315 623 0293 Email: [email protected] Follow Us On: LinkedIn: https://in.linkedin.com/company/the-business-research-company Twitter: https://twitter.com/tbrc_info Facebook: https://www.facebook.com/TheBusinessResearchCompany YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ Blog: https://blog.tbrc.info/ Healthcare Blog: https://healthcareresearchreports.com/ Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

0 notes