#europe construction equipment market

Explore tagged Tumblr posts

Text

Europe Construction Equipment Market Size, Share, Report 2022-2029

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, estimated the Europe construction equipment market size at USD 169.81 billion in 2022. During the forecast period between 2023 and 2029, the Europe construction equipment market size is projected to grow at an impressive CAGR of 6.16% reaching a value of USD 256.51 billion by 2029. Current trends in the European construction industry are influenced by both the growth of automation in construction and the shifting technology landscape. The majority of European countries are gradually incorporating technologically modern and automated technology and equipment into the construction industry to speed up the processes, increase reliability, and boost efficiency. Massive infrastructure redevelopment projects in Ukraine, ravaged by Russia’s war in the country, and Türkiye, hit by recent massive earthquakes, are expected to provide significant growth opportunities for the companies in Europe construction equipment market during the period in analysis.

Europe Construction Equipment Market - Overview

The specialized machinery needed to complete building jobs is known as construction equipment. Many jobs, including as drilling, hauling, excavation, paving, and grading, need the use of these instruments. Many industries, including manufacturing, oil and gas, and construction and infrastructure, are represented in the European market. The major goal of designing new machinery is to make adjustments that will increase the machines' capacity for speed, efficiency, and precision. These changes aim to protect the environment while also improving operator comfort and safety through sound emission control and attenuation.

Sample Request @ https://www.blueweaveconsulting.com/report/europe-construction-equipment-market/report-sample

Opportunity: Country-wide redevelopment & recovery projects in Türkiye and Ukraine

Major companies in Europe construction equipment market are expected to gain from significant opportunities provided by the massive infrastructure projects in earthquake-hit Türkiye and war-ravaged Ukraine. In Türkiye, analysts estimated that the urban redevelopment across the country post the earthquake would provide huge opportunities for the construction and related industries in total investment of more than USD 250 billion. On February 06, 2023, a 7.8-magnitude of earthquake hit Türkiye and Syria, killing tens of thousands of people and severely damaging infrastructure in cities and villages across its fault line. The President of Türkiye announced that the government would engage in a comprehensive construction program to rebuild cities with safety and sustainability.

In Ukraine, Russia’s war in the country has been continuing for more than a year now. Consequently, infrastructure across Ukraine has been severely damaged. In September 2022, Ukraine government, the European Commission, and the World Bank, along with their partners, estimated the cost of Ukraine’s reconstruction and recovery would be about USD 350 billion. As the war continues, the cost is anticipated to escalate.

Massive redevelopment and recovery projects in Türkiye and Ukraine are expected to provide lucrative growth opportunities for construction and supplementary industries. It, in turn, is projected to aid the growth of Europe construction equipment market during the forecast period between 2023 and 2029 and beyond.

Europe Construction Equipment Market – By Power Output

Europe construction equipment market is divided into four segments based on power output: 100 HP, 101–200 HP, 201–400 HP, and >400 HP. Among these, the 201–400 HP segment is expected to grow rapidly. Because of the high demand from infrastructure redevelopment and recovery project, the market for 201–400 HP construction equipment is growing at the highest CAGR during the forecast period.

Impact of COVID-19 on Europe Construction Equipment Market

The COVID-19 pandemic adversely affected on the profitability of the construction equipment market during the first half of 2020, owing to a lack of capital and personnel, disruptions in the supply chain, and a halt in large construction projects. However, new, massive infrastructure projects in transportation, smart buildings, and renewable energy are a top priority for European government officials.

Competitive Landscape

Europe construction equipment market is fiercely competitive. Prominent players in the market include Caterpillar, CNH Industrial N.V., Doosan Corporation, Escorts Limited, Hitachi Construction Machinery Co., Ltd., Hyundai Construction Equipment Co., Ltd., J C Bamford Excavators Ltd, and Deere & Company. These companies use various strategies, including increasing investments in their R&D activities, mergers, and acquisitions, joint ventures, collaborations, licensing agreements, and new product and service releases to further strengthen their position in the Europe construction equipment market.

Contact Us:

BlueWeave Consulting & Research Pvt. Ltd

+1 866 658 6826 | +1 425 320 4776 | +44 1865 60 0662

0 notes

Link

#market research future#heavy construction equipment#heavy equipment market size#construction equipment europe#european construction

0 notes

Text

GE PowerHaul

After I offered, @valtionrautatiet-official asked me to post some pictures of the locomotive that is nowadays known as the Dr20, used by the private freight operator North Rail in Finland. Here it is in 2012, long before anyone ever even considered sending it to Finland, in Berlin. The reason that it's in Berlin specifically is that it's at Innotrans, the biggest trade fair and exhibition for railroads that exists. At this point it had the paint job of HHPI (Heavy Haul Power International, despite the important sounding name really just one of many European freight rail companies with headquarters in Germany), with their trademark blue and red and their company policy of putting Newton's second law on it. "Project Power" also sounds cool, doesn't it? Well, it turns out they never entered service for HHPI. Way too much history under the cut.

The story behind these eight locomotives is weird and opaque, and there is a lot of stuff we may never know, but on a very fundamental level it seems to be one of the victims of what I call the six-axle diesel curse. This basic of that theory of mine is that it's impossible to sell big, heavy, powerful diesel locomotives, the kind that are so powerful that they need six axles for all the weight from their big engine and diesel tank, in (West) Germany and to a certain extent central and Western Europe, at least nowadays, unless you do it by accident.

The German locomotive industry has wanted to build big six-axle diesel locomotives since the end of steam traction. There was a prototype six-axle version of the V 200, named V 300, in the 1950s, but DB didn't want it (a related but less powerful version was sold to Yugoslavia to haul Tito's private train). For the Americans here, the Krauss-Maffei locomotives of the Southern Pacific and Rio Grande were related to that.

A few years later, in 1962, we get the V 320, a six-axle version of the V 160 locomotive family. The four-axle version was very popular and is still in service, but they only built the prototype of the six-axle version. Interestingly, that one prototype is still around as well, hauling construction trains. Deutsche Bahn was never interested, they preferred the flexibility of having more smaller units. And anyway, they were busy electrifying the busy main lines that would have made the most use of those heavy machines.

In the 1970s Henschel and BBC (the electric equipment one, not the British TV one) built three copies of the DE 2500 both with four and six axles, but those were really more experimental machines.

In the late 1980s and early 1990s, MaK tried to sell their DE 1024, and I actually have a picture of that ne.

They built three prototypes, and Deutsche Bahn seemed to genuinely toy with the idea… but in the end it was decided to electrify the lines in the (mostly flat) north that hadn't been electrified yet anyway.

And at the same time, the wall fell, and suddenly Germany had access to all the locomotives of the east, now mostly surplus since mostly the industry they served did not survive the transition to western markets. East Germany had bought powerful six-axle diesel locomotives in enormous numbers from the Soviet Union, specifically modern-day Ukraine, and those were available, good enough and already paid for. In particular the class 232 and related, known as "Ludmilla" among rail fans, have proven very useful.

MaK was able to sell an altered version of that locomotive to Norway, but that turned out to be be a huge disaster as they developed a habit of catching on fire. Eventually Siemens (who briefly owned MaK) had to take them back, and since then they've changed hands an astonishing number of times - apparently right now Hector Rail and RDC Autozug have a lot of them. Here's one in Hamburg Altona when it was used on regional trains there.

The three prototypes went to locally owned operator HGK, where two of them also burned down. DB probably dodged a bullet there. Interestingly enough, the only one that didn't burn down was number 13, but that was finally scrapped a few years ago.

In the mid-1990s, ADtranz (later Bombardier) and GE got together to build the Blue Tiger locomotive, a very distinctive-looking and noisy machine. They sold 11 to various private operators in Germany, 30 to Pakistan and 20 to Malaysia. Not terrible, but not a huge success either.

But in the 2000s, things were changing. Liberalisation meant that more and more companies were running services all throughout Europe. The busy main lines were electrified, but many of the border crossings weren't yet, so there was a new need for big six-axle diesel locomotives.

The big beneficiary of this was EMD from North America, who were already supplying such locomotives to Great Britain. The rail companies there needed these machines to replace unreliable British-built power, and to replace environmentally friendly electric locomotives, because most of the British network is not electrified and the few sections that are have way too much traffic on them.

The Class 66 is an ugly mess, designed by figuratively building a metal shed in the inside of a tiny British rail tunnel. It's so noisy that drivers in Norway get hazard pay for being in them. But it works and it was mass produced, and a lot of them made their way to the continent in short order.

Other companies wanted in on that business. Voith decided to enter locomotive building after previously supplying traction equipment. They had high hopes for their Maxima series of locomotives, which they started building in 2008, and they had their own leasing company. They did a lot of marketing and the machine won prestigious design awards.

At one point they had a hundred pre-orders. In the end their own leasing company folded, and they only built twenty, which they didn't even manage to sell that quickly. Nowadays they've stopped producing locomotives again.

General Electric, the other North American locomotive company, wanted in on that action as well. Sure, it hadn't worked with the Blue Tiger, but years had passed and things were different now. For their new product, the PowerHaul, they decided to follow what EMD had done. They started with the class 77 for the British market, first shown at Innotrans in 2010.

Then they wanted to work their way out to wider Europe, with a special continental version that was designed with a bigger shell to match the larger tunnels on the continent. That way they weren't quite as cramped. EMD had considered a similar idea, a European-sized class 66, but decided against that.

GE also did not intend to make them themselves. Instead after the initial batch of British 77s, they transferred production to their Turkish partner Tülomsaş, who supplied some more British ones and the ones for central Europe. 29008 is one of them.

In the end all of these plans fell through. A lot of the international border crossings did get electrified much quicker than the diesel sellers had hoped. The one near where I live, the Montzenroute, started electric running in December of 2008, and it was actually the makers of electric locomotives who made bank off of the new international railway world. Here is a Bombardier TRAXX electric locomotive during the first week that freight trains from Germany to Belgium were running with electric power, just a few hundred meters from the border.

But the business changing is one thing, the story of the PowerHauls seems to be even more complicated. After all, GE did have a launch customer for their PowerHaul, in the form of HHPI. The locomotives were built, painted in HHPI colors, and tested. And then… well, nothing. They never entered service, instead sitting for years in Cottbus, Germany. I have no idea whether they ever got approved for service in Germany. Finnish Wikipedia says "HHPI had no use for them", but that sounds like a euphemism. Clearly HHPI had some use for powerful locomotives, they've recently taken delivery of some Stadler EuroDuals.

The EuroDual and the closely related Euro9000, pictured below, seem to be the solution to the six axle diesel curse though the conceptually simple but technologically difficult trick of simultaneously being a very powerful electric locomotive as well. They have already delivered more of them than Voith Maxima, GE Blue Tiger and GE PowerHaul combined. Sorry for the pictures, they don't park the locomotives well for good photos at Innotrans.

Also, GE was not able to find any customer in Germany, nor in Sweden, where some units of that type were tested at some point. Locomotives of that type were built for Turkey, though, and I haven't heard anything negative about them there. Those were also at Innotrans, in 2014.

And then, years after everyone had forgotten about these machines, they suddenly turned up in Finland, in the hands of North Rail (formerly Operail), one of the few private companies there. That required at least new couplings, new axles (Finland has a different rail gauge, the measurement of how far the rails are apart), probably adjustments to the breaks, new train control systems and so on.

It's possible that North Rail was thoroughly convinced by the advantages of GE's concept or something, but I think it's far more likely that they just got a really good deal because GE was happy someone took them off their hands.

The reason they're in Finland is almost certainly that Operail needed some cheap machines that weren't doing anything, and these units were just that. But why were they not doing anything? Why were these machines doomed to sit in Cottbus for years, essentially still in new condition, painted for an operator that didn't want them? I'm sure you'll find plenty of theories if you look on online forums, and it's even possible that one of them is the truth, but unless some rail journalist decides to really dig into that, we'll probably never know for certain.

If you allow me to speculate: It certainly doesn't sound like a success story, and there have been all sorts of other stories where trains didn't get approval to run in the country they were ordered for, or had severe technical defects. Ask an Austrian rail fan about the Talent 3, a danish about the IC 4 or a dutch or Belgian about the Fyra to get some really fun rants. I don't know if these locomotives belong in that hall of shame, but it would certainly be an explanation.

My guess is that there won't be any more of these machines ever. GE Transportation doesn't even exist anymore, the whole part of the business got sold to Wabtec a few years ago. But if these machines are doing well in Finland now, good for them! Finally someone found something to do with these weird-looking units.

16 notes

·

View notes

Text

All About Flange-Udhhyog

Q1: What are the different types of flanges, and how do I choose the right one for my application?

A1: There are several types of flanges, including:

Weld Neck Flanges: Designed for high-pressure applications and welded to the pipe, providing a strong connection.

Slip-On Flanges: Slide over the pipe and are welded both inside and outside, ideal for low-pressure applications.

Blind Flanges: Used to close the end of a piping system, preventing the flow of fluids.

Socket Weld Flanges: For small-diameter pipes, where the pipe is inserted into the flange and welded.

Lap Joint Flanges: Used with a stub end, allowing for easier disassembly.

To choose the right flange, consider the application pressure, temperature, pipe size, and the type of connection required.

Q2: How do flange standards vary by country, and what should I know about them?

A2: Flange standards can vary significantly between countries. For instance:

ANSI (American National Standards Institute): Commonly used in the USA, focusing on pressure ratings and dimensions.

DIN (Deutsches Institut für Normung): Widely used in Europe, specifying metric dimensions and pressure ratings.

JIS (Japanese Industrial Standards): Used in Japan, similar to ANSI but with different specifications.

When selecting flanges, be aware of the applicable standards in your region to ensure compatibility with existing piping systems.

Q3: What materials are commonly used for flanges, and what are their advantages?

A3: Common materials for flanges include:

Mild Steel (MS): Cost-effective and suitable for low-pressure applications.

Stainless Steel: Corrosion-resistant and ideal for high-pressure and high-temperature applications.

Carbon Steel: Offers strength and durability for industrial applications.

Alloy Steel: Used for specialized applications requiring high strength and resistance to wear and corrosion.

The choice of material should be based on the operating environment, pressure, temperature, and the medium being transported.

Q4: How can I prevent leakage in flange connections?

A4: To prevent leakage in flange connections:

Use Quality Gaskets: Select the right gasket material based on the application and ensure proper installation.

Ensure Proper Alignment: Misalignment can lead to leaks; ensure that flanges are correctly aligned before tightening.

Tighten Bolts Uniformly: Follow the manufacturer's specifications for bolt torque to ensure even pressure distribution.

Regular Maintenance: Inspect flanges periodically for wear or damage and replace gaskets as necessary.

Q5: What are the most common applications for MS flanges in various industries?

A5: MS flanges are commonly used in:

Oil and Gas: Connecting pipelines and equipment.

Water Supply: Used in municipal and industrial water systems.

Construction: In various structural applications for strength and support.

Manufacturing: In machinery and equipment to facilitate fluid flow and pressure control.

Q6: How does the price of flanges fluctuate in the current market?

A6: The price of flanges can fluctuate based on several factors:

Material Costs: Increases in raw material prices can lead to higher flange costs.

Supply Chain Issues: Disruptions in manufacturing or transportation can affect availability and pricing.

Market Demand: Increased demand in specific industries can drive prices up.

Regularly monitoring market trends and supplier prices can help you anticipate changes.

Q7: What are the benefits of using stainless steel flanges over mild steel flanges?

A7: Benefits of using stainless steel flanges include:

Corrosion Resistance: Stainless steel can withstand harsh environments, making it suitable for chemical and coastal applications.

Strength and Durability: Offers better strength-to-weight ratios and longevity compared to mild steel.

Aesthetic Appeal: Stainless steel has a polished finish that is visually appealing in exposed applications.

However, stainless steel flanges are typically more expensive than mild steel flanges.

Q8: How do I determine the right flange size for my piping system?

A8: To determine the right flange size:

Measure the Pipe Diameter: Determine the outer diameter of the pipe.

Check Pressure Ratings: Ensure that the flange matches the pressure rating of the piping system.

Refer to Standards: Use ANSI, DIN, or other relevant standards to find the corresponding flange dimensions for your pipe size and pressure requirements.

Q9: What is the significance of flange pressure ratings?

A9: Flange pressure ratings indicate the maximum pressure a flange can withstand at a specified temperature. They are essential for:

Safety: Ensuring that the flange can handle the operational pressures without failing.

Compatibility: Matching flanges with piping and equipment rated for similar pressures prevents leaks and accidents.

Understanding pressure ratings helps in selecting appropriate flanges for your application.

Q10: Are there any recent advancements in flange manufacturing technology?

A10: Recent advancements in flange manufacturing technology include:

3D Printing: Allowing for rapid prototyping and customized designs.

Improved Materials: Development of new alloys that enhance corrosion resistance and strength.

Automation: Use of automated machinery for precision and efficiency in flange production.

Quality Control Technologies: Enhanced inspection techniques using non-destructive testing methods to ensure product integrity.

These advancements contribute to better quality, reduced production times, and cost savings in flange manufacturing.

#Flanges#MSFlanges#FlangeManufacturing#PipingSolutions#IndustrialEquipment#PipingIndustry#FlangeDesign#FlangeStandards#FlangeApplications#MechanicalEngineering#MildSteel#StainlessSteel#CarbonSteel#AlloySteel#OilAndGas#Construction#WaterSupply#Manufacturing#Engineering#ManufacturingInnovation#IndustrialSupply#QualityControl#SafetyFirst#TechAdvancements

5 notes

·

View notes

Text

Valves Market is Estimated to Witness High Growth

Valves Market is Estimated to Witness High Growth Owing to Rising Constructional and Infrastructure Development Activities The valves market comprises products such as gate valves, globe valves, check valves, butterfly valves, ball valves and pressure regulating valves which are used to control the flow, pressure and direction of fluids. Valves are extensively used in power plants, refineries, oil & gas, water & wastewater and construction activities. These products play a key role in fluid transportation and management which makes them an integral component across various industrial sectors. Rising infrastructure development projects across both developed and developing nations are augmenting the demand for valves. Moreover, growing pipeline networks for oil & gas transportation is also favoring market growth. The Global valves market is estimated to be valued at US$ 83 Mn in 2024 and is expected to exhibit a CAGR of 3.5% over the forecast period 2024 To 2031. Key Takeaways Key players operating in the valves market are Tyson Foods, Inc., JBS S.A., Pilgrim's Pride Corporation, Wens Foodstuff Group Co. Ltd., BRF S.A., Perdue Farms, Sanderson Farms, Baiada Poultry, Bates Turkey Farm, and Amrit Group. The major players are focusing on capacity expansion plans and mergers & acquisitions to gain market share. Rising population and changing diets are expected to fuel the growth of the poultry sector which presents significant opportunities for valve manufacturers. With the growing poultry industry, demand for processing equipment including valves is also projected to rise substantially over the forecast period. The global valves market is estimated to witness growth across key regions such as North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. This can be attributed to surging investments in oil & gas, water & wastewater infrastructure, and industrial development projects worldwide. Emerging economies with high urbanization rates like China and India also offer lucrative prospects for market expansion. Market Drivers The key driver behind the Valves Market Demand is the increasing constructional and infrastructure development activities worldwide. There is huge government focus as well as private investments toward projects such as roadways, railways, metro stations, power generation, water supply, etc. which involves extensive use of valves in various process applications. Further, the rising need for energy and growing focus on rural electrification has boosted investments in power transmission and distribution sector augmenting valves demand.

PEST Analysis

Political: The valves market is regulated by laws pertaining to safety, environmental protection and quality standards. New regulations regarding emissions could impact demand patterns. Economic: Changes in the global and regional economic conditions directly impact spending on industries like oil & gas, energy & power, and water & wastewater management which influences Valves demand. Social: Growing population and urbanization is increasing requirements for water, energy and other infrastructure development which boost the usage of valves. Technological: Advancements in materials and designs of valves are improving efficiency, lowering costs and enabling usage in newer applications. Digitalization is also aiding remote monitoring of industrial valves. The regions concentrating maximum valves market share in terms of Valves Market Size and Trends include North America, Europe and Asia Pacific. North America accounts for a major portion owing to strong presence of end-use industries like oil & gas and significant infrastructure spending. Europe and Asia Pacific are also sizable markets led by Germany, China, India respectively. The fastest growing regional market for valves is expected to be Asia Pacific led by increasing investments in water & wastewater management, power projects and industrial activities in China and India. Rising standards of living and initiatives to improve urban infrastructure will further drive the demand across developing nations in the region.

Get more insights Valves Market

Discover the Report for More Insights, Tailored to Your Language.

French German Italian Russian Japanese Chinese Korean Portuguese

About Author:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191)

#Coherent Market Insights#Valves Market#Control Valves#Globe Valves#Plug Valves#Gate Valves#Ball Valves#Butterfly Valves

2 notes

·

View notes

Text

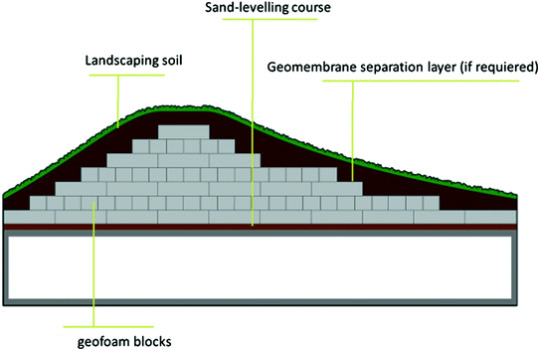

Unraveling the Growth Potential of the Geofoams Market: Global Outlook

The global geofoams market size is expected to reach USD 972.6 million by 2027, expanding at a CAGR of 2.7%, according to a new report by Grand View Research, Inc. Factors such as availability of geofoams at low cost coupled with its superior strength and durability are projected to fuel the market growth. Expansion of the construction industry across the globe coupled with the infrastructural developments in economies such as India, China, Brazil, Mexico, Saudi Arabia, and others is expected to propel the demand for geofoams over the forecast period. In addition, maintenance of the existing infrastructure in developed nations is likely to drive the growth of the market.

Geofoams Market Report Highlights

The expanded polystyrene geofoams segment accounted for USD 508.2 million in 2019 and is projected to expand at a CAGR of 3.1% from 2020 to 2027. The compatibility of the product has resulted in its increasing adoption for applications including roads and highway construction, building and infrastructure, and others

The road and highway construction application segment accounted for 38.07% of the total market and is projected to expand at a CAGR of 3.4% from 2020 to 2027 on account of the rising infrastructural growth across the developing economies including China, India, Brazil, UAE, Saudi Arabia, and others

Asia-Pacific accounted for USD 278.5 million in 2019 and is estimated to expand at a CAGR of 3.2% from 2020 to 2027 owing to the rising demand for road pavement, which is anticipated to further benefit the growth

China accounted for the highest market share in Asia Pacific on account of the rapidly expanding construction industry in the country

Europe market is estimated to expand at a CAGR of 2.8% owing to the rising number of construction and infrastructural activities in economies including Spain, Italy, and others

For More Details or Sample Copy please visit link @: Geofoams Market Report

Geofoams are increasingly used in the construction industry as it helps in suppressing the noise and vibrations. In addition, it is easy to handle and does not require any special equipment for installation. The product is increasingly used in the railway track systems, below the refrigerated storage buildings, storage tanks, and others to avoid ground freezing.

The geofoams undergo chemical changes when it comes in contact with petroleum solvents. It turns into a glue-type substance, thereby losing its strength. This factor is projected to limit the use of geofoams in the construction industry which is projected to restrict the industry growth over the forecast period.

#Geofoam#Expanded polystyrene (EPS)#Geofoam blocks#Construction materials#Road and highway construction#Retaining walls#Geotechnical engineering#Soil stabilization#Environmental protection#Earthquake resistance#Noise and vibration control#Water management#Hydrostatic pressure#Thermal insulation#Structural stability

12 notes

·

View notes

Text

A brief account of Pennsic 50

TLDR: Fantastic event, pity about the climate zone it's in.

Let me get that negative bit out of the way: I don't handle heat well, and Pennsic has absolutely punishing heat and humidity. I was basically unable to do anything useful between 13:00 and 17:30 on any given day (and right through the evening in the lower-lying lake-adjacent parts of the site). I tried to tough it out, but that didn't work, and I ended up sitting in the air-conditioned internet café for many of those hours through much of War Week. I didn't as much as see the battlefield, let alone the opening ceremonies, field battle, etc, because I would have just passed out on the field. As it was, I pretty much passed out on the day we were packing down because I was lifting and moving stuff in the heat, and couldn't go sit in the aircon. It was quite frustrating, and there was absolutely nothing that could be done about it.

So what I did do was go to classes in the mornings, do shopping at hours when I was able, and either hang out at our own camp, or go to various parties in the evenings.

The array of classes was downright incredible. There was no topic, as far as I could see, that was not touched upon at least. I went to about eight or ten in total, plus the sizable Arts & Sciences display. All of the classes I went to were food-related, and one of them, given by Magister Galefridus Peregrinus, jumped one of my longer-term projects forward by, I estimate, about two and a half years (it was about non-baking use of Fertile Crescent grains in Medieval Europe, and is relevant to my pre-Norman Irish Cooking stuff). I have good notes from many of the rest, too, and a raft of things to look up.

The shopping was also unbelievable. 200 stalls or so, and while some of them were more LARP or gamer-oriented, most were relevant. for myself, I got a basket-backpack of a kind I've been looking for for years, a pair of turnshoes, two small cast-iron pans, a new tooled leather belt, about six different kinds of smoked salt, various bits of Pelican bling, many metres of Drachenwald trim, and (appropriately) a very nice seax as a kitchen knife. Probably a lot of other stuff, too - I haven't unpacked yet - but those are the things that come to mind. I also bought a veritable pile of stuff for other people, and have taken note of a host of merchants for online buying later. There were some interesting gaps in the market, too - I would have thought that pre-strapped or bossed shields would be commonly available, and saw essentially none, and that there would be more period-ish cookware and camp equipment for sale (there was some, but not very much).

Speaking of cookware, it was notable how few camps had any period cooking arrangements. I saw some very impressive modern camp kitchen setups (the East Kingdom State Kitchen was essentially equivalent to the best indoor kitchens I've cooked in), but I saw precisely two period-ish kitchens, out of hundreds of camps (although I didn't see them all; that was just not possible). Given there were more than 11,000 people there, it was essentially not a thing that was done.

Some of the camps and buildings were terrifyingly fine, though. The Pleasure Pavilions were a set of absolutely beautiful tents, and Casa Bardicci is an actual miracle of construction. There were a varierty of other buildings, as well as gatehouses, ships, and so forth.

The social side of things is a slower burn. Putting faces to names, and meeting many of Nessa's fighting family was excellent, and there've been a number of conversations started that I think will go on for years (and a plot to try out various porridges on people with Baron Cormacc Mac Gilla Brigde). I also caught up with a number of people I haven't seen in years, and decades in some cases. I was particularly pleased to get to spend time properly with Duchess Qamar al-Nisa and Lady Alina Rose, who are two of my favourite people.

I expect I'll have some more thinking on various aspects of the event in time, and how some of the things there can be transferred to events here. I'd like to particularly note that climate aside, the site is fantastic, in terms of both geography and facilities. It also had fireflies and crickets, which made up for a lot.

17 notes

·

View notes

Photo

New Post has been published on https://www.vividracing.com/blog/mercedes-sprinter-overland-forged-wheels-lifted/

VanUp Custom Mercedes Sprinter Overland Build on VRForged Wheels

The Mercedes Sprinter van was originally designed to allow contractors and service providers to haul equipment to and from different job sites. This van was extremely popular in Europe because of its size and powerful diesel engine. Since they are primarily sold as empty shells inside, the Sprinter soon became the go to platform for travelers, transportation companies, RVs, and motocross racers wanting to custom outfit their own. When COVID was at its peak, the desire to hit the road and work from wherever was the new dream. So the RV craze went, well, crazy! Taking a combination of the Overland and RV market, saw the explosive growth of the Mercedes Sprinter Overland builds. These builds allowed people to travel to all the great places on and off-road that traditional RVs just couldn’t go to. Equipped with beds, bathrooms, and kitchens, the exterior look and function was equally important. With ladders, awnings, bike racks, and big lights from companies like Baja Designs, Rigid, and others, the last component to make the Van official are the wheels.

VR Forged introduced their 1 piece forged monoblock wheels to the Sprinter Van community in late 2021. Combining the style of our car and truck wheels with a 6 spoke design and beefy ring element, the wheels were built specifically for the Sprinter use. Each VR Forged forging is constructed using a 10,000 ton press to make a strong and pure aluminum monoblock. Wheels are machined to extensive tolerances and then go through a series of tests including impact testing, salt spray, and fatigue testing as see on our Manufacturing Page Here. These particular wheels were built in a 17×7.5 +50mm offset weighing only 23.8lbs per wheel. But the important engineering element of these wheels is its load rating of 2500lbs per wheel to handle the weight and offroad abuse.

The guys at VanUp choose to use the VR Forged wheels because of their design, quality, and fitment. Their vans feature unique custom King Shock setups that are perfect for overland use but require a wheel that has the right clearance and load rating. Along with a line of their own products, VanUp builds these vans at 2 locations with 1 here locally in Mesa, Arizona and the other in Davis, CA. If you are looking for a beast of a Mercedes Sprinter Van, the VanUp guys are your go to source!

VanUp Website – https://www.vanupoffroad.com/

Van Up Offroad Instagram – https://www.instagram.com/vanupoffroad/

VR Forged D14 Mercedes Sprinter Wheels – https://www.vividracing.com/vr-forged-d14-wheel-set-mercedes-sprinter-van-overland-17×75-50mm-6×130-p-156488508.html

3 notes

·

View notes

Text

Challenges and Opportunities in the Power Trowel Floater Market

Power Trowel Floater Market

The Power Trowel Floater Market is experiencing significant growth, driven by increasing construction activities and technological advancements. The Asia-Pacific region, particularly China and India, is witnessing substantial growth owing to booming construction activities, increased infrastructure investments, and government initiatives for smart city projects. Europe follows closely, driven by renovation projects and sustainable construction practices, while Latin America and the Middle East & Africa exhibit promising opportunities with ongoing industrial and infrastructural developments.

Key Market Trends

Technological Advancements: The market is witnessing innovations such as variable-speed trowels, lightweight designs, and fuel-efficient models that improve operational efficiency.

Increased Automation: The demand for ride-on power trowels is rising due to their ability to cover larger areas with enhanced precision and reduced manual effort.

Sustainable Construction Practices: Growing environmental concerns are encouraging manufacturers to develop eco-friendly power trowels with lower emissions and improved fuel efficiency.

Rising Infrastructure Investments: Government and private sector investments in commercial and residential infrastructure are bolstering market growth worldwide.

Enhanced Safety Features: Manufacturers are incorporating ergonomic designs and safety mechanisms to reduce operator fatigue and workplace accidents.

Frequently Asked Questions (FAQs)

What is a power trowel floater? A power trowel floater is a construction tool used for finishing concrete surfaces, ensuring a smooth and polished appearance.

What factors are driving the power trowel floater market? The market is driven by increasing construction activities, infrastructure development, technological advancements, and the need for efficiency in concrete finishing.

Which regions are witnessing the highest market growth? Asia-Pacific and North America are leading in market growth due to rising urbanization and infrastructure investments.

What are the different types of power trowels? There are walk-behind power trowels and ride-on power trowels, catering to different project sizes and efficiency requirements.

What are the latest innovations in power trowel floaters? Recent innovations include fuel-efficient engines, improved maneuverability, variable speed control, and enhanced safety features.

For more market insights, browse related reports:

Continuous Positive Airway Pressure Interface Devices Market

Pharmaceutical Packaging Equipment Market

Medical Device Cleaning Market

Scaffold Technology Market

Carbon Textile Reinforced Concrete Market

Biomass Solid Fuel Market

1 note

·

View note

Text

Top Forging Manufacturers in India You Should Know

India has emerged as a global Forging manufacturers in India hub, with a diverse industrial landscape that includes sectors such as automotive, aerospace, construction, and energy. Among the key components of manufacturing, forging stands out as a critical process in producing durable, high-performance metal parts. Forging is the process of shaping metal using localized compressive forces, often in the form of hammering, pressing, or rolling. The result is a strong, high-quality metal product with a fine-grain structure, which is essential for industries that demand precision and reliability.

With India’s growing industrial needs, numerous forging manufacturers are playing a crucial role in meeting the demands for high-quality metal components. In this article, we will highlight some of the top forging manufacturers in India that are leading the industry in innovation, quality, and customer satisfaction.

Bharat Forge Limited Overview: Bharat Forge Limited (BFL) is one of India’s largest and most renowned forging manufacturers, headquartered in Pune, Maharashtra. The company was established in 1961 and has since become a global leader in forging, serving multiple sectors including automotive, defense, aerospace, and railways. Bharat Forge is recognized for its advanced manufacturing technologies and is a prominent supplier to major global automotive and industrial companies.

Key Products and Services: Bharat Forge manufactures a wide range of products, including:

Automotive parts like crankshafts, connecting rods, and wheel hubs Aerospace components such as turbine discs and compressor rotors Industrial products including forgings for construction, mining, and oil and gas sectors The company is known for its high-precision, high-quality forged products that meet global standards. Why You Should Know Them: Bharat Forge’s commitment to innovation, research, and development has made it a key player in the forging industry. With state-of-the-art facilities and a robust supply chain network, the company’s reach extends to international markets, including the U.S., Europe, and Japan. They are particularly known for their ability to deliver high-strength components that meet the rigorous demands of the automotive and defense industries.

Kirloskar Forgings Limited Overview: Founded in 1990, Kirloskar Forgings Limited is another well-established player in the Indian forging industry. Based in Pune, Maharashtra, the company is a part of the prestigious Kirloskar Group, which is known for its diverse manufacturing portfolio across various sectors, including engineering, agriculture, and infrastructure.

Key Products and Services: Kirloskar Forgings is a leader in producing forged components primarily for the automotive sector. Their product range includes:

Engine parts like crankshafts and camshafts Transmission components Chassis components Forged parts for construction and industrial machinery Their forging products are manufactured using cutting-edge technology and are known for their reliability and durability. Why You Should Know Them: Kirloskar Forgings is known for its continuous innovation and quality assurance processes. With a focus on improving operational efficiencies, the company’s facilities are equipped with advanced machinery for the manufacturing of high-precision components. Kirloskar Forgings also holds various industry certifications, including ISO and TS certifications, which highlight their commitment to global quality standards.

Sona Group Overview: Sona Group is a significant name in the forging industry in India. Founded in 1995, the group has grown to become a global supplier of high-quality forged and machined components for the automotive and industrial sectors. The company has manufacturing facilities in India and abroad, making it one of the leading exporters of forged products.

Key Products and Services: Sona Group’s product line includes:

Automotive parts such as differential gears, steering knuckles, and drive shafts Industrial forgings for heavy machinery and construction equipment Custom forging solutions for specific customer needs The company focuses heavily on quality, and their products meet stringent international standards in terms of material composition and finish. Why You Should Know Them: Sona Group’s strong reputation is built on its ability to cater to both domestic and international markets with a wide variety of forged products. They have a strong R&D capability and invest in advanced technology to remain competitive in the global market. Sona Group is also recognized for its efficient production processes, which allow them to deliver products at competitive prices while maintaining high quality.

Usha Forgings Overview: Usha Forgings is a leading forging manufacturer in India, specializing in the production of a wide range of forgings for various industries such as automotive, construction, and heavy machinery. Established in 1974, Usha Forgings has earned a solid reputation for quality and precision in forging.

Key Products and Services: The company’s product portfolio includes:

Forged products for automotive applications such as wheel hubs, steering parts, and suspension components Industrial forgings for machinery and structural applications Custom-made forged components tailored to customer requirements Usha Forgings is known for using advanced technologies like computer-aided design (CAD) and computer-aided manufacturing (CAM) to ensure product precision. Why You Should Know Them: Usha Forgings has a strong focus on customer satisfaction and quality control. Their manufacturing facilities are equipped with state-of-the-art forging and machining equipment, allowing them to produce high-strength, durable components. They also have a solid track record in meeting the unique needs of global clients, making them a go-to partner for forging solutions.

Sumeet Industries Limited Overview: Sumeet Industries Limited, founded in 1978, is one of India’s leading manufacturers of forged and machined components for the automotive and industrial sectors. Based in Rajkot, Gujarat, Sumeet Industries has established itself as a major player in the manufacturing of high-quality forged products.

Key Products and Services: Sumeet Industries specializes in producing:

Automotive forgings, including steering and suspension parts, axle shafts, and wheel hubs Precision-machined forged components Forged products for engineering and heavy machinery applications The company provides both standard and custom forging solutions, catering to a broad spectrum of industries. Why You Should Know Them: Sumeet Industries’ focus on quality and customer-oriented solutions has made them a preferred supplier for many global OEMs (Original Equipment Manufacturers). Their extensive experience in the forging industry, coupled with modern manufacturing techniques, ensures that the products meet international standards. Sumeet Industries also places a strong emphasis on continuous improvement and environmental sustainability.

Mahindra Forgings Overview: Mahindra Forgings, a part of the renowned Mahindra Group, is one of India’s top forging manufacturers, particularly known for its forged components for the automotive sector. The company operates numerous facilities across India and has a robust presence in international markets.

Key Products and Services: Mahindra Forgings manufactures a diverse range of products, including:

Automotive forgings like axle shafts, gear blanks, and drive shafts Forged products for agriculture, construction, and defense applications Machined forgings and components for industrial use Mahindra Forgings utilizes advanced techniques such as high-precision forging and heat treatment to produce durable, high-strength products. Why You Should Know Them: Mahindra Forgings stands out for its deep industry expertise, strong global supply chain, and focus on innovation. As a part of the Mahindra Group, they benefit from a solid infrastructure and operational synergies that make them highly competitive in both domestic and international markets.

Conclusion India has a rich and vibrant forging industry with many key players making significant contributions to the global manufacturing landscape. Companies like Bharat Forge, Kirloskar Forgings, Sona Group, Usha Forgings, Sumeet Industries, and Mahindra Forgings are leading the way in producing high-quality forged components for various industries, ranging from automotive to aerospace. These manufacturers leverage cutting-edge technologies, maintain rigorous quality control standards, and invest heavily in research and development to ensure that their products meet the growing demands of the global market.

As industries across the world continue to evolve, these top forging manufacturers in India are well-positioned to drive innovation, sustainability, and excellence in the forging sector. Their ability to deliver high-performance, durable products makes them essential partners for businesses in need of reliable and high-quality metal components. Whether it is for large-scale industrial applications or specialized automotive components, these forging manufacturers in India have set a high benchmark for quality, innovation, and customer satisfaction.

0 notes

Text

Brazed Plate Heat Exchangers Market: Regional Analysis, Competitive Landscape, and Key Players

The global brazed plate heat exchangers market size is expected to reach USD 1.62 billion by 2030, registering a CAGR of 6.3% over the forecast period, according to a new report by Grand View Research, Inc. Rising product demand, particularly on account of cost-effectiveness, lower carbon footprints, and higher energy efficiency is anticipated to drive the industry. According to Centrum Institutional Research, investments in the chemical industry have increased 2.5 times in the last decade, rising to 6,100 crores in FY22. Brazed plate heat exchangers are used in the chemical manufacturing process to cool, heat, and mix chemicals.

The chemical industry’s rapid expansion is projected to be a major driver for market growth. In industrial power generation engines, lubricating oil is required to optimize performance, protect moving parts, and provide optimal operating conditions for internal components. A brazed plate heat exchanger is used for activation units and engines in power generation industrial facilities as it has oil-cooling properties. Rapid industrialization in growing economies and rising investments in commercial, industrial, and residential projects have contributed to a rise in industry growth. Furthermore, increased product demand in the food, oil & gas, and other industries due to lower operational costs will also support market growth.

Brazed plate heat exchangers are utilized in the oil & gas industry for various applications, such as selective gas component extraction, natural gas evaporation, and industrial gas consumption. Brazed plate heat exchangers are now chosen over traditional shell & tube heat exchangers due to their thermal efficiency, compactness, and quicker lead time. Providers of brazed plate heat exchangers are adopting several strategies, including acquisitions, mergers, new product developments, and geographical expansions to enhance their industry presence. For instance, in October 2021, Alfa Laval launched the AC74 to improve energy efficiency and enable the use of refrigerants with a low global warming potential.

Brazed Plate Heat Exchangers Market Report Highlights

The multi-circuit segment is estimated to expand at a steady CAGR over the forecast period owing to advantages, such as a low maintenance cost, smaller footprint, and energy efficiency

The HVAC-R segment accounted for the maximum share in 2022. Due to their lower footprint, brazed plate heat exchangers have become increasingly popular among HVAC equipment manufacturers

The Europe region accounted for the maximum revenue share in 2022. Rising public and private infrastructure investments are expected to drive brazed plate heat exchanger demand in the HVAC & refrigeration industry

Asia Pacific is estimated to advance at the fastest CAGR over the forecast period owing to increased industrial construction and infrastructure activities in emerging nations, such as India, China, Vietnam, and Thailand

In February 2022, Alfa Laval launched AC540 brazed plate heat exchangers, such as ACK540, ACH540, CBP540 and ACP540, which were manufactured in San Bonifacio, Italy

Brazed Plate Heat Exchangers Market Segmentation

Grand View Research has segmented the global brazed plate heat exchangers market on the basis of product, application, and region:

Brazed Plate Heat Exchangers Product Outlook (Revenue, USD Million, 2018 - 2030)

Single-circuit

Multi-circuit

Brazed Plate Heat Exchangers Application Outlook (Revenue, USD Million, 2018 - 2030)

HVAC-R

Chemical & Petrochemical

Food & Beverage

Power Generation

Heavy Industry

Others

Brazed Plate Heat Exchangers Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

US

Canada

Mexico

Europe

France

Germany

Italy

Asia Pacific

China

Japan

India

Central & South America

Brazil

Middle East & Africa

Saudi Arabia

UAE

Key players in the Brazed Plate Heat Exchangers Market

Alfa Laval

Danfoss

Kelvion Holding GmbH

SWEP International AB

Xylem Inc.

API Heat Transfer

AIC

Hisaka Works, Ltd.

Charts Industries, Inc.

Order a free sample PDF of the Brazed Plate Heat Exchangers Market Intelligence Study, published by Grand View Research.

0 notes

Text

Drone Analytics Market Value: Growth, Share, Size, Analysis, and Insights

Drone Analytics Market Size And Forecast by 2032

The study also emphasizes the broader implications of the strategies employed by these companies on the Drone Analytics Market. Their innovations and market contributions not only shape the industry today but also pave the way for its future trajectory. By analyzing these companies, the report equips stakeholders with actionable insights to understand competitive positioning, identify growth opportunities, and devise strategies to thrive in this dynamic and evolving market landscape.

The global drone analytics market size was valued at USD 9.07 billion in 2024 and is projected to reach USD 68.50 billion by 2032, with a CAGR of 28.75% during the forecast period of 2025 to 2032.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-drone-analytics-market

Which are the top companies operating in the Drone Analytics Market?

The Top 10 Companies in Drone Analytics Market include leading firms. These companies are known for their strong market presence, innovative products, and ability to meet customer demands. They continue to drive growth in the industry through their commitment to quality and innovation, making them key players in the Drone Analytics Market.

**Segments:**

- **By Type:** The drone analytics market can be segmented by type into on-premises and cloud-based solutions. On-premises solutions involve deploying the analytics software within the company's infrastructure, providing more control over data but requiring higher maintenance. Cloud-based solutions, on the other hand, offer scalability and accessibility advantages, making them increasingly popular among businesses looking for cost-effective and flexible options.

- **By Application:** In terms of application, the global drone analytics market can be categorized into agriculture, construction, mining, infrastructure, and others. Agriculture is one of the prominent sectors utilizing drone analytics for crop monitoring, irrigation management, and pest detection. Construction and mining industries leverage drones for site surveying, tracking progress, and ensuring safety standards. Infrastructure projects also benefit from drone analytics for inspection, maintenance, and planning purposes.

- **By End-User:** The end-user segmentation of the drone analytics market includes industries such as agriculture, construction, oil & gas, insurance, and others. Agriculture remains a key end-user, employing drones for precision farming and yield optimization. Construction companies utilize drone analytics for project monitoring and resource management. Oil & gas industry benefits from aerial surveys, pipeline inspections, and environmental monitoring using drone technology.

- **By Region:** Geographically, the global drone analytics market is divided into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America leads the market due to early adoption of drone technology, presence of key industry players, and regulatory support for commercial drone operations. Europe follows closely with significant investments in drone analytics for various applications. Asia-Pacific shows high growth potential driven by expanding agriculture and infrastructure sectors.

**Market Players:**

- **DJI:** A leading player in the drone industry, offering a range of commercial drones equipped with advanced analytics capabilities for various sectors. - **PrecisionHawk:** Specializing in drone technology for agriculture, construction, and energy industries, providing end-to-end solutions for data collection and analysis. - **Airware:** Focuses on enterprise drone analytics solutions, catering to industries like mining, insurance, and utilities with customizable software platforms. - **Agribotix:** Known for its agricultural drone analytics software, helping farmers optimize crop production through data-driven insights. - **DroneDeploy:** Offers cloud-based drone mapping and analytics platform for industries such as agriculture, construction, and surveying, simplifying data visualization and decision-making processes.

https://www.databridgemarketresearch.com/reports/global-drone-analytics-market The drone analytics market is experiencing significant growth driven by the increasing adoption of drones across various industries for enhanced data collection and analysis. One key trend that is shaping the market is the shift towards cloud-based solutions, which offer scalability, accessibility, and cost-effectiveness advantages over traditional on-premises solutions. Cloud-based drone analytics platforms are becoming popular among businesses looking for flexibility and ease of use in managing and analyzing drone data. The ability to store and process large amounts of data on the cloud is particularly attractive for industries such as agriculture, construction, and infrastructure, where vast amounts of data need to be analyzed in real-time to make informed decisions.

In terms of application segmentation, the agriculture sector stands out as a prominent user of drone analytics technology for various purposes such as crop monitoring, irrigation management, and pest detection. The construction and mining industries are also leveraging drone analytics for improved site surveying, progress tracking, and safety compliance. Additionally, infrastructure projects benefit from drone analytics for tasks such as inspection, maintenance, and planning, highlighting the diverse applications of drone technology across different sectors.

When considering the end-user segmentation of the drone analytics market, industries such as agriculture, construction, oil & gas, and insurance emerge as key players driving the adoption of drone technology. Agriculture continues to be a significant end-user of drone analytics solutions, utilizing drones for precision farming and yield optimization. Construction companies rely on drone analytics for project monitoring and resource management, while the oil & gas industry uses drones for aerial surveys, pipeline inspections, and environmental monitoring.

Geographically, North America leads the global drone analytics market, supported by early adoption of drone technology, a strong presence of industry players, and favorable regulations for commercial drone operations. Europe closely follows with substantial investments in drone analytics across various applications. The Asia-Pacific region shows high growth potential in the drone analytics market, fueled by expanding agriculture and infrastructure sectors, creating opportunities for market players to tap into the region's growing demand for drone analytics solutions.

In conclusion, the drone analytics market is evolving rapidly, driven by technological advancements, diversified applications across industries, and growing demand for data-driven insights. Market players such as DJI, PrecisionHawk, Airware, Agribotix, and DroneDeploy are at the forefront of providing innovative drone analytics solutions tailored to the specific needs of different sectors, further propelling the growth and adoption of drone technology in the global market.**Segments:**

Global Drone Analytics Market, By Type (On-Premises, On-Demand), Solution (End- To-End Solutions, Point Solutions), Application (Thermal Detection, Geolocation Tagging, Aerial Monitoring, Ground Exploration, Volumetric Calculations, 3D Modeling, Others), End User (Agriculture and Forestry, Construction, Insurance, Mining and Quarrying, Utility, Telecommunication, Oil and Gas, Transportation, Scientific Research, Others), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa) Industry Trends and Forecast to 2032

- The drone analytics market is experiencing rapid growth driven by the increasing adoption of drones across various industries for enhanced data collection and analysis. - A key trend shaping the market is the shift towards cloud-based solutions, offering scalability, accessibility, and cost-effectiveness advantages over traditional on-premises solutions. - Agriculture is a prominent sector utilizing drone analytics for crop monitoring, irrigation management, and pest detection. - Construction and mining industries leverage drones for site surveying, progress tracking, and ensuring safety standards. - Infrastructure projects benefit from drone analytics for inspection, maintenance, and planning purposes. - North America leads the market with early adoption of drone technology, while Europe follows with substantial investments in drone analytics. - The Asia-Pacific region shows high growth potential driven by expanding agriculture and infrastructure sectors.

**Market Players:**

The major players covered in the drone analytics market include Delair, AeroVironment, Inc., DroneDeploy, Esri, PrecisionHawk, Inc., Delta Drone, VIATechnik LLC, Pix4D SA, Kespry Inc., Optelos LLC, HUVRdata, Sentera, Inc., BAE Systems, Boeing, Saab AB, Thales Group, Textron Systems, 3DR, Elbit Systems Ltd., and AgEagle Aerial Systems Inc., among other domestic and global players. Market share data is available for global, North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and South America separately. DBMR analysts provide competitive analysis for each competitor separately.

In addition to the market players mentioned, technological advancements and the growing demand for data-driven insights are propelling the adoption of drone technology in the global market. The diverse applications of drone technology across different sectors, such as agriculture, construction, oil & gas, and insurance, highlight the extensive reach and impact of drone analytics solutions. The ability of cloud-based platforms to store and process large amounts of data is particularly appealing for industries requiring real-time analysis, such as agriculture, construction, and infrastructure.

The segmentation of the drone analytics market by type, application, end-user, and region provides a holistic view of the market landscape, offering insights into the specific needs and preferences of various industries. As the market continues to evolve, market players will need to innovate and tailor their solutions to meet the evolving demands of different sectors, driving further growth and adoption of drone analytics technology worldwide.

The forecasted trends and industry analysis indicate a promising future for the drone analytics market, with opportunities for expansion and development across different regions and industries. With leading players at the forefront of innovation and competition, the market is poised for continued growth and advancement in the coming years, offering new possibilities for businesses seeking to leverage the power of drone technology for data analytics and decision-making processes.

Explore Further Details about This Research Drone Analytics Market Report https://www.databridgemarketresearch.com/reports/global-drone-analytics-market

Key Insights from the Global Drone Analytics Market :

Comprehensive Market Overview: The Drone Analytics Market is witnessing rapid expansion, fueled by increasing demand for advanced solutions and evolving consumer needs.

Industry Trends and Projections: The market is projected to grow at a CAGR of X%, with a notable shift towards digitalization and automation in the coming years.

Emerging Opportunities: There is a rising demand for eco-friendly products and services, creating new business avenues within the market.

Focus on R&D: Companies are prioritizing innovation and research to develop next-generation products and enhance competitive advantages.

Leading Player Profiles: Market leaders continue to drive growth through strategic acquisitions and product innovation.

Market Composition: The market is segmented by product type, region, and application, with a mix of both established and emerging players.

Revenue Growth: The market is experiencing significant revenue growth, attributed to increased consumer spending and the expansion of digital services.

Commercial Opportunities: There are substantial opportunities for expansion in untapped regions, particularly in developing economies where demand is rising.

Find Country based languages on reports:

https://www.databridgemarketresearch.com/jp/reports/global-drone-analytics-markethttps://www.databridgemarketresearch.com/zh/reports/global-drone-analytics-markethttps://www.databridgemarketresearch.com/ar/reports/global-drone-analytics-markethttps://www.databridgemarketresearch.com/pt/reports/global-drone-analytics-markethttps://www.databridgemarketresearch.com/de/reports/global-drone-analytics-markethttps://www.databridgemarketresearch.com/fr/reports/global-drone-analytics-markethttps://www.databridgemarketresearch.com/es/reports/global-drone-analytics-markethttps://www.databridgemarketresearch.com/ko/reports/global-drone-analytics-markethttps://www.databridgemarketresearch.com/ru/reports/global-drone-analytics-market

Data Bridge Market Research:

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 981

Email:- [email protected]"

0 notes

Text

Top Flange Manufacturers in India | Best Quality & Prices

Flanges are essential components in piping systems, connecting pipes, valves, pumps, and other equipment. India has a thriving flange manufacturing industry, offering high-quality, cost-effective solutions for various industrial applications. This article highlights top manufacturers, product types, industry standards, and key considerations when choosing a supplier.

Top Flange Manufacturers in India

Here are some of the leading flange manufacturers in India:

1. Rajendra Industrial Corporation

Specializes in stainless steel and carbon steel flanges

ISO 9001:2015 certified

Exports to the USA, UAE, and Europe

2. Kalikund Steel & Engineering Company

Offers ANSI, ASME, DIN, and API flanges

Custom manufacturing available

Strong global presence

3. Metalica Forging Inc.

Expertise in alloy steel, duplex steel, and nickel alloy flanges

Fast turnaround time

Supplies to oil & gas, petrochemical industries

4. Fitwel Industries LLP

Wide range of slip-on, weld neck, and blind flanges

Competitive pricing with quality assurance

Exports to over 30 countries

5. Riddhi Siddhi Metal Impex

Specializes in industrial flanges for chemical and power sectors

Uses advanced CNC machinery for precision manufacturing

Compliance with international standards

Types of Flanges

Indian manufacturers produce a wide variety of flanges, including:TypeDescriptionWeld NeckIdeal for high-pressure applicationsSlip-OnEasy to install, commonly used in low-pressure systemsBlindUsed to seal pipe endsThreadedSuitable for small diameter pipesSocket WeldPreferred in high-pressure applicationsLap JointWorks well in systems requiring frequent dismantlingOrificeUsed for measuring flow rates

Flange Manufacturing Standards in India

Indian manufacturers adhere to global quality standards, including:

ANSI/ASME B16.5 – Standard for pipe flanges

EN 1092-1 – European flange standard

JIS B2220 – Japanese Industrial Standard

API 6A – Standard for petroleum and natural gas industry

IS 6392 – Indian standard for steel pipe flanges

How to Choose the Best Flange Manufacturer?

Consider these factors when selecting a manufacturer:

Certifications & Compliance – Ensure they meet global standards.

Material Quality – Check the grade of steel used.

Production Capacity – Choose a supplier with adequate resources.

Customization – Look for manufacturers offering custom solutions.

Delivery & Logistics – Ensure timely delivery with global shipping options.

Customer Reviews – Read testimonials and ratings for reliability.

Benefits of Choosing Indian Flange Manufacturers

Cost-Effective – Competitive pricing compared to global markets

High-Quality Standards – ISO and API-certified products

Advanced Manufacturing – CNC and automated production

Strong Export Market – Supply to the USA, Middle East, and Europe

FAQ Section

1. What materials are used in flange manufacturing?

Flanges are typically made from stainless steel, carbon steel, alloy steel, duplex steel, and nickel alloys.

2. What industries use flanges?

Flanges are used in oil & gas, petrochemical, power generation, water treatment, and construction industries.

3. How to check flange quality?

Check for compliance with ANSI, ASME, and ISO standards, along with material certifications.

4. What is the delivery time for bulk orders?

Most manufacturers offer a lead time of 4-6 weeks for bulk orders, depending on customization requirements.

5. Can I get customized flanges?

Yes, many Indian manufacturers provide custom-made flanges based on specific project needs.

1 note

·

View note

Text

Electric Utility Vehicles Market: Trends, Growth, and Future Outlook

What Are Electric Utility Vehicles, and Why Are They Important?

Electric Utility Vehicles (EUVs) are compact, battery-powered vehicles designed for specialized tasks like cargo transport, maintenance, and passenger movement across short distances. These vehicles are widely used in sectors such as agriculture, construction, hospitality, and public services due to their efficiency, low maintenance costs, and zero emissions.

The global Electric Utility Vehicles market is projected to grow from USD 8.6 billion in 2023 to USD 18.2 billion by 2030, at a CAGR of 11.5%, driven by the rising focus on sustainable transportation and advancements in battery technology.

How Are Electric Utility Vehicles Used?

Logistics and Cargo Transport: Commonly used for last-mile delivery and cargo handling in warehouses and factories.

Agriculture and Farming: Electric UTVs help with crop transportation, field maintenance, and equipment handling.

Construction Sites: Used for hauling materials and personnel on large job sites.

Hospitality and Tourism: Resorts, airports, and theme parks use these vehicles for passenger transport and facility maintenance.

Where Is the Electric Utility Vehicles Market Growing the Fastest?

Adoption of electric utility vehicles is highest in the following regions:

North America: Driven by increasing demand from agriculture, construction, and recreational sectors.

Europe: Strong focus on environmental regulations and electric mobility solutions in public services.

Asia-Pacific: Rapid urbanization, growing e-commerce logistics, and government incentives for electric vehicles in countries like China and India.

Emerging markets in Latin America and Africa are also adopting electric utility vehicles to reduce operational costs and environmental impact.

What Are the Challenges in This Market?

High Initial Costs: Despite lower operating expenses, the upfront cost of electric utility vehicles is still a barrier for some businesses.

Charging Infrastructure: Limited availability of charging stations in remote areas can slow adoption.

Battery Performance: Battery capacity and charging time remain key challenges, especially for heavy-duty use.

What’s Next for Electric Utility Vehicles?

The future of electric utility vehicles looks promising with several key trends:

Advancements in Battery Technology: Longer battery life and faster charging solutions will enhance efficiency.

Autonomous Electric Utility Vehicles: Integration of autonomous technology for optimized operations in warehouses and industrial facilities.

Increased Adoption in Public Services: Use in municipal services such as waste management and park maintenance will expand.

With growing concerns about sustainability and rising fuel prices, electric utility vehicles are set to play an increasingly vital role in the global transportation ecosystem.

Conclusion

The Electric Utility Vehicles Market is on a strong growth trajectory, driven by innovation in electric mobility and growing demand for eco-friendly solutions. From agriculture to public services, these vehicles are transforming how tasks are performed.

Looking to transition to electric utility vehicles? Mark & Spark Solutions can help you find the perfect solution for your business. Visit our website to explore how we can assist you in making the switch to electric.

0 notes

Text

Global Stump Cutter & Grinder Market Size, Share, and Future Outlook (2025-2034)

Stump Cutter Grinder Market Growth and Forecast (2024-2035)

The global Stump Cutter Grinder Market was valued at approximately USD 1.28 billion in 2023 and is projected to grow to USD 1.35 billion in 2024. With a steady compound annual growth rate (CAGR) of 5.76%, the market is expected to reach USD 2.5 billion by 2035. This growth is driven by increasing demand for landscaping, reforestation efforts, and urbanization projects worldwide.

Market Drivers

Rising Demand for Landscaping Services – Growing urbanization and infrastructure projects drive the need for tree removal and land clearing solutions.

Reforestation and Sustainable Land Management – Government initiatives for afforestation and forest conservation boost the adoption of stump cutter grinders.

Technological Advancements – Innovations in automation, remote operation, and fuel efficiency are enhancing product adoption.

Increasing Construction and Infrastructure Development – Roadway expansions, commercial projects, and residential developments necessitate tree clearing operations.

Environmental Regulations and Safety Compliance – Stricter policies regarding land clearance and eco-friendly machinery are influencing market trends.

Key Market Dynamics

Growing Mechanization in Forestry – Advanced machinery is replacing traditional methods, improving efficiency.

Rising Demand for Compact and Portable Grinders – Smaller, mobile stump grinders are gaining popularity in urban areas.

Cost and Maintenance Concerns – High initial costs and maintenance requirements can restrain market growth.

Increasing Adoption of Electric and Battery-Powered Grinders – The shift towards eco-friendly alternatives is creating new opportunities.

Key Market Opportunities

Expansion of Commercial Landscaping – The growing commercial sector and demand for aesthetic landscapes are fueling product adoption.

Technological Innovations – AI-powered and autonomous stump cutters are expected to revolutionize operations.

Emerging Markets in Asia-Pacific and Latin America – Rapid urbanization and deforestation concerns present lucrative growth prospects.

Integration of IoT and Smart Monitoring – Enhanced machine tracking and predictive maintenance solutions can optimize operational efficiency.

Market Segmentation

By Type:

Walk-Behind Stump Grinders – Preferred for small-scale and residential applications.

Self-Propelled Stump Grinders – Ideal for professional landscapers and mid-sized projects.

Towable Stump Grinders – Used in large-scale forestry and construction applications.

By Power Source:

Gas-Powered – Traditional, high-power machines used for heavy-duty operations.

Electric/Battery-Powered – Gaining traction due to lower emissions and operational efficiency.

By End-User:

Residential – Homeowners and small-scale landowners utilizing compact grinders.

Commercial & Municipal – Professional landscapers and government projects benefiting from large-scale machinery.

Segment Insights

Walk-behind stump grinders are experiencing steady growth due to their affordability and ease of use in home landscaping.

Electric-powered grinders are increasingly favored in regions with strict environmental regulations.

Commercial and municipal sectors dominate the market share due to large-scale deforestation and reforestation projects.