#equity release solutions

Explore tagged Tumblr posts

Text

Sun Grepa Peso Asset Builder returns: Unlocking wealth and security beyond borders

In the ever-evolving landscape of financial goals and aspirations, affluence often brings with it a unique set of dreams – dreams that revolve around building, securing, and sustaining wealth for a brighter future. For the privileged few in the Philippines, these aspirations are about to receive a significant boost as Sun Life Grepa Financial, Inc. (Sun Life Grepa), a renowned life insurer in the…

View On WordPress

#affluence#credit and equity-linked Note#financial goals#financial prosperity#financial security#global investment opportunities#guaranteed insurability#international markets#investment-linked life insurance#limited time opportunity#Philippines#press release#Richard S. Lim#Sun Grepa Peso Asset Builder#Sun Life Grepa#Sun Life Grepa Financial#tailored financial solutions#wealth accumulation

0 notes

Text

I've had a headcanon for a while that Breha and Fox are really into the romance genre - like, in a way that if the book/show/movie is good, they enjoy it as a good piece of media, and otherwise, they read or watch things together and have fun with it. Bail is...not so much into this, as much as he can also enjoy a good piece of media, but the second part of the experience is kind of lost to him.

He will listen to Breha and Fox talk about them and tries to guess what is going on in any given book/show based only on what they tell him.

(If he is actually a bit invested. Shh. No he isn't. No, he's not watching this- alright, fine, you menaces)

So, there's this relatively new show. It started a bit before the war, and gained a lot of popularity then, and when the show was put on hiatus because of the war, the fans were impatiently awaiting for more. The show is about mostly fictional planets and their high-society, royals and nobility.

Breha and Fox watch the part of the show that came out before the war, and make Bail watch with them as well (Bail watches, because they are asking and he wants to spend time with them, and, hey. He likes looking at them when they are happy and joking around). Then, some time after, the show announces that it will be coming back with new episodes!

The episodes start releasing. Breha and Fox watch them, and make Bail watch them as well (no, he isn't invested at all-). One week, there's a new character introduced. A Princess, who is going to become a Queen soon. She is from a very old and rich planet, that does arts and peace and nature. Breha says that it reminds her of Alderaan a bit, perhaps they have taken some inspiration.

One episode, the Princess meets a nobleman, who is very politically idealistic and believes in equity, and is striving for making the galaxy a more peaceful and unified place. The actor is very tall.

Fox jokes that they kinda remind him of Breha and Bail. Breha laughs. Bail squints his eyes at the screen.

The Princess becomes a Queen, while becoming increasingly close with the nobleman. Then, one week, they introduce another new character. A former soldier, who has now returned from the war, and the Queen and the nobleman meet him when they are in an event, discussing how to make more peaceful solutions.

Bail frowns at the screen. The actor is not a clone, but looks very much like one, with his tanned skin and dark, curly hair.

Fox looks at the character as well.

"Oh", he says.

"Oh", Breha says as well. "I do think...that they have taken inspiration from close by."

You don't say, Bail thinks.

He's not super stoked about this development, but at least the two other actors do not resemble him and Breha too much. He can...sort of understand the choice of casting someone who looks kind of like the clones into the role of the soldier. It's commentary. Easy to understand. It's....fine. They are just drawing inspiration from their overall dynamic, nothing more. There's nothing else that seems too recent.

Then Bail goes for work to Coruscant, and gives statements regarding his views on the clone rights, the war, and his relationship with the clones and how, even though he cannot claim himself to be a part of their culture, he and Breha and Alderaan as a whole have tied themselves into it and consider it to be a part of their culture as well.

It's a good statement. Bail is proud of it and the reaction it causes. The way Fox and Breha look at him after is the best reward he could possibly ask for.

Then, a few weeks later, a new episode comes out. The nobleman gives a speech about the war and cultures and how he relates to them. It's very much the statement Bail gave, but just reworded to fit the world of the show.

Oh, Bail thinks. Oh, it is on.

Bail decides to have his own fun. He starts to make very showy gestures to Breha and Fox in public. They know immediately what he is doing, and go along with it.

Some of the things he did end up in the show. Bail can deduce from what those things are when whoever it is who is gathering material is present.

Bail knows the press. He knows how they dress, he knows how they operate. Once he knows where to look, it is very easy to spot them.

It's a rare occasion that both Breha and Fox are accompanying him to Coruscant. Bail is playing it up, until he notices the person who is very much not press but who is very much recording and making notes, when Bail is not even saying anything to any of the people surrounding them.

Bail turns to look straight towards the camera.

He person holding it stiffens, but doesn't turn away instantly. Not so easily intimidated, then. Bail can respect that at least.

Bail continues to stare at the camera, not saying anything. Just staring. Fox and Breha have caught on to what he is doing by then, and they are trying their best not to burst out laughing.

Bail continues to stare at the camera. He has stared down bounty hunters, separatists, assassins, the sith. He can do this all day.

Finally, the camera turns away. Bail smiles, and clims into their speeder with Breha and Fox.

As soon as the doors are closed and the speeder starts moving, Breha and Fox lose it. They cannot stop laughing the whole way, and are barely able to contain it once they arrive to the Senate.

Unsurprisingly, at least for some, the plotline of the three characters in the show starts to steer to entirely new directions in the very next episode.

#I'm sorry but the thought of Bail having beef with the producers of space bridgerton is giving me life#looks directly into the camera like he is in the office#sw#tcw#bail organa#breha organa#commander fox#bail/breha/fox

93 notes

·

View notes

Text

New COVID vaccines have arrived just as a vaccine equity program is ending - Published Aug 28, 2024

This article hits the nail on the the head: “We know the easier we make these vaccines, the more accessible these vaccines are, the more people will get them,” Jetelina said. “And they are expensive, especially for uninsured people; the whole access issue is a major challenge.”

Last week, the Food and Drug Administration approved two COVID-19 vaccines earlier than expected due to record-breaking surges of the virus. Instead of releasing them in the fall, following the pattern of previous coronavirus vaccine roll outs, they are available as early as this week. However, for some people, time is already running out to get the updated shots.

For the nearly 27 million adults who do not have health insurance, the new coronavirus vaccines will only be available for free until August 31. That’s because the Center for Disease Control and Prevention’s Bridge Access Program, which provided free coronavirus vaccines to uninsured adults, will end. Over the last year, the program provided free vaccines for nearly 1.5 million people since it launched in September 2023. Without insurance, the vaccine can cost at least $115.

“Uninsured adults are going to have more difficulty accessing the vaccines this fall,” Dr. Kelly Moore, president and CEO of Immunize.org, a nonprofit organization that works to increase vaccination rates and is funded by the CDC, told Salon. “Budget cuts on the federal government side have eliminated that program, and the amount of money available to purchase the COVID vaccine and offer it to people who are uninsured is quite limited.”

While the program was meant to be temporary, the original termination date for the program was slotted for December 2024. However, the fiscal 2024 government funding bill rescinded $4.3 billion in COVID-19 funding, some of which was being used for the program, as reported by The Hill in May. After August 31 of this year, local health departments might have a small amount of free vaccine available, but supply is expected to be limited for those without health insurance. While the Biden administration advocated for a more permanent solution in 2025, Congress hasn’t agreed to appropriate the funds.

“We hoped that the Bridge Access Program would be a bridge to a more permanent solution, a safety net program that would ensure affordable access to recommended vaccines for uninsured adults,” Moore said. “But unfortunately, it's turned out to be a bridge to nowhere.”

The ending of the program comes at a time when public health officials will be tasked with the assignment of getting vaccines into more peoples’ arms. The optics of last year’s vaccine roll-out was chaos, and not as many people received the vaccines as health officials hoped. Only about 28% of Americans received updated shots last year, a decline from 69% when the first round of vaccines were released.

In a statement to Salon, a spokesperson for the CDC said the Department of Health and Human Services (HHS) has started a campaign called "Risk Less. Do More." to increase uptake of vaccines, including for COVID. The public health agency said it is also "providing additional resources to support access to COVID vaccines this fall and winter season to serve needs of the most vulnerable populations, including uninsured adults, farmworkers, tribal populations and others."

"Much of that support will be provided to the 64 state and local public health departments through their immunization programs," the agency said.

This year, the two new vaccines are updated versions of the mRNA vaccines produced by Moderna and Pfizer-BioNTech, They are specifically designed to vaccinate people against the KP.2 strain, which has been driving a large proportion of infections this summer. For the last several weeks, related but different strains KP.3 and KP.3.1.1 have been the ones most responsible for infections lately. The vaccines still offer cross-protection against these variants, but it's another indicator that this virus will always be changing, evolving new ways of evading our immunity.

Want more health and science stories in your inbox? Subscribe to Salon's weekly newsletter Lab Notes.

“They have an updated vaccine formula, and that's a good thing,” Katelyn Jetelina, an epidemiologist and author of the newsletter Your Local Epidemiologist, told Salon. “This virus mutates incredibly quickly, and so we need to patch up our immunity walls to make sure we can recognize this vaccine or recognize the virus as it changes, and that is one driving factor why we have updated vaccines every fall.”

The vaccines are recommended for everyone six months and older, with a few exceptions. If you’ve had a recent COVID-19 infection, officials recommend waiting two to three months to get the vaccine. For everyone five years old and older, even if they’ve never been vaccinated against the coronavirus before, these two new vaccines only require one shot. Anyone younger than five may have multiple doses depending on whether they’ve been vaccinated before or not and what vaccine they received.

“The reason that we're no longer recommending multiple doses of vaccines for people who've never been vaccinated is that if you've never been vaccinated at this point, it's almost certain that you've had at least one infection with the coronavirus virus to prime your immune system,” Moore said. “So your immune system is already familiar with this virus, and it just needs to be reminded and updated with the latest vaccine.”

Moore said it’s most important for people who are older than 65, the age group where most serious COVID disease occurs, to receive the latest vaccine. According to the CDC’s data tracker, weekly deaths from COVID-19 have steadily risen across the country and wastewater viral activity has increased since May. Currently, the national level is “very high,” according to the CDC. One bit of good news is that the federal government plans to offer each household four free at-home COVID-19 tests again starting at the end of September.

Moore said aside from vaccine access being limited to uninsured Americans, she expects this year’s roll-out to be less chaotic than last year’s because people might have been experiencing “vaccine fatigue.”

“There was also a lot of distraction, in a positive way, about the offering of a new RSV vaccine available for the same sort of populations, older adults, 60 and over,” Moore said. “So there was a lot of focus on the RSV vaccine, and I think people just have been tired of thinking about COVID, and that's unfortunate because the vaccine is our best defense against COVID infection and the risk of long COVID.” *NADICA'S NOTE: Masking to not catch covid in the first place is the best defense against long covid*

Jetelina said it will be “interesting” to see if more people get vaccinated this year, especially since the HHS has a big vaccine campaign coming this fall that will target high-risk people.

“I'm curious if that will move the needle, but I will say I'm not holding my breath,” she said. “I don't think a lot of other things have changed since last year, people are still tired of hearing about COVID, there's still a lot of confusing information out there, and I don't know how many minds we can really, truly change from season to season.”

Jetelina said she is also concerned about the Bridge Access Program ending.

“We know the easier we make these vaccines, the more accessible these vaccines are, the more people will get them,” Jetelina said. “And they are expensive, especially for uninsured people; the whole access issue is a major challenge.”

#covid#mask up#pandemic#covid 19#wear a mask#coronavirus#sars cov 2#public health#still coviding#wear a respirator

24 notes

·

View notes

Text

The ripple effect

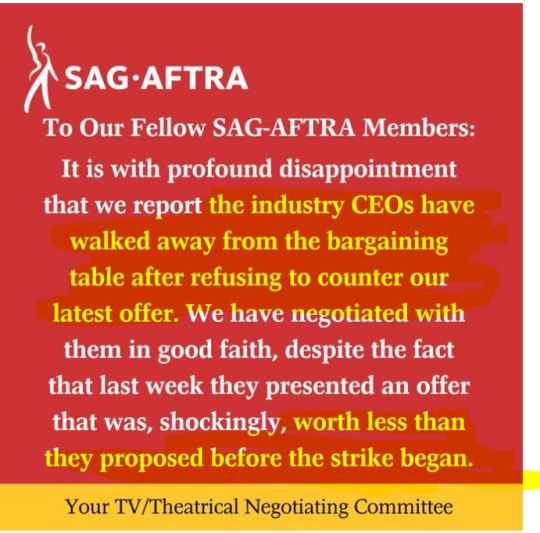

So finally, it would seem the news from Hollywood are not good at all. A press release from SAG-AFTRA informs us that AMPTP/TPTB chose to drop the towel after a very long negotiation process (not a good sign, in my book), that continued even after their latest unacceptable offer, as you can read down below (https://x.com/sagaftra/status/1712368110253285730?s=20):

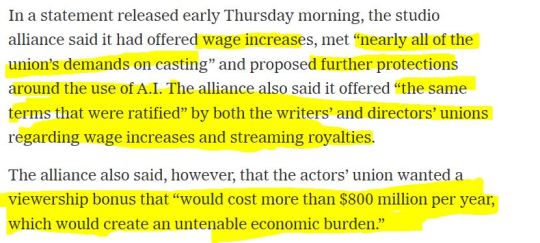

The mainstream media (always NYT, in this house) reported also on the studios' offer, which may or may not be helpful for understanding what exactly is at stake (https://www.nytimes.com/2023/10/12/business/media/actors-strike-talks-suspended.html?searchResultPosition=2):

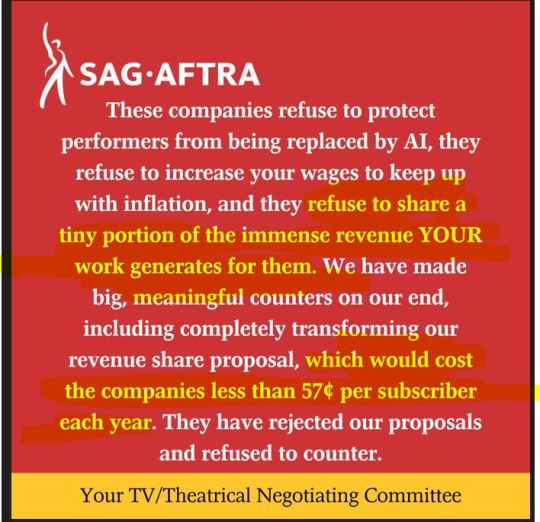

Now that is a very hardball, completely insolent position. I am peeling my eyes in disbelief at the idea of offering 'further protections around the use of A.I.', when it was hoped that the use of A.I. would be treated as an exception, not as future reality the industry should work 'around'. This is what really is at stake, not the almost abusive allegation of 'unbearable economic burden' (that is a mafioso pretext) an 800 million USD yearly viewership bonus would supposedly entail. The real financial impact of such a compromise solution, as disclosed by SAG-AFTRA, is negligible: 'less than 57 cents/subscriber'.

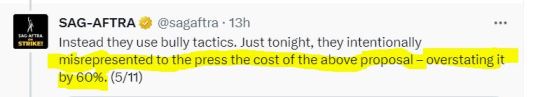

And, to make things worse, it would seem the studios deliberately lied to the press, too (it would not be the first time - we shippers know it so well, eh?):

All this circus, despite a cataclysmic impact on California's economy:

(Sourced at: https://www.nytimes.com/2023/09/21/realestate/writers-strike-rent-ny-la.html).

And that was the situation three weeks ago, when I found this article and promptly set it aside, waiting for the right moment to share it with you. And you know the situation is serious, when news like these are to be found not in the business, but in the real estate section of the newspaper. Along with this kind of comments, likely to suggest the possibility of unrest, if things go on like this:

People living in their flats without electricity or sleeping in their cars: it would seem this strike added unwanted insult to the drastic COVID injury in this particular sector of the labor market.

But what interested me the most about this whole affair was the ripple effect on the British film industry, in an attempt to see what is next for OL's Season 8. Thankfully, I didn't have to go very far and speculate more than the NYT did itself. Oh, and before Mordor starts shouting insanities, their LHR's correspondent paper, back in September, is called 'Hollywood Strikes Send a Chill Through Britain’s Film Industry' (https://www.nytimes.com/2023/09/19/business/hollywood-strikes-uk-filmmaking-industry.html):

Despite my unflappable optimism, I have to say that doesn't sound good at all, especially when you know this is precisely the case for OL, a production 'with stars who are SAG-AFTRA members' (or at least compelled to stand in solidarity with the strike, by SAG-AFTRA's own statement of conduct). I predict a very late start for the shooting of Season 8. And further unrest in the UK sector 'in the middle of next year' means that UK based and staffed productions may be fewer and less important, since that calendar announced by Equity could seriously compromise their promotion, a risk not many studios are willing to take. So less alternatives for both S&C, at least for the UK alone.

The writers' strike was a very long one - five months. I suppose the studios are willing to play for time and prefer a long stalemate of the negotiations with SAG-AFTRA, in the attempt of breaking the union consensus from the inside. With people's economies gone and the prospect of a dire, uncertain way ahead, there is no way SAG-AFTRA's compensations, mainly aimed at keeping people afloat with their rent costs, could cover the real impact on its members' everyday lives, on the long run. They would also prefer to foolishly cry over a fictitious 800 million USD 'burden' and not see the (at least) six times bigger negative impact on the local economy, which translates both in net losses of profit for thousands of businesses (mainly SMEs) and thousands of lost jobs.

And in the middle of all this, it would seem that Herself is on her way to the NYCC. Whatever for, sweet summer child, I would brazenly ask this strange, diminutive woman who started it all.

55 notes

·

View notes

Text

One silver lining of the COVID-19 pandemic is the now-ubiquitous availability of interactive technologies, such as Zoom conferencing and document collaboration, to connect students to educational opportunities that previously would not have been available to them. For instance, CollegePoint is a national initiative that provides remote college advising to high-achieving, lower-income high school seniors across the country. These students often lack access to individualized college planning support in their communities and are underrepresented at the highest-quality colleges and universities in the country.

America’s selective higher education institutions are one of the strongest pathways to economic mobility, so encouraging more academically talented, lower-income students to engage in remote college advising could be an important driver of financial opportunity and greater equity in the U.S. Ongoing challenges with the U.S. Department of Education’s release of the updated Free Application for Federal Student Aid (FAFSA) is another way individualized, remote advising may be instrumental in helping students and families identify affordable and high-quality college options.

Getting students to initiate and sustain engagement with remote advising can be challenging, however. For instance, a prior RCT we conducted of CollegePoint found that 25% of students who signed up for the program never met with their advisor, and those who did participate had fairly modest engagement

11 notes

·

View notes

Text

Trans Charter - Music & Entertainment Press Release 2025

F

OR IMMEDIATE RELEASE

Groundbreaking Trans Charter Launched to Transform Inclusivity in the Global Music Industry

The music industry takes a monumental step toward equity and inclusion with the launch of the Trans Charter, a pioneering initiative designed to establish clear guidelines and support for transgender and non-binary individuals across the sector. Led by esteemed music industry advocate Saskhia Menendez, the charter aims to break barriers, foster allyship, and drive systemic change within the creative industries.

With a deep-rooted commitment to diversity and accessibility, the Trans Charter outlines essential policies and practices for music organizations, labels, venues, and industry professionals to create safer, more inclusive spaces. The initiative has been developed in collaboration with leading industry experts, LGBTQIA+ advocates, and music professionals to ensure comprehensive and actionable solutions.

Key Objectives of the Trans Charter:

Inclusive Hiring & Representation – Encouraging equitable opportunities for trans and non-binary artists, executives, and creatives.

Safe Performance & Workplace Environments – Establishing anti-discrimination policies, gender-neutral facilities, and inclusive working conditions.

Fair Pay & Economic Equity & Growth – Addressing wage disparities and ensuring equal opportunities for career advancement and growing creativity.

Education & Awareness – Providing resources and training on trans inclusivity for industry professionals.

Authentic Visibility – Advocating for fair and accurate representation of trans and non-binary talent in media and marketing.

Saskhia Menendez, a leading force behind the charter and a dedicated advocate for underrepresented communities, emphasizes the urgency of this initiative:

“The Trans Charter is more than a document, it’s a movement toward lasting change. The music industry has the power to set an example of inclusivity, and this charter ensures that trans and non-binary individuals are not only seen but fully supported and empowered.”

Industry Support & Call to Action

The launch of the Trans Charter has already garnered support from key stakeholders, including music executives, artists, and advocacy organizations. Industry leaders are encouraged to sign and adopt the charter, integrating its principles into their operations and fostering a more equitable industry for all.

For organizations and professionals looking to support or implement the charter, more information and resources are available at https://www.linkedin.com/in/misssaskhia/

About Saskhia Menendez

Saskhia Menendez is a multi-racial trans woman, international advocate, and industry innovator committed to amplifying marginalized voices. As the host of Music Industry Insights Worldwide, a recognized speaker, and a dedicated campaigner for inclusivity, she continues to shape the global music landscape with initiatives like the Trans Charter.

For media inquiries, interview requests, or partnership opportunities, please contact: Saskhia Menendez

Sign Up Now !!

3 notes

·

View notes

Text

The main theme of this US election, and all rightwing victories, is bigotry

I know this is not welcome news, because bigotry is a persistent problem with no easy fix. It consistently shows up in polls for the most important topics for voters: immigration. Kamala Harris got less votes than Biden, Trump got more votes than Obama. Trump's most common scapegoats are foreigners and racialized minorities.

Kamala is not more of a warhawk or more of a leftist than Biden or Obama. The idea that those things cost her the election is cope.

She lost the election because the right has legitimized scapegoating undesirables. This is why the right is winning all over the world: bigotry has successfully been marketed as anti-establishment, as a force for change.

This is possible because neoliberal ideology has presented itself as a meritocracy, and it is not.

This is possible because profit-based media is incentivized to polarize and manufacture consent for exploitation and wars.

This is possible because lip service to inclusivity is used to mask a decline in purchasing power for the poor.

Everybody knows things are getting worse, but we see symbolic victories for inclusivity at the same time. This pushes us to connect the two: maybe I'm poor because bipoc people are gaining cultural and economic equity? Maybe I feel unsafe because my workplace is asking me to make space for people I'd never considered before? If my life is getting worse and their life is getting better, surely they are taking value from me?

Not true, but this is the conclusion that neoliberalism tends towards. In reality, marginalized groups are suffering under the same conditions as privileged groups, and even more so. But the fact that the gap is shrinking in some cases has lead to misplaced jealousy.

Neoliberal technocrats like the Democrats in the US or the centrist parties in Europe have stopped pointing at billionaires as the beneficiaries of our exploitation. There is barely any media left that dares to point out how 'the economy' is mainly the spending habits of the super-rich, and that they want prices to be high, wages to be low, and a growing workforce of people desperate enough to work for peanuts and apathetic enough not to organize. Shareholders rely on immigration being restricted so there is a captive workforce that can not benefit from the wealth they create for foreign investors.

Bigotry is the only way to release the pressure that late capitalism puts on us, without endangering its structure.

Bigotry allows us to blame scapegoats for both their successes (they don't deserve to have it better) and their failures (they don't deserve my help because they are useless to society) and their political action (they don't deserve attention/consideration).

The solution is not to pretend the system is fine, it is to point out markets are inherently biased towards the rich, and markets have taken over society.

In short, the only alternative to bigotry is an inclusive, Big Tent socialism. And that hasn't been on the ballot in most countries. Even parties that used to be socialist have become 'compassionate capitalists'. Overt socialism certainly does not have a voice in media because it is not profitable.

Making it clear that Democrats have abandoned workers and unduly favored billionaires is the only way forward. It's socialism or barbarism. The time for centrism has passed.

2 notes

·

View notes

Note

Maya was clear that she saw Liam's abuse as a result of distress that ran deep and his coping strategies with that distress. So if I talk about Liam it will be in those terms. ///

In her book she said some of the distress arouse from the contrast between his career and Harry's and the poor reception of LP1. I remember the same Guardian critic Laura Snape was very cruel about LP1 (awful 1* review) and very nice about Fine Line which was released a week later.

I just think the whole solo fandom thing is fucking toxic. The fans, the media, the industry ... all pitting them against each other and the same person coming out on top year after year.

Oh anon - I know fandom is notorious for blaming women for the actions of men - but responding 'Laura Snapes wrote a negative review of Liam's work' in response to a description of Liam's abuse - is taking fucked up fandom to another level.

But far more importantly - the way you present mental distress here You focus on the fact that Liam is being compared to other people and the fact that in this comparison external validation is not being distributed equally. Suggesting that if only external validation was distributed equally - if he got enough of it - Liam would not be experiencing this distress - is a model of mental distress that sets you up for failure.

(And of all the forms of external validation to suggest should be distributed equally - using reviews as your main example is completely absurd. People respond to art in all sorts of ways - which will always be complicated. When you put something out into the world you are taking a huge risk - including that people won't like it. But I'm mostly leaving that alone and are going to pretend to focus on a form of external validation where some form of equity of distribution would be reasonable)

External validation can be nice (although it can also be complicated), but it will not and cannot address the fractures in our psyches. There is all the evidence in the world (including within 1D) that external validation is not a solution to mental distress.

We need some kind of recognition - we need to do things people value and we need to be seen. We don't need, and can't all have, the extraordinary recognition that you describe as Harry coming up on top. Stadium tours, awards, even someone with authority engaging with and appreciating something we've created - those only go to some people - and they never have been distributed fairly and never will be.

Our mental distress lies to us - it sends us in completely the wrong way to try and fix it. Chasing after external validation as a way of trying to eliminate mental distress is a fools errand. Short term distress around rejection, or not getting something we want, or failure - is really normal. Learning to sit with that distress and get through it rather than running in all sorts of directions is a skill that it's possible to strengthen (one of the most important changes of my adult life has been experiencing applying to jobs as something that felt unbearable distressing, to something that was possible, with a significant toll).

Of course Liam experiences some distress at career difficulties - we all would. That's not what his ex-girlfriend wrote a book about. Liam responded to his distress by being cruel and abusive to people around him (particularly his ex) and seeking relief in substances that had a history of making him more abusive - in this condition he chased his girlfriend with an axe.

Our brains are lying to us. It's really common to feel distress and think 'I must do X then I will be valid and not feel distress'. That's a trap that will only keep people on a hamster wheel of distress - chasing relief that will not come. Even if you do achieve X it will not be enough - your brain will give you another goal. I think it can be useful to think of eating disorders here - the idea that being thin enough will cure someone's eating disorder will strike a lot (not enough) people as obviously illogical. The same is true for Liam and success (or Harry and success for that matter) and for so many people in different ways - if we chase things because we feel like we're not good enough - then getting those things are unlikely to make us feel good enough.

There is an alternative (although it is not to listen to that voice, and build our ability to tolerate our distress, manage triggers, and eventually heal some of the wounds that made our distress so strong in the first place.

#I love Laura Snapes' review of LP#which is not the point#but incisive negative reviews of 1D's solo album#are something I really appreciate#not the boring pans#but Rolling Stones review of Walls#or Pitchfork's Fine Line review#they've articulated things that I wasn't able to

6 notes

·

View notes

Text

About Bower Home Finance

At Bower Home Finance, we provide expert financial solutions focusing on equity release, mortgages, and related financial services. With a regional office located in Thornaby and extending our services throughout Stockton-on-Tees, the Northeast, and the UK, we aim to offer our clients reliable and personalised financial advice. With years of experience in the industry, Bower Home Finance stands as a pillar of trust and expertise for those looking to navigate the complexities of equity release and mortgage planning.

Why Choose Bower Home Finance?

Bower Home Finance is a beacon of excellence in the equity release and mortgage advisory sector, recognised for its profound expertise and bespoke services. With a nationwide network of adept financial specialists, Bower Home Finance is an industry leader and a dynamic force, adeptly navigating the complexities of the market, economic fluctuations, and intricate regulations. Their commitment to understanding each client's unique situation and tailoring solutions to individual needs is at the heart of their operations. This client-centric approach is evident in their dedication to providing high-quality financial guidance without pressure, ensuring clients feel confident and in control of their financial journey. Whether it's equity release plans or other home finance products, Bower Home Finance's experts guide clients at every step, ensuring decisions are made confidently and comfortably.

The journey of Bower Home Finance, from its humble beginnings in Havering-atte-Bower in 2006 to becoming a nationwide advisory powerhouse, reflects its commitment to providing customers 'shelter' and 'protection' for financial services. Their evolution from a local mortgage advisor to a trusted provider of comprehensive equity release advice and bespoke services for high-net-worth individuals underlines their growth and commitment to excellence. With a reputation bolstered by numerous awards and a commitment to ethical, fair, and sustainable practices, Bower Home Finance is not just a leader in financial advice but also a company known for its internal community engagement and active pursuit of environmentally responsible policies. Their mission extends beyond business success, providing a desire to be a respected employer and a firm dedicated to positively impacting the planet, aiming for carbon neutrality by 2030.

Website: https://www.bowerhomefinance.co.uk

Address: Christine House, Sorbonne Close, Thornaby, Stockton On Tees, TS17 6DA

Phone Number: 0800 411 8668

Contact Email ID: [email protected]

Business Hours: Monday - Thursday : 08:30 AM - 07:00 PM Friday : 08:30 AM - 06:00 PM Saturday : 09:00 AM - 01:00 PM Sunday : Closed

2 notes

·

View notes

Text

By: David Millard Haskell

Published: Feb 15, 2024

Almost two months ago, Tesla CEO and Twitter (now X) owner Elon Musk, made critical statements on X about the field of diversity, equity, and inclusion (DEI). In a post that’s now been viewed nearly 36 million times, Musk stated “DEI must DIE. The point was to end discrimination, not replace it with different discrimination.”

Recently, Musk showed he was willing to do his part to hasten DEI’s demise. In its official filings with the US Securities and Exchange Commission, Tesla did a clean sweep of DEI language and references to DEI initiatives. The world’s largest electric vehicle manufacturer is now DEI-free.

Musk’s comment and related actions reflect a growing consensus that DEI ideology and instruction—educational materials steeped in critical social justice and offered as mandatory training by most corporations, educational systems and government agencies—does not work.

That is, it fails to deliver on its promise to reduce prejudice and produce greater harmony among groups. Ironically, as Musk observes, it appears to promote the divisive concept popularized by self-proclaimed “anti-racism” scholar and DEI guru, Ibram X. Kendi, that “the only solution to past discrimination is present discrimination.”

In the US, several high-profile controversies have further solidified the connection between questionable concepts (like Kendi’s) promoted in DEI training and reverse discrimination against Caucasians as well as academically successful Asians, and Israel-supporting Jews.

There have been similar DEI-influenced controversies in Canada. The suicide of Toronto public school principal Richard Bilkszto awakened many to the destructive nature of this caustic curriculum. When announcing his death, Bilkszto’s lawyer traced his deteriorating mental health and ultimate demise to a series of diversity, equity and inclusion workshops he had attended. (The allegations have not yet been proven in court.)

Recordings show that Bilkszto was subjected to repeat harassment and humiliation based on his skin colour after he politely questioned the DEI trainer about one of her claims.

Shortly after Bilkszto’s death in July of 2023, the trainer in question, Kiki Ojo-Thompson, released a statement on the website of her consulting company, the KOJO Institute. It said: “This incident is being weaponized to discredit and suppress the work of everyone committed to diversity, equity, and inclusion” which is “building a better society for everyone.”

But is it true that the concepts and training of DEI builds “a better society for everyone?”

This was a question that the Aristotle Foundation for Public Policy asked me to answer. To do that I examined the findings of the most significant DEI studies from recent decades published in top social scientific journals like the Annual Review of Psychology, Anthropology Now, Journal of Experimental Psychology, Psychological Science, and Journal of Personality and Social Psychology. Authors of the reviewed literature are from various universities including Harvard, Princeton, Yale, Michigan, Syracuse, Aberdeen and others.

What the research shows is surprising—for some. For example, claims that “DEI works!” are not supported; multiple meta-analyses of hundreds of studies could not discern any clear evidence that DEI instruction changes people’s attitudes for the better.

In one particularly damning analysis, the researchers concluded “Implementation of DT [Diversity Training] has clearly outpaced the available evidence that such programs are effective in achieving their goals.”

On the other hand, the research provides clear proof: DEI instruction can activate and even increase bigotry among participants.

You’d think that such a conclusion would cause our corporate, academic, and political leaders to immediately withdraw the millions they’re spending on DEI programs and DEI staff. But old habits die hard, especially when those enforcing the habits have to admit that they’ve been hoodwinked.

The practice of blood-letting lasted more than one thousand years and only began to fall out of fashion in the mid-1800s when a Parisian physician, Pierre Louis, finally decided to measure patient outcomes. To his surprise, the application of leeches to a person’s back or the cutting and draining of the vein at their elbow didn’t do anything positive and could make matters worse.

We now can say the same about DEI.

History is riddled with instances of scholarship exposed as snake oil. Let’s learn our lesson: In the absence of evidence, you need to throw out the leeches.

David Millard Haskell is the author of “What DEI research concludes about diversity training: It is divisive, counter-productive, and unnecessary.” He is a professor and researcher at Wilfrid Laurier University and a Senior Fellow with the Aristotle Foundation for Public Policy.

--

By: David Millard Haskell

Published: Feb 12, 2024

Introduction

In July 2023, public school principal Richard Bilkszto killed himself. When announcing his death, Bilkszto’s lawyer traced his deteriorating mental health and ultimate demise to diversity, equity, and inclusion (DEI) workshops his school board required him to attend.1 Recordings show that he was harassed and humiliated by the DEI trainer for questioning one of her claims.2

A growing number of high-profile cases suggest that diversity workshops and their supporting materials regularly promote questionable claims—particularly about the overarching, malicious character of the majority population.3 Similarly, hostility toward those who challenge DEI claims is part of the pattern.4 In Canada, students who challenge claims have been punished or expelled5; employees have been suspended.6 One whistleblower who leaked DEI training session material maligning the majority population lost his employment.7

While the hostility Bilszto was subjected to during his DEI training is not unusual, his extreme response to it is an outlier. But it also sounds an alarm. It draws our attention to the potentially negative nature of this instruction that is now ubiquitously conducted— usually as a mandatory exercise—in most corporations, educational systems, and government agencies.

The DEI training that Bilkszto attended focused heavily on race; this is typical. While DEI instruction can be as varied as it is pervasive, so-called “anti-racism education” tends to get the most attention during workshops.

Supporters justify DEI training—in particular, the “anti-racist” variety—with the argument that Canada, and Western nations generally, are systemically racist. The logic is this: the medicine must be applied everywhere because the disease is everywhere.

Specifically, DEI advocates assert that discrimination against minorities, while not explicit, is embedded in society’s institutions, and therefore leads to disparities. They hold up any difference in outcomes between the country’s majority and minority populations— at least when they skew negatively for the minority—as obvious proof of systemic racism.8

However, a rudimentary understanding of statistical analysis leads to the conclusion that it is in fact not “obvious” that differences in outcomes between racial and ethnic cohorts are evidence of racism; correlation does not equal causation. In fact, in his recent Reality Check on systemic racism claims in Canada, the Aristotle Foundation’s Matthew Lau evaluates the empirical data and comes to this conclusion:

If the typical anti-racism activist in Canada today is looking for widespread institutional or systemic racism… they will not find it. …Moreover, the data on disparities in income, educational attainment, occupational outcomes, and public school test scores show that, on average, Asians are doing better than the white population.9

Operating under the assumption that society is overrun with intolerance, the expressed goal in DEI workshops is to generate harmony amongst diverse populations. To that end, independent consultants or in-house DEI staff lead participants through a curriculum focusing on such concepts as implicit bias, white privilege, and micro-aggressions.

With reference to the existing scholarship, this Reality Check investigates whether diversity, equity, and inclusion instruction actually leads to greater harmony and tolerance—or to the opposite. As we will see, the national and international research10 shows there is often a disconnect between the evidence and the claims of DEI advocates. (See the appendix table for a short summary of the literature on DEI instruction.)

Diversity training in practice: Aggressive, and justified by circular “proofs”

To “prove” the effectiveness of DEI instruction, proponents often point to surveys conducted before and after workshops that show, following training, participants are much more likely to articulate answers that align with the pro-DEI ideas. That is to say, someone who takes the training can, afterwards, recite what they were told. In these testimonials it is seldom mentioned that for many participants job security and career advancement is contingent on giving the “right” answers.11

This type of methodology has drawn criticism and has proven to be unreliable. In a 2022 article, after reviewing the scholarly literature on DEI instruction, psychological researchers Patricia Devine and Tory Ash concluded that scholars of diversity training “too often use proxy measures for success that are far removed from the types of consequential outcomes that reflect the purported goals of such trainings.”12

A disconnect between DEI claims and DEI outcomes: A look at the literature

Despite criticism of their methods, proponents of DEI instruction continue to assert that it is effective. “Effective,” for them, means more than just reciting talking points from a workshop, they claim that their programs actually change behaviour. Websites and public documents from independent DEI consultants and in-house DEI office staff promise that because of their instruction, workplace harmony, productivity, and collaboration across groups will increase, discrimination will be reduced, and bias and bigotry will be lessened.13

However, the research does not support claims of behavioural change. For example, in their 2018 article “Why Doesn’t Diversity Training Work?” published in Anthropology Now, Harvard Sociologist Frank Dobbin and colleague Alexandra Kalev observed:

Nearly all Fortune 500 companies do training, and two thirds of colleges and universities have training for faculty according to our 2016 survey of 670 schools. Most also put freshmen through some sort of diversity session as part of orientation. Yet hundreds of studies dating back to the 1930s suggest that antibias training does not reduce bias, alter behaviour or change the workplace.14 Supporting Dobbin and Kalev’s observation, numerous systematic reviews and meta-analyses—an advanced research method that combines the data of multiple studies to identify overall trends—have determined that the ability of DEI training to elevate harmony and/or decrease prejudice (in any lasting way) is undetectable or negligible.15 Those systematic reviews and meta-analyses are cited in this paper’s endnotes; however, for the purpose of illustration, the key findings of some of the most significant and representative works are discussed below.

In a review of all available research between 2003 and 2008 focusing on the impact of DEI programs, Elizabeth Paluck, then at Harvard and now at Princeton, and Donald Green at Yale generated a sample of 985 studies. After aggregate, statistical assessment they concluded:

… the causal effects of many widespread prejudice-reduction interventions, such as workplace diversity training and media campaigns, remain unknown… Due to weaknesses in the internal and external validity of existing research, the literature does not reveal whether, when, and why interventions reduce prejudice in the world.16

Updating her research in 2021 with a second meta-analysis of over 400 current studies, Paluck and colleagues again found little evidence that instruction in diversity, equity, and inclusion works to decrease prejudice. They begin by stating: “Although these studies report optimistic conclusions, we identify troubling indications of publication bias that may exaggerate effects.”17

They then clarify what they mean by “exaggerate effects.” When examined through the lens of their rigorous methodology, Paluck and team found that the effect size of diversity-type training is near zero. This is of consequence because effect size measures the difference between those who participated in the training and those who did not. DEI proponents say their training makes a difference; the research disagrees. Importantly, the effect size (minimal as it was) decreased as the academic rigour of the study increased (e.g., as the sample size became larger).18

In their 2022 meta-analysis, Divine and Ash uphold the findings of Paluck and others writing:

Our primary conclusion following our review of the recent literature echoes that of scholars who conducted reviews of the DT [Diversity Training] literature in the past. Despite multidisciplinary endorsement of the practice of DT, we are far from being able to derive clear and decisive conclusions about what fosters inclusivity and promotes diversity within organizations. Implementation of DT has clearly outpaced the available evidence that such programs are effective in achieving their goals.19

Contributing to the muted outcomes of DEI programs, the meta-analyses repeatedly observe that even when diversity-type training seems to produce a measurable, positive effect, that effect tends not be enduring. Negative stereotypes and prejudices that appear to decrease immediately following a DEI workshop typically re-emerge when evaluated a few weeks or months later.20

DEI does have an impact… but it’s not positive

While the “good” of DEI training remains elusive, the harms associated with such instruction are less equivocal.

DEI instruction has been shown to increase prejudice and activate bigotry among participants by bringing existing stereotypes to the top of their minds or by implanting new biases they had not previously held. Reviewing the related findings of past research, Dobbin and Kalev state: “Field and laboratory studies find that asking people to suppress stereotypes tends to reinforce them—making them more cognitively accessible to people.”21

For example, in a laboratory setting, a University of Toronto research team led by Lisa Legault (now at Clarkson University) determined that race-focused DEI campaigns that exert strong pressure on people to be non-prejudiced backfired, yielding heightened levels of bigotry.22

Similarly, for their landmark paper “Out of mind but back in sight: Stereotypes on the rebound,” the University of Aberdeen’s Neil Macrae and colleagues conducted experiments measuring the outcomes of DEI-type training that, like Legault et al., asked participants to reject prejudicial stereotypes. They confirmed that in trying to suppress bigotry, DEI-type training can activate it:

Indeed, this work suggests that when people attempt to suppress unwanted thoughts, these thoughts are likely to subsequently reappear with even greater insistence than if they had never been suppressed (i.e., a “rebound” effect). … The results provide strong support for the existence of this effect… stereotype suppressors [those told to suppress their bias] responded more pejoratively to a stereotyped target on a range of dependent measures.23

Simply put, numerous studies show that when DEI-type workshop leaders instruct participants to suppress their biases—be they existing or newly implanted—many will cling to them more tightly and mentally generate additional justifications for their presence.24

The language and practice of division: DEI’s inequitable treatment and impact

While DEI-type instruction can activate prejudice in individuals of any race, in its ability to produce feelings of isolation and demoralization, it has a singular effect on the majority population.25 In his article “Diversity-related training: What is it good for?” Columbia University sociologist and research fellow Musa al-Gharbi summarizes the findings on that phenomenon:

Diversity-related training programs often depict people from historically marginalized and disenfranchised groups as important and worthwhile, celebrating their heritage and culture, while criticizing the dominant culture as fundamentally depraved (racist, sexist, sadistic, etc.) … In short, there is a clear double-standard in many of these programs… The result is that many members from the dominant group walk away from the training believing that themselves, their culture, their perspectives and interests are not valued at the institution—certainly not as much as those of minority team members—reducing their morale and productivity. … The training also leads many to believe that they have to “walk on eggshells” when engaging with members of minority populations…. As a result, members of the dominant group become less likely to try to build relationships or collaborate with people from minority populations.26

Illustrating al-Gharbi’s point that DEI instruction can lead participants to perceive the majority population less sympathetically, researcher Erin Cooley at New York’s Colgate University and her team found that teaching students about white privilege, a core component of the DEI curriculum, does not make them feel more compassion toward poor people of colour but can “reduce sympathy [and] increase blame… for White people struggling with poverty.”27

To al-Gharbi’s point that such instruction hinders unity, a 2022 study from the University of Michigan analyzed online discussions and found that mention of white privilege made even previously “supportive whites” less supportive of racially progressive policies, less engaged in group discussions, and “led to less constructive responses from whites and non-whites.”28

While the Caucasian majority is typically the focus of contempt in DEI instruction, leaving them feeling isolated and demoralized, increasingly participants of Asian ethnicity are also being targeted. In achieving, on average, greater salary and educational outcomes than the majority population (as Matthew “DEI instruction has been shown to increase prejudice and activate bigotry among participants by bringing existing stereotypes to the top of their minds or by implanting new biases they had not previously held.” What DEI research concludes about diversity training Lau showed in his Reality Check),29 this community presents a problem to the major claim of DEI instruction that skin colour or ethnicity matters most for success.

The solution that some DEI advocates have adopted is to deny that Asians qualify as visible minorities. They claim that having outcomes similar to the majority population puts one in the majority population and excludes one from being a “person of colour.”30 Borrowing ideas from academic race studies,31 some DEI proponents have begun to refer to Asians as “white adjacent” (or near white) and have accused them of perpetuating “white supremacy.”32 On the extreme end, certain school boards in the United States have gone so far as to remove the category “Asian” from student profiles, lumping anyone of Asian ancestry into the “White” category.33

Beyond denying minority status to those of Asian ancestry, the current trend among DEI consultants and departments is to weight the scales against them (a move reminiscent of the institutional racism they faced in some Western countries during the 19th and early 20th century34). Nowhere has this been more obvious than in college admissions in the US. Striking evidence shows that, for the benefit of diversity and inclusion, Asian students are being excluded from some of America’s most elite universities.35

Specifically, submissions before the US Supreme Court disclosed that when applying to Harvard, the University of North Carolina, and other universities, students of Asian descent are required to hold entrance exam scores “450 points higher than black [students]… to have the same chance of admission.”36 Thus, out of a possible score of 1600 for combined math and verbal skills on the SAT, Asian students need to be nearly perfect.37

Such universities justify their unequal standards for admission by citing their commitment to a core notion of DEI instruction: “Diversity is our strength.” They note that without intervention, the proportion of Asian students would skyrocket leaving less room for other visible minorities. That is, there would be “diversity” but not the right type of diversity. Therefore, to achieve the right outcomes, criteria other than academic merit need to be implemented.38

In the US, these unequal standards have been successfully challenged. In summer of 2023, citing violations of America’s Fourteenth Amendment and federal civil rights law, the Supreme Court ruled that universities cannot discriminate by race when making admission decisions.39

Canada has no such legislation; in fact, our Charter of Rights and Freedoms40 and our human rights laws41 allow for discrimination against the majority population. This constitutional allowance has now resulted in employment postings that, in the name of DEI, explicitly promote reverse or “recycled racism.”42

Conclusion

While job candidates not categorized as a minority are increasingly prevented from applying for certain employment openings, the research shows that a reputation for promoting DEI can more generally affect job applications to an organization. Specifically, findings reveal that some Caucasian candidates perceive organizations that heavily promote messages of diversity and inclusion as potentially discriminatory work environments.43

DEI’s negative perception extends beyond potential job candidates. Two-thirds of human resource specialists—those in charge of overseeing DEI initiatives—report that diversity training does not have positive effects.44 Interestingly, both the research into DEI and the majority of those involved in such training have arrived at the same conclusion: when it comes to harmony and tolerance, DEI does not make things better, but it can make things worse.

==

It's time to start talking about DEI the same way we talk about homeopathy. It's fake, it's unscientific, it's not based on evidence, and not only doesn't work, it makes things worse.

In the case of DEI, this is not a bug, it's a feature.

Marx was frustrated that he could not get the proletariat to rise up against the bourgeoisie, because they were comfortable, especially with the free market producing inexpensive items of comfort.

DEI's objective isn't to unify, it's explicitly to divide, to agitate for "liberation," a violent revolution in which liberal secular society is torn down. Those designated "oppressed" are supposed to come out feeling paranoid and persecuted, and those designated "oppressors" are supposed to come out feeling guilty and shamed. Because then the expectation is they'll both work together to destroy society and replace it with a Maoist, Leninist "utopia." The kind that killed millions.

#David Millard Haskell#diversity equity and inclusion#diversity#equity#inclusion#DEI bureaucracy#DEI apparatchiks#antiracism#antiracism as religion#neoracism#pseudoscience#cultural homeopathy#religion is a mental illness

1 note

·

View note

Text

How can releasing equity in my home help me?

Releasing equity from your home offers a flexible and practical solution for enhancing your quality of life while retaining homeownership.

This approach enables you to access funds without selling your property, providing the means to pursue various improvements and endeavours. You can continue residing in your home, ensuring stability and familiarity.

Whether equity release is right for you will depend on several factors. If you would like to find out more, our Property team can put you in touch with a suitable advisor.

If you need independent legal advice on an equity release contract, contact us today:

2 notes

·

View notes

Text

Tapuwa Dangarembizi: An Inspiring Journey of a Sustainable Energy Advocate

Individuals like Tapuwa Dangarembizi are shining examples of hope and inspiration in a world that needs sustainable energy solutions immediately. Dangarembizi has dedicated his life to advocating for renewable resources, addressing climate change, and ensuring a brighter future for generations to come as a passionate advocate for sustainable energy. His journey illustrates the topic, Tapuwa Dangarembizi What is the importance of sustainable energy that everyone needs to understand?

Dangarembizi's Mission to Educate About Sustainable Energy

Dangarembizi devoted himself to a variety of sustainability initiatives after finishing his education. He passionately formed alliances with communities, championing the development of renewable energy modalities such as solar panels, reducing reliance on decreasing fossil fuel sources while increasing energy accessibility. Using a variety of methods, he spread knowledge about the numerous benefits of sustainable energy systems, organizing social gatherings and enlightening educational initiatives, which emphasizes its beneficial effects on the environment and the human experience.

The Importance of Renewable Energy: Reasons to Learn About and Support Sustainable Energy

The journey of Tapuwa Dangarembizi sheds light on the significance of renewable energy sources in the context of addressing the most urgent problems facing the world today. A few of the most important reasons why everyone should learn about and support sustainable energy are as follows:

Climate Change Mitigation: Electricity generation facilities that burn fossil fuels to create electricity are an important factor contributing to global warming because of the greenhouse gases they release. On the other hand, renewable energy sources like solar, wind, and hydropower give us lesser carbon footprints and have the upside of helping to make serious progress toward achieving the reduction of global emissions.

Energy Access and Equity: Energy access for underprivileged communities around the world can be significantly enhanced by adopting sustainable energy solutions. By bridging the energy gap, it provides people everywhere with access to affordable, reliable electricity and gives them authority over their own energy futures. Creating a sustainable and fair energy future for the world requires prioritizing renewable resources.

Energy Security: When countries find themselves dependent on a limited supply of fossil fuels, their energy security is threatened because they are more vulnerable to market fluctuations and political unrest. Countries can seek to accomplish and strengthen their energy security by diversifying their energy portfolios and reducing their reliance on imported fossil fuels by adopting the use of renewable energy sources.

Environmental Preservation: The future of our planet's environment is at stake. The air we breathe and the water we drink are tainted by conventional energy sources. Once lush forests are collapsing before our very eyes. Sustainable energy, on the other hand, shines like a light by protecting ecosystems, contributing to biodiversity, and keeping our planet habitable for future generations to inherit.

Wrapping up!

In pursuit of sustainable energy solutions, Tapuwa Dangarembizi's journey illustrate the ability of individuals to effect change. By understanding and supporting sustainable energy, we can all work toward a greener, more sustainable future. It is a moral responsibility to support renewable energy sources, encourage energy conservation, and lobby for policies and following Leading the Way to a Green Horizon - Tapuwa Dangarembizi's Sustainable Energy Breakthroughs that will accelerate the transition of economies around the world to ones that are powered by clean energy.

#Environmental#Security#Mitigation#Tapuwa Dangarembizi#Sustainable Energy#Advocate#Inspiring#communities#environment#addressing

6 notes

·

View notes

Text

Taking the Pain out of High Net Worth mortgages for U.S. Real Estate, without AUM requirements

With inexpensive funding and various tax advantages, everyone should take advantage of the benefits of a mortgage when investing in U.S. real estate regardless of the loan size. However, why do the wealthy often find it increasingly difficult to obtain mortgage financing without AUM?

With a portfolio of assets worth millions of dollars, one may assume that securing credit would be a straightforward task for a high net worth (HNW) individual. Unfortunately, the reality can be quite different especially if you’re a foreign national or U.S. Expat.

The unique nature of a HNW’s wealth – their income, investments, and liquidity – puts this group of people at a surprisingly high risk of being turned away by conventional banks unless they are willing to deposit a significant amount of funds for the bank to manage. This is certainly true in the mortgage market, and what’s more, it is an issue that has become more prevalent post-Covid.

American Mortgages has a dedicated HNW Team that focuses on mortgage solutions for foreign nationals and U.S. expatriate clients.

“As a company, our focus is finding solutions that go beyond what Private Banks can offer was the cornerstone of why this has been so successful. Our goal is to be a viable solutions provider and a trusted partner for the private banks and their clients. None of our loans require AUM, hence there are no funds taken away from their current investments or portfolio.” – Robert Chadwick, co-founder of Global Mortgage Group and America Mortgages.

America Mortgages HNW mortgage loans have a multitude of options when it comes to qualifying for a large mortgage loans regardless of the passport you hold.

Asset Depletion – a surprisingly simple way to establish your income. AM Liquid Portfolio uses a unique view on “asset depletion” to qualify HNW clients using their investment portfolio without an encumbrance or pledge of assets. Essentially, all of your assets are entered into a calculation, and a final number is churned out. The final number is then used as the income to qualify. In most cases, as long as the income is sufficient, no other person’s income documentation is required. This makes an often complicated and tedious process simple, transparent, and painless.

Debt Service Coverage – When it comes to HNW borrowers, one of the most overlooked and misunderstood loan programs is debt service coverage. HNW borrowers tend to own multiple properties in various asset classes. If the property is used as a rental, then there may not be any requirement to go through the tedious process of providing and verifying personal income. Again, as HNW borrowers tend to have very complicated tax returns, this is a straightforward way to show the borrower’s debt serviceability.

Debt service coverage ratio– or DSCR – is a metric that measures the borrower’s ability to service or repay the annual debt service compared to the amount of net operating income (NOI) the property generates. DSCR indicates whether a property is generating enough income to pay the mortgage. For real estate investors, lenders use the debt service coverage ratio as a measurement to determine the maximum loan amount.

Bridge/Asset Based Lending – With Covid still in play, it’s not uncommon for investors to experience a temporary liquidity event. Rather than selling their property, they are using their real estate to release equity. Asset-based lending is an option for both residential (non-owner-occupied) and commercial properties.

Simply stated, HNW bridge loans are used for residential and commercial investment property when more traditional institutional financing sources may not be available. Due to temporary liquidity, many borrowers have capital needs that traditional sources often can’t meet. For example, a borrower purchases property out of bankruptcy or foreclosure and needs to close quickly “same as cash” before long term financing can be arrange.

Simplified Income – HNW borrowers often have personal and business tax returns, which are complicated. The complexity of these returns often turns into an administrative nightmare for the borrower when dealing with a mortgage lender. What makes America Mortgages unique is the fact that 100% of our clients are living and working outside of the U.S. We are dealing with HNW clients from Shanghai to Sydney. Simply put, translations and understanding tax codes, deductions, net income, etc., is painful.

America Mortgages HNW Simplified Income documentation is just that. We do not require years or, in some cases, decades of tax returns, P&L, A&L, bank statements, etc. We take an often complicated process and simplify it; 1. If you’re self-employed, we will request a letter from your accountant stating the last two years’ income and current YTD. 2. If you’re employed, then a letter from your employer on company letterhead stating your last two years’ income and current YTD is sufficient. Yes, it’s that simple and painless.

As 100% of our clients are either Foreign Nationals or U.S. Expats, we understand the intricacies and complexities of this type of lending for our borrowers. It’s as simple as that. Our HNW loan programs are structured to meet our client’s requirements. Providing competitive pricing with the assurance that your loan will close is our only focus, and no one does it better.

For more information, Visit: https://usbridgeloans.com/taking-the-pain-out-of-high-net-worth-mortgages-for-u-s-real-estate-without-aum-requirements/

4 notes

·

View notes

Text

Practice of Sustainability in Clinical Trials

Climate change has become a joke ian the post pandemic world, especially inside Clinical Research Organization. Being the epicentre for care delivery, CROs need to be more sensitive about the climate change than before. But sustainability research reveals the very opposite.

Did you know that the healthcare industry is responsible for a significant portion of global carbon emissions? According to the Intergovernmental Panel on Climate Change (IPCC), healthcare accounts for approximately 4.4% of all emissions worldwide. One healthcare sector that has come under particular scrutiny is the pharmaceutical industry, which is responsible for generating a significant amount of waste, including clinicaltrial and pharmaceutical’s industrial waste. Adding to this list is improper disposal of hazardous waste. This leads to severe environmental consequences, demanding the need for sustainable practices in the healthcare industry.

But, few healthcare leaders believe that this narrative should be changed. They are riding the wheels of change by adhering to sustainable practices. From reducing energy consumption in healthcare facilities to properly managing hazardous waste, care professionals are taking action to mitigate their impact on the environment.

So how are healthcare professionals managing growth and development while also implementing sustainable practices?

Join us as we explore the world of sustainability in healthcare and clinical trials. We'll take a deep dive into the various measures and practices that are being implemented to promote a more sustainable future for the healthcare industry.

Health Equity: Inclusion of Clinical Trial Diversity Clinical trials, at its fundamental core, is about enhancing care delivery, across all geographies, especially inclusion of underrepresented communities. This makes it highly significant that CROs need to ensure that any clinical trial has equal participation from patients of all communities. This not helps to study a particular ailment and its impact across various geographies but also helps to facilitate a solution for any health disorder that may impact differently to different communities.

For instance, if a clinical trial that aims at drug discovery for a communicable disease, only includes white or black; European or Asian community and is not inclusive of all the communities, scientists may end up investing large chunk of investment solving only one portion of the problem. But, today, communities are not defined by geography. In the globalized world, communities are intertwined but on the genetic front, a treatment for population of white hierarchy may not be suitable for Asian or African community.

This leads to the necessity of inclusion of clinical trials for all racial and ethnic population.

Fortunately, there are several steps implemented in this direction by FDA, USA.Few are listed below:

In 2019, the FDA issued draft guidance aimed at improving the diversity of participants in clinical trials. This guidance was finalized in November 2020.

In 2018, the MRCT Center Diversity Workgroup was formed by Brigham and Women's Hospital and Harvard, which published a guidance document in 2020 and a toolkit in early 2021. Additionally, the Pharmaceutical Research and Manufacturers of America (PhRMA) and its member companies released industry-wide principles on clinical trial diversity in November 2020, which took effect in April 2021.

In 2020, the American Medical Association partnered with the All of Us program to gain better insights into disease prevention and treatment.

Finally, the National Academies of Sciences, Engineering, and Medicine published a report titled "Strategies for ensuring diversity, inclusion, and meaningful participation in clinical trials."

Carbon Footprint: A Major Climate Crisis

Clinical trials are an essential part of drug development and are crucial to ensuring the safety and efficacy of new drugs before they are made available to the public. However, there has been a growing awareness of the need to incorporate sustainability practices in clinical trials to reduce their environmental impact. According to a study published in the Journal of Cleaner Production, the carbon footprint of clinical trials in the United Kingdom alone was estimated to be 179,000 tonnes of CO2e per year, which is equivalent to the annual emissions of over 37,000 cars. This highlights the significant environmental impact of clinical trials and the need to reduce their carbon footprint.

The study also found that the most significant contributor to the carbon footprint of clinical trials was related to patient travel, accounting for 68% of the total emissions. This suggests that reducing patient travel through the use of virtual trial methods and patient-centric trial designs could significantly reduce the carbon footprint of clinical trials.

Decentralized Monitoring: A 360° Solution to Climate Crisis

In response to suggestive trial design, the practice of sustainability in clinical trials has emerged. This involves taking into consideration the social, economic, and environmental impact of clinical trials, including reducing energy and resource consumption during the trial process and minimizing the amount of waste generated. By doing so, the drug development process can become more sustainable and contribute to the overall goal of achieving a more sustainable healthcare system.

Additionally, studies have shown that, decentralized monitoring methods are becoming increasingly popular in clinical trials, as they offer several advantages over traditional site-based monitoring. Decentralized monitoring involves using remote technologies to monitor trial activities, rather than relying on physical site visits.

Some benefits of decentralized monitoring include:

Reduced Travel-related Emissions: Since decentralized monitoring does not require physical site visits, there is a significant reduction in travel-related emissions. This can help inminimizing the carbon footprint of a clinical trial and reduce its environmental impact.

Increased Efficiency: This practicecan be more efficient than traditional monitoring methods, as it allows for real-time data analysis and monitoring. This means that any issues or discrepancies can be identified and addressed quickly, reducing the risk of delays or errors.

Cost Savings: Budget is a primary concern when dealing with clinical trial. Decentralized monitoring solves it by beingless expensive than traditional monitoring methods, as it eliminates the need for travel and on-site monitoring resources. This can help to reduce the overall cost of a clinical trial, making it more accessible and affordable.

Improved Patient Experience: Decentralized monitoring can help to improve the patient experience, as it reduces the need for patients to travel to trial sites for monitoring visits. This can help to minimize the burden on patients and improve overall patient satisfaction.

Overall, decentralized monitoring methods offer several benefits for clinical trials, including reduced travel-related emissions, increased efficiency, cost savings, and improved patient experience. Incorporating these methods into clinical trial design can help to promote sustainability and reduce the environmental impact of clinical research.

Furthermore, the disposal of clinical trial waste can also have a significant environmental impact. By implementing waste reduction and recycling programs, the amount of waste generated by clinical trials can be minimized. This can include the recycling of packaging materials, reducing the use of disposable items, and implementing appropriate disposal methods for hazardous waste.

Are Global Laws pro-sustainability? Check it out!

Sustainability is the only solution. But, should not be only reserved up to speeches in global forums and international summits. To take that first leap, government and legal institutions have legislated various laws for public and private CRO. Implementing These laws and acts aim to promote sustainable practices and ensure that healthcare facilities and services are accessible to all.

Hospital Survey and Construction Act, also known as the Hill-Burton Act, a federal law, enacted in 1946, provides funding for the construction and modernization of hospitals and other healthcare facilities, with the goal of making healthcare services accessible to all individuals. As part of the act, healthcare facilities are required to provide a reasonable amount of free or reduced-cost healthcare services to those who cannot afford to pay.

Hill-Burton Act also requires healthcare facilities to prioritize the use of energy-efficient technologies and sustainable building materials in their construction and renovation projects. This not only reduces the environmental impact of healthcare facilities but also leads to long-term cost savings through reduced energy consumption and maintenance costs.

The Environmental Protection Agency's (EPA) Clean Air Actwas first passed in 1963 and later amended in 1990, aims to reduce air pollution and improve air quality. The Clean Air Act applies to all industries, including the pharmaceutical industry, and requires companies to adhere to strict emissions standards and implement pollution control measures.

In addition, the EPA also regulates the disposal of hazardous waste, including pharmaceutical waste generated by clinical trials. Pharmaceutical companies are required to follow strict guidelines for the disposal of hazardous waste, including the use of specialized disposal methods and the implementation of waste reduction and recycling programs.