#epf academy

Explore tagged Tumblr posts

Photo

OC Pride Challenge 2023 Week Two: LGBTQIA+ Tropes Day Eight: Cast Full Of Gay

Featuring the main cast of EPF Academy: *Agent A/Amelia (Top left, Lesbian, starts dating Evelyn in first season). *Agent V/Valeria (Top right, Ace/Aro). *Agent Z/Zachary (Second left, Bisexual). *Agent H/Harper (Second right, pansexual). *Agent K/Kai (Third left, Gay, starts dating Jonah in first season). *Agent R/Ryder (Third right, Demisexual Bisexual). *Agent S/Skylar (Fourth left, Transgender Lesbian, starts dating Kaitlyn in first season). *Evelyn (Fourth right, Lesbian, starts dating Amelia in first season). *Jonah (Bottom left, Gay, starts dating Kai in first season). *Kaitlyn (Bottom right, Lesbian, starts dating Skylar in first season),

#opc2023#oc pride challenge 2023#oc pride challenge#epf academy#(too many characters to tag#but uh trying to do aesthetics for penguin ocs was a challenge#given im used to humanoid ones#but here we go)

4 notes

·

View notes

Text

Employment law in India - Employee Provident Fund (EPF) and Social Security

Employee Provident Fund (EPF) and Social Security: Safeguarding Workers' Future The Employees’ Provident Funds and Miscellaneous Provisions Act, of 1952, is a cornerstone of India’s social security framework. It ensures financial security for employees by mandating contributions towards provident funds, pensions, and insurance benefits. The Act covers a wide range of employment sectors and provides a safety net for employees and their families, especially in times of need.

Key Features of the EPF Act

Provident Fund (PF): Employers and employees contribute equally to the Provident Fund. The accumulated amount and interest are payable to the employee upon retirement, resignation, or specified contingencies.

Employee Pension Scheme (EPS): A portion of the employer’s contribution is directed toward the pension scheme. Provides monthly pension to employees upon retirement or to their dependents in the event of the employee’s demise.

Employee Deposit Linked Insurance Scheme (EDLI): Provides a lump-sum insurance benefit to the nominee in case of the employee’s death during the service period. The benefit amount is linked to the employee’s last drawn salary.

Applicability: The Act applies to establishments employing 20 or more persons. Covers employees earning up to a specified wage ceiling, though voluntary coverage is available for higher earners. Objectives of the Act

To ensure financial independence and stability for employees post-retirement.

To provide a safety net for employees’ families in unforeseen circumstances.

To promote a culture of savings and long-term financial planning among workers. Landmark Judgments on EPF and Social Security

Regional Provident Fund Commissioner v. Sri Krishna Manufacturing Co. (1962) The Supreme Court held that the EPF Act is a beneficial legislation aimed at securing the welfare of employees. The Court emphasized that its provisions must be interpreted liberally to fulfill its objectives.

Manipal Academy of Higher Education v. Provident Fund Commissioner (2008) This case clarified the definition of "basic wages" to calculate EPF contributions. The Court ruled that allowances forming part of the regular wages must be included in the calculation, ensuring fair contributions.

Surya Roshni Ltd. v. Employees Provident Fund (2019) The Supreme Court reiterated that special allowances paid to employees must be included as part of "basic wages" for EPF contribution purposes, ensuring transparency and fair practices.

M/S Himachal Pradesh State Forest Corporation v. Regional Provident Fund Commissioner (2008) The Court highlighted that even contract workers engaged through intermediaries are entitled to EPF benefits, underscoring the Act’s inclusive nature. Challenges in Implementation

Compliance Gaps: Many small and medium enterprises struggle to comply with the Act due to administrative or financial constraints.

Informal Sector Exclusion: Much of India’s workforce is informal, limiting the Act’s reach.

Lack of Awareness: Employees often lack understanding of their entitlements under the EPF scheme.

Delay in Claims: Procedural delays can hinder timely access to benefits. The Way Forward

Expanding Coverage: Extending the applicability of the EPF Act to include informal sector workers and smaller establishments.

Streamlining Processes: Simplifying claim procedures through digitization and automation.

Awareness Campaigns: Educating employees and employers about the benefits and obligations under the Act.

Strengthened Enforcement: Enhancing monitoring mechanisms to ensure compliance and address grievances efficiently. Conclusion The Employees’ Provident Funds and Miscellaneous Provisions Act, of 1952, plays a pivotal role in India’s social security landscape. By providing financial security through provident funds, pensions, and insurance benefits, the Act safeguards employees and their families against uncertainties. While significant progress has been made, addressing implementation challenges and expanding its coverage can further strengthen its impact, ensuring a secure and dignified future for India’s workforce

#employment lawyer in india#employment lawyers#labour lawyers#labor lawyers#employment lawyer#employment lawyers in india

0 notes

Text

Tally ERP 9 Course Near Me in Mohali: Your Guide to the Best Institutes

If you are searching for the best Tally ERP 9 course near me in Mohali, you're on the right path to advancing your career in accounting and financial management. Tally ERP 9 is one of the most widely used accounting software programs in India, designed to meet the growing needs of small and medium businesses (SMEs). It is used to manage accounting, inventory, payroll, GST, taxation, and more.

In this blog, we’ll explore why learning Tally ERP 9 is essential, what to expect from a comprehensive course, and the best training institutes in Mohali where you can master this software.

Why Learn Tally ERP 9?

Tally ERP 9 is an essential tool for professionals in finance and accounting. Here are some of the key reasons to learn Tally ERP 9:

Complete Business Solution: It covers multiple aspects of business management including accounting, inventory, payroll, and taxation.

GST Compliance: Tally ERP 9 is widely used for GST calculations, filing, and compliance, making it an important tool for businesses.

Career Growth: Mastering Tally ERP 9 opens up job opportunities in accounting, finance, and taxation across industries.

User-Friendly Interface: It’s easy to learn and use, which makes it a preferred choice for small and medium enterprises.

Wide Industry Usage: Tally is used across various sectors like retail, manufacturing, services, and education.

What to Expect in a Tally ERP 9 Course?

Before enrolling in a Tally ERP 9 course near you in Mohali, ensure that the curriculum is comprehensive, covering both basic and advanced features. A complete Tally ERP 9 course will typically include the following topics:

1. Introduction to Tally ERP 9

Overview of Tally ERP 9 software

Installation and licensing process

Tally interface and navigation

Creating and managing companies in Tally

2. Accounting with Tally

Recording transactions

Ledger creation and management

Creating and managing vouchers (Payment, Receipt, Sales, Purchase, etc.)

Preparing trial balance, profit & loss account, and balance sheet

3. Inventory Management

Stock item creation

Managing stock categories and stock groups

Recording inventory transactions

Inventory reports and valuation

4. Taxation in Tally ERP 9

GST setup in Tally ERP 9

Creating GST-compliant invoices

Filing GSTR-1 and GSTR-3B

TDS and TCS management

5. Payroll Management

Employee creation and payroll setup

Salary, allowances, and deductions configuration

Generating payslips and payroll reports

EPF and ESI compliance

6. Advanced Tally Features

Cost centers and cost categories

Multi-currency management

Budgets and scenario management

Audit and security controls

7. GST in Tally ERP 9

GST registration process

GST calculation and reporting

Input tax credit management

Creating GST returns in Tally

8. Job Placement Assistance

Resume building

Interview preparation

Job placement support

Top Tally ERP 9 Institutes Near You in Mohali

Here are the top-rated Tally ERP 9 training institutes in Mohali that offer comprehensive courses for students and professionals:

1. Mohali Career Point (MCP)

Mohali Career Point is a leading institute offering a complete Tally ERP 9 with GST course. Their curriculum is designed for beginners and professionals, ensuring you get a deep understanding of all features of Tally ERP 9.

Course Highlights:Complete Tally ERP 9 with GST training

Practical sessions on taxation, payroll, and inventory

Real-world projects and case studies

Certification upon course completion

Job placement assistance

Mode: Classroom and online

Duration: 2-3 months

Certification: Tally ERP 9 with GST certification

Contact: +91 7696 2050 51

2. Tally Academy Mohali

Tally Academy Mohali provides specialized training in Tally ERP 9 with a focus on real-world application. This institute is known for its industry-relevant training modules and experienced faculty.

Course Details:Hands-on training in Tally ERP 9

GST integration and compliance

Payroll and inventory management

Certification and job assistance

Mode: Online and offline

Contact: +91 9876 5432 10

3. ABC Institute of Technology

ABC Institute of Technology offers a well-structured Tally ERP 9 course that covers all aspects of accounting, taxation, and payroll. This institute is ideal for working professionals who need flexible class timings.

Course Overview:Tally basics and advanced features

GST compliance and reporting

Financial statements preparation

Job assistance and certification

Mode: Classroom and virtual classes

Contact: +91 8765 4321 09

4. Tally Pro Academy

Tally Pro Academy focuses exclusively on Tally ERP 9 and related accounting software. Their Tally ERP 9 course is comprehensive, covering all the critical features required to manage a business effectively.

Course Features:Complete training in Tally ERP 9

GST, TDS, and payroll management

Practical learning with real-world case studies

Certification and placement support

Mode: Online and offline classes

Contact: +91 9987 6543 21

Benefits of Learning Tally ERP 9 in Mohali

Affordable Fees: Compared to larger cities, Tally ERP 9 courses in Mohali offer high-quality training at lower costs.

Expert Trainers: Mohali has several top-notch institutes with trainers who are industry experts in accounting and finance.

Job Opportunities: The growing business environment in Mohali provides ample job opportunities for individuals skilled in Tally ERP 9.

Practical Learning: The institutes in Mohali focus on hands-on learning through real-life projects and case studies, ensuring you gain practical experience.

Career Opportunities After Tally ERP 9 Training

After completing a Tally ERP 9 course, you can explore a variety of career paths, including:

Accounts Executive

Accountant

Senior Accountant

Finance Executive

Tally Operator

GST Practitioner

Payroll Executive

With the growing need for financial management and compliance, Tally ERP 9 professionals are in demand across industries.

0 notes

Note

Okay, stupid challenge time; LIST THE DUMBEST headcannons you have for any characters in any of your fandoms (i.e; Hatchetverse/starkid, Club penguin, goosebumps, etc)

Thank you anon for this delightful challenge.

-There is a Hatchetfield timeline in which Ziggs's plan to get a bunch of dogs to chase away the weed birds actually happened. In this timeline, every dog in hatchetfield has telekinetic powers, but as Ziggs suspected, they are surprisingly chill. The worst they've done is get dog treats off the counter using their new abilities.

-Blinky and Bill Cipher from Gravity Falls once fistfought eachother while invading the subconscious of a human. There can be only one sadistic people-watching god with a B name in this mindscape.

-Those who possess the gift are subject to many dangers, we know that well.... but also, some forms of the gift make for a really authentic cosplay. There's a subsection of those with the gift who would much rather dress as their favorite superhero than fight as rich people watch.

-In Goosebumps, a curse is automatically placed upon everyone between the ages of ten and thirteen. This curse makes you 98% more likely to encounter a supernatural entity than at any other age.

-Furthermore; kids who do not experience the supernatural (or don't have a friend/relative/neighbor who did) are the supernatural entity. Looking at you, Hannah.

-In the movie universe, Curly and Slappy have a rivarly, due to both being Goosebumps mascots. Slappy doesn't actually care much about the rivalry, he just uses it as an excuse to cause mischief. Curly, on the other hand, will never forgive Slappy for replacing him, or for his constant "ribbing." Get it because- because he's a- he's a sk- he's a skele-

-The Sugar Bowl from A Series Of Unfortunate Events doesn't contain sugar, or a medusoid mycelium cure, or VFD secrets, or anything else that people have theorized. What it actually contains is that rootbeer float Lemony was looking for during All The Wrong Questions.

-The kids who attended Prufrock Preparatory school brag about how they met "the Baudelaire murderers." The stories they've told get more and more far fetched as time goes on, and the stories get passed down each year. Ten years from The Austere Academy, kids are talking about how Sunny Baudelaire once ate the gym coach's leg in front of the entire school. It's an awful, elongated game of telephone that will continue in Prufrock until the school inevitably gets shut down for its unethical rules.

-Herbert P. Bear from Club Penguin is in terrible debt. Building elaborate lairs and then abandoning them really eats into your wallet. He has yet to pay his debts and most likely never will.

-In addition to the headcanon above, Herbert does not pay his taxes. Who's gonna stop him? The EPF? They can't even arrest him for his several other crimes.

-Most disputes on the island are settled by dance battle. Disagreement about the property line between igloos? Dance battle. Divorce settlement? Dance battle. Tax evasion? Well, typically that's handled in the courts since it's not really a dispute, but since I know Herbert would absolutely hate it, we're settling it with a dance battle!

-If you cuss in the Club Penguin universe you instantly vanish from reality. All that's left behind is a giant floating orange sign that says "oops! You said a bad word! Your life account is now banned for: forever." That's why the alternative "grub" was cultivated, so penguins wouldn't have to worry about the hellish floating sign of doom.

So yep, those are some of my sillier headcanons. Enjoy!

#ask#challenge#headcanons#silly headcanons#hatchetfield#starkid#goosebumps#club penguin#a series of unfortunate events#asoue#nightmare time 2 spoilers#a series of unfortunate events spoilers

34 notes

·

View notes

Text

FOMA 45: International Style, Structure and Space

Guillermo Dürig selected five projects for this month’s FOMA. Cases are part of the International Style in North America and Europe, which share modernist principles of volume, regularity and flexibility. Their large-scale structures offer various solutions for public programs creating new spatial typologies and constructive synergies while transcending the classic disciplines of architecture and engineering with specific and unique solutions.

Morphological implementation of the large - scale structure in the context of the city. | Collage MvdR office, © MoMA, New York, scanned from: Phyllis Lambert, Mies van der Rohe in America, Montréal and New York 2001, p. 462.

The two-tone aluminium panels make the structure of the Chicago Convention Hall Project. | Model MvdR office, © MoMA, New York, scanned from: Phyllis Lambert, Mies van der Rohe in America, p. 473.

The entire hall of the Chicago Convention Hall Project rests on the peripheral pillars. | Drawing MvdR office, © MoMA, New York, scanned from: Phyllis Lambert, Mies van der Rohe in America, p. 467.

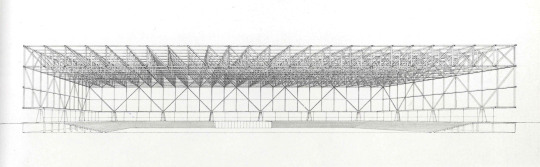

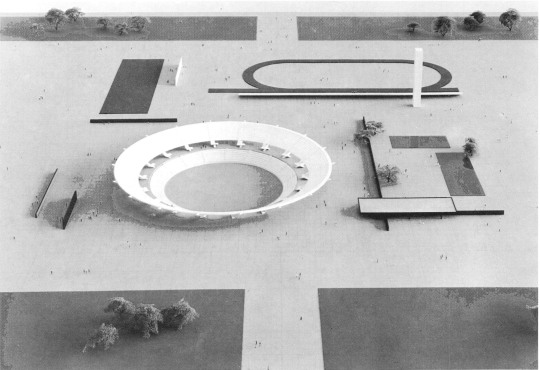

Mies van der Rohe created his Chicago Convention Hall Project (1953-54) in which the clear-span roof shelter of 219,45x219,45 m creates a polyvalent hall defining a universal space able to host 50’000 seated people and a sports arena or an exhibition space. The exposed structure is engineered as a non-hierarchical two-way truss system resting on punctual supports, aiming for greatest purity following Mies’ ideal: “Construction not only determines form but is form itself.” [1] The composition of the façade is directly derived from the trusses and cladded with different tonalities of insulated aluminium panels, making its constructive logic of the buildings main expression. The hall itself, as the largest of four buildings, sits in the centre of a plane field, flanked by smaller box-shaped volumes in a typical Miesian composition. There is no need for spatial or morphological mediation to the surrounding city as stated by Mies: “A Hall of this dimension doesn’t depend on its environment: it creates its environment.”[2]

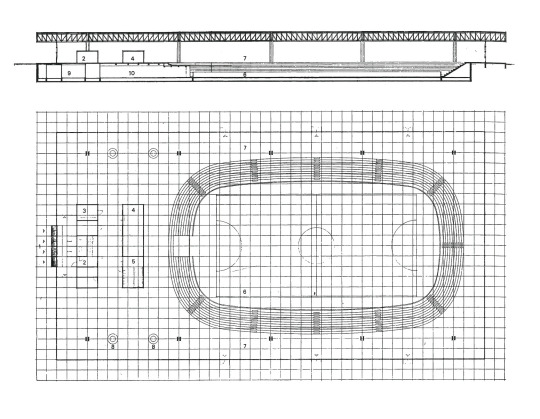

The second case is a student Master Thesis by Emmanuel Glyniadakis, entitled A sports centre (1964) under the supervision of Myron Goldsmith, Fazlur Kahn and Davis Sharpe. A minimal structure defines the space for an arena, a track with field area, a swimming pool and a flexible area for diverse sporting activities under an 810-foot-square (246,88x246,88 m) roof.

A minimalistic architecture shelters various functions. | Photo © Charles Reynolds, scanned from: Myron Goldsmith; Werner Blaser (Ed.), Buildings and Concepts, New York 1987, p. 153.

Functions as detached elements on a plane grid. | Photo © Charles Reynolds, scanned from: Werner Blaser (Ed.), Buildings and Concepts, p. 152.

Ground level with different sports arenas in the open space. | Plan © Emmanuel Glyniadakis, from: Werner Blaser (Ed.), Buildings and Concepts, p. 151.

The steel structure consists of a two-way grid with a height of 5,18 m and rests on nine pillars. While the grandstands in the convention hall are sunk into the ground, the project arranges the different elements like furniture objects on a plane field, creating a formal composition. A glazed wall along the roof’s periphery seamlessly shelters the program with the public space expanding as a continuous grid from the inside to the outside. The project’s architectural expression is characterised by the minimal and consequent expression of the structure and its programmatic infills.

Franz Füeg has created a grid based on the dimension of 1,68 m served as basis for the church’s strict modularity and final dimensions of 37,3m by 25,6m. The facade of the St. Pius Church in Meggen (Switzerland) consists of steel profiles, which don’t only hold the marble panels in place, but also support the main structure made out of filigree and custom-made trusses.

Overview over the church, the bell tower and adjacent buildings for the parish (left). | Photo: Archives de la construction moderne (ACM), EPF Lausanne, taken from: Kunst + Architektur in der Schweiz, 56, 2005, p. 56.

The 28mm thick Pantelikom marble from Athens filters the daylight and illuminates the space evenly. | Photo © Archives de la construction moderne (ACM), EPF Lausanne, from: Kunst + Architektur in der Schweiz, 2005, p. 57.

Diagonal wind bracings in the four corners stabilize the structure. The sloping topography of the site exposes a concrete base acting as a precise and sober volume for the lightweight church to sit on. The industrial use of steel as well as the project’s modularity bases on what Füeg had conceptually described as “start building a church as if it would be a factory.” [3]

The floor plan of the church and its repetitive grid. | Scanned from: Jürg Graser, Gefüllte Leere, Zürich 2014, p. 217.

The translucent marble panels shine outward during the night and light the hall subtly during daytime, creating a volume of light. The non-industrial trusses excluded, the constructive excellence, the rigorous execution of the details as well as the exposed structure are consciously derived from Mies’ idea of the symbiosis of architecture and construction.

A weightless roof hovering above a glass volume. | Photo © Arne Jacobsen, Royal Academy of Fine Arts Library, collection architectural drawings, scanned from: Carsten Thau, Kjeld Vindum, Arne Jacobsen, Copenhagen 2001, p.454.

The Sports hall for the City of Landskrona (Sweden) by Arne Jabcobsen consists of a rectangular roof of 52x92 m, a podium elevated 20 cm over the ground and a transparent glass wall in-between. In order to remove every vertical sensation and reinforce the horizontal character, the columns are shifted to the inside of the hall and split in two.

The ball field and the bleachers as depression in the plinth. | © Dissing + Weitling’s archives, from: Carsten Thau, Kjeld Vindum, Arne Jacobsen, p.457.

In order to remove every vertical sensation and reinforce the horizontal character, the columns are shifted to the inside of the hall and split in two. The structure and the technical installations are hidden above a suspended ceiling, turning the roof into an abstract apparatus, breaking with Mies’ ideology of the structure as the main space defining element. The focus shifts from the construction to the volume. [4]

Like furniture elements, two wooden boxes stand inside the open space. | © Arne Jacobsen, from: Carsten Thau, Kjeld Vindum, Arne Jacobsen, p.454.

A ball field with its bleachers is sunk into the podium, two wooden pavilions house ancillary rooms. The wardrobes as well as the technical areas are inside the podium. While the architectural language and spatial organization still roots in the International Style, a new facet emerges as the expression shifts to “[…] a dematerialized architecture, an architecture without gravity. The dream of a hovering plane” as described by Thau and Vindum.[5]

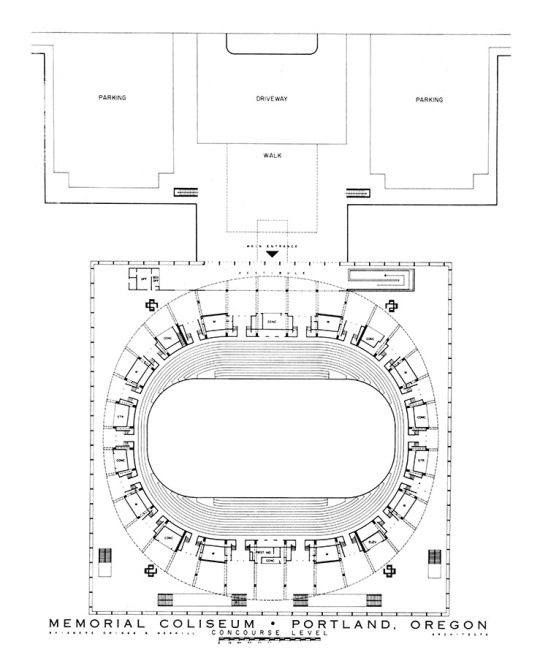

The freestanding, multifunctional concrete oval bowl of the The Memorial Coliseum’s sports arena is wrapped in a 360-foot-square (109,72x109,72m) box. The four reinforced concrete columns are shifted into the inside and are totally independent from the arenas’ structure as well as the façade, offering a clear height of 10,97m.

Filigree pavilion resting on an elevated plinth. | Photo © Julius Shulman, SOM

Cantilevered steel trusses are optimised in height and width according to the spans and hidden together with the technical ducts above a false ceiling following Jacobsen’s strategy of prioritising the space itself.

Circulation space between stadium and façade. | Photo © Art Hupy

While the spectators access the stadium from the parking lot through the glazed public area surrounding the oval, a plinth containing the restricted program is introduced.

Access level of the spectators. | Plan © SOM

Being surrounded by a new artificial embankment, the glass pavilion appears to hover over the terrain. Staff and athletes access it through precise incisions in the ascending slope. The minimal architectural expression is characterized by the conceptual tour de force between the abstractness of the shell and its sculptural content.

---

FOMA 45: Guillermo Dürig

Guillermo Dürig is a swiss architect based in Zurich. He graduated from the Swiss Federal Institute of Technology in Zurich (ETH) obtaining his diploma in 2013. After interning at Juan Navarro Baldeweg in Madrid in the years 2009-10, Guillermo joined Jean-Pierre Dürig’s practice in 2013 and becoming the head of DÜRIG AG in 2021. The main interest of the office lies in the development of radical and conceptual projects, as well as in the execution of public buildings and large-scale infrastructures. In 2015 Guillermo co-organized the summer school ‘MAU’ in Motovun (Croatia). From 2016-19 he worked as a teaching assistant at the chair of Marc Angélil at the ETH, being in charge of organization of the semester on Madrid and Porto. Additionally, he has been a guest critic at the ETH as well as at the ZHAW. His works have been featured and exhibited in various specialized media.

_

Notes:

Mies van der Rohe, lecture, Chicago occasion and date unknown, quoted after: Fritz Neumeyer, Mies van der Rohe on the Building Art. The Artless Word, Cambridge 1991, p. 325.

Mies van der Rohe, undated typescript, probably prior to 11 November 1953, quoted after Phyllis Lambert, Mies van der Rohe in America, Montréal and New York 2001, p. 463.

Franz Füeg, Gedanken zum Kirchenbau, in: Bauen + Wohnen, 1958, 11, pp. 294-296. Quote translated by the author

On this shift see: Carsten Thau, Kjeld Vindum, Arne Jacobsen, Copenhagen 2001, p. 456.

Carsten Thau, Kjeld Vindum, Arne Jacobsen, p. 458.

Guillermo would like to thank Joshua Brägger and Philipp Krauer.

10 notes

·

View notes

Text

Minimum Area Required for CBSE School

To get the CBSE affiliation for any School, the government has set the minimum criteria to pass to get the CBSE affiliation. The minimum criteria include Recognition letter, NOC, Society/Trust, Affidavit, Infrastructure & Facility, Adequacy of Teaching staff, Salary & Allowances, Service condition, Essential safety certificates, School managing committee, Enrolment of students, EPF scheme, Reserve funds, Balance sheets, Franchisee schools, school website & the last which we dive deep into the blog that is land requirement, documents & certificates.

The new CBSE affiliation law released in Oct 2018, defines the land requirements for setting up a CBSE affiliated school in India.

The norms under the law specify the minimum requirements for setting up a Secondary school i.e. up to class X or a Senior Secondary School means up to class XII. The norms have also decided to run the number of the section under each class depends on the minimum available land.

Here is a table detailing the land requirements based on the location of the school, the type of affiliation allowed, and the number of sections that can be operated: (Source: Newton Schools).

S No

Location of School

Land Requirement / Campus Area

Affiliation Allowed

Optimum No. of Sections (From classes l/VI to X/XII)

1

Anywhere in India

Minimum of 6000

Up to Class-XII

38

2

Anywhere in India

8000 Square Meters

Up to Class-XII

48

3

Anywhere in India

>8000 Square Meters

Up to Class-XII

12 sections for every 2000 square meters

4

In Municipal limits of cities with a population exceeding 15 Lakhs

Minimum 4000 Square Meters

Up to Class-XII

28

5

In hilly areas prescribed by the Planning Commission (NITI Aayog)

Minimum 4000 Square Meters

Up to Class-XII

28

6

In Municipal Limits of the State Capital Cities

Minimum 4000 Square Meters

Up to Class-XII

28

7

In the North-Eastern States

Minimum 4000 Square Meters

Up to Class-XII

28

8

In the state of Jammu and Kashmir

Minimum 4000 Square Meters

Up to Class-XII

28

9

In Municipal Limits of Ghaziabad, NOIDA, Faridabad and Gurugram cities

Minimum 4000 Square Meters

Up to Class-XII

28

10

In the Municipal Limits of Panchkula and Mohali/SAS Nagar

Minimum 4000 Square Meters

Up to Class-XII

28

11

In the Municipal Limits Class-X cities (Ahmedabad, Bengaluru, Hyderabad, Pune) or on the Hill Stations (For Secondary Level)

Minimum 2000 Square Meters

Up to Class-X only

10

12

In the Municipal Limits Class-X cities (Ahmedabad, Bengaluru, Hyderabad, Pune) or on the Hill Stations (For Senior Secondary Level)

Minimum 3000 Square Meters

Up to Class-XII

24

13

In the Municipal Limits of Chennai, Delhi, Kolkata, and Mumbai Or the state of Arunachal Pradesh Or the state of Sikkim Or the Islands (For Secondary Level)

Minimum 1600 Square Meters

Up to Class-X only

10

14

In the Municipal Limits of Chennai, Delhi, Kolkata and Mumbai Or the state of Arunachal Pradesh Or the state of Sikkim Or the Islands (For Senior Secondary Level)

Minimum 2400 Square Meters

Up to Class-XII

24

15

In the Municipal Limits of Chennai, Delhi, Kolkata, and Mumbai Or the state of Arunachal Pradesh Or the state of Sikkim Or the Islands (For Senior Secondary Level)

3200 Square Meters

Up to Class-XII

28

* The total number of sections taken together for classes XI and XII should not be more than 1/3 of an optimum number of sections allowed on the basis of landholding for any school.

* The number of sections and students shall be restricted as per the actual facilities in the school.

* The approx number of students shall be 40 in each section. The availability of one square meter Built-up Floor Area per child in the classrooms is an absolute necessity in the school.

Smrti Academy is the best CBSE School located at Huskur, Bangalore close to Madduramma Temple covering a nearby area such as Sarjapur Road, Hosa Road, Ananth Nagar, Agrahara, and Dommasandra. Smrti Academy’s 3-acre campus has totally built-up area that is 120,000 sq. ft. more than the minimum land required for CBSE Affiliation.

The School is covering Foundation Stage, Preparatory Stage, and Middle Stage education, earlier known as Montessori, pre-primary & primary School respectively.

0 notes

Text

06th June 2020 Current affairs & Daily News Analysis

Sixth mass extinction may be one of the most serious environmental threats

The ongoing sixth mass extinction may be one of the most serious environmental threats to the persistence of civilisation, according to new research published in the journal Proceedings of the National Academy of Sciences of the United States of America (PNAS) About: Names: This ongoing extinction of species, which coincides with the present Holocene epoch is known as Holocene extinction, Sixth extinction or Anthropocene extinction. Background: In the history of Earth we’ve had five major extinction events in the history of life.The five mass extinctions that took place in the last 450 million years have led to the destruction of 70-95 % of the species of plants, animals and microorganisms that existed earlier. The most recent was about 65 million years ago when an asteroid crashed into the Yucatán and took out the dinosaurs, changing the climate dramatically. Important Info : Sixth extinction vs earlier five extinctions This ongoing extinction of species is a result of human activity. Earlier extinctions were caused by “catastrophic alterations” to the environment, such as massive volcanic eruptions, depletion of oceanic oxygen or collision with an asteroid.The current rate of extinction of species is estimated at 100 to 1,000 times higher than natural background rates.This large number of extinctions spans numerous families of plants and animals, including mammals, birds, amphibians, reptiles and arthropods. Source : Indian Express (Environment) Best UPSC Civil Services Current affairs The Times Higher Education (THE) Asia University Ranking for 2020 was launched recently

About: Times Higher Education (THE) is a weekly magazine based in London, reporting specifically on news and issues related to higher education. The Times Higher Education (THE) Asia University Rankings 2020 use the same 13 performance indicators as the THE World University Rankings. The universities are judged in four core areas: (1) Teaching, (2) Research, (3) Knowledge Transfer and (4) International Outlook. Key Findings: China is home to the continent’s top two universities for the first time this year, as Tsinghua University is ranked 1 and Peking University is ranked 2. With eight institutes in the top 100, India is the third most represented country in the Ranking. The Indian Institute of Science (IISc) Bangalore retains its top position in the country by attaining the 36th spot globally. Eight Indian Institutes of Technology (IITs) have also been featured in the top 100. Source : Indian Express (Education) Best UPSC Civil Services Current affairs At the virtual UK-hosted Global Vaccine Summit 2020, Prime Minister Narendra Modi announced that India will contribute $15 million to an international vaccine alliance, GAVI

GAVI GAVI, officially Gavi, the Vaccine Alliance, is a public–private global health partnership with the goal of increasing access to immunisation in poor countries. GAVI has observer status at the World Health Assembly. It was founded in 2000 and is located at Geneva, Switzerland. The Vaccine Alliance brings together developing country and donor governments, the World Health Organization, UNICEF, the World Bank, the vaccine industry, technical agencies, civil society, the Bill & Melinda Gates Foundation and other private sector partners. Important Info : Global Vaccine Summit 2020 London At the summit, GAVI launched the ‘Gavi Advance Market Commitment for COVID-19 Vaccines (Gavi Covax AMC)’, a new financing instrument aimed at incentivising vaccine manufacturers to produce sufficient quantities of eventual COVID-19 vaccines, and to ensure access for developing countries.The Gavi Covax AMC is being launched with an initial goal of raising US$ 2 billion. Source : Times of India (International Relations) Best UPSC Civil Services Current affairs The Ministry of Statistics and Programme Implementation released the latest Periodic Labour Force Survey (PLFS). The survey was conducted during July 2018-June 2019

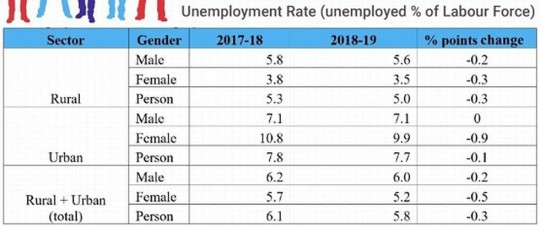

Key Findings: India’s unemployment rate improved from the 45-year high of 6.1% in 2017-18 to 5.8% in 2018-19. Women’s unemployment fell from 5.7% to 5.2%, while male unemployment only fell from 6.2% to 6%. Urban unemployment was still at a high of 7.7% in 2018-19, a marginal drop from 7.8% in 2017-18, while rural unemployment fell from 5.3% to 5%. The Labour Force Participation Rate (LFPR) also improved marginally, from 36.9% in 2017-18 to 37.5% in 2018-19. Unemployment rate, however, rose among Scheduled Castes to 6.4 % from 6.3 %, and for Scheduled Tribes to 4.5 % from 4.3 %. But unemployment rate among Other Backward Classes inched lower to 5.9 % from 6 %. In 2018-19, unemployment rate for youth in the 15-29 years age bracket was 17.3 %, as against 17.8 % a year ago. Unemployment rate among urban youth was higher than the all-India number at 20.2 % as against 20.6 % a year ago. Important Info : Labour Force Participation Rate (LFPR) is defined as the percentage of persons in labour force (i.e. working or seeking or available for work) in the population.Worker Population Ratio (WPR) is defined as the percentage of employed persons in the population.Unemployment Rate (UR) is defined as the percentage of persons unemployed among the persons in the labour force. Source : Indian Express (Economy) Best UPSC Civil Services Current affairs Retirement fund body, Employees' Provident Fund Organisation (EPFO) said it has released Rs 868 crore pension along with Rs 105 crore arrear on account of restoration of commuted value of pension

About: The government, had, in February this year notified the restoration of full pension after 15 years of retirement for pensioners who have commuted part of their pension at the time of retirement. This has resulted in a substantial increase in pension for those EPFO pensioners who retired before September, 26, 2008 and had opted for partial commutation of pension. Commutation of pension will cost the government Rs 1500 crore. The higher pension benefit will be restored after 15 years from the date of receiving commuted pension at the time of retirement. This means an individual who retired on April 1, 2005, would be eligible to receive the benefit of higher pension after 15 years i.e. from April 1, 2020. Important Info : As per Employees' Pension Scheme (EPS) rules, an EPFO member who retired before September 26, 2008 could get maximum one-third of pension as lump-sum i.e. commuted pension and remaining two-thirds was paid as monthly pension to an employee for his/her lifetime. As per current EPF rules, EPFO members do not have an option to receive the commutation benefit.EPFO is an organisation under labour ministry that administers EPF and EPS schemes. Source : Economic Times (Economy) Best UPSC Civil Services Current affairs Union Electronics and IT Minister announced three schemes, with a ₹48,000-crore outlay, for setting up of large number of electronic and mobile manufacturing units in the country

Production Linked Incentive Scheme (PLI) for Large Scale Electronics Manufacturing (outlay of nearly ₹41,000 crore) The PLI Scheme shall extend an incentive of 4% to 6% on incremental sales (over base year) of goods manufactured in India and covered under the target segments, to eligible companies, for a period of five years subsequent to the base year. Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS) (outlay of about ₹3,300 crore) The SPECS shall provide financial incentive of 25% on capital expenditure for the identified list of electronic goods, i.e., electronic components, semiconductor/ display fabrication units, Assembly, Test, Marking and Packaging (ATMP) units, specialized sub-assemblies and capital goods for manufacture of aforesaid goods. Modified Electronics Manufacturing Clusters (EMC 2.0) Scheme (about ₹3,800 crore) The EMC 2.0 shall provide support for creation of world class infrastructure along with common facilities and amenities, including Ready Built Factory (RBF) sheds / Plug and Play facilities for attracting major global electronics manufacturers, along with their supply chains. Important Info : Benefits The Schemes will help offset the disability for domestic electronics manufacturing and hence, strengthen the electronics manufacturing ecosystem in the country.The three new schemes are expected to attract substantial investments, increase production of mobile phones and their parts to around 10 lakh crore by 2025. It will also generate around five lakh direct and 15 lakh indirect jobs. Do you know? According to Union Electronics Minister, India’s global share in electronics has risen form 1.3 % in 2012 to 3 % in 2018. India has become the second largest manufacturer of mobile phones in the world. From just two mobile manufacturing factories, the country has now 200 such units. Source : All India Radio (Economy) Best UPSC Civil Services Current affairs Russian President Vladimir Putin declared a state of emergency after 20,000 tonnes of diesel oil to spilled into Ambarnaya river, turning its surface crimson red

About: Ambarnaya is a shallow river in Siberia, Russia which flows in a northerly direction into Lake Pyasino. On leaving Lake Pyasino, the waters emerge as the Pyasina River. The Ambarnaya river is part of a network that flows into the environmentally sensitive Arctic Ocean. Important Info : May 2020 Diesel spill On May 29, 2020, an estimated 20,000 tonnes of Diesel oil leaked into the river following the collapse of a power plant owned by Norilsk Nickel.With a 12 km stretch of river seriously affected, Russia's president Vladimir Putin declared a state of emergency within Russia’s Krasnoyarsk Region, located in the Siberian peninsula. Source : Indian Express (Geography) Best UPSC Civil Services Current affairs Supreme Court ordered that a plea to change India’s name exclusively to ‘Bharat’ be converted into a representation and forwarded to the Union government, primarily the Ministry of Home Affairs, for an appropriate decision About: The petition, seeks an amendment to Article 1 of the Constitution, to change India’s name exclusively to ‘Bharat’. It wants ‘India’ to be struck off from the Article. Bharat and India are both names given in the Constitution. India is already called ‘Bharat’ in the Constitution. Article 1 of the Constitution, says “India, that is Bharat, shall be a Union of States”. Important Info : Arguments By Petitioner: ‘India’ is a name of foreign origin. The name can be traced back to the Greek term ‘Indica’. Instead, The word ‘Bharat’ is closely associated to our Freedom Struggle. The cry was ‘Bharat Mata ki Jai’.”This will ensure citizens of this country to get over the colonial past and instil a sense of pride in our nationality. It will also justify the hard fought freedom by our freedom fightersThere should be uniformity in the name of the nation. There are many names of India like Republic of India, Bharat, India, Bharat Ganarajya, etc, thus creating confusion. Arguments against: The Supreme Court had dismissed a similar petition in 2016. Then CJI T.S. Thakur had said that every Indian had the right to choose between calling his country ‘Bharat’ or ‘India’.The name India derives ultimately from Sanskrit Síndhu which was the name of the Indus River as well as the country at the lower Indus basin. Source : Times of India (Polity & Goverance) Best UPSC Civil Services Current affairs Prime Minister Narendra Modi condoled the death of veteran filmmaker Basu Chatterjee, the torchbearer of Hindi ‘middle-of-the-road’ cinema. He passed away due to age-related illness at the age of 90

About: Basu Chatterjee (1930 – 2020) was an Indian film director and screenwriter. Through the 1970s and 1980s, alongwith filmmakers such as Hrishikesh Mukherjee and Basu Bhattacharya, he was the torchbearer of Hindi middle-of-the-road cinemae. the light-hearted, middle class, family dramas that emerged as a parallel narrative to the more mainstream Angry Young Man movies. He is best known for his films Chhoti Si Baat, Chitchor, Rajnigandha, Ek Ruka Hua Faisla etc. He directed the TV Series Byomkesh Bakshi and the popular Rajani (TV series) for Doordarshan both of which were successful TV serials. Source : The Hindu (Person in News) Best UPSC Civil Services Current affairs Pangong Tso is the site of eye-to-eye confrontation between Indian and Chinese troops, following a scuffle in early May. Both sides have ramped up their troop presence but "disengagement" process is also underway About: Pangong Tso is a long narrow, deep, endorheic (landlocked) lake situated at a height of about 4,350 m in the Ladakh Himalayas. It is 134 km long and 5 km wide at its broadest point. In the Ladakhi language, Pangong means extensive concavity, and Tso is lake in Tibetan. The brackish water lake freezes over in winter, and becomes ideal for ice skating and polo. It is not a part of the Indus river basin area and geographically a separate landlocked river basin. The lake is not a Ramsar site yet. It is in the process of being identified under the Ramsar Convention as a wetland of international importance. Important Info : Line of Actual Control (LAC) and Pangong Tso lake The disputed boundary between India and China, also known as the Line of Actual Control (LAC), mostly passes on the land, but Pangong Tso is a unique case where it passes through the water as well.The points in the water at which the Indian claim ends and Chinese claim begins are not agreed upon mutually. As things stand, 45 km-long western portion of the lake is under Indian control, while the rest is under China’s control.By itself, the lake does not have major tactical significance. But it lies in the path of the Chushul approach, one of the main approaches that China can use for an offensive into Indian-held territory. Fingers in the lake: The barren mountains on the lake’s northern bank, called the Chang Chenmo, jut out like a palm and the various protrusions are referred to as 'fingers.'While India claims that the LAC starts at Finger 8, China claims that it starts at Finger 2, which is presently dominated by India. India physically controls area only up to Finger 4. Source : Indian Express (Geography) Best UPSC Civil Services Current affairs Daily Current affairs and News Analysis Best IAS Coaching institutes in Bangalore Vignan IAS Academy Contact Vignan IAS Academy Enroll For IAS Foundation Course from Best IAS / IPS Training Academy in Bangalore

Latest Current affairs

Read the full article

#bestiascoachingcentreinbangalore#bestiascoachinginbangalore#BestIASCoachinginHSRLayoutBangalore#IASCoachinginHSRLayout#TopRankedIASCoachinginBangalore

0 notes

Text

Interpretation of term ‘Basic Wages’ of EPF & MP Act, 1952 and Impact of Recent Judgment of Supreme Court delivered in Surya Roshni Ltd v. EPFO, 2019 LLR 339 (SC)

This article is written by Puneet Gupta, pursuing a Diploma in Industrial and labour law, from LawSikho discusses the interpretation of term ‘Basic wages’ of EPF & MP Act, 1952.

The recent judgment passed on 28.02.2019 by the Hon’ble Supreme Court in the matter of Regional Provident Fund Commissioner Vs. Vivekananda Vidyamandir and other connected appeals considered the scope of ‘basic wages’ and allowances liable for PF contributions. The said judgment is published under the caption Surya Roshni Ltd.& Ors. vs. The State of Madhya Pradesh EPF RPFC and Ors. 2019 LLR 339 (SC).

Many messages are being circulated on social media with catchy and scary titles like “Supreme Court delivered a landmark and long-awaited judgment …. PF is applicable on basic salary plus all allowances, unexpected judgment”. From the perusal of the above judgment, it is seen that the Learned Judges have not settled any new legal principle. Nowhere in the judgment, it has been held that all allowances would attract PF liability. The appeals filed by various companies against the various High Court judgments have been dismissed because they (appellants) have failed to prove the rationale behind giving those allowances to their employees. The bench comprising Justice Arun Mishra and Justice Navin Sinha has observed that “no material has been placed by the establishments to demonstrate that the allowances in question being paid to its employees were either variable or were linked to any incentive for production resulting in greater output by an employee and that the allowances in question were not paid across the board to all employees in a particular category or were being paid especially to those who avail the opportunity”.

click above

The position of law remains as it was before the judgement. All that the learned judges have done is, to reproduce the provisions of the EPF Act, 1952 and refer to the 6-judge Constitutional bench landmark judgment of the Hon’ble Supreme Court delivered in the matter of Bridge and Roof Company ( India ) Limited V. Union of India, 1962-II L.L.J. 490 and the principles reiterated in the matter of Manipal Academy of Higher Education Vs. Provident Fund Commissioner LLR 2008 SC 443. The Hon’ble bench has missed the opportunity to settle the controversies on various allowances, once and for all. Had the Hon’ble Supreme Court has given a comprehensive detailed order, the anxieties among the employers/HR professional would not have cropped up.

In fact, issue before the court was, as to whether special allowance [Civil Appeal No. 6221 of 2011]; Variable Dearness Allowance(VDA), house rent allowance (HRA) travel allowance, canteen allowance, lunch incentive [Civil Appeal Nos. 3965-66 of 2013]; management allowance, conveyance allowance [Civil Appeal Nos. 2969-70 of 2013 and Civil Appeal Nos. 3967-68 of 2013]; education allowance, food concession, medical allowance, special holidays, night shift incentives and city compensatory allowance [Transfer Case (c) No. 19 of 2019 (arising out of T.P.(C) No. 1273 of 2013], constitute part of basic wages or not. The bench has not discussed these issues in the judgment and nothing has been said as to whether any of these components of wage should be treated as `basic wage’ or otherwise. The Hon’ble Supreme Court in Surya Roshni case (supra) has not considered the scope of the words “or any other similar allowance payable to the employee in respect of his employment or of work done in such employment” under Section 2(b)(ii).

The position of law has been discussed in paragraph 8 to 14 of the judgment delivered by the Hon’ble Supreme Court in Surya Roshni case (supra). However, paragraph 14 contains the crux and the operative part of the judgment, which is reproduced under:

‘14. Applying the aforesaid tests to the facts of the present appeals, no material has been placed by the establishments to demonstrate that the allowances in question being paid to its employees were either variable or were linked to any incentive for production resulting in greater output by an employee and that the allowances in question were not paid across the board to all employees in a particular category or were being paid especially to those who avail the opportunity. In order that the amount goes beyond the basic wages, it has to be shown that the workman concerned had become eligible to get this extra amount beyond the normal work which he was otherwise required to put in. There is no data available on record to show what were the norms of work prescribed for those workmen during the relevant period. It is therefore not possible to ascertain whether extra amounts paid to the workmen were in fact paid for the extra work which had exceeded the normal output prescribed for the workmen. The wage structure and the components of salary have been examined on facts, both by the authority and the appellate authority under the Act, who have arrived at a factual conclusion that the allowances in question were essentially a part of the basic wage camouflaged as part of an allowance so as to avoid deduction and contribution accordingly to the provident fund account of the employees. There is no occasion for us to interfere with the concurrent conclusions of facts. The appeals by the establishments, therefore, merit no interference. Conversely, for the same reason, the appeal preferred by the Regional Provident Fund Commissioner deserves to be allowed.’

The above judgment has created a panic situation among the HR lobby and the employers and many queries are coming up seeking guidance for restructuring the wages packages/CTC of their employees. It is apprehended that the PF Deptt having the recent judgment at hand, are likely to increase their inspections and audits in order to recover the additional PF contributions along with interest and damages for delayed contribution in respect of such establishment where rationale behind giving such allowance is missing. The probable outcome in such cases would not only lead to increase in PF liability of the employer(s) but would simultaneously may cause loss to the employee(s) as it is likely to increase the employees’ PF contribution, which would, in turn, decrease their ‘carry home salary’, particularly for those employees, drawing wages up to Rs.15000 per month, but would eventually increase their retirement benefits.

As an Employer or an HR Professional, one has to go through the provisions of law contained in Section 2(b) and Section 6 of the EPF Act,1952 and to follow the settled principles of law laid down in Bridge & Roof case, Manipal Case (supra) and the points reiterated in recent judgment (2019 LLR 339). Before adverting to the principles laid down in the above judgments, it has become necessary to set out the relevant provisions of the Act for purposes of the present controversy.

Section 2(b) of the EPF & MP Act, 1952 reads as under:

“Section 2(b) “basic wages” means all emoluments which are earned by an employee while on duty or on leave or on holidays with wages in either case in accordance with the terms of the contract of employment and which are paid or payable in cash to him, but does not include—

(i) the cash value of any food concession;

(ii) any dearness allowance (that is to say, all cash payments by whatever name called paid to an employee on account of a rise in the cost of living), house-rent allowance, overtime allowance, bonus, commission or any other similar allowance payable to the employee in respect of his employment or of work done in such employment;

(iii) any presents made by the employer;”

“Section 6: Contributions and matters which may be provided for in Schemes.

The contribution which shall be paid by the employer to the Fund shall be ten percent. Of the basic wages, dearness allowance and retaining allowance, if any, for the time being payable to each of the employees whether employed by him directly or by or through a contractor, and the employees’ contribution shall be equal to the contribution payable by the employer in respect of him and may, if any employee so desires, be an amount exceeding ten percent of his basic wages, dearness allowance and retaining allowance if any, subject to the condition that the employer shall not be under an obligation to pay any contribution over and above his contribution payable under this section:

Provided that in its application to any establishment or class of establishments which the Central Government, after making such inquiry as it deems fit, may, by notification in the Official Gazette specify, this section shall be subject to the modification that for the words “ten percent”, at both the places where they occur, the words “12 percent” shall be substituted:

Provided further that where the amount of any contribution payable under this Act involves a fraction of a rupee, the Scheme may provide for rounding off of such fraction to the nearest rupee, half of a rupee, or the quarter of a rupee.

Explanation I – For the purposes of this section, dearness allowance shall be deemed to include also the cash value of any food concession allowed to the employee.

Explanation II – For the purposes of this section, “retaining allowance” means allowance payable for the time being to an employee of any factory or other establishment during any period in which the establishment is not working, for retaining his services.”

On the plain reading of the above two sections, it is clear that some allowances/components/amounts have been expressly excluded for making payment of PF contributions. The list of expressly excluded allowances are house-rent allowance, overtime allowance, bonus, commission or any other similar allowance payable to the employee in respect of his employment or of work done in such employment and any presents made by the employer.

The question arises for the applicability of PF Act on allowances prevalent in the industry that forms part of CTC such as, special allowance, Transport allowance, Conveyance allowance, Education allowance, Canteen allowance, Lunch incentive, Management allowance, Medical allowance, City compensatory allowance, Night shift Incentive etc. These allowances are required to be tested in accordance with the definition of basic wages contained in the act and the basic principles laid down by the Hon’ble Supreme Court of India in Bridge & Roof case, Manipal Case and the points reiterated in recent judgment (2019 LLR 339). In Bridge & Roof case (Supra), it was held that the intent of the legislature was not that whatever is price for labour and arises out of contract is included in the definition of “basic wages”, since the main part of the definition is subject to exceptions in clause (ii), and these exceptions clearly show that they include even the price for labour.

To ascertain the correct position of law, and structuring the wages/salary of their employees, the HR Professionals are hereby advised to consider the following principles of law :

First Principle

Where the wages are universally, necessarily and ordinarily paid to all across the board such emoluments are basic wages. Whatever is not paid by all concerns or may not be earned by all employees of concern is excluded from the definition of basic wages. If such allowances are variably paid to the employees of concern and are not paid ordinarily to all the employees and is having a proper rationale for their payment, such allowances would stand excluded for payment of contribution under the Employees’ Provident Fund & Miscellaneous Provisions Act, 1952.

Merely giving fancy nomenclature to allowances would not absolve the employer from making the payment of PF contributions, rather he has to give proper explanation about the nature and rationale behind the making of such payment. It is advised that there should be in place a detailed policy in the company for payment of each allowance and reason for payment thereof so that the same can be explained to the PF authorities.

Second Principle

Where the payment is specially paid to those who avail of the opportunity, is not ‘basic wages’ as defined under Section 2(b) of the Act,1952. In other words, a payment payable to an employee, only on the occasion of availing an opportunity or undertaking a special task, would stand excluded from the definition of basic wages.

By way of examples :

Overtime allowance, though it is generally in force in all concern, is not earned by all employees of a concern. It is earned in accordance with the terms of the contract of employment but because it may not be earned by all employees of a concern so, it is excluded from the ambit of ‘basic wages’.

Washing Allowance : If the company has provided uniform to their employees or employee is working in an area where the uniforms or clothes of the employee are required to be neat, clean and tidy (for e.g.peons, Chauffeurs, kitchen boy etc.) or due to his working condition his clothes get dirty and needs periodical washing, then giving of washing allowance to such employees if supported by reasons and logic can be kept outside from the purview of ‘basic wages’.

Night Shift allowance, High altitude allowance, field allowance, Hill allowance etc. could be considered to be such allowances that are paid to an employee who avails such opportunity. However, proper reasoning supported by logic and documentary proof would be required to oust them from the purview of ‘basic wages’.

Third Principle

Any payment by way of a special incentive or work is not basic wages. If such incentive payment is variable and is linked to any production bonus or incentive or sales incentive of the company, then such payment does not fall within the definition of basic wages. The Hon’ble Supreme Court in Bridge & Roof case (supra) has observed that

“The core of such a plan is that there is a base or a standard above which extra payment is earned for extra production in addition to the basic wages which is the payment for work up to the base or standard Such a plan typically guarantees time wage up to the time represented by standard performance and gives workers a share in the savings represented by superior performance. The scheme in force in the Company is a typical scheme of production bonus of this kind with a base or standard up to which basic wages as time wages are paid and thereafter extra payments are made for superior performance. This extra payment may be called incentive wage and is also called a production bonus. In all such cases however the workers are not bound to produce anything beyond the base or standard that is set out. The performance may even fall below the base or standard but the minimum basic wages will have to be paid whether the basic or standard is reached or not. When however the workers produce beyond the base or standard what they earn is not basic wages but production bonus or incentive wage. It is this production bonus which is outside the definition of “basic wages” in Section 2(b), for reasons which we have already given above.”

Similarly, in order to motivate employees for maximum attendance and to minimize the absenteeism at workplace, the employer introduced attendance bonus to those employees who remain present themselves on all working days, such attendance allowance would also not attract PF liability.

All bonus/incentives should be backed by a policy stating the circumstances and logic for payment of each incentive/bonus and the company should be in position to explain as to “Why such incentive/reward is being paid to the employees?”. Further, all payment of incentive must be based on written policy of the company and such payment of the incentive/reward should be calculated according to the company’s policy.

Fourth Principle

The ‘presents’ made by the employer to an employee by way of inam or reward does not fall within the definition of the term ‘basic wages’. Such presents or rewards should not be ordinarily earned in accordance with the terms of the contract of employment. Where the employer has introduced the scheme of Inam and he has the right to reverse or withdraw it at his discretion, the payment of Inam or presents under such scheme will not be treated as ‘basic wages’ and contribution is not payable.

Further, where there is no scheme of Inam in writing but still employer might be making the ex-gratia payment which is not accordance with the terms of the contract of employment, still such payment of inam or presents will not attract PF liabilities.

Fifth Principle

Quantum of allowances: The allowances should not be disproportionately high vis vis wages of an employee, otherwise it will raise suspicion that it is not a genuine allowance but is a subterfuge to reduce the PF liability. To avoid such a situation the quantum of allowances should be reasonable.

I have been receiving queries regarding the percentage/quantum of HRA which can be paid to an employee and at the same time, it should not create suspicion for PF Authorities of being a camouflage.

I think there is a misconception prevalent amongst HR Lobby that a maximum of 50% HRA (For metro cities) and 40% HRA (Non-metro cities) could be considered while designing the CTC / wage package and is excluded from the definition of ‘basic wages’ and hence, not objectionable by the PF Authorities. Reference to the Income Tax Act, 1961 for determining the quantum of HRA is misplaced. The Income Tax Act provides only for the limit of deduction permissible on income earned by employee, which is the least of the following amounts:

Actual HRA received;

50% of the basic salary for those living in metro cities and

40% for those living in non-metro cities; or

Actual rent paid less 10% of basic salary.

The Income Tax Act, 1961 does not provide for the maximum amount of HRA that can be paid to an employee in an establishment. Moreover, for availing deduction on HRA under the Income Tax Act, 1961, the least of the amounts hereinbefore mentioned is to be considered. A mere reference to only one of these clauses [i.e. 50% of basic salary (Metro cities) and 40% of basic salary (Non-Metro cities)] is a fallacy.

Sixth Principle

In case of Domestic employees (posted in India) whose salary is above the prescribed statutory limit (at present Rs. 15000) and is a member of PF has to contribute the PF upto the statutory limit. If any establishment/company has been paying any allowance(s) to such employee, then such payment of allowance would not be taken in consideration for deduction of PF Contribution. Thus, the company /establishment is not liable to contribute the PF Contribution on those allowances, even special allowance, if the ‘basic wage’ of the domestic employee is over and above the Rs.15000/-.

However, in the case of International Worker, there is no such prescribed statutory limit and thus, the PF contributions would be paid on full salary that may come under the ambit of ‘basic wages’.

Conclusion

In my opinion, it is high time to draft a comprehensive wage structures of the employees, which should be based on the principles enumerated above, to avoid any litigation from the PF authorities.

The judgment passed in Surya Roshni case (supra) has only interpreted the position of law that was already placed in statute, thus the implication would be retrospective.

Students of Lawsikho courses regularly produce writing assignments and work on practical exercises as a part of their coursework and develop themselves in real-life practical skill.

The post Interpretation of term ‘Basic Wages’ of EPF & MP Act, 1952 and Impact of Recent Judgment of Supreme Court delivered in Surya Roshni Ltd v. EPFO, 2019 LLR 339 (SC) appeared first on iPleaders.

Interpretation of term ‘Basic Wages’ of EPF & MP Act, 1952 and Impact of Recent Judgment of Supreme Court delivered in Surya Roshni Ltd v. EPFO, 2019 LLR 339 (SC) published first on https://namechangers.tumblr.com/

0 notes

Text

Interpretation of term ‘Basic Wages’ of EPF & MP Act, 1952 and Impact of Recent Judgment of Supreme Court delivered in Surya Roshni Ltd v. EPFO, 2019 LLR 339 (SC)

This article is written by Puneet Gupta, Advocate, here he discusses the interpretation of term ‘Basic wages’ of EPF & MP Act, 1952.

The recent judgment passed on 28.02.2019 by the Hon’ble Supreme Court in the matter of Regional Provident Fund Commissioner Vs. Vivekananda Vidyamandir and other connected appeals considered the scope of ‘basic wages’ and allowances liable for PF contributions. The said judgment is published under the caption Surya Roshni Ltd.& Ors. vs. The State of Madhya Pradesh EPF RPFC and Ors. 2019 LLR 339 (SC).

Many messages are being circulated on social media with catchy and scary titles like “Supreme Court delivered a landmark and long-awaited judgment …. PF is applicable on basic salary plus all allowances, unexpected judgment”. From the perusal of the above judgment, it is seen that the Learned Judges have not settled any new legal principle. Nowhere in the judgment, it has been held that all allowances would attract PF liability. The appeals filed by various companies against the various High Court judgments have been dismissed because they (appellants) have failed to prove the rationale behind giving those allowances to their employees. The bench comprising Justice Arun Mishra and Justice Navin Sinha has observed that “no material has been placed by the establishments to demonstrate that the allowances in question being paid to its employees were either variable or were linked to any incentive for production resulting in greater output by an employee and that the allowances in question were not paid across the board to all employees in a particular category or were being paid especially to those who avail the opportunity”.

click above

The position of law remains as it was before the judgement. All that the learned judges have done is, to reproduce the provisions of the EPF Act, 1952 and refer to the 6-judge Constitutional bench landmark judgment of the Hon’ble Supreme Court delivered in the matter of Bridge and Roof Company ( India ) Limited V. Union of India, 1962-II L.L.J. 490 and the principles reiterated in the matter of Manipal Academy of Higher Education Vs. Provident Fund Commissioner LLR 2008 SC 443. The Hon’ble bench has missed the opportunity to settle the controversies on various allowances, once and for all. Had the Hon’ble Supreme Court has given a comprehensive detailed order, the anxieties among the employers/HR professional would not have cropped up.

In fact, issue before the court was, as to whether special allowance [Civil Appeal No. 6221 of 2011]; Variable Dearness Allowance(VDA), house rent allowance (HRA) travel allowance, canteen allowance, lunch incentive [Civil Appeal Nos. 3965-66 of 2013]; management allowance, conveyance allowance [Civil Appeal Nos. 2969-70 of 2013 and Civil Appeal Nos. 3967-68 of 2013]; education allowance, food concession, medical allowance, special holidays, night shift incentives and city compensatory allowance [Transfer Case (c) No. 19 of 2019 (arising out of T.P.(C) No. 1273 of 2013], constitute part of basic wages or not. The bench has not discussed these issues in the judgment and nothing has been said as to whether any of these components of wage should be treated as `basic wage’ or otherwise. The Hon’ble Supreme Court in Surya Roshni case (supra) has not considered the scope of the words “or any other similar allowance payable to the employee in respect of his employment or of work done in such employment” under Section 2(b)(ii).

The position of law has been discussed in paragraph 8 to 14 of the judgment delivered by the Hon’ble Supreme Court in Surya Roshni case (supra). However, paragraph 14 contains the crux and the operative part of the judgment, which is reproduced under:

‘14. Applying the aforesaid tests to the facts of the present appeals, no material has been placed by the establishments to demonstrate that the allowances in question being paid to its employees were either variable or were linked to any incentive for production resulting in greater output by an employee and that the allowances in question were not paid across the board to all employees in a particular category or were being paid especially to those who avail the opportunity. In order that the amount goes beyond the basic wages, it has to be shown that the workman concerned had become eligible to get this extra amount beyond the normal work which he was otherwise required to put in. There is no data available on record to show what were the norms of work prescribed for those workmen during the relevant period. It is therefore not possible to ascertain whether extra amounts paid to the workmen were in fact paid for the extra work which had exceeded the normal output prescribed for the workmen. The wage structure and the components of salary have been examined on facts, both by the authority and the appellate authority under the Act, who have arrived at a factual conclusion that the allowances in question were essentially a part of the basic wage camouflaged as part of an allowance so as to avoid deduction and contribution accordingly to the provident fund account of the employees. There is no occasion for us to interfere with the concurrent conclusions of facts. The appeals by the establishments, therefore, merit no interference. Conversely, for the same reason, the appeal preferred by the Regional Provident Fund Commissioner deserves to be allowed.’

The above judgment has created a panic situation among the HR lobby and the employers and many queries are coming up seeking guidance for restructuring the wages packages/CTC of their employees. It is apprehended that the PF Deptt having the recent judgment at hand, are likely to increase their inspections and audits in order to recover the additional PF contributions along with interest and damages for delayed contribution in respect of such establishment where rationale behind giving such allowance is missing. The probable outcome in such cases would not only lead to increase in PF liability of the employer(s) but would simultaneously may cause loss to the employee(s) as it is likely to increase the employees’ PF contribution, which would, in turn, decrease their ‘carry home salary’, particularly for those employees, drawing wages up to Rs.15000 per month, but would eventually increase their retirement benefits.

As an Employer or an HR Professional, one has to go through the provisions of law contained in Section 2(b) and Section 6 of the EPF Act,1952 and to follow the settled principles of law laid down in Bridge & Roof case, Manipal Case (supra) and the points reiterated in recent judgment (2019 LLR 339). Before adverting to the principles laid down in the above judgments, it has become necessary to set out the relevant provisions of the Act for purposes of the present controversy.

Section 2(b) of the EPF & MP Act, 1952 reads as under:

“Section 2(b) “basic wages” means all emoluments which are earned by an employee while on duty or on leave or on holidays with wages in either case in accordance with the terms of the contract of employment and which are paid or payable in cash to him, but does not include—

(i) the cash value of any food concession;

(ii) any dearness allowance (that is to say, all cash payments by whatever name called paid to an employee on account of a rise in the cost of living), house-rent allowance, overtime allowance, bonus, commission or any other similar allowance payable to the employee in respect of his employment or of work done in such employment;

(iii) any presents made by the employer;”

“Section 6: Contributions and matters which may be provided for in Schemes.

The contribution which shall be paid by the employer to the Fund shall be ten percent. Of the basic wages, dearness allowance and retaining allowance, if any, for the time being payable to each of the employees whether employed by him directly or by or through a contractor, and the employees’ contribution shall be equal to the contribution payable by the employer in respect of him and may, if any employee so desires, be an amount exceeding ten percent of his basic wages, dearness allowance and retaining allowance if any, subject to the condition that the employer shall not be under an obligation to pay any contribution over and above his contribution payable under this section:

Provided that in its application to any establishment or class of establishments which the Central Government, after making such inquiry as it deems fit, may, by notification in the Official Gazette specify, this section shall be subject to the modification that for the words “ten percent”, at both the places where they occur, the words “12 percent” shall be substituted:

Provided further that where the amount of any contribution payable under this Act involves a fraction of a rupee, the Scheme may provide for rounding off of such fraction to the nearest rupee, half of a rupee, or the quarter of a rupee.

Explanation I – For the purposes of this section, dearness allowance shall be deemed to include also the cash value of any food concession allowed to the employee.

Explanation II – For the purposes of this section, “retaining allowance” means allowance payable for the time being to an employee of any factory or other establishment during any period in which the establishment is not working, for retaining his services.”

On the plain reading of the above two sections, it is clear that some allowances/components/amounts have been expressly excluded for making payment of PF contributions. The list of expressly excluded allowances are house-rent allowance, overtime allowance, bonus, commission or any other similar allowance payable to the employee in respect of his employment or of work done in such employment and any presents made by the employer.

The question arises for the applicability of PF Act on allowances prevalent in the industry that forms part of CTC such as, special allowance, Transport allowance, Conveyance allowance, Education allowance, Canteen allowance, Lunch incentive, Management allowance, Medical allowance, City compensatory allowance, Night shift Incentive etc. These allowances are required to be tested in accordance with the definition of basic wages contained in the act and the basic principles laid down by the Hon’ble Supreme Court of India in Bridge & Roof case, Manipal Case and the points reiterated in recent judgment (2019 LLR 339). In Bridge & Roof case (Supra), it was held that the intent of the legislature was not that whatever is price for labour and arises out of contract is included in the definition of “basic wages”, since the main part of the definition is subject to exceptions in clause (ii), and these exceptions clearly show that they include even the price for labour.

To ascertain the correct position of law, and structuring the wages/salary of their employees, the HR Professionals are hereby advised to consider the following principles of law :

First Principle

Where the wages are universally, necessarily and ordinarily paid to all across the board such emoluments are basic wages. Whatever is not paid by all concerns or may not be earned by all employees of concern is excluded from the definition of basic wages. If such allowances are variably paid to the employees of concern and are not paid ordinarily to all the employees and is having a proper rationale for their payment, such allowances would stand excluded for payment of contribution under the Employees’ Provident Fund & Miscellaneous Provisions Act, 1952.

Merely giving fancy nomenclature to allowances would not absolve the employer from making the payment of PF contributions, rather he has to give proper explanation about the nature and rationale behind the making of such payment. It is advised that there should be in place a detailed policy in the company for payment of each allowance and reason for payment thereof so that the same can be explained to the PF authorities.

Second Principle

Where the payment is specially paid to those who avail of the opportunity, is not ‘basic wages’ as defined under Section 2(b) of the Act,1952. In other words, a payment payable to an employee, only on the occasion of availing an opportunity or undertaking a special task, would stand excluded from the definition of basic wages.

By way of examples :

Overtime allowance, though it is generally in force in all concern, is not earned by all employees of a concern. It is earned in accordance with the terms of the contract of employment but because it may not be earned by all employees of a concern so, it is excluded from the ambit of ‘basic wages’.

Washing Allowance : If the company has provided uniform to their employees or employee is working in an area where the uniforms or clothes of the employee are required to be neat, clean and tidy (for e.g.peons, Chauffeurs, kitchen boy etc.) or due to his working condition his clothes get dirty and needs periodical washing, then giving of washing allowance to such employees if supported by reasons and logic can be kept outside from the purview of ‘basic wages’.

Night Shift allowance, High altitude allowance, field allowance, Hill allowance etc. could be considered to be such allowances that are paid to an employee who avails such opportunity. However, proper reasoning supported by logic and documentary proof would be required to oust them from the purview of ‘basic wages’.

Third Principle