#entresto

Explore tagged Tumblr posts

Text

Novartis'in Dördüncü Çeyrek Performansı ve Başarıları

New Post has been published on https://lefkosa.com.tr/novartisin-dorduncu-ceyrek-performansi-ve-basarilari-39037/

Novartis'in Dördüncü Çeyrek Performansı ve Başarıları

Novartis’in dördüncü çeyrek performansı ve başarıları üzerine kapsamlı bir analiz. Şirketin finansal sonuçları, stratejik gelişmeleri ve geleceğe dair hedefleri hakkında detaylı bilgiler.

https://lefkosa.com.tr/novartisin-dorduncu-ceyrek-performansi-ve-basarilari-39037/ --------

#dördüncü çeyrek#Entresto#finansal sonuçlar#ilaç satışları#kalp yetmezliği#Kesimpta#Kisqali#meme kanseri#net kar#Novartis#satış artışı#Ekonomi

0 notes

Text

"The Biden administration on Thursday [August 15, 2024] released prices for the first 10 prescription drugs that were subject to landmark negotiations between drugmakers and Medicare, a milestone in a controversial process that aims to make costly medications more affordable for older Americans.

The government estimates that the new negotiated prices for the medications will lead to around $6 billion in net savings for the Medicare program in 2026 alone when they officially go into effect, or 22% net savings overall. That is based on the estimated savings the prices would have produced if they were in effect in 2023, senior administration officials told reporters Wednesday.

The Biden administration also expects the new prices to save Medicare enrollees $1.5 billion in out-of-pocket costs in 2026 alone.

“For so many people, being able to afford these drugs will mean the difference between debilitating illness and living full lives,” Chiquita Brooks-LaSure, administrator for the Centers for Medicare & Medicaid Services, told reporters. “These negotiated prices. They’re not just about costs. They are about helping to make sure that your father, your grandfather or you can live longer, healthier.”

It comes one day before the second anniversary of President Joe Biden’s signature Inflation Reduction Act, which gave Medicare the power to directly hash out drug prices with manufacturers for the first time in the federal program’s nearly 60-year history.

Here are the negotiated prices for a 30-day supply of the 10 drugs, along with their list prices based on 2023 prescription fills, according to a Biden administration fact sheet Thursday.

What Medicare and beneficiaries pay for a drug is often much less than the list price, which is what a wholesaler, distributor or other direct purchaser paid a manufacturer for a medication before any discounts...

The administration unveiled the first set of medications selected for the price talks in August 2023, kicking off a nearly yearlong negotiation period that ended at the beginning of the month.

The final prices give drugmakers, which fiercely oppose the policy, a glimpse of how much revenue they could expect to lose over the next few years. It also sets a precedent for the additional rounds of Medicare drug price negotiations, which will kick off in 2025 and beyond.

First 10 drugs subject to Medicare price negotiations

Eliquis, made by Bristol Myers Squibb, is used to prevent blood clotting to reduce the risk of stroke.

Jardiance, made by Boehringer Ingelheim and Eli Lilly, is used to lower blood sugar for people with Type 2 diabetes.

Xarelto, made by Johnson & Johnson, is used to prevent blood clotting, to reduce the risk of stroke.

Januvia, made by Merck, is used to lower blood sugar for people with Type 2 diabetes.

Farxiga, made by AstraZeneca, is used to treat Type 2 diabetes, heart failure and chronic kidney disease.

Entresto, made by Novartis, is used to treat certain types of heart failure.

Enbrel, made by Amgen, is used to treat autoimmune diseases such as rheumatoid arthritis.

Imbruvica, made by AbbVie and J&J, is used to treat different types of blood cancers.

Stelara, made by Janssen, is used to treat autoimmune diseases such as Crohn’s disease.

Fiasp and NovoLog, insulins made by Novo Nordisk.

In a statement Thursday, Biden called the new negotiated prices a “historic milestone” made possible because of the Inflation Reduction Act. He specifically touted Vice President Kamala Harris’ tiebreaking vote for the law in the Senate in 2022.

Harris, the Democratic presidential nominee, said in a statement that she was proud to cast that deciding vote, adding there is more work to be done to lower health-care costs for Americans.

“Today’s announcement will be lifechanging for so many of our loved ones across the nation, and we are not stopping here,” Harris said in a statement Thursday, noting that additional prescription drugs will be selected for future rounds of negotiations."

-via CNBC, August 15, 2024

#public health#healthcare#united states#us politics#biden#harris#kamala harris#medicare#medicaid#healthcare accessibility#prescription drugs#big pharma#insulin#good news#hope

3K notes

·

View notes

Text

The Biden administration said Thursday that it had reached an agreement with drugmakers to lower prices on the 10 costliest prescription drugs under Medicare. It's part of the federal government's first-ever drug pricing negotiations, a cost reduction it claims could help ease the financial burden on the estimated 1 in 7 older adults in the U.S. struggling to pay for their medications. Here are the negotiated prices for the drugs, based on a 30-day supply: Eliquis, a blood thinner from Bristol Myers Squibb and Pfizer: $231 negotiated price, down from $521 list price. Xarelto, a blood thinner from Johnson & Johnson; $197 negotiated price, down from $517 list price. Januvia, a diabetes drug from Merck: $113 negotiated price, down from $527 list price. Jardiance, a diabetes drug from Boehringer Ingelheim and Eli Lilly: $197 negotiated price, down from $573 list price. Enbrel, a rheumatoid arthritis drug from Amgen: $2,355 negotiated price, down from $7,106 list price. Imbruvica, a drug for blood cancers from AbbVie and Johnson & Johnson: $9,319 negotiated price, down from $14,934 list price. Farxiga, a drug for diabetes, heart failure and chronic kidney disease from AstraZeneca: $178 negotiated price, down from $556 list price. Entresto, a heart failure drug from Novartis: $295 negotiated price, down from $628 list price. Stelara, a drug for psoriasis and Crohn’s disease from J&J: $4,695 negotiated price, down from $13,836 list price. Fiasp and NovoLog, diabetes drugs from Novo Nordisk: $119 negotiated price, down from $495 list price.

70 notes

·

View notes

Text

Jonathan Cohn at HuffPost:

The first-ever negotiations between the federal government and pharmaceutical companies have led to agreements that will lower the prices of 10 treatments, reducing costs for the Medicare program and for some individual seniors, the Biden administration announced early Thursday morning. This round of negotiations began in 2023 and took place because of the Inflation Reduction Act, the law that Democrats in Congress passed on a party-line vote and that President Joe Biden signed two years ago. The new prices are for drugs covering a variety of conditions, including diabetes and inflammatory illnesses, and are set to take effect in January 2026. The negotiation process is going to happen each year, with a new set of drugs each time. If all goes to plan, that means the scope of drugs subject to negotiated prices will grow each year, while the savings will accumulate.

“When these lower prices go into effect, people on Medicare will save $1.5 billion in out-of-pocket costs for their prescription drugs and Medicare will save $6 billion in the first year alone,” Biden said in a prepared statement, citing figures that analysts at the U.S. Department of Health and Human Services calculated and published on Thursday. “It’s a relief for the millions of seniors that take these drugs to treat everything from heart failure, blood clots, diabetes, arthritis, Crohn’s disease, and more ― and it’s a relief for American taxpayers.” Of course, those numbers refer to aggregate savings on drug spending. Figuring out what they will mean for individual Medicare beneficiaries is difficult, because so much depends on people’s individual circumstances ― like which drugs they take, or which options for prescription coverage they use. It also depends on knowing the actual, real prices for these drugs today, after taking into account the discounts that private insurers managing Medicare drug plans extract from manufacturers. Those discounts are proprietary information that the federal government cannot release.

Great news: The Biden Administration, pharmaceutical companies, and Medicare have negotiated hefty price reductions for 10 high-cost drugs, including Januvia, FIASP, and Entresto.

#Joe Biden#Kamala Harris#Biden Administration#Prescription Drug Prices#Prescription Drugs#Medicare#Inflation Reduction Act#Senior Citizens#Policy

35 notes

·

View notes

Text

The patents for vyvanse and entresto finally expire in early 2024

49 notes

·

View notes

Text

Cardiology review

21 days of DAPT, and then clopidogrel alone is ok if mild stroke. Alteplase if 5.5 hours after symptoms. Thrombectomy within 6 hours; but some pts can benefit from thrombectomy within 24 hours of symptoms onset.

Jardiance prevents hospitalization in pts with HFpEF.

Lower to BP no more than 25% in the first hour for pt's with hypertensive emergency.

From Up To Date:

Acute management – Optimal therapy, including the choice of agent and the blood pressure goal, varies according to the specific hypertensive emergency. It is generally unwise to lower the blood pressure too quickly or too much, as ischemic damage can occur in vascular beds that have reset their autoregulatory threshold to the higher level of blood pressure. For most hypertensive emergencies, mean arterial pressure should be reduced by approximately 10 to 20 percent in the first hour and then gradually during the next 23 hours so that the final pressure is reduced by approximately 25 percent compared with baseline. [So it is 25% in 24 hours].

[According to the rationale for the question, it said to lower the BP 25% in 1 hour, then to 160/100 mmHg.}

The major exceptions to modest and gradual blood pressure lowering over the first 24 hours are:

•Acute phase of an ischemic stroke – The blood pressure is usually not lowered unless it is ≥185/110 mmHg in patients who are candidates for reperfusion therapy (table 2) or ≥220/120 mmHg in patients who are not candidates for reperfusion therapy.

•Acute aortic dissection – The systolic blood pressure is rapidly lowered to a target of 100 to 120 mmHg (to be attained in 20 minutes).

•Spontaneous hemorrhagic stroke – The systolic blood pressure can be rapidly reduced if no contraindications exist.

Stop the ACEI 36 hours before starting Entresto in pts you are switching from ACEI to Entresto for HFrEF.

Non-DHP CCBs (verapamil and diltiazem) are not good for pts with HFrEF. The pt already has a poor EF and these meds slow the HR.

2 notes

·

View notes

Text

I have been quietly reading the Locked Tomb books for the last 3 months and while I have been immensely enjoying them to date, I finally hit the point where I put Nona down and made a disgusted noise because whomst the fuck put Judith on anticoagulants while she is presumably in heart failure? Does she have an arrhythmia as well? Great, she needs the ac for that, but where are the heart failure meds? Get that bitch some Entresto

#Mr Defira tried to soothe my rage by pointing out that we're supposed to think she's being poorly medicated anyway#is this Tamsyn being incorrect about cardiac medications or is this The Narrative#pointing out how thin supplies are or how inept Blood of Eden are#IT DOESN'T MATTER SHE'S MEDICATED INCORRECTLY AND I NEED TO FIX IT

18 notes

·

View notes

Text

Kevin Siers

* * * *

Joe Biden continues to deliver on his promises. On Tuesday, the Biden administration announced that it would begin negotiating prescription prices with drug manufacturers for ten commonly prescribed drugs:

Eliquis, Jardiance, Xarelto, Januvia, Farxiga, Entresto, Enbrel, Imbruvica, Stelara and Fiasp/NovoLog insulin products.

In remarks at the White House, President Biden said that the negotiations for drugs covered by Medicare would include

drugs to treat everything from heart failure, blood clots, diabetes, kidney disease, arthritis, blood cancers, Crohn's disease and so much more. Today is the start of a new deal for patients where Big Pharma doesn't just get a blank check at your expense and the expense of the American people. On my watch, health care should be a right not a privilege in this country.

Per the Inflation Reduction Act, the administration would designate an additional 15 drugs for price negotiations in 2027 and 2028, and 20 new drugs per year thereafter. Tens of millions of Americans will pay substantially lower out-of-pocket costs when the lower prices take effect in 2026.

What is the Republican response to Biden’s historic achievements on behalf of the American people? They plan to impeach him. Why? It doesn’t matter. Distraction is the point. Republicans are willing to “Shoot first, ask questions later” because of Trump's increasing legal jeopardy. In apparent recognition of Trump's self-evident guilt, Republicans are willing to do anything to change the subject—even if that means impeaching Biden on “grounds to be named later.”

As one “GOP lawmaker” told CNN (anonymously),

There’s no evidence that Joe Biden got money, or that Joe Biden, you know, agreed to do something so that Hunter could get money. There’s just no evidence of that. And they can’t impeach without that evidence. And I don’t I don’t think the evidence exists.

Of course, the House GOP caucus is doing Trump's bidding. See Forbes, Trump Tells Congressional Republicans: Impeach ‘The BUM’ Biden Or ‘Fade Into Oblivion’.

The threatened impeachment inquiry against Biden will overlap with the one-month period remaining for passing eleven spending bills necessary to fund the government beginning October 1, 2023. So, as the nation careers toward a government shutdown, Republicans will waste time with empty political melodrama attacking a president who continues to overperform and exceed expectations.

In addition to a sham impeachment, Republicans may use the “must-pass” spending bills for the 2023-2024 budget to strip funding for special counsel Jack Smith’s prosecutors. See Talking Points Memo, Far-Right House GOPers Toss Targeting Trump Prosecutors Into Shutdown Threat Mix.

Here’s the takeaway for people who yearn for the return to the rule of law: The threats to impeach Biden and defund Jack Smith are signs of desperation and fear. They signal that Trump is on the defensive and that at long last the American people are gaining the upper hand after six years in which Trump has run amok. If Trump were confident of his legal defenses, he would not be calling on House Republicans to rescue him.

[Robert B. Hubbell Newsletter]

#far right extremism#radical right wing#MAGA#Robert B. Hubbell#Robert B. Hubbell Newsletter#Kevin Siers

2 notes

·

View notes

Text

Finalgon the Kind, son of Entresto and Aleve, Master of Healing, come forth to our land…

No one:

House of Finwë naming their kids:

1K notes

·

View notes

Text

RIP jen lindley you would have loved entresto

#dawsons creek#this is perhaps the nichest thing ive said in a while#well except that one post about what's their face liking lithium#j

0 notes

Link

0 notes

Text

Slice of life...

We often use the time period of "a year" to indicate progression; another year older, five years sober, ten years married, she's been gone for four years this Christmas, and so on... I don't remember the exact date, but it was the weekend after getting back from Harbor Springs last year... which I just did yesterday, that I got a call from my mom, and was told that she had colon cancer, and from there we just put a brick on the gas pedal of scans, tests, chemo, surgery, recovery... And through that, my dad's heart went downhill fast, leading to scans and tests and surgeries for him. Entresto is a medication you see on TV for people with heart failure, imagine my surprise when I found out my dad was taking it! Oh yeah, and Waffles, can't forget about him, go to get another bunch of masses removed, and find out that we can't, because he doesn't have three, he has eight, and the cancer is storming his little body.

🤯

So... A year ago. I have been feeling pensive as of late, and I think it's because of this; some sort of subconscious closure, like I can finally let my guard down, finally freaking breathe again... Because in the last year, Waffles started chemo, and he is doing great. My dad's heart is stabilized, function is up, a-fib and PVCs are grearly reduced. And my mom has beaten stage four colon cancer. And all good news, but fuck has it been a lot to go through. Mentally exhausting, nevermind stupid shit at work, and other things going on with the family... Can it be that I can finally turn the page on this cumulative nightmare? That "what's next" (never ask that!) might just be "and they all lived happy ever after"?

I would be OK with that.

It is quarter to 10 on Saturday. I have been home for about 17 hours. I have been awake since 6:30. It is sunny and peaceful. It is going to be a good day. 🥔

0 notes

Text

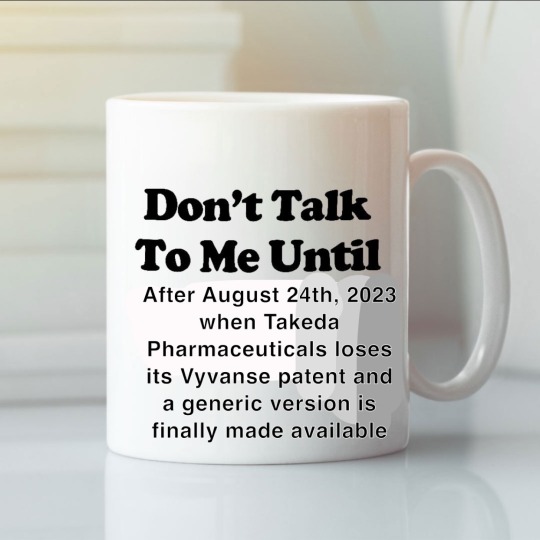

Takeda’s Vyvanse, Aug. 24 (ADHD)

Pfizer’s Eraxis, Sept. 22 (antifungal)

Johnson & Johnson’s Stelara, Sept. 25 (psoriasis & Crohn's)

Merck’s Isentress, Oct. 3 (HIV)

Eiger’s Zokinvy, Oct. 17 (progeria) (but still has an exclusivity clause)

Astellas’ Myrbetriq, Nov. 4 (urinary incontinence)

Novartis’ Entresto, Nov. 27 (heart failure)

Amgen’s Otezla, Dec. 9 (psoriasis) (but court rulings block generics until 2028)

Novo Nordisk’s Victoza and Saxenda, Dec. 30 (diabetes)

39K notes

·

View notes

Text

The Centers for Medicare and Medicaid Services on Tuesday announced the first 10 prescription drugs that will be subject to Medicare price negotiations under the Inflation Reduction Act, a critical step in the Biden administration’s attempt to drive down the high cost of prescription drugs for older people. Medicare provides health insurance coverage to 65 million people in the United States, according to KFF, a nonpartisan group that studies health policy issues. While the program wields enormous power over the costs of other aspects of medical care, dictating how much doctors and hospitals can be paid for medical services, it has been barred from negotiating drug costs. That will change next year, when Medicare for the first time will be able to directly haggle with drugmakers over prices for the costliest medications. The negotiated prices will go into effect in 2026. The drugs selected to undergo negotiations are: Eliquis, a blood thinner Xarelto, a blood thinner Januvia, a diabetes drug Jardiance, a diabetes drug Enbrel, a rheumatoid arthritis drug Imbruvica, a drug for blood cancers Farxiga, a drug for diabetes, heart failure and chronic kidney disease Entresto, a heart failure drug Stelara, a drug for psoriasis and Crohn's disease Fiasp and NovoLog, for diabetes

4 notes

·

View notes

Text

An UWS CVS. Photo By Ed Hersh

UWS Independent Pharmacies Face Existential Threat From PBMs: Survey

— September 25, 2024 | By Ed Hersh | Westside Rag | New York, NY

Small Independent Pharmacies on the Upper West Side — and Citywide– say they face continued existential threats from what they claim is a Conflict-of-Interest-Ridden insurance reimbursement system that favors the big chain pharmacies.

In a recent survey of 176 independent pharmacies, released by the New York City Pharmacists Society, 92 percent of independent pharmacists say they were forced to turn away patients in the previous six months because insurance reimbursements they receive for many Brand-Name Drugs are actually below the cost they must pay for them. These include Eliquis, Entresto, Humira, Jardiance, Ozempic, Xarelto, Biktarvy, and Many Other Medications, often critical for managing chronic conditions and improving quality of life.

“The untold story is that there are so many people trying to find an independent pharmacy to fill a prescription, but they can’t because the pharmacies can’t afford to fill that prescription,” an Upper West Side independent pharmacist told us, anonymously for fear of being shut out of the reimbursement system. “Even though pharmacies must, by contract, fill all prescriptions they are sent, some independent pharmacies have found a way around it. There’s nothing to force them to order the medication,” he admitted. “Probably by now, you know which drugs you’re going to have to sell at a big loss. So, you probably don’t keep those around for that reason.”

What’s behind it? Independent pharmacies blame Pharmacy Benefit Managers (PBMs). As we first reported over a year ago, PBMs are the controversial middlemen between insurers, patients, drug makers, and pharmacies. You may not have heard of PBMs, but if you have insurance, you have dealt with them. On behalf of insurance companies, they negotiate prices with drug companies and set the prices that pharmacies are paid by the insurers, and then what the pharmacies can charge their customers. This includes those with Private Insurance As Well As Medicare “Part D” Drug Plans.

In what seems like a conflict of interest, the top three PBMs are companies that also offer insurance and other healthcare services, including their own pharmacies that compete with independent drug stores. CVS Health owns PBM Caremark and Aetna Insurance, as well as CVS pharmacies, specialty mail-order pharmacies, and a physician’s group. United Health, the insurance giant, owns the mail order pharmacy OptumRx, specialty pharmacies, physician groups and express medical and surgical centers. The insurer Cigna owns the PBM Express Scripts and a specialty pharmacy.

In addition, the reason we could not get UWS pharmacists to speak to us on record about this situation is that there is a “gag clause” in all pharmacy contracts with the PBMs forbidding them to discuss the details of their reimbursements with their patients and customers, under penalty of losing their contracts

So how are our local independent pharmacies staying afloat? Ironically, some generic drugs have a greater profit margin. Additionally “some pharmacies do more [non-prescription] business in the front of the store,” the pharmacist told us. “For some of them, the owner’s working 80 hours a week, and he’s got a skeleton crew.” And some have shortened their days and business hours.

For many, says NYCPS spokesman Tom Corsillo, the neighborhood pharmacy is a lifeline. “People who use independent pharmacies tend to be the most vulnerable populations, folks who need to understand dosage and rely on the level of counsel independent pharmacies provide.”

There have been bipartisan calls for scrutiny and regulation of PBMs at a national level, including hearings on Capitol Hill. And just this last Friday, the Federal Trade Commission announced new action against the three largest PBMs — Caremark Rx, Express Scripts (ESI), and OptumRx — for engaging in what the FTC calls, in a release “anticompetitive and unfair rebating practices that have artificially inflated the list price of insulin drugs, impaired patients’ access to lower list price products, and shifted the cost of high insulin list prices to vulnerable patients.”

For its part, the Pharmaceutical Care Management Association, the PBM’s trade group, defends its members’ practices. In a statement emailed to WSR, PCMA spokesman Greg Lopes said, “PBMs recognize the vital role pharmacies play in creating access to prescription drugs for patients, especially community pharmacies in rural areas. There are unfortunately many factors for pharmacy closures, but blaming PBMs is not based on the facts,” and added, “It should be noted that in New York [State], between 2014 and 2024, the number of independent pharmacies actually grew from 2,470 to 3,058, a 23.8% increase.” But he could not specify in what part of the state that growth had occurred.

The NYC pharmacists’ survey taken in July says that in the year ahead, “96 percent of the respondents indicated they are very likely to stop carrying additional medications if reimbursement rates are further reduced as projected. Additionally, 96 percent of respondents anticipate having to lay off employees or reduce store hours to cope with these financial challenges.”

As for Friday’s FTC complaint, (which only applies to insulin medications) the FTC says it “seeks to put an end to the Big Three PBMs’ exploitative conduct and marks an important step in fixing a broken system—a fix that could ripple beyond the insulin market and restore healthy competition to drive down drug prices for consumers.”

What can concerned citizens do? Corsillo says “you have to contact your elected officials. Ultimately, they’re going to have to write new laws to rein in PBMs and they need to hear from their constituents that this is something they care about.”

0 notes

Text

Pharmaceutical industry forecasts to 2026

One of the major issues currently plaguing the pharmaceutical sector relates to clinical trials. Since the spread of the coronavirus, hundreds of trials have been suspended and the issuing of opinions on those that have been conducted is delayed. This problem means that the longer this situation continues, the more likely it is that regulatory decision-making will be slowed down. This, of course, could affect patient access to new medical solutions. And from a macroeconomic perspective, the loss of jobs and productivity indicates that a global economic downturn is coming. If this proves true, governments and patients will have less and less money to spend on healthcare. In this context, investors seem to have sidelined the economic risks of a pandemic, hoping they will be offset by the potential of new treatments for the disease.

Market share growth

The only companies that have reported projected market share gains by 2026 are AstraZeneca, BMS and AbbVie. In the case of BMS, the deal that has contributed most to this growth is the acquisition of Celgene. For AbbVie, the acquisition of Allergan has had a very positive impact, being a strategically favourable move to diversify its drug portfolio, also in view of the impending loss of exclusivity for Humira in 2023.

AstraZeneca's market share is expected to grow steadily; mainly driven by sales of drugs such as Tagrisso, Lynparza and Imfinzi, which continue to be the UK company's growth drivers. Takeda will remain on the sidelines in the ranking of the top ten best-selling prescription drugs for 2026. Despite the acquisition of Shire in 2019 and its contribution to the company's revenue growth, there are downsides. One of the most notable is the patent expiration of the Advate drug in 2019, resulting in a drop in sales of about a billion dollars. Overall, the top ten pharmaceutical companies will lose 6.2% of total market share. And the main impact of this phenomenon will be Pfizer.

The rise of biotechnology

It is worth noting that biotechnology is set to change direction in the coming years. By 2026, biotech drugs are expected to occupy a major share of the top 100 drugs, accounting for 55% of the total, up 16% from 2012. In this context, Roche will remain the largest company in biologic drugs. A detailed analysis of Roche's data shows that despite losing 5.8% of market share due to the loss of biologics patents, the company is still the largest biologics manufacturer in the world. These include Avastin, Herceptin and Rituxan, which account for the company's largest sales. According to another forecast in the report, Amgen will drop two positions due to the loss of market share of its Enbrel (autoimmune diseases) drug compared to similar drugs from competitors.

Following it, Novo Nordisk will move to the third position, boosted by strong sales growth of Ozempic and Ribelsus (diabetes drugs), which will have sales of about $15 billion by 2026. The paper also predicts that AbbVie will drop out of the top ten leaders in this field. This will occur as a result of the loss of the Humira patent in the US by 2023. Novartis will join the top ten in this segment due to sales growth of Cosentyx and Entresto (psoriasis and heart failure drugs respectively); also among the drugs driving the company's growth will be the launches of Arzerra (chronic lymphocytic leukaemia) and Inclisiran (an experimental molecule being studied for the treatment of atherosclerotic cardiovascular disease).

Diversified research

The EvaluatePharma report also looks at the most promising R&D projects up to 2026. The list of initiatives is diversified across several therapeutic areas, with large corporations actively participating, but there is also room for mid-cap companies to sneak into the ranking. In first place is tirzepatide, Eli Lilly's diabetes and obesity drug. It moved up in the rankings thanks to Eli Lilly's focus on it, comparing it in trials to its drug Trulicity, which brings the company big sales. Novartis is in second place thanks to Inclisiran, a molecule being investigated for the treatment of atherosclerotic cardiovascular disease. Inclisiran became part of Novartis Group's armoury through its acquisition of The Medicines Company earlier this year. Approval of the therapy is expected in the second half of this year, and the drug is expected to compete directly with Repatha (Amgen) in the atherosclerotic disease drug line-up.

There are also high hopes for Biogen's Alzheimer's disease drug aducanumab. The drug, which targets the beta-amyloid protein, was due to be submitted to the FDA in early 2020; delays caused by the current situation could make investors nervous, given that it could be the first new drug to treat this type of dementia in 15 years. In the area of autoimmune diseases, Bristol-Myers Squibb has BMS-986165, an investigational tyrosine kinase inhibitor for the treatment of psoriasis. The drug is expected to show good results and help BMS recover sales in psoriasis following the sale of its Otezla drug following its merger with Celgene.

Diverse specialities

GlaxoSmithKline's multiple myeloma drug belantamab mafodotin made the ranking. Roche also made the top 10 due to promising research projects with its drug for the treatment of spinal muscular atrophy, rizdiplam. The therapy has received a priority review from the FDA, but the Swiss company is awaiting a final decision due by the end of August.

Among the smaller companies' projects, four made it into the top 10. In first place is argenx with its immunosuppressant efgartimod, which has had good results in trials on patients with generalised myasthenia gravis. Then there is the collaboration between Vir Biotechnology and Alnylam to develop ALN-HBV02, an RNAi therapy for the treatment of chronic hepatitis B infections. Also in this group of mid-cap companies is Iovance Biotherapeutics with its cell therapy that has received FDA fast track status for the treatment of advanced melanoma. Rounding out this group is Allakos with its esophagitis and gastritis drug currently in Phase 3 clinical trials.

Product ranking

While not grouping drugs by speciality, the consultancy also ranked the ten drugs expected to be the top-selling drugs by 2026. As mentioned above, the list will be topped by Keytruda, an anti-PD-1 immunotherapy drug. Second place will also go to immunotherapy drugs, in this case Opdivo, whose mechanism of action is similar to Keytruda. In third place is Eliquis (apixaban), an anticoagulant used to prevent venous thromboembolism and stroke in patients suffering from atrial fibrillation. Bictarvi (bictegravir sodium; emtricitabine; tenofovir alafenamide fumarate), an antiviral drug from Gilead Sciences used in patients with HIV, ranked fourth.

In the middle of the table, in fifth place, would be Imbruvica (ibrutinib), a drug developed by AbbVie and Janssen, a Bruton's tyrosine kinase inhibitor used to treat patients with mantle cell lymphoma. Oncology is also in sixth and seventh places with Pfizer's Ibrance (palbociclib) for the treatment of certain breast cancers and Tagrisso (osimertinib mesylate), an EGFR inhibitor for the treatment of non-small cell lung cancer.

The last three positions in the table are occupied by drugs from different fields. In eighth place is Sanofi's Dupixent (dupilumab), an interleukin 4 and 13 inhibitor for patients with atopic dermatitis, asthma and chronic rhinosinusitis with nasal polyposis. Ninth place went to Vertex Pharmaceuticals' Trikafta (elexacaftor, ivacaftor, tezacaftor), an advanced therapy for the treatment of cystic fibrosis. Finally, closing the table in tenth place is Ozempic (semaglutide) from NovoNordisk Pharmaceuticals, used as a diabetic drug - which can be combined with other therapies - to prevent the development of cardiovascular disease in these patients.

0 notes