#economicforecasting

Explore tagged Tumblr posts

Text

Predicting the Next Crash? Decoding the Secrets of the Yield Curve Inversions | Morning Check-In

0 notes

Text

#ReNews#MortgageRateUpdate#InterestRates#RealEstateMarket#HomeFinancing#EconomicForecast#Finance#Economy#HomeBuying#RealEstate#HomeLoans#HousingMarket

1 note

·

View note

Text

Gold in 2024: A Promising Future Amid Rising Central Bank Demand

Gold has long been a safe haven for investors seeking stability in times of economic uncertainty. In 2024, this trend shows no signs of slowing down, especially with the rising demand from central banks. One key player driving this surge is Russia, which has significantly increased its gold reserves. This article explores why central banks are accumulating gold, examines key data and trends, and…

#AssetDiversification#CAC 40#Central banks#CentralBankDemand#CentralBankGold#CentralBankPolicy#CentralBanks#CommodityInvestment#CommodityMarket#CurrencyDevaluation#economic uncertainty#EconomicForecasts#EconomicUncertainty#EmergingMarkets#FinancialMarkets#FinancialStability#GeopoliticalRisks#GlobalEconomy#GlobalFinance#GlobalInvestments#GlobalWealth#gold#gold purchases#GoldBars#GoldBullion#GoldCoins#GoldDemand#GoldETF#GoldForecast2024#GoldGrowth

1 note

·

View note

Text

#BankOfAmerica#EconomicOutlook#RecessionUpdate#CEOReport#FinancialForecast#EconomicForecast#MarketTrends#BusinessNews#FinancialNews#EconomicInsights#news#ceo#success#entrepreneur#brand#marketing#business

0 notes

Text

#GoldPriceForecast#XAUUSD#ForexTrading#GoldMarket#TechnicalAnalysis#GoldOutlook#MarketTrends#TradingStrategies#EconomicForecast#PreciousMetals#Investing

0 notes

Text

Union Budget 2024: Top 20 Highlights Impacting The Real Estate Sector

0 notes

Text

Budget 2024 is here! Discover the exciting new opportunities and shifts in costs that could shape your future.

#Budget2024#EconomyUpdate#FiscalPolicy#FinancialPlanning#TaxUpdates#EconomicGrowth#FutureEconomy#GovernmentBudget#TaxPolicy#EconomicDevelopment#BudgetPlanning#CorporateFinance#EconomicForecast

0 notes

Text

Ticket Sorter Market Market Overview: Exploring Industry Expansion by 2032

New Research Report on “Ticket Sorter Market Market” provide insightful data on the main market segments, dynamics, growth potentials and future prospects of industry. The study covers complete analysis on changing market trends for industry. The report shows the year-on-year growth of each segment and touches upon the different factors that are likely to impact the growth of each market segment. Each segment has analyzed completely on the basis of its production, consumption as well as revenue. And also offers Ticket Sorter Market market size and share of each separate segment in the industry.

Get a Sample Copy of the Report at - https://www.proficientmarketinsights.com/enquiry/request-sample/1465

The global Ticket Sorter Market size was USD 5858.3 million in 2024 and the market is projected to touch USD 7933.4 million by 2031, exhibiting a CAGR of 4.0% during the forecast period.

Top Key Players in the Ticket Sorter Market Market:

Giesecke & Devrient: (Germany)

Glory Global Solutions: (UK)

Laurel: (Japan)

De La Rue: (UK)

Toshiba: (Japan)

Kisan: (South Korea)

Cummins-Allison: (USA)

Request Sample for Covid-19 Impact Analysis - https://www.proficientmarketinsights.com/enquiry/request-covid19/1465

The Ticket Sorter Market market research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, application, and industry.

Market split by Type, can be divided into:

Small Size Note Sorter

Medium Size Note Sorter

Large Size Note Sorter

Market split by Application, can be divided into:

BFSI

Retail

Others

Report presents a detailed picture of the market by the way of study, synthesis, and summation of data from multiple sources by an analysis of key parameters. Our Ticket Sorter Market market covers the following areas:

Ticket Sorter Market market sizing

Ticket Sorter Market market forecast

Ticket Sorter Market market industry analysis

Inquire or Share Your Questions If Any Before the Purchasing This Report -https://www.proficientmarketinsights.com/enquiry/pre-order-enquiry/1465

What Global Ticket Sorter Market Market Report Offers?

Provides strategic profiling of key players in the Ticket Sorter Market market.

Drawing a competitive landscape for the world Ticket Sorter Market industry.

Describes insights about factors affecting the Ticket Sorter Market market growth.

Analyze the Ticket Sorter Market industry share based on various factors- price analysis, supply chain analysis etc.

Extensive analysis of the industry structure along with Ticket Sorter Market market forecast 2020-2024.

Granular Analysis with respect to the current Ticket Sorter Market industry size and future perspective.

Regions Covered in Ticket Sorter Market Market Report:

North America (United States, Canada and Mexico)

Europe (Germany, UK, France, Italy, Russia and Turkey etc.)

Asia-Pacific (China, Japan, Korea, India, Australia, Indonesia, Thailand, Philippines, Malaysia and Vietnam)

South America (Brazil etc.)

Middle East and Africa (Egypt and GCC Countries)

Purchase this Report (Price 2900 USD for a Single-User License) - https://www.proficientmarketinsights.com/purchase/1465

#MarketInsights#TechnologyTrends#IndustryAnalysis#ConsumerBehaviour#DataDriven#FinancialAnalysis#BusinessIntelligence#HealthcareIndustry#MarketTrends#EmergingMarkets#GlobalReports#SustainabilityReports#Insights4Sale#EconomicForecast#ResearchReports#MarketSegmentation#MarketAnalysis#CompetitiveAnalysis#Healthcare#AerospaceAndDefence#Agriculture#Automations#ChemicalsAndAdvancedMaterials#FoodAndBeverages#InformationAndCommunicationTechnology#OilAndGas#PowerAndEnergy

1 note

·

View note

Text

Americans Brace for Inflation Nightmare ㅤ Inflation expectations have surged to 7.1%, the highest in over 40 years, as consumers brace for a prolonged economic crisis driven by soaring prices and persistent core CPI inflation. ㅤ Follow RTD to stay in the loop on the latest events happening around the world and more. ㅤ Share so others can watch, listen & learn. 👊🏾 ㅤ ㅤ

#InflationCrisis#RisingInflation#ConsumerSentiment#Economy2024#CoreCPI#FinancialCrisis#EconomicUpdate#PriceSurge#InflationExpectations#EconomicForecast

0 notes

Text

Key Announcements from the UK Spring Budget 2024

Discover the crucial updates from the UK Spring Budget 2024 with our comprehensive breakdown. From tax changes to economic forecasts, we've got you covered. Dive into the details and understand how these announcements may impact your financial strategies. Visit the link below to read more:

0 notes

Text

AI Set to Transform 40% of Global Jobs

#AI#ArtificialIntelligence#IMF#GlobalWorkforce#JobDisruption#IMFReport#EconomicForecast#CNN#GDP#Trending#technology

0 notes

Text

Bank of America CEO Brian Moynihan Reveals Research Team No Longer Forecasting a Recession

Brian Moynihan, CEO of Bank of America, recently suggested that the Biden administration and the Federal Reserve have successfully navigated the economy through a “soft landing” after recent inflationary pressures. He indicated that the banking giant no longer anticipates a recession for the U.S. economy.

Despite ongoing economic weaknesses, Moynihan highlighted that consumer spending remains robust, holding steady at pre-pandemic levels. "Our Bank of America Research team is excellent and no longer predicts a recession," Moynihan stated during an interview with CBS’s Margaret Brennan on "Face the Nation." He noted that this represents a significant shift from last year, when a recession was anticipated.

Moynihan observed that consumer expenditure growth has slowed to about 3% compared to the previous year. He attributed this slowdown to high interest rates, which are exerting pressure on consumers. Although spending is still occurring, it is happening at a more measured pace. "The customer is moving more slowly. Although there is money in their accounts, it is gradually being spent," Moynihan remarked. He emphasized that the Federal Reserve needs to be cautious to avoid overly dampening economic activity.

Bank of America anticipates two interest rate cuts this year—one at the Fed's next meeting and another in December—and predicts four additional rate reductions in 2025. This forecast comes after the Fed surprised markets in July by opting not to lower rates.

Regarding the anticipated rate cuts, Moynihan commented, "So we’re getting back to normal, and that’s going to take a while for people to adjust." He added that this adjustment period will affect both corporate and consumer perspectives.

Following a sharp decline in American markets after last week’s disappointing job data and the Fed's decision to hold rates steady, markets have since largely recovered. Additionally, mortgage rates have recently decreased as lenders brace for an expected Fed cut.

READ MORE

#BankOfAmerica#EconomicOutlook#RecessionUpdate#CEOReport#FinancialForecast#EconomicForecast#MarketTrends#BusinessNews#FinancialNews#EconomicInsights

0 notes

Text

Trading Strategy Poll | The Investing Forex

#GoldPriceForecast#XAUUSD#ForexTrading#GoldMarket#TechnicalAnalysis#GoldOutlook#MarketTrends#TradingStrategies#EconomicForecast#PreciousMetals#Investing#GoldTrading#Forex#GoldPriceAnalysis#FederalReserve#ForexMarket#EconomicNews

0 notes

Text

youtube

Dive into the latest economic developments with our YouTube video script, 'Economic Alert: Recession Signals Flashing - What You Need to Know!' In this engaging 10-minute video, we break down the recent decline in leading economic indicators, exploring the potential implications for the U.S. economy. From forecasts of a short recession to the Federal Reserve's stance, we unravel the complexities of the economic puzzle.

#EconomicAlert#RecessionSignals#USGDP#LeadingIndicators#ConferenceBoard#EconomicForecast#FinancialNews#EconomicOutlook#FedMinutes#InterestRates#ConsumerSpending#InflationConcerns#LaborMarket#StockMarket#HomePrices#Youtube

0 notes

Text

2023-24 के बजट में प्रत्यक्ष कर संग्रह | 18.23 लाख करोड़ रुपये का अनुमान

शुद्ध प्रत्यक्ष कर संग्रह चालू वित्त वर्ष में नौ अक्तूबर तक 21.82 फीसदी बढ़कर 9.57 लाख करोड़ रुपये पहुंच गया। कंपनियों व व्यक्तिगत करदाताओं के बेहतर योगदान से शुद्ध प्रत्यक्ष कर संग्रह बढ़ा है। इस साल अप्रैल से 9 अक्तूबर तक 1.50 लाख करोड़ का रिफंड जारी किया गया है। वित्त मंत्रालय ने मंगलवार को … Read more

#DirectTaxCollection#Budget2023#TaxRevenue#FiscalEstimates#TaxCollection2023#RevenueProjections#TaxEstimates#2023Budget#EconomicForecast#TaxRevenueTarget

0 notes

Text

The U.S. Debt Ceiling and Its Global Implications

Every country’s financial structure houses various integral concepts that dictate its economic narrative. One such pivotal yet complex concept is the ‘debt ceiling.’ Frequently appearing in U.S. financial news, the term ‘debt ceiling’ refers to the maximum limit set by Congress on the amount of national debt that the U.S. government can accrue to meet its financial obligations. The term ‘ceiling’ signifies a limit beyond which the national debt cannot extend.

What is the Debt Ceiling

The debt ceiling functions as a regulatory limit on the amount of national debt the U.S. Treasury can accrue to pay for the expenditures that Congress has already approved. It acts as a checkpoint to monitor and control government spending.

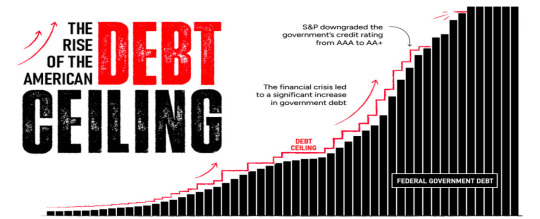

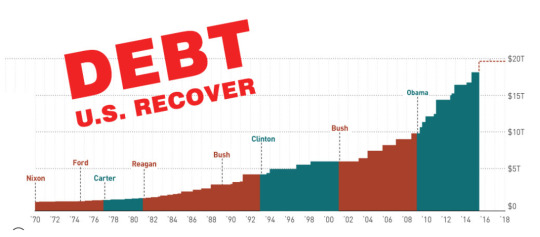

Over the past century, the debt ceiling has been raised or suspended multiple times, each change reflecting the evolving realities and necessities of government spending and borrowing. It’s an interesting dance between policy, spending, and repayment, and an essential cog in the wheel of U.S. financial mechanisms.

Why is the U.S. in Debt and Unable to Repay It?

Over the years, the U.S. has built up a colossal national debt, a daunting figure that’s largely the outcome of varied factors such as heavy government spending, enduring economic crises like the 2008 financial meltdown, the COVID-19 pandemic, and certain tax policies that have influenced the debt scenario.

The complex challenge of repaying this debt is deeply intertwined with the global economic structure’s complexities. While it’s easy to assume that the trade deficit, characterized by a higher import volume than export, contributes to the debt, it doesn’t directly add to the national debt. However, it does play a role in influencing the overall economic health of the nation and indirectly impacts the debt situation.

But, what are the reasons that the U.S. has hit the debt ceiling and is not able to overcome it?

Government Spending: The U.S. government spends substantially on various programs such as defence, healthcare, social security, and interest payments on the national debt. This spending often exceeds the government’s revenues, resulting in a deficit that adds to the national debt.

Economic Crises: Economic downturns often necessitate increased government spending to stimulate the economy and provide relief.

Tax Policies: Tax policies also play a role in the debt scenario. Tax cuts, while potentially stimulating economic growth, can decrease government revenue, thus increasing the deficit if not accompanied by corresponding reductions in government spending.

Interest Payments: As the national debt grows, so does the interest the government must pay on that debt. These interest payments can become a significant part of the budget, leaving less room for other spending priorities and creating a cycle that can cause the debt to grow even further.

Managing and repaying the U.S. debt is a complex issue that involves a careful balance of government spending and revenue, fiscal policy decisions, and managing the country’s economy in the context of a global economic system.

The Size and Scope of U.S. Debt

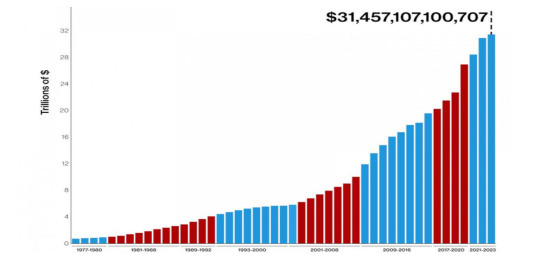

As of 2023, the U.S. national debt stands at a staggering $31.4 trillion, earning the country the status of being the world’s largest debtor.

Where Does the U.S. Borrow From?

The United States acquires debt by issuing Treasury securities like Treasury bonds, notes, and bills. These financial instruments are bought by a wide array of investors, including individuals, corporations, and foreign governments.

Who Are Its Biggest Lenders?

The U.S.’s most substantial debt holders on the international front are Japan and China. Other countries, including the United Kingdom, Brazil, and Ireland, also hold significant portions of U.S. debt. The United States owes Japan approximately $1.28 trillion, while China holds around $1.06 trillion of U.S. debt. The amounts owed to other lenders vary, typically falling into the range of billions of dollars.

Consequences of Hitting the Debt Ceiling

The U.S. hitting its debt ceiling can have significant global implications due to the interconnectedness of today’s global economy.

Here are some potential global consequences:

Impact on Global Markets: The U.S. Treasury market is the largest and most liquid bond market in the world. If the U.S. defaults on its debt obligations, it could cause widespread volatility in global markets. Investors, both domestic and foreign, might start doubting the creditworthiness of the U.S., causing a sell-off of U.S. Treasury securities that could disrupt financial markets worldwide.

Currency Fluctuations: The U.S. dollar is the world’s primary reserve currency, meaning many countries hold it in large quantities to carry out international trade. A U.S. debt default could weaken the dollar, leading to currency fluctuations and economic instability globally.

Global Economic Slowdown: The U.S. economy plays a vital role in driving global growth. Any economic disruption in the U.S., like a recession triggered by a debt default, could have a domino effect on the world economy, potentially leading to a global economic slowdown or recession.

Impact on Foreign Debt Holders: Countries like China and Japan, which hold significant amounts of U.S. debt, could face losses if the U.S. were to default. This could impact their economic stability.

Reduced Confidence in Global Financial System: The U.S. is seen as a global economic leader, and its debt is considered one of the safest investments. A debt default could shake confidence in the global financial system, leading to economic uncertainty and reduced investment.

Potential for Increased Borrowing Costs: If a U.S. default leads to a downgrade in its credit rating, borrowing costs for the U.S. could increase, which could then impact borrowing costs globally. This could make it more expensive for governments, businesses, and individuals worldwide to borrow money.

Here are some potential individual consequences:

In short, the U.S. hitting its debt ceiling and potentially defaulting on its debt repayments could have serious, far-reaching consequences for the global economy. It highlights the need for prudent fiscal policy not only for the U.S. but for economies around the globe. But, what will the citizens of the U.S. face because of hitting its debt ceiling?

The wrangling over the debt ceiling can create economic uncertainty, negatively impacting consumer and business confidence. This can lead to reduced business investments, job cuts, and slower economic growth.

The government might have to make tough choices about which bills to pay. This could put programs like Social Security, Medicare, and military pensions at risk, directly affecting the citizens dependent on these programs.

The uncertainty and the potential for increased government borrowing costs can trickle down to the public in the form of higher interest rates for mortgages, auto loans, student loans, and credit cards.

The debate and uncertainty surrounding the debt ceiling often lead to stock market volatility. This can affect the retirement savings and investment portfolios of everyday Americans.

The Domino Effect: Recession and Layoffs

The repercussions of the U.S. hitting its debt ceiling can go far beyond its own borders, owing to the country’s significant role in the global economy. A notable concern is the potential for a worldwide economic recession and the dreaded consequence – mass layoffs.

As the keystone of global markets, the U.S. economy’s health directly influences financial currents worldwide.

Imagine this: the U.S., unable to lift its debt ceiling, defaults on its debt. This scenario would unsettle financial markets and could seriously undermine investors’ confidence. The ensuing decline in investments can ripple through economies, leading businesses to scale back or shut down, manifesting the dire reality of layoffs.

A U.S. default could also send shockwaves through economies heavily reliant on exporting to the U.S. A debt default could trigger a contraction in the U.S. economy, causing a slump in demand for imports. As a result, these export-dependent economies may see their growth slow down, potentially leading to job cuts in various sectors.

A U.S. debt default could create a ripple effect in global interest rates. As investors’ confidence shakes, they may demand higher returns to compensate for the increased risk, causing a surge in global interest rates. This increase in borrowing costs can hurt businesses and households, leading to a decline in spending, further slowing economic growth, and potentially driving more layoffs.

How Will the U.S. Recover from This Debt?

Recovering from such an overwhelming amount of debt is a long-term and complex process. It requires the implementation of severe cost-cutting measures, comprehensive tax reforms, and strategies to stimulate economic growth.

An integral part of this process is maintaining fiscal discipline to prevent uncontrolled debt accumulation. However, these measures must be carefully balanced to ensure that they don’t hinder economic growth or place an unfair burden on the nation’s citizens.

Read more at: https://dsb.edu.in/the-us-debt-ceiling-and-its-global-implications/?utm_source=tumblr&utm_medium=tumblr&utm_campaign=tumblr+us+debt

#USDebtCeiling#GlobalImplications#EconomicImpact#FinancialMarkets#USFiscalPolicy#DebtCrisis#EconomicOutlook#FinancialStability#GovernmentShutdown#GlobalEconomy#USDollar#TradeTensions#MonetaryPolicy#BudgetDeficit#EconomicForecast#india#fintech#jobs#banking#education#google#ai#blockchain

0 notes