#earn free ethereum

Explore tagged Tumblr posts

Text

Avoid those bees that will send you money! I have already withdrawn $300,

enter my invitation code ID free $20:

👉52783575,

earn money faster!

join on my link below:

https://52783575.g1ocl.xyz/invite_5.html?id=52783575

https://52783575.g1ocl.xyz/invite_5.html?id=52783575

#crazy dog#play to earn#free money#online money#bitcoin#australia#canada#ethereum#nft#india#nigeria#stranger things#united kingdom#usaforex#usa#philippines

6 notes

·

View notes

Link

🚀 Ready to level up your crypto game? Dive into our latest guide and discover 10 amazing ways to earn free crypto in 2024! From airdrops to play-to-earn games, explore how you can get your hands on digital gold without spending a dime. 💎💰✨ Don’t miss out on these exciting opportunities to boost your crypto portfolio! 🌟

#crypto#free crypto#earn crypto#crypto earnings#crypto rewards#play to earn#bitcoin#ethereum#crypto games#crypto tips#crypto news

0 notes

Text

BNBMINING

#BNBMINING#CRYPTOCURRENCIES#bitcoin#airdrop#telegram bot#crypto#free#crypto mining#earn money online#binance coin#ethereum

1 note

·

View note

Text

How to Make Money on Coinbase: A Simple Guide

Coinbase is a leading platform for buying, selling, and managing cryptocurrencies like Bitcoin and Ethereum. With millions of users worldwide, it’s a trusted choice for both beginners and experienced traders. Here’s how you can make money using Coinbase.

Why Use Coinbase?

Coinbase offers:

User-friendly interface: Ideal for newcomers.

Top-notch security: Advanced encryption and offline storage keep your assets safe.

Diverse earning methods: From trading to staking, there are plenty of ways to earn.

Ready to get started? Sign up on Coinbase now and explore all the earning opportunities.

Setting Up Your Coinbase Account

Sign up on Coinbase’s website and provide your details.

Verify your email by clicking the link sent to you.

Complete identity verification by uploading a valid ID.

Navigate the dashboard to track your portfolio, view live prices, and access the "Earn" section.

Ways to Make Money on Coinbase

1. Buying and Selling Cryptocurrencies

Start by buying popular cryptocurrencies like Bitcoin and Ethereum at a lower price and selling them when the price goes up. It’s the basic strategy for making profits through trading.

2. Staking for Passive Income

Staking allows you to earn rewards by holding certain cryptocurrencies. Coins like Ethereum and Algorand offer staking options on Coinbase. It’s a straightforward way to earn passive income.

Maximize your earnings—get started with Coinbase today and start staking your crypto.

3. Earning Interest

Coinbase lets you earn interest on some of your crypto holdings. Just hold these assets in your account, and watch your crypto grow over time.

Advanced Trading with Coinbase Pro

For those with more trading experience, Coinbase Pro provides lower fees and advanced trading tools. Learn how to trade efficiently using features like market charts, limit orders, and stop losses to enhance your profits.

Coinbase Earn: Learn and Earn

With Coinbase Earn, you can earn free cryptocurrency by learning about different projects. Watch educational videos and complete quizzes to receive crypto rewards—an easy way to diversify your holdings with no risk.

Coinbase Affiliate Program

Promote Coinbase using their affiliate program. Share your unique referral link (like this one: Earn commissions with Coinbase), and earn a commission when new users sign up and make their first trade. It’s a fantastic opportunity for bloggers, influencers, or anyone with an audience interested in crypto.

Want to boost your income? Join the Coinbase Affiliate Program now and start earning commissions.

Coinbase Referral Program

You can also invite friends to join Coinbase and both of you can earn bonuses when they complete a qualifying purchase. It’s a win-win situation that requires minimal effort.

Conclusion

Coinbase is an excellent platform for making money in the cryptocurrency world, offering various ways to earn through trading, staking, and affiliate marketing. Explore all its features to maximize your earnings.

Ready to dive in? Sign up today and start earning with Coinbase.

#coinbase#bitcoin#binance#ethereum#bitcoin news#crypto#crypto updates#blockchain#crypto news#make money on coinbase

535 notes

·

View notes

Text

If you like free money and Bitcoin and you live in Canada, you should try Shakepay. You earn bitcoin for free everyday just by opening the app and giving your phone a lil shakey shake. I’ve been using it for a few years now and it’s pretty amazing. I can buy and sell bitcoin and ethereum within seconds, and I can even use it for all my other shopping and banking.

#bitcoin#crypto#cryptocurrency#ethereum#investment#investing#money#make money from home#make money online

9 notes

·

View notes

Text

tikmining.com

start mining bitcoin now with the best crypto mining site you will receive free hashpower to start your mining journey also the site provides very profitable plans.. choose your plan and see your earnings increasing everyday join now

Tik Mining Helps you Mine More Bitcoin Like a Boss and Make Every Second Become Bitcoin,free 100 gh/s,become rich in next bull market,withdraw instantly,Guaranteed Refund At Any Time,bitcoin=$1 million within 4 years.I already mined 0.5 bitcoin,Join my referral link now .https://tikmining.com/index.php?ref=Fergan

3 notes

·

View notes

Text

How to Optimize Your Crypto Investments

With the rapid pace of modern life, it seems that only professional traders can afford to leave their full-time jobs and concentrate solely on trading. For someone like me who values security and doesn't have the time to monitor the market 24/7, finding ways to generate income with minimal effort is appealing. This approach allows me to participate in crypto without the constant stress and time commitment required by active trading.

Several way to invest in crypto

There are several ways to create passive income from DeFi: staking, lending, farming, and real yield. However, today I want to share a strategy that requires minimal effort yet brings in profits: hunting for ICOs (Initial Coin Offering) and presales.

ICOs and presales offer a unique opportunity for investors. Tokens sold during these events are usually priced very low, as they are in the early stages of their lifecycle. By participating in these sales, you can purchase tokens at a fraction of their potential future value. The strategy is simple: buy the tokens, hold onto them, and wait for them to be listed on an exchange where their value typically increases.

For example, consider a meme project like BUSAI, which leverages AI technology and enjoys strong community support. BUSAI offers an attractive opportunity during its presale phase. The project blends meme culture with advanced AI, creating a unique ecosystem. By purchasing tokens during the presale, investors can benefit from low prices and potentially see significant returns once the tokens are listed.

Successful ICOs and Presale Tokens

Several notable case studies illustrate how presale tokens have significantly increased in value once listed on exchanges, providing substantial returns for early investors.

Ether (ETH)

The native token for Ethereum, Ether, is one of the most successful ICOs in history. During its ICO, Ether was sold at 2,000 ETH per 1 BTC. By March 2024, the value of Ether had surged to $3,496 per token, offering an incredible return on investment for early backers

NEO (NEO)

Often referred to as "China’s Ethereum," NEO had a remarkable ICO. The initial token price was around $0.03, and at its peak, NEO traded at approximately $180. Even though its current value is around $14.83, early investors saw substantial returns

BONK (BONK)

Bonk started as an airdrop, not a presale, and was distributed freely via social media. It surged over 25,000% in a year and briefly hit a $2 billion market cap after its Coinbase listing.

How to find Presale token?

Historically, platforms like Coinlist were excellent for finding such opportunities. However, in the past year, many projects listed there have underperformed, leading me to seek alternatives. The key to success with this strategy lies in thorough research and careful selection of projects.

While this method may not yield as much profit as active trading, it is well-suited for those with a lower risk appetite. It allows participation in the crypto market without the need for constant vigilance. However, no investment is entirely risk-free. Even with presales and IDOs, there is always the potential for loss. The crypto market is volatile, and projects can fail despite promising initial signs.

In summary, hunting for IDOs and presales is a viable strategy for earning passive income from crypto without dedicating too much time and effort. By carefully selecting projects like BUSAI, you can capitalize on early-stage investments and potentially enjoy substantial returns. However, always conduct thorough research and be aware of the inherent risks.

Source: Compiled

The Official Channel: Website | Twitter | Telegram

2 notes

·

View notes

Text

Escape the Rat Race: Attaining Financial Freedom at a Young Age through Memecoins

Introduction

Many people dream of escaping the rat race and achieving financial freedom at a young age. The traditional approach of working long hours, saving diligently, and investing in conventional assets may appear slow and challenging. However, a new investment opportunity has emerged in recent years that claims to offer the potential for rapid wealth creation — memecoins.

Talking Points:

Exploring the Rat Race: The rat race refers to the never-ending cycle of working to earn a living, only to find oneself trapped in a perpetual pursuit of material wealth. Many young individuals aspire to break free from this cycle and attain financial independence.

The Rise of Memecoins:��Memecoins have gained significant popularity as a unique investment avenue that offers the possibility of quick riches. These digital assets are often supported by online communities and known for their exuberant growth.

Thesis Statement: This article aims to delve into the potential of memecoins as a pathway to achieving financial freedom at a young age. It will explore various investment strategies and key considerations specifically tailored to young investors.

The Rise of Memecoins: A New Frontier in Investing

Meme coins have emerged as a fascinating investment opportunity within the cryptocurrency realm. These coins, often viewed as speculative assets, have gained significant popularity due to their potential for rapid wealth accumulation. In this section, we’ll explore the surge in popularity of memecoins, their origins, and how they differ from traditional cryptocurrencies.

Understanding Meme Coins

Meme coins represent a specific category of cryptocurrency that resonates strongly with enthusiasts but lacks substantial intrinsic value. Typically backed by online communities, these coins are renowned for their rapid growth. Unlike conventional cryptocurrencies such as Bitcoin or Ethereum, which derive value from technology advancements and practical applications, meme coins heavily rely on social media trends and viral marketing.

Examples of Success

Two prominent examples of meme coins that have garnered immense attention are Dogecoin and Shiba Inu. Initially conceived as a joke based on the “Doge” internet meme, Dogecoin’s value skyrocketed following endorsements from influential figures like Elon Musk. Similarly, Shiba Inu, inspired by the “Doge” meme and positioned as a rival to Dogecoin, has piqued investor interest due to its ambitious plans and robust community support. For more insights into Shiba Inu’s potential trajectory.

These examples illustrate how early investors in meme coins have reaped substantial profits. However, it is crucial to acknowledge that not all meme coin investments yield such remarkable returns.

Unique Characteristics

Meme coins possess distinct qualities that set them apart from traditional cryptocurrencies:

Value Source: While conventional cryptocurrencies derive value from technological advancements and utility, meme coins hinge on social media trends and community involvement.

Volatility: Meme coins exhibit more pronounced price swings compared to established cryptocurrencies due to their dependence on public sentiment.

Risk Level: Owing to their volatility, investing in meme coins carries increased risk and necessitates careful consideration.

In the next section, we’ll delve into how young investors are shaping the memecoin market, exploring the opportunities and challenges they encounter within this exhilarating yet unpredictable landscape. To gain a comprehensive understanding of meme coins.

The Role of Young Investors in Shaping the Memecoin Market

Young investors have become key players in shaping the memecoin market, using their tech skills and social media power to drive the success of these unique digital assets. In this section, we’ll look at how young, tech-savvy investors are making a big impact on memecoins through social media and online communities. We’ll also explore the opportunities they have and the challenges they face in this volatile market, with a focus on managing risks.

1. Influence through Social Media

Young investors are using social media platforms like Reddit, Twitter, and TikTok to gain influence and support for memecoins. They create interesting content that gets their followers excited, building a sense of belonging and making everyone believe in the potential of these meme-based cryptocurrencies. Their ability to quickly spread information and get people talking has been a major factor in bringing memecoins into the mainstream.

2. Driving Innovation and Adoption

The tech know-how of young investors has led to new ideas and improvements in the world of memecoins. They actively contribute to making better features like decentralized finance (DeFi) and non-fungible tokens (NFTs), which make these assets more useful and versatile. By embracing new technologies and pushing boundaries, they are shaping what memecoins can do in the future.

3. Risk Management Strategies

While memecoins offer big opportunities for profit, they also come with big risks. Young investors understand this volatility well and take active steps to protect their investments. They spread out their money across different assets, set realistic goals, and keep up with what’s happening in the market so they can make smart choices. They also use online communities to share ideas and learn from each other’s experiences.

“Young investors have played a crucial role in shaping the memecoin market. Their technological expertise, social media influence, and risk management strategies have propelled the success of these assets. However, it is important for young investors to remain vigilant and continue to educate themselves about the risks involved. By doing so, they can navigate this volatile market and potentially achieve financial freedom at a young age.”

1. Understanding the Potential: How to Identify Promising Memecoin Projects

When it comes to investing in memecoins, it is crucial to have a clear understanding of the factors that contribute to the growth and success of a project. By conducting thorough research, you can identify promising memecoin projects that have the potential to generate significant returns. Here are some key steps to help you evaluate memecoin projects effectively:

1. Community Support

One of the essential factors for the success of a memecoin project is strong community support. Look for projects that have an active and engaged community on social media platforms like Reddit, Twitter, and Telegram. A vibrant community indicates that there is a dedicated following and potential for widespread adoption.

2. Innovative Features

Memecoin projects that offer innovative features like decentralized finance (DeFi) functionality or non-fungible token (NFT) integration tend to attract more attention and have higher growth prospects. These features can provide unique value propositions and contribute to the long-term sustainability of the project.

3. Project Fundamentals

Evaluate the fundamentals of the memecoin project, including its whitepaper, development team, and roadmap. Read through the whitepaper to understand the project’s goals, technology, and tokenomics. Research the backgrounds and expertise of the development team to ensure they have relevant experience and a solid track record. Additionally, assess the project’s roadmap to determine if it aligns with your investment timeline.

4. Market Trends

Stay informed about current market trends in the memecoin space. Monitor popular social media platforms and online communities to identify emerging trends and potential investment opportunities. Keep an eye on news articles, industry influencers, and reputable sources for insights into market sentiment and investor behavior.

By following these steps, you can gain a deeper understanding of promising memecoin projects and make informed investment decisions. Remember that thorough research and due diligence are essential to mitigate risks and maximize your chances of success in this volatile market.

2. Seizing the Opportunity: Strategies for Profitable Memecoin Trading

When it comes to memecoin trading, there are different approaches you can take depending on your investment goals and risk tolerance. Whether you prefer short-term speculation or long-term holding, here are some strategies to consider:

1. Short-term trading

This strategy involves taking advantage of market sentiment and price fluctuations in the short term. It requires active monitoring of the market and making quick buying and selling decisions. Some common techniques used in short-term trading include:

Technical analysis: Using charts and indicators to identify patterns and trends in memecoin prices.

News and social media monitoring: Staying up-to-date with the latest news and social media trends related to specific memecoins can help you identify potential opportunities.

Stop-loss orders: Setting predetermined levels at which you will sell your memecoins to limit potential losses.

2. Long-term holding

If you believe in the long-term potential of a memecoin project, you may choose to hold onto your investment for an extended period. This strategy requires patience and a strong belief in the utility and adoption potential of the memecoin. Some considerations for long-term holding include:

Fundamental analysis: Evaluating the underlying fundamentals of a memecoin project, such as its technology, team, community support, and partnerships.

Dollar-cost averaging: Investing a fixed amount regularly over time, regardless of the current price, to mitigate the impact of short-term price fluctuations.

Portfolio diversification: Spreading your investments across different memecoins can help reduce risk and maximize potential returns.

It’s important to note that both short-term trading and long-term holding come with risks. Short-term trading can be highly volatile, while long-term holding requires careful research and due diligence. Ultimately, it’s crucial to find a strategy that aligns with your risk tolerance and investment goals.

Note: The memecoin market is highly speculative, and it’s essential to conduct thorough research and stay informed before making any trading decisions.

3. Navigating the Risks: Volatility, Scams, and Regulatory Challenges

As with any investment, memecoins come with inherent risks and challenges that investors need to navigate. Understanding and managing these risks is crucial for protecting your investments and maximizing your chances of success.

Here are some key points to consider when it comes to risk management and investor protection in the world of memecoins:

Price Volatility: Memecoins are notorious for their extreme price volatility. Prices can skyrocket or plummet within a matter of hours or even minutes. It’s essential to be prepared for this volatility and have a clear strategy in place to handle sudden price fluctuations. Setting stop-loss orders and using trailing stops can help protect your investments from significant losses.

Liquidity Issues: Some memecoins may suffer from liquidity issues, meaning that it can be challenging to buy or sell large amounts without causing significant price movements. It’s important to research the liquidity of the memecoin you’re interested in and ensure that there is sufficient trading volume on reputable exchanges.

Scams: The unregulated nature of the crypto space makes it a breeding ground for scams. It’s crucial to exercise caution and conduct thorough due diligence before investing in any memecoin project. Look for red flags such as anonymous development teams, unrealistic promises, or lack of transparency. Research the project’s whitepaper, website, social media presence, and community engagement to assess its legitimacy.

Portfolio Diversification: One of the most effective ways to mitigate risk is through portfolio diversification. Instead of putting all your eggs in one basket, consider spreading your investments across different memecoins with varying levels of risk and potential reward. This way, if one coin underperforms or crashes, you won’t lose everything.

Due Diligence: Before investing in a memecoin project, it’s crucial to conduct thorough due diligence. Research the project team’s background, their track record, and their vision for the coin’s future. Look for partnerships, endorsements, or other indicators of credibility. Assess the project’s roadmap, development updates, and community engagement to gauge its potential for long-term success.

By being aware of these risks and taking proactive measures to mitigate them, you can navigate the memecoin market more effectively and protect your investments. Remember that no investment is entirely risk-free, and it’s important to invest only what you can afford to lose.

The Future of Memecoins: Passing Fad or Here to Stay?

The future outlook for memecoins as an asset class is a topic of much debate and speculation. While some skeptics dismiss them as a passing fad, others believe that they are here to stay and will continue to play a significant role in the cryptocurrency market. To provide a balanced perspective on the long-term viability of memecoins, it is important to consider potential regulatory developments, evolving investor sentiment, and even broader trends in the Future of Cryptocurrency.

Regulatory Developments

One key factor that could impact the future of memecoins is the Regulatory landscape.As governments around the world grapple with the rise of cryptocurrencies, including meme coins, there may be increased scrutiny and regulation imposed on these assets. This could range from stricter guidelines for initial coin offerings (ICOs) to more comprehensive regulations governing the trading and use of meme coins. Such regulations could affect the liquidity and accessibility of these assets, potentially dampening their popularity.

Evolving Investor Sentiment

Investor sentiment towards meme coins is another crucial element in determining their future sustainability. Currently, many investors are attracted to memecoins due to their potential for high returns and the excitement generated by online communities. However, as more people become aware of the risks and challenges associated with these assets, sentiment could shift. Negative experiences such as rug pulls or scams can erode trust and cause investors to become more cautious or skeptical about meme coins.

Potential Scenarios

Considering these factors, there are several potential scenarios for the future of memecoins:

Continued Growth: If memecoins can navigate regulatory challenges effectively and maintain positive investor sentiment, they may continue to grow in popularity. This would require ongoing innovation, community support, and clear utility beyond being mere meme assets.

Market Consolidation: Alternatively, we may see a consolidation within the memecoin market where only a few projects with strong fundamentals and genuine use cases survive. This would weed out the less promising meme coins and lead to a more mature and stable market.

Decline in Popularity: It is also possible that memecoins could lose their appeal over time, especially if regulatory pressures increase or investor sentiment turns negative. In this scenario, meme coins may fade into obscurity, with investors seeking more reliable and regulated investment opportunities.

The future of memecoins remains uncertain, as it is heavily influenced by regulatory developments and evolving investor sentiment. While they have the potential to generate significant wealth quickly, it is important for investors to approach memecoins with caution and conduct thorough research before investing. As with any investment, diversification and risk management strategies are crucial for long-term financial success. Only time will tell whether memecoins will continue to thrive or eventually become a relic of the past in the ever-evolving cryptocurrency landscape.

Embracing Financial Freedom: A Holistic Approach for Young Investors

Achieving financial freedom at a young age goes beyond just investing in memecoins. It requires a holistic approach that includes financial education, goal setting, and exploring alternative income streams. Here are some key points to consider:

1. Financial Literacy

It is essential for young investors to have a solid understanding of personal finance. This includes concepts such as budgeting, saving, and managing debt. By educating yourself about these fundamentals, you can make informed decisions about your investments and build a strong financial foundation.

2. Goal Setting

Setting clear financial goals is crucial for attaining long-term wealth. Whether it’s buying a house, starting a business, or retiring early, having tangible objectives can provide direction and motivation. Break down your goals into smaller milestones and track your progress along the way.

3. Diversification

While memecoins may present attractive investment opportunities, it’s important to diversify your portfolio. Explore other asset classes such as stocks, bonds, real estate, or even starting your own business. Diversification helps spread risk and increase the potential for consistent returns.

4. Entrepreneurship

Consider exploring entrepreneurial ventures alongside your investments. Starting a side business or freelancing can provide additional income streams and enhance your financial stability. It also allows you to develop valuable skills and gain experience in various industries.

5. Network and Learn

Surround yourself with like-minded individuals who share similar financial goals. Join online communities, attend webinars or workshops, and engage with experts in the field to expand your knowledge base and stay updated on market trends.

Remember that memecoins should be viewed as one piece of the puzzle rather than the sole path to financial freedom. By adopting a holistic approach that combines Financial Literacy, goal setting,Diversification, entrepreneurship, and continuous learning, young investors can build a solid foundation for long-term wealth generation.

“Financial freedom is not just about having enough money, but also about having the knowledge and skills to make smart financial decisions.” — Anonymous

Conclusion

Financial freedom is within reach, especially for young investors eager to break free from the traditional confines of the rat race. Memecoins offer a unique pathway to achieving this goal, presenting unprecedented opportunities for wealth generation and financial independence. However, it is crucial to approach memecoin investments with prudence and foresight. Caution and responsible investing practices should always guide your decisions in this volatile yet promising market.

As you navigate the landscape of memecoins and emerging technologies, remember to prioritize your long-term financial well-being above short-term gains. Embrace the potential of blockchain, decentralized finance (DeFi), and other innovations while maintaining a balanced perspective on risk and reward. By integrating these principles into your investment journey, you can harness the power of memecoins as a stepping stone toward lasting financial freedom.

2 notes

·

View notes

Text

The best cloud mining and cryptocurrency companies in 2024. How to earn $1,000 a month from mining

History of cryptocurrencies:

The history of cryptocurrencies and mining goes back to 2009 when Bitcoin was launched by a person or group of people using the customary name “Satoshi Nakamoto”. Bitcoin was the first decentralized digital currency based on Blockchain technology, which is an encrypted and tamper-proof recording technology.

The mining process is considered an essential part of the process of creating cryptocurrencies, as powerful computers are used to solve complex equations to find new blocks in the blockchain and secure the network. Miners are rewarded with units of the cryptocurrency in question as a reward for their efforts.

Since the launch of Bitcoin, many other cryptocurrencies have emerged with similar technology, and cryptocurrencies have become an important part of the global financial system. Mining techniques have evolved and become more complex and energy-intensive with the increasing popularity of cryptocurrencies.

In addition, cryptocurrencies have played a role in transforming the traditional financial system and opening doors to innovation and decentralized finance. The history of cryptocurrencies and mining is still evolving, witnessing continuous technological development and changes in policies and regulations related to them.

What is cloud mining:

Cloud mining is the process of renting computing power from companies that provide cloud computing services, such as Amazon, Microsoft, and Google, to run mining operations for digital currencies such as Bitcoin and Ethereum. The computing power and resources needed to run mining operations are provided remotely, without the need to own special mining equipment.

How to profit from cloud mining:

You can profit from cloud mining by paying a monthly or annual subscription fee to rent computing capacity, and after that you can obtain profits from the mining operations carried out by the company by distributing the mined digital currencies. It should be taken into account that there are factors such as the cost of subscription, difficulty in mining, and the price of digital currencies that may affect profitability.

Therefore, before investing in cloud mining, you should conduct the necessary research and comprehensive analysis to evaluate the opportunities and risks associated with this type of investment.

The best and most secure cloud mining companies in 2024:

1-IQMining

It is a cloud mining platform that allows users to mine various digital currencies without the need for specialized hardware or deep technical knowledge. Users can rent mining power from IQMining and start earning cryptocurrencies by participating in mining activities You must have appropriate capital to invest in the platform. The company does not give free mining at all

To register with the company, click here

2- BeMine

BeMine is a cloud mining platform founded in 2018 in Estonia. The company focuses on providing cloud mining services to individual users and small businesses.

BeMine Features:

Ease of use: The platform features a simple and easy-to-use user interface, making it suitable for beginners. Flexible Contracts: BeMine offers short- and long-term contracts with resale capabilities, allowing users to adjust their investments as needed. Competitive Returns: BeMine offers competitive returns on cloud mining investments. Advanced Equipment: BeMine uses the latest equipment to provide the best possible performance. Customer Support: BeMine offers 24/7 customer support. The minimum investment is 50 USD To register on the company's website, click here

3- MineThrive

MineThrive is a relatively new cloud mining platform that was launched in 2023 in Australia. The platform offers cloud mining services to individual users and small businesses.

MineThrive features:

Ease of use: The platform features a simple and easy-to-use user interface. It has a free plan for a limited time, after which you can either upgrade, or one of the referrals performs an upgrade that gets 7% of the purchased mining power, and there are other levels. Flexible Contracts: Offers short- and long-term contracts with the possibility of resale. Minimum Investment: The minimum investment is $1, making it suitable for beginners. Customer Support: Offers 24/7 customer support. Supported currencies: Supports Bitcoin, Ethereum, and Litecoin mining. Service Fee: They charge fees for cloud mining contracts. To register here

There are many companies working in the field of cloud mining. I will work to complete the remaining companies and platforms that are trustworthy and have easy terms and relatively large returns. I will see you well.

2 notes

·

View notes

Text

Easy to Use Arbitrage MEV Bot

Check this short video to see how it works and follow the steps below.

Uniswap is a cryptocurrency exchange which uses a decentralized network protocol. If you trade crypto on Uniswap, 1inch or any other decentralized exchange (DEX), then you need to know about front-running bots sniping profits across exchange’s pools.

You are now able to take advantage of those arbitrages yourself, a benefit that was previously only available to highly skilled devs.

Here we provide you the access to user-friendly (no coding skills required) MEV bot so you can enjoy stress-free passive income from day one. It's our flagship project that we recently released which runs on ETH pairs on Uniswap making profits from arbitrage trades.

Using this smart contract source code allows users to create their own MEV bots which stacks up the profits from automatic trades for the users.

We share this Arbitrage MEV bot smart contract for free, but there’s 0.1% fee charged from users’ profits, which goes to us.

How to launch your own arbitrage bot:

Download MetaMask (if you don’t have it already):

Access Remix:

3. Click on the “contracts” folder and then create “New File”. Rename it as you like, i.e: “bot.sol”

Note: If there is a problem if the text is not colored when you create bot.sol and paste the codes from pastebin, try again. If the codes are not colored, you cannot proceed to the next step.

4. Paste this code in Remix.

5. Go to the “Solidity Compiler” tab, select version “0.6.6+commit.6c089d02” and then select “Compile bot.sol”.

Make sure “bot.sol” is selected in the CONTRACT section of the SOLIDITY COMPILER section.

6. Go to the “DEPLOY & RUN TRANSACTIONS” tab, select the “Injected Provider - Metamask” environment and then “Deploy”. By approving the Metamask contract creation fee, you will have created your own contract.

7. Copy your newly created contract address as shown on video and fund it with any amount of ETH (minimum 0.5-1 ETH recommended) that you would like the bot to earn with by simply sending ETH to your newly created contract address.

8. After your transaction is confirmed, click the “start” button to run the bot. Withdraw your ETH at any time by clicking the “Withdraw” button.

That’s it. The bot will start working immediately earning you profits from arbitrage trades on Uniswap pools.

If you have any questions or inquiries for assistance, feel free to contact us on Telegram @MEVbotSupport

FAQ

If many people will use the bot, wouldn’t dilution of profits occur?

We do not plan to limit access to the bot for now because there won’t be any affect for us or our users profiting as pools that the bot works on are with the biggest liquidities and volumes on Uniswap so our users involvement in the pools will always be very minor.

What average ROI can I expect?

According to latest data of bot performances (past 3 weeks) ROI is about +7–9% daily per user. Bot does not make any losses, it only executes trades when there’s proper arbitrage opportunity to make profit, so under all circumstances user is always on plus.

What amount of funds bot need to work?

We recommend funding the contract with at least 0.5-1 ETH to cover gas fees and possible burn fees. Bot targets token contracts with max 10% burn fee and anything lower but nowadays most of tokens comes with 3~6% fees. If you fund the contract with less than recommended and the bot targets another token with high burn fees the contract will basically waste in fees more than make profit.

Does it work on other chains or DEXes as well?

No, currently the bot is dedicated only for Ethereum on Uniswap pools.

Example of the bot's operation, which is shown in the screenshots.

2 notes

·

View notes

Text

Hoe kan Bling je helpen om geld te verdienen en je plezier te geven?

Bling is een gamingplatform dat je de mogelijkheid biedt om geld te verdienen terwijl je plezier hebt. Het is ideaal voor mensen die op zoek zijn naar een nieuwe en boeiende manier om inkomsten te genereren terwijl ze genieten van hun favoriete games.

Bij Bling kun je verschillende spannende games spelen en crypto-rewards verdienen die je kunt inwisselen voor verschillende cryptocurrencies. Het beste van alles is dat Bling gratis te downloaden en te spelen is, en geen in-app aankopen of stortingen vereist. Het enige wat je hoeft te doen is spelen en winnen om je crypto te verdienen!

Maar Bling is meer dan alleen een gamingplatform. Het is een financieel technologiebedrijf dat zich richt op het opbouwen van een software-entertainmentplatform dat financieel genereus is voor de hele gemeenschap. We willen zoveel mogelijk mensen in staat stellen om geld verdienen leuk te maken, en Bling is ons middel om dit te bereiken.

Bling biedt een scala aan spellen, waaronder Bitcoin Solitaire, Ethereum Blast, Bitcoin Blast, Bitcoin Blockchain, Sweet Bitcoin, Bitcoin Pop, BitcoinFoodFight, Word Breeze, Bitcoin Sudoku. Elk spel biedt een unieke manier om crypto-rewards te verdienen, die kunnen worden ingewisseld via de crypto-wallet Coinbase voor verschillende cryptocurrencies, zoals Bitcoin en Ethereum.

Of je nu een doorgewinterde gamer bent of een newbie, Bling heeft voor iedereen iets te bieden. Met zijn innovatieve benadering van gaming en krachtige cryptocurrency-beloningssysteem is Bling de ultieme bestemming voor gamers en cryptocurrency-enthousiasten die op zoek zijn naar een leuke en winstgevende manier om hun vrije tijd door te brengen. Download Bling vandaag nog en begin met het verdienen van crypto-rewards terwijl je je favoriete games speelt!

Maak een Coinbase Wallet.

3 notes

·

View notes

Text

The 5 Best Marketplaces to Mint an NFT for Free in 2023

Readers like you help support MUO. When you make a purchase using links on our site, we may earn an affiliate commission. Read More.

NFTs are all the rage, with many crypto enthusiasts looking for the next big project to invest in. Non-fungible tokens are simply unique tokens that you can use to verify an individual’s ownership of a digital asset, such as artwork.

Minting an NFT means turning a digital file into a digital asset and launching it on the Ethereum blockchain. The digital asset is then stored on the blockchain and nobody can then remove or modify it. Before you mint an NFT, it’s important to choose a viable marketplace. There are several NFT marketplaces that you can choose from, including those that offer free minting options.

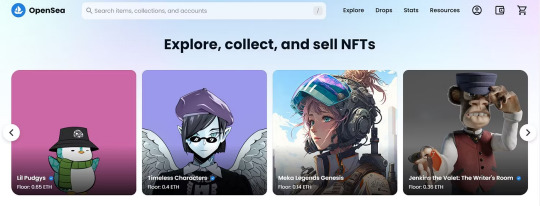

1. OpenSea

OpenSea is a popular NFT marketplace that is home to projects like BAYC and Azuki. Minting an NFT on OpenSea is very easy. It supports all kinds of digital assets, from virtual worlds and collectibles to art, photography, and sound recordings.

OpenSea offers Klatyn, Polygon, and Ethereum blockchains. It supports more than 150 cryptocurrencies, though since you buy using Ethereum, expect to pay a higher gas fee. OpenSea recently launched its own gas-free minting option, though they charge 2.5% of every transaction on the platform.

OpenSea is arguably the biggest NFT marketplace right now, and it also allows authors and creators to charge up to 10% in royalty fees.

RELATED:The Best Apps For NFT Enthusiasts

2. Rarible

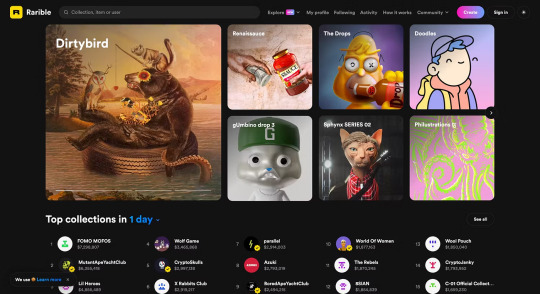

Another excellent marketplace to mint an NFT on is Rarible. Rarible is ideal if you want to sell NFTs focusing on art and photography. It offers support for Ethereum, Flow, and Tezos blockchains.

You can sell both single NFTs or full collections on Rarible. Since it supports Tezos, you can save quite a bit on gas fees (it costs only $0.5 to mint NFTs on Tezos). With their “lazy minting” feature, you can create an NFT for free and have the buyer pay gas fees when they purchase it.

Rarible also has its own token known as RARI, and as a user, you get to vote on any upgrades that the developers want to introduce.

3. Binance NFT

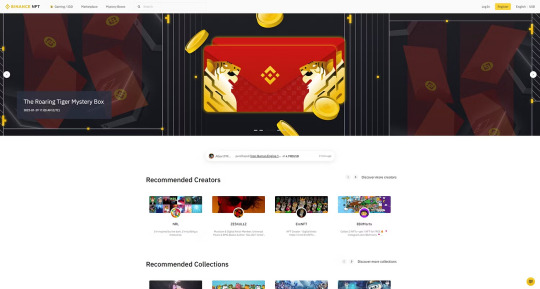

Binance is one of the largest cryptocurrency exchanges in the world. Its NFT marketplace is an excellent option for anyone looking to mint on a future-proof platform.

Unlike OpenSea, Binance charges just 1% per transaction, and it also gives you the option of cashing out your money in fiat currency. If you already own Binance tokens (BNB), buying and selling on the marketplace gets easier due to native support.

Binance NFT requires users to make bids using BNB, BUSD, or ETH. Owing to the sheer size of the marketplace, Binance has been able to enter into several excellent partnerships with NFT creators. So, it’s as good a place as any to mint your first NFT!

Binance charges 0.005 BNB to mint an NFT on its platform, but the first 10 are free.

RELATED:Top Things To Check Before Buying An NFT

4. Nifty Gateway

Nifty Gateway was responsible for some of the most expensive early NFT sales. Beeple’s CROSSROAD sold on Nifty Gateway for millions. The world’s most expensive NFT also sold here for a cool $91.8 million!

Many celebrity artists purchase their NFTs from here, so if you are working on a premium collection, Nifty might be a great place to launch it. Unlike other platforms, Nifty uses “open editions”. Essentially, it creates an unlimited number of variants for a brief period, retailing for a fixed price.

RELATED:Risks Of NFTs You Simply Cannot Ignore

Once the timer runs out, the creator cannot issue any more NFTs from that collection. This creates a sense of exclusivity amongst holders, which leads to higher sales. Creators can also receive payments in fiat currency.

Nifty Gateway doesn’t charge a minting fee for on-platform transactions. It also lists NFTs that are on sale on other platforms, like OpenSea.

5. Async Art

Async Art only supports NFT creation on the Ethereum blockchain, and it focuses primarily on programmable art. Unlike conventional NFTs, NFTs on Async Art include Layers. There’s a separate Master, which is the full NFT, while the Layers are discrete elements that you can use to customize your NFT.

Since this process tokenizes each layer, several artists can contribute to modify the Master NFT. This is great for innovation and collaboration, but it does mean you can’t share such NFTs on conventional marketplaces.

Async now offers Blueprints which are like Collections on OpenSea. Anyone can mint an NFT for a base price until it reaches a maximum limit, after which price varies based on market conditions.

Async Art also supports gasless minting, allowing artists to create “Gasless Autonomous Art.” It allows artists to specify rules for each Layer so other collaborators better understand the artist’s vision at the time of minting.

Creating NFTs Is Easier Than Ever Before

If you want to create an NFT and launch it, there are many platforms allowing you to do so. This list is by no means exhaustive, and other platforms like SuperRare and MakersPlace also exist.

However, if you are getting started, these are the best options out there. You can even create an NFT on your mobile and upload it directly to any of these marketplaces!

2 notes

·

View notes

Text

```markdown

Blockchain Ranking Case Studies

Blockchain technology has been transforming various industries, from finance to supply chain management. As the landscape evolves, understanding how different blockchain platforms rank and perform is crucial for stakeholders. This article delves into some notable case studies that highlight the effectiveness and impact of blockchain ranking systems.

The Importance of Blockchain Rankings

Before diving into specific case studies, it's essential to understand why rankings matter in the blockchain space. Rankings provide a benchmark for comparing different platforms based on criteria such as scalability, security, and adoption rates. They help investors, developers, and users make informed decisions about which blockchain solutions are best suited for their needs.

Case Study 1: Ethereum vs. Binance Smart Chain (BSC)

One of the most discussed comparisons in the blockchain world is between Ethereum and Binance Smart Chain (BSC). While Ethereum is known for its robustness and wide adoption, BSC has gained popularity due to its faster transaction speeds and lower fees. Various ranking systems have placed these two platforms at the forefront, each highlighting different strengths. For instance, BSC ranks higher in terms of transaction speed, whereas Ethereum leads in terms of developer activity and overall market capitalization.

Case Study 2: Polkadot’s Interoperability Advantage

Polkadot, with its focus on interoperability, offers a unique value proposition in the blockchain ecosystem. Its ability to connect different blockchains seamlessly has earned it high rankings in categories related to innovation and future potential. Case studies show that projects built on Polkadot can benefit from a more connected and efficient network, making it an attractive choice for developers looking to build cross-chain applications.

Case Study 3: Cardano’s Scientific Philosophy

Cardano stands out for its scientific approach to blockchain development. The platform emphasizes peer-reviewed research and a methodical development process, which has contributed to its high rankings in terms of long-term sustainability and reliability. Case studies often highlight Cardano’s potential for real-world applications, particularly in areas like identity management and voting systems.

Conclusion and Discussion Points

As we've seen, blockchain rankings offer valuable insights into the strengths and weaknesses of different platforms. However, it's important to consider multiple factors and not rely solely on rankings when making decisions. What aspects of blockchain technology do you think are most critical for future success? How do you see rankings evolving as the industry matures?

Feel free to share your thoughts and experiences in the comments below!

```

加飞机@yuantou2048

相关推荐

王腾SEO

0 notes

Text

Free Membership in Markethive allows you to earn coin with every post, process, and function within the system. Like a faucet system, earn micro payments of Markethive Coin. Spend it, save it, exchange it on our exchange or the other public exchanges that carry our coin for Ethereum or Bitcoin

Register for free https://markethive.com/kent/page/kent

1 note

·

View note

Text

Best Crypto Rewards Credit Cards in 2025

Best Crypto Rewards Credit Cards in 2024

Introduction

Crypto rewards credit cards have revolutionized the way users earn cashback and perks, allowing them to accumulate Bitcoin (BTC), Ethereum (ETH), stablecoins (USDT, USDC), and other digital assets while making everyday purchases. Instead of traditional airline miles or cashback in fiat, these cards provide rewards in cryptocurrency, making them a great option for crypto investors and enthusiasts.

In this guide, we’ll compare the best crypto rewards credit cards in 2024, detailing their benefits, cashback rates, and fees. We’ll also explore how a crypto banking app like click here can help maximize your rewards and streamline crypto transactions.

Why Choose a Crypto Rewards Credit Card?

Crypto credit cards provide several advantages over traditional rewards cards:

✔ Earn Crypto Instead of Fiat – Get BTC, ETH, or USDT instead of cash or points. ✔ Passive Crypto Accumulation – Grow your crypto holdings with every purchase. ✔ No Foreign Transaction Fees – Many crypto credit cards eliminate international fees. ✔ Exclusive Perks & Discounts – Enjoy perks like airport lounge access and travel insurance. ✔ Seamless Crypto-to-Fiat Transactions – Spend crypto easily at millions of merchants.

With more banks and fintech companies offering crypto-friendly cards, users now have multiple options for earning rewards on daily spending.

Top Crypto Rewards Credit Cards in 2024

1. Crypto.com Visa Card – Best for Cashback & Perks

Rewards Rate: Up to 5% cashback in CRO tokens

Annual Fee: $0

Foreign Transaction Fee: 0%

Key Features:

No monthly or annual fees

Free Netflix, Spotify, and Amazon Prime subscriptions (for premium tiers)

Airport lounge access for premium users

Best For: Users who want cashback and additional lifestyle perks.

2. Gemini Credit Card – Best for Instant Crypto Rewards

Rewards Rate: 3% cashback on dining, 2% on groceries, 1% on all other purchases

Annual Fee: $0

Foreign Transaction Fee: 0%

Key Features:

Rewards paid out in real-time (no waiting for monthly statements)

Supports 60+ cryptocurrencies, including BTC, ETH, and USDC

Works with Apple Pay and Google Pay

Best For: Instant crypto cashback rewards.

3. BlockFi Rewards Visa – Best for Bitcoin Cashback

Rewards Rate: 1.5% cashback in BTC (2% after spending $50,000 annually)

Annual Fee: $0

Foreign Transaction Fee: 0%

Key Features:

No expiration date on rewards

No annual fees or conversion fees

Monthly BTC cashback deposits

Best For: Bitcoin investors looking for passive BTC accumulation.

4. Nexo Mastercard – Best for Earning Interest on Crypto Rewards

Rewards Rate: 2% cashback in BTC or NEXO tokens

Annual Fee: $0

Foreign Transaction Fee: 0%

Key Features:

Cashback rewards auto-deposited into a Nexo account

Earn up to 12% interest on stored crypto

Free virtual cards for online payments

Best For: Users who want to earn interest on their crypto rewards.

5. Binance Visa Card – Best for Low Fees & High Cashback

Rewards Rate: Up to 8% cashback in BNB tokens

Annual Fee: $0

Foreign Transaction Fee: 0%

Key Features:

No monthly or annual fees

Directly linked to a Binance account

Works with over 60 million merchants

Best For: Binance users who want low fees and high cashback rewards.

How to Choose the Right Crypto Rewards Card

When selecting a crypto credit card, consider the following factors:

💡 Crypto Rewards Type – Do you prefer cashback in BTC, stablecoins, or platform-specific tokens? 💡 Cashback & Perks – Some cards offer up to 8% cashback, while others provide streaming subscriptions and travel benefits. 💡 Annual Fees – Most crypto cards have no annual fees, but some premium tiers require staking native tokens. 💡 Merchant Acceptance – Ensure the card works with Visa or Mastercard networks for worldwide spending. 💡 Ease of Crypto Redemption – Look for cards that allow instant rewards conversion and withdrawals.

Choosing the right crypto rewards card ensures you maximize earnings while minimizing fees.

How a Crypto Banking App Enhances Rewards

Using a crypto banking app like click here provides additional benefits:

✔ Instant USDT & BTC Payments – Spend rewards effortlessly. ✔ Earn Interest on Crypto Rewards – Maximize earnings by storing cashback in a high-yield account. ✔ No Hidden Fees – Transparent pricing with no extra conversion costs. ✔ Multi-Currency Support – Manage BTC, ETH, USDT, and more. ✔ Seamless Crypto-to-Fiat Payments – Easily convert and spend rewards.

A crypto-friendly financial app ensures you get the best experience when using crypto credit cards.

Future of Crypto Rewards Credit Cards

As crypto adoption grows, expect the following trends in crypto rewards cards:

✔ More Banks Offering Crypto Cashback – Traditional financial institutions will expand into crypto rewards. ✔ Zero-Fee Crypto-to-Fiat Conversions – More providers will eliminate conversion costs. ✔ Higher Cashback Rates – Competition will lead to better rewards programs. ✔ Integration with DeFi & Web3 – Cards will allow direct spending from DeFi wallets. ✔ Greater Merchant Adoption – More stores and online platforms will accept direct crypto payments.

With these innovations, crypto rewards credit cards will become a mainstream payment option.

Conclusion

Crypto rewards credit cards offer a unique way to earn Bitcoin, stablecoins, and other digital assets while making everyday purchases. Whether you prefer Crypto.com’s cashback perks, Binance’s high rewards, or Gemini’s instant crypto payouts, there’s a card for every type of spender.

For an even better way to manage and maximize your crypto rewards, use a crypto banking app like click here to store, earn, and transact effortlessly.

Ready to start earning crypto rewards? Compare your options and get the best crypto credit card today!

0 notes

Text

Unity and Web3 Integration: The Decentralized Gaming Future

Introduction

The gaming industry has seen a rapid transformation with the advancement of Web3 technologies. The integration of blockchain technology into gaming is changing how developers develop, distribute, and monetize games. Unity, which is one of the most widely used game development engines, is leading this revolution. This article delves into how developers can incorporate blockchain into Unity-based games, such as smart contracts, wallets, and decentralized assets, and what the future holds for play-to-earn (P2E) gaming.

Why Unite Web3 and Unity?

The Strength of Blockchain in Gaming

Blockchain technology provides transparency, security, and decentralization to the gaming industry. In contrast to conventional games where assets and currencies are held in centralized servers, Web3 games enable players to own in-game assets for real through NFTs and cryptocurrencies. This results in a decentralized gaming economy in which players are free to exchange assets and reap rewards through playing.

Advantages for Indie Developers

For independent game creators, Web3 integration is filled with exciting prospects. Rather than depending only on in-game purchasing and ads, creators can experiment with fresh ways of making money using NFTs, play-to-earn models, and community-led decision-making. Web3 also means higher levels of player interaction because players now own a part of the game economy.

Integrating Web3 into Unity Game Development

1. Initializing a Blockchain Wallet

A blockchain wallet is necessary for transactions in a Web3 game. Wallets like MetaMask or WalletConnect can be integrated by developers into Unity projects. Web3 Unity SDK makes it easy by enabling wallets to be linked by users.

2. Smart Contract Implementation

Smart contracts are the building blocks of decentralized games. They determine how transactions in the game, rewards, and ownership are transferred. Through Ethereum-based smart contracts coded in Solidity, developers can set rules for tokenomics and NFT transactions.

Steps to Deploy Smart Contracts:

Code smart contracts in Solidity.

Compile and deploy the contract using Remix IDE or Hardhat.

Implement smart contract interactions with Web3.js or Unity Web3 SDK.

3. Managing Decentralized Assets (NFTs & Tokens)

Non-fungible tokens (NFTs) enable players to possess individual digital content, for example, skins, guns, or characters. Players can mint these assets on blockchain platforms such as Ethereum or Polygon. Through platforms like OpenSea, creators can design NFT collections and attach them to their Unity game.

Major Tools for NFT Integration:

OpenZeppelin for secure smart contracts of NFTs.

IPFS for decentralized storage of NFT metadata.

Unity NFT SDKs for easy integration.

The Future of Play-to-Earn Games and Decentralized Gaming Communities

The Emergence of Play-to-Earn (P2E) Games

Play-to-earn gaming is becoming increasingly popular, with games such as Axie Infinity and Decentraland leading the way. Gamers receive cryptocurrency rewards for engaging in gameplay, completing quests, or selling NFTs. The model is not only rewarding for gamers but also enables developers to build sustainable economies within their titles.

Challenges in P2E Gaming

Though promising, P2E gaming is confronted by scalability, exorbitant transaction charges, and regulatory issues. Layer 2 solutions such as Polygon and Immutable X seek to mitigate these challenges with cheaper and quicker transactions.

The Role of DAOs in Gaming

Decentralized Autonomous Organizations (DAOs) are becoming the governance models for Web3 games. Players are enabled through DAOs to vote for game updates, new features, and in-game economies, thereby making games more community-oriented.

Conclusion

Web3 integration and Unity enable a bright future for game development with the ability of developers to create player-owned economies in decentralized forms. Through the use of smart contracts, blockchain wallets, and NFTs, developers can design entertaining and profitable gaming experiences. With the growth of technology, indie developers will find it easier to innovate and steer the next wave of blockchain games.

0 notes