#eSIM Market Growth

Explore tagged Tumblr posts

Text

The Future of Smart Card ICs: Contactless Payments and Beyond

Smart cards, also known as integrated circuit cards (ICCs), are portable plastic cards embedded with integrated circuits. They facilitate secure identification, authentication, data storage, and application processing. Available in contact-based and contactless formats, smart cards find applications across financial transactions, identification, public transit, healthcare, and more. The evolution of technology continues to expand their scope, making them indispensable in a digitally interconnected world.

Explore our report to uncover in-depth insights - https://www.transparencymarketresearch.com/smart-card-ic-market.html

Key Market Drivers

Rise in Adoption of Contactless Payment Methods The growing preference for contactless payment methods has emerged as a key driver of the smart card IC market. These payments allow transactions without physical touch between the payment card and terminal, offering enhanced convenience and security. According to Barclays, the average UK contactless user performed 220 “touch-and-go” transactions in 2022, reflecting a notable increase from 180 transactions in 2021. Such trends underscore the increasing reliance on contactless technologies, boosting demand for smart card ICs.

Increase in Utilization of Smartphones The widespread adoption of smartphones, particularly those equipped with Near Field Communication (NFC) technology, has amplified the usage of mobile payment systems like Apple Pay, Google Pay, and Samsung Pay. Smart card ICs play a pivotal role in these systems by ensuring secure payments and robust authentication. Leading manufacturers are leveraging advanced technologies to enhance the reliability and performance of their offerings. For instance, Infineon’s launch of the SLC26P security controller in 2022 highlights the innovation driving market growth.

Market Trends

Biometric and Fingerprint Solutions: Vendors are developing next-generation biometric cards and fingerprint sensor packages to cater to the rising demand for cutting-edge security solutions.

eSIM Adoption: The proliferation of eSIMs for machine-to-machine (M2M) communication and 5G network access is a significant trend shaping the market landscape.

Integration of Advanced Technologies: Investments in blockchain, artificial intelligence (AI), and 5G networks are creating new avenues for smart card IC applications.

Market Challenges and Opportunities

While the market is witnessing robust growth, challenges such as high implementation costs and cybersecurity threats persist. However, these challenges present opportunities for innovation, as companies develop advanced encryption technologies and cost-effective solutions to address these concerns.

Key Player Strategies

Prominent players such as Samsung, STMicroelectronics, NXP Semiconductors, and Infineon Technologies are employing strategic initiatives to maintain competitive advantages:

Technological Advancements: Samsung’s patent for an IC integrating fingerprint reading, storage, and processing capabilities, granted in 2024, exemplifies the focus on innovation.

Product Launches: STMicroelectronics’ introduction of the ST4SIM-201 embedded SIM in 2022 demonstrates the emphasis on meeting evolving market demands.

Collaborations and Partnerships: Leading companies are collaborating with stakeholders across industries to expand their market footprint.

Contact:Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected]

0 notes

Text

0 notes

Text

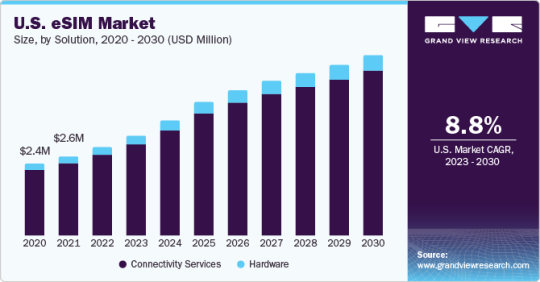

eSIM Market Product Analysis, Share by Types and Region till 2030

The global eSIM market is expected to reach USD 15,464.0 million by 2030 at a CAGR of 7.9% from 2023 to 2030, according to a study conducted by Grand View Research, Inc. Technological developments in consumer electronic devices such as smartphones, laptops, tablets, wearables fueling the eSIM market growth. Furthermore, due to the small size of the chipset, eSIMs are likely to be widely used in smartphones. For example, in 2018, Apple, Inc. released an iPhone featuring dual SIM capabilities, including a Nano-SIM and an eSIM. Furthermore, Apple, Inc. has included eSIM in their tablet and watch series.

SIM cards with eSIMs are considerably smaller than those with physical SIMs. Chipsets are therefore smaller when integrated into devices. Device manufacturers benefit from eSIM technology since they can save space by eliminating the physical SIM card tray and SIM card slot. Thus, factors such as compact design specification and multiple carrier support of the eSIM are propelling the market growth.

The 5G technology is intended to deliver faster internet speeds and more network capacity. 5G is expected to provide download speeds of 1 gigabit per second while lowering latency to less than a millisecond. This is expected to have a beneficial impact on the eSIM market, expanding its acceptance across a range of cellular-enabled devices. As a result, network service providers and OEMs are overhauling their infrastructure in order to efficiently manage the connectivity and speed provided by 5G. eSIM technology, which can be easily integrated into smaller devices like fitness bands, wearables, and smartwatches, is the future of 5G.

Gather more insights about the market drivers, restrains and growth of the Global eSIM Market

eSIM Market Report Highlights

Due to connectivity subscriptions from M2M devices, the connectivity services segment held the greatest market share in 2022

The hardware segment is expected to attain a substantial CAGR throughout the forecasted period due to smartphone manufacturers' use of eSIM technology

Due to technological improvements and IoT connectivity among devices, the consumer electronics segment is expected to expand at a considerable CAGR of more than 9.2% throughout the forecast period

Browse through Grand View Research's Communication Services Industry Research Reports.

Open RAN Market: The global open RAN market size was estimated at USD 4.51 billion in 2024 and is projected to grow at a CAGR of 25.6% from 2025 to 2030.

Broadcasting And Cable TV Market: The global broadcasting and cable TV market size was estimated at USD 356.45 billion in 2024, registering a CAGR of 4.0% from 2025 to 2030.

eSIM Market Segmentation

Grand View Research has segmented the global eSIM market based on solution, application, and region:

eSIM Solution Outlook (Revenue in USD Million, 2017 - 2030)

Hardware

Connectivity services

eSIM Application Outlook (Revenue in USD Million, 2017 - 2030)

Consumer Electronics

Smartphones

Tablets

Smartwatches

Laptop

Others

M2M

Automotive

Smart Meter

Logistics

Others

eSIM Regional Outlook (Revenue in USD Million, 2017 - 2030)

North America

US

Canada

Europe

UK

Germany

France

Asia Pacific

China

Japan

India

Australia

South Korea

Latin America

Brazil

Mexico

Middle East and Africa

Saudi Arabia

South Africa

UAE

Order a free sample PDF of the eSIM Market Intelligence Study, published by Grand View Research.

0 notes

Text

eSIM Market 2030: Trends, Opportunities, Challenges & Leading Key Players Review

The global eSIM market is expected to reach USD 15,464.0 million by 2030 at a CAGR of 7.9% from 2023 to 2030, according to a study conducted by Grand View Research, Inc. Technological developments in consumer electronic devices such as smartphones, laptops, tablets, wearables fueling the eSIM market growth. Furthermore, due to the small size of the chipset, eSIMs are likely to be widely used in smartphones. For example, in 2018, Apple, Inc. released an iPhone featuring dual SIM capabilities, including a Nano-SIM and an eSIM. Furthermore, Apple, Inc. has included eSIM in their tablet and watch series.

SIM cards with eSIMs are considerably smaller than those with physical SIMs. Chipsets are therefore smaller when integrated into devices. Device manufacturers benefit from eSIM technology since they can save space by eliminating the physical SIM card tray and SIM card slot. Thus, factors such as compact design specification and multiple carrier support of the eSIM are propelling the market growth.

The 5G technology is intended to deliver faster internet speeds and more network capacity. 5G is expected to provide download speeds of 1 gigabit per second while lowering latency to less than a millisecond. This is expected to have a beneficial impact on the eSIM market, expanding its acceptance across a range of cellular-enabled devices. As a result, network service providers and OEMs are overhauling their infrastructure in order to efficiently manage the connectivity and speed provided by 5G. eSIM technology, which can be easily integrated into smaller devices like fitness bands, wearables, and smartwatches, is the future of 5G.

Gather more insights about the market drivers, restrains and growth of the Global eSIM Market

eSIM Market Report Highlights

Due to connectivity subscriptions from M2M devices, the connectivity services segment held the greatest market share in 2022

The hardware segment is expected to attain a substantial CAGR throughout the forecasted period due to smartphone manufacturers' use of eSIM technology

Due to technological improvements and IoT connectivity among devices, the consumer electronics segment is expected to expand at a considerable CAGR of more than 9.2% throughout the forecast period

Browse through Grand View Research's Communication Services Industry Research Reports.

Open RAN Market: The global open RAN market size was estimated at USD 4.51 billion in 2024 and is projected to grow at a CAGR of 25.6% from 2025 to 2030.

Broadcasting And Cable TV Market: The global broadcasting and cable TV market size was estimated at USD 356.45 billion in 2024, registering a CAGR of 4.0% from 2025 to 2030.

eSIM Market Segmentation

Grand View Research has segmented the global eSIM market based on solution, application, and region:

eSIM Solution Outlook (Revenue in USD Million, 2017 - 2030)

Hardware

Connectivity services

eSIM Application Outlook (Revenue in USD Million, 2017 - 2030)

Consumer Electronics

Smartphones

Tablets

Smartwatches

Laptop

Others

M2M

Automotive

Smart Meter

Logistics

Others

eSIM Regional Outlook (Revenue in USD Million, 2017 - 2030)

North America

US

Canada

Europe

UK

Germany

France

Asia Pacific

China

Japan

India

Australia

South Korea

Latin America

Brazil

Mexico

Middle East and Africa

Saudi Arabia

South Africa

UAE

Order a free sample PDF of the eSIM Market Intelligence Study, published by Grand View Research.

0 notes

Text

eSIM Market 2030 - Top Countries Data with Future Scope and Top Key Players Analysis

The global eSIM market is expected to reach USD 15,464.0 million by 2030 at a CAGR of 7.9% from 2023 to 2030, according to a study conducted by Grand View Research, Inc. Technological developments in consumer electronic devices such as smartphones, laptops, tablets, wearables fueling the eSIM market growth. Furthermore, due to the small size of the chipset, eSIMs are likely to be widely used in…

0 notes

Text

Future of the eSIM Market: How It’s Revolutionizing the Telecom Industry

The global eSIM market was valued at USD 8.07 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 7.9% from 2023 to 2030. This market growth is primarily driven by the increasing adoption of Internet of Things (IoT)-connected devices, particularly in machine-to-machine (M2M) applications and consumer electronics. One of the key trends contributing to this growth is the rising frequency of eSIM profile downloads across consumer devices. As more and more devices become eSIM-enabled, the market continues to accelerate.

According to Mobilise, the number of eSIM-enabled devices reached 1.2 billion in 2021, and this number is expected to increase significantly to 3.4 billion by 2025, reflecting the growing integration of eSIM technology across a wide range of devices.

A significant factor in the expansion of the eSIM market is its adoption within the automobile industry. The integration of eSIM technology into vehicles has introduced remarkable flexibility in offering cellular connectivity to cars and trucks. This shift is unlocking new capabilities and features for connected vehicles. In the coming years, it is expected that all cars will be equipped with cellular connectivity, improving the driving experience through innovative linked services. Recently, the automotive industry has made a significant advancement by implementing the GSMA-embedded SIM specification. This development is set to enhance vehicle connectivity and improve the security of various connected services, further enabling the next generation of connected and smarter automobiles.

Gather more insights about the market drivers, restrains and growth of the eSIM Market

Regional Insights

North America

North America led the eSIM market in 2022, accounting for the largest revenue share of 39.1%. The region is also expected to grow at the fastest compound annual growth rate (CAGR) of 8.7% during the forecast period. This growth is primarily driven by the strong presence of network providers and the rapid pace of technological advancements within the region. North America benefits from its advanced infrastructure, robust digital ecosystem, and the increasing adoption of IoT devices, all of which support the continued growth of eSIM technology.

Europe

Europe is also projected to experience significant growth over the forecast period. European companies have historically been early adopters of new technologies, and the region is home to many key market players, including Giesecke+Devrient Mobile Security GmbH, NXP Semiconductors N.V., and STMicroelectronics, among others. Additionally, Europe is witnessing a rising demand for smart connected devices and connected vehicles, particularly with the growing adoption of eSIM-enabled smartphones, smart cars, and other IoT devices. These factors position Europe to maintain a strong market presence alongside North America during the forecast period.

Asia Pacific

Asia Pacific is expected to see substantial growth as well, fueled by the increasing number of eSIM-enabled devices, particularly in the smartphone market. Major smartphone manufacturers such as Huawei and Samsung Electronics have already introduced eSIM-enabled devices, which are driving the momentum for eSIM adoption across the region. This shift is positioning eSIM as the future mainstream SIM technology for connected devices. Additionally, several original equipment manufacturers (OEMs) in countries like China and India are developing eSIM solutions, collaborating across the ecosystem to create innovative development paths. For example, in June 2021, IDEMIA, a leading eSIM manufacturer, expanded its production capacity in India, aiming to boost global eSIM production. According to Giesecke+Devrient (G&D), a German digital solutions provider, it is projected that 25-30% of smartphones will have eSIM capabilities by 2024.

Browse through Grand View Research's Communication Services Industry Research Reports.

• The global web real-time communication market size was valued at USD 8.71 billion in 2024 and is projected to grow at a CAGR of 45.7% from 2025 to 2030.

• The global near field communication market size was valued at USD 30.85 billion in 2024 and is projected to grow at a CAGR of 12.3% from 2025 to 2030.

Key Companies & Market Share Insights

Industry players in the eSIM market are actively pursuing strategies like product launches, acquisitions, and collaborations to expand their global presence and enhance market competitiveness. For example, in September 2022, BICS, a digital communications services and IoT company, partnered with Thales, a global technology provider, to streamline the integration of eSIM for the Internet of Things (IoT). This strategic collaboration aims to build an open ecosystem for eSIM technology within the IoT sector, allowing for easier integration and more efficient deployment of eSIM solutions across various industries. The collaboration is designed to enhance connectivity and operational efficiency, which could lead to more widespread adoption of eSIM technology.

As the eSIM market grows, competition is expected to intensify, with companies focused on developing advanced, cost-effective solutions. The ability of eSIM technology to simplify the process of switching between mobile network operators is expected to drive heightened competition among service providers. The growing ease with which consumers can change operators is likely to encourage more switching, leading to a more competitive landscape in the telecommunications sector.

For instance, in September 2021, Deutsche Telekom AG announced the launch of an in-car 5G and personal eSIM networking service in partnership with Bayerische Motoren Werke AG (BMW). The collaboration utilized personal eSIM technology and MobilityConnect to link the vehicle's connectivity with the customer’s mobile network on a 5G basis, enabling a more integrated and seamless experience for connected car users. This innovative solution highlights how companies are leveraging eSIM technology to enhance connectivity and create new value-added services in the automotive sector.

The following are some of the major participants in the global eSIM market

• Arm Limited

• Deutsche Telekom AG

• Giesecke+Devrient GmbH

• Thales

• Infineon Technologies AG

• KORE Wireless

• NXP Semiconductors

• Sierra Wireless

• STMicroelectronics

• Workz

Order a free sample PDF of the eSIM Market Intelligence Study, published by Grand View Research.

0 notes

Text

0 notes

Text

ESIM Imaging Market Size, Status and Forecast 2030

eSIM Industry Overview

The global eSIM market size was valued at USD 8.07 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.9% from 2023 to 2030. The market growth is driven by the rising adoption of IoT-connected devices in M2M applications and consumer electronics. There is an upsurge in the number of times eSIM profiles were downloaded across consumer devices. The eSIM market is propelling due to the rise in the adoption of eSIM-connected devices. According to Mobilise, in 2021, there were 1.2 billion eSIM-enabled devices, with the number expected to climb to 3.4 billion by 2025.

Gather more insights about the market drivers, restrains and growth of the eSIM Market

The introduction of eSIM in the automobile industry has provided tremendous flexibility in providing cellular connectivity to trucks and cars while unlocking new capabilities and features. It is expected that within the next several years, all cars will be cellular enabled, resulting in a better driving experience facilitated by novel linked services. Recently, the automotive industry took a giant step toward enabling the next generation of connected automobiles by implementing the GSMA-embedded SIM specification to strengthen vehicle connectivity. It is intended to improve security for various connected services.

The eSIM-enabled solutions offer automatic interoperability across numerous SIM operators, connection platforms, and remote SIM profile provisioning. With multiple network service providers involved in the operating chain, maintaining the security of these systems has grown complicated. Mobile Network Operators' (MNOs') credentials are collected and kept by the eSIM in the device's inbuilt software, making them vulnerable to security breaches. Furthermore, the operation of eSIM across numerous physical platforms and MNOs exposes it to several virtual environment concerns. As a result, the operational flexibility provided by eSIM may be rendered ineffective if security is breached, impeding market expansion.

Industry 4.0 is a technological breakthrough that has introduced smart machinery with automatic communication and control. Industry 4.0 refers to a networked environment in which actionable data and information are transferred between Machine to Machine (M2M) and Machine to Other (M2O) devices via the Internet of Things (IoT). Wi-Fi, sensors, RFID (radio frequency administrations), and autonomous computing software are all used in M2M systems to analyze data and send it over a network for further processing. M2M systems frequently rely on public and cellular networks for internet access. These factors enabled the integration of electronic manufacturers with eSIM (embedded SIM cards) into M2M systems, thereby contributing to market expansion. By enabling M2M communication, eSIM technology has enabled advancements in the connected ecosystem.

The increasing penetration of smartphones across countries such as China, India, Japan, and the U.S. is further anticipated to fuel market growth. Smartphone manufacturers such as Google, Samsung Electronics Co., Apple, Inc., and Motorola Mobility LLC, Ltd. have started implementing eSIM technology into their smartphones in alliance with several network service providers. For instance, Apple, Inc. has partnered with six service providers, Ubigi, MTX Connect, Soracom Mobile, GigSky, Redtea Mobile, and Truphone, to offer eSIM service. Smartphone and consumer electronics manufacturers' increasing adoption of eSIM to provide an enhanced and secure user experience is expected to bolster market growth.

Browse through Grand View Research's Communication Services Industry Research Reports.

• The global speech analytics market was valued at USD 2.82 billion in 2023 and is projected to grow at a CAGR of 15.7% from 2024 to 2030. Advancements in omnichannel integration capabilities fuel the market's growth.

• The global commerce cloud market size was estimated at USD 17.78 billion in 2023 and is expected to grow at a CAGR of 22.8% from 2024 to 2030. The market is experiencing robust growth driven by several key factors.

eSIM Market Segmentation

Grand View Research has segmented the global eSIM market based on solution, application, and region:

eSIM Solution Outlook (Revenue in USD Million, 2017 - 2030) • Hardware • Connectivity services

eSIMc Application Outlook (Revenue in USD Million, 2017 - 2030) • Consumer Electronics o Smartphones o Tablets o Smartwatches o Laptop o Others • M2M o Automotive o Smart Meter o Logistics o Others

eSIM Regional Outlook (Revenue in USD Million, 2017 - 2030) • North America o U.S. o Canada • Europe o UK o Germany o France • Asia Pacific o China o Japan o India o Australia o South Korea • Latin America o Brazil o Mexico • Middle East and Africa o Saudi Arabia o South Africa o UAE

Order a free sample PDF of the eSIM Market Intelligence Study, published by Grand View Research.

Key Companies profiled: • Arm Limited • Deutsche Telekom AG • Giesecke+Devrient GmbH • Thales • Infineon Technologies AG • KORE Wireless • NXP Semiconductors • Sierra Wireless • STMicroelectronics • Workz

Recent Developments

• In May 2023, Lonestar Cell MTN, a South African conglomerate, introduced eSIM technology in Liberia. This advancement allows subscribers to switch to eSIM-compatible devices without the hassle of removing physical SIM cards. Customers can scan a QR code provided at any Lonestar Cell MTN service center.

• In March 2023, Gcore, a public cloud and content delivery network company, launched its Zero-Trust 5G eSIM Cloud platform. This platform offers organizations across the globe a secure and dependable high-speed networking solution. By utilizing Gcore's software-defined eSIM, companies can establish secure connections to remote devices, corporate resources, or Gcore's cloud platform through regional 5G carriers.

• In February 2023, Amdocs, a software company, collaborated with Drei Austria to introduce a groundbreaking eSIM solution. This collaboration enables Drei Austria's customers to access the advantages of digital eSIM technology through a fully app-based experience. The innovative "up" app offers a seamless and entirely digital SIM journey powered by Amdocs' eSIM technology at Drei Austria.

• In December 2022, Grover, a subscription-based electronics rental platform, joined forces with Gigs, a telecom-as-a-service platform, to introduce Grover Connect, its very own mobile virtual network operator (MVNO), in the U.S. Through Grover Connect, customers in the U.S. can effortlessly activate any eSIM-enabled technology device, eliminating the complexities associated with carrier offers and contracts that may not align with their device rental duration.

• In October 2022, Bharti Airtel, a telecommunications service provider based in India, unveiled its "Always On" IoT connectivity solutions. This offering enables seamless connectivity for IoT devices across multiple Mobile Network Operators (MNOs) through an embedded SIM (eSIM) technology. Particularly beneficial for vehicle tracking providers, auto manufacturers, and scenarios where equipment operates in remote areas, requiring uninterrupted and widespread connectivity.

0 notes

Text

eSIM Market Size To Reach USD 15,464.0 Million By 2030

eSIM Market Growth & Trends

The global eSIM market is expected to reach USD 15,464.0 million by 2030 at a CAGR of 7.9% from 2023 to 2030, according to a study conducted by Grand View Research, Inc. Technological developments in consumer electronic devices such as smartphones, laptops, tablets, wearables fueling the eSIM market growth. Furthermore, due to the small size of the chipset, eSIMs are likely to be widely used in smartphones. For example, in 2018, Apple, Inc. released an iPhone featuring dual SIM capabilities, including a Nano-SIM and an eSIM. Furthermore, Apple, Inc. has included eSIM in their tablet and watch series.

SIM cards with eSIMs are considerably smaller than those with physical SIMs. Chipsets are therefore smaller when integrated into devices. Device manufacturers benefit from eSIM technology since they can save space by eliminating the physical SIM card tray and SIM card slot. Thus, factors such as compact design specification and multiple carrier support of the eSIM are propelling the market growth.

The 5G technology is intended to deliver faster internet speeds and more network capacity. 5G is expected to provide download speeds of 1 gigabit per second while lowering latency to less than a millisecond. This is expected to have a beneficial impact on the eSIM market, expanding its acceptance across a range of cellular-enabled devices. As a result, network service providers and OEMs are overhauling their infrastructure in order to efficiently manage the connectivity and speed provided by 5G. eSIM technology, which can be easily integrated into smaller devices like fitness bands, wearables, and smartwatches, is the future of 5G.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/esim-market

Industry 4.0 is a technological breakthrough that has introduced smart machinery with automatic communication and control. Industry 4.0 refers to a networked environment in which actionable data and information are transferred between Machine to Machine (M2M) and Machine to Other (M2O) devices via the Internet of Things (IoT). Wi-Fi, sensors, RFID (radio frequency administrations), and autonomous computing software are all used in M2M systems to analyze data and send it over a network for further processing. M2M systems frequently rely on public and cellular networks for internet access. These factors enabled the integration of electronic manufacturers with eSIM (embedded SIM cards) into M2M systems, thereby contributing to market expansion. By enabling M2M communication, eSIM technology has enabled advancements in the connected ecosystem.

eSIM Market Report Highlights

Due to connectivity subscriptions from M2M devices, the connectivity services segment held the greatest market share in 2022

The hardware segment is expected to attain a substantial CAGR throughout the forecasted period due to smartphone manufacturers' use of eSIM technology

Due to technological improvements and IoT connectivity among devices, the consumer electronics segment is expected to expand at a considerable CAGR of more than 9.2% throughout the forecast period

Regional Insights

North America dominated the market and accounted for the largest revenue share of 39.1% in 2022. and is expected to grow at the fastest CAGR of 8.7% over the forecast period. The growth is due to the network providers' high presence and the region's fastest technological advancements. The growth is due to the network providers' high presence and the region's fastest technological advancements.

Europe is expected to grow significantly during the forecast period. European companies are the early adopters of the latest technologies. At the same time, the regions are headquarters to several prominent market players, such as Giesecke+Devrient Mobile Security GmbH, NXP Semiconductors N.V., STMicroelectronics, and others. These areas also witness the rising adoption of smart connected devices and cars. Due to all these factors, these two regions are expected to maintain their lead during the forecast period.

eSIM Market Segmentation

Grand View Research has segmented the global eSIM market based on solution, application, and region:

eSIM Solution Outlook (Revenue in USD Million, 2017 - 2030)

Hardware

Connectivity services

eSIMc Application Outlook (Revenue in USD Million, 2017 - 2030)

Consumer Electronics

M2M

eSIM Regional Outlook (Revenue in USD Million, 2017 - 2030)

North America

Europe

Asia Pacific

Latin America

Middle East and Africa

List of Key Players in eSIM Market

Arm Limited

Deutsche Telekom AG

Giesecke+Devrient GmbH

Thales

Infineon Technologies AG

KORE Wireless

NXP Semiconductors

Sierra Wireless

STMicroelectronics

Workz

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/esim-market

0 notes

Text

The Evolving Landscape of the Mobile Virtual Network Operator (MVNO) Market

The Mobile Virtual Network Operator (MVNO) Market was valued at USD 80.2 billion in 2023-e and will surpass USD 122.3 billion by 2030; growing at a CAGR of 6.2% during 2024 - 2030.MVNOs, which lease wireless capacity from major carriers to offer their own branded mobile services, are becoming increasingly significant players in the telecommunications industry. This blog explores the current state, growth drivers, challenges, and future prospects of the MVNO market.

MVNOs have been around for a couple of decades, but their prominence has surged in recent years. They provide a compelling alternative to traditional mobile network operators (MNOs) by offering specialized services, competitive pricing, and unique value propositions. Unlike MNOs, MVNOs do not own the infrastructure they use to provide services; instead, they purchase bulk access to network services from established carriers.

Get a Sample Report: https://bit.ly/4foQHof

Key Drivers of Growth

Technological Advancements

The advent of 5G technology is a significant growth driver for MVNOs. With higher speeds and lower latency, 5G enables MVNOs to offer enhanced services, such as Internet of Things (IoT) solutions, smart city applications, and high-definition video streaming. Additionally, advancements in eSIM technology simplify the process for consumers to switch providers, further boosting the appeal of MVNOs.

Changing Consumer Preferences

Modern consumers are increasingly seeking flexibility, personalized services, and cost-effective solutions. MVNOs cater to these demands by offering tailored plans that can be more easily customized compared to the rigid structures of traditional MNOs. This flexibility is particularly attractive to younger, tech-savvy users and niche markets.

Regulatory Support

In many regions, regulatory bodies are promoting competition in the telecom sector by encouraging the entry of MVNOs. Policies that facilitate access to wholesale network services at reasonable rates are crucial in lowering barriers to entry and fostering a competitive market environment.

Challenges Facing MVNOs

Intense Competition

The MVNO market is highly competitive, with numerous players vying for market share. This competition can lead to thin margins, making it challenging for smaller MVNOs to sustain their operations. Larger MNOs also pose a constant threat with their extensive resources and established customer bases.

Dependence on MNOs

MVNOs rely heavily on the infrastructure and network quality of MNOs. Any issues with the parent network, such as coverage gaps or service outages, directly impact the MVNO's customers. Negotiating favorable terms with MNOs can also be a significant challenge, especially for newer or smaller MVNOs.

Customer Acquisition and Retention

Attracting and retaining customers in a crowded market requires significant investment in marketing, customer service, and value-added services. MVNOs need to continually innovate and differentiate their offerings to stay relevant and appealing to their target audiences.

Get an insights of Customization: https://bit.ly/3SwsWB0

Future Prospects

Despite the challenges, the future looks promising for the MVNO market. The continuous rollout of 5G networks, along with the expansion of IoT and connected devices, presents new opportunities for MVNOs to diversify their services. Partnerships with technology companies and enterprises can also open up new revenue streams, such as providing connectivity solutions for smart devices and enterprise IoT applications.

Furthermore, the rise of digital-first and digital-only MVNOs, which operate primarily online without physical stores, is reshaping the industry. These digital MVNOs can reduce operational costs and offer seamless, app-based experiences, appealing to the growing segment of digital-native consumers.

Conclusion

The MVNO market is poised for sustained growth, driven by technological advancements, evolving consumer preferences, and supportive regulatory environments. While competition remains fierce and challenges abound, MVNOs that can effectively leverage new technologies, offer differentiated services, and maintain strong customer relationships will continue to thrive. As the telecom landscape evolves, MVNOs will play an increasingly vital role in providing innovative, flexible, and affordable mobile services to a diverse range of consumers.

#Mobile Virtual Network Operator (MVNO)#Mobile Virtual Network Operator (MVNO) Demand#Mobile Virtual Network Operator (MVNO) Growth

0 notes

Text

Smart Card Market : Analysis of Upcoming Trends and Current Growth

The Smart card market size is projected to reach USD 16.9 billion by 2026, from USD 13.9 billion in 2021; growing at a compound annual growth rate (CAGR) of 4.0% during the forecast period.

Major drivers for the growth of the smart card market are surged demand for contactless card (tap-and-pay) payments amid COVID-19, proliferation of smart cards in healthcare, transportation, and BFSI verticals; increased penetration of smart cards in access control and personal identification applications; and easy access to e-government services and risen demand for online shopping and banking.

Download PDF: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=285

By Vertical segment, the smart card market share for telecommunications segment held the largest share of the market A subscriber identity module (SIM) card is a type of microcontroller-based smart card used in mobile phones and other devices. A SIM identifies and authenticates a subscriber to a wireless cell phone network. The telecommunications segment accounted for the maximum share of 42% of the smart card market in 2020. Expanding global mobile network and improvements in its infrastructure are boosting the growth of the market. In addition, COVID-19 led to an increased demand for connectivity. The current crisis provided a push to the trend of digitalization of business and private communication with cellular technology, along with the generalization of digital conferences. Moreover, the penetration of high-end SIM card technologies, such as LTE, 5G, M2M, eSIM, and SWP, is expected to augment the market growth in the coming years.

By Interface, contactless segment of smart card market is projected to account for largest size of the market during the forecast period A contactless smart card includes an embedded smart card secure microcontroller or equivalent intelligence, internal memory, and a small antenna; it communicates with readers through a contactless radio frequency (RF) interface. Radio-frequency identification (RFID) or near-field communication (NFC) communication technologies are primarily used for contactless smart card applications. COVID-19 is positively impacting the contactless smart card industry growth as the World Health Organization (WHO) and governments across the world are advocating the use of contactless smart cards for various purposes to ensure social distancing to contain the spread of the virus. Contactless smart cards provide ease, speed, and convenience to users. The contactless interface has become highly relevant in the current COVID-19 situation, especially for payment applications, as it facilitates safe and secure transactions without physical contact.

By Region, smart card market in APAC estimated to account for the largest size of the market. Smart card market statistics in Asia Pacific (APAC) is the largest market during forecast period. The robust financial system that is being increasingly digitized and government agencies incorporating smart chip-based systems for better monitoring of processes are propelling several APAC countries to adopt smart card solutions owing to increasing demand, specifically in the transportation, BFSI, retail, government, and healthcare sectors. Smart cards are used to purchase tickets in metros, buses, and ferries, among others, in several countries in APAC. China is projected to witness the highest demand for smart cards in the region owing to a large consumer base and the presence of a number of smart card manufacturers.

Properly implemented smart cards in all sectors have proven highly effective in combating thefts and fraud. Government projects, such as the Aadhar card in India, drive the demand for smart cards for use in a number of sectors. Moreover, security concerns, particularly within the public sphere, are also expected to fuel the growth of the market in APAC.

Top Smart Card Companies - Key Market Players Thales Group (France), IDEMIA (France), Giesecke + Devrient GmBH (Germany), CPI Card Group (US), HID Global Corporation (US), Watchdata (China), Eastcompeace (China), Inteligensa (US), ABCorp (US), and CardLogix (US) are a few major smart card companies in the market.

0 notes

Text

Soy Protein Market is Estimated to Witness High Growth Owing to Rising Health Consciousness among Consumers

Soy protein is a versatile plant-based protein derived from soybeans. It offers various health benefits such as lowering cholesterol levels, reducing menopausal symptoms, and increasing bone mineral density. It is widely used as a meat alternative and sports nutrition product due to its high protein content. The growing vegan population and demand for meat substitutes are driving the demand for soy protein. It is used in various protein-enriched food products such as baked goods, dietary supplements, beverages, meat analogs, and other applications. The Global Soy Protein Market is estimated to be valued at US$ 8.66 billion in 2024 and is expected to exhibit a CAGR of 4.6% over the forecast period 2024 to 2031. Key Takeaways Key players operating in the Soy Protein Market are Anmol Chemicals, Bartek Ingredients Inc., Changmao Biochem, ESIM Chemicals, Fuso Chemical Co. Ltd, Merck KGaA, Polynt, Thirumalai Chemicals Ltd, UPC Group, and Yongsan Chemicals Inc., and XST Biological Co. Ltd. The soy protein market offers lucrative growth opportunities owing to the rising demand for plant-based meat alternatives and sports nutrition products. The market players are investing in new product development and production expansion to cater to the growing demand. Globally, the Asian and North American regions hold significant shares in the soy protein market and are expected to witness high growth owing to increasing health consciousness among consumers. The growing vegan population in Western countries is also expected to boost the demand. Market Drivers Growing vegan consumer base and flexitarian diets: Changing consumer preferences towards vegan and plant-based diets due to health, ethical, and environmental concerns is a key factor driving the Soy Protein Market Demand. The increasing number of people reducing or eliminating animal protein from their diets is propelling the market growth.

Get more insights on Soy Protein Market

About Author:

Money Singh is a seasoned content writer with over four years of experience in the market research sector. Her expertise spans various industries, including food and beverages, biotechnology, chemical and materials, defense and aerospace, consumer goods, etc. (https://www.linkedin.com/in/money-singh-590844163)

0 notes

Text

eSIM/iSIM to Dominate 70% of Cellular Devices by 2030

Counterpoint’s latest “eSIM Device Market Outlook” report predicts that from 2024 to 2030, global shipments of xSIM-enabled devices will exceed 9 billion units, with a compound annual growth rate of 22%. This forecast includes all form factors such as hardware-based eSIM (eUICC), iSIM (iUICC), nuSIM, and soft SIM. The launch of eSIM-only iPhone models in the US in 2022 marked a turning point,…

0 notes

Text

Explore AirHub's comprehensive guide to the leading countries offering robust eSIM IoT connectivity solutions. Learn about key markets driving innovation and growth in the IoT landscape.

0 notes

Text

Diabetic Retinopathy Market is Predicted to Exhibit Remarkable Growth During the Forecast Period (2023-2032), Esimates DelveInsight | Genentech, Regeneron Pharma, Roche, Opthea Limited, Kodiak Science

http://dlvr.it/T6j113

0 notes

Text

Diabetic Retinopathy Market is Predicted to Exhibit Remarkable Growth During the Forecast Period (2023-2032), Esimates DelveInsight | Genentech, Regeneron Pharma, Roche, Opthea Limited, Kodiak Science

http://dlvr.it/T6j0GK

0 notes