#double entry accounting

Explore tagged Tumblr posts

Text

super burnt out from school and work and all i can think about is fulgrim watching me struggle to comprehend business and accounting stuff

#“wdym you cant do double entry accounting lemme call my brother”#im delusional and mentally exhausted pls ignore me 😭#i will eventually draw this (+ something based off the drabble I did)#wuvz talks

11 notes

·

View notes

Text

0 notes

Text

youtube

#class 11 accounts#double entry book keeping#financial accounting#accounting of goods and services tax#cadeveshthakur#classes by cadt#Youtube

1 note

·

View note

Text

0 notes

Text

Streamline Your Year-End Tax Preparation with Winx Global As we approach the end of the calendar year, it’s time to get your tax affairs in order! 📅 At Winx Global, we understand that the year-end brings a host of tax tasks, including preparing and filing 1099, 1040, 1120, and 1120S forms. 📑 Need a tax accountant to help you with your 1099s, 1040s, 1120s, 1120S forms, and other tax needs? We’re just an email or call away. 📞✉ Reach out to us today and let’s make tax season stress-free together! 🌐 www.winxglobal.in ✉ [email protected]

#top accounting firms in the us#double-entry bookkeeping in accounting#usaccounting#TaxPreparation#YearEndTaxes#TaxSeason#TaxAccountant#WinxGlobal#StressFreeTaxes#TaxHelp#TaxFiling#Finance#Accounting

1 note

·

View note

Text

#small business#bookkeeers#bookkeepingservices#accounting services#accounting canada#double entry bookkeeping#small biz accounting

0 notes

Text

Boost Productivity with Our Bookkeeping Company in Canada

Reduce your financial burden with the leading bookkeeping company in Canada. We restore excellence in your financial processes, from paying attention to detail in all financial records to being an expert adviser so the processes are accurate and efficient. Trust Canadian Cypress for bookkeeping solutions for a smooth and worry-free financial journey. Enjoy top-class customer service in every transaction you make with us as a client.

#double entry bookkeeping#Bookkeeping Company in Canada#accounting & bookkeeping services#Bookkeeping services cost#bookkeeping services for nonprofits#online bookkeeping services#online small business bookkeeping services#bookkeeping in quickbooks#bookkeeper service near me#bookkeeping with xero#Bookkeeping & Payroll Services

1 note

·

View note

Text

Reblog if you’re allowed to complain about civilisational incompetence!

perhaps before you’re allowed to complain about civilisational incompetence you have to at least demonstrate that you’ve mastered basic double entry bookkeeping

81 notes

·

View notes

Text

What Are The Most Common Accounting Mistakes To Avoid?

Avoiding accounting mistakes is crucial for maintaining financial accuracy and compliance. Here are some of the most common accounting mistakes to steer clear of:

Not Keeping Proper Records:

Failing to maintain organized and detailed financial records can lead to errors and make it challenging to track expenses, revenue, and financial transactions accurately.

Mixing Personal And Business Finances:

Combining personal and business finances can lead to confusion and make it difficult to separate business expenses for tax purposes.

Not Reconciling Bank Statements:

Neglecting to reconcile bank statements regularly can result in errors and missed transactions, potentially leading to incorrect financial statements.

Ignoring Petty Cash Transactions:

Overlooking small cash transactions can lead to discrepancies in cash flow and unaccounted for expenses.

Not Backing Up Financial Data: Failing to back up financial data can put your business at risk of losing critical financial information in case of data loss or system failure.

Misclassifying Expenses:

Incorrectly categorizing expenses can distort financial reports and affect tax deductions. Ensure expenses are categorized accurately.

Late or Incorrect Tax Filings:

Missing tax deadlines or submitting incorrect tax returns can result in penalties and interest charges.

Ignoring Depreciation:

Failing to account for depreciation of assets can lead to an overestimation of asset values and incorrect financial statements.

Not Tracking Accounts Receivable And Payable:

Neglecting to monitor accounts receivable can lead to unpaid invoices while ignoring accounts payable can result in missed payments and penalties.

Inadequate Internal Controls:

Lack of internal controls can make your business susceptible to fraud and errors. Implement internal controls to safeguard your finances.

Not Reconciling Inventory:

Failure to reconcile inventory regularly can lead to inaccurate financial statements and potentially impact profitability calculations.

Overlooking Reimbursements:

Failing to record reimbursements for business expenses can lead to understated income.

Incomplete Documentation:

Incomplete or missing documentation for financial transactions can make it challenging to verify and track financial activities.

Not Seeking Professional Help:

Avoiding the assistance of a professional accountant or tax advisor can result in missed tax-saving opportunities and increased risk of errors.

Ignoring Changes in Accounting Standards:

Neglecting to stay updated with changes in accounting standards can lead to non-compliance and inaccurate financial reporting. To avoid these common accounting mistakes, consider implementing strong financial practices, utilizing accounting software, seeking professional advice, and maintaining a commitment to accuracy and compliance.

0 notes

Text

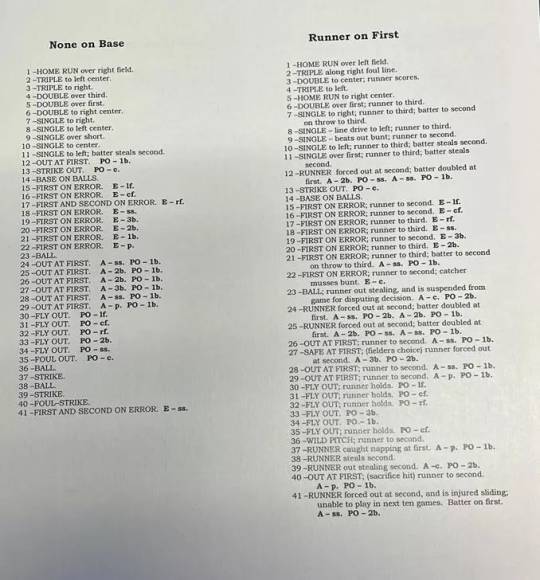

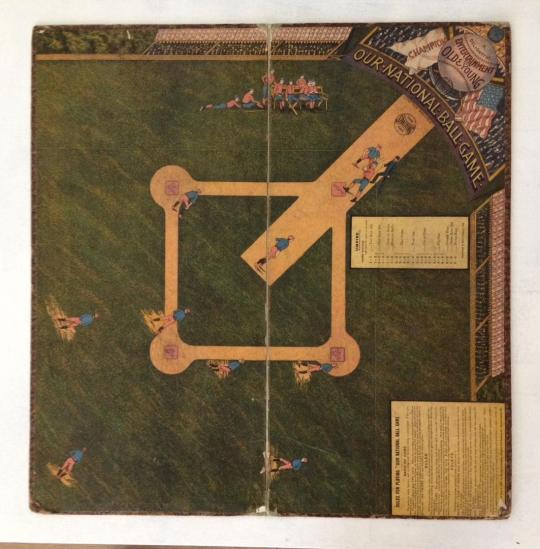

I'm spinning this off of the main thread about tracing the origin of the term "d66" because it's not strictly germane to the topic – none of these examples actually use the term "d66" to describe their dice-rolling methods – but I'm going to post it anyway as a matter of general interest: following a conversation with Tumblr user @notclevr, it appears that before tabletop wargames (and, nearly concurrently, tabletop RPGs) got their hands on the mechanic, the principal (though by no means exclusive) users of the old "roll a six-sided die twice, reading one die as the 'tens' place and the other die as the 'ones' place" trick may have been tabletop American baseball simulators.

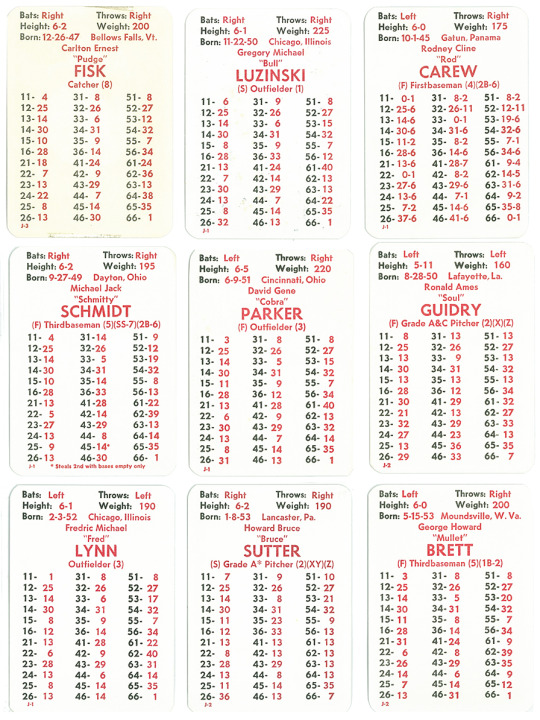

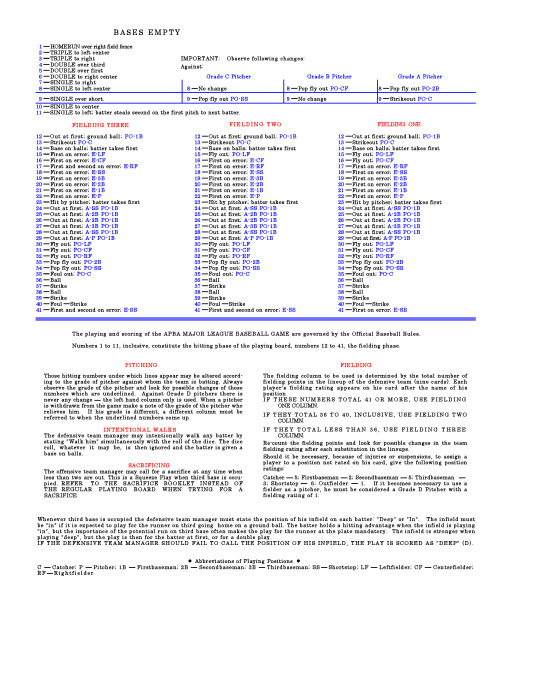

The most notable example of the type – and the only well-known example still in publication today – is J Richard Seitz' APBA Baseball, first published in either 1950 or 1951 (accounts vary). In this game, a d66 roll is cross-referenced with a card representing the active player and a "board" representing the current situation on the field:

For example, with Carlton Fisk at bat, a d66 roll of 31 would yield a result of "8". Assuming for the sake of argument that the situation on the field is a runner on first and a grade C pitcher, consulting the "Runner on First Base" board, this corresponds to an outcome of "SINGLE—line drive to left; runner to third".

(This example is, strictly speaking, incorrect, as Carlton Fisk didn't have his major league debut until 1969 and I'm using the wrong lookup tables for any year in which he played, but you get the idea!)

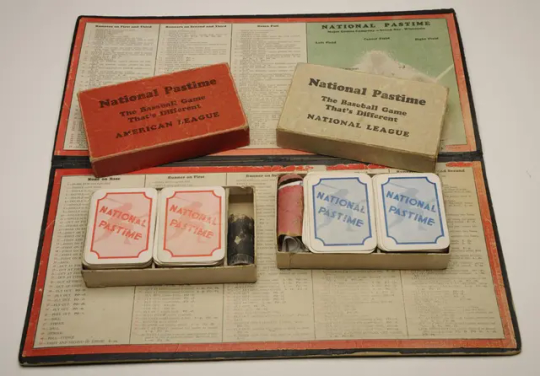

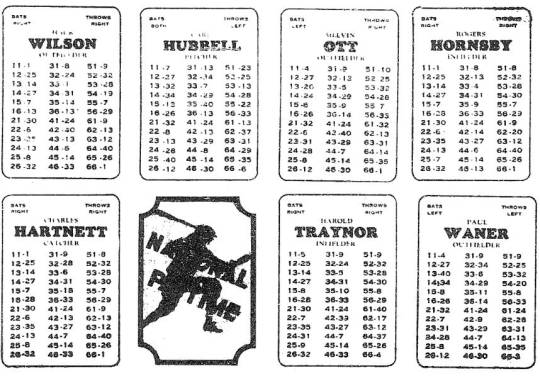

Interestingly, APBA Baseball is not the first game to use this setup. It's heavily derived from Clifford Van Beek's National Pastime, a game whose patent was registered in 1925, though it wasn't actually published until 1930. Even at a glance, the similarities are substantial:

Indeed, though National Pastime's lookup tables are much simpler than APBA Baseball's, where they overlap they're often word for word identical. It's generally accepted that Seitz plagiarised National Pastime without credit when creating APBA Baseball (ironically, given his own famously combative stance toward alleged imitators!), though he was within his rights to do so, as National Pastime had fallen into the public domain by the time APBA Baseball was published.

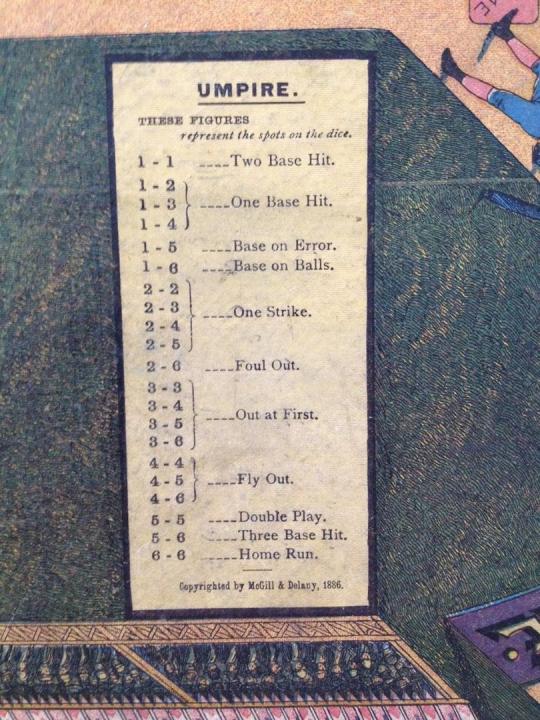

We can go back even further, though. As far as I've been able to determine, the earliest known tabletop baseball simulator to use d66 lookup tables for resolving plays is Edward K McGill's Our National Ball Game, first published in 1886:

A copy of the game's 1887 US patent application can be downloaded here. This one uses an unusual 21-entry variant of the standard d66 lookup table in which the order of the rolled digits is insignificant, with doubles being half as likely as non-doubles rolls; it's unclear whether McGill was aware of this when he laid out the table. Unlike later incarnations of the genre, there are no individual player statistics, with all at-bats being resolved via the same table.

#gaming#tabletop games#board games#baseball#apba baseball#national pastime#our national ball game#game design#history

2K notes

·

View notes

Text

youtube

Time tracking using Asana in Accounting | business accountability | Future proof accounts

In this video, Neha talks about how we can use Asana for team to track time - Making it simple for staff to add time spent. Are you ready to take charge of your accountability? In this video, we unveil effective strategies to help you stay on track, whether in business or personal endeavors. We explore the importance of accountability in business ethics and introduce you to the world of accounts payable bookkeeping. Plus, learn how to create an Asana account effortlessly and discover how Asana can make accountability easy. Don't miss out on valuable insights that can transform the way you approach accountability.

#keep yourself accountable#how to keep myself accountable#ways to keep yourself accountable#business accountability#accounts payable bookkeeper#bookkeeper tasks list#task of a bookkeeper#asana create account#accountability made easy using asana#accountability made easy#accountability made easy using Asana#accountability in business ethics#ethical accountability#accountant bookkeeper#Future proof accounts#bookkeeping double entry accounting double entry bookkeeping#Youtube

0 notes

Text

https://srprofcorp.com/accounting-and-bookkeeping-service/

Accounting & Bookkeeping Services Calgary: Simplifying Your Financial Management

As a small business owner in Calgary, managing your finances effectively is crucial for the growth and success of your company. While you may have excellent products or services to offer, it is equally important to maintain accurate financial records and ensure compliance with tax regulations. This is where professional accounting and bookkeeping services come into play. In this article, we will explore the benefits of hiring accounting and bookkeeping services in Calgary, discuss the importance of professional bookkeeping for small businesses, and shed light on the cost considerations involved.

#bookkeeping accounting#certified bookkeeper#double entry bookkeeping#bookkeeping services for small business#bookkeeping services

0 notes

Text

#Bookkeeping Basics#Small Business Owners#Single-Entry Bookkeeping#Double-Entry Bookkeeping#Cash Accounting#Accrual Accounting#Accounting Software#Spreadsheets#Professional Services#Expenses

0 notes

Video

youtube

Double Entry Book Keeping with GST| Class 11| CA Foundation| B.Com| Part 1|Journal Entries Explained

Double Entry Book Keeping with GST| Class 11| CA Foundation| B.Com| Part 1|Journal Entries Explained #youtube #learning #accounting #cadeveshthakur @cadeveshthakur Welcome to another insightful session on Double Entry Bookkeeping with GST! In this detailed video, we will cover the fundamentals of journal entries with GST components, making it easy for Class 11 students, CA Foundation aspirants, B.Com students, and accountants to grasp the concept. 🔹 What You’ll Learn: ✅ Basics of Double Entry System ✅ Understanding CGST, SGST & IGST in Journal Entries ✅ Real-world examples to record GST transactions ✅ Common errors and how to avoid them This video is a part of our "Accounting ki Neev" playlist, where we lay a strong foundation in accounting concepts. Don’t forget to follow the playlist for more such content! 📢 Like, Share & Subscribe to @cadeveshthakur for more accounting lessons. Let’s master bookkeeping together! 🚀 Index 00:00:00 to 00:00:39 Introduction 00:00:40 to 00:06:18 GST Basics|GST Journal Entry 00:06:19 to 00:12:52 Purchase Entry Intra-State 00:12:53 to 00:15:52 Purchase Entry Inter-State 00:15:53 to 00:20:40 Trade Discount Entry 00:20:41 to 00:25:40 Purchase Return Entry 00:25:41 to 00:29:22 Drawing Entry 00:29:23 to 00:32:49 Rent Entry 00:32:50 to 00:44:30 Asset Purchase Entry 00:44:31 to 00:46:52 Telephone Charges Entry 00:46:53 to 00:50:11 Advertisement Expense Entry 00:50:12 to 00:52:10 Bank Charges Entry 00:52:11 to 00:55:28 Printing & Stationery Expense Entry 00:55:59 to 00:58:02 Postage & Courier Expense Entry 00:58:03 to 01:01:26 Goods lost by fire entry 01:01:27 to 01:04:06 Goods gifted to staff 01:04:07 to 01:07:32 Goods distributed as sample 01:07:33 to 01:08:50 Important Note Ending cadeveshthakur,double entry bookkeeping class 11 chapter 1,double entry bookkeeping chapter 1,double entry bookkeeping class 12 chapter 1,double entry bookkeeping class 12 one shot,double entry bookkeeping class 11 chapter 2,double entry bookkeeping class 12,double entry bookkeeping ts grewal class 11,double entry bookkeeping financial accounting class 11 chapter 1,double entry bookkeeping class 11 chapter 1 in nepali,double entry bookkeeping in hindi Accounting ki Neev https://www.youtube.com/playlist?list=PL1o9nc8dxF1R-7X5N-O8_rGEWYYskY8BF 🎥 Hello, lovely viewers! Welcome back to the @cadeveshthakur channel! 🎉 I’m thrilled to have you here, and I want to connect with you beyond YouTube. Let’s take our journey together to the next level! 😊 LinkedIn: https://www.linkedin.com/in/cadeveshthakur/ Instagram: https://www.instagram.com/cadeveshthakur/ Twitter: https://twitter.com/cadeveshthakur Facebook: https://www.facebook.com/cadevesh Whatsapp Group: https://whatsapp.com/channel/0029Va6GOVE9MF92Ylmo7e0L #cadeveshthakur https://cadeveshthakur.com/ Remember, our community is more than just a channel—it’s a family. Let’s connect, learn, and grow together! Hit that Subscribe button, tap the notification bell, and let’s spread financial wisdom one click at a time. 🚀 Remember, knowledge empowers us all! Let’s learn together and navigate the complex world of finance with curiosity and diligence. Thank you for being part of the cadeveshthakur community! 🙌 Disclaimer: The content shared on this channel is purely for educational purposes. As a Chartered Accountant, I strive to provide accurate and insightful information related to GST, income tax, accounting, and tax planning. However, please note that the content should not be considered as professional advice or a substitute for personalized consultation. If you found this video helpful, don’t forget to LIKE 👍, SHARE ↗️ it with your friends, and SUBSCRIBE 🔔 to my channel, cadeveshthakur, for regular updates on GST, accounting, finance, and the latest market insights. ✨ Press the Bell Icon 🔔 so you never miss an update and get notified the moment I upload a new video packed with valuable information just for you! Your support helps me create more content to simplify complex topics and keep you informed. Thank you! 😊

#youtube#class 11 accounts#double entry bookkeeping class 11#class 11 coaching#cadeveshthakur#classes by ca dt

0 notes

Text

youtube

Ida Butera talking about her experience with Future Proof Accountants courses

In this video Ida Butera, Senior Accountant from Andresen Mccarthy Partners, shares her experience using Future Proof Accountants Courses and webinars.

#accounting & bookkeeping#book keeping#book keeping services#book keeping and accounting#small business bookkeeping#freelance bookkeeping#auditing accrual#depreciation and amortization#chart of accounts#double entry bookkeeping#cash flow statement#financial statements#accounting basics#accrual accounting#Ida Butera talking about her experience with Future Proof Accountants courses#ida buteras experience#experience sharing#future proof accountants courses#Youtube

0 notes

Text

Why Choose Double Entry Bookkeeping in Accounting??

Double-entry bookkeeping is widely regarded as the most effective method of accounting for several reasons. Here are some of the key benefits offered by bookkeeping from Winxglobal:

Accuracy and Completeness:

Balanced Accounts: Double-entry bookkeeping in accounting ensures that every transaction affects at least two accounts, maintaining the fundamental accounting equation (Assets = Liabilities + Equity). This balancing act helps in maintaining accurate records.

Error Detection: Because the system requires that debits and credits are equal, it makes it easier to detect errors and discrepancies. If the books do not balance, it indicates that something is wrong.

Comprehensive Financial Picture:

Detailed Records: By recording both aspects of each transaction, businesses can maintain detailed and comprehensive records of their financial activities. This enables better tracking of revenue, expenses, assets, and liabilities.

Informed Decision Making: With detailed and accurate records done by the best accountant for small businesses, businesses can analyze their financial health more effectively and make informed strategic decisions.

Fraud Prevention:

Internal Controls: The structure of double-entry bookkeeping allows for internal controls to be implemented, which can help prevent and detect fraud. The requirement for balanced entries means any manipulation in one account needs a corresponding entry elsewhere, making it harder to conceal fraudulent activity.

Regulatory Compliance:

Legal and Tax Requirements: Many regulatory bodies and tax authorities require businesses to use double-entry bookkeeping. It provides a clear audit trail, which is essential for audits and compliance with legal standards.

Standardization: Double-entry bookkeeping by Winxglobal is the standard method of accounting, making it easier to compare financial statements across different businesses and industries.

Financial Statements Preparation:

Income Statement and Balance Sheet: Double-entry bookkeeping offered by the best accounting firms in the US simplifies the preparation of key financial statements. The income statement (which shows profit or loss) and the balance sheet (which show financial position) are derived directly from the double-entry records.

Cash Flow Statement: It also aids in preparing the cash flow statement, which is crucial for understanding the liquidity and cash movements within a business.

Historical Analysis:

Trend Analysis: By maintaining records over multiple periods, businesses can perform trend analysis to identify patterns and make projections. This historical data is invaluable for planning and forecasting.

Performance Measurement: It allows for the assessment of financial performance over time, helping businesses evaluate their growth and profitability.

Professional Standards:

GAAP and IFRS: Double-entry bookkeeping aligns with Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), which are the benchmarks for financial reporting globally.

Consistency and Comparability: Using double entry ensures consistency in financial reporting, making it easier to compare financial statements from different periods and different organizations.

In summary, double-entry bookkeeping in accounting offers a robust framework for maintaining accurate, detailed, and compliant financial records, which are essential for effective business management and decision-making. To get more details, visit

https://www.winxglobal.in/

0 notes