#dont contribute to misinformation folks

Explore tagged Tumblr posts

Text

Dairy Farms

And cue the militant vegans screaming at me in the notes because I dare to talk about *gasp* dairy (although a lot of people like just repeating the same information and yelling, no youre wrong and im right)

But jokes aside, it's actually really hard to find accurate information on the diary industry because organizations like PETA and basically any animal welfare group screams that dairy is evil, dairy is scary

It's not

A lot of the pictures you see of mistreatment of the cows are A: extreme examples and are outliers (and often from organic farms) or B: out of context (like a picture of a cow in a field where it rained the night before so theres a lot of mud)

Because simply put, dairy cows produce more milk when they're not stressed. It is literally in the farmers best financial interest to keep the animals happy and healthy. A cow can straight up stop producing milk if they get too stressed. And when we still milked, you want to know how we got them into the stalls? We opened the gates from the field and they all walked in and stood in their spots. My grandpa only had to nudge one out and over into her spot. (We even waited on Granny cow to get in)

Dairy calves are usually taken away from their moms not long after they're born, but there are reasons for this. One, dairy cows aren't usually the best moms. If you get between them and a calf, yeah they'll charge you, but it doesn't matter if its their calf or not.

Two, its for safety reasons, not just for the farmer but for the calf. Cows are big creatures, and they can accidentally kill the calves or the calves can get sick because they dont have a strong immune system

And before anyone says 'the cows are crying for their children' no they aren't. The cows literally do not care. When I was younger, and when we still milked, the young calves were kept in the back of the barn, through a big open doorway. Those were the calves of the milking cows, who walked into the barn and their stalls without guidance, who at any moment could have went back there to try to get to the calves. And not one of them did.

(I also saw a story that had people being 'i will never buy dairy again this is so sad' and it just proves how guillible people are. The whole thing was a dairy cow hid one of her twins so it wouldnt get killed and she kept coming to the parlor dry, which meant a single calf drank six to seven gallons of milk. You know, just like twelve times what they normally drink.)

Male dairy calves are not immediately shot in the head and to suggest that is frankly disgusting. We don't tend to keep them, because as I've said before bulls are dangerous, but also they're sold off to other farmers to raise for meat. (Also veal crates are illegal in nine states in the US including in some of the highest dairy producing states)

I think I've explained AI for cows before, so I'm not touching on that again except to say that bulls can end up crushing a cows pelvis and that yeah, those cows would be getting very pregnant anyways

Those white hutches you can see cows in are designed to keep them nice and comfortable. I remember my mom's fiance's sister-in-law throwing a fit when her son worked at the larger dairy farm up the road. (she also threw a fit when said kid got kicked by a cow, and its like what were you doing to the cow?)

Also fun fact, cows kick to the side, which means if they really didn't want to be milked uh, yeah

The milking machines don't hurt, its like a light vacuum (my grandpa had be shove my finger into one of the tubes once) aka what the babies would be doing when drinking

Cows are part of the carbon cycle, which means they really aren't as big of a climate issue as people make them out to be. Essentially, the methane they release will turn to CO2 and then that will get taken up by plants. You can't create something out of nothing, and the methane is a by product of their metabolism. By this logic, human's millions or billions of tons of carbon dioxide we breath is also contributing to global warming (its not, because again its part of the carbon cycle, unlike coal which is carbon thats been out of the cycle for a long time)

Oh, and the biggest thing is, small farms sell their milk too. And there are levels that you have to meet in order to have your milk sold (aka that there is pus in milk thing is a lie) and that includes antibiotics.

#not a prompt#i wanted to talk about dairy today apparently#if you guys have any questions dont be afraid to ask#this is incase someone wants to write a story that has a dairy farm in it#dont contribute to misinformation folks

133 notes

·

View notes

Text

I currently dont have the mental/emotional capacity to answer this really big ask by an anon in detail by each section, but also I dont really understand how to answer it, except that spreading awareness about islamophobia/racism/xenophobia starts by the efforts white ppl make to hold the people around them accountable. Obviously its important to address and combat institutional levels of structural oppression but again that starts by speaking up to those around you. You can try looking for minority religious/ethnic groups dedicated to grassroots level work combating misinformation and oppression in your country. Redirecting folk to listen to the oppressed doesn't necessarily mean absolving yourself of the work or performatism per se, because it IS your responsibility to work to listen to speakers and writers and scholars who have been discussing this. I don't wanna be all like you need to rely on literature but both Muslim and non-Muslim thinkers native to the so-called middle east and the global south in general have been writing and discussing about the harms of oriental and western imperialist ideologies and portrayals of "Islamic" countries and the people for centuries.

Idk if I make any sense myself or have answered your question but yeah. I have no doubt you mean well and are not trying to come to me to help fix your guilt, as you mentioned in the ask, but as a white person caught in despair and feeling hopeless about your country's treatment of Muslims and racial and minority ethnic groups doesn't help contribute to bettering anything for us unfortunately, its just again me trying to tell you what to do. I don't live in your country so my knowledge is limited, its better to seek more understanding from those that do live where you live or have much better knowledge of the curriculum and politics of your country.

3 notes

·

View notes

Text

Who Raises More Money Democrats Or Republicans

New Post has been published on https://www.patriotsnet.com/who-raises-more-money-democrats-or-republicans/

Who Raises More Money Democrats Or Republicans

The Fundraising Arm Of The Us Democratic Party Raised More Money In July Than Its Republican Counterpart Helped By Big Contributions From Billionaire Donors Including Investor George Soros And Former Google Chief Executive Eric Schmidt Disclosures Filed On Friday With The Federal Election Commission Showed The Democratic National Committee Raised About $131 Million Last Month Above The $129 Million Raised By The Republican National Committee

Reuters

The fundraising arm of the U.S.Democratic Party raised more money in July than its Republican counterpart, helped by big contributions from billionaire donors including investor George Soros and former Chief Executive Eric Schmidt.

Disclosures filed on Friday with the Federal Election Commission showed the Democratic National Committee raised about $13.1 million last month, above the $12.9 million raised by the Republican National Committee. The RNC still had more money in the bank at the close of the month – $79 million compared to nearly $68 million held by the DNC – although Democrats narrowed the gap.

Raising more money does not necessarily translate into Election Day victory, but a big bank account helps U.S. parties support their candidates’ campaigns and pays for ads and polling. Democrats have narrow majorities in the U.S.Senate and the House of Representatives, and losing control of either in the November 2022 contests would be a blow to Democratic President Joe Biden’s agenda.

While the DNC has raised slightly more than the RNC this year, Republicans have been spending money more aggressively. It also spent more in July, shelling out $1 million to JDB Marketing Inc, a Mount Pleasant, South Carolina firm that specializes in direct mail fundraising.

Some of the DNC’s largest outlays during the month were also to support fundraising efforts, including more than $1.1 million to RWT Production, a direct mail firm from Annandale, Virginia.

READ MORE ON:

Democrats Raised Twice The Money Republicans Did In Five 2020 Races That Could Determine Control Of The Senate

U.S.Senate2020 ElectionDemocratic PartyRepublican Party

Democratic challengers raised nearly twice the amount Republicans did in first-quarter fundraising in five must-watch races that could determine who controls the Senate, the latest campaign finance figures showed.

Republican incumbents facing tough re-elections races in Arizona, Colorado, Kentucky, Maine and North Carolina all raised significantly less cash than their Democratic rivals in the first three months of 2020.

These contests are some of the best opportunities Democrats have to flip the seats and regain the Senate majority in November. They’re rapidly becoming some of the most expensive and contentious matchups in the country. In Kentucky, for example, the multi-million dollar ad war between Senate Majority Leader Mitch McConnell and Amy McGrath started 16 months before Election Day.

In some races, such as Maine and North Carolina, Democrats actually doubled the amount of cash brought in by their Republican challengers. In Maine, state representative Sara Gideon raised nearly three times more money than four-term incumbent Susan Collins.

The Senate is now made up of 53 Republicans, 45 Democrats and two independents who caucus with the Democrats. Democrats need to win four seats to regain control of the chamber, or three seats if the vice president is a Democrat. The vice president serves as the “president of the Senate” and can cast tie-breaking votes.

Thirty S&p 500 Ceos Vote For Biden With Their Wallet Though They Dont Contribute As Much As Trumps 15 Do

S&P 500 chief executives have combined to give more money to Trump’s campaign than Biden’s, even as the Democratic challenger has more S&P CEOs as donors.

+0.47%

As the Nov. 3 election sparks record campaign contributions, the CEOs of S&P 500 companies are helping to fund the war chests of President Donald Trump and challenger Joe Biden, while also contributing to other Republican and Democratic politicians.

In their political giving as individuals, these chief executives have combined to give more to Trump than Biden. Some 15 CEOs whose companies are components of the S&P 500 US:SPX have donated a total of $2.489 million to Trump’s principal campaign committee, its joint fundraising groups with the Republican National Committee or pro-Trump super PACs.

Meanwhile, 30 chief execs have contributed $536,100 to Biden’s main campaign committee, its joint groups with the Democratic National Committee or pro-Biden super PACs. These figures come from a MarketWatch analysis of processed Federal Election Commission data on individual contributions made between January 2019 and August 2020. Anyone who held the CEO job in 2019 or 2020 at a company that was part of the S&P 500 is included.

S&P 500 CEOs giving their own money to Trump’s campaign

* Former CEO who held the position during the FEC’s 2020 election cycle that started Jan. 1, 2019

Total $536,100.00

* Former CEO who held the position during the FEC’s 2020 election cycle that started Jan. 1, 2019

Companies’ responses

Here’s How The Deficit Performed Under Republican And Democratic Presidents From Reagan To Trump

This article was updated Aug. 2 to include a graph with the annual federal deficit in constant dollars.

A viral post portrays Democrats, not Republicans, as the party of fiscal responsibility, with numbers about the deficit under recent presidents to make the case.

Alex Cole, a political news editor at the website Newsitics, . Within a few hours, several Facebook users postedscreenshots of the tweet, which claims that Republican presidents have been more responsible for contributing to the deficit over the past four decades.

Those posts racked up several hundred likes and shares. We also found , where it has been upvoted more than 53,000 times.

“Morons: ‘Democrats cause deficits,’” the original tweet reads.

Reagan took the deficit from 70 billion to 175 billion. Bush 41 took it to 300 billion. Clinton got it to zero. Bush 43 took it from 0 to 1.2 trillion.Obama halved it to 600 billion. Trump’s got it back to a trillion.Morons: “Democrats cause deficits.”

— Alex Cole July 23, 2019

Screenshots of the tweet on Facebook were flagged as part of the company’s efforts to combat false news and misinformation on its News Feed.

At PolitiFact, we’vereportedextensively on how Republicans and Democrats often try to pin the federal deficit on each other — muddying the facts in the process. So we wanted to see if this Facebook post is true.

Some people confuse the federal deficit with the debt — but they’re two separate concepts.

Featured Fact-check

The First Modern Campaign Finance Restrictions Were Soon Followed By A Boom In Pac Spending

FEC, Corrado, Center for Responsive Politics

In the early 1970s, and particularly after the election spending abuses revealed in the Watergate scandal, Congress put new limits on donations to candidates. But the overall amount of money in politics didn’t decline. The money instead started going to PACs, or political action committees, rather than candidates. Thousands of new ones were formed, and they started raising hundreds of millions of dollars each year overall. This shows a problem for would-be campaign finance regulators: If one particular aspect of election spending is regulated or capped, big money will try to find another way in.

Congress Responds More To The Preferences Of The Wealthy Than To Those Of Average People

Gilens and Page, “Testing Theories of American Politics

Who really matters in our democracy — the general public, or wealthy elites? These charts, from a study by political scientists Martin Gilens of Princeton and Benjamin Page of Northwestern, seek to answer that question. The first one — the flat line — shows that as more and more average citizens support action on an issue, they’re not any more likely to get what they want. That’s a shocking finding in a democracy. In contrast, the next chart shows that as more economic elites want a certain policy change, they do become more likely to get what they want. Specifically, if fewer than 20 percent of wealthy Americans supported a policy change, it only happened about 18 percent of the time. But when 80 percent of them were in support, the change ended up happening 45 percent of the time. There’s no similar effect for average Americans.

Big Problems With Small Money Republicans Catch Up To Democrats In Online Giving

Alex Seitz-Wald

WASHINGTON — Republicans are beginning to catch up with Democrats in online fundraising, creating for the first time in modern history a political landscape where both parties are largely funded by small donations — for better or, some say, for worse.

Democrats, who have dominated online fundraising since the early days of the internet, have claimed that the billions they raise in small donations are evidence that they are the party of the people, less reliant on wealthy donors and business interests than the GOP.

Republicans have spent years playing catch-up, mostly unsuccessfully. But now, just in time for the 2022 midterm elections, they are starting to pull even, thanks in large part to former President Donald Trump and his army of online devotees.

“This is the harvest of the seeds of digital infrastructure Republicans have been planting for years,” said Matt Gorman, a GOP strategist who worked for the party’s congressional campaign arm during the last midterm election. “That’s why you’re seeing things like freshman members of the House raising over $1 million . In 2018, we were begging folks to raise a fifth of that.”

Even out of office, Trump continues to raise massive sums of money, largely online. He announced Saturday that his political groups had collected nearly $82 million in the first half of the year , giving him a war chest of more than $102 million.

Democratic Party Committees Raised More Money Than Republican Committees In 2013

Paul Blumenthal

WASHINGTON — The three major Democratic Party committees raised $16 million more than their Republican Party counterparts in 2013.

The Democratic committees raised $193 million for the year, compared with $177 million for the three Republican committees, according to reports filed with the Federal Election Commission.

The fundraising success for the Democratic committees stems from big numbers posted by the Democratic Congressional Campaign Committee and the Democratic Senatorial Campaign Committee. The DCCC raised $75.8 million, the most of any party committee, while the DSCC pulled in $52.7 million. Both committees topped their Republican counterparts by more than $15 million.

“Our substantial fundraising lead is the result of one major dynamic: Americans are ready to replace this broken Republican Congress with leaders who have the right priorities and who will focus on solving problems,” DCCC Chairman Steve Israel said in a statement.

The Republican National Committee, however, beat the Democratic National Committee in head-to-head fundraising for the year. In 2013, the RNC raised $80.6, almost $16 million more than the $64.7 million pulled in by the DNC.

The money raised by these committees will finance large advertising purchases in battleground House and Senate races, among other things.

Report: Trump Has Raised More Money In California Than Most Democrat Candidates

California is well known as arguably the most liberal state in America, however recent statistics may shock both Democrats and Republicans.

It looks like there may be more Trump supporters in the “deep blue” state of California than most people think.

According to the news site Cal Matters, President Trump comes in third place for the most money raised in California out of all the Democratic candidates. He is just behind Mayor Pete Buttigieg of Indiana and Senator Kamala Harris who resides in California.

Check out what Cal Matters reported:

This may come as surprise to the president, the national media and more than a few Californians, but there are plenty of Trump supporters in the “Resistance State,” too. And since the beginning of the year, they’ve been spending a lot of money to keep the president in the White House.

New campaign finance statistics show that President Donald Trump raised $3.2 million—more money from the California donor class than all of his Democratic challengers, but two.

Not only that, but the Trump campaign collected more from itemized small donors—those who gave in increments of less than $100 at a time—than anyone else in the field. The president bested even Democratic contender Bernie Sanders in the small-donor sweepstakes.

But it’s not all pixie dust for Trump in California: 89% of all itemized presidential campaign donations from Californians went to contenders out to defeat him.

More than $3 million has come since the beginning of this year.

Democratic Senate Hopefuls Are Raising Tons Of Money They’re Also Spending It

Congressional races heat up as Dems try to fl…02:14

Democratic Senate hopeful Jaime Harrison of South Carolina raised $57 million between July and September. Sara Gideon in Maine raised more than $39 million in that same period. And Mark Kelly in Arizona brought in $38.7 million.

These eye-popping numbers shattered the previous record for fundraising, Beto O’Rourke’s $38 million cash haul in the third quarter of 2018.

Now the Democrats are spending that money in the face of massive Republican super PAC funds. And it’s left many Republican candidates with more cash on hand than the Democrats in the final weeks of the race.

In South Carolina, where the Senate race is unexpectedly tight, Harrison’s $57 million in three months was double Republican incumbent Senator Lindsey Graham’s $28 million haul, a state record for a Republican. Records show from July through September, Harrison spent more than $55 million. According to his October FEC filing, Harrison paid AL Media LLC more than $42 million over three months for TV, radio and digital advertising. He also spent another $6.5 million for digital advertising and services to Mothership Strategies, and $2 million to Blueprint Strategy LLC for radio and billboard advertising. $641,000 went to “direct mailing services.” That amounts to more than $51 million spent on ads and direct mail alone.

Who Is Richer Democrats Or Republicans The Answer Probably Wont Surprise You

Which of the two political parties has more money, Democrats or Republicans? Most would rush to say Republicans due to the party’s ideas towards tax and money. In fact, polls have shown about 60 percent of the American people believe Republicans favor the rich. But how true is that? can help you write about the issue but read our post first.

Presidential Campaign Spending Is Overwhelmingly On Tv Ads In Swing States

Data: Kantar, Analysis: John Sides, Washington Post

Presidential campaign money goes overwhelmingly to purchasing TV ads in just a few swing states. This map shows where ad spending was heaviest in 2012: Florida, Virginia, and Ohio, where more than $150 million was spent. Iowa, North Carolina, Colorado, and Nevada saw more than $50 million each. But most of the country saw nothing at all. Presidential campaigns have become a quadrennial stimulus bill for purple states funded by donors in red and blue states.

Democratic Party Enters 2021 In Power And Flush With Cash For A Change

The Democratic National Committee has a roughly $75 million war chest, raising the party’s hopes of keeping power in 2022 and accelerating a Democratic shift in the Sun Belt states.

After years of flirting with financial disaster, the Democratic Party entered 2021 not only in control of the White House, the House and the Senate but with more money in the bank than ever before at the start of a political cycle.

The Democratic National Committee will report to the Federal Election Commission on Sunday that it ended 2020 with $38.8 million in the bank and $3 million in debts, according to an advance look at its financial filings. In addition, there is roughly $40 million earmarked for the party, left over from its joint operations with the Biden campaign, according to people familiar with the matter. This gives the Democrats a roughly $75 million war chest at the start of President Biden’s tenure.

“This is a number that is unimaginable,” said Howard Dean, a former party chairman.

Party data, resources and infrastructure undergird candidates up and down the ballot, and Democratic officials are already dreaming of early investments in voter registration that may accelerate the political realignment Democrat are hoping to bring about in key Sun Belt states.

“We had to juggle who we were going to pay,” Tom Perez, who until earlier this month was the chairman of the D.N.C., said of the early part of his tenure, which began in 2017.

The Supreme Court Has Struck Down Many Limitations On Election Spending

Over the past four decades, Congressional attempts to regulate the campaign finance system have repeatedly been stymied by the Supreme Court on First Amendment grounds. This table lists the major cases in which the court has ruled campaign finance restrictions unconstitutional — and how closely divided the court has been in every case. The first major such case was Buckley v. Valeo, in 1976, which struck down much of the newly-adopted campaign finance infrastructure in the name of free speech. The next major campaign finance overhaul — the 2002 McCain-Feingold law — survived an initial court challenge in 2003. But after Justice Sandra Day O’Connor was replaced with the more conservative Sam Alito in 2006, the court had a majority that objected to major provisions of the law. Since then, a series of 5-4 decisions have narrowed the scope of permissible campaign finance regulations further and further.

Us Democratic Fundraising Arm Outraises Republican Counterpart In July

Jason Lange

Supporters of Democratic U.S. presidential nominee Joe Biden gather with their cars for a socially distanced election celebration as they await Biden’s remarks and fireworks in Wilmington, Delaware, U.S. November 7, 2020. REUTERS/Jonathan Ernst

WASHINGTON, Aug 20 – The fundraising arm of the U.S. Democratic Party raised more money in July than its Republican counterpart, helped by big contributions from billionaire donors including investor George Soros and former Google Chief Executive Eric Schmidt.

Disclosures filed on Friday with the Federal Election Commission showed the Democratic National Committee raised about $13.1 million last month, above the $12.9 million raised by the Republican National Committee.

The RNC still had more money in the bank at the close of the month – $79 million compared to nearly $68 million held by the DNC – although Democrats narrowed the gap.

Raising more money does not necessarily translate into Election Day victory, but a big bank account helps U.S. parties support their candidates’ campaigns and pays for ads and polling.

Democrats have narrow majorities in the U.S. Senate and the House of Representatives, and losing control of either in the November 2022 contests would be a blow to Democratic President Joe Biden’s agenda.

Soros, a famed investor and a bogeyman of conservatives due to his status as a major donor for liberal causes, gave the DNC at least $250,000 in July.

Who Raised More Money In A Majority Of Tight House Races Democrats Did

Total reported in the most competitive House races

DEMOCRATS RAISED $172MILLION

With the midterm elections just weeks away, Democratic candidates have outraised their Republican opponents in a majority of the 69 most competitive House races, according to fund-raising numbers filed by the candidates on Monday. Some of the biggest earners include two Democratic women: Mikie Sherrill in New Jersey’s 11th District and Amy McGrath in Kentucky’s Sixth District.

Many Democratic candidates raised large sums from small donations online. Democrats are betting on small donor energy to make a difference in tight races.

Facing a host of tough races, Republican Party leaders have begun pulling money away from some struggling incumbents, especially in suburbs where President Trump is unpopular.

How much candidates in the most competitive House races have raised

*Incumbent shown with an asterisk.

DISTRICT

Republicans Winning Money Race As They Seek To Take Over House In 2022

The National Republican Congressional Committee announced Wednesday that it had raised $45.4 million in the second quarter of 2021, the most it has ever raised in three months of a non-election year, as Republicans seek to take over the House in 2022.

House GOP leader Kevin McCarthy This story has been updated with additional developments Wednesday.

The Most Famous Political Figures Can Make Millions In Speaking Fees

CNN

For the top echelon of famous and recognizable political figures, there’s another way to cash in after leaving offices — by giving high-priced speeches to corporate groups. Former politicians and aides from both parties participate in this practice — the more famous they are, the higher the fee they tend to be able to charge. But the undisputed king of speaking fees is Bill Clinton, who charges at least $250,000 per speech — and charged $750,000 for at least one. This chart, based on data assembled by CNN, shows how speaking fees have made Clinton over $100 million since he left office.

How Trumps Team Spent Most Of The $16 Billion It Raised Over 2 Years

Biden and Trump spar in final presidential debate

President Donald Trump‘s reelection team kicked off 2020 with what seemed like an unbeatable cash advantage, boasting a massive fundraising operation, bolstered by the joint efforts of the Republican Party.

Fast-forward 10 months and they’ve burned through a whopping $1.4 billion of the more than $1.6 billion raised over the last two years, struggling to keep up with former Vice President Joe Biden, more than what former President Barack Obama’s reelection campaign and the Democrats had raised and spent by the end of the 2012 cycle.

The revealing figures, released as the two presidential candidates debated on stage Thursday night for the last time before Election Day, came after the campaign blew through $63 million in the first two weeks of October alone — a critical time when it only brought in $44 million. The vast majority of the money spent during that time — nearly $45 million — went to television and online advertising, according to the latest disclosure report filed to the Federal Election Commission, as Biden and pro-Biden efforts ramped up his ad spending.

MORE: Trump campaign trailing behind Biden in funding, weeks before Election Day, new filings show

MORE: Trump commits to familiar playbook to define Biden in tamer final debate: ANALYSIS

So where has the president’s money gone?

MORE: Trump heads into final campaign stretch forced to play defense against Biden

Questions about staff payments

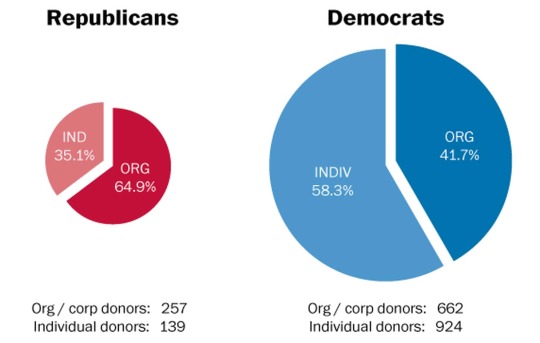

The Massive Difference In How Democrats And Republicans Raise Money

You probably have a preconceived notion of where the political parties raise their money. Republicans get lots of donations from wealthy individuals and corporate interests; Democrats get money from less rich individuals and a somewhat overlapping set of corporate interests. Well, we have news for you: That perception is completely correct.

arrow-right

At least, that is, for the parties’ Governors Associations. On Tuesday, organizations and candidates that raise money for political campaigns had to file quarterly reports with the Federal Election Commission. The Democratic Governors Association and the Republican Governors Association both reported how much they’d raised between April 1 and June 30. The RGA did much better, about $24 million raised versus under $14 million, although the DGA had more donors, about 1,500 to 400.

When money is given to these groups, which can accept unlimited donations unlike their federal counterparts, the organizations have to document who gave, and how much, and when. Organizations that give just list an address; individuals have to identify their employer. Which lets us see pretty easily how those two groups break down.

And so, we see that the RGA got a much larger percentage of their donations from organizations than did the DGA.

far86 times

Who are these beneficent individuals? The DeVos family, of Amway fame. Las Vegas megadonor Sheldon Adelson. And Kotch? Koch? Someone named “David Koch,” if you’ve heard of him.

Congressional Staffers Can Take Trips Funded By Foreign Governments

Washington Post

After the Jack Abramoff lobbying scandal, Congress put several new restrictions on gifts that could be offered to members of Congress or their staffers. Yet there’s one significant loophole that remains — Congressional staffers are allowed to take trips abroad funded by foreign governments.The Washington Post’s TW Farnam reported on paid trips taken by Congressional staffers last year, and the map here is our depiction of Farnam’s findings. Between 2006 and 2011, 226 staffers took trips to China, 121 to Taiwan, and 65 to Saudi Arabia — where those countries’ governments footed the bill.

0 notes

Text

replying to @redcherrieblossoms who replied to this post (sorry folks, this is going to be long. The rest under the cut because yea

Right so "wiccanery" youre not wiccan yet thats your username on here. And yeah witch craft isn't closed yet when people do it for "aesthetic" I consider that appropriating. You had a chance educate people on shit and you chose to make it a quick 15 seconds of fame. I didn't say anything about the practice being a closed one. Its hilarious to me that youve been somewhat a witch for 2 years and you think you know so much as to have an article. There are witches who have been practicing solitary and in covens for ages and either still dont write about it or are discredited for a small thing they say. But its ok. The few people who do know well enough will see that you failed to mention anything about sigils. Do you even know what sigils are? I remember my second year of witchcraft i knew so little about it that i didnt even care to talk about it. Theres a lot to learn and im not saying you shouldnt voice what you do know but the article came off as childish and uninformed. Next time you get an opportunity like that. Take your time and plan what you say. Talk to other witches. Perhaps youre solitary but id suggest you look into covens because they can teach you way more than you think you can learn. Yeah a lot of witches dont cast circles but you should have given that option so that people can decide for themselves if they want to do it. Misinformation about such a minute detail is more important than you think.

Ok, I’m going to address this by parts.

“Right so "wiccanery" youre not wiccan yet thats your username on here.” Yes. I started as a Wiccan, chose that name, and now I’m not Wiccan but I don’t feel like changing my username as I have many things linked across my whole blog and it’s a pain in the ass to change it again. Plus, I like how it sounds, and I like to make it think as “wicce” which is ancient english for witch if I remember correctly.

“And yeah witch craft isn't closed yet when people do it for "aesthetic" I consider that appropriating.” That’s your problem, because considering the meaning and the rest of examples of appropriation, most of the community I think wouldn’t agree. But you’re free to believe whatever you want, so be it. I don’t like it being used as a trend or as “aesthetic”, but apart from informing, there’s not much we can do (that’s what I was intending with the article).

“You had a chance educate people on shit and you chose to make it a quick 15 seconds of fame.” Ok, I don’t consider it a 15 minutes of fame thing. People had already approached me. I only do what feels right and try to shed a light on stuff, which is what I did. It’s not like I live off from this blog either or some shit like that. Also, what the fuck am I supposed to do if someone approaches me asking about stuff?! “No, I haven’t been a witch for X years yet so I can’t answer or do interviews”. Fuck that. I wanted to help, and it was a simple subject.

“I didn't say anything about the practice being a closed one.” You said i make it seem as cultural appropriation, and cultural appropriation is something suffered by closed practices (which neo wicca and witchcraft aren’t).

“Its hilarious to me that youve been somewhat a witch for 2 years and you think you know so much as to have an article.“ You don’t know a thing about me. Why are you so bitchy about it? I’ve been actively practicing for more than 2, but learning for 5 or so, but I consider myself (and a lot of people I know do too) as a fast learner so I don’t have much trouble absorbing lots of information. I have an article (two actually, because someone else had also interviewed me a while ago) because I made a post about emoji spells trying to shed a light on what it was and how it works as at that time I had seen many floating around (this post here). People evidently got a hang of it and they come up to me thinking I am super knowledgable on the subject. It’s very simple so there isn’t much knowledge to acquire, it’s not like energy work which is very extensive (and I’m not so well versed in it), so I was more than willing to help.

“There are witches who have been practicing solitary and in covens for ages and either still dont write about it or are discredited for a small thing they say.“ Okay, I don’t do what I do based on what others of my similar position do. I do whatever I feel, and if I feel I can help, I do it. And if they get discredited, I’m so sorry for that, no one should have that happen to them, as everyone perceives their practice as their own and people shouldn’t boss around others’ practices telling them it’s “wrong” if it works for them. If they make valid points, they should be welcomed for their contribution. If they have a wrong idea (i.e. thinking wicca and witchcraft are the same for example, of course they should be educated on the subject).

“But its ok. The few people who do know well enough will see that you failed to mention anything about sigils. Do you even know what sigils are?“ I’m sure you haven’t seen the original post I made that sparked a lot of the emoji spells and being approached for that. I linked it before. You’ll see that I mention that emoji spells work very much like sigils, and if you were bothered to look a bit through my blog, you would have seen that I recommend sigils to most people who come in asking for help, as it’s very easy and simple magic and anyone with pen and paper can do them. I love sigils and I love making them. This validates my previous point that you don’t know nothing about me (apart from skimming through my blog and probably reading my about me page). The reason why I didn’t mention it in this article is because I forgot... People forget things all the time, and I was in a rush when the interviewer approached me so I just concentrated on the emoji subject and my mind left out pretty much the rest.

“I remember my second year of witchcraft i knew so little about it that i didnt even care to talk about it.“ Well, that’s you and your path. I’m in my whatever (second, apparently, it feels like more) year of witchcraft and I feel I have learned so much, but that there’s still so much to learn. I’m willing to help out anyone who approaches me and asks about a subject I know about (if I just know a little, I tell them that little I know about and direct them to other sources); and if I don’t know about, I try to find information and/or direct them to other places so at least I can be of some help. If you didn’t feel like talking about it, then that’s on you, why do I have to be like you?

“Theres a lot to learn and im not saying you shouldnt voice what you do know but the article came off as childish and uninformed.“ I didn’t write it and I didn’t edit it either; I’m pretty sure they made it to be a friendly approach, which may sound childish to some. I just answered the questions that they asked to the best of my knowledge, and considering there isn’t much depth to emoji spells, there isn’t much to say.

“Next time you get an opportunity like that. Take your time and plan what you say.“ I mean, I did think it out, I took my time to answer it, but there isn’t much to add to that subject, as I said. And I wasn’t part of how the final result was. I was just interviewed.

“Talk to other witches. Perhaps youre solitary but id suggest you look into covens because they can teach you way more than you think you can learn.“ Again, you don’t know a thing about me. I’m not in any coven irl because there’s none in my area, but I talk to many witches online all the time in the various witchy servers I’m in, and I try to help out anyone over there. Sure, I always learn new stuff, be it from reading things that are posted or checking on people’s questions and tagging along, which is amazing and why I love being in those servers.

“Yeah a lot of witches dont cast circles but you should have given that option so that people can decide for themselves if they want to do it. Misinformation about such a minute detail is more important than you think.“ If you read the post I made, you would have seen that I added the idea that you can opt for not using the circle, which apparently I had left out before (my bad), but now it’s there, and in the interview, they asked me if the circle was mandatory, to which I replied that no, it wasn’t, and you can opt for using it or not. I posted the article and added a note at the bottom if you care to read it (read it here). Personally, I disapprove of the decision of not including that in the article (the fact that you can choose not to use the circle, that is), but I’m not in the editing team, so I can’t do anything (and I have absolutely no idea how to reply on snapchat stories, I don’t even think it’s possible).

At this moment I just feel you’re bitching just because, which I honestly don’t get. If you have a grudge with me or anything, send me a PM letting me know why, or do whatever you want. Have a nice day!

5 notes

·

View notes

Text

i wanna add that being in the tumblr mindset of constantly looking for things that could potentially be 'problematic' is such a shitty fuckin mindset like god forbid someone likes something that isnt purely unproblematic. obviously if its something legit bad thats a different story.

anyways ive grown to really not give as much of a fuck anymore like theres so many butthurt folks on here and so much misinformation on stuff that ive gotten to the point where i dont give a fuck anymore if i have to be an asshole to someone. i can and will be an ass ¯\_(ツ)_/¯ ive just really had enough of the bullshit on here.

i like to keep to myself on some stuff like posting about my special interest etc because i highkey hate most of the people in the prog fanbase on here but at the same time i wanna be able to contribute more and not give a fuck about it. but if its correcting folks on misinfo then yes ill do that even if i gotta be an asshole

anyways im h

im gonna complain about how shitty tumblr is and what it made me into for a second

Keep reading

10 notes

·

View notes

Text

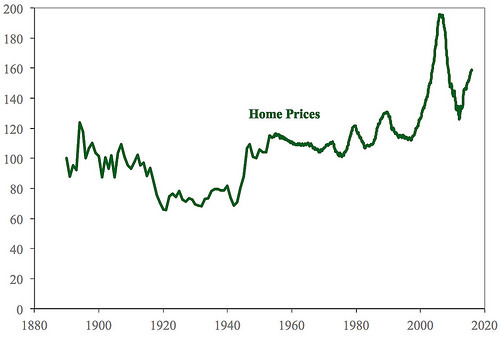

Is your home a better investment than the stock market?

Shares 169 Ill admit it: There are times that I think everything that needs to be said about personal finance has been said already, that all of the information is out there just waiting for people to find it. The problem is solved. Perhaps this is technically true, but now and then as this morning Im reminded that teaching people about money is a never-ending process. There arent a lot of new topics to write about, thats true (this is something that even famous professional financial journalists grouse about in private), but there are tons of new people to reach, people who have never been exposed to these ideas. And, more importantly, theres a constant stream of new misinformation polluting the pool of smart advice. (Sometimes this misinformation is well-meaning; sometimes its not.) Heres an example. This morning, I read a piece at Slate by Felix Salmon called The Millionaires Mortgage. Salmons argument is simple: Paying off your house is saving for retirement. Now, I dont necessarily disagree with this basic premise. I too believe that money you pay toward your mortgage principle is, in effect, money youve saved, just as if youd put it in the bank or invested in a mutual fund. Many financial advisers say the same thing: Money you put toward debt reduction is the same as money youve invested. (Obviously, theyre not exactly the same but theyre close enough.) So, yes, paying off your home is saving for retirement. Or, more precisely, its building your net worth. But aside from a sound basic premise, the rest of Salmons article boils down to bullshit.

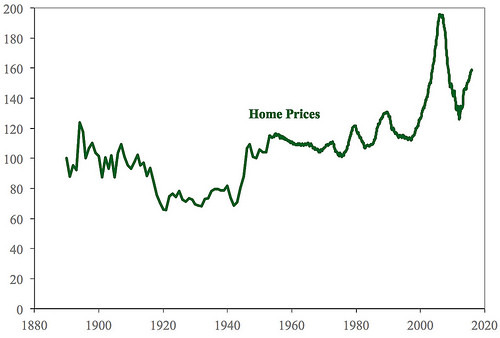

Lying with Statistics Looking past the paying off your house is saving for retirement subtitle on his piece (a subtitle that was likely added by an editor, not by Salmon), we get to his actual thesis: Making mortgage payments can, in theory, be a way to accumulate wealth almost as effectively as contributing to a retirement fund. Im glad Salmon qualified this statement with in theory and almost because this is pure unadulterated bullshit. And its dangerous bullshit. Heres how this logic works: If you buy an urban house today for $315,000 (the average price) and it appreciates at 8 percent a year for the next 15 years, you will be living in a $1 million house by the time you pay off your 15-year mortgage, and you will own it free and clear. Which is to say: Youll be a millionaire. For this to be true, heres what has to happen.: Home prices in your area have to appreciate at an average of eight percent not just this year and next year, but for fifteen years.You have to take out a 15-year mortgage instead of a 30-year mortgage.You need to stay in that house (or continue to own it) for that entire fifteen years.Once youve become a millionaire homeowner, you now have to tap that equity for it to be of use. To do that, you have to sell your home, acquire a reverse mortgage, or otherwise creatively access the value locked in your home. The real problem here, of course, are the assumptions about real estate returns. Salmon spouts huckster-level nonsense: The 8 percent appreciation rate is aggressive, but not entirely unrealistic: Its lower than the 8.3 percent appreciation rate from 2011 through 2017, and also lower than the 9 percent appreciation rate from 1996 to 2007. Thats right. Salmon cites stats from 1996 to 2007, then 2011 to 2017 and completely leaves out 2008 to 2010. WTF? This as if I ran a marathon and told you that I averaged four minutes per milebut I was only counting the miles during which I was running downhill! Or I told you that Get Rich Slowly earned $5000 per monthbut I was only giving you the numbers from April. Or I logged my alcohol consumption for thirty days and told you I averaged three drinks per weekbut left out how much I drank on weekends. This isnt how statistics work! You dont get to cherry pick the data. You cant just say, Homes in some markets appreciated 9% annually from 1996 to 2007, then 8.3% annually from 2011 to 2017. Therefor, your home should increase in value an average of eight percent per year. What about the gap years? What about the period before the (very short) 22 years youre citing? What makes you think that the boom times for housing are going to continue? Long-Term Home Price Appreciation In May, I shared a brief history of U.S. homeownership. To write that article, I spent hours reading research papers and sorting through data. One key piece of that post was the info on U.S. housing prices. Let me share that info again. For 25 years, Yale economics professor Robert Shiller has tracked U.S. home prices. He monitors current prices, yes, but hes also researched historical prices. Hes gathered all of this info into a spreadsheet, which he updates regularly and makes freely available on his website. This graph of Shillers data (through January 2016) shows how housing prices have changed over time:

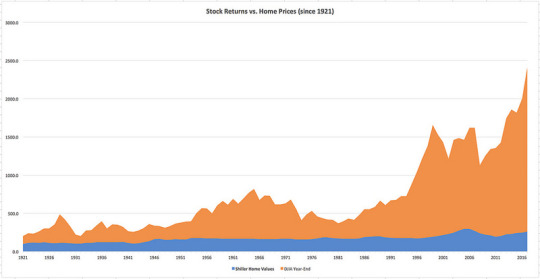

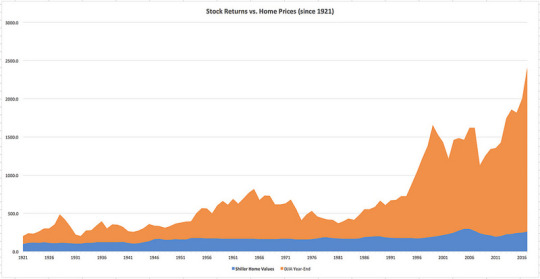

Shillers index is inflation-adjusted and based on sale prices of existing homes (not new construction). It uses 1890 as an arbitrary benchmark, which is assigned a value of 100. (To me, 110 looks like baseline normal. Maybe 1890 was a down year?) As you can see, home prices bounced around until the mid 1910s, at which point they dropped sharply. This decline was due largely to new mass-production techniques, which lowered the cost of building a home. (For thirty years, you could order your home from Sears!) Prices didnt recover until the conclusion of World War II and the coming of the G.I. Bill. From the 1950s until the mid-1990s, home prices hovered around 110 on the Shiller scale. For the past twenty years, the U.S. housing market has been a wild ride. We experienced an enormous bubble (and its aftermath) during the late 2000s. It looks very much like were at the front end of another bubble today. As of December 2017, home prices were at about 170 on the Shiller scale. (Personally, I believe that once interest rates begin to rise again, home prices will decline.) Heres the reality of residential real estate: Generally speaking, home values increase at roughly the same (or slightly more) than inflation. Ive noted in the past that gold provides a long-term real return of roughly 1%, meaning that it outpaces inflation by 1% over periods measured in decades. For myself, thats the figure I use for home values too. Crunching the Numbers Because Im a dedicated blogger (or dumb), I spent an hour building this chart for you folks. I took the afore-mentioned housing data from Robert Shillers spreadsheet and combined it with the inflation-adjusted closing value of the Dow Jones Industrial Average for each year since 1921. (I got the stock-market data here.) If youd like, you can click the graph to see a larger version.

Let me explain what youre seeing. First, I normalized everything to 1921. That means I set home values in 1921 to 100 and I set the closing Dow Jones Industrial Average to 100. From there, everything moves as normal relative to those values.Second, Im not sure why but Excel stacked the graphs. (Im not spreadsheet savvy enough to fix this.) They should both start at 100 in 1921, but instead the stock market graph starts at 200. This doesnt really make much of a difference to my point, but it bugs me. There are a few places 1932, 1947 where the line for home values should actually overtake the line for the stock market, but you cant tell that with the stacked graph. As the chart shows, the stock market has vastly outperformed the housing market over the long term. Theres no contest. The blue housing portion of my chart is equivalent to the line in Shillers chart (from 1921 on, obviously). Now, having said that, there are some things that I can see in my spreadsheet numbers that dont show up in this graph. Because Felix Salmon at Slate is using a 15-year window for his argument, I calculated 15-year changes for both home prices and stock prices. Ill admit that the results surprised me. Generally speaking, the stock market does provide better returns than homeownership. However, in 30 of the 82 fifteen-year periods since 1921, housing provided better returns. (And in 14 of 67 thirty-year periods, housing was the winner.) I didnt expect that. In each of these cases, housing outperformed stocks after a market crash. During any 15-year period starting in 1926 and ending in 1939 (except 1932), for instance, housing was the better bet. Same with 1958 to 1973. In other words, if you were to buy only when the market is declining, housing is probably the best bet if youre making a lump-sum investment and not contributing right along. Another thing the numbers show is that youre much less likely to suffer long-term declines with housing than with the stock market. Sure, there are occasional periods where home prices will drop over fifteen or thirty years, but generally homes gradually grow in value over time. The bottom line? I think its perfectly fair to call your home an investment, but its more like a store of value than a way to grow your wealth. And its nothing like investing in the U.S. stock market. For more on this subject, see Michael Bluejays excellent articles: Long-term real estate appreciation in the U.S. and Buying a home is an investment. Final Thoughts Honestly, I probably would have ignored Salmons article if it werent for the attacks he makes on saving for retirement. Take a look at this: If youre the kind of person who can max out your 401(k) every year for 30 or 40 years straight disciplined, frugal, and apparently immune to misfortune then, well, congratulations on your great good luck, and I hope youre at least a little bit embarrassed at how much of a tax break youre getting compared to people who need government support much more than you do. Holy cats! Salmon has just equated the discipline and frugality that readers like you exhibit with good luck, and simultaneously argued that you should be embarrassed for preparing for your future. He wants you to feel guilty because youre being proactive to prepare for retirement. Instead of doing that, he wants you to buy into his bullshit millionaires mortgage plan. This crosses the line from marginal advice to outright stupidity. Theres an ongoing discussion in the Early Retirement community about whether or not you should include home equity when calculating how much youve saved for retirement. There are those who argue absolutely not, you should never consider home equity. (A few of these folks dont even include home equity when computing their net worth, but that fundamentally misses the point of what net worth is.) I come down on the other side. I think its fine good, even to include home equity when making retirement calculations. But when you do, you need to be aware that the money you have in your home is only accessible if you sell or use the home as collateral on a loan. Regardless, Ive never heard anyone in the community argue that you ought to use your home as your primary source of retirement saving instead of investing in mutual funds and/or rental rental properties. You know why? Because its a bad idea! Shares 169 https://www.getrichslowly.org/home-investment/

0 notes

Text

Who Raises More Money Democrats Or Republicans

New Post has been published on https://www.patriotsnet.com/who-raises-more-money-democrats-or-republicans/

Who Raises More Money Democrats Or Republicans

The Fundraising Arm Of The Us Democratic Party Raised More Money In July Than Its Republican Counterpart Helped By Big Contributions From Billionaire Donors Including Investor George Soros And Former Google Chief Executive Eric Schmidt Disclosures Filed On Friday With The Federal Election Commission Showed The Democratic National Committee Raised About $131 Million Last Month Above The $129 Million Raised By The Republican National Committee

Reuters

The fundraising arm of the U.S.Democratic Party raised more money in July than its Republican counterpart, helped by big contributions from billionaire donors including investor George Soros and former Chief Executive Eric Schmidt.

Disclosures filed on Friday with the Federal Election Commission showed the Democratic National Committee raised about $13.1 million last month, above the $12.9 million raised by the Republican National Committee. The RNC still had more money in the bank at the close of the month – $79 million compared to nearly $68 million held by the DNC – although Democrats narrowed the gap.

Raising more money does not necessarily translate into Election Day victory, but a big bank account helps U.S. parties support their candidates’ campaigns and pays for ads and polling. Democrats have narrow majorities in the U.S.Senate and the House of Representatives, and losing control of either in the November 2022 contests would be a blow to Democratic President Joe Biden’s agenda.

While the DNC has raised slightly more than the RNC this year, Republicans have been spending money more aggressively. It also spent more in July, shelling out $1 million to JDB Marketing Inc, a Mount Pleasant, South Carolina firm that specializes in direct mail fundraising.

Some of the DNC’s largest outlays during the month were also to support fundraising efforts, including more than $1.1 million to RWT Production, a direct mail firm from Annandale, Virginia.

READ MORE ON:

Democrats Raised Twice The Money Republicans Did In Five 2020 Races That Could Determine Control Of The Senate

U.S.Senate2020 ElectionDemocratic PartyRepublican Party

Democratic challengers raised nearly twice the amount Republicans did in first-quarter fundraising in five must-watch races that could determine who controls the Senate, the latest campaign finance figures showed.

Republican incumbents facing tough re-elections races in Arizona, Colorado, Kentucky, Maine and North Carolina all raised significantly less cash than their Democratic rivals in the first three months of 2020.

These contests are some of the best opportunities Democrats have to flip the seats and regain the Senate majority in November. They’re rapidly becoming some of the most expensive and contentious matchups in the country. In Kentucky, for example, the multi-million dollar ad war between Senate Majority Leader Mitch McConnell and Amy McGrath started 16 months before Election Day.

In some races, such as Maine and North Carolina, Democrats actually doubled the amount of cash brought in by their Republican challengers. In Maine, state representative Sara Gideon raised nearly three times more money than four-term incumbent Susan Collins.

The Senate is now made up of 53 Republicans, 45 Democrats and two independents who caucus with the Democrats. Democrats need to win four seats to regain control of the chamber, or three seats if the vice president is a Democrat. The vice president serves as the “president of the Senate” and can cast tie-breaking votes.

Thirty S&p 500 Ceos Vote For Biden With Their Wallet Though They Dont Contribute As Much As Trumps 15 Do

S&P 500 chief executives have combined to give more money to Trump’s campaign than Biden’s, even as the Democratic challenger has more S&P CEOs as donors.

+0.47%

As the Nov. 3 election sparks record campaign contributions, the CEOs of S&P 500 companies are helping to fund the war chests of President Donald Trump and challenger Joe Biden, while also contributing to other Republican and Democratic politicians.

In their political giving as individuals, these chief executives have combined to give more to Trump than Biden. Some 15 CEOs whose companies are components of the S&P 500 US:SPX have donated a total of $2.489 million to Trump’s principal campaign committee, its joint fundraising groups with the Republican National Committee or pro-Trump super PACs.

Meanwhile, 30 chief execs have contributed $536,100 to Biden’s main campaign committee, its joint groups with the Democratic National Committee or pro-Biden super PACs. These figures come from a MarketWatch analysis of processed Federal Election Commission data on individual contributions made between January 2019 and August 2020. Anyone who held the CEO job in 2019 or 2020 at a company that was part of the S&P 500 is included.

S&P 500 CEOs giving their own money to Trump’s campaign

* Former CEO who held the position during the FEC’s 2020 election cycle that started Jan. 1, 2019

Total $536,100.00

* Former CEO who held the position during the FEC’s 2020 election cycle that started Jan. 1, 2019

Companies’ responses

Here’s How The Deficit Performed Under Republican And Democratic Presidents From Reagan To Trump

This article was updated Aug. 2 to include a graph with the annual federal deficit in constant dollars.

A viral post portrays Democrats, not Republicans, as the party of fiscal responsibility, with numbers about the deficit under recent presidents to make the case.

Alex Cole, a political news editor at the website Newsitics, . Within a few hours, several Facebook users postedscreenshots of the tweet, which claims that Republican presidents have been more responsible for contributing to the deficit over the past four decades.

Those posts racked up several hundred likes and shares. We also found , where it has been upvoted more than 53,000 times.

“Morons: ‘Democrats cause deficits,’” the original tweet reads.

Reagan took the deficit from 70 billion to 175 billion. Bush 41 took it to 300 billion. Clinton got it to zero. Bush 43 took it from 0 to 1.2 trillion.Obama halved it to 600 billion. Trump’s got it back to a trillion.Morons: “Democrats cause deficits.”

— Alex Cole July 23, 2019

Screenshots of the tweet on Facebook were flagged as part of the company’s efforts to combat false news and misinformation on its News Feed.

At PolitiFact, we’vereportedextensively on how Republicans and Democrats often try to pin the federal deficit on each other — muddying the facts in the process. So we wanted to see if this Facebook post is true.

Some people confuse the federal deficit with the debt — but they’re two separate concepts.

Featured Fact-check

The First Modern Campaign Finance Restrictions Were Soon Followed By A Boom In Pac Spending

FEC, Corrado, Center for Responsive Politics

In the early 1970s, and particularly after the election spending abuses revealed in the Watergate scandal, Congress put new limits on donations to candidates. But the overall amount of money in politics didn’t decline. The money instead started going to PACs, or political action committees, rather than candidates. Thousands of new ones were formed, and they started raising hundreds of millions of dollars each year overall. This shows a problem for would-be campaign finance regulators: If one particular aspect of election spending is regulated or capped, big money will try to find another way in.

Congress Responds More To The Preferences Of The Wealthy Than To Those Of Average People

Gilens and Page, “Testing Theories of American Politics

Who really matters in our democracy — the general public, or wealthy elites? These charts, from a study by political scientists Martin Gilens of Princeton and Benjamin Page of Northwestern, seek to answer that question. The first one — the flat line — shows that as more and more average citizens support action on an issue, they’re not any more likely to get what they want. That’s a shocking finding in a democracy. In contrast, the next chart shows that as more economic elites want a certain policy change, they do become more likely to get what they want. Specifically, if fewer than 20 percent of wealthy Americans supported a policy change, it only happened about 18 percent of the time. But when 80 percent of them were in support, the change ended up happening 45 percent of the time. There’s no similar effect for average Americans.

Big Problems With Small Money Republicans Catch Up To Democrats In Online Giving

Alex Seitz-Wald

WASHINGTON — Republicans are beginning to catch up with Democrats in online fundraising, creating for the first time in modern history a political landscape where both parties are largely funded by small donations — for better or, some say, for worse.

Democrats, who have dominated online fundraising since the early days of the internet, have claimed that the billions they raise in small donations are evidence that they are the party of the people, less reliant on wealthy donors and business interests than the GOP.

Republicans have spent years playing catch-up, mostly unsuccessfully. But now, just in time for the 2022 midterm elections, they are starting to pull even, thanks in large part to former President Donald Trump and his army of online devotees.

“This is the harvest of the seeds of digital infrastructure Republicans have been planting for years,” said Matt Gorman, a GOP strategist who worked for the party’s congressional campaign arm during the last midterm election. “That’s why you’re seeing things like freshman members of the House raising over $1 million . In 2018, we were begging folks to raise a fifth of that.”

Even out of office, Trump continues to raise massive sums of money, largely online. He announced Saturday that his political groups had collected nearly $82 million in the first half of the year , giving him a war chest of more than $102 million.

Democratic Party Committees Raised More Money Than Republican Committees In 2013

Paul Blumenthal

WASHINGTON — The three major Democratic Party committees raised $16 million more than their Republican Party counterparts in 2013.

The Democratic committees raised $193 million for the year, compared with $177 million for the three Republican committees, according to reports filed with the Federal Election Commission.

The fundraising success for the Democratic committees stems from big numbers posted by the Democratic Congressional Campaign Committee and the Democratic Senatorial Campaign Committee. The DCCC raised $75.8 million, the most of any party committee, while the DSCC pulled in $52.7 million. Both committees topped their Republican counterparts by more than $15 million.

“Our substantial fundraising lead is the result of one major dynamic: Americans are ready to replace this broken Republican Congress with leaders who have the right priorities and who will focus on solving problems,” DCCC Chairman Steve Israel said in a statement.

The Republican National Committee, however, beat the Democratic National Committee in head-to-head fundraising for the year. In 2013, the RNC raised $80.6, almost $16 million more than the $64.7 million pulled in by the DNC.

The money raised by these committees will finance large advertising purchases in battleground House and Senate races, among other things.

Report: Trump Has Raised More Money In California Than Most Democrat Candidates

California is well known as arguably the most liberal state in America, however recent statistics may shock both Democrats and Republicans.

It looks like there may be more Trump supporters in the “deep blue” state of California than most people think.

According to the news site Cal Matters, President Trump comes in third place for the most money raised in California out of all the Democratic candidates. He is just behind Mayor Pete Buttigieg of Indiana and Senator Kamala Harris who resides in California.

Check out what Cal Matters reported:

This may come as surprise to the president, the national media and more than a few Californians, but there are plenty of Trump supporters in the “Resistance State,” too. And since the beginning of the year, they’ve been spending a lot of money to keep the president in the White House.

New campaign finance statistics show that President Donald Trump raised $3.2 million—more money from the California donor class than all of his Democratic challengers, but two.

Not only that, but the Trump campaign collected more from itemized small donors—those who gave in increments of less than $100 at a time—than anyone else in the field. The president bested even Democratic contender Bernie Sanders in the small-donor sweepstakes.

But it’s not all pixie dust for Trump in California: 89% of all itemized presidential campaign donations from Californians went to contenders out to defeat him.

More than $3 million has come since the beginning of this year.

Democratic Senate Hopefuls Are Raising Tons Of Money They’re Also Spending It

Congressional races heat up as Dems try to fl…02:14

Democratic Senate hopeful Jaime Harrison of South Carolina raised $57 million between July and September. Sara Gideon in Maine raised more than $39 million in that same period. And Mark Kelly in Arizona brought in $38.7 million.

These eye-popping numbers shattered the previous record for fundraising, Beto O’Rourke’s $38 million cash haul in the third quarter of 2018.

Now the Democrats are spending that money in the face of massive Republican super PAC funds. And it’s left many Republican candidates with more cash on hand than the Democrats in the final weeks of the race.

In South Carolina, where the Senate race is unexpectedly tight, Harrison’s $57 million in three months was double Republican incumbent Senator Lindsey Graham’s $28 million haul, a state record for a Republican. Records show from July through September, Harrison spent more than $55 million. According to his October FEC filing, Harrison paid AL Media LLC more than $42 million over three months for TV, radio and digital advertising. He also spent another $6.5 million for digital advertising and services to Mothership Strategies, and $2 million to Blueprint Strategy LLC for radio and billboard advertising. $641,000 went to “direct mailing services.” That amounts to more than $51 million spent on ads and direct mail alone.

Who Is Richer Democrats Or Republicans The Answer Probably Wont Surprise You

Which of the two political parties has more money, Democrats or Republicans? Most would rush to say Republicans due to the party’s ideas towards tax and money. In fact, polls have shown about 60 percent of the American people believe Republicans favor the rich. But how true is that? can help you write about the issue but read our post first.

Presidential Campaign Spending Is Overwhelmingly On Tv Ads In Swing States

Data: Kantar, Analysis: John Sides, Washington Post

Presidential campaign money goes overwhelmingly to purchasing TV ads in just a few swing states. This map shows where ad spending was heaviest in 2012: Florida, Virginia, and Ohio, where more than $150 million was spent. Iowa, North Carolina, Colorado, and Nevada saw more than $50 million each. But most of the country saw nothing at all. Presidential campaigns have become a quadrennial stimulus bill for purple states funded by donors in red and blue states.

Democratic Party Enters 2021 In Power And Flush With Cash For A Change

The Democratic National Committee has a roughly $75 million war chest, raising the party’s hopes of keeping power in 2022 and accelerating a Democratic shift in the Sun Belt states.

After years of flirting with financial disaster, the Democratic Party entered 2021 not only in control of the White House, the House and the Senate but with more money in the bank than ever before at the start of a political cycle.

The Democratic National Committee will report to the Federal Election Commission on Sunday that it ended 2020 with $38.8 million in the bank and $3 million in debts, according to an advance look at its financial filings. In addition, there is roughly $40 million earmarked for the party, left over from its joint operations with the Biden campaign, according to people familiar with the matter. This gives the Democrats a roughly $75 million war chest at the start of President Biden’s tenure.

“This is a number that is unimaginable,” said Howard Dean, a former party chairman.

Party data, resources and infrastructure undergird candidates up and down the ballot, and Democratic officials are already dreaming of early investments in voter registration that may accelerate the political realignment Democrat are hoping to bring about in key Sun Belt states.

“We had to juggle who we were going to pay,” Tom Perez, who until earlier this month was the chairman of the D.N.C., said of the early part of his tenure, which began in 2017.

The Supreme Court Has Struck Down Many Limitations On Election Spending

Over the past four decades, Congressional attempts to regulate the campaign finance system have repeatedly been stymied by the Supreme Court on First Amendment grounds. This table lists the major cases in which the court has ruled campaign finance restrictions unconstitutional — and how closely divided the court has been in every case. The first major such case was Buckley v. Valeo, in 1976, which struck down much of the newly-adopted campaign finance infrastructure in the name of free speech. The next major campaign finance overhaul — the 2002 McCain-Feingold law — survived an initial court challenge in 2003. But after Justice Sandra Day O’Connor was replaced with the more conservative Sam Alito in 2006, the court had a majority that objected to major provisions of the law. Since then, a series of 5-4 decisions have narrowed the scope of permissible campaign finance regulations further and further.

Us Democratic Fundraising Arm Outraises Republican Counterpart In July

Jason Lange

Supporters of Democratic U.S. presidential nominee Joe Biden gather with their cars for a socially distanced election celebration as they await Biden’s remarks and fireworks in Wilmington, Delaware, U.S. November 7, 2020. REUTERS/Jonathan Ernst

WASHINGTON, Aug 20 – The fundraising arm of the U.S. Democratic Party raised more money in July than its Republican counterpart, helped by big contributions from billionaire donors including investor George Soros and former Google Chief Executive Eric Schmidt.

Disclosures filed on Friday with the Federal Election Commission showed the Democratic National Committee raised about $13.1 million last month, above the $12.9 million raised by the Republican National Committee.

The RNC still had more money in the bank at the close of the month – $79 million compared to nearly $68 million held by the DNC – although Democrats narrowed the gap.

Raising more money does not necessarily translate into Election Day victory, but a big bank account helps U.S. parties support their candidates’ campaigns and pays for ads and polling.

Democrats have narrow majorities in the U.S. Senate and the House of Representatives, and losing control of either in the November 2022 contests would be a blow to Democratic President Joe Biden’s agenda.

Soros, a famed investor and a bogeyman of conservatives due to his status as a major donor for liberal causes, gave the DNC at least $250,000 in July.

Who Raised More Money In A Majority Of Tight House Races Democrats Did

Total reported in the most competitive House races

DEMOCRATS RAISED $172MILLION

With the midterm elections just weeks away, Democratic candidates have outraised their Republican opponents in a majority of the 69 most competitive House races, according to fund-raising numbers filed by the candidates on Monday. Some of the biggest earners include two Democratic women: Mikie Sherrill in New Jersey’s 11th District and Amy McGrath in Kentucky’s Sixth District.

Many Democratic candidates raised large sums from small donations online. Democrats are betting on small donor energy to make a difference in tight races.

Facing a host of tough races, Republican Party leaders have begun pulling money away from some struggling incumbents, especially in suburbs where President Trump is unpopular.

How much candidates in the most competitive House races have raised

*Incumbent shown with an asterisk.

DISTRICT

Republicans Winning Money Race As They Seek To Take Over House In 2022

The National Republican Congressional Committee announced Wednesday that it had raised $45.4 million in the second quarter of 2021, the most it has ever raised in three months of a non-election year, as Republicans seek to take over the House in 2022.

House GOP leader Kevin McCarthy This story has been updated with additional developments Wednesday.

The Most Famous Political Figures Can Make Millions In Speaking Fees

CNN

For the top echelon of famous and recognizable political figures, there’s another way to cash in after leaving offices — by giving high-priced speeches to corporate groups. Former politicians and aides from both parties participate in this practice — the more famous they are, the higher the fee they tend to be able to charge. But the undisputed king of speaking fees is Bill Clinton, who charges at least $250,000 per speech — and charged $750,000 for at least one. This chart, based on data assembled by CNN, shows how speaking fees have made Clinton over $100 million since he left office.

How Trumps Team Spent Most Of The $16 Billion It Raised Over 2 Years

Biden and Trump spar in final presidential debate

President Donald Trump‘s reelection team kicked off 2020 with what seemed like an unbeatable cash advantage, boasting a massive fundraising operation, bolstered by the joint efforts of the Republican Party.

Fast-forward 10 months and they’ve burned through a whopping $1.4 billion of the more than $1.6 billion raised over the last two years, struggling to keep up with former Vice President Joe Biden, more than what former President Barack Obama’s reelection campaign and the Democrats had raised and spent by the end of the 2012 cycle.

The revealing figures, released as the two presidential candidates debated on stage Thursday night for the last time before Election Day, came after the campaign blew through $63 million in the first two weeks of October alone — a critical time when it only brought in $44 million. The vast majority of the money spent during that time — nearly $45 million — went to television and online advertising, according to the latest disclosure report filed to the Federal Election Commission, as Biden and pro-Biden efforts ramped up his ad spending.

MORE: Trump campaign trailing behind Biden in funding, weeks before Election Day, new filings show

MORE: Trump commits to familiar playbook to define Biden in tamer final debate: ANALYSIS

So where has the president’s money gone?

MORE: Trump heads into final campaign stretch forced to play defense against Biden

Questions about staff payments

The Massive Difference In How Democrats And Republicans Raise Money

You probably have a preconceived notion of where the political parties raise their money. Republicans get lots of donations from wealthy individuals and corporate interests; Democrats get money from less rich individuals and a somewhat overlapping set of corporate interests. Well, we have news for you: That perception is completely correct.

arrow-right

At least, that is, for the parties’ Governors Associations. On Tuesday, organizations and candidates that raise money for political campaigns had to file quarterly reports with the Federal Election Commission. The Democratic Governors Association and the Republican Governors Association both reported how much they’d raised between April 1 and June 30. The RGA did much better, about $24 million raised versus under $14 million, although the DGA had more donors, about 1,500 to 400.

When money is given to these groups, which can accept unlimited donations unlike their federal counterparts, the organizations have to document who gave, and how much, and when. Organizations that give just list an address; individuals have to identify their employer. Which lets us see pretty easily how those two groups break down.

And so, we see that the RGA got a much larger percentage of their donations from organizations than did the DGA.

far86 times

Who are these beneficent individuals? The DeVos family, of Amway fame. Las Vegas megadonor Sheldon Adelson. And Kotch? Koch? Someone named “David Koch,” if you’ve heard of him.

Congressional Staffers Can Take Trips Funded By Foreign Governments

Washington Post