#derivbot

Explore tagged Tumblr posts

Text

#BinaryBots#DerivBots#AutoTrading#FreeTradingBots#BinaryOptions#TradingBots#DerivBot#BestBinaryBot#BinaryTrading#TradingAutomation

0 notes

Text

Dive into the Exciting World of Financial Accumulator Options Trading with Deriv.

Dive into Financial Accumulator Options Trading with Deriv

___________________________________________________________

Introduction

Accelerate Your Earnings: With accumulator options, your payout skyrockets as long as the spot price remains within a specific range from the previous spot. Remember to close your trade before it reaches the upper or lower barrier to lock in your profits.

With accumulator options, your risk is clear-cut: it's limited to your initial stake or premium, say $5, with no margin requirements. The potential profit is boundless and can skyrocket as long as the upper or lower barrier isn't breached. At a 5% growth rate, your maximum profit is capped at 230 ticks, triggering automatic expiration and profit transfer to your account. Plus, there's a $10,000 ceiling on single-trade payouts; once reached, your trade closes, funnelling the earnings directly into your account. Accumulator options enable you to forecast whether the market spot price will remain within a specified range, offering an opportunity for potential gains.

Embark on Your Financial Journey: Exploring Accumulator Options Trading with Deriv

Accumulator options are presently available on derived indices, with future expansions into additional markets anticipated. Currently, traders can engage in trading the renowned Deriv volatility indices, ranging from the relatively stable 10 Index to the highly dynamic 100 Index. These derived indices operate 24/7/365, ensuring constant volatility and enabling traders worldwide to participate at their convenience, free from the constraints of traditional market hours.

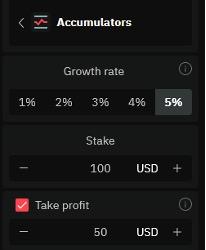

Understanding Your Growth Rate

Beyond choosing the underlying index to determine your preferred volatility level, you also have the option to set your growth rate at 1%, 2%, 3%, 4%, or 5%. This decision is finalised upon opening your contract and remains fixed throughout the duration of the trade.

Balancing Risk and Reward

Opting for a higher growth rate entails a narrower range, increasing the chance of your option expiring with no value. However, it also elevates the potential profits. It's the age-old trading conundrum: weighing risk against reward. Conversely, selecting a lower growth rate appeals to traders seeking reduced risk and aiming to minimise the likelihood of their accumulator option expiring worthless.

Exploring Growth Rate: Two Real-Life Examples

5% growth rate

Following the entry spot tick, your stake will steadily increase by 5% for each tick, as long as the spot price stays within ± 0.0049358253% of the previous spot price. It's important to note that with a 5% growth rate, the range is relatively narrow.

1% growth rate

Following the entry spot tick, your stake will steadily increase by 1% for each tick, as long as the spot price remains within ± 0.0064867741% of the previous spot price. With a 1% growth rate, the trading range is wider, resulting in a lower risk of knockout. Traders can also opt for growth rates between 1% and 5% for a balanced risk-reward ratio, tailored to their individual risk tolerance levels.

Manual vs. Automatic Profit Taking

Manual Profit Taking

You have the flexibility to close an accumulator option at any time after the initial tick by simply clicking the SELL button. This instantly credits your stake and profits to your account, mitigating any additional risk exposure. However, if the upper or lower barrier is breached before you execute the trade closure, the option will expire worthless.

Clicking the Sell button will close the trade

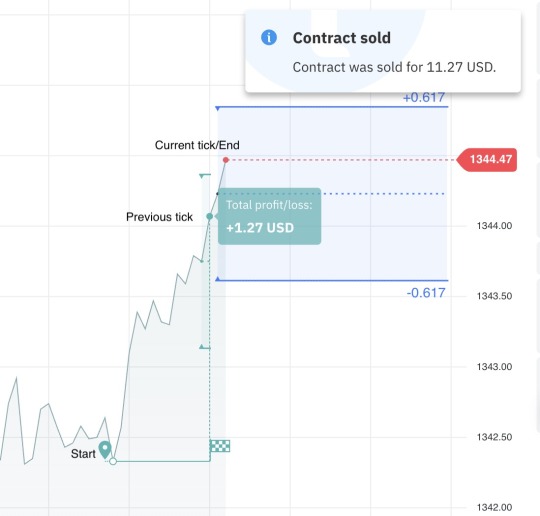

If you choose to press SELL in this scenario, you will receive $134.01, comprising $100 as your original stake returned and an additional $34.01 as profit. It's important to be aware of the slippage risk, which entails the potential for slight price fluctuations in either direction by the time your trade is closed.

Automatic profit taking

In addition to manually closing a position to secure profits, you have the option to utilise the take profit feature. This feature enables you to set a predetermined level at which a trade will automatically close. For instance, you could set your take profit level at $50. Once the option reaches this threshold, the trade will close automatically, and your account will be credited with the profits and stake.

On the right, you'll find an illustration featuring a 5% growth rate, a $100 stake, and a $50 take profit. It's important to note that the take profit level cannot be adjusted once the trade is initiated. However, you still retain the ability to manually close the trade before it reaches the specified level. For example, if the trade achieves a $25 profit and you decide to secure gains, you can do so by clicking the sell button.

Take profit is set to $50.

Navigating Option Expiration

If you fail to close an accumulator option prior to the upper or lower barrier level being breached, it will automatically close. This results in the loss of any unrealized accumulated gains along with your stake. Until you initiate a new trade, you will not have any exposure. The following example illustrates a losing accumulator trade in which the market spot price dropped below the lower barrier price.

Lower barrier is breached, so the option closes at zero.

Short-Term Options: A Closer Look

Accumulator options are inherently short-term, ranging from 45 to 230 ticks in duration. This results in rapid realisation of potential losses or profits. For traders interested in longer-term opportunities, it's advisable to explore alternative options available on the deriv platform.

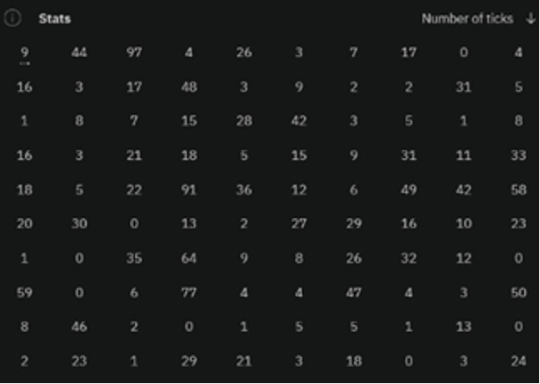

Utilising Statistics for Informed Decisions

To review the outcomes of the past 100 trades, simply click on 'Stats' and expand the view. The 'Stats' section showcases the history of consecutive tick counts, illustrating the duration the price remained within the specified range. Additionally, you can observe the number of ticks accumulated by the current option (open trade), denoted by the first number in the top left-hand column (as shown by '9' in this instance). Further details can be accessed by clicking on the three dots below. Furthermore, a summary of the last 10 trades is presented in the chart located at the bottom.

Statistical overview of historical accumulator option trades

Harnessing Technical Analysis and Charting

For traders keen on pattern analysis, transferring this data into a spreadsheet is an option. Additionally, the underlying index data (e.g., Volatility 100 Index) can be downloaded in CSV format. Given the short-term nature of these options, the default chart is a tick chart, also referred to as a line chart. Users can further augment this chart with widely-used technical analysis tools such as Moving Averages, Bollinger Bands, and MACD.

A chart enhanced with Bollinger Bands and MACD

Emphasising Full Fair Transparency

Similar to all Deriv products, every accumulator option undergoes thorough auditing and maintains complete transparency. Upon opening and closing each trade, regardless of its magnitude, a distinctive reference ID number is assigned. This meticulous process guarantees that every trade can be easily verified in the event of disputes or inquiries.

Exploring Effective Strategies for Accumulator Options

While it's essential for each trader to formulate their own trading strategy, here are several crucial factors to contemplate:

Mastering Money Management Techniques

Although you're cognizant of your maximum risk with an accumulator option, prudent money management remains paramount. For instance, if your overall risk threshold is $500, opting to risk 3% per trade equates to $15 per trade, affording you the opportunity for 33 trades. Naturally, you can adjust this percentage based on your individual risk tolerance.

Optimising Profit-Taking Strategies

Considering the rapid pace of accumulator options, adopting a lower-risk approach involves capturing profits after a few ticks, such as 3 ticks. Although this may result in modest gains, it mitigates the risk of the option expiring worthless. Conversely, some traders pursue a contrasting strategy by aiming for profits of 20 ticks or more. While this tactic may result in more trades expiring worthless, the successful trades yield substantially larger returns.

Maintaining Emotional Discipline

Maintaining emotional discipline is crucial, regardless of the market you're trading in. Numerous traders establish daily thresholds, ceasing trading once a predetermined profit target is reached or if losses exceed a set limit. It's advisable to refrain from trading on days where outcomes are unfavourable, opting instead to regroup. Furthermore, persist in utilising a demo account to explore new trading methodologies while temporarily stepping away from live trading.

Summary and Next Steps

Prior to committing actual funds, it's prudent to acquaint yourself with the product through a demo account, readily available at deriv.com. Here, you can explore accumulator options within authentic market environments and pricing dynamics, all without incurring financial risk. Once you've gained confidence in its functionality, transitioning to a funded account enables you to commence trading accumulator options with a nominal investment starting from just $5.

Here's to your trading success!

Dancun Juma.

Frequently Asked Questions

Q: On which markets are accumulator options available for trading?

A: Currently, accumulator options are accessible on volatility indices within derived indices. Expansion into additional markets is planned for the future.

Q: Can I open multiple accumulator options simultaneously?

A: While you're limited to one contract per instrument at a time, you can have multiple accumulator options open across different instruments. For example, you can have trades on Volatility 10, 75, and 100 Indices concurrently, but not multiple trades on the same instrument simultaneously.

Q: Is there a possibility of Deriv manipulating accumulator options?

A: Absolutely not. Deriv maintains a sterling reputation for fairness and ethical conduct across its 25-year tenure. With robust automation on its trading platforms, alterations to terms or prices for individual trades are prevented. Every trade undergoes auditing and receives a unique ID number, ensuring transparency and accountability.

Q: Are there any disparities between a Deriv demo and real account aside from funding sources?

A: No, both accounts operate identically on the same platform, featuring uniform pricing and terms. Consequently, performance on a demo account typically mirrors that of a real account, and vice versa.

Q: Can I automate accumulator options using Deriv Bot?

A: Presently, Deriv Bot does not support accumulator options automation. Trades must be executed manually, although the take profit feature remains available for use.

Q: Can I close an accumulator option at any time?

A: Yes, you have the flexibility to close your accumulator contract whenever you're content with the payout amount. However, if the spot price breaches the predefined range limits, your contract will automatically close, resulting in the loss of accumulated payout.

Q: Can I initiate an accumulator option trade at any time?

A: Indeed, accumulator options are tradable whenever the underlying market is operational, offering 24/7 availability for derived indices. However, temporary unavailability may occur if Deriv's internal stake limits are reached. Upon closure of existing positions, these limits reset, enabling normal contract opening.

Q: Is the accumulator option payout influenced by the direction of the underlying index?

A: No, payout escalation depends solely on the tick-by-tick movement of the underlying index within a predetermined range, unaffected by its overall trend. Only breaching the range limits impacts the outcome, resulting in potential losses.

Join derive today the best online trading platform and stand a chance of skyrocketing your earnings

#FinancialFreedom#DerivTrading#AccumulatorOptions#VolatilityIndices#TradingStrategies#RiskManagement#TechnicalAnalysis#ProfitTaking#EmotionalDiscipline#MarketAnalysis#OnlineTrading#Fintech#InvestmentStrategies#TradingTips#FinancialEducation#DayTrading#TradingPlatform#DerivBot#FreelanceCareer#OnlineIncome#WorkFromHome#FinancialIndependence#InvestmentOpportunities#TradingCommunity#FinancialMarkets#TraderLife#SuccessInTrading#PassiveIncome#EarnFromHome

0 notes

Text

Deriv Bot Review What Does it Do & Can You Profit From It | Trading.Biz

#DerivBot #TradingBots #investmentreview

📖 Read more here: https://tinyurl.com/3u56j27b

youtube

3 notes

·

View notes

Link

You haven’t seen me for quite some time, right traders? So, here’s an exciting piece that any of you would be eager to hear. This article will reveal the names of the top 3 profitable binary options robots of the year 2021.

Note that last year, these robots were equally impressive, and traders responded positively to them.

#binary options#binbotpro#binarycom#derivbot#optionstrading#automatedtrading#tradingbot#optionstrader#binarytrader

0 notes