#debt collection process for small business

Explore tagged Tumblr posts

Text

re: last reblog - saw a TikTok ad the other day of a zoomer lifestyle peddler visually coded as a Nonbinary Dirtbag Leftist (dyed ratty hair, conspicuous piercings, cheap punk clothing) attempting to sell me an ebook about how to elevate my class position by buying a turnkey business like a laundromat.

so, exploiting the poor. and I mean they aren't wrong, that's how you get class mobile. I don't think it's actually possible to run a business like that ethically and still make a profit. maybe I'm wrong. but it seems like every bit of the profit is extracted from a dependence upon the poverty of the clientele, eg, lack of access to home laundry, charging greater than cost for time, water, soap and cleanliness which are all human rights, hiring employees at minimum wage, etc. the entire basis of charging money for such an amenity is a process of creating waste also, it creates waste in travel from home to the Laundromat, it creates waste in putting a laundromat in a storefront where housing could be, it creates waste in handling money and bills for a business that isnt essential etc etc. and it's an economic coercion because clean clothes aren't something you can budget or cut down on, you basically have your clientele by the balls.

on the other hand I'm rapidly approaching a grinding surface in terms of either entering into one of these exploitative processes as a means-of-production owner, which would be accomplished purely through debt on my part, or having to withdraw to permanent poverty, and the third option is winning the lottery either literally or figuratively through an unforeseen inheritance, sudden recovery from illness, or getting popular on social media in a way that produces profit

I think the anarcho syndicalists are broadly correct in that small organization is the correct move, eg, I'm about to lead test my apartment water supply and do some other moves that I expect to use to lower my rent, but the bigger project would be to contact the other tenants and see if they'd be interested in essential a "hostile" acquisition of the building based on having it fail a bunch of inspections, which I absolutely think is possible.

I could see using a small syndicate of partners/friends to collectively purchase the laundromat as a co-op. but would the profit splitting make it not worthwhile? maybe we would recoup from not having to hire any employees and just taking the shifts ourselves. this is the classic American immigrant model and it's a classic for a reason. I would really hate trying to do all that horizontal organizing though (huge cost for me personally)

idk how any of those stuff works. my parents are from the managerial-intellegentsia officer class and are stupid about money from a weird combination of having too much of it and too little. the overeducated poor. food insecure people who get all the jokes on Frasier. extraordinarily weird class position, it's sort of like being in the circus or being a pickpocket. you can fool people into thinking you're wealthy when you aren't, which is why I'm so insane on here about grammar and spelling, because you don't know until you're actually on the other side of it how much your level of education affects your material existence, even if the education is DIY. I have been literally homeless for periods of time and have almost always been poor, and the amount of "skating by" you can do on good grammar and nice table manners is like a big secret no one tells you anymore because the boomers pretended they got rid of all that jive during the summer of love. people have gotten REALLY mad at me on here about this topic I think because they think I'm enforcing these cultural standards every time I try to teach people about them. I'm trying to warn you!!

think of it this way: how long is someone willing to let you stay in their coffee shop or diner or house if you're "acting poor", vs how long if you're charming and helpful and conscientious? if you're loud and using "low class" dialect vs if someone has at some point taught you to act fancy? this is extremely racialized obviously. I can't speak on that.

the communist coin op laundry could have a shuttle service and group wash nights where people can combine laundry to use the big washers and dryers for larger loads at lower total cost if they were willing to sort out their clothes at the end 😔

83 notes

·

View notes

Text

Unveiling Limited Liability Partnership Registration: A Step-by-Step Guide

In the realm of business structures, Limited Liability Partnerships (LLPs) have emerged as a favored choice for entrepreneurs seeking a balance between liability protection and operational flexibility. Offering the advantages of both traditional partnerships and limited liability companies, LLPs provide a unique framework that appeals to a wide array of professionals and businesses. If you're considering forming an LLP, navigating through the registration process can seem daunting. However, fear not! In this comprehensive guide, we'll break down the intricacies of LLP registration, simplifying each step to set you on the path to success.

Understanding Limited Liability Partnerships

Before delving into the registration process, let's grasp the essence of Limited Liability Partnerships. An LLP combines features of both partnerships and corporations, providing its partners with limited personal liability akin to shareholders in a corporation. This implies that partners are not personally liable for the debts and obligations of the business beyond their investment. This protective shield for personal assets makes LLPs an attractive option for professionals such as lawyers, accountants, consultants, and small businesses.

Step-by-Step Guide to LLP Registration

1. Choose a Name

Ensure that your chosen name complies with the regulations stipulated by the relevant authority. It should not infringe on existing trademarks and should reflect the nature of your business.

2. Obtain Digital Signature Certificates (DSC)

LLP registration necessitates the use of Digital Signature Certificates (DSC) for filing various documents electronically. Obtain DSCs for all partners involved in the LLP.

3. Obtain Designated Partner Identification Number (DPIN)

This unique identification number is mandatory for all individuals intending to be appointed as partners.

4. Drafting LLP Agreement

The LLP agreement outlines the rights and duties of partners, profit-sharing ratios, decision-making procedures, and other pertinent details. Draft a comprehensive LLP agreement in accordance with the provisions of the LLP Act.

5. File Incorporation Documents

Compile and file the necessary incorporation documents with the Registrar of Companies (ROC). These documents typically include Form 1 (Incorporation Document) and Form 2 (Details of LLP Agreement). Pay the requisite fees along with the submission.

6. Registrar Approval and Certificate of Incorporation

Upon submission of documents, the Registrar will scrutinize the application. If all requirements are met satisfactorily, the Registrar will issue a Certificate of Incorporation, officially recognizing the LLP's existence.

7. Obtain PAN and TAN

After obtaining the Certificate of Incorporation, apply for Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for the LLP.

8. Compliance with Regulatory Requirements

Ensure compliance with all regulatory requirements post-incorporation. This includes maintaining proper accounting records, filing annual returns, and adhering to tax obligations.

2 notes

·

View notes

Text

Enhance Your Revenue Cycle with MAS LLP's AR Management Services

In today's dynamic business landscape, efficient management of accounts receivable (AR) is crucial for maintaining healthy cash flow and sustaining business growth. However, many organizations struggle with the complexities of AR processes, leading to cash flow bottlenecks, increased bad debt, and compromised financial stability. This is where MAS LLP steps in, offering comprehensive AR management services designed to optimize your revenue cycle and maximize collections. At MAS LLP, we understand the challenges businesses face in managing their AR effectively. Our dedicated team of professionals leverages industry expertise, advanced technology, and proven strategies to streamline your AR operations and accelerate cash flow. Here's how our AR management services can benefit your organization:

Improved Cash Flow: Timely invoicing, proactive follow-up, and efficient collection strategies are the cornerstones of our AR management approach. By optimizing these processes, we help you minimize payment delays and accelerate cash inflows, providing your business with the liquidity needed to fuel growth and innovation. Reduced Bad Debt: Unpaid invoices and delinquent accounts can have a significant impact on your bottom line. With MAS LLP's AR management services, you can minimize bad debt exposure through diligent credit risk assessment, early intervention, and strategic debt recovery efforts, safeguarding your financial health and profitability. Enhanced Customer Relationships: Effective AR management isn't just about collecting payments; it's also about nurturing positive relationships with your customers. Our team adopts a customer-centric approach, balancing firmness with professionalism to ensure that collections efforts preserve goodwill and loyalty, fostering long-term partnerships and customer satisfaction. Streamlined Processes: Manual AR processes are prone to errors, delays, and inefficiencies, leading to operational bottlenecks and increased administrative costs. MAS LLP automates and streamlines your AR workflows, leveraging cutting-edge technology and best practices to minimize human intervention, improve accuracy, and boost productivity. Compliance and Risk Mitigation: Regulatory requirements and industry standards governing AR practices are constantly evolving. MAS LLP stays abreast of these changes, ensuring that your AR processes remain compliant and aligned with best practices, thereby minimizing legal and regulatory risks associated with non-compliance. Actionable Insights: Informed decision-making is key to optimizing your AR performance. MAS LLP provides actionable insights and analytics, offering visibility into key AR metrics, trends, and performance indicators. This empowers you to identify areas for improvement, refine your strategies, and drive continuous process optimization. Scalability and Flexibility: Whether you're a small business or a large enterprise, MAS LLP's AR management services are scalable and adaptable to your evolving needs. We tailor our solutions to suit your unique requirements, providing the flexibility to adjust service levels, accommodate growth, and navigate fluctuations in demand seamlessly. Partner with MAS LLP to unlock the full potential of your accounts receivable function and transform it into a strategic asset for your business. With our comprehensive AR management services, you can optimize your revenue cycle, enhance financial stability, and unlock new opportunities for growth and success. Contact us today to learn more about how we can support your AR needs and drive lasting value for your organization.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services#AR management services

3 notes

·

View notes

Text

Occasionally, one hears suggestions that a debt-ceiling showdown that leaves the Treasury without enough cash to pay all its bills will resemble a government shutdown, which has occurred several times in recent memory when Congress has failed to pass appropriation bills on time. This post explains the difference.

What is the debt ceiling?

When the federal government runs a deficit—that is, spends more than it collects in revenue—it borrows money to cover the difference by issuing IOUs in the form of U.S. Treasury securities. The debt ceiling is a limit, set by Congress, on the amount of borrowing the Treasury can do, currently $31.4 trillion. The Treasury hit that ceiling in January 2023 and has been taking what are known as “extraordinary measures” to keep paying the bills. But it will run out of maneuvering room sometime in the next several months, perhaps as early as June 2023, unless Congress acts.

(For more on the debt ceiling, see “What is the federal debt ceiling?” and “How worried should we be if the debt ceiling isn’t lifted?”.)

What happens in a government shutdown?

Under the Antideficiency Act (initially passed in 1884 and amended in 1950), federal agencies cannot spend or obligate any money without an appropriation (or other approval) from Congress. When Congress fails to enact the 12 annual appropriation bills, federal agencies must cease all non-essential functions until Congress acts. This is known as a government shutdown. During shutdowns, many federal employees are told not to report for work. Government employees who provide what are deemed essential services, such as air traffic control and law enforcement, continue to work, but don’t get paid until Congress takes action to end the shutdown. All this applies only to the roughly 25% of federal spending subject to annual appropriation by Congress. Benefits such as Social Security continue to flow because they are authorized by Congress in laws that do not need annual approval (although the services offered by Social Security benefit offices may be limited during a shutdown). In addition, the Treasury can continue to pay interest on U.S. Treasury debt on time.

There have been four shutdowns where operations were affected for more than one business day. In 1995-1996, President Clinton and the Republican Congress were unable to agree on spending levels, so the government shut down twice, for a total of 26 days. In 2013, a standoff over funding for the Affordable Care Act resulted in a 16-day shutdown. And in December 2018 and January 2019, a dispute over border wall funding led to a shutdown that lasted 35 days; it was a partial shutdown because Congress had previously passed five of the 12 appropriation bills. (For more on shutdowns, see the Committee for a Responsible Federal Budget’s FAQ.)

Shutdowns can be disruptive, leading to delays in processing applications for passports, small business loans, or government benefits; shuttered visitor centers and bathrooms at national parks; fewer food-safety inspections, and various inconveniences. But shutdowns are now sufficiently likely that the White House Office of Management & Budget posts the contingency plans that government agencies maintain for shutdowns. In short, members of Congress, government employees, financial markets, and the press generally understand what happens when a failure to pass appropriations bills leads to a government shutdown.

So how is that different from a failure to raise the debt ceiling?

Because tax revenues aren’t sufficient to cover all federal spending, the federal government borrows a lot—an average of more than $7 billion per business day. Raising the debt ceiling doesn’t increase federal spending beyond what already has been approved by Congress; it simply allows the government to pay for purchases and obligations it already has made.

Because Congress in the past has always lifted the debt ceiling before the Treasury has run out of money, no one knows for sure what will happen if Congress doesn’t act this time—what the Treasury and the Federal Reserve will do, and how financial markets will react. Failure to make timely interest and principal payments on U.S. Treasury securities, regarded as the safest financial asset in the world, would be an unprecedented default and, among other things, would call into question the credibility of the U.S. government’s promises and probably raise the interest rate that investors demand to hold U.S. Treasury debt in the future.

In contrast to government shutdowns, a failure to raise the debt ceiling threatens not only the spending subject to annual appropriation by Congress, but all federal spending—including interest on the debt and Social Security, Medicare, and other government benefits. Federal employees can continue working—there is no need for agencies to decide which services are essential and which are not—but their paychecks may be delayed.

We know from transcripts of Federal Reserve meetings that when this issue arose in 2011, the Obama Treasury was planning to make all interest and principal payments and to delay paying all its other bills—including government benefits. The Biden Treasury hasn’t said what it plans to do if Congress doesn’t raise the debt ceiling in time. It is, however, likely to make interest and principal payments on Treasury debt. Whether and how it will prioritize other payments is unclear—but someone will not get paid on time; there simply won’t be enough cash to meet every obligation.

What is the connection between raising the debt ceiling and reducing the federal deficit?

Legally, there is no connection, though sometimes the two issues occur close together if the Treasury bumps up against the debt ceiling close to the end of the federal fiscal year on September 30, the deadline for approving appropriations bills (even if only temporary ones).

Still, members of Congress have used the imperative of raising the debt ceiling as leverage in negotiations in Congress and with the White House over appropriation bills and, sometimes, over broader tax and spending policies. (This maneuver usually is used by members of Congress from a party other than the president’s party.) In 2011, for instance, President Obama and the Republican majority in the House reached a multi-part agreement—the Budget Control Act—just a couple of days before the Treasury ran out of cash. Among other things, it put caps on total appropriated spending and created a special congressional committee to craft a plan to reduce future deficits. The committee failed to come to agreement, triggering a series of automatic spending cuts.

10 notes

·

View notes

Text

Crowdsourcing

Crowdsourcing is the process of using social media, the internet, and smartphone apps to gather work, information, or views from a huge number of individuals (Pratt & Gonsalves, 2023).

Crowdsourcing is predicated on the assumption that a heterogeneous and dispersed group might produce novel concepts, insightful observations, and solutions that might not be achievable through conventional channels. Through the utilization of crowdsourcing, both individuals and organizations can access an extensive range of resources, expertise, and viewpoints.

3 Examples of Crowdsourcing Campaigns in Malaysia

Tabung Harapan Malaysia (Malaysia Hope Fund)

The Malaysian government started the Tabung Harapan Malaysia (Malaysia Hope Fund) campaign in 2018 to solicit public donations in an effort to lower the nation's debt. Support for the campaign was tremendous, with money coming in from Malaysians all around the nation and even outside (Chan, 2018).

Projek57

youtube

Source: https://youtu.be/UabNP7QaaU4?si=N0JExhlzK2PB92IA

Malaysia's Projek57 is a social business with the mission of fostering nationalism and unity. They started a crowdsourcing initiative to collect designs, ideas, and narratives in order to produce a product that is exclusively Malaysian. People responded quite well to the campaign, sharing their experiences and submitting their drawings, which were turned into a variety of items (Projek, 2023).

Citizen Engagement

The government of Malaysia has aggressively started a number of initiatives to crowdsource ideas and solutions from its citizens. Numerous regional organizations have taken the lead and started crowdsourcing projects (Zahari, 2016).

How is crowdsourcing used by communities during disasters?

Gathering information: Information on the disaster, including its location and extent of damage, the number of people impacted, and the resources required to respond to it, can be gathered through crowdsourcing (Crowdsourcing - PrepareCenter, 2023).

Mapping: Maps of the disaster region made via crowdsourcing can be used to assist responders in planning their actions and identifying places that require assistance (Tavra et al., 2021).

Resource allocation: Resources like food, water, and medical supplies can be found and distributed to the communities that need them the most using crowdsourcing (Crowdsourcing - PrepareCenter, 2023).

Volunteer coordination: Organizing volunteers who wish to assist with the disaster response effort can be done using crowdsourcing. Volunteers can be paired with projects based on their availability and skill set (Crowdsourcing Toolkit for Emergency Management - Integrating Crowdsourcing, n.d.).

Situational awareness: Real-time updates on the catastrophe situation, such as the whereabouts of emergency responders, the condition of vital infrastructure, and the requirements of impacted communities, can be obtained through crowdsourcing (Crowdsourcing - PrepareCenter, 2023).

Can crowdfunding build a community for creatives?

YES, crowdsourcing may help creatives form communities. Independent artists and small groups can use crowdfunding, a popular new internet fundraising method, to reach a much wider audience. In addition to being a helpful tool for marketing, crowdfunding websites like Kickstarter, IndieGogo, and GoFundMe may be used to earn money for artistic endeavors (Crowdfunding Arts Projects, 2017). For artists, crowdfunding may be a useful and somewhat easy method of directly raising funds and building a more intimate relationship with their fans (WomenArts, n.d.).

Here are some examples of how crowdsourcing may foster a creative community:

Engaging with supporters

Through crowdfunding, artists may interact more personally with their followers. Contributors, no matter how tiny, feel invested in the project and are more inclined to tell their own networks about it (WomenArts, n.d.).

Building an audience

Creatives can use crowdfunding to expand their audience for their work. A successful campaign can inspire interest in the undertaking and draw in new followers and backers (Crowdfunding for Artists, n.d.).

Networking

Creatives can network with other artists and organizations in their sector by using crowdfunding. With the social networking tools included into many crowdfunding platforms, creatives may interact with other users and share their work (Berman, n.d.).

Feedback

Crowdfunding can give artists insightful criticism of their work. On the campaign website, supporters can provide feedback and recommendations, which can assist artists in refining their work and strengthening the community surrounding their initiatives (Crowdfunding for Artists, n.d.).

References

Pratt, M. K., & Gonsalves, C. (2023, March 31). crowdsourcing. CIO. https://www.techtarget.com/searchcio/definition/crowdsourcing

Chan, T. F. (2018, June 1). Malaysia has so much debt it launched a crowdfunding campaign — and it raised $1.8 million in 24 hours. Business Insider. https://www.businessinsider.com/malaysia-started-a-crowdfunding-campaign-to-pay-off-debt-2018-6

Projek. (2023, September 3). HOME - PROJEK57. PROJEK57 - a MOVEMENT OF HOPE. https://www.projek57.com/

Zahari, A. (2016, January 23). Public sector crowdsourcing in Malaysia – Citizen engagement. Crowdsourcing Week. https://crowdsourcingweek.com/blog/public-sector-crowdsourcing-in-malaysia-citizen-engagement/

Crowdsourcing - PrepareCenter. (2023, February 4). PrepareCenter. https://preparecenter.org/topic/crowdsourcing/

Tavra, M., Racetin, I., & Peroš, J. (2021). The role of crowdsourcing and social media in crisis mapping: a case study of a wildfire reaching Croatian City of Split. Geoenvironmental Disasters, 8(1). https://doi.org/10.1186/s40677-021-00181-3

Crowdsourcing Toolkit for Emergency Management - Integrating Crowdsourcing. (n.d.). https://www.crowdsourceem.org/integrating-crowdsourcing

Crowdfunding arts projects. (2017, January 20). Crowdfunding Arts Projects | Wired Canvas. https://wiredcanvas.com/marketing-ideas-generator/crowdfunding-arts-projects

WomenArts. (n.d.). Introduction to crowdfunding - WomenArts. https://www.womenarts.org/skills/crowdfunding/

Crowdfunding for artists. (n.d.). Artquest. https://artquest.org.uk/how-to-articles/crowdfunding/

Berman, N. (n.d.). Best Crowdfunding Platforms for Artists. https://blog.fracturedatlas.org/best-crowdfunding-platforms-artists

3 notes

·

View notes

Text

On Skykin, aka Sky Folk or Celestials

I’m doing some write ups on the giants (minigiants?) from my story The Exiles Ever After, for anyone interested. Here’s Part I!

Note: ‘Celestial’ is an archaic term rarely used in the current era.

The Skykin are so named because they primarily live in the Cloud Islands, floating structures that resemble clouds despite being solid. Their average height range is between 12 and 17 feet tall for adults. As a result, other kinfolk (particularly humans) tend to refer to them as giants. Using the term “giant” is controversial among the Skykin themselves, as it implies they are larger than “normal.”

Sky Folk who have been forced to leave the Islands and emigrate to the land, or those who choose to do so, are referred to as Exiles. Exile can occur as a result of a criminal transgression, financial issues, or even simple social pressure.

Physiology:

Skykin have the same range of skin and hair color as humans do. However, barring unusual circumstances such as albinism, their eyes are almost always gold. They live, on average, between 70-100 years and age at a similar rate to humans and Flower Folk.

Their diet varies widely based on the culture of their Island of residence. They are omnivorous, but tend to favor plant-based meals over meat ones on most Islands due to meat and poultry being expensive; beef, in particular, always needs to be imported and is considered a luxury. Eggs are common sources of animal protein, and goats are seeing increased popularity both as livestock and pets.

Pregnancy lasts one year. Throughout much of their history, Sky Folk have had difficulties with birth and fertility rates. New advances in prenatal care, midwife practices and medical discoveries have helped to amend this issue, which has resulted in a small population boom in the modern era.

Due to their size, the average Skykin is a physical powerhouse compared to a human. While many dismiss this as unimportant, some will use it as an excuse to show off and perform feats of strength as a form of art.

Politics:

The Sky is formally and collectively known as The Federated Islands of the Sky Republic. The Republic is a democracy centered in the Celestial Capital of Vox, a massive Sky Island located in the equatorial region over an ocean. All Islands with a population over a certain threshold have representatives in the High Senate of Vox. Larger Islands will themselves have a senate or a high council, while smaller, village-sized populations may have a mayor or elected magistrates.

The Republic was founded after the fall of the Golden Theocracy, a nation ruled by priest-kings and royal families entwined. While a less stringent adaptation of the Solarist religion practiced by the Theocracy is still widespread and dominant, a deep-seated mistrust of royalty and nobility lingers throughout the Sky.

The process of Exile was designed, initially, to deal with criminal elements. If a crime is serious enough to mark the accused as a ‘social danger’ but not enough to merit prison or death, the accused is sent to live on the planet and left to their own devices. Children of Exiled will follow their parents unless relatives intervene. Some manage to integrate with human-dominated cultures, while others may live in isolation. Larger cities, such as Nautilus, may have neighborhoods of Exiled Skykin with buildings sized to accommodate them. Unfortunately, the practice of Exile has become more widespread, some seeing it as a way to dispose of business rivals by spreading rumors of ‘instability’ or ‘chaos.’ As self-imposed Exile will end debts, some desperate individuals opt for a life of uncertainty on the land over potential indentured servitude

Culture:

While Sky cultures vary greatly from Island to Island and among Exiled, there are common beliefs and traditions spread throughout the Republic.

Much of their cultures center around creation of art, music, food and fashion. To create is the highest form of labor, and to strive to be the best is the purpose of work. A sense of competition, healthy and otherwise, fuels trade between Islands as a baker may seek to use “the finest sunflower oil made of the most beautiful flowers,” and the oil press will seek out seeds from “sunflowers of ancient lineage.” The baker will use the oil to create a pastry “in the shape of a great swan, filled with the finest custard and thousand-year crystallized fruit.” As a result, it’s not uncommon for human royalty and nobility to hire Sky artisans to design their wedding feasts or compose operas. (Such commissions are almost always done through a Merchant intermediary.)

The Sky Folk would deny that their size is exceptional in and of itself, but many believe it reflects something exceptional about them in the eyes of the universe and the Sun. They are largest, and from largeness comes grandiosity, luxury and excess. Everything one does, one must do in extremes. Epic poems may last hours. Fashions often reflect those of the lands beneath an Island due to trade and cultural adaptation, but often more lavish and outlandish even among the poorest Skykin citizen.

Relations between humans and the Sky are chilly in the modern era. It’s believed among Skykin, particularly devout Solarists, that the land (often referred to as The Center of the Universe, to the dismay of some astronomers) is the core of corruption in the world, the source of ‘chaos,’ that which is unpredictable and destructive. And as humans and Flower Folk live on the surface, they are corrupted with social disorder that could lead to the downfall of the Republic if it spread. In turn, humans often see Sky Folk as arrogant, difficult to deal with, and all too eager to dump their problems (read: the Exiled) on human nations while claiming moral superiority. This, in addition to the innate issues when one kin is more than twice the size of the other, lead to Exiles being mistreated and sometimes turning to violence and bullying in retaliation.

It is worth noting that physical violence itself is considered an aberration, the last resort of the weak, and most look down upon it. As arrogant as they can come across, the average Skykin is a “gentle giant.” Individuals, of course, vary. More to follow!

12 notes

·

View notes

Text

'It was not too long ago that the future of cinemas looked decidedly grim.

Empire Cinemas fell into administration in early July, as the lingering effects of Covid allied to the cost of living crisis took its toll on the company.

Six Empire cinemas were closed immediately with the loss of 150 jobs, while the future of a further seven, including one in Clydebank, remain in the balance, as they continue to trade and administrators at BDO strive to find a buyer. The company had employed 437 people in total before the failure.

Around the same time, the much bigger Cineworld Group, similarly blighted by the fall-out from Covid, was completing a long-running financial restructuring process which formally ended on August 1, when it exited Chapter 11 bankruptcy in the US.

Cineworld emerged with lower debt and a new management team, its assets having transferred to a new company, though the process resulted in heavy losses for investors.

Throughout the bankruptcy process, business carried on as usual at all the Cineworld outlets, including those trading under the Regal, Cinema City, Picturehouse and Planet brands.

Now, thanks to some of the biggest releases in living memory, many of those theatres will be enjoying their best summers in years.

Cinemas were one of the biggest business victims of the pandemic, as restrictions forced the closure of multiplexes and independents for long spells and the production of films was severely hampered, curbing the flow of new releases.

This year, however, the industry is back with a bang, aided in no small measure by a sequence of summer blockbusters which have attracted audiences in their droves.

Two hotly anticipated movies have been crucial to the revival.

Barbie, a story based on the Mattel doll starring Margot Robbie and directed by Greta Gerwig, hit the billion-dollar mark in gross takings this week, just 17 days after its release, Warner Bros Pictures announced, following one of the biggest marketing campaigns seen for a film in years.

Released on the same day as Barbie was Oppenheimer, the latest epic from director Christopher Nolan, which charts US efforts to develop the atomic bomb as the Second World War drew to a close through the story of physicist J Robert Oppenheimer.

While Oppenheimer has not scaled the same financial heights as Barbie, it had still grossed more than $500m in ticket sales by this week.

Both films have drawn huge audiences in the UK, with Barbie generating sales of £18.5m and Oppenheimer £10.9m on their opening weekend, according to figures compiled by the British Film Institute, and are continuing to pack them in.

But “Barbenheimer”, as the two films have been collectively termed owing to their simultaneous release date, have not been the only shows in town this summer.

Prior to their arrival in theatres, UK cinemas have also been able to drum up millions of pounds in ticket sales from Tom Cruise’s Mission: Impossible - Dead Reckoning Part One, Guardians of the Galaxy Vol. 3, and Indiana Jones and the Dial of Destiny, which is likely to be Harrison Ford’s final outing as the titular archaeologist-come-adventurer.

And there is more to come, with Martin Scorsese’s Killers of the Flower Moon, Dune: Part Two, The Marvels, and The Creator still to come before the year is out.

A recent visit to my local multiplex as various family members took in Barbenheimer underlined the impact which this summer’s big releases have had. People were milling about the foyer in what looked to be unprecedented numbers, which was no doubt great for sales of popcorn and hot dogs.

But the cinemas are not the only businesses which seem to be benefiting from this big summer of film. As we walked through the mall on our way from the car park to the theatre, it was abundantly clear that restaurants, cafes, and shops were doing well too.

With kids off school for the summer, many parents have no doubt been taking their children (Barbie is rated 12A by the British Board of Film Classification) to the cinema over recent weeks to keep them occupied.

David Pierotti, general manager for the Silverburn shopping and leisure mall in Glasgow, said this summer had been a “standout” for the destination, with the “temperamental Scottish weather” playing its part as footfall and sales have risen by 22% and 11% compared with the same period last year.

And he is in no doubt the release of the summer blockbusters has helped.

Mr Pierotti told The Herald: “We are in no doubt that the release of Barbie and Oppenheimer have been massive hits – we believe our Cineworld has enjoyed one of its best months yet which, given the global success of the films, is no surprise and this has also encouraged spend in our other stores and restaurants.”

Of course, going to the cinema is far from cheap so, at a time when inflation is still rampant and interest rates are continuing to rise, businesses will have been encouraged that consumers are showing resilience by going to the movies and visiting restaurants as part of the experience.

How this will all pan out in the longer term is difficult to forecast. The summer holidays will end soon, and the next slate of big movies is unlikely to match the broad appeal of Barbie and Oppenheimer, meaning there will be perhaps less impetus for people to visit their local multiplex.

Cost of living pressures and high interest rates are not going away, and when Christmas eventually comes into view for parents in the autumn, many families will have other things to spend their diminishing disposable income on than trips to the pictures.

Moreover, there is another danger lurking in the wings for the cinema industry.

Ongoing industrial action by actors and screenwriters in the US, who are in dispute with studios over pay and safeguards around artificial intelligence, has disrupted production activity, sparking concerns that the release of films and television shows will be delayed. It was recently reported in the US that Warner Bros may seek to delay the release of Dune: Part 2 until 2024 to ensure its stars, including Timothée Chalamet and Zendaya, will be available to promote the movie on its release.

Film buffs here will be keeping a close eye on developments. In the meantime, cinemas will be hoping the magic of Barbenheimer is just the start of a great theatrical revival.'

#Dune: Part Two#Oppenheimer#Barbie#Barbenheimer#The Marvels#The Creator#Warner Bros#Guardians of the Galaxy: Vol 3#Mission Impossible Dead Reckoning: Part One#Indiana Jones and the Dial of Destiny#Margot Robbie#Greta Gerwig#Christopher Nolan#Killers of the Flower Moon#Martin Scorsese

2 notes

·

View notes

Text

Effective Debt Collection Solutions with Bluechip Collections: Serving Melbourne and Sydney

At Bluechip Collections, we understand the challenges businesses face when it comes to managing overdue accounts and maintaining cash flow. As a leading debt collection agency operating in Melbourne and Sydney, we specialize in providing tailored and efficient debt recovery solutions to a variety of clients across different sectors.

In today’s competitive business landscape, managing finances effectively is crucial. That’s where Bluechip Collections comes in. With our deep expertise and extensive experience in debt collection in Melbourne and Sydney, we offer unparalleled services that not only recover debts but also preserve the relationships our clients have with their customers. Our approach is professional and respectful, ensuring that all parties are treated with dignity throughout the process.

What sets Bluechip Collections apart is our commitment to transparency and ethical practices. We operate in full compliance with the industry standards and legal requirements, providing our clients with peace of mind that their reputation and legal standing are in good hands. Whether you are a small business in Sydney or a large corporation in Melbourne, our team is equipped to handle your debt recovery needs with the utmost professionalism and efficiency.

Our services include comprehensive debt recovery, from initial consultation to the final stages of collecting owed monies. We utilize the latest technologies and strategies in debt collection, ensuring that our processes are not only effective but also swift. This minimizes the duration of the collection period, which in turn helps our clients improve their financial health quicker.

Bluechip Collections also believes in customizing its approach based on client needs. We understand that every business is unique, and so are its collection needs. Whether you need support with large scale debt collection sydney or require a more focused approach in Melbourne, our flexible solutions are designed to meet your specific requirements.

In conclusion, if you are looking for a reliable debt collection agency Melbourne or Sydney, look no further than Bluechip Collections. Our team of experts is ready to assist you in reclaiming your financial stability with strategic and respectful debt recovery services. Trust us to be your partner in navigating the complexities of debt collection, ensuring your business thrives in any financial climate.

For more info, visit our site https://bluechipcollections.com.au/

0 notes

Text

IRS Wage Garnishment: What It Means, Why It Happens, and How You Can Stop It

It’s Monday morning. You’re running on caffeine fumes and a sliver of hope as you open the mail. Then—bam—you see it. A letter from the IRS. You scan the page, your eyes land on those dreadful words: “Wage Garnishment.” Your heart plummets. Questions come fast and furious: How much will they take? Will I have enough left for rent? Will my boss know?

Feel the weight of that dread? You’re not alone. Thousands of Americans wake up to this harsh reality every day. But here’s the good news… there’s a way out. You can turn this nightmare into a fresh start. And we’re here to help you do exactly that.

What Exactly Is Wage Garnishment?

Wage garnishment is the IRS or state tax authority’s legal power to intercept part of your paycheck before it even hits your bank account. Instead of receiving your full pay, you only get what’s left after they’ve taken a chunk for your unpaid taxes.

For a lot of folks, that feels like a sucker punch: “They can take my money before I can even pay my bills?!” Unfortunately, yes, they can. But—and this is key—this doesn’t have to go on forever. In fact, if you act quickly, you might stop it before it even begins.

How the IRS Pulls the Trigger on Garnishment

Early Warnings (aka “We’re Coming for You!”)

The IRS rarely comes out of nowhere. Before they garnish your wages, they’ll typically send multiple notices—like CP14, CP501, and others—telling you about your unpaid taxes. These letters might sound alarmist, but they’re actually your chance to nip this in the bud.

Final Notice of Intent to Levy

If you let those initial letters sit unopened, or if you read them, freak out, and then bury them under a pile of mail, the IRS escalates to the “Final Notice of Intent to Levy.” This is your neon-bright, flashing sign that says: “We really mean business.” Once you get this letter, the clock is ticking.

The Actual Garnishment

If you don’t respond or make any moves, the IRS gives your employer a heads-up that they must start withholding a portion of your wages. At this point, it’s serious, but it’s still not hopeless. You have options, even if the garnishment has already started.

The Consequences of Doing Nothing

Let’s get real for a second: ignoring wage garnishment notices can snowball into a financial crisis. You risk:

Damage to Your Credit Score: Late payments and outstanding debts are big red flags for credit bureaus.

Strained Employer Relationship: While your boss might understand life happens, constant wage levies can feel embarrassing.

Ongoing Financial Stress: Garnishment doesn’t go away on its own. It keeps happening until the debt is paid or the IRS decides to stop.

The moment you see that ominous envelope in your mailbox, whether it’s a first notice or a final one, is the moment to lean in—not lean out. It’s the perfect time to get proactive and break free.

How to Stop or Prevent Wage Garnishment

The good news? You have options. Yes, even if the IRS is already getting cozy with your paycheck.

Negotiate a Payment Plan (Installment Agreement)

You can reach out to the IRS and set up an installment plan. Think of it like a monthly subscription, except instead of paying for streaming movies, you’re paying down your tax debt in smaller bites. If you set it up properly, the IRS will usually pause or stop the garnishment, because they see that you’re making an effort to pay regularly.

Offer in Compromise (OIC)

Ever seen those commercials that say, “Settle your debt for less than you owe!”? That’s an OIC in a nutshell. If you genuinely can’t pay the full amount, you can negotiate to pay a lower, more manageable sum. The catch? It’s tricky to get the IRS to agree. But with the right tax pros on your side, you can drastically improve your chances of hearing “Yes.”

Collection Due Process (CDP) Hearing

Once you get that “Final Notice of Intent to Levy,” you have a small window to request a Collection Due Process Hearing. Filing for a CDP hearing effectively puts the brakes on the garnishment until your appeal is heard. It’s your moment to prove that garnishment is unnecessary or that you have a better solution.

Prove Financial Hardship

If losing a chunk of your paycheck means you can’t cover the basics like rent, groceries, or utilities, you could be placed in “Currently Not Collectible” status. It’s not a get-out-of-debt-free card, but it does give you breathing room while you figure out a longer-term plan.

Why It’s Smart to Get Professional Help

Look, the IRS code is no light bedtime reading. It’s more like a 2,000-piece puzzle, all the same shade of gray. You can try to tackle it solo. But if you want to keep your sanity, teaming up with a pro who understands IRS lingo and the labyrinth of paperwork can be a life-saver.

When you work with a tax professional:

We handle the back-and-forth with the IRS on your behalf—because nobody loves spending hours on hold.

We identify the best possible path to reduce your debt or stop garnishment.

We ensure all your rights are protected.

We give you peace of mind so you can focus on living your life.

Most of all, we’re in your corner, making sure you’re not just another case number getting lost in the shuffle.

Our Promise: We’ve Got Your Back

If you’re thinking, “I can’t deal with this alone,” you’re absolutely right—and you don’t have to. Our team’s entire mission is to help people exactly like you who feel overwhelmed by the IRS. We’ve seen it all: wage garnishments, tax liens, bank levies, you name it. And we know how to tackle each one.

When you come to us, here’s what you can expect:

A Judgment-Free Zone

We get it: life happens. Our goal is to get you out of this tough spot without any lectures or guilt trips.

A Personalized Game Plan

We’ll evaluate your finances, debts, and future goals to craft a strategy that fits you. No cookie-cutter solutions here.

Clear Communication

We’ll keep you in the loop every step of the way. Confused about forms or deadlines? We’ll break it down, no jargon allowed.

Speedy Action

Time is critical when it comes to wage garnishments. We move fast because every paycheck counts.

The Road to Financial Freedom Starts with a Single Step

Maybe this all sounds daunting. Maybe you’re telling yourself, “I’ll call them after I get paid,” or “I’ll look into it next week.” But the longer you wait, the tighter the IRS’s grip becomes.

Instead, imagine waking up without that pit in your stomach. Imagine opening your mailbox and not cringing at every letter with the IRS logo. That’s what financial freedom feels like. That’s what we want for you.

Ready to Reclaim Your Paycheck?

It’s time to stop letting the IRS decide how much of your paycheck you get to keep. Let’s get you on the path to real relief, where wage garnishment notices become distant memories and your financial future looks brighter than ever.

Call or Email Us Today Don’t wait. Grab the phone, shoot us an email, or fill out the form on our website. The sooner we talk, the sooner we can lift that crushing weight off your shoulders.

Your Next Paycheck Deserves to Be Yours—Fully. And we’re here to make sure that happens. Let’s do this, together.

Final Thoughts

Wage garnishment doesn’t have to be the story of your life, it can be just a chapter. By understanding your rights, acting quickly, and getting the right help, you can turn this tough situation into a fresh start. We’re on your side, ready to guide you through the twists and turns so you can come out stronger on the other side.

You deserve peace of mind and the paycheck you’ve worked hard for. Let’s claim that back for you, starting now.

Contact Us :

Address - 8315 Northern Blvd. Suite 2, Jackson Heights, New York 11372

Phone - (844) 829-2292

Email - [email protected]

Website - Tax Relief R Us

Blog - IRS Wage Garnishment: What It Means, Why It Happens, and How You Can Stop It

0 notes

Text

Build Business Credit: 6 Steps to Corporate Credit Success

Did you know that nearly 70% of small businesses fail within the first ten years due to cash flow issues? Building business credit is crucial for long-term success. It opens doors to better financing options, lower interest rates, small business loans, and increased purchasing power. Establishing a strong credit profile can help you secure loans and attract investors.

It’s not just about borrowing money; it’s about creating a solid financial foundation. By following simple steps like registering your business and managing debts wisely, you can boost your credit score. This post will guide you through the essentials of building business credit, ensuring your venture thrives in today’s competitive market.

Understanding Business Credit

Define Business Credit

Business credit serves as a financial tool. It allows companies to borrow money and acquire goods or services on credit. This is crucial for managing cash flow and operational expenses.

Credit scores determine how much credit a business can access. These scores are calculated based on the company’s credit history and payment behavior. Factors like payment timeliness, outstanding debts, and credit utilization impact these scores significantly.

Credit reporting agencies track and report business credit information. They collect data from lenders and suppliers. This data helps create a comprehensive picture of a business's financial health. Establishing business credit is essential. It separates personal and business finances, protecting personal assets from business liabilities.

Importance of Business Credit

Strong business credit leads to better loan terms and lower interest rates. Lenders view businesses with good credit as less risky. This advantage can save significant amounts over time.

Good business credit enhances credibility with suppliers and vendors. Suppliers may offer favorable payment terms to businesses with solid credit histories. This can improve relationships and lead to better deals.

Having solid business credit opens doors to larger contracts and funding opportunities. Many clients prefer working with businesses that have established credit histories. It protects owners against personal liability in case of business debts. This separation is vital for any entrepreneur looking to minimize risk.

Differences from Personal Credit

Personal and business credit scores differ in several ways. Different scoring models apply to each type of credit. Personal scores often rely heavily on individual payment history, while business scores focus more on the company's financial activities.

Personal credit can affect business credit, especially for new enterprises without established histories. Lenders may check personal scores when evaluating new businesses. This connection highlights the importance of maintaining good personal credit.

Business credit ties directly to the entity rather than the individual owner. This distinction means that issues in personal credit do not automatically translate to business financing problems. However, serious personal credit issues can limit access to loans for the business.

Steps to Establish Business Credit

Obtain an EIN

Applying for an Employer Identification Number (EIN) is the first step. Visit the IRS website to complete the application. The process is straightforward and free. An EIN is crucial for tax purposes. It also allows you to open a business bank account.

Having an EIN separates your business identity from your personal identity. This separation is vital for establishing business credit. Many lenders require an EIN when you apply for business credit. Without it, your application may be rejected.

Businesses without an EIN face challenges in financial transactions. They may struggle with tax filings and banking activities. Obtaining an EIN sets a solid foundation for your business credit journey.

Get a Dun & Bradstreet Number

Registering for a DUNS number is essential for building business credit. This unique identifier is issued by Dun & Bradstreet. It helps establish credibility with lenders and suppliers. You can apply for a DUNS number online, and it's free of charge.

A DUNS number plays a significant role in assessing your creditworthiness. Many businesses check this number before extending credit or forming partnerships. Keeping your DUNS information updated is crucial. Accurate information reflects your current credit status and strengthens your credibility.

Regularly reviewing your DUNS profile ensures that all details are correct. Mistakes can lead to misunderstandings with potential creditors or partners. Businesses must prioritize maintaining their DUNS information to build trust in the marketplace.

Open a Business Bank Account

Opening a dedicated business bank account is vital for separating personal and business finances. This separation simplifies tracking income and expenses. It also aids in better financial management overall.

Using a business bank account positively impacts your business credit scores. Lenders look favorably on businesses that maintain clear financial records. Regular transactions demonstrate active financial management.

Maintaining a positive balance in this account builds strong banking relationships. Banks appreciate customers who manage their accounts well. These relationships can lead to better loan terms and credit opportunities in the future.

Build Credit Without Personal Reliance

Choose the Right Structure

Business structure plays a crucial role in building credit. Choosing between an LLC, corporation, or sole proprietorship can impact your credit journey. An LLC or corporation separates personal and business liabilities. This separation protects personal assets if the business faces financial trouble.

Certain structures enhance credibility. Investors and lenders often prefer to work with corporations or LLCs. These structures signal professionalism and commitment. They may also offer tax benefits that sole proprietorships do not provide.

Registering your business structure with the state is essential. This step establishes legitimacy and allows you to obtain necessary licenses. It also helps in opening business bank accounts and building credit. Consulting with legal or financial professionals can guide you in selecting the best structure for your needs.

Manage Vendor Accounts

Establishing vendor accounts is another way to build credit without relying on personal finances. Select vendors that report payment history to credit bureaus. This practice directly contributes to your business credit score.

Timely payments are vital for a positive credit history. Paying vendors on time shows responsibility and reliability. It builds trust and strengthens relationships with suppliers, which can lead to better terms in the future.

Negotiating favorable payment terms can significantly improve cash flow. For example, securing longer payment periods allows more time to generate revenue before settling bills. Monitoring vendor relationships ensures they align with your credit-building goals. Regular communication can help you stay informed about changes in reporting practices.

Use Corporate Credit Options

Corporate credit cards are valuable tools for managing business expenses. They allow businesses to separate personal spending from business costs effectively. Using corporate credit responsibly contributes to building a solid credit profile.

Paying off corporate credit balances in full and on time is crucial. Late payments can harm your credit score and damage relationships with lenders. Consistent, responsible use of these cards demonstrates financial health.

Corporate credit options often come with rewards and benefits. Many cards offer cashback or travel points based on spending. These perks can be advantageous for businesses looking to maximize their expenses while building credit.

Monitoring and Enhancing Creditworthiness

Monitor Credit Reports

Regularly checking both personal and business credit reports is crucial. This practice ensures that all information is accurate. Errors or inaccuracies can harm a business’s credit score. Identifying discrepancies early can prevent long-term damage.

Monitoring credit reports helps spot potential fraud. Identity theft remains a significant risk for businesses. If someone uses your business information without permission, it can lead to severe financial consequences. By keeping a close eye on credit activity, you can catch these issues quickly.

Using services that provide alerts for changes in credit status is beneficial. These services notify you of any updates or suspicious activities. Understanding your credit score is essential as well. A good score opens doors to better financing options. Knowing how scores work allows businesses to strategize effectively.

Strengthen Vendor Relationships

Building strong relationships with vendors enhances credit terms and support. Vendors appreciate loyalty and consistent purchasing. Regular communication helps discuss credit needs and payment terms openly.

When businesses maintain open lines of communication, they foster trust. This trust can lead to better credit terms in the future. For example, if a vendor sees that you consistently pay on time, they may offer extended payment terms.

Resolving disputes quickly is also vital in maintaining positive vendor relationships. Disagreements can arise, but swift resolution shows professionalism. Keeping vendors happy can lead to more favorable terms down the line.

Apply for Credit Wisely

Researching and comparing different credit options before applying is essential. Not all credit offers are the same. Some may have hidden fees or unfavorable terms.

Applying for credit only when necessary helps avoid multiple inquiries on your report. Each inquiry can slightly lower your score. Therefore, timing applications strategically is key.

Understanding the terms and conditions of credit agreements cannot be overstated. Businesses must know what they are signing up for to avoid future complications. Maintaining a healthy credit utilization ratio also plays a significant role in improving credit scores.

Closing Thoughts

Building business credit is essential for your financial health. It opens doors to better financing options, lowers interest rates, and enhances your company’s credibility. By understanding the steps to establish and monitor your creditworthiness, you set your business up for lasting success.

Don’t underestimate the power of good credit. Take action now to build a robust credit profile without relying on personal guarantees. Start implementing these strategies today and watch your business thrive. Your future financial freedom starts with informed decisions—so get to work!

Frequently Asked Questions

What is business credit?

Business credit refers to a company's creditworthiness, which helps secure loans, credit lines, and favorable financing terms without relying on personal credit.

Why is building business credit important?

Building business credit separates personal and business finances. It enhances borrowing capacity and improves payment terms with suppliers and lenders.

How can I start building business credit?

To start, register your business, obtain a federal Employer Identification Number (EIN), open a business bank account, and apply for a business credit card.

Can I build business credit without using my personal information?

Yes, you can build business credit independently by using your EIN, establishing trade lines with vendors, and ensuring timely payments.

How often should I monitor my business credit?

Monitor your business credit regularly—at least quarterly. This helps identify inaccuracies early and ensures your credit profile stays healthy.

What factors affect my business credit score?

Key factors include payment history, outstanding debts, length of credit history, types of credit used, and new credit inquiries.

How can I improve my business credit score?

Improve your score by paying bills on time, reducing debt levels, diversifying your credit mix, and maintaining a low utilization ratio on revolving accounts.

0 notes

Text

Unlocking Stalled Revenue: Expert Collection Agency Solutions for Businesses

As a business owner, there's nothing more frustrating than watching revenue stall due to unpaid debts and delinquent accounts. You've invested time, resources, and effort into providing quality goods and services, only to have customers fail to pay their dues. The good news is that there are expert solutions available to help you unlock stalled revenue and get your business back on track.

The Challenge of Debt Collection

Debt collection can be a daunting task, especially for small to medium-sized businesses. It requires a significant amount of time, resources, and expertise, which can be difficult to allocate when you're already stretched thin. Moreover, debt collection can be a delicate matter, requiring a careful balance between firmness and diplomacy.

The Benefits of Partnering with a Collection Agency

This is where a professional collection agency comes in. By partnering with a reputable collection agency, you can unlock stalled revenue and recover debts that might otherwise be written off. Here are just a few benefits of working with a collection agency:

Expertise: Collection agencies specialize in debt recovery and have the expertise and resources to navigate complex debt collection laws and regulations.

Time and Resource Savings: By outsourcing debt collection to a professional agency, you can free up valuable time and resources to focus on core business activities.

Increased Recovery Rates: Collection agencies have a higher success rate in recovering debts than businesses that try to collect debts on their own.

Improved Customer Relationships: A professional collection agency can help maintain positive customer relationships by handling debt collection in a respectful and diplomatic manner.

How Collection Agencies Work

So, how do collection agencies work their magic? Here's a step-by-step overview of the debt collection process:

Initial Consultation: The collection agency meets with you to discuss your debt collection needs and goals.

Debt Verification: The agency verifies the debt and ensures that all necessary documentation is in place.

Contact with the Debtor: The agency makes contact with the debtor to discuss the debt and negotiate payment terms.

Payment Plans: The agency works with the debtor to establish a payment plan that is manageable and realistic.

Follow-up and Monitoring: The agency follows up with the debtor to ensure that payments are made on time and in full.

Conclusion

Unlocking stalled revenue requires expertise, resources, and a strategic approach. By partnering with a professional collection agency, you can recover debts, improve cash flow, and get your business back on track. Don't let unpaid debts hold you back – seek the help of a reputable collection agency today.

0 notes

Text

Commercial Claims in British Columbia

Commercial claims in British Columbia are handled through the Civil Resolution Tribunal (CRT) and the BC Provincial Court's Small Claims Division, depending on the claim amount and type.

The CRT handles claims up to $5,000, offering an online dispute resolution system accessible 24/7. This includes most consumer and business disputes, personal property disputes, and debt collection matters. The process involves negotiation, facilitation, and if necessary, adjudication by a tribunal member.

For claims between $5,001 and $35,000, the BC Provincial Court's Small Claims Division has jurisdiction. These cases typically involve monetary disputes, contract disagreements, personal property claims, and debt collection. Claims exceeding $35,000 must be filed with the BC Supreme Court, unless the claimant is willing to abandon the excess amount.

The filing process for Provincial Court claims requires completing a Notice of Claim form detailing the dispute and relief sought. After filing, the court serves the defendant, who has 14 days to respond. Mediation is mandatory for claims between $10,000 and $35,000 in most registries.

Settlement conferences are a key component, where a judge helps parties understand their cases' strengths and weaknesses, encouraging resolution before trial. If settlement isn't reached, the case proceeds to trial, where each party presents evidence and arguments before a judge.

Common types of commercial claims include:

Time limitations are crucial. The basic limitation period is two years from when the claim is discovered. For debts, the limitation period typically starts from the last payment or written acknowledgment of the debt.

Businesses can represent themselves in both the CRT and Provincial Court. However, for incorporated companies in Provincial Court, legal representation is required unless the court grants permission otherwise. This differs from the CRT, where incorporated companies can self-represent.

Evidence requirements vary by forum but generally include:

Cost considerations include filing fees, service fees, and potential legal representation costs. The CRT's fees start at $125 for claims up to $3,000, while Provincial Court fees begin at $100 and increase based on claim value. Successful parties may recover some costs, including filing fees and reasonable expenses.

Enforcement options for successful claims include:

The commercial claims system emphasizes accessible justice while maintaining procedural fairness. Alternative dispute resolution methods are encouraged throughout the process to promote efficient resolution and maintain business relationships where possible.

Recent developments include expanded online services, streamlined procedures for certain claim types, and increased monetary jurisdiction for the CRT. These changes aim to improve access to justice while reducing costs and delays in commercial dispute resolution.

0 notes

Text

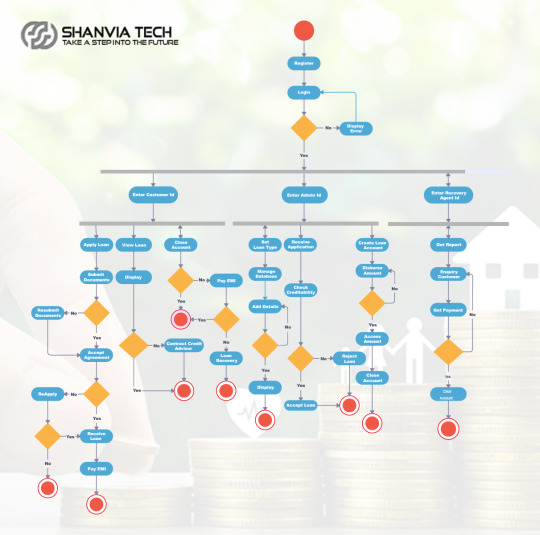

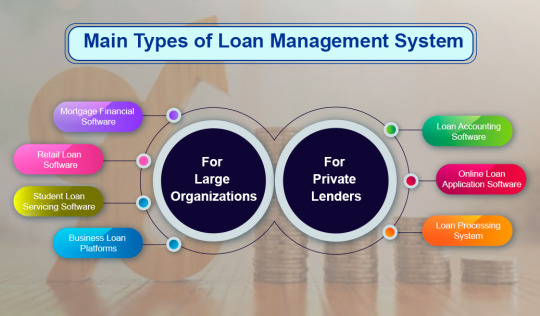

Loan Management System: Guide to Build a System

Financial institutions are constantly adapting to keep up with the ever-changing needs of their customers in today’s fast-moving digital world. One of the most important areas of this evolution is loan servicing. A lot has changed over the years. The Loan Management Software (LMS), which was once a reliable tool for simplifying the loan process and helping people and businesses achieve their goals, no longer meets the demands of today’s environment. Without an efficient Loan Management System (LMS) in place, many are facing financial setbacks, whether it’s through small personal loans or large corporate financing. In economic development loans are a very important part that gives the money to individual and other business to grow them in there full potential. Nonetheless, efficient management of loans necessitates strong systems to tackle difficult tasks such as loan application, loan approval process, disbursement, repayment and compliance monitoring. This is when a Loan Management System comes into the picture to allow financial institutions for simplifying their operations and delivering better customer experiences.

1.What Is a Loan Management System?

A loan management system allows banks, credit unions, captives, and other lenders to streamline the management of all their lending processes, thus reducing operational (and other) expenses. This advent of digital technology has made it possible for smaller consumer lenders to enter the industry. This technology has allowed many such lenders to identify niches for their portfolios, enabling them to make loans to those lacking significant traditional credit histories without increasing their risk exposure.

When it comes to loan management, systems generally are no longer on-premise solutions, as was the case with legacy lending software and the onsite servers that supported it. Instead of involving massive upfront investments, modern lending platforms use cloud-based servers. This offers lenders numerous benefits, including increased flexibility, scalability, and security, along with enabling easier compliance with regulations like those concerning the security and storage of customer data. Smart automation of processes through artificial intelligence (AI), data analytics featuring machine learning algorithms, almost limitless data storage in the cloud, software apps that improve user experience, and other technologies all have advanced lending software.

Key features of an LMS include:

Loan Origination: Simplifies the borrower application process, credit checks, and underwriting. Automation speeds up approvals and minimizes errors.

Loan Servicing: Manages payments, calculates interest, tracks balances, and handles ongoing loan maintenance after approval.

Loan Accounting: Tracks financial details like interest earned, principal payments, and other loan-related data.

Customer Service: Includes tools for seamless communication between lenders and borrowers.

Reporting and Analytics: Generates insights on loan status, portfolio risk, and performance metrics.

Compliance and Regulation: Ensures all processes adhere to local and international regulations.

Debt Collection: Helps manage delinquent accounts, contact borrowers, and streamline recovery efforts.

2.How to Build a Loan Management System?

Developing a loan management system requires a thoughtful and structured approach. It's about creating a powerful tool that streamlines the lending process, making it more efficient and organized. To get it right, you need to understand the system's building blocks and how they fit together. Choosing the right technology is also crucial. But that's just the starting point. You also need to incorporate essential features, rigorously test the system, and ensure it's properly deployed and maintained. By taking a meticulous and comprehensive approach, you can deliver a reliable loan management solution that truly meets the needs of your users.

Step 1: Understanding the Components and Architecture:

Building a robust loan management system starts with a clear understanding of its core components and architecture.

Front-End User Interface: This is what borrowers and lenders see and interact with. A user-friendly and responsive design is essential.

Back-End Database: This is the system's core, storing all loan data. Data security, efficient retrieval, and scalability are critical.

Modules: These handle different stages of the loan lifecycle:

Loan Origination: Manages the loan application and approval process.

Loan Servicing: Handles ongoing loan management, including payments and adjustments.

Debt Collection: Activated when payments are missed.

Reporting: Provides insights into loan performance and other key metrics.

Data Structure: How data is stored and accessed within the database.

Workflows: Streamlined, often automated processes for handling various loan-related tasks.

Integration Points: Connections with external systems, such as credit bureaus or payment gateways.

As well-designed loan management system improves operational efficiency, enhances user experience, and boosts overall performance for lending institutions.

Step 2: Selecting the Right Technology Stack

Selecting the right technology stack is absolutely critical for a high-performing loan management system. Here's a breakdown of key considerations:

Programming Languages: Common choices include JavaScript, typescript and java, offering robust and scalable solutions.

Web Frameworks: Frameworks like Express, React, flutter and Ruby on Rails provide structure and speed up development.

Databases: GraphQL and PostgreSQL are popular database options, known for their reliability and performance.

Cloud Infrastructure: Utilizing cloud services provides scalability and ensures system reliability. APIs (Application Programming Interfaces): APIs are essential for seamless integration with external systems, like payment gateways or credit bureaus.

Third-Party Services: Integrating third-party services can enhance functionality, adding features like fraud detection or automated reporting. Careful selection of each of these components ensures the loan management system is efficient, effective, and meets the needs of both lenders and borrowers.

Step 3: Implementing Key Features and Functionalities:

A robust loan management system requires key features tailored to specific needs. These include:

Loan Origination: Streamlined processing of loan applications and approvals.

Borrower Management: Comprehensive handling of borrower data and profiles.

Automated Payments: Efficient and automated processing of borrower payments.

Document Management: Organized storage and easy retrieval of loan documents.

Credit Scoring: Integration with credit bureaus for borrower creditworthiness assessment.

Risk Assessment: Tools to evaluate loan risk levels and inform lending decisions.

Crucially, these features must align with the organization's specific loan types and operational requirements. Customization ensures the system effectively supports unique business processes and optimizes loan management.

Step 4: Testing and Quality Assurance

A comprehensive loan management system hinges on key features and functionalities. These often include:

Loan Origination: Efficient processing of loan applications, from submission to approval.

Borrower Information Management: Comprehensive storage and management of borrower data.

Automated Payment Processing: Streamlined handling of borrower payments, including automated reminders and processing.

Document Management: Organized storage and easy retrieval of all loan-related documentation.

Credit Scoring: Integration with credit reporting agencies to assess borrower creditworthiness.

Risk Assessment: Tools and processes to evaluate the risk associated with each loan.

Critically, these features must be tailored to your organization's specific needs and the types of loans you manage. This customization ensures the system effectively supports your unique requirements and operational workflows.

Step 5: Deployment and Maintenance

Once development and testing are complete, the loan management system is ready for deployment. The choice between on-premises (in your own data center) and cloud deployment depends on your organization's needs. After deployment, ongoing maintenance, updates, and monitoring are crucial for the system's long-term success.

Here's a closer look at these key stages:

Deployment Options: On-premises gives you full control, while cloud deployment (using platforms like AWS, Azure, or Google Cloud) reduces infrastructure management.

Maintenance and Support: This includes bug fixes, security updates, and adding new features as needed.

Updates and Monitoring: Regular security patches and performance monitoring ensure the system stays secure and runs smoothly.

Scalability: You'll need to be able to scale the system as your organization grows, whether that means expanding cloud resources or adding hardware to your on-premises setup.

User Training and Support: Proper training and support for users will ensure they can use the system effectively.

Backup and Disaster Recovery: Having solid backup and disaster recovery plans is essential to protect your data in case of an emergency.

Whether you choose on-premises or cloud, careful deployment and maintenance are vital for the system's reliability, security, and adaptability. These efforts ensure the system performs well and meets the evolving needs of your financial institution.

3.Benefits of Loan Management System Software

A Loan Management System (LMS) software provides several benefits including streamlined loan processes, centralized data management, faster loan approvals, reduced operating costs, improved tracking and transparency, enhanced regulatory compliance, and ultimately, increased customer satisfaction by facilitating efficient loan management across all stages, from application to repayment.

Automation Reduces Errors: A major benefit of loan management software is the reduction of human error. Manual loan processing is susceptible to mistakes, including incorrect calculations, data entry errors, and processing delays. Automation minimizes these risks, ensuring accurate loan calculations, proper documentation, and consistent application of lending policies. This leads to improved data integrity, reduced compliance issues, and increased overall efficiency in loan processing.

Optimizing Loan Processes for Time Savings: Loan management software significantly saves time. Automating loan origination, document verification, credit checks, and loan servicing eliminates time-consuming manual tasks. Organized workflows and automated processes speed up loan application processing, reducing turnaround time and boosting operational efficiency. This allows staff to focus on higher-value activities and improves the customer experience.

Real-Time Loan Performance Reporting: Loan management software empowers lenders with digital reporting and analytics, providing valuable insights into loan portfolios and performance. Real-time data analysis enables tracking of key metrics, risk assessment, and informed decision-making. By leveraging these analytics, lenders can identify trends, detect potential defaults, and optimize loan strategies, ultimately improving risk management and profitability.