#day trading vs swing trading

Explore tagged Tumblr posts

Text

Day Trading vs. Swing Trading — Choosing the Right Strategy for You

In Forex trading, two main strategies stand out: day trading and swing trading. While both involve buying low and selling high, they differ significantly in approach and risk.

Day Trading involves buying and selling within the same day, aiming to capitalize on small price movements. It’s fast-paced and requires constant attention to the market, making quick decisions to secure profits.

Swing Trading, on the other hand, holds investments for days or weeks to capture larger price movements driven by market trends. It’s less intense than day trading but demands strategic decision-making to ride market waves effectively.

Pros and Cons

Trading Style Pros Cons

Day Trading: Quick profits, fast-paced high-risk, requires constant vigilance.

Swing Trading: Lower risk, the opportunity for larger gains, Slower pace, and market shifts can impact profits.

Choosing Your Strategy

The choice between day trading and swing trading depends on your risk tolerance, time commitment, and trading goals. Day trading offers quick rewards but carries higher risks and costs, while swing trading provides more stability with the potential for larger profits over time.

Other Considerations

Factors like tax implications, capital requirements, and experience level also influence your trading style. For instance, day traders face regular income taxes, whereas swing traders benefit from lower capital gains taxes on longer-term investments.

In conclusion

There’s no one-size-fits-all answer. Explore different trading strategies, consider your personal circumstances, and practice with demo accounts before committing to real capital. Whether you opt for day trading’s adrenaline rush or swing trading’s calculated moves, always trade responsibly and within your means. Happy trading!

1 note

·

View note

Text

Intraday vs swing trading - Features and differences

Understand the features of intraday and swing trading with examples. Explore the differences between them to analyse what suits you better.

#swing-trading#day-trading#swing-trading-vs-day-trading#what-is-swing-trading-vs-day-trading#swing-trading-vs-day-trading-which-is-more-profitable

0 notes

Text

I was thinking about how one of my favorite genres of Sonadow content is Shadow realizing Sonic is way more fucked up than him (the alien hybrid made in a lab in space). And then I had the thought of Shadow realizing ALL of Sonic's friends are sort of weird and terrifying in their own right.

Sonic:

Him being freaky is a given

No one really knows much about his origins, yet he has power on the same level of Shadow, who was engineered in a lab with the help of an alien dictator

Is usually chill but relishes any opportunity to flex his powers and push them to the limit

Only thing keeping him from being an interdimensional threat is his altruism, which Shadow has somehow learned to just trust (which honestly scares him more)

Tails:

First off, why is this child flying a plane? Does he have a license? (The subject was quickly changed last time Shadow asked)

It takes months for Eggman to come up with new tech for his schemes only for this kid to reverse engineer it and come up with a new counter in half a day

Shadow has seen him make weapons that violate the Geneva Conventions out of a mechanical pencil and box of scraps

Also has better aim than GUN snipers with 10 years of training

Shadow takes him out first when it's him vs Sonic team because he doesn't want to risk either Tails getting a clear shot or him having time to pull out some other bullshit

Knuckles:

Knuckles being insanely strong is nothing new, Shadow is also strong

The difference is that Shadow's strength either comes from momentum, precise control of chaos energy, and/or knowing exactly where to aim. Knuckles doesn't need to do that, he's just strong enough to lift a mountain on his own

Shadow would think that Knuckles just doesn't know how to use chaos energy in that way (he's too dense to figure out Rouge is flirting after all)

Until one day Shadow's Chaos Emerald is acting weird. He reluctantly brings it up to the group chat to see if they're having the same issue. Knuckles says "Hold on" and goes quiet for a couple minutes

Then Shadow's Chaos Emerald goes dark. He would have thought this was a harbinger of another disaster if it didn't regain its color a second later. It's also working perfectly fine again

Knuckles used the Master Emerald to fucking turn them off and on again ("Yeah, it's the Master Emerald for a reason.")

Sonic asks if that's tied to the time Knuckles punched the Super out of him and that only causes even more questions that Shadow is too exhausted to ask about

Amy:

At first glance, she seems the most normal. She's got an apartment in the city, a day job, and is an active member of the community

Is a bit of a jack-of-all-trades when it comes to abilities

Shadow held her hammer once, and it's easily over a ton, but she's swinging it around all day with no problem

At first Shadow thought her bracelets were similar to his limiters, but they're just bracelets. But they are almost solid gold and crack the ground when they drop

Even weirder is that while she has more muscle than the average girl, it's nowhere near the amount needed to be as strong as she is. And he doesn't sense that her body's being augmented by chaos energy the way he does

And when Shadow thought about that, he started thinking about where she stores that hammer. He stores small stuff in his quills all the time, but no way could Amy do that with something of that size. Even when he watched closely, he just saw her hide it behind her back, and it was gone

It becomes obvious that Amy has some control over chaos energy, but the way she used it was so weird that Shadow can't make sense of the how or if she even knows she's doing it

And then there's how she always seems to know exactly where Sonic is. Shadow was starting to think she put a tracker on him with how precise she was

That was until Shadow noticed that every time he ran into her on accident, she instead seemed to be...expecting him

Amy chalked it up to her tarot cards, Shadow isn't so sure

Just what exactly was she seeing when she mixed him or Silver up with Sonic?

Cream and Vanilla:

Shadow hadn't had many run ins with Cream, but had heard she was stronger than she looked

Sonic once joked that she'd become a more popular hero than him if her mother let her go on more adventures

Shadow didn't think much of it until an incident in which he was fighting Eggman's badniks

A couple had escaped and were heading to a Chao Garden. Shadow goes after as fast as he can, but when he gets there, he's cheerfully greeted by Cream, sitting on a pile of destroyed badniks

Shadow walks her home, and is greeted by her mother and her overprotective pet robot. Gemerl is easy enough for Cream to calm down though

Though Vanilla is a...different story. She seems friendly enough on the outside, even invites Shadow to stay for dinner. But something about her unnerves him enough to gently turn them down

The look in Vanilla's eyes was too familiar, he'd only seen it in very experienced GUN agents. Like she was sizing him up, looking for any weak spots, and considering the best way to dispose of him if necessary. But not out of any malice, just as a force of habit

On his way home, Shadow remembers tales from an older GUN agent about the legendary Agent V. Said agent had been said to be dangerous enough that few knew their face, but had gone missing several years ago. But the lack of records on them or any urgency for GUN to find out what happened to them led many to believe that they were just a myth

But Rouge once said with certainty that she did exist

Shadow decides not to make that connection

#anyway this makes shadow less self conscious about being the weird one#sonic the hedgehog#shadow the hedgehog#tails the fox#miles tails prower#knuckles the echidna#amy rose#cream the rabbit#vanilla the rabbit#rouge the bat#this thought hit me so hard i had to make my first ever sonic post#imagine knuckles using the master emerald like a wifi router#also headcanons about amy having latent space manipulation abilities#and vanilla as an ex gun agent

56 notes

·

View notes

Text

Cloud + Reno Flirting Headcanons | FFVII

Summary: How they flirt with you at the beginning vs. a long time into your relationship. Fem!Reader.

Notes: I've been in a huge Cloud Strife loving mood (probably because I recently finished CCR) and I'm also just coping with the fact that I don't have a PS5 to play Rebirth AAA

Cloud Strife

Beginning of the Relationship

Honestly, he's not even sure how he managed to win your heart in the first place. Poor boy is confused

He has absolutely no experience when it comes to romance, much less flirting but that's what happens when your life is full of unresolved trauma + Sephiroth

And, in his own words, he has "no good qualities" besides knowing how to swing a sword

A lot of time is spent in his room practicing pick-up lines in the mirror and then cringing at himself because oh gosh he's just so AWKWARD has he always been like this???

He only tried learning how to flirt in the first place in order to impress you and because that's what "normal couples do" but he soon realized he's not normal and it's best to just leave it at that

Eventually he just gives up and treats you like he normally does. Soft glances, lingering touches, and the occasional smile when he's feeling especially fond

Thankfully you don't seem to mind his, but part of him still feels guilty that he's not as romantic with you as he could be

Established Relationship

Over time Cloud's figured out how to flirt with you in his own way

His quiet observations have led him to figure out what sorts of things you like and what specifically makes you all flustered

On that note, one of Cloud's favorite things now is making you turn into a blushing mess

He's not usually so bold, but the sight of you hiding your face in your hands and stumbling on your words makes his heart do backflips

He's not saying it out loud, but internally he's crying over how cute you are

And he's not even doing anything super flirty. He just does his usual thing but turns it up a notch, and it works like a charm

Soft glances turn into unabashed stares. Lingering touches turn into hands trailing down your waist or jawline. Smiles turn into lips pressed against your cheek, already over and done with before you can register what happened

Without fail, you're left wearing a flustered expression, unable to form the right words in response. And it inflates Cloud's ego. Just a little bit

Reno

Beginning of the Relationship

It's no secret that Reno's universally known as a shameless flirt, but now that he's involved with you, he becomes even more shameless than before

He pulls out all the stops to elicit a reaction from you. Not only does it fill him with pride knowing he has such effect on you, but he also just finds your facial expressions to be incredibly adorable. And he WILL tell you that

Whether it's a hand on your thigh during meetings or whispered words against your ear in the hallways, he never passes up an opportunity to make you flustered

However, you should know that none of his words are shallow or spoken half-heartedly. When he calls you lovely or breathtaking, he means every word he says

He would never tell you something he doesn't mean, so no rejecting his compliments, okay? You deserve to have nice things said about you

And he always makes sure to say something sweet to you every single morning

Just seeing that gorgeous smile appear on your face lifts his spirits. He wouldn't trade your happiness for anything

Established Relationship

After a while, Reno tones down on the flirting, but he's still the same suave romancer you know him to be

Now that he's with you, he just feels like he doesn't have to try so hard, you know?

It's not that he didn't enjoy flirting with you at every given moment in the beginning. It just sunk in one day that you're his, and no one is ever going to take you away from him

Now he knows that all it takes to make you flustered is a sincere "I love you" falling from his lips. What you want is something real and genuine, and the same goes for him

He still pulls tricks on you if only to see you glaring at him all red in the face, but his romantic gestures have become much more natural

It's a quick kiss on the cheek when he has to go off on a mission, a hand on your waist as you sit on his lap, or a gentle ruffling of your hair when you're playing coy with him

At the end of the day, he knows he doesn't have to prove how much he loves you. You already know you have a place in his heart

And, without question, he knows that he has a place in yours, too

#I just wanted to write for FFVII again :3#these boys do something to me#🪻 - kat writes#ffvii x reader#cloud x reader#reno x reader

501 notes

·

View notes

Text

Unleash True Financial Freedom: The Incredible Benefits of Forex Trading!

Hey you! Yes, you. Are you tired of the monotonous 9-to-5 grind? Feel like your bank account is mocking you every time you check the balance? Well, let me throw a superhero cape on that boredom and show you the fantastic world of Forex trading! Buckle up, because we’re about to embark on an adventure filled with thrilling benefits that’ll have you saying, “Take my money!” faster than you can whip out your wallet.

The 24/5 Trading Circus: Join the Show Anytime!

Welcome to the biggest financial circus in town! The Forex market is open 24 hours a day, five days a week. Yes, you heard me right! Whether you're a night owl sipping coffee at 3 AM or an early bird downing energy drinks at sunrise, Forex trading welcomes you with open arms. Unlike the typical stock market that yawns between 4 PM and 9:30 AM, Forex never sleeps. So whether you want to trade during your lunch break or while binge-watching your favorite show, it’s all possible!

Profit Potential (Ka-Ching!)

Oh boy, let’s talk about money—our favorite subject! In Forex trading, the potential for profit is HUGE! The market is known for its high liquidity and volatility, which translates to more opportunities for you to earn some serious dough. With the right strategies, you can capitalize on even the tiniest price movements. Just think: Your coffee money could become vacation money—or, who are we kidding, more coffee money!

Imagine this: You invest in a currency pair (let’s say, Euro vs. US Dollar), and when the rate goes up, you sell it for a profit. You can leverage your trades too, which means you can control larger amounts of money with a smaller initial investment. Just remember, like swinging a katana, leverage comes with its risks—so always manage it wisely!

Flexibility Like a Contortionist

One of the biggest perks of Forex trading is the flexibility it offers. Not only can you trade anytime, but you can also do it from anywhere—your couch, the beach, or even your secret lair! All you need is an internet connection and a device (computer, smartphone, your trusty old flip phone—kidding!).

This allows you to balance your trading activities with your other life commitments. Whether you’re a parent juggling school runs or a college student grasping at academic survival, Forex trading can fit snugly right into your schedule. Plus, it’s a fantastic way to unleash your inner entrepreneur!

Low Barriers to Entry

You don’t need a million bucks to start trading in Forex! Many brokers have lowered the entry barriers, allowing you to open an account with a minimum deposit that won’t make your wallet cry. You can start with as little as $100 or even less. Serious business—no need to sell your kidney on the black market!

Thanks to demo accounts, you can dip your toes in the Forex waters without risking your hard-earned cash. These accounts enable you to practice trading strategies, familiarize yourself with the trading platform, and build your confidence before venturing into the wild west of live trading. It’s like a training montage, but with fewer sweatbands and more graphs!

Education and Resources Galore!

Attention, knowledge seekers! If you’re worried about being a novice in the Forex game, fear not! The world of Forex trading is littered with educational resources and tools. From online courses, webinars, trading forums, and YouTube channels, you can find all the information you need to sharpen your skills like a katana-wielding assassin.

Forex brokers often provide platforms that offer advanced analytical tools, live charting, and a treasure trove of tutorials. You can learn about fundamental and technical analysis, trading strategies, risk management, and much more. It’s like Hogwarts for future traders, minus the wands and the Sorting Hat!

Economic Autonomy

Now, let’s talk about that magical “financial independence” everyone raves about. Forex trading can help you take control of your finances and create your own economic destiny. No longer do you need a boss dictating your paycheck. Oh, sweet freedom! If you become a competent trader, you can earn as much or as little as you want, depending on your strategies and commitment.

With consistent efforts, savvy trading skills, and effective risk management, you can even turn Forex into your main hustle. Who wouldn't want to ditch the office and trade in their PJs?

A Community of Fellow Traders

When you enter the Forex trading arena, you’re not alone! There’s a whole community of traders out there who share insights, strategies, and the battle scars of successful trades. This camaraderie can be a powerful motivator, as sharing experiences can enhance your learning curve and keep your spirits high during tough times.

Plus, social trading platforms allow you to follow and mimic experienced traders' strategies. It’s like having your own personal Yoda guiding you through the trading galaxy. Just don’t worry if you end up in a trading swamp—you’ll get out of it in no time!

Unlocking the Power of Automation

For those who prefer to sit back, relax, and let technology do the heavy lifting, Forex offers a plethora of automation tools. From trading algorithms to robots (yes, I said robots!), you can program your trading strategy and let them execute trades even when you’re out saving the world. Or, you know, doing your laundry.

Automation allows for fast execution, minimizes emotional trading decisions, and can work for you during off-hours. Just make sure to monitor your trades—robots can malfunction too. We’re not quite at the “Terminator” level just yet!

Trade Forex With Someone Else's Money Using Prop Firms, Trade $100K Of Someone Else's Money; Learn More And Get Started Now - https://checkout.blueguardian.com/ref/32/

Conclusion: Time to Suit Up!

So there you have it, budding traders—the fabulous benefits of Forex trading, sprinkled with a bit of humor and a dash of sarcasm. Whether you're dreaming of financial independence, seeking flexibility, or looking to dive into an engaging world full of knowledge and community, Forex might just be your financial superhero.

Before you leap into action, remember to do your research, practice good trading habits, and always have fun! The world of Forex trading awaits you—so summon your inner superhero, grab your trusty device, and let the trading adventures begin. Until next time—stay profitable, my friends!

Trade Forex With Someone Else's Money Using Prop Firms, Trade $100K Of Someone Else's Money; Learn More And Get Started Now - https://checkout.blueguardian.com/ref/32/

Prestige Business Financial Services LLC

"Your One Stop Shop To All Your Personal And Business Funding Needs"

Website- https://prestigebusinessfinancialservices.com

Email - [email protected]

Phone- 1-800-622-0453

2 notes

·

View notes

Note

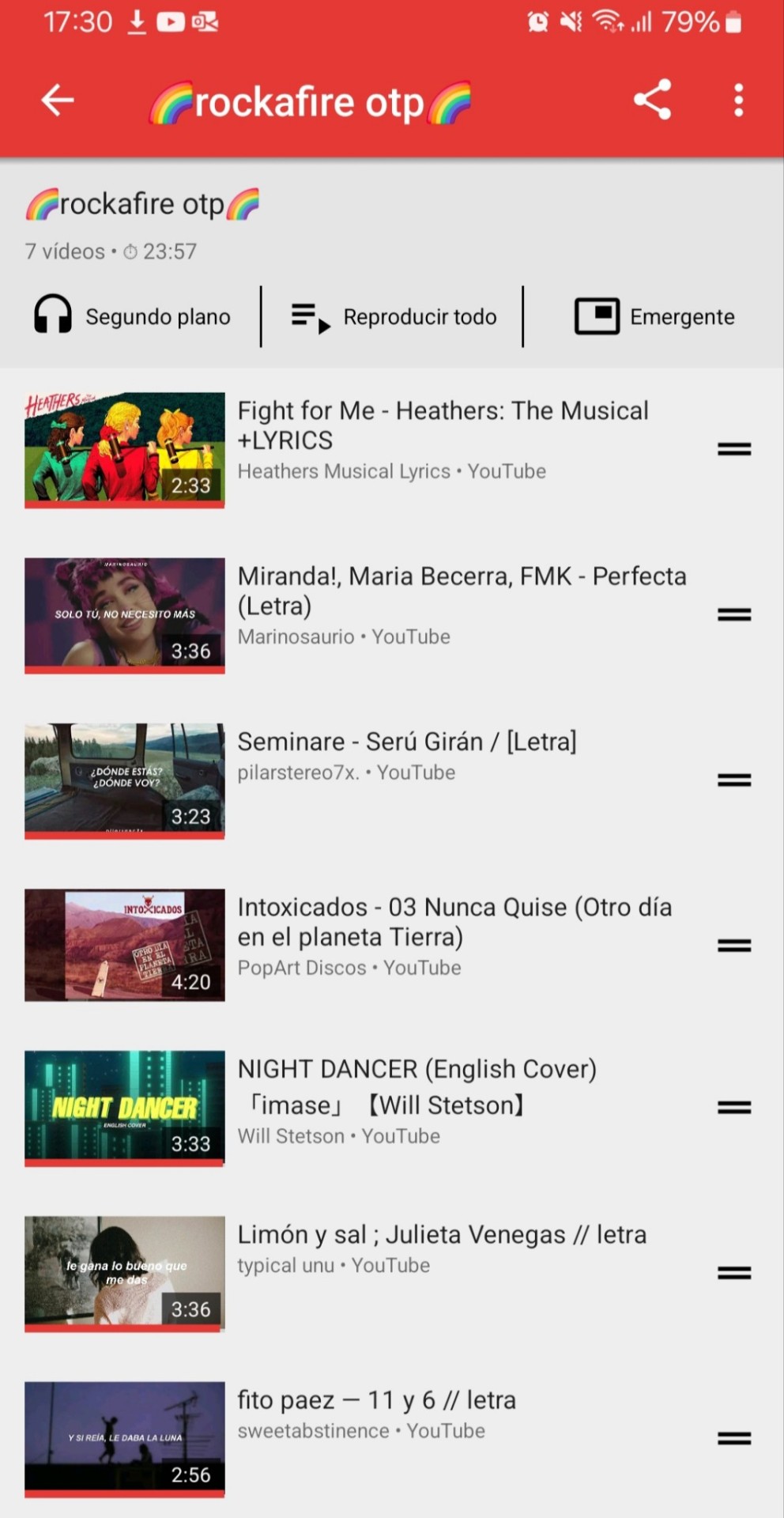

do u have any rolfe and earl headcanons?!?!?! NOT FORCING BTW!!!! U SAID U SHIP THEM I THINK….

I started drafting an answer and Tumblr didn't save it 😭😭 but yeah i do ship them!!!! They might be one of the ships i've into the longest lol. I even got my partner to ship em before we got together!!! (It's how I won her over lol/j)

Putting hcs under the cut!!

Ok so my biggest hc here not only re:this ship but also in general to the rockafire is that Earl is. Not actually a puppet lol??? But yeah my hc is that he's like. A monster type dude similar to Mr Munch basically ¯\_(ツ)_/¯ like in general my hcs for the rockafire rely a bit on their world running on magical realism rules, where ppl see things that we'd think Odd as ordinary. Like random furry monsters just existing lol. But anyways. Continuing w that, Earl's Specific Brand Of Creature™ is just naturally tiny and light, ergo why Rolfe can just. Swing him around like that 😭 also as I mentioned in this fic, he's also very feline like and can purr, among other things!!! Going onto the shippy aspect, as i wrote on the afromentioned fic, Earl's purring is one sure fire way to calm Rolfe down if he's having a hard time 💖💖 the downsize tho is that Earl doesn't like doing it in public :/ so it's really a thing just for the two of them

(Eventually Earl becomes trusting enough to do it around the rest of the band, but everytime he realizes he's doing it he threatens them to not go around saying it. They all agree but tbf its like an open secret at this point 😭)

Anyways, all this to say Earl had a Whole life before meeting Rolfe. And i think they had a Very Funny meet 'cute' where Earl was like. A server at a comedy club Rolfe decided to do stand up at (i think its funny if Rolfe used to do stand up by himself and SUCKED at it) and Rolfe was so bad even Earl started heckling him while waiting tables and Rolfe was SO offended bc what does this lowlife server know about comedy??? So they started to trade barbs back and forth and everyone else in the club thought it was HILARIOUS and even some ppl started wondering if it was all part of some Really Funny Bit and they had agreed to do this beforehand but. No lmao they literally just Have Chemistry when it comes to comedy. Anyways eventually Rolfe's time ran out and he was thinking like 'oh great i wasted my whole time fighting with this rando i'm gonna get booed off again-' but nah fam he was cheered on bc the fight was HILARIOUS. Rolfe wondered wtf was up but when he noticed ppl praising a very confused Earl he wised up about it and asked him if he wanted to do an act together and. Earl said No. So Rolfe just began going to the club to BEG Earl to be on his act it was High Key Pathetic 😭 but Earl did eventually agree (mostly bc word spread out abt the funny 'comedian vs server' act and the club threatened to fire Earl if he didn't do it again :'D) so yeah they eventually began hanging out outside the club, at first just to keep working on their act but eventually they started liking each others company. Like they Don't Agree with each other in a BUNCH of stuff but they could Argue about it in a fun way and they both enjoyed it. And when they Did agree it was also fun like they could talk for HOURS.

Yeah the thing is, living together and being close as they were eventually their feelings wandered into a more Flirty spot and (without quite meaning to) they began putting into their act to the point everyone was like 🤨🏳️🌈❓️ at them. And the club owners turned out to be... pretty fucking homophobic!!! So one day they were just like 'we know what you are' and dead up fired them. Probably called them some slurs on their way out too 😭 and the funny thing is Rolfe and Earl hadn't even NOTICED they were being flirty with each other so they were SHOOKED and frankly very fucking pissed off. They just made it back into their apartment like

Another thing that def helped their bond it's that they were both deeply lonely people and had like No Friends??? So in my hc Rolfe had a pretty awful home life and grew up Very Isolated so yeah. His social skills consisted on acting like he was better than anyone else then being Shocked when that resulted in ppl finding him annoying. And Earl once again i have a Whole Headcanon but tl;dr is that he's from Argentina (like me hi i like projecting 👋) and back then thing's were... Not Great™ so he had to leave and rebuild his life somewhere else and it was HARD and he was also Grumpy about having to move in the first place so yeah 😬 suddenly tho they found each other and become Close Acquaintes, maybe even Friends??? Dare i say even Close Friends??? It got to the point that they decided to move in together to save up on rent and work more on their act and stuff. And they were Pretty Good at it too!!! Everything was going well... maybe too well...

Rolfe: Wow I can't believe we were fired and over fake accusations too???

Earl: Yeah i mean wtf are they on?? We're not dating???

Rolfe: Yeah I mean i am gay but not at you lol ur not my type??

Earl: Yeah same i think guys are hot but not you ur a geek

Rolfe: The club owners are CRAZY

Earl: Yeah lol imagine us dating??

Rolfe: Lol that would be weird

Earl: Heh... yeah...........

Earl:

Rolfe:

Earl: ...So u wanna make out-

Rolfe: YES

So yeah lol ironically they started having a Thing bc of that whole situation. Club owners created their worst enemy fr.

I do think they didn't sit down to discuss the Terms of their relationship until MUCH later, so they never really called each themselves boyfriends or anything. They just had an Unspoken Thing™ and they figured it out as they went.

Anyways, they stayed in that town for a while and began doing their act at different clubs (changing it as they went from 'server vs comedian' to 'audience member vs comedian' bc several clubs weren't willing to let Earl act as if he worked there) but the past club owners kept spreading rumors abt them so eventually no club in town would take them :/ so they decided 'actually fuck this town' and just. Got into a van to go around the country as a traveling act. And they did very well!!!! They def had their ups and downs but it was mostly positives. At one point they ended in a club that had a STRICT 'the comedians must stay only on stage' that they weren't told about until last second so they had to change their WHOLE act with a few minutes to spare.

Rolfe: Wait hold up i have an idea... ✨️puppet✨️

Earl: Fuck off i'm not pretending to be a puppet-

*smash cut to Earl on Rolfe's hand*

Earl: I hate you

Rolfe: Love you too ❤️

That act ended up being a MASSIVE success tho so ¯\_(ツ)_/¯ Earl had to learn to cope

But then one day they stopped at a Showbiz place and meet Wolfman (as mentioned in my fic, he's Rolfe's older brother who he lost contact with) and well. Rolfe and Wolfman had a pretty emotional encounter and Earl decided it was better if they stayed 'just for a while'. Before they knew it they were helping Wolfman's bestie (Fatz) on making a new band since the WP5 was breaking up and they had a whole STAGE for themselves and yknow what maybe they could stay for a while longer...

3 years and a shared house later: Wait shit. We're Attached now.

ANYWAYS this thing devolved into a whole origin story huh 😭 lemme drop some actual hcs here real quick

Rolfe is older than Earl by like 2 yrs (i usually write Rolfe as 37 and Earl as 35, for reference)

Rolfe is the most physically affectionate of the two, he has an habit of getting Affection Zommies™ (term coined by my girlfriend) and just. Picking up Earl to cuddle him or squeeze him or nuzzle him 🥹 and Earl just rolls with it like "oh i'm being pick up. Ok then." It's like the meme of 'came home drunk last night and got too happy to see my cat' yknow

They both smoke, but Rolfe smokes those v long and 'softer' ones while Earl smokes a heavier type (Earl probably smokes weed too on accasion). Anyways, point is, they 100% do that 'leaning really close to light up their cig with the one their partner is smoking' thing like. ALL THE TIME. And everyone thinks they're being romantic but in reality they started doing it to make their lighters last longer 😭

They lowkey have a ratatouille style system to cooking?? Like Rolfe is ok at cooking but NEEDS the recipe. On the flipside Earl has a hard time cooking bc of his side but he just Gets cooking like he can eyeball and improv things and ends up with fantastic stuff. So what they usually do is Rolfe cooks while Earl watches him and gives him indications. And yes, their system works

They're both v good with children!!! And actually like them!!! It wasn't a huge sacrifice for them to change their act to make it more kid friendly. They're also not bad babysitters.

Rolfe loves sewing and clothing design and the like. It can be hard to find stuff Earl's size, so he'll sometimes make him clothes

(Half the time is stuff not really Earl's style but is the thought that counts?)

Rolfe LOVES Earl's voice he thinks he's the best singer in the band and is constantly trying to get him more songs. Earl himself doesn't think he's that good, but he does like to sing and has fun w it so he's also not complaining.

Even tho they usually write their skits beforehand, they're also p good at improv if things go wrong. For ex. the Frank Sinatra skit was meant to have a different ending where the song went without an hitch, but then Technical Difficulties happened and they had to run with it

Earl wont admit it but he genuinaly likes how soft and fluffy Rolfe is.... world hard and cold, fur soft and warm ( ⸝⸝´꒳`⸝⸝)

On that note, Earl has an habit of kneading on Rolfe without meaning to (cat-like creature babeeeeyyy). Rolfe feels flattered every time it happens so he doesn't say anything, even if he might ocasionally get Poked at by claws (yes Earl has retractile claws)

I said this earlier, but Rolfe's parents are pretty garbage. They keep sending Rolfe letters trying to guilt him into taking care of them (send them money), and they can cause Rolfe to spiral. Earl's solution is to check for them constantly and shred them whenever he sees them. He just takes his claws to them and goes wild

If Earl ever meets Rolfe's parents, heads will roll

They're both also very aware of each other's issues/trauma, since they were all they had for a while they ended up accidentally trauma dumping on each other early on.

Yknow that one trope where the tall partner lets stuff in high shelves so the short one has to ask them for help? Yeah Rolfe's the complete opposite. He tries makes sure everything is accesible to Earl, esp if it's stuff he uses constantly

They're both pretty early risers, with the difference Rolfe also has an habit of staying up late. As a result, Rolfe is usually a zombie in the mornings before he gets his caffeine dose. Earl ends up trying to make sure he doesn't get himself hurt by running into walls or smthn

Yeah i think that's all i have rn!!! I've actually been at this for a few hours.... lol....

As an extra, here!!! I made a playlist for them a while ago!!!

https://www.youtube.com/watch?v=DmHPhhJWNKI

https://www.youtube.com/watch?v=LNaHpezFjng

https://www.youtube.com/watch?v=8Djn8yRscS8

https://www.youtube.com/watch?v=ybhNZqEnkYQ

https://www.youtube.com/watch?v=aX8JmX-PJ8k

https://www.youtube.com/watch?v=EemlA7ICn6Y

https://www.youtube.com/watch?v=LViL6-nt3wQ

(Yeah i know most of these are in spanish, sorry they just Fit)

Thanks for the ask!!! 💖

2 notes

·

View notes

Text

Stock Trading: A Gateway to Financial Freedom

Stock trading is one of the most popular ways to generate wealth and achieve financial independence. Whether you are looking for short-term profits or long-term investment growth, understanding the fundamentals of the stock market is essential. With the rise of online trading platforms and advanced analytical tools, anyone can enter the market and make informed decisions. However, stock trading comes with risks, and success requires strategy, discipline, and continuous learning. In this article, we will explore the basics of stock trading, different trading strategies, risk management techniques, and tips to maximize your profits.

source:تعلم التداول من الصفر

Understanding Stock Trading

Stock trading involves buying and selling shares of publicly traded companies on stock exchanges like the New York Stock Exchange (NYSE) and NASDAQ. When you buy a stock, you become a partial owner of the company. The value of your investment increases or decreases based on market conditions, company performance, and investor sentiment.

There are two main types of market participants:

Traders – Engage in frequent buying and selling to capitalize on short-term price movements.

Investors – Focus on long-term wealth accumulation by holding stocks for years or decades.

Types of Stock Trading Strategies

Successful traders use different strategies based on their risk tolerance and financial goals. Here are some of the most common approaches:

Day Trading – Traders buy and sell stocks within the same day, taking advantage of small price fluctuations. This strategy requires quick decision-making, technical analysis, and real-time market data.

Swing Trading – Stocks are held for a few days or weeks to capture short- to medium-term price trends. Swing traders rely on technical indicators and chart patterns to identify trading opportunities.

Scalping – A high-frequency trading method where traders execute multiple trades in a single day to make small but consistent profits. It requires speed and precision.

Momentum Trading – Involves buying stocks with strong upward momentum and selling before the trend reverses. Traders rely on news events, earnings reports, and volume analysis.

Position Trading – A long-term strategy where investors hold stocks for months or years, based on fundamental analysis and company growth potential.

Fundamental vs. Technical Analysis

There are two primary methods for analyzing stocks:

Fundamental Analysis – Evaluates a company's financial health, earnings reports, market position, and long-term growth potential. Investors use this approach to identify undervalued stocks.

Technical Analysis – Focuses on historical price movements, trend lines, moving averages, and other indicators to predict future price actions. This method is popular among short-term traders.

Combining both approaches can improve trading accuracy and decision-making.

Factors That Influence Stock Prices

Several factors impact stock prices, including:

Company Performance – Earnings reports, revenue growth, and management decisions affect stock value.

Market Sentiment – Investor confidence, economic trends, and news events drive stock price fluctuations.

Economic Indicators – Interest rates, inflation, and employment data influence the overall stock market.

Political and Global Events – Government policies, geopolitical conflicts, and trade agreements can cause market volatility.

Risk Management in Stock Trading

Managing risk is essential for long-term success. Here are some key strategies:

Stop-Loss Orders – Automatically sell a stock when it reaches a predetermined price to limit losses.

Diversification – Spreading investments across different sectors reduces overall risk.

Position Sizing – Allocating a fixed percentage of capital per trade prevents significant losses.

Avoiding Emotional Trading – Making decisions based on fear or greed can lead to poor trading choices.

Essential Tools for Stock Trading

Technology has revolutionized stock trading, providing traders with advanced tools to enhance their strategies. Some essential tools include:

Trading Platforms – Online brokers offer real-time data, charting tools, and order execution.

Stock Screeners – Help traders filter stocks based on market trends and technical indicators.

Algorithmic Trading – Automated trading systems execute trades based on predefined rules.

Mobile Apps – Allow traders to monitor the market and trade from anywhere.

Challenges in Stock Trading

Stock trading is not without challenges, including:

Market Volatility – Prices can fluctuate rapidly, leading to unexpected losses.

Psychological Pressure – Managing stress and emotions is crucial for maintaining discipline.

Lack of Knowledge – Many beginners lose money due to inadequate research and unrealistic expectations.

Continuous learning, practice, and a well-defined strategy can help traders overcome these challenges.

also:شرح التداول للمبتدئين

Conclusion

Stock trading offers immense opportunities for financial growth, but it requires knowledge, patience, and risk management. Whether you are an active trader or a long-term investor, understanding market trends, utilizing the right trading strategies, and maintaining discipline are key to success. With the right approach, stock trading can be a powerful tool for building wealth and achieving financial freedom.

more:تعليم التداول من الصفر

0 notes

Text

The Hidden Profit Formula: Mastering CAD/NZD with Interest Rate Announcements Why the CAD/NZD Pair is a Goldmine for Smart Traders Most Forex traders obsess over EUR/USD or GBP/JPY, missing out on a low-key gem: the Canadian Dollar (CAD) vs. New Zealand Dollar (NZD). This currency pair is a playground for interest rate traders, offering predictable movements tied to central bank policies. Why? Because both Canada and New Zealand are commodity-driven economies, but their monetary policies often diverge, creating juicy trading opportunities. Let’s unlock the ninja tactics and hidden insights you need to profit from CAD/NZD interest rate announcements. The Interest Rate Game: How CAD/NZD Moves on Announcements Interest rate announcements from the Bank of Canada (BoC) and Reserve Bank of New Zealand (RBNZ) drive massive CAD/NZD moves. Here’s why: - The Carry Trade Magnet – Traders love CAD/NZD because it often presents a lucrative carry trade. When New Zealand’s interest rate is higher, traders buy NZD. When Canada’s rate is higher, traders shift to CAD. Simple in theory—but let’s get deeper. - Interest Rate Differentials – The difference between Canadian and New Zealand interest rates dictates price action. A widening gap favors one currency over the other. - Inflation Wars & Economic Surprises – CPI reports, employment data, and GDP growth influence central bank decisions. If one country surprises the market, the CAD/NZD pair reacts violently. Pro Tip: Don’t just look at the headline interest rate. Read the central bank statement to gauge the next policy move. How to Predict CAD/NZD Moves Like a Pro Most traders blindly react to news. You’ll trade like an insider by following these steps: 1. Track Rate Expectations Before the Announcement - Use tools like the Overnight Index Swaps (OIS) market to see what traders expect. - If the BoC is expected to hike rates by 0.25% but surprises with 0.50%, CAD/NZD will skyrocket. - The opposite is true for RBNZ. 2. Compare Canada vs. New Zealand Economic Data - Canada’s Key Indicators: GDP growth, oil prices, inflation, and employment numbers. - New Zealand’s Key Indicators: Dairy prices, housing market data, and inflation reports. 3. Watch the Yield Spread - The difference between 2-year Canadian bonds and 2-year New Zealand bonds is a leading indicator for CAD/NZD. - A rising spread in favor of CAD = bullish CAD/NZD. - A falling spread in favor of NZD = bearish CAD/NZD. Expert Quote: “The CAD/NZD pair is heavily influenced by central bank expectations. Tracking rate differentials ahead of announcements can give traders a significant edge.” — Kathy Lien, Managing Director at BK Asset Management Ninja Tactics: Secret CAD/NZD Trading Strategies Forget the basic "wait for the news" strategy. Here’s how pros actually trade CAD/NZD around interest rate announcements. 1. The Pre-News Fade Play - The market often overprices rate hikes/cuts before they happen. - If CAD/NZD spikes pre-announcement, fade it (sell into strength) if expectations are too high. - Works best when market positioning is extreme (watch COT reports for trader positioning). 2. The Post-Announcement Liquidity Grab - Markets fake out retail traders right after the announcement with a false move. - Wait for the initial spike, then enter in the opposite direction after the first 15 minutes. - Works best when the rate move was expected but market overreacted. 3. The "Mismatch Play" Strategy - If BoC is hawkish and RBNZ is dovish, long CAD/NZD for a 3-5 day swing trade. - If BoC is dovish and RBNZ is hawkish, short CAD/NZD and ride the trend. Real-World Case Study: The March 2023 RBNZ Surprise In March 2023, the RBNZ shocked markets by hiking rates 50bps instead of 25bps. The CAD/NZD pair tanked nearly 200 pips in 24 hours as traders adjusted to the unexpected move. Lesson: The biggest moves happen when markets are caught off guard. Always track rate hike/cut expectations beforehand. Final Takeaways: How to Stay Ahead of the Market - Follow interest rate expectations (OIS market) before announcements. - Track CAD/NZD yield spreads for a leading indicator. - Use smart trading tactics like the fade play, liquidity grab, and mismatch strategy. - Stay informed with real-time Forex news and expert analysis. For elite Forex insights, trading tools, and advanced strategies, check out StarseedFX. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Long-Term vs. Short-Term Investing: Which Strategy Works Best?

Investment in the stock market offers many strategies, with long -term and short -term investment two primary approaches. Each method has its own benefits and challenges, and choosing properly depends on an investor’s financial goals, risk tolerance and marketing skills. Whether you are an experienced investor or just starting, you can work with an stock advisory company for stocks help you make informed decisions and maximize the return. Let’s find out both strategies to decide that the best works for different investment needs.

Understanding Short Term Investment

Long -lasting investment involves keeping shares or other property for a longer period, usually five years or more. The goal cycle is to benefit from development, dividends and general market assessment.

The benefits of long -term investment

1. Compounding Return — the longer you invest, the more opportunity to grow more due to composite returns.

2. Lower Risk of Market Volatility — Markets fluctuate daily but long -term investors are less affected by short -term instability.

3. Tax Benefits — In many areas, long -term capital gains are taxed at low prices than short -term benefits.

4. Low stress and effort — investors do not need to track down daily price movements, making it a more passive strategy.

Long -Term Investment Challenges

· It is a strong ability to meet patience and market falls.

· It can take years to realize important returns.

· It is not suitable for investors in search of quick profits.

· A corporation can help long -term investors choose high quality shares and build a diverse portfolio for stable development.

Understanding of Short -Term Investment

Short -term investment involves buying and selling shares or financial equipment within a short period from a few days to a few months. The main goal is to utilize ups and downs in the price and make a quick profit.

The benefits of short -term investment

Quick gain capacity — traders can use quick price movements.

Flexibility in strategies — Investors can use techniques such as day trafficking, swing trade and speed investments.

Utilizing the market Trend- Short term investors can respond to news, revenue reports and financial changes.

Challenges with short -term investment

High risk — market volatility can cause significant disadvantages.

Requires Expertise — Competence requires successful activities requires experience and intensive market knowledge.

Higher taxes and fees — frequent trade can lead to high tax and brokerage fees.

For those interested in short -term investments, stock consulting services provides real -time insights, technical analysis and stock recommendations to help traders make profitable decisions.

Which Strategy Works Best?

The best strategy depends on personal investment goals:

For long -term development: Investors seeking stability, money accumulation and low risk should choose long -term investment with expert guidance from the stock consulting company.

For quick returns: Those who can withstand high risk and actively manage their portfolio, with support from stock advisory services, prefer short -term trade.

Finally, a balanced approach containing elements in both strategies can produce optimal results. Working with a professional corporation ensures that investors achieve expert insights that fit their risk hunger and financial goals.

#best stock market advisor#stock market advisory#stock market advisory services#top micro cap stocks#stock market

0 notes

Text

Fundamental vs. Technical Analysis: Which One Should You Learn First?

Introduction: When you first dip your toes into the stock market, you’ll quickly come across two major types of analysis: Fundamental Analysis and Technical Analysis. Both are essential tools for making informed investment decisions, but they approach the market from entirely different angles. As a stock market training center in Bhopal, we often get asked, "Which one should I learn first?" While there’s no definitive answer for everyone, this blog will break down the core differences, benefits, and which analysis might suit you best as a beginner.

Understanding the Basics:

1. What is Fundamental Analysis?

Fundamental analysis involves evaluating a company’s financial health and overall business performance to determine its stock’s intrinsic value. The goal is to identify whether the stock is undervalued or overvalued in relation to its actual worth.

Key Factors in Fundamental Analysis:

Earnings Reports: Profitability, revenue, and cash flow.

Balance Sheets: Debt, assets, liabilities, and equity.

Economic Indicators: Interest rates, inflation, and GDP growth.

Industry & Competitor Analysis: How the company stacks up against others in the same industry.

When is Fundamental Analysis Useful?

Long-Term Investment: Ideal for value investors who plan to hold stocks for the long haul.

Company Evaluation: If you want to understand the company's potential for growth, dividends, and stability.

Identifying Undervalued Stocks: Fundamental analysis helps investors find stocks that are undervalued relative to their true worth.

2. What is Technical Analysis?

Technical analysis, on the other hand, focuses on price movements and trading volumes to predict future market behavior. Rather than evaluating the company’s fundamentals, technical analysis looks at past market data, primarily charts, to forecast the direction of stock prices.

Key Tools in Technical Analysis:

Charts & Patterns: Candlestick patterns, support, resistance, and trendlines.

Indicators & Oscillators: RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), moving averages, etc.

Volume Analysis: Understanding how trading volume affects price movement.

When is Technical Analysis Useful?

Short-Term Trading: Perfect for day traders or swing traders looking to make profits in shorter time frames.

Timing Market Entries/Exits: Helps investors identify optimal buy/sell points based on price action.

Market Sentiment: Technical analysis can also help you gauge market sentiment, whether bullish or bearish.

Which One Should You Learn First?

Now that we know the differences between fundamental and technical analysis, let’s look at which one is better for you as a beginner.

If You Want to Invest Long-Term:

If your goal is to buy and hold stocks for years and grow your wealth steadily over time, then fundamental analysis is the best place to start. It will teach you how to evaluate a company’s true potential, helping you choose stocks that are fundamentally strong.

Why Start with Fundamentals?

Stability & Growth: Understanding a company’s financials allows you to make well-informed decisions that align with your long-term financial goals.

Simplicity: Fundamental analysis is often easier for beginners to grasp because it focuses on the company’s real-world performance, which is intuitive.

Avoid Emotional Trading: With fundamental analysis, you focus on the company’s intrinsic value, rather than reacting to short-term price fluctuations.

If You Want to Trade Actively (Short-Term):

If you're leaning toward day trading or swing trading, technical analysis might be more beneficial to learn first. It helps you react quickly to market movements and allows you to make trades based on the patterns and trends of stock prices.

Why Start with Technical Analysis?

Quick Profits: With technical analysis, you can learn how to capitalize on short-term market movements.

Visualization: It helps you understand how to use charts and indicators, providing a visual representation of the market’s behavior.

Active Trading: If you plan to make multiple trades per day or week, technical analysis gives you the tools to spot opportunities quickly.

At Shower Wealth Academy in Bhopal, we offer comprehensive courses that cover both types of analysis. Whether you are a beginner looking to get started or an experienced trader wishing to refine your skills, our expert-led courses are designed to give you the tools you need to succeed.

Ready to take control of your financial future? Call Us today and start your journey toward becoming a skilled investor or trader!

0 notes

Text

Understanding Crypto Markets: A Deep Dive into Blockchain Trading

Crypto markets are a dynamic and evolving space, shaping the future of digital finance. From Bitcoin’s early days to the rise of decentralized exchanges, the crypto ecosystem offers a revolutionary way to trade, invest, and interact with digital assets.

But how do these markets function? What makes them different from traditional stock markets? Let’s break it down.

Primary vs. Secondary Crypto Markets

Crypto markets can be categorized into:

🔹 Primary Markets – Where new cryptocurrencies are issued. 🔹 Secondary Markets – Where existing cryptocurrencies are traded.

The primary market is where digital assets are first created, often through mechanisms like mining or token minting. In contrast, the secondary market allows traders to buy and sell these assets on exchanges.

How Cryptocurrencies Are Created

Unlike traditional currencies printed by central banks, cryptocurrencies emerge through different mechanisms:

✅ Proof-of-Work (PoW) – Used by Bitcoin, where miners solve complex mathematical problems to validate transactions and earn rewards. ✅ Proof-of-Stake (PoS) – Instead of mining, users stake their tokens to validate transactions, reducing energy consumption. ✅ Other Consensus Mechanisms – Models like Byzantine Fault Tolerance (BFT) or Proof-of-Authority (PoA) ensure security while optimizing efficiency.

Many blockchain projects use token minting to create digital assets. Platforms like Ethereum allow developers to generate tokens for various applications, from financial services to gaming.

Types of Crypto Tokens

Crypto tokens can be divided into three major categories:

🔹 Utility Tokens – Provide access to a platform or service. Example: A token granting access to a decentralized cloud storage network. 🔹 Payment Tokens – Used as a digital currency within a specific ecosystem. Example: A token required to purchase computing power on a blockchain-based network. 🔹 Security Tokens – Represent ownership or investment, similar to stocks. These are subject to financial regulations.

Crypto Fundraising: ICOs & STOs

Many companies raise capital through:

✅ Initial Coin Offerings (ICOs) – Selling utility or payment tokens to investors. ✅ Security Token Offerings (STOs) – Selling tokenized securities, often representing company shares.

Compared to traditional stock markets, tokenized assets offer advantages like instant transactions, 24/7 trading, and reduced reliance on intermediaries. However, regulations continue to evolve, shaping the future of digital asset fundraising.

Crypto Exchanges: Centralized vs. Decentralized

Exchanges facilitate crypto trading, but not all operate the same way:

🔹 Centralized Exchanges (CEXs) – Operate like traditional stock exchanges, handling trades on a central server. They offer fiat-to-crypto conversions but introduce a single point of failure. 🔹 Decentralized Exchanges (DEXs) – Operate on blockchain networks, enabling peer-to-peer trades without intermediaries. They offer greater security but lack fiat gateways and are often slower.

Both models play a crucial role in the crypto ecosystem, with CEXs dominating volume while DEXs push for decentralized financial sovereignty.

Challenges & Opportunities in Crypto Markets

While crypto markets share similarities with traditional finance, they also present unique challenges:

❌ Regulatory Uncertainty – Governments worldwide are still defining legal frameworks for digital assets. ❌ Market Manipulation – Issues like wash trading and insider trading are concerns in unregulated environments. ❌ 24/7 Trading Volatility – Unlike traditional markets, crypto trades never stop, leading to unpredictable price swings.

At the same time, these markets offer incredible opportunities:

✅ New Investment Avenues – Crypto markets introduce decentralized finance (DeFi), NFT economies, and tokenized assets. ✅ Global Accessibility – Unlike traditional markets, crypto allows anyone with an internet connection to participate. ✅ Rapid Technological Evolution – Advancements in blockchain security, efficiency, and smart contract development continue to improve the space.

Future of Crypto Markets

Crypto markets are still in their early stages, with immense room for growth. Researchers and investors are constantly exploring:

📌 Investor behavior in ICOs & STOs 📌 Trader psychology in volatile markets 📌 Regulatory frameworks for digital assets 📌 Market manipulation detection techniques

As blockchain adoption expands, the financial landscape is set to transform, making crypto markets an exciting space to watch. 🚀

0 notes

Text

Stock Market Tamil: Fibonacci Levels பயன்படுத்தி Intraday & Swing Trading Strategies!

@ParkaviFinance Intraday & Swing Trading Tamil | Parkavi Finance Intraday & Swing Tradingல் Parkavi Financeயுடன் எளிய வழிமுறைகளை கற்றுக்கொள்ளுங்கள்! Stock Selection - NSE இல் இருந்து Top Gainers & Losers (Nifty / F&O Stocks மட்டும்) தேர்வு செய்வது. Trend Identification - Uptrend அல்லது Downtrendஐ எளிதாக கண்டுபிடிக்கும் முறை Fibonacci Values - Parkavi Finance Fibonacci Calculator Link Parkavi Finance Tamil - பயன்படுத்தி Golden Ratio Level கண்டறிவது. Previous Day High & Low - Intraday Tradingக்கு முக்கியமான High & Low Breakout Strategy Risk Management - Entry, Stop-loss & Exit Strategies ------------------------------- Youtube Timeline 00:00 - Overview of Strategy (Strategies for Intraday & Swing Trading) 01:43 - Stock Selection (How to pick stocks from NSE Top Gainers & Losers) 03:09 - Trend Identification (Uptrend vs Downtrend – How to Identify?) 04:32 - Finding Fibonacci Values (Using Fibonacci Calculator from Parkavi Finance) 06:01 - Exploring the Strategy (How to apply Fibonacci & trend analysis for better trading decisions) 10:24 - Risk Management (Entry, Stop-loss & Exit Strategies) 12:22 - Outro & CTA (Like, Share & Subscribe for more trading insights!)

Watch Now - Stock Market Tamil: Fibonacci Levels பயன்படுத்தி Intraday & Swing Trading Strategies!

----------------------- Additional Resources

Read in English - https://www.parkavifinance.com/2025/02/how-to-use-fibonacci-levels-in-intraday.html

Read in Tamil - https://tamilparkavifinance.blogspot.com/2025/02/intraday-swing-trading-fibonacci-levels.html ------------------

Watch the full video to master Intraday & Swing Trading! இந்த வீடியோவை கண்டிப்பாக பாருங்கள்! உங்கள் Intraday & Swing Trading Performance-ஐ மேம்படுத்துங்கள்! Like, Share & Subscribe செய்ய மறக்காதீர்கள்!

#FibonacciRetracementtamil #IntradayTrading #SwingTrading #StockMarketTamil #NSETopGainers #NiftyFutures #OptionsTrading #TechnicalAnalysis #FibonacciTrading #GoldenRatio #TradingStrategy #StockSelection #RiskManagement #NSEIndia #ParkaviFinance #TradingForBeginners #StopLoss #StockMarketTips #PriceAction #TrendAnalysis

#investing stocks#stock market#financial updates#financial freedom#trading strategies#breakout stocks#share market#youtube

0 notes

Video

youtube

Day Trading vs. Swing Trading: Which Strategy Suits You?

0 notes

Text

Copy Trading Forex vs. Crypto: Which Offers Better Returns?

Copy trading allows investors to mirror the trades of experienced professionals, offering a way to participate in financial markets without extensive knowledge. But which market—forex or crypto—offers better returns? This post explores copy trading in both markets to help you decide.

What is Copy Trading?

Copy trading forex involves replicating the trades of successful traders. Copy trading platforms and tools connect traders with experts, automatically mirroring their actions in the copier's account. This simplifies market participation for less experienced individuals.

Copy Trading in Forex

The forex market, the world's largest and most liquid, involves currency exchange. It operates 24/5 and is known for liquidity and volatility. Forex copy traders often focus on strategies like scalping, day trading, and swing trading, using forex copy trading software to replicate expert trades.

Pros: High liquidity, lower volatility (compared to crypto), regulated environment.

Cons: Lower returns (compared to crypto during bull markets), limited trading hours (weekdays).

Copy Trading in Crypto

The crypto market, while younger, has experienced rapid growth. It operates 24/7 and is known for high volatility and potential for significant returns. Crypto copy traders also use copy trading tools for crypto signals, often employing short-term strategies like momentum trading and arbitrage.

Pros: Potential for higher returns, 24/7 market access, growing adoption.

Cons: High volatility, less regulation, susceptibility to market manipulation.

Forex vs. Crypto: Key Differences

Market: Forex is the largest, most liquid financial market (currencies). Crypto involves decentralized digital assets.

Participants: Forex: Central banks, institutions, retail traders. Crypto: Retail traders, institutions, miners, developers.

Regulation: Forex is heavily regulated. Crypto has less regulation.

Structure: Forex is centralized. Crypto is decentralized.

Volatility: Forex is relatively stable. Crypto is highly volatile.

Risk and Return: Forex vs. Crypto

Forex offers more stable price movements and moderate returns with sound risk management. Crypto offers higher potential returns but with significantly greater risk due to volatility.

Beginner-Friendliness

Forex is generally considered more beginner-friendly due to its stability and predictability. Crypto can be a faster learning experience but carries higher risk.

Best Signal Copier

Telegram Signal Copier (TSC) is a top choice for copying trades in both forex and crypto. TSC automates copying signals from Telegram channels to your trading platform.

Tips for Successful Copy Trading

Choose the right software: Look for transparent platforms with real-time tracking and risk management features.

Evaluate signal providers: Research their performance, style, and risk management.

Manage your own strategy: Set your own risk limits.

Conclusion

Copy trading in forex and crypto offers unique opportunities. Forex provides stability, while crypto offers higher potential returns with greater volatility. Using the right tools can maximize your success.

FAQs

Crypto vs. Forex: Crypto offers higher potential returns with higher risk. Forex is more stable.

Trading Crypto like Forex: Yes, similar strategies can be used, but crypto's volatility requires caution.

Beginners: Forex is generally better for beginners.

Profitability: Crypto has higher profit potential, but Forex with leverage can also be risky.

Crypto Safety: Crypto trading involves risks like volatility and regulation.

Popular Crypto: Bitcoin is the most popular.

0 notes

Text

https://cryptotradingindia.com/day-trading-vs-swing-trading-cryptos/

Day Trading vs Swing Trading Cryptos:- The trading of cryptocurrencies has become more well-known as investors attempt to take advantage of the market's.

0 notes

Text

Stock Trading: How to Start and Learn from Scratch

Stock trading is an exciting financial activity that allows individuals to buy and sell shares of publicly traded companies. It offers opportunities for profit but also carries risks. Whether you are a beginner looking to understand the basics or someone seeking to improve your trading skills, this guide will help you learn how stock trading works and how to start from scratch. source:دورات تداول الأسهم للمبتدئين

What is Stock Trading?

Stock trading refers to the buying and selling of company shares through stock exchanges. When you buy a stock, you are purchasing a small ownership stake in a company. The goal of traders is to make profits by selling stocks at a higher price than they were purchased.

There are two main types of stock trading:

Day Trading – Buying and selling stocks within the same day to take advantage of short-term price movements.

Long-Term Investing – Holding stocks for months or years, focusing on the company’s growth over time.

How Stock Trading Works

Stock trading is conducted through stock exchanges such as the New York Stock Exchange (NYSE) and the Nasdaq. Investors use brokerage accounts to trade stocks, and prices are determined by supply and demand.

The key elements of stock trading include: Stock Exchanges: Platforms where stocks are traded (e.g., NYSE, Nasdaq). Brokers: Companies or online platforms that allow you to buy and sell stocks. Market Orders vs. Limit Orders: A market order buys or sells at the current price, while a limit order sets a specific price for the trade. Stock Prices: Prices fluctuate based on company performance, economic conditions, and investor sentiment.

How to Start Stock Trading from Scratch

If you are new to stock trading, follow these steps to get started:

1. Learn the Basics

Before investing money, it is crucial to understand basic trading concepts, including:

Stock market terminology (e.g., shares, dividends, bull vs. bear markets).

Types of stocks (e.g., blue-chip stocks, growth stocks, dividend stocks).

Fundamental analysis (evaluating a company’s financial health).

Technical analysis (using charts and patterns to predict price movements). more:دورات التحليل الفني للاسهم

2. Choose a Reliable Brokerage Account

To trade stocks, you need a brokerage account. Choose a platform that offers: Low fees and commissions User-friendly interface Educational resources for beginners Real-time stock market data

Some popular brokers include E*TRADE, TD Ameritrade, Robinhood, and Fidelity.

3. Practice with a Demo Account

Many brokers offer paper trading (simulated trading) that allows beginners to practice buying and selling stocks without risking real money.

4. Start with Small Investments

As a beginner, start with small amounts of money and focus on low-risk stocks before exploring high-risk trades.

5. Develop a Trading Strategy

Successful traders follow strategies such as: Buy and Hold – Investing in strong companies for long-term growth. Swing Trading – Holding stocks for a few days or weeks to capitalize on price movements. Scalping – Making multiple small trades within a day to gain quick profits.

6. Keep Learning and Stay Updated

Stock markets are constantly changing. Follow financial news, study successful traders, and continue learning through books, online courses, and market analysis.

Common Mistakes to Avoid

Investing without research – Always analyze companies before buying their stocks. Letting emotions drive decisions – Fear and greed can lead to poor trading choices. Overtrading – Making too many trades can increase risks and transaction fees. Ignoring risk management – Set stop-loss orders to minimize losses.

Conclusion

Stock trading can be a rewarding way to build wealth, but it requires patience, knowledge, and discipline. By understanding the basics, choosing a good broker, practicing with a demo account, and following a trading strategy, beginners can start their journey in stock trading confidently. also:تعليم التداول من الصفر

Would you like recommendations for books or online courses to help you learn more?

0 notes