#dabur nepal chairman

Explore tagged Tumblr posts

Text

Early life of Pradip Burman - Life & Education

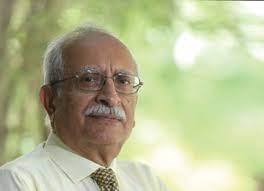

Pradip Burman born in 1942 at Amritsar (Punjab), is a great-grandson of the founder of Dabur, Dr. S. K Burman.

https://medium.com/@timesdelhi/pradip-burman-biography-founder-of-mobius-foundation-chairman-of-dabur-nepal-pvt-limited-db08516783cf

1 note

·

View note

Text

Pradip Burman | Biography — Founder of Mobius Foundation, Chairman of Dabur Nepal Pvt Limited

Pradip Burman is the Chairman of the Mobius Foundation which is establishing two schools — the World Environment School in Coorg,and in Village Atrouli.Read the latest new of pradip burmn here. visit:https://www.pradipburman.in/category/blog/

#pradip burman#pradip burman news#pradip burman about us#pradip burman biography#founder mobius foundation#dabur nepal chairman#medium blog#pradipburman medium

0 notes

Video

youtube

IIBM MBA MANAGERIAL ECONOMICS EXAM ANSWER PROVIDED

IIBM MBA MANAGERIAL ECONOMICS EXAM ANSWER PROVIDED IIBM MBA MANAGERIAL ECONOMICS EXAM ANSWER PROVIDED IIBM MBA MANAGERIAL ECONOMICS EXAM ANSWER PROVIDED

Managerial Economics MM.100 Section A: Objective Type & Short Questions (30 marks) Part one: Multiple choice: I.Demand is determined by (1) a) Price of the product b) Relative prices of other goods c) Tastes and habits d) All of the above II. When a firm’s average revenue is equal to its average cost, it gets (1) a) Super profit b) Normal profit c) Sub normal profit d) None of the above III. Managerial economics generally refers to the integration of economic theory with business (1) a) Ethics b) Management c) Practice d) All of the above IV. Which of the following was not immediate cause of 1991 economic crisis (1) a) Rapid growth of population b) Severe inflation c) Expanding Fiscal deficit d) Rising current account deficit V.Money functions refers to : (1)

a) Store of value b) Medium of Exchange c) Standard of deferred payments d) All of the above VI. Given the price, if the cost of production increases because of higher price of raw materials, the supply (1) a) Decreases b) Increases c) Remains same d) Any of the above This section consists of multiple choices and Short Notes type questions. Answer all the questions. Part one questions carry 1 mark each & Part two questions carry 5 marks each. Examination Paper of Managerial Economics IIBM Institute of Business Management VII. Total Utility is maximum when (1) a. Marginal Utility is maximum b. Marginal Utility is Zero c. Both of the above d. None Of The Above VIII. Cardinal approach is related to (1)

a. Equimarginal Curve b. Law of diminishing returns c. Indifference Curve d. All of the above IX. Marginal Utility curve of a consumer is also his (1)

a) Supply Curve b) Demand Curve c) Both of above d) None of above X. Government of India has replaced FERA by (1)

a) The competition Act b) FRBMA c) MRTP Act d) FEMA Part Two: 1. What is Managerial Economics? What is its relevance to Engineers/Managers? (5) 2. “Managerial Economics is economics that is applied in decision making” Explain? (5) 3. Differentiate b/w, Micro economics vs. macroeconomics? (5) 4. Factors Affecting Price Elasticity of Demand? (5) Section B: Caselets (40 marks) END OF SECTION A This section consists of Caselets. Answer all the questions. Each Caselet carries 20marks. Detailed information should form the part of your answer (Word limit 150 to 200 words). IIBM Institute of Business Management

Examination Paper of Managerial Economics Caselet1 Dabur is among the top five FMCG companies in India and is positioned successfully on the specialist herbal platform. Dabur has proven its expertise in the fields of health care, personal care, home care and foods. The company was founded by Dr. S. K. Burman in 1884 as small pharmacy in Calcutta (now Kolkata), India. And is now led by his great grandson Vivek C. Burman, who is the Chairman of Dabur India Limited and the senior most representative of the Burman family in the company. The company headquarter is in Ghaziabad, India, near the Indian capital New Delhi, where it is registered. The company has over 12 manufacturing units in India and abroad. The international facilities are located in Nepal, Dubai, Bangladesh, Egypt and Nigeria. S.K. Burman, the founder of Dabur, was trained as a physician. His mission was to provide effective and affordable cure for ordinary people in far-flung villages. Soon, he started preparing natural remedies based on Ayurveda for diseases such as Cholera, Plague and Malaria. Due to his cheap and effective remedies, he became to be known as ‘Daktar’ (Indian izedversion of ‘doctor’). And that is how his venture Dabur got its name—derived from Daktar Burman. The company faces stiff competition from many multinational and domestic companies. In the Branded and Packaged Food and Beverages segment major companies that are active include Hindustan Lever, Nestle, Cadbury and Dabur. In case of Ayurvedic medicines and products, the major competitors are Baidyanath, Vicco, Jhandu, Himani and other pharmaceutical companies. Vision statement of Dabur says that the company is “dedicated to the health and wellbeing of every household”. The objective is to “significantly accelerate profitable growth by providing comfort to others”. For achieving this objective Dabur aims to: Focus on growing core brands across categories, reaching out to new geographies, within and outside India, and improve operational efficiencies by leveraging technology. Be the preferred company to meet the health and personal grooming needs of target consumers with safe, efficacious, natural solutions by synthesizing deep knowledge of Ayurveda and herbs with modern science. Be a professionally managed employer of choice, attracting, developing and retaining quality personnel. Be responsible citizen with a commitment to environmental protection. Provide superior returns, relative to our peer group, to our shareholders. Chairman of the company Vivek C. Burman joined Dabur in 1954 after completing his graduation in Business Administration from the USA. In 1986 he was appointed as the Managing Director of Dabur and in 1998 he took over as Chairman of the Company. IIBM Institute of Business Management

Examination Paper of Managerial Economics Under Vivek Burman’s leadership, Dabur has grown and evolved as a multi-crore business house with a diverse product portfolio and a marketing network that traverses the whole of India and more than 50 countries across the world. As a strong and positive leader, Vivek C. Burman had motivated employees of Dabur to “do better than their best”—a credo that gives Dabur its status as India’s most trusted nature-based products company. Leading brands More than 300 diverse products in the FMCG, Healthcare and Ayurveda segments are in the product line of Dabur. List of products of the company include very successful brands like Vatika, Anmol, Hajmola, Dabur Amla Chyawanprash, Dabur Honey and Lal Dant Manjan with turnover of Rs.100 crores each. Strategic positioning of Dabur Honey as food product, lead to market leadership with over 40% market share in branded honey market; Dabur Chyawanprash is the largest selling Ayurvedic medicine with over 65% market share. Dabur is a leader in herbal digestives with 90% market share. Hajmola tablets are in command with 75% market share of digestive tablets category. Dabur Lal Tail tops baby massage oil market with 35% of total share. CHD (Consumer Health Division), dealing with classical Ayurvedic medicines, has more than 250 products sold through prescription as well as over the counter. Proprietary Ayurvedic medicines developed by Dabur include Nature Care Isabgol, Madhuvaani and Trifgol. However, some of the subsidiary units of Dabur have proved to be low margin business; like Dabur Finance Limited. The international units are also operating on low profit margin. The company also produces several “me – too” products. At the same time the company is very popular in the rural segment. Questions 1. What is the objective of Dabur? Is it profit maximisation of growth maximisation? (10) 2. Do you think the growth of Dabur from a small pharmacy to a large multinational company is an indicator of the advantages of joint stock company against the proprietorship form? Elaborate. (10)

0 notes

Text

Mr Pradip Burman Shares His View On Overpopulation

The birth rate is at an all-time higher in India as compared to the death rate. India is in the second position globally for the highest population and is said to step up to the first position by 2025. Also, its landmass is much smaller to accommodate a higher population. Such issues have been noticed by social leaders like Mr Pradip Burman and are making valuable efforts to eradicate overpopulation.

Mr Pradip Burman, chairman of Dabur, Nepal and a board member of Aviva Life Insurance, is a philanthropist, sworn environmentalist and a crusader of sustainability. He has been the director of his ancestral FMCG company Dabur India. He has also founded Ayurvet, a company manufacturing herbal products for animals.

According to Mr Pradip Burman, overpopulation has led to the two biggest sustainability challenges, i.e. climate change and air pollution. Due to air pollution, our children are suffering. They have asthma, lung ailments and other respiratory problems from a young age. Pollution is also the leading cause of climate change. It is happening through overpopulation because the greater the population, the higher the emission of gases.

Mr Pradip Burman further says,” Overpopulation is the most significant challenge faced by many countries today. As the global population grows towards 10 billion, consumption of water, food and energy is increasing, which results in the depletion of non-renewable resources. But these challenges can be overcome through solutions like recycling and 100% consumption of renewable energy. We have to recycle everything and consume resources that will come from renewable energy. If we can execute these two things, I think the problem will be solved”.

Being around philanthropists and environmentalists all his life, Mr Pradip Burman is determined towards protecting the environment and is currently working for various social causes. One of them is population stabilization through Project Aakar.

Advertisements

REPORT THIS AD

Project Aakar is an initiative that focuses on curbing overpopulation in India. Setting up the project in 2 districts in Uttar Pradesh, namely Barabanki and Bahraich, they educate the people in rural areas on the importance of family planning, reproduction, and the usage of contraceptives. The reason behind starting this initiative in these regions is due to its high fertility rate. They are also creating awareness among newly married and young unmarried people. There are primary health centres where they make contraceptives and distribute them to young couples. Their short film, namely ‘Dampatti No 1’, depicts the importance of family planning and has won an award for the best film towards family planning.

Project Akar is an initiative through the Mobius Foundation, a non-profit organization founded by Mr Pradip Burman that works towards environmental protection. The organization aims to protect the ecosystem by educating people about the importance of sustainable development that can also help eradicate overpopulation. They organize awareness programs that help to curb overpopulation, pollution and traditional practices that harm the environment.

Besides Project Aakar, they have also initiated two more projects, i.e. World Environmental School (WESc) and Gyan Anant Vidyalaya (GAV). These are educational institutes that help people educate about the importance of a sustainable environment and the harmful consequences of resource extinction in the future.

In today’s world, we can’t deny the significance of sustainable development. Adhering to the goals of stabilizing overpopulation is the need of the hour, and we as a country should come forward together to accomplish this mission.

0 notes

Text

Make 3 small changes in your daily life to save the environment by Pradip Burman

Pradip Burman is the chairman of Dabur, Nepal, an influential leader, sworn environmentalist and a crusader of sustainability. He has been a great observant all his life and has adapted a keen interest in protecting the environment through his NGO,

Mobius Foundation

The traditional practices are ruining the environment. Thus to protect it, Mr Pradip Burman encourages people to adopt sustainable practices in their daily lives. According to him, the top 3 small changes people should make in their daily life to save the environment are as follows:

To reduce the use of single-use plastics

According to Mr Pradip Burman, there was this ever-existing pandemic before the covid-19 outbreak. It is environmental pollution due to plastic.

Plastics are used in our everyday life for various purposes in the form of packets, carry bags, bottles, containers, covers and many more. Most of these plastics are single-use and are thrown away right after their usage. These single-use plastics travel to various water bodies and landscapes and pollute these areas. The soil loses its quality, the water is filled with garbage, and there is no place for the plants and animals to breathe. This entire process disturbs the ecosystem.

To avoid this, Mr Pradip Burman encourages people to replace single-use plastics with reusable products like cloth bags, metal containers, reusable plastic bottles, paper packets, etc. These products should be adopted in our lifestyle to make it a habit to save the environment. 2. To be more responsible towards the environment.When humanity was suffering from the

Covid-19 outbreak, the environment was healing, the species returned to their natural habitat, the water bodies were getting cleaned, and the skies were clear even through our balconies. Mr Pradip Burman guided people to reflect on these changes happening in our surroundings and the reasons behind them.

Human bodies are resistant to disease when it is fit and taken care of properly. Similarly, the environment becomes immune to climate change and other effects when not exposed to pollution. This shows that the state of the environment is directly connected with us.

The pandemic has shown this positive side to humans. Such positivity helps us fight any crisis. Imagining our relationship with nature, it is our responsibility to take necessary precautions to save the environment. 3. To have family planning.Overpopulation is one of the top concerns in the rise of climate change. Some of the cities in India don't have space to breathe due to the high population and their toxic habits. The roads are covered with vehicles emitting gases, there is no proper dumping ground, plastic waste is increasing, and thus carbon footprint is at an all-time high.

Mr Pradip Burman saw this concern and encouraged people to take preventive measures to curb overpopulation. He started the initiative 'Project Akar' to spread awareness about family planning and its various benefits to the environment. This initiative educates newly married couples and unmarried youngsters in rural areas of Uttar Pradesh about using contraceptives.

Mother nature is our first home. It has already been harmed enough by humans. To let it heal, adopt these practices by Mr Pradip Burman to save the planet from destroying completely.

0 notes

Text

Pradip Burman - The Man Behind Gyan Burman Liver Unit

Pradip Burman reflects the success achieved by Dabur Nepal Pvt. Ltd., which is the subsidiary of Dabur India Ltd. Apart from being the Chairman of the former; he is also the grandson of the founder of Dabur, Dr. S. K. Burman.

He is associated with charity and social works that are targeted to help the people get over the adversities of life. Recently, the Gyan Burman Liver Unit, which is led by him, launched the 3rd edition of the Gyan Burman Liver Unit Report after the 15 years research.

In conjugation with Dr. Samiran Nundy, the leading gastrointestinal surgeon, Pradip Burman released the report on the Biliary and liver science.

Pradip Burman started the journey of the GBLU or Gyan Burman Liver Unit on 2003 as a tribute to the memory of Gyan Burman. The target of this foundation was to offer selfless service to the society that will help it recover the complex ailments. He also stated that the research report that was created after an intense research for 15 years will produce remarkable changes in the society by treating the hepatobiliary ailments. Also, it will boost the motivation to transplant liver in the common man. Dr. Samiran Nundy has expressed his gratitude to Mr. Pradip Burman and his family. He stated that since the family allowed him to explore the niche of the liver ailments, he could excel in the genre. He expects the research to help people in a great way.

In fact, in 2003, GBLU conducted a conference, which consisted of 50 doctors across the nation who discussed the current status of liver transplantation in the country and the scopes for improvement. Since the awareness program, India has witnessed none less than 73 centers that are dedicated to the liver transplant. In 2017, 1600 successful liver transplants were accomplished.

0 notes

Text

Dabur celebrates 25 years in Nepal

Dabur celebrates 25 years in Nepal

KATHMANDU: Dabur Nepal Pvt Ltd, a leading ayurveda and natural healthcare company, has celebrated its 25 years in Nepal amid a programme here on Monday. The programme was attended by Prime Minister Sher Bahadur Deuba, Indian Ambassador to Nepal Manjeev Singh Puri, Chairman of Dabur India Ltd Anand Burman, CEO of Dabur India Ltd Sunil Duggal and Managing Director of Dabur Nepal Pvt Ltd Rukma…

View On WordPress

0 notes

Text

Development of Ayurvet Adarsh-Gram Chidana by Pradip Burman

In collaboration with Mobius Foundation, solar street lights were installed in Chidana, a village adopted by Pradip Burman, at the Lord Shiva Gaushala, Shahpur near the biogas plant facility of SATHI.

About Pradip Burman

Graduated in B.Sc Mechanical Engineering from MIT in Boston, USA. Pradip Burman went on to work as the Director of Dabur, Kolkata. He now operates as the Chairman of Dabur Nepal Pvt Limited.

Organisations lead by him:

Mobius Foundation

AGES (Alternative Green Energy Solutions)

SUNDESH (Sustainable Development Society)

Ayurvet Limited

Sanat Products

World Environment School

ICSE (International Conference of Sustainability Education)

Project: Installation of solar street lights by Pradip Burman near the biogas plant facility of SATHI

1 note

·

View note

Text

The Role of Pradip Burman in Tackling Environmental Issues

Mr Pradip Burman, chairman of Dabur, Nepal, is a noteworthy leader, a sworn environmentalist and a devotee of sustainability. He has been the director of his ancestral company Dabur India and founded Ayurvet, selling herbal products for animals. Looking up to social leaders and philanthropists all his childhood, he has imbibed an enthusiasm for environmental conservation. As he grows up, he lends his hand towards various social causes.

A mechanical engineer from the Massachusetts Institute of Technology, USA, Pradip Burman has been majorly curious about social work since his college days. He developed a sonic aid that benefits visually challenged people and locates the hindrances utilizing ultrasonic wave signals from the sonic machine.

Being the head of Dabur has stimulated him to select natural ingredients, i.e. Ayurveda medicine, to cure health issues like arthritis. He also focuses on the CSR activities of Dabur. He started a sustainable development community SUNDESH, where he worked for 25 years in villages to improve the life of the residents sustainably.

In one of his interviews, he says he has committed the rest of his life to preserve mother nature in all ways possible. In 2015, he launched a non-government organization called Mobius Foundation, which focuses exclusively on protecting the environment through awareness campaigns. These campaigns educate citizens to adopt sustainable methods in daily life.

Mobius Foundation focuses on improving the technique of “reduce, reuse, and recycle” that will help in zero waste management. Other focus areas include developing education, renewable energy, curbing pollution and population stabilization. There are also three main initiatives by Mobius Foundation:

World Environment School (WESc): WESc is a green school constructed according to the sustainability guidelines and spreads across 100 acres of hills in Coorg. It’s a primary school where the students are taught about practical experience in sustainability development.

Project Akar: Overpopulation affects sustainable guidelines and every other factor of environment preservation. Therefore, Project Akar aims to decrease the rate of births by educating about family planning and the benefits of using contraceptives.

Gyan Anant Vidyalay (GAV): GAV is a school introduced in backward rural areas and villages of India to educate youth about sustainable development and how to reduce the consequences of resource extinction in the future.

Environment protection through sustainability is not a one-person show. As citizens, we should come ahead and fruitfully lend our hands towards it. According to Mr Pradip Burman., “We are at war to save this planet, and we have lost a battle. We must win this war by acting in unison for the survival of future generations.”

0 notes

Text

Sustainability Development - The talk with Pradip Burman

Sustainability development is conserving natural resources in the present to fulfil people’s needs without compromising the needs of future generations. It is crucial to protect our planet and win battles against overpopulation, climate change, pollution, global warming, etc. Pandemic has been a major obstacle to sustainable development goals. However, leaders like Pradip Burman are making valuable efforts to curb such issues.

Mr Pradip Burman, chairman of Dabur, Nepal and a board member of Aviva Life Insurance, is an influential leader, sworn environmentalist and a crusader of sustainability. He has been the director of FMCG major Dabur India, his ancestral company, and founded Ayurvet, producing herbal products for animals. Being around social leaders and philanthropists all his life, he has imbibed a keen interest in environmental protection and is currently working for various social causes.

According to Mr Pradip Burman, climate change and air pollution are the most significant sustainability challenges today. Due to rising levels of air pollution, the children are suffering from diseases like asthma and other lung ailments. Air pollution is also the main reason behind global warming and climate change. It is, however, linked to population because the more the population, the greater will be the amount of gases. It is a step-down effect that carries on and on.

The population is at an all-time high, and due to advancement in the medical field, the life expectancy rate has improved. In a way, it’s good news, but it does put pressure on the planet. Stating which he provides two solutions to this problem, i.e. recycling and using renewable energy. He says, “We have to recycle everything, and we have to use 100% resources that come from renewable energy.”

He explains that if we continue to live like this, the next generation will not survive. Today people are lacking clean drinking water and are breathless due to highly polluted air. Plus, the energy consumed is from non-renewable sources, and there are no proper waste management techniques. Soon there will be no energy to use, and a pyre of waste will be gathered around us. The only solution to such problems is adopting sustainable practices in our lifestyle.

In 2015, 119 countries came together to sign The Paris Agreement, a legally binding international treaty to address climate change and its impacts. Each country has been given a sustainable development goal in which India has been given a target of 227 gigawatts of renewable energy. It was divided into solar energy, wind energy, and biomass energy. According to Mr Pradip Burman, India is well on its way to reaching that target.

He further says that he has dedicated the rest of his life to revive the planet in all the ways he could. So in 2015, he founded Mobius Foundation, Best NGO in Delhi, focus solely on conserving the ecosystem through spreading awareness about adopting sustainable practices. The 3 main initiatives by Mobius Foundation are:

Project Akar: Overpopulation impacts practically sustainability and every other aspect of the planet. Therefore it works for stabilising the population through spreading awareness about family planning and the advantages of using contraceptives.

2. World Environment School (WESc): Spread over 100 acres of hills in Coorg, WESc is a green school built upon sustainability guidelines. Here, students will gain practical experience in sustainability issues.

3. Gyan Anant Vidyalay (GAV): It is a school set up in backward rural areas of India to bring awareness about the sustainable environment and the consequences of resource extinction in the next generation.

Sustainable development is not a one-man show, but we as a nation should come forward and successfully implement it. Explaining this, Mr Pradip Burman says, “We are at war to save this planet, and we have lost a battle. We must win this war by acting in unison for the survival of future generations.”

0 notes

Text

Mr Pradip Burman Shares His View On Overpopulation

The birth rate is at an all-time higher in India as compared to the death rate. India is in the second position globally for the highest population and is said to step up to the first position by 2025. Also, its landmass is much smaller to accommodate a higher population. Such issues have been noticed by social leaders like Mr Pradip Burman and are making valuable efforts to eradicate overpopulation.

Mr Pradip Burman, chairman of Dabur, Nepal and a board member of Aviva Life Insurance, is a philanthropist, sworn environmentalist and a crusader of sustainability. He has been the director of his ancestral FMCG company Dabur India. He has also founded Ayurvet, a company manufacturing herbal products for animals.

According to Mr Pradip Burman, overpopulation has led to the two biggest sustainability challenges, i.e. climate change and air pollution. Due to air pollution, our children are suffering. They have asthma, lung ailments and other respiratory problems from a young age. Pollution is also the leading cause of climate change. It is happening through overpopulation because the greater the population, the higher the emission of gases.

Mr Pradip Burman further says,” Overpopulation is the most significant challenge faced by many countries today. As the global population grows towards 10 billion, consumption of water, food and energy is increasing, which results in the depletion of non-renewable resources. But these challenges can be overcome through solutions like recycling and 100% consumption of renewable energy. We have to recycle everything and consume resources that will come from renewable energy. If we can execute these two things, I think the problem will be solved”.

Being around philanthropists and environmentalists all his life, Mr Pradip Burman is determined towards protecting the environment and is currently working for various social causes. One of them is population stabilization through Project Aakar.

Project Aakar is an initiative that focuses on curbing overpopulation in India. Setting up the project in 2 districts in Uttar Pradesh, namely Barabanki and Bahraich, they educate the people in rural areas on the importance of family planning, reproduction, and the usage of contraceptives. The reason behind starting this initiative in these regions is due to its high fertility rate. They are also creating awareness among newly married and young unmarried people. There are primary health centres where they make contraceptives and distribute them to young couples. Their short film, namely ‘Dampatti No 1’, depicts the importance of family planning and has won an award for the best film towards family planning.

Project Akar is an initiative through the Mobius Foundation, a non-profit organization founded by Mr Pradip Burman that works towards environmental protection. The organization aims to protect the ecosystem by educating people about the importance of sustainable development that can also help eradicate overpopulation. They organize awareness programs that help to curb overpopulation, pollution and traditional practices that harm the environment.

Besides Project Aakar, they have also initiated two more projects, i.e. World Environmental School (WESc) and Gyan Anant Vidyalaya (GAV). These are educational institutes that help people educate about the importance of a sustainable environment and the harmful consequences of resource extinction in the future.

In today’s world, we can’t deny the significance of sustainable development. Adhering to the goals of stabilizing overpopulation is the need of the hour, and we as a country should come forward together to accomplish this mission.

0 notes

Video

youtube

IIBMS ongoing exam answer sheets provided. Whatsapp 91 9924764558

MANAGERIAL ECONOMICS IIBMS ONGOING EXAM ANSWER SHEETS PROVIDED WHATSAPP 91 9924764558

CONTACT:

DR. PRASANTH BE MBA PH.D. MOBILE / WHATSAPP: +91 9924764558 OR +91 9447965521 EMAIL: [email protected] WEBSITE: www.casestudyandprojectreports.com

Mangerial Economics

Marks - 100

Attempt Any Four Case Study

CASE – 1 Dabur India Limited: Growing Big and Global

Dabur is among the top five FMCG companies in India and is positioned successfully on the specialist herbal platform. Dabur has proven its expertise in the fields of health care, personal care, homecare and foods.

The company was founded by Dr. S. K. Burman in 1884 as small pharmacy in Calcutta (now Kolkata), India. And is now led by his great grandson Vivek C. Burman, who is the Chairman of Dabur India Limited and the senior most representative of the Burman family in the company. The company headquarters are in Ghaziabad, India, near the Indian capital New Delhi, where it is registered. The company has over 12 manufacturing units in India and abroad. The international facilities are located in Nepal, Dubai, Bangladesh, Egypt and Nigeria.

S.K. Burman, the founder of Dabur, was trained as a physician. His mission was to provide effective and affordable cure for ordinary people in far-flung villages. Soon, he started preparing natural remedies based on Ayurved for diseases such as Cholera, Plague and Malaria. Due to his cheap and effective remedies, he became to be known as ‘Daktar’ (Indianised version of ‘doctor’). And that is how his venture Dabur got its name—derived from Daktar Burman.

The company faces stiff competition from many multi national and domestic companies. In the Branded and Packaged Food and Beverages segment major companies that are active include Hindustan Lever, Nestle, Cadbury and Dabur. In case of Ayurvedic medicines and products, the major competitors are Baidyanath, Vicco, Jhandu, Himani and other pharmaceutical companies.

Vision, Mission and Objectives

Vision statement of Dabur says that the company is “dedicated to the health and well being of every household”. The objective is to “significantly accelerate profitable growth by providing comfort to others”. For achieving this objective Dabur aims to:

Focus on growing core brands across categories, reaching out to new geographies, within and outside India, and improve operational efficiencies by leveraging technology.

Be the preferred company to meet the health and personal grooming needs of target consumers with safe, efficacious, natural solutions by synthesising deep knowledge of ayurveda and herbs with modern science.

Be a professionally managed employer of choice, attracting, developing and retaining quality personnel.

Be responsible citizens with a commitment to environmental protection.

Provide superior returns, relative to our peer group, to our shareholders.

Chairman of the company

Vivek C. Burman joined Dabur in 1954 after completing his graduation in Business Administration from the USA. In 1986 he was appointed Managing Director of Dabur and in 1998 he took over as Chairman of the Company.

Under Vivek Burman’s leadership, Dabur has grown and evolved as a multi-crore business house with a diverse product portfolio and a marketing network that traverses the whole of India and more than 50 countries across the world. As a strong and positive leader, Vivek C. Burman has motivated employees of Dabur to “do better than their best”—a credo that gives Dabur its status as India’s most trusted nature-based products company.

Leading brands

More than 300 diverse products in the FMCG, Healthcare and Ayurveda segments are in the product line of Dabur. List of products of the company include very successful brands like Vatika, Anmol, Hajmola, Dabur Amla Chyawanprash, Dabur Honey and Lal Dant Manjan with turnover of Rs.100 crores each.

Strategic positioning of Dabur Honey as food product, lead to market leadership with over 40% market share in branded honey market; Dabur Chyawanprash is the largest selling Ayurvedic medicine with over 65% market share. Dabur is a leader in herbal digestives with 90% market share. Hajmola tablets are in command with 75% market share of digestive tablets category. Dabur Lal Tail tops baby massage oil market with 35% of total share.

CHD (Consumer Health Division), dealing with classical Ayurvedic medicines has more than 250 products sold through prescription as well as over the counter. Proprietary Ayurvedic medicines developed by Dabur include Nature Care Isabgol, Madhuvaani and Trifgol.

However, some of the subsidiary units of Dabur have proved to be low margin business; like Dabur Finance Limited. The international units are also operating on low profit margin. The company also produces several “me – too” products. At the same time the company is very popular in the rural segment.

Questions

What is the objective of Dabur? Is it profit maximisation or growth maximisation? Discuss.

Do you think the growth of Dabur from a small pharmacy to a large multinational company is an indicator of the advantages of joint stock company against proprietorship form? Elaborate.

CASE – 2 IT Industry: Checkered Growth

IT industry is now considered as vital for the development of any economy. Developing countries value the importance of this industry due to its capacity to provide much needed export earnings and support in the development of other industries. Especially in Indian context, this industry has assumed a significant position in the overall economy, due to its exemplary potentials in creating high value jobs, enhancing business efficiency and earning export revenues. The IT revolution has brought unexpected opportunities for India, which is emerging as an increasingly preferred location for customised software development. Experts are estimating the global IT industry to grow to US$1.6 million over the coming six years and exports to reach Rs. 2000 billion by 2008. It is envisaged that Indian IT industry, though a very small portion of the global IT pie, has tremendous growth prospects.

Stock Taking

The decade of 1970 may be taken as the stage of introduction of the Indian IT industry. The early years were marked by 75 per cent of software development taking place overseas and the rest 25 per cent in India. Exports of Indian software until the mid-1970s was mainly Eastern Europe, followed by US. Tata Consultancy Services (TCS) was among the pioneers in selling its services outside India, by working for IBM Labs in the US. The hardware segment lagged behind its software counterpart. With instances of exports worth US$ 4 million in 1980, the software segment of the industry has shown an uneven profile. It was not until 1980s that vigorous and sustained growth in software exports begun, as MNCs like Texas Instruments started to take serious interest in India as a centre of software production. Destinations of export also underwent changes, with US dominating the main export market with 75 per cent of the exports. The IT Enabled Services (ITeS) segment, however, had not emerged at this stage.

It was also during the mid to late 1980s that computer firms shifted focus from mainframe computers (the mainstay of MNCs) to Personal Computers (PCs). In March 1985, Minicomp installed the first ever PC at CSI, Delhi; this changed the entire industry for good. With the entry of networking and applications like CAD/CAM, PC sales soared in 1987-88, touching 50,000 units.

From a modest growth in the mid-1980s software exports moved up to Rs. 3.8 billion in 1991-92. Since then, it grew at an incredible rate, up to 115 per cent in 1993. The hardware could also register an annual growth of 40 per cent in this period, backed by a surging demand for PCs and networking. Growth of the industry was also driven by the emergence and rapid growth of the ITeS segment.

IT sector’s share of GDP rose steadily in this period, rate of increase being the highest at 44.91 per cent in 2000-01. It was in the same year that the size of the total IT market was the biggest in the decade, at Rs. 56,592 crore. The overall IT market was also found to increase till 2000-01. The overall IT market was also found to increase till 2000-01, with the only exception of 1998-99. The domestic market also showed an overall increase till 2000-01, registering a spectacular CAGR of 50.39 per cent. Aggregate output of software and services also increased in this period, though at an uneven rate. Of approximately $1 billion worth of sales in 1991-1992, domestic hardware sales constituted 37.2 per cent (13.4 per cent growth over the previous year), exports of hardware 6.6 per cent.

During 2000-01 the growth in the hardware segment was driven mainly by PCs, which contributed about 58 per cent of the total hardware market. This period also witnessed the phenomenon of increasing share of Tier 2 and cities in PC sales, thereby indicating PC penetration into the hinterland. PC shipments had increased by 35 per cent every year from 1997 till 2000-01 when it reached 1.8 million PCs. The commercial PC market saw a growth of 23.5 per cent mainly due to slashing of prices by major vendors.

It was in 2001-02 that the industry had a sharp fall in rate of growth of its share of GDP to 5.90 per cent, from 44.91 per cent in the previous year. The total IT market also showed a fall in growth rate from 56.42 per cent in 2000-01 to a mere 16.24 per cent in the next year, growing further at the rate of 16.25 per cent in the next year. Software export was also affected, registering a low growth of 28.74 per cent and failed to maintain its growth rate of 65.30 per cent in the previous year. It got further lowered to 26.30 per cent in 2002-03. CAGR of total output of software and services (in Rs. crore) came down to 25.61 in 2001-02 and further to 25.11 in 2002-03. The domestic market showed a steep decline in growth to 3 per cent in 2001-02 from an outstanding 50.39 per cent in 2000-01. It could, however, recover by growing at 4.11 per cent in the next year.

Table 1: Indian IT Industry: 1996-97 to 2002-03

Year

A*

B*

C*

D*

E*

1996-97

1997-98

1998-99

1999-00

2000-01

2001-02

2002-03

1.22

1.45

1.87

2.71

2.87

3.09

18,641

25,307

36,179

56,592

65,788

76,482

3,900

6,530

10,940

17,150

28,350

36,500

46,100

6,594

10,899

16,879

23,980

37,350

47,532

59,472

9,438

12,055

14,227

18,837

28,330

29,181

30,382

*A: share of GDP of the Indian IT market, B: size of the Indian IT market (in Rs. crore), C: software and services exports (in Rs. crore), D: size of software and services (in Rs. crore), E: size of the domestic market (in Rs. crore)

Questions

1. Try to identify various stages of growth of IT industry on basis of information given in the case and present a scenario for the future.

2. Study the table given. Apply trend projection method on the figures and comment on the trend.

3. Compute a 3 year moving average forecast for the years 1997-98 through 2003-04.

CASE – 3 Outsourcing to India: Way to Fast Track

By almost any measure, David Galbenski’s company Contract Counsel was a success. It was a company Galbenski and a law school buddy, Mark Adams, started in 1993; it helps companies find lawyers on a temporary contract basis. The growth over the past five years had been furious. Revenue went from less than $200,000 to some $6.5 million at the end of 2003, and the company was placing thousands of lawyers a year.

At then the revenue growth began to flatten; the company grew just 8% in 2004 despite a robust market for legal services estimated at about $250 billion in the United States alone. Frustrated and concerned, Galbenski stepped back and began taking a hard look at his business. Could he get it back on the fast track? “Most business books say that the hardest threshold to cross is that $10 million sales mark,” he says. “I knew we couldn’t afford to grow only 10% a year. We needed to blow right through that number.”

For that to happen, Galbenski knew he had to expand his customer base beyond the Midwest into large legal supermarkets such as Boston, New York, and Washington, D.C. He also knew that in doing so, he could run into stiff competition from larger publicly traded rivals. Contract Counsel’s edge has always been its low price, Clients called when dealing with large-scale litigation or complicated merger and acquisition deals, either of which can require as many as 100 lawyers to manage the discovery process and the piles of documents associated with it. Contract Counsel’s temps cost about $75 an hour, roughly half of what a law firm would charge, which allowed the company to be competitive despite its relatively small size. Galbenski was counting on using the same strategy as he expanded into new cities. But would that be enough to spur the hyper growth that he craved for?

At that time, Galbenski had been reading quite a bit about the growing use of offshore employees. He knew companies like General Electric, Microsoft and Cisco were saving bundles by setting up call and data centers in India. Could law firms offshore their work? Galbenski’s mind raced with possibilities. He imagined tapping into an army of discount-priced legal minds that would mesh with his existing talent pool in the U.S. The two work forces could collaborate over the Web and be productive on a 24-7 basis. And the cost could be massive.

Using offshore workers was a risk, but the payoff was potentially huge. Incidentally Galbenski and his eight-person management team were preparing to meet for their semiannual review meeting. The purpose of the two-day event was to decide the company’s goals for the coming year. Driving to the meeting, Galbenski struggled to figure out exactly what he was going to say. He was still undecided about whether to pursue an incremental and conservative national expansion or take a big gamble on overseas contractors.

The Decision

The next morning Galbenski kicked off the management meeting. Galbenski laid out the facts as he saw them. Rather than look at just the next five years of growth, look at the next 20, he said. He cited a Forrester Research prediction that some 79,000 legal jobs, totaling $5.8 billion in wages, would be sent offshore by 2015. He challenged his team to be pioneers in creating a new industry, rather than stragglers racing to catch up. His team applauded. Returning to the office after the meeting, Galbenski announced the change in strategy to his 20 full-timers.

Then he and his team began plotting a global action plan. The first step was to hire a company out of Indianapolis, Analysts International, to start compiling a list of the best legal services providers in countries where people had comparatively strong English skills. The next phase was vetting the companies in person. In February 2005, just three months after the meeting in Port Huron, Galbenski found himself jetting off on a three months trip to scout potential contractors in India, Dubai, and Sri Lanka. Traveling to cities like Bangalore, Chennai and Hyderabad, he interviewed executives from more than a dozen companies, investigating their day-to-day operations firsthand.

India seemed like the best bet. With more than 500 law schools and about 200,000 law students graduating each year, it had no shortage or attorneys. What amazed Galbenski, however, was that thanks to the Web, lawyers in India had access to the same research tools and case summaries as any associate in the U.S. Sure, they didn’t speak American English. “But they were highly motivated, highly intelligent, and extremely process-oriented,” he says. “They were also eager to tackle the kinds of tasks that most new associated at law firms look down upon” such as poring over and coding thousands of documents in advance of a trial. In other words, they were perfect for the kind of document-review work he had in mind.

After a return visit to India in August 2005, Galbenski signed a contract with two legal services companies: QuisLex, in Hyderabad, and Manthan Services in Bangalore. Using their lawyers and paralegals, Galbenski figured he could cut his document-review rates to $50 an hour. He also outsourced the maintenance of the database used to store the contact information for his thousands of contractors. In all, he spent about 12 months and $250,000 readying his newly global company. Convincing U.S. based clients to take a chance on the new service hasn’t been easy. In November, Galbenski lined up pilot programs with four clients (none of which are ready to publicise their use of offshore resources). To help get the word out, he launched a website (offshore-legal-services.com), which includes a cache of white papers and case studies to serve as a resource guide for companies interested in outsourcing.

Questions

1. As money costs will decrease due to decision to outsource human resource, some real costs and opportunity costs may surface. What could these be?

2. Elaborate the external and internal economies of scale as occurring to Contract Counsel.

3. Can you see some possibility of economies of scope from the information given in the case? Discuss.

CASE – 4 Indian Stock Market: Does it Explain Perfect Competition?

The stock market is one of the most important sources for corporates to raise capital. A stock exchange provides a market place, whether real or virtual, to facilitate the exchange of securities between buyers and sellers. It provides a real time trading information on the listed securities, facilitating price discovery.

Participants in the stock market range from small individual investors to large traders, who can be based anywhere in the world. Their orders usually end up with a professional at a stock exchange, who executes the order. Some exchanges are physical locations where transactions are carried out on a trading floor. The other type of exchange is of a virtual kind, composed of a network of computers and trades are made electronically via traders.

By design a stock exchange resembles perfect competition. Large number of rational profit maximisers actively competing with each other, trying to predict future market value of individual securities comprises the main feature of any stock market. Important current information is almost freely available to all participants. Price of individual security is determined by market forces and reflects the effect of events that have already occurred and are expected to occur. In the short run it is not easy for a market player to either exit or enter; one cannot exit and enter for few days in those stocks which are under no delivery. For example Tata Steel was in no delivery from 29/10/07 to 02/11/07. Similarly one cannot enter or exit on those stocks which are in upper or lower circuit for few regular trading sessions. Therefore a player has to depend wholly on market price for its profit maximizing output (in this case stock of securities). In the long run players may exit the market if they are not able to earn profit, but at the same time new investors are attracted by rise in market price.

As on 01/11/07 total market capital at Bombay Stock Exchange (BSE) is $1589.43 billion (source: Business Standard, 1/11/2007); out of this individual investors account for only $100bn. In spite of the fact that individual investors exist in a very large number, their capital base is less than 7% of total market capital; rest of capital is owned by foreign institutional investor and domestic institutional investors (FIIs and DIIs), which are very small in number. Average capital owned by a single large player is huge in comparison to small investor. This situation seems to have prompted Dr Dash of BSE to comment ‘The stock market activity is increasingly becoming more centralised, concentrated and non competitive, serving interest of big players only.” Table 2 shows the impact of change in FII on National Stock Exchange movement during three different time periods.

Table 2: Impact of FIIs’ Investment on NSE

Wave

Date

Nifty

close

Change in Nifty Index

FLLS Net Investment

(Rs.Cr.)

Change in Market Capitalisation

(Rs.Cr.)

Wave 1

From

To

17/05/04

26/10/05

1388.75

2408.50

1019.75

59520

5,40,391

Wave 2

From

To

27/10/05

11/05/06

2352.90

3701.05

1348.15

38258

6,20,248

Wave 3

From

To

12/05/06

13/06/06

3650.05

2663.30

-986.75

-9709

-4,60,149

By design, an Indian Stock Market resembles perfect competition, not as a complete description (for no markets may satisfy all requirements of the model) but as an approximation.

Questions

Is stock market a good example of perfect competition? Discuss.

Identify the characteristics of perfect competition in the stock market setting.

Can you find some basic aspect of perfect competition which is essentially absent in stock market?

CASE – 5 The Indian Audio Market

The Indian audio market pyramid is featured by the traditional radios forming its lower bulk. Besides this, there are four other distinct segments: mono recorders (ranking second in the pyramid), stereo recorders, midi systems (which offer the sound amplification of a big system, but at a far lower price and expected to grow at 25% per year) and hi-fis (minis and micros, slotted at the top end of the market).

Today the Indian audio market is abound with energy and action as both national and international majors are trying to excel themselves and elbow the others, ushering in new concepts, like CD sound, digital tuners, full logic tape deck, etc. The main players in the Indian audio market are Philips, BPL and Videocon. Of these, Philips is one of the oldest and is considered at the leading national brands. In fact it was the first company to introduce a range of international products such as CD radio cassette recorder, stand alone CD players and CD mini hi-fi systems. With the easing of the entry barriers, a number of new international players like Panasonic, Akai, Sansui, Sony, Sharp, Goldstar, Samsung and Aiwa have also entered the arena. This has led to a sea of changes in the industry and resulted in an expanded market and a happier customer, who has access to the latest international products at competitive prices. The rise in the disposable income of the average Indian, especially the upper-income section, has opened up new vistas for premium products and has provided a boost to companies to launch audio systems priced as high as Rs. 50,000 and beyond.

Pricing across Segments

Super Premium Segment: This segment of the market is largely price-insensitive, as consumers are willing to pay a premium in order to obtain products of high quality. Sonodyne has positioned itself in this segment by concentrating on products that are too small for large players to operate in profitably. It has launched a range of systems priced between Rs. 30,000 to Rs. 60,000. National Panasonic has launched its super premium range of systems by the name of Technics.

Premium Segment: Much of the price game is taking place in this segment, in which systems are priced around Rs. 25,000. Even the foreign players ensure that the pricing is competitive. Entry barriers of yester years compelled the demand by this segment to be partially met by the grey market. With the opening up of the market, the premium segment is witnessing a rapid growth and is currently estimated to be worth Rs. 30 crores. Growth of this segment is also being driven by consumers who want to upgrade their old music systems. Another major stimulating factor is the plethora of financing options available, bringing more and more consumers to the market.

Philips has understood the Indian listener well enough to dictate the basic principles of segmentation. It projects its products as high quality at medium price. In fact, Philips had successfully spotted an opportunity in the wide price gap between portable cassette players and hi-fi systems and pioneered the concept of a midi system (a three-in-one containing radio, tape deck and amplifier in one unit). Philips has also realised that there is a section of the rich consumer which values not just power but also clarity and is willing to pay for it. The pricing strategy of Philips was to make the most of its image as a technology leader. To this end, it used non-price variables by launching of a range of state of art machines like the FW series, and CD players. Moreover, it came up with the punch line in its advertisements as, “We Invent For You”.

BPL stands second only to Philips in the audio market and focuses on technology as its USP. Its kingpin in the marketing mix is its high technology superior quality product. It is thus at being the product-quality leader. BPL’s proposition of fidelity is translated in its punchline for its audio systems as, ‘e-fi your imagination’ (d-fi stands for digital fidelity). The company follows a market skimming strategy. When a new product was launched, it was placed in the top end of the market, and priced accordingly. The company offers a range of products in all price segments in the market without discounting the brand.

Another major player, Videocon, has managed to price its products lower even in the premium segment. The success of the Powerhouse (a 160 watt midi launched by Philips in 1990) had prompted Videocon to launch the Select Sound range of midi stereo systems at a slightly lower price. At the premium end, Videocon is making efforts to upgrade its image to being “quality-driven” by associating itself with the internationally reputed brand name of Sansui from Japan, and following a perceived value pricing method.

Sony is another brand which is positioning itself as a premium product and charges a higher price for the superior quality of sound it offers. Unlike indulging into price wars, Sony’s ad-campaigns project the message that nothing can beat Sony in the quality and intensity of sound. National Panasonic is another player that has three products in the top end of the market, priced in the Rs. 21,000 to Rs. 32,000 range.

Monos and Stereos: Videocon has 21% share I the overall audio market, but has been a major player only in personal stereos and two-in-ones. Its history is written with instances where it has offered products of similar quality, but at much lower prices than its competitors. In fact, Videocon launched the Sansui brand of products with a view to transform its image from that of being a manufacturer of cheap products to that of being a company that primes quality, and also to obtain a share of the hi-fi segment. Sansui is being positioned as a premium brand, targeting the higher middle, upper income groups and also the sensitive middle class Indian consumer.

The objective of Philips in this segment is to achieve higher sales volumes and hence its strategy is to expand its range and have a product in every segment of the market. The pricing method used by Philips in this segment is providing value for money.

National Panasonic offers products in the lower end of the market, apart from the top of the range. In fact, it reduced the price of one of its small two-in-ones from Rs. 3,500 to Rs. 2,400, with the logic that a forte in the lower end of the market would help in building brand reliability across a wider customer base. The company is also guided by the logic that operating in the price sensitive region of the market will help it reach optimum levels of efficiency. Panasonic has also entered the market for midis.

These apart, there also exists a sector in the Indian audio industry, with powerful regional brands in mono and stereo segments, having a market share of 59% in mono recorders and 36% in stereo recorders. This sector has a strong influence on price performance.

Questions

What major pricing strategies have been discussed in the case? How effective these strategies have been in ensuring success of the company?

Is perceived value pricing the dominant strategy of major players?

Which products have reached maturity stage in audio industry? Do you think that product bundling can be effectively used for promoting sale of these products?

Attempt Any Four Case Study

Case 1: Zip Zap Zoom Car Company

Zip Zap Zoom Company Ltd is into manufacturing cars in the small car (800 cc) segment. It was set up 15 years back and since its establishment it has seen a phenomenal growth in both its market and profitability. Its financial statements are shown in Exhibits 1 and 2 respectively.

The company enjoys the confidence of its shareholders who have been rewarded with growing dividends year after year. Last year, the company had announced 20 per cent dividend, which was the highest in the automobile sector. The company has never defaulted on its loan payments and enjoys a favorable face with its lenders, which include financial institutions, commercial banks and debenture holders.

The competition in the car industry has increased in the past few years and the company foresees further intensification of competition with the entry of several foreign car manufactures many of them being market leaders in their respective countries. The small car segment especially, will witness entry of foreign majors in the near future, with latest technology being offered to the Indian customer. The Zip Zap Zoom’s senior management realizes the need for large scale investment in up gradation of technology and improvement of manufacturing facilities to pre-empt competition.

Whereas on the one hand, the competition in the car industry has been intensifying, on the other hand, there has been a slowdown in the Indian economy, which has not only reduced the demand for cars, but has also led to adoption of price cutting strategies by various car manufactures. The industry indicators predict that the economy is gradually slipping into recession.

Exhibit 1 Balance sheet as at March 31,200 x

(Amount in Rs. Crore)

Source of Funds

Share capital 350

Reserves and surplus 250 600

Loans :

Debentures (@ 14%) 50

Institutional borrowing (@ 10%) 100

Commercial loans (@ 12%) 250

Total debt 400

Current liabilities 200

1,200

Application of Funds

Fixed Assets

Gross block 1,000

Less : Depreciation 250

Net block 750

Capital WIP 190

Total Fixed Assets 940

Current assets :

Inventory 200

Sundry debtors 40

Cash and bank balance 10

Other current assets 10

Total current assets 260

-1200

Exhibit 2 Profit and Loss Account for the year ended March 31, 200x

(Amount in Rs. Crore)

Sales revenue (80,000 units x Rs. 2,50,000) 2,000.0

Operating expenditure :

Variable cost :

Raw material and manufacturing expenses 1,300.0

Variable overheads 100.0

Total 1,400.0

Fixed cost :

R & D 20.0

Marketing and advertising 25.0

Depreciation 250.0

Personnel 70.0

Total 365.0

Total operating expenditure 1,765.0

Operating profits (EBIT) 235.0

Financial expense :

Interest on debentures 7.7

Interest on institutional borrowings 11.0

Interest on commercial loan 33.0 51.7

Earnings before tax (EBT) 183.3

Tax (@ 35%) 64.2

Earnings after tax (EAT) 119.1

Dividends 70.0

Debt redemption (sinking fund obligation)** 40.0

Contribution to reserves and surplus 9.1

* Includes the cost of inventory and work in process (W.P) which is dependent on demand (sales).

** The loans have to be retired in the next ten years and the firm redeems Rs. 40 crore every year.

The company is faced with the problem of deciding how much to invest in up

gradation of its plans and technology. Capital investment up to a maximum of Rs. 100

crore is required. The problem areas are three-fold.

The company cannot forgo the capital investment as that could lead to reduction in its market share as technological competence in this industry is a must and customers would shift to manufactures providing latest in car technology.

The company does not want to issue new equity shares and its retained earning are not enough for such a large investment. Thus, the only option is raising debt.

The company wants to limit its additional debt to a level that it can service without taking undue risks. With the looming recession and uncertain market conditions, the company perceives that additional fixed obligations could become a cause of financial distress, and thus, wants to determine its additional debt capacity to meet the investment requirements.

Mr. Shortsighted, the company’s Finance Manager, is given the task of determining the additional debt that the firm can raise. He thinks that the firm can raise Rs. 100 crore worth debt and service it even in years of recession. The company can raise debt at 15 per cent from a financial institution. While working out the debt capacity. Mr. Shortsighted takes the following assumptions for the recession years.

A maximum of 10 percent reduction in sales volume will take place.

A maximum of 6 percent reduction in sales price of cars will take place.

Mr. Shorsighted prepares a projected income statement which is representative of the recession years. While doing so, he determines what he thinks are the “irreducible minimum” expenditures under

recessionary conditions. For him, risk of insolvency is the main concern while designing the capital structure. To support his view, he presents the income statement as shown in Exhibit 3.

Exhibit 3 projected Profit and Loss account

(Amount in Rs. Crore)

Sales revenue (72,000 units x Rs. 2,35,000) 1,692.0

Operating expenditure

Variable cost :

Raw material and manufacturing expenses 1,170.0

Variable overheads 90.0

Total 1,260.0

Fixed cost :

R & D ---

Marketing and advertising 15.0

Depreciation 187.5

Personnel 70.0

Total 272.5

Total operating expenditure 1,532.5

EBIT 159.5

Financial expenses :

Interest on existing Debentures 7.0

Interest on existing institutional borrowings 10.0

Interest on commercial loan 30.0

Interest on additional debt 15.0 62.0

EBT 97.5

Tax (@ 35%) 34.1

EAT 63.4

Dividends --

Debt redemption (sinking fund obligation) 50.0*

Contribution to reserves and surplus 13.4

* Rs. 40 crore (existing debt) + Rs. 10 crore (additional debt)

Assumptions of Mr. Shorsighted

R & D expenditure can be done away with till the economy picks up.

Marketing and advertising expenditure can be reduced by 40 per cent.

Keeping in mind the investor confidence that the company enjoys, he feels that the company can forgo paying dividends in the recession period.

He goes with his worked out statement to the Director Finance, Mr. Arthashatra, and advocates raising Rs. 100 crore of debt to finance the intended capital investment. Mr. Arthashatra does not feel comfortable with the statements and calls for the company’s financial analyst, Mr. Longsighted.

Mr. Longsighted carefully analyses Mr. Shortsighted’s assumptions and points out that insolvency should not be the sole criterion while determining the debt capacity of the firm. He points out the following :

Apart from debt servicing, there are certain expenditures like those on R & D and marketing that need to be continued to ensure the long-term health of the firm.

Certain management policies like those relating to dividend payout, send out important signals to the investors. The Zip Zap Zoom’s management has been paying regular dividends and discontinuing this practice (even though just for the recession phase) could raise serious doubts in the investor’s mind about the health of the firm. The firm should pay at least 10 per cent dividend in the recession years.

Mr. Shortsighted has used the accounting profits to determine the amount available each year for servicing the debt obligations. This does not give the true picture. Net cash inflows should be used to determine the amount available for servicing the debt.

Net Cash inflows are determined by an interplay of many variables and such a simplistic view should not be taken while determining the cash flows in recession. It is not possible to accurately predict the fall in any of the factors such as sales volume, sales price, marketing expenditure and so on. Probability distribution of variation of each of the factors that affect net cash inflow should be analyzed. From this analysis, the probability distribution of variation in net cash inflow should be analysed (the net cash inflows follow a normal probability distribution). This will give a true picture of how the company’s cash flows will behave in recession conditions.

The management recognizes that the alternative suggested by Mr. Longsighted rests on data, which are complex and require expenditure of time and effort to obtain and interpret. Considering the importance of capital structure design, the Finance Director asks Mr. Longsighted to carry out his analysis. Information on the behaviour of cash flows during the recession periods is taken into account.

The methodology undertaken is as follows :

Important factors that affect cash flows (especially contraction of cash flows), like sales volume, sales price, raw materials expenditure, and so on, are identified and the analysis is carried out in terms of cash receipts and cash expenditures.

Each factor’s behaviour (variation behaviour) in adverse conditions in the past is studied and future expectations are combined with past data, to describe limits (maximum favourable), most probable and maximum adverse) for all the factors.

Once this information is generated for all the factors affecting the cash flows, Mr. Longsighted comes up with a range of estimates of the cash flow in future recession periods based on all possible combinations of the several factors. He also estimates the probability of occurrence of each estimate of cash flow.

Assuming a normal distribution of the expected behaviour, the mean expected

value of net cash inflow in adverse conditions came out to be Rs. 220.27 crore with standard deviation of Rs. 110 crore.

Keeping in mind the looming recession and the uncertainty of the recession behaviour, Mr. Arthashastra feels that the firm should factor a risk of cash inadequacy of around 5 per cent even in the most adverse industry conditions. Thus, the firm should take up only that amount of additional debt that it can service 95 per cent of the times, while maintaining cash adequacy.

To maintain an annual dividend of 10 per cent, an additional Rs. 35 crore has to be kept aside. Hence, the expected available net cash inflow is Rs. 185.27 crore (i.e. Rs. 220.27 – Rs. 35 crore)

Question:

Analyse the debt capacity of the company.

CASE – 2 GREAVES LIMITED

Started as trading firm in 1922, Greaves Limited has diversified into manufacturing and marketing of high technology engineering products and systems. The company’s mission is “manufacture and market a wide range of high quality products, services and systems of world class technology to the total satisfaction of customers in domestic and overseas market.”

Over the years Greaves has brought to India state of the art technologies in various engineering fields by setting up manufacturing units and subsidiary and associate companies. The sales of Greaves Limited has increased from Rs 214 crore in 1990 to Rs 801 crore in 1997. The sales of Greaves Limited has increased from Rs 214 crore in 1990 to Rs 801 crore in 1997. Profits before interest and tax (PBIT) of the company increased from Rs 15 crore to Rs 83 crore in 1997. The market price of the company’s share has shown ups and downs during 1990 to 1997. How has the company performed? The following question need answer to fully understand the performance of the company:

Exhibit 1

GREAVES LTD.

Profit and Loss Account ending on 31 March (Rupees in crore)

1990

1991

1992

1993

1994

1995

1996

1997

Sales

Raw Material and Stores

Wages and Salaries

Power and fuel

Other Mfg. Expenses

Other Expenses

Depreciation

Marketing and Distribution

Change in stock

214.38

170.67

13.54

0.52

0.61

11.85

1.85

4.86

1.18

253.10

202.84

15.60

0.70

0.49

15.48

1.72

5.67

3.10

287.81

230.81

18.03

1.11

0.88

16.35

1.52

5.14

4.93

311.14

213.79

37.04

3.80

2.37

25.54

4.62

5.17

0.48

354.25

245.63

37.96

4.43

2.36

31.60

5.99

9.67

- 1.13

521.56

379.83

48.24

6.66

3.57

41.40

8.53

10.81

5.63

728.15

543.56

60.48

7.70

4.84

45.74

9.30

12.44

11.86

801.11

564.35

69.66

9.23

5.49

48.64

11.53

16.98

- 5.87

Total Op Expenses

202.72

239.40

268.91

291.85

338.77

493.41

672.20

731.75

Operating Profit

Other Income

Non-recurring Income

11.61

2.14

1.30

13.70

3.69

2.28

18.90

4.97

0.10

19.29

4.24

10.98

15.48

7.72

16.44

28.15

14.35

0.46

55.95

11.35

0.52

69.36

13.08

1.75

PBIT

15.10

19.67

23.97

34.51

39.64

42.98

65.67

82.64

Interest

5.56

6.77

11.92

19.62

17.17

21.48

28.25

27.54

PBT

9.54

12.90

12.05

14.89

22.47

21.50

37.42

55.10

Tax

PAT

Dividend

Retained Earnings

3.00

6.54

1.80

4.74

3.60

9.30

2.00

7.30

4.90

7.15

2.30

4.85

0.00

14.89

4.06

10.83

4.00

18.47

7.29

11.18

7.00

14.50

8.58

5.92

8.60

28.82

12.85

15.97

15.80

39.30

14.18

25.12

Exhibit 2

GREAVES LTD.

Balance Sheet (Rupees in crore)

1990

1991

1992

1993

1994

1995

1996

1997

ASSETS

Land and Building

Plant and Machinery

Other Fixed Assets

Capital WIP

Gross Fixed Assets

Less: Accu. Depreciation

Net Tangible Fixed Assets

Intangible Fixed Assets

3.88

11.98

3.64

0.09

19.59

12.91

6.68

0.21

4.22

12.68

4.14

0.26

21.30

14.56

6.74

0.19

4.96

12.98

4.38

10.25

23.57

15.79

7.78

0.05

21.70

33.49

5.18

11.27

71.64

19.84

51.80

4.40

30.82

50.78

6.95

34.84

123.39

25.74

97.65

22.03

39.71

75.34

8.53

14.37

137.95

33.90

104.05

22.45

42.34

92.49

8.87

13.92

157.62

42.56

115.06

20.04

43.07

104.45

10.35

14.36

172.23

53.87

118.86

21.11

Net Fixed Assets

6.89

6.93

7.83

56.20

119.68

126.50

135.10

139.97

Raw Materials

Finished Goods

Inventory

Accounts Receivable

Other Receivable

Investments

Cash and Bank Balance

Current Assets

Total Assets

LIABILITIES AND CAPITAL

Equity Capital

Preference Capital

Reserves and Surplus

5.26

29.37

34.63

38.16

32.62

3.55

8.36

117.32

124.21

9.86

0.20

27.60

6.91

33.72

40.63

53.24

40.47

14.95

8.91

158.20

165.13

9.86

0.20

32.57

7.26

38.65

45.91

67.97

49.19

15.15

12.71

190.93

198.76

9.86

0.20

37.42

21.05

53.39

74.44

93.30

24.54

27.58

13.29

233.15

289.35

18.84

0.20

100.35

28.13

52.26

80.39

122.20

59.12

73.50

18.38

353.59

473.27

29.37

0.20

171.03

44.03

58.09

102.12

133.45

64.32

75.01

30.08

404.98

531.48

29.44

0.20

176.88

53.62

69.97

123.59

141.82

76.57

75.07

33.46

450.51

585.61

44.20

0.20

175.41

50.94

64.09

115.03

179.92

107.31

76.45

48.18

526.89

666.86

44.20

0.20

198.79

Net Worth

37.66

42.63

47.48

119.39

200.60

206.52

219.81

243.19

Bank Borrowings

Institutional Borrowings

Debentures

Fixed Deposits

Commercial Paper

Other Borrowings

Current Portion of LT Debt

14.81

4.13

4.77

12.31

0.00

2.33

0.00

19.45

3.43

16.57

14.45

0.00

3.22

0.00

26.51

9.17

19.99

15.03

0.00

3.10

0.08

24.82

38.09

4.56

14.08

0.00

3.18

0.12

55.12

38.76

4.37

15.57

15.00

17.08

15.08

64.97

69.69

4.37

17.75

0.00

1.97

0.02

70.08

89.26

2.92

20.81

0.00

2.36

1.49

118.28

63.60

1.49

19.29

0.00

2.57

1.57

Borrowings

38.35

57.12

73.72

84.61

130.82

158.73

183.94

203.66

Sundry Creditors

Other Liabilities

Provision for tax, etc.

Proposed Dividends

Current Portion of LT Dept

37.52

5.70

3.18

1.80

0.00

49.40

10.16

3.82

2.00

0.00

59.34

10.70

5.14

2.30

0.08

77.27

3.59

0.31

4.06

0.12

113.66

1.42

4.40

7.29

15.08

148.13

1.99

7.70

8.58

0.02

153.63

1.70

12.19

12.85

1.49

179.79

3.04

21.43

14.18

1.57

Current Liabilities

48.20

65.38

77.56

85.35

141.85

166.42

181.86

220.01

TOTAL LIABILITIES

Additional information:

Share premium reserve

Revaluation reserve

Bonus equity capital

124.21

8.51

165.13

8.51

198.76

8.51

289.35

47.69

8.91

8.51

473.27

107.40

8.70

8.51

531.67

107.91

8.50

8.51

585.61

93.35

8.31

23.25

666.86

93.35

8.15

23.25

Exhibit 3

GREAVES LTD.

Share Price Data

1990

1991

1992

1993

1994

1995

1996

1997

Closing share price (Rs)

Yearly high share price (Rs)

Yearly low share price (Rs)

Market capitalization (Rs crore

EPS (Rs)

Book value (Rs)

27.19

29.25

26.78

65.06

4.79

35.64

34.74

45.28

21.61

67.77

6.82

37.22

121.27

121.27

34.36

236.56

9.73

42.54

66.67

126.33

48.34

274.84

1.93

57.75

78.34

90.00

42.67

346.35

2.66

40.61

71.67

100.01

68.34

316.87

7.16

64.98

47.5

90.00

45.00

210.02

5.03

45.35

48.25

85.00

43.75

213.34

9.01

50.73

Questions

How profitable are its operations? What are the trends in it? How has growth affected the profitability of the company?

What factors have contributed to the operating performance of Greaves Limited? What is the role of profitability margin, asset utilisation, and non-operating income?

How has Greaves performed in terms of return on equity? What is the contribution of return on investment, the way of the business has been financed over the period?

CASE – 3 CHOOSING BETWEEN PROJECTS IN ABC COMPANY