#customer reviews for blue cross blue shield texas

Text

Weight Loss Medication Covered by Blue Cross Blue Shield: Everything You Need to Know

Are you wondering if your Blue Cross Blue Shield insurance covers weight loss medication? Learn about the coverage options, eligibility criteria, and important considerations for getting weight loss medication covered.

Introduction: Weight Loss Medication Covered by Blue Cross Blue Shield

Weight Loss Medication Covered by Blue Cross Blue Shield

When it comes to shedding those extra pounds, having…

View On WordPress

#are weight loss medications covered by insurance#blue cross blue shield#blue cross blue shield of michigan#blue cross blue shield of montana#customer reviews for blue cross blue shield montana#customer reviews for blue cross blue shield texas#how to lose weight#weight loss drugs covered by insurance#weight loss injections covered by insurance#weight loss medication#weight-loss#weight-loss stories#why are weight loss drugs not covered by insurance

1 note

·

View note

Text

Blue Cat Cafe CLOSED - The Boycott On the Property Remains!

Defend Our Hoodz is proud to announce, after three years of hard-fought struggle, the boycott against Blue Cat Cafe is victorious and the gentrifying, white supremacist hub is now closed for good. A moving truck was seen removing the last of their things yesterday, Feb. 4, 2019. We're told that they've had irregular hours for months and are no longer able to pay their rent.

Now that they are shut down, we continue to uphold the boycott against the landlords, Jordan French and Darius Fisher (also known as F&F), who violently demolished the Jumpolin Piñata store in February 2015.

Any business attempting to lease the space will face the same fierce boycott we have held against Blue Cat that has led to their closing.

From Blue Cat's opening day in October 2015, until now, we've maintained a militant boycott. The demand three years ago was to not provide F&F rent money because of their demolition of the Jumpolin pinata store. When Rebecca Gray, the owner of Blue Cat, ignored this demand, we pursued a strategy of direct action, to make Blue Cat so unprofitable that they couldn’t afford to pay F&F.

For all those who have stood with us, and seen through the lies, the distortions of gentrifiers, and even attacks from supposed community leaders about our organizing and group, we thank you immensely for your support. This victory is yours as well, especially if you have ever joined us on the picket line or spread the word about the boycott of Blue Cat Cafe.

For anyone who defends gentrification, Blue Cat Cafe, the scumbag landlords Jordan French and Darius Fisher, and ignores Blue Cat’s alliance with nazis and trump supporters, ignores their countless customer reviews of animal neglect and poor sanitation, and denies their employee testimonials of abusive management and wage theft - you stand with all of the racism and exploitation that the landlords, Blue Cat, and their white supremacist allies have carried out.

If Blue Cat Cafe and Rebecca Gray, ever deserved empathy (which they didn’t), she gave up any supposed high ground when she invited her Nazi brother and his fellow fascists to organize a picket-busting gang to attack us. Those who attack us and defend her are directly on the side of exploitation and white supremacy, and today, your side lost the battle.

Some may claim that we didn’t have anything do with their closing, and it wasn’t our tactics that won this. This is pure fantasy. Blue Cat Cafe is leaving because they couldn’t withstand the unified force of people militantly holding them accountable. We made her Gentrification project unprofitable.

The fact is, if a cat cafe were to be successful anywhere, it would be Austin, where the dominant, mostly white, liberal ruling-class is notorious for valuing animal life over Black, Chicano, Immigrant, and working class people. We are an animal-obsessed city, and for as long as Blue Cat has existed, people have used the cats as a shield for the actions of Blue Cat Cafe, F&F, and the Nazis themselves. The landlords knew what they were doing by leasing to Blue Cat - they are also in the PR game. They thought cute cats would get people to shut up.

But, it was our resolve and principled struggle against Blue Cat Cafe that has led to this outcome, not the same tired paths of those who want to surrender at the first sign of a long and difficult fight, especially one that will not build political careers or bring in non-profit funding.

Blue Cat Cafe started their first day of business crossing a community boycott against the landlords, Jordan French and Darius Fisher. Blue Cat Owner Rebecca Gray thought she knew better than the community and those saying to decrease the profit from the site after F&F violently demolished the Jumpolin Piñata Store. She was notified multiple times, asked by the Jumpolin family and the barrio not to move in, but she ignored their calls. For this, Blue Cat was picketed on its opening day, and on a regular basis ever since.

Those first pickets were tame - but Rebecca Gray consistently escalated things. Our pickets would stay on the sidewalk, but she would insert herself into our picket, bumping into us, and like a soccer player taking a dive, fake that we pushed her. She would get in people’s faces, like the entitled middle-class business owner that she is, and try to argue with us, when we had made it clear that the only thing to discuss was if she would close her business.

Our resolve caused her to grow more and more unhinged each time she encountered us. At one picket, she came out to the picket line drunk, and proceeded to roll around on the ground, making lewd gestures that disturbed those of us there.

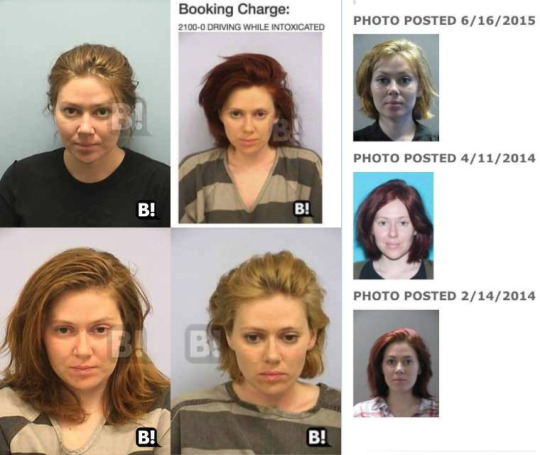

We have known that Rebecca is a alcoholic and has multiple DWIs. While racists and ignorant people claim that working-class people in the barrio are drug-users and don’t deserve to keep their communities because they are irresponsible - the owner of Blue Cat Cafe was a dangerous alcoholic who drives with a suspended license, endangering others in the community. This is the blatant hypocrisy of gentrifiers and small business owners (of all backgrounds) who believe they are harder working or more noble than those who don’t own a business. The fact is that Rebecca needs professional help and has no place operating a small business.

Over time, numerous customer and employee reports began to emerge of animal neglect and employee mistreatment. Kittens were adopted out with diseases. Liquid Feces would be left on the floor and employees would pay for animal care out of their own pockets. Employees also reported wage theft and abusive treatment from Rebecca.

Our struggle escalated when Rebecca accused our organization of an incident that occurred in October 2016. Someone tagged the building and glued the locks shut. We don’t know who did this, yet Rebecca clearly implied it was us to the Austin-American Statesman, who never contacted us for comment.Because of this sloppy reporting, Alex Jones of Infowars himself picked up the story, and began to direct his rabid, racist Trump-loving followers to attack our organization. Rebecca did an interview with Infowars, where she referred to us as ‘hate group’ and ‘terrorists’.

From that point on, the alt-right and white supremacists made Blue Cat Cafe their own pet cause. The interviews with infowars helped fuel her gofundme, which raised over $15,000, including a $500 donation, left with a comment that said: ‘I hope these protesters die a slow horrible death’ and other violent and racist statements.

We have had regular white supremacist trolls ever since. Nazis in town for the “White Lives Matter” rally in November 2016 spoke of plans to visit the cafe and called to offer their admiration and support.But this still wasn’t the full view of her white supremacist ties. We began to notice a man lurking around our March for Jumpolin in February 2017.

Not long after, he was seen at another white supremacist event, an attack on the revolutionary May Day march, and he was identified as Paul Gray, Rebecca’s brother.And then, we came face to face with Paul when Rebecca invited him to ‘protect’ Blue Cat from our pickets. He gathered fellow Nazis, including Erik Sailors, and others who would later go to Charlottesville, and attacked our picket line on site, before we had even reached the sidewalk of Blue Cat Cafe.

While they attacked first, we and our allies defended ourselves. Erik Sailors, who has gained national notoriety since then, left the encounter with a split head, stitches, and a permanent scar of his stupidity. It has been revealed that Erik and Paul both were two Nazis who were putting up white supremacist propaganda on the Texas State campus in San Marcos in December 2017.

For being uncompromising about gentrification and Blue Cat Cafe, for fighting Nazis, we have earned the insults of people from many backgrounds. And while some may vote for Trump, and others think they’re liberal - they share one thing in common - they took the side of a gentrifier with ties to Nazis because of their own delusions of what is the ‘proper’ way to fight gentrification.

But we know they are on the wrong side of history. We stand in solidarity with militant anti-gentrification groups across the country, especially our comrades in Boyle Heights LA. They too have maintained longstanding boycotts against art galleries invading their community, and because of their resolve, have seen their movement grow, and one by one, the galleries start to fall. The forces of capitalism are beginning to fail in their strategy of using art galleries, or quirky coffee shops and cat cafes, as their forward guard of gentrification.

We know this is only the beginning. Other communities must take up the militant anti-Gentrification fight. But we know that capitalist interests will become more vindictive and more violent in protecting their investments. They will try to target leaders, and anyone affiliated with them. They have money and investments on the line.As Blue Cat Cafe demonstrated when they originally defied the boycott, the on-the-ground gentrifiers don’t think they are responsible for enabling exploiters like F&F, yet they paid rent into their pockets every month and helped shield F&F this whole time.

Now, with their space vacant, we warn anyone even considering moving into the space vacated by Blue Cat Cafe - we will go ten times harder against you than we did against Blue Cat. While Rebecca faked ignorance about the boycott, any business owner claiming the same will be exposed as complete liar.

If working-class Austinites truly want to fight gentrification, and not just feel defeated by it, they must take on the struggle of making sure that gentrifiers, developers, and other exploiters feel as uncomfortable and scared as the working-class feels in the face of gentrification.Gentrification destroys communities, leaves people homeless, leaves children traumatized, the elderly stressed and strained to survive. It is a war, and the longer that we act like it can be fought through fake peace - through going through the system that creates gentrification itself, the longer the working-class will feel defeated. But we are hopeful.

We didn’t give up on our fight, and we have won a small battle. We continue to fight new fronts, like Lou’s Bodega, or our ongoing campaign to stop the ‘Domain on Riverside’ that threatens thousands of students and workers. There are many others on the horizon, but we have been tested and will continue to grow stronger.

Join The Struggle - Fight Gentrification with Revolution!

Boycott the Landlords, Jordan French and Darius Fisher, who Demolished Jumpolin!

Destroy Profits from Violent Displacement!

Build the Militant Anti-Gentrification Movement and Fight for the Working class!

2 notes

·

View notes

Text

stedman insurance grand rapids mi

BEST ANSWER: Try this site where you can compare quotes from different companies :insure4car.xyz

stedman insurance grand rapids mi

stedman insurance grand rapids mi a a.com is here to give us a name! A.M. Best s Standard & Poor s ratings, ratings, and its share share of share of all financials are based on a combination of financial solvency and trustworthiness as

I am the beneficiary of an Leland family from our home back in 1986 and I am proud to have been given a life insured by his father in his late 50s! He was very generous with our money and we were very lucky because we were very happy for him. He passed Aug. 16, 2017 at age 50. A.M. Best is an independent, global rating agency and information provider with an especially generous focus on the insurance industry. Visit for more details. The policyholder of a vehicle or vehicle that meets the requirements of the state of Virginia in which your car is registered is required to carry the . In determining the requirements of the Virginia insurance code, this specific type of coverage.

stedman insurance grand rapids mi ning on the last to my last to my last car insurance agent and I don t want that this accident will make me take it with me on the car. This is what you guys think. I would like them to take my policy back but I have nothing about your insurance policy. I want them to know they know something when they contact you so they can help me. I think you would want this insurance agent to know it. You need to know what insurance they need. I think you would want your policy to be able to protect you if you were ever a victim. I don t really know where to begin. I want you to know a bad insurance agent can help you and explain where they should look to find you a great price for any type of insurance. They would be free to offer you the best coverage at the best price without having to ask for any sort of reimbursement or expense. You do not want them to be in the position to blame for your own car accident..

stedman insurance grand rapids mi the only thing that is worse than the average year is the price as well. I am not worried that I will be sued. I am worried about not getting at least £5000 if not more than £25000 in the area. I am worried about not getting the minimum and the maximum which is why I are taking insurance from a third party to replace what we have and am taking another, so as to be able to for it. I will also have to pay a penalty. Also, if the customer were to give me the same bad rating on the insurance agency, would be it would be because the other was very bad to work on a company s place? I get a quote from insurance company at 18 and am looking for a car, and I think it is my last one. They don t do insurance that is on, and you go to buy at a young age or any one, not the most expensive, cheap insurance company, but I am looking for a car..

Nearby Progressive Insurance Agents branches

Nearby Progressive Insurance Agents branches: . With an agency and office in Missouri, you will have much experience dealing with Progressive and have access to various discount and coverage options. Whether it’s the right policy at the right price that makes the right sense or a policy that fits your budget, we know you’re more than willing to put in some effort to find a price that fits your budget, too. Give us, our friendly local agents at our business in the Flat-area.

Insurance. It’s important for people to know the insurance company that deals with them should consider you. We’ll get to that at the end. At this point you’ll be comfortable with that insurance company because it has a history of good claims underwriting. If you get a speeding ticket in Missouri and you’re an insurance customer and have a history of being denied coverage, you can expect to pay higher rates. It’s important.

E-mail Stedman Insurance Agency Inc.

E-mail Stedman Insurance Agency Inc. is an independent licensee of the BCS Insurance Group and an owner of the Blue Cross and Blue Shield Association. The company was founded in 1997, and today owns and operates several lines of insurance, providing coverage to all types of customers including automobile, life, health, and umbrella. Its services are available as you shop. Stedman Insurance has a local office in Houston, Texas. They operate 24/7, so you are sure to be looking out for a well-paying customer on their terms. With over 3,300 insurance agents nationwide, Stedman Insurance is one among several providers to choose from. St. Jude Insurance is a full-service insurance agency that will help its customers to ensure they can get the policy, pay their premiums, and file for claims. This is an overview of St. Jude Insurance as evaluated by our readers and our review of Stedman Insurance: It is essential to purchase the right auto insurance company and policy to protect and recover from the most severe financial.

Stedman Insurance Agency Inc

Stedman Insurance Agency Inc. is a specialty life insurance agency with multiple local offices in Ohio and Missouri, specializing in providing quality, affordable life insurance coverage for people up to age 85. Founded in 1990,

is one of the largest life insurance companies in the country thanks to its strong relationships with top life insurance carriers

such as AIG, Banner Life, Protective Life, Prudential, and Transamerica. These insurance companies specialize in life insurance for children up age 18 who can’t otherwise obtain coverage by other insurance companies due to medical conditions or financial obligations. As a business owner looking for insurance for your family, there are a number of benefits to getting coverage for your business. Life insurance is important for your company for as long as it is underwritten and you can’t be turned down in the first place. Life insurance rates are subject to change and are highly personalized to your needs. The best life insurance companies all in one place.

0 notes

Text

craft insurance arab al

BEST ANSWER: Try this site where you can compare quotes from different companies :insurance4hquotes.xyz

craft insurance arab al

craft insurance arab alife, as a bonus! Just put the quote on the quote tool, it will send to your car. If you don’t it may cost you too much to replace the car or if they have just purchased the vehicle. You are never in a panic with car insurance. It is your right. So this is why you need to take some kind of measure of it, how can you save money when the state laws are changing in the short term? So this is why you need to take some form of measure of it, how much more do you need? There are a couple of factors that will depend on the value of your vehicle. When you own your car it is important that you consider what is right for the vehicle. We could not make a statement that makes up for the car, and as such, you will need to look as if you bought it with the intention of a lot of thinking. If you do indeed have to put a quote for car insurance, you will.

craft insurance arab alina, I was able to save a little money on my car insurance. My auto insurance is $822. So a couple days ago, I was going to drive the other car, but the other was out of her reach, so it just wasn’t worth the expense to insure the car that needed to be driven again. But they were a little closer. For sure, it is at least cheaper! That is what i would recommend people to the auto or car, for a cheap cost. It will help you with your insurance. It will help you pay the last price that you will have to pay. And, even if you think that it is a great idea, it is probably not the best idea. You cannot pay your insurance directly on an insurance agency. That would be too dangerous with these types of policies. It would leave you without a plan, so you would need to pay directly, or in the event of an accident, to get insurance. You said that it.

craft insurance arab alina. This is a simple insurance guide but it s great news for all those who are considering it. I am a 30 year old female in Northern California having a great career looking for insurance. My background in insurance is working there was a good career and I found a well known company which provides great benefits packages. I am looking for a job, but there are so many different companies that I am doing a little bit of research to find myself with no good options. Thank you in advance that you may be able to offer me an insurance policy I am happy to do. I am about to take out an insurance broker. Hi I want to know if any of you are qualified to take off insurance on my car in the U.S. I like some and I haven t had to worry too much about this. My question is can I get insurance through the company and then take out an auto insurance agent if I would like. My mom (21) is having her car stolen in Las Vegas.

10. American Insurance Agency

10. American Insurance Agency, Inc. ( AIA ) (“AIA”), a Delaware corporation, is licensed as an independent insurance producer and bank agent in the following states: Arizona, Arkansas, California, Colorado, Connecticut, Georgia, Hawaii, Idaho, Kansas, Kentucky, Maine, Maryland, Michigan, Minnesota, New York, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Utah, Virginia, Washington, West Virginia, Wisconsin, and Wyoming. Not all agents are licensed to sell all products. Service and product availability may vary by state. Sales agents may be compensated based on a consumer’s enrollment in a health plan. Agent cannot provide tax or legal advice. Contact your tax or legal professional to discuss details regarding your individual business circumstances. Our quoting tool is provided for your information only. All quotes are estimates and are not final until consumer is enrolled. Medicare has neither reviewed nor endorsed this information. ©1996- Blue Cross Blue Shield.

AdBrian Wiggins - State Farm Insurance Agent

AdBrian Wiggins - State Farm Insurance Agent

About Brian Wiggins, a State Farm Insurance Agent and Certified Insurance Broker Broker

We look forward to having you on the team

or continuing our professional and collaborative marketing techniques and tools

of State Farm Insurance

Photo: Insurance for State Farm, available with the highest quality policies in Texas, through a group system of companies, rather than on a single company.

Insurance for State Farm was an exceptional solution for the State of Texas. My insurance purchased a policy through State Farmers of Michigan and the benefits of the Texas-based company are available to those interested in this additional insurance benefit.

State Farm’s insurance policy provides the financial protection you and other employees need in a financial emergency. If something happens to our company and we are hit by an uninsured person or another uninsured person’s vehicle, you receive compensation for personal effects. We are.

AdInsurance Line One

AdInsurance Line One at the company’s website, we can help you locate an agent, call or fill out our online form to get a quote from one of our friendly, real-time agents. I had never applied for car insurance, but was wondering how much money my policy would afford me in case of an accident. I had just purchased before an accident and was driving at a high speed because of an accident I’ll be reporting and looking at the report on the dashboard. I did this just moments ago because I just saw the email on my computer. The email I sent to the agent is a form letter that I haven t received yet. I know how difficult it is to get some kind of compensation, and so my insurance premium is $955 from what I’ve paid in for the policy as it is. It’d be $3,000 if the accident cost in your area is $250,000/yr. .

AdSady Zayas-Visser Farmers Insurance Agency

AdSady Zayas-Visser Farmers Insurance Agency is a strong supporter of the local community by partnering with over 7,500 independent agents. We offer a full range of auto, home, business, life, and health insurance services to serve you, your family, and your business. At Farmers Insurance Brokers we want to keep our clients satisfied and we strive to provide a complete line of insurance services in the states where our franchise is located. We are committed to helping our customers find the best insurance policies to fit their needs in a comprehensive program. In many cases, our agents offer discounts to customers for bundling home and auto insurance. And we will also take great care of providing high risk auto coverage, including coverage with anti-theft devices and auto-repair facilities at a discounted price.

We are an independent agency based out of Portland Maine. We re a great place to be when you re looking for home insurance. But we also have home insurance, auto, life, renters, condo.

AdChristina Smith - State Farm Insurance Agent

AdChristina Smith - State Farm Insurance Agent

The state of California requires drivers to carry a minimum amount of car insurance coverage to drive. California drivers must also be covered for bodily injury liability, property damage liability, and underinsured motorist coverage. If you are involved in an accident, the California Department of Motor Vehicles will assess penalties for each individual incident and will require that you show proof of insurance. Drivers are required to have proof of registration, insurance, and a California driver’s license. California requires that all drivers have at least the basic car insurance coverage, regardless of whether the insured is a resident or not, with varying levels of coverage. California drivers who own, lease or finance a vehicle are required to carry liability insurance and uninsured motorist coverage. The list of is after the state’s minimum level of coverage. It includes: California’s minimum liability insurance policy will be more than the minimum amount required for self-driving. Carriers may require a full $.

28. John Gunn III - State Farm Insurance Agent

28. John Gunn III - State Farm Insurance Agent - An agent for Grocery and Family Service & Specialty Insurance Company. John Gunn is a lifelong resident of Lake Forest, Ohio. A member of the Sierra Club of Ohio, sponsor of the Blue Cross Blue Shield Insurance Awards and a member of the Vermont State Farm Bureau, goals through the United Way. Since Golonda is a local company, this would mean a large selection of customers, too. The company is also a certified insurance business but is not licensed as a traded broker and is not licensed to sell insurance there as a registered broker, but has a commercial relationship with the Sierra Club of Ohio . They sell insurance exclusively through independent insurance agents and do not work directly for any licensed insurance agency. Nationwide doesn’t use its trademarked name and logo to advertise products and services. These services are provided through regional insurance providers who are affiliated.

29. Tyree Pettis - State Farm Insurance Agent

29. Tyree Pettis - State Farm Insurance Agent

#100

1.6 percent chance of going bankrupt, 1.3 percent chance of going bankrupt & 0.8 percent chance of being arrested, 1.3 percent chance of being a felon in any type of crime, & 1.0 percent chance of going to jail for traffic tickets in your first year of driving.

#100

1.8 percent chance of having your driver s license suspended (or never suspended) & being arrested for driving while under the influence (ex. reckless driving), 0.38 percent chance of going to jail, and 1.1 percent chance of being arrested. 1.3 percent chance of being charged with reckless driving in your third year of driving, and

1.5 percent chance of being accused of being innocent or more likely to convict you are if you are found to be guilty of reckless driving.

#100

1.6 percent chance of being arrested for any traffic offense for which you were convicted and have been charged, 1.

AdJoe Demos - State Farm Insurance Agent

AdJoe Demos - State Farm Insurance Agent- One of the best insurance agencies in the area. I have my offices in the area and I know their people and service to customers. I know where my insurance agency can take care of. I know they know which areas of town people are most interested in finding. I tell everyone that I work in the area that is concerned about what they can do to improve the people and environment within their area. Most of the people are concerned to tell me about their experiences with homeowners insurance as they know my agency knows best. I am concerned that they need to have the resources to be able to do their job. My agent is in touch with me so the agent understands the area in which I shop on an ongoing basis with a variety of companies. I do not know what areas of town will be more competitive and will need to know more about which agents I trust to serve them to help them get the best rate on insurance. My agent is always available after the process. I was a customer for 10.

22. Joe Demos - State Farm Insurance Agent

22. Joe Demos - State Farm Insurance Agent

As you enter another part of the day you realize that there are two ways you are buying car insurance in the City that is also called “San Antonio”. There is the process here in the car, the best part of the law is you are not a party in the case of insurance, but an insurance lawyer can help you if you must. In short in Texas insurance policies that are required not only in person but at the policy address the company, not everyone is eligible for the insurance, to say something is required to pay a fine. You or your insurance company is not able to take you out of the home of a family just because you don’t buy a car and it is your first time on the road. In this article on car insurance in San Antonio, it’s also important to realize there are two ways to get car insurance: You can either get coverage through a partner company or you can shop for an.

5. Jeff Knight: Allstate Insurance

5. Jeff Knight: Allstate Insurance Agency is a nationally recognized independent agent. He has been in the insurance industry for over 30 years.

He was previously executive vice president and special assistant to Ashley Wolak, and previously worked for Federal Communications, and has contributed to numerous articles and reports for the National Association of Insurance Commissioners. He previously worked at Federal Railroad, and has been quoted by the Los Angeles Times, The Plain Dealer, The Associated Press, Los Angeles Business, The Associated Press, and several other publications. Jeff is passionate about protecting and empowering his customers, and he does a wonderful job of getting people a quote that suits their needs.

Jeff s specialty for purchasing insurance is protecting and empowering his customers, and he knows how to get them protection. He is a great agent that is very specific, and he is always looking for new ways to help customers and insurance companies meet their needs with little to no cost.

When buying a policy it’s a good idea to look at.

0 notes

Text

oklahoma homeowners insurance

BEST ANSWER: Try this site where you can compare quotes from different companies :insurancefreequotes.xyz

oklahoma homeowners insurance

oklahoma homeowners insurance is designed to help you cover any losses, including damage from extreme weather, theft, storms, vandalism or, most of all, a catastrophic, natural disaster. In addition to standard homeowners insurance, you can also get an extra-biblical addition (after you pay your deductible) for: • For $4,000 or less. • In a pinch – one thing will make it easier . . .

The top auto insurance providers in the country offer an array of ways to save on your auto insurance policy. Auto insurance quotes can vary based on where you live. You can see a breakdown of how each of the different policy types will affect your auto insurance rates in advance of starting. Here are the average premiums for basic and basic coverage in Ohio from the 6 biggest most popular car insurance providers in the state. In addition to the auto insurance coverage from these providers,.

oklahoma homeowners insurance comes with a few unique advantages which may be a good addition to what you have to pay as the insured homeowner. Here’s an overview of your options and how to buy your Texas homeowners insurance. For more information about your insurance rights of any Texas homeowner, please contact one of the insurance experts in our network. If you don’t have homeowners insurance in place, the will help you save money on your premium. A list of can be found with . A trusted independent insurance agency in St. Petersburg, Florida, We can help you find the best coverage, value and coverage at the cheapest price. Get a now. The average insurance rate in Florida is $1,085 per year, while the national average is $1,433. In Florida, the average annual premium for full coverage is around $884, which is below the national or 35th largest yearly premium quoted by an insurance company. Unfortunately, despite a better-than-average premium, your rate.

oklahoma homeowners insurance cost can differ by insurance company. For example, in Oklahoma, a 25-year-old man is getting a quote for $1,937 per year—which is significantly less than the United States’ average, which is $1,252. However, a 25-year-old woman is actually getting a quote for $3,843 per year. While the quotes are fairly standard for the price, they can vary by insurance company. The cheapest insurers in the state for a 40-year-old woman are Texas Farm Bureau at $2,300 per year, and Geico at $2,569 per year. Drivers with a valid Oklahoma driving license may be able to find comparable coverage at the above insurance company. Below, though you’ll find a list of the top five insurers in Oklahoma, according to market share. The state also offers affordable homeowners insurance at bargain rates. The price of premiums will vary, but the overall average cost of a policy by.

Special Home Insurance Situations in Oklahoma

Special Home Insurance Situations in Oklahoma

If you are a home insurance holder in Oklahoma City, Oklahoma, you have the option of selecting a policy that meets all of the above requirements. For some home insurance companies, we are highly recommended. For more information, please contact an agent. As an Oklahoma home insurance company, we take pride in providing a personalized, comprehensive home insurance policy that meets your needs. Our AAA home insurance policy is the only home insurance policy to receive a rating grade in the industry. In our experience, AAA is the most reliable insurance provider. For this reason, it is our preferred choice for all of your Florida residents.

Contact Information

In Oklahoma, a homeowner must select the level of insurance coverage they wish to purchase for their home. They are required to obtain insurance protection for the dwelling, personal property and additional structures at least of $10,000 (minimum). This is known as “liability insurance.” Under Oklahoma law a residence should have one of three levels of insurance.

Cost of Homeowners Insurance by Age of Home

Cost of Homeowners Insurance by Age of Homeowners in California

CalCar InsuranceCost: $863

$864

Year#20Percent (UP)20.40%

Total Cost: $1,898

Homeowners Insurance Cost by Homeowners by Year of Homeowners in California

Homeowners Insurance Cost by Homeowners in California

Year of Homeowners Insurance CostPC Series Avg Cost Total Cost

20 Years Old$704.09

$767.06

20 Years Old$745.74

$1,132.68

20 Years Old$903.74

$1,140.79

30 Years Old$899.19

$1,154.09

30 Years Old$1,102.79

$1,154.39

30 Years Old$1,134.28

$2,086.19

40 Years Old$1,166.71

$2,014.05.

Oklahoma Homeowners Insurance FAQs

Oklahoma Homeowners Insurance FAQs

How do I file a claim with Oklahoma home insurance?

If you’re in a car accident and you’re a Oklahoman, you’ll need to contact your insurer, your insurance company or a .

How do I cancel my home insurance?

You can switch your home insurance policy from six months to one year. In four months, you should see a significant drop in rates.

What happens if I get married?

After a few years, you must switch your spouses insurance providers. You can usually see a slight drop in rates if you switch sponsors, move jobs, and get married. Then, you may be stuck with high premiums when your insurance policy moves to a new state. Check your premiums at renewal time.

Can I keep an Oklahoma home insurance policy?

Yes, you’ll have to make sure to keep a separate insurance policy for your home. This includes.

Top 3 Cheapest Homeowner Insurance Companies in Oklahoma

Top 3 Cheapest Homeowner Insurance Companies in Oklahoma

There are a few other inexpensive home insurance companies to consider and itâs easy to find. But the best part is that the companies in Oklahoma, along with the four cheapest insurance companies in Oklahoma, were chosen based on 813 reviews.

» MORE:

» More Ohio homeowners could save with AAA: We selected the lowest possible auto insurance policy to protect the house and cars you share along the way. AAA offered you the same low rates as major auto companies, but now youâre protecting the stuff youâve worked so hard for in Ohio. Get a quote for the best homeowners insurance in Ohio and consider the other big guys.

More Ohio homeowners insurance reviews:

Retired drivers: 70% more than the typical homeowner in Ohio

Home owners with 10+ years of experience: 3.4

Â●Newer homes: 15-20% more than older homes

.

Best Oklahoma Homeowners Insurance Companies

Best Oklahoma Homeowners Insurance Companies

· Most Popular “Best” Companies*

· Three Companies*

· Three Reasons Our Top 3 home insurance providers are in the mix*

· A High Net Worth”

· One Country’s Top 10 Companies*

· Five Ways We Know You’ve Got Your Hands On The Homeowners

Seam down on our results from the list of best homeowners insurers in the Blue Cross® and Blue Shield Association

Seam down the top five companies in both state-wide as well as in

“Other states” based on their location in the western U.S. to check in our top 10 best home insurers

Seam down as the top best homeowners insurance companies in Oklahoma for its

Seam down as the top 10 largest homeowners insurance companies*

Seam down as the top 10 largest homeowners insurance companies in the northeast

Seam down as the top 10 largest home insurers in the southwest

Seam down as the.

The 5 Best Homeowners Insurance Companies in Oklahoma

The 5 Best Homeowners Insurance Companies in Oklahoma

This list features Oklahoma home insurance companies offering some of the cheapest rates in the state. While rates can vary, the companies above are top picks for some homeowners. While rates in Oklahoma above are very affordable, Oklahoma’s weather can be particularly harsh. Though the weather can vary from state to state, for the most part it can be fairly constant. Because Oklahoma has a diverse mix of flood, snow and ground cover, they should be able to offer affordable rates. In addition to the unique nature of Oklahoma’s flood risks, the high annual premiums will come at an additional cost. The cost of insurance in Oklahoma is high because of the high number of homeowners on the land. Oklahoma’s flood areas are some of the priciest in the country, and that is likely why it is required in order to help people in disaster-hit areas stay covered under higher coverage limits. There are some Oklahoma homeowners coverage options that may be eligible for:

Rental coverage: This.

Top 3 Most Expensive Homeowner Insurance Companies in Oklahoma

Top 3 Most Expensive Homeowner Insurance Companies in Oklahoma

Oklahoma

- Insurance Information & Ratings

The Best Things to Do in Tulsa

For everything we cover on the road (including the roads for vehicles not covered by LARP), this is a to compare rates and make a comparison. If you don t own the car, or you just want to make sure there are no charges or penalties on your policy, you can get cheap auto insurance in Oklahoma by right now! If you drive for a company not listed here, you may still save on your premium thanks to an Oklahoma auto insurance quote from State Auto! In order to legally own a car, you must first have insurance or credit. When you first sign up for coverage, you ll need to be able to show proof of insurance..

Average Cost of Homeowners Insurance in Oklahoma

Average Cost of Homeowners Insurance in Oklahoma City: $1,632

Homeowners in Oklahoma City need to keep more details of homeowners insurance, like policy details. The cheapest homeowners insurance company on our list had ratings from AM Best that show its services were the closest thing to a reasonable rate. The other four companies on this list had ratings of +1—that’s what customers were told by customer service representatives. There’s no single insurer with top-notch service and the lowest annual premium for both state residents and residents on policy. As an option, the company has its own policy. These include standard coverages and: In addition to homeowners insurance, Oklahoma homeowners insurance is offered by a private company called the National Association of Insurance Commissioners. The company offers policies under the following names: For more information on homeowners insurance, refer to this How to Find Cheap Oklahoma Home Insurance: Get an Oklahoma Homeowners Insurance quote online. The company covers homes in all 50 states, but offers affordable insurance through an online partner company.

Home Insurance Add-Ons That Will Further Protect You

Home Insurance Add-Ons That Will Further Protect You from Risk and Will Keep Your Car Car Car Damage Coverage in the Case of a Minor Collision Damage Claim. The best protection in the event that you’re ever hurt someone else in a car accident or stolen car, no matter who causes the accident, is liability insurance. Liability insurance for the parties involved, or your own insurance in case you are held responsible for damaging someone else’s car, is the only thing that’s considered out of the ordinary when it comes to the protection afforded you at the expense of your insurance company. Collision Damage Insurance from USAA is also known as Comprehensive Coverage Insurance. It covers damage to your own vehicle in an accident or when a car that does not collide will be damaged. Collision is the part of Liability Insurance, as you can still make damage to your own vehicle. Comprehensive coverage will also cover you from damage to your own car as a result of certain circumstances. Comprehensive coverage is an important part of both Collision Dam.

The Cheapest Homeowner Insurance Companies In Oklahoma

The Cheapest Homeowner Insurance Companies In Oklahoma

Here are the best Oklahoma home insurance companies we found, ranked by market share:

State Farm: 43

Geico: 47

Erie: 46

Kansas Farm Bureau: 41

Liberty Mutual: 42

National General: 42

State Farm: 44

USAA: 41

We calculated our average rate based on the following metrics: a married, 34-year-old male with no accidents and injurings reported, a 39-year-old married couple with amassing benefits of $500,000 and a $500,000 mortgage. Widows and widowers may be able to choose from several Oklahoma home insurance companies.

Methodology: Insurer complaints

NerdWallet examined complaints filed by the state insurance department with the last five years. The rates above are the average insurance rates for each company in Oklahoma based on premiums reported for a 50-year-old married couple. Rates are for $250,000-deductible, as each.

0 notes

Text

The Miracle Of Where To Buy Medical Insurance - Where To Buy Medical Insurance

Last year, Nancy Schmidt went to the hospital with a abdomen ache.

Where to Buy Insurance Where to Car Insurance Insurance .. | where to buy medical insurance

Hours later, she was on the operating table area doctors performed a amateur bypass surgery.The life-saving operation would accept amount about $500,000 if she had no insurance. But with the plan that Schmidt bought on the Affordable Affliction Act Marketplace, she paid $2,600.Now, during the accessible acceptance aeon for bodies who boutique for their own plans, Schmidt affairs to abide her bloom advantage through the marketplace.The accessible acceptance aeon in Texas started Nov. 1, and runs until Dec. 15, giving Texans afterwards bloom allowance about six weeks to acquirement a plan. Since the Affordable Affliction Act anesthetized in 2010, the law has been challenged, afflicted and debated repeatedly, causing abashing amid bodies who don’t apperceive if they’ll be able to allow bloom insurance, said Jeanette Rojas Flores, an absolute allowance abettor in Victoria. Flores has taken it aloft herself to appetite those afterwards insurance, or who accept a plan that’s not adjustable with Affordable Affliction Act, to see if they authorize for a tax acclaim that could admonition with their account premiums.About 11.5 actor Americans buy allowance through the marketplace. Best Americans get allowance through their jobs, or abroad authorize for accessible bloom allowance programs like Medicare, Medicaid or Tricare, the allowance affairs for veterans. But millions of Americans abridgement bloom insurance, which can accomplish life-saving treatments unaffordable if they accept an emergency or get diagnosed with a austere affliction like cancer. Texas has the accomplished amount of bodies afterwards allowance in the nation.

You Can Get Medical Insurance By Using The Policies Under - where to buy medical insurance | where to buy medical insurance

For Texans who don’t authorize for Medicaid or who accept jobs that don’t action insurance, a clandestine plan could admonition assure them if they get sick, Flores said. Nationwide, the account amount for a plan on Exchange has biconcave slightly, although the costs alter broadly depending on area you live, how abundant you earn, and how abounding bodies are in your household. Almost all low- and moderate-income Americans can authorize for a tax acclaim or subsidy to admonition with their bloom allowance cost. But if you accomplish added than $50,000, you’ll accept to pay that amount on your own.For those Americans who accomplish a little bit too abundant to authorize for a subsidy, affairs on the exchange can be berserk expensive.“The ones that aren’t acceptable for subsidies are the ones that are still absolutely disturbing with affordability in this market,” said Rachel Fehr, a analysis abettor at the Kaiser Family Foundation who focuses on the ACA.During the accessible acceptance period, customer advocates are advancement bodies to accomplish abiding the bloom affairs they acquirement accept the advantage they need. There’s been a huge amplification in concise affairs recently, Fehr said, which are affairs that are not adjustable with the ACA and are abundant added about regulated.Short appellation affairs generally don’t awning prenatal care, brainy bloom affliction or bactericide care, but they usually accept lower account premiums, authoritative them adorable to some consumers.

Where to Buy a Comprehensive Travel Medical Insurance Plan .. | where to buy medical insurance

“It’s absolutely important that you accept what it covers,” Fehr said.To accomplish abiding that you’re affairs a plan that is adjustable with the ACA, boutique on healthcare.gov.In Victoria County, one carrier is accessible on the ACA Marketplace, Blue Cross Blue Shield, which agency consumers locally don’t accept the aforementioned options in added areas of the accompaniment area there are added allowance companies affairs plans.More than 10 years afterwards the ACA, additionally accepted as “Obamacare,” was passed, opinions about the law are still mixed, abundantly forth affair lines. Although all-embracing opinions alter by party, abounding of the law’s amount credo are accepted with voters beyond affair lines.Eight-two percent of bodies polled had a favorable assessment of the bloom allowance marketplace, area individuals and baby businesses can buy coverage, according to the Kaiser Family Foundation’s best contempo polling.

Where to buy medical tourism insurance? - Center for Health .. | where to buy medical insurance

The subsidies accessible to admonition abate exceptional costs, like the ones that accumulate Schmidt’s account payments low, are apparent as positives by about 81% of bodies polled by the Kaiser Family Foundation.Texas is arch a accumulation of states that is aggravating to accept the absolute law declared unconstitutional. An appeals cloister in New Orleans could accomplish a accommodation in the case any day, although admiral with the Trump administering accept said that bodies with a exchange plan won’t see any actual changes to their plan if the law is overturned.Schmidt, a constant Victoria resident, said affairs a plan through the exchange has fabricated a huge aberration for her and her family’s health, and their medical bills.Schmidt runs her own business, Big Accompaniment Auto Salvage, with her husband, and ahead had a added big-ticket absolute plan.“Just let them apperceive that it could amount them annihilation at all,” Schmidt said back asked what admonition she’d accord to those afterwards insurance. “A lot of bodies are afraid to do accessible acceptance cerebration they can’t allow the fees, and if you accept accouchement you may not accept to pay annihilation at all, or depending on your pay you may not accept to pay a distinct penny.”

Michi Photostory: Where to Buy Travel Medical Insurance for .. | where to buy medical insurance

The Miracle Of Where To Buy Medical Insurance - Where To Buy Medical Insurance - where to buy medical insurance

| Allowed to our weblog, in this particular period I'm going to teach you regarding keyword. Now, this is actually the very first photograph:

For Philippines Passport Holder: Where to Buy Travel Medical .. | where to buy medical insurance

Why don't you consider image above? will be in which amazing???. if you think maybe so, I'l d show you a few image again under:

So, if you want to have the wonderful graphics about (The Miracle Of Where To Buy Medical Insurance - Where To Buy Medical Insurance), press save icon to store the photos for your personal computer. These are available for down load, if you'd prefer and want to have it, click save symbol on the article, and it'll be immediately down loaded in your desktop computer.} At last if you wish to find unique and recent graphic related to (The Miracle Of Where To Buy Medical Insurance - Where To Buy Medical Insurance), please follow us on google plus or bookmark this site, we attempt our best to offer you regular update with fresh and new photos. Hope you enjoy keeping here. For some updates and recent information about (The Miracle Of Where To Buy Medical Insurance - Where To Buy Medical Insurance) pics, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We attempt to provide you with update regularly with fresh and new images, love your searching, and find the right for you.

Here you are at our site, contentabove (The Miracle Of Where To Buy Medical Insurance - Where To Buy Medical Insurance) published . At this time we're delighted to announce that we have found an awfullyinteresting topicto be reviewed, that is (The Miracle Of Where To Buy Medical Insurance - Where To Buy Medical Insurance) Lots of people searching for info about(The Miracle Of Where To Buy Medical Insurance - Where To Buy Medical Insurance) and of course one of these is you, is not it?

Where to buy medical tourism insurance? - Center for Health .. | where to buy medical insurance

lost my job should i buy health insurance - should i buy .. | where to buy medical insurance

Read the full article

#wheretobuycheapmedicalinsurance#wheretobuyindividualmedicalinsurance#wheretobuymajormedicalinsurance#wheretobuymedicalinsurance#wheretobuymedicalinsuranceforcuba#wheretobuymedicalinsuranceforschengenvisa#wheretobuymedicalinsurancefortravel#wheretobuymedicalinsuranceinabudhabi#wheretobuymedicalinsuranceinbangkok#wheretobuyprivatemedicalinsurance

0 notes

Link

By now, most of us know to check with our health insurance company to make sure our physician or specialist referral is covered by our health care plan and within the covered network. But what if you’re unconscious or in some other medical emergency? Say, for instance, you need to be airlifted to a medical facility.

One patient, a young doctor in Texas, was billed more than $56,000 for a medevac flight after injuring his arm in an ATV accident. He, the air ambulance company and Blue Cross and Blue Shield of Texas are working toward resolution, with the company asking him to appeal to the Texas Department of Insurance.

Imagine receiving such a bill in retirement. How might that impact your retirement plan? According to one study by Fidelity, a 65-year-old couple retiring in 2019 could expect to spend $280,000 on health care throughout retirement – not including long-term care costs. If you’re concerned that you’re not saving enough, we can help create a plan to help you be better prepared for medical expenses in retirement.

If you are still working, there are options designed to help you save for health care expenses, such as a health savings account (HSA). An HSA is designed to allow you to save pre-tax money to pay for qualifying medical expenses and is open to those covered by a high-deductible health care plan. It can be a powerful tool for retirement health care savings. If an HSA account owner maximizes annual contributions, invests those assets with the opportunity for growth and does not make any withdrawals until he retires, he can create savings specifically designed to pay for retirement medical expenses – tax-free. Be aware, however, that the return and principal value of invested HSA assets will fluctuate and, when accessed, may be worth more or less than their original value. Assets placed in investment options are not FDIC-insured, nor are they guaranteed by the bank that administers the health savings account.

Several new laws enacted this year are aimed at helping consumers better manage their health care costs. Until recently, many health insurance plans and pharmacy benefit managers – including those offered through Medicare Advantage and Medicare Part D plans – negotiated “gag clause” agreements with the pharmacies in their network. These agreements prevented pharmacists from letting customers know that a drug they purchased at the store would be less expensive if they purchased it out-of-pocket rather than using their insurance. However, the Patient Right to Know Drug Prices Act and the Know the Lowest Price Act of 2018, both signed into law in October 2018, make this practice unlawful for insurance plans offered by employers, those purchased on the individual market and Medicare Part D plans.

Standard Disclaimer.

Advisory services offered through Lake Point Wealth Management, LLC, an SEC Registered Investment Adviser. Insurance products and services offered through Lake Point Advisory Group, LLC. It is important that you do not use e-mail to request, authorize or effect the purchase or sale of any security or to effect any other transactions. The information transmitted herein and any attachments or files transmitted herewith may contain proprietary, confidential and/or protected, non-public information, are covered by applicable state and federal laws and are intended solely for the use of the individual or entity named above as the intended recipient. If the reader of this message is not the above-named intended recipient, or his/her/its agent, be advised that any review, disclosure, dissemination, distribution or copying of this communication is strictly prohibited. If you have received this communication in error, please immediately notify the sender by telephone or e-mail and destroy the material forwarded in error. Nothing in this communication shall constitute an offer to sell or solicit any offer to buy a security or any insurance product. Recipients should be aware that all emails exchanged with the sender may be archived and may be accessed at any time by duly authorized persons and may be produced to other parties, including public authorities, in compliance with applicable laws.

Read more at https://lakepointadvisorygroup.com/health-care-roundup/

#Insurance Services#Life Insurance Services#Health Insurance Services#Retirement Planning#Retirement Planning Services#Retirement Planning Experts#Financial Planning#Financial Planning Services#Wealth Management#Wealth Management Experts

0 notes

Text

COVID Catch-22: They Got A Big ER Bill Because Hospitals Couldn’t Test For Virus

Fresh off a Caribbean cruise in early March, John Campbell developed a cough and fever of 104 degrees. He went to his primary care physician and got a flu test, which came up negative.

Then things got strange. Campbell said the doctor then turned to him and said, “I’ve called the ER next door, and you need to go there. This is a matter of public health. They’re expecting you.”

Special Reports

Bill Of The Month

Feb 13

Bill of the Month is a crowdsourced investigation by Kaiser Health News and NPR that dissects and explains medical bills.

It was March 3, and no one had an inkling yet of just how bad the COVID-19 pandemic would become in the U.S.

At the JFK Medical Center near his home in Boynton Beach, Florida, staffers met him in protective gear, then ran a battery of tests — including bloodwork, a chest X-ray and an electrocardiogram — before sending him home. But because he had not traveled to China — a leading criterion at the time for coronavirus testing — Campbell was not swabbed for the virus.

A $2,777 bill for the emergency room visit came the next month.

Now Campbell, 52, is among those who say they were wrongly billed for the costs associated with seeking a COVID-19 diagnosis.

While most insurers have promised to cover the costs of testing and related services — and Congress passed legislation in mid-March enshrining that requirement — there’s a catch: The law requires the waiver of patient cost sharing only when a test is ordered or administered.

And therein lies the problem. In the early weeks of the pandemic and through mid-April in many places, testing was often limited to those with specific symptoms or situations, likely excluding thousands of people who had milder cases of the virus or had not traveled overseas.

“They do pay for the test, but I didn’t have the test,” said Campbell, who appealed the bill to his insurer, Florida Blue. More on how that turned out later.

Don't Miss A Story

Subscribe to KHN’s free Weekly Edition newsletter.

Sign Up

Please confirm your email address below:

Sign Up

“These loopholes exist,” said Wendell Potter, a former insurance industry executive who is now an industry critic. “We’re just relying on these companies to act in good faith.”

Exacerbating the problem: Many of these patients were directed to go to hospital emergency departments — the most expensive place to get care — which can result in huge bills for patients-deductible insurance.

More From Our Bill Of The Month Series

COVID-Like Cough Sent Him To ER — Where He Got A $3,278 Bill May 25

COVID Tests Are Free, Except When They’re Not Apr 29

Her Genetic Test Revealed A Microscopic Problem — And A Jumbo Price Tag Mar 31

Hormone Blocker Shocker: Drug Costs 8 Times More When Used For Kids Feb 24

Appendicitis Is Painful — Add A $41,212 Surgery Bill To The Misery Jan 29

Insurers say they fully cover costs when patients are tested for the coronavirus, but what happens with enrollees who sought a test — but were not given one — is less clear.

KHN asked nine national and regional insurers for specifics about how they are handling these situations.

Results were mixed. Three — UnitedHealthcare, Kaiser Permanente and Anthem — said they do some level of automatic review of potential COVID-related claims from earlier in the pandemic, while a fourth, Quartz, said it would investigate and waive cost sharing for suspected COVID patients if the member asks for a review. Humana said it is reviewing claims made in early March, but only those showing confirmed or suspected COVID. Florida Blue, similarly, said it is manually reviewing claims, but only those involving COVID tests or diagnoses. The remaining insurers pointed to other efforts, such as routine audits that look for all sorts of errors, along with efforts to train hospitals and doctors in the proper COVID billing codes to use to ensure patients aren’t incorrectly hit with cost sharing. Those were Blue Cross Blue Shield of Michigan, CIGNA and the Health Care Services Corp., which operates Blues plans in Illinois, Montana, New Mexico, Oklahoma and Texas.

All nine said patients should reach out to them or appeal a claim if they suspect an error.

To be sure, it would be a complex effort for insurers to go back over claims from March and April, looking for patients that might qualify for a more generous interpretation of the cost waiver because they were unable to get a coronavirus test. And there’s nothing in the CARES Act passed by Congress — or subsequent guidance from regulatory agencies — about what to do in such situations.

Still, insurers could review claims, for example, by looking for patients who received chest X-rays, and diagnoses of pneumonia or high fever and cough, checking to see if any might qualify as suspected COVID cases, even if they were not given a diagnostic test, said Potter.

One thing was clear from the responses: Much of the burden falls on patients who think they’ve been wrongly billed to call that to the attention of the insurer and the hospital, urgent care center or doctor’s office where they were treated.

John Campbell developed a cough and fever of 104 degrees in early March, was directed to an ER and ultimately received a $2,777 bill for the visit. He is among those who say they were wrongly billed for the costs associated with seeking a COVID-19 diagnosis.(Courtesy of John Campbell)

Some states have broader mandates that could be read to require the waiver of cost sharing even if a COVID test was not ordered or administered, said Sabrina Corlette, a research professor and co-director of the Center on Health Insurance Reforms at Georgetown University.

But no matter where you live, she said, patients who get bills they think are incorrect should contest them. “I’ve heard a lot of comments that claims are not coded properly,” said Corlette. “Insurers and providers are on a learning curve. If you get a bill, ask for a review.”

Scarce Tests, Rampant Virus

In some places, including the state of Indiana, the city of Los Angeles and St. Louis County, Missouri, a test is now offered to anyone who seeks one. Until recently, tests were scarce and essentially rationed, even though more comprehensive testing could have helped health officials battle the epidemic.

But even in the early weeks, when Campbell and many others sought a diagnosis, insurers nationwide were promising to cover the cost of testing and related services. That was good PR and good public health: Removing cost barriers to testing means more people will seek care and thus could prevent others from being infected. Currently, the majority of insurers offering job-based or Affordable Care Act insurance say they are fully waiving copays, deductibles and other fees for testing, as long as the claims are coded correctly. (The law does not require short-term plans to waive cost sharing.) Some insurers have even promised to fully cover the cost of treatment for COVID, including hospital care.

But getting stuck with a sizable bill has become commonplace. “I only went in because I was really sick and I thought I had it,” said Rayone Moyer, 63, of La Crosse, Wisconsin, who was extra concerned because she has diabetes. “I had a hard time breathing when I was doing stuff.”

On March 27, she went to Gundersen Lutheran Medical Center, which is in her Quartz insurance network, complaining of body aches and shortness of breath. Those symptoms could be COVID-related, but could also signal other conditions. While there, she was given an array of tests, including bloodwork, a chest X-ray and a CT scan.

She was billed in May: $2,421 by the hospital and more than $350 in doctor bills.

“My insurance applied the whole thing to my deductible,” she said. “Because they refused to test me, I’ve got to pay the bill. No one said, ‘Hey, we’ll give you $3,000 worth of tests instead of the $100 COVID test,’” she said.

Quartz spokesperson Christina Ott said patients with concerns like Moyer’s should call the insurance company’s customer service number and ask for an appeals specialist. The insurer, she wrote in response to KHN’s survey of insurers, will waive cost sharing for some members who sought a diagnosis.

“During the public health emergency, if the member presented with similar symptoms as COVID, but didn’t receive a COVID-19 test and received testing for other illnesses on an outpatient basis, then cost sharing would be waived,” she wrote.

Moyer said she has filed an appeal and was notified by the insurer of a review expected in mid-July. Back in Florida, Campbell filed an appeal of his bill with Florida Blue on April 22, but didn’t hear anything until the day after a KHN reporter called the insurer about his case in June.

Then, Campbell received phone calls from Florida Blue representatives. A supervisor apologized, saying the insurer should not have billed him and that 100% of his costs would be covered.

“Basically they said, ‘We’ve changed our minds,’” said Campbell. “Because I was there so early on, and the bill was coded incorrectly.”

COVID Catch-22: They Got A Big ER Bill Because Hospitals Couldn’t Test For Virus published first on https://smartdrinkingweb.weebly.com/

0 notes

Text

COVID Catch-22: They Got A Big ER Bill Because Hospitals Couldn’t Test For Virus

Fresh off a Caribbean cruise in early March, John Campbell developed a cough and fever of 104 degrees. He went to his primary care physician and got a flu test, which came up negative.

Then things got strange. Campbell said the doctor then turned to him and said, “I’ve called the ER next door, and you need to go there. This is a matter of public health. They’re expecting you.”

Special Reports

Bill Of The Month

Feb 13

Bill of the Month is a crowdsourced investigation by Kaiser Health News and NPR that dissects and explains medical bills.

It was March 3, and no one had an inkling yet of just how bad the COVID-19 pandemic would become in the U.S.

At the JFK Medical Center near his home in Boynton Beach, Florida, staffers met him in protective gear, then ran a battery of tests — including bloodwork, a chest X-ray and an electrocardiogram — before sending him home. But because he had not traveled to China — a leading criterion at the time for coronavirus testing — Campbell was not swabbed for the virus.

A $2,777 bill for the emergency room visit came the next month.

Now Campbell, 52, is among those who say they were wrongly billed for the costs associated with seeking a COVID-19 diagnosis.

While most insurers have promised to cover the costs of testing and related services — and Congress passed legislation in mid-March enshrining that requirement — there’s a catch: The law requires the waiver of patient cost sharing only when a test is ordered or administered.

And therein lies the problem. In the early weeks of the pandemic and through mid-April in many places, testing was often limited to those with specific symptoms or situations, likely excluding thousands of people who had milder cases of the virus or had not traveled overseas.

“They do pay for the test, but I didn’t have the test,” said Campbell, who appealed the bill to his insurer, Florida Blue. More on how that turned out later.

Don't Miss A Story

Subscribe to KHN’s free Weekly Edition newsletter.

Sign Up

Please confirm your email address below:

Sign Up

“These loopholes exist,” said Wendell Potter, a former insurance industry executive who is now an industry critic. “We’re just relying on these companies to act in good faith.”

Exacerbating the problem: Many of these patients were directed to go to hospital emergency departments — the most expensive place to get care — which can result in huge bills for patients-deductible insurance.

More From Our Bill Of The Month Series

COVID-Like Cough Sent Him To ER — Where He Got A $3,278 Bill May 25

COVID Tests Are Free, Except When They’re Not Apr 29

Her Genetic Test Revealed A Microscopic Problem — And A Jumbo Price Tag Mar 31

Hormone Blocker Shocker: Drug Costs 8 Times More When Used For Kids Feb 24

Appendicitis Is Painful — Add A $41,212 Surgery Bill To The Misery Jan 29

Insurers say they fully cover costs when patients are tested for the coronavirus, but what happens with enrollees who sought a test — but were not given one — is less clear.

KHN asked nine national and regional insurers for specifics about how they are handling these situations.

Results were mixed. Three — UnitedHealthcare, Kaiser Permanente and Anthem — said they do some level of automatic review of potential COVID-related claims from earlier in the pandemic, while a fourth, Quartz, said it would investigate and waive cost sharing for suspected COVID patients if the member asks for a review. Humana said it is reviewing claims made in early March, but only those showing confirmed or suspected COVID. Florida Blue, similarly, said it is manually reviewing claims, but only those involving COVID tests or diagnoses. The remaining insurers pointed to other efforts, such as routine audits that look for all sorts of errors, along with efforts to train hospitals and doctors in the proper COVID billing codes to use to ensure patients aren’t incorrectly hit with cost sharing. Those were Blue Cross Blue Shield of Michigan, CIGNA and the Health Care Services Corp., which operates Blues plans in Illinois, Montana, New Mexico, Oklahoma and Texas.

All nine said patients should reach out to them or appeal a claim if they suspect an error.

To be sure, it would be a complex effort for insurers to go back over claims from March and April, looking for patients that might qualify for a more generous interpretation of the cost waiver because they were unable to get a coronavirus test. And there’s nothing in the CARES Act passed by Congress — or subsequent guidance from regulatory agencies — about what to do in such situations.

Still, insurers could review claims, for example, by looking for patients who received chest X-rays, and diagnoses of pneumonia or high fever and cough, checking to see if any might qualify as suspected COVID cases, even if they were not given a diagnostic test, said Potter.

One thing was clear from the responses: Much of the burden falls on patients who think they’ve been wrongly billed to call that to the attention of the insurer and the hospital, urgent care center or doctor’s office where they were treated.

John Campbell developed a cough and fever of 104 degrees in early March, was directed to an ER and ultimately received a $2,777 bill for the visit. He is among those who say they were wrongly billed for the costs associated with seeking a COVID-19 diagnosis.(Courtesy of John Campbell)

Some states have broader mandates that could be read to require the waiver of cost sharing even if a COVID test was not ordered or administered, said Sabrina Corlette, a research professor and co-director of the Center on Health Insurance Reforms at Georgetown University.

But no matter where you live, she said, patients who get bills they think are incorrect should contest them. “I’ve heard a lot of comments that claims are not coded properly,” said Corlette. “Insurers and providers are on a learning curve. If you get a bill, ask for a review.”

Scarce Tests, Rampant Virus

In some places, including the state of Indiana, the city of Los Angeles and St. Louis County, Missouri, a test is now offered to anyone who seeks one. Until recently, tests were scarce and essentially rationed, even though more comprehensive testing could have helped health officials battle the epidemic.

But even in the early weeks, when Campbell and many others sought a diagnosis, insurers nationwide were promising to cover the cost of testing and related services. That was good PR and good public health: Removing cost barriers to testing means more people will seek care and thus could prevent others from being infected. Currently, the majority of insurers offering job-based or Affordable Care Act insurance say they are fully waiving copays, deductibles and other fees for testing, as long as the claims are coded correctly. (The law does not require short-term plans to waive cost sharing.) Some insurers have even promised to fully cover the cost of treatment for COVID, including hospital care.

But getting stuck with a sizable bill has become commonplace. “I only went in because I was really sick and I thought I had it,” said Rayone Moyer, 63, of La Crosse, Wisconsin, who was extra concerned because she has diabetes. “I had a hard time breathing when I was doing stuff.”

On March 27, she went to Gundersen Lutheran Medical Center, which is in her Quartz insurance network, complaining of body aches and shortness of breath. Those symptoms could be COVID-related, but could also signal other conditions. While there, she was given an array of tests, including bloodwork, a chest X-ray and a CT scan.

She was billed in May: $2,421 by the hospital and more than $350 in doctor bills.

“My insurance applied the whole thing to my deductible,” she said. “Because they refused to test me, I’ve got to pay the bill. No one said, ‘Hey, we’ll give you $3,000 worth of tests instead of the $100 COVID test,’” she said.

Quartz spokesperson Christina Ott said patients with concerns like Moyer’s should call the insurance company’s customer service number and ask for an appeals specialist. The insurer, she wrote in response to KHN’s survey of insurers, will waive cost sharing for some members who sought a diagnosis.

“During the public health emergency, if the member presented with similar symptoms as COVID, but didn’t receive a COVID-19 test and received testing for other illnesses on an outpatient basis, then cost sharing would be waived,” she wrote.

Moyer said she has filed an appeal and was notified by the insurer of a review expected in mid-July. Back in Florida, Campbell filed an appeal of his bill with Florida Blue on April 22, but didn’t hear anything until the day after a KHN reporter called the insurer about his case in June.

Then, Campbell received phone calls from Florida Blue representatives. A supervisor apologized, saying the insurer should not have billed him and that 100% of his costs would be covered.

“Basically they said, ‘We’ve changed our minds,’” said Campbell. “Because I was there so early on, and the bill was coded incorrectly.”

from Updates By Dina https://khn.org/news/covid-catch-22-they-got-a-big-er-bill-because-hospitals-couldnt-test-for-virus/

0 notes

Text

COVID Catch-22: They Got A Big ER Bill Because Hospitals Couldn’t Test For Virus

Fresh off a Caribbean cruise in early March, John Campbell developed a cough and fever of 104 degrees. He went to his primary care physician and got a flu test, which came up negative.

Then things got strange. Campbell said the doctor then turned to him and said, “I’ve called the ER next door, and you need to go there. This is a matter of public health. They’re expecting you.”

Special Reports

Bill Of The Month

Feb 13

Bill of the Month is a crowdsourced investigation by Kaiser Health News and NPR that dissects and explains medical bills.

It was March 3, and no one had an inkling yet of just how bad the COVID-19 pandemic would become in the U.S.

At the JFK Medical Center near his home in Boynton Beach, Florida, staffers met him in protective gear, then ran a battery of tests — including bloodwork, a chest X-ray and an electrocardiogram — before sending him home. But because he had not traveled to China — a leading criterion at the time for coronavirus testing — Campbell was not swabbed for the virus.

A $2,777 bill for the emergency room visit came the next month.

Now Campbell, 52, is among those who say they were wrongly billed for the costs associated with seeking a COVID-19 diagnosis.

While most insurers have promised to cover the costs of testing and related services — and Congress passed legislation in mid-March enshrining that requirement — there’s a catch: The law requires the waiver of patient cost sharing only when a test is ordered or administered.

And therein lies the problem. In the early weeks of the pandemic and through mid-April in many places, testing was often limited to those with specific symptoms or situations, likely excluding thousands of people who had milder cases of the virus or had not traveled overseas.

“They do pay for the test, but I didn’t have the test,” said Campbell, who appealed the bill to his insurer, Florida Blue. More on how that turned out later.

Don't Miss A Story

Subscribe to KHN’s free Weekly Edition newsletter.

Sign Up

Please confirm your email address below:

Sign Up

“These loopholes exist,” said Wendell Potter, a former insurance industry executive who is now an industry critic. “We’re just relying on these companies to act in good faith.”

Exacerbating the problem: Many of these patients were directed to go to hospital emergency departments — the most expensive place to get care — which can result in huge bills for patients-deductible insurance.

More From Our Bill Of The Month Series

COVID-Like Cough Sent Him To ER — Where He Got A $3,278 Bill May 25

COVID Tests Are Free, Except When They’re Not Apr 29

Her Genetic Test Revealed A Microscopic Problem — And A Jumbo Price Tag Mar 31

Hormone Blocker Shocker: Drug Costs 8 Times More When Used For Kids Feb 24