#cryptolearning

Explore tagged Tumblr posts

Text

Insider Secrets Revealed: Where to Find the Next Big Crypto Pump!

#cryptodigitalinsight#cryptocurrency#cryptoeducation#cryptoanalysis#cryptolearning#responsiblecrypto#smartcryptoinvesting#cryptoresearch#longtermgrowth

0 notes

Text

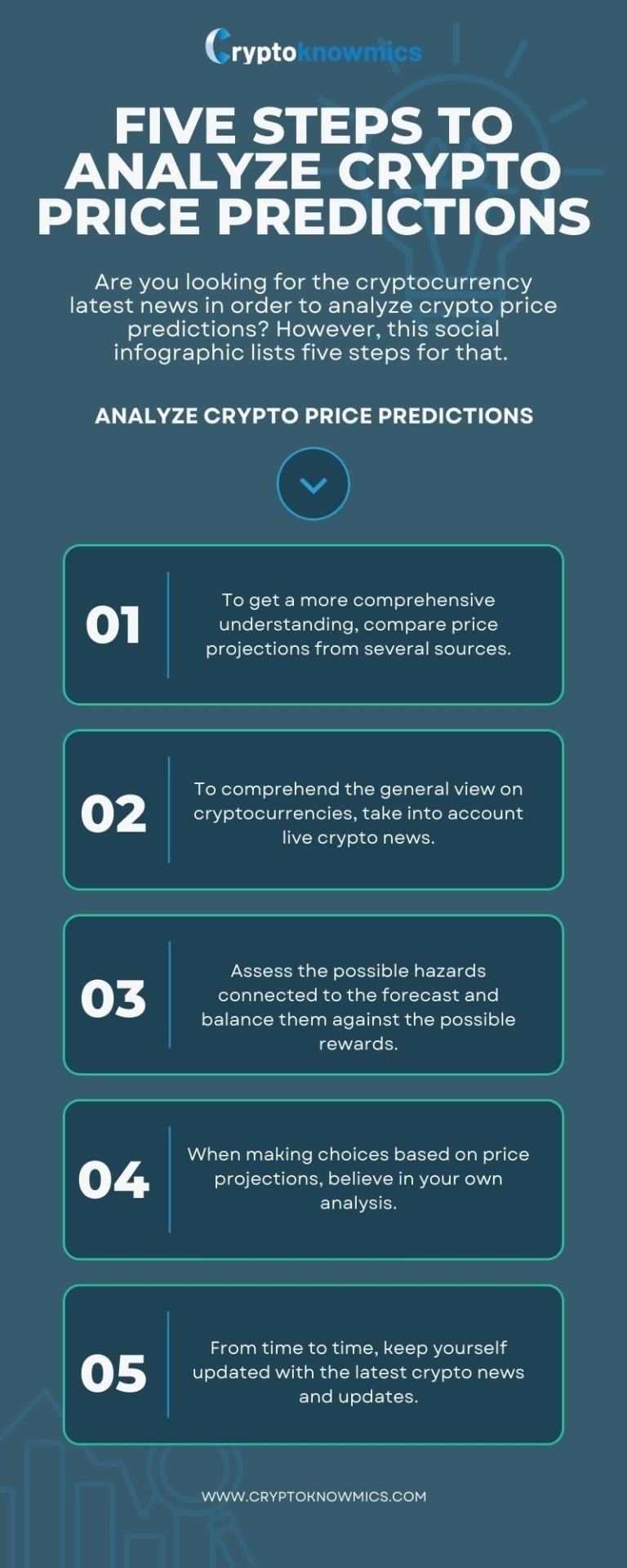

Are you looking for the cryptocurrency latest news in order to study crypto price predictions? However, this social infographic lists five steps for that.

#CryptoNewsUpdate#CryptocurrencyInsights#CryptoPricePredictions#CryptoAnalysis#InfographicGuidance#CryptoTips#CryptoResearch#DigitalCurrencyNews#CryptoTrends#CryptoLearning

0 notes

Text

Crypto-currency trading strategies: Tips for maximizing profits

Trading in cryptocurrencies has grown in popularity as a means of profiting from the quickly developing market for digital assets. The decentralized finance (DeFi) movement and the adoption of blockchain technology throughout the world present many business prospects in the cryptocurrency industry. However, traders must use efficient techniques that minimize risk and increase returns to thrive in this dynamic and turbulent market. In this post, we'll take a closer look at several fundamental crypto-currency trading techniques that can help traders get around the market's intricacies and increase their chances of success.

1. Perform research.

It's crucial to conduct a careful study before making any investing decisions in the cryptocurrency industry. While following hype or speculative patterns may be alluring, it is more dependable to base your trades on fundamental analysis. Examine the underlying technology, leadership, collaborations, and real-world applications of the cryptocurrencies you're contemplating trading. Projects with strong foundations, active development teams, and a welcoming community should be sought out.

Keep up with news and events in the cryptocurrency world since big announcements or changes in regulations can cause huge price changes. To obtain a sense of prospective opportunities and threats, you should also follow industry experts, influencers, and reliable sources.

2. Create a trading strategy

To successfully navigate the unstable cryptocurrency market, you must have a clearly defined trading strategy. Your trading strategy should outline specific goals, degrees of risk tolerance, and trade entry and exit tactics. Choose your favorite trading approaches, such as long-term investing, swing trading, or day trading.

Create guidelines for position sizing, which defines how much money you put into each transaction. A general guideline is to never risk more than 1% to 2% of your entire cash on a single trade. When market conditions are unfavorable, following tight money management techniques can help safeguard your capital from significant losses.

3. Technical analysis

Technical analysis is the process of analyzing previous price charts and forecasting future price patterns using a variety of indicators and models. It aids traders in spotting patterns, levels of support and resistance, and possible entry and exit locations for their trades.

Moving averages (MA), which smooth price data to identify trends, the relative strength index (RSI), which evaluates overbought or oversold conditions, and the moving average convergence and divergence (MACD), which evaluates changes in momentum are some examples of common technical indicators.

Although technical analysis can offer useful information, it is important to keep in mind that it is not perfect. Technical indications might be ignored in favor of market mood, current affairs, and fundamental changes, which can affect prices.

4. Make your portfolio more diverse.

Spreading your investments over a variety of assets is referred to as diversification in risk management. It lessens the effect of the performance of each asset on the total value of your portfolio. By diversifying, you lessen the danger of suffering significant losses if the price of a particular asset declines by avoiding putting all of your money in a single cryptocurrency.

A well-diversified cryptocurrency portfolio often consists of coins from many categories, including well-known ones like Bitcoin and Ethereum, promising altcoins with cutting-edge technology, and stablecoins for risk reduction.

5. Use stop-loss orders

In the trading of cryptocurrencies, stop-loss orders are crucial risk management instruments. A stop-loss order automatically sells a cryptocurrency at a predetermined price to reduce future losses. If the market goes against your position, placing a stop-loss order enables you to get out of a trade before suffering large losses.

Consider your risk tolerance and the asset's volatility when determining stop-loss levels. The stop-loss order shouldn't be put too close to the price it is at right now because it can be activated by sudden changes in the market.

6. Follow market trends

Markets for cryptocurrencies are impacted by emotions and trends. You may make smart trading selections by closely monitoring key market trends and investor mood. News sources, forums, and social media sites are useful tools for assessing market sentiment.

Finding and monitoring market trends can help you spot chances and stay away from deals that go against the grain of popular opinion. To ensure a trend's validity and durability, though, careful investigation and analysis should always be done before acting on it.

7. Avoid FOMO and FUD

Two typical emotions that can have a significant impact on trading decisions are fear of missing out (FOMO) and fear, uncertainty, and doubt (FUD). For fear of missing out on prospective gains, FOMO might cause someone to buy an asset at its peak. In contrast, due to fear and uncertainty, FUD can cause panic selling during a market slump.

Stick to your trading strategy and refrain from pursuing quick gains if you want to avoid making irrational mistakes. Instead of being influenced by market emotions, base your transactions on thorough study, analysis, and logical thinking.

8. Be mindful of fees

Exchange fees, withdrawal fees, and transaction fees are just a few of the fees associated with trading cryptocurrencies. These fees, particularly for high-frequency traders or when there are few transactions involved, can significantly affect your overall profitability.

To find the best options, compare the costs charged by various exchanges and trading platforms. To prevent your revenues from being reduced, also consider any potential hidden fees.

9. Stay disciplined

Successful cryptocurrency traders must have both discipline and patience. Maintain your trading plan and methods even when the market is volatile. Refrain from acting rashly or departing from your well-established trading strategy.

Wait for the proper moments to arise while maintaining your patience. Since the price of cryptocurrencies is often volatile, exercising patience might help investors avoid taking hasty decisions that could result in losses.

10. Learn from your mistakes

The process of trading on the cryptocurrency market involves ongoing learning. Accept that you will make mistakes or lose along the path. Consider these encounters as worthwhile learning opportunities rather than becoming frustrated.

Examine your transactions and determine what went correctly and wrong. You can improve your trading decisions in the future by identifying patterns in your trading behavior and modifying your strategy accordingly.

CONCLUSION

Although trading cryptocurrencies includes some inherent risks, it may also be quite lucrative. Trading professionals can improve their chances of success in this changing market by taking a thorough and thoughtful strategy.

Always do your homework, create a sound trading strategy, use technical analysis judiciously, diversify your holdings, and employ effective risk management techniques. Keep an eye out for market trends and feelings; refrain from acting on impulse; and place an emphasis on self-control and endurance.

Additionally, consider trading as a learning opportunity. It takes constant learning and development to successfully navigate the ever-evolving cryptocurrency market. You'll be better prepared to increase your trading profits by paying attention to this advice.

If you're interested in learning more, you can check out my recommended “Course of Crypto and Bitcoin”

"Disclosure: This article includes affiliate links. If you click on these links and make a purchase, I may earn a commission at no additional cost to you. I only recommend products or services that I have personally used and believe will add value to my readers. Your support through these affiliate links is greatly appreciated and helps me continue to provide valuable content on mastercryptoforall.blogspot.com. Thank you!"

#CryptocurrencyTrading#CryptoEducation#Blockchain#DeFi#CryptoMarket#InvestingTips#CryptocurrencyTips#CryptocurrencyNews#CryptoCommunity#CryptocurrencyInsights#CryptoLearning#CryptocurrencyInvesting#CryptocurrencyEducation#CryptocurrencyExpert#CryptoBeginner#Bitcoin#Ethereum#CryptocurrencyPortfolio#CryptoDiscipline#CryptoLearningOpportunity

0 notes

Text

Summary of "The Basics of Bitcoins and Blockchains" by Antony Lewis

“The Basics of Bitcoins and Blockchains” by Antony Lewis is an accessible and comprehensive guide to understanding the fundamentals of cryptocurrencies, particularly Bitcoin, and the underlying technology of blockchain. Lewis demystifies complex concepts and provides a beginner-friendly introduction to the world of digital currencies and distributed ledger technology. This summary provides an…

View On WordPress

#Bitcoin101#BitcoinBasics#Blockchain101#BlockchainBasics#Cryptocurrency101#CryptoEducation#CryptoKnowledge#CryptoLearning#CryptoTutorial

0 notes

Text

Crypto vs Gold: Which is the Better Investment? | Crypto Elite

youtube

========================================== 👉 Subscribe for more Videos: ========================================== Investing in crypto or gold? Which asset reigns supreme? In this video, we compare the pros and cons of cryptocurrency and gold, exploring their historical performance, risk factors, and potential for growth. Whether you're a seasoned investor or just starting out, this video will help you decide which asset is right for you. Watch now and join the conversation! #Crypto101 #BlockchainBasics #BitcoinExplained #CryptocurrencyEducation #DigitalCurrency #CryptoNewbies #WalletWisdom #LearnCrypto #CryptoBeginner #DecodingCryptocurrency #CryptoAdventure #BlockchainTech #BitcoinIntro #CryptoLearning #CryptoCurious #CryptoTips #Cryptocurrency101 #MiningExplained #NakamotoLegacy #CryptoCommunity without hashtags SEO TAGS: crypto,crypto news,investment,crypto vs forex,crypto vs forex trading,best crypto investment,best crypto investments,crypto investment 2023,which crypto to invest,crypto vs gold,crypto vs gold vs cash,crypto vs stocks,crypto banter,what is token crypto,cryptocurrency vs forex,crypto bull run,why crypto market is down,why crypto market is going down today,share vs crypto,forex vs cryptocurrency trading,governments crypto,crypto update

0 notes

Video

youtube

I TRIED CRYPTO TRADING FOR 1 WEEK (AND HERE'S WHAT HAPPENED)

#crypto #cryptotrading #cryptocurrency #investment #volatility #riskmanagement #diversification #marketanalysis #learningopportunity #emotionalcontrol #patience #discipline #tradingstrategy #markettrends #marketvolatility #experiencedtraders #beginnersguide #cryptomarket #cryptoplatform #cryptoexchange #tradingexperience #cryptoinvestment #cryptosuccess #riskmanagementstrategy #cryptotrends #cryptolearning

#youtube#crypto#cryptotrading#cryptocurrency#investment#volatility#riskmanagement#diversification#marketanalysis#learningopportunity

0 notes

Photo

Cryptocurrency Passive Income options!!! Follow for daily Crypto News & Knowledge #cryptoinforgraphics, #crypto, #cryptocurrencies, #infographics, #cryptoknowledge, #cryptoinformation, #cryptolearning

0 notes

Text

0 notes

Text

Learn Applications of Governance and DAO in Web3 with Recorem | July 29, 8:30PM IST

📢 Join our 5th masterclass of "Transitioning into Web3.0" with Raj Karia Founder of Truts and Learn:

✅ Learn the Applications of Governance and DAO in Web3 ✅ Know why do DAO matters? ✅ The Promise, Implications and Challenges ahead

📆 July 29 🕣 8:30 PM IST

✨ Learn, Network & find opportunities in Web3!

💼 100+ High Paying Web3 Jobs like Blockchain Developer & Internships, from 50+ Web3 companies worldwide for you!

Join our Discord for more updates: https://lnkd.in/d9KAGUTZ

Register FREE Now:

#web3#web3jobs#web3events#web3learning#web3community#event#dao#daocommunity#blockchain#nft#nfts#nftcommunity#defi#dapps#cryptolearning#decentralized#metaverse#metaversenft#metaverseevents#jobs#career#networking#internship

0 notes

Photo

Uno de mis libros favoritos sobre desarrollo artístico. De paso te comento que a finales de junio conocerás mi #PróximoLibro y mi #podcast en #Patreon. Y mi colección de ilustraciones digitales "CryptoLearning" en #Opensea. - - - - - #Adiósalasorejasdeburro #Melodíafiscal #CryptoLearning #Nft #Nftartist https://www.instagram.com/p/CdGd8ZErBGc/?igshid=NGJjMDIxMWI=

#próximolibro#podcast#patreon#opensea#adiósalasorejasdeburro#melodíafiscal#cryptolearning#nft#nftartist

0 notes

Photo

The More You Learn, The More You Earn Join Zinox - Best Crypto Trading E-Academy - - To Reach Us, 📧 [email protected] 🌐 https://zinox.io

#zinox#crypto#cryptocurrency#cryptoacademy#learncryptotrading#learncrypto#cryptocourse#cryptolearning#cryptotradingcourse#cryptoinvestor#investment#bitcoin

0 notes

Link

Top 5 IDO Launchpads Cardano - Cardano launchpad

0 notes

Text

Crypto Vocabulary

All wording/terms you never heard before and that will help you to seize a full understanding of crypto world.

Start learning to speak the same language as any other crypto nerd.

Enjoy !

0 notes

Photo

Weekly goals for crypto investment. #cryptominium #cryptolearning #cryptoeducation. Not financial advise this just for education and entertainment purposes. https://www.instagram.com/p/CGh44bSg3_-/?igshid=1chmxhzg0uzr3

0 notes

Link

3 notes

·

View notes

Photo

Learn a New SKILL to Drive Faster to your DESTINATION!!! #education #forex #forextrader #forexlearning #cryptolearning #cryptocurrency #entrepreneur #networkmarketing #mentorship (at Saskatoon, Saskatchewan) https://www.instagram.com/p/BvxDSDbHbXY/?utm_source=ig_tumblr_share&igshid=1xdma9sznpce1

#education#forex#forextrader#forexlearning#cryptolearning#cryptocurrency#entrepreneur#networkmarketing#mentorship

0 notes