#crypto wash trading

Explore tagged Tumblr posts

Text

Quinque gazump linkdump

On OCTOBER 23 at 7PM, I'll be in DECATUR, presenting my novel THE BEZZLE at EAGLE EYE BOOKS.

It's Saturday and any fule kno that this is the day for a linkdump, in which the links that couldn't be squeezed into the week's newsletter editions get their own showcase. Here's the previous 23 linkdumps:

https://pluralistic.net/tag/linkdump/

Start your weekend with some child's play! Ada & Zangemann is a picture book by Matthias Kirschner and Sandra Brandstätter of Free Software Foundation Europe, telling the story of a greedy inventor who ensnares a town with his proprietary, remote-brickable gadgets, and Ada, his nemesis, a young girl who reverse engineers them and lets their users seize the means of computation:

https://fsfe.org/activities/ada-zangemann/index.en.html

Ada & Zangemann is open access – you can share it, adapt it, and sell it as you see fit – and has been translated into several languages. Now, there's a cartoon version, an animated adaptation that is likewise open access, with digital assets for your remixing pleasure:

https://fsfe.org/activities/ada-zangemann//movie

Figuring out how to talk to kids about important subjects is a clarifying exercise. Back in the glory days of SNL, Eddie Murphy lampooned Fred "Mr" Rogers style of talking to kids, and it was indeed very funny:

https://snl.fandom.com/wiki/Mr._Robinson

But Mr Rogers' rhetorical style wasn't as simple as "talk slowly and use small words" – the "Fredish" dialect that Mr Rogers created was thoughtful, empathic, inclusive, and very effective:

https://memex.craphound.com/2019/07/09/the-nine-rules-of-freddish-the-positive-inclusive-empathic-language-of-mr-rogers/

Lots of writers have used the sing-songy fairytale style of children's stories to make serious political points (see, e.g. Animal Farm). My own attempt at this was my 2011 short story "The Brave Little Toaster," for MIT Tech Review's annual sf series. If the title sounds familiar, that's because I nicked it from Tom Disch's tale of the same name, as part of my series of stolen title stories:

https://locusmag.com/2012/05/cory-doctorow-a-prose-by-any-other-name/

My Toaster story is a tale of IoT gone wild, in which the nightmare of a world of "smart" devices that exert control over their owners is shown to be a nightmare. A work colleague sent me this adaptation of the story as part of an English textbook, with lots of worksheet-style exercises. I'd never seen this before, and it's very fun:

http://ourenglishclass.net/wp-content/uploads/sites/6/2024/09/bravetoaster.pdf

If you like my "Brave Little Toaster," you'll likely enjoy my novella "Unauthorized Bread," which appears in my 2019 collection Radicalized and is currently being adapted as a middle-grades graphic novel by Blue Delliquanti for Firstsecond:

https://arstechnica.com/gaming/2020/01/unauthorized-bread-a-near-future-tale-of-refugees-and-sinister-iot-appliances/

Childlike parables have their place, but just because something fits in a "just so" story, that doesn't make it true. Cryptocurrency weirdos desperately need to learn this lesson. The foundation of cryptocurrency is a fairytale about the origin of money, a mythological marketplace in which freely trading individuals who struggled to find a "confluence of needs." If you wanted to trade one third of your cow for two and a half of my chickens, how could we complete the transaction?

In the "money story" fairy tale, we spontaneously decided that we would use gold, for a bunch of nonsensical reasons that don't bear even cursory scrutiny. And so coin money sprang into existence, and we all merrily traded our gold with one another until a wicked government came and stole our gold with (cue scary voice) taaaaaaxes.

There is zero evidence for this. It's literally a fairy tale. There is a rich history of where money came from, and the answer, in short is, governments created it through taxes, and money doesn't exist without taxation:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

The money story is a lie, and it's a consequential one. The belief that money arises spontaneously out of the needs of freely trading people who voluntarily accept an arbitrary token as a store of value, unit of account, and unit of exchange (coupled with a childish, reactionary aversion to taxation) inspired cryptocurrency, and with it, the scams that allowed unscrupulous huxters to steal billions from everyday people who trusted Matt Damon, Spike Lee and Larry David when they told them that cryptocurrency was a sure path to financial security:

https://pluralistic.net/2024/02/15/your-new-first-name/#that-dagger-tho

It turns out that private money, far from being a tool of liberation, is rather just a dismal tool for ripping off the unsuspecting, and that goes double for crypto, where complexity can be weaponized by swindlers:

https://pluralistic.net/2022/03/13/the-byzantine-premium/

We don't hear nearly as much about crypto these days – many of the pump-and-dump set have moved on to pitching AI stock – but there's still billions tied up in the scam, and new shitcoins are still being minted at speed. The FBI actually created a sting operation to expose the dirtiness of the crypto "ecosystem":

https://www.theverge.com/2024/10/10/24267098/fbi-coin-crypto-token-nexgenai-sec-doj-fraud-investigation

They found that the exchanges, "market makers" and other seemingly rock-ribbed institutions where suckers are enticed to buy, sell, track and price cryptos are classic Big Store cons:

http://www.amyreading.com/the-9-stages-of-the-big-con.html

When you, the unsuspecting retail investor, enter one of these mirror-palaces, you are the only audience member in a play that everyone else is in on. Those vigorous trades that see the shitcoin you're being hustled with skyrocketing in value? They're "wash trades," where insiders buy and sell the same asset to one another, without real money ever changing hands, just to create the appearance of a rapidly appreciating asset that you had best get in on before you are priced out of the market.

This scam is as old as con games themselves and, as with other scams- S&Ls, Enron, subprime – the con artists have parlayed their winnings into social respectability and are now flushing them into the political system, to punish lawmakers who threaten their ability to rip off you and your neighbors. A massive, terrifying investigative story in The New Yorker shows how crypto billionaires stole the Democratic nomination from Katie Porter, one of the most effective anti-scam lawmakers in recent history:

https://www.newyorker.com/magazine/2024/10/14/silicon-valley-the-new-lobbying-monster

Big Tech – like every corrupt cartel in history – is desperate to conjure a kleptocracy into existence, whose officials they can corrupt in order to keep the machine going until they've maximized their gains and achieved escape velocity from consequences.

No surprise, then, that tech companies have adopted the same spin tactics that sowed doubt about the tobacco-cancer link, in order to keep the US from updating its anemic privacy laws. The last time Congress gave us a new consumer privacy law was 1988, when they banned video store clerks from disclosing our VHS rental history to newspapers:

https://en.wikipedia.org/wiki/Video_Privacy_Protection_Act

By preventing confining privacy law to the VCR era, Big Tech has been able to plunder our data with impunity – aided by cops and spies who love the fact that there's a source of cheap, off-the-books, warrantless surveillance data that would be illegal for them to collect.

Writing for Tech Policy Press, the Norcal ACLU's Jake Snow connects the tobacco industry fight over "pre-emption" to the modern fight over privacy laws:

https://www.techpolicy.press/big-tech-is-trying-to-burn-privacy-to-the-ground-and-theyre-using-big-tobaccos-strategy-to-do-it/

In the 1990s, Big Tobacco went to war against state anti-smoking laws, arguing that the federal government had the right – nay, the duty – to create a "harmonized" national system of smoking laws that would preempt state laws. Strangely, politicians who love "states' rights" when it comes to banning abortion, tax-base erosion and "right to work" anti-union laws suddenly discovered federal religion when their campaign donors from the Cancer-Industrial Complex decided that states shouldn't use those rights to limit smoking.

This is exactly the tack that Big Tech has taken on privacy, arguing that any update to federal privacy law should abolish muscular state-level laws, like Illinois's best-in-class biometric privacy rules, or California's CPPA.

Like Big Tobacco, Big Tech has "funded front groups, hired an armada of lobbyists, donated millions to campaigns, and opened a firehose of lobbying money," with the goal of replacing "real privacy laws with fake industry alternatives as ineffective as non-smoking sections."

Whether it's understanding the origin of money or the Big Tobacco playbook, knowing history can protect you from all kinds of predatory behavior. But history isn't merely a sword and shield, it's also just a delight. Internet pioneer Ethan Zuckerman is road-tripping around America, and in August, he got to Columbus, IN, home to some of the country's most beautiful and important architectural treasures:

https://ethanzuckerman.com/2024/08/29/road-trip-the-company-town-and-the-corn-fields/

The buildings – clustered in within a few, walkable blocks – are the legacy of the diesel engine manufacturing titan Cummins, whose postwar president J Irwin Miller used the company's wartime profits to commission a string of gorgeous structures from starchitects like the Saarinens, IM Pei, Kevin Roche, Richard Meier, Harry Weese, César Pelli, Gunnar Birkerts, and Skidmore. I had no idea about any of this, and now I want to visit Columbus!

I'm planning a book tour right now (for my next novel, Picks and Shovels, which is out in February) and there's a little wiggle-room in the midwestern part of the tour. There's a possibility that I'll end up in the vicinity, and if that happens, I'm definitely gonna find time for a little detour!

Tor Books as just published two new, free LITTLE BROTHER stories: VIGILANT, about creepy surveillance in distance education; and SPILL, about oil pipelines and indigenous landback.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

#pluralistic#linkdump#linkdumps#iot#internet of shit#brave little toaster#drm#copyfight#fsfe#big tobacco#denialism#Ada and Zangemann#Matthias Kirschner#ethan zuckerman#columbus#ohio#road trips#architecture#fbi#sting operations#pump and dump#scams#crypto#cryptocurrency#wash trading#ethereum

46 notes

·

View notes

Text

youtube

The FBI Rounded Up Crypto Criminals and It was Funny!

The FBI created their own crypto token called NexFundAI as part of an investigation into price manipulation in crypto markets. As a result of the investigation, the SEC charged three “so-called market makers” and nine individuals for allegedly engaging in schemes to boost the prices of certain crypto assets. The Department of Justice charged 18 people and entities for “widespread fraud and manipulation” in crypto markets.

#youtube#crypto#scam#nexfundai#sec#patrick boyle#manipulation#caitlyn jenner#iggy azalea#sexy aidrop#crypto scam#nft#fbi#wash trading#fraud#cryptocurreny trading#mannythehitman#saitachain#blockchain#robo inu

0 notes

Text

for the record this is 100% still true. he invested in bitcoin in 2010 (ortega absolutely made fun of him when he found out) and when he came back after heartbreak he checked back in on the crypto scene and found out he was sitting on like a million dollars and he absolutely used part of that to scam nft dudes before he pulled out completely with a fuck ton of money.

yeah okay sure canon says eden makes his money skimming but in my heart of hearts he's a crypto scammer

#eden#hanging out with ortega and he just turns to eden like 'wait shit you should know. crypto is huge now you should cash out'#meanwhile eden has already been wash trading fugly apes for 6 months#he's funding anarchy with the power of decentralized currency amen#(more accurately: the power of gullible idiots)

9 notes

·

View notes

Text

by Amy Castor and David Gerard

3 notes

·

View notes

Text

Wash Trading Remains ‘Widespread’ in DeFi, Researcher Kaiko Says | Daily Reports Online

Last week’s roundup of crypto promoters and traders following an elaborate sting operation by federal prosecutors served as a reminder that fake trades used to inflate prices continue to be lingering issue in the digital asset world. The wash trading strategy used to boost the FBI-created token NexFundAI remains a common practice on decentralised-finance exchanges (dexes), and can be encountered…

0 notes

Text

FBI Takes Down Crypto Wash Trading Ring, Seizes $25 Million

The Federal Bureau of Investigation (FBI) has successfully dismantled a major wash trading operation in the cryptocurrency sector. According to the U.S. Department of Justice (DOJ), the ring involved four cryptocurrency companies, four market makers, and their employees. The group conspired to deceive crypto users and steal millions through fraudulent trading. Also Read: FBI Sounds Warning on…

0 notes

Text

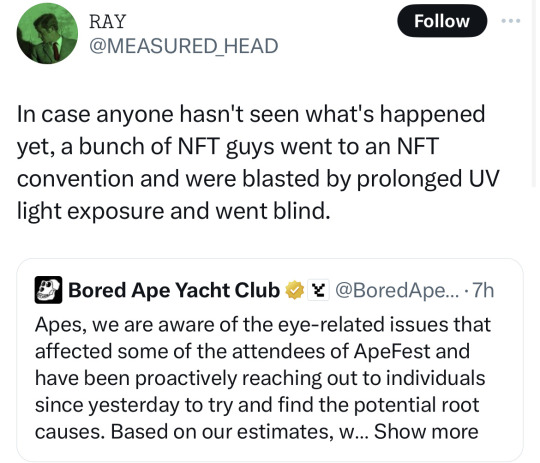

>Covid causes a massive fakeout stock market crash >the resulting bounce leads to tons of people investing in crypto >crypto hits all time highs >people who missed the crypto boom scramble for the next big thing >NFTs become the new Crypto craze, in part because moronic wannabe tech guys are now convinced that the future of all business and technology will be VR meetings, digital real estate, and celebrity endorsed twitter avatars that cost five-to-six figures >Covid health and safety protocols lead to tons of medical supplies and PPE being produced in huge quantities >present day >NFT market totally crashed >Covid restrictions lightened or lifted around the world >Ape NFT bagholders still in denial, so they keep throwing more money at their failed attempt at a subculture with expensive parties that are meant to show that the ape craze isn't dead (it absolutely is) >overstock of disinfectant UV lights produced to help fight covid now gathering dust in Hong Kong and Chinese warehouses >manufacturers start selling whatever they can to whoever will take it >Hong Kong club owners buy medical grade UV lights thinking they're UV blacklights to impress tasteless Ape bagholder >Ape bagholders get severe skin and eye damage all because of a stupid party they paid to fly to in a desperate attempt to convince each other that NFTs are still totally a good investment after they got scammed by people wash-trading their own NFTs to manipulate their prices >and they only did that because missed out on every other market swing that happened post-covid, largely thanks to government bail out funny money and companies buying their own stocks to manipulate their stock prices

It's like pottery.

66K notes

·

View notes

Text

Wash trading crypto is illegal? Wow. I didn't know that... People made lots of money. What else can you say? The profits were amazing, whether you agree or not. The profits were amazing and people made lots of money. I'm actually saddened to hear that.

1 note

·

View note

Text

FBI Charges Three Crypto Firms and 15 People for Fraud

US prosecutors charged three crypto firms and 15 individuals for widespread fraud.

The FBI used a digital token to expose market manipulation in the crypto industry.

Gotbit, ZM Quant, and CLS Global engaged in wash trading to manipulate trading volumes.

In the latest crackdown, federal prosecutors have filed charges against three cryptocurrency firms and fifteen people. In this investigation, the FBI found extensive amounts of market manipulation. This case was the first time the FBI created a digital token with the ultimate aim of uncovering scandals in the cryptocurrency market.

Companies Involved in Manipulation

The firms involved in the scheme are Gotbit, ZM Quant, and CLS Global. The prosecutors said that these companies employed fictitious trading strategies to pump up the value of crypto tokens. Such manipulation created the investors’ perception that these tokens have sustainable demand. This was carried out by Gotbit, an AR app developed by Aleksei Andriunin and others, the initiators of the operation. Andriunin was arrested in Portugal, while two more staff members, Fedor Kedrov and Qawi Jalili, based in Russia, were also charged.

ZM Quant and CLS Global also participated in illegal activities. They agreed to manipulate a token created by NexFundAI, a company set up by the FBI. Authorities monitored the trading of this token to reduce the risk to retail investors. Before the manipulation could harm anyone, token trading was disabled.

Related: https://cryptotale.org/fbi-reports-5-6-billion-lost-in-2023-crypto-fraud-cases/

Executives and Employees Face Charges

Manpreet Kohli, CEO of Saitama, was arrested in the United Kingdom. Prosecutors say Saitama’s leadership inflated the value of their tokens to a market valuation of $7.5 billion. Kohli and several executives secretly sold their tokens for profit, leaving investors with worthless assets. Five employees of the company were charged, with three agreeing to plead guilty.

Several other individuals from market-making firms were also charged. Liu Zhou, the founder of MyTrade, and employees from ZM Quant and CLS Global were implicated. Notably, Liu Zhou has agreed to plead guilty.

Ongoing Legal Action

The investigation of this fraud, which began in March 2018, has led to the arrest of four people so far. Over $25 million in Virtual Currency has been taken away from criminals. The U.S. Securities and Exchange Commission (SEC) has also instituted civil cases supported by the charges.

Authorities are using new techniques, such as the creation of NexFundAI, to uncover fraud in the crypto industry. The defendants now face serious legal consequences. The investigation is ongoing as prosecutors aim to prevent future crimes in the evolving digital asset market.

0 notes

Text

US sting operation catches crypto firms 'wash trading' to boost token values

New Post has been published on Sa7ab News

US sting operation catches crypto firms 'wash trading' to boost token values

Federal prosecutors set up a fake company to bust four crypto market makers, who they say artificially increased trade volume to boost token values.

... read more !

0 notes

Text

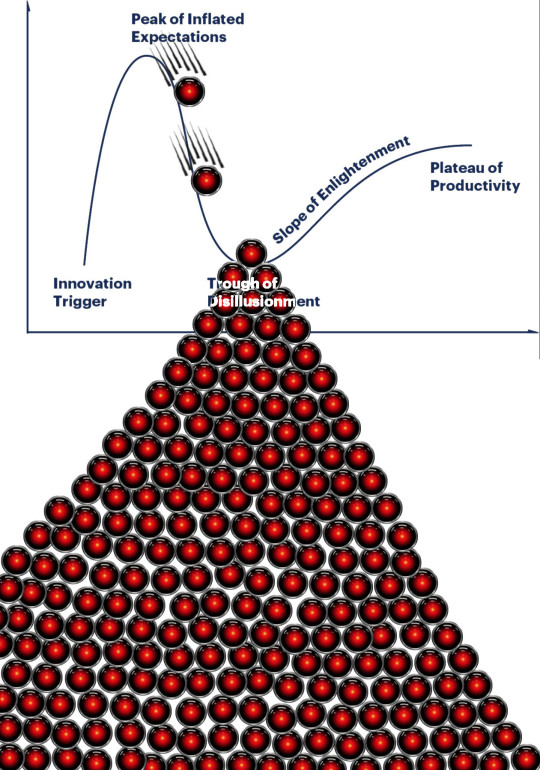

The AI hype bubble is the new crypto hype bubble

Back in 2017 Long Island Ice Tea — known for its undistinguished, barely drinkable sugar-water — changed its name to “Long Blockchain Corp.” Its shares surged to a peak of 400% over their pre-announcement price. The company announced no specific integrations with any kind of blockchain, nor has it made any such integrations since.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/03/09/autocomplete-worshippers/#the-real-ai-was-the-corporations-that-we-fought-along-the-way

LBCC was subsequently delisted from NASDAQ after settling with the SEC over fraudulent investor statements. Today, the company trades over the counter and its market cap is $36m, down from $138m.

https://cointelegraph.com/news/textbook-case-of-crypto-hype-how-iced-tea-company-went-blockchain-and-failed-despite-a-289-percent-stock-rise

The most remarkable thing about this incredibly stupid story is that LBCC wasn’t the peak of the blockchain bubble — rather, it was the start of blockchain’s final pump-and-dump. By the standards of 2022’s blockchain grifters, LBCC was small potatoes, a mere $138m sugar-water grift.

They didn’t have any NFTs, no wash trades, no ICO. They didn’t have a Superbowl ad. They didn’t steal billions from mom-and-pop investors while proclaiming themselves to be “Effective Altruists.” They didn’t channel hundreds of millions to election campaigns through straw donations and other forms of campaing finance frauds. They didn’t even open a crypto-themed hamburger restaurant where you couldn’t buy hamburgers with crypto:

https://robbreport.com/food-drink/dining/bored-hungry-restaurant-no-cryptocurrency-1234694556/

They were amateurs. Their attempt to “make fetch happen” only succeeded for a brief instant. By contrast, the superpredators of the crypto bubble were able to make fetch happen over an improbably long timescale, deploying the most powerful reality distortion fields since Pets.com.

Anything that can’t go on forever will eventually stop. We’re told that trillions of dollars’ worth of crypto has been wiped out over the past year, but these losses are nowhere to be seen in the real economy — because the “wealth” that was wiped out by the crypto bubble’s bursting never existed in the first place.

Like any Ponzi scheme, crypto was a way to separate normies from their savings through the pretense that they were “investing” in a vast enterprise — but the only real money (“fiat” in cryptospeak) in the system was the hardscrabble retirement savings of working people, which the bubble’s energetic inflaters swapped for illiquid, worthless shitcoins.

We’ve stopped believing in the illusory billions. Sam Bankman-Fried is under house arrest. But the people who gave him money — and the nimbler Ponzi artists who evaded arrest — are looking for new scams to separate the marks from their money.

Take Morganstanley, who spent 2021 and 2022 hyping cryptocurrency as a massive growth opportunity:

https://cointelegraph.com/news/morgan-stanley-launches-cryptocurrency-research-team

Today, Morganstanley wants you to know that AI is a $6 trillion opportunity.

They’re not alone. The CEOs of Endeavor, Buzzfeed, Microsoft, Spotify, Youtube, Snap, Sports Illustrated, and CAA are all out there, pumping up the AI bubble with every hour that god sends, declaring that the future is AI.

https://www.hollywoodreporter.com/business/business-news/wall-street-ai-stock-price-1235343279/

Google and Bing are locked in an arms-race to see whose search engine can attain the speediest, most profound enshittification via chatbot, replacing links to web-pages with florid paragraphs composed by fully automated, supremely confident liars:

https://pluralistic.net/2023/02/16/tweedledumber/#easily-spooked

Blockchain was a solution in search of a problem. So is AI. Yes, Buzzfeed will be able to reduce its wage-bill by automating its personality quiz vertical, and Spotify’s “AI DJ” will produce slightly less terrible playlists (at least, to the extent that Spotify doesn’t put its thumb on the scales by inserting tracks into the playlists whose only fitness factor is that someone paid to boost them).

But even if you add all of this up, double it, square it, and add a billion dollar confidence interval, it still doesn’t add up to what Bank Of America analysts called “a defining moment — like the internet in the ’90s.” For one thing, the most exciting part of the “internet in the ‘90s” was that it had incredibly low barriers to entry and wasn’t dominated by large companies — indeed, it had them running scared.

The AI bubble, by contrast, is being inflated by massive incumbents, whose excitement boils down to “This will let the biggest companies get much, much bigger and the rest of you can go fuck yourselves.” Some revolution.

AI has all the hallmarks of a classic pump-and-dump, starting with terminology. AI isn’t “artificial” and it’s not “intelligent.” “Machine learning” doesn’t learn. On this week’s Trashfuture podcast, they made an excellent (and profane and hilarious) case that ChatGPT is best understood as a sophisticated form of autocomplete — not our new robot overlord.

https://open.spotify.com/episode/4NHKMZZNKi0w9mOhPYIL4T

We all know that autocomplete is a decidedly mixed blessing. Like all statistical inference tools, autocomplete is profoundly conservative — it wants you to do the same thing tomorrow as you did yesterday (that’s why “sophisticated” ad retargeting ads show you ads for shoes in response to your search for shoes). If the word you type after “hey” is usually “hon” then the next time you type “hey,” autocomplete will be ready to fill in your typical following word — even if this time you want to type “hey stop texting me you freak”:

https://blog.lareviewofbooks.org/provocations/neophobic-conservative-ai-overlords-want-everything-stay/

And when autocomplete encounters a new input — when you try to type something you’ve never typed before — it tries to get you to finish your sentence with the statistically median thing that everyone would type next, on average. Usually that produces something utterly bland, but sometimes the results can be hilarious. Back in 2018, I started to text our babysitter with “hey are you free to sit” only to have Android finish the sentence with “on my face” (not something I’d ever typed!):

https://mashable.com/article/android-predictive-text-sit-on-my-face

Modern autocomplete can produce long passages of text in response to prompts, but it is every bit as unreliable as 2018 Android SMS autocomplete, as Alexander Hanff discovered when ChatGPT informed him that he was dead, even generating a plausible URL for a link to a nonexistent obit in The Guardian:

https://www.theregister.com/2023/03/02/chatgpt_considered_harmful/

Of course, the carnival barkers of the AI pump-and-dump insist that this is all a feature, not a bug. If autocomplete says stupid, wrong things with total confidence, that’s because “AI” is becoming more human, because humans also say stupid, wrong things with total confidence.

Exhibit A is the billionaire AI grifter Sam Altman, CEO if OpenAI — a company whose products are not open, nor are they artificial, nor are they intelligent. Altman celebrated the release of ChatGPT by tweeting “i am a stochastic parrot, and so r u.”

https://twitter.com/sama/status/1599471830255177728

This was a dig at the “stochastic parrots” paper, a comprehensive, measured roundup of criticisms of AI that led Google to fire Timnit Gebru, a respected AI researcher, for having the audacity to point out the Emperor’s New Clothes:

https://www.technologyreview.com/2020/12/04/1013294/google-ai-ethics-research-paper-forced-out-timnit-gebru/

Gebru’s co-author on the Parrots paper was Emily M Bender, a computational linguistics specialist at UW, who is one of the best-informed and most damning critics of AI hype. You can get a good sense of her position from Elizabeth Weil’s New York Magazine profile:

https://nymag.com/intelligencer/article/ai-artificial-intelligence-chatbots-emily-m-bender.html

Bender has made many important scholarly contributions to her field, but she is also famous for her rules of thumb, which caution her fellow scientists not to get high on their own supply:

Please do not conflate word form and meaning

Mind your own credulity

As Bender says, we’ve made “machines that can mindlessly generate text, but we haven’t learned how to stop imagining the mind behind it.” One potential tonic against this fallacy is to follow an Italian MP’s suggestion and replace “AI” with “SALAMI” (“Systematic Approaches to Learning Algorithms and Machine Inferences”). It’s a lot easier to keep a clear head when someone asks you, “Is this SALAMI intelligent? Can this SALAMI write a novel? Does this SALAMI deserve human rights?”

Bender’s most famous contribution is the “stochastic parrot,” a construct that “just probabilistically spits out words.” AI bros like Altman love the stochastic parrot, and are hellbent on reducing human beings to stochastic parrots, which will allow them to declare that their chatbots have feature-parity with human beings.

At the same time, Altman and Co are strangely afraid of their creations. It’s possible that this is just a shuck: “I have made something so powerful that it could destroy humanity! Luckily, I am a wise steward of this thing, so it’s fine. But boy, it sure is powerful!”

They’ve been playing this game for a long time. People like Elon Musk (an investor in OpenAI, who is hoping to convince the EU Commission and FTC that he can fire all of Twitter’s human moderators and replace them with chatbots without violating EU law or the FTC’s consent decree) keep warning us that AI will destroy us unless we tame it.

There’s a lot of credulous repetition of these claims, and not just by AI’s boosters. AI critics are also prone to engaging in what Lee Vinsel calls criti-hype: criticizing something by repeating its boosters’ claims without interrogating them to see if they’re true:

https://sts-news.medium.com/youre-doing-it-wrong-notes-on-criticism-and-technology-hype-18b08b4307e5

There are better ways to respond to Elon Musk warning us that AIs will emulsify the planet and use human beings for food than to shout, “Look at how irresponsible this wizard is being! He made a Frankenstein’s Monster that will kill us all!” Like, we could point out that of all the things Elon Musk is profoundly wrong about, he is most wrong about the philosophical meaning of Wachowksi movies:

https://www.theguardian.com/film/2020/may/18/lilly-wachowski-ivana-trump-elon-musk-twitter-red-pill-the-matrix-tweets

But even if we take the bros at their word when they proclaim themselves to be terrified of “existential risk” from AI, we can find better explanations by seeking out other phenomena that might be triggering their dread. As Charlie Stross points out, corporations are Slow AIs, autonomous artificial lifeforms that consistently do the wrong thing even when the people who nominally run them try to steer them in better directions:

https://media.ccc.de/v/34c3-9270-dude_you_broke_the_future

Imagine the existential horror of a ultra-rich manbaby who nominally leads a company, but can’t get it to follow: “everyone thinks I’m in charge, but I’m actually being driven by the Slow AI, serving as its sock puppet on some days, its golem on others.”

Ted Chiang nailed this back in 2017 (the same year of the Long Island Blockchain Company):

There’s a saying, popularized by Fredric Jameson, that it’s easier to imagine the end of the world than to imagine the end of capitalism. It’s no surprise that Silicon Valley capitalists don’t want to think about capitalism ending. What’s unexpected is that the way they envision the world ending is through a form of unchecked capitalism, disguised as a superintelligent AI. They have unconsciously created a devil in their own image, a boogeyman whose excesses are precisely their own.

https://www.buzzfeednews.com/article/tedchiang/the-real-danger-to-civilization-isnt-ai-its-runaway

Chiang is still writing some of the best critical work on “AI.” His February article in the New Yorker, “ChatGPT Is a Blurry JPEG of the Web,” was an instant classic:

[AI] hallucinations are compression artifacts, but — like the incorrect labels generated by the Xerox photocopier — they are plausible enough that identifying them requires comparing them against the originals, which in this case means either the Web or our own knowledge of the world.

https://www.newyorker.com/tech/annals-of-technology/chatgpt-is-a-blurry-jpeg-of-the-web

“AI” is practically purpose-built for inflating another hype-bubble, excelling as it does at producing party-tricks — plausible essays, weird images, voice impersonations. But as Princeton’s Matthew Salganik writes, there’s a world of difference between “cool” and “tool”:

https://freedom-to-tinker.com/2023/03/08/can-chatgpt-and-its-successors-go-from-cool-to-tool/

Nature can claim “conversational AI is a game-changer for science” but “there is a huge gap between writing funny instructions for removing food from home electronics and doing scientific research.” Salganik tried to get ChatGPT to help him with the most banal of scholarly tasks — aiding him in peer reviewing a colleague’s paper. The result? “ChatGPT didn’t help me do peer review at all; not one little bit.”

The criti-hype isn’t limited to ChatGPT, of course — there’s plenty of (justifiable) concern about image and voice generators and their impact on creative labor markets, but that concern is often expressed in ways that amplify the self-serving claims of the companies hoping to inflate the hype machine.

One of the best critical responses to the question of image- and voice-generators comes from Kirby Ferguson, whose final Everything Is a Remix video is a superb, visually stunning, brilliantly argued critique of these systems:

https://www.youtube.com/watch?v=rswxcDyotXA

One area where Ferguson shines is in thinking through the copyright question — is there any right to decide who can study the art you make? Except in some edge cases, these systems don’t store copies of the images they analyze, nor do they reproduce them:

https://pluralistic.net/2023/02/09/ai-monkeys-paw/#bullied-schoolkids

For creators, the important material question raised by these systems is economic, not creative: will our bosses use them to erode our wages? That is a very important question, and as far as our bosses are concerned, the answer is a resounding yes.

Markets value automation primarily because automation allows capitalists to pay workers less. The textile factory owners who purchased automatic looms weren’t interested in giving their workers raises and shorting working days. ‘ They wanted to fire their skilled workers and replace them with small children kidnapped out of orphanages and indentured for a decade, starved and beaten and forced to work, even after they were mangled by the machines. Fun fact: Oliver Twist was based on the bestselling memoir of Robert Blincoe, a child who survived his decade of forced labor:

https://www.gutenberg.org/files/59127/59127-h/59127-h.htm

Today, voice actors sitting down to record for games companies are forced to begin each session with “My name is ______ and I hereby grant irrevocable permission to train an AI with my voice and use it any way you see fit.”

https://www.vice.com/en/article/5d37za/voice-actors-sign-away-rights-to-artificial-intelligence

Let’s be clear here: there is — at present — no firmly established copyright over voiceprints. The “right” that voice actors are signing away as a non-negotiable condition of doing their jobs for giant, powerful monopolists doesn’t even exist. When a corporation makes a worker surrender this right, they are betting that this right will be created later in the name of “artists’ rights” — and that they will then be able to harvest this right and use it to fire the artists who fought so hard for it.

There are other approaches to this. We could support the US Copyright Office’s position that machine-generated works are not works of human creative authorship and are thus not eligible for copyright — so if corporations wanted to control their products, they’d have to hire humans to make them:

https://www.theverge.com/2022/2/21/22944335/us-copyright-office-reject-ai-generated-art-recent-entrance-to-paradise

Or we could create collective rights that belong to all artists and can’t be signed away to a corporation. That’s how the right to record other musicians’ songs work — and it’s why Taylor Swift was able to re-record the masters that were sold out from under her by evil private-equity bros::

https://doctorow.medium.com/united-we-stand-61e16ec707e2

Whatever we do as creative workers and as humans entitled to a decent life, we can’t afford drink the Blockchain Iced Tea. That means that we have to be technically competent, to understand how the stochastic parrot works, and to make sure our criticism doesn’t just repeat the marketing copy of the latest pump-and-dump.

Today (Mar 9), you can catch me in person in Austin at the UT School of Design and Creative Technologies, and remotely at U Manitoba’s Ethics of Emerging Tech Lecture.

Tomorrow (Mar 10), Rebecca Giblin and I kick off the SXSW reading series.

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

[Image ID: A graph depicting the Gartner hype cycle. A pair of HAL 9000's glowing red eyes are chasing each other down the slope from the Peak of Inflated Expectations to join another one that is at rest in the Trough of Disillusionment. It, in turn, sits atop a vast cairn of HAL 9000 eyes that are piled in a rough pyramid that extends below the graph to a distance of several times its height.]

#pluralistic#ai#ml#machine learning#artificial intelligence#chatbot#chatgpt#cryptocurrency#gartner hype cycle#hype cycle#trough of disillusionment#crypto#bubbles#bubblenomics#criti-hype#lee vinsel#slow ai#timnit gebru#emily bender#paperclip maximizers#enshittification#immortal colony organisms#blurry jpegs#charlie stross#ted chiang

2K notes

·

View notes

Link

La operación del FBI, denominada Operation Token Mirrors, no tiene precedentes en el espacio de las criptomonedas y 18 personas y entidades han sido acusadas por su presunto fraude y manipulación en las acusaciones anunciadas el miércoles.

0 notes

Text

US sting operation catches crypto firms 'wash trading' to boost token values

New Post has been published on Douxle News

US sting operation catches crypto firms 'wash trading' to boost token values

Federal prosecutors set up a fake company to bust four crypto market makers, who they say artificially increased trade volume to boost token values.

... read more !

0 notes

Text

Ex-Executives Face Justice in Multimillion-Dollar Cryptocurrency Scam: DOJ Verdict

Key Points

Shane Hampton and Michael Kane, former executives at Hydrogen Technology Corporation, have been sentenced to prison for crypto fraud.

They manipulated the market and fraudulently inflated the value of HYDRO, the company’s native crypto, earning about $2 million in profits.

Shane Hampton, a resident of Philadelphia, and Florida-based Michael Kane, both former high-ranking officials at Hydrogen Technology Corporation, have been handed prison sentences for their involvement in a multimillion-dollar crypto fraud scheme.

Hampton, 32, served as the head of financial engineering, while Kane, 39 and co-founder of the company, held the position of CEO until his arrest in 2022.

Market Manipulation Scheme

An announcement revealed that both Hampton and Kane were implicated in a market manipulation scheme that swindled investors out of millions of dollars. These investors had put their faith in the company’s vision and invested in HYDRO, the company’s native crypto.

From October 2018 to April 2019, the pair collaborated with South African crypto company Moonwalkers Trading Limited to manipulate the price of HYDRO on an unnamed US-registered crypto exchange. Using an automated trading bot, they flooded the market with fake orders and fraudulent trades to deceive investors and artificially inflate the value of HYDRO.

The duo and their co-conspirators carried out about $7 million in “wash trades” and placed over $300 million in “spoof trades” for HYDRO using the bot. These deceptive trades were designed to trick retail investors into buying HYDRO by artificially inflating its price.

They managed to make approximately $2 million in profits from selling HYDRO over a period of about 10 months. However, their fraudulent activities were eventually detected by the US Securities and Exchange Commission (SEC), which sued the former executives for fraud in 2022.

Legal Proceedings and Verdict

Following the SEC’s lawsuits in September of 2022, Kane pleaded guilty in November 2023 to one count of conspiracy to commit securities price manipulation, one count of conspiracy to commit wire fraud, and two counts of wire fraud.

Before he pleaded guilty, Kane and his company were ordered by a New York court in April 2023 to pay $2.8 million in remedies and civil penalties.

Hampton, on the other hand, was convicted by a federal jury in February of the same year for one count of conspiracy to commit wire and securities fraud in violation of the US federal law. During his trial, the jury unanimously agreed that the sales of HYDRO constituted investment contracts, thereby classifying the token as a security.

Historic Crypto Case

This case marked the first criminal jury trial where a cryptocurrency, in this case HYDRO, was classified as a security under American law.

Principal Deputy Assistant Attorney General Nicole Argentieri stated that this was the first instance in which a federal criminal trial jury found a cryptocurrency to be a security and that manipulating cryptocurrency prices was securities fraud.

She also emphasized that the sentencing of both Kane and Hampton should serve as a deterrent to other potential wrongdoers in the crypto economy. She further added that law enforcement will persist in its efforts to protect consumers and will not rest until all culprits are brought to justice.

0 notes

Text

Table of ContentsIntroductionIdentifying Red Flags: Recognizing Suspicious Trading Patterns and Market AnomaliesUnderstanding Pump-and-Dump Schemes: How to Spot and Avoid Market ManipulationRegulatory Landscape: Exploring Legal Frameworks and Enforcement Mechanisms for Market ManipulationQ&AConclusionUnveiling the Secrets: Understanding Market Manipulation Tactics in CryptoIntroduction**Understanding Market Manipulation Tactics in the Crypto Markets** The cryptocurrency market, characterized by its volatility and decentralized nature, has become a fertile ground for market manipulation. Understanding these tactics is crucial for investors to protect their assets and make informed decisions. This introduction explores the various forms of market manipulation employed in the crypto space, their impact on market dynamics, and the measures taken to combat them.Identifying Red Flags: Recognizing Suspicious Trading Patterns and Market Anomalies**Understanding Market Manipulation Tactics in the Crypto Markets** In the rapidly evolving world of cryptocurrencies, market manipulation poses a significant threat to investors. Understanding the tactics employed by manipulators is crucial for safeguarding your investments. One common tactic is wash trading, where an individual or group places buy and sell orders simultaneously to create artificial volume and inflate prices. This can mislead investors into believing there is genuine demand for a particular asset. Pump-and-dump schemes involve artificially inflating the price of a cryptocurrency through coordinated buying and positive social media hype. Once the price reaches a peak, the manipulators sell their holdings, leaving unsuspecting investors with worthless assets. Another tactic is spoofing, where large orders are placed and quickly canceled to create the illusion of high demand or supply. This can influence market sentiment and trigger price movements in the desired direction. Front-running involves using privileged information to trade ahead of large orders, profiting from the subsequent price changes. This practice is particularly prevalent in decentralized exchanges, where order books are publicly visible. Insider trading, the illegal use of non-public information to make trades, is also a concern in the crypto markets. Manipulators may have access to sensitive information about upcoming events or partnerships that can significantly impact prices. Recognizing suspicious trading patterns and market anomalies is essential for identifying potential manipulation. Extreme price fluctuations, unusually high trading volume, and sudden changes in market sentiment can all be red flags. Investors should also be wary of social media hype and unsolicited investment advice. Manipulators often use these channels to spread misinformation and promote their schemes. To protect yourself from market manipulation, conduct thorough research before investing in any cryptocurrency. Monitor market activity closely and be skeptical of sudden price movements. Consider using reputable exchanges with strong security measures and transparent trading practices. By understanding the tactics employed by manipulators and recognizing suspicious trading patterns, investors can mitigate the risks associated with market manipulation in the crypto markets. Vigilance and informed decision-making are key to safeguarding your investments and ensuring a fair and transparent market environment.Understanding Pump-and-Dump Schemes: How to Spot and Avoid Market Manipulation**Understanding Market Manipulation Tactics in the Crypto Markets** The cryptocurrency market, while offering immense potential, is not immune to manipulation. One prevalent tactic is the pump-and-dump scheme, where fraudsters artificially inflate the price of a coin or token to sell it at a profit. Understanding these schemes is crucial for investors to protect their assets. Pump-and-dump schemes typically involve a group of individuals who coordinate to buy a specific cryptocurrency in large quantities.

This creates a surge in demand, driving up the price. Once the price reaches a desired level, the manipulators sell their holdings, causing the price to plummet. Spotting pump-and-dump schemes can be challenging, but there are telltale signs. Rapid price increases with minimal volume, followed by a sudden drop, are often indicative of manipulation. Additionally, social media hype and endorsements from influencers can be used to create a false sense of legitimacy. To avoid falling victim to these schemes, investors should conduct thorough research before investing in any cryptocurrency. Look for projects with strong fundamentals, a clear roadmap, and a transparent team. Avoid investing based solely on social media hype or promises of quick profits. Another common manipulation tactic is wash trading, where individuals buy and sell the same cryptocurrency multiple times to create the illusion of high trading volume. This can artificially inflate the price and attract unsuspecting investors. To detect wash trading, investors should examine the order book for large buy and sell orders that are executed at similar prices. Additionally, they should look for accounts that trade frequently with themselves or with a small group of other accounts. Finally, it is important to be aware of insider trading, where individuals with access to non-public information use that knowledge to profit from cryptocurrency trades. This can include information about upcoming announcements, partnerships, or regulatory changes. To mitigate the risks of insider trading, investors should only trade on reputable exchanges that have strong compliance measures in place. They should also avoid trading based on rumors or unverified information. By understanding these market manipulation tactics and taking appropriate precautions, investors can protect themselves from financial losses and contribute to the integrity of the cryptocurrency market.Regulatory Landscape: Exploring Legal Frameworks and Enforcement Mechanisms for Market Manipulation**Understanding Market Manipulation Tactics in the Crypto Markets** Market manipulation, a pervasive issue in traditional financial markets, has found its way into the burgeoning crypto markets. Understanding these tactics is crucial for investors and regulators alike. One common tactic is wash trading, where an individual or group places buy and sell orders simultaneously to create artificial volume and inflate prices. This can mislead investors into believing there is genuine demand for a particular cryptocurrency. Another tactic is spoofing, where large orders are placed and quickly canceled to create the illusion of liquidity. This can attract unsuspecting investors who may buy or sell at unfavorable prices. Pump-and-dump schemes involve artificially inflating the price of a cryptocurrency through coordinated promotions and false information. Once the price reaches a peak, the manipulators sell their holdings, leaving unsuspecting investors with worthless assets. Front-running involves using privileged information to trade ahead of others. In the crypto markets, this can occur when exchanges or insiders have access to order flow data and execute trades before other participants. Insider trading, a serious offense in traditional markets, also occurs in the crypto space. Individuals with access to non-public information, such as upcoming exchange listings or regulatory changes, may use this knowledge to profit unfairly. Regulators are taking notice of these manipulative tactics and are developing frameworks to address them. The Securities and Exchange Commission (SEC) has brought enforcement actions against individuals and entities involved in market manipulation in the crypto markets. The Commodity Futures Trading Commission (CFTC) has also taken steps to regulate the crypto markets, including establishing a framework for digital asset spot markets. These efforts aim to protect investors and ensure fair and orderly markets.

In addition to regulatory enforcement, self-regulatory organizations (SROs) play a role in combating market manipulation. SROs, such as the Crypto Market Integrity Coalition (CMIC), provide guidance and best practices to market participants. Investors can also protect themselves by being aware of common manipulative tactics and conducting thorough research before investing in any cryptocurrency. They should also be wary of unsolicited investment advice and avoid platforms with a history of questionable practices. Understanding market manipulation tactics in the crypto markets is essential for investors and regulators alike. By staying informed and working together, we can create a fairer and more transparent market environment.Q&A**Question 1:** What is wash trading? **Answer:** A deceptive practice where an individual or group buys and sells the same asset multiple times to create the illusion of trading activity and artificially inflate the price. **Question 2:** How does pump and dump work? **Answer:** A scheme where a group of individuals artificially inflates the price of a cryptocurrency through coordinated buying, then sells their holdings at a profit, leaving other investors with worthless assets. **Question 3:** What are the signs of a rug pull? **Answer:** Sudden price drops, disappearing developers, and a lack of liquidity, indicating that the creators have abandoned the project and taken investors' funds.Conclusion**Conclusion:** Understanding market manipulation tactics in the crypto markets is crucial for investors to protect their assets and make informed decisions. By recognizing common red flags and employing due diligence, investors can mitigate the risks associated with market manipulation. Regulators and exchanges play a vital role in combating these tactics through enforcement actions and implementing robust surveillance systems. As the crypto market continues to evolve, it is essential for all stakeholders to remain vigilant and work together to maintain a fair and transparent trading environment.

0 notes

Text

Tornado Cash alternative

Tornado Cash is an application that "washes" your crypto by blending your coins in with others so it's not attached to your unique wallet. It chips away at Ethereum and permits you to trade your coins for new ones that can't be followed back to where they came from. Tornado Cash helps add security to the Ethereum blockchain by stirring up your crypto with others so it's not as simple to follow where it came from.

0 notes