#crypto wallets explained

Explore tagged Tumblr posts

Text

One of those video game merchants who sells rare and endgame gear in exchange for the ancient coin of a fallen empire, except it's a modern setting, and instead of rare coins the merchant wants keys to abandoned crypto wallets containing a specific defunct cryptocurrency. They won't explain why.

1K notes

·

View notes

Text

Al-Naji explained that purchasing BTCLT through the BitClout platform involved a “totally decentralized” so-called “atomic swap” whereby investors would deposit the crypto asset bitcoin into BitClout’s treasury wallet and receive BTCLT in exchange. This exchange, however, only operated in one direction, meaning that BTCLT investors could not exchange their tokens back into bitcoin or fiat currency (e.g., U.S. dollars) via the BitClout platform. This fact was not explained in the BitClout White Paper. Al-Naji privately explained to an early investor that he viewed this technical limitation as a positive feature of the platform because restricting the ability to sell BTCLT had the effect of driving up its price.

You've heard of write-only memory, now it's time for buy-only assets

32 notes

·

View notes

Text

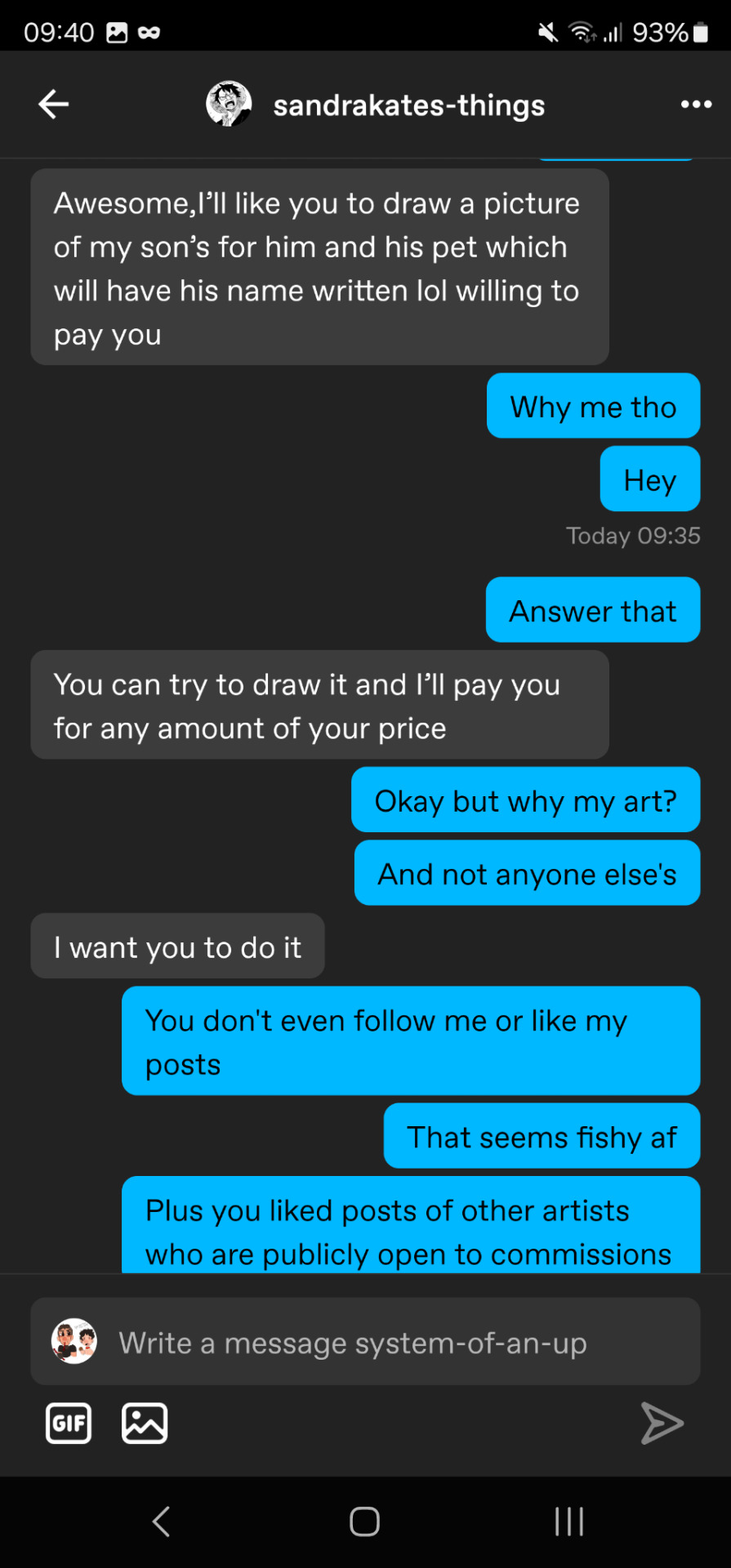

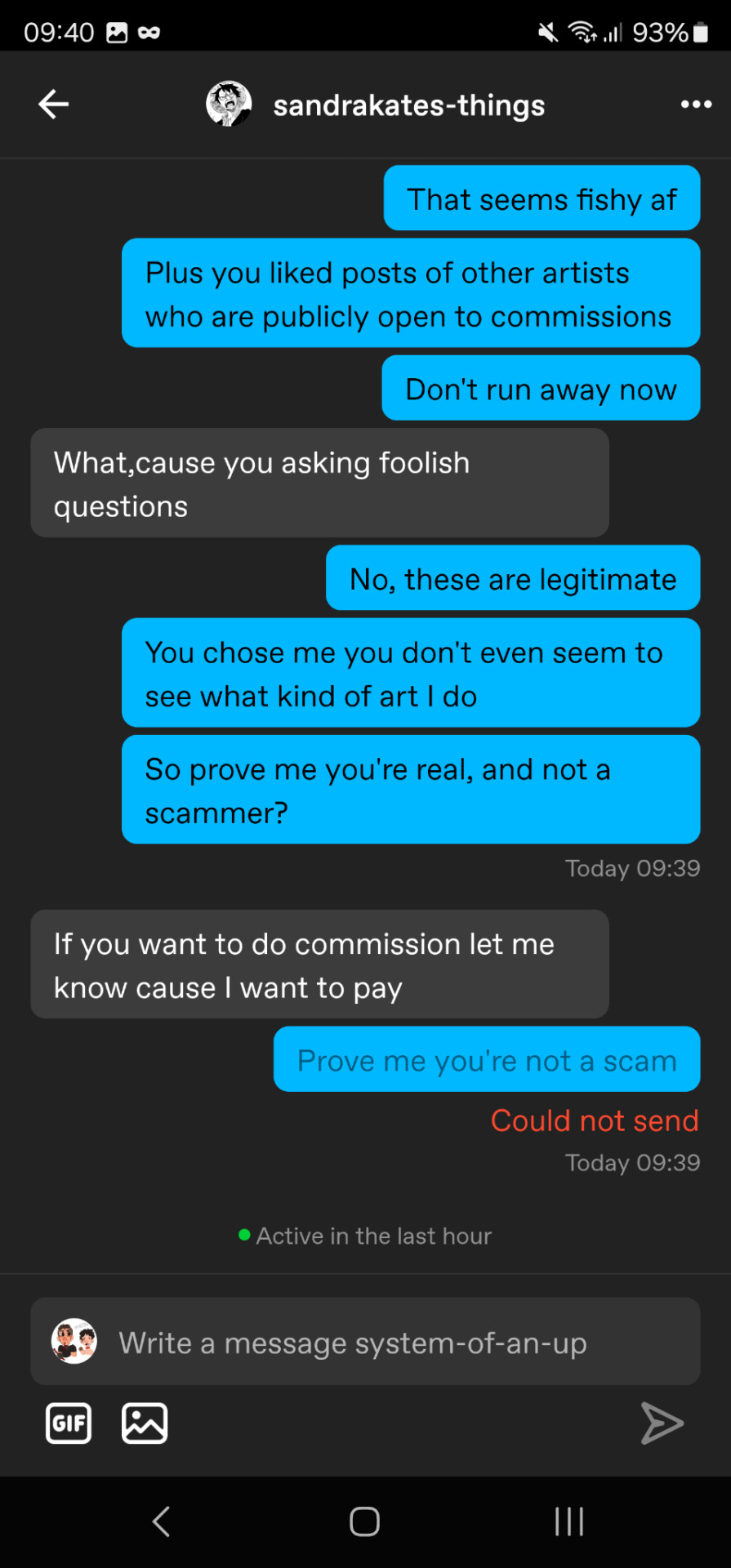

I'm so clever

Stay safe artists.

How to recognize an art scam?

1. Hi can you draw a picture of my son and his pet? I'll pay you anything what are your prices?

That's the most common question I got several times on other websites. Whether you gave prices or not they won't look into it. They never looked at your account, in fact. They pish you into making high prices for them to get refunded later.

2. They don't follow you, or they didn't like your art a while ago.

When you're commissioning an artist, it's because you enjoy their art. The least you'd normally do is give their art likes, comments, or follow you.

3. Just do it

A normal client would totally understand your suspicions and would prove they're not a scammer by explaining what they like in your art. For example, the choice of color palette, the graphic paw (funny way to say signature style), etc. They can also make you feel guilty about your questions. Don't.

4. They'll insist on a certain payment method that could give them advantages, and/or pay you AFTER.

Okay, let's say you're gonna buy bread. The baker hands you your baguette. You are right in front of them, so it's okay to pay after.

Now, you are asking for a developer to make you a script. They have no guarantee that you are real, nor that you are honest. It's normal for them to ask you to pay them first. Or 50% before 50% in the middle.

If you take PayPal, don't. They have a 180d refund policy, and even if the client was hobest at first, PayPal is by the buyer's side and not yours. It doesn't matter if you did the commission, the buyer CAN be refunded.

Solutions?

KYC. Know Your Customer. Sniff shady customers. But it's not really 100% working.

Use a middleman. This one decreases trust from the buyer's side but someone who has seen your commissions before and trusts you from the beginning wouldn't be too affected.

Make them sign an online contract before the commission. A lawyer can make you one or you can make one yourself. Email them, and if they're not a scammer they would sign it. Then you could contact PayPal in case of refund with this contract that person signed with their REAL information + their username and PayPal acc.

Ask for CRYPTOCURRENCY or set up a private XMR <your crypto currency> wallet. Few people really use crypto though.

DMCA them in case they use your art after refusing to pay you. Keep reverse-searching (Google Lens/Images) your art after getting scammed. As long as you have screenshots of the conversation with the client, you have all rights to do so.

13 notes

·

View notes

Text

People continue to ask if Bitcoin will replace the dollar. They believe that the recent surge in Bitcoin indicates that it will topple the USD as the world’s reserve currency, but that is merely propaganda. You must understand that Bitcoin is simply a trading vehicle, not a currency. I cannot stress that point enough. My opinion has been unpopular, and clients have walked away due to my stance on crypto. That’s fine, as I am not in this for the money. I can only adequately inform my clients of the unbiased truth and hope that those willing to listen will heed the computer’s warnings.

To begin with, there is much speculation about the founder(s) — Satoshi Nakamoto – who created Bitcoin (BTC) on June 3, 2009. The mystery person or group (or government agency) has been MIA since 2011. Yet 1 million Bitcoins remain in their original account, untouched. His wallet is estimated to be worth over $81 billion at the time of this writing, and if this is indeed an individual, he or she is one of the top 15 richest people in the world. They have never moved a fraction of a BTC from their account. So, one wallet contains 5% of all mined bitcoin. Will this person or entity perpetually hold?

They expect us to believe some mysterious Japanese man created the blockchain technology and simply evaded all world governments. They claim Bitcoin is an anti-government vehicle, but it is a bureaucrat’s dream because it allows them to track where funds are coming from and going. In 1996, the US government released a white paper entitled, “How to make a mint: the cryptography of anonymous electronic cash.” Released by the National Security Agency Office of Information Security Research and Technology, this document explains how a government agency could create something like Bitcoin or another cryptocurrency. They had been attempting to create one for years and then magically Bitcoin came on the scene.

I encourage anyone interested in crypto to read my article regarding this study. Blockchain was created with surveillance at the top of mind.

9 notes

·

View notes

Text

📌 Bitcoin ETFs Explained – Why Everyone’s Talking About Them

📈 What’s a Bitcoin ETF? And Why Is It a Big Deal?

A Bitcoin ETF (Exchange-Traded Fund) lets investors buy BTC through the stock market—no wallets, no private keys needed.

✅ Easier for traditional investors ✅ Safer for institutions ✅ Legitimizes Bitcoin as a mainstream asset

🔥 Why it's trending:

The U.S. approved spot Bitcoin ETFs in early 2024

Firms like BlackRock & Fidelity are involved

Bitcoin soared past $100K afterward

💡 Think of ETFs as crypto’s bridge to Wall Street.

📩 Do you think ETFs are good or bad for Bitcoin’s future? 🔁 Reblog if Bitcoin's finally going mainstream.

#crypto#cryptocurrency#bitcoin#bitcoin ETF#crypto education#crypto for beginners#blockchain#investing#financial freedom#The Block Drop#ethereum#finance news#crypto awareness#crypto radar#crypto trending#passive income#future of money#crypto updates#btc etf#crypto investing

2 notes

·

View notes

Text

Beginner’s Guide to Cryptocurrencies: Learn How to Make Money Safely

Beginner’s Guide to Cryptocurrencies: Learn How to Make Money Safely

If you’re just starting out with digital currencies, don’t worry—you’re in good company! Cryptocurrencies can feel overwhelming at first, but with the right guidance, anyone can grasp how they work and how to invest safely.This guide will break down the basics, explain how cryptocurrency operates, and walk you through the essential steps to start investing wisely.By the end, you’ll have a solid foundation in cryptocurrency, security tips to protect your investments, and insights into the best strategies to make money safely in 2025. What is Cryptocurrency? ryptocurrency, often called "crypto," is a form of digital currency that exists purely in electronic form. Unlike the cash in your wallet or the balance in your bank account, cryptocurrencies are decentralized, meaning they are not controlled by any government or financial institution.Instead, they operate on blockchain technology—a secure, transparent ledger that records all transactions in a way that is nearly impossible to alter. How Does Cryptocurrency Work? Imagine a digital notebook where every transaction is permanently recorded and visible to everyone. This notebook is known as the blockchain. Each transaction is verified by a network of computers, making it highly secure and resistant to fraud.Unlike traditional banking systems, where a central authority like a bank processes transactions, cryptocurrencies rely on a decentralized system. This means users have more control over their funds, but it also means they are responsible for keeping their investments safe. Why is Cryptocurrency Popular? There are several reasons why cryptocurrency has gained so much attention over the years:- Decentralization: No single entity has control over cryptocurrencies. - Security: Transactions are encrypted, making them highly secure. - Transparency: Blockchain records all transactions, ensuring accountability. - Growth Potential: Many investors view cryptocurrencies as a promising new financial opportunity.Whether you want to use crypto for everyday purchases, transfer money internationally, or invest in the long term, understanding how it works is the first step.

How to Invest in Cryptocurrency for Beginners If you’re ready to take the plunge into cryptocurrency investing, follow these steps to ensure a smooth and secure experience. Step 1: Choose a Cryptocurrency Exchange Before you can buy cryptocurrency, you’ll need to create an account on a cryptocurrency exchange. Think of an exchange as an online marketplace where you can trade digital currencies.Popular platforms like Bybit, Coinbase, and Kraken offer user-friendly interfaces, making them ideal for beginners.🔥 Looking for a secure and easy-to-use exchange? Start your crypto journey with Bybit and enjoy seamless trading with exclusive bonuses! 👉 Sign Up for Bybit Now Step 2: Decide on the Cryptocurrency to Invest In With thousands of cryptocurrencies to choose from, selecting the right one can feel daunting.For beginners, it's often best to start with well-established options like Bitcoin (BTC) or Ethereum (ETH), as they tend to be more stable and widely accepted. These coins have a proven track record and are generally less risky compared to newer, lesser-known cryptocurrencies. Step 3: Set Up a Secure Wallet Once you’ve chosen an exchange and purchased your cryptocurrency, you need a place to store it. Cryptocurrency wallets come in two main types:- Hot Wallets: These are online wallets connected to the internet, making them convenient but also more vulnerable to hacking. - Cold Wallets: These are offline wallets (like hardware devices or paper wallets) that provide better security for long-term storage.For beginners, a combination of both types is recommended—use a hot wallet for small, frequent transactions and a cold wallet for large investments. Step 4: Make Your First Purchase Once your wallet is set up, you can buy your first cryptocurrency.You don’t have to purchase a whole Bitcoin or Ethereum—you can buy fractions of a coin based on your budget. After purchasing, the cryptocurrency will be stored in your wallet. Step 5: Develop an Investment Strategy Investing in cryptocurrency isn’t just about buying and holding—it’s about having a plan. Some common strategies include:- HODLing: Holding onto your crypto for the long term, regardless of market fluctuations. - Trading: Actively buying and selling crypto to take advantage of price swings. - Staking: Earning passive income by locking up your crypto to support blockchain operations.Understanding these strategies will help you make informed investment decisions.Correlated Article:

How to Travel the World and Make Money: The Digital Nomad’s Guide to Earning with Cryptocurrencies

Risks of Investing in Cryptocurrency While cryptocurrency has the potential for high returns, it also comes with risks. Here are some key factors to be aware of: 1. Scams and Fraud Scammers often prey on beginners with fake investment schemes, phishing attacks, and pump-and-dump schemes. Always research projects thoroughly before investing your money. 2. High Volatility Cryptocurrency prices can change dramatically within hours. While this presents an opportunity for profit, it also means you can lose money just as quickly. It’s essential to be prepared for market swings. 3. Lack of Regulation Unlike traditional investments, cryptocurrency is still relatively unregulated in many countries. This means fewer protections for investors and a higher risk of encountering scams or fraudulent projects. 4. Security Threats Although blockchain technology is secure, hackers frequently target exchanges and wallets. Always use strong passwords, enable two-factor authentication (2FA), and consider using a hardware wallet for extra security. Best Crypto for Beginners to Invest In If you’re unsure where to start, here are some of the most beginner-friendly cryptocurrencies:- Bitcoin (BTC): The original and most well-known cryptocurrency, often considered the safest bet for new investors. - Ethereum (ETH): Known for its smart contract capabilities, Ethereum is a great choice for those interested in blockchain applications. - Litecoin (LTC): Offers faster transactions and lower fees than Bitcoin. - Binance Coin (BNB): Useful for those trading on Binance and involved in the broader crypto ecosystem. - Cardano (ADA): A research-driven cryptocurrency focusing on sustainability and scalability.Starting with these established coins can help reduce risk while you learn the ropes.

Cryptocurrency Security Tips Keeping your crypto safe is crucial. Follow these best practices to protect your investments: 1. Use Strong Passwords & Enable 2FA Create long, unique passwords for your exchange and wallet accounts. Use two-factor authentication (2FA) for an extra layer of security. 2. Store Large Amounts in a Cold Wallet For secure, long-term storage, use a hardware wallet such as Ledger or Trezor. Keeping your funds offline adds an extra layer of protection, making it much harder for hackers to gain access. 3. Avoid Suspicious Links & Scams Never click on unsolicited emails, fake airdrops, or suspicious investment offers. Scammers often impersonate crypto platforms to steal your credentials. 4. Use Reputable Exchanges & Wallets Stick to well-known platforms with strong security measures. Always verify websites before entering sensitive information. Conclusion: Your Next Steps in The Crypto Market Cryptocurrency can be an exciting and profitable investment if approached wisely. This guide has provided you with the essential knowledge to get started safely.Whether you choose to buy and hold Bitcoin, trade Ethereum, or explore new investment opportunities, the key is to start slowly, stay informed, and always prioritize security. Ready to take your first step into cryptocurrency trading? Bybit offers a secure, beginner-friendly platform to buy, sell, and trade crypto.Sign up today and take advantage of exclusive bonuses! 👉 Join Bybit Now and Claim Your Welcome Bonus

Frequently Asked Questions (FAQs) about Cryptocurrency Trading for Beginners

Is cryptocurrency legal? Yes, cryptocurrency is legal in many countries, but regulations vary. Some countries fully support it, while others impose restrictions or bans.Always check your local laws before investing. How much money do I need to start investing in cryptocurrency? You can start with as little as $10, depending on the exchange. Many platforms allow fractional purchases, meaning you don’t need to buy a whole Bitcoin or Ethereum. What is the safest way to store cryptocurrency? A hardware (cold) wallet is the safest option for long-term storage. It keeps your crypto offline, making it less vulnerable to hacking. Use a combination of hot and cold wallets for security and convenience. Can I lose money in cryptocurrency? Yes, due to market volatility, cryptocurrency prices can rise and fall dramatically. You can lose money if the market drops or if you invest in a scam. Only invest what you can afford to lose. How do I avoid cryptocurrency scams? - Use reputable exchanges and wallets. - Enable two-factor authentication (2FA). - Avoid unsolicited investment offers and emails. - Verify the legitimacy of projects before investing. Should I invest in new cryptocurrencies? New cryptocurrencies can offer high rewards but also carry high risks. Some are legitimate, while others are scams. Conduct thorough research before investing in any new digital asset. What are gas fees? Gas fees are transaction fees paid to process transactions on a blockchain. Networks like Ethereum require gas fees for smart contract operations, and these fees can fluctuate depending on network demand. Can I earn passive income with cryptocurrency? Yes! Some ways to earn passive income include:- Staking: Locking up your crypto to support blockchain operations and earn rewards. - Yield farming: Providing liquidity to decentralized finance (DeFi) protocols for returns. - Lending: Lending your crypto to earn interest on platforms like Aave or Compound. Is cryptocurrency taxed? In many countries, cryptocurrency is subject to capital gains tax. Selling crypto for a profit, trading, or earning through staking may require tax reporting. Check your local tax laws to ensure compliance. What happens if I lose access to my wallet? If you lose access and do not have your backup seed phrase, you may lose your funds permanently. Always store your seed phrase securely in a physical location, never online. What is the difference between a coin and a token? - Coin: A cryptocurrency that operates on its own blockchain (e.g., Bitcoin, Ethereum). - Token: A digital asset that operates on an existing blockchain (e.g., ERC-20 tokens on Ethereum). How do I send cryptocurrency to someone else? - Copy the recipient’s wallet address. - Paste the address into your wallet’s “Send” section. - Choose the amount to send and confirm the transaction. - Double-check the address before finalizing the transaction to avoid errors. How long does a cryptocurrency transaction take? Transaction times vary depending on the blockchain network and congestion. Bitcoin transactions can take 10 minutes to an hour, while Ethereum transactions typically take a few minutes. Some blockchains, like Solana, offer near-instant transactions. What is a blockchain fork? A fork occurs when a blockchain network splits into two separate versions due to changes in protocol or disagreements in the community. Hard forks (e.g., Bitcoin Cash from Bitcoin) create a new chain, while soft forks update an existing chain without splitting. What are the best cryptocurrencies for beginners to invest in? Some beginner-friendly cryptocurrencies include:- Bitcoin (BTC): The most established and widely accepted cryptocurrency. - Ethereum (ETH): Known for smart contracts and decentralized applications. - Litecoin (LTC): Offers faster transactions and lower fees than Bitcoin. - Cardano (ADA): A research-driven cryptocurrency focused on sustainability. Can I use cryptocurrency for everyday purchases? Yes! Many businesses accept cryptocurrency for payments, and crypto debit cards allow users to spend their digital assets like cash. However, adoption varies by location. What is a stablecoin? A stablecoin is a cryptocurrency designed to maintain a stable value by being pegged to a fiat currency (e.g., USDT, USDC). These are useful for reducing volatility and making transactions easier. What is DeFi (Decentralized Finance)? DeFi is a blockchain-based financial system that eliminates traditional intermediaries like banks. It offers services such as lending, borrowing, and trading through smart contracts on platforms like Uniswap and Aave. Can I mine cryptocurrency? Yes, but mining is not as profitable for individuals as it used to be. Bitcoin mining requires specialized hardware (ASICs), while other cryptocurrencies like Ethereum (until its transition to proof-of-stake) could be mined with GPUs. What is an NFT (Non-Fungible Token)? NFTs are unique digital assets that represent ownership of art, music, virtual goods, and more. Unlike cryptocurrencies, each NFT is one of a kind and cannot be exchanged on a one-to-one basis. How do I track my crypto investments? You can track your portfolio using crypto tracking apps like:- CoinMarketCap - CoinGecko - Blockfolio - Delta What happens to my cryptocurrency if I die? Without proper estate planning, your cryptocurrency could be lost forever. To ensure your assets are passed on, store your private keys and seed phrases securely and designate a trusted person to access them. What is a rug pull? A rug pull is a type of scam in which developers abandon a project after raising funds, leaving investors with worthless tokens. Read the full article

#beginner’sguidetocrypto#bestcryptocurrenciesforbeginners#Bitcoin#blockchaintechnology#cryptoexchange#cryptotrading#Cryptocurrency#cryptocurrencyforbeginners#cryptocurrencyinvestmentstrategies#cryptocurrencyrisks#cryptocurrencysecuritytips#digitalcurrencies2025#Ethereum#howtobuycryptocurrency#howtoinvestincryptocurrency#howtomakemoneywithBitcoin#howtoprotectyourcryptocurrency#makemoneywithcryptocurrency#safecryptoinvestment#securecryptocurrencyinvesting

2 notes

·

View notes

Text

STON.fi’s Grant Program: Fueling Innovation on TON

The world of Web3 is constantly evolving, with new ideas shaping the future of decentralized finance, gaming, and blockchain applications. But turning ideas into reality requires more than just passion—it requires resources, funding, and the right ecosystem to thrive.

That’s where STON.fi’s Grant Program comes in. As the most active decentralized exchange (DEX) on The Open Network (TON), STON.fi isn’t just facilitating seamless crypto trading—it’s actively investing in builders who are pushing the boundaries of what’s possible in Web3.

With grants of up to $10,000, developers, founders, and teams working on DeFi, GameFi, and blockchain applications now have a chance to bring their ideas to life with the support of a strong, high-utility ecosystem.

Why STON.fi

STON.fi has established itself as the leading DEX on TON, and the numbers speak for themselves:

$5.2 billion+ total trading volume (the highest among DEXs on TON)

4 million+ unique wallets (representing 81% of all DEX users on TON)

25,800+ daily active users, with 16,000 making multiple transactions daily

8,000+ new users joining each day, making it the fastest-growing DEX on TON

700+ trading pairs active daily, ensuring a dynamic, liquid market

STON.fi isn’t just growing—it’s setting the standard for DeFi activity on TON. The strength of its ecosystem makes it the perfect launchpad for new projects that need exposure, funding, and a strong technical backbone.

What Does the Grant Program Offer

The STON.fi Grant Program is more than just financial support. It’s a strategic boost that provides:

✅ Funding up to $10,000 to build and expand projects

✅ Technical integration support for leveraging STON.fi’s ecosystem

✅ Ecosystem access, ensuring collaboration and visibility

✅ Growth opportunities, including exposure to STON.fi’s vast user base

This isn’t just for DeFi protocols—NFT platforms, Web3 games, and blockchain tools that enhance the TON ecosystem are all eligible. The goal is impactful innovation, with projects that contribute to user growth, activity, and adoption on TON.

Meet the Latest Grant Winners

STON.fi has already begun funding promising projects that align with its mission. Two standout teams recently received grants:

Farmix – Leveraged Yield Farming

Farmix is redefining yield farming by offering leveraged positions on STON.fi’s liquidity pools. This allows users to optimize their farming strategies, maximize returns, and strengthen the liquidity of key pairs, including:

STON/USDt

PX/TON

STORM/TON

The project directly contributes to the growth of STON.fi’s ecosystem, increasing total value locked (TVL) and transaction volume while giving users more ways to earn.

TonTickets – Web3 Prize Gaming

TonTickets is bringing a fresh gamification model to blockchain. Players lock tokens, earn tickets, and redeem them for rewards—adding an interactive layer to Web3 engagement.

By integrating STON.fi’s swap technology, winners can instantly convert rewards into TON, creating real utility and seamless transactions. This initiative doesn’t just benefit TonTickets—it enhances the entire STON.fi ecosystem by increasing activity and liquidity.

Who Can Apply

STON.fi is looking for projects that bring real utility and innovation to the TON ecosystem. Ideal applicants include:

🚀 DeFi builders creating financial tools and liquidity solutions

🎮 GameFi projects integrating blockchain with gaming mechanics

🔗 Web3 infrastructure developers focused on trading tools, NFT utilities, and more

💡 Innovators with unique blockchain applications that strengthen TON’s adoption

STON.fi isn’t just looking for ideas—it’s looking for scalable projects with a clear roadmap and impact potential.

How to Apply

The application process is straightforward:

1️⃣ Submit your proposal, detailing the project’s goal and impact on TON

2️⃣ Show technical feasibility and explain how it integrates with STON.fi

3️⃣ Outline a roadmap that highlights your growth and development strategy

Successful applicants receive not just funding, but also technical and ecosystem support, ensuring their project can thrive within the TON blockchain.

Final Thoughts

STON.fi isn’t just a DEX—it’s a catalyst for Web3 innovation. By supporting builders with funding, infrastructure, and an active user base, it’s ensuring that TON becomes a hub for next-gen blockchain applications.

For developers, founders, and teams looking to launch, scale, and grow, this grant program offers a unique opportunity to gain funding, technical backing, and immediate exposure within a high-utility ecosystem.

The next wave of Web3 innovation is happening now. Will your project be part of it?

4 notes

·

View notes

Text

Demystifying Liquidity Provision, Farming, and Staking: A Practical Guide

The world of cryptocurrency can sometimes feel like stepping into a maze of complex terms and concepts. "Liquidity provision," "farming," and "staking" might sound intimidating at first, but these activities are more approachable than they seem. They’re not just buzzwords—they’re practical ways for you to make your crypto work for you.

In this article, I’ll break these concepts down, explain how they work, and show you why they matter, all in a way that’s relatable and easy to understand.

Liquidity Provision: Becoming the Market’s Backbone

Imagine you’re at a bustling farmer’s market. For the market to thrive, there needs to be a steady supply of goods for buyers and sellers to trade. In the crypto world, liquidity pools play the role of that marketplace. They’re stocked with two types of tokens, like ETH and USDT, allowing people to trade between them easily.

When you provide liquidity, you’re like a vendor stocking the market with your goods (tokens). In return for your contribution, you earn a share of the transaction fees every time someone trades.

It’s simple: you’re helping the system run smoothly, and you get paid for it. Platforms like STON.fi make it easy to get started with liquidity provision, offering a straightforward way to earn passive income.

Provide liquidity now

Farming: Extra Rewards for Supporting the System

Let’s take the farmer’s market analogy a step further. Imagine the market organizer thanks you for bringing in your goods by giving you bonus tokens as a reward. That’s essentially what farming is.

Once you provide liquidity, you receive LP (Liquidity Provider) tokens as proof of your contribution. By “farming,” you lock these LP tokens into a specific program to earn additional rewards.

For instance, a crypto project might incentivize farming by offering its native tokens as bonuses. The longer you stay in the farm, the more you earn. It’s like a loyalty program that rewards your commitment.

Farm tokens now

Staking: Locking Up for Long-Term Benefits

Now, let’s say you decide to deposit your earnings from the market into a savings account, locking it up for a fixed period in exchange for interest. That’s staking in a nutshell.

With staking, you lock your tokens into a network to support its operations, such as validating transactions or maintaining security. In return, you earn rewards over time.

Platforms like STON.fi offer unique incentives for staking, such as ARKENSTON (an NFT tied to your wallet) and GEMSTON (a token with governance rights). Staking not only rewards you but also allows you to play an active role in shaping the future of the platform.

Stake STON now

How They Work Together

Each of these activities serves a unique purpose:

1. Liquidity Provision: Keeps the trading system fluid and earns you transaction fees.

2. Farming: Boosts your rewards by incentivizing participation with bonus tokens.

3. Staking: Locks your assets for long-term benefits and deeper involvement in the platform’s ecosystem.

You don’t have to pick just one. Many crypto enthusiasts combine these strategies to diversify their earnings and maximize their participation in the ecosystem.

Why Should You Care

You might be wondering, “Why should I get involved?” The answer lies in both the opportunity to grow your crypto holdings and the chance to contribute to the larger vision of decentralized finance (DeFi).

Think of it this way: just like investing in stocks or real estate, liquidity provision, farming, and staking allow you to put your assets to work. The key difference? You’re actively participating in a financial revolution that’s reshaping how we interact with money.

While there are risks involved—such as token price fluctuations or smart contract vulnerabilities—the potential rewards can be worth it. It’s about balancing caution with opportunity and finding the strategies that suit your goals.

Making It Personal: Start Small, Learn, and Grow

Entering the world of liquidity provision, farming, and staking doesn’t require a massive investment or expert knowledge. It’s okay to start small, test the waters, and learn as you go.

For example, when I first tried liquidity provision, I treated it like learning a new skill. I started with a small amount, observed how the system worked, and gradually increased my participation as I gained confidence.

The same goes for farming and staking. Think of them as tools in your financial toolkit—each serving a specific purpose and working together to help you achieve your goals.

Liquidity provision, farming, and staking aren’t just technical terms—they’re opportunities. By understanding these concepts and using them wisely, you can grow your crypto holdings and actively participate in a transformative financial ecosystem.

If you’re new to crypto, don’t let the jargon scare you away. Start with what you’re comfortable with, stay curious, and remember that every small step you take adds up.

What’s your experience with liquidity provision, farming, or staking? I’d love to hear your thoughts and answer any questions you might have. Let’s navigate this journey together!

4 notes

·

View notes

Text

What is USDT (Tether)? Is it a scam? (A must-read for beginners)

If you're new to cryptocurrency, you've likely heard of "USDT" or "Tether." In the news, phrases like "USDT scam" or "Tether money laundering" frequently appear, causing many newcomers to doubt the legitimacy of USDT. So, what exactly is USDT, and is it a scam? This article will explain what USDT is, its uses, and how to avoid potential scams involving it.

What is USDT (Tether)?

USDT, short for Tether, is a cryptocurrency issued by Tether Limited. Similar to other cryptocurrencies like Bitcoin or Ethereum, USDT is a virtual currency. What sets USDT apart is its 1:1 peg to the US dollar, making it a "stablecoin." In other words, 1 USDT typically equals 1 USD (with slight fluctuations). USDT is designed to function as a digital version of the dollar and is commonly used as a stable store of value in cryptocurrency trading.

Launched in 2014 under the name Realcoin, later rebranded as Tether, USDT's goal was to offer a digital asset backed by traditional currencies (primarily the US dollar), helping cryptocurrency users avoid the extreme volatility of other digital currencies. Tether operates by claiming that for every 1 USDT issued, the company holds an equivalent value in USD or other assets in reserve, thus maintaining its stable value.

Why is USDT often linked to scams?

USDT itself is not a scam; it is a legitimate cryptocurrency. The reason we often hear about "USDT scams" is that fraudsters prefer to use USDT's stability and widespread use in their schemes.

Because 1 USDT is roughly equal to 1 USD and is widely accepted across major crypto exchanges, scammers frequently use fake platforms or fraudulent investment opportunities to trick victims into buying or transferring USDT. Since USDT can be quickly converted into fiat currency or other cryptocurrencies, it's a preferred tool for scammers. However, this doesn't make USDT a scam in and of itself.

How do scammers use USDT to commit fraud?

Common methods include:

Fake exchanges: Scammers create fake cryptocurrency exchanges to steal users' personal information and funds. They may lure you into buying USDT, but you soon realize that the USDT is either fake or nonexistent.

Impersonating customer service or friends: Through social media or phishing, scammers impersonate customer service representatives or friends, tricking you into buying USDT and transferring it to them under the guise of investment or transaction needs. In reality, your funds vanish.

Phishing websites: Fraudsters create fake websites, appearing identical to official platforms, to trick users into entering their wallet private keys or passwords, enabling them to steal USDT.

How to avoid USDT-related scams?

Use trusted exchanges: Always purchase USDT through reputable cryptocurrency exchanges (such as Binance, OKX, Bitget, gate·io, bybit). These platforms are highly regulated and more secure.

Be wary of false investment opportunities: Any promise of "high returns with zero risk" should be viewed skeptically. The crypto market is highly volatile, and promises of quick profits often signal scams.

Avoid clicking on suspicious links: If you receive unfamiliar links, especially those encouraging you to buy USDT or make transactions, exercise caution to avoid phishing traps.

Does USDT always maintain a 1:1 peg to the USD?

While USDT is intended to maintain a 1:1 peg with the US dollar, slight fluctuations may occur during periods of market stress or loss of confidence in Tether's reserves. However, most of the time, USDT remains stable at around 1 USD.

For other currencies like TWD or HKD, the USDT exchange rate is influenced by market demand. In domestic markets, USDT prices may slightly differ from the direct USD exchange rate, depending on supply and demand dynamics.

Where can you buy USDT?

Through regulated cryptocurrency exchanges: The safest way to purchase USDT is through reputable global exchanges, which support various payment methods, including bank transfers and credit cards.

OTC (Over-the-Counter) dealers: In certain regions like Hong Kong, you can buy USDT at physical stores. However, exercise caution as not all stores are regulated, and scams do exist.

Avoid private transactions: Refrain from purchasing USDT through unofficial channels or individual sellers, especially those involving cash deals, as these carry high risks of fraud or theft.

Common Questions (FAQ)

How is USDT different from other cryptocurrencies? USDT is a stablecoin, meaning its value is relatively stable (around 1 USD), while other cryptocurrencies like Bitcoin or Ethereum are highly volatile. USDT is typically used as a store of value in crypto trading, while Bitcoin, for example, is more suitable for investment.

Is USDT safe? USDT itself is safe, but due to its popularity, scammers often use it in fraudulent schemes. Always use trusted platforms to purchase USDT and remain vigilant.

Why does USDT sometimes "de-peg"? USDT can experience minor fluctuations when market confidence in Tether's reserves wanes or in times of market stress. However, these instances are usually temporary.

Is USDT a good investment for beginners? USDT is not typically seen as an investment but rather as a stable store of value. It's more like a "digital dollar" in the crypto market, ideal for transferring value rather than speculating.

Conclusion

USDT is not a scam; it's a widely used stablecoin, designed to maintain a 1:1 value with the US dollar. However, due to its popularity, it is often used by scammers as a tool for fraud. To avoid being scammed, always purchase USDT through official channels and be cautious of investment offers. Remember, all investments carry risks, and caution is key to protecting your assets.

Through this article, I hope you now have a clearer understanding of USDT and how to avoid scams involving it. If you have further questions, feel free to reach out.

3 notes

·

View notes

Text

Demystifying Liquidity Provision, Farming, and Staking: A Practical Guide

The world of cryptocurrency can sometimes feel like stepping into a maze of complex terms and concepts. "Liquidity provision," "farming," and "staking" might sound intimidating at first, but these activities are more approachable than they seem. They’re not just buzzwords—they’re practical ways for you to make your crypto work for you.

In this article, I’ll break these concepts down, explain how they work, and show you why they matter, all in a way that’s relatable and easy to understand.

Liquidity Provision: Becoming the Market’s Backbone

Imagine you’re at a bustling farmer’s market. For the market to thrive, there needs to be a steady supply of goods for buyers and sellers to trade. In the crypto world, liquidity pools play the role of that marketplace. They’re stocked with two types of tokens, like ETH and USDT, allowing people to trade between them easily.

When you provide liquidity, you’re like a vendor stocking the market with your goods (tokens). In return for your contribution, you earn a share of the transaction fees every time someone trades.

It’s simple: you’re helping the system run smoothly, and you get paid for it. Platforms like STON.fi make it easy to get started with liquidity provision, offering a straightforward way to earn passive income.

Farming: Extra Rewards for Supporting the System

Let’s take the farmer’s market analogy a step further. Imagine the market organizer thanks you for bringing in your goods by giving you bonus tokens as a reward. That’s essentially what farming is.

Once you provide liquidity, you receive LP (Liquidity Provider) tokens as proof of your contribution. By “farming,” you lock these LP tokens into a specific program to earn additional rewards.

For instance, a crypto project might incentivize farming by offering its native tokens as bonuses. The longer you stay in the farm, the more you earn. It’s like a loyalty program that rewards your commitment.

Staking: Locking Up for Long-Term Benefits

Now, let’s say you decide to deposit your earnings from the market into a savings account, locking it up for a fixed period in exchange for interest. That’s staking in a nutshell.

With staking, you lock your tokens into a network to support its operations, such as validating transactions or maintaining security. In return, you earn rewards over time.

Platforms like STON.fi offer unique incentives for staking, such as ARKENSTON (an NFT tied to your wallet) and GEMSTON (a token with governance rights). Staking not only rewards you but also allows you to play an active role in shaping the future of the platform.

How They Work Together

Each of these activities serves a unique purpose:

1. Liquidity Provision: Keeps the trading system fluid and earns you transaction fees.

2. Farming: Boosts your rewards by incentivizing participation with bonus tokens.

3. Staking: Locks your assets for long-term benefits and deeper involvement in the platform’s ecosystem.

You don’t have to pick just one. Many crypto enthusiasts combine these strategies to diversify their earnings and maximize their participation in the ecosystem.

Why Should You Care

You might be wondering, “Why should I get involved?” The answer lies in both the opportunity to grow your crypto holdings and the chance to contribute to the larger vision of decentralized finance (DeFi).

Think of it this way: just like investing in stocks or real estate, liquidity provision, farming, and staking allow you to put your assets to work. The key difference? You’re actively participating in a financial revolution that’s reshaping how we interact with money.

While there are risks involved—such as token price fluctuations or smart contract vulnerabilities—the potential rewards can be worth it. It’s about balancing caution with opportunity and finding the strategies that suit your goals.

Making It Personal: Start Small, Learn, and Grow

Entering the world of liquidity provision, farming, and staking doesn’t require a massive investment or expert knowledge. It’s okay to start small, test the waters, and learn as you go.

For example, when I first tried liquidity provision, I treated it like learning a new skill. I started with a small amount, observed how the system worked, and gradually increased my participation as I gained confidence.

The same goes for farming and staking. Think of them as tools in your financial toolkit—each serving a specific purpose and working together to help you achieve your goals.

Liquidity provision, farming, and staking aren’t just technical terms—they’re opportunities. By understanding these concepts and using them wisely, you can grow your crypto holdings and actively participate in a transformative financial ecosystem.

If you’re new to crypto, don’t let the jargon scare you away. Start with what you’re comfortable with, stay curious, and remember that every small step you take adds up.

Visit the Stonfi Dex now

What’s your experience with liquidity provision, farming, or staking? I’d love to hear your thoughts and answer any questions you might have. Let’s navigate this journey together!

4 notes

·

View notes

Text

Understanding Liquidity Provision, Farming, and Staking in Simple Terms

When it comes to crypto, there are a lot of terms that can feel overwhelming, especially if you're new to the space. "Liquidity provision," "farming," and "staking" might sound like complicated financial jargon, but they’re actually pretty straightforward once you break them down.

In this article, I’m going to explain what these concepts mean, how they work, and why you might want to get involved. If you’ve been looking for ways to grow your crypto holdings or just want to understand how these activities fit into the world of decentralized finance (DeFi), this is the place to start. Let’s dive in!

Liquidity Provision: A Simple Way to Earn from Your Crypto

Imagine you’re at a market. For people to buy and sell goods, there needs to be a steady supply of products—apples, oranges, whatever people are exchanging. In the crypto world, liquidity pools are like that marketplace. They hold two types of tokens (e.g., ETH and USDT) in equal value to allow smooth trading between them.

Now, here’s where you come in. By providing liquidity, you’re essentially helping to stock the market with the tokens that traders need to make exchanges. In return for contributing your tokens to the pool, you earn a share of the transaction fees whenever someone makes a trade.

It’s a win-win situation. You help the market run smoothly, and in return, you get paid! On platforms like STON.fi, liquidity provision is a great way to start earning passive income, just by holding onto your crypto and putting it to work.

Farming: Earning Extra Rewards for Your Support

Once you provide liquidity to a pool, you’ll be given LP (Liquidity Provider) tokens, which represent your share of that pool. Farming comes into play when you take those LP tokens and lock them into a "farm." Think of farming as a rewards program—it’s a way to earn extra rewards just for keeping your tokens in the pool.

For example, let’s say a crypto project wants to encourage more people to trade its token. To do this, they might create a farm on a platform like STON.fi and offer additional tokens as rewards for those who participate. The more you contribute to the farm, the more rewards you get.

It’s kind of like earning loyalty points for making purchases at your favorite store. The longer you keep your tokens locked in, the more rewards you earn. It’s an easy way to boost your earnings on top of the transaction fees you already earn from liquidity provision.

Staking: Locking Tokens for Long-Term Benefits

Staking is another way to earn rewards, but it works a bit differently from liquidity provision and farming. Instead of putting your tokens into a liquidity pool, you’re locking them away for a period of time to help secure a network. Think of it like investing in a savings account: you lock away your money for a certain period, and in return, you earn interest over time.

When you stake tokens on platforms like STON.fi, you don’t have to worry about trading or liquidity pools. Your tokens are simply locked up in a smart contract, and in return, you earn rewards that can’t be earned through liquidity provision or farming.

The rewards for staking on STON.fi include unique benefits like ARKENSTON, an NFT tied to your wallet, and GEMSTON, a community token that gives you access to voting rights in the platform’s decentralized community. Staking is a way to earn long-term value and participate in the growth of the platform.

How They All Work Together

So, now that we know what liquidity provision, farming, and staking are, you might be wondering how they all fit together. Well, each of these activities serves a different purpose in the crypto ecosystem, but they all have one thing in common: they allow you to earn rewards for participating in decentralized finance.

Here’s how you can think about it:

1. Liquidity Provision: You’re helping the market function by making sure there’s enough supply of tokens for trading. In return, you earn a share of transaction fees.

2. Farming: Once you’ve provided liquidity, you can earn extra rewards by locking your LP tokens in a farm.

3. Staking: This is more of a long-term commitment. You lock up your tokens in a staking contract and earn unique rewards, like NFTs and governance tokens.

Each one offers a unique way to earn, and you can participate in all of them to diversify your earnings and be a part of the growing DeFi ecosystem.

Why Should You Care

Participating in liquidity provision, farming, and staking isn’t just about earning rewards—it’s also about being part of something bigger. You’re helping make decentralized finance work, and in doing so, you’re contributing to a system that’s changing the way we think about money and finance.

While there are risks involved (as with any investment), getting involved in these activities can be an exciting way to grow your assets and learn more about the crypto space.

The beauty of crypto is that it allows anyone to participate, no matter how small your starting point is. Whether you're holding a few tokens or a large portfolio, there's a way for you to get involved in liquidity provision, farming, or staking and earn along the way.

Final Thoughts

At the end of the day, liquidity provision, farming, and staking are three ways to put your crypto assets to work. By participating, you’re not only earning rewards, but you’re also supporting the decentralized financial ecosystem that’s changing the world.

If you’re new to this space, take it slow, learn as you go, and remember that every step you take is helping you get more comfortable with how crypto works. Start small, and as you gain confidence, you can explore more opportunities.

I hope this breakdown has helped you understand these concepts a bit better! If you have any questions or want to share your experiences with liquidity provision, farming, or staking, feel free to drop a comment below. I’d love to hear from you!

3 notes

·

View notes

Text

Crypto trading mobile app

Designing a Crypto Trading Mobile App involves a balance of usability, security, and aesthetic appeal, tailored to meet the needs of a fast-paced, data-driven audience. Below is an overview of key components and considerations to craft a seamless and user-centric experience for crypto traders.

Key Elements of a Crypto Trading Mobile App Design

1. Intuitive Onboarding

First Impressions: The onboarding process should be simple, guiding users smoothly from downloading the app to making their first trade.

Account Creation: Offer multiple sign-up options (email, phone number, Google/Apple login) and include KYC (Know Your Customer) verification seamlessly.

Interactive Tutorials: For new traders, provide interactive walkthroughs to explain key features like trading pairs, order placement, and wallet setup.

2. Dashboard & Home Screen

Clean Layout: Display an overview of the user's portfolio, including current balances, market trends, and quick access to popular trading pairs.

Market Overview: Real-time market data should be clearly visible. Include options for users to view coin performance, historical charts, and news snippets.

Customization: Let users customize their dashboard by adding favorite assets or widgets like price alerts, trading volumes, and news feeds.

3. Trading Interface

Simple vs. Advanced Modes: Provide two versions of the trading interface. A simple mode for beginners with basic buy/sell options, and an advanced mode with tools like limit orders, stop losses, and technical indicators.

Charting Tools: Integrate interactive, real-time charts powered by TradingView or similar APIs, allowing users to analyze market movements with tools like candlestick patterns, RSI, and moving averages.

Order Placement: Streamline the process of placing market, limit, and stop orders. Use clear buttons and a concise form layout to minimize errors.

Real-Time Data: Update market prices, balances, and order statuses in real-time. Include a status bar that shows successful or pending trades.

4. Wallet & Portfolio Management

Asset Overview: Provide an easy-to-read portfolio page where users can view all their holdings, including balances, performance (gains/losses), and allocation percentages.

Multi-Currency Support: Display a comprehensive list of supported cryptocurrencies. Enable users to transfer between wallets, send/receive assets, and generate QR codes for transactions.

Transaction History: Offer a detailed transaction history, including dates, amounts, and transaction IDs for transparency and record-keeping.

5. Security Features

Biometric Authentication: Use fingerprint, facial recognition, or PIN codes for secure logins and transaction confirmations.

Two-Factor Authentication (2FA): Strong security protocols like 2FA with Google Authenticator or SMS verification should be mandatory for withdrawals and sensitive actions.

Push Notifications for Security Alerts: Keep users informed about logins from new devices, suspicious activities, or price movements via push notifications.

6. User-Friendly Navigation

Bottom Navigation Bar: Include key sections like Home, Markets, Wallet, Trade, and Settings. The icons should be simple, recognizable, and easily accessible with one hand.

Search Bar: A prominent search feature to quickly locate specific coins, trading pairs, or help topics.

7. Analytics & Insights

Market Trends: Display comprehensive analytics including top gainers, losers, and market sentiment indicators.

Push Alerts for Price Movements: Offer customizable price alert notifications to help users react quickly to market changes.

Educational Content: Include sections with tips on technical analysis, crypto market basics, or new coin listings.

8. Social and Community Features

Live Chat: Provide a feature for users to chat with customer support or engage with other traders in a community setting.

News Feed: Integrate crypto news from trusted sources to keep users updated with the latest market-moving events.

9. Light and Dark Mode

Themes: Offer both light and dark mode to cater to users who trade at different times of day. The dark mode is especially important for night traders to reduce eye strain.

10. Settings and Customization

Personalization Options: Allow users to choose preferred currencies, set trading limits, and configure alerts based on their personal preferences.

Language and Regional Settings: Provide multilingual support and regional settings for global users.

Visual Design Considerations

Modern, Minimalist Design: A clean, minimal UI is essential for avoiding clutter, especially when dealing with complex data like market trends and charts.

Color Scheme: Use a professional color palette with accents for call-to-action buttons. Green and red are typically used for indicating gains and losses, respectively.

Animations & Micro-interactions: Subtle animations can enhance the experience by providing feedback on button presses or transitions between screens. However, keep these minimal to avoid slowing down performance.

Conclusion

Designing a crypto trading mobile app requires focusing on accessibility, performance, and security. By blending these elements with a modern, intuitive interface and robust features, your app can empower users to navigate the fast-paced world of crypto trading with confidence and ease.

#uxbridge#uxuidesign#ui ux development services#ux design services#ux research#ux tools#ui ux agency#ux#uxinspiration#ui ux development company#crypto#blockchain#defi#ethereum#altcoin#fintech

2 notes

·

View notes

Text

Cryptocurrency for Beginners: Essential Insights and Guidance

Cryptocurrency, a digital and decentralized form of money, has transformed the way we think about finance and technology.

For beginners, navigating the world of cryptocurrency can be both exciting and overwhelming.

This article serves as a comprehensive guide, offering beginners insights into the fundamental aspects, benefits, risks, and practical steps to get started in the cryptocurrency realm.

youtube

Understanding Cryptocurrency: The Basics

At its core, cryptocurrency is a digital or virtual form of currency that utilizes cryptographic techniques to secure transactions and control the creation of new units.

Unlike traditional currencies issued by governments and central banks, cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

1. How Cryptocurrencies Work

Cryptocurrencies operate on blockchain technology, which is a distributed and immutable ledger that records all transactions.

Each transaction is grouped into a "block," and these blocks are linked together, creating a chain of information.

This decentralized nature ensures transparency, security, and resistance to censorship as Perseus Crypto explains it nicely.

2. Key Cryptocurrency Concepts

Blockchain: A decentralized ledger that records all transactions in a secure and transparent manner.

Wallet: A digital tool that stores your cryptocurrency holdings, enabling you to send, receive, and manage your coins.

Private and Public Keys: Cryptographic keys that grant access to your cryptocurrency. The public key is like an address, while the private key is your password.

Mining: The process of validating transactions and adding them to the blockchain using powerful computers and solving complex mathematical puzzles.

Benefits of Cryptocurrency

1. Financial Inclusion: Cryptocurrencies enable access to financial services for the unbanked and underbanked populations around the world.

2. Decentralization: Cryptocurrencies operate on decentralized networks, reducing the influence of central authorities and intermediaries.

3. Security: Blockchain's cryptographic techniques ensure secure transactions and protection against fraud and hacking.

4. Transparency: Transactions on a blockchain are public and transparent, enhancing accountability.

5. Borderless Transactions: Cryptocurrencies enable fast and low-cost cross-border transactions.

6. Potential for Growth: Some cryptocurrencies have experienced significant price appreciation, offering opportunities for investment growth.

Risks and Considerations

1. Volatility: Cryptocurrency prices can be highly volatile, leading to rapid and unpredictable value changes.

2. Security Concerns: Cryptocurrencies are susceptible to hacking, scams, and phishing attacks. Secure storage is crucial.

3. Regulatory Environment: Regulations for cryptocurrencies vary by jurisdiction and can impact their legality, taxation, and use.

4. Lack of Understanding: The complexity of the technology and market can lead to uninformed decisions.

5. Lack of Regulation: The decentralized nature of cryptocurrencies means there may be no recourse for fraudulent activities or disputes.

Getting Started with Cryptocurrency

1. Education Is Key

Before investing in or using cryptocurrencies, educate yourself about the technology, terminology, and potential risks.

Numerous online resources, courses, and communities provide valuable insights.

2. Choose the Right Cryptocurrency

Research different cryptocurrencies to understand their purposes, use cases, and market trends.

Bitcoin, Ethereum, and others have distinct features and applications.

3. Select a Reliable Exchange

Choose a reputable cryptocurrency exchange to buy, sell, and trade cryptocurrencies.

Look for factors like security measures, fees, user-friendliness, and available coins.

4. Secure Your Investments

Use strong, unique passwords for your exchange accounts and enable two-factor authentication (2FA).

Consider using hardware wallets for enhanced security.

5. Start Small and Diversify

For beginners, start with a small investment you can afford to lose.

Diversify your investments across different cryptocurrencies to manage risk.

6. Stay Informed

Stay updated with the latest news and trends in the cryptocurrency space.

Follow reputable cryptocurrency news websites, blogs, and social media accounts.

7. Avoid FOMO and Emotional Decisions

Fear of missing out (FOMO) and emotional decisions can lead to impulsive actions.

Stick to your investment strategy and avoid making decisions solely based on short-term price movements.

8. Be Prepared for the Long Term

Cryptocurrency investments are often more successful with a long-term perspective.

Avoid making decisions based on daily market fluctuations.

Conclusion

As you embark on your journey into the world of cryptocurrency, remember that education and caution are your best allies.

Understand the technology, the benefits, and the risks before making any investment decisions.

With the right knowledge and a thoughtful approach, you can navigate the complex and dynamic cryptocurrency landscape, potentially harnessing its benefits and contributing to the evolution of modern finance.

2 notes

·

View notes

Text

How To Become Rich by Investing in Crypto - This article explains how to earn your way to riches in the crypto space and become a miner. Crypto miners are rewarded with coins by validating transactions on the blockchain. To do so, they must solve extremely complicated mathematical equations, which requires extensive computing power.

How People Actually Make Money From Cryptocurrencies - This article explains how people actually make money from cryptocurrencies and how to make money on cryptocurrency that’s just sitting in your crypto wallet: staking and yield farming.

How to Make Money with Bitcoin and How to Get Rich with BTC - This article explains how to make money with Bitcoin and how to get rich with BTC. Crypto is a volatile asset, and you will need a combination of knowledge, starting funds, and quite a lot of luck to become rich using Bitcoin. That said, it is easier to make money using Bitcoin than traditional stocks – there’s a lot more profit to be earned due to higher price volatility. invest in yourself now

#learning #education #learn #school #motivation #english #love #study #teaching #alpha #students #teacher #knowledge #crypto #fun #training #success #children #art #money #freedom #life #inspiration #bitcoin #onlinelearning #business #earning #language #learnenglish #growth

2 notes

·

View notes

Text

What Are the Bitcoin Withdrawal and Purchase Limits on Cash App?

Ever wondered how much Bitcoin you can actually buy or withdraw on Cash App? You're not alone! Bitcoin has become the new digital gold, and apps like Cash App make buying and withdrawing it as easy as sending a text message. But, as you might guess, there are some limits in place. Let’s dive in and break it all down in simple, easy-to-follow terms.

Understanding Bitcoin on Cash App

Before we jump into limits, let’s get clear on what Cash App does with Bitcoin. Cash App isn’t just for sending money to your friends anymore—it’s also a handy tool for buying, selling, and even withdrawing Bitcoin to your own wallet. Think of it as your mini crypto exchange, right in your pocket.

Why Are There Bitcoin Limits on Cash App?

You might be wondering, "Why even have limits?" Great question!

Imagine trying to carry $1 million in cash in your backpack—it’d be a security nightmare. The same principle applies here. Limits protect you (and Cash App) from fraud, theft, and market swings. They also help Cash App comply with regulations.

Bitcoin Purchase Limits on Cash App

Now, let's talk numbers.

• Cash App Daily Bitcoin Purchase Limit: You can buy up to $100,000 worth of Bitcoin in a 24-hour period.

• Cash App Weekly Bitcoin Purchase Limit: Also tied to a $100,000 cap, but based on your activity over a rolling 7-day period.

That’s a lot of Bitcoin for the average user! But, of course, not everyone needs to buy that much every week.

Bitcoin Withdrawal Limits on Cash App

When you want to move your Bitcoin off Cash App and into your own wallet, here’s what you need to know:

• Cash App Daily Bitcoin Withdrawal Limit: $2,000 worth of Bitcoin per 24-hour period.

• Cash App Weekly Bitcoin Withdrawal Limit: $5,000 worth of Bitcoin over a 7-day rolling window.

Think of it like watering a garden—you can only use a certain amount of water each day and week.

Cash App Daily Limits Explained

Cash App Daily limits are simple: they reset every 24 hours from the time of your first transaction. So if you hit your purchase or withdrawal cap today at 2 PM, it’ll reset around 2 PM tomorrow.

It’s like a daily allowance—spends it wisely!

Weekly and Monthly Limits

Cash App looks at your activity over the last 7 days to enforce weekly limits.

Unlike daily limits, weekly limits don't reset on a specific day. Instead, it's a "rolling window" of your last 7 days’ activity.

There’s currently no strict monthly limit, but Cash App weekly limits can stack up if you’re very active.

How to Check Your Bitcoin Limits on Cash App

Checking your limits is easy-peasy.

1. Open your Cash App.

2. Tap the Bitcoin section.

3. Look for any messages about your limits or attempt a withdrawal/purchase to see if you hit a cap.

Cash App usually gives you a warning if you're close to or have exceeded your Cash App limits.

Can You Increase Your Bitcoin Limits?

Short answer: Yes, but it’s not automatic.

You’ll need to verify your identity fully through Cash App, which includes:

• Providing your full name

• Date of birth

• Last four digits of your Social Security Number (SSN)

In some cases, they might ask for a photo of your government-issued ID too.

How Verification Impacts Your Limits

Verification is your ticket to higher limits.

Without it, you’re stuck with very low Bitcoin transaction caps, or sometimes, you may not be able to withdraw Bitcoin at all.

Think of it like getting a driver's license—you need it if you want to drive on the big roads!

What Happens If You Hit Your Bitcoin Limit?

If you hit your limit, don’t worry—no need to panic.

You simply have to wait until your limit resets. In the meantime, you can:

• Plan your transactions better next time.

• Request verification if you haven’t already.

Patience is key here!

Tips to Manage Your Bitcoin Transactions

Here’s how you can make your life easier when dealing with Bitcoin on Cash App:

• Plan big purchases or withdrawals ahead of time.

• Break up transactions across different days.

• Stay verified to enjoy higher limits.

A little planning can save you a lot of headaches later.

Safety Tips for Buying and Withdrawing Bitcoin

Handling Bitcoin is a bit like handling a delicate treasure chest.

• Always double-check wallet addresses when withdrawing.

• Enable two-factor authentication (2FA) on your Cash App account.

• �� Never share your Cash App login credentials.

Better safe than sorry when it comes to your hard-earned Bitcoin!

Common Issues with Bitcoin Limits on Cash App

Sometimes, users run into issues like:

• Limits not resetting when expected.

• Withdrawal delayed because of security reviews.

• Confusion between Bitcoin selling vs withdrawing.

If you ever get stuck, contacting Cash App support is usually the best move.

Final Thoughts

Understanding Bitcoin withdrawal and purchase limits on Cash App is like learning the traffic rules before driving—you'll avoid costly mistakes and frustration.

FAQs

1. What is the daily Bitcoin withdrawal limit on Cash App?

The daily Bitcoin withdrawal limit on Cash App is $2,000 within a 24-hour period.

2. How much Bitcoin can I buy daily on Cash App?

You can buy up to $100,000 worth of Bitcoin every 24 hours on Cash App.

3. Can I increase my Bitcoin withdrawal limit on Cash App?

Yes, by verifying your identity fully, you may be eligible for higher Bitcoin withdrawal limits.

4. How do I know if I’ve reached my Bitcoin limit on Cash App?

Cash App will notify you when you attempt to make a purchase or withdrawal that exceeds your limit.

5. Why is my Bitcoin withdrawal delayed on Cash App?

Withdrawals may be delayed if they trigger a security review, if there’s a network backlog, or if you haven’t completed full verification.

1 note

·

View note

Text

Risc Zero Airdrop Review: Key Details, Eligibility, and Value Analysis

The Risc Zero airdrop offers users a new way to earn rewards by joining tasks connected to the project’s latest launch. Many people in the crypto space are looking for a chance to get in early on strong projects, and Risc Zero has gained attention for its technology and confirmed airdrop event. With a total of $52 million raised and free participation, the rewards are seen as attractive by the community. Those interested in the Risc Zero airdrop should know that the process involves completing specific steps to become eligible. People are tracking updates closely, hoping to make the most of this opportunity. This review explains how the airdrop works, why it matters, and what expectations are realistic for participants. Today’s Airdrop Checker Even: Step-by-Step Claim: 🌐 Step 1: Visit the Official Airdrop Reward Page. Dive into the action by heading to the official airdrop page, where all live events are waiting for you. Log into your account by connecting your wallet from any MOBILE DEVICE. 📱 Step 2: Use Your Mobile Wallet Eligibility checks are mobile-exclusive! Grab your smartphone and ensure you’re using a mobile wallet to participate. 💎 Step 3: Meet The Eligibility Criteria Make sure your wallet isn’t empty or brand new—only active wallets qualify. If one doesn’t work, don’t worry! Try again with another wallet to secure your rewards. You can claim many rewards from multiple wallets, so try to use multiple wallets to increase your chance to claim. 💰 Step 4: Withdraw The Tokens After signing the approval from your wallet, wait 5 to 10 minutes, and then congratulations! You will see a token claim in your wallet. You can easily exchange your tokens from SushiSwap, PancakeSwap, and many more. Overview of the Risc Zero Airdrop Risc Zero is launching an airdrop tied to its work in zero-knowledge technology within the blockchain industry. The airdrop aims to attract developers and crypto users, highlighting its role in the wider cryptocurrency market. What Is the Risc Zero Airdrop? The Risc Zero airdrop is a planned distribution of tokens to selected users. This airdrop serves as a reward for those who have supported or engaged with the Risc Zero platform and its community. Participants often need to complete specific actions to qualify. Common tasks include joining social channels, engaging with Risc Zero apps, or holding certain cryptocurrencies. Token holders will receive Risc Zero tokens directly into their wallets if they meet the requirements. Airdrops like this help promote new projects and encourage community growth. They give users early exposure to the ecosystem before the tokens are widely available on exchanges. Purpose and Significance The main purpose of the Risc Zero airdrop is to increase awareness and kickstart community growth around its technology. Risc Zero is focused on zero-knowledge proofs, which improve privacy and trust in decentralized applications. By distributing tokens for free, the Risc Zero team hopes to reward early supporters and attract developers who will build new applications using its zero-knowledge virtual machine (zkVM). This helps expand the reach of their technology in the crypto market. For the wider blockchain industry, the airdrop signals growing interest in more secure and private blockchain solutions. Early participants can join the community and contribute to the project’s adoption. Eligibility Criteria Eligibility for the Risc Zero airdrop depends on following specific guidelines set by the team. These may include: Completing tasks like interacting with Risc Zero products or educational content. Joining official Telegram, Discord, or Twitter channels. Holding certain cryptocurrencies in a wallet at the time of the airdrop snapshot. Most airdrop requirements are published in advance to ensure transparency. Participants should stay updated with official Risc Zero channels to avoid missing deadlines or key steps. A table of potential eligibility tasks may look like this: Task Requirement Join

Telegram group Yes Follow on Twitter Yes Use a zkVM-powered app Sometimes Hold specific tokens Often required Completing all required steps ensures a higher chance of successfully receiving the airdrop. Security and Performance Analysis Security and performance are essential for any blockchain protocol, especially when handling airdrops. Users need confidence that their assets are safeguarded and that the system operates efficiently under real-world conditions. Vulnerability Assessment A thorough review of Risc Zero highlights its commitment to addressing known vulnerabilities such as buffer overflows and memory corruption. The protocol is designed in a way that aims to reduce common exploit vectors present in other cryptography systems. Independent code audits have inspected Risc Zero’s virtual machine (zkVM), searching for bugs and weaknesses. Past research in the field has shown that zero-knowledge systems are not immune to vulnerabilities—one study reviewed over 140 such incidents in SNARKs—but Risc Zero’s core uses safe coding practices to lessen such risks. Despite these efforts, vulnerability management is an ongoing process. Developers must keep up with new threats, patch exploits quickly, and constantly monitor for issues that could affect security or user funds. Security Mechanisms Risc Zero integrates several layers of security into its zkVM. This includes sandboxing user input, strict memory verification, and use of formal verification where feasible. By applying these methods, it minimizes risks such as code injection or unauthorized data access. Key protection mechanisms include: Memory isolation: Prevents buffer overflows and data leakage. Restricted execution environments: Only pre-approved code can run. Active debugging tools: Developers can trace unexpected behavior within the zkVM. The team also leverages cryptographic proofs to ensure calculations are accurate and tamper-proof. Regular audits and bug bounties are encouraged to catch potential exploits before they harm users. Performance Metrics Performance is evaluated by transaction speed, proof generation times, and system resource usage. Risc Zero’s zkVM is engineered to balance cryptographic strength with computational efficiency. In benchmarking tests, it efficiently processes a high number of transactions per second, with fast proof verification times. The use of lightweight cryptographic operations means that it remains accessible even for users with limited computing power. A key performance metric is latency. Risc Zero keeps delays low during both normal transactions and large-scale airdrop events. Resource management is also optimized, allowing the zkVM to operate reliably even as network demand grows. This blend of speed and reliability makes the protocol suited for busy environments like token distributions. Technical Features and Ecosystem Impact RISC Zero brings unique advantages to blockchain and zero-knowledge infrastructure through its technical design. Its innovations can influence how developers, gamers, and AI projects interact with decentralized systems. Precision Airdrop Implementation RISC Zero enables a precision airdrop mechanism using its zero-knowledge proof capabilities. With this, tokens or assets are distributed based on verifiable actions, wallet histories, or participation—without exposing private user information. The proof system ensures that only eligible participants receive allocations. This reduces spam and makes distribution efficient. By applying zero-knowledge proofs, the process becomes transparent and secure for all parties. Users benefit from airdrops that truly reward engagement and provable activity. This approach helps establish trust in token distribution, which can matter in projects involving native code, provenance, and permissionless blockchains. Native Code and Provenance RISC Zero allows execution of native code for zero-knowledge proofs. Developers can work with code in languag