#compare cd key prices

Explore tagged Tumblr posts

Text

Stocks Up, Gold Down in Americans' Best Investment Ratings

Real estate continues to lead as the perceived best long-term investment

— By Jeffrey M. Jones | May 15, 2024

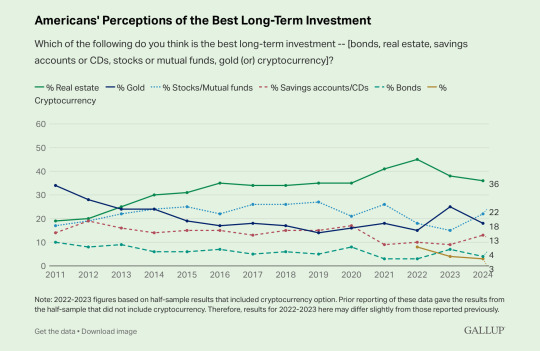

Washington, D.C. — Americans continue to rank real estate as the best investment for the long term among six options. Thirty-six percent choose real estate, followed by stocks or mutual funds (22%), gold (18%), and savings accounts or CDs (13%). Relatively few Americans believe bonds (4%) or cryptocurrency (3%) are the best long-term investments.

The percentage of adults choosing real estate is similar to a year ago, but more identify stocks and fewer name gold as the best investment this year. Stocks were last higher than now in 2021, when 26% chose them, while gold has returned to more typical levels after an increase last year.

The latest results are based on Gallup’s annual Economy and Personal Finance survey, conducted April 1-22. Since 2011, Gallup has asked Americans to choose among real estate, stocks, gold, savings accounts and bonds as the best investment. Cryptocurrency was added as an option in 2022.

Real estate has topped the list each year since 2014, with between 30% and 45% (in 2022) selecting it. In 2013, real estate essentially tied for first with gold and stocks; it trailed gold in 2011 and 2012.

Americans’ historical tendency to choose real estate as the best long-term investment is consistent with their usual expectations of rising local home values.

Earlier surveys conducted between 2002 and 2010 that did not include gold as an option typically found real estate or stocks as the top choice. However, several 2008-2010 surveys showed savings accounts finishing first or tied for first. Those Great Recession-era polls were conducted at a time when housing and stock values suffered deep losses, making the security of savings accounts seem attractive for investors.

The recent performance of real estate and stocks likely explains their high position on the list this year. U.S. real estate values are down from the record high in the fourth quarter of 2022, when the median home sale price was $479,500. However, they remain well above the average values from early 2021 and before. Stock values also reached new highs this year, according to the major U.S. stock indices.

Upper and Lower Income Adults Diverge on Value of Stocks, Savings Accounts

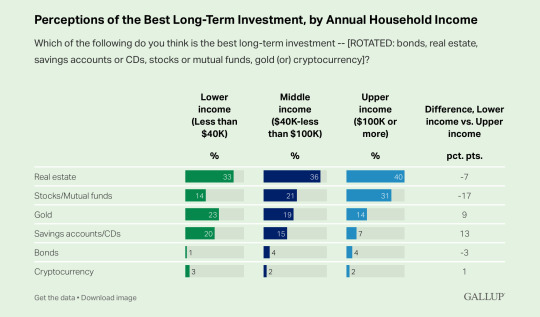

Americans at all income levels perceive real estate as a better investment than other options. However, people from different income groups disagree on the value of other investments, most notably stocks and savings accounts.

Whereas 31% of upper-income Americans say stocks are the best investment, 14% of lower-income Americans agree. Lower-income Americans are more likely to pick gold (23%) or savings accounts (20%) than stocks. Just 7% of upper-income Americans believe savings accounts are the best choice for investors.

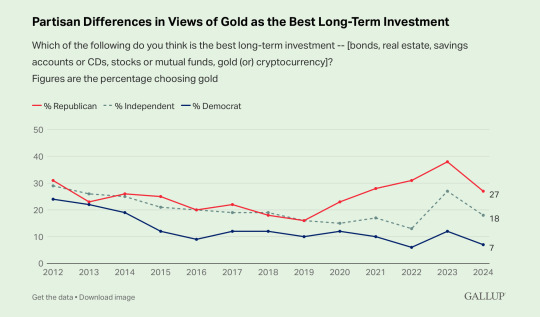

Beyond variations among income groups, there is a consistent political party difference in perceptions of gold’s value. Currently, 27% of Republicans pick gold as the best investment, compared with 7% of Democrats and 18% of independents. Last year, a trend-high 38% of Republicans named gold, compared with 12% of Democrats and 27% of independents.

In each year of the trend except 2013, Republicans have been significantly more likely than Democrats to say gold is the best investment. However, the gap between Republicans and Democrats has widened significantly since 2020.

During the past five years, Republicans have also diverged from independents in views of gold. Between 2012 and 2019, Republicans and independents were about equally likely to choose gold as the best investment.

Members of almost every key subgroup are more likely now than a year ago to say stocks are the best investment and less likely to say gold is. The major exception to these patterns is found among Americans aged 55 and older, whose opinions are unchanged from a year ago.

Stock Ownership Holding at Higher Level

Gallup’s annual update finds that 62% of U.S. adults have money invested in the stock market, including individual stocks, a stock mutual fund or a retirement savings account. The figure is essentially unchanged from last year but reflects a return to stock ownership levels not seen since the Great Recession in 2008.

Stock ownership is highly correlated with income. The vast majority (87%) of upper-income Americans, those with annual household incomes of $100,000 or more, own stock. That compares with 25% of lower-income Americans (those whose annual incomes are less than $40,000). About two-thirds of middle-income Americans, 65%, own stock.

Bottom Line

For most of the past two decades, real estate values have grown, and those increases were especially large between 2021 and 2022. As such, it is not surprising that Americans have consistently believed real estate is the best long-term investment, even though other sources, particularly stocks, have also shown steady growth over time.

Stock values reached record levels earlier this year, and those higher values help explain why more Americans than a year ago think stocks should be the top choice for investors. The increase has come mainly at the expense of gold, which briefly was the top pick in 2011 and 2012 when real estate and stocks weren't performing as well as now.

#Economy#News.Gallup.Com#Best | Investment | Ratings#Stock | Gold | Up & Down#USA 🇺🇸#All Gallup#Headlines#Business#Business & Industry#Investors#Trade & Investment

2 notes

·

View notes

Text

High Yield Savings Account: Maximizing Returns While Safeguarding Your Savings

From the realm of individual finances, the quest for higher returns often comes along with increased threats. Even so, for risk-averse people trying to find a safe yet satisfying choice, the High Produce Savings Account emerges being an attractive option. An Increased Yield Savings Account supplies the excellent balance between growing your cash and preserving its basic safety. On this page, we are going to explore exactly what a Higher Produce Bank Account is, its pros, and tips on how to make the most of this investment automobile to accomplish your financial objectives.

Understanding High Yield Savings Account:

A High Deliver Bank Account is a form of bank account provided by banks and credit unions. What packages it besides a traditional bank account is the significantly higher monthly interest it gives. When standard cost savings balances may offer nominal earnings, Great Produce Financial savings Profiles try to outpace rising prices and supply a lot more significant revenue on the settled funds.

Advantages of High Yield Savings Account:

Competitive Interest Rates: The key good thing about a very high Generate Bank Account will be the increased rate of interest. These balances typically offer costs well on top of the countrywide average, leading them to be an attractive selection for those seeking greater earnings on their price savings.

Safety and Security: Great Deliver Financial savings Balances are usually reinforced with the Federal government Deposit Insurance plan Company (FDIC) in the United States or comparable downpayment insurance coverage plans in other nations. This means that your deposited money is insured up to a particular restriction (usually $250,000 per depositor), ensuring the security of your funds even in the event of a lender failure.

Liquidity: Substantial Deliver Financial savings Profiles provide you with the versatility of quick access to your funds. Unlike some long-term investments, you may pull away cash from the bank account whenever you need it without incurring penalties.

No Investment Risk: Contrary to shares or joint money, which can be susceptible to industry variances, an increased Yield Bank Account offers a stable comeback without disclosing your price savings to investment risk.

No Lock-In Period: As opposed to certificates of deposit (CDs), which require that you secure your cash set for a particular word, Great Produce Cost savings Accounts have zero secure-in time. This means you can access your resources whenever essential without restrictions.

Making the Most of Your High Yield Savings Account:

To maximize the benefits of a High Yield Savings Account, consider the following strategies:

Research and Compare Rates: Different banking institutions offer diverse rates on Substantial Deliver Savings Accounts. Make time to research and compare prices to get the best deal for your cost savings.

Automate Regular Contributions: Set up automated transfers from your principal bank checking account in your Higher Yield Savings Account. Automating efforts allows you to conserve consistently and builds your savings more quickly.

Leverage Compound Interest: Substantial Deliver Savings Credit accounts typically ingredient attention, which suggests your attention earns attention as time passes. The greater number of you leave your money from the profile, the quicker it is going to develop.

Use It for Emergency Fund: Higher Generate Savings Credit accounts are fantastic for positioning your urgent fund. These balances supply both safety and liquidity, making certain your money is plentiful when unanticipated costs come up.

Monitor and Adjust: Keep close track of the interest rates and also the performance of your own Substantial Generate Bank Account. If you locate much more competing charges in other places, think about relocating your resources to a greater-paying profile.

Conclusion: A Very High Generate Bank Account is a wonderful choice for people seeking to boost their price savings while keeping safety and liquidity. It's very competitive rates, basic safety through FDIC insurance coverage, and suppleness transform it into a valuable accessory for your fiscal toolkit. By investigating charges, automating contributions, leveraging ingredient fascination, and taking advantage of it as an emergency account, you can get the most from your Great Generate Bank Account and get your monetary goals with confidence and ease. Remember, while Higher Yield Financial savings Profiles offer greater profits than normal financial savings profiles, they are certainly not intended for long-term prosperity-building or great-risk purchase aims. Instead, they give a solid foundation for preserving your savings and making constant, risk-totally free returns.

Find More Information: High Yield Savings Account

youtube

2 notes

·

View notes

Text

Optimizing Digital Identity with the Right CIAM Partner

In today’s hyper-connected digital economy, ensuring secure and seamless user access is more than a technical requirement—it’s a business necessity. Enterprises are investing in Customer Identity and Access Management (CIAM) solutions to provide personalized experiences, meet regulatory obligations, and safeguard customer data. However, the marketplace is flooded with CIAM vendors, each claiming to offer the most innovative platform. That’s why understanding the Best Practices for Evaluating CIAM Providers is critical to making the right decision.

The right CIAM solution should do more than just handle logins—it should empower your business to scale, secure digital touchpoints, and improve user experience. This blog offers a detailed breakdown of the Best Practices for Evaluating CIAM Providers, helping businesses navigate complexity and choose strategically.

Start with Business Objectives and Use Cases

Before comparing technical features or pricing, businesses must align their identity strategy with core objectives. This is one of the essential Best Practices for Evaluating CIAM Providers. Determine what success looks like in your CIAM initiative.

Consider the following:

What are the key identity touchpoints across web, mobile, and APIs?

Are you serving B2C, B2B, or B2E users?

Do you need support for multi-brand, multi-region, or multi-language experiences?

What’s your roadmap for expansion, integrations, and identity-driven personalization?

Clear articulation of goals streamlines vendor selection and minimizes mismatches later.

Security and Compliance Must Be Non-Negotiable

Security is the foundation of CIAM. Among the Best Practices for Evaluating CIAM Providers, ensuring enterprise-grade security capabilities is a top priority. Threats such as credential stuffing, phishing, and account takeovers are on the rise.

Look for a provider that offers:

Multi-factor authentication (MFA)

Passwordless authentication support

Risk-based access controls

Advanced threat intelligence

End-to-end encryption

Role-based access management

Additionally, regulatory compliance cannot be an afterthought. Ensure the provider helps you comply with:

GDPR

CCPA

HIPAA

SOC 2

ISO/IEC 27001

Choose a provider with a proven record in privacy, data residency, and audit trails to ensure global compliance.

Scalability and Uptime Assurance

One of the core Best Practices for Evaluating CIAM Providers is evaluating scalability. As your user base grows, so should your identity platform—without downtime or degradation.

Evaluate providers on:

Cloud-native infrastructure

Global data centers

CDN support

Horizontal scaling

High availability (99.99% uptime SLA)

The platform should support rapid onboarding of millions of users, seasonal peaks, and business expansions without re-architecture.

Integration Capabilities Across the Ecosystem

Your CIAM platform must integrate with your digital infrastructure. This is among the most strategic Best Practices for Evaluating CIAM Providers, especially for enterprise environments.

Evaluate whether the CIAM provider offers:

RESTful APIs and SDKs

Webhooks and event triggers

Federation protocols (OAuth2, SAML, OpenID Connect)

Pre-built connectors to tools like Salesforce, Adobe, and Microsoft Azure

Compatibility with CI/CD pipelines

Robust integrations future-proof your identity management and accelerate value realization across departments.

Delivering a Seamless User Experience

Modern consumers expect frictionless, secure interactions. One of the most user-focused Best Practices for Evaluating CIAM Providers is ensuring that the platform can deliver intuitive identity journeys.

Key UX features to evaluate:

Social logins (Google, Facebook, Apple ID)

Branded and customizable login screens

Progressive profiling

Self-service account recovery

Passwordless options (biometric, magic link, OTP)

A positive user experience reduces abandonment, improves engagement, and strengthens brand loyalty.

Privacy Management and Consent Control

Today’s users are privacy-conscious and demand control over their data. Among the Best Practices for Evaluating CIAM Providers, a robust privacy management engine is a must.

Ensure your CIAM solution offers:

Real-time consent capture

Preference management dashboards

Data minimization tools

Support for data portability and deletion

Legal versioning of consent forms

Automated compliance workflows

These capabilities are crucial not only for compliance but for maintaining customer trust.

Customization and Workflow Orchestration

Not all businesses are the same—and neither are their CIAM needs. As part of the Best Practices for Evaluating CIAM Providers, check if the platform offers customization without heavy development work.

Evaluate flexibility in:

Theming and branding

Custom attributes and registration fields

Workflow design (drag-and-drop or code-based)

Event hooks and triggers

Conditional logic (e.g., location-based MFA)

The provider should allow you to modify onboarding flows, authentication rules, and profile enrichment strategies without vendor lock-in.

Analytics and Reporting

Understanding how users interact with your system is vital for improving both security and experience. A key element in the Best Practices for Evaluating CIAM Providers is the presence of embedded analytics tools.

Seek CIAM platforms that provide:

Real-time dashboards

Login and registration funnel analysis

Session intelligence

Anomaly detection and alerting

Export and API access for external BI tools

Data-driven insights can optimize journeys, identify threats, and uncover opportunities for personalization.

Vendor Support and Community Ecosystem

Strong vendor support can be the difference between a successful rollout and a failed project. Among the critical Best Practices for Evaluating CIAM Providers is reviewing the quality of vendor support.

Look for:

24/7 global support

Dedicated success managers

Extensive documentation and API guides

Developer forums and Slack communities

Transparent product roadmaps

A vendor invested in your success will accelerate deployment and simplify scaling.

Transparent Pricing and Clear ROI

Pricing models for CIAM vary—by MAU (monthly active users), API calls, feature tiers, or enterprise licenses. One of the most practical Best Practices for Evaluating CIAM Providers is clarity in cost structure.

Before signing:

Understand the pricing model

Identify additional or hidden fees

Calculate cost per user vs. benefit

Forecast scale-related charges

Ask for detailed usage analytics

The right CIAM partner should provide ROI in reduced support tickets, improved user retention, and faster onboarding.

Check Real-World Performance and Customer Stories

Proof matters. The final among the Best Practices for Evaluating CIAM Providers is validation through case studies and references.

Request:

Industry-specific success stories

Performance benchmarks

Case studies on global scalability

Testimonials from enterprise clients

Implementation timelines

This ensures you’re choosing a provider with experience in real-world, complex environments—not just PowerPoint capabilities.

Read Full Article : https://bizinfopro.com/webinars/best-practices-for-evaluating-ciam-providers/

About Us : BizInfoPro is a modern business publication designed to inform, inspire, and empower decision-makers, entrepreneurs, and forward-thinking professionals. With a focus on practical insights and in‑depth analysis, it explores the evolving landscape of global business—covering emerging markets, industry innovations, strategic growth opportunities, and actionable content that supports smarter decision‑making.

#CustomerExperience#CyberSecurityBestPractices#DigitalIdentityManagement#CIAMSolutions#IdentityAndAccessManagement

0 notes

Text

Software Development Company in Chennai: Driving Digital Transformation with Expertise

In today’s fast-paced digital landscape, partnering with the best software development company in Chennai can make all the difference between thriving online and getting lost in the crowd. Chennai, often referred to as the “Gateway to South India,” has emerged as a powerhouse for technology services, offering cost-effective solutions without compromising on quality. This article delves into what sets a top-tier software development company in Chennai apart, the services you can expect, and how to choose the right partner for your unique business needs.

Why Chennai Is a Hub for Software Development

Rich Talent Pool Chennai boasts prestigious institutions like the Indian Institute of Technology Madras (IIT-M) and Anna University, ensuring a steady influx of highly skilled graduates. Local companies benefit from engineers versed in the latest programming languages, frameworks, and best practices.

Cost-Effectiveness Compared to Western markets, Chennai-based firms offer competitive pricing models—whether it’s fixed-price, time-and-materials, or dedicated teams—allowing businesses of all sizes to access premium development talent.

Cultural Compatibility & Communication Chennai’s professionals are well-versed in English and accustomed to collaborating with global clients. This cultural alignment fosters seamless project management, clear requirements gathering, and timely delivery.

Core Services Offered

A leading software development company in Chennai typically provides end-to-end services, including:

Custom Software Development From enterprise-grade ERP systems to niche applications, expert teams architect solutions tailored to your workflows, ensuring scalability and maintainability.

Web & Mobile App Development Leveraging frameworks like React, Angular, Flutter, and native SDKs, these firms deliver responsive web portals and engaging mobile experiences for iOS and Android.

Cloud Solutions & DevOps Cloud-native architectures on AWS, Azure, or Google Cloud, combined with CI/CD pipelines and automated testing, guarantee high availability and rapid release cycles.

UI/UX Design User-centric interfaces and intuitive experiences are crafted through thorough research, wireframing, and prototyping—cementing your brand identity and driving user engagement.

Quality Assurance & Testing Comprehensive QA services—including functional, performance, security, and compatibility testing—ensure your product launches defect-free and satisfies industry standards.

Maintenance & Support Post-launch support models guarantee that your software evolves with your business, with timely updates, patch management, and technical assistance.

Key Differentiators of the Best Firms

Agile Methodologies Embracing Scrum or Kanban frameworks, top Chennai companies iterate quickly, incorporate feedback, and adapt to changing requirements—minimizing risks and maximizing ROI.

Domain Expertise Whether you’re in healthcare, finance, e-commerce, or education, look for a partner with proven domain knowledge. Their familiarity with compliance, standards, and pain points accelerates development.

Transparent Communication Regular sprint reviews, demos, and clear documentation foster trust. The best vendors provide dedicated project managers who serve as your single point of contact.

Innovation & R&D Leaders invest in research—exploring AI/ML, blockchain, IoT, and AR/VR—to deliver cutting-edge features that give you a competitive advantage.

Strong Portfolio & Client Testimonials Case studies, client reviews, and performance metrics (such as improved process efficiency or revenue growth) showcase a firm’s track record and reliability.

How to Choose the Right Software Development Company in Chennai

Define Your Requirements Before you start, create a detailed list of features, integrations, and performance expectations. This clarity helps vendors provide accurate proposals.

Evaluate Technical Expertise Review their tech stack, certifications, and open-source contributions. A partner invested in community projects often brings deeper insights.

Assess Cultural Fit Schedule introductory calls to gauge communication style, work ethic, and responsiveness. A good cultural match streamlines collaboration.

Request Proposals & Compare Solicit RFPs (Request for Proposals) from multiple vendors. Compare not just costs but timelines, deliverables, and support terms.

Start Small Consider a pilot project or MVP (Minimum Viable Product) engagement. This allows you to test the waters, evaluate performance, and build trust before scaling up.

Conclusion & Next Steps

Choosing the best software development company in Chennai means aligning with a team that combines technical prowess, industry insight, and a commitment to your vision. Whether you’re a startup seeking rapid growth or an enterprise striving for digital transformation, Chennai’s vibrant tech ecosystem promises solutions that are innovative, reliable, and cost-effective.

Ready to get started? Reach out to a reputable software development company in Chennai today for a free consultation and discover how your next software project can become a competitive advantage.

0 notes

Text

Top 7 Visual Testing Tools for 2025

What is Visual Testing?

Visual testing, also known as visual regression testing or UI testing, is a method of software testing that focuses on validating the visual appearance of user interfaces. While traditional functional testing ensures that the software behaves correctly, visual testing ensures that it looks correct across different browsers, devices, screen sizes, and operating systems.

In simple terms, visual testing compares screenshots or visual representations of a web or mobile application against a known “baseline” to detect unintended visual changes. These changes could include layout shifts, font inconsistencies, missing images, or alignment issues that affect user experience but may not break functionality.

With the rapid evolution of web design trends, complex UI components, responsive layouts, and cross-platform compatibility needs, visual testing has become a vital step in modern software quality assurance (QA) pipelines.

Types of Visual Testing

Visual testing can be categorized into three main types based on how comparisons and verifications are performed:

1. Pixel-by-Pixel Comparison

This technique compares each pixel in the captured screenshots to detect differences. It’s highly accurate but can also be sensitive to small changes such as anti-aliasing, font rendering differences, or dynamic content.

2. DOM-based Visual Testing

Rather than relying on screenshots alone, DOM-based tools analyze the underlying structure of the page (Document Object Model) to understand layout and styling rules. This method helps identify structural layout changes more reliably than raw image comparison.

3. AI/ML-Powered Visual Testing

These tools leverage artificial intelligence and machine learning to intelligently detect meaningful visual differences while ignoring minor or expected changes. They help reduce false positives and are ideal for large-scale and dynamic UI environments.

Top Visual Testing Tools for 2025

With growing demand for high-quality digital interfaces, the market for visual testing tools continues to expand. Here’s a curated list of the Top 7 Visual Testing Tools for 2025 that stand out for their features, ease of integration, and innovation:

1. Genqe.ai

Overview: Genqe.ai Eyes is one of the most popular AI-powered visual testing tools in the market. It uses Visual AI to perform intelligent image comparison and identify differences that affect user experience.

Key Features:

AI-powered visual comparison

Integration with Selenium, Cypress, Playwright, and other frameworks

Cross-browser and cross-device testing

Root cause analysis for visual bugs

Ultrafast Grid for parallel execution

Ideal For: Enterprises and teams looking for scalable, intelligent, and accurate visual testing solutions.

Pricing: Offers a free tier with limited features; premium plans are usage-based.

2. Percy by BrowserStack

Overview: Percy is a visual testing and review platform that seamlessly integrates into CI/CD pipelines. It is well-suited for frontend developers and product teams aiming to catch visual bugs early in development.

Key Features:

Instant visual diffs and feedback

GitHub and GitLab integration

BrowserStack cross-browser testing support

Supports Cypress, Selenium, Storybook, and more

Ideal For: Agile teams and frontend developers focused on fast feedback loops.

Pricing: Free plan available; paid plans scale with usage.

3. Chromatic

Overview: Built by the creators of Storybook, Chromatic offers visual regression testing and UI review for component-based applications. It’s especially powerful in the context of design systems and component libraries.

Key Features:

UI snapshot testing

Visual version control

Seamless integration with Git and Storybook

Review and approval workflows

Ideal For: Teams using component-driven development and Storybook for UI design.

Pricing: Free tier for small teams; paid plans for enterprise needs.

4. LambdaTest Visual Regression Cloud

Overview: LambdaTest is a cloud-based cross-browser testing platform that recently enhanced its offerings with a powerful visual regression testing suite.

Key Features:

Automated screenshot comparison

Responsive testing support

Integration with major CI/CD tools

Test across real devices and browsers

Ideal For: QA teams and developers seeking end-to-end cross-browser and visual testing.

Pricing: Offers a free plan; pricing scales with number of users and tests.

5. Screener

Overview: Screener combines visual testing with behavior-driven development (BDD) testing. It allows teams to write visual test scenarios in simple Gherkin syntax and capture UI changes effectively.

Key Features:

Gherkin-style visual test writing

Works with Storybook, Selenium, and WebDriver

Visual baselines and diffs

Review workflows

Ideal For: Teams with a strong focus on design and user stories.

Pricing: Tiered pricing based on usage and team size.

6. VisualReview

Overview: An open-source visual testing tool, VisualReview offers a self-hosted solution for teams that need flexibility and control over their test infrastructure.

Key Features:

Self-hosted visual testing server

Manual and automated test comparison

Simple UI to review visual changes

REST API integration

Ideal For: Teams seeking open-source or customizable alternatives.

Pricing: Free and open-source.

7. TestCafe Studio with Visual Regression Add-ons

Overview: TestCafe is a popular end-to-end testing framework, and with its ecosystem of plugins and add-ons, it supports visual regression testing. The Visual Regression plugin captures screenshots during test execution and compares them with baselines.

Key Features:

No browser plugins needed

JavaScript-based test scripting

Visual difference detection through plugins

Runs on any OS with Node.js

Ideal For: Developers who prefer JavaScript and open test APIs.

Pricing: Free and open-source; Studio edition is commercially licensed.

Bottom Line

Visual testing is no longer optional in today’s software development lifecycle — it’s essential. With user interfaces growing increasingly complex and diverse, ensuring visual consistency across platforms and updates is critical for maintaining brand integrity, user trust, and product usability.

The tools listed above provide a range of features suited for different team sizes, workflows, and technical requirements. Whether you’re a startup looking for a free, open-source solution or an enterprise seeking intelligent AI-powered visual testing, there’s a tool on this list that can elevate your UI testing strategy in 2025.

To choose the right one:

Evaluate your tech stack compatibility

Assess CI/CD and workflow integration

Consider pricing and scalability

Check for AI and cross-browser capabilities

As the emphasis on user experience intensifies, incorporating visual testing into your QA arsenal will not only improve product quality but also speed up development cycles by catching issues early — before they reach your users.

0 notes

Text

Inflation and Interest Rates in 2025: What Rising Costs and Rate Hikes Mean for Your Money

Meta Description:

Stay ahead in 2025 with expert insights into inflation trends and interest rate forecasts. Learn how cost of living adjustments impact your finances and how to prepare for economic changes.

Introduction: Why Inflation and Interest Rates Matter Now More Than Ever

In 2025, the relationship between inflation and interest rates is a top concern for consumers, investors, and businesses. As inflation trends continue to affect everyday expenses and interest rate forecasts shift frequently, staying informed is critical. Understanding how these economic forces interact helps you make better decisions about saving, borrowing, and long-term planning.

From cost of living adjustments (COLAs) to mortgage rates, inflation and interest rates have a ripple effect on nearly every aspect of personal finance.

What Is Inflation?

Inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power. For example, if inflation is 4%, your $100 today buys only $96 worth of goods next year.

What Causes Inflation?

Key drivers of inflation include:

Supply chain disruptions

Increased consumer demand

Higher wages and production costs

Government stimulus or spending

Global economic instability

Current Inflation Trends in 2025

According to economic analysts, inflation trends in 2025 are more moderate compared to recent years but still above pre-pandemic levels. Categories like housing, groceries, energy, and healthcare remain elevated, contributing to a persistent rise in the cost of living.

Key stats:

Core inflation is hovering around 3.8%

Rent and housing costs have seen 6% year-over-year increases

Grocery prices continue to climb, especially in meats and produce

What Are Interest Rates?

Interest rates represent the cost of borrowing money, typically set by a country's central bank (e.g., the U.S. Federal Reserve). When inflation rises, central banks often increase rates to slow down borrowing and reduce inflation.

Interest Rate Forecasts for 2025

Economists expect interest rate forecasts to remain volatile through 2025. The Federal Reserve has signaled a more cautious approach to future hikes but hasn’t ruled out rate increases if inflation remains stubborn.

Forecast Highlights:

Short-term interest rates may range between 4.75% and 5.25%

Mortgage rates are expected to stay between 6.5% and 7.5%

Auto and personal loan rates are trending upwards

How Inflation and Interest Rates Affect You

1. Cost of Living Adjustments (COLAs)

Many retirees and workers receive cost of living adjustments to help offset inflation. For example, Social Security benefits increased by 3.2% in 2025 to reflect rising prices.

2. Mortgage and Loan Payments

Higher interest rates mean larger monthly payments for homebuyers and borrowers. Refinancing may be less attractive during high-rate periods.

3. Credit Card Debt

With average credit card APRs now exceeding 22%, carrying a balance becomes more expensive as rates climb.

4. Savings and Investment Returns

Savings accounts and CDs offer better returns than in previous years

Bond yields may rise, but equity markets often become more volatile during rate hikes

How to Protect Your Finances in 2025

✅ Reassess Your Budget

Factor in higher utility, grocery, and housing expenses due to inflation.

✅ Lock in Fixed Rates

If you're planning a major loan or mortgage, consider locking in today’s rates before they rise further.

✅ Build an Emergency Fund

Higher costs mean unexpected bills can hit harder. Aim for 3–6 months of expenses.

✅ Diversify Investments

Inflation-resistant assets such as real estate, TIPS (Treasury Inflation-Protected Securities), and dividend-paying stocks can help hedge against inflation.

✅ Monitor COLA Changes

If you're on a fixed income, track cost of living adjustments to ensure your benefits or salary stay competitive.

Need Personal Or Business Funding? Prestige Business Financial Services LLC offer over 30 Personal and Business Funding options to include good and bad credit options. Get Personal Loans up to $100K or 0% Business Lines of Credit Up To $250K. Also credit repair and passive income programs.

Book A Free Consult And We Can Help - https://prestigebusinessfinancialservices.com

Email - [email protected]

Final Thoughts: Stay Smart About Inflation and Interest Rates

The dynamic between inflation and interest rates is complex but crucial for anyone looking to manage their money effectively in 2025. By staying informed on inflation trends, interest rate forecasts, and cost of living adjustments, you can take strategic steps to protect your wealth and financial future.

Need Personal Or Business Funding? Prestige Business Financial Services LLC offer over 30 Personal and Business Funding options to include good and bad credit options. Get Personal Loans up to $100K or 0% Business Lines of Credit Up To $250K. Also credit repair and passive income programs.

Book A Free Consult And We Can Help - https://prestigebusinessfinancialservices.com

Email - [email protected]

Prestige Business Financial Services LLC

"Your One Stop Shop To All Your Personal And Business Funding Needs"

Website- https://prestigebusinessfinancialservices.com

Email - [email protected]

Phone- 1-800-622-0453

#inflation trends#interest rate forecasts#cost of living adjustments#personal finance#personal loans#entrepreneur#personalfunding

0 notes

Text

Mastering Cost Optimization in the Cloud: Strategies for Maximum Efficiency

As more businesses migrate to the cloud, managing costs effectively has become a top priority. While cloud computing offers unmatched scalability and flexibility, it can also lead to ballooning expenses if not properly monitored and optimized. The good news? With the right strategies, you can significantly reduce your cloud spend without compromising performance.

In this blog, we’ll explore key tactics and best practices to help you master cost optimization in the cloud, from rightsizing resources to leveraging automation and real-time monitoring.

Why Cloud Cost Optimization Matters

Cloud platforms operate on a pay-as-you-go model — which is both a strength and a challenge. Without proper governance, unused resources, over-provisioned instances, and inefficient architectures can quietly inflate your bill.

Effective cost optimization enables businesses to:

Improve ROI on cloud investments

Free up budget for innovation

Ensure predictable billing for long-term planning

Align infrastructure spend with business goals

Proven Cloud Cost Optimization Strategies

1. Rightsize Your Resources

Overprovisioning is one of the most common sources of cloud waste. Continuously analyze usage metrics and adjust compute, storage, and network resources to match actual demand. Use autoscaling features to dynamically scale based on load.

2. Leverage Reserved Instances and Savings Plans

For predictable workloads, consider purchasing reserved instances or committing to savings plans from providers like AWS, Azure, or Google Cloud. These can offer up to 70% cost savings compared to on-demand pricing.

3. Automate with Infrastructure as Code (IaC)

IaC tools like Terraform and AWS CloudFormation allow you to define and manage infrastructure through code, reducing manual provisioning errors and avoiding resource sprawl. With version control, you can track changes and eliminate forgotten, idle services.

4. Implement Real-Time Monitoring and Optimization

Use cloud-native and third-party monitoring tools to gain visibility into your resource usage and costs. Real-time alerts and dashboards help you take immediate action when anomalies or spikes occur.

5. Clean Up Unused and Orphaned Resources

Regularly audit your cloud environment to identify and remove:

Unattached storage volumes

Idle compute instances

Unused IP addresses

Expired snapshots or backups

These resources can silently increase your monthly spend if left unchecked.

6. Optimize Storage and Data Transfer

Not all data needs to live on high-cost, high-performance storage. Use tiered storage options and archive infrequently accessed data. Also, monitor data transfer fees — especially for multi-region or hybrid deployments.

7. Incorporate Cost Awareness into CI/CD Pipelines

Integrate cost checks into your CI/CD process to evaluate the financial impact of new deployments or architectural changes. This encourages a cost-conscious culture among development and operations teams.

Building a Cost-Optimization Culture

Technology alone isn’t enough. Cost optimization requires a culture of accountability and transparency:

Tag resources by project, team, or environment for clear cost attribution

Set budgets and alerts to avoid overspending

Educate teams about the cost implications of their design and deployment decisions

Conduct regular reviews with finance, engineering, and operations to align on goals

How Salzen Cloud Can Help

At Salzen Cloud, we take a proactive approach to cost optimization. We help businesses:

Design efficient cloud architectures

Automate resource provisioning with IaC

Implement intelligent monitoring systems

Integrate cost controls into DevOps pipelines

Ensure compliance without sacrificing performance

Whether you're already in the cloud or just beginning your migration journey, our team can help you maximize efficiency, minimize costs, and stay future-ready.

Ready to optimize your cloud spending? Let’s talk about how Salzen Cloud can help you build a leaner, smarter cloud strategy that drives results.

0 notes

Text

The Evolution of Car MP3 Players: Navigating the Future of In-Vehicle Entertainment

The Evolution of Car MP3 Players: Navigating the Future of In-Vehicle Entertainment

In the ever-evolving landscape of automotive technology, car MP3 players have become an indispensable part of the in-vehicle entertainment system. These devices have transformed the way we listen to music and consume media while on the road. This article delves into the various aspects of car MP3 players, including their development, current industry trends, and the advantages and disadvantages they present to users and manufacturers alike.Get more news about Portable Bluetooth Speaker,you can vist our website!

The Rise of Car MP3 Players Car MP3 players first emerged in the late 1990s and early 2000s as a revolutionary alternative to traditional cassette and CD players. They allowed users to store thousands of songs on a single device, providing unprecedented access to music and other digital content. Over the years, these devices have become more sophisticated, incorporating features such as USB connectivity, Bluetooth compatibility, and support for various audio formats.

Current Industry Trends Integration with Smartphones and Tablets One of the most significant trends in the car MP3 player industry is the integration with smartphones and tablets. Modern car MP3 players often come with Bluetooth connectivity, enabling seamless pairing with mobile devices. This integration allows users to stream music, podcasts, and other audio content directly from their devices, enhancing the overall listening experience. Advanced User Interfaces User interfaces for car MP3 players have also evolved, with many devices now featuring touchscreens and voice-activated controls. These interfaces provide a more intuitive and user-friendly experience, reducing distractions and improving safety for drivers. Support for Multiple Audio Formats Car MP3 players have expanded their support for various audio formats, including MP3, WAV, FLAC, and more. This compatibility ensures that users can play a wide range of audio files, catering to different preferences and requirements.

Industry Leaders and Innovations Shenzhen GXY Electronics Co., Ltd. As a leading manufacturer in the consumer electronics industry, Shenzhen GXY Electronics Co., Ltd. has been at the forefront of car MP3 player innovation. The company offers a diverse range of car MP3 players that combine advanced features with high-quality sound performance. Their products often include additional functionalities such as FM radio, video playback, and GPS navigation, providing a comprehensive entertainment solution for drivers. Other Key Players Other notable players in the car MP3 player industry include brands such as Pioneer, Alpine, and JVC. These companies have also made significant contributions to the development of car MP3 players, introducing features such as high-resolution screens, built-in Wi-Fi, and app integration.

Advantages of Car MP3 Players Convenience and Portability Car MP3 players offer unparalleled convenience and portability, allowing users to carry their entire music library in a compact device. This eliminates the need for physical media such as CDs or cassette tapes, making it easier to organize and access music. Cost-Effectiveness Compared to other in-car entertainment systems, car MP3 players are relatively cost-effective. They provide a high return on investment by offering a wide range of features at an affordable price point. Customization and Personalization Car MP3 players allow users to customize their listening experience by creating playlists, adjusting equalizer settings, and accessing various audio formats. This level of personalization ensures that users can tailor their entertainment to their specific preferences.

Future Outlook Integration with Autonomous Vehicles As autonomous vehicles become more prevalent, the role of car MP3 players in providing entertainment will become even more significant. These devices will likely evolve to offer more advanced features and better integration with vehicle systems, enhancing the overall driving experience. Advancements in Audio Technology Future car MP3 players will benefit from advancements in audio technology, such as improved sound quality, noise cancellation, and spatial audio. These improvements will provide users with a more immersive and enjoyable listening experience. Increased Focus on Safety Manufacturers will continue to address safety concerns by developing car MP3 players with features that minimize distractions. This may include voice-activated controls, simplified user interfaces, and integration with vehicle safety systems.

Conclusion Car MP3 players have come a long way since their inception, transforming the way we listen to music and consume media while on the road. Despite facing some challenges, these devices continue to offer numerous advantages, making them an essential part of the in-vehicle entertainment system. As technology advances and new trends emerge, car MP3 players will likely remain a staple in the automotive industry, providing users with convenient, personalized, and enjoyable listening experiences.

0 notes

Text

Why Chennai Is Home to the Best Software Development Company in India

Chennai has emerged as one of Asia’s leading IT hubs, earning its reputation as the go‑to destination for businesses seeking premier software development services. When you search for the best software development company in Chennai, you’re tapping into a pool of skilled developers, innovative methodologies, and cutting‑edge technologies that power digital transformation across industries.

1. What Makes a “Best Software Development Company in Chennai”?

Technical Expertise

Proficiency across multiple stacks: Java/.NET, Python/Django, JavaScript (React, Angular, Vue), and mobile frameworks (Flutter, React Native).

In‑house specialists in emerging fields: AI/ML, blockchain, IoT, and cloud‑native architectures.

Proven Delivery Model

Agile and DevOps practices ensure iterative delivery, rapid feedback, and continuous integration/continuous deployment (CI/CD).

Strong project governance, transparency, and clear communication channels.

Domain Experience

Track record in key verticals: finance, healthcare, e‑commerce, education, and logistics.

Case studies showcasing measurable ROI, performance uplift, and scalability.

Customer‑Centric Culture

Dedicated account managers and cross‑functional teams focused on aligning with your business goals.

Post‑launch support, maintenance, and strategic roadmap planning.

2. Why Chennai? Advantages of Partnering with a Software Development Company in Chennai

Cost‑Effectiveness Salaries and operational costs in Chennai remain competitive compared to many Western and other Asian IT centers—without compromising on talent quality.

Rich Talent Pool Chennai’s tech ecosystem is fueled by premier engineering colleges (like IIT Madras and Anna University) and institutes that produce thousands of skilled graduates yearly.

Time‑Zone Compatibility Working with teams in IST (UTC +5:30) enables convenient overlap with Europe and even partial hours with the Americas, fostering real‑time collaboration and faster turnaround.

Robust IT Infrastructure State‑of‑the‑art tech parks, reliable power supply, and extensive broadband connectivity make it easy to scale projects up or down.

3. Core Services Offered by a Top Software Development Company in Chennai

Custom Software Development

Tailor‑made solutions that fit your unique workflows and user requirements.

End‑to‑end services from requirement gathering and prototyping to deployment and beyond.

Web & Mobile App Development

Responsive, progressive web applications (PWAs) built on modern JavaScript frameworks.

Native and cross‑platform mobile apps with focus on performance, security, and user experience.

Enterprise Solutions & ERP/CRM

Scalable enterprise resource planning (ERP) and customer relationship management (CRM) systems.

Seamless integration with existing databases, third‑party APIs, and legacy systems.

Cloud Services & DevOps

Architecting cloud‑native applications on AWS, Azure, or Google Cloud Platform.

Automated CI/CD pipelines, containerization (Docker, Kubernetes), and infrastructure as code (Terraform).

Data Analytics & AI/ML

Data warehousing, BI dashboards, and predictive analytics to turn raw data into actionable insights.

Custom machine learning models for recommendation engines, fraud detection, and image/text processing.

Quality Assurance & Testing

Comprehensive testing services, including functional, performance, security, and usability testing.

Test automation frameworks to accelerate release cycles.

4. How to Choose the Best Software Development Company in Chennai

Portfolio & Case Studies Review past projects, industry verticals, and client testimonials to gauge diversity and depth of expertise.

Technical Assessment Conduct small pilot projects or technical evaluations to verify coding standards, architecture clarity, and responsiveness.

Communication & Cultural Fit Ensure the team communicates clearly, respects deadlines, and aligns with your company culture and values.

Pricing Model & Engagement Terms Compare fixed‑price, time‑and‑materials, and dedicated‑team models to find the best fit for budget flexibility and long‑term collaboration.

Post‑Launch Support Clarify SLAs for maintenance, bug fixes, and feature enhancements to keep your application evolving smoothly.

5. Spotlight: Success Stories

E‑Commerce Transformation A mid‑sized retailer partnered with a leading Software Development Company in Chennai to migrate from a monolithic platform to microservices on AWS. Results: 40% faster page loads, 99.9% uptime, and a 25% uplift in conversion rate.

Healthcare Analytics Platform A healthcare startup tapped Chennai’s AI/ML talent to build a predictive analytics engine for patient risk scoring. After deployment, the platform improved early intervention rates by 30%.

6. Conclusion & Next Steps

Choosing the best software development company in Chennai means more than just engaging a vendor—it’s about forging a strategic partnership that accelerates innovation, optimizes costs, and delivers tangible business outcomes.

Define Your Goals: Outline your project scope, objectives, and KPIs.

Shortlist Vendors: Look for proven expertise, domain knowledge, and cultural alignment.

Engage & Evaluate: Run a pilot, validate technical capabilities, and confirm communication processes.

Scale & Innovate: Once chosen, leverage Chennai’s talent ecosystem to continuously evolve your digital product.

Ready to elevate your software journey? Partner with a premier Software Development Company in Chennai and turn your vision into reality.

0 notes

Text

Key Benefits of Deploying Oracle WebCenter Content on Oracle Cloud Infrastructure (OCI)

In today’s digital-first world, managing enterprise content effectively is more critical than ever. Oracle WebCenter Content (WCC), a powerful content management platform, provides organizations with robust capabilities for document management, imaging, records retention, and digital asset management. When combined with the scalability and resilience of Oracle Cloud Infrastructure (OCI), the solution becomes even more compelling.

This blog explores the key benefits of deploying Oracle WebCenter Content on OCI, and how organizations can unlock greater agility, performance, and cost-efficiency.

🚀 1. Scalability and Elastic Performance

Deploying WCC on OCI allows businesses to scale resources based on workload demands. Whether you're serving a small team or an enterprise-wide rollout, OCI’s elastic compute and storage services can grow (or shrink) with your usage.

Auto-scaling compute instances

Flexible storage tiers (Object, Block, Archive)

Load balancers for high-throughput scenarios

Result: No more over-provisioning or under-performance issues—just right-sized infrastructure.

🔒 2. Enterprise-Grade Security

Security is a top priority for content platforms, especially when managing sensitive business documents and records. OCI delivers a defense-in-depth approach with built-in services to protect data and applications.

OCI Vault for key management and secrets

Identity and Access Management (IAM) with fine-grained policies

Virtual Cloud Network (VCN) for network isolation

Always-on encryption at rest and in transit

Result: Peace of mind knowing your content repository is protected by Oracle’s secure cloud foundation.

💡 3. Simplified Integration with Oracle Ecosystem

Oracle WCC integrates seamlessly with other Oracle products—like Oracle APEX, Oracle Fusion Apps, and Oracle Integration Cloud—especially when hosted on the same cloud platform.

Native OCI services make integration easier

Faster data movement between services

Unified support for Oracle stack components

Result: Accelerated time-to-value and smoother workflows across business processes.

💰 4. Optimized Cost Efficiency

OCI is known for its predictable pricing and lower total cost of ownership (TCO) compared to other major cloud providers. You pay only for what you use—without the "cloud tax."

Flexible billing models

Reserved compute options for long-term savings

Storage tiers tailored to content access patterns

Result: Maximize ROI while modernizing your content infrastructure.

🛠️ 5. Automation & DevOps Support

Deploying WCC on OCI opens the door to automation, faster updates, and streamlined lifecycle management through infrastructure-as-code and CI/CD pipelines.

Terraform support via OCI Resource Manager

CLI, SDK, and REST APIs for custom orchestration

Integration with tools like Ansible, Jenkins, and GitHub

Result Move away from manual provisioning and towards a DevOps-enabled, agile environment.

📈 6. High Availability and Disaster Recovery

OCI’s globally distributed regions and availability domains enable robust business continuity planning. Deploying WCC in a multi-region setup with automated backups and failover ensures maximum uptime.

OCI Block Volume and Object Storage replication

Backup & Restore options via OCI Backup service

Cross-region disaster recovery configurations

Result: Maintain business operations even during outages or data center issues.

🌍 7. Global Reach with Local Compliance

Whether you're a global enterprise or a regional business, OCI provides localized cloud regions to meet compliance, latency, and data sovereignty needs.

45+ cloud regions worldwide

Sovereign cloud options for public sector

Alignment with GDPR, HIPAA, and other regulations

Result: Meet compliance without sacrificing performance or agility.

✅ Conclusion

Oracle WebCenter Content remains a cornerstone for enterprise content management. By deploying it on Oracle Cloud Infrastructure, you can amplify its strengths while gaining access to modern cloud-native capabilities. From security and scalability to cost and compliance, the benefits of running WCC on OCI are clear and compelling.

Whether you're planning a migration or building a new content-centric application, OCI is the natural fit for Oracle WebCenter Content.

0 notes

Text

Bank of Maharashtra rebounds 20% from 52-week low after strong Q4 business update

Shares of state-owned Bank of Maharashtra jumped 20 percent from their 52-week low on Tuesday, April 8, after the lender released a strong business update for the March 2025 quarter (Q4 FY25). The sharp rebound in the stock price came as the bank reported solid year-on-year growth across key business indicators, signaling operational strength and renewed investor confidence.

Business Update

According to provisional data, Bank of Maharashtra’s total business stood at ₹5,47,159 crore as of March 31, 2025, marking a 15.33 percent increase over ₹4,74,411 crore recorded in the same period last year. The bank’s performance was driven by a balanced growth in both deposits and advances, as well as continued focus on its low-cost deposit base.

Total deposits grew 13.45 percent year-on-year to ₹3,07,152 crore, up from ₹2,70,747 crore in March 2024. On a quarter-on-quarter basis, deposits rose by 10.1 percent. The rise was supported by strong traction in CASA (Current Account and Savings Account) deposits, which rose 14.64 percent to ₹1,63,669 crore. As a result, the CASA ratio improved to 53.29 percent from 52.73 percent in the year-ago period and 49.28 percent in the December 2024 quarter, indicating a healthier deposit mix.

Gross advances also recorded a robust increase of 17.84 percent year-on-year, rising to ₹2,40,007 crore as of March 2025, compared to ₹2,03,664 crore in March 2024. Despite this growth, the credit-deposit (CD) ratio moderated slightly to 78.14 percent in Q4, down from 81.95 percent in the previous quarter, although still higher than the 75.22 percent reported a year ago.

Stock Price Trend

Following the announcement, the PSU bank stock saw a sharp intraday rally of 4.8 percent, touching a high of ₹45.75. This marked a 20 percent recovery from its 52-week low of ₹38.11, which it had hit in the previous session on April 7. However, the stock continues to trade significantly below its 52-week high of ₹73.50, recorded in June 2024 — still about 38 percent away.

Over the last one year, shares of Bank of Maharashtra have lost nearly 34 percent of their value. The April rally follows five straight months of losses. The stock declined 0.15 percent in March, 9.5 percent in February, 1.7 percent in January, and 8.5 percent in December. So far in April, it has shed 3 percent.

Intensify Research Services is a professional stock consultive firm in Indore in share market latest news. We provide expert investment advice and guidance to individuals and High Net-Worth Individuals (HNIs), valuable trading tips and strategies for maximum profit. Visit us at Intensify Research Services to learn more.

#sharemarketing#stockinvestment#sharetrading#sharemarket#shareinvestor#investment#share this post#stock market#sharetrader#stocks

0 notes

Text

TestComplete vs. Selenium: Which One is Right for You?

Introduction

Automated testing is essential for delivering high-quality software. Two of the most popular automation tools in the market are TestComplete and Selenium. While both tools help in testing web applications, they cater to different needs and use cases. In this blog, we will compare TestComplete and Selenium based on features, ease of use, flexibility, and pricing to help you decide which tool is right for you.

What is TestComplete?

TestComplete is a commercial test automation tool developed by SmartBear that allows testers to automate UI testing for web, desktop, and mobile applications. It supports multiple scripting languages, including JavaScript, Python, and VBScript, and comes with a built-in record-and-playback feature for easy test creation.

Key Features of TestComplete:

Supports desktop, web, and mobile applications

Record-and-playback for scriptless automation

Keyword-driven testing and data-driven testing

Integration with CI/CD tools like Jenkins, Azure DevOps

AI-powered object recognition for reliable element detection

Paid tool with dedicated customer support

What is Selenium?

Selenium is an open-source framework used for web application automation. It provides flexibility and control over test execution, making it ideal for developers and testers who need full customization. Selenium supports multiple programming languages like Java, Python, C#, and JavaScript.

Key Features of Selenium:

Open-source and free to use

Supports all major browsers (Chrome, Firefox, Edge, Safari)

Works with multiple programming languages

Can be integrated with TestNG, JUnit, and CI/CD tools

Requires coding knowledge for test automation

Supports parallel test execution using Selenium Grid

TestComplete vs. Selenium: Key Differences

FeatureTestCompleteSeleniumLicensePaid (Commercial)Free (Open-Source)Ease of UseBeginner-friendly, supports scriptless testingRequires coding skillsSupported AppsWeb, Desktop, MobileWeb OnlyLanguages SupportedJavaScript, Python, VBScriptJava, Python, C#, JavaScript, Ruby, PHPIntegrationCI/CD tools like Jenkins, AzureCompatible with TestNG, JUnit, CI/CD toolsTest ExecutionBuilt-in scheduler for running testsNeeds third-party tools for schedulingAI Object RecognitionYesNoParallel TestingSupportedSupported via Selenium Grid

Which One Should You Choose?

Choose TestComplete If:

✅ You need an easy-to-use tool with record-and-playback features ✅ Your team has limited coding skills but needs quick automation ✅ You need to automate web, desktop, and mobile applications ✅ You want a commercial tool with dedicated support

Choose Selenium If:

✅ You need a free, open-source solution for test automation ✅ You have a team with strong programming skills ✅ You only need to test web applications ✅ You want flexibility and customization with different programming languages

Conclusion

Both TestComplete and Selenium are powerful test automation tools, but they serve different purposes. TestComplete is ideal for teams looking for a user-friendly, all-in-one commercial solution, while Selenium is best for developers who prefer an open-source and highly customizable framework.

If you’re interested in mastering TestComplete and improving your automation testing skills, consider enrolling in TestComplete Online Training for hands-on learning and expert guidance.

Would you like to learn more? Let us know in the comments! 🚀

phone number-+91 9655877577

0 notes

Text

Understanding AWS Pricing: Tips to Save Money

Introduction

Amazon Web Services (AWS) provides a powerful cloud platform with flexible pricing, allowing businesses to pay only for what they use. However, without proper planning, AWS costs can quickly escalate. This guide will help you understand AWS pricing models and provide actionable strategies to optimize costs and save money.

1. AWS Pricing Models Explained

AWS offers multiple pricing models to cater to different workloads. Understanding these models can help you choose the most cost-effective option for your use case.

a) Pay-as-You-Go

Charged based on actual usage with no upfront commitments.

Ideal for startups and unpredictable workloads.

Example: Running an EC2 instance for a few hours and paying only for that time.

b) Reserved Instances (RIs)

Offers significant discounts (up to 72%) compared to on-demand pricing in exchange for a long-term commitment (1 or 3 years).

Best for applications with predictable, steady-state workloads.

Example: A database server that runs 24/7 would benefit from a Reserved Instance to reduce costs.

c) Savings Plans

Flexible alternative to Reserved Instances that provides savings based on a committed spend per hour.

Covers services like EC2, Fargate, and Lambda.

Example: Committing to $100 per hour on EC2 usage across any instance type rather than reserving a specific instance.

d) Spot Instances

Allows you to purchase unused EC2 capacity at steep discounts (up to 90%).

Ideal for batch processing, CI/CD pipelines, and machine learning workloads.

Example: Running a nightly data processing job using Spot Instances to save costs.

e) Free Tier & Budgeting Tools

AWS Free Tier offers limited services for free, ideal for small-scale experiments.

AWS Budgets & Cost Explorer help track and analyze cloud expenses.

Example: AWS Lambda includes 1 million free requests per month, reducing costs for event-driven applications.

2. Key Cost-Saving Strategies

Effectively managing AWS resources can lead to substantial cost reductions. Below are some best practices for optimizing your AWS expenses.

a) Right-Sizing Resources

Many businesses overprovision EC2 instances, leading to unnecessary costs.

Use AWS Compute Optimizer to identify underutilized instances and adjust them.

Example: Switching from an m5.large instance to an m5.medium if CPU utilization is consistently below 30%.

b) Auto Scaling & Load Balancing

Automatically scales resources based on traffic demand.

Combine with Elastic Load Balancing (ELB) to distribute traffic efficiently.

Example: An e-commerce website that experiences traffic spikes during sales events can use Auto Scaling to avoid overpaying for unused capacity during off-peak times.

c) Storage Cost Optimization

AWS storage costs can be reduced by choosing the right storage class.

Move infrequently accessed data to S3 Intelligent-Tiering or S3 Glacier.

Example: Archive old log files using S3 Glacier, which is much cheaper than keeping them in standard S3 storage.

d) Optimize Data Transfer Costs

Inter-region and cross-AZ data transfers can be costly.

Use AWS PrivateLink, Direct Connect, and edge locations to reduce transfer costs.

Example: Keeping all resources within a single AWS region minimizes inter-region transfer fees.

e) Serverless & Managed Services

AWS Lambda, DynamoDB, and Fargate reduce infrastructure management costs.

Example: Instead of running an EC2 instance for a cron job, use AWS Lambda, which runs only when needed, reducing idle costs.

f) Leverage Savings Plans & Reserved Instances

Choose Savings Plans for predictable workloads to reduce compute costs.

Reserve database instances (RDS, ElastiCache) for additional savings.

Example: Committing to a Savings Plan for consistent EC2 usage can reduce expenses significantly compared to on-demand pricing.

g) Monitor and Control Costs

Enable AWS Cost Anomaly Detection to identify unexpected charges.

Use AWS Budgets to set spending limits and receive alerts.

Example: Setting a budget limit of $500 per month and receiving alerts when 80% of the budget is reached.

3. AWS Cost Management Tools

AWS provides several tools to help you monitor and optimize costs. Familiarizing yourself with these tools can prevent overspending.

a) AWS Cost Explorer

Helps visualize and analyze cost and usage trends.

Example: Identify which services are driving the highest costs and optimize them.

b) AWS Budgets

Allows users to set custom spending limits and receive notifications.

Example: Setting a monthly budget for EC2 instances and receiving alerts when nearing the limit.

c) AWS Trusted Advisor

Provides real-time recommendations on cost savings, security, and performance.

Example: Recommends deleting unused Elastic IPs to avoid unnecessary charges.

d) AWS Compute Optimizer

Suggests right-sizing recommendations for EC2 instances.

Example: If an instance is underutilized, Compute Optimizer recommends switching to a smaller instance type.

Conclusion

AWS pricing is complex, but cost optimization strategies can help businesses save money. By understanding different pricing models, leveraging AWS cost management tools, and optimizing resource usage, companies can efficiently manage their AWS expenses.

Regularly reviewing AWS billing and usage reports ensures that organizations stay within budget and avoid unexpected charges.

WEBSITE: https://www.ficusoft.in/aws-training-in-chennai/

0 notes

Text

How to Choose the Best Selenium Course Online for Your Career

Introduction

In today's tech-driven world, software testing is a crucial skill, and Selenium is at the forefront of automated testing. Whether you are a beginner or an experienced professional, choosing the right Selenium course online can significantly impact your career growth. But with so many options available, how do you find the best course that fits your needs?

This guide will walk you through the key factors to consider when selecting a Selenium certification course that aligns with your career goals and provides hands-on training for real-world applications.

Why Learn Selenium?

Selenium is an industry-leading open-source automation tool used for web application testing. Here are some compelling reasons why mastering Selenium is a great career move:

High Demand: Companies worldwide rely on Selenium for automated testing.

Cost-Effective: Unlike paid tools, Selenium is open-source and widely adopted.

Cross-Browser Compatibility: Selenium supports major browsers like Chrome, Firefox, and Edge.

Integration with Programming Languages: You can use Java, Python, C#, and more.

Strong Career Growth: QA professionals with Selenium expertise earn competitive salaries.

Key Factors to Consider When Choosing a Selenium Course Online

1. Comprehensive Curriculum

A good Selenium course training should cover:

Selenium WebDriver basics and advanced concepts

Integration with frameworks like TestNG and JUnit

Hands-on experience with real-world projects

API testing with Selenium

Integration with CI/CD tools like Jenkins

2. Hands-On Training & Real-World Applications

Theory alone is not enough. Look for courses that offer:

Live projects with real-world scenarios

Hands-on coding assignments

Interactive sessions with industry experts

3. Selenium Certification & Industry Recognition

A Selenium certification course adds value to your resume. Ensure the course provides:

A recognized certification upon completion

Credibility with employers and hiring managers

4. Instructor Expertise

The instructor should have real-world experience in software testing and Selenium automation. Check for:

Industry experience

Strong teaching credentials

Positive student reviews

5. Flexible Learning Options

If you have a busy schedule, opt for:

Self-paced learning

Live instructor-led classes

Weekend or evening batch options

6. Support and Community Access

A good course should offer:

24/7 student support

Discussion forums for doubt resolution

Lifetime access to course materials

7. Affordable Pricing & Value for Money

Compare pricing with the course content to ensure you are getting the best value. Many platforms offer:

Flexible payment plans

Free trial classes

Discounted group enrollments

Recommended Course Structure for Maximum Learning

If you’re looking for a structured approach, here’s an ideal course structure:

Module 1: Introduction to Selenium

Basics of automation testing

Overview of Selenium and its components

Module 2: Selenium WebDriver

Setting up Selenium WebDriver

Locators and interaction methods

Module 3: Advanced Selenium Concepts

Handling pop-ups, alerts, and iframes

Working with dynamic elements

Module 4: Test Automation Frameworks

TestNG and JUnit

Page Object Model (POM)

Module 5: Continuous Integration & Deployment

Integrating Selenium with Jenkins

Running tests in parallel

Module 6: Real-World Projects & Certification

Hands-on project assignments

Final assessment and certification

The Benefits of Enrolling in H2K Infosys’ Selenium Course

H2K Infosys offers a Selenium certification training that ticks all the right boxes:

Expert-Led Training: Industry professionals with real-world experience.

Hands-On Learning: Live projects and assignments.

Flexible Schedule: Choose from live or self-paced learning options.

Affordable Pricing: Competitive rates with installment options.

Certification & Career Support: Recognized certification and job assistance.

Conclusion & Call to Action

Choosing the right Selenium course online can shape your career in software testing. H2K Infosys offers expert-led, hands-on Selenium certification courses designed to equip you with real-world skills. Enroll today and take the next step in your career!

#Selenium course#Selenium course online#Selenium course training#Selenium certification#Selenium certification training#Selenium certification course

0 notes

Text

How to Get Your Music on Spotify in India: A Beginner’s Guide

If you're an independent artist in India, upload your track on Spotify in India could be one of the best decisions you make for your music career. Spotify has become a global platform for artists to showcase their work and reach millions of listeners. But, as an independent musician, navigating the distribution process can be a bit tricky if you're not familiar with the steps. In this beginner’s guide, we will walk you through everything you need to know to get your track uploaded and heard on Spotify.

Why Spotify is Essential for Independent Artists in India

Spotify is the world’s largest music streaming service, with millions of active users worldwide. In India, the platform has seen significant growth over the past few years, making it a key player in the local music scene. As an artist, Spotify provides access to a massive audience, helping you grow your fan base both locally and internationally.

One of the greatest advantages of Spotify is its algorithm-driven playlists, such as Discover Weekly and Release Radar, which expose your music to listeners based on their preferences. This increases your chances of being discovered, especially for indie artists who don’t have the same resources as major labels. Additionally, Spotify allows you to track your streaming data, giving you insights into your audience, where they are from, and which tracks they love the most.

Setting Up Your Artist Profile on Spotify

Before you start uploading your tracks, it’s important to set up and claim your artist profile on Spotify. This process ensures that you have control over your music, allowing you to make updates, share new releases, and interact with your fans.

To get started, visit the Spotify for Artists website and sign in with your existing Spotify account. Once logged in, you’ll be prompted to claim your artist profile. If your music is already on Spotify, you should be able to find your profile and claim it right away. If you’re a new artist, you may need to wait for your music to be distributed before your profile can be created.

Choosing a Music Distribution Service to Upload Your Track

In order to get your music on Spotify, you’ll need to use a music distribution service. These platforms act as intermediaries, uploading your music to Spotify and other streaming services on your behalf. There are several options available, but the most important thing is to choose a service that best suits your needs as an independent artist.

One popular choice for independent musicians in India is Deliver My Tune. This distributor allows you to upload your music to Spotify, Apple Music, Amazon Music, and other streaming platforms. What makes Deliver My Tune a great option is its affordable pricing, user-friendly interface, and timely support. The platform ensures that your tracks are uploaded without any hassle, so you can focus on your music career.

Other distributors you might consider include TuneCore, CD Baby, and DistroKid. These platforms offer a range of pricing models and distribution options, so it’s worth comparing them based on your specific goals.

Uploading Your Track: A Detailed Step-by-Step Guide

Once you’ve chosen your distribution service, the next step is to upload your music. The process is generally straightforward but requires attention to detail. Here’s a general outline of the steps involved:

Create an account with your chosen distributor: Start by signing up with the service. You’ll need to provide your personal details, music genre, and payment information.

Upload your track: Prepare your track in the required file format (usually WAV or MP3) and upload it through the distributor’s portal. Make sure that your audio quality is top-notch to ensure the best listening experience for your audience.

Add artwork and metadata: High-quality album art is crucial for the success of your track. Ensure that your artwork is eye-catching and meets Spotify’s image requirements. You’ll also need to add metadata, such as track titles, artist names, and album details.