#commercial real estate loan providers

Text

Apply for Fast Business Loan - Catch Rupee is your one-stop solution for a small business loan, machinery loan, loan for a women-owned business In Pune. Feel free to contact us for your financial need. Call Us Today!

#Small business loan in Pune#Business loans for startups in Pune#Business loan for new business#Commercial real estate loans#Startup loan for new business#New small business loans in Pune#Business loan provider in Pune

0 notes

Text

Drealty-Best Flats in noida extension

Drealty-Best House Sale Company in Noida, Semi Furnished with Geysers, Smart Lock, modular kitchen, Chimney, Fan, Light, Jhumar, etc More Information visit -

#Flats in noida extension#2-3 bhk in noida extension#Best Real estate agent in Delhi ncr#Best home loan provider#Home loan lowest roi#Loan on lowest ROI#commercial real estate near me#place real estate#best value real estate#Apply for Personal Loan#start up business loans

1 note

·

View note

Text

Best value real estate Service and ,Best home loan provider is a full-service company in Noida,

1. State Bank of India (SBI): SBI is one of the largest and most trusted banks in India. It offers home loans with competitive interest rates and flexible repayment options. SBI has branches and customer service centers in Noida, making it easily accessible for residents.

2. HDFC Ltd: HDFC Ltd is a leading housing finance company in India. It provides home loans to individuals and offers various features like attractive interest rates, flexible repayment options, and quick loan processing. HDFC Ltd has a strong presence in Noida and is known for its customer service.

3. ICICI Bank: ICICI Bank is another prominent bank in India that offers home loans. It provides a range of home loan products and services tailored to meet the requirements of different customers. ICICI Bank has branches and loan processing centers in Noida, making it convenient for borrowers.

4. Axis Bank: Axis Bank is known for its competitive interest rates and customer-friendly home loan products. It offers home loans with attractive features such as doorstep service, flexible repayment options, and quick loan approvals. Axis Bank has a presence in Noida, making it a viable option for borrowers in the area.

5. Punjab National Bank (PNB): PNB is a public sector bank in India that provides home loans to individuals. It offers housing loans with competitive interest rates, easy documentation, and personalized customer service. PNB has branches and loan centers in Noida, making it accessible to borrowers in the region.

Remember, it's essential to thoroughly research and compare the terms, interest rates, repayment options, and customer reviews of different home loan providers in Noida before making a decision. Additionally, consider consulting with a financial advisor or contacting the banks directly for the most up-to-date and accurate information.

Flats in noida extension2-3 bhk in noida extension

Best Real estate agent in Delhi ncr,Best home loan provider

#Home loan lowest roi#commercial#real estate near me#Loan on lowest ROI#start up business loans#best home loan provider#loan against property#personal loan against property#loan against plot

0 notes

Video

youtube

HelloI hope you are doing well,My name is Prashant rathour from VEDIC AG...

#youtube#best personal loans#Flats in noida extension#2-3 bhk in noida extension#Best Real estate agent in Delhi ncr#Best home loan provider#Home loan lowest roi#Loan on lowest ROI#commercial real estate near me#place real estate#best value real estate#Apply for Personal Loan#start up business loans#commercial property loan#best car financing deals#loan against property#personal loan against property#loan against plot#car loans near me#best car loan rates today#best used car loan rates#car finance near me#apply for car loan#personal finance loans#small business loans

0 notes

Text

FINPLATE is the UAE’s leading mortgage broker, with a wide selection of low interest rates and flexible financing options. Full Details: https://finplate.com/

#finance#loans in hours#commercial real estate#find the best loan for you#mortgage loan#loan provider

1 note

·

View note

Text

Letitia James Turns the Screws on Trump

The inflated $464 million bond required to appeal effectively denies him due process.

By The Editorial Board

Wall Street Journal

March 18, 2024

New York Attorney General Letitia James’s use of lawfare to take down Donald Trump is getting uglier by the day. She is now threatening to seize the former President’s assets after effectively denying him the ability to appeal the grossly inflated civil-fraud judgment against him.

Mr. Trump’s lawyers wrote Monday in a court filing that they’ve been unable to obtain a bond to guarantee last month’s $464 million judgment. Defendants are required to post bonds to appeal verdicts. Mr. Trump’s lawyers say securing the full bond would be “impossible” since most of his assets are illiquid.

One way to satisfy the bond would be to borrow against his real-estate holdings. But Mr. Trump’s lawyers say that only a handful of insurance companies have “both the financial capability and willingness to underwrite a bond of this magnitude,” and “the vast majority are unwilling to accept the risk associated with such a large bond.”

What’s more, his lawyers say that none of the insurers that Mr. Trump’s team approached “are willing to accept hard assets such as real estate as collateral for appeal bonds.” This isn’t surprising given the recent write-downs in commercial real estate and enormous uncertainty about their valuations, especially in places like New York. Insurers may also fear Ms. James’s legal retribution if they provide the bond to Mr. Trump.

Thus in order to appeal the judgment, Mr. Trump could have to unload property in a fire sale. If he were later to win on appeal, his lawyers rightly argue that he would have suffered an enormous, irreparable loss.

Ms. James no doubt knows she has Mr. Trump in a bind. She and courts have opposed his requests to reduce the bond even though a court-appointed independent monitor overseeing his businesses eliminates the risk he could dispose of or transfer his assets to make the judgment harder for the state to enforce.

As we wrote last month, the judgment is overkill. None of Mr. Trump’s business partners lost money lending to him or claimed to have been deceived by his erroneous financial statements. No witness during the trial said his alleged misrepresentations changed its loan terms or prices, and there was no evidence that he profited from his alleged deceptions.

Nonetheless, state trial judge Arthur Engoron ordered him to “disgorge” $355 million in “ill-gotten gains.” This sum was based on the interest-rate savings that a financial expert retained by Ms. James estimated Mr. Trump netted from his legerdemain. But this calculation seems dubious since banks said they didn’t alter their loan terms.

The judge also tacked on profits that Mr. Trump putatively made on properties for which he submitted false financial statements without demonstrating that the latter enable the former. He also added “pre-judgment interest” dating back to the day Ms. James launched her investigation in 2019. This makes Mr. Trump liable for alleged wrongdoings before he was even charged. All of this provides plausible grounds for appeal.

Whatever his transgressions, defendants are entitled to due process, which includes the right to appeal. Ms. James is trying to short-circuit the justice system to get Mr. Trump, as she promised she would during her 2018 campaign. Anyone who does business in New York ought to worry about how Ms. James could likewise twist the screws on them.

#trump#trump 2024#ivanka#americans first#america#america first#repost#president trump#donald trump#democrats#wall street journal#New York#Democrat Corruption

47 notes

·

View notes

Text

Navigating the Mortgage Market: Finding the Best Mortgage Company in UAE

Navigating the mortgage market in the UAE can be challenging, given the numerous options available. This guide will help you find the best mortgage company for your needs, ensuring you secure favorable mortgage terms and rates.

For more insights into Dubai's real estate market, visit home loan dubai.

Understanding the UAE Mortgage Market

Market Overview: The UAE mortgage market is diverse and competitive, with a wide range of local and international banks offering various mortgage products. Understanding the market landscape is essential for making the right choice.

Types of Mortgages: Mortgages in the UAE can be classified into fixed-rate and variable-rate mortgages. Fixed-rate mortgages provide stability with consistent monthly payments, while variable-rate mortgages fluctuate based on market conditions.

Eligibility Criteria: Each mortgage company has its own eligibility criteria, including income requirements, employment status, and credit history. Understanding these criteria will help you identify which companies you qualify for.

For more investment options, explore Buy Commercial Properties in Dubai.

Key Features of Mortgage Companies

Competitive Interest Rates: Leading mortgage companies offer competitive interest rates, helping you save money over the loan term. Compare the rates offered by different companies to find the best deal.

Flexible Loan Terms: Look for mortgage companies that offer flexible loan terms, including various repayment periods and options for early repayment without penalties.

Customer Service: Excellent customer service is essential when dealing with mortgage companies. Choose a company with a strong reputation for providing responsive and helpful support.

Quick Approval Process: The approval time for mortgages can vary between companies. Select a company known for its quick and efficient approval process to avoid delays in your property purchase.

Additional Services: Some mortgage companies offer additional services such as mortgage insurance, property valuation, and financial planning advice. These services can add value and convenience to your mortgage experience.

For mortgage services, visit Mortgage Financing in Dubai.

Steps to Finding the Right Mortgage Company

Research and Compare: Start by researching various mortgage companies in the UAE. Use online platforms, read customer reviews, and compare their mortgage products and services.

Seek Recommendations: Ask friends, family, or colleagues for recommendations. Personal experiences can provide valuable insights into the reliability and efficiency of different mortgage companies.

Consult a Mortgage Broker: A mortgage broker can provide expert advice and help you find the best mortgage deals. They can also assist with the application process and negotiations.

Pre-Approval: Get pre-approved for a mortgage to understand your borrowing capacity and increase your chances of securing a good deal. Pre-approval also makes you a more attractive buyer to sellers.

Meet with Representatives: Schedule meetings with representatives from different mortgage companies to discuss your needs and ask questions. This will help you gauge their responsiveness and willingness to assist.

Review Terms and Conditions: Carefully review the terms and conditions of the mortgage offers. Pay attention to interest rates, loan terms, fees, and any other conditions that may affect your mortgage.

For property management services, visit Apartments For Rent in Dubai.

Popular Mortgage Companies in UAE

HSBC: Known for its competitive interest rates and flexible mortgage options, HSBC is a popular choice for homebuyers in the UAE.

Emirates NBD: Emirates NBD offers a range of mortgage products tailored to different needs, along with excellent customer service and quick approval times.

Mashreq Bank: Mashreq Bank provides personalized mortgage solutions with attractive rates and minimal fees, making it a preferred choice for many buyers.

ADCB: Abu Dhabi Commercial Bank (ADCB) offers comprehensive mortgage products with competitive rates and flexible repayment options.

Dubai Islamic Bank: For those seeking Sharia-compliant mortgage solutions, Dubai Islamic Bank offers a variety of Islamic mortgage products with favorable terms.

For property sales, visit Property For Sale in Dubai.

Real-Life Success Story

Consider the case of Noor and Hadi, who recently purchased their dream home in Dubai. By working with a reputable mortgage company, they secured a mortgage with favorable terms. The mortgage company provided expert advice, handled the paperwork, and ensured a smooth process from start to finish. This allowed Noor and Hadi to focus on finding their perfect home without worrying about the complexities of securing a mortgage.

For more insights into Dubai's real estate market, visit home loan dubai.

Future Trends in the UAE Mortgage Market

Digitalization: The UAE mortgage market is embracing digitalization, with many companies offering online application processes, digital document submission, and virtual consultations. This trend is making the mortgage process more efficient and convenient.

Sustainable Mortgages: There is a growing demand for sustainable mortgages that support environmentally friendly and energy-efficient homes. Mortgage companies are beginning to offer products that cater to this demand.

Flexible Mortgage Products: Mortgage companies are increasingly offering flexible mortgage products that cater to the diverse needs of homebuyers. This includes options for expatriates, first-time buyers, and investors.

For property sales, visit Sell Your Apartments in Dubai.

Conclusion

Navigating the mortgage market in the UAE involves careful research, comparison, and consideration of various factors. By understanding the market, seeking recommendations, and evaluating your options, you can secure a mortgage that meets your needs and financial goals. For more resources and expert advice, visit home loan dubai.

6 notes

·

View notes

Text

Buying Property in Thailand

Thailand is an attractive destination for property buyers due to its scenic landscapes, vibrant cities, and welcoming culture. However, purchasing property in Thailand, especially as a foreigner, involves navigating a complex legal framework and understanding the local market intricacies. This comprehensive guide will provide detailed insights, enhancing expertise and credibility by delving into the legalities, procedures, and best practices for buying property in Thailand.

1. Understanding the Legal Framework

Key Legal Restrictions:

Land Code Act B.E. 2497 (1954): Foreigners cannot own land in Thailand except under specific conditions.

Condominium Act B.E. 2522 (1979): Foreigners can own up to 49% of the total floor area of a condominium building.

Foreign Business Act B.E. 2542 (1999): Regulates foreign business activities and investments, impacting property purchases for business purposes.

Exceptions and Alternatives:

Board of Investment (BOI) Projects: Foreigners investing in BOI-promoted projects can acquire land under specific conditions.

Long-Term Leases: Foreigners can lease land for up to 30 years, with options to renew.

Thai Company Ownership: Forming a Thai company where foreigners hold less than 50% of shares allows indirect land ownership.

2. Types of Property Available for Purchase

Condominiums:

Freehold Ownership: Foreigners can own condominium units outright.

Ownership Percentage: The foreign ownership quota in a condominium building should not exceed 49%.

Leasehold Properties:

Land and Houses: Foreigners can lease land and houses for up to 30 years, with potential for renewal.

Registration: Leases exceeding three years must be registered at the Land Department to be legally enforceable.

Investment Properties:

Commercial Real Estate: Foreigners can invest in commercial properties through long-term leases or joint ventures with Thai partners.

Resort and Hotel Investments: Special regulations apply to foreign investments in resort and hotel properties, often requiring joint ventures.

3. Due Diligence and Legal Processes

Conducting Due Diligence:

Title Search: Verify the property’s legal status, ownership history, and any encumbrances or disputes.

Zoning and Land Use: Ensure the property complies with local zoning laws and land use regulations.

Environmental Compliance: Check for any environmental restrictions or issues affecting the property.

Engaging Legal and Financial Advisors:

Real Estate Lawyer: Hire a reputable lawyer specializing in Thai real estate to guide you through the legal processes.

Financial Advisor: Consult a financial advisor to understand tax implications, financing options, and investment strategies.

Steps in the Buying Process:

Reservation Agreement: Sign a reservation agreement and pay a reservation fee to secure the property.

Due Diligence: Conduct thorough due diligence with the help of legal advisors.

Sale and Purchase Agreement (SPA): Draft and sign the SPA, detailing the terms and conditions of the sale.

Deposit Payment: Pay a deposit, typically 10-30% of the purchase price.

Transfer of Ownership: Complete the transfer at the Land Department, paying the remaining balance and associated fees.

4. Costs and Taxes Involved

Purchase Costs:

Transfer Fee: 2% of the appraised property value.

Stamp Duty: 0.5% of the purchase price or appraised value, whichever is higher.

Withholding Tax: 1% of the appraised value or the actual sale price, whichever is higher.

Specific Business Tax (SBT): 3.3% of the appraised or actual sale price, applicable if the property is sold within five years of acquisition.

Ongoing Costs:

Common Area Fees: Monthly fees for maintenance of common areas in condominiums.

Property Tax: Annual property tax based on the assessed value of the property.

Utilities and Maintenance: Regular expenses for utilities, repairs, and maintenance.

5. Financing Options

Local Financing:

Thai Banks: Some Thai banks offer mortgage loans to foreigners for condominium purchases.

Eligibility Criteria: Generally, borrowers need to have a work permit, proof of income, and a good credit history.

Foreign Financing:

Home Country Banks: Some buyers secure financing from banks in their home countries, leveraging their assets abroad.

International Mortgage Providers: Specialized financial institutions provide mortgages for international property purchases.

Payment Plans:

Developer Financing: Some developers offer financing plans with staggered payments during the construction period.

Installment Payments: Buyers can negotiate installment payments directly with sellers or developers.

6. Common Pitfalls and How to Avoid Them

Legal Complications:

Unclear Title: Always verify the title to avoid disputes and ensure clear ownership.

Zoning Issues: Confirm zoning regulations to ensure the property can be used as intended.

Contractual Disputes: Have all agreements reviewed by a lawyer to prevent misunderstandings and ensure enforceability.

Financial Risks:

Currency Fluctuations: Be aware of exchange rate risks when making payments in foreign currency.

Hidden Costs: Account for all additional costs such as taxes, fees, and maintenance expenses.

Financing Challenges: Ensure you have a clear financing plan and understand the terms of any loans or payment plans.

7. Enhancing Expertise and Credibility

Demonstrating Professional Credentials:

Legal Qualifications: Highlight the legal qualifications and experience of your advisors and partners.

Professional Experience: Detail your experience in handling property transactions in Thailand.

Memberships and Affiliations: Include memberships in professional organizations like the Thai Bar Association, the Real Estate Broker Association, or international property associations.

Providing Authoritative References:

Cite Legal Documents: Reference specific sections of the Land Code Act and Condominium Act to support your points.

Expert Opinions: Incorporate insights from recognized experts in Thai real estate law and property investment.

Including Detailed Case Studies:

Client Testimonials: Feature testimonials from clients who have successfully purchased property in Thailand with your assistance.

Real-Life Examples: Provide detailed examples of successful transactions, highlighting any challenges overcome and solutions implemented.

Visual Aids and Infographics:

Process Flowcharts: Use flowcharts to depict the steps involved in the property buying process.

Diagrams: Create diagrams to visually explain key legal concepts and ownership structures.

#buying property in thailand#property in thailand#property lawyers in thailand#thailand#property#lawyers in thailand

2 notes

·

View notes

Text

Your Guide to Securing Luxury Properties for Sale in Dubai

Securing luxury properties for sale in Dubai requires careful planning and a thorough understanding of the market. This blog provides a comprehensive guide to help you secure the best luxury properties in Dubai.

For more information on real estate, visit Dubai Real Estate.

Why Invest in Luxury Properties in Dubai?

High ROI: Dubai's luxury real estate market offers high returns on investment due to its desirability and robust demand.

Tax Benefits: Dubai offers a tax-free environment, making it an attractive destination for real estate investment.

World-Class Amenities: Luxury properties in Dubai come with world-class amenities, including private pools, gyms, and concierge services.

Prime Locations: Many luxury properties are located in prime areas, offering stunning views and easy access to key attractions.

Security: Dubai is known for its safety and security, providing peace of mind for property owners.

For property purchase options, explore Buy Residential Properties in Dubai.

Steps to Securing Luxury Properties in Dubai

Determine Your Budget: Establishing a clear budget is the first step. Consider all costs, including property price, taxes, maintenance, and any additional fees.

Research the Market: Understand the current market trends, prices, and types of luxury properties available. This will help you make informed decisions.

Choose the Right Location: Prime locations for luxury properties in Dubai include Palm Jumeirah, Downtown Dubai, Emirates Hills, Dubai Marina, and Jumeirah Beach Residence.

Hire a Real Estate Agent: A reputable real estate agent can provide valuable insights, show you suitable properties, and handle negotiations.

Visit Properties: Schedule visits to potential properties to assess their condition, amenities, and overall appeal.

Legal Considerations: Ensure all legal aspects are covered, including property registration, contracts, and compliance with local regulations.

Financing Options: Explore mortgage financing options to determine the best way to finance your purchase.

Make an Offer: Once you find the perfect property, make a competitive offer. Your agent can help negotiate the best terms.

Finalize the Purchase: Complete the necessary paperwork, pay the required fees, and finalize the purchase.

For mortgage financing options, visit Commercial Mortgage Loan in Dubai.

Popular Areas for Luxury Properties

Palm Jumeirah: Known for its iconic palm-shaped island, Palm Jumeirah offers luxurious villas and apartments with stunning views.

Downtown Dubai: Home to the Burj Khalifa and Dubai Mall, Downtown Dubai offers upscale living in the city's heart.

Emirates Hills: Often referred to as the "Beverly Hills of Dubai," Emirates Hills features luxurious villas with golf course views.

Dubai Marina: Known for its vibrant nightlife and waterfront properties, Dubai Marina is a popular choice for luxury living.

Jumeirah Beach Residence (JBR): This beachfront community offers a mix of luxury apartments and penthouses with stunning sea views.

For rental property management services, visit Rent Your Property in Dubai.

Tips for Securing Luxury Properties

Set a Budget: Determine your budget before you start looking at properties. This will help narrow down your options and prevent overspending.

Research the Market: Understand the current market trends and property values in the areas you're interested in.

Work with a Realtor: A reputable realtor with experience in the luxury market can help you find the best properties and negotiate the best deals.

Inspect the Property: Ensure the property is in good condition and meets your standards. Consider hiring a professional inspector.

Consider Future Value: Think about the property's potential for appreciation and its resale value.

For property sales, visit Sell Your Apartments in Dubai.

Real-Life Success Story

Consider the case of Sophia, an investor from the UK who decided to invest in a luxury penthouse in Downtown Dubai. With the help of a local realtor, Sophia found a stunning property that met all her requirements. The realtor guided her through the buying process, ensuring all legalities were handled smoothly. Today, Sophia enjoys a high return on her investment, with the penthouse's value appreciating significantly.

Future Trends in Dubai's Luxury Real Estate Market

Sustainable Living: There is a growing demand for eco-friendly and sustainable luxury properties.

Smart Homes: Properties equipped with smart home technology are becoming increasingly popular.

Wellness Amenities: Luxury properties are now offering wellness-focused amenities such as spas, gyms, and yoga studios.

Flexible Spaces: There is a trend towards properties with flexible living spaces that can be adapted to different needs.

Branded Residences: Collaborations with luxury brands to create branded residences are on the rise.

Conclusion

Securing luxury properties for sale in Dubai requires careful planning and a thorough understanding of the market. By following the steps outlined in this guide and working with a reputable realtor, you can find and secure the perfect luxury property in Dubai. For more resources and expert advice, visit Dubai Real Estate.

2 notes

·

View notes

Text

Energy Finance and Investment Service |Charter Union Finance

Energy finance and investment services play a crucial role in the development and growth of the renewable energy sector. As the demand for clean and sustainable energy sources continues to rise, companies and individuals seek financial expertise to navigate the complex landscape of energy investments. For more information, call +852 8199 9324 and visit the website at. www.charterunionfin.com/financial-solutions/

#Financial Solution Advisor#Energy Financing & Investing#Healthcare finance services#Commercial Real Estate Financing#Commercial real estate finance#Equipment Finance Service Provider#Financial Instrument services#Business finance service#Apply for small business loan#Hong Kong#kowloon

0 notes

Text

A Guide to the Most Luxurious Properties for Sale in Dubai

Dubai is synonymous with luxury, and its real estate market offers some of the most opulent properties in the world. From stunning penthouses to sprawling villas, the options are endless. This guide will help you navigate the market for the most luxurious properties for sale in Dubai.

For more information on home loans, visit Home Loan UAE.

Why Invest in Luxury Properties in Dubai?

High ROI: Dubai's luxury real estate market offers high returns on investment due to its desirability and robust demand.

Tax Benefits: Dubai offers a tax-free environment, making it an attractive destination for real estate investment.

World-Class Amenities: Luxury properties in Dubai come with world-class amenities, including private pools, gyms, and concierge services.

Prime Locations: Many luxury properties are located in prime areas, offering stunning views and easy access to key attractions.

Security: Dubai is known for its safety and security, providing peace of mind for property owners.

For commercial property investment options, explore Buy Commercial Properties in Dubai.

Types of Luxury Properties in Dubai

Penthouses: Located in high-rise buildings, penthouses offer panoramic views of the city and luxurious living spaces.

Villas: Spacious villas with private gardens, pools, and state-of-the-art facilities are available in exclusive communities.

Townhouses: Luxury townhouses offer a blend of privacy and community living, with high-end finishes and amenities.

Beachfront Properties: Properties along the coastline provide direct beach access and breathtaking ocean views.

Golf Course Properties: These properties offer views of lush golf courses and access to exclusive golf clubs.

For mortgage financing options, consider Mortgage Financing in Dubai.

Popular Areas for Luxury Properties

Palm Jumeirah: Known for its iconic palm-shaped island, this area offers some of the most luxurious villas and apartments in Dubai.

Downtown Dubai: Home to the Burj Khalifa and Dubai Mall, this area offers upscale living in the heart of the city.

Emirates Hills: Often referred to as the "Beverly Hills of Dubai," this gated community offers luxurious villas with golf course views.

Dubai Marina: Known for its vibrant nightlife and stunning waterfront properties, Dubai Marina is a popular choice for luxury living.

Jumeirah Beach Residence (JBR): This beachfront community offers a mix of luxury apartments and penthouses with stunning sea views.

For rental property management services, visit Apartments For Rent in Dubai.

Tips for Buying Luxury Properties in Dubai

Set a Budget: Determine your budget before you start looking at properties. This will help narrow down your options and prevent overspending.

Research the Market: Understand the current market trends and property values in the areas you're interested in.

Work with a Realtor: A reputable realtor with experience in the luxury market can help you find the best properties and negotiate the best deals.

Inspect the Property: Ensure the property is in good condition and meets your standards. Consider hiring a professional inspector.

Consider Future Value: Think about the property's potential for appreciation and its resale value.

For property sales, visit Sell Your Property.

Real-Life Success Story

Consider the case of James, an investor from the UK who decided to invest in a luxury villa in Palm Jumeirah. With the help of a local realtor, James found a stunning property that met all his requirements. The realtor guided him through the buying process, ensuring all legalities were handled smoothly. Today, James enjoys a high return on his investment, with the villa's value appreciating significantly.

Future Trends in Dubai's Luxury Real Estate Market

Sustainable Living: There is a growing demand for eco-friendly and sustainable luxury properties.

Smart Homes: Properties equipped with smart home technology are becoming increasingly popular.

Wellness Amenities: Luxury properties are now offering wellness-focused amenities such as spas, gyms, and yoga studios.

Flexible Spaces: There is a trend towards properties with flexible living spaces that can be adapted to different needs.

Branded Residences: Collaborations with luxury brands to create branded residences are on the rise.

Conclusion

Investing in luxury properties in Dubai offers numerous benefits, from high ROI to world-class amenities. By understanding the market, working with a reputable realtor, and considering future trends, you can make a sound investment in Dubai's luxury real estate market. For more resources and expert advice, visit Home Loan UAE.

5 notes

·

View notes

Text

The Ultimate Guide to Buying Luxury Properties in Dubai

Introduction to Luxury Properties in Dubai

Dubai's real estate market is synonymous with luxury, offering a wide range of high-end properties that attract investors and homebuyers from around the world. From opulent villas and expansive penthouses to exclusive apartments in prestigious neighborhoods, Dubai's luxury real estate sector is thriving. This guide provides a comprehensive overview of the process of buying luxury properties in Dubai, offering valuable insights and practical tips to help you secure your dream home.

For more information on home loans, visit Home Loan UAE.

Why Invest in Luxury Properties in Dubai?

Dubai is a global hub that combines modernity with tradition, making it an attractive destination for luxury real estate investment. Here are several compelling reasons to invest in luxury properties in Dubai:

Strategic Location: Dubai's geographical location serves as a crucial gateway between the East and the West, making it a central hub for business and tourism.

World-Class Amenities: Luxury properties in Dubai come equipped with world-class amenities, including private beaches, state-of-the-art fitness centers, and high-end retail and dining options.

Tax Benefits: Dubai offers tax-free income on rental yields and capital gains, making it an attractive destination for investors.

High Rental Yields: The city provides some of the highest rental yields in the world, making it a lucrative investment opportunity.

Strong Economy: Dubai's robust and diversified economy supports a stable real estate market, providing a secure investment environment.

For property purchase options, explore Buy Commercial Properties in Dubai.

Understanding the Luxury Property Market in Dubai

The luxury property market in Dubai is characterized by its diversity and opulence. Properties range from high-rise apartments with breathtaking views to sprawling villas with private pools and gardens. Key areas known for luxury properties include:

Palm Jumeirah: An iconic man-made island offering exclusive beachfront villas and luxury apartments.

Dubai Marina: Known for its stunning skyline and waterfront living, Dubai Marina offers high-rise luxury apartments and penthouses.

Downtown Dubai: Home to the Burj Khalifa and Dubai Mall, Downtown Dubai offers luxury apartments in a vibrant urban setting.

Emirates Hills: Often referred to as the "Beverly Hills of Dubai," this gated community offers expansive villas and mansions.

Steps to Buying Luxury Properties in Dubai

Define Your Requirements: Determine your budget, preferred location, property type, and essential amenities.

Research the Market: Conduct thorough research on the luxury property market in Dubai. Use online portals, consult real estate agents, and attend property exhibitions.

Secure Financing: If you require financing, explore mortgage options. For more details, visit Mortgage Financing in Dubai.

Hire a Real Estate Agent: Engage a reputable real estate agent specializing in luxury properties to guide you through the process.

View Properties: Schedule viewings of shortlisted properties to assess their suitability.

Make an Offer: Once you find the right property, make an offer through your agent.

Legal Checks and Documentation: Ensure all legal checks are completed, and necessary documentation is in place.

Finalize the Purchase: Complete the payment and transfer the property title to finalize the purchase.

For rental options, visit Apartments For Rent in Dubai.

Financial Considerations

Investing in luxury properties requires careful financial planning. Here are some key financial considerations to keep in mind:

Budgeting: Determine your budget, including the purchase price, closing costs, maintenance fees, and potential renovation costs.

Mortgage Options: Explore different mortgage options to find the best rates and terms. A mortgage consultant can provide valuable advice and assistance.

Down Payment: Be prepared to make a significant down payment, typically ranging from 20% to 30% of the property value.

Currency Exchange: If you are an international buyer, consider the implications of currency exchange rates on your investment.

Legal Considerations

Title Deed: Ensure the property has a clear title deed issued by the Dubai Land Department (DLD).

No Objection Certificate (NOC): Obtain an NOC from the developer if purchasing an off-plan property.

Property Registration: Register the property with the DLD to formalize ownership.

Legal Advice: Consider hiring a legal advisor to assist with the legal aspects of the purchase.

Choosing the Right Real Estate Agent

A reputable real estate agent can make the process of buying a luxury property much smoother. Here are some tips for choosing the right agent:

Experience and Reputation: Choose an agent with extensive experience and a strong reputation in the luxury property market.

Market Knowledge: Ensure the agent has in-depth knowledge of the specific areas and properties you are interested in.

Client Testimonials: Look for client testimonials and reviews to gauge the agent's performance and reliability.

Communication Skills: Select an agent who communicates effectively and is responsive to your needs and concerns.

Viewing and Selecting Properties

When viewing luxury properties, consider the following factors:

Location: The location of the property is crucial. Consider proximity to amenities, views, and the overall neighborhood.

Quality of Construction: Assess the quality of construction, materials used, and overall craftsmanship.

Amenities and Features: Ensure the property offers the amenities and features that are important to you, such as private pools, gyms, and security.

Future Development Plans: Research any future development plans in the area that could impact the value and desirability of the property.

Making an Offer and Negotiating

Once you find the perfect property, making an offer and negotiating terms is the next step. Here are some tips:

Offer Price: Work with your agent to determine a fair offer price based on market value and recent sales.

Negotiation Strategy: Have a clear negotiation strategy and be prepared to make counteroffers.

Inclusions and Exclusions: Clearly outline what is included in the sale, such as furnishings, fixtures, and appliances.

Contingencies: Include contingencies in your offer to protect your interests, such as financing and inspection contingencies.

Closing the Deal

The final step in buying a luxury property is closing the deal. This involves several key tasks:

Final Walkthrough: Conduct a final walkthrough of the property to ensure it is in the agreed-upon condition.

Finalizing Financing: Secure your mortgage and ensure all financing details are in order.

Signing the Contract: Review and sign the sales contract, ensuring all terms and conditions are clearly outlined.

Transfer of Ownership: Complete the transfer of ownership with the Dubai Land Department.

For more resources and expert advice, visit Home Loan UAE.

Real-Life Success Story

Consider the case of James, an investor from the UK, who purchased a luxury penthouse in Dubai Marina. With the help of a local real estate agent and a mortgage consultant, James secured a competitive mortgage rate and finalized the purchase within three months. His investment has since appreciated in value, providing substantial rental income.

Conclusion

Buying luxury properties in Dubai can be a rewarding investment, provided you navigate the process with due diligence and expert guidance. By following the steps outlined in this guide and leveraging professional services, you can secure a luxury property that meets your needs and investment goals. For more resources and expert advice, visit Home Loan UAE.

2 notes

·

View notes

Text

Dreality-Best value real estate Service Company in Noida

Reality

When it comes to determining the "best value" in real estate services and home loan providers, it can vary depending on individual needs and preferences. However, I can provide you with some general information on finding the best options in these areas.

Best Value Real Estate Services:

Research and compare: Take the time to research different real estate agencies or agents in your area. Look for their track record, customer reviews, and the range of services they offer. Compare their fees and commission rates to ensure they provide good value for their services.

Local expertise: Choose a real estate agent or agency with strong knowledge and experience in the specific area where you are looking to buy or sell a property. Local experts can provide valuable insights into market trends, pricing, and potential investment opportunities.

Transparent communication: Look for real estate professionals who communicate clearly and honestly. They should be responsive to your queries and provide regular updates on the progress of your transaction. Transparency in pricing and fees is also important.

Negotiation skills: A good real estate agent should have strong negotiation skills to help you secure the best possible deal. This includes not only negotiating the purchase or sale price but also other aspects like repairs, contingencies, and closing costs.

Best Home Loan Providers:

Interest rates and terms: Compare the interest rates, loan terms, and repayment options offered by different lenders. Look for lenders that provide competitive rates and flexible terms that suit your financial situation.

Loan options: Consider lenders that offer a variety of loan programs to meet your specific needs. This could include fixed-rate mortgages, adjustable-rate mortgages, FHA loans, VA loans, or other specialized loan options.

Fees and closing costs: Evaluate the fees and closing costs associated with obtaining a loan from different providers. Some lenders may have lower origination fees, processing fees, or closing costs, which can save you money in the long run.

Customer service: Look for a lender that provides excellent customer service and is responsive to your needs throughout the loan application and approval process. A reliable lender should be available to answer your questions and guide you through the process.

Reputation and reviews: Check online reviews and ratings of different lenders to gauge their reputation and customer satisfaction levels. Look for lenders with positive feedback and a strong reputation in the industry.

Remember, these are general guidelines, and it's essential to conduct thorough research and consider your specific requirements when choosing the best value real estate services and home loan provider for your needs.

#2-3 bhk in noida extension#best real estate agent in delhi ncr#Best Real estate agent in Delhi ncr#Best home loan provider#Home loan lowest roi#Loan on lowest ROI#commercial real estate near me#place real estate#best value real estate#Apply for Personal Loan#start up business loans#commercial property loan#best car financing deals#loan against property#personal loan against property#loan against plot#car loans near me#best car loan rates today#best used car loan rates#car finance near me

0 notes

Text

Blue Melon Capital Reviews | 5 Key Factors to Consider When Securing Real Estate Financing

Securing financing for real estate investments is a critical aspect of property ownership and development. Whether you're purchasing your dream home or investing in commercial properties, navigating the complex landscape of real estate financing requires careful consideration of several key factors. Blue Melon Capital Reviews shares some essential elements to keep in mind when seeking financing for your real estate ventures.

1. Creditworthiness and Financial Health

One of the foremost factors lenders consider when assessing real estate financing applications is the borrower's creditworthiness and financial health. Your credit score, debt-to-income ratio, and overall financial stability play pivotal roles in determining the terms of your loan, including interest rates and loan amounts. Before applying for financing, it's crucial to review your credit report, address any discrepancies or outstanding debts, and ensure your financial records reflect a favorable picture. Building a strong credit profile not only enhances your chances of securing financing but also opens doors to more competitive loan options with favorable terms.

2. Property Valuation and Collateral

The value of the property you intend to finance serves as collateral for the loan, influencing the lender's risk assessment and loan-to-value (LTV) ratio. Conducting a thorough property valuation, including appraisal and assessment of market trends, is essential to determine its fair market value accurately. Additionally, lenders may impose specific requirements regarding the type, condition, and location of the property, which can affect financing options. Understanding the collateral requirements and ensuring the property meets these criteria is crucial for securing favorable financing terms and minimizing risks for both parties involved.

3. Loan Terms and Structure

Blue Melon Capital Reviews believes real estate financing encompasses a variety of loan options, each with distinct terms, structures, and repayment schedules. From traditional mortgages to commercial loans, bridge financing, and construction loans, selecting the right loan product tailored to your specific needs is vital. Consider factors such as interest rates, loan duration, down payment requirements, and prepayment penalties when evaluating different financing options. Additionally, understanding the implications of fixed-rate versus adjustable-rate mortgages and the impact of market fluctuations on loan payments is essential for making informed decisions about loan terms and structure.

4. Lender Relationships and Options

Building strong relationships with lenders and exploring diverse financing options can provide valuable insights and opportunities for securing favorable terms. Researching reputable lenders, including banks, credit unions, mortgage brokers, and private lenders, allows you to compare rates, fees, and eligibility criteria to find the best fit for your financing needs. Moreover, cultivating open communication and transparency with lenders throughout the application process can strengthen your negotiating position and increase the likelihood of securing financing on favorable terms. By leveraging diverse lender relationships and exploring alternative financing sources, you can optimize your real estate financing strategy and mitigate potential challenges.

5. Regulatory and Legal Considerations

Navigating the regulatory and legal landscape surrounding real estate financing is paramount to ensure compliance and mitigate risks. Familiarize yourself with applicable laws, regulations, and licensing requirements governing real estate transactions and lending practices in your jurisdiction. Additionally, consult legal professionals specializing in real estate law to review loan agreements, contracts, and disclosure documents thoroughly. Understanding your rights and obligations as a borrower, as well as potential legal implications, empowers you to make informed decisions and safeguard your interests throughout the financing process.

In conclusion, securing real estate financing requires careful consideration of various factors, including creditworthiness, property valuation, loan terms, lender relationships, and regulatory compliance. By prioritizing these key elements and conducting thorough due diligence, borrowers can enhance their chances of securing financing on favorable terms while minimizing risks and maximizing returns on their real estate investments. Remember to seek guidance from financial advisors, real estate professionals, and legal experts to navigate the complexities of real estate financing and make informed decisions aligned with your long-term objectives.

2 notes

·

View notes

Text

Investments in place matter. Public spaces such as parks and community centers as well as businesses such as restaurants and bars signal local prosperity, add a richness to the neighborhood, and enhance community wealth by attracting further investment.

Grocery stores are a crucial component of this ecosystem. And premium grocery chains focused on natural, organic, and specialty foods (commonly referred to as “fresh format” stores) such as Whole Foods and Trader Joe’s[1] not only provide healthy shopping options for residents, but also serve as markers of high-income, desirable areas, which contributes to increased property values and an image of security and stability. Conversely, the lack of these assets—or the proliferation of chains associated with poverty, such as dollar stores—can indicate to investors and developers that a community is struggling or lacks a clientele that would make investing profitable. These patterns can drive an upward or downward spiral of investment, concentrating wealth in already-wealthy areas while diverting it from struggling ones.

Community investment patterns are often influenced by race as well as wealth. Analyzing the distribution of grocery stores in several large U.S. cities, we find that premium grocery stores are less likely to be located in Black-majority neighborhoods, regardless of the average household income of those neighborhoods, and are substantially more likely to be located in neighborhoods where the Black population share is less than 10%.

In other words, businesses and the broader real estate and financing sectors are not investing even in prospering Black-majority neighborhoods, which devalues these communities and hinders opportunities for growth.

Devaluation of Black communities has led to disparities in food access

Uneven food systems across neighborhoods of varying racial compositions reveal ways that American society signals the value it places on the people in those communities.

The devaluation of Black neighborhoods is linked with redlining and mid-20th century “urban renewal” projects that labeled many Black neighborhoods as “slums” and demolished them. Meanwhile, federal, state, and local leaders invested in infrastructure that brought suburban white residents to and from urban cores, signaling the higher intrinsic value of white communities. These policies acted on the presumed lower value of people and assets in Black communities, which shows up in the kinds of amenities a community offers.

Federal Housing Finance Agency appraisal reports have allowed researchers to confirm that homes in Black neighborhoods are valued roughly 20% lower than equivalent homes in non-Black neighborhoods, and are nearly twice as likely to appraise below the contracted selling price. Similar devaluation patterns have been found in commercial real estate in Black-majority neighborhoods, which makes it difficult for Black entrepreneurs to get loans to start new businesses or invest in existing ones. Customer-facing businesses that do establish themselves in Black-majority neighborhoods face lower customer ratings and less revenue.

One part of the larger structure of business and commercial real estate devaluation in Black-majority communities is “food apartheid,” or disparities in access to food that have been produced by structural racism in residential and investment patterns, such as supermarket redlining. Though differences in food access are often blamed for elevated food insecurity and worse nutritional outcomes in Black communities, the relationship may not be as strong as is often believed, as our Brookings Metro colleagues pointed out in a 2021 report. They found that while there has been a tendency to frame the problem of food insecurity and poor nutrition in low-income neighborhoods as one of “food deserts” (areas with limited access to affordable and nutritious food), a number of recent studies have shown that greater access to food retailers does not correlate to reduced food insecurity, and that shoppers, even those without vehicles, do not necessarily choose to shop at the nearest supermarket.

Furthermore, the rise of food delivery services during the COVID-19 pandemic has resulted in greater access to grocery delivery services for most Americans living in traditionally defined “food deserts.” While financial insecurity and the higher cost of healthier food play a bigger role in food insecurity and nutritional deficits among low-income Americans, segregation and differing retail options in Black-majority neighborhoods still matter, because they are symptoms of a broader problem of devaluation and underinvestment in Black communities, which has real consequences for local wealth retention and development.

Beyond issues of access, this report presumes that store type is an economic statement of value that can spur or throttle investment in an area. The store types present in a community are a judgement of the level of investment a community is worthy of.

Premium grocery stores are absent from wealthy Black-majority communities

We analyzed the locations of premium grocery retailers in 10 U.S. metro areas with populations over 1 million and substantial numbers of high-income, non-rural census block groups with Black-majority populations.[2] We found strong evidence for underinvestment across all 10 metro areas.

As seen in Table 1, in seven of the 10 metro areas studied, none of the Black-majority, non-rural block groups in the top quartile for household income were located within 1 mile of a premium grocery store and only in one metro area—Washington, D.C.—was the percentage above 5%. For block groups in the same income brackets but with less than a 10% share of Black residents, the percentage that were located within 1 mile of a premium grocery store ranged from 10% in Atlanta to 34% in Los Angeles. Furthermore, Black-majority block groups in each income quartile of all the metro areas studied had a lower chance of being within 1 mile of a premium grocery store than block groups in that metro area overall.[3]

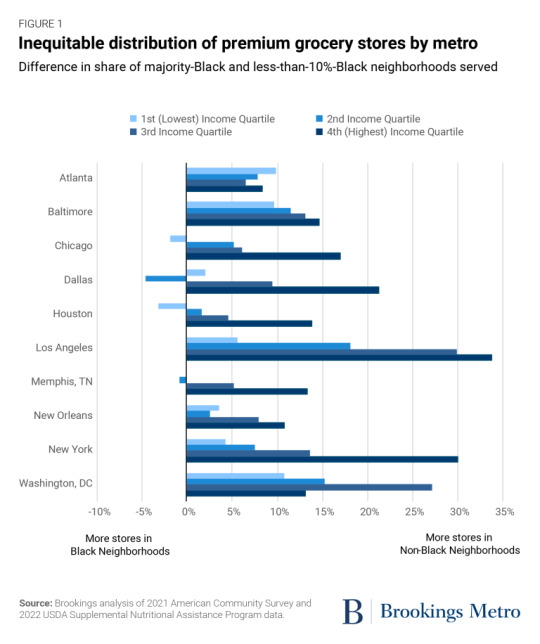

While we see the same pattern of underinvestment in wealthy Black communities across all 10 cities in our sample, there are significant differences between metro areas as well. Figure 1 highlights the difference in the shares of Black and non-Black neighborhoods near premium grocery stores. The differences in premium grocery store prevalence in wealthy neighborhoods are lowest in the low-income metro areas (New Orleans and Memphis, Tenn., which have median household incomes below $60,000), and largest in Washington, D.C., New York, and Los Angeles (which are among the wealthiest metro areas in our sample).

Another difference appears when we look at low-income block groups. In some metro areas (Atlanta and Baltimore in particular), the deficit of premium grocery stores is similar across low-income and high-income Black neighborhoods. However, in two metro areas (Houston and Chicago), Black-majority communities in the bottom income quartile were actually more likely to be located near a premium grocery store than low-income communities with few Black residents. In both cases, the differences are small, and the low-income Black neighborhoods in question are in relatively dense urban areas adjacent to higher-income neighborhoods.

Comparing premium grocery store locations in the Washington, D.C. and Atlanta metro areas

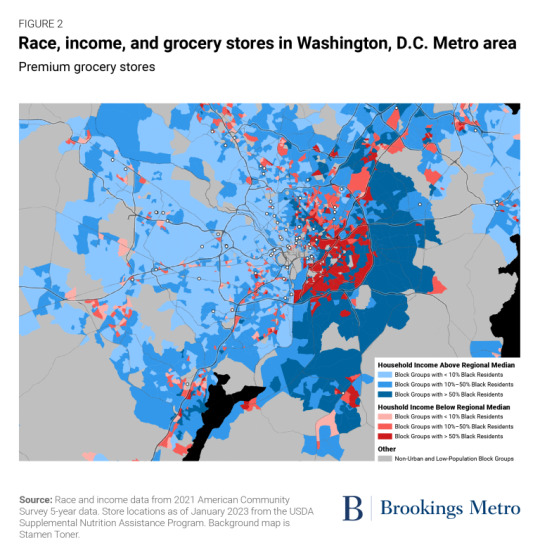

The Washington, D.C. metro area is the highest-income metro area that we studied, with a median household income of $111,000 according to 2021 American Community Survey (ACS) 5-year estimates. It is also home to Prince George’s County and Charles County in Maryland, the second-highest and highest-income Black-majority counties in the country. Still, our analysis demonstrates the differences in investment distributions between Black-majority and predominantly white neighborhoods. For example, the absence of high-end retailers, including premium grocery outlets, in Prince George’s County has been a point of concern in those high-income Black communities for decades.

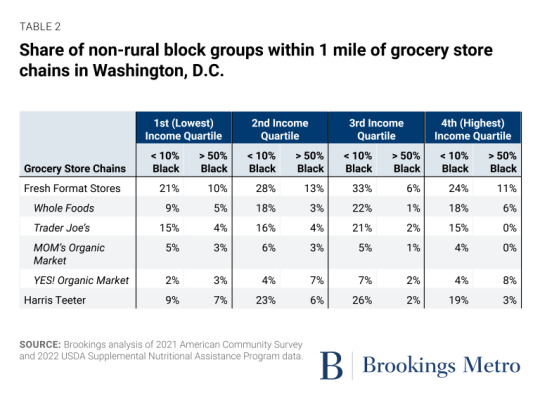

The Washington, D.C. area is home to roughly 20 Trader Joe’s and Whole Foods locations each, as well as two local organic chains: MOM’s Organic Market and Yes! Organic Market. The national chains are much more likely to be located in neighborhoods with few Black residents across the income spectrum, while the two local chains show a much smaller racial disparity. In the case of Yes! Organic Market, this is partly a consequence of the fact that all of their stores are located in the urban core—often in gentrifying areas—and thus close to historically Black communities. However, it may also be evidence that locally owned stores are less likely to undervalue Black neighborhoods than national chains with less familiarity with the areas where they operate.

As seen in Figure 2, a belt of high-income block groups with Black-majority populations wraps roughly a third of the way around the Capital Beltway in the District’s eastern and southern suburbs. However, while high-income areas in other parts of the Washington, D.C. suburbs are scattered with Whole Foods, Trader Joe’s, and MOM’s Organic Market locations, the two MOM’s locations in the belt are near its ends, in areas with less predominately Black populations, and neither of the national chains has any locations in the belt. In fact, while each of the chains has a single location in Prince George’s County and none in Charles County, these stores are located within a mile of each other, and very near the University of Maryland’s flagship campus, in a part of the county that is not majority-Black.

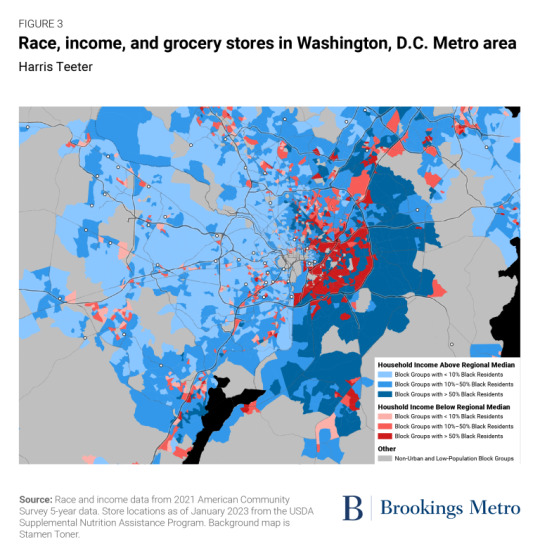

A similar pattern is seen in the locations chosen by the Kroger-owned conventional grocery retailer Harris Teeter (Figure 3), which began to move into the Washington, D.C. area in the early 2000s and has focused its expansion on upscale markets. Although Harris Teeter is now the third-largest grocery chain in the region with 44 stores, it has no stores in Charles County and only two in Prince George’s County—neither in a Black-majority neighborhood and both near the county’s border with majority-white Baltimore suburbs.

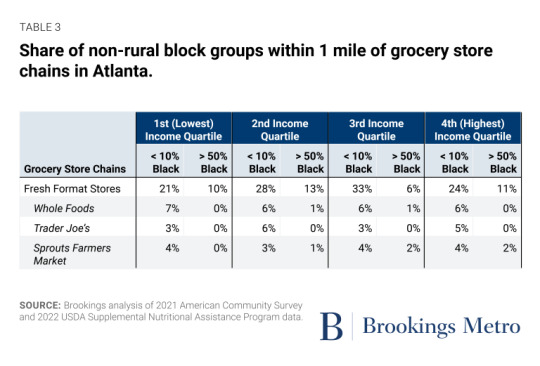

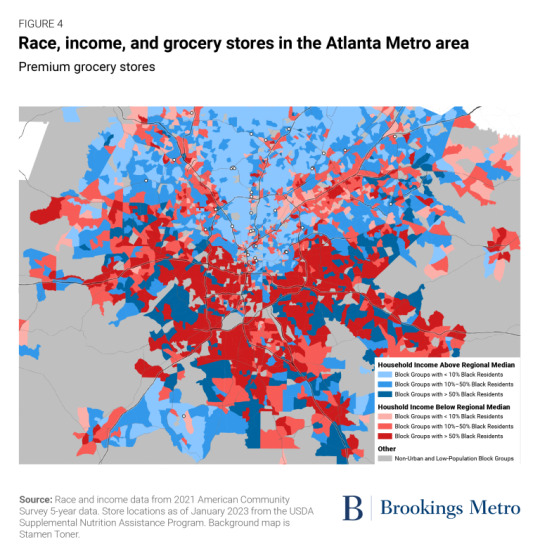

The distribution of premium grocery chains in Atlanta, shown in Table 3 and Figure 4, provides a good comparison to Washington, D.C., since Atlanta has the smallest percentage of top-quartile block groups within 1 mile of a premium grocery store among the metro areas we studied. While relatively few block groups in the Atlanta area are located near premium grocery stores, nearly all of those that are have few Black residents.

Premium grocery stores are rare overall in the Atlanta area, but the ones that are present are nearly all confined to a corridor running north of downtown that has some of the region’s smallest shares of Black residents. The major suburban “edge city” job clusters of Buckhead and Perimeter Center are also home to pairs of premium grocery stores.

Dollar stores are more common in Black-majority communities at all income levels

The absence of premium grocers from even high-income Black-majority communities is an example of the disinvestment side of food apartheid. However, there is a second component to the different food retail ecosystems in Black and non-Black (especially white) neighborhoods: the prevalence of less-desirable food options. Studies have shown that the prevalence of fast-food restaurants is positively correlated with the percentage of Black residents in urban neighborhoods in the U.S. Similar trends have been found for liquor stores.

Chain dollar stores are one example of food retailers that have targeted Black-majority urban neighborhoods for store locations, often saturating these communities with outlets and making it more difficult for local businesses and other grocery chains to become established. While dollar stores can fill a need in low-income neighborhoods, they are often regarded as predatory businesses that harm communities more than they benefit them, due to very low wages, displacing other grocery options while failing to sell fresh food, store design that increases the rate of armed robberies, and OSHA and FDA violations that put customers and employees at risk.

As shown in Table 4, in every metro area in our cohort except Washington, D.C. (where dollar stores are less prevalent overall, likely due to the metro area’s substantially higher incomes), Black-majority neighborhoods in the top income quartile were more likely to have a dollar store within 1 mile than high-income neighborhoods with a share of Black residents lower than 10%. Furthermore, in six of the 10 metro areas (New York, Los Angeles, Chicago, Houston, New Orleans, and Memphis), most Black-majority neighborhoods in the top income quartile were within 1 mile of a dollar store. In fact, in New York and Chicago, Black-majority neighborhoods in the top income quartile were more likely to be near a dollar store than non-majority-Black neighborhoods in any income quartile.

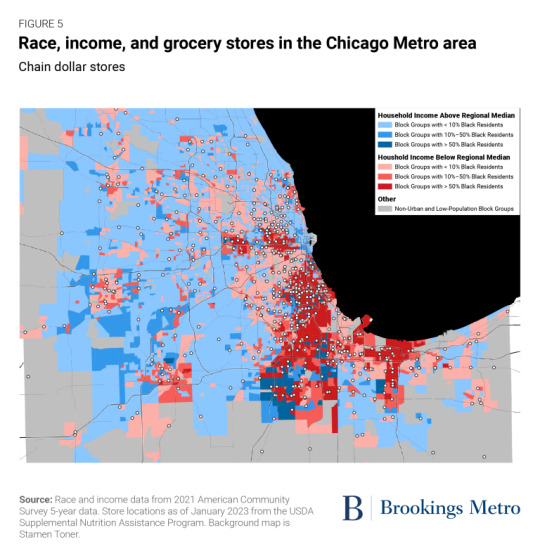

Figure 5 shows the situation in Chicago, where dollar stores are concentrated in and near Black-majority areas, including the higher-income ones south of the city. Dollar stores are significantly less common in areas with few Black residents. While chain dollar stores are much more numerous than fresh-format grocery stores, they still concentrate in neighborhoods with lower incomes and higher shares of Black residents. Many of these neighborhoods have not just one, but a cluster of several dollar stores—making it especially hard for businesses that compete with them to become established.

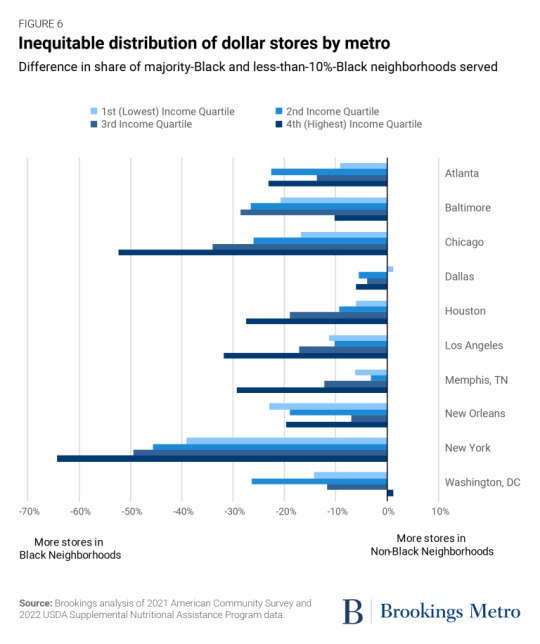

As shown in Figure 6, Black-majority block groups were more likely than block groups with a share of Black residents lower than 10% to be within 1 mile of a dollar store for each income quartile in each metro area, with two exceptions: the highest quartile in Washington, D.C. (where dollar stores are especially rare) and the lowest quartile in Dallas (where the racial differences in dollar store locations are smallest overall). And while there is an overall trend toward more dollar stores in Black-majority neighborhoods, the patterns in each metro area are very different.

Dallas has especially small differences—never more than 7 percentage points—in dollar store prevalence between Black-majority block groups and those with Black population shares lower than 10%, while there is a very large variation in dollar store prevalence by income, with roughly 85% of lowest-quartile and 30% of highest-quartile block groups within 1 mile of a dollar store. And among cities with substantial racial disparities, these disparities follow different patterns with income. In Washington, D.C., dollar stores are most over-represented in low-income Black neighborhoods, while the difference is smaller in third-quartile neighborhoods and negative in neighborhoods in the fourth income quartile. On the other hand, Atlanta, Baltimore, and New Orleans show similar disparities across income quartiles, while Houston, Los Angeles, Memphis, Chicago, and New York show the biggest disparities in high-income neighborhoods, which have few dollar stores when they have few Black residents but far more when they are majority-Black.

Like other local assets, grocery stores influence investment decisions

No single asset type alone determines the value of a place or the willingness of entrepreneurs, businesses, developers, and private individuals to invest in it. Rather, community, consumption, institutional, and other asset types are all part of a unified ecosystem that creates value and indicates potential investment opportunities.

The decisions food retailers make have obvious direct impacts on residents, such as the length of a trip to their preferred store. But their indirect impacts can be even more important. The presence of premium (or discount) retail in a community can drive the decisions of other retailers to locate in or avoid the community, thus strengthening or weakening the tax base. Furthermore, the presence of premium amenities in a community makes it more appealing to wealthier residents, which raises home values and potentially contributes to firms’ decisions on where to locate offices.

The less obvious outcomes of these choices—including their implications for place-based, racialized wealth divides—are no less important. Local assets and infrastructure matter to community well-being and development, and the differences in grocery store chains indicate a broader structural issue of financing practices and corporate underinvestment in Black communities. The tendency to frame this solely as a problem of access has led to suggestions that delivery services can bring about equality between communities. However, disparities in access were always just a symptom of a deeper and more fundamental problem of devaluation and divestment that need to be directly addressed.

12 notes

·

View notes