#commercial real estate appraisal Toronto

Explore tagged Tumblr posts

Text

The Depths of Commercial Real Estate Appraisal in Toronto

Delve into the intricate world of commercial real estate appraisal in toronto where financial intricacies meet urban landscapes. Navigate through property valuations, market trends, and regulatory frameworks shaping the city's dynamic real estate terrain. Uncover the depths of appraisal methodologies influencing key investment decisions in this bustling canadian metropolis.

Know More : https://nationalappraisals.ca/commercial/

0 notes

Text

Property Valuation Commercial Real Estate Appraisal Toronto

In the dynamic landscape of toronto's commercial real estate market, accurate property valuation is a crucial element for informed decision-making. As the economic heartbeat of canada, toronto boasts a diverse and thriving business environment, making precise commercial real estate appraisal paramount. This process involves assessing the worth of properties, considering various factors such as location, market trends, and property characteristics. In the vibrant metropolis of toronto, where property values can fluctuate rapidly, a reliable commercial real estate appraisal provides stakeholders with a strategic edge. This introduction delves into the intricate world of property valuation, highlighting the significance of commercial real estate appraisal in toronto's ever-evolving market. Whether it's for investment, development, or transactional purposes, understanding the nuances of property valuation is essential for navigating the complexities of the commercial real estate landscape in this bustling city.

Understanding the Foundations of Property Valuation

In this commercial real estate appraisal Toronto comprehensive exploration, we delve into the intricate process of property valuation, unraveling the various factors that contribute to determining the commercial real estate appraisal in Toronto. From the fundamentals of market analysis to the evaluation of physical attributes, this segment provides a solid foundation for grasping the complexities involved in ascertaining the true value of commercial properties.

Navigating Toronto's Dynamic Real Estate Market

Discover the dynamic landscape of Toronto's commercial real estate market in this section, where we examine the ever-shifting economic and market conditions that influence property valuation. Unraveling the intricacies of supply and demand, economic indicators, and market trends, readers gain insight into the dynamic forces that shape property values in this vibrant urban environment.

Methodologies in Commercial Real Estate Appraisal

Explore the diverse methodologies employed in commercial real estate appraisal, ranging from the income approach to the sales comparison method. Through detailed explanations and real-world examples, this segment demystifies the tools appraisers use to assign value to commercial properties in Toronto. Gain a nuanced understanding of how these methodologies are applied and their impact on the final valuation.

The Role of Market Analysis in Toronto Property Valuation

Dive into the critical role that market analysis plays in property valuation, with a specific focus on the Toronto real estate scene. From evaluating local trends and economic indicators to understanding the impact of zoning regulations, this section provides a comprehensive overview of how a thorough market analysis is instrumental in determining the true worth of commercial properties in this bustling Canadian metropolis.

Factors Influencing Commercial Real Estate Values in Toronto

Examine the multifaceted factors that contribute to the valuation of commercial real estate in Toronto. From location and property size to the condition of the building and surrounding infrastructure, this segment dissects the myriad elements that appraisers consider when assigning value to commercial properties. Readers gain a deep appreciation for the intricate web of variables that collectively shape the market value of these assets.

Challenges and Nuances in Toronto Commercial Property Appraisal

Delve into the challenges and nuances that appraisers face when valuing commercial properties in Toronto. From navigating regulatory complexities to addressing unique market dynamics, this section sheds light on the hurdles that must be overcome to arrive at accurate and reliable appraisals in this dynamic urban environment.

Emerging Trends in Commercial Real Estate Valuation in Toronto

Explore the cutting-edge trends shaping the future of commercial real estate valuation in Toronto. From the integration of technology and data analytics to the influence of sustainability and environmental considerations, this final segment provides a forward-looking perspective on the evolving methodologies and factors that will shape property valuation practices in the vibrant Toronto real estate market.

Conclusion

In conclusion, the process of property valuation and commercial real estate appraisal in toronto is a crucial aspect of the real estate industry, playing a pivotal role in decision-making for investors, lenders, and other stakeholders. Toronto's dynamic and ever-evolving real estate market demands accurate and comprehensive valuations to ensure fair transactions and informed investment strategies.

1 note

·

View note

Text

Evaluation to Investment Commercial Real Estate Appraisal Toronto

Welcome to the bustling world of commercial real estate in toronto, where every property holds a unique story and potential for investment. In this dynamic landscape, the bridge from evaluation to investment is built on the foundation of robust commercial real estate appraisal practices. As investors and stakeholders seek opportunities in this thriving canadian metropolis, understanding the intricacies of appraisal becomes paramount. This introduction sets the stage for a journey into the heart of toronto's commercial real estate market, where valuation isn't just a number it's a strategic tool. From navigating the city's distinct considerations to decoding the factors that shape property values, we embark on a comprehensive exploration. Join us as we unravel the complexities of commercial real estate appraisal in toronto, offering insights that empower investors, developers, and industry enthusiasts to make informed decisions in this vibrant urban landscape.

Toronto's Economic Tapestry: A Canvas for Commercial Real Estate Valuation

commercial real estate appraisal toronto is intricately woven into the city's economic fabric. From the bustling financial district to burgeoning tech hubs, understanding the economic landscape is crucial for accurate property valuation. This section delves into the diverse sectors that shape Toronto's economy and explores how they influence commercial real estate appraisal, providing a comprehensive overview for investors seeking to align their strategies with the city's economic pulse.

Navigating Regulatory Waters: Legal Frameworks in Toronto's Real Estate Valuation

As with any thriving real estate market, Toronto's commercial sector operates within a framework of regulations and legal nuances. Here, we navigate the legal waters that shape commercial real estate appraisal, exploring zoning laws, property taxes, and other regulatory factors. By gaining insights into Toronto's legal landscape, investors can ensure their evaluations align with the city's legal requirements, mitigating risks and fostering a solid foundation for investment decisions.

Market Trends and Emerging Patterns: Impact on Property Valuation

Toronto's real estate market is in a perpetual state of evolution, with trends and patterns that can significantly influence property values. In this section, we analyze the market dynamics, exploring factors such as demand-supply dynamics, rental trends, and emerging neighborhood patterns. Investors will gain valuable insights into the market forces shaping property values, allowing them to make informed decisions that capitalize on evolving trends.

The Role of Location: Micro and Macro Influences on Property Appraisal

Location remains a timeless mantra in real estate, and in Toronto, the significance of location is multi-faceted. From neighborhood vibes to proximity to key amenities, this section dissects the micro and macro influences that location exerts on commercial property appraisal. By understanding the nuanced impact of location, investors can tailor their strategies to capitalize on the unique advantages presented by different areas within the city.

Technological Innovations in Appraisal: Navigating the Digital Frontier

The world of real estate appraisal is undergoing a technological revolution, and Toronto is no exception. In this segment, we explore the role of technological innovations such as data analytics, machine learning, and virtual reality in shaping commercial property valuations. Understanding these tools equips investors with the means to harness data-driven insights, enhancing the precision and efficiency of their appraisal processes.

Sustainability and Green Valuation: A Growing Imperative in Toronto's Market

With a growing emphasis on sustainability, Toronto's commercial real estate market is witnessing a shift towards green valuation practices. This section delves into the factors that contribute to sustainable property values, including energy efficiency, environmental certifications, and the overall eco-friendly profile of commercial properties. Investors looking to align their portfolios with sustainable practices will find valuable insights into the growing importance of green valuation in Toronto.

Risk Mitigation Strategies: Safeguarding Investments in Toronto's Real Estate Arena

Every investment carries an element of risk, and in the world of commercial real estate, strategic risk mitigation is key. This section explores the potential risks associated with property appraisal in Toronto and provides actionable strategies to safeguard investments. From economic downturns to unforeseen market shifts, investors will gain a comprehensive toolkit for navigating uncertainties and ensuring the resilience of their commercial real estate portfolios in the vibrant city of Toronto.

Conclusion

In conclusion, the journey from evaluation to investment in Toronto's commercial real estate landscape is a nuanced exploration of economic intricacies, legal frameworks, market dynamics, and technological advancements. Navigating the city's diverse neighborhoods, understanding sustainable practices, and employing risk mitigation strategies are essential elements for savvy investors. Toronto's real estate market offers a dynamic canvas where informed decisions, backed by comprehensive appraisal insights, can unlock unparalleled opportunities. As the city continues to evolve, the synergy between evaluation and investment remains a strategic imperative, shaping a narrative of growth and prosperity for those who navigate the complexities of commercial real estate appraisal with foresight and precision.

0 notes

Text

Looking for a reliable real estate appraiser in Toronto? Appraisal Hub offers accurate property valuations and expert appraisal services for residential and commercial real estate. Contact them today for professional appraisals services!

0 notes

Text

The Comprehensive Guide to National Appraisal Services in Toronto

National Appraisal Services in Toronto offers comprehensive and reliable valuation solutions for a diverse range of properties. With a team of experienced and certified appraisers, we provide accurate assessments tailored to the unique characteristics of each property. Whether you're a homeowner, real estate investor, lender, or legal professional, our services cater to various needs, including mortgage financing, estate planning, taxation, litigation support, and more. We understand the intricacies of Toronto's dynamic real estate market and leverage our expertise to deliver insightful valuations that align with current market trends and regulations. Trust National Appraisal Services to provide you with dependable valuation reports that support informed decision-making and enable you to maximize the value of your real estate assets in Toronto's competitive landscape.

The Expertise of National Appraisal Services Toronto

National Appraisal Services Toronto specializes in providing thorough and comprehensive property valuations tailored to your specific needs. Our team of skilled appraisers meticulously assesses various factors, including property condition, market trends, and location, to deliver accurate and reliable valuation reports.

The Expertise Behind Toronto Real Estate Appraisals

With a deep understanding of Toronto's dynamic real estate market, our appraisers possess the knowledge and insight needed to navigate its complexities. We stay abreast of local trends, regulations, and developments to ensure that our clients receive valuation services that are aligned with the current market landscape.

How Our National Appraisal Services Toronto Serve Homeowners?

Whether you're a homeowner, investor, lender, or legal professional, our appraisal services cater to a diverse range of clients and property types. From residential homes to commercial properties, our team has the expertise to meet your specific valuation needs with precision and professionalism.

How National Appraisal Services Toronto Ensures Accuracy and Reliability?

At National Appraisal Services, we prioritize accuracy and reliability in all our valuation assessments. Our appraisers adhere to industry best practices and standards, utilizing advanced methodologies and technology to ensure that our clients receive valuation reports that they can trust.

The Role of Appraisal Services Toronto in Real Estate Transactions

Our appraisal services play a crucial role in facilitating various financial transactions, including mortgage financing, refinancing, and property sales. By providing accurate valuations, we help our clients make informed decisions and navigate the complexities of real estate transactions with confidence.

National Appraisal Services Toronto Litigation Support for Real Estate Disputes

In addition to valuation services, National Appraisal Services offers litigation support and consultation for legal professionals and individuals involved in real estate disputes. Our appraisers can provide expert testimony and guidance to support your case effectively.

Client Satisfaction at National Appraisal Services Toronto

At National Appraisal Services, client satisfaction is our top priority. We are dedicated to providing personalized service, timely communication, and exceptional results to ensure that our clients receive the highest level of satisfaction with our appraisal services in Toronto.

Conclusion

In conclusion, National Appraisal Services in Toronto stands out as a premier provider of appraisal solutions, driven by a steadfast commitment to client satisfaction. Our dedication to delivering personalized service, timely communication, and exceptional results ensures that each client receives the highest level of satisfaction. With a team of experienced appraisers who understand the intricacies of Toronto's real estate market, we offer comprehensive valuation services tailored to meet diverse needs. Whether you're a homeowner, investor, lender, or legal professional, you can trust National Appraisal Services to provide accurate and reliable assessments that support informed decision-making. Experience the difference with National Appraisal Services and let us exceed your expectations.

0 notes

Text

The Role of National Appraisal Services in Toronto

National Appraisal Services in Toronto offers comprehensive appraisal solutions for a diverse range of properties across the Greater Toronto Area (GTA). With a team of experienced and certified appraisers, we provide accurate and reliable valuation services tailored to meet the unique needs of our clients. Whether you're buying, selling, refinancing, or investing in real estate, our appraisal services offer valuable insights to support informed decision-making. We specialize in residential, commercial, and industrial properties, utilizing advanced appraisal methodologies and industry-leading technology to deliver timely and precise valuation reports. Our commitment to professionalism, integrity, and client satisfaction sets us apart as a trusted appraisal partner in Toronto's dynamic real estate market. Partner with National Appraisal Services for expert appraisal solutions that help you navigate the complexities of property valuation with confidence.

Introduction to National Appraisal Services Toronto

Gain insight into the role and significance of National Appraisal Services Toronto real estate landscape. Learn about the company's mission, values, and commitment to providing high-quality appraisal services to clients across the region.

Comprehensive Property Valuation Solutions

Explore the diverse range of appraisal services offered by National Appraisal Services Toronto. From residential homes and condominiums to commercial properties and industrial sites, discover how their team of expert appraisers delivers accurate and reliable valuations tailored to clients' needs.

Expertise in Toronto's Real Estate Market

Learn about National Appraisal Services Toronto's in-depth knowledge of Toronto's real estate market. With a thorough understanding of local market trends, regulations, and property dynamics, their appraisers provide invaluable insights to clients seeking to buy, sell, or invest in Toronto's diverse real estate landscape.

Client-Centric Approach to Service Delivery

Discover how National Appraisal Services Toronto prioritizes client satisfaction and excellence in service delivery. From initial consultation to final appraisal reports, their team remains committed to meeting clients' needs, providing personalized attention, and delivering timely and accurate appraisals that exceed expectations.

Cutting-Edge Technology and Methodologies

Explore the innovative technologies and methodologies utilized by National Appraisal Services Toronto to streamline the appraisal process and enhance accuracy. From advanced appraisal software to data analytics tools and market research databases, their appraisers leverage cutting-edge resources to deliver precise and reliable valuations.

Adherence to Industry Standards and Ethics

Understand National Appraisal Services Toronto's unwavering commitment to upholding industry standards and ethical practices. With a team of certified appraisers and adherence to professional guidelines, they ensure integrity, transparency, and reliability in every appraisal assignment.

Trusted Partner for Real Estate Professionals and Individuals

Learn why National Appraisal Services Toronto is the trusted partner of real estate professionals, lenders, attorneys, and individuals seeking expert appraisal services. With a reputation for excellence, integrity, and professionalism, they are the go-to choice for accurate and reliable property valuations in the Toronto area.

Conclusion

In conclusion, National Appraisal Services in Toronto plays a vital role in the real estate market by providing accurate and reliable property valuation services. With a commitment to professionalism, integrity, and excellence, their team of experienced appraisers ensures that clients receive thorough and objective assessments of property values. By leveraging comprehensive data analysis, market research, and industry expertise, National Appraisal Services delivers valuable insights that inform critical decisions for buyers, sellers, lenders, and investors. Their dedication to quality and customer satisfaction underscores their reputation as a trusted partner in the real estate industry. With a focus on transparency and adherence to regulatory standards, National Appraisal Services in Toronto continues to uphold the highest standards of professionalism and integrity in property valuation services.

0 notes

Text

Unlocking the Value: 3 Methods to Appraise Commercial Real Estate in Toronto

Welcome to the bustling world of commercial real estate in Toronto! Whether you're a seasoned investor or a budding entrepreneur, understanding the value of your property is paramount. But fear not! In this guide, we'll explore the three key methods to appraise commercial real estate in the vibrant city of Toronto.

Commercial Appraisal: Unveiling the True Worth

Picture this: You've found the perfect commercial property in Toronto, but how do you determine its value? Here's where commercial appraisal swoops in to save the day. This process involves a thorough examination of various factors to assess the property's market worth accurately.

Sales Comparison Approach: Peeking at the Neighbors

Ever heard the saying, "Birds of a feather flock together"? Well, in the world of real estate, this rings true! The sales comparison approach involves evaluating similar properties in Toronto that have recently been sold. By comparing these sales prices with the subject property, appraisers can gauge its value

In bustling Toronto, where every street corner tells a different story, commercial real estate appraisal is both an art and a science. With a plethora of properties dotting the skyline, knowing the worth of your investment is paramount. Let's delve into the three quintessential methods of appraising commercial real estate in the heart of Canada's largest city.

Sales Comparison Approach: Unveiling the Neighborhood Secrets

Just like exploring Toronto's diverse neighborhoods, the sales comparison approach relies on uncovering the secrets of neighboring properties. By analyzing recent sales of comparable properties in Toronto, appraisers can gauge the market value of the subject property. This method provides a snapshot of how similar properties are priced, offering insights into the potential worth.

Income Capitalization Method: Crunching the Numbers

Ah, the rhythmic pulse of Toronto's financial district! Here's where the income capitalization method steps in, focusing on the property's income potential. By estimating the net operating income (NOI) - the income generated after deducting operating expenses - and applying a capitalization rate, appraisers derive the property's value. In Toronto's dynamic rental market, this method shines bright, especially for income-generating properties like office spaces or apartment buildings.

Cost Approach: Building Blocks of Value

Toronto's skyline is a testament to its ever-evolving landscape, filled with architectural marvels. The cost approach, much like constructing a skyscraper, involves evaluating the cost of rebuilding the property from scratch. By considering the land value, construction costs, and depreciation, appraisers determine the property's value. While this method may not always align with market trends, it provides a solid foundation for valuing unique or specialized properties.

Wrapping It Up: Navigating Toronto's Commercial Real Estate Terrain

In the bustling metropolis of Toronto, where every street corner tells a different story, understanding the value of commercial real estate is essential. Whether you're eyeing a chic office space in the financial district or a quaint storefront in the vibrant neighborhoods, knowing the worth of your investment is key to success. Through meticulous appraisal methods like the sales comparison approach, income capitalization method, and cost approach, unlocking the true value of commercial properties in Toronto becomes an achievable feat. So, venture forth with confidence, for the city's real estate landscape awaits your exploration!

Conclusion: Unlocking Toronto's Commercial Real Estate Value

In summary, the value of commercial real estate in Toronto is a multifaceted puzzle, with appraisal methods serving as the guiding light. So, whether you're a seasoned investor or a newcomer to the scene, mastering these methods will set you on the path to real estate success in the bustling metropolis of Toronto. Happy investing!

0 notes

Text

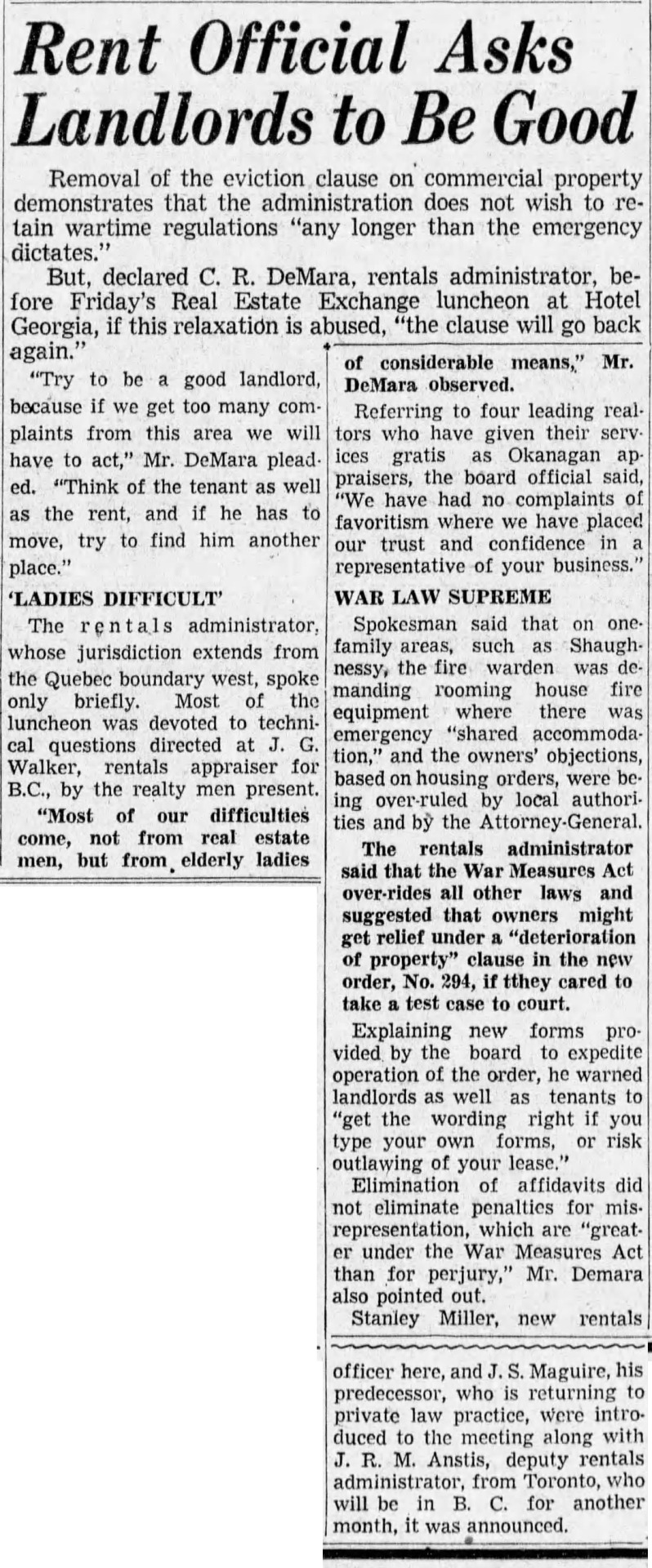

"Rent Official Asks Landlords to Be Good," Vancouver Sun. October 16, 1943. Page 5. --- Removal of the eviction clause on commercial property demonstrates that the administration does not wish to retain wartime regulations "any longer than the emergency dictates."

But, declared C. R. DeMara, rentals administrator, before Friday's Real Estate Exchange luncheon at Hotel Georgia, if this relaxation is abused, "the clause will go back again."

"Try to be a good landlord, because if we get too many complaints from this area we will have to act," Mr. DeMara pleaded. "Think of the tenant as well as the rent, and if he has to move, try to find him another place."

'LADIES DIFFICULT' The rentals administrator, whose jurisdiction extends from the Quebec boundary west, spoke only briefly. Most of the luncheon was devoted to technical questions directed at J. G. Walker, rentals appraiser for B.C., by the realty men present.

"Most of our difficulties come, not from real estate men, but from, elderly ladies of considerable means," Mr. DeMara observed.

Referring to four leading realtors who have given their services gratis as Okanagan appraisers, the board official said, "We have had no complaints of favoritism where we have placed our trust and confidence in a representative of your business."

WAR LAW SUPREME Spokesman said that on one-family areas, such as Shaughnessy, the fire warden was demanding rooming house fire equipment where there was emergency "shared accommodation," and the owners' objections, based on housing orders, were being over-ruled by local authorities and by the Attorney-General.

The rentals administrator said that the War Measures Act over-rides all other laws and suggested that owners might get relief under a "deterioration of property" clause in the new order, No. 294, if they cared to take a test case to court.

Explaining new forms provided by the board to expedite operation of the order, he warned landlords as well as tenants to "get the wording right if you type your own forms, or risk outlawing of your lease."

Elimination of affidavits did not eliminate penalties for misrepresentation, which are "greater under the War Measures Act than for perjury," Mr. Demara also pointed out.

Stanley Miller, new rentals officer here, and J. S. Maguire, his predecessor, who is returning to private law practice, were introduced to the meeting along with J. R. M. Anstis, deputy rentals administrator, from Toronto, who will be in B. C. for another month, it was announced.

#vancouver#rent control#realtors#landlordism#middle class ideology#taxpayers as political pressure group#pressure group#civic society#property owners#landlords vs tenants#war measures act#wartime housing#canada during world war 2

0 notes

Text

The Role of National Appraisal Services in Toronto

National Appraisal Services in Toronto plays a pivotal role in the real estate landscape, providing invaluable insights into property valuation. With a deep understanding of local market dynamics, these services offer comprehensive and accurate assessments crucial for buyers, sellers, and financial institutions. Utilizing advanced methodologies, they navigate the nuances of Toronto's diverse neighborhoods, ensuring fair and precise property appraisals. As a trusted guide in the real estate journey, National Appraisal Services contribute to informed decision-making, facilitating seamless transactions and fostering confidence in the market. Whether assessing residential or commercial properties, their expertise serves as a cornerstone, enhancing transparency and reliability in the vibrant and ever-evolving real estate market of Toronto.

The Expertise of National Appraisal Services Toronto

In the heart of Canada's real estate hub, National Appraisal Services Toronto stands as a beacon of expertise, navigating the dynamic landscape of the city's property market. Armed with in-depth knowledge of Toronto's diverse neighborhoods, these services provide a comprehensive understanding of local market trends, enabling clients to make informed decisions in the ever-evolving real estate sector.

The Core Function of National Appraisal Services Toronto

At the forefront of property valuation, National Appraisal Services in Toronto excels in delivering precision and accuracy. Whether determining the value of residential homes, commercial spaces, or investment properties, their skilled appraisers utilize advanced methodologies to provide clients with a thorough and reliable assessment. This commitment to accuracy serves as a cornerstone in facilitating transparent and trustworthy real estate transactions.

The Crucial Role of Appraisal Services in Toronto's Real Estate Financing

National Appraisal Services in Toronto plays a pivotal role in the financial landscape by guiding real estate transactions with meticulous property valuation. Financial institutions rely on their expertise to assess collateral value, ensuring that lending decisions are grounded in accurate appraisals. This crucial function contributes to the stability and confidence of Toronto's real estate financing sector.

National Appraisal Services as Toronto's Real Estate Authority

Beyond the city limits, National Appraisal Services in Toronto offers insights that resonate globally. By combining local expertise with a global perspective, they empower clients to make strategic real estate decisions. Their nuanced understanding of Toronto's market trends positions them as a trusted authority, facilitating seamless transactions for both local and international clients.

National Appraisal Services as Business Catalysts

In the dynamic world of commercial real estate, National Appraisal Services in Toronto serves as a catalyst for businesses. From office spaces to retail establishments, their specialized appraisers provide accurate valuations that align with the unique demands of the commercial sector. This expertise is instrumental in facilitating strategic decision-making for businesses seeking to thrive in Toronto's competitive commercial real estate environment.

National Appraisal Services in Toronto's Home Valuation Expertise

National Appraisal Services excels in unraveling the complexities of Toronto's residential real estate market. Whether determining the value of a single-family home, condominium, or luxury residence, their appraisers bring a deep understanding of neighborhood dynamics, property trends, and market fluctuations. This residential market mastery ensures that clients receive comprehensive and tailored assessments for their homes.

The Shield of National Appraisal Services Toronto

National Appraisal Services in Toronto acts as a shield against potential risks in real estate transactions. By conducting thorough due diligence and risk assessments, they contribute to the mitigation of uncertainties, providing clients with a robust understanding of the risks associated with a particular property. This commitment to diligence safeguards the interests of buyers, sellers, and investors in Toronto's dynamic real estate market.

National Appraisal Services and the Human Element in Real Estate

National Appraisal Services in Toronto recognizes that real estate is not just about numbers; it's about people and their aspirations. With a client-centric approach, these services go beyond valuation, offering personalized insights and guidance. Whether assisting first-time homebuyers or seasoned investors, National Appraisal Services understands the human element in every real estate transaction, fostering trust and ensuring a positive experience for all involved.

Conclusion

In conclusion, National Appraisal Services in Toronto stands as an indispensable pillar in the city's real estate ecosystem, weaving together expertise, precision, and a client-centric ethos. As navigators of Toronto's dynamic property market, their role extends beyond numerical valuation to become stewards of informed decision-making and risk mitigation. Whether influencing residential or commercial landscapes, their impact reverberates globally, contributing to the financial stability and confidence of Toronto's real estate sector. National Appraisal Services in Toronto is more than an assessment of property value; it is a beacon of reliability, providing a human touch to an intricate industry, ensuring that every client journey is characterized by trust, transparency, and the unwavering commitment to facilitating successful real estate transactions in this vibrant metropolis.

0 notes

Text

Elevate Your Real Estate Transactions: National Appraisal Services in Toronto

With a dedicated team of skilled appraisers, we provide accurate and comprehensive assessments, ensuring seamless real estate transactions. Our services cater to diverse client needs, ranging from residential properties to commercial estates. Trust us for reliable, timely, and precise appraisals, guiding you through every step of your real estate journey. Experience excellence in property valuation with National Appraisal Services in Toronto.

Know More: https://nationalappraisals.ca/

1 note

·

View note

Text

FAQs on Real Estate as a Career

Q: What qualifications do I need to pursue a career in real estate?

A: The qualifications required can vary depending on your location. In many places, you will need to complete a pre-licensing course and pass a licensing exam to become a real estate agent. Some states or countries may have additional educational requirements or regulations. Research the specific requirements in your area to ensure you meet the necessary qualifications.

Q: How long does it take to become a licensed real estate agent?

A: The time it takes to become a licensed Real Estate Broker In Toronto can vary. Pre-licensing courses can typically be completed within a few months, and the licensing exam may be scheduled shortly after. However, it's important to note that the timeline also depends on factors such as your availability to complete the coursework and the exam dates offered by the licensing board.

Q: What skills are important for success in real estate?

A: Several skills are crucial for success in real estate. Strong communication and interpersonal skills are essential for building relationships with clients and negotiating deals. Sales and negotiation skills are also important for closing deals and securing favorable terms. Market knowledge, financial literacy, problem-solving abilities, and a strong work ethic are other skills that can contribute to your success in the industry.

Q: How do real estate agents earn income?

A: Top Real Estate Agents typically earn income through commissions. When they help a client buy or sell a property, they receive a percentage of the transaction's value as their commission. The commission rates can vary, but it is typically around 5-6% of the property's sale price. It's important to note that agents are not paid a salary and their income is dependent on their sales and the commissions they earn.

Q: Is it necessary to join a real estate brokerage?

A: In most cases, yes. Real estate agents typically work under a licensed real estate brokerage. The brokerage provides support, training, and resources to agents, as well as a platform to conduct their business. Joining a reputable brokerage can offer benefits such as access to leads, marketing materials, and mentorship opportunities.

Q: Can I work as a part-time real estate agent?

A: Yes, it is possible to work as a part-time real estate agent. Many agents start their careers part-time while maintaining other employment. However, keep in mind that real estate can be demanding, and it requires time and effort to be successful. It's important to assess your availability and commitment to ensure you can meet the needs of your clients and the demands of the industry.

Q: What career opportunities are available within the real estate industry?

A: The real estate industry offers various career opportunities beyond being a real estate agent. You can explore roles such as property manager, real estate appraiser, real estate developer, real estate analyst, real estate consultant, and more. Each role has its own specific requirements and responsibilities, so it's essential to research and determine which path aligns with your interests and goals.

Q: Can I specialize in a specific area of real estate?

A: Yes, specializing in a specific area of real estate can be advantageous. You can choose to specialize in residential properties, commercial properties, luxury properties, rental properties, or even a niche market like sustainable or eco-friendly properties. Specializing allows you to become an expert in a particular field and cater to a specific clientele.

Q: Is real estate a stable career choice?

A: Real estate can provide a stable and lucrative career for individuals who are dedicated and willing to put in the effort. The industry's stability can vary depending on economic conditions and market fluctuations. However, the demand for real estate is generally consistent, as people will always need homes and businesses will require commercial spaces.

Q: How can I grow and advance in my real estate career?

A: To grow and advance in your real estate career, it's important to continually update your skills and knowledge through ongoing education and professional development. Building a strong network and establishing a solid reputation in the industry can also open doors to new opportunities. Additionally, setting goals, being proactive, and seeking mentorship can help you progress and achieve success in your real estate career.

Remember, these FAQs provide general information, and it's important to research and understand the specific regulations and requirements in your local area to pursue a successful career in real estate.

0 notes

Text

At UCAS, we primarily follow two commercial appraiser methods and which are as follows:

Cost Approach: We mostly use this cost approach method for newly built commercial properties in the area and particularly where the cost to build is known. In this regard, our appraiser would make an estimate of what it would cost to replace the same building if it were destroyed.

Sales Comparison Approach:In this approach, our expert team of appraisers estimates the subject residential real estate valuation by comparing it to similar properties that are recently sold out in the area. As a result we come up with a figure that shows the exact price at which each comparable property was sold for if it had the same components as the subject property.

#commercial appraisal toronto#Commercial Real Estate Appraisers#commercial real estate appraisal toronto

1 note

·

View note

Text

Investors Should Look for These Four Qualities in Commercial Mortgage Brokers

Many real estate investors are hesitant to work with a commercial mortgage broker in Toronto because of the commission. The benefits you may get from working with a commercial mortgage broker surpass the expense of the service.

Here are some essential credentials to consider before hiring a mortgage loan broker.

Enduring connections with a range of lenders

Find a broker with ties to a large network of lenders with various capabilities. Consider variables such as interest rates, closing times, credit requirements, and loan-to-value ratios.

Many financing choices

It will help if you are looking for a broker to help you find a construction mortgage in Toronto that fits your unique needs. Rates may be the most crucial element in some transactions. Brokers are aware of the issues crucial to your transaction and can assist you in identifying the best course of action.

Willingness to provide all of the necessary funding for the project

Some lenders will only underwrite a portion of the total funding of the construction mortgage in Toronto for the purchase. Find a lender who can handle your loan size if you need to finance the entire amount.

Transparency about fees and costs

Some loan brokers demand upfront payments and want you to make them regardless of the outcome. These could relate to the appraisal, structural reports, legal counsel, or other related expenses.

Conclusion

Making the appropriate choice in commercial mortgage brokers is crucial to obtaining the funding you require for your venture. Consider the above tips while choosing a commercial mortgage broker in Toronto. You may visit the website of Diane Bertolin for all the QNAs on construction mortgages.

For More :- https://goo.gl/maps/BvYfTzdLbqa4bhSJA

To know more About Commercial Mortgage Rates in Toronto ON please visit our website: dianebertolin.com

0 notes

Text

Discover top-notch real estate appraisal services with Appraisal Hub. Their certified appraisers offer accurate, reliable assessments for residential, commercial, and industrial properties in the Greater Toronto Area. Ensure your property’s true value with their expert appraisal services.

0 notes

Link

PV Realty Advisors is a Toronto Area-based Commercial Appraisal & Consulting Firm providing valuation & consulting services for a wide range of commercial, residential and investment properties. for more information so call on this number and visit our website. 647-812-7010

#Commercial Real Estate Appraisal toronto#commercial property appraisal Toronto#commercial property appraisal#commercial property#property appraisal#property

0 notes

Link

How the Pandemic Left the $25 Billion Hudson Yards Eerily Deserted When Hudson Yards opened in 2019 as the largest private development in American history, it aspired to transform Manhattan’s Far West Side with a sleek spread of ultraluxury condominiums, office towers for powerhouse companies like Facebook, and a mall with coveted international brands and restaurants by celebrity chefs like José Andrés. All of it surrounded a copper-colored sculpture that would be to New York what the Eiffel Tower is to Paris. But the pandemic has ravaged New York City’s real estate market and its premier, $25 billion development, raising significant questions about the future of Hudson Yards. Hundreds of condominiums remain unsold, and the mall is barren of customers. Its anchor tenant, Neiman Marcus, filed for bankruptcy and closed permanently, and at least four other stores, as well as several restaurants, have also gone out of business. The development’s centerpiece, the 150-foot-tall scalable structure known as the Vessel, closed to visitors in January after a third suicide in less than a year. The office buildings, whose workers sustained many of the shops and restaurants, have been largely empty since last spring. Even more perilous, the promised second phase of Hudson Yards — eight additional buildings, including a school, more luxury condos and office space — appears on indefinite hold as the developer, the Related Companies, seeks federal financing for a nearly 10-acre platform on which it will be built. Related, which had said the entire project would be finished in 2024, no longer offers an estimated completion date. The project’s woes are in many ways a microcosm of the broader challenges facing the city as it tries to recover. Related said it was counting on wealthy buyers filling its condos and deep-pocketed customers packing the mall to make Hudson Yards financially viable. But that was before the coronavirus arrived in New York. With the pandemic forcing white-collar workers to stay home — and keeping foreign buyers and tourists away — it is not clear when, or if, demand will reignite for the vast supply of upscale aeries and blue-chip office space crowding the city’s skyline. “The challenges facing Hudson Yards aren’t unique,” said Danny Ismail, an analyst and lead of office coverage for the real estate research firm Green Street Advisors. “All commercial real estate in New York City has been impacted by Covid-19. However, I would argue that post-pandemic, Hudson Yards and the area around it will be one of the better office markets in New York City.” The creation of Hudson Yards capped nearly 30 years of planning for the last large, undeveloped parcel in Manhattan, industrial land between Pennsylvania Station and the Hudson River. It is New York’s largest public-private venture and the city’s biggest development since Rockefeller Center in the 1930s, aided by roughly $6 billion in tax breaks and other government assistance, including the expansion of the subway to the West Side. Even with the subway expansion, Hudson Yards is still relatively isolated from the rest of Manhattan, off the beaten path from the busiest avenues for tourists, shoppers and workers. Related acknowledged that it was facing the same financial problems as the rest of the city, but said tenants were still moving into the project’s office buildings and that Hudson Yards would eventually rebound. Four office buildings at Hudson Yards — including 50 Hudson Yards, which is under construction — are 93 percent leased, a spokesman for Related said, though it is unclear how much of that occurred last year. Facebook signed a lease in late 2019 for roughly 1.5 million square feet. “Our strong office leasing, even during the pandemic, is why we’re well positioned to lead New York’s comeback from Covid and why the adjacent neighborhoods and the entire West Side will recover faster,” the spokesman, Jon Weinstein, said. Still, the troubles confronting Hudson Yards have caused Related to rethink its plans. Led by its billionaire founder Stephen M. Ross, the company set out to build Hudson Yards in two phases. The first phase, which opened in 2019, has four office towers, two residential buildings, a hotel and the mall. The second part was supposed to include 3,000 residences across eight buildings closer to the Hudson River, as well as a 750-seat public school and hundreds of low-cost rental units. At least 265 apartments are meant to be “permanently affordable,” according to a 2009 agreement between City Hall and Related. In total, Hudson Yards was expected to stretch 28 acres over existing rail yards and encompass 18 million square feet of space, roughly double the size of downtown Phoenix. The developer has considered an array of new options, including even a casino, though that idea is no longer front and center, according to Mr. Weinstein. Related cannot construct the second half until it builds a deck over the rail yard. The company, along with Amtrak, has been in discussions with the federal Department of Transportation about a low-interest loan to finance the platform and preserve the right of way for a new rail tunnel under the Hudson that Amtrak is planning to build. Related has been seeking more than $2 billion, according to two officials briefed on the proposal who were not permitted to discuss it publicly. “The residential is going to have to recover, or they switch it up and look at a different product mix over there,” said Robert Alexander, chairman of the tristate region for the real estate brokerage CBRE, which is marketing space at Hudson Yards. “To me, it’s a major development site and there’s very, very, very few major development sites in New York.” Related is also facing pressure from its investors to deliver a fuller accounting of the project’s finances. A group of 35 investors from China — a sliver of the roughly 2,400 who contributed $1.2 billion to Hudson Yards — sued the company last year, accusing it of refusing to open its books or say when it might repay their investments. An arbitrator in the case recently denied the investors’ claims and ruled that Related was not required to disclose detailed financial information. The company’s lawyers said that Hudson Yards was facing “significant headwinds as a result of Covid-19” and that because of the economic downturn and lockdown restrictions, it may be unable to recoup its investment in at least one property there, 35 Hudson Yards, a mixed-use tower with a hotel, according to filings in the case obtained by The New York Times. Another group of Chinese investors, whose contributions of $500,000 per person were part of a United States visa program that can grant them a path to citizenship, are said to also be considering filing a similar lawsuit against Related, according to a person familiar with the situation who was not authorized to speak publicly. Related made it clear before the outbreak that it intended to earn the bulk of its money at Hudson Yards through its condos and mall since Mr. Ross said it had been leasing office space at cost, without taking a profit. The pandemic has laid bare the tough road Related faces. In 2020, 30 residential units sold at Hudson Yards, compared with 157 the year before, according to an analysis for The Times by the appraisal firm Miller Samuel. So far this year, several condos are under contract at Hudson Yards, according to Related, a possible sign that the market may be stabilizing. Still, Manhattan has a record number of condos for sale right now, especially luxury units like those at Hudson Yards, and it could take years for sales to truly bounce back, according to Nancy Wu, an economist at StreetEasy. “Hudson Yards was built for a buyer that’s no longer there and maybe partly a tenant that’s no longer there, and that was someone who wanted to live in Manhattan but not live in the city per se,” said Richard Florida, a professor at the University of Toronto’s Rotman School of Management and School of Cities, referring to the development’s homogeneity and somewhat isolated location. The retail picture is also bleak. The vast space occupied by the failed Neiman Marcus store will no longer be taken by another retailer. Instead, Related will convert it into more offices. In the meantime, the company has intervened in Neiman Marcus’s bankruptcy case claiming that the department store owes $16 million for breaking its lease and an additional $129,000 for the removal of its signage throughout the mall, including a giant sign that hung in a five-story glass atrium. While the mall was closed by lockdown orders from mid-March to early September, shoppers are still largely absent. Related has battled its other beleaguered retail tenants, even threatening stores with $1,500 per day fines for failing to stay open after the mall reopened. Several stores, including Forty Five Ten, a luxury clothing store from Dallas that opened alongside Neiman Marcus, have shuttered permanently. The mall opened with 79 stores and now has 89, Related said. Related said the mall had added at least 11 stores since September, including Herman Miller, Levi’s and Sunglass Hut. In the weeks before Christmas, tourists and office workers were in short supply and some stores were still closed, while others like Rolex were open by appointment only. Mall employees far outnumbered shoppers inside the cavernous building, where the most crowded spot seemed to be the line at Blue Bottle Coffee. Weekday traffic at the Hudson Yards subway station, part of the No. 7 line extension the city paid for to help make the development possible, plunged to an average of 6,500 riders in December, a sharp drop from the 20,000 daily average in 2019, according to the Metropolitan Transportation Authority, which runs the subway. The lack of shoppers at the mall has cut into Related’s revenue because the company structured some retail leases so that shops pay rent based on a percentage of their monthly sales. In addition, a number of leases were specifically tied to the fate of Neiman Marcus — if it closed, smaller stores would not have to pay rent or could break their leases without penalty. Related would not comment about its terms with tenants, including whether any were withholding rent payments. Mr. Weinstein, the company spokesman, said that retail would “always be a key element of our new neighborhood.” Despite the uncertainty, Hudson Yards has already helped turn the neighborhood into a key business district and part of a stretch of Manhattan along the West Side that is becoming a major tech corridor. The development has attracted a who’s who of companies, including HBO, CNN, L’Oréal USA, BlackRock and Tapestry, the parent company of Coach, Kate Spade New York and Stuart Weitzman. “I think New York City will be fine, and Hudson Yards will be fine,” Mr. Florida said. “Will Hudson Yards be the same as it is envisioned? That’s the open question.” Source link Orbem News #Billion #Deserted #Eerily #Hudson #left #Pandemic #yards

0 notes