#commercial property purchase agreement

Explore tagged Tumblr posts

Text

Best Commercial Real Estate Lawyers in Miami | Kleiner law group

To negotiate the market uncertainties and complexities in this real estate environment, a person needs an expert counselor. The services that Kleiner Law Group provides to its clients include commercial property sale, residential property acquisition, commercial property purchase agreement and contracts, corporate and business law.

0 notes

Text

Understanding Real Estate Contract Contingencies in Florida: Protecting Your Investment

Florida Real Estate & Business Attorneys_2 Hey everyone, Florida Real Estate Attorney Ryan S. Shipp here! If you’re buying or selling real estate in Florida, understanding contingencies in your real estate purchase and sales contract is crucial. What Are Contract Contingencies? Contingencies are conditions that must be met before closing, allowing buyers or sellers to cancel without penalty if…

#appraisal contingency#buyer protection#Commercial Real Estate#contract negotiation#contract review#financing contingency#Florida home buying#Florida home selling#Florida property law#Florida Real Estate Attorney#Florida real estate contracts#home buying process#home inspection#home selling process#inspection contingency#Legal guidance#mortgage approval#property appraisal#property purchase agreement#purchase and sale agreement#real estate attorney near me#Real Estate Closing#real estate contingencies#real estate contract#real estate dispute resolution#Real estate investment#Real Estate Law#real estate legal services#Residential real estate#seller protection

0 notes

Text

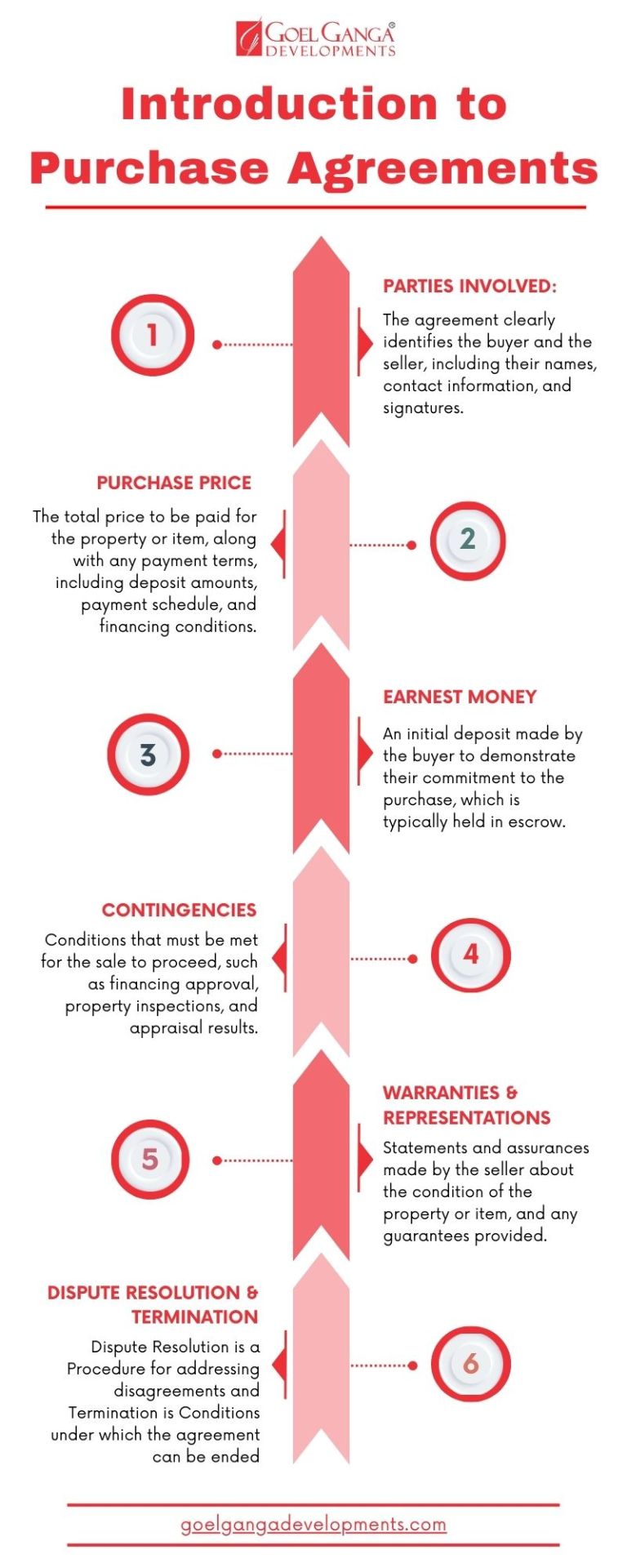

Introduction to purchase agreement?

A purchase agreement is a legally binding contract between a buyer and a seller outlining the terms and conditions of a sale. Whether you're buying a house, a car, or any other significant item, a purchase agreement ensures that both parties understand their obligations and protects their interests.

Key Components of a Purchase Agreement:

Parties Involved: Names and contact details of the buyer and seller.

Description of the Item: Detailed information about the item being sold.

Purchase Price: The agreed-upon price and payment terms.

Closing Date: The date when the sale will be finalized.

Contingencies: Conditions that must be met for the sale to proceed (e.g., home inspections, financing).

Warranties and Representations: Assurances from the seller about the item's condition.

Dispute Resolution: How any disputes will be resolved, often through arbitration or mediation.

Why is a Purchase Agreement Important?

Clarity: It clearly outlines each party’s responsibilities, preventing misunderstandings.

Legal Protection: Provides legal recourse if either party fails to fulfill their obligations.

Financial Security: Ensures that payment terms and conditions are agreed upon in advance.

Peace of Mind: Both parties can proceed with confidence, knowing that their interests are protected.

In summary, a purchase agreement is an essential tool in any significant transaction, providing clarity, legal protection, and peace of mind for both buyers and sellers.

#goel ganga pune#goel ganga developments pune#goel ganga ishanya satara#ganga acropolis baner#ganga aria#commercial property in pune#best builders in pune#premium residential projects in pune#new residential projects in pune#ganga platino kharadi#3 bhk flats in pune kharadi#pune builders and developers#goel ganga developments#commercial property for sale in pune#commercial property for sale in koregaon park pune#commercial projects in koregaon park#best residential projects in pune#residential projects in kharadi#commercial property#real estate projects in kharadi#best construction company in pune#best real estate developers in pune#purchase agreement

1 note

·

View note

Text

America’s first large-scale offshore wind farms began sending power to the Northeast in early 2024, but a wave of wind farm project cancellations and rising costs have left many people with doubts about the industry’s future in the US.

Several big hitters, including Ørsted, Equinor, BP, and Avangrid, have canceled contracts or sought to renegotiate them in recent months. Pulling out meant the companies faced cancellation penalties ranging from $16 million to several hundred million dollars per project. It also resulted in Siemens Energy, the world’s largest maker of offshore wind turbines, anticipating financial losses in 2024 of around $2.2 billion.

Altogether, projects that had been canceled by the end of 2023 were expected to total more than 12 gigawatts of power, representing more than half of the capacity in the project pipeline.

So, what happened, and can the US offshore wind industry recover?

I lead the University of Massachusetts Lowell’s Center for Wind-Energy Science, Technology, and Research (WindSTAR) and Center for Energy Innovation, and follow the industry closely. The offshore wind industry’s troubles are complicated, but it’s far from dead in the US, and some policy changes may help it find firmer footing.

A Cascade of Approval Challenges

Getting offshore wind projects permitted and approved in the US takes years and is fraught with uncertainty for developers, more so than in Europe or Asia.

Before a company bids on a US project, the developer must plan the procurement of the entire wind farm, including making reservations to purchase components such as turbines and cables, construction equipment, and ships. The bid must also be cost-competitive, so companies have a tendency to bid low and not anticipate unexpected costs, which adds to financial uncertainty and risk.

The winning US bidder then purchases an expensive ocean lease, costing in the hundreds of millions of dollars. But it has no right to build a wind project yet.

Before starting to build, the developer must conduct site assessments to determine what kind of foundations are possible and identify the scale of the project. The developer must consummate an agreement to sell the power it produces, identify a point of interconnection to the power grid, and then prepare a construction and operation plan, which is subject to further environmental review. All of that takes about five years, and it’s only the beginning.

For a project to move forward, developers may need to secure dozens of permits from local, tribal, state, regional, and federal agencies. The federal Bureau of Ocean Energy Management, which has jurisdiction over leasing and management of the seabed, must consult with agencies that have regulatory responsibilities over different aspects in the ocean, such as the armed forces, Environmental Protection Agency, and National Marine Fisheries Service, as well as groups including commercial and recreational fishing, Indigenous groups, shipping, harbor managers, and property owners.

In December 2023, the majority of offshore wind power capacity was in China and Europe. The United States had just 42 megawatts, but it was about to launch two new wind farms. (Data source: WFO Global Wind Offshore Wind Report 2023.)

For Vineyard Wind I—which began sending power from five of its 62 planned wind turbines off Martha’s Vineyard in early 2024—the time from BOEM’s lease auction to getting its first electricity to the grid was about nine years.

Costs Balloon During Regulatory Delays

Until recently, these contracts didn’t include any mechanisms to adjust for rising supply costs during the long approval time, adding to the risk for developers.

From the time today’s projects were bid to the time they were approved for construction, the world dealt with the Covid-19 pandemic, inflation, global supply chain problems, increased financing costs, and the war in Ukraine. Steep increases in commodity prices, including for steel and copper as well as in construction and operating costs, made many contracts signed years earlier no longer financially viable.

Led by China and the UK, the world had 67,412 megawatts of offshore wind power capacity in operation by the end of 2023. (Source: WTO Global Offshore Wind Report.)

New and rebid contracts are now allowing for price adjustments after the environmental approvals have been given, which is making projects more attractive to developers in the US. Many of the companies that canceled projects are now rebidding.

The regulatory process is becoming more streamlined, but it still takes about six years, while other countries are building projects at a faster pace and larger scale.

Shipping Rules, Power Connections

Another significant hurdle for offshore wind development in the US involves a century-old law known as the Jones Act.

The Jones Act requires vessels carrying cargo between US points to be US-built, US-operated, and US-owned. It was written to boost the shipping industry after World War I. However, there are only three offshore wind turbine installation vessels in the world that are large enough for the turbines proposed for US projects, and none are compliant with the Jones Act.

That means wind turbine components must be transported by smaller barges from US ports and then installed by a foreign installation vessel waiting offshore, which raises the cost and likelihood of delays.

Dominion Energy is building a new ship, the Charybdis, that will comply with the Jones Act. But a typical offshore wind farm needs more than 25 different types of vessels—for crew transfers, surveying, environmental monitoring, cable-laying, heavy lifting, and many other roles.

The nation also lacks a well-trained workforce for manufacturing, construction, and operation of offshore wind farms.

For power to flow from offshore wind farms, the electricity grid also requires significant upgrades. The Department of Energy is working on regional transmission plans, but permitting will undoubtedly be slow.

Lawsuits and Disinfo

Numerous lawsuits from advocacy groups that oppose offshore wind projects have further slowed development.

Wealthy homeowners have tried to stop wind farms that might appear in their ocean view. Astroturfing groups that claim to be advocates of the environment, but are actually supported by fossil fuel industry interests, have launched disinformation campaigns.

In 2023, many Republican politicians and conservative groups immediately cast blame for whale deaths off the coast of New York and New Jersey on the offshore wind developers, but the evidence points instead to increased ship traffic collisions and entanglements with fishing gear.

Such disinformation can reduce public support and slow projects’ progress.

Just Keep Spinnin’

The Biden administration set a goal to install 30 gigawatts of offshore wind capacity by 2030, but recent estimates indicate that the actual number will be closer to half that.

Despite the challenges, developers have reason to move ahead.

The Inflation Reduction Act provides incentives, including federal tax credits for the development of clean energy projects and for developers that build port facilities in locations that previously relied on fossil fuel industries. Most coastal state governments are also facilitating projects by allowing for a price readjustment after environmental approvals have been given. They view offshore wind as an opportunity for economic growth.

These financial benefits can make building an offshore wind industry more attractive to companies that need market stability and a pipeline of projects to help lower costs—projects that can create jobs and boost economic growth and a cleaner environment.

8 notes

·

View notes

Text

Choosing the Right Commercial Real Estate Financing: Why the SBA 504 Real Estate Loan Stands Out?

Securing the right financing option for commercial real estate could be a significant aspect for business owners. Expanding your business, acquiring a new property, or investing in other assets are all processes that would warrant taking out a loan, and knowing which type of loan to take is important to ensure favorable terms and rates are secured. Of all the different loan products available, many small business owners are keen on the SBA 504 Real Estate Loan. In this blog, we will see the reasons why the SBA 504 loan is worth your consideration when it comes to commercial real estate financing.

Understanding commercial real estate financing

Commercial real estate financing refers to the funding used for buying, improving, or refinancing any income-generating asset such as an office, retail, or industrial building. Business people looking for such funding can consider several sources, such as bank loans, commercial mortgages, and government loans. All these options present their own pros and cons, making it important to select one that fits the needs of one's business.

What Is a 504 Real Estate Loan?

In finance, it is a long-term, fixed-rate loan aimed at small businesses for purchasing capital assets, for example, real estate or expensive machinery. The difference between an SBA 504 real estate loan and an ordinary commercial loan is that the former is a tri-partite agreement between the lender, a CDC (Certified Development Company), and the borrower. Here is how it works:

1. The lender advances 50% of the project costs.

2. A non-profit counterpart, the CDC, takes 40% of that.

3. The last 10% is taken up by the borrower.

This risk-sharing approach helps in giving better terms to the small business owners, making them less risky for the lenders.

Advantages of the SBA 504 Loan for Real Estate Financing

Following are the reasons making the SBA 504 Real Estate Loan an ideal option for most people in need of commercial real estate financing:

Lower Deposit Requirement- In factor analysis, the low deposit perceived as one of the primary working capital loan merits, as in a few cases starting from 10% only required. This is advantageous to most small enterprises that want to safeguard their liquidity. Unlike commercial loans that may have more expensive down payments, the SBA 504 loan enables businesses to keep a greater portion of their funds available for other purposes.

Locked-in Interest Rates-The SBA 504 loan has locked in interest rates, which implies that the interest rate will be charged at the same rate for the duration of the loan. This provides an element of certainty that is often not present owing to the unique nature of other commercial real estate financing. This makes it easily possible to plan and budget for such activities.

Amortization Schedule- The repayment period of the SBA 504 loan is also quite long, often extending to a full 25 years on the purchase of real estate. This helps to lower the level of monthly payments; hence, it’s easier for small businesses to repay their debts. Greater repayment terms are a big plus in comparison with several direct commercial financing institutions whose repayment periods tend to be shorter.

Enabler for Investment Spending- Where a business has the need to make an investment, such as a purchase of a bigger office, a warehouse, or buying machinery, the SBA 504 loan comes in handy. It is a perfect match for advancing companies that are in serious need of buying new properties.

Why Choose Zeus Commercial Capital?

Finding the right financing can be hard, and that’s where Zeus Commercial Capital stands out. We form and manage portfolios of debt to minimize cost while enabling the financing of all commercial real estate loans. You can rely on us for professional assistance and successful realization of your plans and goals in regard to SBA 504 real estate loans.

Final Thoughts

The importance of selecting the most appropriate commercial real estate financing for the advancement and achievement of your business cannot be overstated. The majority of small businesses can opt for the SBA 504 Real Estate Loan since it has comparatively low equity requirements, fixed government rates, as well as more extended payback periods. For those seeking professional assistance with understanding the most appropriate financing options for their business, Zeus Commercial Capital is available. We will help you with relevant guidance and find the most suitable solution.

2 notes

·

View notes

Text

Turkish Real Estate Law

Navigating the complex world of real estate in Turkey can be challenging, especially for foreign investors unfamiliar with the local legal landscape. Hiring a seasoned Turkey real estate lawyer is crucial to ensuring your property transactions are secure and compliant with Turkish laws. At our law firm, we specialize in providing expert legal advice and services to both local and international clients seeking to invest in Turkish real estate. From the bustling streets of Istanbul to the tranquil beaches of Antalya, our Turkey real estate attorneys are well-versed in handling all aspects of property law, making the process of buying, selling, or managing property seamless and efficient.

Why Choose a Turkey Real Estate Lawyer?

Turkey has emerged as a prime destination for real estate investment due to its strategic location, economic growth, and favorable investment climate. However, the legal framework governing real estate in Turkey is complex, involving numerous regulations and procedures. A qualified Turkish real estate lawyer can provide invaluable assistance in navigating these complexities. Our legal team is adept at managing various aspects of real estate transactions, including property sales and purchases, title deed transfers, and contract preparations. We also handle disputes and litigation between parties, ensuring your rights are protected throughout the process.

What Services Do Turkey Real Estate Attorneys Offer?

Due Diligence and Title Deed Transfers: One of the essential roles of a Turkey real estate lawyer is conducting thorough due diligence on the property. This includes verifying the title deed’s authenticity, ensuring there are no encumbrances or legal disputes associated with the property, and checking for any unpaid taxes or debts. Proper due diligence is crucial in avoiding future legal issues. Our Turkey real estate law firm takes a proactive approach to protect your investment.

Contract Drafting and Review: Real estate transactions involve complex contracts that need to be carefully drafted and reviewed to safeguard the interests of both parties. Our Turkish real estate attorneys specialize in preparing clear, legally sound contracts that outline all terms and conditions of the sale, minimizing the risk of disputes. We also review existing contracts to ensure compliance with Turkish real estate laws.

Legal Representation in Disputes: In the event of disputes over property ownership, rental agreements, or other real estate-related issues, having a skilled Turkey real estate attorney is invaluable. Our law firm provides robust legal representation, seeking amicable settlements or pursuing litigation to protect our clients' rights and interests.

Guidance on Turkish Citizenship and Residency through Property Investment: Turkey offers the possibility of obtaining citizenship or residency through real estate investment. Our Turkish real estate lawyers provide comprehensive guidance on the requirements and procedures for acquiring Turkish citizenship by property purchase. This process involves meeting certain investment thresholds and legal criteria, which we navigate on your behalf to streamline the application process.

Why Turkey is a Hotspot for Real Estate Investment

Turkey’s real estate market is attractive to investors due to its dynamic economy, growing urbanization, and strategic geographical position, bridging Europe and Asia. Cities like Istanbul, Antalya, and Izmir offer excellent opportunities for investment, whether for residential, commercial, or vacation purposes. Additionally, the low cost of living, combined with high-quality healthcare and education systems, makes Turkey a desirable destination for expats and retirees. Our Turkey real estate law firm is committed to helping clients capitalize on these opportunities while ensuring all legal aspects are handled professionally.

Common Questions about Real Estate Investment in Turkey

Can you sue doctors in Turkey for malpractice? While this question is not directly related to real estate, it illustrates the broader legal concerns that foreign investors might have. Turkey has a robust legal framework to address various legal disputes, including medical malpractice. Similarly, the country's property laws are well-regulated to protect investor interests.

Is it safe to invest in Turkish real estate? Yes, with the right legal guidance, investing in Turkish real estate is safe. Our Turkish real estate lawyers conduct thorough due diligence and handle all necessary legal processes to ensure a secure investment.

What role does a Turkey real estate lawyer play in property purchase? A Turkey real estate lawyer plays a critical role in managing the entire property purchase process, from due diligence and contract drafting to title deed transfer and dispute resolution. Engaging a lawyer ensures that all legal procedures are followed, reducing the risk of future complications.

How do I get Turkish citizenship through real estate investment? Foreign investors can obtain Turkish citizenship by purchasing property worth a minimum of $400,000. Our Turkish real estate attorneys guide you through the application process, ensuring compliance with all legal requirements and facilitating a smooth path to citizenship.

Conclusion

Engaging a knowledgeable Turkey real estate lawyer is essential for anyone considering real estate investment in Turkey. Whether you're purchasing a home for personal use, investing in commercial property, or seeking to obtain Turkish citizenship, our Turkey real estate law firm provides comprehensive legal services tailored to your needs. With our expertise, you can navigate the complexities of the Turkish real estate market confidently and securely. For more information or to schedule a consultation, please contact our office.

3 notes

·

View notes

Text

Buying Property in Thailand

Thailand is an attractive destination for property buyers due to its scenic landscapes, vibrant cities, and welcoming culture. However, purchasing property in Thailand, especially as a foreigner, involves navigating a complex legal framework and understanding the local market intricacies. This comprehensive guide will provide detailed insights, enhancing expertise and credibility by delving into the legalities, procedures, and best practices for buying property in Thailand.

1. Understanding the Legal Framework

Key Legal Restrictions:

Land Code Act B.E. 2497 (1954): Foreigners cannot own land in Thailand except under specific conditions.

Condominium Act B.E. 2522 (1979): Foreigners can own up to 49% of the total floor area of a condominium building.

Foreign Business Act B.E. 2542 (1999): Regulates foreign business activities and investments, impacting property purchases for business purposes.

Exceptions and Alternatives:

Board of Investment (BOI) Projects: Foreigners investing in BOI-promoted projects can acquire land under specific conditions.

Long-Term Leases: Foreigners can lease land for up to 30 years, with options to renew.

Thai Company Ownership: Forming a Thai company where foreigners hold less than 50% of shares allows indirect land ownership.

2. Types of Property Available for Purchase

Condominiums:

Freehold Ownership: Foreigners can own condominium units outright.

Ownership Percentage: The foreign ownership quota in a condominium building should not exceed 49%.

Leasehold Properties:

Land and Houses: Foreigners can lease land and houses for up to 30 years, with potential for renewal.

Registration: Leases exceeding three years must be registered at the Land Department to be legally enforceable.

Investment Properties:

Commercial Real Estate: Foreigners can invest in commercial properties through long-term leases or joint ventures with Thai partners.

Resort and Hotel Investments: Special regulations apply to foreign investments in resort and hotel properties, often requiring joint ventures.

3. Due Diligence and Legal Processes

Conducting Due Diligence:

Title Search: Verify the property’s legal status, ownership history, and any encumbrances or disputes.

Zoning and Land Use: Ensure the property complies with local zoning laws and land use regulations.

Environmental Compliance: Check for any environmental restrictions or issues affecting the property.

Engaging Legal and Financial Advisors:

Real Estate Lawyer: Hire a reputable lawyer specializing in Thai real estate to guide you through the legal processes.

Financial Advisor: Consult a financial advisor to understand tax implications, financing options, and investment strategies.

Steps in the Buying Process:

Reservation Agreement: Sign a reservation agreement and pay a reservation fee to secure the property.

Due Diligence: Conduct thorough due diligence with the help of legal advisors.

Sale and Purchase Agreement (SPA): Draft and sign the SPA, detailing the terms and conditions of the sale.

Deposit Payment: Pay a deposit, typically 10-30% of the purchase price.

Transfer of Ownership: Complete the transfer at the Land Department, paying the remaining balance and associated fees.

4. Costs and Taxes Involved

Purchase Costs:

Transfer Fee: 2% of the appraised property value.

Stamp Duty: 0.5% of the purchase price or appraised value, whichever is higher.

Withholding Tax: 1% of the appraised value or the actual sale price, whichever is higher.

Specific Business Tax (SBT): 3.3% of the appraised or actual sale price, applicable if the property is sold within five years of acquisition.

Ongoing Costs:

Common Area Fees: Monthly fees for maintenance of common areas in condominiums.

Property Tax: Annual property tax based on the assessed value of the property.

Utilities and Maintenance: Regular expenses for utilities, repairs, and maintenance.

5. Financing Options

Local Financing:

Thai Banks: Some Thai banks offer mortgage loans to foreigners for condominium purchases.

Eligibility Criteria: Generally, borrowers need to have a work permit, proof of income, and a good credit history.

Foreign Financing:

Home Country Banks: Some buyers secure financing from banks in their home countries, leveraging their assets abroad.

International Mortgage Providers: Specialized financial institutions provide mortgages for international property purchases.

Payment Plans:

Developer Financing: Some developers offer financing plans with staggered payments during the construction period.

Installment Payments: Buyers can negotiate installment payments directly with sellers or developers.

6. Common Pitfalls and How to Avoid Them

Legal Complications:

Unclear Title: Always verify the title to avoid disputes and ensure clear ownership.

Zoning Issues: Confirm zoning regulations to ensure the property can be used as intended.

Contractual Disputes: Have all agreements reviewed by a lawyer to prevent misunderstandings and ensure enforceability.

Financial Risks:

Currency Fluctuations: Be aware of exchange rate risks when making payments in foreign currency.

Hidden Costs: Account for all additional costs such as taxes, fees, and maintenance expenses.

Financing Challenges: Ensure you have a clear financing plan and understand the terms of any loans or payment plans.

7. Enhancing Expertise and Credibility

Demonstrating Professional Credentials:

Legal Qualifications: Highlight the legal qualifications and experience of your advisors and partners.

Professional Experience: Detail your experience in handling property transactions in Thailand.

Memberships and Affiliations: Include memberships in professional organizations like the Thai Bar Association, the Real Estate Broker Association, or international property associations.

Providing Authoritative References:

Cite Legal Documents: Reference specific sections of the Land Code Act and Condominium Act to support your points.

Expert Opinions: Incorporate insights from recognized experts in Thai real estate law and property investment.

Including Detailed Case Studies:

Client Testimonials: Feature testimonials from clients who have successfully purchased property in Thailand with your assistance.

Real-Life Examples: Provide detailed examples of successful transactions, highlighting any challenges overcome and solutions implemented.

Visual Aids and Infographics:

Process Flowcharts: Use flowcharts to depict the steps involved in the property buying process.

Diagrams: Create diagrams to visually explain key legal concepts and ownership structures.

#buying property in thailand#property in thailand#property lawyers in thailand#thailand#property#lawyers in thailand

2 notes

·

View notes

Text

Understanding Dubai's Residential Property Market: A Buyer's Guide

Understanding Dubai's residential property market is essential for making informed buying decisions. This buyer's guide provides an in-depth look at the key aspects of the market and tips for successful property purchases.

For more information on real estate, visit Dubai Real Estate.

Market Overview

Market Dynamics: Dubai's real estate market is dynamic and influenced by various factors such as economic growth, government policies, and global trends. Understanding these dynamics helps buyers make informed decisions.

Property Types: Dubai offers a wide range of residential properties, including apartments, villas, townhouses, and penthouses. Each property type has its own advantages and considerations.

Regulatory Framework: The Dubai Land Department (DLD) and the Real Estate Regulatory Agency (RERA) oversee the market, ensuring transparency and protecting buyers' rights. Familiarize yourself with the regulations and guidelines set by these authorities.

For property purchase options, explore Buy Residential Properties in Dubai.

Financing Options

Home Loans: Most buyers in Dubai finance their purchases through home loans. Several banks and financial institutions offer competitive mortgage rates and flexible terms. Research different lenders and compare their offers to find the best deal.

Mortgage Pre-Approval: Obtain a mortgage pre-approval to determine your budget and streamline the buying process. A pre-approval gives you a clear idea of your borrowing capacity and demonstrates to sellers that you are a serious and qualified buyer.

Down Payment: Ensure you have sufficient funds for the down payment, typically 20-25% of the property's value for expatriates. Consider additional costs such as registration fees, agent commissions, and maintenance charges.

For mortgage services, consider Mortgage Brokers UAE.

Choosing the Right Property

Location: Choose a location that aligns with your lifestyle and investment goals. Popular residential areas in Dubai include Downtown Dubai, Dubai Marina, Palm Jumeirah, and Arabian Ranches. Consider factors such as proximity to schools, workplaces, and amenities.

Developer Reputation: Research the reputation of the property developer. Established developers with a track record of delivering high-quality projects on time are usually a safer choice.

Property Condition: Inspect the property for any structural issues, maintenance needs, and potential repairs. Hire a professional inspector if necessary to ensure the property is in good condition.

For rental property management, visit Rent Your Property in Dubai.

Legal Considerations

Title Deed Verification: Ensure the property has a clear title and is free from any legal disputes or encumbrances. The DLD provides title deed verification services to help buyers confirm the property's legal status.

Sales Agreement: Review the sales agreement carefully and seek legal advice if needed. Ensure all terms and conditions are clearly outlined, including the price, payment schedule, and any additional costs.

Residency Visa: Property buyers in Dubai may be eligible for a residency visa. The visa duration and requirements vary depending on the property's value and the buyer's nationality. Consult with the DLD or a legal expert to understand the specific visa requirements and benefits.

For property sales, visit Sell Your Property in Dubai.

Market Trends and Opportunities

Sustainable Developments: There is a growing demand for eco-friendly and sustainable properties in Dubai. Developers are increasingly incorporating green building practices and energy-efficient features into their projects.

Smart Homes: The adoption of smart home technology is on the rise. Properties equipped with advanced security systems, automated lighting, and climate control are becoming more popular.

Mixed-Use Communities: Integrated communities that offer a mix of residential, commercial, and recreational facilities are gaining popularity. These developments provide residents with a convenient and holistic living experience.

Real-Life Success Story

Consider the case of Maria, an expatriate who successfully navigated Dubai's residential property market. Maria conducted thorough market research, obtained mortgage pre-approval, and chose a reputable developer. By following the guidelines outlined in this buyer's guide, Maria secured a luxurious villa in Arabian Ranches and enjoys the community's amenities and family-friendly environment.

Future Trends in Dubai Real Estate

Sustainable Developments: Developers are increasingly incorporating eco-friendly and sustainable practices into their projects. Properties with green features such as solar panels, energy-efficient appliances, and sustainable materials are becoming more popular.

Smart Homes: The adoption of smart home technology is on the rise. Properties equipped with advanced security systems, automated lighting, and climate control are becoming more popular.

Mixed-Use Communities: Integrated communities that offer a mix of residential, commercial, and recreational facilities are gaining popularity. These developments provide residents with a convenient and holistic living experience.

Conclusion

Understanding Dubai's residential property market is essential for making informed buying decisions. By staying informed about market dynamics, exploring financing options, choosing the right property, and navigating legal considerations, you can make a successful investment. For more resources and expert advice, visit Dubai Real Estate.

2 notes

·

View notes

Text

Blue Melon Capital Reviews | 5 Key Factors to Consider When Securing Real Estate Financing

Securing financing for real estate investments is a critical aspect of property ownership and development. Whether you're purchasing your dream home or investing in commercial properties, navigating the complex landscape of real estate financing requires careful consideration of several key factors. Blue Melon Capital Reviews shares some essential elements to keep in mind when seeking financing for your real estate ventures.

1. Creditworthiness and Financial Health

One of the foremost factors lenders consider when assessing real estate financing applications is the borrower's creditworthiness and financial health. Your credit score, debt-to-income ratio, and overall financial stability play pivotal roles in determining the terms of your loan, including interest rates and loan amounts. Before applying for financing, it's crucial to review your credit report, address any discrepancies or outstanding debts, and ensure your financial records reflect a favorable picture. Building a strong credit profile not only enhances your chances of securing financing but also opens doors to more competitive loan options with favorable terms.

2. Property Valuation and Collateral

The value of the property you intend to finance serves as collateral for the loan, influencing the lender's risk assessment and loan-to-value (LTV) ratio. Conducting a thorough property valuation, including appraisal and assessment of market trends, is essential to determine its fair market value accurately. Additionally, lenders may impose specific requirements regarding the type, condition, and location of the property, which can affect financing options. Understanding the collateral requirements and ensuring the property meets these criteria is crucial for securing favorable financing terms and minimizing risks for both parties involved.

3. Loan Terms and Structure

Blue Melon Capital Reviews believes real estate financing encompasses a variety of loan options, each with distinct terms, structures, and repayment schedules. From traditional mortgages to commercial loans, bridge financing, and construction loans, selecting the right loan product tailored to your specific needs is vital. Consider factors such as interest rates, loan duration, down payment requirements, and prepayment penalties when evaluating different financing options. Additionally, understanding the implications of fixed-rate versus adjustable-rate mortgages and the impact of market fluctuations on loan payments is essential for making informed decisions about loan terms and structure.

4. Lender Relationships and Options

Building strong relationships with lenders and exploring diverse financing options can provide valuable insights and opportunities for securing favorable terms. Researching reputable lenders, including banks, credit unions, mortgage brokers, and private lenders, allows you to compare rates, fees, and eligibility criteria to find the best fit for your financing needs. Moreover, cultivating open communication and transparency with lenders throughout the application process can strengthen your negotiating position and increase the likelihood of securing financing on favorable terms. By leveraging diverse lender relationships and exploring alternative financing sources, you can optimize your real estate financing strategy and mitigate potential challenges.

5. Regulatory and Legal Considerations

Navigating the regulatory and legal landscape surrounding real estate financing is paramount to ensure compliance and mitigate risks. Familiarize yourself with applicable laws, regulations, and licensing requirements governing real estate transactions and lending practices in your jurisdiction. Additionally, consult legal professionals specializing in real estate law to review loan agreements, contracts, and disclosure documents thoroughly. Understanding your rights and obligations as a borrower, as well as potential legal implications, empowers you to make informed decisions and safeguard your interests throughout the financing process.

In conclusion, securing real estate financing requires careful consideration of various factors, including creditworthiness, property valuation, loan terms, lender relationships, and regulatory compliance. By prioritizing these key elements and conducting thorough due diligence, borrowers can enhance their chances of securing financing on favorable terms while minimizing risks and maximizing returns on their real estate investments. Remember to seek guidance from financial advisors, real estate professionals, and legal experts to navigate the complexities of real estate financing and make informed decisions aligned with your long-term objectives.

2 notes

·

View notes

Text

How Foreigners Can Easily Own a House in Vietnam?

How Foreigners Can Easily Own a House in Vietnam?

Because making an overseas property investment is a significant decision, it is recommended that the investors consult with real estate dispute lawyers in Vietnam for assistance in determining the developer's eligibility, construction permits, and other project-related legal documents. To ensure the protection of rights, reduce risks, and ensure compliance, it is essential to review the transaction documents in relation to the deposit agreement, sales agreement, and any other agreements the developer might propose.

On November 25th, 2014, the National Assembly of the Socialist Republic of Vietnam has approved the Housing Act 2014. The fact that a foreigner can buy a house in Vietnam is one of the most notable new changes.

Houses can be owned by foreign organizations and individuals in Vietnam:

-Overseas organizations and individuals putting resources into lodging development under projects in Vietnam as per the arrangements of the Housing Law and related authoritative archives;

-In Vietnam, businesses with foreign investment capital are operating, as are foreign investment funds, foreign bank branches, branch or representative offices of foreign businesses, and foreign investment funds.

-Foreign citizens are allowed to enter Vietnam.

What are forms of ownership housing foreigner in Vietnam?

-investment in the construction of housing in Vietnam as part of the project, in accordance with the Housing Law and related legislation;

-Apartments and single-family homes are included in the investment projects of housing construction. Commercial housing can be purchased, leased, donated, or passed down. (With the exception of housing projects aimed at safeguarding Vietnam's national defense and security, as mandated by the Government of Vietnam).

What are conditions, rights and obligations of foreigner when buy house in Vietnam?

For people or associations putting resources into lodging development under a project in Vietnam while seeking to possess houses in Vietnam they should fulfill the accompanying circumstances:

-Have an investment certificate

- Have housing developments constructed within the project in accordance with housing law.

When looking to buy a house in Vietnam, foreign businesses with foreign investment capital, branch or representative offices of foreign businesses, foreign investment funds, and foreign bank branches must meet the following conditions:

-Have investment certificates or documents relating with the license to operate in Vietnam gave by the skillful State offices of Vietnam.

Foreign individuals buying a house in Vietnam

-Allowed entry into Vietnam, but do not entitled to diplomatic and consular privileges and immunity.

Foreign businesses with foreign investment capital, branch or representative offices of foreign businesses, foreign investment funds, and foreign bank branches in Vietnam, as well as individual foreign buyers of homes in Vietnam, are eligible to own homes in Vietnam when:

-Rent, buy, donate, inherit, or own no more than 30% of an apartment building's units; Foreigners are not permitted to buy, lease, donate, inherit, or own more than two hundred fifty individual houses, including villas and semi-detached houses, in areas with a population equivalent to that of ward-level administrative;

-In accordance with the terms of the contract of sale, lease, donation, or inheritance, foreign individuals are entitled to own a home for a maximum of 50 years from the date of issuance of the certificate of ownership, which may be extended as required by the government. The certificate must also specify the period of ownership of the property;

-In the case of foreign individuals married to a citizen of Vietnam or hitched to a Vietnam resident got an outside country, they can possess the houses for a long and stable term. Additionally, like Vietnamese citizens, they enjoy owner rights;

Foreign organizations shall have the right to own a house in accordance with the contract of sale, lease, donation, or inheritance, but not longer than the period outlined in the certificate of ownership, which may include an extended period. The time it takes to own a house starts on the date the certificate of ownership is received and is listed on the certificate.

2 notes

·

View notes

Text

A purchase agreement is a legal contract outlining the terms and conditions of a property sale. For Goel Ganga Developments, it ensures clarity and protection for both buyers and the company. Key elements include identification of parties, detailed property descriptions, purchase price, and payment terms. It also covers contingencies like financing and inspections, closing dates, and possession details. The agreement includes earnest money provisions, warranties, default consequences, and dispute resolution methods. By clearly defining these aspects, Goel Ganga Developments ensures a smooth transaction process and reinforces trust with its customers.

#goel ganga developments#best builders in pune#goel ganga developments pune#new residential projects in pune#commercial property in pune#ganga platino kharadi#premium residential projects in pune#pune builders and developers#commercial property for sale in pune#3 bhk flats in pune kharadi#2bhk for sale#2 bhk flat in dhanori#2 bhk for sale in kharadi#2 bhk flats in kondhwa pune#commercial property in koregaon park#new properties in koregaon park pune#purchase agreement#ganga aria dhanori#ganga nakshatra#commercial property for sale in koregaon park pune#best residential projects in pune#luxurious apartments in baner#luxury residential projects in pune#commercial construction projects#best construction company in pune#goel ganga ishanya satara#nibm pune#office space in viman nagar pune#top builders in pune#real estate developers in pune

1 note

·

View note

Text

What Are Real Estate Issues During Transaction?

What Are Real Estate Issues During Transaction?

The buyer and seller would neglect to use lawyers until real estate dispute lawyers in Vietnam are needed.

The real estate market is generally an appealing business sector with an enormous wellspring of possible speculative benefits for financial backers. Since the land exchange is in every case high in worth, and purchasing a property for the vast majority is consistently a day-to-day existence time significant choice, and ordinarily with the monetary help from the bank, consequently in the created country, real estate dispute attorneys are constantly associated with all means of the exchange to guarantee the genuine exchange of the property. Real estate dispute lawyers in Vietnam will then be referred to for guidance and representation whenever a dispute arises.

Disputes arising from the sales and purchase agreement and deposit agreement in Vietnam

In point of fact, the majority of real estate transactions in Vietnam are carried out by the buyers and sellers themselves without the assistance of real estate attorneys. As a result, numerous disputes arise as a result of these transactions regarding the property deposit agreement, the property sales and purchase agreement between the buyer and the real estate developer for a new property, or the agreement between the buyer and the previous owner for a resale property.

Since residential property is one of the most frequently traded types of real estate, it is important to ensure that the conditions for property transfer are met before participating in property-related transactions. For a transfer to be successful, the related parties must adhere to and fulfill the aforementioned conditions.

Conditions for the property to be transferred: free from claim or dispute from other parties

The fundamental elements of the property transfer transaction include the following: The transferred property is not the subject of a claim, complaint, or ownership dispute; In the case of property owners with a specific term, the transferred property must be within the ownership period; The transferred property is not restricted for the purposes of judgment enforcement or compliance with administrative decisions made by competent state agencies that are legally effective; A decision on land recovery or a notice of house clearance or demolition from a competent agency is not required for the transferred property.

The property transferor must fulfill the following requirements for the parties to the property transaction:

Seller of the property has the right to sell or not?

The person or entity permitted or authorized by the owner to carry out the transaction on property in accordance with the provisions of the law is the transferor;

The person who bought the house from the investor or the person who has received the transfer of the house purchase and sale contract is the transferor in the case of a commercial house purchase and sale contract.

In accordance with civil law, the transferor must be an individual with full civil act capacity to conduct housing transactions;

Unless the organization donates a home out of gratitude or charity, the transferor must have legal status if it is an organization.

Can the buyer meet conditions to buy the property?

At the same time, the transferee shall also meet the conditions, specifically including the following conditions:

It is not necessary for the transferee to have a permanent residence registration in the location where the transferred housing is located; instead, as long as the transferee is a domestic individual, they will have full civil act capacity to conduct property transactions in accordance with civil law.

Under Vietnam law, the transferee must have full civil capacity to conduct housing transactions if they are a foreigner or an overseas Vietnamese. In addition, according to Vietnamese law, this individual must be eligible to own homes, and neither temporary nor permanent residence registrations are required at the location where the transferred housing is located;

Assuming the transferee is an association, it will have lawful status and not rely upon the business environment enlistment and foundation; on the off chance that it is an unfamiliar association, it should be qualified to claim a house in Vietnam as per the arrangements of regulation; assuming that the association is approved to figure out how to house, it should have the capability of giving land benefits and be working in Vietnam under the law on land business.

What are potential disputes during the property transaction?

There are also disputes arisen from situations in particular:

One of the parties would like to exit the transaction if the property's market price rises or falls during the transaction.

The deals and acquisition of property is finished and enrolled at the authority yet the merchant keep on living there won't surrender the property for certain purposes behind some obscure time.

When compared to the property details outlined in the sales and purchase agreement, the developer may alter the property's design.

The property's quality does not meet the terms of the sales and purchase agreement.

Additionally, when entering into a property transaction, one may need to pay close attention to fraudulent acts in the sale and purchase of property.

How real estate dispute lawyers in Vietnam could help?

As said, there are what is happening that question could emerge in a real estate transaction. It is essential to connect law firm spend significant time in land exchange for trading property in Vietnam to stay away from expected debates and safeguard their wellbeing for dealer and defend venture for purchaser. In the event of a dispute, real estate dispute lawyers in Vietnam should be hired by the buyer or seller.

3 notes

·

View notes

Text

Property and houses for sale - Real Estate Agent London Ontario

LONDON, ONT.-- A flourishing housing market doesn't necessarily imply great times for everybody in the game. Passion for the London Ontario property market as well as a consolidated interest for providing the most effective feasible experiences for our clients. More for our communities try this, more for our sector as well as more helpful our customers understand their desires. Sign up for our regular monthly e-newsletter with special residential properties, ideas, market records as well as the current news.

We advertise your building on several digital paper systems varying in size from small-town weekly newspaper websites to nationally-recognized news media websites and apps.

Business opportunity is plentiful, the area varies, and also the community is increasing.

With our substantial experience that spread over 25 years and critical market knowledge, we aid you find the most effective homes available and also rent in East London.

Functioning very closely with our network of our branches across London, we provide a top quality solution, professional expertise and recommendations to residential or commercial property designers, financiers as well as personal purchasers. From off strategy sales to organizing a mortgage for a new construct building, we add worth at every stage of the process. With our extensive experience that spread over 25 years and tactical market knowledge, we assist you discover the most effective residential properties available for sale and rent out in East London. We are passionate to manage clients and also provide them a distinctive experience than our competitors.

Airshow London Pre

Do you have enduring experience in the realty sector as well as are searching for new obstacles as well as an appealing job perspective? As a realty agent at Engel & Völkers, you can utilize your skills to develop a successful job. As an independent, mobile property agent, you benefit from our expanding worldwide network with strong ties to special customers and matching residential or commercial properties.

youtube

From swimming to golf to hockey to skating, lots of fun and also exciting activities remain in shop for you. The city additionally offers a range of entertainment rental areas that you can pick from. Basement apartments and also removed residences are one of the most typical rental residential properties in London. Sold information is from the Toronto Real Estate Board MLS starting January 1, 2018. Texas Real Estate Compensation Customer Defense Notification Sotheby's International Realty Affiliates LLC completely supports the principles of the Fair Real Estate Act and the Level Playing Field Act.

Household Real Estate Professionals Residential Property

Our website, contains an active database of listings that has been assembled from over 20 Several Listing Solutions and many added listings that can not be located online. We likewise have an useful blog site that assists you stay up to date on with the ever-changing globe of Realty. Each of our certified, seasoned and professional Realtors is supplied a personal web page. All our qualified, knowledgeable and expert Real estate professionals have actually been trained to make use of the most innovative software program to promote the Real Estate process for you. Our Agents deal with Matrix, Rappatoni, Type Simpleness as well as lots of other energetic programs to help with establishing a listing, producing agreements, giving electronic trademarks and carrying a transaction easily throughout.

youtube

youtube

City Realtor started as a family members run business with its founders having over 25 years of home experience in London. At its core City Realtor still keeps firm its household worths of loyalty, count on as well as respect. These values are highly installed in our dealings with all of our clients as well as customers. City Realtor was founded to try and help people obtain the most effective possible experience of the real estate market in East London.

Our experts offer up-to-date market understanding and analysis throughout all home markets by means of our resource center. Understanding & Point of view is our center for household, industrial as well as rural write-ups and study from professionals supplying industry-leading suggestions and evaluation. With the competence of our ever-expanding specialist international network of workplaces we can assist find you the perfect residence throughout the world. The listing content on this internet How 2 remove black heads site is protected by copyright and various other laws, and is intended solely for the private, non-commercial usage by individuals. Any type of various other reproduction, distribution or use the material, in whole or partially, is especially prohibited. The restricted usages include commercial usage, "screen scraping", "data source scratching" and also any kind of other task intended to accumulate, store, reorganize or control information on the pages created by or presented on this website.

youtube

Are you aiming to let your property in London, however unsure where to begin? Please review our detailed overview to the procedure of allowing your building.

2 notes

·

View notes

Text

The Essential Role of Commercial Real Estate Brokers

Commercial real estate transactions can be a complex process involving a myriad of legal, financial, and logistical challenges. Whether you are a buyer or a seller, navigating the intricacies of the commercial real estate market can be overwhelming. This is where a commercial real estate broker comes in - a licensed professional who can assist you throughout the entire transaction process. In this blog post, you will find out the essential role of a commercial real estate broker in commercial real estate transactions and how they can assist you.

Market Knowledge and Research

One of the most significant advantages of working with a commercial real estate broker is their extensive knowledge and understanding of the local market. They can provide you with detailed information on market trends, property values, and other relevant data that can help you make informed decisions. They can also conduct thorough research on properties of interest, including their zoning and legal requirements, environmental issues, and other potential obstacles that could impact your transaction.

Assistance with Negotiation and Documentation

Best Real Estate Brokers in Westchester can also help you with the negotiation process, ensuring that you receive the best deal possible. They can also assist with preparing and reviewing all necessary documents, including purchase agreements, lease agreements, and other legal documents.

Connections to Industry Professionals

Commercial real estate brokers often have established relationships with other industry professionals, such as attorneys, bankers, appraisers, and property inspectors. This can be especially beneficial when it comes to obtaining financing, obtaining necessary permits, and navigating complex legal issues.

Managing the Transaction Process

A commercial real estate transaction involves a range of activities, including property inspections, appraisals, and due diligence. A commercial real estate broker can help manage these activities, ensuring that everything runs smoothly and on schedule. They can also help you avoid potential pitfalls that could delay or derail your transaction.

Saving Time and Money

Working with a commercial real estate broker can ultimately save you time and money. They can help you identify potential properties that fit your criteria, negotiate favorable terms, and navigate the complex transaction process. You can streamline the process and avoid costly mistakes by leveraging their expertise and knowledge.

In conclusion, a commercial real estate broker plays an essential role in commercial real estate transactions. If you are considering a commercial real estate transaction, it is highly recommended that you work with licensed and experienced commercial real estate companies in Westchester county NY to ensure a successful outcome.

#commercialrealestate#commercialproperty#realestateagent#realestate#realestateadvisors#propertyadvisors#nurealtyadvisors#investmentproperty

3 notes

·

View notes

Text

What Are The Factors I Need To Consider When Buying A Property In Dubai

Thanks to the increased foreign direct investments and free trade agreements between UAE and other countries, Dubai has become one of the most happening cities in the world, especially for the wealthy across the globe.

Besides free trade, low tax and zero income tax, Dubai is also dubbed as the business hub of the Middle East and enjoys the status as a favorite travel destination. Such features along with political stability and investment in infrastructure significantly boosted the country’s real estate.

Reportedly, Dubai saw a 76 per cent rise in real estate transactions in 2022 which amounted to a whopping $140 billion, with a majority of buyers from Russia. If you are lured by the lush lifestyle and cheap service from low-wage laborers procured from Asia, Africa and the Middle East, and propelled to buy a property here, here’s how to make a smart purchase and enjoy your slice of the cake.

The Current Trends Of Property Demand In Dubai

While real estate in Dubai is broadly classified on a residential and commercial basis, the former is further classified as villas, apartments, penthouses and working houses or studio apartments that the opulent purchase to house their staff.

The commercial property includes office spaces, trade areas, warehouses, exhibition halls and industrial properties. While the demand for office space is believed to have subsided, the need for warehouses has increased due to enhanced e-commerce developments.

The huge retail companies and international markets in the Emirates have caused this demand for warehouses and sorting places.

Appreciation For Dubai Property

The strategic location and accentuating economy add to the appreciation of property value in Dubai. The flawless infrastructure makes any real estate investment fruitful, especially the off-plan ones.

Through flexible payment plans, off-plan properties have enhanced appreciation since the property price increases as the building nears completion. Likewise, even end users benefit from buying a property at a lower cost with more value for money.

Buyers can also benefit from various plans provided by promoters like post-handover payment plans and rent-to-own plans to name a few. Early investments offer immense profits through the appreciation perspective.

Allegedly the price of properties which are arriving in the markets here are expected to rise by 25 per cent per year. Demand for villas has superseded those for apartments and despite the shortage of luxury villas, the demand only grows.

Zeroing In On The Right Property

The buyer must clarify self about the property type, purpose of the purchase, preferred locality and its functionality to satisfy the purpose, amount affordable for purchase, mortgage possibilities and the developer’s reputation to hand over the property in the scheduled time while purchasing the property.

It is equally important to check the risks involved and estimated ROI on completion of the project.

Timespan Of Occupation

Purchasing a home anywhere across the world, leave alone in Dubai, must be considered on both a short and long-term basis. An apartment purchased by a newlywed or young couple may seem insufficient when the family expands.

Purchasing villas gives the option to expand and redesign besides providing a better return on investments. These villas which are excellently furnished can be sold to one of the increasing numbers of interested buyers if owners choose to relocate to another country.

Budget

As of February 2023, the starting price of a property in Dubai is reportedly between AED 3 lakhs to 3.5 lakhs. The price of apartments in Dubai depends upon floor area, locality and amenities among various other factors.

The buyer must be prepared to pay a 10 per cent refundable registration fee while purchasing the desired property.

Location

The instance found below shows how price varies among localities for almost the same floor area.

One-bedroom apartments measuring 800 to 900 square feet at Business Bay and Dubai Hills Estate at Mohammed Bin Rasheed are affordable. One-bedroom apartments are also available at Al Wasl (Jumeira), Dubai South City (Jabal Ali) at affordable rates.

Single-bedroom apartments at Emaar Burj Vista measuring between 700 to 1000 square feet cost more than AED 2,00,000 at Downtown Dubai, Dubai Marina. Proximity to Dubai Mall, Dubai Mall Metro Station and easy connectivity to Sheik Zayed Road and Dubai Property justifies the costly price of this single-bedroom apartment.

The Purchase Medium

A buyer could save a lot of money by avoiding brokers or middlemen while purchasing property in Dubai directly from the owner. Notably, brokers charge a 2 per cent agency fee and a 5 per cent VAT charge on the fee.

However, while avoiding brokers, one forgoes professional assessment of properties and expert navigation of transaction details like the contract paperwork, for instance, the art of negotiating.

Dubai Land Department Service Charges

Dubai Land Department service charges, which are mandatory while purchasing property in Dubai, may be shared equally by the buyer and seller or might be entirely paid by the buyer. The DLD charges amount to 4 percent of the property value.

Additionally, the buyer may need to pay a mortgage registration fee if bought through a loan, which amounts to 0.25 per cent of the loan along with AED 290. If the DLD is not paid within 60 days, the purchase is understood to be canceled.

Property Service Charges

The property service charges which are calculated on a square foot basis may range between AED 3 to 30. Besides property service charges one must foot Dubai Electricity and Water Authority fees along with insurance fees, security deposit and property transfer fees.

The property service charge varies along with locations, project type and purchase purpose. The buyer should also pay a ‘sinking fund’ which is a reserve fund that meets expenses for major repairs in future. Interestingly the 10 to 15 per cent price drop in key locations of Dubai facilitates developers selling to new end users.

While places like International City, Discovery Gardens have low service charges at 7 Dirhams per square feet (psf), Business Bay, Dubai Marina, Jumeirah Lakes Towers, Sports City, Jumeirah Village Circle charge moderately at 10 Dirhams psf.

Arabian Ranches 1 and 2 require AED 0.89 psf and 2.44 psf respectively while Burj Vista property owners shell out a massive AED 17.44 psf for property services.

Amenities And Their Scalability, Effectiveness And Quality

Villas are equipped with clubhouses, gyms and modern equipment and are tagged with excellent resale value. Villas in Dubai Hills, Arabian Ranches, Palm Jumeirah, Emirates Hills, Damac Hills and Al Furjan are sought for 18-hole golf course plus proximity to the city, connectivity to Sheik Mohammed Bin Zayed Road, Waterfront view, Privacy with palatial layout, family-friendly atmosphere and proximity to Expo 2020 site in the same order.

Handling Installments

Installment plans are popular in Dubai real estate purchases. 10 percent of the total cost is paid as advance which is followed by installments that cover half the entire cost at the time of handover.

Documents Required

Copies of documents including Emirates ID, passport, Visa page, reservation form, Sales and Purchase Agreement and Mortgage Contract if applicable required while purchasing property in Dubai.

Check Developer Background

It pays to check the developer’s track records before approaching them to buy property. If the developer lacks dedication, his property abounds in unsatisfactory plans and poor finishes while laying tiles, cupboards and walls.

Where To Purchase Off-Plan Properties

Purchasing a property through D Realtors, a professional and authentic real estate player in Dubai, fetches access to the functionally and aesthetically best property in Dubai which is spread across in prestigious locations such as Mohammed Bin Rashid City, The Fields, Burj Khalifa district and Sheik Zayed Road to name a few.

Final Words

The decision to join the game cannot be delayed too much since the prospects have already caught the eyes of many. Waste no time in deciding to take the plunge because the competition is already in the news.

Share this:

#Government approved realtors in dubai#D realtors#Dubai real estate brokers#Realtors in uae#Rent property in dubai#Lease property in dubai#Real estate in dubai#Uae real estate brokers#Buy property in dubai#Buy property in uae#Realtors in dubai#Freehold property in dubai#Buy apartment in dubai#Rera approved brokers in dubai

2 notes

·

View notes

Text

What Are Real Estate Issues During Transaction?

The buyer and seller would neglect to use lawyers until real estate dispute lawyers in Vietnam are needed.

The real estate market is generally an appealing business sector with an enormous wellspring of possible speculative benefits for financial backers. Since the land exchange is in every case high in worth, and purchasing a property for the vast majority is consistently a day-to-day existence time significant choice, and ordinarily with the monetary help from the bank, consequently in the created country, real estate dispute attorneys are constantly associated with all means of the exchange to guarantee the genuine exchange of the property. Real estate dispute lawyers in Vietnam will then be referred to for guidance and representation whenever a dispute arises.

Disputes arising from the sales and purchase agreement and deposit agreement in Vietnam

In point of fact, the majority of real estate transactions in Vietnam are carried out by the buyers and sellers themselves without the assistance of real estate attorneys. As a result, numerous disputes arise as a result of these transactions regarding the property deposit agreement, the property sales and purchase agreement between the buyer and the real estate developer for a new property, or the agreement between the buyer and the previous owner for a resale property.

Since residential property is one of the most frequently traded types of real estate, it is important to ensure that the conditions for property transfer are met before participating in property-related transactions. For a transfer to be successful, the related parties must adhere to and fulfill the aforementioned conditions.

Conditions for the property to be transferred: free from claim or dispute from other parties

The fundamental elements of the property transfer transaction include the following: The transferred property is not the subject of a claim, complaint, or ownership dispute; In the case of property owners with a specific term, the transferred property must be within the ownership period; The transferred property is not restricted for the purposes of judgment enforcement or compliance with administrative decisions made by competent state agencies that are legally effective; A decision on land recovery or a notice of house clearance or demolition from a competent agency is not required for the transferred property.

The property transferor must fulfill the following requirements for the parties to the property transaction:

Seller of the property has the right to sell or not?

The person or entity permitted or authorized by the owner to carry out the transaction on property in accordance with the provisions of the law is the transferor;

The person who bought the house from the investor or the person who has received the transfer of the house purchase and sale contract is the transferor in the case of a commercial house purchase and sale contract.

In accordance with civil law, the transferor must be an individual with full civil act capacity to conduct housing transactions;

Unless the organization donates a home out of gratitude or charity, the transferor must have legal status if it is an organization.

Can the buyer meet conditions to buy the property?

At the same time, the transferee shall also meet the conditions, specifically including the following conditions:

It is not necessary for the transferee to have a permanent residence registration in the location where the transferred housing is located; instead, as long as the transferee is a domestic individual, they will have full civil act capacity to conduct property transactions in accordance with civil law.

Under Vietnam law, the transferee must have full civil capacity to conduct housing transactions if they are a foreigner or an overseas Vietnamese. In addition, according to Vietnamese law, this individual must be eligible to own homes, and neither temporary nor permanent residence registrations are required at the location where the transferred housing is located;

Assuming the transferee is an association, it will have lawful status and not rely upon the business environment enlistment and foundation; on the off chance that it is an unfamiliar association, it should be qualified to claim a house in Vietnam as per the arrangements of regulation; assuming that the association is approved to figure out how to house, it should have the capability of giving land benefits and be working in Vietnam under the law on land business.

What are potential disputes during the property transaction?

There are also disputes arisen from situations in particular:

One of the parties would like to exit the transaction if the property's market price rises or falls during the transaction.

The deals and acquisition of property is finished and enrolled at the authority yet the merchant keep on living there won't surrender the property for certain purposes behind some obscure time.

When compared to the property details outlined in the sales and purchase agreement, the developer may alter the property's design.

The property's quality does not meet the terms of the sales and purchase agreement.

Additionally, when entering into a property transaction, one may need to pay close attention to fraudulent acts in the sale and purchase of property.

How real estate dispute lawyers in Vietnam could help?

As said, there are what is happening that question could emerge in a real estate transaction. It is essential to connect law firm spend significant time in land exchange for trading property in Vietnam to stay away from expected debates and safeguard their wellbeing for dealer and defend venture for purchaser. In the event of a dispute, real estate dispute lawyers in Vietnam should be hired by the buyer or seller.

1 note

·

View note