#cnbc awarded research firm Indore

Explore tagged Tumblr posts

Text

Sensex Rises Over 300 Points Amid Positive Global Cues, Nifty Trades Above 16,200

Indian equity benchmarks traded higher on opening trades on Friday, taking a cue from global markets.

Indian equity benchmarks traded higher on opening trades on Friday, taking a cue from global markets. Asian stocks followed Wall Street gains overnight as fears of an economic slowdown eased. Additionally, the pound began to recover from recent losses after Boris Johnson stepped down as British Prime Minister.

Trends in Nifty Futures on the Singapore Exchange (SGX Nifty) have indicated a cautious start for national indices.

The 30-stock BSE Sensex Index jumped 316 points or 0.58% to 54,495 at the start of the session, while the broader NSE Nifty jumped 104 points or 0.64% to 16,236.

Small and mid cap stocks were trading on a strong note as Nifty Midcap 100 was up 0.32% and small caps were up 0.59%.

13 of the 15 sector indicators - compiled by the National Stock Exchange - were traded in green. The Nifty Bank and Nifty Auto sub-indices outperformed the NSE platform up 0.67% and 0.77% respectively.

On the specific stock front, M&M was Nifty's best gain as the stock climbed 2.80% to ₹ 1,165.05. Winners also include L&T, Coal India, Axis Bank and NTPC.

The overall market size was positive as 1,715 stocks were advancing while 622 were down on BSE.

In the BSE 30-share index, L&T, M&M, NTPC, Axis Bank, ICICI Bank, UltraTech Cement, PowerGrid, Infosys, Tech Mahindra, Kotak Mahindra Bank, Sun Pharma and Wipro were among the best gainers.

Additionally, shares of Life Insurance Corporation of India (LIC), the country's largest insurer and largest national financial investor, were up 1.17% to ₹ 706.30.

Conversely, Asian Paints, Tata Steel, IndusInd Bank, Hindustan Unilever, Titan, TCS, Bajaj Finance, Dr Reddy's, and Maruti all traded in the red.

Sensex was up 427 points or 0.80% to close at 54,178 on Thursday, while Nifty was up 143 points or 0.89% to settle at 16,133.

For more information, visit: https://theequaleresearch.com/

#commodity currency leader#currency leader#Advisory mandi winner#cnbc awarded research firm#cnbc awarded research firm Indore#cnbc awarded advisory firm#cnbc awarded researcher#currency commodity trading#currency commodity trading Indore#best financial advisor firms#best financial advisor firms in Indore#best commodity currency leader#sebi registered advisory firm#investment advisor Indore

2 notes

·

View notes

Text

SIP accounts reach an all-time high of 5.55 crores, investment of 12,276 crores

Despite the continued sale of foreign investors from Indian stock markets, the decline in global markets, the weakness of the rupee, the rise in inflation, retail investors have confidence in mutual funds. Last June, the number of SIP accounts hit an all-time high of 5.55 crore. Not only this, the investment from SIP also reached an all-time high of Rs 12,276 crore.

The mutual fund portfolio grew 31% year-on-year

According to data from Amfi, an association of mutual fund companies, equity funds recorded net investments for the 16th consecutive month in June. The asset under management in the sector reached an all-time high of Rs 35.64 lakh crore. The number of mutual fund portfolios grew 31% year-on-year. These increased to 13.46 crore from 10.25 crore in June 2021.

The number of SIP accounts hit an all-time high of 5.55 crore. The net AUM of the retail schemes (Equity + Hybrid + Solution Oriented) grew 16% yoy to Rs 17.91 lakh crore. Retail schemes saw positive net flow of Rs 13,338 crore in June for the 16th consecutive month after March 2021.

All retail equity schemes recorded positive inflows in June

says NS Venkatesh, CEO of Amfi, the trend of small investors to save through SIPs. The mega trend of financialization of savings also continues in the country. All retail equity schemes, indices, ETFs and FoFs showed positive investments in June. This reflects the confidence of retail mutual fund investors towards long-term growth amidst the ups and downs of the stock market.

For more information, visit: https://theequaleresearch.com/

#commodity currency leader#currency leader#Advisory mandi winner#cnbc awarded research firm#cnbc awarded research firm Indore#cnbc awarded advisory firm#cnbc awarded researcher#currency commodity trading#currency commodity trading Indore#best financial advisor firms#best financial advisor firms in Indore#best commodity currency leader#sebi registered advisory firm#investment advisor Indore

1 note

·

View note

Text

Stock market boomed due to global market trend, Sensex crossed 54 thousand

Good signals from the global market and falling crude prices drove the Indian stock market higher on Thursday. On Thursday morning, Sensex and Nifty began trading with green brands. At the start of the trading session, the 30 point Sensex opened with a gain of 395.71 points to 54,146.68. Meanwhile, the 50-point Nifty opened at 16,113.75. During the pre-opening session, 29 out of 30 Sensex shares rose.

On the other hand, due to buying in the global stock market, there was a slight rise in the US market. The Dow Jones closed with a gain of 400 points, up 70 points. Computer stocks continually strengthen the market. The European market saw an increase of up to 1.5%. The Asian market also showed strength.

The movement of the stock market

Wednesday Earlier Wednesday, after a long stretch, there was a huge rally in the stock market. At the end of the trading session, the 30-point BSE Sensex jumped 616.62 points to close at 53,750.97. Meanwhile, the National Stock Exchange Nifty closed at 15,989.80 points with a gain of 178.95 points.

For more information, visit: https://theequaleresearch.com/

#commodity currency leader#currency leader#Advisory mandi winner#cnbc awarded research firm#cnbc awarded research firm Indore#cnbc awarded advisory firm#cnbc awarded researcher#currency commodity trading#currency commodity trading Indore#best financial advisor firms#best financial advisor firms in Indore#best commodity currency leader#sebi registered advisory firm#investment advisor Indore

1 note

·

View note

Text

Domestic cylinder price hiked by Rs 50

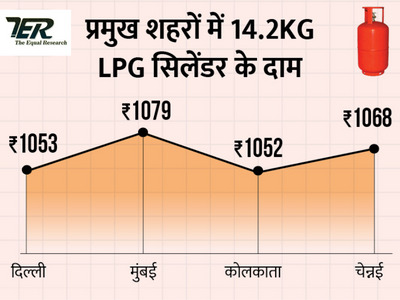

Rs 1053 will have to be paid on a 14kg bottle in Delhi, the price has risen for the second time in 48 days.

After the reduction in the price of commercial gas cylinders, the prices of domestic gas cylinders increased again after 48 days. According to the latest update from Indian Oil, you will now have to pay Rs 50 more for an unsubsidized 14.2 kg bottle. In the capital Delhi, the price of the 14 kg cylinder has risen from Rs 1003 to Rs 1053.

Earlier on May 19, oil companies had raised the price of domestic LPG gas cylinders by Rs 3,50 paise. At the same time, the prices of commercial gas cylinders have also been increased by Rs.

Cylinder crossed Rs 1100 in these cities

Bihar: Supaul (Rs 1157.5), Patna (Rs 1151), Bhagalpur (Rs 1150.5) and Aurangabad (Rs 1149.5)

Madhya Pradesh: Bhind (Rs.1132), Gwalior (Rs.1137) and Morena (Rs.1137)

Jharkhand: Dumka (Rs 1110.5) and Ranchi (Rs 1110.57)

Chhattisgarh: Kanker (Rs.1141) and Raipur (Rs.1124)

Uttar Pradesh: Sonbhadra (Rs.1140)

The gas cylinder has become more expensive by Rs 218.50 in 1 year

The price of domestic gas cylinder in Delhi on July 1, 2021 was Rs 834.50, which has now risen to Rs 1053. That is, over the past year, the price of domestic gas cylinder has increased by 218 .50. At the same time, the subsidy on this was also removed.

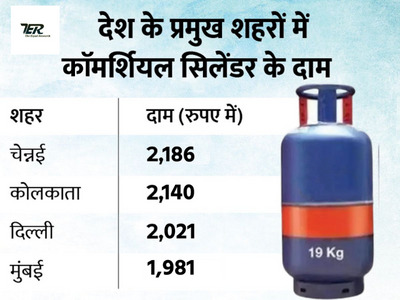

Commercial gas cylinders The cheapest prices

commercial gas cylinders were cut off on July 1. Due to which the price of commercial 19kg bottle in Delhi has risen from Rs 2,219 to Rs 2021. Similarly, from Rs 2,322 in Kolkata, this bottle will now be available for Rs 2,140. The price in Mumbai has risen from Rs 2171.50 to Rs 1981 and in Chennai from Rs 2373 to Rs 2186.

As a result, the price of the gas cylinder has dropped by Rs 198 in Delhi, Rs 182 in Kolkata, Rs 190.50 in Mumbai and Rs 187 in Chennai. In June last month, tariffs for commercial cylinders were reduced by Rs 135. However, no relief was given by oil companies to domestic gas cylinders. The price of a 14.2 kg gas cylinder in Delhi is Rs 1003.

For more information, visit: https://theequaleresearch.com/

#commodity currency leader#currency leader#Advisory mandi winner#cnbc awarded research firm#cnbc awarded research firm Indore#cnbc awarded advisory firm#cnbc awarded researcher#currency commodity trading#currency commodity trading Indore#best financial advisor firms#best financial advisor firms in Indore#best commodity currency leader#sebi registered advisory firm#investment advisor Indore

0 notes

Text

Made an empire of 43 thousand crores by investing in shares

Rakesh Jhunjhunwala, 62, is nicknamed the Big Bull of the stock market and now owns an airline.

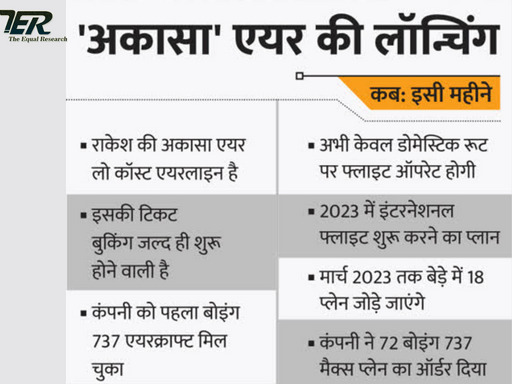

The Big Bull of the stock market, Rakesh Jhunjhunwala, who traveled from Rs 5,000 to Rs 43.39 crore, has a birthday today, July 5. He turned 62. Jhunjhunwala will also enter the aviation sector with the airline "Akasa" this month.

Jhunjhunwala was once a bear in the stock market i.e. bears. He made huge profits through short selling in 1992 when the Harshad Mehta scam came to light. There were several reputable cartels in the Indian stock market in the 1990s.

One of these cartels was that of Manu Manek which was the Bear Cartel. Manu Manek's cartel was called Black Cobra and he was also followed by Radhakishan Damani and Rakesh Jhunjhunwala. Journalist Sucheta Dalal exposed Harshad Mehta's scams after which the stock market crashed.

In such a situation, today we tell you about Jhunjhunwala's investment journey through his learnings and interesting fact graphs related to him.

Rakesh Jhunjhunwala launching “Akasa” airline soon:

For more information, visit: https://theequaleresearch.com/

#commodity currency leader#currency leader#Advisory mandi winner#cnbc awarded research firm#cnbc awarded research firm Indore#cnbc awarded advisory firm#cnbc awarded researcher#currency commodity trading#currency commodity trading Indore#best financial advisor firms#best financial advisor firms in Indore#best commodity currency leader#sebi registered advisory firm#investment advisor Indore

0 notes

Text

Sensex fell nearly 150 points, Nifty near 15700, selling in metal stocks, M&M and Tata Steel top losers

There is a decline in the Indian stock market today. The Sensex and Nifty indices weakened in today's trading. There is a liquidation of about 150 points in the Sensex. At the same time, Nifty has also moved closer to 15700. There is a sell-off in IT and metal stocks. The Nifty Metal Index is down about 1.95% and the IT Index is down 0.65%. At the same time, the auto index is also down. While the banking and financial indices show gains. The pharmaceutical, real estate and FMCG indices are also in the green.

Right now, the Sensex is up 150 points and trading at the 52,759.89 level. While Nifty is up 37 points at the 15715 level. Today's major losers include Tata Steel, M&M, TCS, Wipro, Tech Mahindra, Dr Reddy's and HDFC.

For more information, visit: https://theequaleresearch.com/

#commodity currency leader#currency leader#Advisory mandi winner#cnbc awarded research firm#cnbc awarded research firm Indore#cnbc awarded advisory firm#cnbc awarded researcher#currency commodity trading#currency#commodity trading Indore#best financial advisor firms#best financial advisor firms in Indore#best commodity currency leader#sebi registered advisory firm#investment advisor Indore

1 note

·

View note