#cfa online course india

Explore tagged Tumblr posts

Text

CFA Online Coaching in India Tailored for Your Success

Transform your CFA preparation with Unique Global Education's top-rated online coaching in India. Flexible, effective, and tailored for success! Looking for the best CFA online coaching in India? Unique Global Education provides unmatched training, expert mentorship, and a proven track record of success.

MORE INFO: https://uniqueglobaleducation.com/cfa-online-classes/

0 notes

Text

#CFA#CFA Level 1#CFA Level 2#CFA Level 3#cfa course in india#cfa online#cfa video#CFA Course#CFA Pebdive

0 notes

Text

US CMA Eligibility and Course Details: A Path to Success in Management Accounting

If you aspire to excel in the field of management accounting, obtaining the Certified Management Accountant (CMA) designation in the United States can be a significant milestone in your career. The CMA is a globally recognized certification that demonstrates your proficiency in financial planning, analysis, control, and decision support.

To embark on this professional journey, it is essential to understand the eligibility requirements and cma us course details. Let's explore these aspects and discover how they can propel you toward success.

Eligibility for US CMA Certification: us cma eligibility

Education: To be eligible for the CMA certification, you must hold a bachelor's degree from an accredited college or university. However, this requirement can be fulfilled within seven years of passing the CMA exam.

Professional Experience: You need to have two continuous years of professional experience in management accounting or financial management. This requirement can be completed before or after passing the exam. Relevant experience may include financial analysis, budgeting, internal auditing, strategic planning, or other related roles.

US CMA Course Details:

The US CMA program consists of two parts: Part 1 and Part 2. Each part covers specific areas of expertise, ensuring a comprehensive understanding of management accounting concepts and practices.

Part 1: Financial Planning, Performance, and Analytics

External Financial Reporting Decisions

Planning, Budgeting, and Forecasting

Performance Management

Cost Management

Internal Controls

Part 2: Strategic Financial Management

Financial Statement Analysis

Corporate Finance

Decision Analysis and Risk Management

Investment Decisions

Professional Ethics

The CMA exam is computer-based and administered by the Institute of Management Accountants (IMA). Each part consists of 100 multiple-choice questions and two essay scenarios. It is essential to note that the exam is offered during three testing windows each year: January and February, May and June, and September and October. This allows you to plan and prepare accordingly.

Preparing for the CMA exam requires dedication and comprehensive study. Various resources are available to support your preparation, including textbooks, review courses, online materials, and practice exams. It is advisable to create a study plan and allocate sufficient time for each topic.

Benefits of US CMA Certification:

Achieving the US CMA certification opens up numerous opportunities for professional growth and advancement. Here are some of the benefits:

Global Recognition: The CMA designation is globally recognized and respected, enhancing your credibility and professional standing in the field of management accounting.

Career Opportunities: CMA-certified professionals are sought after by employers for their in-depth knowledge and skills in financial planning, analysis, and decision support. This certification can unlock doors to rewarding career paths in various industries and organizations.

Competitive Advantage: The CMA certification sets you apart from your peers, demonstrating your commitment to continuous learning and professional development. It showcases your ability to add value to organizations through strategic financial management.

Networking and Community: As a CMA, you gain access to a vast network of professionals and experts in the field of management accounting. Engaging with this community can provide valuable insights, mentorship opportunities, and a platform to exchange ideas and best practices.

In conclusion, pursuing the US CMA certification can be a significant step toward achieving excellence in management accounting. Understanding the us cma eligibility and course details will help you plan and prepare effectively for the CMA exam. With dedication, study, and a strong work ethic, you can embark on a rewarding journey toward professional success and recognition as a CMA-certified professional.

#us cma eligibility#cma us course details#certified financial analyst#cfa institute india#ca final online classes

1 note

·

View note

Text

Top Reasons to Pursue an ACCA Qualification in 2025

The ACCA (Association of Chartered Certified Accountants) qualification has earned a stellar reputation globally as a gold standard in finance and accounting. Aspiring professionals aiming to boost their career prospects in these fields should consider this highly regarded certification. If you’re in India, cities like Ahmedabad, Pune, and Jaipur offer excellent resources to prepare for the ACCA exam. Here are the top reasons to pursue an ACCA qualification in 2025 and how regional options like ACCA courses in Ahmedabad, BBA ACCA, and coaching in Pune or Jaipur can help you succeed.

1. Global Recognition

The ACCA qualification is internationally recognized, making it a passport to a thriving global career in accounting and finance. Professionals with this certification can work in over 180 countries. Whether you aim to work in multinational corporations or establish your consultancy firm, ACCA provides a solid foundation for career growth.

If you're located in Ahmedabad, the city offers various options for an ACCA course in Ahmedabad that cater to students looking for world-class coaching at affordable rates.

2. Comprehensive Curriculum

The ACCA curriculum covers critical areas like financial reporting, audit, and taxation. The comprehensive nature of the syllabus ensures that professionals are well-equipped to handle diverse responsibilities. Many students opt for integrated programs like BBA ACCA, which blend business administration basics with ACCA's expertise, making them job-ready even before completing their professional qualification.

This integrated approach ensures that students gain academic and professional expertise, increasing their employability in competitive job markets.

3. Flexibility in Learning

One of the most attractive features of the ACCA qualification is its flexibility. Students can study at their own pace, making it suitable for working professionals and fresh graduates. The option to take exams quarterly allows learners to balance studies and work commitments effectively.

For students in Pune, ACCA classes in Pune provide flexible schedules, including weekend batches and online options, to meet the needs of various learners. The city's thriving educational ecosystem is ideal for those balancing academics and work.

4. High Demand in India

India is witnessing a growing demand for ACCA-certified professionals due to its expanding financial sector. As businesses and startups thrive, the need for professionals with international accounting expertise has surged.

Cities like Jaipur have emerged as new hubs for ACCA coaching. With reputed institutions offering ACCA coaching in Jaipur, students can now access top-notch training closer to home, eliminating the need for relocating to metro cities.

5. Cost-Effective Qualification

Compared to other global qualifications like CPA (Certified Public Accountant) or CFA (Chartered Financial Analyst), ACCA is relatively cost-effective. Additionally, many institutes in cities such as Ahmedabad, Pune, and Jaipur provide affordable coaching and installment payment options for ACCA classes, making the qualification accessible to a broader audience.

6. Pathway to Higher Education

The ACCA qualification opens doors to further academic and professional opportunities. ACCA members often pursue master’s degrees or specialized certifications to further enhance their expertise.

In Pune, institutions offering ACCA course in Pune often guide how to leverage the qualification for advanced studies. This creates a seamless pathway for students looking to expand their academic horizons.

7. Enhanced Earning Potential

Professionals with an ACCA qualification command higher salaries compared to their non-certified counterparts. Employers value the practical knowledge and global perspective that ACCA members bring to the table, making them invaluable assets to organizations.

Enrolling in an ACCA course in Ahmedabad can be a cost-effective way to boost your earning potential, especially when compared to the average cost of training in other cities.

8. Supportive ACCA Ecosystem in India

India has a growing network of ACCA-approved learning providers and exam centers, ensuring that students receive excellent support throughout their learning journey. Cities like Ahmedabad, Pune, and Jaipur are rapidly becoming hubs for ACCA training, offering numerous classes, study groups, and online resources to help students succeed.

For instance, ACCA coaching in Jaipur is known for its personalized attention, which helps students overcome challenges and ace their exams. Similarly, Pune boasts an array of institutions offering ACCA classes in Pune with experienced faculty and comprehensive study materials.

9. Opportunities for Specialization

The ACCA qualification allows professionals to specialize in areas like taxation, auditing, and financial management. This ability to focus on niche areas gives ACCA members a competitive edge in the job market.

If you’re interested in starting your ACCA journey, exploring an ACCA course in Ahmedabad is a smart choice. Ahmedabad is home to numerous institutions that cater to the specific interests of students, helping them identify the specialization that aligns with their career goals.

10. Career Progression and Job Security

The ACCA qualification is designed to ensure long-term career progression. With ACCA, professionals are not just prepared for immediate job roles but also for leadership positions in the future.

Moreover, institutions offering ACCA coaching in Jaipur and ACCA classes in Pune focus on career counseling and placement support, ensuring that students transition smoothly from academics to successful professional lives.

In 2025, the ACCA qualification remains a top choice for aspiring professionals looking to excel in the fields of accounting and finance. Its global recognition, flexible learning options, and increasing demand in India make it an ideal choice for career advancement. Cities like Ahmedabad, Pune, and Jaipur provide excellent resources to help students achieve their ACCA dreams.

Whether you choose an ACCA course in Ahmedabad, a BBA ACCA program, or specialized coaching in Pune or Jaipur, this qualification is your gateway to a promising future. Don’t wait—start your ACCA journey today and unlock a world of opportunities!

0 notes

Text

Enroll Now for 11th and 12th Commerce Classes at Sukrishna Commerce Academy – Patna!

Sukrishna Commerce Academy, we are dedicated to providing high-quality education for students in 11th and 12th Commerce Classes in Patna. Our expert faculty, personalized attention, and proven teaching methods ensure that you are well-prepared for board exams and your future career in the business world.

Why Choose Sukrishna Commerce Academy? 📚 Experienced Faculty: Our teachers are highly qualified and experienced, bringing real-world insights and practical knowledge to the classroom.

🎯 Comprehensive Curriculum: We offer a complete curriculum that covers all the subjects of 11th and 12th commerce, including Accountancy, Business Studies, Economics, Mathematics, and English.

📝 Personalized Attention: We believe in small class sizes to provide each student with the individual attention they deserve.

📈 Proven Results: With a track record of excellent results, many of our students have gone on to pursue successful careers in business, finance, and entrepreneurship.

💡 Interactive Learning: We focus on making learning engaging and interactive through real-life case studies, discussions, and practical examples.

🎓 Future Career Opportunities: Whether you’re looking for CA, CMA, CFA, or business management courses, we prepare you for various career options after school.

Our Services Include: Classroom Coaching: Interactive and in-depth lessons with expert faculty. Test Series: Regular mock tests to help you prepare for board exams and competitive exams. Doubt Clearing Sessions: Special sessions for clearing doubts and ensuring better understanding. Subject-Specific Workshops: Focused workshops for subjects like Accountancy, Business Studies, and Economics. Online Learning Support: Access to digital resources for additional practice and learning.

Start Your Journey Toward Success Today! Don’t wait! Take the first step toward building a strong foundation for your future. Sukrishna Commerce Academy is here to help you achieve your academic goals and pave the way for a successful career in commerce.

📞 Contact us today to learn more about our courses and enroll for 11th and 12th Commerce classes near you in Patna!

For more information call us at : 080846 96222

Or visit us : www.sukrishna.in

Address : 3rd floor surya crystal boring road chauraha, Patna, India, Bihar

#SukrishnaCommerceAcademy#CommerceClassesPatna#11th12thCommerce#CommerceEducation#PatnaStudents#LearnCommerce#BoardExamPreparation#CommerceAcademyPatna#FutureBusinessLeaders#CommerceStudies

0 notes

Text

Professionals in investment management and financial analysis can earn a distinguished credential by passing the CFA (Chartered Financial Analyst) exam. It covers subjects like ethics, financial reporting, portfolio management, and stock analysis and is offered at three different levels. The test thoroughly assesses applicants' knowledge and analytical abilities, preparing them for positions in asset management, finance, and investing.

0 notes

Text

Study in Singapore Made Easy: Ghum India Ghum Teams Up with Kaplan

Ghum India Ghum, a trusted name in the travel industry for over a decade, is now embarking on an exciting journey into education. The company is collaborating with Singapore's prestigious Kaplan University to bring world-class education closer to Indian, Vietnamese, and Sri Lankan students. This partnership aims to empower students with global opportunities. By merging travel expertise with education, Ghum India Ghum is creating a unique platform for aspiring learners to study in Singapore and achieve their academic dreams.

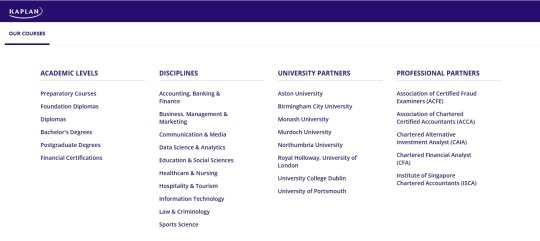

Why Choose Kaplan University?

Kaplan University is a global leader in education. It offers a wide range of courses tailored to today’s industry needs. Students can benefit from:

Internationally Recognized Degrees: Kaplan provides globally accepted certifications.

Flexible Learning Options: Online and in-person classes make learning accessible.

Industry-Relevant Curriculum: Courses are designed to meet real-world demands.

Whether you want to pursue a degree or upgrade your skills, Kaplan University has something for everyone. It is an ideal choice for students looking to study abroad in Singapore.

Courses Offered at Kaplan University

Students from India, Vietnam, and Sri Lanka can now access Kaplan’s extensive academic programs. These courses cater to different career stages:

Academic Levels

Preparatory Courses: For students aiming to build foundational knowledge and skills.

Foundation Diplomas: Introductory courses leading to advanced studies.

Diplomas: Specialized qualifications for skill-building and entry into industries.

Bachelor’s Degrees: Undergraduate programs for diverse disciplines.

Postgraduate Degrees: Advanced education for career progression.

Financial Certifications: Industry-recognized credentials in finance.

Disciplines Covered

Accounting, Banking & Finance: Essential for careers in financial management and banking.

Business, Management & Marketing: Focused on leadership, strategy, and market insights.

Communication & Media: Ideal for roles in public relations, journalism, and advertising.

Data Science & Analytics: Equips students with skills in data-driven decision-making.

Education & Social Sciences: For aspiring educators and social service professionals.

Healthcare & Nursing: Prepares students for careers in healthcare management and clinical roles.

Hospitality & Tourism: Targeted at those aiming for leadership in travel and hospitality industries.

Information Technology: Focus on programming, cybersecurity, and IT infrastructure.

Law & Criminology: Foundation for legal careers and understanding criminal justice.

Sports Science: Designed for careers in sports management and fitness.

University Partners

Kaplan University collaborates with renowned universities, ensuring high-quality education:

Aston University

Birmingham City University

Monash University

Murdoch University

Northumbria University

Royal Holloway, University of London

University College Dublin

University of Portsmouth

Professional Partners

Kaplan University also works with esteemed professional organizations to offer certifications:

Association of Certified Fraud Examiners (ACFE)

Association of Chartered Certified Accountants (ACCA)

Chartered Alternative Investment Analyst (CAIA)

Chartered Financial Analyst (CFA)

Institute of Singapore Chartered Accountants (ISCA)

This variety ensures that students can find a program suited to their career goals. For those considering study abroad options, Kaplan University in Singapore offers unparalleled academic and career opportunities.

How Students Can Benefit

Students from India, Vietnam, and Sri Lanka stand to gain significantly from this collaboration:

Global Exposure: Learn from experienced educators and interact with an international student community.

Career Advancement: Kaplan’s courses enhance job prospects and earning potential.

Affordable Education: The partnership aims to offer competitive tuition fees.

Comprehensive Support: Ghum India Ghum provides guidance through the application process.

The Role of Ghum India Ghum

As part of this collaboration, Ghum India Ghum will:

Facilitate admissions to Kaplan University.

Offer expert counseling to students and parents.

Provide travel assistance for students heading to Singapore.

Create customized packages combining education and travel.

This blend of services makes the transition seamless and stress-free. For students aspiring to study abroad in Singapore, Ghum India Ghum ensures a smooth journey.

How to Apply

Interested students can reach out to Ghum India Ghum for detailed guidance. The process includes:

Exploring available courses.

Submitting applications with necessary documents.

Receiving end-to-end support for visa and travel arrangements.

Final Thoughts

Ghum India Ghum’s collaboration with Kaplan University Singapore is a game-changer. It combines the best of travel and education, opening doors for students from India, Vietnam, and Sri Lanka to succeed globally. This initiative aligns with the company’s vision to empower individuals through unique opportunities.

So, take the first step towards a brighter future. Connect with Ghum India Ghum today and explore Kaplan University’s exceptional programs. Whether you’re considering study abroad options or looking to study in Singapore, this partnership offers the perfect platform to achieve your educational goals.

#Study in Singapore#rajasthan tour package#international tour package#travel agency in delhi#jaipur tour package#travel agency in india#himachal tour package#south india tour package#golden triangle package#kerala tour package#varanasi tour package

1 note

·

View note

Text

Advanced Certification Courses in Bangalore for Skill Enhancement

Press the Link to Get Admission to Best Short Term Classes in Bangalore

https://www.senfineacademy.com/ | Call-9845412266

Bangalore, often referred to as the Silicon Valley of India, is a hub for learning and innovation. Known for its dynamic environment, the city offers a plethora of opportunities for professionals, students, and job seekers to enhance their skill sets. Certification courses in Bangalore cater to various domains and are tailored to meet the needs of individuals aspiring to advance in their careers. Whether you're looking to upskill in technology, management, or creative fields, Bangalore has options that combine quality, flexibility, and relevance.

Why Opt for Certification Courses?

Certification courses offer specialized knowledge and practical skills in a concise timeframe. They bridge the gap between academic knowledge and industry requirements, making candidates job-ready. Here are some key benefits of pursuing certification courses:

Enhanced Career Prospects: Certifications add credibility to your resume, making you stand out in a competitive job market.

Skill Specialization: These courses allow you to master niche skills, making you a valuable asset in your field.

Flexibility: Most certification courses are short-term and designed to suit working professionals, students, or entrepreneurs.

Networking Opportunities: Certification programs often bring together professionals and mentors, helping you expand your professional network.

Popular Domains for Certification Courses in Bangalore

Bangalore is home to an array of certification courses across various domains. Here are some popular fields to explore:

1. Digital Marketing

Digital marketing is a rapidly growing field, and certification in this domain can open up opportunities in SEO, SEM, social media marketing, content marketing, and analytics. With a growing emphasis on online presence, skilled digital marketers are in high demand.

2. Data Science and Analytics

As data continues to drive decision-making in businesses, certification courses in data science, machine learning, and artificial intelligence have gained immense popularity. These courses focus on tools like Python, R, and Tableau, equipping candidates with analytical skills.

3. Project Management

Certifications like PMP (Project Management Professional) and Agile/Scrum methodologies help professionals excel in managing complex projects efficiently. Bangalore’s vibrant IT and startup ecosystem creates a demand for certified project managers.

4. Cloud Computing and Cybersecurity

With businesses moving to cloud platforms, certifications in cloud computing (AWS, Azure, Google Cloud) and cybersecurity are crucial for IT professionals. These certifications validate expertise in securing and managing cloud infrastructure.

5. Creative and Design Fields

Bangalore’s growing creative industry offers certification courses in graphic design, UI/UX design, video editing, and animation. These courses help you build a strong portfolio and develop practical skills for the creative domain.

6. Language Proficiency and Communication Skills

Language and communication play a pivotal role in career success. Certification courses in spoken English, business communication, and public speaking are widely popular in Bangalore.

7. Finance and Accounting

For individuals aiming to specialize in finance, certification programs like CFA (Chartered Financial Analyst), CPA (Certified Public Accountant), and short-term courses in investment banking and financial modeling are great options.

8. Human Resource Management

Certifications in HR management, like SHRM or HR Analytics, are ideal for professionals looking to enhance their knowledge in recruitment, performance management, and employee relations.

9. Technology and Software Development

Bangalore’s IT industry thrives on innovation, and certifications in programming languages, software development, and DevOps are highly sought after. Courses in Python, Java, and web development cater to both beginners and experienced professionals.

How to Choose the Best Certification Course?

With numerous options available, selecting the right certification course can be daunting. Here’s how you can choose wisely:

Assess Your Goals: Understand your career aspirations and choose a course that aligns with your objectives.

Check Market Demand: Research the demand for the skills you want to learn and their relevance in the job market.

Accreditation: Ensure the certification is recognized by industry leaders or reputed organizations.

Flexible Learning Options: If you’re a working professional, opt for courses that offer weekend or online classes.

Practical Training: Look for programs that provide hands-on projects and real-world applications.

Trends in Certification Courses

In recent years, the approach to certification courses has evolved significantly. Here's a look at the latest trends:

Blended Learning: A mix of online and offline classes allows learners to balance education with their schedules.

Microlearning Modules: Bite-sized learning content focuses on specific skills, making it easier to absorb information.

Focus on Emerging Technologies: Courses in blockchain, Internet of Things (IoT), and artificial intelligence are gaining traction.

Global Certifications: Many courses now offer global recognition, enabling candidates to explore international opportunities.

Customized Programs: Organizations are increasingly collaborating with training providers to offer customized certification courses for their employees.

Conclusion

Certification courses in Bangalore offer an excellent opportunity to upskill and stay relevant in a fast-changing job market. The city’s vibrant learning ecosystem caters to a diverse range of interests and career paths. Whether you’re a fresher aiming to boost your employability or a professional looking to climb the corporate ladder, there’s a course designed just for you.

Investing in the right certification program not only enhances your knowledge but also demonstrates your commitment to professional growth. Take the leap, explore your options, and let Bangalore be your gateway to success!

0 notes

Text

Top CFA Exam Prep Classes in India – Authorized and Trusted Provider

Achieve your goal of becoming a Chartered Financial Analyst (CFA) with India's only authorized prep provider for the world’s top certifications in accounting and finance. Our CFA exam classes are tailored to ensure you excel in all levels of the exam, providing you with the knowledge and skills needed to succeed in the finance industry.

Why Enroll in Our CFA Exam Prep Classes?

Authorized Training Provider: As India’s first and only authorized prep provider, we offer official study materials and expert-led courses for comprehensive exam preparation.

Expert Instructors: Benefit from the guidance of experienced CFA charterholders and industry professionals who bring practical insights into the classroom.

Complete Coverage of CFA Levels: Our curriculum covers all three levels of the CFA exam, including key topics such as financial analysis, portfolio management, and ethical standards.

Flexible Learning Options: Choose from online and offline classes, with options for regular and fast-track courses to accommodate your learning needs.

Extensive Study Support: Access mock exams, practice questions, and customized study plans to boost your confidence and improve exam performance.

0 notes

Text

Top CFA Online Coaching in India – Unique Global Education

Prepare for the CFA exam with India’s leading online coaching provider, Unique Global Education. Our comprehensive CFA online coaching offers expert guidance, interactive sessions, and flexible learning to help you succeed. Join us for top-tier coaching designed to fit your schedule and ensure your success on exam day!

VISIT US: https://uniqueglobaleducation.com/cfa-online-classes/

0 notes

Text

Types of BCom: Courses in India, After 12th | Zell

Types of BCom: Courses in India, After 12th

After finishing your 12th grade, do you want to pursue a B.Com?

Everything you need to know about the many B.Com course options and which one to choose is provided here.

After completing their 10+12 education, the majority of students enroll for the Bachelor of Commerce degree. The three-year B.Com degree is best suited for students who decided to major in commerce following their 12th grade. There are many other programs available for B.Com. as well, though, so you'll need to know what each sort of school offers specifically in order to select the best one for your future. Here is a summary of the 14 BCom course categories and 4 honors courses that are currently offered.

Popular BCom Courses in India

1. B.Com In Banking and Finance

The difficulties that arise in the banking and financial industry are addressed in this course. This course should be a part of your graduating degree and CFA, also known as the Chartered Financial Analyst course, should be a part of your professional degree if you want to pursue a prominent banking position after finishing your education. You will gain a solid grasp of managing accounts, banking, banking rules, etc. in this course.

Job opportunities:

Accountant

Cashier

Credit Risk Manager

equity Research Analyst

Loan Officer

2. B.Com In Banking and Insurance

As the name implies, there are many similarities between this course and the BCom in Banking and Finance course. Although you will also be prepared for banking employment by this course, the principles you will study will differ significantly from those in Banking and Insurance. You may learn about banking laws, insurance policies, and regulatory requirements here, as well as how to authorize claims.

Job opportunities:

Claims Officer

Financial Advisor

Insurance Manager

Loan Counsellor

Marketing Agent

3. B.Com In Accounting

The BCom in Accounting is a demanding program that covers all accounting topics, including accounting, banking, management, and taxation, for individuals who wish to pursue a career in the industry. After you've grasped these ideas, you can enroll in ACCA to solidify your knowledge and advance to the position of worldwide chartered accountant.

Job opportunities:

Chartered Accountant

Economist

Executive Assistant

Finance Manager

Financial Analyst

Operations Manager

Tax Accountant

4. B.Com in Applied Economics

This course would be ideal for anyone with a strong interest in economics as it enables them to comprehend the fundamental rules and institutions that regulate the economy. Our knowledge of the economy helps us to solve business financial issues in a way that complies with laws and regulations.

Job opportunities:

Business Analyst

Data Analyst

Economics Teacher

Financial Analyst

Investment Banker

Lead Modeller

5. B.Com in Business Administration

Those who wish to enter the management side of the company should take this course. To obtain comprehensive understanding of management ideas and enhance your managerial, decision-making, communication, and practical abilities, you may enroll in this course in addition to the US CMA course. One of the benefits of earning a US CMA degree is the ability to work overseas.

Job opportunities:

Banker

Business Analyst

Exporter

Financial Adviser

Importer

Marketing Manager

Retail Manager

6. B.Com In E-Commerce

E-commerce is a new industry that is becoming more and more well-known every day. This is one of the best BCom degree options in India if you are interested in designing or overseeing online shopping experiences. A combination of academic, technical, and practical learning experiences are included in this course.

Job opportunities:

Accountant

Assistant Manager

Bookkeeper

Business Consultant

Finance Manager

Marketing Manager

7. Other Types of BCom Courses

7. Other Types of BCom Courses

Other than these popular B.Com courses there are other B.Com courses available that open doors to various career prospects. Some of them are –

BCom Marketing

B.Com. in Finance

B.Com. in Computer Applications

B.Com. in Management Studies

B.Com. in Information Technology

B.Com. in Statistics

B.Com. in Supply Chain Management

B.Com. in Tourism and Travel Management

8. Types of BCom. Honours courses

BCom. (Honours) in Accountancy

BCom (Honours) in Accounting and Finance

BCom (Honours) in Economics

BCom (Honours) in Marketing

We hope that with this detailed article on the types of BCom courses in India after 12th grade, you have received an in-depth understanding of the skills you’ll gain and what to expect. If you are interested in joining of any these courses, then pursuing a professional degree will give you the edge you need. To know more about the Chartered Financial Analyst course click on the WhatsApp icon at the side of this blog and get in touch with our experts directly.

FAQs on Bcom

How many types of BCom courses are there?

There are two sorts of BCom courses: BCom General and BCom Honours. There are four BCom honors courses and fourteen BCom regular courses available right now.

Which type of BCom course is the best?

One of the greatest programs for anyone looking to enter the accounting or finance fields is the BCom in Accounts and Finance. This course contributes to a solid foundation in f&a principles.

What is General BCom?

Another name for General BCom is BCom pass. Students can build management, financial, accounting, and banking abilities with this kind of BCom education, which can be further strengthened with professional courses.

Is BCom hard to study?

Luckily, BCom courses are not that hard to study for or clear. But if you are planning to take them along with professional courses, then choosing a coaching institute would be the right choice for you.

Which is the best job after BCom?

If you happen to enter the accounting field after choosing BCom then becoming an ACCA, US CMA or US CPA will bring you tremendous job growth. If in case you wish to get into finance, then becoming Financial Analyst or a Risk Manager would be an ideal option.

0 notes

Text

Finance Courses Online

Types of Finance Courses After 12th

Every Finance aspirant can even choose online finance courses with certificates. There are a variety of finance courses available after the 12th, ranging from undergraduate degrees to professional certifications. Here are some of the most popular options:

Chartered Accountancy (CA): CA is one of the most prestigious and sought-after finance qualifications in India. The CA course is conducted by the Institute of Chartered Accountants of India (ICAI) and is divided into three levels: Foundation, Intermediate, and Final.

Company Secretary (CS): CS is another professional course that deals with corporate governance and legal matters. The CS course is conducted by the Institute of Company Secretaries of India (ICSI) and is divided into three levels: Foundation, Executive, and Professional.

BBA in Finance: BBA in Finance is a three-year undergraduate degree that provides a comprehensive foundation in financial concepts and principles. The BBA in Finance syllabus includes subjects such as accounting, financial management, economics, and investment management.

B.Com: B.Com is a three-year undergraduate degree that focuses on the principles of commerce and accounting. The B.Com syllabus includes subjects such as accounting, economics, business law, and marketing.

Certified Financial Analyst (CFA): CFA is a professional certification that is highly valued by employers in the financial industry. The CFA exam is administered by the CFA Institute and covers a wide range of financial topics, including investment analysis, portfolio management, and financial reporting.

Certified Financial Planner (CFP): A Certified Financial Planner (CFP) is a highly qualified financial professional who helps individuals and families achieve their financial goals. CFPs must complete rigorous education, experience, and ethical requirements before earning their certification. They are also required to complete continuing education courses to maintain their credentials.

#acca classes#acca coaching#economy#accaglobal#entrepreneur#finance#acca course#acca online#marketing#fintram

0 notes

Text

#CFA#CFA Level 1#CFA Level 2#CFA Level 3#CFA Level 1 Pendrive#CFA Level 2 Pendrive#CFA Level 3 Pendrive#FRM#FRM Part 1#FRM Part 2#CA#CA Foundation#CA Inter

0 notes

Text

Icfai Center For Distance and Online Education

In 1984, the ICFAI was established with a vision of empowering quality education in this competitive world. In 1985, the college successfully announced the launch of the CFA course. ICFAI group’s business school IBS has been ranked amongst the top-ranked B-Schools in India. It successfully announced the chain of Indian Business Schools (IBS) in 1995 across India.

0 notes

Text

ICAI Releases Self-Paced Online Modules (SPOM) SET A and SET B on Digital Learning Campus Portal

ICAI ANNOUNCEMENT on 07 MAY 2024

The Board of Studies of the Institute of Chartered Accountants of India (ICAI) has taken a significant leap forward in enhancing the learning experiences of the students with the introduction of Self-Paced Online Modules (SPOM). It provides an enriched and flexible learning experience to our students in alignment with the New Scheme of Education and Training wherein students are required to complete the minimum prescribed 40 learning hours of Self-Paced Online Modules in both SET A: Corporate and Economic Laws and SET B: Strategic Cost & Performance Management as available on the ICAI Digital Learning Campus https://lms.icai.org/login. The students may note the following: -

Students who have registered for the Final Course can only undergo SPOM courses at their own pace, anytime and anywhere.

No separate fee is payable for Self-Paced Online Modules.

Students can monitor their learning journey and track the completion status of SPOM on the dashboard of the ICAI Digital Learning Campus.

After completing the prescribed number of hours of learning students have to appear for the SPOM test to be conducted by the Examination Department. (A separate announcement in this regard will be web-hosted by the Examination Department in due course).

Students may refer to the Examination announcement-https://resource.cdn.icai.org/75658exam61200.pdf for exemption(s) in SPOM.

Students can log in to the ICAI Digital Learning Campus Portal by using the following methods: -

1. Login at https://lms.icai.org/login with OTP (OTP will be received on registered Mobile no. with Self-Service Portal (SSP, ICAI only)

2. Sign in with SSP (Login details)

Important Instructions: -

Students are advised before logging in to read the FAQs carefully. Click here to read the FAQs.

Students must have a Desktop/Laptop with a webcam for undergoing Self-Paced Online Modules.

Students need to have an internet connection with a minimum speed of 2 to 5 Mbps to effectively engage with the topics available on the ICAI Digital Learning Campus.

Students should ensure proper light for face detection since this platform automatically compares the student's face detection with the SSP profile photo.

During Self-Paced Online Module (SPOM) learning, students are advised to remain within the webcam's frame throughout the SPOM duration.

About Smart Learning Destination:

Smart Learning Destination is the top online place in India for getting ready for exams. We provide more than 2000 high-quality video courses and connect you with over 200 excellent professors. We cover various exams like CA| CS| CMA| ACCA| CFA| FRM. You can watch classes online or get them on pen drives and Google Drive giving you the freedom to study at your own pace, whenever and wherever you want.

Benefits:

👉Lowest Price 👉Instant Delivery 👉 Instant Support 👉 Our Professionals Provide Proper Counseling as & when students needed.

✅Your Dream Depends On Your Decision, Decide Now...🤔

👉For more information 🤙Call us Now at 8448072073 /8871374677

👉👉Visit - smartlearningdestination.com

Thank you for choosing Smart Learning Destination as your partner in exam preparation.

Please login to comment

0 notes

Text

Investment management, financial analysis, ethics, and portfolio management are the main topics of the esteemed CFA (Chartered Financial Analyst) program for finance professionals. With its thorough understanding of subjects including economics, financial reporting, and risk management, it equips students for advanced positions in asset management and investment analysis around the world.

#CFA#CFA COURSE#CFA EXAM#CFA FEES#CFA ELIGIBILITY#CFA EXEMPTIONS#CFA CERTIFICATION#cfa salary#CFA JOB

0 notes