#cfa fees in india

Explore tagged Tumblr posts

Text

youtube

CFA Level 1 Fees India

Jumping into the CFA Level 1 journey in India is like diving into the world of financial wisdom. But let's talk about the real deal – the fees. The cost for CFA Level 1 in India varies based on where you're getting your coaching, the study materials, and the exam registration. Cool places like Zell Education are known for giving you the whole package when it comes to CFA Level 1 courses. But it's not just about the money; it's an investment in building a solid foundation for a killer financial career. So, as you waltz into the CFA Level 1 adventure, think about the costs. Consider it a splurge on knowledge and a ticket to a future full of financial know-how and exciting opportunities.

#cfa course in mumbai#cfa coaching fees#cfa cost in india#cfa course fees in india#cfa fees in india#Youtube

0 notes

Text

CFA Exam

The CFA exam is a demanding, multi-level testing procedure intended to evaluate a candidate's proficiency in financial analysis and investment management. There are three tiers to it: Level I emphasizes fundamental understanding and knowledge of financial reporting, ethical norms, and investment instruments. While Level III concentrates on wealth planning and portfolio management, Level II stresses the use of investing tools and concepts in analysis. Candidates must exhibit a deep comprehension of financial concepts at each level, including economics, corporate finance, quantitative methodologies, ethics, equities and fixed income investments, and portfolio management. Level I is provided twice a year, whereas Levels II and III are offered once a year. The tests are administered every year. A crucial prerequisite for becoming a CFA is passing all three levels.

0 notes

Text

CFA Course Full Form

The CFA Institute bestows the internationally recognized professional designation known as Chartered Financial Analyst, or CFA for short. The goal of the CFA program is to offer a thorough education in financial analysis, investment management, and ethical standards. Each of the three exam levels (Level I, II, and III) focuses on a different facet of finance. While Level III focuses on wealth planning and portfolio management, Level II explores asset valuation and financial analysis, while Level I stresses fundamental knowledge and ethical standards. Candidates must fulfill professional experience requirements, pass all three exam levels, and abide by the CFA Institute's Code of Ethics and Standards of Professional Conduct in order to obtain the CFA designation.

#cfa#cfa course#cfa exam#cfa fees#cfa eligibility#cfa exemptions#cfa certification#cfa salary#cfa india

0 notes

Text

#CFA#CFA COURSE#CFA EXAM#CFA FEES#CFA GLOBAL#CFA INDIA#CFA CERTIFICATION#CFA ELIGIBILITY#CFA EXEMPTIONS#CFA SALARY#CFA SYLLABUS

0 notes

Text

Common Mistakes to Avoid When Taking the CFA Exams!

The Chartered Financial Analyst (CFA) exams are renowned for testing conceptual understanding of the financial markets and hold significant importance in the field of investment management. Cracking the exam requires a disciplined and rigorous journey where there is no room for mistakes.

The CFA (Chartered Financial Analyst) exams are a rigorous series of examinations divided into three levels. These exams have varying passing rates and levels of difficulty. Over the past decade, the pass rates for each level of the CFA exams have been as follows: Level I – 41%, Level II – 45%, and Level III – 52%. These pass rates indicate the challenging nature of the exams and the need for thorough preparation and dedication.

While the pass rates may seem challenging, there is hope for candidates through prep providers like 1FIN. While 1FIN offers a pass protection scheme, it is important to note that retaking the CFA exam would still require candidates to pay the registration fee again to the CFA Institute.

To excel in these exams and unlock promising career opportunities, it is crucial to avoid common mistakes that candidates often encounter. This article aims to delve into some of these mistakes and provide valuable insights on how to avoid them, paving the way for success in the CFA exams.

Mistakes to Avoid When Taking the CFA Exams

1. Starting the Preparations Late

Starting late in preparing for the CFA exams can significantly affect a candidate’s performance. Adequate preparation is crucial for success, and failing to begin studying on time can lead to insufficient coverage of the exam syllabus. The CFA Institute recommends 300+ study hours for each exam level, and adhering to these guidelines is essential.

By starting late, candidates may not allocate sufficient time to grasp the complex concepts tested in the exams. This can result in a lack of conceptual clarity, making it challenging to answer questions accurately. Moreover, starting late increases the risk of missing out on important topics, negatively impacting overall exam performance.

Understanding the exam pattern is also crucial. For Level I, independent multiple-choice questions (MCQs) are presented, while Level II and III involve short case studies followed by MCQs and essay-type questions, respectively. Starting late can limit candidates’ ability to effectively tackle these varied question formats, further jeopardizing their chances of success.

To avoid the pitfalls of starting late, candidates should create a study schedule, adhere to recommended study hours, and allocate ample time for concept revision and topic coverage. Beginning the preparation process early allows for a comprehensive understanding of the exam material, increasing the likelihood of success on exam day.

2. Failure to Give Due Weightage to Topics

It is crucial to give each topic its due weight when preparing for the CFA exams. Different topics hold varying levels of importance in the exams, and understanding their weightage can help you prioritize your study efforts effectively.

For example, in Level 1, topics such as Ethics and Financial Statement Analysis (FSA) carry a significant weightage of 15-20% and 11-14%, respectively. Similarly, in Level 3, Portfolio Management & Wealth Planning holds a substantial weightage of 35-40%.

While it’s essential to focus on these high-weightage topics, it is equally important not to neglect other areas. Maintaining a well-rounded understanding of all subjects ensures you have a comprehensive grasp of the exam material and can tackle questions from various areas.

You increase your chances of performing well across the exam sections by allocating appropriate time and emphasis to each topic. So, be mindful of the weightage assigned to different subjects and create a study plan that covers all areas adequately.

3. Not Practicing Enough

In addition to having a solid understanding of the concepts, it is essential to dedicate enough time to practice solving questions when preparing for the CFA exams. The exams not only test your knowledge but also your ability to apply that knowledge effectively.

Many questions in the CFA exams present options that may seem similar at first glance. Through practice, you can sharpen your skills in differentiating between these options and selecting the most appropriate answer. By engaging in regular practice, you become familiar with the types of questions asked and the patterns in which they are presented.

The question formats vary across the exam levels. Level I consists of independent multiple-choice questions (MCQs) that require you to select the correct answer from the options provided. In Level II, you encounter short case studies followed by MCQs, which require you to analyze the given scenario and make informed choices. Level III includes short case studies, essay-type questions, and MCQs.

By incorporating practice questions into your study routine, you can apply your knowledge effectively, improve your time management skills, and gain confidence in tackling different question formats. Practice is a valuable tool in refining your exam-taking strategies and boosting your overall performance.

4. Choosing the Right Exam Prep Guide

When it comes to preparing for the CFA exams, self-study is undeniably important. However, the effectiveness of self-study alone can vary depending on individual learning styles and preferences.

Many candidates find prep courses highly beneficial in their CFA exam journey. These courses offer structured study plans, expert guidance, and additional resources that can complement your self-study efforts.

When choosing a prep provider, evaluating certain factors is crucial.

consider the quality of instructors who can offer valuable insights, clarify concepts, and provide exam guidance.

assess the study notes and materials provided for effective concept comprehension and comprehensive syllabus coverage.

check if the provider offers an online interface for exam practice, simulating the actual exam environment and facilitating time management skills.

Choosing the right prep provider that aligns with your learning style and offers high-quality resources can enhance your preparation and increase your chances of success in the CFA exams.

5. Exam Day Preparation

Preparing for the exam day is crucial to perform your best during the CFA exams. The exams are conducted in a single day, consisting of two sessions, each lasting 2 hours and 12 minutes. To ensure success, it is important to be mentally and physically prepared. Taking sufficient mock exams is essential to build confidence and assess your knowledge. Aim to achieve a target of 70% correct answers in your practice tests, which indicates a solid understanding of the material.

Time management is a critical factor during the exams. Some questions may be more time-consuming than others, so it is important to allocate your time wisely. Avoid spending too much time on a single question and maintain a steady pace throughout the exam. By practicing time management strategies during your mock exams, you can develop the skills to navigate the exam on D-day efficiently.

Overall, thorough preparation, mock exams, target scores, and effective time management will enhance your chances of success on exam day.

Ace Your CFA Exams With The Right Preparation

Achieving success in the CFA exams requires strategic preparation. By starting early, you can allocate sufficient time to study and ensure you cover all the necessary topics. It is important to give due weightage to each topic, focusing on key areas such as Ethics, Financial Statement Analysis (FSA), and Portfolio Management while maintaining a well-rounded understanding of the entire syllabus.

While self-study is important, getting your exam guidance from the right sources is also essential. Taking mock exams, aiming for a target score of 70%, and managing your time effectively will contribute to your overall performance.

1FIN by IndigoLearn, in collaboration with Kaplan Schweser, combines the expertise of both platforms to provide a powerful and comprehensive CFA study solution. With our innovative learning platform and Kaplan Schweser’s renowned study materials, candidates gain access to a robust and effective preparation resource.

Our study package offers comprehensive resources to support your success. It includes video classes, revision sessions, SchweserNotes, SchweserNotes Videos, SchweserPro QBank, Checkpoint Exams, Mock Exams, QuickSheet, Study Plan, and Doubt Resolution Forums, ensuring a well-rounded and effective learning experience.

Ready to unlock the career opportunities that a CFA designation can offer? With our comprehensive guidance and support, you can! Let’s get started today.

Original Source: Common Mistakes to Avoid When Taking the CFA Exams!

#cfa course#cfa course duration#schweser cfa level 1#cfa#cfa exam#cfa course details#cfa level 1#cfa course fees#cfa course syllabus#cfa salary in india#cfa exam fees

0 notes

Text

CFA - The Gold standard in the Investment and Finance Industry

A chartered financial analyst (CFA) is a globally-recognized professional designation given by the CFA institute. A CFA looks into all the finance fields that mainly cover portfolio management, ethics, valuation, and more.

Requirements:

Passing the exam for all three levels is a requirement to obtain the CFA® charter.

You must have at least 4,000 hours of experience, completed in a minimum of 36 months.

To support your membership application, you need 2-3 professional references.

Submit your membership application to CFA® Institute. Once approved, you will earn the letter "CFA" after your name.

Exam Details:

The CFA course syllabus includes a series of three levels of exams; level I, level II, and, level III, with MCQs and essay questions.

Level I exams are held in June and December.

Levels II and III are held only in June.

Only one exam is taken at a time.

The minimum time duration for completing the exams is 1.5 years to the limit of how the candidate clears the levels.

Success Rate: All three exams have a pass rate that is less than 50%.

That means only 1 in 5 will complete this program.

Job Opportunities:

Portfolio managers, consultants, risk managers, Chief Level Executive, research analysts, Corporate Financial Analyst, etc.

Miles Education Provides the best CFA training in India. Also, in an exclusive collaboration with Kaplan Schweser, Miles is now offering the best CFA program study package in India.

0 notes

Text

Study in Singapore Made Easy: Ghum India Ghum Teams Up with Kaplan

Ghum India Ghum, a trusted name in the travel industry for over a decade, is now embarking on an exciting journey into education. The company is collaborating with Singapore's prestigious Kaplan University to bring world-class education closer to Indian, Vietnamese, and Sri Lankan students. This partnership aims to empower students with global opportunities. By merging travel expertise with education, Ghum India Ghum is creating a unique platform for aspiring learners to study in Singapore and achieve their academic dreams.

Why Choose Kaplan University?

Kaplan University is a global leader in education. It offers a wide range of courses tailored to today’s industry needs. Students can benefit from:

Internationally Recognized Degrees: Kaplan provides globally accepted certifications.

Flexible Learning Options: Online and in-person classes make learning accessible.

Industry-Relevant Curriculum: Courses are designed to meet real-world demands.

Whether you want to pursue a degree or upgrade your skills, Kaplan University has something for everyone. It is an ideal choice for students looking to study abroad in Singapore.

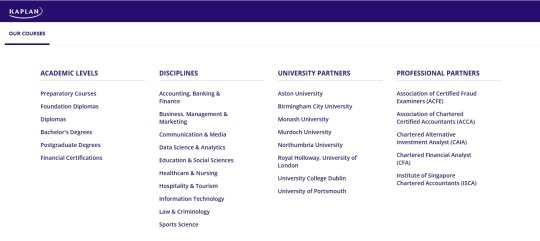

Courses Offered at Kaplan University

Students from India, Vietnam, and Sri Lanka can now access Kaplan’s extensive academic programs. These courses cater to different career stages:

Academic Levels

Preparatory Courses: For students aiming to build foundational knowledge and skills.

Foundation Diplomas: Introductory courses leading to advanced studies.

Diplomas: Specialized qualifications for skill-building and entry into industries.

Bachelor’s Degrees: Undergraduate programs for diverse disciplines.

Postgraduate Degrees: Advanced education for career progression.

Financial Certifications: Industry-recognized credentials in finance.

Disciplines Covered

Accounting, Banking & Finance: Essential for careers in financial management and banking.

Business, Management & Marketing: Focused on leadership, strategy, and market insights.

Communication & Media: Ideal for roles in public relations, journalism, and advertising.

Data Science & Analytics: Equips students with skills in data-driven decision-making.

Education & Social Sciences: For aspiring educators and social service professionals.

Healthcare & Nursing: Prepares students for careers in healthcare management and clinical roles.

Hospitality & Tourism: Targeted at those aiming for leadership in travel and hospitality industries.

Information Technology: Focus on programming, cybersecurity, and IT infrastructure.

Law & Criminology: Foundation for legal careers and understanding criminal justice.

Sports Science: Designed for careers in sports management and fitness.

University Partners

Kaplan University collaborates with renowned universities, ensuring high-quality education:

Aston University

Birmingham City University

Monash University

Murdoch University

Northumbria University

Royal Holloway, University of London

University College Dublin

University of Portsmouth

Professional Partners

Kaplan University also works with esteemed professional organizations to offer certifications:

Association of Certified Fraud Examiners (ACFE)

Association of Chartered Certified Accountants (ACCA)

Chartered Alternative Investment Analyst (CAIA)

Chartered Financial Analyst (CFA)

Institute of Singapore Chartered Accountants (ISCA)

This variety ensures that students can find a program suited to their career goals. For those considering study abroad options, Kaplan University in Singapore offers unparalleled academic and career opportunities.

How Students Can Benefit

Students from India, Vietnam, and Sri Lanka stand to gain significantly from this collaboration:

Global Exposure: Learn from experienced educators and interact with an international student community.

Career Advancement: Kaplan’s courses enhance job prospects and earning potential.

Affordable Education: The partnership aims to offer competitive tuition fees.

Comprehensive Support: Ghum India Ghum provides guidance through the application process.

The Role of Ghum India Ghum

As part of this collaboration, Ghum India Ghum will:

Facilitate admissions to Kaplan University.

Offer expert counseling to students and parents.

Provide travel assistance for students heading to Singapore.

Create customized packages combining education and travel.

This blend of services makes the transition seamless and stress-free. For students aspiring to study abroad in Singapore, Ghum India Ghum ensures a smooth journey.

How to Apply

Interested students can reach out to Ghum India Ghum for detailed guidance. The process includes:

Exploring available courses.

Submitting applications with necessary documents.

Receiving end-to-end support for visa and travel arrangements.

Final Thoughts

Ghum India Ghum’s collaboration with Kaplan University Singapore is a game-changer. It combines the best of travel and education, opening doors for students from India, Vietnam, and Sri Lanka to succeed globally. This initiative aligns with the company’s vision to empower individuals through unique opportunities.

So, take the first step towards a brighter future. Connect with Ghum India Ghum today and explore Kaplan University’s exceptional programs. Whether you’re considering study abroad options or looking to study in Singapore, this partnership offers the perfect platform to achieve your educational goals.

#Study in Singapore#rajasthan tour package#international tour package#travel agency in delhi#jaipur tour package#travel agency in india#himachal tour package#south india tour package#golden triangle package#kerala tour package#varanasi tour package

1 note

·

View note

Text

Post Date:08/11/2024Short Information :Small Industries Development Bank of India (SIDBI) has Recently Invited to the Online Application Form for the Post SIDBI Grade A & Grade B Officer Recruitment 2024.

Small Industries Development Bank of India (SIDBI)

SIDBI Grade A and B Notification 2024 Out

Advt No. 07/Grade A&B/2024-25

Important Dates:

Start Date : 08/11/2024

Last Date : 02/12/2024

Phase I Exam Date : 22/12/2024

Phase II Exam Date : 19/01/2025

Application Fee:

General / OBC / EWS : Rs. 1100/-

SC / ST / PH: Rs. 175/-

You can pay through:

Credit Card

Debit Card

Net Banking

UPI

Age Limit: As on (02/12/2024)

For Grade A Post :

Minimum Age : 21 Years

Maximum Age : 30 Years.

For Grade B Post :

Minimum Age : 25 Years

Maximum Age : 33 Years.

Age Relaxation As per Small Industries Development Bank of India(SIDBI) Grade A & Grade B Recruitment Rules.

Vacancy Details

Total Post : 72 Post

Post Name

Total Post

SIDBI Grade A & B Eligibility

Assistant Manager (Grade A) General

50

Bachelor Degree in Any Stream from Any Recognized University in India with 60% Marks (SC / ST PH 55% Marks) OR CA / CS / CWA / CFA /CMA OR Bachelor Degree in Law LLB with 60% Marks (SC /ST / PH 50% Marks)

2 Experience

More Details Eligibility Details Read the Notification.

Manager (Grade B) General

10

Bachelor Degree in Any Stream from Any Recognized University in India with 60% Marks (SC / ST PH 50% Marks) OR Master Degree in Any Subject with 60% Marks (SC /ST / PH 55% Marks)

5 Experience

Manager (Grade B) Legal

06

Bachelor Degree in Law LLB from Any Recognized University in India with 50% Marks (SC / ST PH 45% Marks)

Enrolled as an Advocate with Bar Council of India

5 Year Work Experience.

More Details Eligibility Details Read the Notification.

Manager (Grade B) Information Technology IT

06

Bachelor Degree in Engineering (Computer Science/ Computer Technology/ Information Technology/ Electronics/ Electronics & Communications) from Any Recognized University in India with 60% Marks (SC / ST PH 55% Marks)

5 Experience

SIDBI Bank A B Officer Grade Selection Process:

Written Exam(Phase-I & Phase-II )

Interview

Document Verification

Medical Examination

SIDBI Bank A B Officer Grade Documents Required :

Candidates Photograph

Candidates signature

Marksheet

Valid Email ID & Mobile No.

SIDBI Bank A B Officer Grade Salary:

Name of the PostSalary (per month)SIDBI Bank A B Officer GradeRs. 100000/- per month Approx.

How To Apply : SIDBI Bank A B Officer Grade

More

0 notes

Text

Choosing the Right SEBI-Registered Stock Advisor for Your Investment Journey

Investing can be both exciting and risky. While the risk of high returns comes with the risk of loss, making rational decisions important for investors. One way to overcome this difficult situation is to seek the help of a SEBI-registered investment adviser. These transactions are regulated by the Securities and Exchange Board of India (SEBI), to ensure compliance with stringent guidelines designed to protect investors. But with so many consulting services available, choosing the right one can be difficult. Here is a detailed guide to help you choose the best SEBI-registered stock advisor for your investment journey.

To understand the Role of Stock Advisor

Before diving into the selection process, it’s important to understand what a stock advisor is. These professionals provide insights, recommendations and strategies based on market research and analysis. They help investors make informed decisions about buying, holding, or selling stocks. It is also the responsibility of SEBI-registered advisors to act in the best interests of their clients, which is more advantageous than non-regulated advisors.

Key Factors to Consider

1. Check SEBI registration

The first step in choosing a stock advisor is to ensure that they are registered with SEBI. This registration assures that the adviser is in compliance with the regulatory framework established to protect investors. You can check their registration on the official SEBI website. Find the advisor’s registration number and confirm that it is valid.

2. Review Credentials and Experience

Check the qualifications and experience of the consultants. A good stock advisor should have the appropriate credentials, such as Chartered Financial Analyst (CFA) or Financial Risk Manager (FRM). In addition, consider the years of service. A consultant with a strong track record and experience navigating market cycles can provide excellent guidance.

3. Evaluate Investment Philosophies and Strategies

Different advisors have different investment philosophies and approaches. Some focus on short-term trading, while others emphasize long-term investments. Before choosing an advisor, make sure the investment strategy matches your financial goals and risk tolerance. Ask them to explain their investment strategies and how they adapt to changing market conditions.

4. Understand Fee Structures

Fees for stock advisory services can vary widely. Some advisors charge a flat fee, while others charge a percentage of your return on investment. It is important to understand how the advisor charges for their services and whether their fee structure is you whether budget meets your expectations. Transparency is the hallmark of a reputable advisor.

5. Look for Customer Testimonials and Reviews

Seek customer testimonials and reviews before making a decision. These can provide valuable insight into an adviser’s credibility, responsiveness, and overall client satisfaction. You can find reviews on the advisor’s website, social media platforms, or independent investment forums. However, beware of overly positive reviews that may not reflect reality.

6. Explore Communication Strategies

Effective communication is critical to a successful advisor-client relationship. Pay close attention to how the mentor communicates in your first contact. Do they answer your questions? Are concepts explained in a way that you can understand? A good advisor should be willing to teach you about the investment process and give you regular updates on how your fund is performing.

7. Check Technology and Equipment

In today’s digital age, the tools and technologies an advisor uses can greatly affect your investment experience. Ask about platforms for research, analysis and portfolio management. Advanced tools can provide better insights and improve decision-making. A tech-savvy consultant can provide features such as real-time updates, performance management and personalized reporting.

8. Discuss Risk Management Practices

Every investment comes with risk, and it is important to understand how your advisors manage these risks. Ask them about their risk management strategies and how they deal with market fluctuations. A trusted advisor should have a well-defined risk management strategy that protects your investment by looking for growth opportunities.

9. Consider Personal Compatibility

Finally, consider your own interaction with the mentor. Strong working relationships are built on trust and understanding. You should feel comfortable discussing your financial goals, concerns and financial aspirations with your advisor. Trust your intuition — if something doesn’t feel right in your communication, it can be a sign to explore other options.

Conclusion

Choosing a qualified SEBI-registered stock advisor is an important step in your investment journey. By taking the time to analyze their credentials, strategies, payment plans, and communication channels, you can make informed decisions that align with your financial goals Remember that investing is a long-term business, and the right mentor can make a big difference to your success. Take the time to research and find an advisor that meets your needs, and you’ll be well on your way to your financial goals.

#best stock market advisor#best trading advisory services#stock market advisory#top micro cap stocks#stock market advisory services

0 notes

Text

Expert Tips: Choosing the Best Mutual Fund Advisor in India for 2024

Choosing the right mutual fund advisor can feel like navigating a maze. With so many options and investment strategies, how do you find the best fit for you? In 2024, as financial markets evolve, selecting the best mutual fund advisor in India is crucial for maximizing returns and securing your financial future. In this article, we’ll guide you step by step on how to choose the perfect advisor, with some insider tips that will simplify your decision-making process.

1. Why Do You Need a Mutual Fund Advisor?

Have you ever wondered why so many individuals rely on mutual fund advisors? Simply said, investing in mutual funds is not a one-size-fits-all approach. You need someone with experienced knowledge to help you navigate the various possibilities, identify risks, and make investments that correspond with your financial objectives. A qualified advisor can assist you in increasing your wealth while keeping your portfolio balanced, even during periods of market turbulence.

2. The Role of Mutual Fund Advisors

A mutual fund advisor serves as your financial counselor. Their duty entails more than just selecting funds; they also educate you on market trends, set realistic goals, and develop a long-term investing strategy. Consider them a GPS for your financial journey—they direct you to your objective while avoiding unneeded dangers.

3. How to Find the Best Mutual Fund Advisor

So, how can you choose the greatest mutual fund advisor in India? Begin by checking their track record. Do they constantly deliver results? Take a look at their clientele—are they satisfied with the service? Do not be hesitant to ask for referrals or look for reviews online. A dependable counsel will have a strong reputation based on trust and shown success.

4. What credentials should a good advisor possess?

When it comes to picking an advisor, qualifications are important. Look for certificates such as Certified Financial Planner (CFP) and Chartered Financial Analyst (CFA). These credentials demonstrate that the advisor has undertaken extensive training and meets industry requirements. Consider the following question: "Would you trust your health with an uncertified doctor?" The same logic applies to your financial situation.

5. Experience: Why It's Important

You would not hire an inexperienced doctor to conduct surgery, right? Similarly, you should not trust your money to an inexperienced advisor. Advisors with extensive experience managing various market cycles will understand how to alter plans in both bullish and bearish markets. Their knowledge can mean the difference between high returns and low performance.

6. Evaluate the Fee Structure

When choosing the best mutual fund advisor in India, it is critical to understand how they are compensated. Are they fee or commission-based? Fee-based advisors charge a flat amount or a percentage of assets, whereas commission-based advisors are compensated based on the items sold. Fee-based advisors are more objective because their income is not dependent on certain investment items.

7. Understanding Their Investment Philosophy.

Is your advisor's investment strategy consistent with your financial goals? Some advisors may emphasize aggressive growth methods, while others may emphasize risk management and capital protection. It's critical to understand how your advisor intends to increase your money and whether their strategy aligns with your risk tolerance.

8. Client Testimonial and Reviews

When it comes to picking an advisor, word of mouth may be an extremely effective weapon. Look up internet reviews and testimonials, or ask the advisor for references. Client satisfaction is a reliable indicator of service quality. However, avoid too glowing or negative reviews; instead, look for balanced, real criticism.

9. Availability and Communication Skills

An advisor should be easy to contact and responsive to your requirements. How frequently will they send you updates on your investments? Do they take the time to explain complex financial topics in terms you can understand? Communication is essential for a good advisor-client relationship. You want someone who will listen, answer your inquiries, and keep you informed.

10. Customization: Tailoring to Your Needs.

Your financial situation is unique, so why settle for generic advice? A smart mutual fund advisor will tailor strategies to your financial objectives, risk tolerance, and time horizon. Whether you're saving for retirement, your child's education, or simply seeking growth, your advisor should provide individualized advice.

11. Technology Integration in Financial Advice

In today's digital environment, financial planning relies heavily on technology. Is your adviser using current tools to track and manage your investments? Technology can increase transparency and provide real-time data on your portfolio's performance. Advisors who use technology can provide a more complete picture of your financial health.

12. Regulatory Compliance and Trustworthiness.

Before choosing an advisor, ensure that they are compliant with India's financial regulations. Advisors should be registered with SEBI (the Securities and Exchange Board of India), which ensures that they act legally and ethically. Trustworthiness is synonymous with regulation. Be skeptical of gurus who offer assured returns; remember that all investments have risks.

13. Comparison of Multiple Advisors: Key Questions

It's a good idea to consult with several consultants before making a decision. Inquire about their investing methods, pricing structure, and historical performance. Face-to-face contact can also help you understand their communication style and personality. Don't rush through the process; choosing the proper advisor is worth the time and effort.

14. Red Flags to Avoid

Not every advisor has your best interests at heart. Watch out for red signals including high-pressure sales tactics, a lack of openness, or a refusal to explain fees. If something feels odd during your encounters, you can walk away and consider choices.

15. Final thoughts on selecting the right advisor

In the end, choosing the best mutual fund advisor in India comes down to finding someone you can trust with your financial destiny. They should have the necessary credentials, expertise, and communication abilities to help you achieve your goals. Remember that a competent advisor is like a financial partner: they succeed when you do

#MutualFund#fundvisor#mutualfund#mutualfundsahihai#onlinefundtransfer#mutualfunds#equity#investmentstrategies#investingmoney#investmentopportunity#investment#financial#financialeducation#investorlife#rightinvestment#financialfreedom#assets#invest

0 notes

Text

youtube

Online CFA Course

Embark on an exciting journey through the world of finance with our Online CFA Course. This isn't your average finance class; it's a dynamic adventure into investment analysis, portfolio management, and ethical finance practices. Explore interactive lessons that are both challenging and enlightening, guided by experienced experts in the field. Navigate complex topics with confidence, learning the ins and outs of financial modeling and decision-making. Connect with fellow learners worldwide, building friendships as strong as a ship's hull. Set sail toward a horizon filled with career opportunities and financial prosperity. With our Online CFA Course, you'll discover the fascinating world of finance in a way that's engaging, informative, and thoroughly enjoyable.

#cfa in mumbai#cfa classes in mumbai fees#best cfa level 2 coaching in india#cfa coaching online india#classes for cfa#Youtube

0 notes

Text

CFA Global

The global network of experts, resources, and organizations connected to the CFA Institute—the regulatory organization that oversees the CFA program—is referred to as CFA Global. With offices in more than 160 nations, the CFA Institute is a worldwide organization that grants the CFA certification to those who fulfill the demanding requirements for training, testing, and work experience. Over 200,000 charterholders, financial professionals, and business executives make up CFA Global's sizable community, all of whom are dedicated to the highest levels of professionalism and ethics in the financial industry. The CFA program's worldwide reach guarantees that the credential is respected and acknowledged internationally, providing chances for career progression in a variety of fields like risk management, corporate finance, and investment management.

0 notes

Text

CFA Course Details

The extensive curriculum of the Chartered Financial Analyst (CFA) course is designed to give finance professionals the essential abilities in portfolio management and investment analysis. Each of the three exam levels in the program focuses on a distinct facet of finance, such as fixed income analysis, equity investments, financial reporting, and ethical standards. Applicants must have a bachelor's degree or comparable work experience in order to enroll. A thorough understanding of international financial markets and investing methods is emphasized in the course. By preparing students for advanced positions in investment banking, asset management, and financial consulting, the CFA program, which is dedicated to ethical practice, greatly expands their employment options and boosts their professional credibility.

0 notes

Text

#FRM#CFA VS FRM#FRM COURSE#FRM GLOBAL#FRM INDIA#FRM EXAM#FRM FEES#FRM ELIGIBILITY#FRM EXEMPTIONS#FRM CERTIFICATION#FRM JOB#FRM SALARY

0 notes

Text

Unlocking Financial Excellence: Why the CFA Course is Your Gateway to a Thriving Career in Finance

Introduction

In today’s competitive financial landscape, standing out from the crowd is more crucial than ever. The Chartered Financial Analyst (CFA) designation has become synonymous with excellence, expertise, and integrity in the finance industry. Whether you’re a recent graduate, an aspiring financial analyst, or a seasoned professional looking to advance your career, the CFA course offers unparalleled opportunities for growth and success. Let’s delve into why the CFA course should be your next career move and how it can transform your professional trajectory.

The CFA Designation: A Mark of Distinction

The CFA designation is globally recognized as the gold standard in finance and investment management. Earning this credential demonstrates a deep understanding of complex financial concepts, ethical standards, and analytical skills. It’s a testament to your dedication, discipline, and commitment to maintaining the highest professional standards.

Comprehensive Curriculum

The CFA program’s rigorous curriculum covers a broad spectrum of financial topics, including:

Ethical and Professional Standards: Ensuring you adhere to the highest ethical guidelines in all financial dealings.

Quantitative Methods: Equipping you with the skills to analyze and interpret financial data.

Economics: Understanding the impact of economic conditions on financial markets and investment decisions.

Financial Reporting and Analysis: Developing proficiency in evaluating financial statements and reports.

Corporate Finance: Learning the intricacies of corporate funding and capital structure.

Equity Investments: Mastering the art of valuing and analyzing stocks.

Fixed Income: Gaining insights into bonds and other fixed-income securities.

Derivatives: Understanding the complexities of options, futures, and other derivative instruments.

Alternative Investments: Exploring investment opportunities beyond traditional asset classes.

Portfolio Management and Wealth Planning: Crafting investment strategies to optimize returns while managing risk.

Career Advancement

The CFA designation opens doors to a wide range of career opportunities in finance. Employers across the globe seek CFA charterholders for their in-depth knowledge and analytical prowess. Whether you aspire to be a portfolio manager, investment banker, financial consultant, or research analyst, the CFA credential significantly enhances your employability and earning potential.

Networking and Professional Growth

Becoming a CFA charterholder grants you access to an elite network of finance professionals. The CFA Institute offers numerous events, workshops, and conferences where you can connect with industry leaders, share knowledge, and stay updated on the latest financial trends. This network can be invaluable for career growth, mentorship, and job opportunities.

Commitment to Ethics

One of the cornerstones of the CFA program is its unwavering focus on ethics and professional conduct. As a CFA charterholder, you are expected to uphold the highest ethical standards in all your professional dealings. This commitment to integrity not only enhances your reputation but also fosters trust with clients and employers.

Global Recognition

The CFA designation is recognized and respected worldwide. Whether you’re working in North America, Europe, Asia, or any other part of the globe, the CFA credential signifies a high level of expertise and professionalism. This global recognition can open up international career opportunities and facilitate cross-border professional mobility.

Conclusion

Embarking on the CFA journey is a challenging yet immensely rewarding endeavor. The knowledge, skills, and ethical grounding you gain through the CFA program can propel your career to new heights. If you’re passionate about finance and committed to achieving excellence, the CFA course is your gateway to a thriving and impactful career in the financial industry. Invest in your future today by enrolling in the CFA program and take the first step towards becoming a distinguished finance professional.

Original Source: cfa course duration

#cfa course#cfa course duration#cfa#cfa exam#cfa course details#cfa course fees#cfa course syllabus#cfa salary in india#cfa exam fees#cfa salary#cfa institute#cfa level 2#cfa syllabus

0 notes

Text

The Requirements and Benefits of Earning the Chartered Financial Analyst Designation

The Chartered Financial Analyst (CFA) is a globally recognized professional designation for finance and investment professionals. The CFA program, administered by the CFA Institute, is a rigorous and demanding program that tests a candidate's knowledge and skills in investment decision-making. To earn the CFA charter, candidates must pass three levels of exams and meet certain work experience and ethical requirements. In this article, we will discuss the criteria for taking the CFA exam and the benefits of earning the CFA charter.

To be eligible to take the CFA exam, candidates must meet the following criteria set by the CFA Institute:

A bachelor's degree or equivalent (e.g. four years of work experience in the investment decision-making process)

A passing score on the CFA Program entrance exam

A professional reference from a CFA or other qualified professional

Agreement to abide by the CFA Institute Code of Ethics and Standards of Professional Conduct

Payment of the exam registration fee.

It is important to note that some countries have additional requirements or restrictions, so it is recommended to check the CFA Institute website for more information or contact them directly.

The CFA duration is a challenging and rigorous test that is divided into three levels. Each level of the exam covers a different set of topics and is designed to test a candidate's knowledge and skills in investment decision-making. The exams are given twice a year, in June and December, and are administered in a computer-based format. The exams are multiple-choice and consist of questions that test a candidate's knowledge of ethical and professional standards, investment tools, and portfolio management.

The CFA program also has an experience requirement for earning the charter. Candidates must have at least 4,000 hours of qualified work experience in investment decision-making, or in a job directly related to the investment decision-making process, before earning the charter.

Earning the CFA charter is a significant accomplishment that is highly valued by employers in the finance and investment industry. The CFA charter is recognized as a global symbol of excellence and professional achievement. The CFA program's curriculum is designed to provide a broad range of knowledge and skills that are essential for investment professionals. It covers topics such as ethics, financial statement analysis, portfolio management, and financial markets. The CFA charter is widely recognized as a benchmark of professional excellence and is highly valued by employers in the finance and investment industry.

In addition to being highly valued by employers, the CFA charter also provides many other benefits to its holders. CFA charter holders have access to a wide range of resources and networking opportunities through the CFA Institute and its local societies. They also have access to exclusive job postings and career development resources. The CFA Institute also provides a range of continuing education and professional development opportunities to help its members stay current with the latest developments in the investment industry.

In conclusion, the CFA program is a rigorous and demanding program that is designed to test a candidate's knowledge and skills in investment decision-making. The CFA charter is a globally recognized professional designation that is highly valued by employers in the finance and investment industry. Earning the CFA charter provides many benefits, including access to resources, networking opportunities, and career development resources. If you are considering a career in finance and investment, earning the CFA charter is a highly recommended step toward achieving professional success.

Now, if you are looking for a reliable and experienced institute to guide you in your journey, Miles Education is a great option to consider. They have a team of experienced professionals who have a deep understanding of the CFA program, and they have a proven track record of helping students successfully pass the CFA exam.

0 notes