#cash on demand (1961)

Explore tagged Tumblr posts

Text

Christmas Classics: Cash on Demand (1961)

Cash on Demand is "A Christmas Carol" heist film from the early 60s starring Peter Cushing. It's really full of Christmas spirit - albeit in a crime/thriller story - in both setting and themes.

It runs on the devilish charisma of Andre Morrell, as a career bank robber, and the serious sweat and stammering of Peter Cushing, who plays a stern Bank Manager who finds himself forced to aid in the theft of his own bank.

It's well written and well performed and it all wraps up in a satisfactory way. I could have easily watched another hour of these actors playing off each other, it's just great.

This year I'm discovering some pretty cool underrated Christmas classics.

#christmas classics#christmas movies#cash on demand 1961#peter cushing#andre morell#british films#christmas#a christmas carol

32 notes

·

View notes

Text

I was told I should post this for any Cash on Demand fans out there (I know we are few).

For the majority of you who aren't familiar, it's a weird take on A Christmas Carol where a suave bank robber walks into a bank and basically terrorizes the stuffy (usually unflappable) manager by kidnapping his family and forcing him to help rob the bank. Doesn't sound much like A Christmas Carol? That's what I thought! Then I watched the movie and sure enough, there are some very similar themes.

It's also just a very fun, tense, well-contained movie that has a pair of fantastic actors set opposite on another. Morell and Cushing do exactly what their roles call for and more. It's just a delight.

#harry fordyce#gore hepburn#pearson#peter cushing#andre morell#the slap heard round the world but somehow not by the rest of the bank#cash on demand (1961)

8 notes

·

View notes

Text

Peter Cushing -- Cash On Demand (1961)

I HIGHLY recommend this film. So well done.

Plot -- Think: Scrooge gets robbed and learns what an asshole he's been.

Seriously, enough cannot be said about Cushing's superb talent.

When someone called him the new Olivier, it's very true. The man is an EXCELLENT actor. He really can play anything. Modern, period, hero, villain. He easily transforms into any role.

Fordyce is a stodgy, uptight asshole of a boss, that any employee wish gets his comeuppance. Quick to judge, and harshly, no empathy or forgiveness.

SPOILERS

His only care is truly his family and that is the one truth about him.

Cushing is able to portray it all. You despise him in the beginning, and slowly begin to feel this man's awful predicament. Then having to rely on the good nature, forgiveness and generosity of the employees he treated poorly.

Chef's kiss.

Watching Peter slowly change from one emotion to the next, making this character human and you sympathize with him in the end - admitting that he has no one, no friends -- only his wife and child. So desperate at losing the only thing he has -- because of money.

Something he was willing to fire an employee earlier for a TINY amount of a mistake.

He's been duped on so many levels and the possibility of being on the hook for it all with the police.

Peter literally takes his character through a gambit of emotions.

Rude, unforgiving, cruel, pathetic, desperate, fear, anger, anxious, despair, worry, self loathing and road to redemption. You believe him every step of the way. Such a great actor.

I love how he has a way with props. Christopher Lee jokingly said he (Cushing) is the only actor he knows that can light a pipe, read the paper, sip his whiskey and recite his lines all at the same time.

As I said before, everything he does in character has meaning. It really is mesmerizing to watch him.

They should use Cushing as an example in acting classes.

Great cast all around. Really wonderful film.

Showcasing my fav old Hollywood actor just how underrated he has always been perceived throughout his career and that Hammer could occasionally put out a really well done non-horror film.

#peter cushing#cash on demand#1961#hammer films#film noir#this man's close ups how is his skin so damn smooth?#damnit I want his skin routine

47 notes

·

View notes

Text

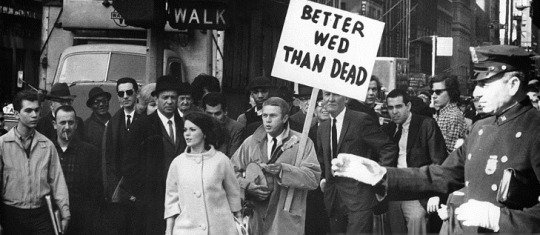

I watched this again after many years and had a revelation. These two kids have the same exact energy and mannerisms as Peter Cushing and André Morell in their respective roles in Cash On Demand:

youtube

#cash on demand (1961)#peter cushing#andre morell#meow choir#internet memes#Youtube#The blonde kid looks vaguely distressed and the brown haired kid has this impish smirk#and looks like he’s trying to make the blonde kid crack up but the blonde kid won’t even look at him#It’s great 😂

4 notes

·

View notes

Text

1 note

·

View note

Text

Quentin Lawrence’s “Cash On Demand” December 20, 1961.

1 note

·

View note

Text

I don't know where to find any good ones but by jove I'm gonna make some now.

When I have the time.

Does anyone know where I can find gifs of Cash on Demand? I've found the lovely screencaps from lovely people, but only two gifs that were on a review post. If possible, I'd like to collect a few more of those, too, if they exist. ❤️

40 notes

·

View notes

Text

Favorite films discovered in 2024

This year, I focused more on rewatching films I hadn't seen in a long time rather than racking up new titles. However, I still encountered plenty of new faves, many of them movies that have been on my watchlist for years. Here are the top twenty.

But first, some interesting patterns in this year's list...

Most represented decade: 1960s

Earliest film represented: 1932

Newest film represented: 1999

Creatives who show up more than once: Robert Mulligan, Walter Matthau, Boris Karloff

The Window (dir. Ted Tetzlaff, 1949)

A young boy (Bobby Driscoll) living in a squalid NYC apartment building witnesses his neighbors (Paul Stewart and Ruth Roman) committing a murder. Unfortunately, the kid's penchant for tall tales prevent anyone from believing him-- except for the killers, eager to alleviate themselves of an inconvenient witness.

Precious few thrillers earn the moniker “Hitchcockian” as well as this intense little gem from RKO. The Hitchcock vibes make sense when you consider Hitchcock’s cinematographer from Notorious was in the director’s chair and the source material was written by Cornell Woolrich, also responsible for the short story behind Rear Window. Augmented by on-location photography of New York City and a grimy, desolate sense of urban decay, The Window is both a great suspense yarn and classic film noir. Despite having a kid for a lead character, the film pulls no punches: both its small-time crook villains and the city setting feel palpably dangerous.

My Neighbors the Yamadas (dir. Isao Takahata, 1999)

The Yamadas, an average middle-class Japanese family, navigate the perils of sharing a television set, a kid going missing during a shopping trip, awkward wedding speeches, and other misadventures.

Between the original Studio Ghibli directorial duo of Hayao Miyazaki and Isao Takahata, Miyazaki will always be the more popular filmmaker, but I think Takahata’s films are more intellectually and emotionally rewarding. This is not meant as a hit on Miyazaki’s undeniable greatness, but Takahata’s movies are far more challenging. That being said, My Neighbors the Yamadas is a lighter entry in his filmography, a slice of life comedy about the eponymous family and their shenanigans in modern Japan. However, beneath the whimsical humor runs an undercurrent of melancholy, an awareness of the transience of life in both its lovely and absurd moments. To date, it gets my vote for the most underrated Ghibli film.

A New Leaf (dir. Elaine May, 1971)

After squandering his ample inheritance, a middle-aged New York layabout (Walter Matthau) decides to marry an eccentric botanist (Elaine May) for her money then murder her ASAP.

Elaine May only directed a few films, but the two I’ve seen—this and the long-maligned Ishtar—were a lot of fun. A New Leaf is the better film though, far more focused and consistently funny. I don't usually belly laugh when watching a movie at home alone, but I did several times here. Even just thinking about some of the things that happen in this film can make me start laughing again. I understand the existing version was not May’s preferred cut and she felt it was butchered by the studio. Even so, this is a great movie regardless of that and one I really want to rewatch soon.

Cash on Demand (dir. Quentin Lawrence, 1961)

Uptight, unpleasant bank manager Harry Fordyce (Peter Cushing) is the boss from hell to his employees, but to criminal extraordinaire Gore Hepburn (Andre Morrel), he's the key to a successful heist. Posing as an insurance representative to get access to Fordyce's office, Hepburn tells the manager he's holding his wife and child, whose lives will be forfeit if he doesn't help him relieve the bank of ninety thousand pounds.

Ho, ho, ho, guess who's got a new Christmas classic to enjoy every year? Cash on Demand is not only a strangely enervating riff on A Christmas Carol's basic set-up (a miserable man is spiritually redeemed through an encounter with ghosts-- or in this case, bank robbers), but it's one of the best, tightest one-location thrillers I have ever seen. I genuinely had no idea where the story was going and found myself in absolute agony as the noose grew tighter around our protagonist's neck. It's a testament to both the writing and Peter Cushing's detailed, very human performance that this film is the emotionally powerful piece of work that it is, and not just a fun, clockwork heist yarn.

Letter from an Unknown Woman (dir. Max Ophuls, 1948)

While trying to evade a duel, an aging playboy (Louis Jordan) receives a letter from a dying woman (Joan Fontaine) who claims he was the love of her life. The letter recounts the details of their love affair, which was the centerpiece of this woman's life and only a mere erotic interlude in his.

The best way to describe this movie is lush romantic melodrama married to a bitter, emotionally brutal tale of a life wasted. The movie is heartbreaking but beautifully shot and performed. I’m not always the biggest fan of Fontaine, but she is fantastic here. Also, I need to watch more Max Ophuls.

Sudden Fear (dir. David Miller, 1952)

A middle-aged playwright (Joan Crawford) thinks she’s found love with a would-be matinee idol (Jack Palance)—instead she realizes she’s being targeted by her new hubby, who only wants her wealth. But he mistakes her emotional vulnerability for a lack of discernment—and a lack of desire to get even.

I like my women-in-peril thrillers when they feature clever heroines driven to survive whatever nightmare their antagonists throw at them and Sudden Fear is amazing in this regard. I know everyone loves Joan Crawford best in Mildred Pierce, but I was floored by her performance here, especially in the dialogue-free scenes. There are campy moments (which I adore), but the story is emotionally compelling and I not only wanted Joan's character to survive, but to thrive post-shitty marriage.

Thieves Like Us (dir. Robert Altman, 1974)

Young lovers Bowie (Keith Carradine) and Keechie (Shelley Duvall) yearn for a white picket fence, a quiet porch, and a case of Cokes (probably because that's all they drink in this film). Too bad Bowie is an escaped convict tied up with bank robbers. Too bad it's the Great Depression. At least there's plenty Coke. Want a Coke?

Most films set in the past do not as painstakingly recreate bygone worlds as strongly as Thieves Like Us. Set in Depression era Mississippi, this film captures the harsh, bleak reality and romantic, consumerist fantasies of its star-cross’d leads, played with sensuous naivete by Keith Carradine and the late, great Shelley Duvall. This is more than just yet another Bonnie and Clyde riff—it’s a tragedy about the elusive American Dream, with snippets of radio music, programs, and ads acting as a Greek chorus in a truly inspired touch. Robert Altman can be an acquired taste, but this is easily my favorite of his films to date.

Targets (dir. Peter Bogdanovich, 1968)

The paths of an aging horror star (Boris Karloff) and a psychotic mass shooter (Tim O'Kelly) cross at a drive-in theater.

Targets was not what I expected: it's a threeway character study between the disheartened horror star, the psychotic shooter, and 1960s America itself. To be honest, you could remake this movie now with a former ‘80s slasher star making the same musings and it would still seem credible—but then of course, you wouldn’t have Karloff in one of the best performances of his career. Targets is rendered even more chilling by its docudrama style. The violence shown isn’t sensationalistic, but presented in clinical detail, making it feel more authentic. Gorier films haven’t frightened me as much as this slow-burn character study.

Losing Ground (dir. Kathleen Collins, 1982)

Despite finding pleasure in research and theory, philosophy professor Sara Rogers (Seret Scott) envies the escatic nature of her painter husband, Victor (Bill Gunn). Their difference in temperaments and Victor's adulterous straying also strain the marriage. However, once Sara takes a job performing a sensuous, emotional role in a student film to get in touch with her own artistic side, Victor grows suspicious and jealous in turn.

Losing Ground was sold to me as a film about a crumbling marriage, but it's more than that. It might be more accurate to call it a portrait of self-discovery, a woman extending beyond her comfort zone to live more fully. I found myself strongly relating to Sara-- like her, I have a creative side I've often been timid to share, being more comfortable with the mind than the body. Being an independent film, it eschews the Hollywood histrionics and melodrama that would normally accompany this subject matter and it's paced perfectly at 90 minutes. Though filmed in the early '80s, the film only played the film festival circuit and never enjoyed a proper theatrical release. Only in 2015 was it rediscovered and then released on home video. The director Kathleen Collins died young, but this film stands a testament to her passion and talent.

Cactus Flower (dir. Gene Saks, 1969)

A middle-aged dentist (Walter Matthau) who poses as a married man to fend off romantic commitment decides to buckle down and wed his much younger girlfriend (Goldie Hawn, looking like a mod Tinker Bell). However, when she insists on speaking with his made-up wife, he recruits his no-nonsense nurse (Ingrid Bergman) into the charade.

Cactus Flower is what I often call a transitional film: released in the late ‘60s, it has one foot in the classical style of Old Hollywood and another in the more liberated counterculture that was shooting out hits like Easy Rider and The Graduate. Directed with unexciting competence by Gene Saks, Cactus Flower’s success largely comes from Ingrid Bergman, Goldie Hawn, and Jack Weston. Bergman I could watch in anything, so I’m biased perhaps, but she walks the fine line between funny and touching as the lonely woman who finds emotional liberation through her roleplaying. The scene where she gets groovy on the dance floor is a highlight of her entire screen career and no, I AM NOT KIDDING.

The Black Room (dir. Roy William Neill, 1935)

Two aristocratic brothers (both Boris Karloff) are at odds over the love of a young woman (Marian Marsh) and an ancient prophecy forecasting the end of their bloodline.

Boris Karloff dives into a double role in this deliciously gothic melodrama. Columbia pulled out all the stops for this one: it drips with sumptuous set design and expressionistic lighting. I was particularly taken by this film’s slightly tongue-in-cheek approach to a more 18th century mode of gothic terror. It goes for full-blooded melodrama with its innocent maidens, secret dungeons, lecherous villain, and ancient curses. It’s as close to a 1930s Castle of Otranto adaptation as we’ve got and by God, I'm grateful for its existence.

Freud: The Secret Passion (dir. John Huston, 1962)

In the late 1880s, young psychiatrist Sigmund Freud (Montgomery Clift) probes into the inner lives of his "hysterical" patients to discover the roots of their mental illnesses. However, these journeys into the subconscious worlds of others bring him into uncomfortable contact with his own demons.

Listening to a podcast episode on John Houston’s Key Largo led me to works of his I hadn’t heard of, such as Freud. I was initially skeptical it could be good. Biopics are my least favorite genre, but this film isn’t so much a biopic as a psychological drama in which Freud is the protagonist and some of his ideas are illustrated through his interactions with the other characters. Instead of wasting time being some melodrama ABOUT Freud the man (the route most biopics go regarding their subjects), it’s about his theories and philosophy, which is a far more interesting approach. The result is a probing, intellectual work. I’m not sure how close Montgomery Clift’s characterization is to the real Freud, but the real star of the show is Houston’s direction, a resurrection of German expressionist aesthetics blended with stark realism.

Paris is Burning (dir. Jennie Livingston, 1990)

This documentary covers 1980s NYC ball culture, where Black and Latino members of the LGBT+ community vogue and perform.

Documentaries are not usually my thing, but Paris is Burning was a longtime resident of my watchlist and I am glad I finally got around to seeing it. It has a time capsule quality, capturing a long-vanished 1980s New York City and the LGBT+ community living there at the time. Obviously, there is a lot of meditation on gender identity, sexuality, and the importance of community in a world hostile to your very existence, but I was also interested by the film's presentation of the materialism and consumption of the Reagan era.

Candyman (dir. Bernard Rose, 1992)

A graduate student (Virginia Madsen) studying urban myths unwittingly summons the Candyman (Tony Todd), the hook-handed ghost of a Black painter who was lynched decades ago.

I expected fun slasher nonsense and instead got a gorgeous, unsettling, modern gothic masterpiece that only occasionally dips its toes into schlock. Candyman is ethereal in all the right ways despite being suffused with despairing urban gloom. I was not surprised to find the script was adapted from a Clive Barker story—like Barker’s The Hellbound Heart (adapted into the Hellraiser films), Candyman is chilling yet eerily beautiful. The moment I finished watching it, I knew this was one I would be itching to revisit. There’s just so much going on regarding race, class, and memory in America. Also, Tony Todd’s voice is a damn treasure.

Merrily We Go to Hell (dir. Dorothy Arzner, 1932)

An alcoholic playwright (Frederic March) and his long-suffering wife (Sylvia Sidney) decide to have an open marriage. It doesn't work out well for either of them.

Merrily We Go to Hell is a sneaky piece of work. Reading the synopsis, one expects the usual salacious pre-code melodrama. The first scenes even resemble your usual romantic comedy, with our central couple having a meet-cute. The actual movie is much more complicated. It's about a married couple thinking love is enough to make their union work despite the husband's alcoholism. However, this idea proves erroneous and attempts to numb the pain through hedonism and extramarital vengeance just pour gasoline on the fire. The emotional honesty here is astonishing and even the "happy ending" isn't so uncomplicated when you think about it. So far, this is my favorite film of director Dorothy Arzner.

Up the Down Staircase (dir. Robert Mulligan, 1967)

An idealistic young teacher (Sandy Dennis) gets her first position at an inner-city high school. However, she finds her enthusiasm worn down by the school system's bureaucracy and the many psychological troubles of her students and fellow faculty.

Ever since I watched Four Seasons a few years ago, I’ve been intrigued by Sandy Dennis. No matter the role, I find her eccentric yet vulnerable screen presence compelling. Up the Down Staircase was Dennis’ first starring vehicle and an unsentimental look at the teaching profession. Having worked as a teacher and in similar jobs in the past, I related strongly to the main character’s compassion fatigue and her frustrated desire to help make her community a better place. While not a cheery film, it is ultimately an optimistic one, even if that optimism is cautious. And of course, Dennis is damn great as always, whetting my appetite for more of her work.

They Shoot Horses, Don’t They? (dir. Sydney Pollack, 1969)

In the thick of the Great Depression, a group of desperate contestants sign up for a grueling dance marathon with a hefty cash prize. Greed, sexual exploitation, health problems, and crushing despair eventually complicate the exhibition.

This movie is so bleak you’ll be just as exhausted as the characters by the tragic finish. I know that doesn’t sound like much of a recommendation, but this is powerful stuff. It does what a great tragedy should do: make you emphasize with the characters and go out into the world more empathetic toward the people around you and more critical of a society in which such awful conditions could be permitted. And like Targets, it’s depressing that this movie’s themes remain relevant to American culture.

Flash Gordon (dir. Frederick Stephani and Ray Taylor, 1936)

A himbo polo player (Buster Crabbe), a middle-aged scientist in hot pants (Frank Shannon), and an ingenue in a blonde wig (Jean Rogers) must save the Earth from a galactic emperor.

Yes, I’m counting a film serial as a single unit on this list. In this corny, breathless saga can be found the seeds of so many modern blockbuster spectacles. The old school space opera aesthetic is always a joy and I love seeing what George Lucas borrowed from the comic book plot and fantastic images for his Star Wars films. Also, the serial is surprisingly horny for a product released after the death knell of the pre-code era, so that’s fascinating too. I watched the episodes, one a night, usually before a feature film, to recreate at least in part the conditions in which old serials were viewed. I highly recommend that approach if you're interested in watching these kind of films-- NEVER binge them.

Silkwood (dir. Mike Nichols, 1983)

Karen Silkwood (Meryl Streep), a union activist and metallurgy worker at a plutonium processing plant, discovers both she and many of her co-workers have been contaminated with high levels of radiation due to blatant safety violations. Rather than remedy the problem, her employers are determined to keep her quiet, but Karen refuses to back down.

Meryl Streep's performance in Silkwood finally showed me what all the hype around her is about. What an astonishing, natural performance-- I forgot I was watching an actor every moment. As for the overall film, it's one of the stronger docudramas out there (as this film was based on a true story). It isn't just a preachy message piece and it allows Silkwood to be both a heroic figure and a flesh and blood human being with flaws like anyone. The domestic drama involving her lover (Kurt Russell) and lesbian roommate (Cher, who also gives an incredible performance) is almost as compelling as the main story. Though released in the early '80s, it feels like a late manifestation of the paranoia thriller genre of the decade before.

Love with the Proper Stranger (dir. Robert Mulligan, 1963)

When a one-night stand with a jazz musician (Steve McQueen) leaves her pregnant and at risk of upsetting her very Catholic family, an innocent sales clerk (Natalie Wood) tracks down her lover and demands he help her get an abortion.

Love with the Proper Stranger is such a unique piece of work that I can forgive the elements that dissatisfy me (like the ending). Wood and McQueen's romance starts out acidic and slowly becomes tender over the course of their bizarre misadventure, and the film itself shifts through several moods. Sometimes it feels like an urban drama, other times a romantic comedy. But it somehow holds together, perhaps because of the chemistry between the lead actors.

What were your favorite film discoveries in 2024?

#the window#my neighbors the yamadas#a new leaf#letter from an unknown woman#thieves like us#targets#freud the secret passion#candyman#sudden fear#cactus flower#flash gordon#the black room#up the down staircase#they shoot horses don't they#cash on demand#losing ground#paris is burning#merrily we go to hell#thoughts#silkwood#love with the proper stranger

45 notes

·

View notes

Text

Hey everybody, it's December now, and that means it's time for me to remind you all that Cash on Demand (1961) is technically a heartwarming Christmas story.

As well as being:

a) an extremely tense and well-scripted bank robbery thriller

b) perhaps one of Peter Cushing's finest performances, in which he is particularly mean and pale and brittle and cries at least twice

b.2) (Andre Morell is excellent also)

c) available in its entirety on youtube so you can go watch it immediately.

And you should.

#i considered liveblogging this movie#(god i didn't watch any movies in november#it sucked)#but i am incapable of being normal about peter cushing while watching cash on demand#so i cannot watch it with any sort of audience

27 notes

·

View notes

Text

Monetary aggregates are not important in themselves. What matters is macroeconomic performance as indicated by GNP, employment, and prices. Monetarist policies are premised on a tight linkage between the stock of money in dollars, say M1, and the flow of spending, GNP in dollars per year. The connection between them is the velocity of money, the number of times per year an average dollar travels around the circuit and is spent on GNP. By definition of velocity, GNP equals the stock of money times its velocity. The velocity of M1 was 6.6 in 1990. If it were predictable, control of M1 would control dollar GNP too. But M1 velocity is quite volatile. For the 1961-90 period its average annual growth was 2.1 percent. Its standard deviation was 3.0 percent. That is, the chance is about one in three in any year that velocity will either rise by more than 5.1 percent or decline by more than 0.9 percent. For the 1981-90 period the mean was -0.15, with a standard deviation of 4.0. (M2 velocity is less volatile, but M2 itself is less controllable.)

read this in an old article, so i decided to check, and

!!!!! ???? thats crazy

so i checked the GNP, and it's fully recovered, growing faster than before 2020 actually, so i checked the M1, and

Before May 2020, M1 consists of (1) currency outside the U.S. Treasury, Federal Reserve Banks, and the vaults of depository institutions; (2) demand deposits at commercial banks (excluding those amounts held by depository institutions, the U.S. government, and foreign banks and official institutions) less cash items in the process of collection and Federal Reserve float; and (3) other checkable deposits (OCDs), consisting of negotiable order of withdrawal, or NOW, and automatic transfer service, or ATS, accounts at depository institutions, share draft accounts at credit unions, and demand deposits at thrift institutions.

Beginning May 2020, M1 consists of (1) currency outside the U.S. Treasury, Federal Reserve Banks, and the vaults of depository institutions; (2) demand deposits at commercial banks (excluding those amounts held by depository institutions, the U.S. government, and foreign banks and official institutions) less cash items in the process of collection and Federal Reserve float; and (3) other liquid deposits, consisting of OCDs and savings deposits (including money market deposit accounts). Seasonally adjusted M1 is constructed by summing currency, demand deposits, and OCDs (before May 2020) or other liquid deposits (beginning May 2020), each seasonally adjusted separately.

so now it includes all liquid deposits, instead of all checkable deposits

As announced on March 15, 2020, the Board of Governors reduced reserve requirement ratios on net transaction accounts to 0 percent, effective March 26, 2020. This action eliminated reserve requirements for all depository institutions and rendered the regulatory distinction between reservable "transaction accounts" and nonreservable "savings deposits" unnecessary. On April 24, 2020, the Board removed this regulatory distinction by deleting the six-per-month transfer limit on savings deposits in Regulation D. This action resulted in savings deposits having the same liquidity characteristics as the transaction accounts currently reported as "Other checkable deposits" on Statistical Release H.6, "Money Stock Measures." Because of the change in their liquidity characteristics, savings deposits will be recognized as a type of transaction account on the H.6 statistical release. The Board will combine H.6 statistical release items "Savings deposits" and "Other checkable deposits" and report the resulting sum as "Other liquid deposits." Like other transaction accounts, other liquid deposits will be included in the M1 monetary aggregate. This action will increase the M1 monetary aggregate significantly while leaving the M2 monetary aggregate unchanged.

the fed removed the reserve requirement on banks! weird!

also, M2 should be unchanged but it wasnt, it also shot up, and accordingly velocity shot down. seems...weird? bad?

16 notes

·

View notes

Text

J'ai évalué Cash on Demand (1961) 8/10

J'ai évalué Cash on Demand (1961) 8/10

https://www.imdb.com/title/tt0054731/

0 notes

Text

Traded Commodities

Any transaction that requires an exchange of data, money, products, and interaction with other parties, sometimes across international borders, harbors significant risks. An effective end-to-end transfer of goods from a producer or supplier to the buyer involves several parties for success, each with a distinct role in the chain. Commodity trading refers to trading goods in large volumes on an official platform with standardized commodity contracts. The transactions and product transfers can happen through spot markets or through futures contracts on future prices. Spot markets are platforms where the commodities, securities, and currencies are traded for immediate delivery in exchange for cash. On the other hand, futures contracts require delivery of the commodity at a future date.

Commodities are broadly classified into hard and soft. Hard commodities are natural resources that require mining or extraction, such as precious metals and oil. Soft commodities are agricultural products and livestock.

Precious metals, commonly traded commodities, include gold, silver, copper, and platinum. The metals are considered to have reliable value, especially during wars and global recession, for protection against inflation and currency devaluation. The suitability of a metal as a trading commodity depends on demand, perceived value, rarity, and applicability in manufacturing, renewable energy, and defense systems. Other metals, such as elements used in motherboards, electric motors, and light-emitting diodes (LEDs), include erbium, holmium, tantalum, and dysprosium. These are referred to as rare earth metals and consist of 17 elements that are in high demand in the electronic industry.

Another commonly traded commodity is energy, which includes crude oil, gasoline, and natural gas. As the driving force of many industries, oil is one of the most traded commodities and regularly exhibits significant price swings due to supply and demand fluctuations. The high volatility in response to external factors makes energy risky to commodity investors, but opportunities for significant gains abound. The common causes of volatility include economic turmoil, manufacturing growth, advances in alternative energy, and enforcement by the Organization of the Petroleum Exporting Countries (OPEC). Investors can trade using three strategies: oil spot price, oil futures, and oil options. The oil spot price is the market rate or the present value of oil at that moment. Oil futures project the oil price at a set date in the future. Options are contracts in which traders convey an intent to purchase or sell oil at a specific price on or before a set date in the future.

Climate differences in various regions mean that some areas produce more agricultural products than others. Common crops include soybeans, cocoa, coffee, wheat, cotton, and sugar. Investors count on fluctuations in supply and demand, the effects of wars, natural calamities, and population growth to wager on profitability. Other factors that affect agricultural commodity trading include shifts in consumer preferences, advances in farming methods, government policies, urbanization, and changes in land use.

Traders also deal in livestock and livestock products. Commonly traded products include meat, milk, dairy, hides, fur, and wool. The Chicago Mercantile Exchange (CME), originally called the Chicago Butter and Egg Board, launched futures contracts on frozen pork bellies in 1961. It has grown to be a major United States exchange platform for livestock trade, with a focus on beef, pork, lamb, and poultry.

0 notes

Text

A Sense of Relief Regarding Taxes

In an attempt to provide some respite to the investors and ensure a taxpayer-friendly approach in revenue collection, the Finance Minister of India has recently assured that theIncome-Tax Authorities (“ITA”) will not recklessly implement the retrospective tax rules. The Government of India (“GoI”) has introduced retrospective amendments in the Income Tax Act, 1961 which empowers the ITA to tax the indirect transfer of shares when the underlying assets are located in India.

The GoI has now referred the issue of retrospective tax rules to the committee headed by Mr. Parthasarathi Shome, (the “Shome Committee”). Earlier, the Shome Committee had recommended that the General Anti Avoidance Rules (“GAAR”) be deferred for three years. GAAR, giving ITA powers to scrutinize any transaction that they feel was structured to evade taxes, was introduced in the Finance Act, 2012 to come into effect from April 1, 2013.

Finance Minister has further stated that the implementation of GAAR provisions and the retrospective tax rules would be subject to the final report of the Shome Committee, which is expected by the end of September, 2012. GAAR provisions and the retrospective tax rules have drawn sharp criticism from all spheres, since its introduction. The recent statements by the Finance Minister appear to be GoI’s effort to perk up the investors who have been apprehensive about the repercussions of implementation of the GAAR provisions and retrospective tax rules.

Law for Safer Workplace The Lok Sabha (Lower House) (“LS”) on September 3, 2012, finally gave its nod to the Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Bill, 2010 (“Bill”), to deal with the menace of sexual harassment at work place. The Bill which was pending before the LS since 2010 underwent a radical facelift, owing to pressures from various women organizations and critical reviews by the parliamentary standing committee, before being approved.

The Bill, which still has to get the Rajya Sabha’s (Upper House) sanction, defines ‘sexual harassment’ to include “any unwelcome act or behavior directly or by implication of physical contact and advances, or a demand or request for sexual favors, or making sexually colored remarks or showing pornography or any other unwelcome physical, verbal or non-verbal conduct of a sexual natures”.

The most noteworthy aspect of the Bill is that it brings under its ambit “domestic workers”, whether employed full-time, part-time or temporarily for household work in any house for remuneration whether in cash or kind, either directly or through any agency.

Some of the key features of the Bill are:

• Provides for safeguards against wrong or fallacious charges of sexual harassment; • Makes it mandatory for every employer to constitute an internal complaints committee at each office or branch with ten or more employees, to deal with cases and complaints of sexual harassment; • Enlists offences that will qualify as sexual harassment viz. making sexual remarks, demand for sexual favor, act of physical advance or an unwelcome touch, etc.; • Applicability of the Bill is wide enough to include not only employees but also clients, customers, apprentice, or daily wage workers who enter the workplace; and • Provides for penalties for employer for noncompliance. While women organizations and activists have welcomed the passing of the Bill, various other social interest groups have raised their concerns on certain aspects that have not been included or addressed in the Bill such as the Bill not protecting male workers against sexual harassment by co-workers.

For more information contact us.

0 notes

Text

An Overview of Dowry Harassment Act and Process to File Case

In dowry harassment, the wife is harassed by her husband or husband’s relative for the dowry. Although, this offense is punishable under law, still, it is very much prevalent in Indian society.

Situation is quite bad in our society. While numerous married women silently suffer dowry harassment from their in-laws' side, some brave females challenge this practice and take legal assistance.

Although, there is one darker side of Dowry Harassment Act. A few women misuse this act to harass their husband.

So, if you are among those people who are suffering due to dowry or due to false use of Dowry Harassment act, then this blog is for you.

In this blog, we will talk about the below mentioned acts.

Dowry and Dowry Harassment

Punishment under Dowry Harassment Act

Way to file for Dowry Harassment Case

False Dowry Harassment Case

What is Dowry?

Dowry is the demand of the groom's side from the bride's family for the successful commencement of their marriage. These demands can be for jewelry, property, vehicles, cash or favors.

Initially, Dahez (as dowry commonly referred to) was the gifts that the bride's side used to give to the groom's family at or before the wedding. However, later this practice took a ugly face when the groom's family members started asking for favors and expensive items from the bride's family. As a result, the free will of the bride's family becomes a compulsion for them.

Understanding the gravity of practice, the honorable court has banned this practice. Now giving dowry and asking for it , both are considered crimes.

What is Dowry Harassment?

The term dowry harassment means physically, mentally and emotionally torturing a bride with dowry demands. Such harassment generally takes place after the consummation of marriage.

Punishment for Dowry Harassment

Dowry harassment is covered under the Dowry Prohibition Act, 1961. Here are more details about this act:

Person or persons who give or take dowry is entitled to imprisonment.

Person or persons who ask for dowry is also punishable.

Dowry is a cognizable and non-bailable offense.

Dowry harassment under the Indian Penal Code,1980

Section 304 (b): If the person is responsible for the death of his wife within 7 years of marriage. Such a person can be tried under dowry harassment act.

Section 498 (a): If the person is responsible for the cruelty to the woman, he will be entitled to imprisonment or a fine.

Way to file for Dowry Harassment Case

We have made the dowry harassment complaint filing easier for you. Here are the steps that you can follow:

File an F.I.R. in nearest police station

Consult a dowry harassment lawyer in Gurgaon or near to your place

If the wife has been torched physically or emotionally, she can file a case under domestic violence too.

False Dowry Harassment Case

It will be wrong to consider that only females suffer here. As in some cases, many females use dowry harassment as a weapon against husbands. If you are also falsely targeted by your wife and her family members under dowry prevention act. You are left with below mentioned options.

Hire the best dowry harassment lawyer in Gurgaon and defend your case.

You can also file a case against your wife.

But in both cases, you need to take the below mentioned things into consideration.

You must collect evidence that support your claim that you are knowingly targeted.

You must seek anticipatory bail.

You must challenge false allegations in the court.

Reach Family Kanoon Law Office

If you are looking for the best advocate in Gurgaon who can help you in the dowry harassment act. Then you are at the right place. We have long years of experience in dowry harassment cases, this experience makes us the dowry harassment lawyer in Gurgaon.

0 notes

Text

Podcast #952: Season’s Screenings — A Tour of Classic Christmas Movies

Watching a holiday movie is a great way to get into the spirit of the season and has become an annual tradition for many families. But what exactly makes a Christmas movie, a Christmas movie, what are some of the best ones ever made, and what makes these gems so classic? Here to answer these questions and take us on a tour of the highlights of the holiday movie canon is Jeremy Arnold, a film historian and the author of Christmas in the Movies: 35 Classics to Celebrate the Season. Today on the show, we talk about what defines a Christmas movie, why we enjoy them so much, and why so many classics in the genre were released during the 1940s. Jeremy offers his take on the best version of A Christmas Carol, whether Holiday Inn or White Christmas is a better movie, why he thinks Die Hard is, in fact, a Christmas movie, what accounts for the staying power of Elf, and much more. At the end of the show, Jeremy offers several suggestions for lesser-known Christmas movies to check out when you’re tired of watching A Christmas Story for the fiftieth time. Movies Mentioned in the Show * Santa Claus (1898) * Scrooge (1901) * Scrooge (1935) * Miracle on Main Street (1939) * Remember the Night (1940) * The Shop Around the Corner (1940) * Holiday Inn (1942) * The Man Who Came to Dinner (1942) * Meet Me in St. Louis (1944) * It’s a Wonderful Life (1947) * Scrooge/Christmas Carol (1951) * We’re No Angels (1955) * Cash on Demand (1961) * Die Hard (1988) * Home Alone (1990) * Home Alone 2 (1992) * The Muppet Christmas Carol (1992) * Elf (2003) Listen to the Podcast! (And don’t forget to leave us a review!) Listen to the episode on a separate page. Download this episode. Subscribe to the podcast in the media player of your choice. Transcript Coming Soon The post Podcast #952: Season’s Screenings — A Tour of Classic Christmas Movies appeared first on The Art of Manliness. http://dlvr.it/T0J0Nq

0 notes