#cash app transfer failed issue

Text

Cash App Direct Deposit: Everything You Need to Know 2023

In this article, we will discuss everything you need to know about Cash App direct deposit. We will cover the basics of what Cash App direct deposit is, what time it hits your account, how long it takes, and much more. If you are a Cash App user, you will find this article very informative.

What is Cash App Direct Deposit?

Cash App is a popular mobile payment app that allows users to send and receive money from their friends and family. In addition to peer-to-peer transactions, Cash App also offers direct deposit, which allows users to receive their pay checks or other payments directly into their Cash App account.

How does Cash App Direct Deposit work?

Setting up Direct Deposit is quick and easy. Here's how to do it:

Open the Cash App on your mobile device.

Tap the "My Cash" tab.

Tap "Cash" at the top of the screen.

Scroll down and select "Direct Deposit."

Follow the on-screen instructions to set up Direct Deposit.

Once you've set up Direct Deposit, your employer or government agency will send your funds directly to your Cash App account on your payday.

What are the benefits of using Cash App Direct Deposit?

Convenience

With Cash App, you don't have to worry about waiting for a physical check or visiting a bank to deposit your funds. Your pay check or government benefits will be automatically deposited into your Cash App account on your payday, making it a fast and convenient way to receive your money.

Security

Cash App is a secure way to receive your funds. Your account is protected by advanced security features, including two-factor authentication and biometric login.

No Fees

Unlike some other payment apps, Cash App doesn't charge any fees for Direct Deposit. That means you can keep more of your hard-earned money in your pocket.

How long does it take to set up Cash App Direct Deposit?

Setting up Cash App Direct Deposit only takes a few minutes. Once you've set up Direct Deposit, it may take a few days for your employer or government agency to process the change and start depositing your funds into your Cash App account.

How do I know when my funds have been deposited?

When your funds have been deposited into your Cash App account, you'll receive a notification from the app. You can also check your balance at any time by opening the Cash App and viewing your account balance.

Can I use Cash App Direct Deposit for other types of payments?

Yes! In addition to receiving your pay check or government benefits, you can also use Cash App Direct Deposit to receive other types of payments, such as payments from friends or family members.

What Time Does Cash App Direct Deposit Hit?

Cash App direct deposit typically hits accounts at around 5 AM Pacific Time (8 AM Eastern Time) on the day of the scheduled deposit. However, the exact timing may vary depending on a few factors, such as your bank's processing times and delays in the ACH system. It's always a good idea to double-check with your employer or the sending bank to confirm the expected timing of your Cash App direct deposit.

How Long Does Cash App Direct Deposit Take?

Cash App direct deposit typically takes one to three business days to post to your account, depending on the sender's bank and the ACH transfer processing times. If you don't see the deposit in your account after three business days, it's a good idea to contact the sender to confirm the transaction details and ensure that the funds were sent to the correct account.

Benefits of Cash App Direct Deposit

There are many benefits to using Cash App direct deposit. First and foremost, it is a convenient and fast way to receive your pay checks or other payments. You don't have to worry about waiting for a check to clear or making a trip to the bank to deposit your funds.

Tips for Using Cash App Direct Deposit

If you are planning to use Cash App there are a few tips that can help ensure a smooth experience. First, make sure that you have your routing and account number handy and provide it to your employer or other payment provider as soon as possible.

#Cash App#Pending Payment#Cash App Pending Payment#Payment Pending on Cash App#How to Resolve Cash App Pending Payments#Cash App Payment Issues#Cash App Payment Pending#Pending Payments on Cash App#Cash App Payment Processing#Cash App Payment Not Going Through#Cash App Payment Failed#Cash App Payment StuckHow to Cancel a Pending Payment on Cash App#Cash App Payment Dispute#Cash App Payment Status#Cash App Payment Verification#Cash App Payment Delay#Cash App Payment Error#Cash App Payment Processing TimeCash App Payment Reversal#Cash App Payment Tracking#Cash App Payment Transfer#How to Complete a Pending Payment on Cash App#How to Check Pending Payments on Cash App#Cash App Payment Confirmation#Cash App Payment Declined#Cash App Payment Notification#Cash App Payment Request#Cash App Payment Scams#Cash App Payment Support.

1 note

·

View note

Text

FULL STORY OF THE SAGA OF THE EXPLOSIVE PHONE AND THE ELECTRONICS STORE THAT TRIED TO GET ME TO COMMIT DOMESTIC TERRORISM! -

This is going to take a hot minute to type, so be patient

on June 18th 2024 I was out running errands, and picked up dinner, in doing so I overdrew the credit union account, I THOUGHT I had zeroed it out, but it had actually overdrawn.

I didn't find out until after the bank had closed, and since the 19th was Juneteenth (a federal holiday in the states) the CU was closed.

I THOUGHT I could sign the account up through Zelle and/or cashapp and just transfer money directly into the account, but Zelle continually failed, and cash app let me enroll it, but not transfer the money to the account.

Continually they said the issue was with the DEBIT CARD, not the account and told me to call the bank. I couldn't.

On the 20th, I woke up early enough to call the bank, and began the arduous process of verifying over the phone with my dad just so I could talk to them, and Zelle, and try to figure out why the everloving hell the zelle system said there was something wrong with the card and not letting me even sign up so I could transfer money into the account.

I spent four hours on this. Calling one, calling the other, being on hold. and NO ONE could fix the problem.

I repeated myself so many times I was tired of hearing myself. I got one person who said it was the carrier, so I had to call t-mobile, except it wasn't tmobile it was mint, and tmobile transferred me to aura and not mint, and finally to mint who said 'oh that feature is already unlocked on the account you need to call the banking institution or zelle.

On the final call to zelle, the new tech was refusing to accept the verification. and starts going through her little trapper keeper script of why she was refusing to accept the verification when we had all the answers all the info and had ACTIVELY BEEN VERIFYING FOR FOUR HOURS until this point when she says, off handedly during her script read (she was literally just reading the fucking bullet points, I could HEAR the pauses as she shifted line down) "Your account must have more than a dollar in it to enroll"

I spin, looking at the phone only to realize that the phone my dad is holding has expanded, and popped the back of itself off. And immediately begin internally panicking but externally I'm just being frustrated because THAT was the problem for the past four hours, not me entering info wrong, not the information being incorrect with the bank, not the debit card being mislinked, not a system error THE ACCOUNT WAS ALREADY OVER DRAWN AND IT TOOK FOUR HOURS AND WIGHT TECHS TO TELL ME THIS CONDITION?!

I tell dad to immediately hang up the phone and give it to me, I'm ready to rip my hair out and he thinks I'm going to throw the phone and kind of clings to it. I say, firmer. "Give me that timebomb NOW" and he goes 'what is the pro- what the fuck is that?"

I saiod "That is a spicy pillow and you need to give itt to me -now-. I'm taking it to best buy it should still be under warranty." "Yeah, yeah.." and he handed me the phone "When did that happen?" "When you took the phone out of the case to talk to zelle a second ago. It's blowing out, and It doesn't need to be here." "Yeah you go handle... this..."

I explain the zelle issue why it wouldn't enroll, and go get dressed, grab the spicy ravioli and run out the door with the idea that I'll go to the credit union two cities over, fix the overdraft and then take care of the phone return. While driving it's still expanding so I reprioritize and decide to return the phone first.

In my mind, this is a simple thing. I know the phone is under warranty, it has become a safety issue, their standard practice of "keep this and send it off" is not a viable option so it will HAVE to be a refund/in store exchange.

I know this because I've had to do this once before in the past. I know how their policies work, I know the standard returns but more importantly I know the severity of a bloated li-ion battery and how fucking important it is to get it into a safe disposal unit to be picked up by hazardous waste techs with a fireproof vehicle

I go in, at this point I am forwardly professional, I am not panicked, excitable or anything I have my mask of professionalism on and I'm all fucking business. I go to customer service and say 'I need to make a return but before that, do you have a fire blanket or fire suppressant for this fire hazard" and I gently set the phone on the counter. My only thought is to safely contain this ACTIVELY EXPANDING lithium battery.

She looks down, eye go wide and goes "I don't know let me check" and runs to the back, I hear from the back "We have a bucket of sand" and I retort "That will do, this needs to be contained immediately please"

They come get it, and take the potential fire hazard to be buried in the sand bucket. NOW we may commence the return process. I immediately put on the customer service interaction mask, and give them the information for the account, I joke that my receipt for the purchase had bleached out in the car (It had, I keep it in the sunglasses holder and it had legitimated denatured) and we agree that is why they have everything digital.

The CS says it's a rapid exchange in store for this, I said yay, that's actually really nice, because 'express' is not great. She agrees, and sends me to the mobile department, I say take all the time they need, I'll pick a new phone and confirm it's what my dad wants, and I know the paperwork is going to take a hot minute.

I confirm dad doesn't care as long as it's functional, so I pick out the same type, but updated model of phone (Moto G Stylus 2023 model to replace the 2021 model that is buried in sand in the back)

I talk to mobile, connecting with the associate over customer horror stories and the like while the new phone that he, customer service, geek squad techs, and two other associates and a manager have seen, agreed this is going to be an instore exchange because of the circumstances.

We begin setting up the phone and I realize the sim card is still in the bomb. I roll back over in my wheelchair to ask if it's safe to get the sim card. And they say they have to check the IMEI anyway and I bawk. We've already confirmed it's probably not safe to turn the phone on right now, and they say it's okay, it's on the sim tray. I didn't know that, good information. And I ask, cautiously, if it'd be okay to turn it on BRIEFLY so I can get only the login email on it to know which email my dad used for logging into google so I can get his contacts and account synched

the tech says "I don't recommend it" I asked if it would be okay to do so knowingly against advice to turn it on, get the info, turn it off and rebury the thing?

By now, it's been confirmed the battery is no longer expanding, and it's not actively leaking, smoking or heating up. We all agree it's a compromised cell within the battery but it hasn't been breeched, so it's safe-ISH to handle, briefly, but it shouldn't be agitated too much just in case.

I suggest removing the back fully so there's no pressure points. I'm ignored.

I get the info, turn off the fire bomb and hand it back, where it's taken back to what I assume is the sand bucket.

after a little while, the replacement phone is ready for login, I begin setting up the phone for my dad and logging in his information so it'll be set up and ready to go. They begin the return paperwork for the other phone.

At this point it's been about 45 minutes. It's been a smooth process where everyone was on the same side of 'we do not want to agitate the bomb, and Asrya should be leaving with a functional phone and NOT a fire hazard."

when they try to do the return, the SKU (sales identification number) comes up as dead meaning that the store chain doesn't carry that model any more, and the system won't accept the item as a return for cash, credit, or refund. It just -won't- . Initially, I tell them I've had to do this only twice before (I didn't mention it was spread out over like twelve years that I've been using this specific protection plan with Best Buy) and that they may have to store manager override it.

I've had to utilize this process before with laptops I had to exchange due to manufacture defects... so I actually do know how the policy works, the former general manager of the store had explained it to me YEARS ago.

So I tell them that it happens, and to take their time, I know it's a pain in the ass and I'm sorry I'm taking up so much resources, but it's really okay and as long as the end result is good, I don't mind waiting.

At this point it's 1 in the afternoon.

I've been at the best buy for an hour.

The manager comes up after a while, telling me that it's physically impossible. And I'm going to have to use the 'express return' system, it's the only solution that their system is allowing them to process.

I start getting frustrated, which means I start crying because I am fighting the urge to begin yelling. I've now been here for over an hour, I was in the middle of handling the situation and I NEED the phone in order to process the banking issue this all started with so my dad doesn't get charged overdraft fees.

I explain I can't wait a week for a new phone and what am I supposed to do with the bloated phone?

they explain this process, and get snippy telling me "It's 2-3 days not a week" I tell them it's 2-3 BUSINESS days "well... yeah" "This is THURSDAY, at the earliest it'll process Friday then ship out on Monday, if I'm LUCKY it'll arrive on TUESDAY at the earliest, and maybe not until Thursday of next week! During that whole time my dad's account will have overdraft fees being applied to it for each day! We can't afford that! On top of that you want me to pay a 70$ deposit just to do this! We do not have that money right now"

I was told I could apply for and use the best buy credit card.

I asked for a phone number to call, that there HAD to be an alternative solution, I said I didn't want to take the fire hazard home with me.

By now they had REMOVED THE PHONE FROM THE BUCKET and were walking around with it after me, trying to get me to take the fucking compromised battery.

I tell them to put that thing back in the sand bucket. And they give me 'corporate's number' a 1877 number. I ask if that's the number to call to talk to a supervisor or manager because this is an exception to the policy if ever there was one. If anyone would have the directions for overriding this dead sku problem, it should be the store manager's area or district manager

I am told there is no area or district manager.

I am FLOORED, I realize I've not been around this system for a couple of years but that information just... baffles me. I ask who THEY call when they have a situation come up that can't be handled in store.

They tell me they call the 1877 number.

I am BAFFLED by this, but I call the 1877 number, the call id comes up as 'best buy express kiosk" and I groan because I recognize this as the trunk line call center. I brace for and prepare to handle this for an hour. I am still trying to be as professional as possible.

I have now been here for going on two hours.

I roll out into the entry way, they CHASE ME with the fucking firebomb of a phone and ask if I'm leaving. I look back at them holding this fucking bloated phone and say no I'm just trying to get out of everyone's way so I can call the number and would they PLEASE put that thing back again and leave it in the safe bucket!

I spend the better part of hour three struggling to get through these customer service techs, explaining the situation and begging for them to transfer me to a manager or supervisor. I'm being denied this at every turn until I get to "returns" and am told to ask THEM for a manager by a tech who seemed to understand the situation and why I was calling.

I'm transferred, the tech listens, agrees that I should NOT be handed a firebomb to go home with, and should not be expected to ship a bloated li-ion battery in the mail and that it should be an in store return with store credit. I ask her to please explain this to the manager and go to remove my headset and put her on speaker so the manager can hear it from corporate

the call disconnected

I break

I begin crying, as quietly as I can, and the manager goes 'well' and I explain the call disconnected... I have to get back to that point.. and roll back into the entry way to begin the process again.

I'm crying, I just need this to work.

I've been here for nearly three hours.

The new tech that answers refuses to confirm the account and begins insisting I give my personal number and email to him. Refusing to accept the account information.

He puts me on hold. I call the corporate number again, merge the calls, and he has me on a mute hold. I get another tech that sound like the same guy, who also eventually puts me on hold, and then disconnects the call.

I'm sobbing and breaking down at this point, I'm having a panic attack, and struggling to maintain any type of composure at this point. I tell them I'm going out to my car so I'm not causing a scene in their store and is the manager positive there is no other option. I need to be leaving with a working phone, or at least I do NOT need to be leaving with a fucking FIRE HAZARD that they are expecting me to ship in the mail it is ILLEGAL to ship compromised batteries in the mail.

this fucking manager looks me dead in the face and says I can purchase a new phone to use, and just bring it back after the 'express return' is finished, or I can just do the express return, but there is NO WAY at all physically for her to do the return, in any shape, form or fashion, that I will have to take the fire hazard phone with me and ship it to their facility when the new phone comes in the mail in five days or so

I say I do not feel comfortable holding onto a FIRE HAZARD for a week, much less being without the ability to do the banking and is best buy going to cover the overdraft fees I'll be incurring and what am I supposed to do with a fucking bloated phone that could explode?!

Her solution? "You can go to walmart and buy a bucket and sand and put it in there if you don't feel safe with it, I hear that sand is good for batteries like this"

I snap... I just.. break down and begin crying because at this point I've been here for three hours, I know what she's suggesting is absolutely wrong, she's lied to me about not having an area/district manager, and she's standing over me like some fucking goon while telling me to take a BOMB home and then send it in the federal post in a week!

I break down, I take the stupid fucking bomb, they make me factory reset the phone I had been working on previously, I take the sim card, and I ask again if there is ANYONE I can call to talk to that will help. Who do THEY call when there's a situation because there HAS to be SOMEONE. They insist that nope, there's ONLY the 1877 number to the call centre.

I'm bawling, I'm broken, and crying I'm having heart issues, my head is screaming, my face feels burnt, and I roll out to the car and put the chair away. While unpacking the chair I realize I had actually put a pack of switch thumbsticks in the cart because I had been hoping to buy them with the leftover store credit I'd have when they all thought it was going to be a store credit exchange.

With my legs SCREAMING in pain, and barely able to walk, I limp back in on my crutches, unintelligibly sobbing and return the nearly-pilfered item, then go back to the truck. St this point I've set the phone on my driver's seat, I begin working on possibly loading the chair back on the truck when there's a loud, gunshot-like POP noise

and for a brief, horrifying moment, I think the battery has just exploded in my truck. Only to realize the heat had actually boiled a bottle of soda, and THAT was what had just exploded.

I'm determined, angry, frustrated, pissed, and petty... I don't want this fucking bomb in my possession, I know for a goddamn fact I am not supposed to have this bomb in my possession, I know that if it goes off and causes damages that best buy will be liable for it, and frankly, while the payout might be nice the inconvenience of having to deal with the damage, replacement, insurance, lawyers, and court costs and investigation are too much for me to handle. I don't want to go through it I JUST want a phone that works, the bank situation to be fixed and to NOT HAVE A FUCKING BOMB IN MY POSSISSION

I begin calling the useless as fuck call centre again, and for the next three and a half hours (totaling seven now) I continually try to explain, repeat, get transferred, sobbing, crying and getting hung up on by asshole techs. and I'm losing more and more composure as it goes on.

I FINALLY get a tech who says 'it should be store credit' I said I need the instructions on how to do that because the manager is claiming to not know how to do it. and I beg her to talk to the manager. Success. I go back in side, clinging to this tiny spider thread of hope that they'll fix it.

the manager takes my phone, asks if she can step tot he side, I say yes, and she comes back and they're both just repeating that the only solution is for me to send this bomb in the mail

I tell them it's ILLEGAL to send it, it's literally a federal crime. It CANNOT be policy to do this. None of them will budge. None will do the override, they're INSISTING I have to wait for a phone to come in, and then send a BOMB in the mail. I tell them this is probably why we've had mail trucks catch fire if they're telling people to do this it's ILLEGAL

The fucking manager says 'it's not actively leaking, it's not smoking or how it SHOULD be legal to send it in the mail' I ask for the salary person she mentioned. I go tot the mobile guy I'd been talking to six hours ago. I ask HIM to get me the salary person. This woman comes over and stands over me, arms crossed, with them angrily standing in front of me, arms crossed, like they're trying to intimidate me out of the store for trying to run a scam.

they continue to tell me there's no other option that they wouldn't spend six hours to tell me know they'd help if they could that I'm going to have to use the mail system.

I ask the salary manager who they call. She says corporate. I say that is horseshit. She gets offended and I clarify. That if their new policies is to call the call center number they gave me that is a horse shit policy and THEY are in danger of running into DANGEROUS situations like this without a way of getting out or around it. Who do I call to complain about that policy then?

"You can complain but it won't do anything to change the answer"

"Who do I call?!"

They give me no answer.

I leave

after seven hours of fighting with them. I leave, in possession of a fire hazard, my head pounding, feeling sick, having now gone through MULTIPLE break downs, melt downs, and panic attacks over the past seven hours of being on site trying to get them to do the right things.

I go home and explain to my parents what happened, I unload the tiny amount of groceries I'd picked up (twenty bucks of emergency cash) and realize how much bullshit it is what had happened. So I begin calling the local investigative news stations to see if they want to look into this.

One of the news stations is VERY interested in the fact this store told me to buy a bucket of sand to put a dangerous fire/explosive into. They're interested that the store can't be called with inbound calls, that there's apparently no area or district manager to call, that the store sent me home with an explosive and told me to send it in the mail.

I send the store to the news station. I call other stations, they're not as interested. That's fine. I'm advised to call the attorney general of commerce and leave them the story. I do.

June 21 2024 - I still need to correct the banking situation so I determine to drive to the bank, make a physical deposit with some change I have on hand to bring the account high enough to accept the cash app deposit I tried to withdraw two days before. And while I am in the area of the credit union, I'll go to a different best buy, explain what happened, and see if they give me the same answer.

The bank was thankfully open two hours later than I though, giving me plenty of time. They accepted the deposit, and I was on my way, I get to the other Best Buy.

The battery has expanded again by this point. But still no leaks, smoke, or active heat but I don't trust it, and moving it is a bad idea. I take it inside, I explain what happened and this store is absolutely horrified of my story.

I show them receipts of what happened. I explain their responses, their 'solutions' and their suggestions. This store's crew is just locked in abject horror that this happened. I explain why the other store wouldn't do the store credit and they say 'let me call my manager' and I tell them about how the other store told me there was NO area or district manager.

They look confused "Well he's kind of a roaming district manager, but... yeah... we have... I have a lot to tell Abby."

I breathe a sigh of relief. I was right, there's an area manager, and a roaming district manager... I wasn't crazy I did remember correctly how their policies worked... I tell them about the 'we call corporate' situation and how I was on the phone for 7 hours thereabouts, being hung up on.. they all continue to look horrified... at this point they hit the same dead sku issue, and I lament a possible repeat. They said they were NOT going to let me have that bomb back, we were NOT going to be sending it through the mail (one even said 'Isn't that considered like.. terrorism?!" and I agreed I was pretty sure it was. ) they said I was leaving with a phone they just had to get 'Abby' to tell them how to bypass this... and she did. In like.. five minutes.

"Is store credit okay? It'll probably have to be store credit" "YES! That's perfect, it means I can just get the phone and a new plan..." They help me find a phone they have (Moto G 5g 2024 model) and even with a new plan, I had 33% of store credit left over!

They tell me that phone is NOT leaving the sand bucket, and there's a brief funny moment of one associate holding up the sim tray (they'd used it to confirm the IMEI and confirm it was the phone under warranty) and the tech laughing and holding this tiny piece of plastic "This is probably the least problematic part of the phone"

I agree... the situation was handled, and I tell them I DID report them to the AG, and the news stations, and one of the associates goes "I'm REALLY surprised that store did that... that's the main hub store of the district, and he's on vacation right now but Roy, the district manager... that's his HOME store... I don't know what they were thinking" and I go "Roy.... Roy.... Mister Roy? Kinda tall, brown/black hair? Used to be the General manager of that store? THAT Mister Roy is the district manager?" "Yeah! He was the general manager there for a while." "Yeah about three0four years ago, I've met him! He's the one who told me about the way the protection plans work"

They all agreed he was not going to be happy, and any new friends that store makes from my reports were justified, they were glad I raised hell about the battery because it would have been a disaster if it'd gone off, and "didn't they know how dangerous these batteries are" and "why the hell did they send you home with that?" and me agreeing it was insane and wrong and just... feeling better to know I wasn't crazy in the way I knew the world was SUPPOSED to work.

So in the end - the banking situation was handled, I was able to get a new working phone for my dad, that did indeed transfer all information, contacts, images and everything over (for as evil as it's become, google synching system and account connections are INCREDIBLE for this exact situation) and I had enough money left over to get the switch thumbsticks I'd wanted to get from the other store... I still have some money left over. and they were cheaper than my local store.

the news station hasn't gotten back to me yet, but they may not until Monday at the earliest, but the situation is done at least, (largely) and the end was a good one.

and that concludes the epic saga of "Asrya and the exploding battery - and the store manager that wanted her to commit an act of domestic terrorism"

3 notes

·

View notes

Text

How to Transfer Money from Venmo to Cash App

Transferring money between Venmo and Cash App may seem complex, but it is straightforward if you know the steps. In this comprehensive guide, we will detail the process to ensure you can move your funds effortlessly.

Understanding the Basics

Before diving into the transfer process, it is essential to understand that Venmo and Cash App are two separate financial services with distinct operating mechanisms. Unfortunately, there is no direct way to transfer money from Venmo to Cash App. However, we can use an intermediary step through your bank account to facilitate this transfer.

Step-by-Step Guide to Transfer Money from Venmo to Cash App

1. Linking Your Bank Account to Venmo

To transfer money from Venmo to Cash App, start by linking your bank account to your Venmo account. Follow these steps:

Open the Venmo App: Ensure you have the latest version of the app.

Navigate to the Menu: Tap on the three horizontal lines in the upper-left corner.

Settings: Select "Settings" from the dropdown menu.

Payment Methods: Go to "Payment Methods" and tap on "Add a Bank or Card."

Add Bank Account: Choose "Bank" and follow the prompts to enter your bank account details. Verify the account by following the verification steps provided by Venmo.

2. Transferring Money from Venmo to Your Bank Account

Once your bank account is linked, you can transfer fund from Venmo to your bank account:

Open the Venmo App: Go to your Venmo balance.

Transfer to Bank: Tap on "Transfer to Bank."

Select Amount: Enter the amount you wish to transfer.

Choose Transfer Speed: Select between "Instant" (with a fee) or "1-3 Business Days" (free).

Confirm Transfer: Review the details and confirm the transfer.

3. Linking Your Bank Account to Cash App

After the money is in your bank account, link the same bank account to your Cash App:

Open the Cash App: Ensure the app is updated.

Banking Tab: Tap on the "Banking" tab (house icon).

Link Bank Account: Select "Add a Bank" and enter your bank account details. Follow the verification process to link your account.

4. Transferring Money from Your Bank Account to Cash App

Finally, transfer the money from your bank account to Cash App:

Open Cash App: Go to the Banking tab.

Add Cash: Tap on "Add Cash."

Enter Amount: Specify the amount to transfer.

Add Money: Confirm the transaction to transfer money from your bank account to Cash App.

Advantages of Using Bank Transfers

Using bank transfers to move money between Venmo and Cash App offers several advantages:

Security: Bank transfers are secure and encrypted, providing a safe way to move your funds.

Convenience: Once set up, transferring money between accounts is quick and easy.

Flexibility: You can manage your finances and utilize the features of both Venmo and Cash App.

Frequently Asked Questions (FAQs)

Can I transfer money directly from Venmo to Cash App?

No, there is no direct way to transfer fund from Venmo to Cash App. You must use a linked bank account as an intermediary.

How long does it take to transfer money from Venmo to a bank account?

The transfer can take 1-3 business days if you choose the free option. Instant transfers are available for a fee and are usually immediate.

Are there any fees associated with transferring money?

Venmo charges a fee for instant transfers. However, standard transfers to your bank account are free. Cash App does not charge fees for adding money from your bank account.

Is it safe to link my bank account to Venmo and Cash App?

Yes, both Venmo and Cash App use encryption and security protocols to protect your financial information.

What should I do if my transfer fails?

If your transfer fails, check if your bank account details are correct and ensure you have sufficient funds. If issues persist, contact Venmo or Cash App customer support for assistance.

2 notes

·

View notes

Text

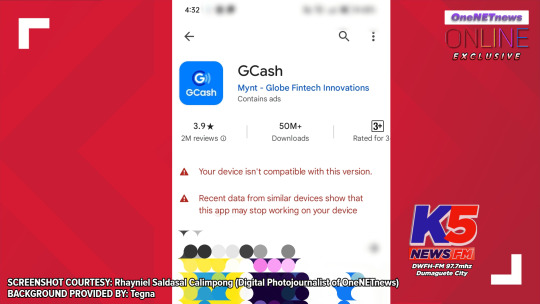

FLASH REPORT: GCash faces widespread Installation Problems that criticized e-wallet users in a New System Version Update [#K5NewsFMExclusive]

(Written by Miko Kubota, Luz Isidora Noceda and Rhayniel Saldasal Calimpong / K5 Tele-Serbisyo Patrol #4 of OneNETnews & Station Manager and President of ONC, Regional Correspondent of Disney XD News, and Freelance News Writer, Online Media Reporter & News Presenter of OneNETnews)

TAGUIG, NATIONAL CAPITAL REGION -- Philippine fintech electronic wallet 'GCash' faced nationwide of frustrations in smartphone installation issues with or without unregistering / re-registering phone models to being associated with their GCash account, per a latest new version of '5.78.0' recently released last week on Wednesday (July 3rd, 2024 – Manila local time), affecting almost all of the Apple iOS and Android smartphones, per some of our examples like Oppo and RealMe.

DWFH-FM 97.7mhz's K5 News FM: Dumaguete was one of the first ones who discovered where several users at GCash have manually failed to unregister old or newer phones in a new version update, especially those who recently tried to re-install after uninstalled this said e-wallet app, but was temporarily locked out and/or potentially lost a registered SIM card due to incompatible new version happening this week on Wednesday afternoon before 2pm (July 10th, 2024). Sometimes, the e-wallet app intermittently crashes from the start, except when going offline for a few seconds before logging in with your own MPIN and turning on WiFi or mobile data in most Android phone models like Oppo.

(ADVISORY PHOTO COURTESY: GCashOfficial via FB PHOTO)

In a latest official social media advisory post stating that there will be a system update to improve your experience for the Filipinos and even OFWs (Overseas Filipino Workers) abroad. Per the new announcement at Futurecast 2024 within late-last June 2024, the new app version of '5.78.0' and later versions in the e-wallet app unveiling to be rolling out new features like Tap to Pay, Smartwatch Payments via QR code (Quick Response) in selected Huawei smartwatches, International Cash-In from the American partnered banks, 30-day Tourist Access for Non-Filipino individuals, and GCash Jr. with Parental Controls.

E-wallet fintech officials say that the funds of GCash remain safe as normal, as long as you keep the registered phone locked in without losing both of your SIM card and a smartphone, which potentially infiltrates virtually from hackers, scammers and phishing individuals.

GCash has currently working out to sort the issue to the e-wallet application developers and is expected to be done by Friday afternoon at 12nn (July 12th, 2024) and advises everyone to re-download the GCash app once the system update is completely fixed. 'K5 News FM: Dumaguete' reached out to Apple and Google but refused to respond to us for a comment via E-Mail correspondent.

System update in the e-wallet app is related to the incompatibility concerns of both Apple iOS and Android smartphones. Self-unregistration is voluntarily possible by transferring a new phone from your old Oppo to RealMe (in the above-mentioned examples) and can be done through GCash national hotline of 2882, instead of GCash Help Center website. Online payments and debit card payments like GCash Visa Card, as well with other e-wallets and digital or physical banks like Maya, Coins.PH, UNO Digital Bank and RCBC (Rizal Commercial Banking Corporation) will not be affected, despite the incompatibility concerns in the GCash app alone.

Online netizens criticized social media, in lacking communication to blame in poor customer service, yet to be boycotting and brutally attacking the e-wallet app if they failed to fix the issue beyond the Friday afternoon deadline and destroying their image of the financial e-wallet tech app company.

GCash apologizes for the inconvenience for those affected by the epidemic of incompatibility concerns and failing to unregister smartphone models, regardless of uninstall and re-installing this said e-wallet app.

Mobile application technicians and developers are working around the clock to sort issues the soonest before the anticipated weekend breaks.

SCREENSHOT COURTESY: Rhayniel Saldasal Calimpong (Digital Photojournalist of OneNETnews)

BACKGROUND PROVIDED BY: Tegna

SOURCE:

https://www.facebook.com/100064643983643/posts/949742470523877 [Referenced FB Captioned PHOTO via GCashOfficial]

and

https://www.yugatech.com/news/top-announcements-from-gcash-at-futurecast-2024/ [Referenced News Article via YugaTech News Bureau]

-- OneNETnews Online Publication Team

#flash report#technology news#taguig#national capital region#NCR#GCash#e-wallet#awareness#system update#fyp#K5 News FM#exclusive#first and exclusive#OneNETnews

0 notes

Text

Cash App Closed My Account and Took My Money: What You Need to Know

Introduction

In recent years, Cash App has become a popular platform for transferring money quickly and conveniently. However, there are growing concerns among users who claim that Cash App closed their accounts and confiscated their funds. This issue can be distressing, especially if the money in question is crucial for personal or business needs. This article aims to provide a comprehensive guide on why Cash App closed your account, what you can do to retrieve your funds, and how to prevent this from happening.

Understanding Why Cash App Closes Accounts

Violation of Terms of Service

Cash App, like any other financial platform, has a set of Terms of Service (TOS) that all users must adhere to. Violating these terms can result in account suspension or closure. Common violations include:

Engaging in fraudulent activities: Any activity deemed fraudulent, such as creating fake accounts or engaging in scams, will lead to immediate account closure.

Suspicious transactions: Frequent or large transactions that trigger anti-money laundering alerts can lead to an account review and possible closure.

Linked accounts: Using the same bank account or card on multiple Cash App accounts can be seen as suspicious behavior.

Unverified Accounts

Cash App requires users to verify their identity to unlock full access to its features. If you fail to verify your account, your activities may be limited, and persistent use without verification can lead to cash app account closed.

Chargebacks and Disputes

If you frequently dispute transactions or request chargebacks, Cash App might view your account as high risk and opt to close it to mitigate potential losses.

What to Do If Cash App Closes Your Account

Contact Customer Support

If your cash app account has been closed, the first step is to contact Cash App Customer Support. Provide all necessary details, including your account information and any relevant transaction IDs. Be prepared to answer questions and provide identification to verify your claim.

Submit a Complaint

If contacting customer support does not resolve the issue, you can file a complaint with the Better Business Bureau (BBB) or the Consumer Financial Protection Bureau (CFPB). These agencies can sometimes expedite the resolution process.

Legal Action

In extreme cases where significant amounts of money are involved, you might consider seeking legal advice. An attorney specializing in financial disputes can provide guidance on whether you have a viable case and help you navigate the legal process.

Preventing Account Closure

Follow the Terms of Service

The simplest way to avoid cash app closing account is to adhere strictly to Cash App’s Terms of Service. Familiarize yourself with these terms and ensure that all your transactions comply with them.

Verify Your Account

Ensure your account is fully verified. This includes providing your full legal name, date of birth, and the last four digits of your Social Security Number (SSN). Verifying your account can reduce the likelihood of it being flagged for suspicious activity.

Monitor Your Transactions

Keep an eye on your transaction history for any irregularities. Report unauthorized transactions immediately to avoid having your account flagged for unusual activity.

Avoid Frequent Chargebacks

While disputes are sometimes necessary, frequent chargebacks can raise red flags. Try to resolve transaction issues directly with the other party before resorting to filing disputes through Cash App.

Understanding Your Rights

Fund Recovery

According to U.S. financial regulations, users have the right to recover their funds if a cash app account is closed. Understanding your rights can help you navigate the recovery process more effectively.

Regulation E

Under Regulation E of the Electronic Fund Transfer Act (EFTA), financial institutions must provide certain protections to consumers. If you believe Cash App has violated these regulations, you may have grounds to file a formal complaint.

Alternatives to Cash App

If you find Cash App’s policies too restrictive or unreliable, consider using alternative platforms. Some popular alternatives include:

Venmo: Known for its social media-like interface and ease of use.

PayPal: Offers robust buyer and seller protections and is widely accepted.

Zelle: A quick and secure way to send money directly between bank accounts.

Conclusion

Having your Cash App account closed and funds confiscated can be a frustrating experience. However, by understanding the common reasons for account closure and taking proactive steps to ensure compliance with Cash App’s policies, you can minimize the risk of encountering these issues. If your cash app account is closed, swift action and knowledge of your rights can help you recover your funds.

For those who have had persistent issues with Cash App, exploring alternative financial platforms might provide a more reliable solution.

0 notes

Text

How to Retrieve Money from a Closed Cash App Account

When your Cash App account gets closed, it can be a frustrating experience, especially if you still have funds in the account. However, there are systematic steps you can follow to retrieve your money. In this article, we provide a comprehensive guide on how to recover your funds from a closed Cash App account.

Understanding Why Your Cash App Account Was Closed

The first step in resolving this issue is understanding why your cash app account was closed. Common reasons include:

Violation of Terms of Service: This could be due to fraudulent activities, multiple disputed transactions, or other breaches of Cash App policies.

Suspicious Activity: Unusual login attempts or transfers could trigger a security lockdown.

Unverified Information: Not completing the necessary verification steps can result in account closure.

Understanding the reason can help you address the specific issue and expedite the recovery process.

Steps to Recover Funds from a Closed Cash App Account

1. Contact Cash App Support

The most direct method to resolve account issues is by contacting Cash App support. Here’s how you can do it:

Via App:

Open the Cash App on your mobile device.

Tap the profile icon on your Cash App home screen.

Scroll down and select "Cash Support."

Choose “Something Else” and navigate to your issue.

Tap “Contact Support” and explain your problem.

Via Website:

Go to the Cash App website.

Scroll down to the bottom of the page and click on “Support.”

Sign in to your account.

Select your issue and click “Contact Support.”

Providing detailed information about your account and the issue will help expedite the process.

2. Verify Your Identity

If your cash app account was closed due to unverified information, you might need to provide additional documentation to verify your identity. This can include:

A government-issued ID

Proof of address

The last four digits of your Social Security Number (SSN)

Ensure all information matches the details you provided during the account setup.

3. Review Transaction History

To ensure you recover all your funds, review your transaction history. This includes:

Pending payments

Completed payments

Received payments

4. Link a New Bank Account or Debit Card

If your previous bank account or debit card is no longer accessible, you will need to link a new one. Here’s how:

In the App:

Open the Cash App and tap the profile icon.

Select “Linked Banks” or “Add Bank.”

Enter the new bank details and follow the prompts to verify.

5. Request a Cash Out

Once your account is accessible and verified, you can transfer the remaining funds to your

Linked bank account or debit card and Follow these steps to request cash out:

In the App:

Open the Cash App and go to the “Banking” tab.

Tap “Cash Out.”

Choose the amount you want to transfer.

Select the desired deposit speed (Instant or Standard).

Confirm with your PIN or Touch ID.

What to do if Support is Unresponsive

In cases where Cash App support is not responsive or the issue remains unresolved, consider the following steps:

1. Escalate the Issue

If initial support attempts fail, escalate the issue by:

Requesting to speak with a higher-level support representative.

Reaching out via multiple channels such as email, social media, or phone.

2. File a Complaint

If your issue persists, you can file a complaint with external agencies:

Better Business Bureau (BBB): Submitting a complaint to the BBB can sometimes prompt faster resolution.

Consumer Financial Protection Bureau (CFPB): This agency handles complaints related to financial products and services.

3. Seek Legal Advice

If all else fails, consult a legal professional who can provide advice on potential next steps, including possible legal action to recover your funds.

Preventing Future Account Closures

To avoid similar issues in the future, consider these preventive measures:

1. Follow Cash App’s Terms of Service

Always adhere to the platform’s terms and policies to prevent violations that could lead to account closure.

2. Verify Your Information

Ensure your personal information is up-to-date and fully verified to avoid any verification-related closures.

3. Monitor Account Activity

Regularly check your account for any suspicious activity and report it immediately to Cash App support.

4. Use Strong Security Practices

Enable two-factor authentication (2FA) on your Cash App account.

Use a unique, strong password and change it regularly.

Avoid sharing your login details with anyone.

By following these detailed steps, you can effectively recover your funds from a closed Cash App account and ensure smoother transactions in the future. Always stay vigilant and proactive to maintain the security and accessibility of your financial resources.

0 notes

Text

How to Resolve Zelle Payment Failed Issue?

Zelle has been promoted as a manner to transfer money to the ones whom you're acquainted with and trust like your own circle of relatives, participants or parents, friends, or maybe your neighbor. The enterprise isn't recommending the use of its carrier for the ones you do not know personally. It additionally warns users that "neither Zelle nor the taking part banks provide a protection application for any transaction or buy carried out thru Zelle." However, sometimes customers face problems if Zelle payment failed.

It may want to manifest because of such a lot of distinct reasons. If you also see the popularity of Zelle payment failed but money taken. It could help in case you inspected the reasons at the back of it- this manner, you may remedy this trouble and efficiently transfer money out of your account.

Why did Zelle payment fail?

Here are some possible reasons because of which payment failed Zelle, but money was taken:

The first thing to do while you revel in a Zelle payment failure is to check the repute of your account. The repute must be correct, however if it's far nevertheless displaying as pending, you have to take movement immediately.

If you have been flagged for a fraudulent transaction, you could touch Zelle support to have them investigate your account.

Other possible motives for a failed payment are server issues, which may be resolved inside some hours. If the problem persists, touch Zelle support to get your account verified.

If your Zelle failed payment, but cash became taken, the following step is to double-take a look at the data. If the recipient has not enrolled in Zelle, you could have entered their account information incorrectly, causing the transaction to fail.

If you have a high-pace net connection, you may be capable of getting a Zelle payment. If you don't, it is possibly because of low-pace net connections or overloading your network. You must additionally make sure that your cell tool has a high-pace wifi signal. If this isn't always the case, you must strive to contact Zelle support to repair the problem. This way, they let you repair the issue.

If your net connection is slow, you could touch Zelle support to get your email address and U.S. cell wide variety moved. Once your email address is connected on your account, you could use the Zelle app to send and receive money. If your cell phone does not work, you could strive for the usage of the monetary institution's on-line banking or cell app. However, in case your net connection is simply too slow, you could still strive using your financial institution's online banking.

Another purpose a Zelle payment would possibly fail is due to the fact the recipient's bank account has now no longer been activated. The sender's bank account isn't always available. In this case, you could touch the Zelle app support team and get them to fix your problem. It's an easy process, however it is still irritating whilst the payment fails. If you are now no longer capable of sending the cash, you could strive to contact the recipient and explain the problem.

Sometimes a Zelle failed payment surely due to the fact the utility is outdated. To make certain that the application is up-to-date, you have to have a sturdy net connection. Otherwise, the application might be outdated, affecting your transactions. If this happens, attempt to download the modern day model of the app, and the problem must cross away. There are many different reasons for a failed Zelle payment, however some are related to your internet connection speed and the type of information you entered.

What are the best ways to fix the issues of Zelle payment that failed but the money was taken?

Many methods let you remove the Zelle payment issue. If you're making the payment successfully and also you may not get the error, but while the error appears again, you must be trying to find the help of the assistance team of the Zelle app. Let them recognize this issue, and they may discover the cause.

Check Version: To fix the failed Zelle payment issue, it is necessary to verify whether or not your model of the software is up-to-date. This may be the cause of the payment not always working. If the software to your phone is not upgraded, a few functions might not function and continuously display issues. So ensure you test the Zelle version of the app. Go to the settings menu and click on the Update tab. If you fail to affirm the model, you can stumble upon an error 101 when you send money.

Check Balance: If you're sending or receiving cash, it's critical to have a sum of money to your account; as we formerly mentioned the motives why because of a loss of funds, the transaction couldn't occur, that's why the payment isn't always successful. Therefore, if the quantity had to ship the cash is insufficient, upload it to the account. Then switch cash the usage of the ideal information.

Check Connection: Ensure that you hold your net's velocity at a degree in which while you make the payment, it would not display a blunders message 404. The net should be dependable sufficient to make certain that the frequency would not vary among low and excessive whilst making payments. In your mind, you should have a web connection of excessive velocity out of your Internet Service Provider, and additionally the wifi must be sturdy and feature sturdy indicators to be walking at excessive velocity to your device.

Be sure to keep tune of your fee status while using Zelle. If your payment is pending, the receiver can't transfer payment using your mobile or email number.

When the state of your payment is correct, and the account shows the amount, but it isn't but in the bank account you sent it, the error might still show. Contact the support team by calling the toll-free number. We are sure that you will have overcome the challenges of the Zelle unsuccessful transaction. The following steps should be useful for you. However, if you have to face the same issue, talk about the issue with the Zelle team. They will help you with the best methods.

0 notes

Text

How to Withdraw Money from Robinhood to Bank Account

Withdrawing money from your Robinhood account to your bank account is a straightforward process, but ensuring that each step is followed correctly is essential for a smooth transaction. This comprehensive guide will walk you through the process, ensuring that you can transfer your funds with ease and confidence.

Understanding Robinhood Withdrawal Policies

Before initiating a withdrawal, it’s crucial to understand Robinhood’s withdrawal policies. Robinhood allows users to withdraw up to $50,000 per business day. However, if you have recently sold securities, the proceeds from those sales may take up to five business days to settle before they can be withdrawn.

Step-by-Step Guide to Withdrawing Money from Robinhood to Your Bank Account

Open the Robinhood App: Begin by opening the Robinhood app on your mobile device. Ensure that you are logged into your account. If you are using the Robinhood website, log in through your preferred web browser.

Navigate to the Account Tab: Once logged in, tap on the account icon located at the bottom right corner of the screen. This will take you to your account overview page.

Select 'Transfers': On the account overview page, you will see several options. This option allows you to initiate a transfer of funds either to or from your Robinhood account.

Choose 'Transfer to Your Bank': In the 'Transfers' menu, select the 'Transfer to Your Bank' option. This will open a new screen where you can specify the amount you wish to transfer.

Enter the Amount: Enter the amount of money you wish to withdraw. Ensure that the amount does not exceed your available withdrawal balance.

Select Your Bank Account: Choose the bank account where you want the funds to be transferred. If you have linked multiple bank accounts, make sure to select the correct one. If you have not yet linked a bank account, you will need to add one by providing your bank’s routing number and your account number.

Review and Confirm: Review the details of your transfer to ensure everything is correct. Once you are satisfied, confirm the transfer. The funds will typically be transferred to your bank account within three to five business days.

Understanding Settlement Periods

One of the critical aspects of withdrawing funds from Robinhood understands the settlement periods. When you sell stocks or other securities, the proceeds from the sale must go through a settlement period before they become available for withdrawal. This period usually lasts two business days, referred to as T+2 (trade date plus two days).

Instant Withdrawals

While the standard withdrawal process takes a few days, Robinhood also offers instant withdrawals for a small fee. This service allows you to access your funds immediately, bypassing the usual settlement period. However, the instant withdrawal feature may not be available to all users and is subject to certain conditions.

Withdrawing to a Different Bank Account

If you need to withdraw funds from Robinhood to a different bank account, you must link the new bank account to your Robinhood account. This can be done through the 'Banking' section in the app. After adding and verifying the new bank account, you can proceed with the withdrawal process as described above.

Troubleshooting Common Issues

Insufficient Funds: One common issue user’s face is insufficient funds in their Robinhood account. Ensure that your account has enough settled cash to cover the withdrawal amount. Remember, unsettled funds from recent sales cannot be withdrawn until the settlement period is complete.

Incorrect Bank Details: If the bank details you entered are incorrect, the withdrawal will fail. Double-check the routing number and account number of your bank account before confirming the transfer.

Pending Transactions: Pending transactions, such as recent deposits or sales, can affect your available balance. Ensure all transactions are fully settled before attempting a withdrawal.

Withdrawal Limits: Robinhood imposes a daily withdrawal limit of $50,000. If you attempt to withdraw more than this limit, the transaction will be declined. Plan your withdrawals accordingly to stay within this limit.

Contacting Robinhood Support: If you encounter any issues during the withdrawal process, Robinhood’s customer support team is available to assist you. You can reach out to them through the app or via the Robinhood website.

Conclusion

Withdrawing money from your Robinhood account to your bank account is a simple process if you follow the steps outlined in this guide. By understanding the withdrawal policies, settlement periods, and potential issues, you can ensure a smooth transfer of your funds. Whether you opt for the standard withdrawal process or utilize the instant withdrawal feature, Robinhood provides flexible options to access your money when you need it.

0 notes

Text

What does cash out failed to mean on the Cash App?

Cash App cash out feature allows users to transfer money directly from their Cash App balance into their bank accounts. This is an easy way to access funds. However sometime Cash App cash out failed due to so many different reasons, including insufficient funds or incorrect bank details, network problems, an outdated app version, and suspicious activities. This error message indicates that your Cash App cash-out request was denied due to various reasons, such as being suspicious or not passing identity verification. If you cancel your cash-out request, the funds will be returned to either your Cash App balance or linked account by ACH or wire transfer. This may take up to 3 business days, depending on what financial institution issued the funds.

What are the Common reasons for Cash App cash out failed?

Cash App displays the 'Cash out failed' error when a user attempts to transfer money from their Cash App to their linked bank accounts but fails to complete the transaction successfully. This error can be confusing and frustrating, leaving users to wonder why their cash-out request was unsuccessful. Several factors can lead to 'Cash Out Failed' error on Cash App, including:

Cash App cash out from your account can be affected by temporary maintenance or outages that prevent transactions from going through.

Having more funds in your Cash App account is one of the most common reasons for Cash App failures. To cash out successfully, you must have at least $50 in your Cash app account. If you still need to, you may need to add additional funds before trying again.

Cash App cashing out issues can be due to security concerns. If the system flags a transfer as failed, it detects suspicious behaviour that prevents you from completing your transfer.

Updates to the Cash App platform can introduce bugs or compatibility problems that may affect cash-out functionality.

Cash App users must complete the identity verification process to ensure security and prevent fraud. Otherwise, transactions will fail, and funds will be lost.

What are the Steps to Resolve Cash App Cash Out Failed Issues?

Cash App support can help you resolve the issue. Other solutions include ensuring that your internet connection is stable, checking your account balance, and updating your Cash App. You can also retry transactions, review transaction details, seek assistance from Cash App Support, explore alternative withdrawal options, monitor your account, and stay informed about app updates. Here are the steps to fix this Cash App cash out failed issues:

You must check your Cash App balance before you cash out to make sure that you have enough funds.

Check your internet connection. Make sure you have a steady connection to prevent connectivity problems.

Update your Cash App to its latest version.

Double-check your account information to make sure it is correct. For instance, always recheck that the account number and routing numbers are correct.

Cash App customer support can also help you in resolving the Cash App cash out errors.

How to Fix Cash App Cash-Out Failed?

There are several ways that you can help you in fixing the Cash App cash out failed errors. First, ensure there is enough money available your Cash App account. Next, double-check that the recipient's details are correct. Also check that you have high speed Internet or Wi-Fi connection. If necessary, you can contact Cash App Customer Support or update your browser. If you are still having problems, try cashing out a smaller amount to see if the transaction goes through.

What Happens When Cash Out Fails in Cash App?

If a Cash App cash-out fails, the funds are left in your Cash App account and not transferred to your linked Bank Account. You will receive a notification with the details of any errors that caused these issues. To avoid further issues or possible loss of funds, it is important to resolve the issues as soon as possible. So, verify that your payment information matches what the recipient needs. Also, update the Cash App to its latest version and avoid suspicious activity.

0 notes

Text

What time does Cash App direct deposit hit on Fridays?

Cash App is a widely-used mobile payment service that allows users to send and receive money quickly and conveniently. One of the key features of Cash App is the ability to set up direct deposit and have your paycheck, government benefits, or any other recurring income deposited directly into your Cash App account. Many users wonder what time does direct deposit will hit, especially when it falls on a Friday. While the exact timing may vary from person to person, there are some general guidelines to consider.

Firstly, it's important to understand that direct deposit times can differ depending on the policies and processes of your employer or organization issuing the payment. Generally, employers initiate direct deposits in the early hours of the morning. This usually happens on the day before the official payment date, which for most people is on a Friday. However, keep in mind that not all employers have the same practices, and the time can vary. It's a good idea to check with your employer's HR department or payroll office to get accurate information specific to your situation.

Secondly, some individuals may receive their direct deposits earlier than others due to various factors. For instance, if your bank or financial institution has a different processing time, it can affect the speed at which the funds are made available in your Cash App account. Similarly, some employers have partnerships with specific financial institutions or payroll processors, which could accelerate the processing time. These factors contribute to the discrepancy in direct deposit arrival times for different individuals.

Furthermore, it is worth mentioning that Cash App does not influence the timing of direct deposits. Cash App serves as a platform for receiving and managing funds but does not control when the funds are sent by the employer or organization. As such, any delay experienced in receiving direct deposits on Fridays is likely due to the internal processes of the organization responsible for distributing the payments.

In addition, it is crucial to ensure that your direct deposit information is correctly set up in your Cash App account. A wrong or incomplete bank account and routing numbers can result in delays or failed transfer attempts. Double-checking your account details and comparing them to the details provided by your employer or organization can prevent problems and ensure that what time does cash app direct deposit hit on Fridays.

In conclusion, the time at which Cash App direct deposits hit on Fridays is not a one-size-fits-all answer. The exact timing can vary depending on several factors, including your employer’s practices and policies, your financial institution's processing time, and any partnerships between your employer and financial institutions. It is advisable to contact your employer's HR department or payroll office for specific information regarding your direct deposits. Additionally, ensuring that your direct deposit details are accurate in your Cash App account will help prevent any issues or delays in receiving your funds.

0 notes

Text

How to resolve if Cash App direct deposit failed?

In today's digital age, direct deposits have revolutionised how we receive payments, offering convenience and efficiency. However, despite the seamless nature of platforms like Cash App, users may encounter instances where their direct deposits fail to go through as expected. You're not alone if you've ever experienced a failed direct deposit on Cash App. In this comprehensive guide, we'll explore the common reasons behind failed direct deposits on Cash App and provide actionable solutions to address these issues effectively.

Unpacking Cash App Direct Deposit Failed:

Direct deposits on Cash App are designed to streamline the payment process, allowing users to receive funds directly into their accounts without needing physical checks or manual transfers. However, several factors can contribute to the failure of a direct deposit, leading to frustration and inconvenience for users. Understanding these factors is essential for troubleshooting and resolving issues promptly.

Common Causes of Cash App Direct Deposit Failures:

Incorrect Account Information: One of the most common reasons for Cash App direct deposit failed is inaccurate or outdated account information provided by the sender. Errors in account numbers, routing numbers, or other essential details can result in failed transactions.

Bank Account Restrictions: Some banks or financial institutions may restrict certain types of transactions, including direct deposits. If your bank account is subject to such restrictions, it may prevent direct deposits from being processed successfully.

Insufficient Funds: The transaction may fail if the sender's account does not have sufficient funds to cover the direct deposit amount. It's essential to ensure that the sender has enough funds available before initiating a direct deposit on the Cash App.

Network Issues: Technical glitches or network disruptions on Cash App's end can also contribute to failed direct deposits. These issues may arise due to server maintenance, software updates, or other unforeseen circumstances.

Security Checks: Cash App employs stringent security measures to protect users from fraud and unauthorised transactions. A direct deposit flagged for potential security risks may be rejected or delayed until additional verification steps are completed.

Solutions to Address Cash App Direct Deposit Failed:

Verify Account Information: Double-check the account information provided by the sender to ensure accuracy. Verify account numbers, routing numbers, and other relevant details before initiating a direct deposit on Cash App.

Check Bank Account Restrictions: Verify with your bank or financial institution to determine if there are any restrictions or limitations on direct deposits. If necessary, update your account settings to allow for successful transactions.

Ensure Sufficient Funds: Confirm that the sender's account has enough funds to cover the direct deposit amount. If funds are insufficient, coordinate with the sender to ensure the necessary funds are available before retrying the transaction.

Monitor Transaction History: Keep an eye on your Cash App transaction history to track the status of direct deposits. This can help you identify any failed transactions early on and take appropriate action to resolve them.

Contact Customer Support: If you see that Cash App direct deposit failed and returned to originator, contact customer support for assistance. The support team can provide insights into your transaction's status and offer guidance on potential solutions.

FAQs:

Q: How long can a failed direct deposit be returned to the originator on Cash App?

A: If a direct deposit fails on the Cash App, the funds are typically returned to the originator's account within 1-5 business days, depending on the policies of the sender's bank or financial institution.

Q: Can I cancel a failed direct deposit on Cash App?

A: Once a direct deposit has failed on the Cash App, it cannot be cancelled. However, you can contact customer support for assistance in resolving the issue and retrieving the funds.

Q: Will I be notified if my direct deposit fails on Cash App?

A: Cash App may send notifications or updates regarding failed direct deposits. However, if you're concerned about a failed transaction, check your transaction history or contact customer support for more information.

Conclusion:

Encountering a failed direct deposit on Cash App can be frustrating, but it's essential to remain calm and proactive in addressing the issue. By understanding the common causes of direct deposit failures and implementing practical solutions, users can confidently navigate the Cash App platform and ensure smooth transactions. Remember, verifying account information, communicating with the sender, and seeking assistance from customer support are critical steps in resolving failed direct deposits and maintaining financial stability on Cash App.

#Cash app direct deposit#cash app direct deposit pending#cash app direct deposit failed#cash app direct deposit failed and returned to originator#cash app deposit pending#cash app pending direct deposit#Direct Deposit Cash App#Cash App Direct Deposit Time#Cash App Direct Deposit late#Cash App Direct Deposit Time Not Showing-up#Direct Deposit With Cash App#What Time Does Cash App Direct Deposit Hit#What Time Does Cash App Direct Deposit Hit on Wednesday#What Time Does Cash App Direct Deposit Hit on Tuesday#What Time Does Cash App Direct Deposit Hit on Thursday#Cash App direct deposit hit

0 notes

Text

Why my Cash App direct deposit failed and is returned to the originator?

Direct deposit offers a convenient way to receive payments directly into your Cash App account. However, there are instances where the direct deposit may fail and be returned to the sender, also known as the originator. If you've encountered this issue and are wondering why your Cash App direct deposit failed and returned to originator, you're not alone. In this comprehensive guide, we'll explore the possible reasons behind such failures and provide insights to help you navigate the situation effectively.

Understanding Cash App Direct Deposit:

Before delving into why a Cash App direct deposit may fail and be returned to the originator, let's first understand the basics of the direct deposit process:

Initiation by Sender: Direct deposits are initiated by the sender, which could be your employer, government agency, or any other entity authorised to make payments. The sender provides your Cash App routing and account numbers to facilitate the deposit.

Processing by Cash App: Upon receiving the deposit instructions, Cash App processes the direct deposit and credits the funds to your account. This process typically occurs early in the morning on the scheduled deposit date.

Availability of Funds: Once the direct deposit is processed successfully, the funds become available in your Cash App account for use in various transactions, such as purchases, bill payments, or transfers to other accounts.

Why Your Cash App Direct Deposit Failed?

Now, let's explore some common reasons why a Cash App direct deposit may fail and be returned to the originator:

Incorrect Account Information: One of the most common reasons Cash App direct deposit failed is incorrect account information provided by the sender. This could include errors in the routing number, account number, or other essential details needed to process the deposit.

Closed Account: If your Cash App account is closed or frozen at the time the direct deposit is initiated, the transaction will fail, and the funds will be returned to the originator. To avoid such issues, it's essential to ensure that your account is active and in good standing.

Insufficient Funds: If there are insufficient funds in your Cash App account to cover the direct deposit amount, the transaction may fail. It's crucial to maintain a sufficient balance in your account to avoid such situations.

Banking Errors: Sometimes, direct deposit failures may occur due to errors or issues within the banking system, such as network connectivity issues, processing delays, or technical glitches. These issues are beyond Cash App's control but can impact the successful processing of direct deposits.

FAQs:

Q: What should I do if my Cash App direct deposit fails and is returned to the originator?

A: If your Cash App direct deposit fails and is returned to the originator, you should contact the sender (e.g., your employer or payer) to verify the account information provided and request re-issuance of the payment. Additionally, you may need to update your Cash App account information if any discrepancies are identified.

Q: How long does it take for a returned Cash App direct deposit to be reissued?

A: The time it takes for a returned Cash App direct deposit to be reissued depends on various factors, including the policies and procedures of the sender. It's advisable to contact the sender promptly to request reissuance and follow up accordingly.

Q: Can I prevent Cash App direct deposit failures in the future?

A: To minimise the risk of direct deposit failures, ensure that your Cash App account information is accurate and up to date. Additionally, maintain a sufficient balance in your account to cover incoming deposits and monitor your account regularly for any issues or discrepancies.

Conclusion:

Encountering a Cash App direct deposit failure and return to the originator can be frustrating, but understanding the reasons behind such failures is the first step toward resolution. By addressing potential issues such as incorrect account information, account status, and banking errors, you can minimise the risk of future failures and ensure a smoother direct deposit experience. If you have further questions or concerns about direct deposits, don't hesitate to reach out to Cash App support for assistance.

#Cash app direct deposit#cash app direct deposit pending#cash app direct deposit failed#cash app direct deposit failed and returned to originator#cash app deposit pending#cash app pending direct deposit#Direct Deposit Cash App#Cash App Direct Deposit Time#Cash App Direct Deposit late#Cash App Direct Deposit Time Not Showing-up#Direct Deposit With Cash App#What Time Does Cash App Direct Deposit Hit#What Time Does Cash App Direct Deposit Hit on Wednesday#What Time Does Cash App Direct Deposit Hit on Tuesday#What Time Does Cash App Direct Deposit Hit on Thursday#Cash App direct deposit hit

0 notes

Text

How do you Send Money from Chime to Cash App Step by Step Guide

In today's digital age, online payment platforms have become an integral part of our financial transactions. Among the popular ones are Cash App and Chime, both offering convenient ways to manage and transfer funds. If you're wondering how do you send money from chime to cash app or vice versa, you've come to the right place. This comprehensive guide will walk you through the process, ensuring a smooth and hassle-free money transfer.

What is Cash App and Chime:

Before delving into the step-by-step instructions, let's briefly understand the two platforms: