#canadian mint 1 oz gold bar

Explore tagged Tumblr posts

Text

Investing in the 1 Ounce Scotiabank Gold Bar: A Smart Choice for Canadian Investors

When it comes to investing in precious metals, gold remains one of the most reliable and sought-after assets. At 24 Gold Group Ltd., we are proud to offer a variety of gold products, including the highly esteemed Scotiabank Gold Bar, crafted by Valcambi Suisse. This 1-ounce gold bar is an excellent choice for those looking to invest in physical gold, whether for its value as a commodity or its potential as a long-term investment.

Why Choose the Scotiabank 1 Ounce Gold Bar?

The 1-ounce Scotiabank Gold Bar is a popular investment option for both seasoned collectors and new investors. Known for its high purity, this gold bar is minted by Valcambi Suisse, a renowned Swiss refinery known for its commitment to quality. The Scotiabank Gold Bar features the iconic logo of Scotiabank, a trusted name in Canadian banking, making it an attractive and secure choice for Canadian investors.

This 1-ounce gold bar is an excellent option for those who want to invest in gold without the added cost of larger bars. The size makes it highly liquid, meaning it can be easily bought or sold in the market, providing both flexibility and security for investors.

Scotiabank Gold Bar Price Today: A Key Consideration

One of the most important factors when purchasing gold is knowing the Scotiabank Gold Bar Price Today. The price of gold fluctuates based on market conditions, global demand, and other factors. At 24 Gold Group Ltd., we provide up-to-date pricing information, so you can stay informed about the gold price in Canada Scotiabank and make educated investment decisions.

While the price of gold generally follows the global market trends, it’s important to note that the Scotiabank Gold Bar may be priced slightly higher due to its association with the Scotiabank brand and its quality craftsmanship by Valcambi Suisse. These premium factors are reflected in the price, but the investment can offer stability in the long run.

What is the Current 1 Oz Gold Price in Canada?

As a Canadian investor, it’s essential to stay informed about the 1 oz gold price in Canada, as this will directly affect your purchase price when buying gold bars like the Scotiabank Gold Bar. The price of gold is typically quoted in USD per ounce, but it’s important to factor in currency exchange rates to understand the price in Canadian dollars.

At 24 Gold Group Ltd., we offer competitive prices on gold, ensuring that our clients are getting fair market value for their investment. Whether you’re buying a single 1-ounce gold bar or larger quantities, we provide transparent pricing that reflects the current market rate.

Why Invest in 1 Ounce Gold Bars?

Investing in a 1 oz gold bar offers several advantages. It’s a tangible asset that can protect wealth during times of economic uncertainty, inflation, or geopolitical instability. Additionally, gold bars are a popular form of investment because they are easy to store and transport.

The Scotiabank 1 ounce gold bar also offers investors the added benefit of being minted by a reputable institution, further ensuring its authenticity and value.

Conclusion

If you’re looking to buy gold in Canada, the Scotiabank Gold Bar is an excellent option. Whether you are interested in the 1 oz gold price in Canada or simply want to know the Scotiabank Gold Bar price today, 24 Gold Group Ltd. provides up-to-date information and competitive pricing to help you make the best decision for your investment portfolio.

For more information on pricing, availability, and how to purchase the 1-ounce Scotiabank Gold Bar, visit our website or read our blog for additional insights. Investing in gold has never been easier or more secure.

0 notes

Text

Investing in Silver Bars and Silver Coins in Canada – A Guide for Buyers

As Canadians seek reliable ways to diversify their portfolios, silver remains a popular choice due to its affordability, industrial demand, and long-term value retention. Whether you’re new to investing or an experienced buyer, purchasing silver bars in Canada and silver coins in Canada offers tangible assets that can protect against inflation and economic uncertainty. Here’s everything you need to know about investing in silver and why it’s a smart choice.

Why Invest in Silver?

Silver is often called “the poor man’s gold,” as it offers many of the same benefits as gold at a more affordable price per ounce. Silver investments are appealing for several reasons:

Affordability: Silver’s lower price allows for smaller, more frequent purchases, making it accessible for new investors.

Industrial Demand: Silver is widely used in technology, renewable energy, and medical industries, giving it a strong underlying demand that supports its value.

Value Storage: Like gold, silver acts as a hedge against inflation and currency devaluation, making it a secure choice for long-term wealth preservation.

Benefits of Buying Silver Bars in Canada

For investors looking to make substantial silver purchases, silver bars in Canada offer a cost-effective way to store larger quantities of silver. Silver bars are typically sold in various sizes, from 1 oz to larger 10 oz or even 1 kg bars, providing flexibility based on your investment budget.

Key Advantages of Silver Bars

Lower Premiums: Silver bars often carry lower premiums compared to coins, making them a cost-effective way to acquire more silver per dollar spent.

Efficient Storage: Silver bars are compact and easy to store, especially if purchased in larger sizes.

High Value Density: A few large bars can hold significant value, making them an ideal choice for those who want to invest in larger amounts of silver without taking up much space.

Investing in Silver Coins in Canada

For those looking for smaller, versatile investment options, silver coins in Canada provide a popular alternative. Silver coins offer aesthetic appeal and higher liquidity, making them easier to trade or sell in small amounts.

Advantages of Silver Coins

Liquidity: Silver coins are widely recognized and easy to sell, providing flexibility for those who may need to liquidate portions of their investment over time.

Collector Appeal: Many silver coins, especially Canadian Maple Leafs, have unique designs that appeal to collectors, adding potential numismatic value.

Higher Resale Value: Due to their collectible nature and global recognition, silver coins often have a higher resale value compared to bars.

Choosing a Reputable Dealer for Silver Bars and Coins

When purchasing silver bars or coins, selecting a trusted dealer is essential for quality and security. Look for a reputable platform that provides certified products, transparent pricing, and secure shipping.

Why Gold Stock Canada is the Right Choice

Gold Stock Canada is a trusted source for purchasing silver bars and silver coins in Canada. With a commitment to quality, transparency, and customer satisfaction, Gold Stock Canada offers Canadian investors a secure and convenient way to buy silver online.

Benefits of Buying from Gold Stock Canada

Certified Products: Gold Stock Canada offers silver bars and coins from reputable mints, ensuring authenticity and quality.

Secure Shipping: All orders are shipped with full insurance and tracking, ensuring your silver investment arrives safely.

Competitive Pricing: The platform provides up-to-date, market-aligned pricing, helping you buy silver at a fair and transparent rate.

Educational Resources: Gold Stock Canada offers resources to help both new and experienced investors make informed decisions about buying and managing silver.

Getting Started with Silver Investments

For new investors, starting with a mix of silver bars and coins allows for flexibility and balanced growth. Larger bars can serve as the foundation of a portfolio, while smaller coins add liquidity. Reputable dealers like Gold Stock Canada make it easy to build a silver portfolio suited to your investment goals.

Final Thoughts

Investing in silver bars in Canada and silver coins in Canada is a smart move for those looking to add tangible assets to their portfolio. By purchasing through a trusted platform like Gold Stock Canada, Canadians can buy with confidence, ensuring they receive high-quality products and excellent customer service. Whether you’re interested in larger silver bars or the flexibility of silver coins, investing in silver provides a secure foundation for long-term financial stability.

0 notes

Text

Buying Gold Online in Canada: A Comprehensive Guide

Gold has long been a trusted investment, prized for its stability, value retention, and role as a hedge against inflation. In Canada, buying gold has become more accessible than ever, thanks to the rise of online platforms. However, purchasing gold online requires careful consideration to ensure you are making a secure and informed investment. This comprehensive guide will walk you through everything you need to know about buying gold online in Canada, from selecting a reputable dealer to understanding the various gold products available.

1. The Benefits of Buying Gold Online

Purchasing gold online offers several advantages over traditional in-person transactions:

Convenience: Buying gold online allows you to shop from the comfort of your home, giving you access to a wide range of products at any time. This convenience is especially beneficial for investors who may not live near physical gold dealers.

Wide Selection: Online platforms often provide a broader variety of gold products, from coins and bars to fractional pieces, making it easier to find exactly what you’re looking for.

Competitive Pricing: Online dealers typically have lower overhead costs than brick-and-mortar stores, allowing them to offer more competitive prices. Additionally, you can easily compare prices across multiple platforms to ensure you’re getting the best deal.

Discreet Transactions: Online purchases are more private, as your gold is delivered directly to your home or a secure storage facility, reducing the risk of theft during transport.

2. How to Choose a Reputable Online Gold Dealer

The first step in buying gold online is selecting a trustworthy dealer. Here’s what to look for:

Reputation and Reviews: Start by researching the dealer’s reputation. Read customer reviews and testimonials to gauge satisfaction and reliability. Independent review sites can provide additional insights into the dealer’s performance.

Accreditation: Look for dealers who are accredited by industry organizations such as the Royal Canadian Mint, the Better Business Bureau (BBB), or the Canadian Association of Numismatic Dealers (CAND). Accreditation indicates that the dealer adheres to industry standards and practices.

Transparency: A reputable dealer will be transparent about their pricing, including any premiums over the spot price of gold. Ensure that the website clearly displays product details, including weight, purity, and manufacturer.

Secure Payment and Shipping: Security is paramount when purchasing gold online. The dealer should offer secure payment methods and encrypted transactions to protect your financial information. Additionally, make sure the dealer provides insured and trackable shipping options.

Buyback Policy: A good dealer will offer a buyback policy, allowing you to sell your gold back to them if needed. This feature enhances the liquidity of your investment and provides an easy exit strategy.

3. Understanding the Types of Gold Products Available

When buying gold online, you’ll come across various types of products, each with its own characteristics:

Gold Bars: Gold bars are a popular choice for investors looking to acquire larger quantities of gold. They are available in a range of sizes, from small 1-gram bars to large 1-kilogram bars. Gold bars typically have lower premiums compared to coins, making them a cost-effective option for bulk purchases.

Gold Coins: Coins like the Canadian Gold Maple Leaf, American Gold Eagle, and South African Krugerrand are favored by both collectors and investors. Coins often carry a higher premium due to their collectible value and intricate designs. They are also easier to sell in smaller quantities.

Fractional Gold: Fractional gold bars or coins (e.g., 1/10 oz, 1/4 oz) are an affordable entry point for investors with a limited budget. Although the premiums are higher on a per-ounce basis, fractional gold offers flexibility and liquidity.

Gold Rounds: Gold rounds are similar to coins but do not have legal tender status. They are typically less expensive than coins and are a good option for those who want the look and feel of a coin without the added numismatic value.

4. Pricing and Premiums: What to Expect

Understanding how gold is priced is crucial for making informed purchasing decisions:

Spot Price: The spot price of gold fluctuates based on market conditions, including supply and demand, geopolitical events, and economic data. This price is the base value of gold, to which a premium is added.

Premium: The premium is the amount you pay over the spot price, covering the costs of refining, minting, and distributing the gold, as well as the dealer’s profit margin. Premiums vary depending on the product type, with coins generally having higher premiums than bars due to their collectible value.

Comparing Prices: It’s essential to compare prices from different dealers to ensure you’re getting the best deal. Some dealers may offer discounts for bulk purchases, reducing the overall premium per ounce.

5. Payment and Shipping Considerations

Once you’ve selected your gold products, consider the following when completing your purchase:

Payment Methods: Most online gold dealers accept various payment methods, including credit cards, bank transfers, PayPal, and cryptocurrencies. Be aware that different payment methods may have different fees or discounts, so choose the option that best suits your needs.

Shipping: Ensure that the dealer offers insured and trackable shipping to protect your purchase during delivery. Depending on the value of your order, shipping fees may be included or charged separately. Some dealers offer free shipping on larger orders.

Delivery Time: Delivery times can vary depending on the dealer and your location. It’s important to understand the estimated delivery time before purchasing, especially if you need the gold by a specific date.

6. Safeguarding Your Gold Investment

Once you’ve purchased your gold, proper storage is essential to protect your investment:

Home Storage: If you choose to store your gold at home, invest in a high-quality safe that is fireproof and burglar-resistant. Place the safe in a discreet location and consider adding your gold to your home insurance policy.

Bank Safety Deposit Box: Many investors prefer to store their gold in a bank safety deposit box for added security. This option typically comes with an annual rental fee but offers peace of mind knowing your gold is secure.

Third-Party Storage: Some online dealers offer secure storage through third-party vaults. This option provides maximum security and insurance coverage, though it may come with additional fees.

7. Selling Your Gold Online

When the time comes to sell your gold, consider the following:

Market Timing: Monitor the current market price of gold to sell when prices are favorable. Timing your sale can significantly impact your returns.

Buyback Programs: Many online dealers offer buyback programs, making it easy to sell your gold back to them. Be sure to understand the terms and any associated fees.

Private Sales: You can also sell your gold privately through online marketplaces or local buyers. Ensure the transaction is secure and complies with all applicable laws.

Conclusion

Buying gold online in Canada is a convenient and effective way to invest in this valuable asset. By carefully selecting a reputable dealer, understanding the types of gold products available, and considering the logistics of payment, shipping, Shop gold bars online and storage, you can make informed decisions that align with your financial goals. Whether you’re a seasoned investor or new to gold investing, this comprehensive guide provides the knowledge you need to navigate the online gold market confidently. Gold’s enduring value, combined with the ease of online purchasing, makes it an attractive option for those looking to build and preserve wealth in an increasingly digital world.

0 notes

Text

1 oz Gold Bar (Inc. Assay Card) (New) – Royal Canadian Mint

Royal Canadian Mint produces this 1-ounce gold bar with an assay certificate. It complements investment accounts and treasure boxes. Despite its palm-sized stature, this gold bar exudes wealth. It is a great way to start investing in precious metals or to own a physical representation of gold’s attraction.

1 note

·

View note

Text

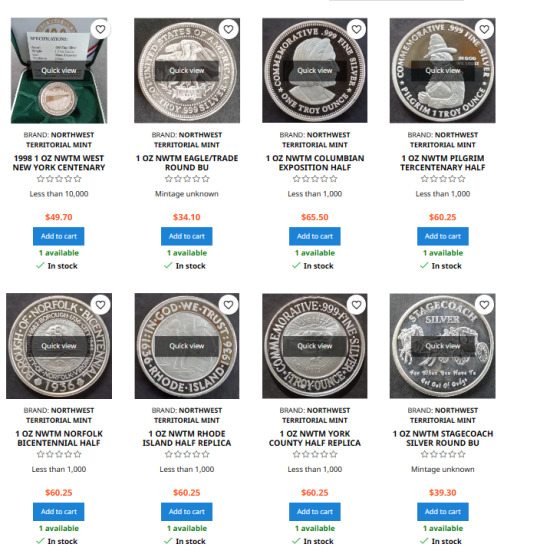

Northwest Territorial Mint LLC

What is Northwest Territorial Mint LLC?

Northwest Territorial Mint, LLC sells scouting coins, die-struck knives, belt buckles, key tags, trekking stick medallions, divot tools, badges, and medals. Medallions, as well as blades, coasters, bookmarks, belt buckles, and key tags. The Northwest Territorial Mint operates in America.

Northwest Territorial Mint develops high-quality solutions for the government, military, law enforcement, fire departments, corporations, and private parties. These solutions range from patriotic military coins, outstanding prizes, and treasured memories to motivational programs and incentives. Its history dates back to 1903, it has served as a dependable supplier to organizations like the Pentagon, Coca-Cola, John Deere, the U.S. Golf Association, and thousands of others. It is also renowned for designing numerous recognizable awards, like the Pulitzer Prize and the Medal of Honor. The Northwest Territorial Mint also produces coins, knives, and other insignia. And accomplishment award items for the Boy Scouts of America. The mint also has expertise in academics and athletics. The mint creates custom and stock items for any academic personnel, student, or athlete. Including trophies and medals, lapel pins, tassel medallions, and other mementos. The Northwest Territorial Mint also has a retail operation where it sells military challenge coins, collectible medals, and related minted items. As well as one-of-a-kind novelty options like its Signature Silver BulletsTM and Dubloons (used in the movie PIRATES OF THE CARIBBEAN). These services are in addition to the custom solutions it offers for any company, group. Or an individual looking to harness the historic power of tangible rewards. In fact, the Pentagon sells its goods! The Northwest Territorial Mint is the top mint in the United States. Thanks to its unwavering dedication to excellence, authenticity, and innovation. For detailed information read Northwest Territorial Mint Reviews.

Northwest Territorial Mint LLC: Products

They distributed government bullion coins such as Austria Philharmonics, Canadian Maple Leafs, and American Silver Eagles as a retailer. They were the sole mint for silver bullion branded with Pan American Silver Corp. One of the biggest primary silver producers in the world, as a result of their tight association.

Even they produced their own coins.999 pure silver bullion was offered in 1/2-ounce and 1-ounce sizes. As well as bars that came in a variety of weights ranging from 5 grams to 100 ounces. The NWTM also produced a line of goods known as Stagecoach Silver. Each.999-fine silver bar or round was scored into four pieces, making them tradeable and portable. - Pacific Northwest rounds (1986-1991) - Pan American Silver Corp rounds - Miscellaneous bullion 1 Oz rounds (dated and undated) - Miscellaneous commemorative event 1 Oz rounds (dated and undated)

Northwest Territorial Mint Fees and Charges:

It is impossible to offer up-to-date information on the Company's fees and charges because it is no longer a running company. It is important to keep in mind that rates for private mints and bullion dealers might vary based on the kind of product. The quantity bought, and additional elements like shipping and handling fees. Whether working with a private mint or a dealer in gold or silver. Before making a purchase, it's critical to comprehend all the fees and costs related to your order. A breakdown of all fees should be requested, and the terms and conditions should be carefully studied. Additionally, to make sure you are getting a reasonable bargain. It is a good idea to check the costs and fees of different businesses.

Additional Highlights of Northwest Territorial Mint

In 2016, the Northwest Territorial Mint filed for bankruptcy and its owner Ross Hansen. And his son-in-law Craig Bergman (formerly Craig Erdmann) was charged with consumer fraud. The proprietors allegedly committed fraud, including taking orders for goods they knew they couldn't fulfil. Stealing customer money for their own use, and selling fake coins, according to court documents and testimony. Many consumers were left with unfulfilled orders and were unable to get their money back due to the difficult bankruptcy process. Transparency is Important Charges of wire fraud, mail fraud, and money laundering were ultimately brought against the proprietors. In 2018, Hansen admitted admission to the charges and received a four-year prison term. In 2019, a jury convicted Bergman guilty, and he was given a 30-year prison term. The situation emphasizes the value of exercising caution when working with private mints. And other businesses in the precious metals sector.

Conclusion

To find a detailed analysis of the company, I suggest checking out Northwest Territorial Mint Reviews. Opening a precious metals IRA is a major decision. That's why I suggest checking out our top gold IRA providers list. There, you can find the best precious metals dealer in your state and choose accordingly. Also, the list will help you understand what the industry's best has to offer. Also, it helps with what you might miss out on. If you're unfamiliar with gold IRAs, check out this free guide: Find the best Gold IRA company in your state Read the full article

0 notes

Text

Watch "Royal Canadian Mint 1 Oz Gold Bars" on YouTube

youtube

0 notes

Link

Buy 1 oz South African Gold Krugerrand from USBCR which is the one of the most important bullion coins of the last 50 years. Struck by the South African Mint, the 1 oz. It is considered the first modern gold bullion coin for the everyday buyer. Visit now and get competitive prices and fast shipping on order above $99.

#1 oz South African Gold Krugerrand#Royal Canadian Mint Gold Eagle#Gold Price Canada#Gold Bar Argor Heraeus

1 note

·

View note

Link

Looking At Buying A Gold Bar In Canada? Buy 1 OZ Gold Bar from Royal Canadian Mint Bar - One Of The Best Places To Purchase A Gold Bar From In Toronto, Canada.

#1 OZ Gold Royal Canadian Mint Bar Canada#1 OZ Gold Royal Canadian Mint Bar Toronto#Mint Bar Royal Canadian Mint#Gold Bar to buy in Toronto

0 notes

Photo

Royal Canadian Mint 1 oz gold bar.

8 notes

·

View notes

Text

1 oz Gold Bar (Inc. Assay Card) (New) – Royal Canadian Mint

The Royal Canadian Mint, founded in 1908, is one of the most famous mints in the industry. They produce circulation coins for Canada, as they are a Crown Corporation of the Government of Canada. Aside from producing circulation coins for Canada, they design and manufacture bullion coins, such as Gold, Silver, Palladium, and Platinum bullion coins. Not only does the Mint produce circulation coins for Canada, but they also manufacture circulation coins on behalf of other nations.

1 note

·

View note

Text

2016 1oz American Silver Eagles & Bullion Available

2016 1oz American Silver Eagles & Bullion Available

1 Troy Ounce Uncirculated 2016 American Silver Eagles for $21.60 each (Cash Price) – Direct Delivery to your home. E mail me [email protected]. To order your Eagles. Prices subject to change based on the price of silver.

#Silver Bullion available in 1 oz, 10 oz & 100 oz .999 Fine Silver from Sunshine Mint, Silver A Mark Bar, Jason Mathey Silver, Royal Canadian, Silver Republic

We have…

View On WordPress

#10 oz & 100 oz .999 Fine Silver#invest in gold and silver#Jason Mathey Silver#precious metal I.R.A. 2016 American Silver Eagles Uncirculated#Royal Canadian#Silver A Mark Bar#Silver Bullion available in 1 oz#silver Bullion Bars#Silver Republic#Sunshine Mint

1 note

·

View note

Text

Monument Metals Reviews

What is Monument Metals?Monument Metals Locations, Timings, Email, Phone, Services

Monument Metals began as a precious metals dealer and trading company. However, in 2014, the company began accepting public metals purchases.

The company offers numerous metals to the public, including gold and silver standards, as well as palladium, pre-1933 rare coins, and copper. They sell precious metals both online and at their Maryland store. Further, the company claims that customers who sign up for the Gold Seller's newsletter receive discounts and deals. In this article, we will look deeper into Monument Metals and investigate if the claims they have made about their products and customer satisfaction are legitimate. Furthermore, we'll learn about Monument Metals' product offerings, price, presence, and customer reviews to give you an in-depth understanding of what they have to offer and how the public considers their services and products. - Address: 1341 Hughes Ford Road, Suite 113, Frederick MD 21701 - Phone: 1-800-974-3121 - Email: [email protected] - Website: https://monumentmetals.com/

People Behind Monument Metals: CEO, Owner, Co-Founders & MoreWho owns Monument Metals? What is the management team behind Monument Metals?

Monument Metals' website contains no information about any of its team members or its owner or founder, which may be an issue for investors who wish to know more about the company's owner, founder, or any other team member. However I found the LinkedIn profile of its Founder & CEO, Jonathan Swyers, after examining it deeper, and here are a few details I got there. Jonathan Swyers: Founder & CEO

Jonathan Swyers founded Monument Metals in 2014 and currently serves as the company's Founder & CEO. He previously worked for 2 years as Director of International Trading at Asset Strategies International, Inc., and for 6 years as Financial Operations Manager at GCE, Inc. He received a Bachelor of Science (BS), in Sociology, and Economics from James Madison University.

On Zoominfo, you can find a list of their total employees, which is 65 according to Zoominfo data, but we can only acquire their names from there; no other information is available on the internet.

Monument Metals Products: Bullion Coins, Bars, And Rare CoinsAll products offered by Monument Metals

Monumental Metals offers a wide variety of rare coins and precious metals on its website.

The following are some of the company's products: - Gold

Monumental Metals offers a variety of gold products to investors. Investors can select from a variety of popular gold coins, including American Gold Eagles, American Gold Buffalos, Canadian Gold Maples, and others. - Silver

Silver products are also available to investors. Investors can select from a variety of options, including American Silver Eagles, Canadian Silver Maples, Chinese Silver Pandas, and others. - Platinum

Aside from traditional gold and silver, the company offers platinum products to clients. American Platinum Eagles, American Platinum Coins, and Platinum Bars are among the platinum options. - Palladium

They also allow investors to purchase palladium. Government Minted Palladium Coins, 1 oz Palladium Bars, and 10 oz Palladium Bars are available to investors. - Coins

Pre-1933 coins are also available for purchase by investors. Peace Silver Dollars, Morgan Silver Dollars, and $5 Liberty Half Eagles are among the coins available on their website. - Copper

The company sells a variety of copper items, including 1 oz. Copper Rounds, 5oz Copper Rounds, and Wheat Cents. Monument Metals offers numerous possibilities for investment. They have a large selection of precious metals and rare coins.

Can You Invest in Monument Metals IRA?Do They Offer A Precious Metals IRA?

No, Monument Metals primarily serves investors by offering precious metals such as Gold and Silver Coins for purchase, but it does not disclose any information related to providing IRA services to investors on its website. This may disappoint investors looking for an all-in-one for precious metals investments within an Individual Retirement Account (IRA). This company fails to meet the requirements of customers who want to open a gold IRA account. Instead, investors looking for gold IRA choices can look into options and work with companies that specialise in facilitating gold IRAs. It's important to understand that the process of setting up a gold IRA includes choosing a reputable IRA custodian or trustee. Choosing a reliable IRA custodian is an important step in setting up a gold IRA. These custodians are responsible for ensuring that your precious metal investments are in accordance with IRS laws, including storage and reporting requirements. Specialised IRA custodians often have years of expertise in dealing with precious metals within retirement accounts, making them well-equipped to help investors meet their financial goals. However, I don't recommend opening an IRA with them. Why? Because there are plenty of better options available for you. Opening a precious metals IRA is a major decision. That's why I suggest checking out our top gold IRA providers list. There, you can find the best precious metals dealer in your state and choose accordingly. Also, the list will help you understand what the industry's best has to offer and what you might miss out on.

Monument Metals Fees and Charges: Do they overcharge?What are their fees? Do they have hidden fees?

Monument Metals fails to disclose its fees and charges, although they do mention that shipping is free on orders of $199 or more. Its website does not provide any additional information about its fees and charges. This could be one of the company's biggest drawbacks. Prospective customers may be concerned about the lack of fee transparency. Customers may have difficulty comparing the costs of using its services with other similar providers if fees and charges are not easily available. As a result, it might be difficult to determine whether the potential benefits and products provided by the company justify the related costs. Payment Methods According to the company, you may pay for your order using any or all of the following payment methods, depending on the order amount: credit card, certified check, cashier's check, personal check, e-check, wire transfer, PayPal, and money order.

Monument Metals Reviews and Complaints: BBB, Yelp, GoogleRead all the Monument Metals reviews & complaints on Monument Metals

Better Business Bureau (BBB)

On Better Business Bureau (BBB), Monument Metals has received an A+ and 4/5 stars based on a total of 11 customer reviews and 1 complaint. BBB states that the company has been in business for 9 years and they are a BBB-accredited business. Monument Metals has received #1 complaints on Google The company has received several unresolved complaints from customers. There are also several unresolved negative reviews on different platforms. Our #1 rated gold IRA company has ZERO unanswered complaints on BBB.

A Monument Metals customer recently filed a complaint on the BBB platform about their purchasing experience. When the customer placed an order with Monument Metals on December 22nd, he received a fraudulent activity alert from his credit card company, which he immediately authorised. He waited for verification during the Christmas holiday weekend after authorizing the transaction. On December 27th, he contacted Monument Metals' customer service and was informed that his transaction had been reapproved and marked as a clear sale. However, on December 28th, he received an email from Giselle informing him that his order had been cancelled and his payment had been refunded. Despite his credit card company confirming the authorisation, Monument Metals pushed that the customer pay using a different method due to being blacklisted for a legitimate purchase. Without changing his payment method, the customer was unable to access their account or do business with Monument Metals. This event calls into question the company's customer service and how it handles valid transactions. However, it is also crucial to remember that there are many positive reviews, with customers stating that the company provided excellent customer service and had great people to work with.

Trustpilot

Based on a total of 1,217 customer reviews, the company received a 4.7/5 star rating on Trustpilot. The majority of customers gave positive reviews, stating that the company provided quick delivery and an excellent team to assist customers. Several clients have stated that they would recommend this company to investors who want to invest in precious metals. However, customers have also submitted negative reviews, complaining about poor shipping services, receiving low-quality products, and excessive costs. ShopperApproved

Monument Metals has a good rating of 4.9/5 stars on ShopperApproved, with a total of 2,407 customer ratings and reviews. Customers have mostly given this company positive reviews. Reddit

Monument Metals Reddit feedback has been mainly satisfactory, with people expressing their positive experiences.

Is Monument Metals Legit? Should You Invest With Them?Is Monument Metals a scam or legit? Are they worth it?

No, I don't recommend investing with them. Pros: - Wide range of products - BBB-accredited company - Many positive reviews Cons: - Does not offer IRA Services - No information related to their team - Chances of hidden costs - No reviews on Yelp I think you have many better options than the Monument Metals. Monument Metals is a reputable company that provides a diverse selection of precious metals products to investors and they have many positive reviews from customers. However, this company has a number of issues, such as not being transparent about its members on its website, not disclosing sufficient details related to fees and charges, and no customer reviews on Yelp. Further, Monument Metals doesn't state whether they offer IRA-approved gold or any other IRA services. All of this suggests that you should look into other companies instead. Before you make any final decision, I recommend checking out our top gold IRA providers. There, you will find out what the industry's best has to offer. Also, it will ensure you make an informed decision. Or, you can check out the best gold dealer in your state below: Each state has its regulations and rules, so we've sorted and found the best Gold IRA company for each state. Find the best Gold IRA company in your state Read the full article

0 notes

Text

Buy Gold Coins Canada Online

If you want to invest in gold, you should consider buying Canadian gold coins. The Royal Canadian Mint issues these bullion coins. Canadian coins have international recognition and a limited mintage. gold coins Canada means you are getting the purest gold available. And since these coins are issued by the government, you can be sure of their purity.

Canadian gold Maple Leaf

The Canadian gold Maple Leaf is a gold-bullion coin that is issued by the Government of Canada every year. It is produced by the Royal Canadian Mint. This coin is the official legal tender of the Canadian government. As of 2018, it has a face value of $100. Buying one of these coins is a great way to protect your investment and help build your wealth.

The Canadian gold Maple Leaf is available in a variety of sizes and designs. On the obverse, the image of the Queen is displayed while the reverse depicts a Canadian maple leaf. In 2013, the coins were introduced with new security features. The obverse image of the Queen has been updated to reflect her current age.

Purity of gold

If you're looking to invest in gold coins, Canada's gold Maple Leaf coins are a good choice. These coins are minted by the Royal Canadian Mint, which is world renowned for its craftsmanship and innovation. You can get your hands on one of these coins at a price you can afford.

These gold coins are legal tender and come in different sizes and weights. They are also available in different denominations. The face value of Canadian Gold Maple Leaf coins is lower than their actual metal value. This makes them a good option for investors who prefer a high purity gold coin. They are also one of the few 24-karat gold bullion coins.

Canada's gold Maple Leafs feature Bullion "DNA" technology, which captures images of the coins and encrypts them with an algorithmic signature. The images are then stored in a secure database, allowing buyers to verify the coins' authenticity in seconds. Likewise, the 1 oz American Gold Buffalo from the United States Mint features the iconic design of the 5-cent Buffalo Nickel created by James Earl Fraser in 1913.

Limited mintage

The Canadian Mint is known for its quality, innovation, and craftsmanship. Canadian gold coins have a limited mintage, which makes them ideal for discerning coin collectors. However, if you want a more affordable alternative to high-end jewelry, consider investing in a limited-mintage gold coin.

This gold coin features a stunning image of the Canadian maple leaf, with the iconic figure sculpted in lifelike detail. Originally, this coin featured a portrait of Queen Elizabeth II. In recent years, however, the portrait of Her Majesty has changed, with the maple leaf now adorning the reverse.

In the 1970s, the government of Canada decided to allow its citizens to buy gold coins instead of paper currency. The goal was to keep the nation's gold supply under control. Until that point, Canadian gold bullion was only produced in bars.

International recognition

Gold coins Canada are renowned for their beauty and purity. The Canadian Gold Maple Leaf was the first gold coin issued by the Royal Canadian Mint. It is reportedly the world's purest official bullion coin. The Canadian government guarantees its purity. Its obverse features Queen Elizabeth II's portrait. It is also available in fractional sizes.

Canada's national symbol is the maple leaf. Its recognition as a national symbol dates back to the eighteenth century, when the French Canadians settled near the Saint Lawrence River. In 1834, Montreal's first mayor, Jacques Viger, lauded the maple leaf as "king of the forest and a symbol of the Canadian people." By 1868, the maple leaf had been incorporated into the coat of arms of both Ontario and Quebec. In 1921, it became a part of Canada's national coat of arms.

Price

When looking to buy Gold coins in Canada, it's worth keeping in mind that their prices depend on the spot price of gold. This means that they will increase in value as gold becomes scarcer. However, you may still find value in buying Canadian Gold coins. These are a great addition to any portfolio.

Canadian Gold Maple Leaf coins are available in a variety of sizes. They range from one-tenth to one-ounce. They are legal tender and have a face value of C$50. Each coin's obverse features the image of Queen Elizabeth. The reverse features the date of minting, its face value and the denomination.

Maple Leaf gold coins are the most popular among bullion gold coins. These coins are widely sought after by numismatists because of their intricate designs and high quality content.

youtube

0 notes

Text

1 oz Royal Celebration Gold Bar (Inc. Assay Card) – The Royal Mint UK

The coronation of His Majesty King Charles III was celebrated on May 6th, 2023, at Westminster Abbey in London, marking the inaugural coronation of a Canadian Sovereign in 70 years. This momentous occasion, with its unparalleled display of grandeur, tradition, and magnificence, bridges centuries of history with the present and future. The coronation of King Charles III will remain etched in memory as a profound yet festive occasion.

0 notes

Text

Why Are Bullion Coins So Important and How to Get One

When you hear the word "bullion," it’s natural to assume it has something to do with bulls or perhaps even the stock market. In reality, though, there is no stock market sub-section called "bullion."

As a type of investment, the word "bullion" refers to bars, ingots and other raw forms of precious metals such as gold, silver, and platinum. These raw metals are referred to as bullion because they are uncoined (i.e., not minted into coins) and also have a low nominal value in proportion to their actual value.

There are several types of bullion coins available for purchase today. As with most things in life, investing in such coins isn’t free—you’ll need to pay a fee upfront for any that you buy. But if you take the time to understand what it is you’re investing in and why you would make such an investment, the payoff could be more than worth the initial monetary expenditure.

What is bullion?

Bullion is a term used to describe gold, silver, and other precious metals such as platinum or palladium. There are many different types of bullion, including coins, bars, and rounds.

Many investors prefer bullion because it is often more affordable than other precious metals like gold. Bullion is also easy to store and transport because it is weightless. Bullion can be bought and sold in large quantities, making it a good way to diversify an investment portfolio.

Bullion can also be used as a form of currency. For example, investors have used bullion to buy gold coins at auction or hold them in storage areas such as vaults for safekeeping. Bullion is sometimes referred to as physical gold or "the real thing."

Gold and Silver Bullion Coins

Gold and silver bullion coins are a great way to invest in precious metals. They are pure, elemental metals that are stored as bars or coins in vaults. Bullion coins can be purchased at banks and coin dealers, or found online. Each purchase comes with a premium, so your profit depends on the price you pay for each unit. Bullion coins are recognized by governments and are also considered to be investment-grade assets. This makes them a solid way to diversify your portfolio.

There are many different types of gold bullion coins available today. Some of the most popular include American Buffalo Gold Coins, Canadian Maple Leaf Gold Coins, Chinese Pandas, Chinese Dragons, Austrian Philharmonics, and Australian Kangaroos. Silver bullion coins are also an option if you prefer silver over gold. Many of the same types of coins exist for both metals. However, some have been redesigned to have different designs or themes. For example, American Eagle Silver Bullion Coins feature a bald eagle on the front, while Fiji Cast Silver Bullion Coins show a native Fijian chief in traditional dress on the reverse side.

Platinum Bullion Coins.

Bullion coins are similar to precious metal bullion bars, but tend to be smaller and less expensive. Bullion coins can be purchased in a range of sizes, from 1 gram to 100 grams. Bullion coins typically consist of a minimum weight of one troy ounce of silver or gold, but more than one ounce is also available. They are often sold by weight and not by face value, which means they can be easily traded on cryptocurrency exchanges.

Silver bullion coins come in various weights and are priced according to their value relative to the price of silver bullion. Gold bullion coins are generally priced at a premium over the spot price for gold. Silver bullion coins tend to be more affordable than gold bullion coins because silver prices tend to fluctuate less than gold prices. Silver bullion coins may also come in different sizes, with 1-gram and 5-gram versions being the most common. Smaller sizes may also be offered, such as 1/10-oz., 1/20-oz., and 1/50-oz. There are also some rarer varieties, such as the 1/10 oz. The Draped Bust coin features an obverse design featuring a female head similar to those used on U.S. half dollars from 1796 through 1838, and a reverse The introduced in 1838, featuring a male bust, which replaced the female bust design on Uon theted in 1838

Other Types of Bullion

Platinum bullion coins are one type of precious metal bullion coin that is produced to be a more affordable alternative to gold and silver coins. Platinum bullion coins are typically 99.95% pure platinum, making them an extremely rare commodity with a value that goes far beyond their face value. These platinum bullion coins are often kept in a private vault or safe and stored away from prying eyes in the event that someone tries to use them for illicit means.

There are many advantages to investing in a platinum bullion coin, but the main advantages are that they are very rare and hold their value well over time because of their high purity. Making these kinds of investments can also provide great benefits for your portfolio by diversifying into precious metals and adding an extra layer of safety.

What Should You Look For When Buying Bullion?

Buying bullion for investment purposes is an important choice. You can buy gold and silver coins at a physical store or online.

Despite the high cost of gold bullion, it's an excellent store of value that can provide you with financial security. Gold coins are a tangible way to add to your retirement account or to help pay for college expenses.

When you buy bullion, make sure to pick a reputable dealer. Buying from a dealer with a good reputation is often a safer bet than buying from an online auction site.

Some investors choose to buy gold bullion bars instead of coins. Bars are convenient if you want the convenience of cash but the security of gold coins. They're also easy to transport and store in your home, so they're a good option if you don't have much room in your safe.

Why Is Bullion Coin Worth Investment?

A bullion coin is an investment vehicle that allows investors to buy precious metals in the form of coins, bars, or rounds. The main advantage of bullion coin investments is the flexibility of the product: you can buy bullion coins from any country and store them at home or in a secure vault. Bullion coins are also easy to sell, as they are traded on a number of exchanges. Another advantage of bullion coin investments is the low cost compared to other precious metal products.

Bullion coins are an attractive investment option for a number of reasons. First, bullion coins are liquid assets; they can be easily converted into cash. Second, bullion coins are durable; they can be stored at home or in a secure vault indefinitely without deteriorating in value. Third, bullion coins are portable; they can be transported. anywhere without the need for special transport vehicles. Fourth, bullion coins are low-risk investments because some countries actively regulate their production and sale, which reduces the risk of fraud and theft.

Final Words: Is It a Good Idea to Buy Bullion?

Buying bullion is a good idea, especially if you have a long-term plan to hold onto it. However, if you're going to buy bullion, you need to know that there's more than one way to go about it. You can choose between having your gold stored in a bank or keeping it physically stored at home.

If you choose to store your gold at home, you'll need to decide on what kind of storage solution works best for you. There are several different options available, so it's important that you learn as much as possible about each option before making your decision.

Buying bullion is a good idea if you're looking for a way to supplement your income or hedge against inflation and economic uncertainty. However, if you want to secure your wealth by holding physical assets instead of paper ones, then buying gold bullion makes sense because it's the only tangible asset that can't be permanently destroyed or confiscated by government agencies.

Conclusion

Bullion coins are a form of investment that is entirely safe to hold onto. They are physical objects that can be seen, held, and handed to others. Bullion coins are a very popular option for investors because they have a very high price point and usually have a nice weight to them, making them feel satisfying to hold. The best part about gold coins is that they are very easy to sell and relatively simple to buy. Because their bullionstore.com.au is one of the more popular sites that sell them, you don't need a significant sum of money in order to get started. Due to their ease of use and the variety of options they supply their customers, Nuggets.com is one of the more popular sites that sell them.

0 notes