#calculate net promoter score

Explore tagged Tumblr posts

Text

Key Metrics for Measuring ROI in Executive Coaching Programs

Executive coaching programs are designed to enhance leadership capabilities, improve decision-making, and drive organizational growth. However, measuring the return on investment (ROI) for these programs can be challenging. To effectively evaluate the impact of executive coaching, organizations need to focus on key metrics that capture both quantitative and qualitative outcomes.

1. Performance Improvement Metrics

One of the primary goals of executive coaching is to boost individual and team performance. Key performance indicators (KPIs) to track include:

Revenue Growth: Measure changes in revenue before and after coaching interventions.

Productivity Levels: Assess improvements in efficiency and output.

Goal Achievement Rates: Evaluate the percentage of strategic goals met post-coaching.

These metrics provide tangible data that reflect the direct impact of coaching on business performance.

2. Leadership Effectiveness

Effective leadership is often the focus of executive coaching. Metrics to consider include:

360-Degree Feedback Scores: Gather feedback from peers, subordinates, and supervisors to measure changes in leadership behavior.

Employee Engagement Surveys: High engagement levels often correlate with strong leadership.

Retention Rates of Key Talent: Improved leadership can reduce turnover among top performers.

Tracking these indicators helps determine how coaching influences leadership capabilities and team dynamics.

3. Behavioral Changes

Executive coaching aims to foster sustainable behavioral changes. Metrics in this area include:

Self-Assessment and Reflection Reports: Regular self-evaluations by the coachee to track personal growth.

Observation by Managers and Peers: Qualitative feedback on observed behavior changes.

Consistency in New Behaviors: Frequency and sustainability of new leadership practices.

These qualitative measures provide insight into the deeper, long-term impact of coaching on personal development.

4. Business Impact Metrics

To link coaching outcomes with business results, consider the following metrics:

Profit Margins: Analyze profit growth attributed to improved leadership decisions.

Operational Efficiency: Measure cost reductions and process improvements.

Customer Satisfaction Scores: Leadership improvements can indirectly boost customer experiences.

These metrics help establish a clear connection between coaching and organizational success.

5. Return on Investment (ROI) Calculation

To quantify ROI, use the following formula:

ROI (%) = [(Net Benefits - Coaching Costs) / Coaching Costs] x 100

Net Benefits: Include increased revenue, cost savings, and productivity gains.

Coaching Costs: Factor in fees, time investments, and resource allocation.

Calculating ROI provides a comprehensive view of the financial impact of executive coaching.

6. Employee Satisfaction and Morale

Coaching can significantly impact workplace culture. Metrics to track include:

Employee Satisfaction Surveys: Measure changes in morale and job satisfaction.

Workplace Climate Assessments: Evaluate improvements in organizational culture.

Conflict Resolution Rates: Assess the effectiveness of leadership in managing workplace conflicts.

Higher employee satisfaction often leads to increased productivity and reduced turnover.

7. Development of High-Potential Employees

Coaching helps identify and develop future leaders. Metrics to consider are:

Promotion Rates: Track the advancement of coached employees.

Leadership Pipeline Strength: Evaluate the readiness of high-potential employees for leadership roles.

Skill Acquisition Metrics: Measure the development of new competencies.

These metrics highlight the role of coaching in talent development and succession planning.

Final Thoughts

Measuring the ROI of executive coaching programs requires a combination of quantitative data and qualitative insights. By focusing on key metrics like performance improvement, leadership effectiveness, behavioral changes, and business impact, organizations can gain a comprehensive understanding of coaching outcomes.

About Growth Fuel

At Growth Fuel, we specialize in empowering organizations through tailored executive coaching programs. Our data-driven approach ensures measurable results, helping leaders unlock their full potential and drive business success. Partner with Growth Fuel to fuel your organization's growth journey today.

#executive coach ny#corporate coaching#measuring roi executive coaching#corporate leadership training

1 note

·

View note

Text

How eNPS Survey is Helping Employees and HR for a Better Workforce

Employee engagement is at the core of a thriving organization. Companies that actively measure and improve employee satisfaction often see higher productivity, reduced turnover, and a more positive workplace culture. One of the most effective tools for gauging employee sentiment is the Employee Net Promoter Score (eNPS) survey. This simple yet powerful survey is transforming how HR teams enhance workplace satisfaction, build engagement strategies, and create a better workforce.

What is an eNPS Survey?

The Employee Net Promoter Score (eNPS) survey is a streamlined approach to measuring employee loyalty and satisfaction. It is based on a single key question:

“On a scale of 0-10, how likely are you to recommend this company as a great place to work?”

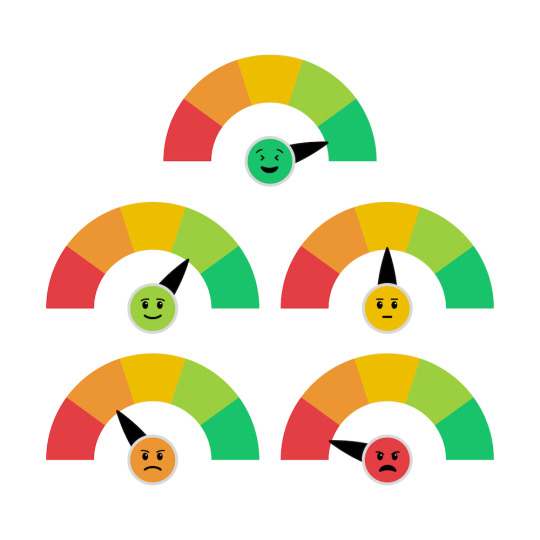

Employees are categorized into three groups based on their responses:

Promoters (9-10): Highly satisfied employees who actively advocate for the company.

Passives (7-8): Neutral employees who are satisfied but not enthusiastic.

Detractors (0-6): Unhappy employees who may leave negative feedback or be disengaged.

The eNPS score is calculated by subtracting the percentage of Detractors from the percentage of Promoters, giving HR teams a clear and measurable indicator of workforce sentiment.

How eNPS Helps Employees

Gives Employees a VoiceeNPS surveys provide employees with a confidential way to express their true opinions about the workplace. This fosters a culture of openness and trust, empowering employees to share feedback without fear of repercussions.

Leads to Meaningful ChangeOrganizations that actively analyze eNPS responses can identify workplace issues and implement targeted improvements. When employees see their concerns addressed, they feel valued, which boosts morale and engagement.

Encourages a Positive Work EnvironmentBy continuously measuring employee sentiment, companies can identify and promote positive workplace initiatives. Employees in a supportive environment are more motivated and productive.

How eNPS Benefits HR Teams

Simplifies Employee Feedback CollectionTraditional employee engagement surveys can be long and time-consuming. The eNPS survey is quick, making it easier to administer regularly without overwhelming employees.

Provides Actionable InsightsThe straightforward scoring system helps HR teams identify trends in employee satisfaction. This allows them to make data-driven decisions about policies, workplace culture, and retention strategies.

Improves Employee RetentionA declining eNPS score signals underlying issues that could lead to turnover. HR teams can address these issues before they escalate, reducing attrition and fostering long-term loyalty.

Enhances Employer BrandingA high eNPS score indicates that employees are happy and willing to recommend the company. This helps attract top talent and strengthens the organization’s employer brand in the job market.

Best Practices for Conducting an eNPS Survey

Ensure Anonymity: Employees should feel safe to provide honest feedback without fear of retaliation.

Survey Regularly: Conduct eNPS surveys quarterly or biannually to track changes over time.

Follow Up with Actions: Responding to feedback and making visible improvements based on survey results reinforces trust and engagement.

Combine with Other HR Metrics: eNPS is powerful but should be used alongside other HR tools, such as pulse surveys and employee rewards programs, to gain a comprehensive view of workplace satisfaction.

Conclusion

The eNPS survey is a game-changer for both employees and HR professionals. By providing a simple, measurable way to assess workforce sentiment, companies can make informed decisions that foster a happier, more productive workplace. When employees feel heard and valued, they are more likely to stay engaged, leading to a stronger, more successful organization. Embracing eNPS as part of your HR strategy can drive long-term improvements in employee experience and overall business performance.

0 notes

Text

5 Metrics to Track in Your Customer Feedback System for Success

A customer feedback system is your secret weapon to understand your audience better and improve your business. Tracking the right metrics ensures you make data-driven decisions and enhance customer satisfaction. Let’s explore the five most important metrics to monitor for a thriving feedback strategy.

1. Customer Satisfaction Score (CSAT)

The Customer Satisfaction Score (CSAT) measures how happy customers are with your product, service, or overall experience. It’s often collected through surveys with questions like:

“How satisfied are you with our service?”

“Rate your experience on a scale of 1 to 5.”

Why CSAT Matters?

CSAT provides immediate insights into customer happiness. A high score indicates success, while a low score highlights areas needing improvement.

How to Track It?

Your customer feedback system can automate survey distribution at key touchpoints, such as after a purchase or customer support interaction. Monitor these trends regularly to spot patterns and adjust strategies.

Example

A SaaS company noticed a drop in CSAT scores during the onboarding phase. They revised their onboarding process, added tutorials, and saw a 20% increase in satisfaction within three months.

2. Net Promoter Score (NPS)

NPS gauges customer loyalty by asking, "How likely are you to recommend us to a friend or colleague?" Respondents rate this on a scale of 0-10 and fall into one of three categories:

Promoters (9-10): Loyal enthusiasts

Passives (7-8): Neutral customers

Detractors (0-6): Unhappy customers

Why NPS Matters?

NPS directly reflects customer loyalty and the likelihood of word-of-mouth referrals. Loyal customers are more likely to buy again and bring new business.

How to Improve NPS?

Identify pain points by analyzing detractor feedback. Use your customer feedback system to automate follow-ups, asking what went wrong and how you can improve.

Example

An online retailer tracked NPS and found many detractors citing delayed deliveries. By partnering with a faster shipping service, they turned detractors into promoters within two months.

3. Customer Effort Score (CES)

The Customer Effort Score (CES) measures how easy it is for customers to interact with your business. It’s assessed through questions like:

“How easy was it to resolve your issue today?”

“Rate the effort required to complete your purchase.”

Why CES Matters?

Customers value simplicity. If interacting with your brand feels effortless, they’re more likely to stay loyal. A high CES score signals smooth processes, while a low score shows friction points.

Tracking CES

Your customer feedback system can send CES surveys after key interactions, like contacting support or making a return. Identify high-effort processes and simplify them.

Example

A subscription box company noticed low CES scores for its cancellation process. They streamlined it by reducing steps and offering self-service options, leading to higher customer retention.

4. Sentiment Analysis

Sentiment analysis goes beyond scores, analyzing the emotions behind customer feedback. This metric categorizes feedback as positive, negative, or neutral.

Why Sentiment Analysis Matters?

It uncovers deeper customer emotions that CSAT, NPS, or CES might miss. Understanding these emotions helps you fine-tune your messaging, products, and services.

How to Use Sentiment Analysis?

Your customer feedback system should leverage AI to process reviews, survey comments, and social media mentions. It detects keywords like “love,” “frustrated,” or “difficult” to gauge sentiment.

Example

A restaurant chain used sentiment analysis to identify complaints about menu changes. By reintroducing popular dishes, they boosted positive sentiment by 35% in just one quarter.

5. Feedback Response Rate

The feedback response rate measures how often customers engage with your surveys. It’s calculated by dividing the number of completed surveys by the total number sent.

Why Feedback Response Rate Matters?

Low response rates can skew results, making it harder to trust the data. A high response rate shows your customers feel valued and heard.

How to Improve Response Rates?

Use your customer feedback system to send personalized survey invites and incentives, like discounts or freebies. Keep surveys short and focused to encourage participation.

Example

A gym offered a free fitness class for completing a feedback survey. This incentive boosted their response rate from 25% to 60%, giving them more actionable data to improve services.

How to Implement These Metrics in Your Customer Feedback System?

Automate Surveys: Use tools to schedule surveys post-purchase or after support interactions.

Segment Responses: Group feedback by customer type, geography, or purchase history for tailored insights.

Act on Feedback: Close the loop by sharing improvements based on customer suggestions.

Conclusion

Tracking the right metrics in your customer feedback system ensures you understand your audience and take action that matters. Whether it’s improving NPS or simplifying customer journeys, these insights drive loyalty and growth. Start monitoring these metrics today to set your business up for long-term success.

0 notes

Text

CSAT vs. NPS vs. CES: Which Survey Tool Should You Use?

In a world where customer satisfaction can make or break a business, understanding the nuances between CSAT vs. NPS vs. CES becomes crucial. These methodologies, each with its unique approach to measuring aspects of customer experience, play pivotal roles in shaping strategies for customer satisfaction and loyalty. Deciphering between a CSAT score, NPS score, and CES score can help you tailor your customer service and product offerings more effectively, ultimately impacting your bottom line. The key to sustained business growth in today’s competitive landscape lies not only in attracting new customers but in retaining existing ones by continuously measuring and improving their experience.

This article will guide you through the basics of CSAT, NPS, and CES, illustrating how each measures customer satisfaction differently and the context in which they are most effectively used. You will explore the advantages and disadvantages of CSAT, NPS, and CES, understanding the impact of CSAT score, NPS score, and CES score on your business. Additionally, you will learn strategies for integrating these metrics into your business practices and how to interpret the scores they generate. By providing a comprehensive comparison of CSAT vs. NPS vs. CES, this article equips you with the knowledge to select the most suitable survey tool for your business needs, ensuring you harness the full potential of customer feedback in driving your business forward.

The Basics of CSAT, NPS, and CES

Defining CSAT

Customer Satisfaction Score (CSAT) is a vital metric used to gauge how satisfied customers are with your products or services. It is expressed as a percentage, where 100% indicates complete satisfaction and 0% indicates complete dissatisfaction. Typically, CSAT is measured through customer feedback collected via surveys that ask questions such as, “How would you rate your overall satisfaction with the [goods/service] you received?” Customers respond using a scale from 1 (very unsatisfied) to 5 (very satisfied), and the results can be averaged to provide a composite customer satisfaction score. CSAT is particularly useful for measuring immediate customer reactions to specific interactions, products, or events, although it has limitations in assessing long-term customer relationships.

Defining NPS

Net Promoter Score (NPS) is a widely recognized metric used to measure customer loyalty and predict business growth. It is calculated based on responses to a single question: “On a scale from 0 to 10, how likely are you to recommend our company/product/service to a friend or colleague?” Based on their ratings, respondents are categorized as Promoters (9–10), Passives (7–8), or Detractors (0–6). The final NPS is derived by subtracting the percentage of Detractors from the percentage of Promoters. This score can range from -100 to 100, with higher scores indicating greater customer loyalty. NPS is valuable for assessing overall customer sentiment and loyalty over the longer term.

Defining CES

Customer Effort Score (CES) measures the ease of customer interaction with a company’s services and products. It focuses on the effort required by customers to achieve their goals, such as getting help from support teams, making a purchase, or leaving a review. CES is typically assessed through a single survey question that asks customers to rate on a scale, for example, “How easy was it for you to solve your problem today?” with responses ranging from very difficult to very easy. This score helps businesses identify points of friction in the customer journey and is particularly useful for evaluating transactional customer interactions.

How CSAT, NPS, and CES Measure Customer Satisfaction Differently

Focus of CSAT

Customer Satisfaction Score (CSAT) is primarily utilized to gauge satisfaction at specific moments within the customer journey. This metric excels in capturing immediate customer reactions to a particular service, product, or interaction. The calculation of CSAT involves identifying the percentage of customers who provided the highest ratings — on a scale of 1 to 5, this would typically be scores of 4 and 5, representing ‘satisfied’ and ‘very satisfied’ customers. Due to its nature, CSAT is highly effective for short-term evaluations but may not fully reflect long-term customer relationships or loyalty.

Focus of NPS

Net Promoter Score (NPS), in contrast, serves a broader purpose by measuring customer loyalty and the likelihood of customers recommending a company to others. This metric categorizes respondents into Promoters, Passives, and Detractors based on their response to how likely they are to recommend the company on a scale from 0 to 10. NPS is particularly valuable for understanding overall customer sentiment and loyalty over a more extended period. It’s not just about satisfaction; it’s about gauging the customer’s intention and their potential to advocate for the brand.

Focus of CES

Customer Effort Score (CES) is centered around the ease of customer interactions with a company’s services or products. Unlike CSAT, which focuses on satisfaction at a particular moment, or NPS, which assesses loyalty and advocacy, CES measures the effort customers must exert to get their issues resolved or needs met. This metric is typically evaluated through a single survey question that asks customers to rate the ease of solving their problem, with responses ranging from very difficult to very easy. CES is crucial for identifying friction points within the customer journey and is a strong predictor of repurchase behavior, as lower effort interactions significantly enhance customer loyalty.

Advantages and Disadvantages of CSAT

Pros

Simplicity and Intuitiveness: CSAT surveys are known for their straightforward nature. They typically involve just one question with a rating scale, making them easy for your customers to understand and complete. This simplicity ensures that you can deploy these surveys at various customer interaction points without causing disruption.

Customizable Rating Scales: You have the flexibility to tailor the rating scales according to the context of the survey, which can range from stars and emojis to numeric scales. This customization allows you to align the survey with the preferences of your target audience, potentially increasing its relevance and appeal.

High Response Rates: Due to their brevity, CSAT surveys often achieve higher response rates compared to other types of customer satisfaction surveys. With fewer questions, customers are more likely to complete the survey, providing you with valuable feedback across different stages of the customer journey.

Immediate Feedback: CSAT is effective for gauging immediate customer reactions to a service or product. This can be particularly useful for quick assessments post-interaction, allowing you to swiftly identify and address issues.

Benchmarking Opportunities: Widely adopted across various industries, CSAT scores allow you to benchmark your performance against industry standards, offering a metric for comparative analysis and improvement.

Read More..

0 notes

Text

Andrew Molon Shares the Top Metrics for Strategic Success

Tracking the right metrics is crucial for achieving success in any business. Whether you are running a startup or managing an established company, knowing what to measure can make all the difference. Andrew Molon, a leading business strategist, believes that focusing on key metrics helps businesses make smarter decisions and grow faster. Here, we explore some of the top metrics Andrew J Molon recommends every strategist should track to ensure long-term success.

1. Revenue Growth

Revenue is the lifeblood of any business. According to Andrew Molon, tracking revenue growth over time shows how well your strategies are working. If revenue is increasing steadily, it’s a sign that your products or services are meeting customer needs. If not, it might be time to revisit your marketing or sales approach.

To calculate revenue growth, compare your current revenue with the same period last year or quarter. This will give you a clear picture of your progress.

2. Customer Acquisition Cost (CAC)

Knowing how much it costs to acquire a new customer is vital for budgeting and profitability. Andrew J Molon stresses that businesses should aim to keep their CAC low without compromising the quality of their outreach efforts.

Divide the total amount spent on marketing and sales by the number of new customers acquired during a specific period. This metric helps determine if your strategies are cost-effective.

3. Customer Retention Rate

Retaining customers is often more cost-effective than acquiring new ones. According to Andrew Molon, a high customer retention rate shows that your business is providing excellent value and service.

To calculate this metric, track the percentage of customers who continue to do business with you over a set period. A low retention rate may indicate issues with customer satisfaction or product quality that need to be addressed.

4. Net Promoter Score (NPS)

Andrew J Molon emphasizes the importance of understanding how likely your customers are to recommend your business to others. The Net Promoter Score (NPS) is a simple yet powerful tool for measuring customer loyalty and satisfaction.

Ask your customers a simple question: “On a scale of 0 to 10, how likely are you to recommend us to a friend?” Customers who score 9 or 10 are promoters, while those scoring 0 to 6 are detractors. Subtract the percentage of detractors from the percentage of promoters to get your NPS.

5. Profit Margin

Profit margin is one of the most important financial metrics. It tells you how much profit your business makes after covering all expenses. Andrew Molon advises businesses to monitor both gross and net profit margins regularly to ensure financial health.

A consistent or growing profit margin indicates that your strategies are effective and sustainable.

6. Employee Productivity

According to Andrew J Molon, the success of a business also depends on the efficiency of its team. Track productivity by measuring output versus hours worked. Happy and productive employees contribute significantly to a company’s growth.

Final Thoughts

Tracking these key metrics can help businesses identify what’s working and where improvements are needed. Andrew Molon believes that businesses that stay data-driven are more likely to achieve sustainable success. By keeping a close eye on these metrics, you can make informed decisions and guide your business toward growth and profitability.

0 notes

Text

How to Measure the Effectiveness of a Quality Assurance Services Company

Selecting a quality assurance services company is a significant decision that can impact your organization’s success. However, choosing the right partner is only the first step; measuring their effectiveness is equally important. This article will guide you through the key metrics and methods to evaluate the performance of your QA provider, ensuring that you receive maximum value from your partnership.

Understanding Quality Assurance Metrics

Quality assurance metrics are quantitative measures used to assess the performance of QA processes and teams. These metrics help organizations understand how well their quality assurance efforts are working and where improvements can be made.

Key Metrics to Measure Effectiveness

1. Defect Density

Defect density measures the number of defects identified in a product relative to its size (e.g., lines of code or function points). This metric provides insight into:

Quality of Deliverables: A lower defect density indicates higher quality.

Effectiveness of Testing: If defect density decreases over time, it suggests that the QA processes are improving.

To calculate defect density, use the formula:

Defect Density=Size of Product/Number of Defects

2. Test Coverage

Test coverage measures the extent to which your testing processes cover the application or product. This includes:

Code Coverage: The percentage of code executed during testing.

Requirement Coverage: The percentage of requirements that have associated test cases.

High test coverage ensures that most features are tested, reducing the likelihood of undetected defects. Aim for at least 80% coverage to ensure comprehensive testing.

3. Test Execution Rate

The test execution rate measures how quickly tests are executed relative to the total number of tests planned. This metric helps assess:

Efficiency of Testing Processes: A higher execution rate indicates efficient testing practices.

Ability to Meet Deadlines: If tests are consistently executed on time, it reflects well on the QA team’s capabilities.

To calculate: Test Execution Rate=Total Number of Tests Planned/Number of Tests Executed×100

4. Mean Time to Detect (MTTD) and Mean Time to Repair (MTTR)

MTTD and MTTR are critical metrics for evaluating how quickly defects are identified and resolved:

Mean Time to Detect (MTTD): Measures the average time taken to identify defects after they occur.

Mean Time to Repair (MTTR): Measures the average time taken to fix defects once they have been identified.

Shorter MTTD and MTTR values indicate an effective quality assurance process that quickly identifies and resolves issues.

5. Customer Satisfaction

Ultimately, customer satisfaction is a vital metric for evaluating the effectiveness of any quality assurance services company. High-quality products lead to satisfied customers, which can be measured through:

Surveys and Feedback: Regularly gather customer feedback on product quality.

Net Promoter Score (NPS): Measure customer loyalty and likelihood to recommend your product based on their experiences.

6. Cost of Quality (CoQ)

Cost of Quality refers to the total costs associated with ensuring good quality products, including prevention costs, appraisal costs, and failure costs. Monitoring CoQ helps organizations understand:

Investment in Quality: A lower CoQ indicates efficient use of resources in maintaining quality.

Impact on Profitability: High failure costs can erode profits; thus, reducing these costs through effective QA practices is essential.

Methods for Measuring Effectiveness

To effectively measure these metrics, consider implementing the following methods:

1. Regular Reporting

Establish a system for regular reporting from your quality assurance services company. This should include detailed insights into key metrics such as defect density, test coverage, and execution rates. Regular updates allow you to track performance over time.

2. Performance Reviews

Conduct periodic performance reviews with your QA partner. These reviews should focus on:

Progress against agreed-upon KPIs (Key Performance Indicators).

Areas for improvement and strategies for addressing challenges.

3. Benchmarking

Benchmark your QA provider’s performance against industry standards or competitors. This can help you identify areas where your partner excels or where improvements are needed.

4. Customer Feedback Analysis

Analyze customer feedback systematically to gauge satisfaction levels related to product quality. Use this data to inform discussions with your QA provider about areas needing attention.

Conclusion

Measuring the effectiveness of a quality assurance services company is crucial for ensuring that you receive maximum value from your partnership. By focusing on key metrics such as defect density, test coverage, test execution rates, MTTD/MTTR, customer satisfaction, and cost of quality, you can gain valuable insights into your QA processes.

#quality assurance services company#quality assurance services#quality assurance companies#qa consulting companies

0 notes

Text

Top Bonuses and Promotions from 1Win: Get the Most out of Your Game

1Win Bonuses Boost Your Winnings

1Win bonuses pump up your initial deposits. New customers rake in extra cash on their first four deposits – up to $700 each. Snag a promo code and meet the wagering requirements to pocket up to $2800 in bonus funds. Use this extra money to dive into 1Win's sportsbook, casino games, and poker tables. The site also dishes out ongoing promotions like accumulator bet boosts, cashback, and loyalty programs. Pop over to the website for the latest terms. Smart use of these deals stretches your gameplay, cuts down risks, and juices up your bankroll. Explore the detailed sections below to maximize your winnings with 1Win bonuses.

Overview of 1Win Bonus Offerings

1 win offers various bonus types to enhance your gaming experience. Here are the main categories:

500% match on first four deposits, up to $2800, using a 1win bonus code

Up to 30% weekly cashback on slot losses

Express bet bonus from 7% to 15% based on selection count

Weekly sports bet leaderboard with prizes and status levels

Welcome Bonus: Up To $2800 Across Four Deposits

New players can claim an impressive 1win casino welcome bonus spread over their first four deposits. This multi-tiered 1win deposit bonus offers up to $700 per deposit, potentially totaling $2800. The structure appeals to new users by providing multiple opportunities to boost their bankroll. Detailed information on wagering requirements and eligibility is available in the sections below.

Bonus Structure and Amounts

Deposit

Bonus %

Max Bonus Amount

1st

200%

$700

2nd

150%

$700

3rd

100%

$700

4th

50%

$700

Total

500%

$2800

Casino Cashback: Recover Up to 30% of Slot Losses

1Win's Casino Cashback program offers players a chance to recoup some of their slot losses. This bonus allows you to recover up to 30% of your weekly slot losses as real, withdrawable cash. It's a safety net that cushions the impact of unlucky streaks. More details on eligible games and terms follow in the sections below.

Cashback Details and Eligibility

Casino cashback rewards players for their loyalty. To access these exciting rewards, players need to complete their 1win login and start playing their favorite games. Here's a breakdown of the casino cashback bonus:

Aspect

Details

Maximum Percentage

30%

Minimum Loss Required

No minimum

Eligible Games

Slots only

Exclusions

Table games, live dealer games

Express Bonus: Boost Your Accumulator Bets

Pump up your profits with the 1win express bonus! This exciting offer turbocharges your accumulator bets when you pick five or more selections. The more you choose, the bigger your potential payout. Sports bettors, get ready to maximize your winnings. Check out the details on percentages and requirements in the sections below. Don't forget to use your 1win bonus code to unlock this game-changing bonus.

Minimum Requirements for Express Bonus

To qualify for the express bonus, meet these key criteria:

Pick at least 5 selections

Each selection must have a minimum odds of 1.3

Only pre-match accumulator bets count

Single and combo bets are eligible

More selections increase your bonus percentage

Max bonus is 15% for 11+ selections

Accumulator Bonus Breakdown

Selections

Bonus Percentage

5

7%

6

8%

7

9%

8

10%

9

11%

10

12%

11+

15%

Leaderboard Bonus: Rewards for Active Players

Climb the 1win leaderboard by placing sports bets. Your wagers earn points based on odds and stake size. As your score rises, you'll unlock exciting 1win bonuses. Regular bettors find this system particularly appealing. Stay tuned for more details on points and leagues.

Points System and Calculation

Rack up points in our leaderboard bonus! For every 1,000 AMD wagered on eligible bets, you'll snag 1 point. Bets must have odds between 1.5 and 5.0. For instance, a 10,000 AMD bet at 2.0 odds bags you 10 points.

Bet types that don't count:

Over/Under

Handicap

Each-way

Leaderboard Types and Leagues

The 1Win Armenia platform offers exciting leaderboard competitions with various leagues. Here's a breakdown of the league tiers and their requirements:

League

Daily Points

Weekly Points

Rewards

Bronze

100+

900+

Free bets

Silver

100-300

900-3000

Free bets, merchandise

Golden

300+

3000+

Free bets, merchandise, gadgets

Additional 1win Promotions

1win offers a variety of bonus opportunities beyond the main welcome offer. These additional 1win bonuses pump up your gameplay and increase your chances of winning. Check out the sections below to learn more about cashback, boosted bets, tournaments, and other exciting promotions available on the platform.

Weekly and Monthly Poker Tournaments

Poker enthusiasts can participate in regular tournaments with varying prize pools and entry fees. Here's a comparison of the weekly and monthly events:

Tournament

Prize Pool

Entry Fee

Weekly

2,000,000 AMD

15,000 AMD

Monthly

4,000,000 AMD

25,000 AMD

Crazy Time Bonus: Win Big

Grab the Crazy Time bonus for massive wins. This promo offers multipliers up to 25,000x. Check for the 1win free bonus code today and score major rewards!

Jump into a Free Poker Showdown!

Join our no-entry-fee poker tournament and dive into a $1,000 prize pool. This thrilling event offers a chance to win cash without upfront costs. Tournament availability varies, so check the website for the latest schedule. Simply register and log in to participate in the action.

Snag Daily Prizes with 1win's Drops & Wins!

Pragmatic Play's Drops & Wins promotion offers exciting daily prizes through 1win. Prize pools and durations vary, so check 1win's website for current details and any required 1win daily bonus code. Don't miss out on these potential winnings!

0 notes

Text

Games Similar to Air Hockey and Foosball for Endless Entertainment

Air hockey and foosball have long been favorites for players seeking fast-paced, competitive fun. Known for their ability to create excitement in homes, recreational centers, and arcades, these games are perfect for players of all ages. However, several other games provide similar thrills, combining reflexes, strategy, and competition. Exploring alternatives to air hockey and foosball opens the door to even more fun and engaging experiences, whether you enjoy tabletop games, classic arcade setups, or innovative physical activities.

This guide introduces some popular games that share similarities with air hockey and foosball. Each option offers dynamic gameplay and endless entertainment, making them excellent additions to any game room or gathering space.

Table Tennis as a Classic Alternative

Table tennis, commonly known as ping pong, is a competitive game that combines speed, skill, and hand-eye coordination, much like air hockey and foosball. Played on a flat table divided by a net, players use paddles to hit a lightweight ball back and forth, aiming to outscore their opponents. The game’s simplicity and fast-paced nature make it ideal for players looking for quick and energetic matches.

The appeal of table tennis lies in its accessibility and versatility. Whether played casually at home or competitively in tournaments, it delivers the same excitement as air hockey and foosball. Players must react quickly, anticipate their opponent’s moves, and control their shots to succeed.

Table tennis also promotes physical activity, requiring players to move and position themselves strategically. Its combination of skill, reflexes, and agility ensures that it remains a popular choice for families, friends, and serious enthusiasts alike.

Shuffleboard as a Strategic Tabletop Game

Shuffleboard is another game that shares the tabletop element of air hockey and foosball. Played on a smooth, elongated table, players slide weighted pucks across the surface to land them in specific scoring zones. The goal is to score points while blocking or knocking out the opponent’s pucks, creating a mix of skill and strategy.

Similar to air hockey, shuffleboard relies on precision and control. Players must carefully calculate the speed and angle of their shots to outmaneuver their opponents. The simplicity of the rules and the competitive nature of the game make it suitable for all skill levels.

Shuffleboard tables come in various sizes, making them adaptable to homes, bars, and recreational spaces. Its mix of strategy and competition ensures that shuffleboard remains an engaging alternative for fans of fast-paced table games.

Pool as a Fun and Competitive Choice

Pool, also known as billiards, is a classic table game that combines skill, precision, and strategy. Much like foosball and air hockey, pool offers competitive gameplay that tests a player’s reflexes and decision-making. The game involves using a cue stick to strike balls into designated pockets on a large table covered with felt.

Pool shares similarities with foosball in terms of strategy and planning. Players must anticipate angles, calculate shots, and execute their moves with precision to win. While pool games can be slower than air hockey, the intense focus and competitive edge keep players engaged.

With various game formats like eight-ball, nine-ball, and snooker, pool provides endless entertainment and variety. Whether played casually with friends or competitively in leagues, pool remains a timeless option for those who enjoy dynamic tabletop games.

Bubble Hockey as a Direct Air Hockey Alternative

Bubble hockey, also known as dome hockey, closely resembles air hockey in terms of gameplay and excitement. Played on a compact tabletop under a clear dome, bubble hockey involves using rods to control miniature players, similar to foosball. The objective is to move a puck into the opponent’s goal while defending your own, creating fast-paced, energetic matches.

Bubble hockey combines the reflex-based nature of air hockey with the strategic elements of foosball. Players must act quickly to maneuver their figures, control the puck, and react to their opponent’s moves. The dome ensures that the puck remains in play, creating non-stop action throughout the game.

Bubble hockey is ideal for fans of both foosball and air hockey, offering a unique twist on traditional table games. It is often found in game rooms, arcades, and sports bars, where it attracts players looking for quick and competitive entertainment.

Carrom as a Skill-Based Table Game

Carrom is a tabletop game that originated in South Asia but has gained popularity worldwide for its blend of skill and strategy. Played on a square wooden board, players use a striker to flick discs, or “carrom men,” into corner pockets. The game requires precision, quick thinking, and excellent hand-eye coordination.

Much like air hockey, carrom involves striking pieces across a smooth surface with controlled force. Players must anticipate angles and rebounds to successfully pocket their pieces while blocking their opponents. The fast-paced action and simple rules make carrom a highly engaging game for players of all ages.

Carrom can be played in singles or doubles, offering flexibility for casual and competitive settings. Its blend of skill, strategy, and quick reflexes ensures that it remains a popular alternative to air hockey and foosball.

Teqball as a Modern, Sport-Inspired Game

Teqball is an innovative game that combines elements of soccer and table tennis, creating a dynamic and engaging experience. Played on a curved table, teqball involves using a soccer ball and any part of the body except the arms and hands to volley the ball back and forth over the table. The objective is to outscore the opponent through precise ball control and strategic play.

Teqball shares similarities with air hockey and foosball due to its reliance on quick reflexes, agility, and strategy. The fast-paced nature of the game keeps players active and engaged, while the curved table adds a unique challenge that requires precision and skill.

The game has gained popularity in recent years, particularly among soccer enthusiasts and athletes. Its competitive yet accessible nature makes teqball an exciting alternative for fans of table games and physical sports alike.

Crokinole as a Classic Dexterity Game

Crokinole is a classic tabletop game that combines elements of shuffleboard and carrom. Played on a circular wooden board, players take turns flicking discs toward a central target area to score points. The game involves a mix of precision, strategy, and quick reflexes, making it similar to air hockey and foosball in its competitive appeal.

Crokinole challenges players to balance offense and defense, aiming to land their discs in high-scoring zones while knocking opponents’ discs off the board. The smooth surface and fast-paced action create a dynamic experience that keeps players focused and engaged.

The simplicity of crokinole makes it suitable for players of all ages, while its strategic depth ensures that it remains entertaining for seasoned competitors. It is a versatile addition to game rooms and social gatherings, offering a unique alternative to traditional table games.

Conclusion

Games similar to air hockey and foosball provide endless opportunities for competitive fun and entertainment. Options like table tennis, shuffleboard, and bubble hockey capture the energy and excitement of these popular games while offering unique gameplay experiences. Whether you prefer fast-paced action, strategic planning, or precision-based challenges, there are countless alternatives to explore.

Investing in these games can enhance any recreational space, providing engaging activities for families, friends, and competitive players. By discovering new games that share the spirit of air hockey and foosball, you can enjoy hours of entertainment while developing skills in reflexes, strategy, and coordination.

1 note

·

View note

Text

Using Regression Analysis To Understand Core Drivers In Your Customer Loyalty Survey

First things first: What’s it?

Regression analysis is a method that helps you determine which factors have the most significant impact on an outcome.

In the context of a customer loyalty survey you’ve built using HubSpot, the outcome we are focused on is the Net Promoter Score (NPS) — the metric used to gauge how likely customers are to recommend your store. While NPS gives you an overall view of customer loyalty, regression analysis allows you to go deeper and uncover what influences that score.

For instance, your customer surveys might ask about product variety, staff responsiveness, or value for money. But simply looking at the responses to these questions doesn’t tell you which factors truly drive NPS. Regression helps you break this down and identify the most important contributors.

***We’ll use the terms customer loyalty and NPS interchangeably in the article; therefore, this also applies to the “NPS survey” and “customer loyalty survey.”

What’s the challenge?

Imagine you’ve collected data from a customer loyalty survey where you asked a set of questions about different aspects of the customer experience, such as:

How do you perceive the variety of products we offer? (Rating 1–10)

How frequently do you shop at our store? (Frequency per month)

How responsive and knowledgeable did you find our staff? (Rating 1–10)

How would you rate the overall value for money? (Rating 1–10)

On a scale of 0 to 10, how likely are you to recommend our store to friends and family? (This is the NPS question)

Let’s assume you’ve collected over 100 responses. For each response, you have ratings on these different aspects and an NPS score.

If you were to look at the raw survey data, you might be able to see patterns in how customers rate their experience. For example, you might notice that customers who rated staff responsiveness highly also tended to have higher NPS scores. But is staff responsiveness really the most important factor affecting NPS? What about value for money or product variety?

This is the challenge of analyzing surveys — simply looking at averages or individual responses doesn’t give you the whole picture. It’s hard to know which factors are statistically significant drivers of customer loyalty and how much each factor influences NPS.

But isn’t customer loyalty analysis straightforward?

At first glance, it seems that way, of course. You collect feedback from your customers, calculate their Net Promoter Score (NPS), and categorize them as Promoters, Passives, or Detractors based on their likelihood to recommend your store. If your NPS is high, everything’s going well; if it’s low, you need to improve. It sounds simple enough, right?

The reality, however, is that many factors influence customer loyalty, and focusing solely on the NPS score doesn’t give you the whole picture. While calculating the NPS score is easy, figuring out why customers rate their experience the way they do and which aspects of that experience drive their loyalty (or lack thereof) is much more complex.

Most marketers stop at basic NPS analysis:

They take the average NPS and compare it to industry benchmarks.

They calculate the percentage of Promoters, Passives, and Detractors, assuming this gives them a clear snapshot of customer satisfaction.

Some might take broad, generalized actions based on the score, such as improving customer service if the NPS is low or enhancing product offerings if they believe that’s the issue.

While this type of analysis might seem sufficient, it often isn’t enough because it doesn’t explain why customers give these scores.

So, what questions should you be asking?

Well, you’ll need to be asking questions that help you go beyond basic reporting:

Are Promoters happy because of the great product variety, or is the responsive staff that matters most to them?

It’s possible that customers who gave you a high NPS score did so because they loved your wide range of products. But, what if staff responsiveness played a more significant role than product variety in their overall satisfaction? If you don’t ask the right questions and analyze the data carefully, you might assume product variety is the key driver of customer happiness when, in fact, it’s the interactions with your staff that truly stand out for them.

Are Detractors unsatisfied with pricing issues, or is the store layout confusing?

Customers who give low NPS scores might cite pricing as a reason for dissatisfaction, but is that the primary issue? Are they frustrated because your store’s layout makes it hard to find what they’re looking for? Maybe pricing isn’t the main pain point, and improving the shopping experience would lead to more impactful changes in their satisfaction.

To illustrate how regression analysis can answer some of these questions, let’s walk through an elaborate example using customer survey data.

How is it relevant for HubSpot data?

For instance, let’s examine Customer Feedback and how regression analysis can enhance your understanding of customer loyalty survey (or similar) data.

Table 1: A glimpse of the customer loyalty survey dataset

Product Variety: How do customers perceive the range of products you offer?

Shopping Frequency: How often do they visit your store?

Store Atmosphere: What do they think about the overall ambiance?

Staff Responsiveness: How helpful and knowledgeable did they find your team?

Value for Money: Do they feel they’re getting a good deal?

Store Navigation: How easily can they find what they need?

Overall Satisfaction: Their general feeling about the shopping experience

Age Range: Which age group does the customer belong to?

Notification Preferences: Are they interested in receiving updates about special offers?

Net Promoter Score (NPS): How likely are they to recommend your store to friends and family?

As you’re already familiar, the golden nugget in this dataset is the Net Promoter Score (NPS). This score tells you how likely a customer is to recommend your store, a powerful indicator of customer loyalty and potential business growth.

But here’s the exciting part: we want to uncover which factors strongly influence this score. Is it the friendly staff? The great deals? Or perhaps the wide range of products? By analyzing this data, you’ll gain valuable insights into what really matters to your customers.

As a marketer, understanding these drivers can change how you go forward with your marketing approach/efforts. As we’ve already laid down before, here’s what it enables you to do:

Focus your efforts on what truly impacts customer loyalty

Customize your marketing messages

Identify areas for improvement that will have the most significant impact on customer satisfaction/loyalty!

Essentially, you wouldn’t have to shoot arrows in the dark.

Okay, so what’s regression analysis, and how does it tie?

Regression analysis is a statistical method that’ll help you understand how changes in one or more factors (called independent variables) affect another factor (called the dependent variable).

In our example:

The independent variables are things like product variety, store atmosphere, and staff responsiveness.

Our dependent variable is the Net Promoter Score (NPS).

Let’s break it down step by step:

Regression analysis looks at how each factor (like store atmosphere) relates to the NPS. It’s like asking, “When store atmosphere scores go up, does NPS tend to go up too?”

The analysis doesn’t just tell us if there’s a relationship; it tells us how strong that relationship is. It’s like saying, “For every point increase in store atmosphere, NPS tends to increase by X points.”

All of this information is combined into a mathematical formula, which can predict NPS based on other factors.

We use this formula on a portion of our data to see how well it predicts NPS. This tells us how reliable our formula is.

Let’s say we come up with this formula:

NPS = 2 × (Staff Responsiveness) + 1.5 × (Value for Money) + …

This would mean:

Improving staff responsiveness by 1 point could increase NPS by 2 points.

Improving perceived value for money by 1 point could increase NPS by 1.5 points.

But we don’t know that yet. That’s what we’re about to find using regression analysis.

Perfect, so how does this work?

We’re using statistical modeling, specifically machine learning (ML) regression, as a substitute for the “formula” we mentioned earlier. Instead of manually calculating how each factor affects NPS, we let the model do the work. (Please note that the code for the regression analysis is beyond the blog’s scope for now!)

The model analyzes customer survey data (Table 1, 1000 rows) to understand how factors like Overall Satisfaction and Value for Money influence NPS (remember the independent and dependent variables we discussed?). The model looks for patterns and assigns weights to each factor, showing how much each impacts NPS.

Table 2: Results of the regression analysis

Take a look at Table 2. What do you observe?

Overall Satisfaction (0.608): For every 1-point increase in overall satisfaction, NPS tends to increase by 0.608 points. This makes Overall Satisfaction the most powerful predictor in the model.

Value for Money (0.401): A 1-point improvement in perceived value for money could increase NPS by 0.401 points. This is the second most important factor in determining NPS.

What about other factors?

Store Atmosphere and Store Navigation have minimal positive effects on NPS, with increases of just 0.003 points and 0.001 points, respectively, for each point increase in their scores.

Fig 1: Correlation matrix between all your variables

Take a look at Fig 1. The correlation matrix visually shows how different factors from the survey are related to each other and NPS. This is a visually friendly way to understand which factors are most strongly linked to customer loyalty. For example, our observation of Overall Satisfaction and NPS having a very high correlation (0.82) is reflected in the correlation matrix as well. Similarly, Value for Money (0.54) and Staff Responsiveness (0.77) also show positive correlations, indicating that focusing on these areas can help improve your customer loyalty.

Take a look at Table 1. What’s the R2 score at the top?

The R-squared (R²) score is a way to measure how well a regression model (or “formula”) explains the variability in the data. In simple terms, it’ll tell you how much of the changes in NPS can be predicted based on the factors we’re analyzing, like Overall Satisfaction and Value for Money. An R² score of 1 means the model perfectly predicts NPS, while an R² of 0 means the model explains none of the variability.

For example, if our R² score is 0.98, it means the factors in the model can explain 98% of the changes in NPS. This is super important because the higher the R² score, the more confident you can be in the model’s predictions.

You can also predict the NPS score from here on

Now that you know the formula from the model, you can also predict the NPS score for any customer. The model takes all the important factors — like Overall Satisfaction and Value for Money — and tells you exactly how much each one impacts NPS. As we saw, if Overall Satisfaction increases by 1 point, NPS goes up by 0.608 points. So, if you know a customer’s satisfaction score, how they feel about value for money, and other details (i.e., the impact of each variable), you can plug those into the formula and predict their NPS score.

Though it’s not super important or a replacement for your customer loyalty/NPS survey, it’s a good note!

What are the different methods for regression analysis?

Now that we understand what regression analysis is, let’s explore some common types.

Think of these as different tools in your data analysis toolkit. Just as you wouldn’t use a hammer for every home repair job, different regression methods are suited for different data types and questions.

1. Linear Regression

This is the simplest and most common type of regression. It looks for a straight-line relationship between variables.

You’ll use it when:

You expect a straightforward, linear relationship between variables

The dependent variable (like NPS) is continuous.

When you want to predict a numerical outcome.

For example, you’ll use linear regression when you want to understand how an increase in customer service rating directly relates to an increase in NPS.

2. Logistic Regression

You’ll use this technique when the outcome you expect is categorical, often binary (yes/no, true/false).

When should you use it?

When you’re predicting a binary outcome.

When you want to classify results into categories.

Say, if we refer to the same table (Table 1), if we applied logistic regression to the same data, instead of predicting a specific NPS score, we would transform the NPS into categories, such as:

Promoters (NPS of 9–10)

Detractors (NPS of 0–6)

Passives (NPS of 7–8)

So, instead of predicting an exact NPS score (like 7 or 9), the model would predict which category a customer falls into — whether they’re a promoter, detractor, or passive. So, let’s say the model has figured out this “formula,” and if you bring in more data (real-time), you’ll be able to predict whether a customer will be a promoter or not (Promoter = 1, Not Promoter = 0). The logistic regression model would analyze factors like Overall Satisfaction and Value for Money and predict the probability of a customer becoming a promoter. This is especially good when you’re working with limited data and want to predict which category your customer might fall into.

3.Multiple Regression

Think of multiple regression as an extension of linear regression that includes two or more independent variables. You’ll want to use this technique when:

When you have multiple factors influencing your outcome.

When you want to understand the relative importance of different variables.

Fig 2: Illustration of linear regression vs. multiple linear regression taken from here

Polynomial Regression

You’ll use polynomial regression when the relationship between variables is curvilinear (not a straight line). So, in this case, perhaps you’re trying to understand how customer satisfaction might increase with age up to a point and then decrease for older customers. The relationship isn’t straightforward here anymore.

Let’s say you’re analyzing how age affects NPS. In some cases, the relationship between age and satisfaction might not be linear:

Younger customers (18–25) might be less satisfied, as they might be looking for trendier or more cost-effective options.

Middle-aged customers (35–45) might have higher satisfaction because the products and services match their needs.

Older customers (55+) might again have lower satisfaction due to different preferences or unmet needs.

Fig 3: Illustration of linear regression (or model) vs. polynomial regression taken from

5. Other techniques to read

If the relationship between variables is curved (like in polynomial regression in Point 4) or complex, linear regression techniques will struggle. For example, if customer satisfaction increases up to a point but then drops after a certain level, a straight-line approach won’t capture that. For example, improving staff responsiveness might help NPS up to a point, but once customers expect a certain level of service, further improvements won’t change their opinion much.

Here are three tree-based methods that are popular alternatives for analyzing complex relationships, especially when the linear methods we discussed above (like linear/multiple regression) don’t fit — for example, decision trees, random forests, and gradient boost regressions:

Decision trees: Great for simplicity and visualization, but they can be too focused on the specific data used to build them, which may reduce their ability to perform well on new or unseen data.

Random forests: More reliable and stable for complex data but computationally heavier.

Gradient boosting: Best for accuracy in tricky data, but comes with high complexity.

***We’re going to look at these techniques in our future blogs!

What regression isn’t

When it comes to regression analysis in marketing, you need to understand its true potential — and, just as importantly, what it can’t do. While regression can provide powerful insights into customer behavior and campaign performance, some common misconceptions exist about how it should be applied. Regression analysis goes beyond simple correlations and requires a nuanced understanding of your data.

Here’s what you need to be careful about:

Assuming that correlation always implies causation, without considering external factors or confounding variables

Applying the same regression model to all scenarios without taking the situation itself into context.

Using regression to justify your marketing decisions rather than to make your future strategies better.

Treating regression analysis as a one-time activity rather than an ongoing process

Overcomplicating your formula by including every possible marketing variable you’ve captured!

Looks great! Give me a quick summary!

Regression analysis will help you pinpoint the exact factors that influence customer behavior, like which aspects of your service lead to higher NPS scores. Sure, the” formula” will work if the number of variables is fewer still, as we saw above, with increasing complexity, the types of ML models we use to understand relationships between the independent and dependent variables.

Techniques like linear regression, multiple regression, and more advanced ones like polynomial regression allow you to understand and predict outcomes based on customer data — think satisfaction scores, spending habits, or even how often they engage with your brand. The more advanced methods, like random forests and gradient boosting, take it a step further by digging deep into complex, non-linear relationships.

But here’s the thing. Continuously running these models manually and interpreting the results can be very cumbersome and challenging. Especially as your dataset grows or you start adding new variables. Your analytics team will be stuck crunching numbers, creating plots, and sending you reports filled with stats, so you’ll spend hours translating data into actionable insights. All of this ultimately (and unfortunately) leads to delayed decision-making and a less responsive marketing strategy. So, what’s the fix?

ConvertML makes your job easier and streamlined with automated regression analysis and interpretation

This is where ConvertML comes in to make your life easier. It automates the entire process of regression analysis, integrating survey data directly from HubSpot and various other sources you’d want to bring: surveys from different platforms, ticketing information, or external DBs in just a few clicks.

How is ConvertML making your job easier and more streamlined?

Streamline the entire regression analytics — automatically considering real-time data, so you don’t have to run algorithms manually.

Instantly visualize your predictions with easy-to-read charts and graphs to make it easier for you to act quickly.

See how each factor impacts outcomes like NPS, with downloadable reports for a deeper dive into the details.

What is ConvertML doing that other companies aren’t?

It interprets the output and provides GenAI recommendations

Once you’ve used ConvertML to automate your regression analysis, the next big challenge is making sense of the output.

Sure, ConvertML’s dashboards, charts, and reports are super intuitive and easy to understand. But what if you’re short on time? What if you need to make a decision right now?!

Well, here’s where ConvertML goes the extra mile!

ConvertML doesn’t just run regression models — it interprets the results for you using GenAI. Instead of digging through numbers and stats yourself, ConvertML instantly provides clear, easy-to-understand summaries.

But it doesn’t stop there. ConvertML gives you actionable recommendations — like pointing out which factors to focus on to improve NPs (or customer loyalty). It helps you quickly pick the best options, use your insights, and get results faster!

Sounds amazing, right?

Schedule a demo to cut through the noise and simplify customer loyalty survey analytics with ConvertML’s automated regression analytics, GenAI summary, and recommendation.

0 notes

Text

Maximising Winnings: Strategies for the Aviator Bonus Game

Online gaming is truly a thrilling phenomenon and bonus gameplay of the aviator sometimes offers players a unique chance to upgrade their gameplay experience. Win Aviator helps gamers to realise their true potential through the use of all bonuses toward winning maximised winnings in the player's journey playing Aviator. Below, one finds everything that one needs to know about Aviator bonus game and the success of scoring maximum winnings.

About Aviator Game Bonus

Aviator bonus games give different incentives or prizes called bonuses provided by online casinos or gaming platforms like Win Aviator. These bonuses try to enhance the overall pleasure and increase the chances of winning for the players. Different types of bonuses such as the deposit match, free bets, and cashback are available to ensure that the participants enjoy added benefits in playing Aviator.

Strategies to Maximise Winning

Review the Terms and Conditions

The first step to maximising winnings with the Aviator bonus game would be to have a complete review of the terms and conditions associated with any bonus received. Knowing the need for the rollover, the time limit, and other restrictions on an account will help you better plan and play and not fall into pitfalls, thereby ensuring that you are making the most of bonuses when placing them during strategic plays.

Select Bonuses That Suit Your Style to play

Different bonuses align with different kinds of players. The right one can significantly change the experience of playing online gambling. For example, high rollers may be attracted to large match bonuses that allow for real big payouts. A more cautious player may opt for cash-back offers that provide a safety net. Choosing bonuses aligned with the individual play styles maximises their advantages and increases their overall success in the Aviator bonus round.

Use Free Bets Wisely

One exciting feature of this game is that it risks calculated stakes without losing money. Whenever one receives free bets, it becomes wise to use them on riskier opportunities with the hope of high rewards. Since personal funds do not play a role, with the right execution, these bets bring in high wins considerably. The earnings of the player can thus be increased considerably while keeping the financial exposure to its minimal scale through smart free bets.

Manage Bankroll

Even when utilising bonuses, sound bankroll management is always essential to the game aviator bonus. The player must set a budget and stick strictly to it, even with active bonuses. Limitation is necessary so that players do not spend or become overly emotive or impulsive due to gaining excitement over bonuses. Discipline in managing your bankroll ensures you have a more sustainable gaming experience and far better long-term results.

Take Advantage of Multiple Bonuses

You can have an almost inexhaustible variety of bonuses during the game Aviator. Do not hesitate to apply several offers at once that will help increase playing time and winning chances. Bonuses in general can stack up for a more positive benefit and additional opportunities to interact with the game. Well, of course, terms and conditions should be kept under close watch to avoid disqualification and therefore really maximise benefits from each bonus.

Always Be Informed About New Bonuses

The online gaming industry is always evolving as casinos always introduce new offers and promotions. Keeping updated information on such offers can raise the chances of winning for players much higher in the Aviator bonus round. Updating through Win Aviator and other reliable sources helps ensure that no offer is ever missed from their end.

Final Thought

Maximising winnings in the Aviator bonus game has nothing to do with your luck. The game needs to be played with proper planning and the effective utilisation of available resources. One must evaluate the terms and conditions, choose the most suitable bonuses, maximise the use of free bets, and work on bankrolls to access numerous offers in gaming. Win Aviator focuses on improving game players to their optimal performance, so every flight with Aviator is thrilling and rewarding. By adopting strategies as found in this book, one embarks on an adventure that contains the thrill of possibly winning big.

0 notes

Text

Measuring the ROI of Sales Training in a Corporate Setting

In an increasingly competitive landscape, companies are prioritizing the development of their sales teams to meet evolving customer demands and drive revenue. Investing in a sales training program for corporates is often seen as a strategic move; however, measuring the return on investment (ROI) of these initiatives is crucial for ensuring that expenditures translate into tangible benefits. This blog explores effective metrics and methodologies that organizations can leverage to assess the effectiveness of their sales training programs.

Understanding the Importance of ROI

Before delving into specific measurement techniques, it's essential to understand why measuring ROI is important for sales training programs. High-quality training can lead to improved sales performance, higher employee retention, and enhanced customer satisfaction. Conversely, ineffective training can waste valuable resources, time, and potentially demotivate sales staff. Tracking ROI helps organizations make informed decisions about ongoing training investments, identify areas for improvement, and ultimately align training with broader business goals.

Key Metrics for Measuring ROI

1. Sales Performance Metrics

The most direct way to measure the effectiveness of a sales training program is to look at sales performance indicators before and after training. Key performance metrics to consider include:

Sales Growth: Compare the percentage increase in sales revenue before and after the training program.

Conversion Rates: Assess the percentage of leads converted into customers before and after training; an increase indicates heightened selling skills.

Deal Size: Analyze the average deal size to understand whether trainees are improving their upselling skills.

2. Employee Performance Metrics

Sales skills aren’t just about hitting numbers; they also involve improved employee performance and engagement. Consider tracking:

Quota Attainment Rates: Measure the percentage of sales reps who meet or exceed their sales quotas post-training.

Activity Metrics: Monitor the number of calls made, meetings booked, and presentations delivered to see if trained employees are more active and engaged.

Client Interaction: Gauge qualitative changes by soliciting feedback from clients regarding their interactions with sales personnel post-training.

3. Retention and Turnover Rates

High turnover rates can be costly for organizations. If a sales training program successfully boosts job satisfaction and team morale, one would expect to see a decrease in turnover rates. By comparing turnover rates before and after the training, corporations can assess whether their investment in sales training programs enhances employee retention.

4. Customer Satisfaction and Loyalty Metrics

Training should not only impact internal sales metrics but also external customer relationships. Utilizing tools such as:

Net Promoter Score (NPS): Assess changes in customer loyalty and satisfaction. An increase post-training can reflect improved service skills among the sales team.

Customer Feedback Surveys: Implement surveys to gauge customer perceptions of the sales process, service levels, and overall satisfaction.

5. Cost-Effectiveness Analysis

To fully understand the ROI, companies should analyze the costs involved versus the benefits accrued. Calculate the training costs (material, time spent, and opportunity costs) against financial gains from increased sales, improved retention, and enhanced customer relations.

Methodologies for Tracking ROI

To measure these metrics effectively, organizations may adopt the following methodologies:

1. Pre- and Post-Training Assessment

Conduct assessments before and after the training program to establish a baseline. This comparison will help you ascertain improvements directly attributed to the training.

2. Regular Performance Reviews

Utilize regular performance reviews to track key metrics over time. Establish a schedule (e.g., monthly or quarterly) to evaluate data and make adjustments to sales strategies and training approaches as necessary.

3. Implementing CRM Tools

Utilize Customer Relationship Management (CRM) software to track sales activities and performance metrics. Many platforms allow for detailed reporting and can automate much of the data collection process, saving time while providing insights.

4. Gather Qualitative Feedback

In addition to quantitative data, consider gathering qualitative feedback from both sales teams and customers. Conduct interviews, focus groups, or informal check-ins to gain deeper insights into the impacts of training.

Conclusion

Measuring the ROI of a sales training program for corporates is not just an essential task but a strategic necessity. Organizations must implement strong metrics and methodologies to ensure that training investments yield positive outcomes. By focusing on direct sales outcomes, employee performance, customer satisfaction, and cost analysis, businesses can make informed decisions that drive sustained success while maximizing the value of their sales training initiatives. A strategic and data-driven approach to measuring ROI will empower organizations to continually enhance their training programs and realize their full potential in the market.

0 notes

Text

How to set up your NBFC- Registration, Operational manual, Licensing, and more

NBFCs (non-banking financial companies), unlike other banking institutions they don't adhere to banking regulations but are regulated by Reserve Bank of India and are registered institutes under the companies act 1956 or Companies Act 2013.

In India, there are mainly two kinds of NBFC:

Depositing accepting NBFCs - regulated by RBI

Non-deposit accepting NBFCs - other financial sector regulators

Advantages of NBFC Registration in India

Provides loans and other credit options

NBFCs are more profitable than private and public sector banks because of less investment.

The registration process is simpler than other banks or lending institutions

Loan processing feature takes lesser time as compared to banks

NBFCs helps in managing portfolios of stock and shares

Helps to trade in money market instruments

CIBIL or credit score does not become hindrance in getting loan

Financial Companies NOT requiring NBFC License

Companies exempted from NBFC registration or don’t require an NBFC license as they regulate by other financial sector regulators -

Housing Finance Companies – National Housing Bank,

Insurance Companies – Insurance Regulatory and Development Authority of India (IRDA),

Chit Fund Companies – respective State Governments,

Stock Broking – (SEBI) Securities and Exchange Board of India,

Companies that run Collective Investment Schemes – SEBI,

Merchant Banking Companies – SEBI,

Mutual Funds – SEBI,

Venture Capital Companies – SEBI,

Nidhi Companies – by Ministry of Corporate Affairs (MCA).

How to Register an NBFC?

Step 1: Register a company under the Companies Act 2013 or 1956.

Step 2: Business financial plan for at least 5 years

Step 3: Minimum Net Owned Funds (except for NBFC-MFIs, NBFC-Factors and CIC) should be Rs. 2 crores. Along with minimum assets should be worth Rs. 200 crores or above

Step 4: Must comply with the capital compliance and FEMA

Step 5: There should be atleast one director in the company from the same background, or one-third of directors should have financial experience

Step 6: A proof of good CIBIL score is requires to register as NBFC.

Step 7: Next, visit RBI’s official website and fill in the application form.

Step 8: Submit all the required documents along with the application form.

Step 9: Once you have submitted the application form, a CARN number will be generated.

Step 10: Send application copy to the regional branch of RBI, along with all attachments– Capital test, Profile of the promoters, High-level business plan, and Area of operation.

Documents for NBFC Registration

Certificate of Company Incorporation.

Information about management with a brochure of the company.