#cafoundationbooks

Explore tagged Tumblr posts

Text

A Performance Analysis with CA Foundation Exam Books

Introduction:

In the world of chartered accountancy, the CA Foundation exam books marks the beginning of a rigorous journey toward professional excellence. Success in this exam not only requires comprehensive knowledge but also strategic preparation and effective study materials. In this blog, we delve into the significance of performance analysis with CA Foundation exam books, exploring how it can enhance preparation and boost success rates.

Understanding the CA Foundation Exam:

The CA Foundation exam serves as the gateway to pursuing a career in chartered accountancy. It covers four subjects: Principles and Practice of Accounting, Business Laws and Business Correspondence and Reporting, Business Mathematics and Logical Reasoning, and Business Economics and Business and Commercial Knowledge. Each subject demands a deep understanding of concepts, along with practical application skills.

The Role of Study Materials:

Study Material For CA Foundation are indispensable resources, offering comprehensive coverage of syllabus topics, examples, practice questions, and mock tests. These materials not only clarify concepts but also aid in assessing understanding and pinpointing areas for improvement.

Importance of Performance Analysis:

Performance analysis involves critically evaluating one's performance in practice tests, mock exams, and self-assessment quizzes. It provides insights into strengths and weaknesses, allowing candidates to tailor their study strategies accordingly. When applied to CA Foundation exam books, performance analysis becomes a powerful tool for optimizing preparation.

Analyzing Strengths and Weaknesses:

By reviewing performance in various subjects and topics, candidates can identify areas where they excel and those that require additional focus. For instance, if a candidate consistently performs well in accounting but struggles with logical reasoning, they can allocate more study time to the latter. This targeted approach maximizes efficiency and ensures comprehensive preparation.

Tracking Progress Over Time:

Regular performance analysis allows candidates to track their progress throughout the preparation phase. By comparing performance metrics from different study sessions, candidates can gauge improvement and adjust their study plans accordingly. This iterative process fosters continuous growth and builds confidence leading up to the exam.

Identifying Effective Study Strategies:

Performance analysis helps candidates discern which study strategies yield the best results. For example, if a candidate discovers that they perform better after reviewing study materials in the morning rather than late at night, they can adapt their study schedule accordingly. This personalized approach optimizes learning and retention, enhancing overall performance.

Utilizing Resources Effectively:

Books for ca exams provide abundant resources like practice questions, solved examples, and explanatory notes. By analyzing performance, candidates can optimize book usage, ensuring thorough syllabus coverage and concept comprehension.

Addressing Exam Anxiety:

Performance analysis can also alleviate exam anxiety by providing candidates with a sense of control and preparedness. By actively monitoring their progress and addressing areas of concern, candidates feel more confident in their abilities. This psychological boost is invaluable on exam day, enabling candidates to perform to the best of their abilities.

Conclusion:

In the pursuit of success in the ca entrance exam, performance analysis with study materials plays a pivotal role. By systematically evaluating strengths and weaknesses, tracking progress, and refining study strategies, candidates can optimize their preparation and boost their chances of success. Aspiring chartered accountants should embrace performance analysis as a valuable tool in their journey toward professional excellence.

1 note

·

View note

Text

Books For CA Foundation June 2024 Exam

In June 2024, the CA Foundation exam will challenge aspiring Chartered Accountants with a comprehensive assessment covering Accounting, Business Laws, Quantitative Aptitude, and Business Economics. This exam serves as a pivotal milestone in their journey towards professional certification. Candidates must demonstrate proficiency in understanding core concepts, applying knowledge to real-world scenarios, and staying updated with current regulations. Success demands diligent preparation, strategic study techniques, and a thorough grasp of the exam syllabus.

Books for students attempting the CA Foundation Exam June 2024

For students preparing for the CA Foundation exam in June 2024, comprehensive study materials covering all subjects is essential. Opt for CA Foundation books specifically tailored to the CA Foundation syllabus, authored by reputable professionals or institutes. Additionally, solve previous years' question papers and practice mock tests to familiarize yourself with the exam pattern and improve time management skills. Utilize supplementary materials like revision guides and concise notes to reinforce key concepts. Ensure the books are up-to-date with the latest amendments and revisions in relevant laws and regulations. Effective time management and focused study are crucial for success.

Here is the list of best CA Foundation books that students can choose to get the best results in their CA Foundation Exam:

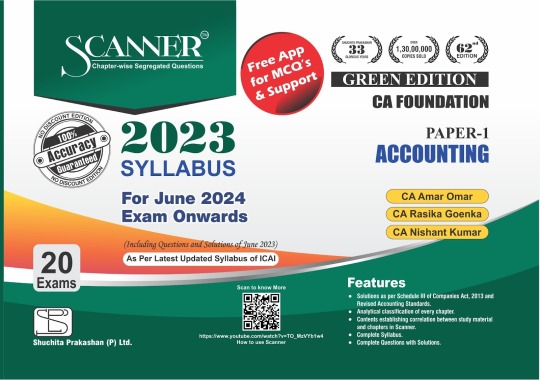

Paper-1: Accounting

Features

Scanner Green Edition CA Foundation Paper 1 Accounting

Solutions as per Schedule III of Companies Act, 2013 and Revised Accounting Standards

Analytical classification of every chapter

Contents establishing correlation between study material and chapter in Scanner

Complete Syllabus

Complete Questions with Solutions

For June 2024 Exam Onwards

Including questions and solutions of June 2023

As per latest updated syllabus of ICAI

Free app for MCQ’s & support

Author: CA Amar Omar, CA Rasika Goenka, CA Nishant Kumar

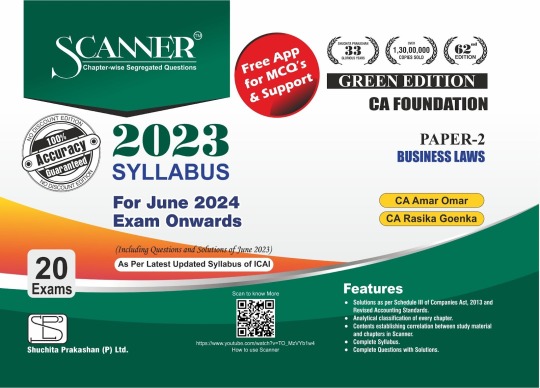

Paper 2: Business Laws

Features

Scanner Green Edition CA Foundation Paper 2 Business Laws

Solutions as per Schedule III of Companies Act, 2013 and Revised Accounting Standards

Analytical classification of every chapter

Contents establishing correlation between study material and chapter in Scanner

Complete Syllabus

Complete Questions with Solutions

For June 2024 Exam Onwards

Including questions and solutions of June 2023

As per latest updated syllabus of ICAI

Free app for MCQ’s & support

Author: CA Amar Omar, CA Rasika Goenka

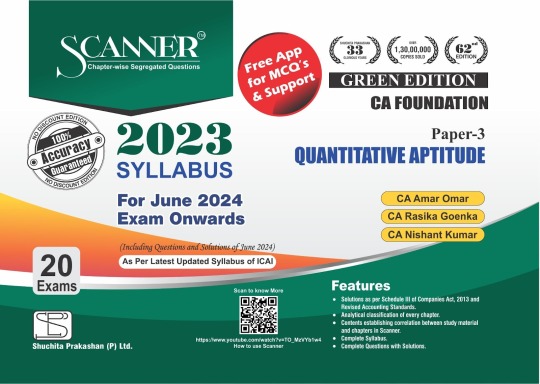

Paper 3: Quantitative Aptitude

Features

Scanner Green Edition CA Foundation Paper 2 Business Laws

Solutions as per Schedule III of Companies Act, 2013 and Revised Accounting Standards

Analytical classification of every chapter

Contents establishing correlation between study material and chapter in Scanner

Complete Syllabus

Complete Questions with Solutions

For June 2024 Exam Onwards

Including questions and solutions of June 2024

As per latest updated syllabus of ICAI

Author: CA Amar Omar, CA Rasika Goenka, CA Nishnat Kumar

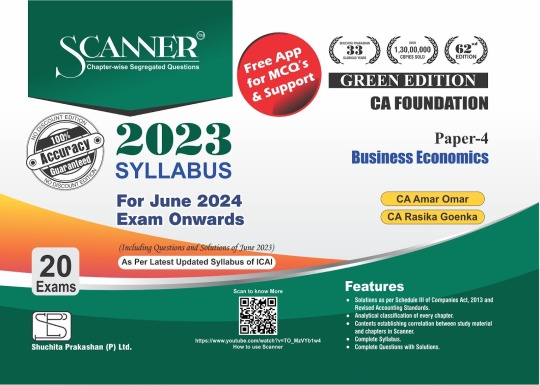

Paper 4: Business Economics

Features

Scanner Green Edition CA Foundation Paper 2 Business Laws

Solutions as per Schedule III of Companies Act, 2013 and Revised Accounting Standards

Analytical classification of every chapter

Contents establishing correlation between study material and chapter in Scanner

Complete Syllabus

Complete Questions with Solutions

For June 2024 Exam Onwards

Including questions and solutions of June 2024

As per latest updated syllabus of ICAI

Author: CA Amar Omar, CA Rasika Goenka

Conclusion

As students prepare for the CA Foundation exam in June 2024, the importance of choosing the appropriate ca foundation study materials cannot be overstated. Opt for textbooks specifically designed to align with the syllabus. Focus on comprehension rather than mere memorization, and allocate sufficient time to practicing with mock tests and previous exam papers. Embrace a well-rounded study strategy and remain abreast of any regulatory updates. With this approach, candidates can approach the exam confidently and set themselves on the path to success in the rigorous realm of Chartered Accountancy.

0 notes

Text

CA Intermediate Study Plan for May 2024 Exams

The CA Intermediate exam is a significant milestone in the journey to becoming a Chartered Accountant. It demands rigorous preparation and a well-structured study plan. As the May 2024 exams approach, it's crucial to create a study plan that optimizes your time and ensures you cover all the necessary subjects and topics. In this blog, we'll outline a comprehensive study plan to help you excel in the CA Intermediate exams.

1. Know the Syllabus:

Understanding the syllabus is the initial crucial step in preparing for the CA Intermediate exam. This exam is split into two groups, each comprising specific subjects. It's essential to thoroughly comprehend the topics and subtopics covered within these groups, as it will guide your study plan and help you focus on the relevant areas. This knowledge will enable you to allocate your time and resources efficiently, increasing your chances of success in the examination.

2. Create a Study Schedule:

To excel in your CA Intermediate exam, a well-structured study schedule is imperative. By allocating your time wisely, you can optimize your preparation. Focus more on subjects that you find challenging, ensuring a deeper understanding. Conversely, dedicate less time to topics in which you are more proficient. Striking a balance in your schedule ensures comprehensive coverage of the syllabus and prevents neglecting any crucial area. It's a key strategy for efficient and effective exam preparation.

3. Gather Study Materials:

Assembling the right study materials is fundamental to your CA Intermediate exam preparation. This includes textbooks, study guides, and online resources. It's essential to obtain the most up-to-date editions and any supplementary materials available, as they reflect current content and changes in the curriculum. Access to a variety of resources enhances your understanding of complex subjects, giving you a well-rounded knowledge base to tackle the exam's challenges effectively. +

4. Group-wise Approach:

Adopting a group-wise approach for your CA Intermediate exam preparation aligns with the exam's structure and can enhance your focus and efficiency. Begin with Group I subjects, which include Accounting, Corporate and Other Laws, Cost and Management Accounting, Taxation. By concentrating on one group at a time, you can delve deeper into the subjects, grasp the nuances, and build a strong foundation. This sequential strategy allows for a more methodical and comprehensive understanding of the topics, paving the way for successful exam performance.

5. Set Monthly and Weekly Goals:

Establishing monthly and weekly study goals is a pivotal aspect of CA Intermediate exam preparation. These goals offer a roadmap for your studies, breaking down the vast syllabus into manageable milestones. Students can take the help of some of the best CA Entrance Exam Books so that they can understand the syllabus well. They serve as a source of motivation, helping you maintain a consistent work ethic. Regularly assessing your progress against these objectives allows you to make necessary adjustments to your study plan, ensuring you remain on course and steadily advance towards your ultimate target of success in the examination.

6. Regular Revision:

Establishing both monthly and weekly study goals is a pivotal strategy for CA Intermediate exam readiness. These defined targets offer a roadmap, providing a clear direction for your studies. Achievable objectives maintain motivation and allow for consistent advancement. Regularly assessing your progress against these goals enables adjustments to your study plan, ensuring you stay aligned with your objectives. This structured approach ensures steady and measurable strides towards comprehensive preparation for the exam.

7. Group II Subjects:

Once you feel reasonably confident with Group I, transition to Group II subjects. Subjects in this group often include Advanced Accounting, Auditing and Assurance, Enterprise Information Systems & Strategic Management, Financial Management & Economics for Finance.

8. Practice Mock Exams:

Practicing mock exams and solving previous years' papers is essential for CA Intermediate preparation. It familiarizes you with the exam format, refines time management skills, and highlights areas needing improvement. By simulating real exam conditions, you gain confidence and a better understanding of what to expect, increasing your chances of success.

9. Intensive Revision:

During the intensive revision phase, which typically starts 1-2 months before the CA Intermediate exam, focus on strengthening your weaker subject areas and solidifying your knowledge across all subjects. Prioritize targeted practice, thorough understanding, and repeated revision to ensure you're well-prepared for the upcoming exam's challenges.

10. Stress Management:

Stress is natural during exam preparations, but effective stress management techniques, such as meditation, relaxation exercises, and maintaining a healthy lifestyle, can help you stay focused and calm.

Conclusion:

A well-structured CA Intermediate study plan is your key to success in the May 2024 exams. Stick to your schedule, stay disciplined, and stay positive. With dedication and effective planning, you can conquer the challenges and move one step closer to achieving your dream of becoming a Chartered Accountant. Best of luck with your preparations and the upcoming exams!

0 notes

Text

Explaining the Role of CAs in Financial Planning and Wealth Management

Introduction

In the realm of financial planning and wealth management, Chartered Accountants (CAs) play a pivotal role in ensuring sound financial strategies and long-term prosperity for individuals and businesses alike. This article aims to shed light on the significant contributions of CAs in this field and how their expertise can benefit clients in managing their finances and achieving their financial goals.

Understanding Financial Planning

Financial planning involves the process of setting financial goals, assessing the current financial situation, formulating strategies, and implementing actions to attain those objectives. It encompasses various aspects, including budgeting, investment planning, risk management, tax planning, retirement planning, and estate planning. CAs possess comprehensive knowledge and expertise in these areas, enabling them to provide holistic financial guidance to their clients.

The Expertise of CAs

CAs undergo rigorous training and examinations to obtain their professional qualifications, equipping them with a deep understanding of accounting principles, taxation laws, financial regulations, and business strategies. For qualifying ca exam aspirants can take the help of some of the best ca entrance exam books. This comprehensive knowledge, combined with their analytical and problem-solving skills, positions CAs as trusted advisors in the realm of financial planning and wealth management.

Roles and Responsibilities

CAs bring several key roles and responsibilities to the table when it comes to financial planning and wealth management:

1. Assessing Financial Health

CAs assess the financial health of individuals or businesses by reviewing their income, expenses, assets, and liabilities. This evaluation helps in identifying areas of improvement and potential risks, laying the foundation for effective financial planning.

2. Setting Financial Goals

Based on the client's aspirations, CAs assist in setting realistic and achievable financial goals. They consider factors such as income, savings, investments, and risk appetite to develop personalised strategies that align with the client's objectives.

3. Budgeting and Cash Flow Management

CAs aid in creating budgets and managing cash flow effectively. They analyse income sources, expenses, and financial commitments to optimise cash flow, control spending, and ensure financial stability. To become a successful CA students can go through the best study materials and textbooks so that they can qualify their exams successfully.

4. Investment Planning

CAs provide valuable insights and recommendations on investment opportunities that align with the client's financial goals, risk tolerance, and time horizon. They assess the potential risks and returns of different investment options, empowering clients to make informed investment decisions.

5. Risk Management and Insurance

Identifying and mitigating financial risks is a crucial aspect of financial planning. CAs analyse the client's risk profile and recommend suitable insurance products to safeguard their financial well-being and protect against unforeseen events.

6. Tax Planning

CAs possess in-depth knowledge of tax laws and regulations. They assist clients in optimising their tax liabilities by identifying legal tax-saving opportunities, ensuring compliance, and maximising tax efficiency.

7. Retirement and Estate Planning

Planning for retirement and managing estate affairs are vital components of financial planning. CAs help clients develop strategies to accumulate wealth for retirement, choose suitable retirement plans, and plan for the orderly transfer of assets to beneficiaries.

Conclusion

Chartered Accountants play a significant role in financial planning and wealth management. Their expertise in assessing financial health, setting financial goals, budgeting, investment planning, risk management, tax planning, retirement planning, and estate planning ensures clients receive comprehensive and tailored financial guidance. To become a successful CA aspirant first must clear all three levels of the CA Exam and for this they can take the help of some of the best CA Entrance Exam books to successfully qualify your exams. By leveraging the skills and knowledge of CAs, individuals, and businesses can navigate the complex financial landscape with confidence and work towards long-term financial prosperity.

0 notes

Text

Ca Entrance Exam Books | CUET Books | CS | CMA | Scanneradda

If you want to qualify for your CA exam with the highest marks then Scanner CA Entrance Exam Books are the best for you.

0 notes

Text

The CA foundation exam is planned for the upcoming months. Many students will study for the foundation exam, but only a few will pass it. The main reason is that there is no substitute for hard work, but candidates can prepare well, work well, and earn commendable marks on the CA foundation by combining hard work and smart work correctly. You will receive the ICAI CA Foundation Study Material once your registration for the CA Foundation exam has been completed successfully.

#CAfoundation#cafoundationcourse#cafoundationcoachingfees#cafoundationbook#cafoundationgroomingeducation#cafoundationcourseonlinecoaching#aboutcafoundationcourse#accountscafoundation#allaboutcafoundation#bestbookforcafoundationaccounts#bestcafoundationcoaching#cafoundationonlineclassesfees#freecafoundationclasses#cafoundationclassesnearme#cafoundationclassesonline

0 notes

Text

The Role of Class 11th and 12th in Securing Admission to CA and CS Courses

Class 11th and 12th are crucial for admission to CA, CS, and other commerce-related professional courses. Prospective students need to perform well in exams such as the Class 12 Board Exam and entrance tests to get accepted into these programs. Here, we'll discuss the importance of these two classes when it comes to being accepted into one of these programs and how you can best prepare for them.

Understand the importance of Class 11th and 12th for admission to professional courses

Class 11th and 12th are paramount for admission to professional courses such as CA, CS, and others. It is essential to understand the importance of these two courses in securing acceptance into one of these programs. They form the foundation for a successful career in commerce-related fields and provide the necessary knowledge needed in this field. Additionally, they also lay down the groundwork for entrance tests/aptitude examinations which most institutes ask applicants to take before admissions.

Professional courses such as CA, CS, and more provide a comprehensive knowledge of various aspects of commerce. They teach students about the basics of accounting and economics, business law, auditing, tax planning, managerial-level budgeting & finance, marketing principles and strategy formats, etc. All this knowledge is gained from both theoretical and practical perspectives. To gain the best theoretical knowledge, aspirants can take the help of Scanner’s CA Entrance Exam Books. This can only be done effectively if there's a solid foundation base support in classes 11th and 12th. A student should have a strong understanding of all the relevant accounting standards, national income levels including concepts such as GDPs (Gross Domestic Product), supply & demand curves, scarcity theories and effective decision making based on results obtained from numerical analysis.

Learn about different streams that can be taken in Class 11th and 12th

Class 11th and 12th are an important part of any student’s education journey. In order to prepare for a successful future, it is essential to select the right stream in Class 11th and 12th. For those intending to pursue professional study in the CA or CS fields, it is highly recommended that they opt for arts, commerce, or science depending on their abilities and interests. Additionally, some institutes offer additional preparatory courses specifically tailored to help potential applicants gain necessary knowledge and build up their confidence levels before taking exams. Students of any stream can appear for CA and CS course.

An additional class in Class 11th and 12th helps students gain expertise in different segments of the subject they intend to pursue. For budding chartered accountants, it is important to opt the best books for ca foundation for subjects such as economics, accounts and law; while those looking to become company secretaries should focus on business laws, audit and taxation. Hence, a student should opt for courses that will help enhance their knowledge and understanding of their chosen professional field.

Acquire in-depth information on the CA and CS course structure and eligibility criteria

Before beginning preparation for the CA and CS courses, it is important to be aware of the course structure and eligibility criteria. This information can be sourced from official websites such as ICAI or ICSI. It is also recommended that potential applicants attend information seminars hosted by these institutions and speak with experts in order to gain more detailed insights into the examination process, question paper formats, study material for ca foundation and selection procedures. Once these details have been noted down and reviewed, students can begin preparing for the entrance exams ahead of time in order to increase their chances of securing admission to the desired course.

It is particularly important for future applicants of CA and CS courses to take class 11th and 12th seriously. Here, they should focus on expanding their knowledge of subjects such as Maths and Accounts, as these will be crucial components of the entrance exams required for admission into the respective programs. In addition to this, those considering pursuing a Professional course like CA (Chartered Accountancy) or CS (Company Secretary) should also strive to develop an understanding of Economics, Legal Aspects of Business, Tax Laws, Business Communication, Leadership and Finance Management in order to gain greater insights into the field before committing to it.

Know what exams to take to compete for a seat in these highly popular courses

Candidates interested in pursuing a CA or CS course need to pass entrance exams such as the CA Foundation Exam for CA and the CS Foundation Exam for CS. These examinations are conducted twice a year and they test the student’s knowledge of accounting, economics, taxation, law, and other core aspects of commerce. While these tests may be relatively straightforward compared to other entrance exams, it is important that students begin preparation at least a few months before attempting them. This can be done through self-study using CA/CS materials such as study guides and reference books like Scanner’s ca foundation books and Scanner’s cs foundation books as well as through professional classes.

The importance of Class 11th and 12th in preparing candidates to excel in professional commerce courses is undeniable. While the entrance exams may be relatively straightforward, those who perform well know the nuances of various concepts which can be gained only through long-term study. Therefore, it is important for students to carefully analyze their syllabus in Class 11th and 12th and pay attention to their academics. This would prove invaluable in helping them secure a seat in these highly popular professional courses as they will have built up a core knowledge base before entering them. Furthermore, such students often tend to perform more confidently by remaining calm during the entrance examination as they understand the concepts better than others.

Get tips on how best to prepare for these exams to make sure your future is secured!

While the journey of preparation ensures success while attempting these tough exams, there are several tips to keep in mind. Firstly, it is important to focus on your 11th and 12th examinations as they provide an essential foundation for understanding the principles that form the basis of CA and CS courses. Further, Class XII results can help universities assess a student’s eligibility for admission into various commerce courses. Lastly, start taking classes or coaching for the exam at the earliest so that you have enough time for rigorous practice. With strong foundations from class 11 and 12 coupled with dedicated preparation time and smart strategies, you will have a good chance at securing admission into CA and CS courses.

To ensure success in these competitive exams, developing a study plan and studying regularly is essential. Besides that, understanding the syllabus of Class XI and XII exams is also important if you wish to succeed in professional courses like CA or CS. The organisations like ICAI and ICSI provide online courses which can help clear doubts about various concepts related to accountancy, mathematics and economics that may appear in the exam papers. Practising mock papers will also give you an idea about the type of questions that come up for the exams. The most important thing is to study from authentic CA Foundation Books. Apart from that, it is important to maintain one’s calm during the entire preparation process- this will keep you focused on your goals and ambitions.

Conclusion

With dedication and the right kind of guidance, cracking an entrance examination and securing admission in a coveted course is absolutely possible. So aim big, prepare well, and remain focused on your goal throughout. Doing this can give you an edge over others to accept the exciting challenge of becoming a Chartered Accountant or Company Secretary and further enhance your career prospects. Good luck!

#CAFoundationBook#CAEntranceExamBooks#CAIntermediateBooks#CAFinalBooks#cafoundationscanner#booksofcafoundation

1 note

·

View note

Text

CA Final Group 1 Books for November 2022 Exam!!

“The harder you work the better you get”

It is a matter of pride to be a Chartered Accountant in India. There are three stages of the exam: CA Foundation, CA Intermediate, and CA Final.

CA Final is the final level of the course. One has to clear this level to become a chartered accountant. Two groups—Group I and Group II—make up the final course. Four core papers make up Group I, whereas three core papers and one elective paper make up Group II. Before taking the CA Final exams, students must select one of the six Elective Paper alternatives. Any candidate who wants to succeed in the exam must go through the CA Final Group 1 books .

Before taking the CA final test, he or she must sign up for a 3-year articleship training programme under a licenced Chartered Accountant. The student must additionally complete a four-week Advanced Integrated Course in Information Technology and Soft Skills during their final two years of training (AICITSS). In the final six months of the articleship training, the CA final test may be taken. A student can enroll as a member of ICAI and receive the designation of CA after completing the articled training and passing both Final Course groups with a minimum of 40% in each subject and 50% overall.

There are many good CA Final Books that any diligent aspirants can prefer. There are four papers in the group 1 exam and their books are listed below respectively:

Green Edition Scanner ( Study Material Based Attempt-Wise Questions with Suggested Answers and Much More)

Applicable For November 2022 Attempt (As per latest updated syllabus of ICAI)

CA Final Group 1: Paper 1- Financial Reporting

Features:

Graph showing marks, categories wise in each chapter in various attempts

Examination Trends Analysis- 5 Attempts

Analytical Classification of every chapter

Marks of each question/part question

List of similarly asked questions

Contents establishing correlation between study material and Chapters in Scanner

Complete Questions with solutions

Complete Test Series

Green Edition Scanner ( Study Material Based Attempt-Wise Questions with Suggested Answers and Much More)

Applicable For November 2022 Attempt (As per latest updated syllabus of ICAI)

CA Final Group 1: Paper 2- Strategic Financial Management

Features:

Graph showing marks, categories wise in each chapter in various attempts

Examination Trends Analysis- 5 Attempts

Analytical Classification of every chapter

Marks of each question/part question

List of similarly asked questions

Contents establishing correlation between study material and Chapters in Scanner

Complete Questions with solutions

Complete Test Series

Green Edition Scanner ( Study Material Based Attempt-Wise Questions with Suggested Answers and Much More)

Applicable For November 2022 Attempt (As per latest updated syllabus of ICAI)

CA Final Group 1: Paper 3- Advanced Auditing & Professional Ethics

Features:

Graph showing marks, categories wise in each chapter in various attempts

Examination Trends Analysis- 5 Attempts

Analytical Classification of every chapter

Marks of each question/part question

List of similarly asked questions

Contents establishing correlation between study material and Chapters in Scanner

Complete Questions with solutions

Complete Test Series

Green Edition Scanner ( Study Material Based Attempt-Wise Questions with Suggested Answers and Much More)

Applicable For November 2022 Attempt (As per latest updated syllabus of ICAI)

CA Final Group 1: Paper 4- Corporate and Economic Laws

Features:

Graph showing marks, categories wise in each chapter in various attempts

Examination Trends Analysis- 5 Attempts

Analytical Classification of every chapter

Marks of each question/part question

List of similarly asked questions

Contents establishing correlation between study material and Chapters in Scanner

Complete Questions with solutions

Complete Test Series

Conclusion:

Nowadays Chartered accountancy is one of the most popular career choices in India after 12th. The professional accounting organisation in India, The Institute of Chartered Accountants of India, is in-charge of managing the CA test programme. The CA test has three levels, and passing each level is required to become a CA.

The first is the CA Foundation, then CA Intermediate, which has two levels and the last is the CA Final. It has two levels as well. One must be conversant with the necessary material and the ICAI-required exam format in order to pass this exam. There are four papers in the CA Final group 1 exam. One can qualify it with the help of CA Entrance Exam books .These books are suggested for anyone preparing for the CA Final Group 1 Exam under ICAI standards. A hardworking candidate always needs the best to read and understand. These books are quite easy to understand and very authentic.

All the very best for the CA Final Exam!!!

0 notes

Text

Which are the subjects that come under the CA Foundation Level!!

Chartered accountants play a significant role in society today. Chartered Accountants are essential for competent financial accounting, reporting, and efficient financial management in business organisations, industry, and the government. Chartered Accountants provide excellent services that ultimately help the economy because of their deep understanding. They operate independently and with competence.

Qualifying the CA Entrance Exam is not child’s play. It needs constant effort and hard work. An aspirant can only succeed if he does unbreakable hard work as well as smart work. CA foundation books can help you succeed in your journey.

CA Foundation is a course which is conducted by the Institute of Chartered Accountants of India and students who have passed 12th grade, are eligible to give the Foundation Examination.

The CA Foundation, as its name implies, is established to test someone's fundamental knowledge. Understanding accounting concepts and their effects on various types of accounts is the goal of the CA Foundation course.

The CA Foundation course has four parts. Given below are the topics covered in each of the four papers of CA Foundation syllabus:

CA Foundation Paper-1: Principles and Practice of Accounting

CA Foundation Paper-2: Business Laws and Business Correspondence and Reporting

CA Foundation Paper-3: Business Mathematics, Logical Reasoning and Statistics

CA Foundation Paper-4: Business Economics and Business and Commercial Knowledge

CA Foundation Paper-1: Principles and Practice of Accounting:

This is the main area of Chartered accountancy course. This paper, i.e., Principles and Practice of Accounting (also referred to as fundamentals of accounting or accounts) gives a basic framework or set of rules followed in accounting. Globally accepted accounting principles are given at one place in a basic form. The very name of the CA course includes Accountant in it. This signifies the requirement of knowledge of accounting from the 1st level itself.

The primary goal of Principles and Practice of Accounting is to give students a conceptual foundation in accounting that they can utilise to prepare financial statements, calculate accounting ratios, and work through straightforward issues. You can take the help of CA Entrance Exam books to learn this paper well.

The subjects covered in this essay are,

Theoretical Framework, Depreciation, Bank Reconciliation Statement, Inventories, and Accounting Process

Consignment, joint ventures, bills of exchange, royalties, the average due date, and current accounts are examples of special transactions.

Conclusion of Sole Proprietorship Accounts, Partnership Accounts, Introduction to Company Accounts, and

Ratios in basic accounting

CA Foundation Paper-2: Business Laws and Business Correspondence and Reporting:

You learn about many types of organisations, their roles, tactics, and legal frameworks in Business Laws and Correspondence and Reporting. Without the rule of law, there would be anarchy and disputes between societal factions and commercial enterprises.

It is believed that legislation serves as the structure and framework for modern business. Every type of company entity requires legal authorization and is subject to a number of laws.

You can improve your capacity to spread information accurately and communicate effectively by engaging in business correspondence and reporting. Professionals must disseminate important information formally both inside and beyond the organisation through reports, presentations, and other forms of presentation. Strong linguistic abilities and familiarity with the many styles of formal business correspondence are prerequisites for this.

CA Foundation Paper-3: Business Mathematics, Logical Reasoning and Statistics:

Every aspect of a professional career in the CA profession necessitates the application of analytical and quantitative skills. Using logic improves practical thinking, screening abilities, and analytical skills, all of which are very important for success in the CA profession.

By gathering, evaluating data using various statistical methods and techniques, and then drawing statistical inferences about the domain, statistics play a crucial role in enriching a particular topic or region.

Students who study statistics are better able to organise the information at hand and present it in a way that makes inferences and decision-making simple. Books for CA Foundation helps students to study things in more better way.

CA Foundation Paper-4: Business Economics and Business and Commercial Knowledge:

We frequently hear people talking about price increase or decrease in market value, changes in tax laws, pricing, GDP growth rates, etc., and occasionally we question why we pay taxes, how exchange rates are determined and why they fluctuate, why social media like WhatsApp and Facebook do not charge for their services, the necessity of international trade agreements, etc.

You can better grasp these dynamics and be able to comprehend them when they occur around you with the help of the Business Economics and Business and Commercial Knowledge paper.

Studying economics at the CA Foundation level aids in understanding social, political, technological, legal, and environmental actions as well as helping students make informed decisions.

Your ability to contribute to the ongoing development of the Indian economy is aided by your understanding of economics. A business organization's environment can be described as a confluence of internal and external elements.

Understanding the business environment is beneficial for spotting business chances, utilising helpful resources, and enhancing the general efficiency, expansion, and profitability of the company.

This essay discusses the nature, complexity, and relationships among the internal and external business environmental elements that affect a company's performance.

Now, after reading this blog, aspirants will surely know which are the four subjects that are covered in CA Foundation. They are: Principles and Practice of Accounting, Business Laws and Business Correspondence and Reporting, Business Mathematics, Logical Reasoning and Statistics, Business Economics and Business and Commercial Knowledge

This will definitely help those aspirants who are preparing themselves for the CA Foundation.

Thanks for reading the blog..Good Luck!!

0 notes

Text

A Complete Guide on CA Articleship

"CA Articleship" refers to a mandatory training program undertaken by aspiring Chartered Accountants (CAs) to gain practical experience in accounting, auditing, taxation, and related fields. Lasting for a stipulated period, typically three years, it provides hands-on exposure under the guidance of a practicing CA or a CA firm. Through real-world engagements, articleship equips candidates with essential skills, knowledge, and professional ethics crucial for their future careers in accountancy. This immersive learning experience plays a pivotal role in the development of competent and ethical professionals, fostering a deep understanding of financial processes and regulatory compliance within the dynamic landscape of commerce and industry.

CA Articleship Eligibility Criteria?

Applicants must meet the eligibility criteria for CA Articleship to be considered for the program. Below are the updated requirements for candidates applying through the CA Foundation Route and direct entry.

CA Foundation Route: Under the CA Foundation Route, as per the current curriculum, students must meet the following criteria to begin their articleship:

Completion of both groups of the CA Intermediate exams and for that students can study from some of the best CA Intermediate Books.

Candidates must participate in a four-week Integrated Course in Information Technology and Soft Skills (ICITSS).

Direct entry method: Nevertheless, candidates are eligible to commence their articleship upon fulfilling the subsequent criteria:

After finishing the four-week Integrated Course on Information Technology and Soft Skills (ICITSS), graduates in commerce or post-graduation with a minimum of 55 percent marks, and graduates from other streams with at least 60 percent marks, are eligible to start articleship or practical training.

Importance of CA Articleship?

Practical Experience: CA Articleship provides hands-on exposure to real-world accounting, auditing, taxation, and financial management practices, allowing candidates to apply theoretical knowledge in practical scenarios.

Skill Development: Through articleship, aspiring Chartered Accountants develop essential skills such as analytical thinking, problem-solving, communication, and decision-making, which are crucial for their professional growth.

Ethical Understanding: Articleship instills a strong sense of professional ethics and integrity by exposing candidates to ethical dilemmas and teaching them to navigate complex ethical issues in the accounting profession.

Mentorship: Under the guidance of experienced Chartered Accountants or CA firms, articles receive mentorship and guidance, helping them to develop professionally and gain valuable insights from seasoned professionals.

Career Preparation: CA Articleship prepares individuals for successful careers in the field of accountancy by providing them with practical experience, industry exposure, and the necessary skills and knowledge to excel in their roles as Chartered Accountants.

Pros of CA Articleship

The advantages of CA articleship include:

Practical Experience: Articles gain hands-on experience in accounting, auditing, taxation, and financial management, enhancing their professional skills.

Professional Development: Articles undergo mentorship from experienced CAs, fostering their growth in terms of knowledge, ethics, and competence.

Networking Opportunities: Interaction with clients, colleagues, and seniors during articleship builds a strong professional network, beneficial for future career prospects.

Career Preparation: Articleship serves as a stepping stone towards a successful career in accountancy, providing the necessary skills and experience required for employment or entrepreneurship.

Global Recognition: The Chartered Accountancy qualification earned through articleship is recognized worldwide, offering opportunities for global career advancement.

Cons of CA Articleship

The drawbacks of CA articleship may include:

Lengthy Duration: The mandatory duration of articleship, typically three years, can be perceived as lengthy, delaying entry into the workforce or higher education.

Financial Constraints: Articles often receive nominal stipends or no financial compensation during articleship, which may pose financial challenges, especially for those from economically disadvantaged backgrounds.

Limited Autonomy: Articles work under the supervision of practicing CAs or CA firms, limiting their autonomy and decision-making opportunities during the training period.

Work-Life Balance: The demanding nature of articleship, coupled with long working hours and tight deadlines, may impact the work-life balance of articles, leading to burnout or stress.

Narrow Exposure: Depending on the placement, articles may have limited exposure to certain areas of accounting or industries, potentially limiting their overall skill set and career options post-qualification.

Conclusion CA Articleship serves as a crucial phase in the journey towards becoming a Chartered Accountant, offering invaluable practical experience, mentorship, and professional development opportunities. For the the most important step is to qualify the ca intermediate and ca foundation exam and that you students can do by taking the help of CA Entrance Exam Books. Despite its challenges, including the lengthy duration and financial constraints, articleship provides a solid foundation for a successful career in accountancy. With hands-on exposure, networking opportunities, and global recognition, articles gain the skills and expertise necessary to excel in the dynamic field of finance. Embracing the challenges and leveraging the opportunities presented during articleship is essential for aspiring CAs to emerge as competent and ethical professionals ready to navigate the complexities of the financial world.

0 notes

Text

Unveiling the Depths of Business Economics in CA Foundation Exam

Business Economics is the application of economic principles to decision-making within a firm. It intertwines economic theories with business practices, offering a lens through which aspiring Chartered Accountants can analyze and comprehend the economic factors influencing corporate decisions. The subject combines both macro and microeconomic principles, giving a complete understanding of the business environment. Students can study this subject well by taking the help of ca foundation books.

Key Concepts in Business Economics for CA Foundation Exam

Demand and Supply Dynamics

One of the cornerstones of Business Economics is the study of demand and supply. CA Foundation candidates must grasp the intricacies of market forces, how they shape pricing strategies, and their impact on business operations. Profound insights into elasticity, market equilibrium, and factors influencing demand are paramount.

Cost Analysis and Optimization

Cost analysis is pivotal in managerial decision-making. As future CAs, a profound understanding of cost structures, fixed and variable costs, and methods for cost optimization is crucial. This knowledge empowers candidates to make informed financial decisions that contribute to the overall efficiency of a business.

Market Structures

Business Economics sheds light on different market structures – perfect competition, monopoly, oligopoly, and monopolistic competition. CA Foundation students should comprehend how each structure influences pricing, production, and overall market dynamics, enabling them to navigate complex business scenarios.

Revenue Management

The intricacies of revenue generation and management are key aspects of Business Economics. CA Foundation aspirants must delve into concepts such as marginal revenue, total revenue, and pricing strategies to cultivate a comprehensive understanding of revenue dynamics within a business. To understand all the concepts well students must go through some of the best ca entrance exam books.

Practical Applications in the Corporate Landscape

Strategic Decision-Making

Equipped with a solid foundation in Business Economics, Chartered Accountants can contribute significantly to strategic decision-making within organizations. The ability to analyze economic factors empowers them to formulate sound strategies, ensuring the financial health and sustainability of the business.

Risk Assessment and Mitigation

Understanding the economic landscape enables CA Foundation graduates to assess and mitigate risks effectively. From economic downturns to market fluctuations, a grasp of Business Economics equips professionals to navigate uncertainties, safeguarding the financial interests of the organizations they serve.

Financial Planning and Budgeting

Business Economics provides the toolkit for effective financial planning and budgeting. CA Foundation candidates, armed with this knowledge, can create realistic budgets, allocate resources efficiently, and contribute to the financial stability of the companies they are associated with.

Success Strategies for CA Foundation Exam in Business Economics

In-Depth Study Material

To master Business Economics, access to high-quality ca foundation study material is paramount. Choose resources that offer comprehensive coverage of topics, ensuring a deep understanding of theoretical concepts and their practical applications.

Practical Problem-Solving

Business Economics in the CA Foundation Exam often involves practical problem-solving. Develop a knack for applying theoretical knowledge to real-world scenarios. This not only enhances exam performance but also prepares candidates for the dynamic challenges of the corporate world.

Regular Practice and Revision

Consistent practice and revision are the keys to success. CA Foundation aspirants should engage in regular revision sessions, reinforcing their understanding of Business Economics concepts and ensuring they are exam-ready.

ConclusionBusiness Economics holds a central position in the CA Foundation Exam, and achieving proficiency in this subject is crucial for those aspiring to become Chartered Accountants. This guide offers a structured approach to grasp essential concepts which studentscan find in some of the best ca foundation books their real-world applications, and effective strategies for excelling in the examination. As you set out on the path to becoming a CA, recognize the significance and practicality of Business Economics. It is more than just an exam topic; it serves as a guiding compass through the complex financial terrain.

0 notes

Text

Common Mistakes to Avoid in CA Exam Preparation

Introduction

Welcome to our comprehensive guide on common mistakes to avoid in CA exam preparation. If you're an aspiring Chartered Accountant (CA) looking to ace your exams, it's essential to be aware of the pitfalls that many students often fall into. In this article, we will discuss the most common mistakes students make during their CA exam preparation and provide you with valuable insights on how to overcome them. By following our expert advice, you can enhance your chances of success and achieve outstanding results in your CA exams.

Lack of Structured Study Plan

One of the biggest mistakes students make is not having a well-structured study plan in place. Without a clear roadmap, it's easy to get overwhelmed by the vast syllabus and lose track of important topics. To avoid this, create a detailed study schedule that outlines the subjects you need to cover and allocates specific time slots for each. Break down your study sessions into smaller, manageable chunks, use some of the authentic ca entrance exam books, and set realistic goals to ensure consistent progress.

Insufficient Time Management

Effective time management is crucial for CA exam preparation. Many students struggle with balancing their study time with other commitments, such as work or personal obligations. To optimise your time, prioritise your study sessions based on the difficulty level of each subject and allocate more time to challenging topics. Avoid procrastination and create a distraction-free study environment to maximise your productivity. Additionally, take regular breaks to prevent burnout and maintain focus.

Inadequate Revision

Another common mistake is neglecting the importance of revision. Merely going through the study material once is not sufficient to retain the vast amount of information required for the CA exams. Schedule dedicated revision sessions where you revisit previously covered topics, solve practice questions and review your notes. Regular revision helps reinforce your understanding and improves long-term retention, increasing your chances of recalling the information during the exam.

Over Reliance on Study Materials

While CA exam study materials are essential for exam preparation, relying solely on them can be a grave mistake. Many students make the error of not referring to additional resources, such as reference books, online tutorials, or interactive study forums. Exploring diverse learning materials allows you to gain a deeper understanding of complex topics and approach them from different perspectives. Supplement your study materials with external resources to broaden your knowledge base and enhance your problem-solving abilities.

Failure to Practise Mock Tests

Mock tests play a crucial role in preparing for the CA exams, yet many students overlook their significance. Taking mock tests provides a simulated exam environment and helps you assess your strengths and weaknesses. It familiarises you with the exam format, time constraints, and improves your time management skills. Analyse your performance in mock tests to identify areas where you need improvement and focus your efforts accordingly. Remember, practice makes perfect, and regular mock tests can significantly boost your confidence and exam readiness.

Ineffective Exam Strategy

Having a well-thought-out exam strategy is vital to perform your best on the CA exams. Many students make the mistake of not devising a clear plan for the actual exam day. Familiarise yourself with the exam pattern, marking scheme, and allocate appropriate time to each section based on the marks allotted. Start with the questions you are most confident about to gain momentum and avoid wasting time on challenging questions initially. Leave ample time for revising your answers and double-checking for any errors before submitting your paper.

Lack of Self-Care

Often underestimated but crucial, self-care plays a significant role in exam preparation. Neglecting your physical and mental well-being can hamper your performance and overall productivity. Ensure you get enough sleep, eat a balanced diet, and engage in regular exercise or relaxation techniques to reduce stress. Take breaks to indulge in activities you enjoy and spend time with loved ones. Maintaining a healthy lifestyle will help you stay focused, and motivated, and perform at your best during the CA exams.

Conclusion

In conclusion, excelling in CA exams requires more than just knowledge of the subject matter. By avoiding common mistakes and implementing effective strategies, you can optimise your CA exam preparation and achieve exceptional results. Remember to create a structured study plan, manage your time efficiently, prioritise revision, diversify your learning resources, practise mock tests, devise an exam strategy, use the best exam study material and prioritise self-care. By following these guidelines, you'll be well-equipped to face the challenges of the CA exams and emerge victorious.

0 notes

Text

Ca Entrance Exam Books | CUET Books | CS | CMA | Scanneradda

CA Foundation Study Time Table For May 2023

You should have a schedule for your CA Foundation studies that includes daily, weekly, and monthly study schedules. Ensure that the study schedule includes portions for the CA Exams Test Series. The CA Foundation test is a requirement for the Chartered Accountancy Course. The exam is the first requirement for becoming a chartered accountant. Currently, passing the Foundation exam is challenging due to the low passing marks and negative marks. Students need to establish a plan for their study time if they want to ace the Foundation exam in the first attempt and also they need to study from one of the best ca foundation books for the best results.

The student who is preparing for CA Foundation benefits from setting specific, well-defined learning objectives. As a result, you should plan your free time as a student in order to give your studies your complete attention.

When preparing for the CA Foundation Course, it is important to analyse and reorganise the syllabus, assign specific time slots to each subject, and plan study sessions in advance. Additionally, taking practice tests can give candidates an insight into how well they are prepared for their upcoming exam. Lastly, allocating sufficient time for revising is critical in order to understand major topics before moving on.

CA Foundation self-study strategy

One can better learn a subject by employing examples that are relevant to him or her personally rather than relying on the lecturer's detailed examples. Create your own self-study schedule and learn at your own pace. Courses are taught at teaching centres at the usual pace, notwithstanding the fact that pupils learn at different rates.

You are not obligated to follow anyone else's schedule or constraints when creating your own self-study timetable for CA Foundation. You can study that subject whenever you choose, without anyone's permission.

Create a customised Study Schedule

A customised study schedule for a CA Foundation student should take into consideration the following factors:

Study pace: Set a realistic pace of studying, taking into account your current workload, level of understanding and how much time you can realistically commit to studying.

Exam date: Plan your study schedule around the date of the CA Foundation exam, making sure you have enough time to cover all the subjects.

Weaknesses: Identify the subjects you struggle with the most and allocate more time for them in your study schedule.

Study resources: Make use of study material from various sources, including best ca entrance exam book, online resources, and past papers.

Breaks and revision: Include regular breaks and time for revision in your study schedule to avoid burnout and consolidate your learning.

Example study schedule:

Day 1-2: 4 hours per day for Economics and Business Studies

Day 3-4: 4 hours per day for Business Laws

Day 5: Revision of Economics and Business Studies

Day 6: Revision of Business Laws

Day 7: Take a break

Day 8-9: 4 hours per day for Accounting

Day 10-11: 4 hours per day for Mathematics and Statistics

Day 12: Revision of Accounting

Day 13: Revision of Mathematics and Statistics

Day 14: Take a break

While making a study timetable, the following things should be focused on:

Goals: Set specific, achievable study goals for each subject, with a focus on areas where you struggle the most.

Time management: Allocate sufficient time for each subject along with allocating time for breaks and revision.

Prioritisation: Prioritise subjects based on their weightage and level of difficulty, allocating more time to the subjects you struggle with the most.

Study methods: Consider different study methods, such as active learning (e.g. practice questions, summarising), and alternate between these methods to keep things interesting.

Realism: Make sure the study schedule is realistic and takes into account any other commitments you may have, such as work or family responsibilities.

Flexibility: Be flexible and adjust the study schedule as needed, based on your progress and level of understanding.

Breaks: Regularly schedule breaks and time for relaxation, to avoid burnout and ensure you are able to maintain focus over the long term.

Guidelines for 1 month study plan for CA Foundation:

Mathematics:

Identify the specific topic you need to study.

Review the basics and essential formulas for the topic.

Allocate time for studying, e.g. 2 hours a day, 5 days a week.

Create a study schedule, breaking down the topic into smaller, manageable sections.

Use different resources, such as textbooks, online tutorials, and practice problems to deepen your understanding.

Solve practice problems regularly to test your understanding and identify areas that need improvement.

Economics:

Start by reviewing the basic principles of economics.

Set a study schedule, allocating time each day or each week to economics.

Practice applying economic concepts by solving problem sets, participating in case studies, or working on projects.

Stay up to date with current economic events and analyse how they relate to the principles studied.

Make flashcards or summarise key concepts and theories in your own words to improve retention.

Consider finding a study group or a tutor to discuss economics with and to receive additional support.

Law:

Allocate specific time slots for studying each subject, taking breaks, and reviewing what you have learned.

Practise active learning techniques such as summarising, asking questions, and explaining the information to someone else.

Join a study group or connect with classmates to discuss and review material, ask questions, and receive feedback.

Apply what you have learned by doing practice questions, writing essays, or taking mock exams.

Keep track of important dates, deadlines, and notes in a planner or an app to stay on top of your studies.

Accounts:

Start with the basics: Ensure that you have a solid understanding of fundamental accounting concepts and principles.

Make a study schedule: Dedicate specific time slots for studying each topic, taking breaks, and reviewing what you have learned.

Use a variety of resources: Utilise textbooks, lecture notes, online tutorials, and practice problems to deepen your understanding.

Practice regularly: Complete practice problems, take mock exams, or work through real-life case studies to apply what you have learned.

Focus on areas of weakness: Identify the areas where you struggle the most and dedicate extra time to studying those topics.

Collaborate with others: Join a study group or connect with friends to discuss and review material, ask questions, and receive feedback.

Stay organised: Keep track of important dates, deadlines, and notes in a planner or an app to stay on top of your studies.

Take breaks: Regular breaks help to refresh your mind and prevent burnout. Take breaks to relax, exercise, or meditate.

Stay up-to-date: Stay informed of recent developments and changes in accounting to maintain a broad perspective and improve your problem-solving skills.

CA Foundation Study Plan for 3 months:

Here's a high-level 3-month study plan for CA Foundation:

Month 1:

Start with the basics of Accounting, Business Laws, and General Economics.

Make brief notes for each subject and revise regularly.

Take mock tests and analyse your strengths and weaknesses.

Month 2:

Focus on strengthening your weak areas and revise all subjects thoroughly.

Start practising problems and take more mock tests.

Give special attention to Accounting, it carries the maximum marks.

Month 3:

Revise all subjects one final time and focus on your weak areas.

Take as many mock tests as possible to build your confidence.

Get clarification on any doubts you have before the final exams.

Conclusion:

Creating a study timetable and following a regular schedule when preparing for the CA Foundation Exam in May is essential. Allocating time to each subject, getting familiar with question types, attending tuition classes, discussing difficult concepts with experienced accountants, studying from some of the best ca entrance exam books and taking practice tests online or through books can help improve chances of success in the exam. Utilising all these resources combined with hard work and dedication will ensure your success.

#cafoundationbooks#CA Entrance Exam Books#CA Foundation Book#CA Intermediate Books#CA Final Books#ca foundation scanner#books of ca foundation

0 notes

Text

How to Clear CA Foundation Exam in the First Attempt?

Every year, The Institute of Chartered Accountants of India (ICAI) holds exams for candidates who are seeking to become chartered accountants. Every candidate wants to pass the CA Foundation exam on their first try and be selected. However, it may be difficult for students to finish in one attempt due to numerous distractions and poor time management.

According to the ICAI's courses, the CA Foundation exam is offered at various levels. Aspiring candidates must pass all levels of ICAI exams in order to become certified Chartered Accountants. For those who are interested in pursuing a career in accounting, passing the foundation exam is both a requirement and the first step as well. Candidates must pass both the CA Intermediate and CA Final exams after passing the CA Foundation Exam to become a Chartered Accountant.

There are some key points which one should keep in mind to clear the CA Foundation in the first attempt:

First cover the most important topics:

You should be able to determine the level of detail a topic requires by looking at the weight each topic carries. Many students waste time on topics that are not as important and don't matter as much in exams. Read from the CA Foundation Books because they have the most authentic stuff. Also, study the most crucial subject when you are most productive. This could be done in the morning time.

Consult the previous year's test papers:

Students can learn a lot about the exam's format and general level of difficulty by completing previous year's CA Foundation question papers. The primary deciding factor for passing the CA Foundation exam, time management skills is the successful strategies are implemented by students who practise the previous years' papers.

Understand the exact stuff you need to study:

Knowing what to study and what not to study is the fundamental element of smart work for passing the CA foundation exam. As a result, the quality of learning and revision that is done scientifically, rather than just the quantity (volume) of materials one has read, is what matters in the CA foundation. Before beginning their studies, students should be familiar with the CA Foundation Examination format.

Additionally, candidates should develop personalised strategies, taking into account their own strengths and weaknesses, as general approaches might not be effective in specific circumstances.

Studying through writing:

For effective learning, answer writing practice is very important.

Reading alone does not adequately prepare you for the exam, according to a recent survey. Writing down the key ideas you read from the books for the ca foundation in a notebook will help you remember them even better. Always take notes while reading important information.

Make a scientific revision:

Reread the material you have already studied. Otherwise, you risk knowing everything but failing to remember it when appearing for the eaxam. According to a recent study, you will retain concepts better and find it easier to recall them during exams if you review the material you learned the previous day and then review it again in the following week.

Taking Mock Exams:

It takes practice to become perfect. A key component of the Core Strategy for succeeding in CA foundation is taking Mock Tests. They are available in the Scanner CA Foundation Books. It is almost impossible to win if you are not taking practice exams. For this reason, practice exams help you become accustomed to the test-taking environment by simulating the exam environment. They replicate the actual feel and look of the test. As a result, exam anxiety is significantly reduced, and there are additional benefits as well.

The following justifications support the importance of taking mock exams:

Helps in the development of exam-cracking strategies: You must plan your approach to the CA Foundation exam, including which sections you will attempt and how much time you will devote to each, in order to do well.

Evaluates performance: By taking these tests, you can identify your strong and weak points. The results of your practice tests allow you to evaluate how well your preparation worked and give feedback on what still needs work.

By taking CA foundation practice exams, you can learn how to manage the pressure of the exam and maintain your composure.

Manage your time to crack the CA Foundation Exam in India:

Appropriate time management skills are one of the most important aspects of CA foundation exam preparation.

The important time management advice listed below will help you prepare for the CA Foundation Exam:

Setting Small and Realistic Goals Daily:

You don't have to win the war today and then unwind tomorrow. Small objectives should be set and accomplished each day. Every day, set modest goals, but make sure you reach them by the end of the day.

Most students look over the entire course syllabus before beginning to freak out about the hefty reading list. Avoid doing this. It is crucial to break down the entire syllabus into smaller sections and sub-sections before setting goals in accordance with those sections. Additionally, concentrate on one chapter at a time rather than studying numerous chapters superficially.

Don't wait for tomorrow:

Preparation is not a magical process. If you think that i have tomorrow and i’ll prepare tomorrow, then it’s wrong, don’t wait for it. Make it today because tomorrow never comes.

Study for no more than two hours at a time.

According to a recent study, two hours is the ideal amount of time for continuous study. Take longer breaks every two hours, about 20 minutes, if you need to keep studying.

Plan for the Day After:

Set priorities a day before.This will help you organise your workload and maintain mental focus on the most crucial task.

Don't forget to give each topic a deadline. Otherwise, you run the risk of having an ineffective study session.

Conclusion: To become a Chartered Accountant in India you need to pass the CA Foundation, CA intermediate then at last the CA Final Exam. It’s not as easy as it looks but not so tough either. One should plan the study strategies to crack the CA Exam. The following are some tips that one should follow to crack the CA Foundation in the first attempt:

First Cover the most important topics

Consult the previous year's test papers

Understand what to research and what not to

Studying through writing:

Make a scientific revision

Taking mock exams:

Manage your time to crack the CA Foundation Exam in India

Setting small and realistic goals daily

Plan for the day after

Visit us at: https://bit.ly/3S4D0iH

0 notes

Text

0 notes