#ca inter coaching

Explore tagged Tumblr posts

Text

Why Panchkula Is Batter Option for Ca Coaching?

Panchkula, located in the northern Indian state of Haryana, is considered a good option for CA (Chartered Accountancy) coaching for several reasons:

Proximity to Major Cities: Panchkula is located close to major cities like Chandigarh and Delhi, which makes it convenient for students from these cities to attend CA coaching classes.

High-Quality Education: There are several well-established and reputed CA coaching institutes in Panchkula that provide quality education and support to students preparing for the CA exam.

Experienced Faculty: The faculty at CA coaching in Panchkula are generally experienced and knowledgeable professionals who have a strong track record of guiding students to success in the CA exam.

Affordable Fees: Compared to other cities, the cost of CA coaching in Panchkula is relatively affordable, making it a cost-effective option for students looking to save on expenses while pursuing their education.

Good Infrastructure: Many of the CA coaching institutes in Panchkula have modern classrooms and study facilities, which provide students with a comfortable and conducive learning environment.

Overall, Panchkula is a good option for CA coaching due to its proximity to major cities, high-quality education, experienced faculty, affordable fees, and good infrastructure.

#Ca Coaching in Panchkula#ca coaching in panchkula#ca coaching in chandigarh#ca inter classes near me#commerce coaching in panchkula#ca foundation classes in panchkula#ca in panchkula#educacion#education#student

3 notes

·

View notes

Text

Crack the CA Exam with Kerala’s Leading CA Coaching Centre – Xylem Learning

Becoming a Chartered Accountant (CA) is a dream for many commerce students, but the journey to success requires dedication, hard work, and the right guidance. With its challenging syllabus and rigorous exams, the CA course demands expert coaching and structured preparation. If you're looking for the best CA coaching center in Kerala, look no further than Xylem Learning.

Why Choose Xylem Learning for CA Coaching?

Xylem Learning has established itself as a trusted name in CA coaching by consistently delivering top results and providing students with the best resources. Here’s why Xylem Learning is the ideal choice for your CA preparation:

1. Expert Faculty with Industry Experience

At Xylem Learning, experienced CA professionals and subject experts guide students through the complex concepts of the CA syllabus. Their real-world expertise ensures that students grasp both theoretical knowledge and practical applications.

2. Comprehensive Study Materials

Success in the CA exams depends on quality study materials. Xylem Learning provides well-structured notes, practice questions, and revision guides that simplify even the most difficult topics, ensuring students are well-prepared.

3. Structured Coaching for All CA Levels

Whether you're preparing for CA Foundation, CA Intermediate, or CA Final, Xylem Learning offers customized coaching programs to meet the unique needs of students at every stage.

4. Regular Mock Tests and Assessments

Consistent practice is key to cracking the CA exams. Xylem Learning conducts frequent mock tests and assessments to help students evaluate their performance, identify weak areas, and build confidence for the final exam.

5. Personalized mentoring and Doubt-Solving Sessions

One-on-one mentorship ensures that students receive individual attention to clarify doubts and strengthen their understanding. The faculty at Xylem Learning is dedicated to providing personalized guidance to every student.

6. Flexible Learning Options

Xylem Learning offers both online and offline coaching, making it accessible to students across Kerala. With interactive online classes and recorded lectures, students can learn at their convenience.

7. Proven Track Record of Success

The institute has a history of producing top CA rank holders and achieving high pass percentages. The success stories of Xylem Learning students are a testament to the institute’s commitment to excellence.

Join Xylem Learning and Start Your CA Journey Today!

If you are determined to crack the CA exam and build a successful career in accounting and finance, Xylem Learning is your ultimate coaching partner. With expert faculty, structured study plans, and result-oriented training, Xylem Learning ensures that you are well-prepared to excel in your exams.

Enroll today and take the first step towards becoming a Chartered Accountant!

For more details, visit Xylem Learning or contact us for course inquiries.

0 notes

Text

Ca Inter Best Coaching

Ca Inter Best Coaching in Jaipur

We offer the best guidance available for CA Foundations courses. For the best CA inter coaching classes in Jaipur Rajasthan, visit Anil Sharma classes.

0 notes

Text

Early Bird Batch for CA Intermediate Jan 2026 | Ultimate CA

🔥 Get a head start on your CA Intermediate Jan 2026 journey with Ultimate CA!

📅 Starting from 5th Feb 📚 Subjects & Educators: ✅ Taxation – CA Vivek Gab ✅ Adv. Accounts – CA Tejas Suchak ✅ Law – CA Indresh Gandhi

📍 100% FREE Sessions on YouTube! 🎥

🔗 Join now: www.ultimateca.com 📞 +91 89830 87331

#CA Intermediate#CA Inter Jan 2026#UltimateCA#CA Inter Classes#Chartered Accountancy#CA Taxation#Advanced Accounting#CA Law#CA Exam Preparation#Free CA Classes#YouTube Sessions#CA Coaching#CA Inter Free Lectures#Online CA Classes

0 notes

Text

Breaking the Geographical Barriers: Accessing Top CA Classes From Anywhere in India

In the rapidly evolving digital world, geography is no longer a barrier to education. Aspiring Chartered Accountants (CAs) from remote towns, bustling cities, and everything in between can now access top-notch CA classes from anywhere in India. The rise of Online CA courses in India has transformed how students prepare for their CA Foundation, Intermediate, and Final exams, enabling equal access to quality education.

Why Breaking Geographical Barriers Matters

The journey to becoming a Chartered Accountant is demanding, requiring students to have the best guidance and resources. Traditionally, students often needed to relocate to metro cities to access premier CA coaching classes, which added financial and emotional strain. Today, the digital transformation of education ensures that every student, regardless of location, has access to top CA classes in India from the comfort of their homes.

The Power of Online CA Courses in India

Online learning platforms have revolutionized the CA preparation landscape. Here’s how:

Expert Faculty: Students now have access to the best mentors and educators, like those at Swapnil Patni Classes, known for their stellar track record in CA coaching.

Live & Recorded Classes: Flexible learning options through live sessions and recorded lectures allow students to learn at their own pace.

Comprehensive Study Materials: Top-tier CA inter classes and CA foundation classes provide exhaustive study materials, mock tests, and doubt-solving sessions.

Cost-Effectiveness: Students save on relocation and accommodation costs while getting high-quality education at affordable rates.

CA Foundation Classes: Building the Right Base

The CA Foundation course is the stepping stone in a CA’s journey, covering subjects like Principles of Accounting, Business Laws, and Quantitative Aptitude. Online CA Foundation classes ensure students across India can access top-notch training, exam-focused study plans, and personalized guidance to ace the exam on their first attempt.

CA Inter Classes: Bridging the Gap to Success

The CA Intermediate level is crucial, as it tests deeper conceptual knowledge and practical application. Through interactive online CA Inter classes, students can participate in group discussions, solve doubts in real-time, and master key subjects such as Accounting, Taxation, and Auditing—all without stepping out of their homes.

Why Choose Swapnil Patni Classes?

Swapnil Patni Classes is a name synonymous with success in CA coaching. With a blend of expert faculty, innovative teaching methods, and result-oriented approaches, SPC bridges the gap between students and their dreams. The online CA courses in India offered by SPC ensure that every student, whether in a metro city or a rural town, gets the same level of mentorship and resources.

Key features of SPC’s online programs include:

Live and recorded lectures for flexibility

Regular tests and performance analysis

Dedicated doubt-solving sessions

Access to comprehensive study materials and mock exams

Conclusion

The availability of top CA coaching classes through online platforms like Swapnil Patni Classes has truly democratized CA education. Students no longer need to uproot their lives or face additional challenges to access quality education. By leveraging the power of technology and enrolling in CA Foundation classes, CA Inter classes, or advanced-level courses, students across India can now confidently prepare for their exams and achieve their CA dreams, no matter where they are located.

To explore more about SPC's online CA courses and start your journey, visit www.swapnilpatni.com.

#CA Classes In India#CA Inter Classes#CA Foundation Classes#Online CA Course In India#CA Coaching Classes#CA Live Classes#CA inter online classes#Best Ca Online Classes

0 notes

Text

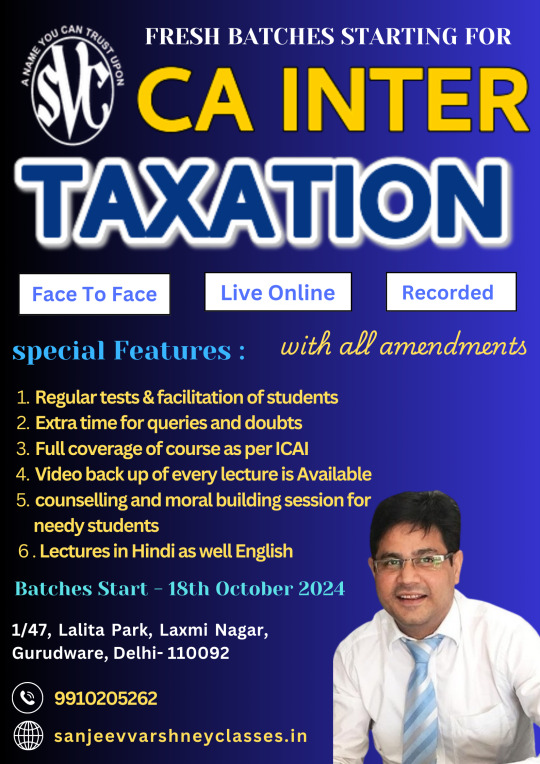

#CA Intermediate Classes#Best CA Inter Coaching#CA Inter Coaching in Laxmi Nagar#CA Inter Online Classes#CA Inter Face-to-Face Classes#CA Intermediate Preparation#CA Inter Mock Tests#CA Inter Taxation Classes

0 notes

Text

0 notes

Text

#CFA#CFA Level 1#CFA Level 2#cfa level 3#FRM#FRM Part 1#FRM Part 2#CA#best ca intermediate coaching in kolkata#ca intermediate#ca inter#ca foundation#ca foundation pendrive#CA Final#CA Final AFM

0 notes

Text

Prize distribution at IGP Institute

0 notes

Text

The Best Faculty and SFM Classes for CA Final and CA Inter in India

The journey to becoming a Chartered Accountant (CA) in India is both challenging and rewarding. One of the pivotal stages in this journey is mastering the Strategic Financial Management (SFM) for the CA Final and choosing the best faculty for CA Intermediate (CA Inter). Here’s a detailed look at why selecting the right SFM classes for CA Final and the best faculty for CA Inter is crucial for aspiring CAs.

SFM Classes for CA Final

Strategic Financial Management (SFM) is a crucial subject in the CA Final exam, requiring a deep understanding of financial concepts, strategic decision-making, and analytical skills. To excel in this subject, choosing the right SFM classes for CA final is essential. Here’s why:

Comprehensive Coverage: The right SFM classes will cover the entire syllabus comprehensively, ensuring that students grasp all necessary concepts.

Expert Guidance: Experienced faculty can break down complex topics into easily understandable segments, making learning more effective.

Practical Approach: Quality SFM classes incorporate practical examples and case studies, helping students apply theoretical knowledge to real-world scenarios.

Updated Material: The financial world is constantly evolving. Good SFM classes offer updated study materials reflecting the latest trends and practices.

Interactive Learning: Engaging teaching methods, including interactive sessions, doubt-clearing forums, and peer discussions, enhance the learning experience.

CA Inter: Best Faculty

The CA Intermediate level serves as a bridge between the foundational knowledge and the advanced concepts in the CA curriculum. Having the best faculty for CA Inter can make a significant difference in a student’s performance. Here’s what to look for in the best CA Inter faculty:

Expertise and Experience: The best faculty possess extensive knowledge and years of teaching experience, allowing them to deliver content effectively.

Innovative Teaching Methods: They use innovative teaching methods to simplify complex topics, making them easier for students to understand and retain.

Personalized Attention: Great teachers recognize that each student learns differently and provide personalized guidance to address individual learning needs.

Strong Communication Skills: Effective communication helps in clearly conveying concepts and engaging students, fostering a better learning environment.

Success Record: Faculty with a proven track record of producing successful students can instill confidence and motivation in their pupils.

Conclusion

Excelling in the CA exams requires dedication, hard work, and the right guidance. Selecting the best SFM classes for CA Final and the CA intern best faculty can significantly impact your preparation and success. By choosing wisely, you equip yourself with the knowledge and skills necessary to navigate the complexities of the CA curriculum and achieve your goal of becoming a Chartered Accountant.

Investing in quality education and expert guidance is a step toward a successful CA career. Choose the best, and let your journey to becoming a Chartered Accountant be smooth and rewarding.

0 notes

Text

What is good to do for a Chartered Accountant after the 12th exam? Students are confused about taking B.Com or taking the road of C.A. directly?

Charting Your Course: When to Begin Your CA Journey?

The esteemed profession of chartered accountant (CA) beckons many aspiring individuals. It promises a diverse range of job opportunities and a well-paying career, making it a popular choice among students.

Not Be confused about choosing a way to take CA

But a crucial question often arises: when to embark on this path?

Should you start right after high school (12th grade) or pursue a Bachelor of Commerce (B.Com.) first?

After your 12th board examination in India, preparing for the Chartered Accountant (CA) exams is a challenging but lucrative road. A diligent study plan, dedication, and concentration are required to become a chartered accountant.

Yes, CA is indeed a very tough path, but it is not impossible to play chess and become a CA. The thorough handbook or study notes will help prospective CAs with their preparation. Nowadays, millions of online study materials are available for free to learn, including CA online coaching classes on the YouTube platform:

The answer, like most things in life, depends on your unique goals and preferences.

Starting after 12th:

Early Start, Early Finish: You get a head start on your CA journey, allowing you to qualify and enter the workforce sooner.

Streamlined Studies: The foundation course for CA, previously known as the Common Proficiency Test (CPT), can be taken right after the 12th. This allows you to integrate CA studies with your undergraduate courses if you choose to pursue one concurrently.

Starting after B.Com:

Strong Foundation: A, B.Com. degree equips you with a solid grounding in commerce and accounting principles, which can prove invaluable during your CA studies.

Master's Degree Option: If you have your sights set on a Master's in Commerce or a related field, completing your B.Com first provides a strong academic base.

The Bottom Line: It's All About You

Ultimately, the decision about when to pursue CA hinges on your aspirations and circumstances. Carefully weigh your options and seek guidance from professionals in the field before making a choice.

Ready to Dive Deeper?

If you're eager to learn more about the CA journey and the exciting career avenues it opens, explore our comprehensive guide (link in bio, if applicable) for a detailed roadmap to becoming a Chartered Accountant.

9 Tips to Overcome Your Fear of the CA Exam

Quitely Understand the Exam Structure: Become acquainted with the subjects, question patterns, and grading system of the CA exam, which includes the final CA exam, the IPCC (Integrated Professional Competence Course), and the CPT (Common Proficiency Test).

Carefully Join a trusted CA online coaching institute (should be online or offline): Make sure the coaching institute you select offers thorough study materials, professional advice, and a well-organized study schedule.

Organizations such as the Institute of Chartered Accountants of India (ICAI) offer guidance and materials to help students get ready.

Schedule a timetable: Create a study plan that addresses each subject in detail. Give each subject adequate attention, taking into account both your level of expertise and the subject's intricacy.

Examining yourself daily is a multivitamin for you. (Regular Practices): To become more familiar with the steps of the exam and improve your ability to organize your time, solve practice questions, mock tests, and pass papers frequently for at least 10 years.

Attention on Theoretical Clarity: Instead of rote memorization, passing the CA exam requires a thorough or solid understanding of the subject matter. Give careful attention to comprehending the fundamental ideas and how they are used in actual situations.

Get Tips for Success: Don't be afraid or hesitate to ask seasoned instructors, fellow students, or mentors for advice. Clarification of ambiguities (doubts) and questions facilitates understanding.

Keep Up with Keep up with important events, revisions, and shifts in accounting rules because these will frequently be covered in the test.

Reviewing the syllabus is important as well: It is essential to regularly review all subjects. Plan time for review in your studies to ensure that you comprehend the material.

Read Also: Syllabus of ICAI CA Foundation Exam 2024: Exam Date, Marks

Maintaining health is good for you: Learning effectively requires not only intense study sessions but also regular breaks, rest periods, and a healthy balance between work and play.

Making an informed choice of the best training institute can be aided by investigating several coaching centers, their success rates, faculty expertise, study materials, and alumni reviews. In addition, organizations like Wisdom Academy - one of the renowned coaching centers—offer CA candidates high-quality instruction and direction. You are free to approach them at any time. outstanding performance on your CA online test.

Remember that passing the #CA examinations require not simply effort but also a planned and methodical CA study strategy. Aspiring CPAs may pass these tests and have a bright future in finance and accounting with hard work and devotion; programs like Wisdom Academy just move you one step closer to realizing your potential.

All the best… "If you want to shine like a sun, first burn like a sun." - Shri Abdul Kalam

#quantitative aptitude for ca#ca final important questions#icai important announcement#success series online classes#ca final standards#ca foundation law chapter 1 revision#ca final exam postpone#icai exam tips session#best test series for ca final#ca inter audit expected questions#best ca online coaching classes#ca intermediate rank preparation

1 note

·

View note

Text

#best faculty for CA Final AFM#best faculty for ca inter fm eco#Best faculty for CFA Level 1#CFA Online Coaching Classes#FRM Part 1#FRM Part 2

0 notes

Text

Best Ca Coaching In Jaipur

Anil Sharma Classes Jaipur: Redefining CA and CS Coaching Excellence

Are you ready to transform your career in Chartered Accountancy or Company Secretary studies? Anil Sharma Classes Jaipur is here to guide you on your journey to success with industry-leading coaching programs designed to help you achieve your professional dreams. Recognized as the Best CA Coaching In Jaipur, our institute offers comprehensive training across all stages of your CA and CS journey.

A Step-by-Step Guide for CA Aspirants

Your journey begins with a strong foundation. Our CA Foundation Coaching In Jaipur program lays the groundwork by covering essential principles and concepts, ensuring you build the confidence needed for advanced studies. As you progress, our CA Inter Best Coaching program offers tailored strategies and exam-focused preparation, helping you navigate the complexities of the Intermediate level. With competitive CA Intermediate Coaching Fees In Jaipur, we ensure that quality education remains affordable while maintaining high standards.

For those preparing for the final hurdle, our Best CA Final Coaching In Jaipur course provides rigorous training, exam simulations, and personalized mentoring to help you excel in your final examinations. Our curriculum is continuously updated to reflect the latest industry trends and regulatory changes, ensuring that you are always one step ahead.

Empowering CS Aspirants for a Successful Career

Beyond CA, Anil Sharma Classes Jaipur is also a trusted name when it comes to CS education. Our comprehensive approach makes us the Best CS Coaching In Jaipur for students aspiring to enter the corporate governance and compliance field. Start your journey with our CS Foundation Coaching In Jaipur course, designed to build a strong base in the fundamental aspects of company law and secretarial practices.

For those advancing in their studies, our CS Executive Coaching In Jaipur program focuses on developing practical skills and strategic thinking necessary for real-world challenges. Finally, our Best CS Professional Coaching In Jaipur course is crafted to prepare you for the professional examinations and to excel in your career as a Company Secretary.

Why Choose Anil Sharma Classes Jaipur?

Anil Sharma Classes Jaipur has earned its reputation as the Best CA Coaching In India through a commitment to academic excellence and a student-centric approach. Here are a few reasons why our institute stands out:

• Experienced Faculty: Our educators bring years of industry experience and academic expertise to the classroom, ensuring that you receive the best guidance possible. • Comprehensive Study Material: We provide regularly updated study materials that align with current exam patterns and industry requirements. • Flexible Learning Options: With both classroom sessions and online lectures, our programs cater to diverse learning styles and schedules. • Proven Success Record: Our alumni consistently achieve top ranks and secure lucrative positions, a testament to the quality of education at our institute.

Invest in Your Future Today

Choosing the right coaching institute is a crucial step toward a successful career in CA or CS. At Anil Sharma Classes Jaipur, we are dedicated to providing you with the tools and insights needed to excel in competitive examinations and beyond. Whether you're looking for CA Foundation Coaching In Jaipur, CA Inter Best Coaching, or comprehensive CS programs, our institute is the perfect partner on your journey to success.

Embark on a path of academic brilliance and professional growth. Join Anil Sharma Classes Jaipur today and experience the transformation that comes with learning from the best. For more details, visit our website or contact us at +91- 9314504460 or visit us at B-103 Saraswati Marg Opposite Gandhi Nagar Railway Station, Jaipur

#ca inter best coaching#ca coaching jaipur#ca coaching classes#Jaipur ca coaching#ca coaching classes in Jaipur

0 notes

Text

How to Avoid Common CA Final Mistakes & Pass in First Attempt

The CA Final is the last and most challenging stage of the Chartered Accountancy journey. Success in this exam requires meticulous preparation, strong conceptual clarity, and an effective study strategy. Many students, despite their hard work, fall into common mistakes that hinder their success. By identifying and avoiding these errors, you can improve your chances of clearing the CA Final in your first attempt.

Not Having a Well-Structured Study Plan

One of the biggest mistakes CA aspirants make is not following a proper study schedule. With a vast syllabus to cover, a structured plan is crucial. Allocate time for each subject, ensuring that you revise and practice regularly. Enroll in CA coaching classes or CA Online Classes to get expert guidance on syllabus completion and time management.

Ignoring Conceptual Clarity

Memorizing topics without understanding the underlying concepts can be detrimental. The CA Final exams are designed to test analytical and application-based knowledge. If you rely solely on rote learning, you may struggle with tricky questions. CA Inter Online Classes and CA Inter Classes provide in-depth explanations and real-world applications to strengthen conceptual clarity.

Procrastinating on Revision

Many students focus on completing the syllabus but neglect revision, which is essential for retention. Allocate at least two months before the exam for dedicated revision. Regularly revisiting topics helps in reinforcing key concepts and prevents last-minute panic. CA Online Classes offer revision programs that help consolidate learning effectively.

Skipping Mock Tests and Practice Papers

Mock tests play a crucial role in exam preparation. They help students assess their strengths and weaknesses while improving time management. Ignoring mock tests can lead to poor performance in the actual exam due to a lack of familiarity with the exam pattern. Platforms like CA coaching classes provide mock test series that simulate real exam conditions.

Lack of Focus on ICAI Study Material

ICAI’s study material and practice manuals are the primary sources for CA exams. Many students rely solely on reference books, missing out on crucial ICAI material. Always prioritize ICAI’s study material, as the exam questions are often framed from it. Supplement your preparation with additional resources, but don’t skip the official content.

Over-Reliance on Selective Study

Some students attempt selective study, focusing only on high-weightage topics. While it’s important to prioritize crucial areas, skipping other topics entirely is risky. The CA Final exam is unpredictable, and selective study can lead to gaps in knowledge. A balanced approach ensures comprehensive coverage of the syllabus.

Not Managing Exam Stress

Exam stress can negatively impact performance. Poor stress management leads to burnout, reduced concentration, and anxiety. Maintain a healthy study-life balance, practice meditation, and take short breaks to stay refreshed. Engaging in CA Foundation Classes early in your CA journey can help you develop stress-coping mechanisms for later stages.

Visit For More Info: https://www.ultimateca.com/

Poor Presentation and Time Management in Exams

Even well-prepared students can lose marks due to poor answer presentation. In CA exams, clarity, structured answers, and proper working notes are crucial. Practicing previous year papers and working on your writing speed will help in managing time effectively during the exam.

Ignoring Amendments and Updates

ICAI frequently updates the syllabus to align with current industry standards and regulations. Ignoring amendments can cost you marks, especially in subjects like taxation and law. Stay updated with ICAI’s announcements and enroll in CA coaching classes that provide regular syllabus updates.

Conclusion

Clearing the CA Final in the first attempt is challenging but achievable with the right strategy. Avoiding common mistakes like poor time management, lack of conceptual clarity, skipping revisions, and ignoring ICAI material can make a significant difference in your preparation. Enroll in CA Online Classes and leverage structured study plans to enhance your learning experience. With dedication, the right guidance, and a disciplined approach, you can successfully pass the CA Final and move forward in your career.

#CA Final#ICAI#CA Online Classes#CA Final exam#CA Foundation Classes#CA Inter Classes#CA coaching classes#Ultimateca

0 notes

Text

How to Use Online Platforms to Clear Doubts Instantly During CA Preparation

The journey to becoming a Chartered Accountant (CA) is demanding, requiring immense dedication and a clear understanding of concepts. With advancements in technology, online platforms have become a crucial tool for CA aspirants to address doubts instantly and enhance their preparation. Whether you're pursuing CA Foundation classes, CA Inter classes, or an online CA course in India, leveraging these platforms effectively can make a significant difference in your success.

Why Instant Doubt Resolution Matters

Clearing doubts as soon as they arise is essential for effective learning. Prolonging unresolved queries can create gaps in understanding, especially when preparing for CA exams, where every concept builds on the previous one. Instant doubt resolution ensures you stay on track, reduces stress, and boosts confidence in tackling challenging topics.

Top Ways to Use Online Platforms for Doubt Resolution

1. Join Live Online Classes

Online CA courses in India have transformed learning by offering interactive live sessions. Platforms like Swapnil Patni Classes provide real-time interaction with faculty, enabling students to ask questions during lectures. This ensures clarity and immediate resolution of doubts, making learning more effective.

2. Participate in Discussion Forums

Discussion forums dedicated to CA coaching classes are excellent platforms to engage with peers and mentors. Websites and apps often have forums where students can post doubts and receive detailed explanations from experienced professionals or fellow aspirants.

3. Leverage Doubt-Solving Apps

Many online CA course providers, including Swapnil Patni Classes, offer doubt-solving apps or dedicated sections on their websites. These tools allow students to upload questions, receive step-by-step solutions, or watch recorded answers, ensuring a seamless learning experience.

4. Utilize Social Media Groups

Social media platforms like Facebook, Telegram, and WhatsApp host groups specifically for CA Foundation and CA Inter classes. These groups facilitate quick doubt resolution by connecting students with tutors and experienced peers. However, it's essential to join reputable groups to ensure accurate information.

5. Schedule One-on-One Sessions

Several online CA courses in India offer personalized doubt-clearing sessions. These one-on-one interactions with faculty members enable students to gain in-depth clarity on complex topics. Scheduling these sessions can be especially helpful for tackling subjects like Accounting and Taxation.

6. Access Recorded Lectures

Revisiting recorded lectures is another effective way to clear doubts. Many CA coaching classes provide access to recorded sessions, allowing students to revisit specific topics and strengthen their understanding.

7. Engage in Online Test Series and Feedback

Participating in online test series is a great way to identify weak areas and seek immediate clarification. Platforms offering CA Inter classes and CA Foundation classes often provide detailed feedback on tests, guiding students on where they need improvement.

Benefits of Using Online Platforms for Doubt Resolution

Convenience and Accessibility: Clear doubts anytime, anywhere without disrupting your schedule.

Expert Guidance: Get insights from top CA experts across India.

Time Efficiency: Save time by resolving queries instantly rather than waiting for physical classes.

Collaborative Learning: Learn from peers and exchange ideas on online platforms.

Why Choose Swapnil Patni Classes?

At Swapnil Patni Classes, we understand the importance of doubt resolution in CA preparation. Our CA coaching classes integrate interactive live sessions, dedicated doubt-solving apps, and expert faculty support to ensure a comprehensive learning experience. Whether you're preparing for CA Foundation or CA Inter, our online CA courses in India are designed to provide the right guidance and resources to help you succeed.

Final Thoughts

In today’s digital age, online platforms are a game-changer for CA aspirants. By utilizing live classes, doubt-solving apps, and social media groups effectively, you can overcome challenges and stay ahead in your preparation. For a structured and supportive learning environment, explore Swapnil Patni Classes and take the first step towards your CA journey.

Visit www.swapnilpatni.com to learn more about our CA Foundation and CA Inter classes. Start your preparation with India’s leading CA coaching institute today!

#ca classes in india#ca coaching classes#online ca course in india#ca foundation classes#ca inter classes#swapnilpatniclasses#ca inter online classes#ca live classes#spcgurukul#best ca online classes

0 notes

Text

CA INTER TAXATION ONLINE CLASSES

The subject of CA Inter Taxation is one of the big basics in the Chartered Accountancy (CA) Intermediate course, and it requires a deep grasp of the Tax laws which is a kind of complex code as well as their applications. The India's premier teacher CA Inter Taxation online classes are only available at Sanjeev Varshney Classes for aspirants. The subjects range from both Direct as well as Indirect Taxes like Income Tax and Goods and Services Tax (GST) etc. The entire course is devotee to the taxation law which is a must for the candidates who want to gain CA Inter Certificate and then to thrive in the accounting and the financial world.

The fact is that Sanjeev Varshney shares his expertise in tax and his ability to break down complex issues has made him a favorite amongst the CA Inter students. The early modules are geared to clear the foundation followed by the others which are to be completed before each exam. The practice tests and the quick clearance of doubts are the learning methods that the students can do.

Sanjeev Varshney Classes offer the students the flexibility to attend both online and physical classes in a way that does not disturb their other activities and studies. The school sells such great reading materials, as textbooks, practice guides, and revision notes, in order that the work be made easy for the teachers.

#CA Inter Taxation#CA Inter Tax Classes#CA Intermediate Taxation#CA Inter Direct Tax#CA Inter Indirect Tax#CA Inter Tax Preparation#CA Inter Tax Coaching

0 notes