#c: srogers

Text

40s pre-serum Steve moodboard ✨

#c: srogers#pre serum steve#40s steve#steve rogers moodboard#b&w#b&w moodboard#pic#mine#courtney talks#moodboard

224 notes

·

View notes

Note

Seriously, though... am I crazy? Would you put Shaggy's ponytail in your mouth too???

that’s a lil ---- unhygienic boo

0 notes

Photo

Voit’s Q3 2019 Orange County Office Space Market Report & Forecast – Just Released!

Top of the Market?

Orange County’s office market has improved steadily since the prior downturn but is now showing signs of slowing in both demand and supply. This is expected, given the current “slow and steady” economic conditions, consolidation of office tenants due to technology, workplace and lifestyle changes and the fact that the economy is effectively at full employment. Absorption has once again turned negative as the market itself consolidates — in large part due to the typical office user no longer needing as big of a footprint — rental growth slows, and vacancy rates show signs of a potential increase. Sale transaction activity has slowed significantly due to a lack of supply, minimal foreign investment and record high pricing — a sure sign of the top of the sales market. But how long will we stay on top? As long as we see positive job growth and vacancy rates stay relatively flat, we can continue to expect sustained levels of lease absorption and rental growth into the foreseeable future, although sales prices and transaction activity will remain muted. However, the longer the economy continues to grow, the more susceptible or fragile it is to be impacted by economic events, or a downgrade in business or consumer sentiment. The trends we’re currently witnessing have historically preceded a downturn, and we’re losing velocity. We are starting to see increases in tenant concessions as landlords continue to shore up their rent rolls at record high rents and fill outstanding vacancies in preparation for “top of the market” sales or favorable debt refinancing. Class A office is currently proving to be the most competitive in terms of current lease concessions due to the high vacancy rates and levels of obsolescence (inconvenience) compared with low-rise office. Office headcounts per square foot have increased dramatically in recent years, particularly in the tech sector, attenuating the increase in demand driven by job growth and new business startups. This presents its own unique set of challenges for landlords (accommodating the increase in parking is just one example) as they adapt to this and many other technology and lifestyle-driven changes. Coworking has greatly impacted current workplace strategy, disrupting office space design and setting new standards for amenities and flexible workspaces. As such, top tier spaces continue to lease at premiums, and Class B or C properties with little to no amenities are struggling to compete, even at discounted rents. Many landlords continue to develop where feasible, battling increasing construction costs and planning hurdles, competition for viable opportunities, and a lack of development options. Adaptive reuse is back in a big, and a good way. “Slow and steady” continues, and with little sign of any growth triggers in the Orange County office market and beyond, it’s just a matter of time before things trend materially downward. While there’s the possibility of a moderate cooling in the run up to next year’s election, due to uncertainty on economic policy among other things, it’s difficult to predict what’s in store for the Orange County office market. We expect to have at least another 12 months of continued, if somewhat muted, growth.

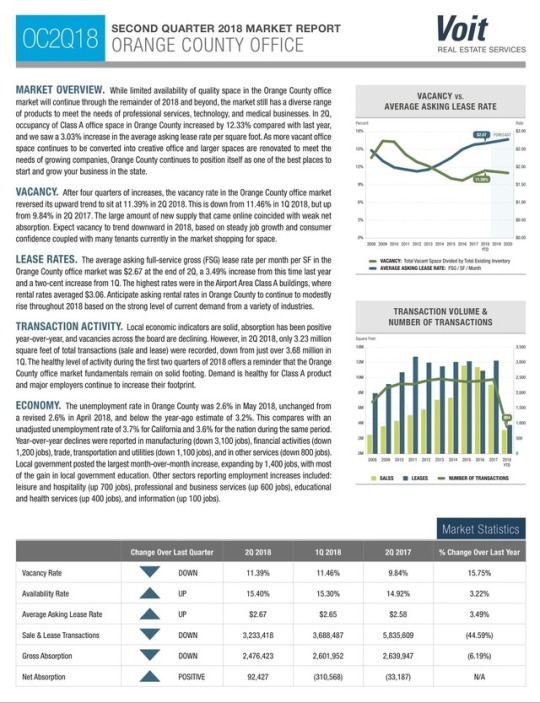

Orange County Office Market Overview

The job market is continuing its positive trend and companies are leasing office space; however, it’s not been enough to keep the vacancy rate from ticking up. While Orange County leasing activity racked up roughly 2.8 million square feet, office vacancy during the third quarter inched up to 11.22%. Typically, this data would indicate signs of an anticipated correction or softening in the office market. However, strong economic and demographic fundamentals suggest the contrary. While some uncertainty exists, we expect the impact to be minimal in Orange County given the diversity of the local economy. Office properties around John Wayne Airport continue to post some of the highest rents in Orange County, with further gradual increases in rents expected alongside decreases in vacancies. Vacancy Rates The office vacancy rate in Orange County increased in the third quarter, inching up 18 basis points. While the increase is minor, it shows the effect of new office product coming online. Direct / sublease space (unoccupied) finished the quarter at 11.22%, down 0.97% from the rate of a year ago. North Orange County posted the lowest vacancy rate of any major submarket at 8.37%, while the Airport Area and Central County had vacancy rates greater than 14% at the end of third quarter. Lease Rates The average asking FSG lease rate per month per square foot in the Orange County office market was $2.83 at the end of the third quarter, a 4.04% increase from this time last year and 0.71% increase from the second quarter. The average quoted rental rate for Class A space was $3.20 per square foot. Class B rental rates came in at $2.43 per square foot. The overall Orange County office market average asking rate is now at an all-time high, surpassing the previous peak of $2.77 in 2007. Transaction Activity Landlords are being challenged by a new breed of office providers who are meeting the growing demand for flexible, collaborative, accessible, short-term office leases — the so-called “coworking” spaces. Not only has coworking altered the way people use and lease office space, it’s also revolutionized the office market. Over the last three quarters, coworking companies have leased more than 500,000 square feet of office space in Orange County. In the third quarter of 2019, 2.9 MSF in total transactions (sale and lease) were recorded, down from 3.8 MSF the previous quarter. Economy The unemployment rate in the Orange County market was 3.0% in August 2019, down from a revised 3.2% in July 2019, and below the year-ago estimate of 3.1%. This compares with an unadjusted unemployment rate of 4.2% for California and 3.8% for the nation during the same period. The growth was evident across all subsectors with three sectors reporting month-over gains: financial activities (up 500 jobs), construction (up 400 jobs) and professional and business services (up 100 jobs each). Construction Total space under construction came in at 450,824 square feet for the third quarter. In Costa Mesa, construction is underway at The Press located at 1375 Sunflower Drive. This former L.A. Times printing facility has a planned conversion into more than 300,000 square feet of creative office space. The Source, located in the Irvine Spectrum, offers a two-building concept with common atrium connectivity and over 70,000 total square feet. Absorption After coming off a positive net absorption of 349,140 square feet in the second quarter, the third quarter ended with negative net absorption of 104,063 square feet. West Orange County had the most substantial positive absorption in the county, recording 61,756 square feet, with tenants such as Multiquip Inc. and Kushco Holdings, Inc. expanding their footprints. Class A office contributed the highest negative net absorption, with a negative 54,482 square feet absorbed in the third quarter: Viant vacated 46,508 square feet in 4 Park Plaza in Irvine, MP Biomedicals vacated 20,860 square feet in 3 Hutton Centre Drive in Santa Ana, and Kinder Morgan vacated 1100 W. Town & Country Road in Orange. FORECAST: Lease Rates Despite slightly elevated vacancies due to new supply, rent growth continues its upward trend. Expect lease rates to continue to climb 2–3% annualized growth in the coming year. Vacancy Rates Demand is solid, lease rates have increased, and unemployment is down. This foundation of strong economic fundamentals has contributed to the long-term strength of the Orange County economy. We expect more of the same through the balance of 2019, with anticipated vacancy rates in the 10–12% range over the next three quarters. Overall The job market is healthy, but it’s not enough to keep the vacancy rate from ticking up. While Orange County racked up roughly 1.5 MSF of leasing activity, office vacancy during the third quarter inched up to 11.22%. Typically, this data would indicate signs of a projected correction or softening in the office market; however, strong economic and demographic fundamentals suggest the contrary. While some doubt exists, we expect the impact to be minimal in Orange County given the diversity of the local economy. For more information on the Orange County office space market and how to capitalize on real estate opportunities to grow your business, contact Stefan Rogers 949.263.5362 / [email protected]. Click HERE to download Voit’s Q4 2019 Orange County Office Space Market Report.

0 notes

Photo

The War’s over, Steve. We can go home.

2K notes

·

View notes

Note

I'm too attracted to Shaggy, does that mean I'll never find happiness?

considerin’ the boy disappeared ? you’re outta luck, sweet pea.

0 notes

Photo

Voit’s Q2 2019 Orange Office Space Market Report & 2019 Forecast – Just Released!

The Orange County Office Market Continues Expansion

Let’s face it, even the most objective of us is slightly biased. This makes us human, after all. With regard to the Orange County office market, information can be interpreted differently depending on these personal biases. For instance, there is plenty to support the argument for continued growth, and there is evidence that a slowdown is around the corner.

Our industry has coined certain catchphrases to signify different cycles for the market. Terms such as “headwinds”, “slowing increases” and “lower growth” can be found in articles that will fuel a bias or belief that a market slowdown is looming. At the same time, you can find articles that report “steady expansion”, “Bulls outnumber Bears” or “more jobs than workers” which would support that the market is sturdy and still growing. The facts are: capital costs remain low, purchase prices continue to rise, speculative development remains steady, and rents are being raised.

However, the office market, like most things in life, can allow varied interpretations of the facts. By my own observation, I would suggest that the market is accelerating but at a slower rate, thus maintaining steady growth. While it may not be the fast-paced market we’ve been experiencing for the past few years, this state of the market presents other, different opportunities.

For office property owners, now might be a good time to take advantage of the healthy market by performing a sale / leaseback. In turn, it’s a great time for an owner-user to take advantage of the very affordable SBA programs that are currently available. Or, if you are a tenant, there are numerous opportunities to upgrade to one of the many creative office space environments with flexible workspaces and abundant amenities.

Whatever side of the fence you’re on, whether you think we’re headed for a downturn or expect the market trajectory to continue, there is no denying that the Orange County office market will continue to march onward and upward for at least the balance of 2019. We will see higher rents and sales prices; however, if the slowing continues, this will cause a shift from a seller’s market towards a buyer’s market. Sellers will not get away with overpricing, just as buyers will be unable to make low ball offers. Sellers will need to exercise patience as the end of the year approaches.

Orange County Office Market Overview

Companies are drawn to Orange County because of its highly educated employment base, which is a contributing factor for the strong office demand. Consistent demand has resulted in vacancies being reduced 30% since 2010. We are currently in the longest economic expansion in United States history, with a solid economy and job growth on the rise, as well as business expansion.

Most Orange County businesses and economists remain optimistic that the expansion will continue into next year.

With the second quarter vacancy rate registering at 11.49%, we should see upward pressure on pricing in Orange County for both lease and sale properties over the next few quarters. This is evidenced by the new all-time high of $2.81 per square foot average asking full-service gross (FSG) rent for Orange County office space.

Vacancy Rates

Office absorption in Orange County strengthened steadily as the labor market expanded. Annual net absorption for the year thus far has been positive in Orange County. Direct / sublease space (unoccupied) finished the quarter at 11.49%, 6 basis points lower than the second quarter of 2018. West County posted the lowest vacancy rate of any major submarket at 6.90%, while the Airport Area and Central County had vacancy rates greater than 12% at the end of this last quarter.

Lease Rates

The average asking FSG lease rate per month per square foot in the Orange County office market was $2.81 at the end of the second quarter, a 5.24% increase from this time last year and a six-cent increase from the first quarter. The average quoted rental rate for Class A space was $3.19 per square foot. Class B rental rates came in at $2.39 per square foot. The overall Orange County office market average asking rate is now at an all-time high, surpassing the previous peak of $2.77 from 2007.

Transaction Activity

In the second quarter of 2019, 3.48 million square feet in total transactions (sale and lease) were recorded, up from 3.30 million square feet the previous quarter. Positive indicators include the low vacancy rate, which has driven a fair amount of new construction, and the abundant supply of quality office space which is expected to accommodate demand.

Economy

The unemployment rate in Orange County was 2.4% in May of 2019, down from a revised 2.6% in April 2019, and below the year-ago estimate of 2.5%. Between May 2018 and May 2019, professional and business services posted the largest year-over-year expansion with a gain of 7,800 jobs. The growth was evident across all subsectors with more than half of the job expansion in administrative and support and waste services (up 4,100 jobs), followed by professional scientific and technical services (up 3,200 jobs), and management of companies and enterprises (up 500 jobs).

Construction

Total space under construction came in at 422,490 square feet for the second quarter. The only project is Spectrum Terrace phase 1, a 422,490 square foot project consisting of three four-story office buildings, part of a 1.1 million square foot ultra-modern office campus nestled on 73 acres of open space in the heart of SoCal’s innovation hub.

Absorption

The Orange County office market posted 395,053 square feet of positive net absorption during the second quarter, giving the market its third consecutive quarter of positive net absorption. Strong market fundamentals and leasing momentum carried from the end of last year into the second quarter. Class B office contributed the highest positive net absorption, with 390,377 square feet absorbed in the second quarter. Class A had a positive net absorption of 11,589 square feet, and Class C finished the second quarter with 6,913 square feet of negative net absorption.

FORECAST:

Lease Rates

Despite slightly elevated vacancies due to new supply, rent growth continues its upward trend. Expect lease rates to continue to climb 2–3% annualized growth in the coming year.

Vacancy Rates

Demand is solid, lease rates have increased, and unemployment is down. This foundation of strong economic fundamentals has contributed to the strengthening of the Orange County economy. We expect more of the same through the balance of 2019, with anticipated vacancy rates in the 10–12% range over the next three quarters.

Overall

Economic growth throughout Orange County is one of the main drivers of the continued low vacancy rates and rent growth. Furthermore, some of this region’s leading businesses are growing at an even faster rate than the economy. High levels of leasing and increasing lease rates have made investment sales more attractive. We are continuing to see a decrease in the amount of available space on the market and increases in occupancy costs. Positive absorption should continue through 2019, and with few new deliveries in the pipeline to alleviate the pressure on vacancy, the market should continue to tighten.

For more information on the Orange County office space market and how to capitalize on real estate opportunities to grow your business, contact Stefan Rogers 949.263.5362 / [email protected].

Click HERE to download Voit’s Q4 2018 Orange County Office Space Market Report.

0 notes

Photo

Voit’s Q1 2019 Orange County Office Space Market Report & 2019 Forecast – Just Released!

There’s Really Nothing Much to Worry About

The Orange County Office Market still offers opportunities on all sides...

Capital costs remain low, fueling steady institutional demand for office buildings, even amid record high pricing and fewer value-add opportunities. Speculative development remains steady, with numerous adaptive reuse projects like The Press in Costa Mesa.

Landlords continue driving up rents wherever possible; however, tenant retention remains steady due to onsite enhancement of amenities / services and flexible workspaces.

Tenants can still strike great deals with an intelligent and creative approach to leasing. And lease expirations offer the perfect opportunity for businesses to realign their workspace with their rapidly changing needs and embrace current office space trends focused on people–recruitment, retention, and productivity.

Owner/occupiers are well situated to execute sale/leasebacks as a convenient and nontraditional way of raising capital or “cashing out” at a profit. And tenants may still able to buy a building, if they can find one, with very affordable SBA programs and relatively low pricing when compared to current leasing rates.

Rental growth slowed marginally in the first quarter, trending with the nominal increase in vacancy, although it is too early to tell if this indicates a permanent shift. The average asking full service gross office rent was $2.79 per square foot per month in the first quarter of 2019, a nominal increase over the fourth quarter of 2018, furthering the slow and steady rental growth we’ve been enjoying. While this would indicate we’re perhaps reaching the top of the bell curve, the continuing tight supply, coupled with steady tenant demand from small businesses and co-working, and historically cheap debt, is likely to sustain further growth through 2019.

It would be reasonable to expect a muted recession/office market slowdown within a couple of years, with all the political turmoil and some recently shaky economic indicators, including the recently inverted yield curve, the “hands-off” Fed, and our simmering trade war with China. However, short-term economic fundamentals remain strong in most areas, and most commercial real estate players remain bullish about the sector.

The economy is strong. The office market is strong (for now). While no one knows for sure, it could certainly continue. There’s nothing wrong with “slow and steady!”

ORANGE COUNTY OFFICE MARKET OVERVIEW:

The Orange County office market rally is extending into 2019. Rent growth has slowed but remains positive, and occupancy levels are elevated. Institutional investors continue to target Orange County, regularly trading trophy properties and office campuses. Landlords have reason to be optimistic, with strong tenant demand across the market and creative space in renovated and newly constructed properties providing leasing flexibility. While vacancy remains below the highs observed in Orange County in the past 4 years, it has slowly been on the rise. With little speculative construction in the pipeline, availability rates remain on a downward trend. All of this suggests that the market will remain tight, with rents continuing to rise into 2019–20 if the U.S. economy can keep out of recession.

Vacancy Rates

Occupancy is being driven by changing consumer preferences. Tenants have reduced their physical footprint despite having a greater number of employees. Net absorption has picked up after a sluggish start to the year, helping to mitigate supply pressures. Vacancy in the Orange County office market was 11.34% at the end of the first quarter of 2019, up 5 basis points from the prior quarter, and up 2.62% compared with the previous year. Expect vacancy to trend downward throughout 2019, based on steady job growth and consumer confidence, coupled with many tenants in the market currently shopping for space.

Lease Rates

With vacancies holding near the 10-year average of 12% so far during 2019, rent gains have grown modestly in recent months. The average asking full-service gross (FSG) lease rate per month per square foot in the Orange County office market was $2.75 at the end of the first quarter, a 3.77% increase from this time last year and a $0.02 increase from the fourth quarter of 2018. Should the national economy fall into recession, office rents will likely fall less than other major markets.

Transaction Activity

In the first quarter of 2019, 2.22 million square feet in total transactions (sale and lease) were recorded, down from 5.40 million square feet the previous quarter. The rising cost of leasing office space has led tenants to consider co-working spaces, particularly for satellite locations. With this trend continuing to grow, in more and more cases, communal offices

are competing with traditional commercial office space for the same tenants. So far in 2019, five co-working firms have leased a combined 267,521 square feet.

Economy

The unemployment rate in Orange County was 2.8% in November of 2018, down from a revised 2.9% in October 2018, and below the year-ago estimate of 3.1%. This compares with an unadjusted unemployment rate of 3.9% for California and 3.5% for the nation during the same period. The professional and business services sectors propel the economy. Orange County is also the third-most diverse high-tech sector in the nation, behind only San Jose and San Diego. Almost 200 Fortune 500 companies have space in one of the Irvine submarkets, and innovation firms including Blizzard Entertainment, Broadcom, Edwards Lifesciences, and Google have a significant footprint in Orange County.

The unemployment rate in Orange County was 3.0% in February of 2019, down from a revised 3.3% in January of 2019, and below the year-ago estimate of 3.1%. This compares with an unadjusted unemployment rate of 4.4% for California and 4.1% for the nation during the same period. Between January and February of 2019, total nonfarm employment increased from 1,642,700 to 1,650,300, an increase of 7,600 jobs. Professional and business services added 3,500 jobs, with 74% of the growth in administrative and support services (up 2,600 jobs), which included temporary help firms.

Construction

The construction pipeline remains slow and steady, continuing the trend of minimal development. Since the first quarter of 2018, supply additions have averaged around 240,000 square feet per quarter. Total space under construction checked in at 1,377,860 square feet at the end of the first quarter with the most notable from Lincoln Property’s Flight @ Tustin Legacy, a spec project that is expected to start delivering any day now. In Irvine, creative office conversions will compete directly with ground-up development. In Costa Mesa, work is underway on The Press, a planned conversion of the former Los Angeles Times printing plant into more than 300,000 square feet of creative office space. In Irvine, Spectrum Terrace, a 1.1 million square foot ultra-modern office campus nestled on 73 acres of open space in the heart of SoCal’s innovation hub is slated to deliver phase 1 mid-year.

Absorption

Absorption gains are being created by co-working operators, and by tenants

moving in Orange County, with net absorption at 339,045 square feet, which totals approximately 11 million square feet of positive net absorption since 2010. Strong market fundamentals and leasing momentum carried from the end of last year into the first quarter. Class B office contributed the

highest positive net absorption, with 203,512 square feet absorbed in the first quarter. Class A had a positive net absorption of 141,925 square feet, and Class C finished the first quarter with 6,392 square feet of negative net absorption.

FORECAST:

Lease Rates

Despite slightly elevated vacancies due to new supply, rent growth continues its upward trend. Expect lease rates to continue to climb 3 – 4% annualized growth in the coming year.

Vacancy

Demand is solid, lease rates have increased, and unemployment is down. This foundation of strong economic fundamentals has contributed to the strengthening of the Orange County economy. We expect more of the same in 2019, with anticipated vacancy rates in the 10 – 11% range over the next three quarters.

Overall

Although uncertainties remain within the Orange County office market, tenants and landlords have been able to remain optimistic. Сo-working is a separate office space market segment that has developed rapidly over the past couple of years in Orange County. The growth rate of the flexible or creative office space and its impact cannot be ignored. However, in 2019, we are keeping one eye on the macroeconomic cycle with the expectation that another recession isn’t a matter of if, but a matter of when — and how severe. Also, we are basically at full employment so absorption will most likely be muted in the foreseeable future.

For more information on the Orange County office space market and how to capitalize on real estate opportunities to grow your business, contact Stefan Rogers 949.263.5362 / [email protected].

Click HERE to download Voit’s Q4 2018 Orange County Office Space Market Report.

0 notes