#buy sell bitcoin price in india

Explore tagged Tumblr posts

Note

are in game currencies you can buy with real money covered under the same laws that make nfts and bitcoin taxable?

DISCLAIMER

I am not an international tax expert. Tax laws are obviously different in different jurisdictions; something that's true in the USA might not be true in the UK or Ukraine or India or Japan or Kenya or whatever. Also, the details of individual games can affect their legal standing. You may wish to consult a local tax expert before filing your return.

Disclaimers aside, probably not.

The thing about NFTs is that you can resell them. If you buy an ugly ape for etherium, you can later sell that ape for etherium and sell the etherium for cash, hopefully more than you paid in. That's what makes crypto stuff taxable; it's an investment.

Most in-game currencies cannot be exchanged for real-world money. You can't buy Fortnite VBucks at 5¢ to the buck and resell it at 7¢ to make a profit, and you can't sell anything for real-world cash. (This the main reason why gambling regulations usually don't apply to lootboxes.)

As far as the law is concerned, buying VBucks in Fortnite is no different from buying DLC on Steam.

Aside from blockchain games like the infamous Axie Infinity, the only ways I can think of for in-game currency purchases to result in taxable transactions probably violate the terms of service. Back in ye olde World of Warcraft days, people would sell their in-game gold for real-world money—profitable, despite (or because of?) being against the TOS.

Obviously, people can buy premium video game currency with their own money; that's what premium currency is for. But hypothetically, if you used that currency to buy an in-game item that you sold for real-world money, that would be a taxable transaction. The amount you sold it for minus the price initially paid for in-game currency would be taxable game.

Again, this is probably a violation of the terms of service you agreed to without reading, which would make this a breach of contract. In the US, you are required to report illegal income; however, as per the fifth amendment, you don't have to report anything that would incriminate yourself. How you report such income without self-incrimination is an exercise for any reader running a Fortnite money laundering business.

3 notes

·

View notes

Text

Navigating the Crypto Landscape: News, Trends, and Investment Strategies for 2025

Since its inception in 2009, Bitcoin has revolutionized how we perceive money and financial transactions. The cryptocurrency market is constantly evolving, with Bitcoin news emerging every second, influencing Bitcoin prices and mining activities. Staying informed is crucial, whether you're a seasoned investor or just starting. This article provides a comprehensive guide to navigating the crypto landscape, covering the latest news, emerging trends, and investment strategies for success in 2025.

Latest Crypto News and Market Trends

Bitcoin (BTC): As of February 2, 2025, Bitcoin is trading at approximately $99,383.00. Bitcoin price hit an all-time high of over $69,000 in November 2021. Analysts believe that Bitcoin’s bull market could extend past 2025 with institutional involvement and shifting market dynamics. Be aware of potential bear traps, which are coordinated selling efforts that cause temporary price dips in a long-term uptrend.

Ethereum (ETH): Ethereum is trading at approximately $3,096.90. Ethereum's dominance in fee earnings remained unchallenged in 2024, with a total of almost $2.5 billion, more than double that of TRON. Analysts are closely watching if Solana can compete with Ethereum to be the top Layer 1 blockchain. Ethereum faces significant resistance at $3,400, with over $1 billion worth of cumulative leveraged shorts set to be liquidated.

Altcoins: Litecoin (LTC) and Mantra (OM) are showing potential for gains. Solana (SOL) is trading at approximately $213.44. Solana is gaining traction with significantly higher daily transactions compared to Ethereum. XRP (XRP) is trading at approximately $2.84. Dogecoin (DOGE) is in focus with Grayscale launching a DOGE trust.

Stablecoins: Tether (USDT) reported net profits of $13 billion in 2024. Kraken is delisting Tether (USDT) and other stablecoins in Europe to comply with MiCA regulations.

Other News: Trump's tariffs may impact the crypto market. North Dakota introduces a bill to uphold Bitcoin mining rights. El Salvador ends mandatory Bitcoin acceptance for merchants. Malaysia is leveraging Blockchain and AI to fight fraud.

Investment Strategies and Tips

Diversification: Consider diversifying your crypto portfolio to mitigate risk. Investing in a mix of Bitcoin, Ethereum, and promising altcoins can provide a balanced approach.

Stay Informed: Keeping a close eye on BTC prices and Bitcoin news is essential due to the cryptocurrency market's volatility.

Utilize Crypto Exchanges: Use cryptocurrency exchanges, Bitcoin ATMs, or P2P marketplaces to buy Bitcoin.

Monitor Market Sentiment: Pay attention to where investment capital is flowing to gauge market sentiment and identify potential high-growth areas.

Be Aware of Regulatory Changes: Stay informed about regulatory developments, such as India's tax penalties on undisclosed crypto gains and Europe's MiCA regulations affecting stablecoins.

Long-Term Holding (HODL): Consider a long-term holding strategy, as demonstrated by Illinois' proposed state-run Bitcoin reserve with a five-year holding period.

Assess Risk Tolerance: Understand the risks associated with cryptocurrency investments and carefully consider your risk tolerance before investing.

Follow Expert Analysis: Look to crypto analysts for insights on market trends, potential breakouts, and future price targets.

Guides

How to Buy Bitcoin: Cryptocurrency Exchange: Use reputable exchanges like Coinbase to purchase Bitcoin. Bitcoin ATMs: Utilize Bitcoin ATMs for quick purchases. P2P Marketplace: Engage in peer-to-peer transactions for potentially better rates.

How to Stay Safe from Crypto Scams: Be wary of "pump-and-dump" schemes: Chainalysis reports that nearly 5% of all tokens launched in 2024 had patterns similar to pump-and-dump schemes. Beware of Telegram scams: Crypto scammers are increasingly using Telegram to target victims. Adjust slippage tolerance: When trading, adjust slippage tolerance to protect your crypto trades from being exploited by sandwich attacks.

How to Earn Free Bitcoin: Bitcoin Faucets: Explore opportunities to earn free Bitcoin through various Bitcoin faucets.

Examples of Successful Crypto Investments

Ethereum Trader: Some cryptocurrency traders are profiting millions from Ether’s downtrend through leveraged trading.

Thumzup Media Corporation: Doubled its Bitcoin holdings to 19.106 BTC, increasing its investment in digital assets to $2 million.

MicroStrategy: MicroStrategy’s stock offering was oversubscribed 3x due to the "Bitcoin Effect".

Tether: Reported net profits of $13 billion during 2024.

The cryptocurrency market offers exciting opportunities, but it also demands vigilance and informed decision-making. By staying updated on the latest news, understanding market trends, and employing sound investment strategies, you can navigate the crypto landscape successfully in 2025.

0 notes

Text

CIFDAQ - Holding the crypto thread between Traders, Investors and Exchanges

CIFDAQ is a much-needed platform in the crypto space where traders, investors, and individuals can get their share with security intact.

Listen to Story

Live TV

Share

Advertisement

Impact Feature

New Delhi,UPDATED: Feb 24, 2022 11:11 IST

The crypto trading space has grown and matured over time, with several blockchain-based project tokens prospering and trying to emulate the market leader Bitcoin. But what about the fascination that the investors and traders have in common? It's the disruption of something different, something unique without compromising the integrity and transparency of a crypto transaction. This is where CIFDAQ becomes a much-needed platform in the crypto space where traders, investors, and individuals can get their share with security intact.

advertisement

On 22nd of February, at 08:09 hours (Switzerland Time/ UTC+ 1), or 12:39 hours (India Standard Time/GMT +5:30), CIFDAQ opened its door for spot trading. With close to 34 + assets like BTC, ETH, LTC, DOGE, MATIC, DOT, SHIB, ATOM, ALGO, BNB, LUNA, SAND, ADA, and more, CIFDAQ gives investors and individuals a stage to exchange multiple cryptocurrencies.

An important consideration while buying Crypto

Must Read

Is chasing 'golden retriever energy' in a partner overrated?

TRENDING TOPICS:

Budget 2025Los Angeles WildfiresHMPV ScareDelhi ElectionDelhi AQI

The supply and demand for cryptocurrencies impact the price of a token. However, because of their decentralized character, they are not susceptible to the same economic and political constraints as other traditional means of payment, making them an attractive alternative. Even though many elements are yet unknown, they may significantly impact the ratio of profit that needs some attention.

How many coins are in circulation and how rapidly are they mined/minted or lost are all important factors to consider.

Furthermore, market capitalization refers to the total value of all currencies in existence as well as how users perceive this value to be developing.

The cryptocurrency is portrayed in the media and how much attention it gets

The degree to which a cryptocurrency may be incorporated into already-existing infrastructures, such as payment systems for e-commerce transactions. Key events include regulatory revisions, security breaches, and economic crises, to name a few examples.

CIFD trading in Cryptocurrencies

CIFD is the native token currency of CIFDAQ. Its trading is a realistic solution for people who wish to speculate on the price movements of cryptocurrencies without really holding the underlying coins. If you feel that the value of a cryptocurrency will increase, you may either go long ('buy') or short ('sell').

Any of these leveraged products may be purchased for as little as a bit of deposit, known as margin, to have complete exposure to the underlying market. Even if you employ leverage, the amount of your profit or loss will be determined by the overall amount of the position you own.

What should investors be aware of when it comes to crypto exchanges?

One thing that investors do not compromise is the rate of return on their assets along with a level playing field. CIFDAQ can provide them with a platform with a mixed breed cross-asset integrated trading platform where they can have multiple options to choose from. It isn't easy to diversify your assets among several exchanges, even in the most well-regulated legal marketplaces.

advertisement

This is where you can choose CIFDAQ that have multiple options like stocks, derivatives, fiats, indices, foreign exchange and more. You should distribute your funds as far as possible and preserve as much of them in secured storage. Dealing with well-known regulated exchanges, your wallets, and reputable custodians are the most effective strategies to avoid cryptocurrency's unethical actors and keep your money safe.

CIFDAQ's dependability is Risk-Free

There is no regulation in India's cryptocurrency economy, and new tokens are emerging every day. Despite the supreme court's decision to overturn the Reserve Bank of India's restriction on cryptocurrencies and the government's vow to adopt a systematic approach to regulation, investors should proceed with caution when picking an intermediary to handle their crypto transactions. To protect your investment in the case of a regulatory setback or the promoter business going bankrupt, Himanshu Maradiya, Founder and CEO of CIFDAQ recommends, “Investing via an established and trustworthy platform. Remember that if you invest in good tokens with a robust business model, the chances of making profits go up substantially.”

advertisement

Most recent developments throughout the Globe Location cannot be a deciding factor in the crypto space. You may trade on the cryptocurrency market since it is worldwide and easily accessible. As a result, it is critical to monitor developments in key markets such as the United States, Singapore, and Europe to ensure that price does not alter due to these changes.

The crypto tax imposed by the United States was a contributing cause to the drop in the value of cryptocurrencies in May. This is where CIFDAQ seems to be the most viable alternative where with the usage of AI Powered Trading Robots, you not only can vouch for a passive income but can also be assured of safety and security at the backend.

Published By:

Anwesha Paul

Published On:

Feb 23, 2022

0 notes

Text

Crypto Tax in India: Key Rules, Regulations, and Compliance in 2024

Cryptocurrencies have grown rapidly in popularity across India, offering significant investment opportunities. However, with this growth comes taxation. Understanding the crypto tax in India is essential for investors, traders, and businesses involved in digital assets. In 2024, the government’s regulations continue to play a pivotal role in shaping crypto taxation policies. This article highlights the key rules, regulations, and compliance requirements for cryptocurrency taxation in India.

1. Overview of Crypto Tax in India

In the Union Budget 2022, the Government of India introduced a comprehensive tax framework for virtual digital assets (VDAs), including cryptocurrencies and NFTs. Since April 1, 2022, cryptocurrencies are subject to a flat 30% tax on income derived from their transfer, regardless of the holding period or type of gains (short-term or long-term).

Additionally, a 1% TDS (Tax Deducted at Source) applies to transactions involving cryptocurrencies. These measures have continued into 2024, reinforcing the government’s efforts to regulate crypto transactions and ensure tax compliance.

2. Key Crypto Tax Rules in India

Flat 30% Tax on Crypto Gains

Any profit earned from the transfer or sale of cryptocurrencies is taxed at 30%.

The tax applies to individuals, businesses, or any entities holding or trading crypto.

No deductions are allowed except for the cost of acquisition (purchase cost). This means expenses like transaction fees, mining expenses, or operational costs cannot be deducted.

Example: If you purchase Bitcoin for ₹1,00,000 and sell it for ₹1,50,000, the taxable income is ₹50,000. You will pay 30% tax on ₹50,000, amounting to ₹15,000.

1% TDS on Crypto Transactions

As per Section 194S of the Income Tax Act, a 1% TDS applies to all crypto transactions exceeding ₹50,000 in a financial year (₹10,000 for specified individuals).

The buyer deducts the TDS and submits it to the government.

This provision is applicable to both crypto-to-crypto trades and crypto-to-fiat transactions.

Example: If you buy cryptocurrency worth ₹1,00,000, the exchange or the buyer will deduct ₹1,000 as TDS and deposit it with the government.

Taxation on Gifts of Crypto Assets

Cryptocurrencies received as gifts are taxable under the gift tax rules if the value exceeds ₹50,000.

The recipient must pay tax on the market value of the crypto asset as part of their income.

3. Compliance Requirements for Crypto Investors

To comply with crypto tax in India, investors and traders must adhere to specific requirements:

Maintain Accurate Records:

Keep detailed records of all cryptocurrency transactions, including purchase price, date of acquisition, sale price, and transaction details.

Record crypto-to-crypto trades, as they are taxable events.

Filing Income Tax Returns (ITR):

Declare income from cryptocurrency under the “Capital Gains” section in the ITR.

Ensure accurate reporting of TDS deducted and crypto gains or losses.

Pay TDS Timely:

If you are a buyer, deduct and deposit the TDS as per Section 194S.

Use government portals like the TRACES website to file TDS.

Report Crypto Gifts:

If you receive cryptocurrency as a gift, include its value in your income when filing returns.

Adhere to Regulatory Requirements:

Always trade on platforms compliant with Indian tax laws.

Verify that exchanges provide proper TDS certificates for transactions.

4. Penalties for Non-Compliance

Non-compliance with crypto tax in India can result in serious penalties:

Interest on Late Tax Payments: Failure to pay taxes on time can attract interest under Section 234A/B/C of the Income Tax Act.

Penalty for Non-Deduction of TDS: If TDS is not deducted, a penalty may apply along with the outstanding tax amount.

Legal Consequences: Concealment of crypto income or gains may lead to fines or legal action under Indian tax laws.

5. Importance of Staying Compliant

With the Indian government actively regulating the crypto market, it is crucial for investors to remain compliant with tax laws. Failing to report crypto gains or adhere to TDS rules can attract scrutiny from the Income Tax Department.

By maintaining proper records, timely filing of tax returns, and seeking expert guidance, investors can avoid penalties and ensure smooth compliance.

Conclusion

The introduction of clear rules regarding crypto tax in India marks a significant step towards regulating the digital asset market. A 30% tax on gains, 1% TDS on transactions, and taxation of crypto gifts have streamlined the process while increasing accountability.

As cryptocurrencies continue to grow in popularity, understanding and complying with these tax laws is essential for every investor. Whether you’re a casual trader or a long-term investor, staying informed and adhering to the regulatory framework will ensure peace of mind and financial security in 2024.

By adopting proper tax practices, Indian crypto investors can embrace the potential of digital assets while remaining on the right side of the law.

0 notes

Text

Tiranga Trading App: A New Frontier in Digital Asset Exchange

In an increasingly digital world, the concept of ownership has extended beyond physical assets to include a wide range of digital properties, from cryptocurrencies to NFTs (non-fungible tokens). One of the latest trends in this space is the emergence of the Tiranga Trading App—a platform that allows users to trade colors as unique digital assets. Named after the Tiranga, the Indian tricolor flag, this app brings together elements of patriotism, digital innovation, and the growing interest in digital asset trading.

In this article, we will explore what the Tiranga Trading App is, how it works, the features it offers, and the potential it holds in the digital marketplace. We will also discuss the implications of trading digital colors and how this innovative platform could shape the future of digital commerce.

What is the Tiranga Trading App?

The Tiranga Trading App is a digital platform that enables users to buy, sell, and trade colors as unique digital assets. Each color on the platform is represented by a hexadecimal code—a combination of six characters (letters and numbers) that define a specific shade in digital design. For example, the color code #FF5733 represents a vibrant shade of orange.

The app takes inspiration from the Tiranga, India's national flag, and is designed to resonate with the themes of national pride, creativity, and digital ownership. Users can trade a variety of colors, including those that reflect the hues of the Indian flag, as well as other popular and rare shades.

How the Tiranga Trading App Works

The Tiranga Trading App functions as a marketplace where users can engage in the trading of digital colors. Here's a breakdown of how the app works:

1. Registration and Account Creation

To start trading on the Tiranga Trading App, users first need to create an account. The registration process is simple and involves providing basic information such as a username, email address, and password. Once the account is created, users may also need to verify their identity to ensure the security of their transactions.

2. Exploring the Color Marketplace

After creating an account, users can browse the app’s marketplace, which features a wide array of colors available for trade. Each color is listed with its hexadecimal code, current market value, and ownership history. The app provides tools to search for specific colors, view trending colors, and explore color palettes that align with certain themes or cultural references.

3. Buying and Selling Colors

To purchase a color, users can select the desired shade and initiate a transaction using the platform’s supported payment methods. Transactions are typically conducted in cryptocurrencies like Bitcoin or Ethereum, though some platforms might also accept traditional payment options. Once a color is purchased, ownership is transferred to the buyer and recorded on the app’s blockchain, ensuring the uniqueness and authenticity of the transaction.

Similarly, users who own colors can list them for sale on the marketplace. They can set their own prices based on factors like rarity, demand, or personal preference. When another user purchases the color, the seller receives the payment in their digital wallet, and the color’s ownership is updated on the blockchain.

4. Trading and Auctions

In addition to direct buying and selling, the Tiranga Trading App allows users to trade colors with one another. This involves exchanging one color for another, often based on mutual agreement between the two parties. The app may also feature an auction system where users can bid on rare or highly sought-after colors. These auctions can generate significant interest and drive up the value of certain shades, especially those associated with cultural significance or artistic value.

5. Creating and Minting Custom Colors

One of the most innovative features of the Tiranga Trading App is the ability to create and mint custom colors. Users can experiment with different RGB (Red, Green, Blue) values to generate unique shades, which can then be minted as NFTs and listed on the marketplace. This feature not only encourages creativity but also allows users to own truly one-of-a-kind digital assets.

Features of the Tiranga Trading App

The Tiranga Trading App offers a range of features designed to enhance the trading experience and make it accessible to a broad audience. Here are some of the key features:

1. User-Friendly Interface

The app is designed with simplicity and ease of use in mind. Whether you’re a seasoned digital asset trader or new to the concept of color trading, the app’s intuitive interface makes it easy to navigate, explore the marketplace, and manage your transactions.

2. Secure Blockchain Technology

Security is a top priority for any digital asset trading platform. The Tiranga Trading App uses blockchain technology to ensure that all transactions are secure, transparent, and verifiable. This technology guarantees that each color is unique and cannot be duplicated, providing users with confidence in their trades.

3. Diverse Color Marketplace

The app’s marketplace features a diverse selection of colors, ranging from common shades to rare and culturally significant hues. Users can explore trending colors, discover new shades, and participate in auctions for exclusive colors.

4. Custom Color Creation and Minting

The ability to create and mint custom colors is one of the most exciting aspects of the Tiranga Trading App. This feature allows users to generate unique shades, mint them as NFTs, and trade them on the marketplace. It’s a creative outlet that combines art and technology in a way that’s accessible to everyone.

5. Social and Community Features

The app includes social features that allow users to share their collections, follow other traders, and participate in community events. This sense of community adds a social dimension to the trading experience, making it more engaging and interactive.

6. Cross-Platform Accessibility

The Tiranga Trading App is available on multiple platforms, including mobile devices, tablets, and desktops. This cross-platform accessibility ensures that users can trade colors and manage their portfolios no matter where they are.

7. Integration with Digital Wallets

The app supports a variety of payment methods, including popular cryptocurrencies and traditional payment options. Integration with digital wallets makes it easy for users to manage their transactions and keep track of their digital assets.

The Potential of Color Trading in the Digital Marketplace

The concept of trading digital colors may seem niche, but it taps into several important trends in the digital world:

1. Digital Ownership and Scarcity

The idea of owning a specific color as a digital asset is a novel concept that aligns with the growing interest in digital ownership. The scarcity of certain colors, combined with their aesthetic and cultural value, can create a unique marketplace where colors are traded as valuable assets.

2. Artistic and Cultural Expression

Colors play a crucial role in art, design, and cultural expression. The Tiranga Trading App provides a platform for artists, designers, and collectors to explore new forms of creative expression and to own colors that have personal or cultural significance.

3. Investment Opportunities

As with other digital assets, colors on the Tiranga Trading App can appreciate in value over time. Rare or trending colors might become valuable investments, offering users the opportunity to profit from their trades. As the concept of color trading grows, it could open up new avenues for digital investment.

4. Community and Social Interaction

The social features of the Tiranga Trading App foster a sense of community among users. Participants can share their collections, collaborate on creative projects, and discuss trends, making color trading not just a financial activity but also a social one.

Challenges and Considerations

While the Tiranga Trading App offers exciting possibilities, there are challenges and considerations to keep in mind:

1. Market Volatility

As with any digital asset, the value of colors can fluctuate based on market trends and user interest. This volatility can make it difficult to predict the long-term value of a color, especially in a new and emerging market.

2. Intellectual Property and Legal Considerations

The concept of owning a color raises questions about intellectual property rights and legal frameworks. While the Tiranga Trading App uses blockchain to verify ownership, users should be aware of the limitations and legal implications of owning and trading digital colors.

3. Accessibility and Education

Color trading is a new concept that may require users to familiarize themselves with digital assets, blockchain technology, and the mechanics of trading. Ensuring that the app is accessible and providing educational resources will be key to attracting a broader audience.

Conclusion

The Tiranga Trading App represents a bold and innovative step in the world of digital asset trading. By allowing users to buy, sell, and trade colors as unique digital assets, the app opens up new possibilities for creativity, investment, and social interaction in the digital marketplace.

Whether you’re an artist looking to explore new creative avenues, an investor seeking the next big trend, or simply someone interested in the intersection of technology and culture, the Tiranga Trading App offers a platform to engage with digital colors in a way that’s both fun and potentially profitable.

0 notes

Text

Understanding Bitcoin Charts and What Influences Bitcoin Prices

Bitcoin, the first and most well-known cryptocurrency, has garnered significant attention from investors, traders, and the general public. Understanding how to read Bitcoin charts and what factors influence its price is crucial for anyone interested in the cryptocurrency market. This article will guide you through the basics of reading Bitcoin charts and explore the factors that impact Bitcoin's price.

How to Read Bitcoin Charts

Bitcoin charts typically use Japanese candlesticks to represent the price movements over a specified time frame. Each candlestick provides a visual summary of Bitcoin's price action, including the opening price, closing price, and the high and low prices within the chosen period. Here's a breakdown of what you need to know:

Candlesticks:

Open Price: The price at which Bitcoin starts trading at the beginning of the time frame.

Close Price: The price at which Bitcoin ends trading at the end of the time frame.

High Price: The highest price reached during the time frame.

Low Price: The lowest price reached during the time frame.

Body: The colored part of the candlestick that shows the difference between the open and close prices. If the close price is higher than the open price, the body is typically green or white. If the close price is lower than the open price, the body is red or black.

Wicks (Shadows): The thin lines extending from the body, indicating the high and low prices.

Technical Analysis Indicators:

Support and Resistance Levels: These horizontal lines indicate price levels where Bitcoin has historically had trouble falling below (support) or rising above (resistance). They help traders identify potential buying or selling points.

Trend Lines: These are diagonal lines that help identify the direction of the market. An upward trend line indicates a bullish market, while a downward trend line indicates a bearish market.

Relative Strength Index (RSI): A momentum oscillator that measures the speed and change of price movements. An RSI above 70 indicates overbought conditions, while an RSI below 30 indicates oversold conditions.

Fibonacci Retracement Levels: Horizontal lines that indicate potential support and resistance levels based on Fibonacci ratios (23.6%, 38.2%, 50%, 61.8%, and 100%).

What Affects the Price of Bitcoin?

Like any other traded asset, Bitcoin's price is primarily influenced by supply and demand dynamics. However, several specific factors and events can significantly impact Bitcoin's value:

Supply and Demand:

Supply: The total number of Bitcoins that can ever exist is capped at 21 million. As more people acquire and hold Bitcoin, the available supply decreases, potentially driving up the price.

Demand: Interest from investors, traders, and the general public increases demand. Higher demand typically leads to higher prices.

Global Events:

Certain global events can affect Bitcoin's price. For example, during India's banknote demonetization in 2016, Bitcoin's price in India surged, trading 20% higher than the global average. Similarly, the announcement of Facebook's Libra project in 2019 sparked a Bitcoin bull run, which lost momentum as regulatory challenges emerged.

Bitcoin Whales:

Bitcoin whales are individuals or entities that hold large amounts of Bitcoin. Their actions, such as buying or selling significant amounts, can cause substantial price fluctuations. These whales can influence market sentiment and create large daily price movements.

Market Sentiment:

News, social media trends, and public perception play a significant role in Bitcoin's price movements. Positive news can drive demand and increase prices, while negative news can have the opposite effect.

Regulatory Developments:

Changes in government regulations and policies regarding cryptocurrencies can impact Bitcoin's price. For instance, stricter regulations can create uncertainty and lead to price drops, while favorable regulations can boost confidence and drive prices up.

Technological Developments:

Advances in blockchain technology, upgrades to the Bitcoin network, and innovations in the broader cryptocurrency space can affect Bitcoin's price. For example, the implementation of the Lightning Network aimed to improve Bitcoin's scalability and transaction speed, positively influencing its price.

Conclusion

Understanding how to read Bitcoin charts and recognizing the factors that influence its price are essential for anyone involved in the cryptocurrency market. By analyzing candlestick patterns, technical indicators, and staying informed about global events, market sentiment, regulatory changes, and technological developments, traders and investors can make more informed decisions and navigate the volatile Bitcoin market more effectively. Whether you're a seasoned trader or a newcomer, staying informed and vigilant is key to succeeding in the dynamic world of Bitcoin trading.

Read More:

0 notes

Text

2024 Crypto Exchange Mastery - Insights and Strategies for Building Success

Best Crypto Exchange - Exploring the World of Cryptocurrency Trading

Looking to jump into the world of cryptocurrency trading? You've come to the right place! In this guide, we'll explore what a crypto exchange is and why finding the best crypto exchange is crucial for your trading journey.

What is a Crypto Exchange?

A crypto exchange, or Cryptocurrency Exchange, is a digital platform where users can trade various cryptocurrencies, such as Bitcoin, Ethereum and Litecoin. Similar to traditional stock exchanges, crypto exchanges connect buyers and sellers, allowing them to exchange digital assets at current market prices.

Experience Our Diverse Portfolio of Customized Crypto Exchanges

At Nadcab Labs, we're experts in making personalized cryptocurrency exchanges that fit exactly what you want. Whether you want to be as big as Kraken, Coinbase, or WazirX, or if you have your own special ideas, we can help make it happen. Here are a few exchanges we've made:

Bitbse: India's premier crypto exchange, offering users the ability to buy, sell, and trade Bitcoin, Ethereum, MTG, and more. Bitbse aims to democratize access to cryptocurrency, inviting anyone who believes in the digital revolution to join.

Bitplug: Setting the new standard in the blockchain world, Bitplug boasts a decentralized structure and advanced security measures. With lightning-fast withdrawals and near-instant transaction verification, Bitplug offers a seamless trading experience for DeFi investors.

Dtbx: A trusted and secure cryptocurrency exchange, Dtbx serves as your guide to the world of the financial system. It provides a user-friendly platform for buying and trading cryptocurrencies, earning the trust of users as the most trusted cryptocurrency platform.

Elucks: Offering an easy, safe, and fast way to buy and sell digital assets, Elucks simplifies the crypto trading process. Users can buy and sell ELUX safely and easily on Elucks P2P, utilizing their preferred payment methods for seamless transactions.

Globel: Providing a highly efficient exchange for stable and secure trade, GlobelX allows users to trade Bitcoin, Ethereum, BAT, and over 150 cryptocurrencies in seconds. With a simple and ultra-secure platform, GlobelX ensures a seamless trading experience for all users.

Advanced Features for Your Cryptocurrency Exchange

Nadcab Labs crypto exchange is equipped with a host of advanced features designed to enhance the trading experience and maximize profitability:

· Limit Order Functionality: Allows traders to buy or sell cryptocurrencies at specified prices, giving them greater control over their trading activities.

· Market Order Capability: Enables traders to execute transactions quickly at the best available current market prices, ensuring fast and efficient trades.

· OTC Trading Support: Facilitates over-the-counter trading for large volume deals, providing privacy and potentially better pricing for traders.

· Stop Loss Options: Empowers traders to set stop-loss orders to automatically sell cryptocurrencies when they reach certain prices, helping manage risk and protect against significant losses.

· Maker-Taker Fee Structure: Implements a fee schedule that incentivizes market makers who add liquidity to the market, while charging takers who remove liquidity.

Choose Nadcab Labs for the Best Crypto Exchange Experience

Nadcab Labs offers the best crypto exchange experience for traders looking to enter the exciting world of cryptocurrency trading. With a comprehensive suite of features, full compliance with regulatory standards, and a commitment to security and reliability, Nadcab Labs platform is the ideal choice for both novice and experienced traders alike. So why wait? Start your crypto trading journey with Nadcab Labs today and unlock the potential of digital assets like never before.

No matter your requirements or aspirations, Nadcab Labs is here to turn your crypto exchange vision into reality. Contact us today to start building your customized exchange and join the digital revolution with confidence.

Author Profile

Nadcab Labs - A Leading Blockchain Developers With over 8+ years of experience in, Custom Blockchain Development, Smart Contract Development, Crypto Exchange Development, Token Creation and Many More Services.

Twitter — twitter.com/nadcablabs

LinkedIn — linkedin.com/company/nadcablabs

Facebook — facebook.com/nadcablabs

Instagram — instagram.com/nadcablabs

Spotify — spotify.com/nadcablabs

YouTube — www.youtube.com/@nadcablabs

#nadcablabs#blockchain#nadcab labs services#blockchain technology#Cryptocurrency Exchange Development#Cryptocurrency Exchange Software Solutions#Cryptocurrency Exchange Developers#Crypto Exchange Development Services

0 notes

Text

Your Guide To Navigating The Digital Financial Frontier

So, you've heard about this thing called cryptocurrency. Maybe your friends won't stop talking about it, or you've seen headlines about people making millions overnight. But what exactly is cryptocurrency, and how can you get in on the action? Don't worry; I've got you covered. Let's embark on a journey to demystify the world of cryptocurrency together.

Understanding the Basics

Before diving headfirst into the world of cryptocurrency, it's essential to grasp the fundamentals. At its core, cryptocurrency is a digital or virtual form of currency that uses cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks based on blockchain technology.

Also Read: From Abhay Bhutada to Nirmal Jain — India’s Top Chartered Accountants

What is Blockchain, Anyway?

Think of blockchain as a digital ledger that records all transactions across a network of computers. Each block in the chain contains a timestamp and a link to the previous block, creating a secure and transparent record of transactions. This decentralized nature eliminates the need for intermediaries like banks, resulting in faster and cheaper transactions.

Bitcoin: The OG Cryptocurrency

When people talk about cryptocurrency, they're often referring to Bitcoin. Created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto, Bitcoin was the first decentralized cryptocurrency. It paved the way for the thousands of cryptocurrencies that followed and remains the most well-known and widely accepted digital currency.

Also Read: MD Abhay Bhutada Provides Glimpse of Poonawalla’s Co-Branded Card Strategy in Q4

The Rise of Altcoins

While Bitcoin may be the poster child for cryptocurrency, there are thousands of alternative cryptocurrencies, or altcoins, available today. These range from Ethereum, which introduced smart contracts and decentralized applications, to meme-inspired coins like Dogecoin. Each altcoin serves a different purpose and operates on its blockchain, offering unique features and capabilities.

Navigating The Cryptocurrency Market

Now that you have a basic understanding of cryptocurrency let's talk about how you can get involved. The first step is to choose a cryptocurrency exchange, which is a platform where you can buy, sell, and trade digital currencies. Popular exchanges include Coinbase, Binance, and Kraken, each offering a user-friendly interface and a variety of cryptocurrencies to choose from.

Investing in Cryptocurrency

With your exchange account set up, you're ready to start investing in cryptocurrency. But before you do, it's essential to do your research and understand the risks involved. Cryptocurrency prices can be highly volatile, with values fluctuating wildly in a short period. As Warren Buffett famously said, "Risk comes from not knowing what you're doing." So take the time to educate yourself and only invest what you can afford to lose.

Storing Your Cryptocurrency

Once you've purchased cryptocurrency, you'll need a secure way to store it. While exchanges offer built-in wallets, it's generally recommended to transfer your digital assets to a hardware wallet or software wallet for added security. Hardware wallets store your cryptocurrency offline, making them less vulnerable to hacking, while software wallets are accessible via desktop or mobile devices.

Also Read: Abhay Bhutada Shares Insights on Poonawalla Fincorp’s Long-Term Objectives

The Future Of Cryptocurrency

As cryptocurrency continues to gain mainstream acceptance, its future looks bright. From decentralized finance (DeFi) platforms to non-fungible tokens (NFTs), blockchain technology is driving innovation across various industries. Whether you're a seasoned investor or a curious newcomer, there's never been a better time to explore the world of cryptocurrency.

In Conclusion

Cryptocurrency may seem like a complex and intimidating concept at first, but with a little knowledge and guidance, anyone can navigate the digital financial frontier. Remember to start small, do your research, and never invest more than you can afford to lose. Who knows? You might just become the next crypto millionaire. Happy investing!

0 notes

Text

0 notes

Text

The Complete Guide to Swing Trading: Strategies, Indicators & Pro Tips

Swing trading is one of the most popular trading styles for retail traders in India. Unlike day trading, which requires constant monitoring of charts, swing trading allows traders to hold positions for a few days to weeks, making it ideal for working professionals.

This guide covers everything you need to know about swing trading, including strategies, technical indicators, risk management, and real-world examples from the Indian stock market.

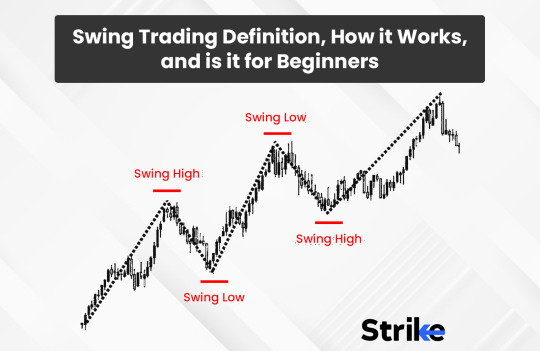

What is Swing Trading & How Does It Work?

Definition of Swing Trading

Swing trading is a short-to-medium-term trading strategy where traders capture price swings in stocks, forex, or crypto. The goal is to buy at support levels and sell at resistance.

How Swing Trading Differs from Other Styles

Best Markets for Swing Trading in India

Stocks: Nifty 50, Bank Nifty, Midcap stocks

Futures & Options (F&O): NSE derivatives

Forex: INR/USD, INR/EUR pairs

Cryptocurrency: Bitcoin, Ethereum on WazirX

How to Get Started with Swing Trading

1. Choosing the Right Brokerage & Charting Tools

To execute swing trades effectively, you need a good brokerage platform and charting tool like:

Strike.money – Advanced charting with indicators

Zerodha Kite – Best for low brokerage fees

Upstox Pro – Fast execution for swing trades

2. Selecting the Right Stocks for Swing Trading

Characteristics of Good Swing Trading Stocks

✅ High trading volume (liquidity) ✅ Clear price trends (uptrend/downtrend) ✅ Volatility for strong price movements

Example: Swing Trade in Reliance Industries

Entry: ₹2,400 (bounce from support)

Exit: ₹2,600 (near resistance)

Profit: ₹200 per share in 7 days

3. Setting Up Your Trading Account

Open a Demat & trading account with a discount broker

Ensure access to technical analysis tools

Learn to use stop-loss & take-profit orders

Best Swing Trading Indicators & Chart Patterns

1. Moving Averages (SMA & EMA)

Moving averages smooth out price action to identify trends.

Simple Moving Average (SMA) – Good for long-term trends

Exponential Moving Average (EMA) – Reacts faster to price changes

📌 Example: Using EMA for Swing Trading in HDFC Bank

50-day EMA as support → Buy at ₹1,500

Price bounces up → Sell at ₹1,650

2. Relative Strength Index (RSI) – Identifying Overbought/Oversold Levels

RSI above 70 → Stock is overbought (sell signal)

RSI below 30 → Stock is oversold (buy signal)

📌 Example: Swing Trade in TCS using RSI

RSI drops to 28 → Buy at ₹3,000

RSI reaches 65 → Sell at ₹3,250

3. Bollinger Bands – Volatility Indicator

Stock touches lower band → Buy signal

Stock touches upper band → Sell signal

📌 Example: Using Bollinger Bands for Swing Trading in Infosys

Stock hits lower band at ₹1,400 → Buy

Price moves to ₹1,550 (upper band) → Sell

4. Fibonacci Retracement – Identifying Support & Resistance

Common Fibonacci levels: 38.2%, 50%, 61.8% 📌 Example: Swing Trading SBI

Stock retraces 50% of previous uptrend → Buy opportunity

5. Volume Indicators – Confirmation of Trend Strength

High volume on breakout → Strong trend

Low volume on breakout → Weak trend

Top Swing Trading Strategies That Work

1. Trend Following Strategy

Buy stocks in an uptrend (higher highs, higher lows)

Sell when trend reverses

📌 Example: Titan Swing Trade

Uptrend confirmed above 200-day EMA → Buy at ₹2,500

Sell near resistance at ₹2,800

2. Breakout Trading Strategy

Enter when stock breaks above resistance

Use volume confirmation for stronger breakouts

📌 Example: Breakout in Bank Nifty

Resistance: 44,000

Breakout above 44,000 with high volume → Buy

Target: 45,500

3. Mean Reversion Strategy

Buy when the stock drops to support levels

Sell when it reverts to the mean

📌 Example: Mean Reversion in Bajaj Finance

Falls to ₹6,800 (support) → Buy

Rebounds to ₹7,200 (resistance) → Sell

Risk Management: How to Minimize Losses in Swing Trading

1. Use Stop-Loss Orders

Swing trading rule: Risk 1-2% of capital per trade

Example:

Entry: ₹1,500

Stop-loss: ₹1,450 (3% risk)

2. Risk-Reward Ratio (RRR)

Ideal RRR: 1:2 or 1:3

If risking ₹500, aim for ₹1,000 profit

3. Avoid Common Swing Trading Mistakes

🚫 Overtrading – Taking too many trades at once 🚫 Ignoring stop-loss – Leads to heavy losses 🚫 Trading without a plan – No clear entry/exit

Swing Trading Psychology: Mastering the Trader’s Mindset

1. Controlling Emotions in Trading

Avoid fear & greed

Stick to predefined strategies

2. Handling Losses Like a Pro

Accept small losses → Part of trading

Don't revenge trade → Leads to emotional decisions

3. Developing Patience & Discipline

Follow your trading plan

Avoid impulsive entries

Best Markets & Stocks for Swing Trading in India (2024)

1. Best Stocks for Swing Trading

✔ Reliance Industries ✔ TCS ✔ Infosys ✔ HDFC Bank ✔ SBI

2. Most Volatile Stocks for Quick Gains

✔ Adani Enterprises ✔ Tata Motors ✔ DLF ✔ JSW Steel

3. Best Sectors for Swing Trading

✔ Banking: High liquidity, volatility ✔ IT: Strong momentum trends ✔ Pharma: Defensive plays

Swing Trading Case Studies: Real-Life Examples

📌 Case Study: Swing Trade in Tata Steel

Entry: ₹125 (support)

Exit: ₹145 (resistance)

Profit: ₹20 per share in 5 days

📌 Case Study: Bank Nifty Swing Trade

Breakout: 44,500 level

Exit: 45,500 level

Profit: 1,000 points in 3 days

FAQs About Swing Trading

✅ How much capital do I need for swing trading? Start with ₹50,000 - ₹1,00,000 for stocks, ₹2-5 Lakhs for F&O.

✅ Can swing trading be profitable? Yes, with proper risk management & strategy.

✅ What time frame is best for swing trading? 1-hour & daily charts work best for swing traders.

Final Thoughts: Is Swing Trading Right for You?

Swing trading is ideal for traders who: ✔ Want short-term profits without daily screen time ✔ Have patience to hold trades for a few days ✔ Follow risk management & strategies

🚀 Ready to start swing trading? Use Strike.money for powerful charting & trade analysis!

0 notes

Text

Unlocking the Potential: A Beginner’s Guide to Crypto Trading in India

Introduction:

In recent years, the cryptocurrency market has gained significant traction in India, with a growing number of individuals exploring the world of digital assets. Cryptocurrency trading offers an exciting opportunity for investors to participate in this dynamic market and potentially generate profits. However, for beginners, navigating the complexities of crypto trading can be daunting. In this beginner’s guide, we’ll provide a comprehensive overview of crypto trading in India, covering everything you need to know to get started on your trading journey. And, of course, we’ll introduce you to Ailtra, your trusted partner in the world of cryptocurrency trading.

Understanding Cryptocurrency Trading:

Cryptocurrency trading involves the buying, selling, and exchanging of digital assets such as Bitcoin, Ethereum, and Ripple. Unlike traditional financial markets, crypto trading operates 24/7, providing traders with ample opportunities to capitalize on price fluctuations. There are various trading strategies employed by traders, including day trading, swing trading, and long-term investing. Each strategy has its pros and cons, and it’s essential to choose one that aligns with your risk tolerance and investment goals.

Getting Started with Crypto Trading in India:

Trading Tips for Beginners:

Conclusion:

Crypto trading in India presents an exciting opportunity for beginners to participate in the global digital economy. By educating yourself, choosing a reliable exchange like Ailtra, and practicing sound trading strategies, you can unlock the potential of cryptocurrency trading and embark on a rewarding investment journey. Remember to start small, diversify your portfolio, and stay informed to maximize your chances

0 notes

Text

What is a Stock Market? Definition and Types of Stock Market

A stock market is a financial marketplace where buyers and sellers trade ownership in companies through the buying and selling of stocks (equities), bonds, and other financial instruments. These markets serve as a critical component of the global financial system, providing a platform for capital formation, investment, and the allocation of resources.

Definition:

In a stock market:

Stocks (Equities):

Represent ownership in a company. When an investor buys shares of a company's stock, they become partial owners of that company.

Bonds:

Represent debt issued by companies or governments. Investors who buy bonds are essentially lending money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity.

Other Financial Instruments:

Derivatives, commodities, and various other securities may also be traded on stock exchanges.

Types of Stock Markets:

Primary Market:

In the primary market, new securities are issued and sold to investors for the first time. This process is known as an Initial Public Offering (IPO). Companies raise capital by selling shares directly to the public.

Secondary Market:

In the secondary market, existing securities are bought and sold among investors. This is where most stock trading occurs. Examples include the New York Stock Exchange (NYSE) and the Bombay Stock Exchange (BSE).

Types of Stock Exchanges:

Major Global Exchanges:

Examples include the New York Stock Exchange (NYSE), NASDAQ (United States), London Stock Exchange (LSE), Tokyo Stock Exchange (TSE), and Euronext (Europe).

National Stock Exchanges:

Each country typically has its own national stock exchange. For example, in India, there is the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

Over-the-Counter (OTC) Markets:

OTC markets operate outside formal exchanges, where trading is conducted directly between buyers and sellers. This includes the trading of certain stocks and bonds.

Cryptocurrency Exchanges:

Platforms where digital currencies like Bitcoin and Ethereum are bought and sold. These operate on blockchain technology.

Functions of Stock Markets:

Facilitates Trading:

Allows buyers and sellers to trade securities, providing liquidity to the market.

Capital Formation:

Companies raise capital by issuing stocks or bonds to the public through IPOs.

Investment Opportunities:

Provides investors with opportunities to invest in various assets, aiming for capital appreciation, dividends, or interest income.

Price Discovery:

Prices of securities are determined by market forces based on supply and demand.

Risk Management:

Investors can use financial instruments like derivatives to manage risk and hedge against market fluctuations.

Economic Indicators:

Stock market indices are often used as economic indicators, reflecting overall market sentiment and economic health.

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari . The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

LTP Calculator the best trading application in india.

You can also downloadLTP Calculator app by clicking on download button.

Conclusion:

The stock market plays a vital role in fostering economic growth, connecting investors with investment opportunities, and providing companies with access to capital. It is a dynamic and complex system influenced by various economic, political, and global factors.

0 notes

Text

Why Bitcoin's Price Fluctuates: A Guide for Investors in Simple English

Bitcoin, the largest cryptocurrency in the world, has experienced ups and downs over the past few years. In 2022, its price crashed from its all-time high of $69,000 to around $15,000. However, in 2023, Bitcoin showed signs of recovery and maintained a level between $39,000 to $45,000. As of Feb. 7, 2024, Bitcoin is trading at $42,917.

The price fluctuations of Bitcoin have been influenced by factors such as macroeconomic conditions, interest rate hikes, and events like the collapse of a major crypto exchange. These factors have led to instability and confusion among investors. Despite these challenges, some investors believe that Bitcoin will continue to show positive trends in the future, especially with the upcoming "halving" event that will decrease mining rewards.

For investors interested in Bitcoin, it is advisable to consider investing a small percentage of their overall portfolio, analyze market volatility, and thoroughly research the best time to buy and sell. Consulting a financial advisor is also recommended. However, it is important to note that investing in Bitcoin, especially in India, can be complex due to government regulations. Investors should diversify their investments and stay informed about the cryptocurrency market.

Read the original article #bitcoin #cryptocurrency

0 notes

Text

Ripple(XRP) Explained: XRP/INR

What is Ripple?

XRP is a digital currency created by Ripple Labs to make moving currencies across the globe fast and reliable. It's like digital cash that gets verified and recorded by a bunch of computers called validator nodes.

Ripple's goal is to make XRP a key player in digital payments, including powering up banking systems.

However, Ripple hit a rough patch when the U.S. Securities and Exchange Commission (SEC) accused them of selling XRP as unregistered securities. This caused some crypto exchanges to stop trading XRP until the situation cleared up.

What Makes XRP Special:

Speedy Transactions: Unlike other cryptocurrencies like Bitcoin or Ethereum, XRP finishes transactions in less than four seconds. Bitcoin can take up to an hour, and Ethereum about 15 seconds, but XRP is lightning fast.

Low Fees: It costs almost nothing (about $0.0001537 on average) to do an XRP transaction, making it super cheap compared to other options.

Unique Things About Ripple(XRP):

You can't mine XRP like you can with Bitcoin. There's a fixed amount (100 billion coins), and most of them are already out there. You have to buy XRP through certain crypto exchanges; you can't make it yourself.

To own XRP, you can use specific wallets like Koinpark Global Cryptocurrency Exchange. These help keep your XRP safe and secure.

So, XRP stands out for its speed, low fees, and different approach to how it's created compared to other cryptocurrencies.

How to Buy/Invest in Ripple(XRP):

Pick a Reliable Global Cryptocurrency Exchange:

Choose a reputable cryptocurrency exchange that facilitates ripple trading on a global scale. For instance, platforms like Koinpark in India are popular and user-friendly and get a konpark cryptocurrency exchange app.

Create an Account: Begin by signing up on your selected exchange. You'll need to provide essential details like your email, and phone number, and complete the KYC (Know Your Customer) process. This includes submitting a government-issued ID, proof of address, a passport-sized photo, and your PAN card.

KYC Verification: After signing up, complete the KYC process by submitting the necessary documents for verification.

Deposit Funds: Once your account is set up and verified, deposit Indian rupees (INR) into your exchange account. Koinpark offers multiple deposit methods such as bank transfers and UPI.

Navigate to Ripple (XRP) Market: After funding your account, go to the Ripple market on the exchange. Look for the trading pair XRP to INR.

Place a Buy Order: Specify the amount of Ripple(XRP) you want to purchase in INR. You can place a buy order at the current market price or set a specific price for your purchase.

Secure Storage: For enhanced security, consider transferring your purchased ripple to a secure wallet. Options like hardware wallets such as Ledger, software wallets like Koinpark’s Parkwallet, or the INR deposit wallet provided by the exchange are popular choices.

Monitor the Market: Stay updated with Ripple's market trends and keep an eye on information provided by the exchange (like Koinpark) to make informed decisions regarding buying or selling XRP.

Conclusion:

Interested in Ripple( XRP)? Use reliable exchanges like Koinpark. Sign up, verify your ID, deposit funds, buy XRP in the market, and secure it in wallets.

Join the festive CryptoXmas campaign hosted by Koinpark! Grab your chance to win an incredible prize worth 25,000 USDT. Don't miss out, join now! - https://www.koinpark.com/xmas-event?theme=light

Take a look at this blog for more information:

0 notes

Text

Bitbse Made Simple: Your Gateway to Crypto Adventure.

Welcome to BitBSE, your global gateway to the exciting world of cryptocurrency! Based in India, BitBSE is a secure and user-friendly crypto exchange platform that enables you to effortlessly buy, sell, and trade popular digital currencies like Bitcoin, Ethereum, MTG, Green Gold, and more. Dive into the world of secure and seamless crypto transactions with BitBSE – your trusted partner in cryptocurrency exploration and investment! 🌐💰 #BitBSE #CryptoExchange #DigitalCurrency

Key Features of BitBSE Exchange

1- Signup Bonus.

Are you new to BitBSE? Join now to get a huge welcome bonus worth Rs. 1,000 in MTG and an incredible Rs. 1,000,000 in Shiba! Start your crypto adventure off right with this amazing bonus increase.

2- Lots of digital choices to check out.

BitBSE offers support for six main blockchains, such as TRC-20, ERC-20, Bitcoin, Doge coin, XRP, and more, so you may explore a wide range of digital assets. Explore the rich and broad world of cryptocurrencies with simplicity.

3- Transactions are Quick and Easy! ⚡💸

With fast and easy options for both INR and cryptocurrency deposits and withdrawals, enjoy seamless trading. You can now transact more quickly and conveniently than ever before.

4- Quick KYC and Fast Bank Verification , No More Hold-Ups! 🕒🛡���

Say goodbye to waiting times! With BitBSE's Fast and Easy KYC and bank verification process, you can begin trading without having to deal with any extra hassles.

5- Multiple Layers of Security!

The most important thing is your safety. With 2FA (Two-Factor Authentication), SMS OTP, and Mail OTP, BitBSE provides an additional layer of security, offering complete protection for your money and data.

6- Dual trading adventure at Bitbse 🔄💹

Customize your BitBSE trading experience! Enjoy the flexibility to select your preferred trading method and take full advantage of every market opportunity, whether you prefer spot or instant trading.

7- Security Certified by ISO! 🔐🏆

Put your trust in BitBSE, which is proud to hold ISO certification, and the highest standards of quality and security. Your cryptocurrency assets are extremely well-protected.

8- Multisignature Wallet -

For security, Bitbse uses a multisignature wallet and offers $50 million in insurance coverage for Bitbse assets.

9 - Also Available on Playstore

Bitbse's mobile app is also available for trading on.You can simply visit it on playstore.

10- Lowest Trading Fees -

At Bitbse we offer trading with some of the lowest trading fees , and our crypto prices are similar to those on binance, making us a competitive exchange

Join BitBSE today and unlock a world of exciting features that make your crypto journey simple, secure, and incredibly rewarding! 🌐💰

Website

Facebook Twitter LinkedIn Instagram YouTube

Download App

#BitBSE #CryptoFeatures #DigitalSecurity #TradingFreedom

0 notes

Text

0 notes