#buy crypto suckers

Explore tagged Tumblr posts

Text

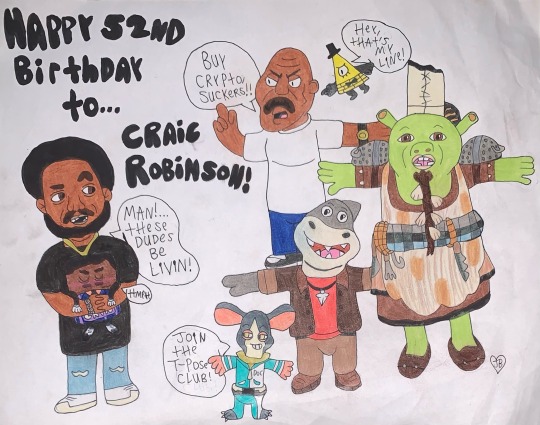

Happy 52nd Birthday to Craig Robinson!

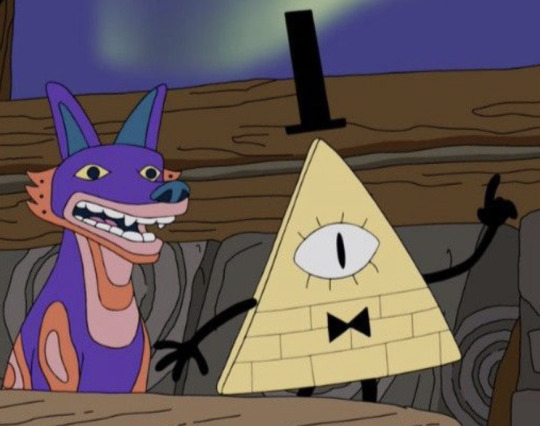

Based on this image from Dorbees

#fanart#craig robinson#happy 52nd birthday#escape from planet earth#doc#shrek 4 cookie#my chimichanga stand#t posting#t pose meme#dorbees#mr poe and yogul#mr shark#the bad guys#mr grits#sausage party#levar brown#the cleveland show#buy crypto suckers#bill cipher#gravity falls#tumblr sexyman#simpsons cameo

20 notes

·

View notes

Text

YEAHHHHHHHHHHHHHHH

#Gravity falls#book of bill#finally i have them all....#letting my gravity falls hyperfixation take the wheel right now so it's all i'll talk about (BE WARNED)#anyone wanna be gravity falls mutuals? (cries in social anxiety)#this bad boy came all the way from murica#BUY CRYPTO SUCKERS! /j

2 notes

·

View notes

Text

Night drunk quote of the night

"I like eating pine cones, they give me *insert gravity falls theme music*"

0 notes

Text

The Crypto Plot Against America’s Gold Reserves

The crypto “industry” was one of the biggest spenders in the 2024 election. It practically single-handedly bought a U.S. Senate seat in Ohio, turfing out labor’s most reliable senator, Sherrod Brown, with $40 million in advertising. And it convinced Donald Trump to make a 180 with a big sack of campaign contributions. Back in 2021, Trump said crypto was a “scam,” but now he has his own coin, his media site is in discussions to buy a crypto exchange, and he’s fully bought into the claims that the industry is overregulated.

So now that crypto has bought great political influence, it’s time to cash in. How might this happen? The basic idea is to turn the American government into the biggest crypto bag-holder of all time. If the plan goes through, hundreds of billions of dollars of public assets will be spent or leveraged to buy a million Bitcoins, allowing the tiny minority of Bitcoin moguls to finally cash out their holdings into real money. It would be one of the biggest upward transfers of wealth in world history.

[...] Crypto shill Sen. Cynthia Lummis (R-WY) proposes the Treasury issue new gold certificates based on the market price [of American gold reserves], and use the resulting cash—$677 billion at current prices—to buy up Bitcoins. In total, her bill would require the government to buy up 200,000 Bitcoins a year for five years, until a “strategic reserve” of a million would be accumulated.

This is revealing on several levels. The whole ideology of cryptocurrency is that it’s supposed to be outside the alleged corruption of governments or the extant financial system. Instead of transactions taking place on platforms run by Wall Street and regulated by the D.C. swamp, fiercely independent crypto entrepreneurs would build new businesses doing … something … out in a fresh economic Wild West.

So why on earth would buccaneering crypto people want the government scooping up a million Bitcoins—or about 5 percent of all that exist? The reason is obvious: so paper Bitcoin billionaires can cash out their holdings into real money without tanking the market. [...] The fundamental value of Bitcoin is zero. Even by crypto standards, the coin is terrible.

[...] Therefore, for early Bitcoin adopters sitting on vast piles of purely speculative assets, there is a huge structural need to get new suckers into the market. For anyone concerned about the corrosive role of money in politics, think about what this means: The crypto industry spent something on the order of $100 million in this election to install a government that will lure sacrificial lambs to a digital asset slaughterhouse, and make a handful of big Bitcoin hoarders generationally wealthy in the exchange.

[...] No one has deeper pockets than the federal government. No need to directly pick the pockets of suckers looking for a get-rich-quick scheme if you can pick everyone’s pockets indirectly by looting a vast store of treasure held in trust for the American people. It’s a logical end point for a technology whose sole meaningful use case is enabling criminal extortion and money laundering: finally carrying out the bank robber’s dream of draining the value in Fort Knox.

151 notes

·

View notes

Text

Biden wants to ban ripoff “financial advisors”

I'll be at the Studio City branch of the LA Public Library on Monday, November 13 at 1830hPT to launch my new novel, The Lost Cause. There'll be a reading, a talk, a surprise guest (!!) and a signing, with books on sale. Tell your friends! Come on down!

Once, American workers had "defined benefits pensions," where their employers promised to pay them a certain amount every year from their retirement to their death. Jimmy Carter swapped that out for 401(k)s, "market" pensions where you have to guess which stocks will be valuable or starve in your old age:

https://pluralistic.net/2020/07/25/derechos-humanos/#are-there-no-poorhouses

The initial 401(k) rollout had all kinds of pot-sweeteners that made them seem like a good deal, like heavy employer matching that doubled or even tripled the value of every dollar you put into the market for your retirement. But over the years, as Reaganomics took hold and workers' power ebbed away, all these goodies were clawed back. In the end, the market-based pension makes you the sucker at the poker table, flushing your savings into a rigged casino that is firmly tilted in favor of finance barons and other eminently guillotineable plutocrats.

Neoliberalism is many things, but most of all it is a cult of individualism. The fact that three generations of workers are nows facing down retirement without pensions that will provide them with secure housing and food – let alone money to see the odd movie, buy birthday gifts for their grandkids, or enjoy a meal out now and then – is framed as millions of individual failures, not a systemic one.

In other words, if you are facing food insecurity and homelessness after a lifetime of hard work, it's because you saved wrong. Perhaps you didn't save enough (through a 40-year run of wage stagnation and skyrocketing housing, health and education costs). Or perhaps you saved wrong, making the wrong bets on the stock market. If you can't afford to run your air conditioner during a heat dome, that's on you: you should have been better at stocks.

Apologists for this system will say that you don't have to be good at stocks – you just have to pay an Independent Financial Advisor to pick the stocks for you and you'll be fine. But IFAs don't work for free! What if you can't afford one?

Enter "predatory inclusion" – the practice of offering scammy, overpriced and substandard products to poor people and declaring it to be a good deed, because otherwise, those poor people would have to do without. The crypto bubble relied heavily on this: think of Spike Lee and others shilling for pump-and-dump scams as a way of "building Black wealth":

https://www.nytimes.com/2021/07/07/business/media/cryptocurrency-seeks-the-spotlight-with-spike-lees-help.html

More recently, Intuit and other scammy tax-prep services have argued against the IRS's plan to offer free tax preparation as bad for Black and brown people, because it will deny them the chance to be deceived and ripped off with TurboTax:

https://pluralistic.net/2023/09/27/predatory-inclusion/#equal-opportunity-scammers

Back in 2018, Trump won the predatory inclusion Olympics, when his Department of Labor let the Fifth Circuit abolish the "Fiduciary Rule" for Independent Financial Advisors:

https://www.investopedia.com/updates/dol-fiduciary-rule/

What was the Fiduciary Rule? It said that your IFN had to put your interests ahead of their own. Like, if there were two different funds you could bet on, and one would pay your IFN a big commission, while the other would be a better bet for you, the IFN couldn't put your retirement savings into the fund that offered them a bribe.

When Trump killed the Fiduciary Rule, he proclaimed it a victory for poor people, especially Black and brown people. After all, if IFNs weren't allowed to accept bribes for giving you bad financial advice, then they would have to make up the difference by charging you for good advice. If you couldn't afford that advice, well, you'd have to make bad retirement investments on your own, without the benefit of their sleazy self-dealing.

The Biden Administration wants to change that. Biden's Acting Labor Secretary is Julie Su, and she's very good at her job. Last spring, she forced west coast dockworkers' bosses to cough up the contract they'd stalled on for a year, with 8-10% raises for every worker, owed retroactively:

https://pluralistic.net/2023/06/16/that-boy-aint-right/#dinos-rinos-and-dunnos

Su has proposed a way to reinstate the Fiduciary Rule, as part of the Biden Administration's war on junk fees, estimating that this will increase retirees' net savings by 20%:

https://prospect.org/labor/2023-11-07-julie-su-labor-retirement-savers/

The new rule will force advisors who cheat their clients to pay restitution, and will require them to deliver all their advice in writing so that this cheating can be detected and punished.

The industry is furious, of course. They claim that "The Market (TM)" will solve this: if you get bad retirement savings advice and end up homeless and starving, then you will choose a different advisor in your next life, after you are reincarnated (I guess?).

And of course, they're also claiming that forcing IFNs to stop cheating their clients will deny poor people access to expert (bad) advice. As the Financial Services Institute's Dale Brown says, this will have a "negative impact on Main Street Americans’ access to financial advice":

https://www.fa-mag.com/news/legal-challenge-predicted-for-new-dol-fiduciary-proposal-75257.html

Here's that rule – read it for yourself, then submit a comment expressing your views on it. The government wants to hear from you, and administrative law requires them to act on the comments they receive:

https://www.federalregister.gov/documents/2023/11/03/2023-23782/proposed-amendment-to-prohibited-transaction-exemptions-75-1-77-4-80-83-83-1-and-86-128

Su is part of a wave of progressive, technically skilled regulators in the Biden administration that resulted from a horse-trading exercise called the Unity Task Force, which divvied up access to top appointments among the progressive wing and the finance wing of the Democratic Party. The progressive appointments are nothing short of incredible – the most competent and principled agency leaders America has seen in half a century:

https://pluralistic.net/2023/10/23/getting-stuff-done/#praxis

But then there's the finance wing's appointments, like Judge Jacqueline Scott Corley, who ruled against Lina Khan's attempt to block the rotten Microsoft/Activision merger (don't worry, Khan's appealing):

https://pluralistic.net/2023/07/14/making-good-trouble/#the-peoples-champion

Perhaps the worst, though, is Biden's Secretary of Commerce Gina Raimondo, a private equity ghoul who did a stint for the notorious wreckers Bain Capital before founding her own firm. Raimondo has stuffed her department full of Goldman Sachs alums, and has sidelined labor and civil society groups as she sets out to administer everything from the CHIPS Act to regulating ChatGPT.

As Henry Burke writes for the Revolving Door Project and The American Prospect, Raimondo's history as a corporate raider, her deference to the finance sector, and she and her husband's conflicts of interest from their massive stakes in companies she's regulating all serve to undermine Biden's agenda:

https://prospect.org/economy/2023-11-08-commerce-secretary-gina-raimondo-undercutting-bidenomics/

When the administration inevitably complains that its popular economic programs aren’t breaking through the media coverage, they’ll have no one to blame but themselves.

The Unity Task Force gave us generationally important policymakers, but ultimately, it's a classic "pizzaburger." If half your family wants pizza, and the other half wants burgers, and you serve them something halfway in between that makes none of them happy, you haven't made a wise compromise – you've just made an inedible mess:

https://pluralistic.net/2023/06/17/pizzaburgers/

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/11/08/fiduciaries/#but-muh-freedumbs

#pluralistic#julie su#fiduciary rule#intergenerational warfare#aging#retirement#401ks#old age#pensions#finance#pizzaburgers#Gina Raimondo

273 notes

·

View notes

Note

Opinions on the roblox game da hood

I do not play video games.

Any enjoyment one gets from “gaming” is artificial. Those “beloved devs” of yours, purposely make addicting games with plenty of micro-transactions opportunities.

They do not care about you, they care about the money. Not player engagement or retainment. Don’t fall for those “free-to-play” scams. If you want to waste money, I suggest NFTs or crypto. You can sucker fools into buying out your stock.

That said, you can click this link below to get started: Crypto-for-idiots.FGI

24 notes

·

View notes

Text

‘I know you love me’

sassy little immortal dragon that will steal your soul and make you buy crypto to laugh at you

probably my favorite dragon, I’m a sucker for heart motifs

13 notes

·

View notes

Text

"it's not just rich people being scammed by crypto rugpulls, it's also regular middle/lower middle class people"

1: anyone who buys crypto intends to profit on it by simply reselling it to the next sucker anyway

2: am i really supposed to feel bad for anyone who has enough disposable income to waste six thousand american dollars on the hawk tuah coin just because theyre not bourgeois

13 notes

·

View notes

Text

Bill is Based???

(Also says the guy who said, "Buy crypto, suckers!" in the Simpsons-)

16 notes

·

View notes

Note

📖 Hojiko

“BUY CRYPTO, SUCKERS!”

7 notes

·

View notes

Text

I know we all love to imagine Tallest Miyuki as a competent Girlboss, but if we roll with the idea that the Tallest are always unqualified idle rich figureheads what would GirlFailure Miyuki look like?

I like to think that she's maybe something like a Lucille Bluth type. Like, she might strut around confidently in a way that commands respect and she can certainly be witty and cleverly manipulative. But she's been so privileged all her life due to having always been taller than her peers, even in childhood, that she's incredibly out of touch and lacking in any practical skills or common sense. Not to mention extremely bigoted and tactless with her casual remarks toward shorter Irkens, Vortians, and others she considers her inferiors regardless of the position they might be in to screw her over.

She oversees the scientists on Vort and makes decisions about whose projects get greenlit and whose don't while being completely scientifically illiterate herself, and because she overestimates herself she's easily swindled. The exact type of person who'd get suckered into throwing money at Theranos or buying into a crypto/NFT pyramid scheme. Basically, no different from Red or Purple, just carries herself with the appearance of more dignity and maturity.

13 notes

·

View notes

Quote

Crypto epitomizes the caveat emptor economy. By design, fraudulent crypto transactions can't be reversed. If you get suckered, that's canonically a you problem. And boy oh boy, do crypto users get suckered (including and especially those who buy Trump's shitcoins)

Cory Doctorow

2 notes

·

View notes

Note

Over a 130 dollars for: trading cards that you may or may not be able to trade with other people (quality of the art may vary) , pins that clearly must've been designed by the creator herself since they're hard to look at, a keychain you don't get to pick, a q&a with a vindictive colorblind peacock-collecting unprofessional woman and the poor souls who have to tolerate her and two episodes of a show that doesn't have the fluid animation or beloved voice talent that made people like it in the first place. What a steal!

Why, you'd be a sucker not to buy it! Just like crypto and timeshares!

16 notes

·

View notes

Text

The funny thing is Bill encounraging people to invest in crypto is sorta canon-compliant considering his Simpsons cameo. Appears on the TV screen again five years after dying just to call you a sucker and telling you to buy crypto. king

13 notes

·

View notes

Text

OK, so this post is actually from 3 years ago, but it's getting shared around again, so let's talk about what's happening with crypto.

Is it actually dead? Well, yes and no.

2023 was, for crypto, the awful no good very bad absolutely terrible year. Basically, the SEC got to reeeeaaallly busting heads on all of the illegal bullshit that the crypto industry is propped up on (they claim its not illegal because they used a different kind of software to do the illegal things; this is, obviously, bullshit). So, thanks Joe Biden for that one I guess. You're a soulless neoliberal ghoul, but god damn did you get a lot of really good shit done (genuinely, if you guys don't know, he's quietly been one of the most effective presidents you guys have ever had... And the "quietly" part - combined with his utterly reprehensible support for Isreal - means you're all gonna stay home this year and let Trump get in instead).

The upshot of this is that the CEO of Binance is facing criminal charges, Sam Bankman Fried of FTX is in jail for 20-something years (and FTX is still a smoking crater) and Coinbase are trying desparately to not get kicked out of US markets.

So why did Bitcoin just post its highest price ever? Well, the long and short is that the whales are really, really desparate to cash out. Anyone who knows whats going on can see that the whole system is dying. Unless they can get a much more favourable regulatory environment very very quickly they're basically locked out of American money, and even that won't fix the fact that consumers are just generally done with crypto.

The price is higher than its ever been (well, kinda... it's basically stalled at the previous all time high), but the actual number of transactions, and especially the number involving real dollars, is lower than its ever been. In other words, the price doesn't reflect what someone will actually pay in real money for crypto. It is, more than ever, a made up number, largely created through price manipulation by Tether.

Tether, for those who don't know, is a crypto that's always supposed to trade 1:1 for a US dollar. This is backed by... well... bullshit. Tether claims to be backed by real reserves, but these claims are blatant lies. In practice, they just print fake money out of thin air, claim its just like real money, then use that fake money to buy other crypto (mostly bitcoin) which pushes the price up. And because so few people actually buy or sell bitcoin now, one big customer can move the price by a lot.

So, the all time high price right now is mostly down to Tether working overdrive to push the price up. This big push has been spurred by two things; Bitcoin ETFs, and the halvening.

Bitcoin ETFs are basically a way to trade bitcoin as an asset without actually holding bitcoin. Instead, someone else holds the bitcoin, and you just buy notional shares of what that bitcoin is worth. Crypto enthusiasts have been treating these as the coming of Jesus, though in reality they just give institutional investors even less reason to actually touch crypto directly. But they are a big marketing opportunity to tell the remaining suckers that this is it, this is when crypto finally goes to the moon (ie, a chance for the people who run the whole scam to cash out their remaining crypto on another injection of idiot cash, or so they hope).

The halvenining is this thing where every four years the crypto payouts to miners drop by half. Miners don't actually create (ie, "mine") bitcoin, that's a myth. What they do is move it; their computers validate transactions so that money can move, and they get paid new bitcoin in return. With payouts halving, the price needs to go up in order for the miners to even keep the lights on. If they start shutting down their systems, the whole system could just seize up, or become vulnerable to takeover by one determined group. Miners are also heavily intertwined with the exchanges and the stablecoins like Tether. So, the price is being manipulated up to keep miners in business.

Right now it's still floating around that all time high, and has struggled to maintain any sort of upward momentum past that point. I suspect it's going to tumble back down soon enough, but I could be wrong. Again, this "market" is so heavily manipulated that price action has no connection to reality.

Is crypto dying? Basically, yes. There's the appearance of life in the corpse, but it's just the big players puppeting the body to make it seem alive. Institutional money (big investment firms) bailed a while back, and they're just trying to trap as many retail (regular Joe) suckers as they can before the whole becomes pointless and they all pivot to shilling AI products.

49K notes

·

View notes

Text

the way crypto ppl think about/talk about memes is so baffling. Like to them memes aren't just shared jokes. they're signifiers of identity that a speculative tokens should be attached to. instead of laughing at a meme people should buy a token of the meme to signify to others that they're a part of that meme's community. and do.. something.

looking at shit from the hawk tuah coin thing those guys keep talking about the inspirational power of the hawk tuah story. it's really baffling to anyone from uh. reality. what the fuck is the hawk tuah story??? it's the kind of rhetoric that can only be born out of running an obvious scam and needing to bend words really awkwardly to pretend you're not running a scam.

Obviously most "project runners" are just going to smile and talk about how we need to believe in the memetic power of memes and invest in memes and talk about how buying tokens that signify the existence of memes is the future bc like, they're trying to do a rugpull and the need suckers. But there's true believers in that space and it's weird. Wholly incomprehensible.

1 note

·

View note