#business loans for women

Explore tagged Tumblr posts

Text

Women entrepreneurs have been breaking barriers and achieving success across various industries. However, securing adequate funding remains a challenge for many women-led businesses. Fortunately, several financial institutions and schemes specifically cater to women entrepreneurs, offering business loans for women, small business loans for women, and female business loan programs. Here are some essential tips to help women entrepreneurs secure a business loan effectively:

1. Understand Your Business Needs

Before applying for a loan, it’s crucial to determine the exact purpose and amount required for your business. Whether it’s for expanding your operations, purchasing equipment, or meeting working capital needs, having a clear understanding of your financial requirements will make it easier to choose the right loan.

2. Research Loan Options for Women Entrepreneurs

Numerous financial institutions and government programs provide business loans tailored specifically for women entrepreneurs. Explore schemes such as the Mudra Yojana for Women, Annapurna Scheme, or loans offered by private banks and NBFCs designed for small business loans for women. Compare interest rates, repayment terms, and eligibility criteria to find the best option.

3. Build a Solid Business Plan

A comprehensive and well-prepared business plan is crucial for convincing lenders of your business’s potential. Highlight your objectives, revenue model, market analysis, and projected financials. A strong business plan demonstrates your preparedness and increases your chances of approval.

4. Maintain a Good Credit Score

Your credit score plays a significant role in the loan approval process. Ensure you have a good credit history by paying your bills and existing loans on time. A high credit score not only improves your chances of approval but may also help you secure lower interest rates.

5. Leverage Collateral-Free Loans

Many lenders offer collateral-free female business loans, making it easier for women entrepreneurs to secure funding without pledging any assets. These loans are typically based on your business’s viability and your creditworthiness.

6. Highlight Your Achievements and Vision

Showcase your business achievements, certifications, or milestones to lenders. Presenting your long-term vision and commitment to growth can instill confidence in the lender, making them more likely to approve your loan.

7. Seek Professional Guidance

If you’re unsure about the loan application process or the best options available, consider seeking advice from financial consultants or mentors. They can guide you through the application process and help you present your case effectively.

8. Utilize Digital Platforms

Many lenders now offer online application processes, making it easier and faster to apply for business loans for women. Use these platforms to compare various loan products and submit your application from the comfort of your home or office.

Conclusion

Securing a female business loan entrepreneur requires preparation, research, and confidence. By understanding your needs, exploring small business loans for women, and presenting a compelling case to lenders, you can access the funding required to grow your business. Female business loans are not just financial tools but also enablers of empowerment, helping women entrepreneurs turn their visions into reality.

#business loans for women#female business loan#small business loans for women#best small business loans for women

0 notes

Text

Top 5 Business Loan Options for Small Enterprises in 2024

In 2024, small enterprises have a wealth of options when it comes to securing business loans. With the right financial backing, businesses can thrive, expand, and navigate challenges effectively. Here’s a look at the Top 5 Business Loan Options for Small Enterprises in 2024, along with guidance on choosing the best loan for your needs.

1. Term Loans: Simple and Structured Financing

A term loan remains a reliable choice for small businesses. With fixed repayment terms and interest rates, term loans provide predictability, making them ideal for major investments like equipment or real estate. You can apply for both secured and unsecured business loans, depending on your creditworthiness and collateral availability. It’s an excellent option for those seeking fast business loan solutions to fund business expansion or new projects.

Pros: Predictable monthly payments, low-interest rates for well-qualified borrowers.

Cons: May require strong credit or collateral, longer approval process.

2. Business Line of Credit: Flexibility for Working Capital Needs

A business line of credit is perfect for businesses that need flexible access to funds. Unlike term loans, you only borrow what you need and pay interest on the amount used. This is ideal for managing day-to-day expenses or covering unexpected costs. As small business funding needs fluctuate, this revolving credit gives you peace of mind when cash flow is tight.

Pros: Only pay interest on what you borrow, great for working capital loan needs.

Cons: Typically requires a good credit score for approval.

3. SBA Loans: Government-Backed Small Business Support

For small enterprises looking for small business loans with competitive interest rates and longer repayment terms, SBA loans (Small Business Administration) are a top option in 2024. These new business loans are government-backed, reducing lender risk and increasing your chances of approval, even with moderate credit scores. SBA loans are especially beneficial for securing large amounts of funding for business growth or debt funding purposes.

Pros: Low-interest rates, long repayment terms, flexible use of funds.

Cons: Lengthy approval process, requires detailed financial documentation.

4. Invoice Financing: Unlock Cash Flow Without Debt

Invoice financing, also known as accounts receivable funding, allows businesses to borrow against un paid invoices. This option is gaining popularity in 2024 because it provides immediate access to cash without taking on new debt. It’s especially useful for businesses facing slow-paying clients. This quick business loan option ensures smooth cash flow without waiting for customer payments.

Pros: Immediate access to cash, no debt acquired.

Cons: Higher costs if invoices remain unpaid.

5. Equipment Financing: Fuel Your Business with Necessary Tools

Equipment financing offers small businesses the opportunity to purchase or lease equipment essential for operations. The equipment itself serves as collateral, which makes this loan easier to qualify for. If your small enterprise needs to upgrade or expand its equipment, this is a great option to preserve cash flow while still acquiring necessary resources. It’s a popular choice for small business loans for women and business loans for small business owners who need tools to stay competitive in their industry.

Pros: No need for additional collateral, tailored for equipment purchases.

Cons: Only applies to equipment purchases or leases.

How to Choose the Best Loan plan for Your Small Business

Selecting the right loan involves understanding your business needs and financial situation. Here are some factors to consider:

Purpose of the Loan: Determine whether you need funds for working capital, expansion, or equipment purchase. Different loans serve different purposes.

Loan Amount and Terms: Assess how much funding you require and the repayment terms. Look for loans that fit your cash flow situation.

Interest Rates: Compare interest rates across different lenders. Lower rates can significantly reduce your overall repayment burden.

Eligibility Criteria: Ensure you meet the lender's requirements, including credit score, business age, and financial documentation.

Lender Reputation: Research lenders to find the best business loan provider in Delhi NCR. Look for reviews and references to gauge their reliability.

Why Choose SFS Enterprise as Top Business Loan Provider in Delhi NCR

When it comes to finding a business loan provider in Delhi, SFS Enterprise stands out as the best business loan provider in Delhi NCR. Here’s why:

Tailored Solutions: SFS Enterprise offers customized loan solutions to meet the unique needs of small businesses.

Quick Processing: With a focus on efficiency, SFS ensures that applications for quick business loans are processed swiftly, allowing businesses to access funds without unnecessary delays.

Flexible Terms: They provide flexible repayment options, making it easier for small enterprises to manage their finances.

Expert Guidance: SFS Enterprise offers expert advice to help businesses navigate the loan application process, ensuring they apply for the most suitable options.

Strong Reputation: As a top business loan provider in Delhi NCR, SFS Enterprise has built a reputation for reliability and customer satisfaction.

Conclusion

In 2024, small enterprises have more loan options than ever to fuel their growth and success. Whether you're seeking a business line of credit for flexible funding, an SBA loan for long-term financing, or equipment financing to upgrade your tools, the right loan can significantly boost your business. Always consider your business needs, financial health, and growth goals before making a decision. For small businesses in Delhi NCR, SFS Enterprises offers the most competitive and accessible financing options to drive your business forward.

For any details regarding same call us at +91-9654622228 or drop an email at [email protected]

#Business loan for ladies from government#small business loans#business line of credit#start up business loans#business loans for women#startup business loans#small business funding#quick business loans#small business loans for women#working capital loan#best small business loans#business loans for small business#apply for business loan#new business loans#unsecured business loans#fast business loan#debt funding

0 notes

Text

Apply for unsecured MSME loans online with Indifi for all businesses including retail, restaurant, e-commerce, etc. Check eligibility, documents, interest-rate etc.

1 note

·

View note

Text

As we celebrate the progress of women in the business world, it's essential to recognize the challenges they may face:Get more information please read this blog.

0 notes

Text

This article will help you learn more about the difficulties faced by Cambodian businesswomen and possible solutions that can help bridge these gaps, with a particular focus on business loans for women.

0 notes

Text

An update to an older story that’s goods news!

When Jenny Nguyen signed the lease to create her dream bar, she wasn’t sure it would stay open for more than a few months.

But earlier this month, 43-year-old Nguyen’s first-of-its-kind establishment in Portland, Oregon, celebrated its one-year anniversary. Aptly named The Sports Bra, it’s a sports bar where only women athletes appear on the TVs.

Business has been good, despite the niche business model and record inflation sending food and beverage prices soaring. The Sports Bra brought in $944,000 in revenue in the eight months it was open in 2022, according to documents reviewed by CNBC Make It.

It was profitable in that first year of business, Nguyen adds.

“It turns out, it’s pretty universal — that feeling of being a women’s sports fan and going into a public place, like a sports bar, and having a difficult time finding a place to show a [women’s] game, especially when there are other men’s sports playing,” Nguyen says.

Initially, she wasn’t sure the idea would work at all. The vast majority of money and attention historically goes to men’s sports only — a big reason why The Sports Bra was reportedly the country’s first bar to only play women’s sports on TV.

It’s also not the kind of thing Nguyen would ordinarily do: She describes herself as “very cautious, risk averse.” But her obsession with women’s sports and frustration with its lack of representation on television screens drove her to empty her life savings — about $27,000 — and give it a try.

“Me, personally, I thought the idea was brilliant and that [it was] what the world needs,” Nguyen says. “But I had no idea that the world would want it. I just wanted to give it a shot.”

How The Sports Bra went from running joke to reality

Nguyen is a lifelong basketball fan who played the sport at Clark College in Vancouver, Washington, before tearing her ACL. She’s also a longtime restaurant worker who spent three years as Reed College’s executive chef.

In 2018, Nguyen and a group of friends wanted to watch the NCAA women’s basketball championship game. They went to a mostly empty sports bar and still had to plead with a bartender to switch one of the smallest TVs — which played without sound — from a men’s sport to the women’s championship game, she recalls.

Together, they jumped up and down celebrating “one of the best games I’ve ever seen,” Nguyen says, as a buzzer-beating three-point shot sealed the championship title for Notre Dame. Afterward, she was struck by the normalcy of her situation.

″[We’d] gotten so used to watching a game like that in the way that we did,” she says, adding that they’d only find better viewing conditions “if we had our own place.”

Days later, she channeled her disappointment into a hypothetical: What would she name her bar? “The very first thing that came into my mind was The Sports Bra,” Nguyen says. “And once I thought it, I couldn’t un-think it, you know? It was catchy. I thought it was hilarious.”

For years, she joked about it. Then, the fallout from social justice movements like #MeToo and the country’s racial reckoning after George Floyd’s murder left her wanting to make a meaningful impact on the world and her community.

Nguyen, who came out as a lesbian at age 17, says she doesn’t always feel welcome at most traditional sports bars. The Sports Bra could help her, and anyone else who’d rarely felt accepted in other sports establishments, feel like she belonged.

“I thought about, if we can even get one kid in here and have them feel like they belong in sports, it’d be worth it,” she says.

Helping other women’s sports bars get started

At first, Nguyen had her savings, and $40,000 in loans cobbled together from friends and family. That would keep The Sports Bra afloat for three months, based on her cost estimates for labor, inventory and other overhead.

In February 2022, she launched a Kickstarter to raise $48,000 — enough money for an extra six-month financial cushion, to build up the sort of regular clientele any bar or restaurant needs to survive long-term.

To Nguyen’s surprise, the campaign raised more than $105,000 in just 30 days, thanks to a viral article in online food publication Eater. “At that moment, when I was looking at that Kickstarter graph, I thought to myself, ‘This might work,’” she says.

But the money, which came from around the country and world, was no guarantee of success. Actual people in Portland still needed to frequent the bar.

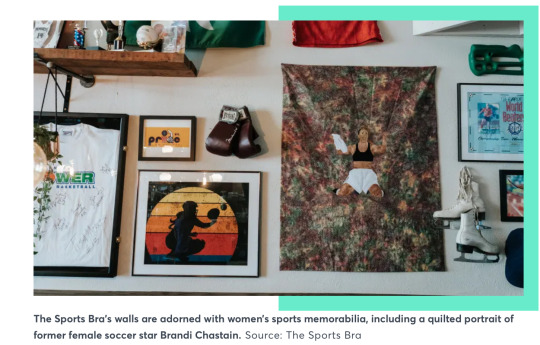

Today, there’s often a line out the door. Women’s basketball icons like Sue Bird and Diana Taurasi showed up, for an event sponsored by Buick, earlier this month. Ginny Gilder, co-owner of the WNBA’s Seattle Storm, has even waited in line to watch her team play on The Sports Bra’s TVs, Nguyen says.

That’s a far cry from the Kickstarter days, which Nguyen says only happened after she was denied business loans by multiple banks and small business associations. The denials commonly cited the high risk of a unique concept run by a first-time entrepreneur during a pandemic, she adds.

Even the bar’s core concept is a struggle: It’s hard to find enough women’s sporting events to fill up the televisions. Only about 5% of all TV sports coverage focuses on female athletes, according to a 2021 University of Southern California study.

Nguyen says she’s taken to reaching out directly to sports networks and streaming services, some of which have hooked her up with access to more women’s sports content. She also spends an inordinate amount of time “scouring” TV listings, a process she likens to “taking a machete and chopping through a jungle.”

But she’s no longer alone. Another bar specializing in women’s sports has opened in nearby Seattle, and Nguyen says she’s in touch with a handful of other prospective entrepreneurs asking her for advice on opening similar visions in other cities.

“I would love to have as many people experience the feeling people experience when they walk through these doors,” she says. “It feels very selfish to keep it to this one building that holds 40 people at a time.”

#USA#oregon#Portland#jenny nguyen#The Sports Bra#A sports bar for women and women’s sports#She was originally denied business loans

1K notes

·

View notes

Text

As a Black Woman in Business, the journey is a blend of resilience and determination. Overcoming hurdles to create space and inspire others.

We navigate diverse landscapes and shatter stereotypes. Embracing our roots as we shape a future where our voices are not just heard, but celebrated.

To the Black Women Entrepreneurs out there, know that your courage and vision are catalysts for change. United, we redefine possibilities and rewrite narratives.

Reach out to us at (800) 452-8485 for some guidance and support.

#business owners#entrepreneur#business loans#small business loans#business funding#small business owner#business#funding#loans#business consulting#black women in business#business consultant#stronger together#empowerment#black business owners

5 notes

·

View notes

Text

Kviku a non-banking credit organization that offers online loans in spain. 🇪🇸

providing hassle-free online loans to meet your urgent financial needs.

Instant approved : Finance Apply now

Read more..

#financial#financial planning#finance management#business#credit score#financial freedom#personal loans#credit cards#finance assignment help#moto: spain 2024#madrid spain#philip ii of spain#spa in ajman#hws spain#spa in chennai#spain eurovision#spain football#spain hetalia#spain news#spain hws#spain art#spain 2023#spain#spain travel#spain visa#spain nt#spain without the s#spain women's national team#spain x reader#spainese

3 notes

·

View notes

Text

people trying to help me in too pushy of a way <3 how do i say thanks so much but leave me alone <3

#i literally dont WANT you to cc the ceo of a center for helping small businesses in an email to me im not in business yet 🙃#she literally immediately scheduled a zoom call for tomorrow morning to talk abt applying for a program im not ready for!!#i dont want to apply for a loan im not ready for all that!!!#i literally wont be opening for almost a decade im just planting trees every spring i dont need to do anything else#in ten years i might want to buy some used equipment#aaaaaaaa#this lady i know has been telling me abt this organization for months which is very nice and encouraging me to reach out to them#but i have literally no need or reason to do that yet#and wont for a few years probably#but she got inpatient ig and just reached out for me and now things are happeninggg#i literally have no pitch for my business it barely exists <3#i registered to claim the name so technically it exists and i planted a crop this spring that wont be ready for 8 years but thats it lol#we dont exist exist#anyway this lady means so very well and wants to help but im so stressed abt this i wasnt ready to deal with this lol#anyway its an organization that helps women and minority businesses or somethingggg idk anything abt it 😭#and im pretty sure the program she's signing me up for will cost money that i dont have 😣#i literally dont need to do a small business workshop at this point im just starting out and wont be open for years#ughhhhh#now i have a business zoom call first thing in the morning like an actual professional adult 😐#this has been a shitpost#anyway its probably a good and wonderful thing that i should be grateful for but its happening too fast and im not prepared#so i dont want to ruin the opportunity by being a dummy who doesn't know abt business ten years before i am even ready for the opportunity#😣😣😣#im sure its all good and fine and helpful but aaaaaaaaaa

2 notes

·

View notes

Text

Empowering Women in Business: Secure Loans with RBI-Approved Apps

Thanks to their innovative ideas, persistence, and determination, women entrepreneurs are already revolutionizing the commercial landscape. However, the process of scaling such businesses sometimes faces financial constraint. It is there that business loan applications, especially those granted approval by RBI, help and give women-led businesses a lifeline. Leading this financial revolution is…

0 notes

Text

Fuel Your Growth: How Business Loans Empower Startups and Entrepreneurs

Starting or expanding a business requires capital. Whether you're launching a startup, scaling an existing venture, or managing operational expenses, a business loan can be the key to success.

What is a Business Loan?

A business loan provides financial assistance to entrepreneurs and business owners to support working capital, equipment purchase, expansion, or operational needs.

Types of Business Loans

Business Loan for Startups – Helps new businesses set up their foundation.

Women Business Loans – Special financial support for women entrepreneurs.

Working Capital Loans – Helps businesses manage day-to-day expenses.

Loan Against Business Assets – Secure funds by pledging business assets.

Why Get a Business Loan?

Access to Capital – Secure funding without depleting your savings.

Flexible Repayment Plans – Choose a plan that aligns with your revenue cycle.

Business Growth & Expansion – Use funds for marketing, hiring, or scaling operations.

Build Creditworthiness – Timely repayment strengthens your business credit score.

How to Apply for a Business Loan?

Determine Loan Type & Amount – Choose a loan based on your business needs.

Prepare Documents – Business plan, financial statements, and KYC documents.

Apply Online or Offline – Submit your application with a trusted lender like InvestKraft.

Loan Approval & Utilization – Get funds and use them for business growth.

InvestKraft: Supporting Entrepreneurs with Tailored Business Loans

At InvestKraft, we provide customized business loan solutions with quick approvals, minimal paperwork, and competitive interest rates to help you focus on growing your business.

Conclusion A business loan is a stepping stone to achieving entrepreneurial success. If you’re looking for the right funding solution, InvestKraft is here to help!

1 note

·

View note

Text

CEO Capital Connection - Helping Businesses to Grow

Discover tailored funding solutions to help your business thrive. Let’s fuel your success with expert guidance and support.

#business funding solutions#business funding#business funding services#business funding for small businesses#business funding startup#business funding new business#business fund raising#us business funding solutions#business funding companies#business funding quick#business funding easy#business funding fast#business funding online#funding your business#business funding partners#small business funding companies#business loans 2 million#business development funding#business equipment funding#business emergency funding#business funding guaranteed#business funding website#business funding network#business funding broker#business funding usa#business funding new york#business funding with no revenue#business funding no revenue#business funding for women#business expansion funding corporation

1 note

·

View note

Text

A loan against property is a 💡 practical and 💸 affordable solution for funding your home renovation 🛠️ or repair needs. By leveraging the value of your property 🏡, you can access substantial funds 💰 at low interest rates 📉 and with flexible repayment terms 🕒. Whether you’re planning a complete makeover 🎨 or managing urgent repairs 🔧, this loan can be your ultimate financial lifeline 🌟.

#policy#loan#business loan#health insurance for women#loan against property#gold loan#home loan#finance#loans

1 note

·

View note

Text

GROW Loan Initiative Unveiled by dfcu Bank to Boost Women-Led Businesses in Eastern Uganda

dfcu Bank has today launched the GROW initiative in Eastern Uganda to support women entrepreneurs in the region with financial support and business training to scale their businesses. The event, held in Jinja, marks a significant step in dfcu Bank’s commitment to fostering economic growth and supporting women in business through access to affordable credit, tailored financial solutions, and…

#Dfcu bank#GROW#GROW Loan Initiative Unveiled by dfcu Bank to Boost Women-Led Businesses in Eastern Uganda

0 notes

Text

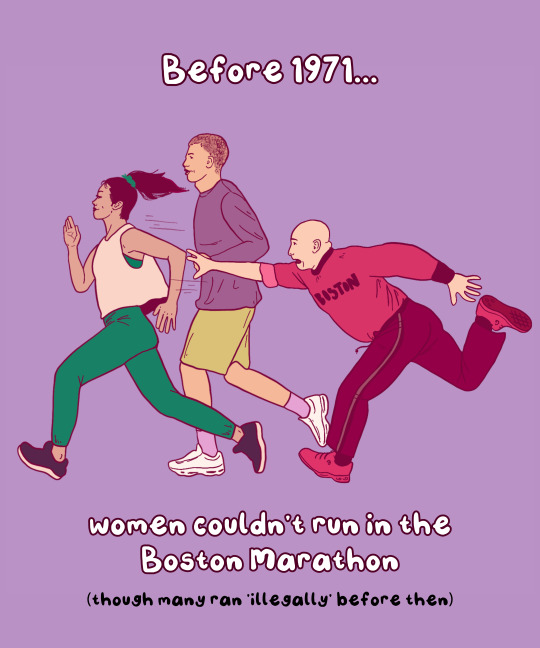

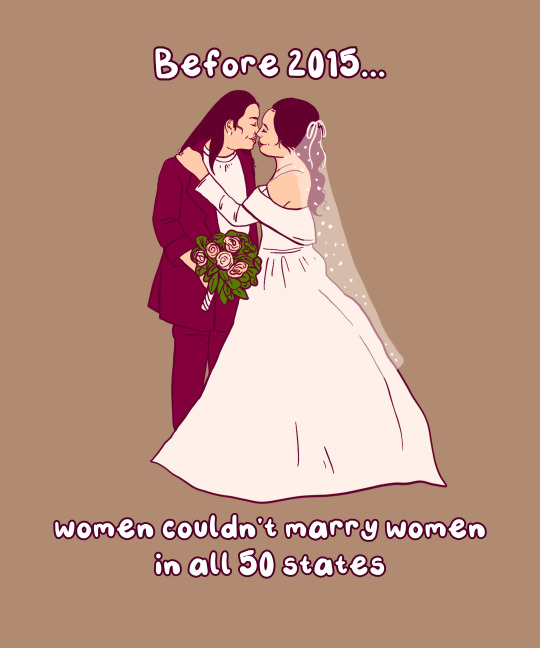

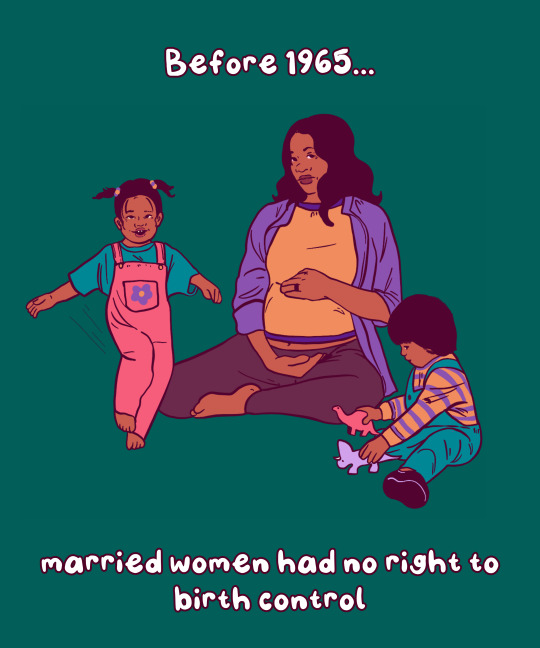

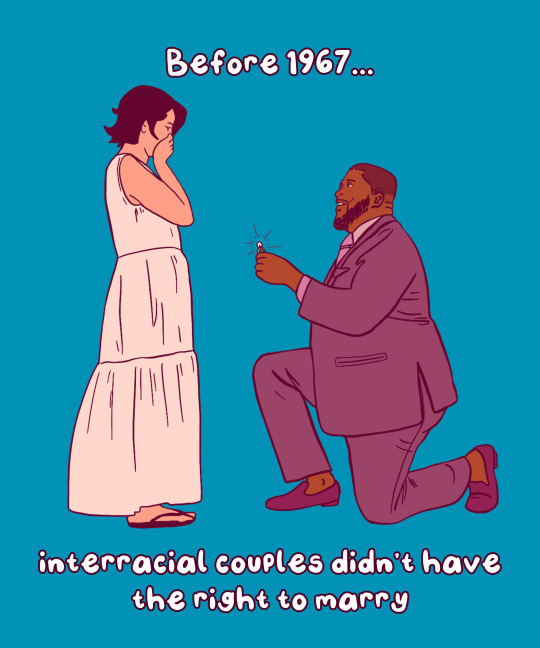

Women's Not So Distant History

This #WomensHistoryMonth, let's not forget how many of our rights were only won in recent decades, and weren’t acquired by asking nicely and waiting. We need to fight for our rights. Here's are a few examples:

📍 Before 1974's Fair Credit Opportunity Act made it illegal for financial institutions to discriminate against applicants' gender, banks could refuse women a credit card. Women won the right to open a bank account in the 1960s, but many banks still refused without a husband’s signature. This allowed men to continue to have control over women’s bank accounts. Unmarried women were often refused service by financial institutions entirely.

📍 Before 1977, sexual harassment was not considered a legal offense. That changed when a woman brought her boss to court after she refused his sexual advances and was fired. The court stated that her termination violated the 1974 Civil Rights Act, which made employment discrimination illegal.⚖️

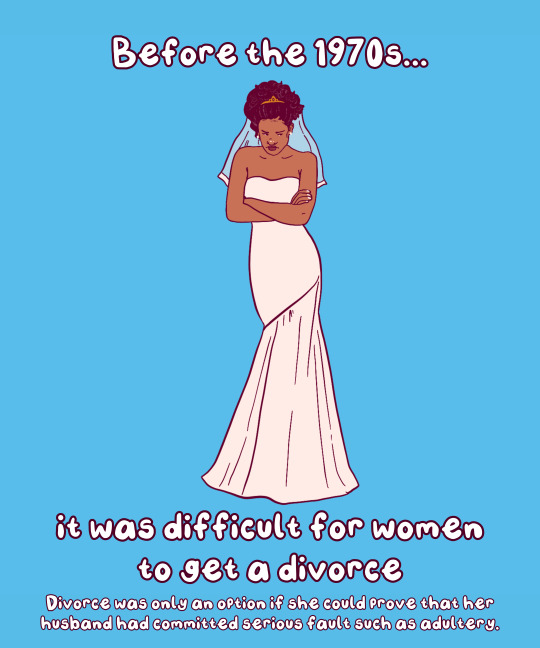

📍 In 1969, California became the first state to pass legislation to allow no-fault divorce. Before then, divorce could only be obtained if a woman could prove that her husband had committed serious faults such as adultery. 💍By 1977, nine states had adopted no-fault divorce laws, and by late 1983, every state had but two. The last, New York, adopted a law in 2010.

📍In 1967, Kathrine Switzer, entered the Boston Marathon under the name "K.V. Switzer." At the time, the Amateur Athletics Union didn't allow women. Once discovered, staff tried to remove Switzer from the race, but she finished. AAU did not formally accept women until fall 1971.

📍 In 1972, Lillian Garland, a receptionist at a California bank, went on unpaid leave to have a baby and when she returned, her position was filled. Her lawsuit led to 1978's Pregnancy Discrimination Act, which found that discriminating against pregnant people is unlawful

📍 It wasn’t until 2016 that gay marriage was legal in all 50 states. Previously, laws varied by state, and while many states allowed for civil unions for same-sex couples, it created a separate but equal standard. In 2008, California was the first state to achieve marriage equality, only to reverse that right following a ballot initiative later that year.

📍In 2018, Utah and Idaho were the last two states that lacked clear legislation protecting chest or breast feeding parents from obscenity laws. At the time, an Idaho congressman complained women would, "whip it out and do it anywhere,"

📍 In 1973, the Supreme Court affirmed the right to safe legal abortion in Roe v. Wade. At the time of the decision, nearly all states outlawed abortion with few exceptions. In 1965, illegal abortions made up one-sixth of all pregnancy- and childbirth-related deaths. Unfortunately after years of abortion restrictions and bans, the Supreme Court overturned Roe in 2022. Since then, 14 states have fully banned care, and another 7 severely restrict it – leaving most of the south and midwest without access.

📍 Before 1973, women were not able to serve on a jury in all 50 states. However, this varied by state: Utah was the first state to allow women to serve jury duty in 1898. Though, by 1927, only 19 states allowed women to serve jury duty. The Civil Rights Act of 1957 gave women the right to serve on federal juries, though it wasn't until 1973 that all 50 states passed similar legislation

📍 Before 1988, women were unable to get a business loan on their own. The Women's Business Ownership Act of 1988 allowed women to get loans without a male co-signer and removed other barriers to women in business. The number of women-owned businesses increased by 31 times in the last four decades.

Free download

📍 Before 1965, married women had no right to birth control. In Griswold v. Connecticut (1965), the Supreme Court ruled that banning the use of contraceptives violated the right to marital privacy.

📍 Before 1967, interracial couples didn’t have the right to marry. In Loving v. Virginia, the Supreme Court found that anti-miscegenation laws were unconstitutional. In 2000, Alabama was the last State to remove its anti-miscegenation laws from the books.

📍 Before 1972, unmarried women didn’t have the right to birth control. While married couples gained the right in 1967, it wasn’t until Eisenstadt v. Baird seven years later, that the Supreme Court affirmed the right to contraception for unmarried people.

📍 In 1974, the last “Ugly Laws” were repealed in Chicago. “Ugly Laws” allowed the police to arrest and jail people with visible disabilities for being seen in public. People charged with ugly laws were either charged a fine or held in jail. ‘Ugly Laws’ were a part of the late 19th century Victorian Era poor laws.

📍 In 1976, Hawaii was the last state to lift requirements that a woman take her husband’s last name. If a woman didn’t take her husband’s last name, employers could refuse to issue her payroll and she could be barred from voting.

📍 It wasn’t until 1993 that marital assault became a crime in all 50 states. Historically, intercourse within marriage was regarded as a “right” of spouses. Before 1974, in all fifty U.S. states, men had legal immunity for assaults their wives. Oklahoma and North Carolina were the last to change the law in 1993.

📍 In 1990, the Americans with Disability Act (ADA) – most comprehensive disability rights legislation in U.S. history – was passed. The ADA protected disabled people from employment discrimination. Previously, an employer could refuse to hire someone just because of their disability.

📍 Before 1993, women weren’t allowed to wear pants on the Senate floor. That changed when Sen. Moseley Braun (D-IL), & Sen. Barbara Mikulski (D-MD) wore trousers - shocking the male-dominated Senate. Their fashion statement ultimately led to the dress code being clarified to allow women to wear pants.

📍 Emergency contraception (Plan B) wasn't approved by the FDA until 1998. While many can get emergency contraception at their local drugstore, back then it required a prescription. In 2013, the FDA removed age limits & allowed retailers to stock it directly on the shelf (although many don’t).

📍 In Lawrence v. Texas (2003), the Supreme Court ruled that anti-cohabitation laws were unconstitutional. Sometimes referred to as the ‘'Living in Sin' statute, anti-cohabitation laws criminalize living with a partner if the couple is unmarried. Today, Mississippi still has laws on its books against cohabitation.

#art#feminism#women's history#women's history month#iwd2024#international women's day#herstory#educational#graphics#history#70s#80s#rights#women's rights#human rights

17K notes

·

View notes

Text

Empowering Dreams: Udyogini Yojana Explained

The Udyogini Yojana is a laudable program that aims at providing financial assistance to women to help them start or expand their businesses. Popularly known as the ’Stree Shakti’ scheme this was initiated by the Government of India to empower women entrepreneurs especially those belonging to a low economic background. Now let us take a deeper look into the details of the Udyogini Yojana to tackle the above question and see how effective it is in empowering wannabe women entrepreneurs.,What is Udyogini Yojana?,Objectives of Udyogini Yojana, Udyogini Scheme Details, Eligibility Criteria, Application Proc ess, Benefits of Udyogini Yojana,

#Udyogini Yojana Loan Apply online#Udyogini Yojana#what is Udyogini yojna#benifit of udyogini yojna#Govt scheme#BJP scheme#loan scheme#women loan scheme#business loan#women business loan#govt loan scheme

0 notes