#business brokers india

Explore tagged Tumblr posts

Link

#transaction advisory services#MSME and SME Acquisition#fundraising consultant#business valuation services in india#business brokers india

0 notes

Text

ASC Group provides professional services for facilitating the buy and sell business in India. Be it a sale or an acquisition, our advisory ensures seamless transactions and adheres to all legal requirements. Contact ASC Group for expert advice today!

#Buy Sell Business Consultant#Buy sell business advisory in india#Buy Sell Business Advisory#Buy sell business consultant in india#business broker india#buy and sell business in india

0 notes

Text

Unlock profitable Earnings with Bharti Share Market Broking Franchise🏪

If you are thinking of starting a business in the stock market sector then this is the right place for you. You can start your own business by taking the Bharti Share Market franchise and help us in providing financial literacy to every person in India.

youtube

#share broker franchise in india#share broking franchise#share broking franchise business#share market broker franchise in india#franchise opportunities#franchise business#franchise#Youtube

0 notes

Text

#Insurance License Registration#Insurance Industry#Insurance Broker License#Insurance Business India#Insurance Compliance

0 notes

Text

The Role of Sea Freight in India's Global Trade Landscape

India, with its strategic geographical location and extensive coastline, has long been a pivotal player in global trade. The country's robust sea freight infrastructure has played a crucial role in establishing and maintaining this position. As global trade continues to expand, the importance of sea freight in India's trade landscape cannot be overstated. Companies like Entail Global, a leading sea freight logistics company in India, are instrumental in facilitating efficient and effective maritime trade operations.

The Importance of Sea Freight in Global Trade

Sea freight is the backbone of global trade, accounting for around 80% of the world’s total trade volume. It is the most cost-effective and efficient mode of transporting large quantities of goods over long distances. Sea freight's ability to handle various cargo types, including bulk, break-bulk, and containerized cargo, makes it indispensable for international trade.

India's Strategic Advantage

India’s geographical location provides a natural advantage for sea freight. The country has a vast coastline of over 7,500 kilometers, dotted with major and minor ports. Key ports like Mumbai, Chennai, Kolkata, and Visakhapatnam serve as vital gateways for international trade. These ports are equipped with modern infrastructure to handle the complexities of global shipping and are supported by a network of logistics companies, including international shipping brokers in India.

Role of Sea Freight Logistics Companies

Sea freight logistics companies in India, such as Entail Global, play a critical role in the seamless movement of goods across borders. These companies offer a wide range of services that include cargo handling, transportation, warehousing, and distribution. Their expertise ensures that goods are transported efficiently, safely, and cost-effectively.

1. Efficient Cargo Handling

Handling cargo efficiently is crucial for minimizing delays and ensuring the smooth flow of goods. Sea freight logistics companies are equipped with the necessary technology and skilled workforce to manage cargo operations effectively. This includes loading and unloading goods, container handling, and ensuring that cargo is properly secured for transit.

2. Custom Clearance Services

Cargo and sea freight custom clearance services are essential for the smooth transit of goods through international borders. Sea freight logistics companies handle the complex documentation and regulatory requirements needed for customs clearance. This includes preparing shipping documents, managing import/export duties, and ensuring compliance with international trade regulations.

3. Transportation and Distribution

Beyond the port, sea freight logistics companies manage the transportation and distribution of goods to their final destinations. This involves coordinating with various stakeholders, including shipping lines, port authorities, and inland transport providers. Effective transportation and distribution networks are crucial for maintaining the integrity and timely delivery of goods.

The Role of International Shipping Brokers

International shipping brokers in India are integral to the sea freight logistics ecosystem. These brokers act as intermediaries between shippers and carriers, negotiating the best shipping rates and terms. Their deep understanding of the global shipping market allows them to provide valuable insights and solutions tailored to the specific needs of their clients.

Negotiating Shipping Rates

Shipping brokers leverage their industry knowledge and relationships with carriers to negotiate competitive shipping rates. This helps businesses manage their shipping costs effectively, ensuring that they remain competitive in the global market.

Route Optimization

Choosing the most efficient shipping routes is critical for reducing transit times and costs. Shipping brokers analyze various factors, including shipping schedules, port congestion, and weather conditions, to recommend the best routes for their clients’ shipments.

Risk Management

International shipping involves inherent risks, such as delays, damage, and loss of cargo. Shipping brokers provide risk management services, including insurance solutions and contingency planning, to mitigate these risks and ensure the safe delivery of goods.

Enhancing India's Global Trade Competitiveness

Sea freight plays a vital role in enhancing India's competitiveness in the global trade landscape. The efficiency and cost-effectiveness of sea freight logistics contribute to the overall reduction of supply chain costs. This, in turn, makes Indian goods more competitive in international markets.

1. Export Growth

Sea freight enables Indian exporters to reach global markets efficiently. The ability to transport large volumes of goods at competitive rates helps Indian exporters capitalize on international trade opportunities. This is particularly important for sectors such as textiles, automotive, and agriculture, which rely heavily on export markets.

2. Import Efficiency

Sea freight is equally important for importing goods into India. Efficient sea freight logistics ensure that raw materials and components needed for manufacturing are delivered in a timely manner. This supports the country’s industrial base and helps maintain the smooth functioning of production processes.

Technological Advancements in Sea Freight

Technological advancements are continuously transforming the sea freight industry. Innovations such as automation, digitalization, and blockchain are enhancing the efficiency and transparency of sea freight operations.

1. Automation and Digitalization

Automation and digitalization are streamlining various aspects of sea freight logistics. Automated systems for cargo handling, real-time tracking, and electronic documentation are reducing operational inefficiencies and improving the accuracy of logistics processes.

2. Blockchain Technology

Blockchain technology is being adopted to enhance the transparency and security of sea freight transactions. By providing a tamper-proof ledger of transactions, blockchain helps reduce fraud, streamline customs processes, and improve the traceability of goods throughout the supply chain.

Sustainability in Sea Freight

Sustainability is becoming an increasingly important consideration in the sea freight industry. Efforts are being made to reduce the environmental impact of shipping operations through the adoption of cleaner fuels, energy-efficient technologies, and sustainable practices.

1. Cleaner Fuels

The shipping industry is shifting towards the use of cleaner fuels, such as liquefied natural gas (LNG) and low-sulfur fuel oil, to reduce greenhouse gas emissions. This transition is being driven by international regulations and the growing demand for environmentally friendly shipping solutions.

2. Energy-Efficient Technologies

Energy-efficient technologies, such as advanced hull designs and propulsion systems, are being implemented to reduce the energy consumption of ships. These innovations help lower the carbon footprint of sea freight operations and contribute to the sustainability of the global shipping industry.

Conclusion

The role of sea freight in India's global trade landscape is undeniably significant. As the country continues to expand its trade horizons, the efficiency and effectiveness of its sea freight logistics will be crucial. Companies like Entail Global, a leading sea freight logistics company in India, are at the forefront of this transformation, providing essential services that facilitate the smooth and efficient movement of goods across international borders.

With the support of sea freight logistics companies, international shipping brokers, and technological advancements, India is well-positioned to enhance its competitiveness in the global trade arena. The ongoing focus on sustainability further ensures that the growth of sea freight operations aligns with the global commitment to environmental responsibility.

As we look to the future, the continued development and optimization of sea freight logistics will play a pivotal role in driving India's trade success, supporting economic growth, and fostering stronger connections with global markets.

#Sea freight logistics company in India#Cargo and sea freight custom clearance services#International shipping broker in India#Air freight logistics company in India#International air cargo services in India#International air freight company in India#Customs clearance agent in India#Customs clearance services in India#Import customs clearance India#import and export sector#supply chain solution#international trade#logistics#Business

1 note

·

View note

Text

Investment Broker India

In the dynamic landscape of the Indian financial market, the role of an investment broker is paramount in guiding clients towards informed and strategic investment decisions. As India's economy continues to evolve, the demand for professional investment services has grown exponentially. Investment brokers India play a pivotal role in connecting investors with lucrative opportunities, providing expert advice, and facilitating transactions in a complex financial environment.

0 notes

Text

#financialfreedom#money#businessloan#india#business#entrepreneur#smallbusiness#realestate#house#investment#businessowner#smallbusinessowner#invest#finance#newhome#investor#broker#bank#capital#househunting#credit

0 notes

Text

Why Professional and Detailed Business Valuation is Important for a Corporation?

Corporate shareholders can plan taxes, mergers and acquisitions, purchases, revenues, fundraising, charitable contributions, legal action, and much more with the aid of valuation. The significance of a tax reporting firm is essential for compliance with tax legislation. Benefits to enterprises for tax purposes shall include divestitures, buyouts, changes in shareholdings, capital gains, and more.

1 note

·

View note

Text

youtube

John Oliver just did an episode on body donation, which was very well-reported as usual.

It cites some older news including this amazing series on body brokers by Reuters. Some thoughts on anonymity being an issue:

It is shocking that there is no regulation on what it means to donate your body to "science," although, I'm not sure exactly who can say what that definition is or should be. Also, plenty of people would be happy to have their bodies used in a museum, but you CAN'T, because body donations are shuffled around and anonymized. We wouldn't have any issue with consent if we let people who WANT to be on display be on display.

When I read The Red Market, an amazing book about the trade in human body parts, it really highlighted the issues with mandated anonymity. WHY does a deceased heart, kidney, or blood donor need to be anonymous? That policy has led to horrific abuse of donors all over the world (egregious examples are given in China and India), living and dead, and the recipients have no idea because of that mandate. Mandated anonymity is a shield against regulation, public understanding, and accountability.

I wonder if people believe in anonymizing things because they think that makes the death not real. I've noticed people selling all sorts of human and animal remains with no description as to where they came from, and no one asks, and no one complains. I understand; sometimes some information is lost to time, or a business owner maybe can't take the time to verify the exact origins of things. Fine.

But take for example all these human fetuses for sale on Facebook. I'm not here to argue about that, although it's odd, and I understand both sides of the controversy regarding selling them. When I saw those posts, no one bats an eye.

Then when someone offered to sell her own aborted fetus (context: this person went in for an abortion but was told the fetus was dead anyway) people freaked out. In the same group where they're buying the fetuses of strangers. So...it's only ok to sell body parts when the person whose body it came from did not consent? That's our standard?

The same goes for animal body parts. "Hey, buy these dead rats!" Fine and dandy. "Buy these dead rats! Here is some context about their lives and/or deaths--" Disgusting! How dare you! Those were living things!

Death is disgusting and horrifying and I'm NOT saying that everyone has to think about it all the time or look at dead bodies or even understand it. What I am saying is that when we complain about transparency and enact policies that make it impossible to actually understand who these body parts are coming from, or to track them, that breeds an industry where abuse of consent is hard to avoid.

Lastly, the end of the Last Week Tonight show showed what happens when you let donors be known. It's beautiful.

947 notes

·

View notes

Note

How competitive was the copper market? Would Ea-Nasir have been one of many sellers of broadly equivalent status all trying to make a buck, like how one town might have six building firms all competing for work, or would he have had a near-monopoly like Starbucks? Would he have been a sole trader who brokered deals between mines and consumers, or would he have managed a warehouse with employees and held stock, etc?

Oh SHIT, I never answered this and it got lost in my drafts! I'm so sorry.

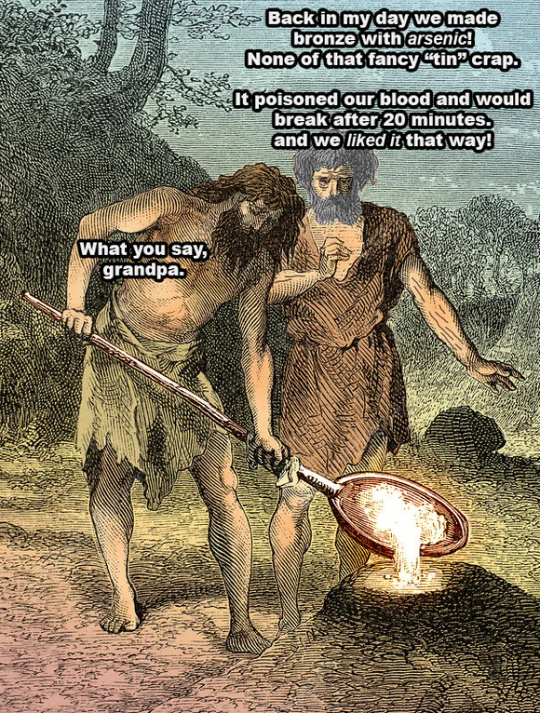

This is a fantastic question! Just to flesh out the picture of the trade in the day: Bronze is an alloy of copper (Cu) with either arsenic (As) or tin (Sn). Arsenic is a common unwanted element in copper deposits, and copper-arsenic-oxide (Cu-As-O) minerals look very similar to plain copper minerals. However, tin (Sn) occurs in very different, rarer, geologic environments, and thus must be sourced from different areas.

Likewise, As-Bronze is less malleable than copper, but not by much; arsenic ions are about the same size. Tin ions form good bronze because they're larger than the copper ions and prevent the metal from freely deforming, so it was prioritized for weapons and tools. Arsenic was used when tin wasn't available.

Ur was known for being one of the best cities for bronzework during the Bronze Age: metalworking services were in high demand, and they were the center of the copper, arsenic, and tin trades. Copper from Oman (or Cyprus, as their industry was developing more at the time), tin from Afghanistan, Southeast Asia, or Turkey, (depending on which archaeologist you talk to), and arsenic from India or Egypt.

So yeah, as a middleman, Ea-Nasir probably had numerous competitors who procured copper from Oman, particularly from the halfway point in Qatar, and then sent it back to Ur. Also referencing the plural translation "-those of the people who travel to Dilmun-", although likely only a few of those merchants were chosen to sell to the temple/government. (But that's speculation. Maybe the temple picked one person a year? Maybe copper tithes meant there was usually supply, and it was only this year during war the temple picked Ea-Nasir to buy from.)

It's also quite possible there were people doing copper business like Ea-Nasir further up the Tigris and Euphrates closer to Cyprus, and there were definitely specialist merchants for arsenic-copper and tin procurement. Once the copper was in the city, his buyers were refiners and metallurgists who made the bronze or copper wares that were purchased/exported throughout the Middle East.

As for employees and stock, I honestly don't know. But from the letters, it sounds like he was stretched rather thin, and he was dealing with buyers' messengers himself. So I wouldn't be surprised (although this is speculation) if it was just him and perhaps a servant/slave of the period to handle things in Ur while he was in Dilmun.

[Image References under the cut]

meme from r/historymemes

Peterson, 2012. Forging Social Networks: Metallurgy and the Politics of Value in Bronze Age Eurasia. The Archaeology of Power and Politics in Eurasia. Cambridge University Press. DOI: https://doi.org/10.1017/CBO9781139061186.018

Content References within my other Ea-Nasir writeups under iamthepulta: #mining history, or #ea nasir

#copper#metallurgy#mining history#trade#bronze age#ea nasir#Technically arsenic bronze would bend afaik but the meme was too funny not to include.

44 notes

·

View notes

Text

Forex Trading For Beginners in India

Forex Trading for Beginners in India introduces newcomers to the dynamic world of currency trading. Covering essential concepts, market insights, and risk management strategies, this guide navigates through the complexities of forex, empowering forex trading in india with foundational knowledge to start their trading journey confidently and responsibly.

#stock broker#forex broker#forex market news#online forex market#forex market#online forex trading#business#forex trading#forexregulationinqury#stock market#forex trading in india

0 notes

Text

ASC Group offers expert services in buying and selling businesses in India. We guide you through legalities, valuation, and negotiations using extensive knowledge of the market. Our license ensures a smooth and efficient business transaction process. Contact ASC Group today for reliable support in business sales and acquisitions.

#Buy Sell Business Advisory#Buy sell business consultant in india#business broker india#buy and sell business in india

0 notes

Text

Start Your Journey in Share Broking with a Profitable Franchise Model🚀

Are you looking for a rewarding business opportunity in the stock market industry? A share broker franchise might be the perfect choice for you. By partnering with established broking firms, like the Bharti share market franchise you can offer clients professional trading services 📈 while benefiting from a strong brand presence and business support. This franchise model provides a ready-made infrastructure, making it easier to dive into the world of stock trading without the complexities of setting it up from scratch. With the growing interest in financial markets, this is an opportunity to build a sustainable business in the fast-growing finance sector 🎯 and Bharti share market franchise in India. Focus on building strong client relationships and staying informed about market trends to ensure long-term success. and 850+ franchise partners a counting all over India 🌎

#share broker franchise in india#share broking franchise#share broking franchise business#share market broker franchise in india#franchise#franchise business

0 notes

Text

In March 2018, an Air India Boeing 787 Dreamliner took off from New Delhi bound for Tel Aviv. This not only marked the first commercial flight between the two capitals, but more importantly, it became the first service to Israel allowed to cross Saudi Arabia’s airspace. This was the outcome of deft diplomacy, and it happened two years before the Abraham Accords were signed, offering the first preview of the “new” Middle East—one anchored around connectivity, wealth, business, and technology instead of ideology, conflict, and confrontation.

Today, the news from the region is more grim than it has been for years. A broader Israel-Iran conflict has taken center stage, Gaza’s civilians are returning to decimated neighborhoods amid a tenuous Israel-Hamas cease-fire agreement, and the collapse of the Assad regime in Syria has exacerbated regional tensions.

The recent killing, by unconfirmed perpetrators, of Zvi Kogan, a 28-year-old Israeli Moldovan rabbi and emissary for Chabad Lubavitch in Abu Dhabi, has been classified as a terrorist attack by Israel. For Israelis, the Kogan murder case challenged a view of Dubai as an oasis of stability and security for everyone, including Jews. This underscores how the Israel-Hamas war has derailed the Israeli Arab rapprochement that characterized the heady days after the Abraham Accords, when Israeli tourists flocked to Dubai as if it were a European capital.

For a country like the United Arab Emirates—which has promoted pluralism and intra-religious harmony by way of inaugurating both a synagogue and Hindu temple on its soil—protecting sociopolitical gains is critical.

But did the very idea of a “new” Middle East—glimpses of which can be seen in the skyscrapers of Dubai and the blueprints of Neom, the futuristic city envisioned by the Saudis—die on Oct. 7, 2023, when Hamas conducted its audacious terror strike against Israel?

For a long time, the meteoric economic rise of countries like the UAE occurred largely because of their own government’s individual policies. However, regional progress today may well demand a rethink in Arab capitals regarding the importance of resolving the Palestine question once and for all.

Many scholars, intellectuals, and politicians believe that confronting aspects of the “old” Middle East that were ignored, like the status of the Palestinian territories and the political rights of Palestinians, is now central to any cohesive forward movement for the Arab world, Israel, and Iran alike. There are also those, such as scholar Marwan Kabalan, who believe that Oct. 7 was partly, if not entirely, designed to derail the progress being made, such as a potential Saudi-Israel normalization and the success of bigger geoeconomic ideas, such as the envisioned India-Middle East-Europe Economic Corridor (IMEC) announced on the sidelines of a G-20 summit in 2023.

The latest war between Israel and Hamas in Gaza, as well as its extension into Lebanon between Israel and Hezbollah, has also rapidly reoriented the regional policies of the Arab states. The chain reaction of events—ranging from the China-brokered detente between Riyadh and Tehran to a rapid disintegration of the Assad family’s control of Syria after more than 50 years of iron-fisted rule—have once again placed the Palestinian cause front and center. The Palestinians have often been used as a crisis of convenience for management of regional politics, including by Arab states. But this is now bound to change with Palestinian self-determination once again finding a global audience.

The Abraham Accords, signed in 2020 by a cluster of Arab states led by the UAE and Israel, sought to normalize political and diplomatic relations and set out a path toward a new regional order. Prosperity, economic progress, developmental integration—in other words, money—is the mantra today.

Regional powers such as the UAE and Saudi Arabia are hedging their bets on allies and pursuing strategic autonomy. In addition to close ties with the United States, they are expanding trade and political outreach with both China and Russia. In July, the air forces of the UAE and China held their second annual joint exercise in the restive Chinese region of Xinjiang, where Beijing has committed itself to systematic and violent repression of its Uyghur Muslim population.

Satellite images that captured these exercises show that the UAE flew its predominantly Western military equipment, including French-made Mirage 2000 fighter aircraft and U.S.-made C-17 Globemaster heavy transport aircraft, deep into Chinese territories. In former U.S. President Joe Biden’s framing of international relations—of an unfolding “democracy verses autocracy” contestation—Arab monarchies have found a sweet spot to thrive in.

The Middle East’s regional disorder has a different and older rulebook to it, where long-standing Western interference in both good and bad faith—led by a wish to reshape regional politics as per the requirements of Washington, London, or Paris—has failed to create outcomes leading to sustainable progress.

The recurring issue of establishing a sovereign Palestinian state is a prime example of the old rulebook’s return.

Iran, as part of its two long-term strategies of supporting an Axis of Resistance along with maintaining a “forward defense” posture, has used the Palestinian cause for its own ends—backing both Hamas and Hezbollah.

Israel’s assassinations of top Hamas and Hezbollah officials in recent months has dealt serious blows to Iran’s regional strategy, but Iran has had some victories away from the battlefield. Its normalization with Saudi Arabia is a merger of the old with the new. For the moment, the Saudis have stepped away from the idea of normalizing ties with Israel, and in return, Saudi oil facilities—which were attacked by Iran’s Houthi allies in Yemen in 2019—have been spared since.

While this does not mean the fundamentals of Saudi-Iran rivalry have been resolved, Riyadh has pushed itself toward neutrality, rather than overt confrontation, to protect its own ongoing economic, political, and ideological diversification.

Amid all these interplays, the return of U.S. President Donald Trump is the proverbial joker in the deck. While it is true that Trump’s own preference for personality over policy may see him push all parties, including Israel, for de-escalation and long-term cease-fires, he is not expected to return U.S. intervention to the era of boots on the ground or even put promotion of democracy at the forefront.

But Trump is also what is known in Persian as a bazaari, meaning one who is always looking for a good deal. The Arabs, Israelis, and Iran alike are cognizant of this trait. In part, this may be a reason why Iran could remain content as a threshold nuclear state to try and box Trump in his own self-aggrandizing narrative as a president who did not start any wars.

The end of the current Israel-Hamas war and a push for a two-state solution is once again emerging as a consensus in the region. The old wisdom of a two-state design has triumphed globally, as it remains the only workable outcome on paper—primarily because no other viable options have been presented for decades.

U.S. Sen. Lindsey Graham, an advisor and close confidant of Trump, has said that the best insurance policy against Hamas is “not an Israeli reoccupation of Gaza but a reform in the Palestinian society” and that only the Arab states can achieve that. But not many leaders within the Arab states seem eager to take up unilateral ownership of such a task, even as they reap the benefits of Israeli military action to dismantle both Hamas and Hezbollah.

Despite more than a year of war, large projects ranging from connectivity to energy security continue to be envisioned. What will be expected from the region is to take ownership of its own regional security, critical for furthering its own economic aims. For this, conflict management, rather than conflict resolution, is the way forward.

An appetite for a new Middle East order may well provide enough motivation to resolve the obstacles created by the resurgence of the old one. The developing cease-fire between Israel and Hamas marks a moment of respite from war and an opening for the Arab states to address Palestinians’ role in the region moving forward. Saudi-Iran normalization can also be a catalyst, and Arab powers, specifically after the Abraham Accords, hold enough political influence across Israel, Iran, and the Palestinian territories to drive a new era of dialogue, compromise, and resolution.

3 notes

·

View notes

Text

CAN I SUCCEED IN BUSINESS AS PER ASTROLOGY, A CASE STUDY

The native wants to know if he would succeed in his business what types of business should he do, as per Vedic astrology of his horoscope.

Based on the given birth details DOB 28 November 2003 at 11:40 pm in Chilakaluripeta, Andhra Pradesh, India and the analysis is done as per KP Vedic astrology padhatti / system.

The plotted horoscope shows simha lagna / leo ascendant with Jupiter in 1st house, ketu in 3rd house, sun in 4th house, mercury n venus in 5th house, moon in 6th house, mars in 7th house, rahu in 9th house and Saturn in 11th house.

The moon is in shravana nakshatra in makar rashi / moon in Capricorn sign and the current ruling mahadasha is rahu.

In order to learn if the native will succeed in business as per his horoscope, one need to study the 7th and 10th cuspal sublord. The study of the current ruling mahadasha will reveal how the dasha lords are going to give their results on the events in the life of the native during their ruling periods.

From the horoscope the 7th cuspal sublord is rahu and its signifying 1,4,5,7,8 and 9th house in the planet level, venus signifying 3,5 and 10th house in the nakshatra level and mercury strongly signifying 2,4 and 11th house as its untenanted in the sublord level.

Venus is in conjunction with mercury signifying 2,4 and 11th house.

Mercury is in conjunction with venus signifying 3,5 and 10th house.

The 10th cuspal sublord is venus and its signifying 3,5 and 10th house in the planet level, ketu signifying 3,5 and 10th house in the nakshatra level and Jupiter signifying 1,5 and 8th house in the sublord level.

Venus is in conjunction with mercury signifying 2,4 and 11th house.

Mercury is in conjunction with venus signifying 3,5 and 10th house.

The current ruling mahadasha is rahu and the analysis of rahu is already done so no need to repeat it again.

From the analysis I conclude that the native will have deep affinity to do business BUT will not get the desired results that he wishes to get from his business.

If the native does not have any other option other than to do only business THEN ONLY HE should business.

Some of the business that gets aligned with the horoscope are teacher, entertainment, writer, publisher, developer, creator, artist, actor, stock broker, finance planner, software developer etc etc are some clues.

#business astrology#astrologer#horoscope posts#horoscope analysis#horoscopes#horoscope readings#horoscope#vedic astrologer#astrology#vedic astrology#vedicastrology#daily horoscope#daily astrology#remedies#indian jyotish#vedic jyotish

4 notes

·

View notes

Photo

On or around 19th February 1792 Arthur Anderson was born at Böd of Gremista, Lerwick.

Having recognised his son was intelligent, and having a great regard for education Arthur was sent to a small elementary school set up by the Rev John Turnbull. However, aged 12, He had to leave school to earn some money. He was employed by Thomas Bolt of Bressay, a fish-curer and general merchant. Arthur was given the job of beachboy, cleaning fish, then spreading them, when salted, on the beach. However, Bolt soon recognised Arthur’s intelligence, and put him to work in his office, where he acquired useful business habits. He also continued to see the Rev Turnbull, who further satisfied his urge to learn.

By the time Arthur was 15, Britain was at war with France, and British navy ships frequently visited Shetland looking for “recruits”. The Press Gang forcibly removed young men to enrol in the Navy, and in 1807 Arthur was frogmarched to a boat waiting to take him to the Navy ship offshore. Fortunately, Bolt’s guarantee that Arthur would join up at 16 saved him, and the following year Arthur found a berth on a visiting warship bound for Portsmouth, and the Royal Navy.

By 1809 he was midshipman on board the 64-gunner HMS Ardent, but soon realised that expenses as an officer required more money than he possessed, so in 1810 he transferred to the smaller HMS Bermuda . There he served five years as captain’s clerk , reading avidly and becoming fluent in Spanish and Portuguese. He left in 1815, one of 3000 Shetlanders who served in the Navy during the Napoleonic Wars.

Seeking work in London, Arthur’s uncle, Peter Ridland, introduced him to Brodie Willcox, a young man starting out as a ship-broker. Employed at first in Willcox’s office as a clerk, the company’s connections with Spain and Portugal meant he soon became invaluable, and in 1822 joined Willcox as a partner in a firm of ship charterers. That same year he married Mary Ann Hill, daughter of a shipowner.

The new firm proved successful, and soon acquired its own ship, later fitted out with guns and used for Portuguese trade. During subsequent civil wars in Spain and Portugal, the company supported the royalists, including shipment of arms and extra vessels – a sound decision, resulting in contracts with both countries to deliver mail, and entitlement to fly a flag embodying the colours of Spain and Portugal.

Despite traditionalists’ misgivings, they began increasingly to use steamships, forming the Peninsular Steam Navigation Company, then in 1840 the Peninsular & Oriental Steam Navigation Company– the beginning of P&O, with Anderson and Willcox directors. While Willcox ran the company in London, Anderson travelled widely, problem-solving. Within ten years, they sailed to India and the Far East, owning property in many countries, and forming an essential part of British trade. This included transportation of opium from India to China – a legal trade at that time, although not universally approved of by the British public.

Having established these regular routes for their ships, Arthur suggested a way to avoid the hazardous journey round the Cape of Good Hope would be to construct a canal between the Mediterranean and the Red Sea, via Suez. However, the British disagreed, and in 1869 France and Egypt collaborated in building the Suez Canal. Meanwhile, Arthur arranged transportation of mail and passengers overland by horse-drawn carriages, with coal for the steamships carried by 4000 camels.

During all this activity, he never forgot his birthplace His philosophy was , “Wealth ought not to be sought for its own sake, but as a means of being useful to others.” It’s a pity the now owners of P & O don’t hold the same beliefs!

In 1836 he founded Shetland’s first newspaper, The Shetland Journal, financed, edited and largely written by himself. He attacked the power wielded by lairds over crofting and fishing, as well as suggesting social improvements, and his Liberal policies proved very popular, including his petition to Parliament protesting against the invidious Corn Laws. Unfortunately, it proved too difficult to produce the paper from London, and after a few years it closed down

In an attempt to break the monopoly of the lairds, and put an end to fishing tenure, he set up the Shetland Fishery Co in 1837on the island of Vaila. He aimed to open up new markets, and provide work for men too poor to have their own boats He introduced new methods, and paid wages. Initially successful, his lease expired in the ‘40s, his health was beginning to fail, and business ceased. However, the lairds’ grip on fishing could be loosened – young men had discovered an independence not available to their parents, and meant to keep it.

In 1839 he was largely responsible for Shetland’s first steamship, enabling speedier mail services. Also, from 1847-1852 he was Liberal MP for Orkney and Shetland.

Nor did he forget the women. Shetland women knew how to knit and spin, to supplement the family income, but usually they “sold” their knitwear to local merchants in exchange for goods, not cash – the invidious Truck System. Arthur encouraged knitting of lace items for a friend’s shop in London, for payment in cash, and in 1837 he presented some fine examples to Queen Victoria. Impressed, she immediately ordered a dozen pairs of lace stockings, the court ladies followed suit and a burgeoning fine lace industry emerged.

Since his own schooldays, Arthur had an interest in the education of those unable to afford private schooling. In 1852 he employed a teacher in the Skerries, then in 1862, despite no local support whatsoever, he built the Anderson Educational Institute in Lerwick, to provide secondary education. It featured a relief sculpture of his parting with Thomas Bolt in 1808, whose advice was to become the school motto – “Dö weel an’ persevere”. This resulted in increased opportunities for Shetland youngsters, and greatly changed the structure of local society. Outwith the isles, he also set up schools in Southampton for the children of P&O employees, while in London he provided the Norwood Working Men’s Institute for social, cultural and trade union purposes.

When his beloved wife died in 1864, he fulfilled her wish of erecting the Widows’ Asylum in Lerwick, (now the Anderson Homes,) intended for the widows of Shetland fishermen and seamen. A separate fund, the Shetland Widows’ Trust, still operates today.

In 1862 Brodie Willcox died, whereupon Arthur became Chairman as well as Managing Director of P&O. However, his poor health finally proved too much, and in February 1868 he too died, aged 76 and still working.

6 notes

·

View notes