#brownfield estate

Explore tagged Tumblr posts

Note

Hi are you based in Poplar? That's where I live! Love your photos of the Brownfield Estate.

Thanks very much. Poplar is very cool. Not only the Brownfield Estate but also Aberfeldy Street, Hale Street and, of course, most of all the Chihuahua.

I'm not quite from Poplar but close- the place where spooked, runaway military horses are eventually stopped!

#london#Poplar#Aberfeldy#chihuahua#street art#urban#urban photography#Brownfield Estate#Balfron Tower#runaway#horses#crazy horses#England#UK

1 note

·

View note

Text

CyberGwen: Midnight Drive

Ship: Miles/Gwen Summary: Gwen and Miles enjoy a quiet drive after the raid in "Jumpoff Point".

=/=

2.1: "Midnight Drive"

The first sweep had taken even longer than expected, and they were both dead tired when they piled into the car.

Over a century ago, the City of New York had rammed massive elevated highways through every part of the growing megacity in an orgy of destruction - a process that had only been halted by the rail-oriented political machine of the Rapid Transit Development Corporation, which instead had carved a dozen new subway lines (and miscellaneous satellite cities) across the metropolitan area, filled in half the East River and a third of the Hudson, and extended Manhattan all the way past Governor’s Island in a bout of real estate megalomania that had yet to abate.

For her part, Gwen was quite happy that the City had overcome opposition and forced a highway through the lush greenery of Latourette Park all those years ago, giving their black government SUV a straight shot to Brooklyn.

They turned onto the big road-and-rail suspension bridge over the Narrows, and Gwen stole glances at her partner, silhouetted… attractively… against the glittering supertalls of the LoLo Manhattan Reclamation.

Miles tugged at his collar. “What?”

“Just admiring the view.” Gwen smiled.

“Oh.” Miles tried to return her smile.

They slid into the monolithic podium of the big RTDC housing estate, and made their way up to Miles’ apartment, perched high above the Urban Renewal Authority brownfields of the South Brooklyn redevelopment project.

True to his word, Miles set up the bed while Gwen enjoyed a luxuriant shower, and she collapsed into it without a thought.

=/=

Author's note: Still grappling with voice and characterization, and figuring out how to weave Miles, Gwen, and the themes and aesthetics of spiderverse into a compelling fic.

#fanfiction#spiderverse fanfic#spiderman into the spiderverse#across the spiderverse#spiderverse fanart#gwen x miles#ghostflower#gwen stacy#spider gwen#miles morales#shipping#miles and gwen#gwiles#gwenmiles#spiderman#miles x gwen#spiderverse fandom

23 notes

·

View notes

Text

🛠️ Brownfield Redevelopment in Detroit

Why Was the Cardinal Health Medical Warehouse Successful Despite Facing Many Challenges?

The Cardinal Health Medical Warehouse stands out as one of Detroit’s most successful brownfield redevelopment projects, despite facing significant hurdles. Unlike failed projects such as the Packard Plant, this redevelopment overcame environmental contamination, legal obstacles, and unexpected construction difficulties to become a key part of Detroit’s healthcare supply chain.

📍 Why Was the Cardinal Health Site Selected?

✅ 1. Prime Location in New Center

The site was strategically located in New Center, an area undergoing revitalization.

Close proximity to Henry Ford Health System (HFHS) made it ideal for a medical distribution center.

Easy access to major roadways and transport routes was essential for efficiently delivering medical supplies to hospitals and clinics.

✅ 2. Clear Demand & Committed End-User

Unlike the Packard Plant, which lacked a confirmed use, this project had a clear tenant from the start.

Henry Ford Health System needed a local medical supply hub to reduce costs and improve efficiency.

Cardinal Health, a major healthcare distributor, agreed to anchor the site, securing its long-term viability.

✅ 3. Brownfield Redevelopment Incentives & Government Support

The project received state and federal incentives, including: ✔️ $1 million grant + $1.5 million loan from MDEQ/Wayne County ✔️ $915,000 loan from Detroit/Wayne County Port Authority ✔️ $1 million Community Redevelopment Grant from MEDC ✔️ $12 million tax increment financing (TIF) package ✔️ 50% real property tax abatement & 100% personal tax abatement

The City of Detroit supported the project as part of its New Center economic revitalization efforts.

✅ 4. Economic Benefits & Job Creation

The redevelopment created 140+ jobs in Detroit, boosting local employment.

The site’s transformation increased property values and attracted more business interest to the area.

It positioned Detroit as a growing hub for healthcare logistics and distribution.

✅ 5. Experienced Developers & Strong Partnerships

KIRCO Development, a real estate firm specializing in industrial and commercial properties, led the project.

KIRCO had the expertise to handle environmental cleanup, land acquisition, and construction challenges.

The collaboration between Cardinal Health, HFHS, KIRCO, and government agencies ensured financial and operational success.

🚧 Major Challenges Cardinal Health Faced

🏗 1. Complex Land Acquisition & Legal Hurdles

The project required acquiring 98 different parcels, many with title defects and unclear ownership histories.

Some land parcels were zoned for different uses (commercial, industrial, residential), complicating approvals.

The City of Detroit’s bankruptcy (2013-2014) further delayed land transfers and legal processes.

💰 2. High Environmental Cleanup Costs

The site was severely contaminated, requiring costly soil remediation.

Developers discovered underground storage tanks, old railroad tracks, and remnants of demolished buildings, adding expenses.

Unexpectedly, excavation crews found basements from demolished homes, further complicating cleanup.

⏳ 3. Unexpected Construction Challenges

During excavation, workers uncovered a labyrinth of underground tunnels that had to be filled in.

Over 17,000 cubic yards of debris were removed before construction could proceed.

A KIRCO executive joked they had “dug up everything but Jimmy Hoffa” due to the surprises underground.

🔑 Key Factors That Made Cardinal Health a Success

🤝 1. Strong Partnerships with Key Stakeholders

Henry Ford Health System (HFHS) partnered with Cardinal Health, ensuring the project had a guaranteed end-user before construction.

KIRCO Development successfully navigated bureaucratic, environmental, and financial hurdles.

💰 2. Extensive Financial Incentives & Support

The project received multiple funding sources, ensuring it could withstand unexpected costs and delays.

Brownfield redevelopment grants and tax incentives made the project financially feasible.

🏆 3. A Clear, Committed End-Use Plan

Unlike the Packard Plant, which lacked a committed tenant, this project had a confirmed purpose from day one.

The facility became a crucial part of Detroit’s healthcare logistics network.

🚀 4. The Willingness to Overcome Obstacles

Developers anticipated challenges but remained flexible, adjusting plans as new issues arose.

The project’s success proved that even the most difficult brownfield sites can be transformed with the right strategy.

📌 Key Takeaways & Lessons for Future Brownfield Redevelopments

🔹 Securing a committed end-user before redevelopment is key to long-term success. 🔹 Brownfield projects need strong public-private partnerships to overcome legal, environmental, and financial challenges. 🔹 Environmental assessments should be done early to anticipate unexpected costs. 🔹 Choosing experienced developers with industrial redevelopment expertise is critical. 🔹 Tax incentives and financial backing make projects more feasible and attractive to investors.

0 notes

Text

Cherokee Investment Partners LLC is a private equity and venture capital firm specializing in the acquisition, remediation, and sustainable redevelopment of brownfields real estate properties.

0 notes

Text

FORMER FARMINGTON SCHOOL TO BECOME SITE FOR 53 TOWNHOMES

Posted by Crain’s Detroit Business | Nick Manesl | August 19, 2024

A long-vacant school building in downtown Farmington will be demolished and replaced by needed "missing-middle" housing.

Demolition of the Maxfield Training Center, just north of Grand River Avenue and east of Farmington Road, began Monday. The redevelopment of the roughly 3-acre site into the $16 million Hillside Townes housing project is being led by Bloomfield Hills-based Robertson Brothers Homes.

Construction is expected to begin later this year and first units are expected to be complete by sometime next year and homes are expected to list in the mid-$300,000 range, according to a news release.

“This empty vacant structure will be replaced with new, vibrant housing that will benefit Farmington residents for generations to come and allow more people to enjoy our energetic and engaging downtown,” Farmington Mayor Joe LaRussa said in the release.

Such infill projects, the redevelopment of dated structures in denser areas, are becoming increasingly common for builders such as Robertson Homes, particularly as large chunks of land have become harder to come by.

“Our Robertson Brothers team is going to make Hillside Townes one of the best places to call home in Metro Detroit,” Robertson President Darian Neubecker said in the release.

The site of the future housing development will be connected to Farmington's central business district via a pedestrian promenade, a project being led by the city. The project received a $1 million brownfield redevelopment grant from the state to help fund site assessments, transportation and disposal of contaminated soil, and demolition work, according to the release.

The project will also result in the reconstruction of Thomas Street, where the existing school building is located, with improved water and utility infrastructure upgrades, as well as walkability and Americans With Disabilities Act improvements

State officials tout the need for missing middle housing — defined in the release as "housing types that fall between single-family homes and mid-rise apartment buildings" — are greatly needed as they can often be more affordable than single-family homes and create more density in neighborhoods.

“Our public engagement work from last year identified housing as the most important issue facing Michigan communities,” Hilary Doe, the state's chief growth officer, said in the release. “People want great places to live and that means being able to offer affordable housing across all income levels if we want to grow our population."

To read about this deal for which Dominion Real Estate Advisors, LLC (DRA) represented the buyer, visit dominionra.com/news.php/752639946046767104

To read this article on Crain's Detroit Business, visit Maxfield Training Center site to become 'middle-market' townhomes | Crain's Detroit Business (crainsdetroit.com)

0 notes

Text

Por: José Sant Roz | Martes, 18/06/2024 1.-Lo vaticinaba en 2018, clara y formalmente el exembajador de EEUU en Venezuela, William Brownfield, que las sanciones a la empresa estatal Petróleos de Venezuela (Pdvsa) acarrearían un impacto en el pueblo entero, “AL CIUDADANO COMÚN Y CORRIENTE”, con lo que estaba plenamente de acuerdo doña María Corina Machado y su banda. “Si vamos a sancionar a Pdvsa tendrá un impacto al pueblo entero, al ciudadano común y corriente de las comunidades de Venezuela. Continue reading Brownfield y MCM, congratulándose por robarnos CITGO… El Inquieto Cobero aplaude desde España!

View On WordPress

0 notes

Text

Greece Investor Visa

The Greece Permanent Residence Permit for Investors application process is overseen by the Aliens and Immigration Department of the Decentralised Administrations, and regulated by Articles 8 and 14 of Law 4332/2015, Law 4251/2014 and Joint Ministerial Decision 68019/2015.

Mobility

Access to Schengen Area

Minimum Capital Outlay

€ 252,510

Minimum Criteria

Choice of Real Estate or an Investment Project

Pre-Requisites

Main applicant must be at least 18 years of age

Application Processing Time

3 Months

Physical Presence

One visit required

About Greece

Greece, officially called the Hellenic Republic, is in the Southern and South-eastern part of Europe with a population of approximately 11 million. Its capital is Athens, and the official language spoken is Greek although English is spoken by many of the locals. Greece adopted the euro as its official currency in 2001, meaning that it was one of the first countries to make use of the euro banknotes and coins.

Greece, a full EU Member State, scores high on all major factors taken into consideration when choosing a new country for relocating, such as quality of life, regulated environment, secure living conditions in urban and rural areas, access to efficient services, residence privileges for family members, freedom to travel, among others. The country presents unique investment opportunities through business development models that promote its competitive advantages and investment potential in various sectors of production. Sectors such as ICT, energy, life sciences, export-oriented manufacturing and logistics are sectors which receive favourable consideration in terms of investment opportunities.

With a new vision for development, Greece aims to attract foreign direct investments in infrastructure, manufacturing, energy, tourism, agriculture and other sectors through flexible and fast administrative procedures, and by promoting its natural resources, well-educated human capital and other unique comparative advantages in the broader South-eastern European region.

Benefits of the Greece Permanent Residence Permit for Investors Programme

The Greece Permanent Residence Permit for Investors Programme (GPRP) was launched in 2013 to attract foreign direct investments to Greece and is the lowest entry point for residency in Europe via a real estate purchase. It is also the only European programme offering permanent residency from day one. The Immigration and Social Integration code, 2014 introduced provisions to facilitate the stay of non-EU nationals, who are granted a five-year residency visa, in return for a real estate investment of EUR 250,000. This visa can be acquired under 90 days and is renewable every five years, if the property investment is retained.

The GPRP also offers an investment route. The investment activity may be implemented through the construction of new facilities (greenfield investments) or business acquisitions, restructuring as well as expansion of current activities (brownfield investments), provided that it has a positive impact on the national economy. Residence permits offered to investors and executives can be renewed every five years, as long as they maintain their position in relation to the investment and the investment continues to be active. Furthermore, up to 10 residence permits may be made available for investors and executives, depending on the scale of the investment.

In Greece, a new economy is in the making. In parallel, investment opportunities are abundant and attractive, in a wide variety of sectors. Greece’s massive reform efforts are opening new investment frontiers that reward both first movers and established players. The next decade is set to see sustained growth in tourism, ICT, energy, environmental sciences, food, beverage and agriculture, logistics, and life sciences. An outward-looking economy that is focused on long-term growth means that investors can look forward to highly favourable returns. As a member of the European Union and the Eurozone, Greece continues to be the economic hub of Southeast Europe, an ideal gateway to the Middle East, Western Europe, and North Africa, and an emerging logistics hub for the entire region.

Commitment expectations

To apply for permanent residence through the GPRP, one of the following commitments is required:

Own real estate property in Greece, either personally or through a 100% owned, legal entity based in Greece or another EU member state. This may also include a plot of land or acreage together with the construction of a building. The total minimum value of the investment must be of EUR 250,000; or

A lease agreement for a minimum of 10 years, for hotel accommodations or furnished tourist residences in integrated tourist resorts, including timeshare agreements as per Law 1652/1986 provided the minimum cost of the lease is EUR 250,000; or

A minimum investment of EUR 250,000 in Greece, either personally or through a 100% owned, legal entity based in Greece or another EU member state. Investment activity may include the construction of new facilities (greenfield investments) or business acquisitions, restructuring or expansion of current activities (brownfield investments). Investment projects must have a positive impact on national development and the economy through factors such as job creation, promotion of domestic resources and vertical integration of domestic production, export orientation, innovation and adoption of new technology;

Further to this, the amount of government-related administrative fees is approximately EUR 2,516 for a single main applicant, and an additional EUR 150 for every adult dependent. Minor dependents are exempt from such fees.

Furthermore, if the real estate route is chosen, one may expect additional fees amounting to approximately 8% of the property’s value to cover typical expenses such as notary fees, new ownership registration, residency permit vouchers, insurance, stamp duty, translations, legal fees for the property transfer and residency permit, and legal checks of the property. An additional 3% Property Transfer Tax or 24% VAT, should also be expected based on various parameters.

This means that the total capital outlay for a single applicant through the real estate route, is approximately EUR 280,166 including the investment, government fees, typical expenses for the acquisition of the real estate and Property Transfer Tax. This indicative amount excludes service providers’ professional fees and any other statutory taxes.

The Application Process

The application process typically commences with the signing of a power of attorney with a service provider to facilitate the liaison with the different stakeholders. This is followed by a visit to the Greek Consulate in your place of residence to apply for a visa to enter Greece (visa type C, or type D where appropriate).

Once you enter Greece, you can apply immediately for a residence permit, after all the procedures for the property purchase have been finalized. In any case, you must apply for a residence permit while your visa is valid. Once the application is submitted, the Greek authorities issue a receipt of application, which may be used as a temporary permit prior to residency being granted.

An appointment at the Decentralized Authority will be required, for the purpose of biometric data collection. Approximately, 2 months from submission the authorities are usually able to issue the residence permit.

The Route To Residency

REAL ESTATE — EUR 250,000 invested in real estate anywhere in Greece, either personally or through a sole-ownership legal entity based in Greece or another EU member stateA total of EUR 250,000 lease for a minimum of 10 years for hotel accommodations or furnished tourist residences in integrated tourist resorts

OR

COMMITMENTS EUR 250,000 invested either personally or through a legal entity, provided that the investment project has a positive impact on national development and the economy.OR

ADMINISTRATIVE FEES — EUR 2,000 for residence permit for 5 years for a single main applicant, and EUR 150 for adult dependents. Dependents under 18 years of age are exempt.EUR 500 for the electronic residence permit. and EUR 16 for a single document permit.

If the investment is in real estate, an approximate 8% should be expected, additional to the value of the property. Furthermore, an additional 3% or 24% may be expected in Property Transfer Tax or V.A.T.

INVESTMENT — EUR 250,000 invested either personally or through a legal entity, provided that the investment project has a positive impact on national development and the economy.

CONTRIBUTION — This programme does not require applicants to make a financial contribution to the state.

And Also — There are restrictions on properties located in border regions. Investors affected by the restrictions above, can request the lifting of the ban for the border regions, along with their application, which should clearly state the intended use for the property. If the investment is in a project that has a positive impact on national development and the economy, up to 10 residence permits may be made available for investors and executives, depending on the scale of the investment. A Private health insurance policy will be required for the whole length of stay;

Sign up to get Latest Updates

0 notes

Text

Complete Guide to Direct Investment: Everything You Need to Know

Direct investment is a powerful strategy for investors looking to take control of their capital. Unlike portfolio investments (stocks, mutual funds, ETFs), direct investments involve ownership stakes in businesses, assets, or infrastructure. Whether it’s private equity, venture capital, real estate, or Foreign Direct Investment (FDI), understanding this investment method can unlock wealth-building opportunities.

This guide will walk you through direct investment types, risks, strategies, and real-world examples (including insights from the Indian stock market).

What is Direct Investment? Why Should You Care?

Direct Investment vs. Portfolio Investment

Direct investment refers to capital deployment where investors actively own and manage assets. This contrasts with portfolio investments, where investors hold passive ownership in publicly traded securities.

🔹 Example: When Reliance Industries directly acquires a stake in an oil refinery, it is a direct investment. However, if an investor buys Reliance shares on the NSE, it is a portfolio investment.

Why Investors Prefer Direct Investment

✔ Control Over Assets – Investors directly influence decision-making and management. ✔ Higher Returns Potential – Direct investments in startups, private equity, or infrastructure can yield higher profits. ✔ Diversification Beyond Stock Markets – Reduces dependence on volatile public markets.

📊 Research Insight: According to SEBI (Securities and Exchange Board of India), Indian private equity and venture capital investments surged to $70 billion in 2022, highlighting the growing preference for direct investment.

Types of Direct Investment: Which One Suits You?

1. Private Equity: Investing in Established Businesses

Private equity (PE) involves investing in mature, privately held companies for expansion, restructuring, or buyouts.

🔹 Example: Blackstone’s investment in Mphasis, a major IT services firm in India, showcases a successful private equity move.

Common Private Equity Strategies: ✔ Leveraged Buyouts (LBOs) – Acquiring companies using debt financing. ✔ Growth Equity – Investing in fast-growing businesses with proven models. ✔ Distressed Investing – Buying undervalued firms for turnaround profits.

2. Venture Capital: Funding High-Growth Startups

Venture capital (VC) focuses on early-stage, high-growth startups in sectors like technology, fintech, and healthcare.

🔹 Example: Sequoia Capital India invested in Zomato, Byju’s, and CRED, fueling their exponential growth.

Key VC Investment Metrics: ✔ Total Addressable Market (TAM) – How big is the potential market? ✔ Revenue Growth Rate – How fast is the startup scaling? ✔ Exit Strategy – IPO or acquisition potential?

3. Real Estate & Infrastructure Investment

Direct investment in real estate and infrastructure can generate passive income and capital appreciation.

🔹 Example: Brookfield Asset Management invested $2 billion in India’s commercial real estate, betting on the growing demand for office spaces.

✔ Commercial Properties – Malls, office spaces, hotels. ✔ Infrastructure Projects – Roads, airports, power plants. ✔ REITs & Fractional Ownership – Alternative direct investment vehicles.

4. Foreign Direct Investment (FDI): International Business Expansion

FDI occurs when a company or investor acquires significant control in a foreign company or asset.

🔹 Example: Amazon India invested over $6.5 billion in its logistics, warehousing, and data centers to strengthen its market presence.

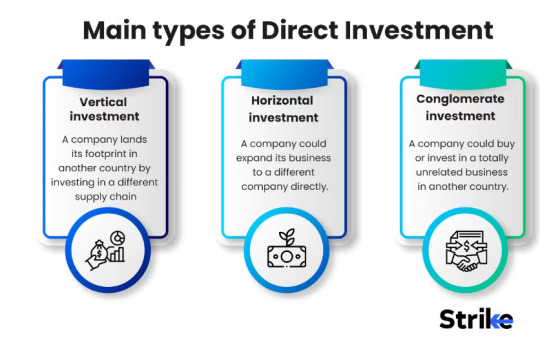

✔ Greenfield Investment – Establishing new facilities, factories, offices. ✔ Brownfield Investment – Acquiring existing businesses/assets abroad.

📊 FDI Trends in India: According to the Department for Promotion of Industry and Internal Trade (DPIIT), India attracted $84 billion in FDI inflows in 2022, led by sectors like technology, e-commerce, and manufacturing.

How to Start Direct Investing: A Step-by-Step Guide

Step 1: Identify the Right Investment Opportunity

✔ Research high-growth sectors like fintech, renewable energy, AI-driven startups. ✔ Analyze financial statements, business models, and growth projections.

🔹 Example: Strike.money, a charting tool, helps investors track real-time market data and stock trends to make informed investment decisions.

Step 2: Conduct Due Diligence

✔ Financial Analysis – Revenue, profitability, debt levels. ✔ Legal & Regulatory Check – Company registration, compliance issues. ✔ Management Team Assessment – Experience, vision, track record.

📌 Case Study: Investors who skipped due diligence in Yes Bank’s debt crisis faced massive losses when the bank’s NPAs surged, forcing RBI intervention.

Step 3: Structure the Investment Deal

✔ Equity vs. Debt Investment – Decide whether to take an ownership stake or provide debt financing. ✔ Exit Strategy – Plan for IPOs, acquisitions, or secondary market sales.

🔹 Example: Early investors in Nykaa exited with 1000%+ returns after its successful IPO in 2021.

Risks & Challenges of Direct Investment: What You Must Watch Out For

✔ Market Volatility & Liquidity Risks – Unlike stocks, private investments lack instant liquidity. ✔ Regulatory & Taxation Barriers – FDI and private equity deals face legal compliance challenges. ✔ Operational & Management Risks – Poor leadership can impact returns.

📌 Case Study: Jet Airways’ bankruptcy highlighted how poor financial planning and mismanagement can destroy direct investments.

Direct Investment vs. Venture Capital vs. Private Equity: Which One is Right for You?

🔹 Example: If you're a long-term investor, investing in private equity (e.g., Reliance Retail expansion) is ideal. However, if you want high-risk, high-reward bets, venture capital (e.g., investing in AI startups) is better.

Future of Direct Investment: Key Trends & Opportunities

✔ Digital-First Investments – Online platforms like Strike.money enable easy access to direct investments and financial insights. ✔ Sustainability & ESG Investments – Investors prioritize renewable energy, EVs, and social impact startups. ✔ Decentralized Finance (DeFi) & Tokenized Assets – Blockchain-based investments are gaining momentum.

📌 Research Insight: According to PwC India, the private market in India is projected to reach $1 trillion by 2028, driven by increased VC and PE investments.

Conclusion: Is Direct Investment Right for You?

Direct investment offers high-reward opportunities but requires thorough research, due diligence, and risk management. Whether you invest in private equity, startups, real estate, or FDI, staying updated with market trends and using tools like Strike.money for data analysis can improve your decision-making.

📌 Key Takeaways: ✔ Diversify Beyond Stocks – Private investments provide higher growth potential. ✔ Understand Market Trends – Follow FDI, VC, and PE reports to spot opportunities. ✔ Use Charting & Analytics Tools – Platforms like Strike.money help track market performance.

🔹 Final Tip: If you’re new to direct investment, start small with angel investing or real estate funds before expanding into larger private market deals. 🚀

💡 What’s Next? Thinking of investing directly in the Indian market? Use Strike.money to analyze stocks, track investment trends, and make data-driven decisions!

0 notes

Text

Harvesting Opportunities: Real Estate Investment and Urban Farming

Introduction:

As cities continue to grow and evolve, the integration of urban farming into Chimpre real estate development presents unique opportunities for investors, developers, and communities alike. Urban farming not only contributes to food security and sustainability but also enhances the livability and resilience of urban environments. In this blog post, we explore the burgeoning trend of urban farming, its benefits, and how real estate investors can capitalize on this growing movement to create value and drive positive change.

The Rise of Urban Farming:

Urban farming, also known as urban agriculture, refers to the practice of cultivating, processing, and distributing food within or near urban areas. From rooftop gardens and vertical farms to community gardens and urban orchards, urban farming takes various forms, each contributing to the local food system and promoting environmental stewardship. As cities grapple with issues such as food insecurity, climate change, and population growth, urban farming emerges as a sustainable solution that not only provides fresh produce but also fosters community engagement, promotes healthy lifestyles, and mitigates environmental impacts.

Benefits of Urban Farming:

Food Security: Urban farming increases access to fresh, nutritious food, particularly in underserved neighborhoods known as food deserts, where residents may lack access to supermarkets or affordable produce.

Environmental Sustainability: By reducing food miles, minimizing carbon emissions associated with transportation, and promoting local food production, urban farming supports sustainable food systems and mitigates the environmental impacts of conventional agriculture.

Community Engagement: Urban farming initiatives bring communities together, fostering social cohesion, promoting health and wellness, and providing opportunities for education, skill-building, and intergenerational exchange.

Economic Development: Urban farming creates employment opportunities, stimulates local economies, and enhances property values by beautifying urban landscapes and repurposing underutilized spaces.

Resilience and Adaptation: Urban farming enhances urban resilience by diversifying food sources, reducing dependence on external supply chains, and increasing local self-sufficiency in the face of disruptions, such as natural disasters or global crises.

Integrating Urban Farming into Real Estate Development:

Chimpre Real estate investors can play a pivotal role in advancing urban farming initiatives by integrating agricultural elements into their development projects:

Mixed-Use Developments: Incorporate rooftop gardens, community plots, or indoor hydroponic systems into mixed-use developments to provide residents with access to fresh produce and green spaces while enhancing the project's sustainability and market appeal.

Brownfield Redevelopment: Transform vacant or contaminated properties into productive urban farms, leveraging remediation efforts to revitalize blighted areas, improve soil health, and create recreational and educational amenities for surrounding communities.

Vertical Farming Facilities: Invest in vertical farming facilities equipped with advanced hydroponic or aeroponic systems, utilizing underutilized vertical space to maximize crop yields, minimize resource inputs, and optimize land use efficiency.

Transit-Oriented Developments: Integrate urban farms and farmers' markets into transit-oriented developments, promoting sustainable transportation options, reducing food miles, and fostering vibrant, walkable neighborhoods with access to fresh, locally grown produce.

Agrihoods: Develop agrihoods, planned communities centered around agricultural production, featuring communal gardens, orchards, and farm-to-table dining options, providing residents with a unique lifestyle experience that prioritizes sustainability, wellness, and connection to nature.

Case Study:

To illustrate the potential of integrating urban farming into Chimpre real estate development, let's consider a hypothetical case study:

Developer XYZ embarks on a mixed-use redevelopment project in an urban neighborhood with limited access to fresh produce. In addition to residential and commercial spaces, the development includes a rooftop greenhouse and community garden, managed in partnership with local urban farming organizations. Residents have the opportunity to participate in gardening workshops, community-supported agriculture programs, and farm-to-table dining experiences, fostering a sense of belonging and promoting healthy lifestyles. The integration of urban farming elements enhances the project's sustainability, marketability, and social impact, attracting environmentally conscious tenants and investors while revitalizing the surrounding neighborhood.

Conclusion:

Urban farming represents a multifaceted opportunity for Chimpre real estate investors to create value, drive innovation, and promote sustainability in urban environments. By embracing urban farming initiatives and integrating agricultural elements into real estate development projects, investors can contribute to food security, environmental stewardship, and community resilience while generating financial returns and fostering vibrant, livable cities for generations to come. As the urban farming movement continues to gain momentum, now is the time for investors to seize the opportunity to harvest the benefits of this growing trend.

0 notes

Text

What Role Do Solar Solutions Play in Urban Development?

As cities expand and populations swell, urban development faces mounting challenges, chief among them is sustainable energy provision. Enter solar solutions—the clean, renewable energy source that’s paving the way for a brighter, greener future in urban landscapes. But what specific role do solar solutions play in the fabric of growing cities, and how are they influencing urban development?

A Beacon for Green Energy

Solar solutions are at the forefront of the green revolution in urban settings. They stand as beacons of innovation, signaling a shift from non-renewable, pollution-heavy energy sources towards cleaner, sustainable alternatives. Solar panels adorning rooftops, solar-powered street lights, and community solar gardens are becoming hallmarks of modern, eco-conscious cities.

Driving Sustainability

In the quest for sustainability, urban areas are increasingly turning to solar solutions to meet their energy needs. Solar power generates electricity without emitting greenhouse gasses, thereby reducing the carbon footprint of cities. This is not only crucial for the environment but also aligns with global commitments to combat climate change.

Energizing Smart Cities

Smart cities integrate information and communication technologies to enhance the quality and performance of urban services. Solar solutions contribute to this vision by providing reliable, decentralized power sources for smart grids, IoT devices, and other digital infrastructure, ensuring that these technologies operate efficiently and sustainably.

Economic Empowerment

The adoption of solar solutions in urban development is also an economic catalyst. The solar industry creates jobs in manufacturing, installation, maintenance, and sales. Additionally, solar power can reduce energy costs for households and businesses, allowing savings to be redirected into the local economy.

Enhancing Resilience

Urban areas are particularly vulnerable to power outages due to natural disasters or system failures. Solar solutions, often paired with energy storage systems, can enhance the resilience of cities by providing backup power during emergencies and reducing reliance on centralized grids.

Aesthetic Integration

Modern solar solutions offer aesthetic flexibility to blend with urban architecture. Solar panels are now designed to integrate seamlessly with building materials, preserving the visual appeal of cityscapes while harnessing clean energy.

Promoting Equity

Solar solutions have the potential to promote energy equity in urban areas. Community solar projects, for example, enable residents who cannot install their own solar panels—whether due to financial constraints or unsuitable living conditions—to benefit from solar energy through shared projects.

Reinventing Unused Spaces

Urban areas often have underutilized spaces such as landfills, brownfields, and rooftops. Solar solutions can transform these spaces into productive clean energy sources, turning idle real estate into power-generating assets for the community.

Regulatory Frameworks and Incentives

Urban development is heavily influenced by zoning laws and building codes. Progressive cities are incorporating solar-friendly policies, offering incentives for solar adoption, and setting ambitious renewable energy targets, all of which reinforce the role of solar solutions in urban planning.

Challenges and Solutions

Despite the clear benefits, integrating solar solutions into urban development is not without challenges. Issues such as installation costs, regulatory barriers, and the aesthetics of solar installations can hinder progress. However, technological advancements, financing options like solar leases and power purchase agreements (PPAs), and supportive policy frameworks are addressing these challenges.

Case Studies: Solar Cities

Cities around the world are showcasing the potential of solar solutions in urban development. For instance, San Francisco’s mandate for solar panels on new buildings, Copenhagen’s goal to become carbon-neutral by 2025 with the help of solar energy, and Dubai’s massive solar park project illustrate the diverse ways in which solar solutions are driving urban development forward.

The Future Is Bright

Looking ahead, the role of solar solutions in urban development is set to grow. Innovations such as transparent solar cells, solar windows, and the integration of solar with electric vehicle charging stations point to a future where solar energy is ubiquitous in urban environments.

Embracing Solar Solutions

For urban developers, city planners, and policymakers, embracing solar solutions is not just about adopting a new technology. It’s about weaving a sustainable narrative into the urban fabric, one that prioritizes the environment, boosts the economy, and fosters resilient communities.

Conclusion

Solar solutions are more than just tools for generating electricity; they are vital components of urban development that enhance sustainability, economic vitality, and resilience. As cities continue to expand and evolve, solar energy stands out as a key player in shaping their future, offering a path to development that is clean, equitable, and sustainable. The role of solar solutions in urban development is not just significant—it is transformative, turning the cities of today into the green metropolises of tomorrow. For a better understanding, contacting us might be a better option. So reach out to us for more information.

0 notes

Text

Environmental Regulations in Albany Commercial Real Estate: Legal Compliance

Albany, New York, is a vibrant hub for commercial real estate, boasting a diverse range of properties, from office buildings and retail spaces to industrial facilities. While the real estate market is booming, it's vital for property owners and investors to be aware of the environmental regulations that govern these assets. Albany's regulatory landscape aims to protect both the environment and public health, and it's essential for those involved in commercial real estate to understand and comply with these regulations. In this article, we'll explore the key environmental regulations that impact commercial real estate in Albany, and the importance of legal compliance.

Understanding Environmental Regulations in Albany

Commercial real estate owners and developers in Albany must navigate a complex web of federal, state, and local environmental regulations. These regulations are designed to address various environmental concerns, including land use, water quality, air quality, hazardous materials, and more. Let's delve into some of the most significant regulations that apply to commercial real estate in Albany:

A. Clean Air Act (CAA)

The Clean Air Act is a federal law aimed at controlling air pollution and improving air quality. Albany, like many other metropolitan areas, has its own air quality standards that must be met. Commercial real estate owners and operators are often subject to regulations that limit emissions from HVAC systems, boilers, and industrial processes. Compliance with these regulations is critical to reducing air pollution and safeguarding public health.

B. Clean Water Act (CWA)

The Clean Water Act addresses water pollution and sets standards for the discharge of pollutants into surface waters. Commercial properties in Albany must comply with local regulations regarding stormwater management and the protection of nearby water bodies, such as the Hudson River. Ensuring that stormwater runoff is properly managed and does not contain contaminants is a fundamental requirement for real estate developers and owners.

C. Hazardous Waste Management

Properties with the potential for hazardous waste generation, such as industrial sites, must adhere to strict hazardous waste management regulations. Compliance includes proper storage, handling, transportation, and disposal of hazardous materials. Violating these regulations can result in severe penalties and harm to the environment.

D. Brownfield Cleanup Program

The Brownfield Cleanup Program in New York aims to encourage the cleanup and redevelopment of contaminated sites, known as brownfields. Commercial real estate developers may encounter brownfield sites and must navigate the program's requirements for assessment, remediation, and site redevelopment. Participation in the program can provide benefits such as liability relief and tax incentives.

E. Wetlands Regulations

Wetlands play a crucial role in maintaining ecological balance and flood control. Albany, like many other regions, has stringent regulations in place to protect wetlands. Commercial real estate projects near wetlands may require permits and undergo environmental impact assessments to ensure that wetland areas are not harmed.

F. Historic Preservation and Environmental Regulations

Albany has a rich historical heritage, and certain commercial properties may fall under historic preservation regulations. When undertaking renovation or development projects on historic properties, it's essential to navigate both environmental and historic preservation regulations to ensure compliance and protect the property's historical integrity.

Importance of Legal Compliance in Commercial Real Estate

Complying with environmental regulations in Albany's commercial real estate sector is not merely about avoiding legal issues; it's about being a responsible and sustainable property owner or developer. Here are some of the key reasons why legal compliance is of paramount importance:

A. Avoiding Legal Penalties

Failure to comply with environmental regulations can result in significant legal penalties. Violations may lead to fines, litigation, or even criminal charges. In addition to the financial burden, legal disputes can be time-consuming and detrimental to a property's reputation.

B. Protecting Public Health and the Environment

Environmental regulations are established to protect public health and the environment. Compliance is an ethical responsibility to ensure that commercial properties do not harm local ecosystems, air quality, or water resources. Non-compliance can lead to pollution, which can have severe consequences for the community.

C. Preventing Delays and Disruptions

Non-compliance with environmental regulations can lead to project delays and disruptions. Regulatory agencies may halt construction or development until compliance is achieved. Delays can be costly, affecting project timelines and budgets.

D. Enhancing Property Value

Compliance with environmental regulations can enhance the value of a commercial property. Properties that are environmentally responsible and in compliance with regulations may be more attractive to buyers and tenants who are increasingly focused on sustainability and responsible real estate practices.

E. Mitigating Liability

Compliance with environmental regulations can help mitigate liability. It demonstrates due diligence in environmental matters and reduces the risk of facing legal claims from affected parties, including neighbors, governmental bodies, or future property owners.

Steps to Ensure Environmental Compliance

Achieving environmental compliance in Albany's commercial real estate market requires a proactive approach. Here are some essential steps to ensure that your property is in compliance with relevant regulations:

A. Conduct Environmental Due Diligence

Before acquiring or developing a commercial property, conduct thorough environmental due diligence. This includes environmental site assessments to identify potential environmental issues, contamination, or regulatory concerns. Understanding these issues upfront is essential for informed decision-making.

B. Consult Environmental Experts

Engage environmental consultants and experts who are well-versed in Albany's regulations. These professionals can provide guidance on compliance requirements, help assess risks, and assist with environmental assessments and remediation when necessary.

C. Secure Necessary Permits and Approvals

For any development or renovation project, secure the required permits and approvals. This may include stormwater permits, air quality permits, wetlands permits, and more. Proper permitting is a fundamental aspect of legal compliance.

D. Implement Best Practices

Incorporate environmental best practices into your property management and development processes. This includes measures to reduce energy consumption, manage stormwater, and minimize hazardous material use. Sustainable practices not only enhance compliance but can also reduce operational costs and improve the property's appeal.

E. Stay Informed and Updated

Environmental regulations can change over time. It's crucial to stay informed about any amendments or new regulations that may affect your commercial property. Regularly consulting with legal counsel or environmental experts can help ensure that you remain in compliance with evolving laws.

Conclusion

Commercial real estate attorney in albany sector, understanding and complying with environmental regulations is a fundamental responsibility for property owners and developers. Legal compliance not only safeguards against penalties and disruptions but also demonstrates a commitment to protecting public health and the environment. By conducting due diligence, consulting with environmental experts, securing necessary permits, implementing best practices, and staying informed, property owners and developers can navigate the regulatory landscape successfully while contributing to a sustainable and responsible real estate market in Albany.

0 notes

Text

Constantly Evolving

The UK and Ireland is a unique retail market and in particular, the UK is one of the leading retail destinations in Europe and it is home to the highest proportion of international retailers. Over the coming pages RLI takes a closer look at the UK and Ireland markets and a selection of retail real estate projects that have recently opened and are due to launch in the years to come.

The role of shopping centres across the UK & Ireland is in an ever-changing flux as consumer behaviour continues to shift post-Covid. What is clear is that there has been an increased desire for a greater integration of leisure & restaurants, residential, healthcare, offices and technological advancements in shopping centres and mixed-use destinations.

Following what has been a relatively challenging start to the year, marginal deflation and improvements to consumer confidence suggest healthier times for retail are imminent, explains Savills in their research article ‘Spotlight: Shopping Centre and High Street – Q1 2023’.

The article moves on to explain that while the Q1 shopping centre investment volume was directly in-line with the five-year average, prices continued to fall as sentiment worsened across the commercial property markets. £369.2M was transacted in the first quarter of 2023 across 19 deals, which is a marked increase in the number of transactions on previous first quarters.

Meanwhile, Cushman & Wakefield’s ‘Irish Investment Marketbeat Q2 2023’ report highlights that investment interest in volumes slowed further in the second quarter of 2023, with only €330M reached across 26 deals compared to €920M across 27 deals in Q1. Despite this, investor interest in the retail sector has improved in recent times thanks to the increase in yield on offer from the sector as well as the resilience in Irish consumer spending.

Projects Across the UK & Ireland

Revised proposals for the final phases of the regeneration of Wapping Wharf, designed to build on the success and special character of Bristol’s popular dockside neighbourhood, have been submitted to Bristol City Council. If approved, the plans for Wapping Wharf North will secure the future of the CARGO independent businesses and create a go-to leisure destination on the city docks. They will also provide much-needed sustainable new homes, shops, restaurants, takeaways and workspaces, together with generous landscaped public spaces and more natural habitat for wildlife to improve biodiversity. The proposals, by developers and owners Umberslade, have been significantly revised following consultation. Significant changes include removing the double-storey rooftop restaurant on the tallest building and one storey on another block and redesigning CARGO and the market hall to make them more like the existing shipping container development.

Developed by Battersea Power Station Development Company, Battersea Power Station opened last year and is at the heart of one of central London’s largest, most visionary new developments, which will see this vast 42-acre (over eight million square feet) former industrial brownfield site become home to a community of homes, shops, bars, restaurants, cafes, offices and over 19 acres of public space. This legendary London landmark and surrounding area has been brought back to life as one of the most exciting and innovative mixed use neighbourhoods in the world – a place for locals, tourists and residents to enjoy a unique blend of shops, bars, restaurants, leisure and entertainment venues, parks and historical spaces. It is a place to shop, eat, drink, live, work and play.

Uniquely located within a renowned London Square addressing Oxford Street, Harley Street and Regent Street this four storey subterranean development will be a world first wellbeing destination incorporating healthcare, retail and commercial space. Cavendish Square London by developer Reef Group is the world’s first mixed-use development specifically for the health and wellbeing industry. Set over four levels below the historic Cavendish Square Gardens, the scheme will total 280,000sq ft with floors of up to 80,000sq ft. Distinct entrances to Harley Street, Regent Street and Oxford Street, offer occupier and customer flexibility; one square, three addresses. Tenant hand over is scheduled for this year.

South London’s Borough Yards has continued its emergence as one of the capital’s leading mixed-use districts with the arrival of 12 new brands. The 140,000sq ft regeneration project – providing new offices, a cinema, shops and restaurants next door to the iconic Borough Market – saw leading beauty, food, fashion and homeware operators open their doors back in June. Borough Yards is one of the most exciting and unique developments in London and the developer MARK is creating a vibrant new London destination to shop, eat, work and play, right next door to the famous culinary crucible, Borough Market. Based in and around a series of restored and reconceived railway arches, Borough Yards is a new chapter for Southwark and the wider Borough Market area. Cheyne Capital Management has provided a £122.8M senior loan to MARK, the pan-European real estate investment manager, to refinance the newly developed, mixed-use scheme. The loan provided was used to refinance the existing lender group following practical completion and partial lease-up.

Bloomsbury Quarter, a project by CCP 5, a fund managed by Tristan Capital Partners, has received resolution to grant from the London Borough of Camden to refurbish and reposition Sicilian Avenue, London’s first historic pedestrianised high street, alongside delivering high-quality, ESG certified office space at Vernon & Sicilian House and 21 Southampton Row. The first part of the refurbishment works at Sicilian Avenue will focus on the west side, delivering 10,000sq ft of retail, while 55,000sq ft of offices is being developed at Vernon & Sicilian House and 21 Southampton Row. Further plans are underway for the remaining space and once complete, Sicilian Avenue will offer 17,000sq ft of prime retail space, extensive amenities and end of journey facilities. The project is targeting a BREEAM Excellent rating. Knight Frank Asset Management is working with Tristan Capital Partners to deliver the repositioning and refurbishment of the site. Alchemy Asset Management is the development manager for Bloomsbury Quarter. Knight Frank and Bluebook are the appointed office agents with P-THREE and CBRE acting as retail agents.

Oldham Council is redeveloping Spindles Town Square, changing it from being solely retail-focused to a place for all the community to use. This means providing better shops, new space for work and an improved leisure and entertainment offer for people of all ages. Work has already started and over the coming months people will begin to see the changes that are afoot as the development works to a summer 2024 completion date. The redeveloped Spindles Town Square will provide a new home for Tommyfield Market, which will relocate to a new split-level market, purpose-built in and around the former TJ Hughes unit. It will boost the centre’s shopping, leisure and entertainment offer, as well as being better for traders who can benefit from increased footfall, access to the adjacent car parks and nearby public transport stops. Part of the transformation will see an improved retail space that will offer shoppers a better experience. The new retail area will make it easier and more enjoyable to visit, with shops in one main area instead of scattered throughout the centre.

Set to complete next year by joint developers Drum Property Group and Stamford Property Investments, Candleriggs Square is a brand-new development in the heart of Glasgow’s Merchant City. The £300M transformation of Candleriggs Square in Glasgow’s Merchant City has reached another significant development milestone with the completion of structural work for a 346-apartment build-to-rent (BTR) complex, forward funded by Legal & General. Designed to meet the growing post-lockdown demand for affordable and high-quality city centre rental accommodation in vibrant city centre locations, the 325,000sq ft building will provide 346 apartments together with a range of retail and commercial units at ground floor level creating an attractive and accessible public realm.

Planning approval has been granted for Brookfield Riverside – a major mixed use new town centre, retail, leisure and housing development for the Borough of Broxbourne. The Borough of Broxbourne and Hertfordshire County Council, together with their development partners Sovereign Centros and Peveril Securities, have received planning approval for the €580M Brookfield Riverside development, part of the wider Brookfield masterplan including a new Garden Village, at Cheshunt, Hertfordshire. Seen as a significant future economic generator for the region, the new town centre and garden village will deliver the 335,000sq m mixed-use town centre development and 1,500 residential dwellings including 1,250 homes and 250 apartments, as well as parking for 2,000 vehicles. Brookfield Garden Village will also provide a primary school, neighbourhood centre and other council facilities needed in the area. The development will also see improved road and junction infrastructure, with new cycling and pedestrian links to connect to Cheshunt and the works are expected to complete in 2025.

The Elephant and Castle Town Centre redevelopment is one of Central London’s largest regeneration projects. The town centre is being brought forward in three main phases. The first phase of development at Elephant and Castle opened in 2017 and is managed by Get Living. Elephant Central incorporates 374 homes for rent alongside 278 student studios, across three buildings. Retail and leisure within the first phase includes a supermarket, a gym, a nursery and independent retailers. The second phase is currently underway and focuses on the comprehensive redevelopment of the former Elephant and Castle shopping centre into a new town centre that will serve as the hub and focal point of the local community. With Multiplex now appointed, the second phase construction is targeted to complete in 2026. The third and final phase will be delivered on the existing London College of Communication, UAL site following their move into their new campus. This phase will provide a further 498 new homes (333 market rent, 49 affordable rent and 116 social rent) as well as retail space and a 500-person capacity cultural venue.

St Michael’s is an exciting new landmark development at the heart of Manchester’s city centre that sets a new standard in quality and experience. With 186,000sq ft of sustainable human-centred workspace, a five-star international hotel, world-class dining and a vibrant public square, St Michael’s will capture the pioneering spirit of this remarkable city. The St Michael’s project is the shared dream of Relentless Developments, KKR and Salboy. Together, they will deliver a thriving business district of Manchester, offering the best office space, in a sustainable building, that will support the health and wellbeing of its occupiers both now and into the future. It starts with No. 1 St Michael’s that will launch next year. Featuring nine stunning floors of people-centric workspace, it will be complemented by world-class rooftop dining, stunning outdoor spaces and a proper British boozer/the renowned Manchester institution, Abercromby. The second phase will launch in 2027 and bring a new five-star hotel, complete with ultra-luxurious spa, dining and leisure facilities – plus an exciting option to call St Michael’s home.

The Crossings in Dublin, Republic of Ireland is a new vibrant shopping and retail environment to serve the affluent and growing catchment and put The Crossings, Adamstown on the map in terms of modern retailing. The first phase of The Crossings is now open and features 11,700sq m of retail space alongside 279 residential units. When fully complete, The Crossings will comprise of 975 residential units, 18,000sq m of retail space and 3,500sq m of commercial uses to include a civic/library building, creche, enterprise centre and primary care facility. Under development by Quintain who are best known for the transformation of Wembley Park in London and the third largest developer in Ireland, The Crossings is being designed to be a truly mixed-use community with a two-acre village green as the focal point for the area as a place to unwind and dine and to bring people together at events, artisan markets and family fun days. https://www.rli.uk.com/uk-ireland-2/

0 notes

Text

Cherokee Investment Partners LLC is a private equity and venture capital firm specializing in the acquisition, remediation, and sustainable redevelopment of brownfields real estate properties. Cherokee has invested in more than 550 properties worldwide. The firm prefers to invest in properties located in North America and Europe.

0 notes

Text

Constantly Evolving

The UK and Ireland is a unique retail market and in particular, the UK is one of the leading retail destinations in Europe and it is home to the highest proportion of international retailers. Over the coming pages RLI takes a closer look at the UK and Ireland markets and a selection of retail real estate projects that have recently opened and are due to launch in the years to come.

The role of shopping centres across the UK & Ireland is in an ever-changing flux as consumer behaviour continues to shift post-Covid. What is clear is that there has been an increased desire for a greater integration of leisure & restaurants, residential, healthcare, offices and technological advancements in shopping centres and mixed-use destinations.

Following what has been a relatively challenging start to the year, marginal deflation and improvements to consumer confidence suggest healthier times for retail are imminent, explains Savills in their research article ‘Spotlight: Shopping Centre and High Street – Q1 2023’.

The article moves on to explain that while the Q1 shopping centre investment volume was directly in-line with the five-year average, prices continued to fall as sentiment worsened across the commercial property markets. £369.2M was transacted in the first quarter of 2023 across 19 deals, which is a marked increase in the number of transactions on previous first quarters.

Meanwhile, Cushman & Wakefield’s ‘Irish Investment Marketbeat Q2 2023’ report highlights that investment interest in volumes slowed further in the second quarter of 2023, with only €330M reached across 26 deals compared to €920M across 27 deals in Q1. Despite this, investor interest in the retail sector has improved in recent times thanks to the increase in yield on offer from the sector as well as the resilience in Irish consumer spending.

Projects Across the UK & Ireland

Revised proposals for the final phases of the regeneration of Wapping Wharf, designed to build on the success and special character of Bristol’s popular dockside neighbourhood, have been submitted to Bristol City Council. If approved, the plans for Wapping Wharf North will secure the future of the CARGO independent businesses and create a go-to leisure destination on the city docks. They will also provide much-needed sustainable new homes, shops, restaurants, takeaways and workspaces, together with generous landscaped public spaces and more natural habitat for wildlife to improve biodiversity. The proposals, by developers and owners Umberslade, have been significantly revised following consultation. Significant changes include removing the double-storey rooftop restaurant on the tallest building and one storey on another block and redesigning CARGO and the market hall to make them more like the existing shipping container development.

Developed by Battersea Power Station Development Company, Battersea Power Station opened last year and is at the heart of one of central London’s largest, most visionary new developments, which will see this vast 42-acre (over eight million square feet) former industrial brownfield site become home to a community of homes, shops, bars, restaurants, cafes, offices and over 19 acres of public space. This legendary London landmark and surrounding area has been brought back to life as one of the most exciting and innovative mixed use neighbourhoods in the world – a place for locals, tourists and residents to enjoy a unique blend of shops, bars, restaurants, leisure and entertainment venues, parks and historical spaces. It is a place to shop, eat, drink, live, work and play.

Uniquely located within a renowned London Square addressing Oxford Street, Harley Street and Regent Street this four storey subterranean development will be a world first wellbeing destination incorporating healthcare, retail and commercial space. Cavendish Square London by developer Reef Group is the world’s first mixed-use development specifically for the health and wellbeing industry. Set over four levels below the historic Cavendish Square Gardens, the scheme will total 280,000sq ft with floors of up to 80,000sq ft. Distinct entrances to Harley Street, Regent Street and Oxford Street, offer occupier and customer flexibility; one square, three addresses. Tenant hand over is scheduled for this year.

South London’s Borough Yards has continued its emergence as one of the capital’s leading mixed-use districts with the arrival of 12 new brands. The 140,000sq ft regeneration project – providing new offices, a cinema, shops and restaurants next door to the iconic Borough Market – saw leading beauty, food, fashion and homeware operators open their doors back in June. Borough Yards is one of the most exciting and unique developments in London and the developer MARK is creating a vibrant new London destination to shop, eat, work and play, right next door to the famous culinary crucible, Borough Market. Based in and around a series of restored and reconceived railway arches, Borough Yards is a new chapter for Southwark and the wider Borough Market area. Cheyne Capital Management has provided a £122.8M senior loan to MARK, the pan-European real estate investment manager, to refinance the newly developed, mixed-use scheme. The loan provided was used to refinance the existing lender group following practical completion and partial lease-up.

Bloomsbury Quarter, a project by CCP 5, a fund managed by Tristan Capital Partners, has received resolution to grant from the London Borough of Camden to refurbish and reposition Sicilian Avenue, London’s first historic pedestrianised high street, alongside delivering high-quality, ESG certified office space at Vernon & Sicilian House and 21 Southampton Row. The first part of the refurbishment works at Sicilian Avenue will focus on the west side, delivering 10,000sq ft of retail, while 55,000sq ft of offices is being developed at Vernon & Sicilian House and 21 Southampton Row. Further plans are underway for the remaining space and once complete, Sicilian Avenue will offer 17,000sq ft of prime retail space, extensive amenities and end of journey facilities. The project is targeting a BREEAM Excellent rating. Knight Frank Asset Management is working with Tristan Capital Partners to deliver the repositioning and refurbishment of the site. Alchemy Asset Management is the development manager for Bloomsbury Quarter. Knight Frank and Bluebook are the appointed office agents with P-THREE and CBRE acting as retail agents.

Oldham Council is redeveloping Spindles Town Square, changing it from being solely retail-focused to a place for all the community to use. This means providing better shops, new space for work and an improved leisure and entertainment offer for people of all ages. Work has already started and over the coming months people will begin to see the changes that are afoot as the development works to a summer 2024 completion date. The redeveloped Spindles Town Square will provide a new home for Tommyfield Market, which will relocate to a new split-level market, purpose-built in and around the former TJ Hughes unit. It will boost the centre’s shopping, leisure and entertainment offer, as well as being better for traders who can benefit from increased footfall, access to the adjacent car parks and nearby public transport stops. Part of the transformation will see an improved retail space that will offer shoppers a better experience. The new retail area will make it easier and more enjoyable to visit, with shops in one main area instead of scattered throughout the centre.

Set to complete next year by joint developers Drum Property Group and Stamford Property Investments, Candleriggs Square is a brand-new development in the heart of Glasgow’s Merchant City. The £300M transformation of Candleriggs Square in Glasgow’s Merchant City has reached another significant development milestone with the completion of structural work for a 346-apartment build-to-rent (BTR) complex, forward funded by Legal & General. Designed to meet the growing post-lockdown demand for affordable and high-quality city centre rental accommodation in vibrant city centre locations, the 325,000sq ft building will provide 346 apartments together with a range of retail and commercial units at ground floor level creating an attractive and accessible public realm.

Planning approval has been granted for Brookfield Riverside – a major mixed use new town centre, retail, leisure and housing development for the Borough of Broxbourne. The Borough of Broxbourne and Hertfordshire County Council, together with their development partners Sovereign Centros and Peveril Securities, have received planning approval for the €580M Brookfield Riverside development, part of the wider Brookfield masterplan including a new Garden Village, at Cheshunt, Hertfordshire. Seen as a significant future economic generator for the region, the new town centre and garden village will deliver the 335,000sq m mixed-use town centre development and 1,500 residential dwellings including 1,250 homes and 250 apartments, as well as parking for 2,000 vehicles. Brookfield Garden Village will also provide a primary school, neighbourhood centre and other council facilities needed in the area. The development will also see improved road and junction infrastructure, with new cycling and pedestrian links to connect to Cheshunt and the works are expected to complete in 2025.

The Elephant and Castle Town Centre redevelopment is one of Central London’s largest regeneration projects. The town centre is being brought forward in three main phases. The first phase of development at Elephant and Castle opened in 2017 and is managed by Get Living. Elephant Central incorporates 374 homes for rent alongside 278 student studios, across three buildings. Retail and leisure within the first phase includes a supermarket, a gym, a nursery and independent retailers. The second phase is currently underway and focuses on the comprehensive redevelopment of the former Elephant and Castle shopping centre into a new town centre that will serve as the hub and focal point of the local community. With Multiplex now appointed, the second phase construction is targeted to complete in 2026. The third and final phase will be delivered on the existing London College of Communication, UAL site following their move into their new campus. This phase will provide a further 498 new homes (333 market rent, 49 affordable rent and 116 social rent) as well as retail space and a 500-person capacity cultural venue.

St Michael’s is an exciting new landmark development at the heart of Manchester’s city centre that sets a new standard in quality and experience. With 186,000sq ft of sustainable human-centred workspace, a five-star international hotel, world-class dining and a vibrant public square, St Michael’s will capture the pioneering spirit of this remarkable city. The St Michael’s project is the shared dream of Relentless Developments, KKR and Salboy. Together, they will deliver a thriving business district of Manchester, offering the best office space, in a sustainable building, that will support the health and wellbeing of its occupiers both now and into the future. It starts with No. 1 St Michael’s that will launch next year. Featuring nine stunning floors of people-centric workspace, it will be complemented by world-class rooftop dining, stunning outdoor spaces and a proper British boozer/the renowned Manchester institution, Abercromby. The second phase will launch in 2027 and bring a new five-star hotel, complete with ultra-luxurious spa, dining and leisure facilities – plus an exciting option to call St Michael’s home.

The Crossings in Dublin, Republic of Ireland is a new vibrant shopping and retail environment to serve the affluent and growing catchment and put The Crossings, Adamstown on the map in terms of modern retailing. The first phase of The Crossings is now open and features 11,700sq m of retail space alongside 279 residential units. When fully complete, The Crossings will comprise of 975 residential units, 18,000sq m of retail space and 3,500sq m of commercial uses to include a civic/library building, creche, enterprise centre and primary care facility. Under development by Quintain who are best known for the transformation of Wembley Park in London and the third largest developer in Ireland, The Crossings is being designed to be a truly mixed-use community with a two-acre village green as the focal point for the area as a place to unwind and dine and to bring people together at events, artisan markets and family fun days. https://www.rli.uk.com/uk-ireland-2/

0 notes

Text

Constantly Evolving

The UK and Ireland is a unique retail market and in particular, the UK is one of the leading retail destinations in Europe and it is home to the highest proportion of international retailers. Over the coming pages RLI takes a closer look at the UK and Ireland markets and a selection of retail real estate projects that have recently opened and are due to launch in the years to come.

The role of shopping centres across the UK & Ireland is in an ever-changing flux as consumer behaviour continues to shift post-Covid. What is clear is that there has been an increased desire for a greater integration of leisure & restaurants, residential, healthcare, offices and technological advancements in shopping centres and mixed-use destinations.

Following what has been a relatively challenging start to the year, marginal deflation and improvements to consumer confidence suggest healthier times for retail are imminent, explains Savills in their research article ‘Spotlight: Shopping Centre and High Street – Q1 2023’.

The article moves on to explain that while the Q1 shopping centre investment volume was directly in-line with the five-year average, prices continued to fall as sentiment worsened across the commercial property markets. £369.2M was transacted in the first quarter of 2023 across 19 deals, which is a marked increase in the number of transactions on previous first quarters.

Meanwhile, Cushman & Wakefield’s ‘Irish Investment Marketbeat Q2 2023’ report highlights that investment interest in volumes slowed further in the second quarter of 2023, with only €330M reached across 26 deals compared to €920M across 27 deals in Q1. Despite this, investor interest in the retail sector has improved in recent times thanks to the increase in yield on offer from the sector as well as the resilience in Irish consumer spending.

Projects Across the UK & Ireland

Revised proposals for the final phases of the regeneration of Wapping Wharf, designed to build on the success and special character of Bristol’s popular dockside neighbourhood, have been submitted to Bristol City Council. If approved, the plans for Wapping Wharf North will secure the future of the CARGO independent businesses and create a go-to leisure destination on the city docks. They will also provide much-needed sustainable new homes, shops, restaurants, takeaways and workspaces, together with generous landscaped public spaces and more natural habitat for wildlife to improve biodiversity. The proposals, by developers and owners Umberslade, have been significantly revised following consultation. Significant changes include removing the double-storey rooftop restaurant on the tallest building and one storey on another block and redesigning CARGO and the market hall to make them more like the existing shipping container development.

Developed by Battersea Power Station Development Company, Battersea Power Station opened last year and is at the heart of one of central London’s largest, most visionary new developments, which will see this vast 42-acre (over eight million square feet) former industrial brownfield site become home to a community of homes, shops, bars, restaurants, cafes, offices and over 19 acres of public space. This legendary London landmark and surrounding area has been brought back to life as one of the most exciting and innovative mixed use neighbourhoods in the world – a place for locals, tourists and residents to enjoy a unique blend of shops, bars, restaurants, leisure and entertainment venues, parks and historical spaces. It is a place to shop, eat, drink, live, work and play.

Uniquely located within a renowned London Square addressing Oxford Street, Harley Street and Regent Street this four storey subterranean development will be a world first wellbeing destination incorporating healthcare, retail and commercial space. Cavendish Square London by developer Reef Group is the world’s first mixed-use development specifically for the health and wellbeing industry. Set over four levels below the historic Cavendish Square Gardens, the scheme will total 280,000sq ft with floors of up to 80,000sq ft. Distinct entrances to Harley Street, Regent Street and Oxford Street, offer occupier and customer flexibility; one square, three addresses. Tenant hand over is scheduled for this year.