#boutique tax credits

Explore tagged Tumblr posts

Text

Unsecured Small Business Loans in Sydney: Supporting Local Businesses

Sydney is a bustling economic hub filled with diverse businesses, from cafés in Darling Harbour to tech startups in the CBD. However, many small business owners struggle to secure the funding they need to grow. Unsecured small business loans in Australia provide a practical solution by offering financial help without requiring collateral.

This guide explains how unsecured small business loans work, their benefits, and how Australian lenders can help you achieve your goals.

What Are Unsecured Small Business Loans?

Unsecured small business loans in Sydney let you borrow money without offering property or equipment as collateral. They’re perfect for businesses with limited assets but strong financial management.

Key Features:

No Collateral Needed: Your personal or business assets are not at risk.

Quick Approvals: Great for businesses needing urgent funding.

Flexible Repayments: Terms that align with your cash flow.

Why Choose Unsecured Loans in Sydney?

1. Sydney’s Dynamic Business Environment

Sydney’s economy thrives on industries like hospitality, retail, and tech. Businesses often need quick funding to grab opportunities, and unsecured loans provide the support to grow without the usual delays.

2. Custom Solutions

Unlike traditional loans, unsecured loans are tailored to small businesses, covering needs like hiring staff, buying equipment, or launching marketing campaigns.

Types of Unsecured Business Loans

Equipment Financing: For purchasing or upgrading tools and machinery.

Business Expansion Loans: Ideal for opening new branches or renovating premises.

Working Capital Loans: Helps manage cash flow during slow seasons.

Invoice Financing: Get cash upfront for unpaid invoices to improve cash flow.

Benefits of Unsecured Business Loans

Fast Process: Apply online and get approval in as little as 24 hours.

Flexibility: Use funds for a variety of purposes, from advertising to payroll.

No Risk to Assets: No collateral means your assets are safe.

Custom Repayment Plans: Payments are adjusted to your revenue cycle.

How to Apply for an Unsecured Small Business Loan

Assess Your Needs: Determine why you need the loan—equipment, hiring, or cash flow management.

Choose a Lender: Look for a lender with a good reputation, reasonable rates, and flexible terms.

Prepare Documents: Most lenders ask for financial statements, tax returns, and proof of identity.

Submit Your Application: Many lenders offer quick online applications.

Trusted Lenders in Sydney

Prospa: Known for quick approvals and tailored options.

Moula: Offers loans with clear terms and no hidden fees.

OnDeck: Provides various financing options for small businesses.

Capify: Great for short-term funding needs.

Real-Life Success Stories

Café in Parramatta: A loan helped a café owner renovate and add outdoor seating, boosting customer visits.

Tech Startup in Surry Hills: Funding allowed a startup to hire developers and complete a project on time.

Boutique in Newtown: Invoice financing helped a retailer manage cash flow during a slow season.

Eligibility Criteria for Unsecured Loans

Most lenders require:

At least 6 months in business

Annual revenue of $75,000 or more

A fair credit history (not always mandatory)

Challenges of Unsecured Business Loans

Higher Interest Rates: Without collateral, rates can be higher.

Shorter Terms: Loans often need to be repaid quickly.

Smaller Amounts: Loan sizes are usually lower than secured options.

Tips to Secure the Best Loan Terms

Compare Lenders: Check rates and terms before choosing.

Keep a Strong Credit Score: Better credit can get you lower rates.

Prepare a Clear Business Plan: Showing lenders your strategy builds confidence in your repayment ability.

Smart Ways to Use Unsecured Loans

Marketing: Fund campaigns to attract more customers.

Equipment Upgrades: Invest in technology to improve efficiency.

Hiring: Bring in skilled employees to support growth.

Seasonal Needs: Cover expenses during slow months.

Frequently Asked Questions

1. Can startups in Sydney get unsecured loans?Yes, as long as they meet eligibility criteria like revenue requirements.

2. How much can I borrow?Loan amounts range from $5,000 to $500,000, depending on the lender and your needs.

3. Are the loans tax-deductible?Yes, interest payments are usually tax-deductible. Speak to your tax advisor for details.

Learn More: Business Renovation Loans in Australia

Empower Your Business Today

Unsecured small business loans in Sydney provide entrepreneurs with the flexibility and speed they need to grow. By choosing the right lender, you can secure funds for expansion, equipment, or cash flow, helping your business thrive in a competitive market.

Take the next step in your business journey by exploring your loan options today!

0 notes

Text

5 Reasons Why a Tax Preparer is Worth Every Penny

Bidita, a successful entrepreneur with an expanding online boutique and team, found herself buried in paperwork when tax season arrived. Despite her best efforts to manage it on her own by sorting through receipts and tax forms, the complicated tax language only made things harder. In the end, she missed important deductions and ended up with a higher tax bill.

That’s when Bidita decided to work with a certified tax preparer, and it made all the difference. Here’s the 5 reasons why tax preparer is worth a penny:

Customized Tax Approach - A tax expert customizes your filings based on your specific needs, whether you’re a freelancer or a business owner. They help optimize your tax strategy throughout the year.

Exclusive Tax Benefits - Tax preparation experts know about hidden credits and deductions that can save you money, especially ones unique to your industry or situation.

Audit Support & Guidance - During audits, a tax professional can walk you through the steps of the process, handle communication with the IRS and quickly resolve issues as well.

Smart Retirement Planning - A tax expert helps you select tax-saving retirement plans like IRAs and 401(k)s, reducing taxable income and securing your future.

Proactive Tax Planning - Beyond tax season, they help you plan for future years, reduce liabilities, and ensure your business grows.

Knowing this, Bidita confidently hands her taxes to her trusted preparer, maximizing savings and staying compliant. Don’t let taxes overwhelm you. Hire a certified tax preparer today, start saving and have financial peace of mind.

0 notes

Text

$50 Deposit

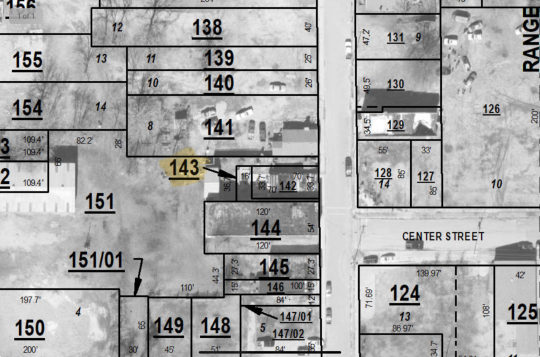

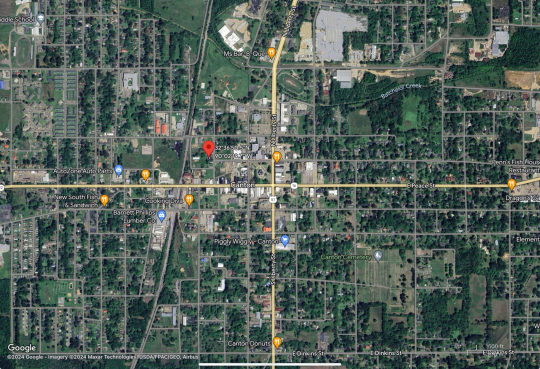

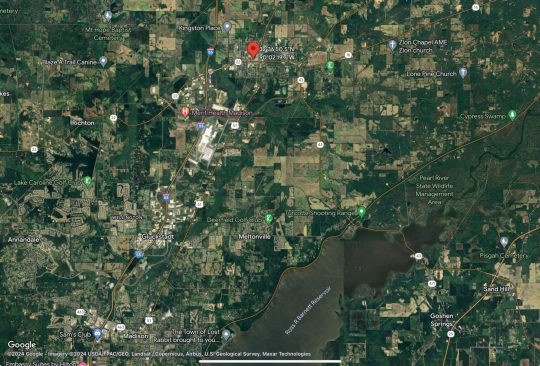

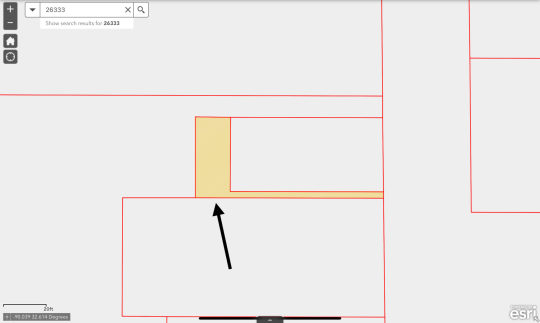

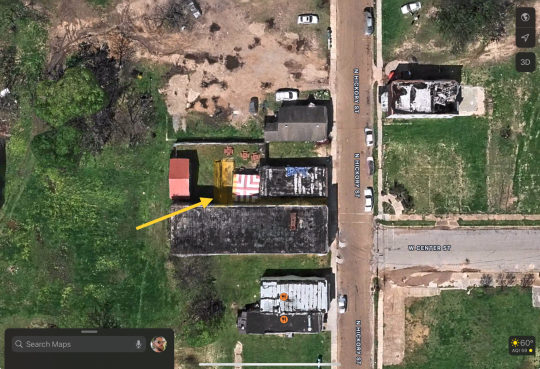

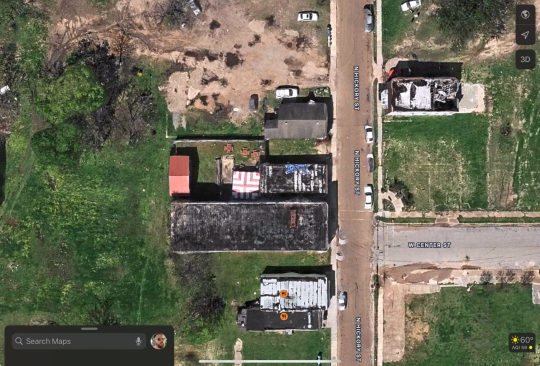

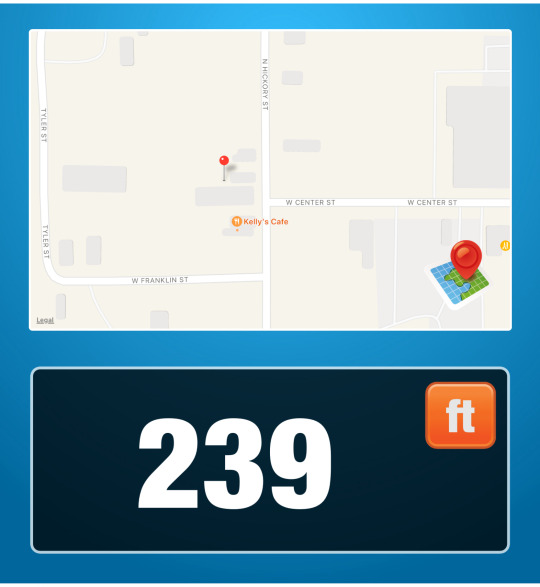

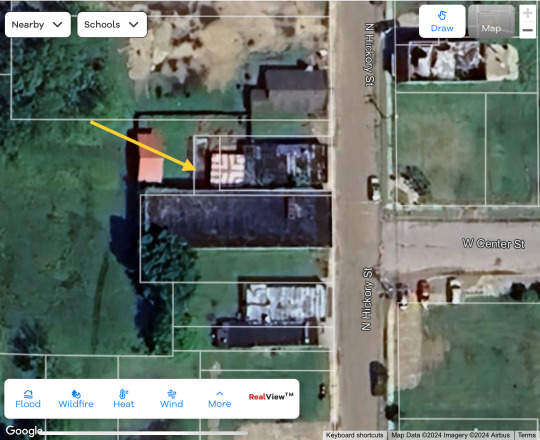

Unique Commercial Opportunity in Downtown Canton, MS - 810 sq.ft.

-$2,999

Calling all Investors and Entrepreneurs! This is your chance to own a piece of prime real estate in the heart of Downtown Canton, Mississippi. Perfect for your portfolio.

Location, Location, Location!

This odd-shaped lot boasts an amazing location with excellent visibility. Situated on Hickory Street, you'll be within walking distance of shops, restaurants, and businesses. Plus, you're just a short drive from the Country Club of Canton, Ross R. Barnett Reservoir, and Downtown Jackson.

Endless Possibilities Await!

While the current footprint is small, the potential is HUGE! With some creativity and city approval, this lot could be the perfect spot for a variety of uses, including:

* Small Business: Boutique shop, coffee cart, bakery, or service provider.

* Storage: Secure your valuables or offer storage solutions to others.

* Living Space (with city approval): Cozy urban dwelling or tiny home.

Flexible Financing Available!

We make owning land easy and affordable. Our seller financing option requires only a $50 down payment followed by monthly payments of $55 until paid in full. Enjoy the benefits of:

* No Credit Check

* No Interest

* No Prepayment Penalty

* No Closing Costs

* No Liens

* No Back Taxes (if paid in full)

Buyer Responsibilities:

* Buyer is responsible for any applicable taxes and maintenance.

Due Diligence Encouraged:

This property is sold "as-is." We recommend conducting your own due diligence to ensure it meets your needs.

Act Now!

This unique opportunity won't last long. Contact us today to learn more and secure your piece of Canton's future!

Landis Homes

* Phone: 619-318-6078

* Email: [email protected]

Easy Payment Methods:

* Apple Pay

* Bitcoin

* Cash App

* PayPal

* Venmo

* Zelle

* Square

* Stripe

Did you know?

Owning a piece of the American Dream is more accessible than you might think. Foreign nationals can purchase property in the U.S. with ease, regardless of their immigration status. Plus, securing a mortgage is achievable even without a U.S. credit history. And the best part? No extra taxes, stamp duties, or hidden restrictions for international buyers. So, start exploring your options and turn your American property dreams into a reality!

0 notes

Text

Bookkeeping for Hospitality: Everything You Need to Know to Streamline Success

In the hospitality industry, effective bookkeeping is essential to maintain financial health and support a thriving business. However, unique challenges arise when tracking finances in such a fast-paced, customer-focused environment. This article will explore bookkeeping for hospitality, common topics every business should understand, challenges, a step-by-step guide, a practical case study, and a conclusion to tie it all together.

Table of Contents

Introduction

Why Bookkeeping is Critical for the Hospitality Industry

Common Bookkeeping Topics Every Hospitality Business Should Know

Challenges of Bookkeeping in Hospitality

Step-by-Step Guide to Effective Hospitality Bookkeeping

Case Study: Efficient Bookkeeping for a Small Boutique Hotel

Conclusion

1. Introduction

Bookkeeping for hospitality businesses is more than just tracking expenses and revenue; it’s about ensuring every part of the financial picture is clear and organized. Proper bookkeeping allows owners to understand their cash flow, minimize waste, and make better decisions for future growth. Whether you're running a restaurant, hotel, or bar, this guide will help you optimize your financial practices and stay ahead in the competitive hospitality industry.

2. Why Bookkeeping is Critical for the Hospitality Industry

The hospitality industry relies heavily on high transaction volumes, fluctuating costs, and variable income streams. These factors make it critical to have an organized system for tracking finances. Proper bookkeeping in hospitality ensures:

Accurate Financial Records: Ensuring that all transactions are accounted for helps with reporting and reduces the risk of errors.

Cash Flow Management: Regular tracking of cash flow prevents cash shortages and keeps operations running smoothly.

Regulatory Compliance: In an industry with high oversight, correct bookkeeping helps comply with tax and payroll regulations.

Informed Decision-Making: Reliable financial records enable owners to make data-driven decisions, adjust budgets, and allocate resources effectively.

3. Common Bookkeeping Topics Every Hospitality Business Should Know

a. Revenue Recognition and Tracking

In hospitality, revenue can come from diverse sources such as bookings, food and beverage sales, and services. Keeping track of these revenue streams individually allows for better budgeting and profitability analysis.

b. Cost of Goods Sold (COGS)

Calculating COGS is essential for understanding the direct costs associated with food, beverages, and other items sold. By keeping COGS in check, businesses can better control pricing strategies and profitability.

c. Inventory Management

Effective inventory management helps prevent overstocking or understocking, both of which can lead to unnecessary expenses. Tracking inventory accurately ensures your cash flow isn’t tied up in excess stock.

d. Labor Costs and Payroll Management

Labor costs are significant in hospitality and can fluctuate depending on the season or demand. Accurately tracking hours, wages, and tips ensures compliance with labor laws and helps keep labor costs manageable.

e. Accounts Payable and Receivable

Maintaining healthy relationships with suppliers and tracking receivables ensures your business has the credit and cash flow needed to sustain operations.

4. Challenges of Bookkeeping in Hospitality

The nature of the hospitality industry presents some unique challenges in bookkeeping. Here are a few:

a. High Transaction Volumes

With high daily transaction volumes, it’s easy to lose track of sales, discounts, and refunds. This volume requires diligent record-keeping to avoid errors.

b. Seasonal Revenue Fluctuations

Hospitality businesses often see seasonal variations, making it harder to predict cash flow accurately. This fluctuation requires a flexible approach to budgeting and forecasting.

c. Variable Labor Costs

Shifts in staffing levels based on demand can create irregularities in payroll expenses. Accurately tracking these fluctuations requires a sophisticated bookkeeping approach.

d. Inventory Management Complexities

Food, beverages, and other perishable items need careful inventory management to avoid waste and loss. Bookkeepers must account for spoilage, shrinkage, and waste accurately.

e. Tax Compliance and Tips Handling

Handling taxes, including sales tax, and correctly recording and distributing tips can be challenging due to strict legal requirements. Failing to manage this accurately can lead to penalties.

5. Step-by-Step Guide to Effective Hospitality Bookkeeping

Step 1: Set Up a Bookkeeping System

Choose software or hire a bookkeeper experienced in the hospitality industry. Many businesses use software like QuickBooks or Xero, which offer tools for tracking revenue, inventory, and payroll.

Step 2: Organize Revenue Streams

Create categories for each revenue source (e.g., food, drinks, room bookings) and track them individually to maintain clarity and accuracy.

Step 3: Manage Inventory Regularly

Schedule regular inventory checks to update stock levels and adjust costs as necessary. Implement inventory software or spreadsheets to stay organized.

Step 4: Track Labor Costs and Payroll Efficiently

Use time-tracking tools to monitor employee hours and integrate payroll software that accounts for varying wages and tip distribution.

Step 5: Stay on Top of Accounts Payable and Receivable

Establish clear payment terms with suppliers and follow up on outstanding invoices. Regularly reviewing these accounts ensures suppliers are paid on time and cash flow remains healthy.

Step 6: Record Financial Transactions Daily

Update your books daily to avoid mistakes and ensure all transactions are recorded. Daily bookkeeping reduces the risk of missing out on small expenses or income.

Step 7: Prepare for Tax Season

Maintain organized records and consult with a tax professional to ensure all deductions and credits are accounted for. This step is crucial in managing tax liabilities accurately.

6. Case Study: Efficient Bookkeeping for a Small Boutique Hotel

Background: Sarah runs a 20-room boutique hotel that also has a small restaurant. Managing the finances was challenging due to the seasonal nature of bookings, fluctuating food costs, and high staff turnover.

Solution: Sarah implemented a cloud-based bookkeeping system that allowed her to integrate revenue streams from the hotel and restaurant. She categorized each expense and income stream separately, making it easier to understand her financials at a glance.

Labor Cost Management: She used payroll software that tracked hours, wages, and tips, ensuring labor costs stayed within budget.

Inventory Optimization: By implementing a weekly inventory check, Sarah reduced food waste by 15% and controlled her COGS more effectively.

Accounts Payable Tracking: She set up automated reminders to keep track of supplier payments, maintaining good relations and stable credit terms.

Outcome: After streamlining her bookkeeping, Sarah saw a significant improvement in cash flow, reduced her operational costs, and found it easier to forecast her budget for peak and off-peak seasons. Her financial records were up-to-date and tax-ready, saving her time and reducing stress.

7. Conclusion

Bookkeeping for hospitality is an essential function that supports the overall health and growth of a business. While challenges like high transaction volumes, fluctuating revenue, and inventory management can make it complex, following a structured approach simplifies the process. By understanding critical topics, using the right tools, and consistently tracking expenses and income, hospitality businesses can achieve financial clarity and stability. Implementing these strategies helps business owners focus more on what they love—serving guests and creating memorable experiences—while maintaining a firm grasp on their finances.

Effective bookkeeping practices ensure that the business operates smoothly, meeting compliance requirements, optimizing costs, and supporting sustainable growth. Whether you're a seasoned restaurateur or a new hotel owner, this guide to bookkeeping for hospitality can serve as a foundation for managing your finances with confidence.

0 notes

Text

Bookkeeping for Hospitality: Everything You Need to Know to Streamline Success

In the hospitality industry, effective bookkeeping is essential to maintain financial health and support a thriving business. However, unique challenges arise when tracking finances in such a fast-paced, customer-focused environment. This article will explore bookkeeping for hospitality, common topics every business should understand, challenges, a step-by-step guide, a practical case study, and a conclusion to tie it all together.

Table of Contents

Introduction

Why Bookkeeping is Critical for the Hospitality Industry

Common Bookkeeping Topics Every Hospitality Business Should Know

Challenges of Bookkeeping in Hospitality

Step-by-Step Guide to Effective Hospitality Bookkeeping

Case Study: Efficient Bookkeeping for a Small Boutique Hotel

Conclusion

1. Introduction

Bookkeeping for hospitality businesses is more than just tracking expenses and revenue; it’s about ensuring every part of the financial picture is clear and organized. Proper bookkeeping allows owners to understand their cash flow, minimize waste, and make better decisions for future growth. Whether you're running a restaurant, hotel, or bar, this guide will help you optimize your financial practices and stay ahead in the competitive hospitality industry.

2. Why Bookkeeping is Critical for the Hospitality Industry

The hospitality industry relies heavily on high transaction volumes, fluctuating costs, and variable income streams. These factors make it critical to have an organized system for tracking finances. Proper bookkeeping in hospitality ensures:

Accurate Financial Records: Ensuring that all transactions are accounted for helps with reporting and reduces the risk of errors.

Cash Flow Management: Regular tracking of cash flow prevents cash shortages and keeps operations running smoothly.

Regulatory Compliance: In an industry with high oversight, correct bookkeeping helps comply with tax and payroll regulations.

Informed Decision-Making: Reliable financial records enable owners to make data-driven decisions, adjust budgets, and allocate resources effectively.

3. Common Bookkeeping Topics Every Hospitality Business Should Know

a. Revenue Recognition and Tracking

In hospitality, revenue can come from diverse sources such as bookings, food and beverage sales, and services. Keeping track of these revenue streams individually allows for better budgeting and profitability analysis.

b. Cost of Goods Sold (COGS)

Calculating COGS is essential for understanding the direct costs associated with food, beverages, and other items sold. By keeping COGS in check, businesses can better control pricing strategies and profitability.

c. Inventory Management

Effective inventory management helps prevent overstocking or understocking, both of which can lead to unnecessary expenses. Tracking inventory accurately ensures your cash flow isn’t tied up in excess stock.

d. Labor Costs and Payroll Management

Labor costs are significant in hospitality and can fluctuate depending on the season or demand. Accurately tracking hours, wages, and tips ensures compliance with labor laws and helps keep labor costs manageable.

e. Accounts Payable and Receivable

Maintaining healthy relationships with suppliers and tracking receivables ensures your business has the credit and cash flow needed to sustain operations.

4. Challenges of Bookkeeping in Hospitality

The nature of the hospitality industry presents some unique challenges in bookkeeping. Here are a few:

a. High Transaction Volumes

With high daily transaction volumes, it’s easy to lose track of sales, discounts, and refunds. This volume requires diligent record-keeping to avoid errors.

b. Seasonal Revenue Fluctuations

Hospitality businesses often see seasonal variations, making it harder to predict cash flow accurately. This fluctuation requires a flexible approach to budgeting and forecasting.

c. Variable Labor Costs

Shifts in staffing levels based on demand can create irregularities in payroll expenses. Accurately tracking these fluctuations requires a sophisticated bookkeeping approach.

d. Inventory Management Complexities

Food, beverages, and other perishable items need careful inventory management to avoid waste and loss. Bookkeepers must account for spoilage, shrinkage, and waste accurately.

e. Tax Compliance and Tips Handling

Handling taxes, including sales tax, and correctly recording and distributing tips can be challenging due to strict legal requirements. Failing to manage this accurately can lead to penalties.

5. Step-by-Step Guide to Effective Hospitality Bookkeeping

Step 1: Set Up a Bookkeeping System

Choose software or hire a bookkeeper experienced in the hospitality industry. Many businesses use software like QuickBooks or Xero, which offer tools for tracking revenue, inventory, and payroll.

Step 2: Organize Revenue Streams

Create categories for each revenue source (e.g., food, drinks, room bookings) and track them individually to maintain clarity and accuracy.

Step 3: Manage Inventory Regularly

Schedule regular inventory checks to update stock levels and adjust costs as necessary. Implement inventory software or spreadsheets to stay organized.

Step 4: Track Labor Costs and Payroll Efficiently

Use time-tracking tools to monitor employee hours and integrate payroll software that accounts for varying wages and tip distribution.

Step 5: Stay on Top of Accounts Payable and Receivable

Establish clear payment terms with suppliers and follow up on outstanding invoices. Regularly reviewing these accounts ensures suppliers are paid on time and cash flow remains healthy.

Step 6: Record Financial Transactions Daily

Update your books daily to avoid mistakes and ensure all transactions are recorded. Daily bookkeeping reduces the risk of missing out on small expenses or income.

Step 7: Prepare for Tax Season

Maintain organized records and consult with a tax professional to ensure all deductions and credits are accounted for. This step is crucial in managing tax liabilities accurately.

6. Case Study: Efficient Bookkeeping for a Small Boutique Hotel

Background: Sarah runs a 20-room boutique hotel that also has a small restaurant. Managing the finances was challenging due to the seasonal nature of bookings, fluctuating food costs, and high staff turnover.

Solution: Sarah implemented a cloud-based bookkeeping system that allowed her to integrate revenue streams from the hotel and restaurant. She categorized each expense and income stream separately, making it easier to understand her financials at a glance.

Labor Cost Management: She used payroll software that tracked hours, wages, and tips, ensuring labor costs stayed within budget.

Inventory Optimization: By implementing a weekly inventory check, Sarah reduced food waste by 15% and controlled her COGS more effectively.

Accounts Payable Tracking: She set up automated reminders to keep track of supplier payments, maintaining good relations and stable credit terms.

Outcome: After streamlining her bookkeeping, Sarah saw a significant improvement in cash flow, reduced her operational costs, and found it easier to forecast her budget for peak and off-peak seasons. Her financial records were up-to-date and tax-ready, saving her time and reducing stress.

7. Conclusion

Bookkeeping for hospitality is an essential function that supports the overall health and growth of a business. While challenges like high transaction volumes, fluctuating revenue, and inventory management can make it complex, following a structured approach simplifies the process. By understanding critical topics, using the right tools, and consistently tracking expenses and income, hospitality businesses can achieve financial clarity and stability. Implementing these strategies helps business owners focus more on what they love—serving guests and creating memorable experiences—while maintaining a firm grasp on their finances.

Effective bookkeeping practices ensure that the business operates smoothly, meeting compliance requirements, optimizing costs, and supporting sustainable growth. Whether you're a seasoned restaurateur or a new hotel owner, this guide to bookkeeping for hospitality can serve as a foundation for managing your finances with confidence.

0 notes

Text

Bookkeeping for Hospitality: Everything You Need to Know to Streamline Success

In the hospitality industry, effective bookkeeping is essential to maintain financial health and support a thriving business. However, unique challenges arise when tracking finances in such a fast-paced, customer-focused environment. This article will explore bookkeeping for hospitality, common topics every business should understand, challenges, a step-by-step guide, a practical case study, and a conclusion to tie it all together.

Table of Contents

Introduction

Why Bookkeeping is Critical for the Hospitality Industry

Common Bookkeeping Topics Every Hospitality Business Should Know

Challenges of Bookkeeping in Hospitality

Step-by-Step Guide to Effective Hospitality Bookkeeping

Case Study: Efficient Bookkeeping for a Small Boutique Hotel

Conclusion

1. Introduction

Bookkeeping for hospitality businesses is more than just tracking expenses and revenue; it’s about ensuring every part of the financial picture is clear and organized. Proper bookkeeping allows owners to understand their cash flow, minimize waste, and make better decisions for future growth. Whether you're running a restaurant, hotel, or bar, this guide will help you optimize your financial practices and stay ahead in the competitive hospitality industry.

2. Why Bookkeeping is Critical for the Hospitality Industry

The hospitality industry relies heavily on high transaction volumes, fluctuating costs, and variable income streams. These factors make it critical to have an organized system for tracking finances. Proper bookkeeping in hospitality ensures:

Accurate Financial Records: Ensuring that all transactions are accounted for helps with reporting and reduces the risk of errors.

Cash Flow Management: Regular tracking of cash flow prevents cash shortages and keeps operations running smoothly.

Regulatory Compliance: In an industry with high oversight, correct bookkeeping helps comply with tax and payroll regulations.

Informed Decision-Making: Reliable financial records enable owners to make data-driven decisions, adjust budgets, and allocate resources effectively.

3. Common Bookkeeping Topics Every Hospitality Business Should Know

a. Revenue Recognition and Tracking

In hospitality, revenue can come from diverse sources such as bookings, food and beverage sales, and services. Keeping track of these revenue streams individually allows for better budgeting and profitability analysis.

b. Cost of Goods Sold (COGS)

Calculating COGS is essential for understanding the direct costs associated with food, beverages, and other items sold. By keeping COGS in check, businesses can better control pricing strategies and profitability.

c. Inventory Management

Effective inventory management helps prevent overstocking or understocking, both of which can lead to unnecessary expenses. Tracking inventory accurately ensures your cash flow isn’t tied up in excess stock.

d. Labor Costs and Payroll Management

Labor costs are significant in hospitality and can fluctuate depending on the season or demand. Accurately tracking hours, wages, and tips ensures compliance with labor laws and helps keep labor costs manageable.

e. Accounts Payable and Receivable

Maintaining healthy relationships with suppliers and tracking receivables ensures your business has the credit and cash flow needed to sustain operations.

4. Challenges of Bookkeeping in Hospitality

The nature of the hospitality industry presents some unique challenges in bookkeeping. Here are a few:

a. High Transaction Volumes

With high daily transaction volumes, it’s easy to lose track of sales, discounts, and refunds. This volume requires diligent record-keeping to avoid errors.

b. Seasonal Revenue Fluctuations

Hospitality businesses often see seasonal variations, making it harder to predict cash flow accurately. This fluctuation requires a flexible approach to budgeting and forecasting.

c. Variable Labor Costs

Shifts in staffing levels based on demand can create irregularities in payroll expenses. Accurately tracking these fluctuations requires a sophisticated bookkeeping approach.

d. Inventory Management Complexities

Food, beverages, and other perishable items need careful inventory management to avoid waste and loss. Bookkeepers must account for spoilage, shrinkage, and waste accurately.

e. Tax Compliance and Tips Handling

Handling taxes, including sales tax, and correctly recording and distributing tips can be challenging due to strict legal requirements. Failing to manage this accurately can lead to penalties.

5. Step-by-Step Guide to Effective Hospitality Bookkeeping

Step 1: Set Up a Bookkeeping System

Choose software or hire a bookkeeper experienced in the hospitality industry. Many businesses use software like QuickBooks or Xero, which offer tools for tracking revenue, inventory, and payroll.

Step 2: Organize Revenue Streams

Create categories for each revenue source (e.g., food, drinks, room bookings) and track them individually to maintain clarity and accuracy.

Step 3: Manage Inventory Regularly

Schedule regular inventory checks to update stock levels and adjust costs as necessary. Implement inventory software or spreadsheets to stay organized.

Step 4: Track Labor Costs and Payroll Efficiently

Use time-tracking tools to monitor employee hours and integrate payroll software that accounts for varying wages and tip distribution.

Step 5: Stay on Top of Accounts Payable and Receivable

Establish clear payment terms with suppliers and follow up on outstanding invoices. Regularly reviewing these accounts ensures suppliers are paid on time and cash flow remains healthy.

Step 6: Record Financial Transactions Daily

Update your books daily to avoid mistakes and ensure all transactions are recorded. Daily bookkeeping reduces the risk of missing out on small expenses or income.

Step 7: Prepare for Tax Season

Maintain organized records and consult with a tax professional to ensure all deductions and credits are accounted for. This step is crucial in managing tax liabilities accurately.

6. Case Study: Efficient Bookkeeping for a Small Boutique Hotel

Background: Sarah runs a 20-room boutique hotel that also has a small restaurant. Managing the finances was challenging due to the seasonal nature of bookings, fluctuating food costs, and high staff turnover.

Solution: Sarah implemented a cloud-based bookkeeping system that allowed her to integrate revenue streams from the hotel and restaurant. She categorized each expense and income stream separately, making it easier to understand her financials at a glance.

Labor Cost Management: She used payroll software that tracked hours, wages, and tips, ensuring labor costs stayed within budget.

Inventory Optimization: By implementing a weekly inventory check, Sarah reduced food waste by 15% and controlled her COGS more effectively.

Accounts Payable Tracking: She set up automated reminders to keep track of supplier payments, maintaining good relations and stable credit terms.

Outcome: After streamlining her bookkeeping, Sarah saw a significant improvement in cash flow, reduced her operational costs, and found it easier to forecast her budget for peak and off-peak seasons. Her financial records were up-to-date and tax-ready, saving her time and reducing stress.

7. Conclusion

Bookkeeping for hospitality is an essential function that supports the overall health and growth of a business. While challenges like high transaction volumes, fluctuating revenue, and inventory management can make it complex, following a structured approach simplifies the process. By understanding critical topics, using the right tools, and consistently tracking expenses and income, hospitality businesses can achieve financial clarity and stability. Implementing these strategies helps business owners focus more on what they love—serving guests and creating memorable experiences—while maintaining a firm grasp on their finances.

Effective bookkeeping practices ensure that the business operates smoothly, meeting compliance requirements, optimizing costs, and supporting sustainable growth. Whether you're a seasoned restaurateur or a new hotel owner, this guide to bookkeeping for hospitality can serve as a foundation for managing your finances with confidence.

0 notes

Text

Bookkeeping for Hospitality: Everything You Need to Know to Streamline Success

In the hospitality industry, effective bookkeeping is essential to maintain financial health and support a thriving business. However, unique challenges arise when tracking finances in such a fast-paced, customer-focused environment. This article will explore bookkeeping for hospitality, common topics every business should understand, challenges, a step-by-step guide, a practical case study, and a conclusion to tie it all together.

Table of Contents

Introduction

Why Bookkeeping is Critical for the Hospitality Industry

Common Bookkeeping Topics Every Hospitality Business Should Know

Challenges of Bookkeeping in Hospitality

Step-by-Step Guide to Effective Hospitality Bookkeeping

Case Study: Efficient Bookkeeping for a Small Boutique Hotel

Conclusion

1. Introduction

Bookkeeping for hospitality businesses is more than just tracking expenses and revenue; it’s about ensuring every part of the financial picture is clear and organized. Proper bookkeeping allows owners to understand their cash flow, minimize waste, and make better decisions for future growth. Whether you're running a restaurant, hotel, or bar, this guide will help you optimize your financial practices and stay ahead in the competitive hospitality industry.

2. Why Bookkeeping is Critical for the Hospitality Industry

The hospitality industry relies heavily on high transaction volumes, fluctuating costs, and variable income streams. These factors make it critical to have an organized system for tracking finances. Proper bookkeeping in hospitality ensures:

Accurate Financial Records: Ensuring that all transactions are accounted for helps with reporting and reduces the risk of errors.

Cash Flow Management: Regular tracking of cash flow prevents cash shortages and keeps operations running smoothly.

Regulatory Compliance: In an industry with high oversight, correct bookkeeping helps comply with tax and payroll regulations.

Informed Decision-Making: Reliable financial records enable owners to make data-driven decisions, adjust budgets, and allocate resources effectively.

3. Common Bookkeeping Topics Every Hospitality Business Should Know

a. Revenue Recognition and Tracking

In hospitality, revenue can come from diverse sources such as bookings, food and beverage sales, and services. Keeping track of these revenue streams individually allows for better budgeting and profitability analysis.

b. Cost of Goods Sold (COGS)

Calculating COGS is essential for understanding the direct costs associated with food, beverages, and other items sold. By keeping COGS in check, businesses can better control pricing strategies and profitability.

c. Inventory Management

Effective inventory management helps prevent overstocking or understocking, both of which can lead to unnecessary expenses. Tracking inventory accurately ensures your cash flow isn’t tied up in excess stock.

d. Labor Costs and Payroll Management

Labor costs are significant in hospitality and can fluctuate depending on the season or demand. Accurately tracking hours, wages, and tips ensures compliance with labor laws and helps keep labor costs manageable.

e. Accounts Payable and Receivable

Maintaining healthy relationships with suppliers and tracking receivables ensures your business has the credit and cash flow needed to sustain operations.

4. Challenges of Bookkeeping in Hospitality

The nature of the hospitality industry presents some unique challenges in bookkeeping. Here are a few:

a. High Transaction Volumes

With high daily transaction volumes, it’s easy to lose track of sales, discounts, and refunds. This volume requires diligent record-keeping to avoid errors.

b. Seasonal Revenue Fluctuations

Hospitality businesses often see seasonal variations, making it harder to predict cash flow accurately. This fluctuation requires a flexible approach to budgeting and forecasting.

c. Variable Labor Costs

Shifts in staffing levels based on demand can create irregularities in payroll expenses. Accurately tracking these fluctuations requires a sophisticated bookkeeping approach.

d. Inventory Management Complexities

Food, beverages, and other perishable items need careful inventory management to avoid waste and loss. Bookkeepers must account for spoilage, shrinkage, and waste accurately.

e. Tax Compliance and Tips Handling

Handling taxes, including sales tax, and correctly recording and distributing tips can be challenging due to strict legal requirements. Failing to manage this accurately can lead to penalties.

5. Step-by-Step Guide to Effective Hospitality Bookkeeping

Step 1: Set Up a Bookkeeping System

Choose software or hire a bookkeeper experienced in the hospitality industry. Many businesses use software like QuickBooks or Xero, which offer tools for tracking revenue, inventory, and payroll.

Step 2: Organize Revenue Streams

Create categories for each revenue source (e.g., food, drinks, room bookings) and track them individually to maintain clarity and accuracy.

Step 3: Manage Inventory Regularly

Schedule regular inventory checks to update stock levels and adjust costs as necessary. Implement inventory software or spreadsheets to stay organized.

Step 4: Track Labor Costs and Payroll Efficiently

Use time-tracking tools to monitor employee hours and integrate payroll software that accounts for varying wages and tip distribution.

Step 5: Stay on Top of Accounts Payable and Receivable

Establish clear payment terms with suppliers and follow up on outstanding invoices. Regularly reviewing these accounts ensures suppliers are paid on time and cash flow remains healthy.

Step 6: Record Financial Transactions Daily

Update your books daily to avoid mistakes and ensure all transactions are recorded. Daily bookkeeping reduces the risk of missing out on small expenses or income.

Step 7: Prepare for Tax Season

Maintain organized records and consult with a tax professional to ensure all deductions and credits are accounted for. This step is crucial in managing tax liabilities accurately.

6. Case Study: Efficient Bookkeeping for a Small Boutique Hotel

Background: Sarah runs a 20-room boutique hotel that also has a small restaurant. Managing the finances was challenging due to the seasonal nature of bookings, fluctuating food costs, and high staff turnover.

Solution: Sarah implemented a cloud-based bookkeeping system that allowed her to integrate revenue streams from the hotel and restaurant. She categorized each expense and income stream separately, making it easier to understand her financials at a glance.

Labor Cost Management: She used payroll software that tracked hours, wages, and tips, ensuring labor costs stayed within budget.

Inventory Optimization: By implementing a weekly inventory check, Sarah reduced food waste by 15% and controlled her COGS more effectively.

Accounts Payable Tracking: She set up automated reminders to keep track of supplier payments, maintaining good relations and stable credit terms.

Outcome: After streamlining her bookkeeping, Sarah saw a significant improvement in cash flow, reduced her operational costs, and found it easier to forecast her budget for peak and off-peak seasons. Her financial records were up-to-date and tax-ready, saving her time and reducing stress.

7. Conclusion

Bookkeeping for hospitality is an essential function that supports the overall health and growth of a business. While challenges like high transaction volumes, fluctuating revenue, and inventory management can make it complex, following a structured approach simplifies the process. By understanding critical topics, using the right tools, and consistently tracking expenses and income, hospitality businesses can achieve financial clarity and stability. Implementing these strategies helps business owners focus more on what they love—serving guests and creating memorable experiences—while maintaining a firm grasp on their finances.

Effective bookkeeping practices ensure that the business operates smoothly, meeting compliance requirements, optimizing costs, and supporting sustainable growth. Whether you're a seasoned restaurateur or a new hotel owner, this guide to bookkeeping for hospitality can serve as a foundation for managing your finances with confidence.

0 notes

Text

Elevate Your Business Efficiency: The Power of POS Systems

In today's fast-paced retail and service environment, managing your business effectively is more crucial than ever. Have you ever felt overwhelmed by inventory counts, customer transactions, and sales reporting? If you’re involved in a furniture POS system, a Brewery POS System, a Dry Cleaners POS System, a Boutique POS System, or a Jewelry POS System, understanding the right tools to streamline these processes can be a game-changer. Let’s explore why investing in a POS system is a vital step for your business!

Understanding POS Systems

A Point of Sale (POS) system is the heart of any retail or service business. It’s not merely a cash register; it’s a comprehensive solution for handling sales, tracking inventory, and managing customer data.

What Does a POS System Do?

A POS system manages all transactions, from sales to inventory management and customer relationships. Here’s a quick breakdown of its primary functions:

Transaction Processing: Accept payments, calculate totals, and issue receipts.

Inventory Management: Keep track of stock levels and sales trends.

Reporting and Analytics: Generate reports that provide insights into sales performance and customer preferences.

Customer Relationship Management: Store customer data and track their buying habits.

Ever thought about how much smoother your operations could run with a dedicated POS system?

Why Your Business Needs a POS System

Speed and Efficiency: A reliable POS system speeds up transactions, reducing waiting times for customers. Imagine having a line of happy customers instead of frustrated ones!

Accurate Inventory Tracking: Keeping tabs on inventory is essential, especially in industries with numerous products. A POS system provides real-time updates, helping prevent stockouts or overstock situations.

Detailed Sales Reports: Want to know which products are your best sellers? A POS system offers detailed sales reports, helping you make data-driven decisions.

Improved Customer Experience: With a POS system, you can provide personalised services by tracking customer purchases and preferences.

Streamlined Operations: From managing staff schedules to integrating with eCommerce platforms, a POS system brings everything under one roof.

How Does a POS System Work?

At its core, a POS system processes transactions through a simple but effective workflow:

Scanning: Products are scanned using barcodes, instantly adding them to the customer’s cart.

Total Calculation: The system calculates the total amount, including taxes and discounts.

Payment Processing: It accepts various payment methods—cash, credit/debit cards, and digital wallets.

Receipt Issuance: Finally, a receipt is printed or emailed, completing the transaction.

This streamlined process helps businesses save time and reduce errors, ultimately enhancing customer satisfaction.

Industry-Specific Benefits of POS Systems

Now that we understand the basics, let’s look at how different types of businesses can benefit from tailored POS systems.

Furniture POS System

For furniture retailers, managing large inventories and custom orders is critical. A dedicated furniture POS system can transform your business by:

Order Management: Efficiently handle special orders and customer requests.

Space Optimization: Keep track of large items and manage showroom space effectively.

Delivery Scheduling: Integrate delivery logistics to ensure timely customer service.

Isn’t it time you simplified your furniture sales?

Brewery POS System

Breweries have unique challenges. A Brewery POS System designed for this industry offers features like:

Tap Management: Track sales by the keg or glass, ensuring accurate inventory levels.

Loyalty Programs: Foster customer loyalty with rewards and promotions tied directly to purchases.

Batch Monitoring: Keep tabs on brewing processes and stock levels in real-time.

Imagine serving your customers quickly while keeping them coming back for more!

Dry Cleaners POS System

In the dry cleaning industry, efficiency is key. A Dry Cleaners POS System can help by:

Order Tracking: Monitor the status of each garment from drop-off to pick-up.

Customer Preferences: Maintain records of special cleaning instructions or requests.

Supply Management: Keep track of cleaning supplies and stock levels effectively.

Think about how much easier managing your operations could be!

Boutique POS System

In a boutique environment, customer experience is paramount. A Boutique POS System enhances your service by:

Mobile Checkout: Enable sales staff to assist customers directly on the sales floor.

Customer Profiles: Track customer preferences and purchase history for personalised service.

Visual Merchandising: Integrate with display systems to enhance the shopping atmosphere.

Wouldn’t it be wonderful to offer a personalised shopping experience that keeps customers returning?

Jewelry POS System

For jewelry retailers, managing high-value items requires precision. A Jewelry POS System provides the necessary tools:

Security Features: Safeguard valuable inventory with advanced security measures.

Custom Design Catalogs: Showcase your designs directly through the POS system.

Repair Management: Track repair orders and manage customer requests seamlessly.

Imagine providing a flawless experience from selection to purchase!

Selecting the Right POS System for Your Business

When choosing a POS system, consider these important factors:

Business Type: Different industries have unique requirements; choose a system that fits your needs.

Budget: Determine how much you’re willing to invest, keeping in mind ongoing costs.

Scalability: Look for a system that can grow with your business, accommodating future needs.

Common Concerns Addressed

How Much Will It Cost?

POS system costs can range widely. Basic systems might start at a few hundred pounds, while more advanced solutions can go up to several thousand. It’s essential to consider ongoing fees for updates and support as well.

Will Training Be Required?

Most modern POS systems are user-friendly. However, providing training for your team ensures everyone knows how to utilise the system effectively.

What Happens If My Internet Goes Down?

Many POS systems can operate offline, but confirm this with your provider to prevent disruptions during service.

Can I Use a POS for Online Sales?

Definitely! Many POS systems integrate seamlessly with eCommerce platforms, allowing for smooth management of both in-store and online sales.

Tips for Getting the Most Out of Your POS System

Regular Updates: Keep your software up to date to access the latest features and security enhancements.

Utilise Reporting Features: Regularly analyse sales reports to identify trends and optimise your inventory.

Encourage Staff Feedback: Regularly ask your team for input on the system to find areas for improvement.

Real-Life Examples of POS Success

Let’s take a look at some businesses that successfully implemented POS systems:

Case Study: A Local Brewery

A local brewery adopted a Brewery POS System to track sales by tap. They introduced a loyalty program that rewarded customers for frequent visits. In just six months, they experienced a 25% increase in repeat business.

Case Study: A Boutique Owner

After switching to a Boutique POS System, a boutique owner began using mobile checkout. Customers loved the convenience of being able to pay while shopping, leading to a 30% increase in sales during peak hours.

Conclusion

Investing in a POS system can revolutionise how you manage your business. It’s about more than just transactions; it’s about enhancing efficiency, improving customer satisfaction, and driving sales. Whether you’re in the furniture industry, running a brewery, managing a dry-cleaning service, operating a boutique, or selling jewellery, there’s a POS system tailored just for your needs.

So, what are you waiting for? Take the plunge into the future of business management. With the right POS system, you’ll streamline your operations, increase efficiency, and focus on what really matters: growing your business.

0 notes

Text

Mastering Your Business with the Right POS System: A Comprehensive Guide

Have you ever felt overwhelmed by the complexities of managing your business? Whether you're in the world of furniture, brewing, dry cleaning, boutique fashion, or selling exquisite jewelry, navigating the daily operations can be a challenge. That's where a Point of Sale (POS) system comes into play. This article will explore the benefits of different POS systems tailored to your business needs, including a furniture POS system, Brewery POS System, Dry Cleaners POS System, Boutique POS System, and Jewelry POS System.

What is a POS System?

A Point of Sale system is more than just a cash register; it’s the heart of your business operations. At its core, a POS system is a combination of hardware and software that helps you process sales transactions, manage inventory, track customer data, and generate reports.

Have you ever wondered how a POS system could simplify your daily tasks?

Imagine handling customer transactions in seconds, tracking your stock in real-time, and generating sales reports without breaking a sweat. It’s like having a personal assistant who knows your business inside and out!

Why Your Business Needs a POS System

Let’s dive into the reasons why investing in a POS system is crucial for your business success:

Speed and Efficiency: Nobody enjoys waiting in long lines. A POS system speeds up transactions, enhancing the customer experience and keeping them happy.

Accurate Inventory Management: Have you ever miscounted stock? With a POS system, you receive real-time inventory updates, reducing the risk of overselling or running out of popular items.

In-Depth Reporting: Curious about which products are your best sellers? A POS system provides detailed sales reports, helping you understand your business's performance and make data-driven decisions.

Enhanced Customer Experience: A good POS system helps you track customer preferences and purchase histories, enabling personalised service that keeps them coming back.

Integration Capabilities: Whether you run an online store or a physical location, a POS system can integrate with various platforms, ensuring a smooth operation across channels.

How Does a POS System Function?

Let’s break it down simply. Here’s how a POS system typically works:

Scanning Items: Products are added to the cart through a barcode scanner or manual entry.

Calculating Totals: The system calculates taxes and discounts automatically.

Processing Payments: Accept multiple payment methods like cash, credit/debit cards, or mobile payments.

Generating Receipts: A receipt is printed or emailed to the customer for their records.

This streamlined process not only saves time but also reduces human error—making your operations smoother and more reliable.

Choosing the Right POS System for Your Business

Now that we understand the basics, let’s explore how to choose the right POS system tailored to your specific business needs.

Furniture POS System

If you operate a furniture store, you know that managing large items and custom orders can be tricky. A furniture POS system is specifically designed to handle these challenges:

Custom Orders: Easily manage special orders and keep track of customer specifications.

Inventory Tracking: Monitor large stock items and ensure optimal stock levels.

Delivery Scheduling: Some POS systems allow you to manage delivery schedules efficiently.

Doesn’t that sound like a fantastic solution for furniture retailers?

Brewery POS System

Running a brewery involves unique needs, especially regarding inventory and customer engagement. A Brewery POS System can help you tackle these aspects:

Draft Management: Monitor multiple taps and track sales by the glass or keg.

Loyalty Programs: Encourage repeat business with integrated loyalty rewards.

Real-Time Inventory Control: Keep tabs on your stock levels for kegs and ingredients.

Imagine serving your customers quickly while keeping them loyal to your brand!

Dry Cleaners POS System

For dry cleaners, managing orders and customer preferences is vital. A dedicated Dry Cleaners POS System can enhance your operations:

Order Tracking: Keep track of customer orders from drop-off to pick-up.

Customer Profiles: Maintain records of special requests and preferences.

Inventory Management: Monitor cleaning supplies effectively to avoid shortages.

Think of the peace of mind you’ll gain with an organised system!

Boutique POS System

In the world of fashion boutiques, the shopping experience is everything. A Boutique POS System can enhance that experience significantly:

Mobile POS: Use handheld devices to assist customers throughout the store.

Detailed Customer Profiles: Build comprehensive profiles to provide personalised service.

Integrated Visual Merchandising: Enhance the customer shopping experience with interactive displays.

Wouldn’t it be great to provide an unforgettable shopping experience?

Jewelry POS System

Selling jewelry demands precision and elegance. A tailored Jewelry POS System can make a world of difference:

Secure Inventory Management: Safeguard high-value items with secure tracking.

Custom Design Showcases: Feature custom designs and collections seamlessly.

Repair Order Management: Efficiently manage repair requests and customer tracking.

Imagine elevating your customer service while keeping your high-value items secure!

Addressing Common Questions About POS Systems

What is the Cost of a POS System?

Costs can vary depending on features and scalability. Basic systems might start at a few hundred pounds, while more comprehensive solutions can range into the thousands. Always consider the ongoing fees for updates and support as well.

Is Training Required?

While many POS systems are user-friendly, a little training can go a long way. Consider dedicating some time to train your team to ensure smooth operations.

What If My Internet Connection Fails?

Most modern POS systems have offline capabilities. However, it's essential to check with your provider to ensure your operations won’t be disrupted during an outage.

Can I Use a POS for Online Sales?

Absolutely! Many POS systems can seamlessly integrate with eCommerce platforms, allowing you to manage both in-store and online sales from one location.

Maximising Your POS System

Here are some tips for getting the most out of your POS system:

Keep Software Updated: Regular updates ensure you benefit from the latest features and security measures.

Utilise Reports: Regularly review sales reports to identify trends and inform your decision-making.

Engage Your Staff: Encourage your team to share feedback on the system to help improve efficiency.

Success Stories

Let’s look at a couple of businesses that transformed their operations with the right POS system:

Case Study: A Local Brewery

A local brewery implemented a Brewery POS System that allowed them to track draft sales accurately. They also introduced a loyalty programme that rewarded customers for repeat visits. Within six months, they reported a 25% increase in repeat business.

Case Study: A Fashion Boutique

A boutique owner switched to a Boutique POS System with mobile checkout capabilities. Customers loved the convenience of being able to pay while browsing. This change led to a 30% increase in sales during peak shopping hours.

Conclusion

Investing in a POS system is a crucial step in enhancing your business operations. It not only streamlines your processes but also elevates the customer experience across various sectors, from furniture to brewing, dry cleaning, boutiques, and jewelry sales.

Why wait any longer? The right POS system could be the key to unlocking your business’s potential. So, take the leap, and transform your operations today!

0 notes

Text

Y'all if there are any local small businesses you love, and you have the ability to buy something from them this month, do your future self a favor and spend some money. Things are ROUGH out here in retail (I'm not sure about the legal addictive substance business) and I'm so tired of scrambling to make payroll and rent and payroll taxes and watching my credit card bills get higher and higher and not paying myself in full for several months.

I am guilty of lamenting when a place closes and realizing I hadn't actually shopped/eaten there in a year. There is so much going on in the world and in each of our communities and so much hardship. But our communities need bookstores and boutiques and pet supply stores and all kinds of brick & mortar businesses that really serve the people who live there.

0 notes

Text

The Ultimate Guide to CPAs and CPA Firms in North Carolina

When it comes to managing your finances, especially in a state as economically diverse as North Carolina, having a trusted Certified Public Accountant (CPA) by your side can make all the difference. Whether you're an individual looking to manage your taxes or a business seeking comprehensive financial advice, CPAs in North Carolina are equipped to help you navigate the complexities of financial management.

Understanding the Role of a CPA in North Carolina

So, what exactly does a CPA do? A Certified Public Accountant (CPA) is a licensed professional who provides a wide range of accounting services, including tax preparation, auditing, and financial planning. In North Carolina, CPAs play a crucial role in helping individuals and businesses manage their finances, comply with state and federal tax laws, and plan for the future.

Hiring a CPA in North Carolina is not just about crunching numbers. It's about getting expert advice on how to optimize your financial situation, whether you're a small business owner, a real estate investor, or an individual looking to make smart financial decisions.

CPA Firms in North Carolina

North Carolina is home to numerous CPA firms that cater to various financial needs. From large firms with a broad range of services to smaller boutique firms specializing in niche areas, the state offers a diverse selection of CPA firms.

When choosing a CPA firm in North Carolina, it's essential to consider factors such as the firm's reputation, the range of services offered, and the expertise of the CPAs. Some of the top CPA firms in North Carolina are known for their personalized service, deep industry knowledge, and commitment to helping clients achieve their financial goals.

Real Estate CPA in North Carolina

Real estate is a significant investment, and managing it effectively requires specialized knowledge. This is where a real estate CPA in North Carolina comes in. These professionals specialize in the unique tax and financial needs of real estate investors, offering services such as property tax management, investment analysis, and compliance with state and federal regulations.

Working with a real estate CPA can help you maximize your investment returns, minimize your tax liabilities, and ensure that your real estate transactions are handled efficiently and legally.

CPA Certification Requirements in NC

Becoming a CPA in North Carolina is a rigorous process that requires a combination of education, experience, and examination. Here’s a brief overview of the CPA certification requirements in NC:

Education: To become a CPA in North Carolina, you must have a bachelor’s degree with at least 150 credit hours of coursework, including specific accounting and business courses.

Experience: Candidates must also complete a certain amount of work experience under the supervision of a licensed CPA. This experience is critical as it provides practical knowledge and skills in real-world accounting situations.

CPA Exam: The Uniform CPA Examination is a challenging test that assesses your knowledge and skills in accounting, auditing, taxation, and business law. Passing this exam is a crucial step in becoming a CPA.

Licensure: After passing the CPA exam, candidates must meet additional state-specific requirements to obtain their CPA license in North Carolina.

Navigating this process can be daunting, but the rewards of becoming a CPA in North Carolina are well worth the effort. CPAs are in high demand across various industries, and the credential opens doors to numerous career opportunities.

Choosing the Right CPA in North Carolina

When it comes to selecting a CPA, it's essential to consider your specific needs and goals. Whether you're looking for tax preparation services, financial planning, or audit services, the right CPA will have the expertise and experience to meet your needs.

Consider factors such as the CPA's specialization, experience in your industry, and the range of services offered. In North Carolina, many CPAs offer free consultations, allowing you to discuss your needs and determine if they are the right fit for you.

Benefits of Working with a CPA Firm

One of the main advantages of working with a CPA firm in North Carolina is the comprehensive range of services offered. CPA firms provide everything from tax preparation and planning to auditing and financial consulting. This all-in-one approach ensures that all aspects of your financial life are managed cohesively and effectively.

In addition, CPA firms often have specialists in various areas of accounting and finance, ensuring that you receive expert advice tailored to your specific needs.

Real Estate CPA Services

Real estate investors in North Carolina can benefit significantly from working with a CPA who specializes in real estate. These CPAs offer services such as:

Property Tax Management: Ensuring that your property taxes are accurately calculated and paid on time.

Investment Analysis: Helping you evaluate potential real estate investments to ensure they align with your financial goals.

Regulatory Compliance: Ensuring that your real estate transactions comply with all state and federal regulations.

Navigating the CPA Certification Process

If you're considering becoming a CPA in North Carolina, it's essential to understand the certification process. From meeting the educational requirements to gaining the necessary work experience and passing the CPA exam, the journey to becoming a CPA is challenging but rewarding.

To succeed, focus on gaining practical experience, staying updated on the latest accounting standards, and preparing thoroughly for the CPA exam. Joining a study group or taking review courses can also increase your chances of passing the exam on your first attempt.

Conclusion

In North Carolina, CPAs play a vital role in ensuring financial accuracy, compliance, and strategic planning. Whether you're looking for a CPA firm in North Carolina, specialized real estate accounting services, or a CPA in Statesville, NC, choosing the right professional is key to achieving your financial goals. By understanding the CPA certification requirements in NC and selecting a CPA who meets your specific needs, you can ensure that your financial affairs are in expert hands. For those in North Carolina, "Masters Tax Financial Planning" stands out as a reliable partner in navigating the complexities of financial management and planning.

0 notes

Text

Find the Best Deals on Shelf Company for Sale

Unlocking Opportunities with Shelf Companies

Are you searching for the perfect shelf company for sale? Whether you're an entrepreneur ready to launch a new venture or an established business seeking to expand, finding the right shelf company can be a game-changer. Shelf companies offer numerous advantages, including established credit histories and a head start on business operations. But how do you find the best deals on a shelf company for sale? Let’s explore some key strategies to help you make an informed decision.

Why Choose a Shelf Company?

Shelf companies, also known as aged corporations, are businesses that have been legally registered but have had no significant operations or financial activities. One of the major benefits of buying a shelf company is that it often comes with an already-established credit history. This can be invaluable for securing loans or contracts more easily. Additionally, an aged corporation can lend your business an aura of credibility and stability from the get-go.

Top Tips for Finding the Best Deals

Research Reputable Sources

When looking for a shelf company for sale, start by researching reputable sources. Look for companies that have a solid track record and positive customer reviews. Websites specializing in shelf companies, such as WholesaleShelfCorporations.com, offer a variety of options, from companies with minimal history to those with a rich background. By comparing offerings, you can find a deal that aligns with your business goals.

Consider the Company’s History

Not all shelf companies are created equal. Some may have more extensive histories, which could provide greater advantages in terms of credit and reputation. When evaluating potential purchases, consider factors such as the company’s age and any prior business activities. For example, a shelf company with a few years of history might offer more credibility than one that has just been registered.

Check the Price

Prices for shelf companies can vary widely depending on their age, history, and additional services included. Be sure to compare prices from different sources and understand what is included in the cost. Are there any additional fees for transferring ownership or updating company details? Understanding the total cost will help you avoid any hidden surprises.

Verify Legal Status

Ensure that the shelf company you are interested in is in good standing. Check that there are no outstanding legal issues or unpaid taxes associated with the company. This step is crucial to avoid inheriting any potential problems that could affect your business.

Examples and Insights

Imagine you're launching a tech startup and need a company with an established credit history to secure funding. Purchasing a shelf company with several years of operation could significantly improve your chances of getting a loan. On the other hand, if you're opening a small boutique, a newer shelf company might suffice. The key is to match the company’s history with your specific needs.

The Right Shelf Company for You

Finding the best deal on a shelf company for sale involves careful consideration and research. By understanding your needs, comparing options, and verifying the company’s history, you can make a well-informed decision. Remember, a well-chosen shelf company can provide a strong foundation for your business, offering advantages that go beyond just having a name on paper.

Conclusion

In summary, investing in a shelf company can provide a strategic advantage for your business, whether you're starting fresh or expanding. By focusing on reputable sources, understanding the company’s history, and checking legal status, you can find the best deals available. For those looking to explore a range of shelf companies for sale, WholesaleShelfCorporations.com offers a comprehensive selection and expert guidance to help you make the best choice for your business needs.

0 notes

Text

Tax Considerations for Expanding Your Business Internationally

Sophia had always dreamt of taking her boutique skincare line global. What started as a small operation in her garage had blossomed into a thriving business, with products flying off the shelves across the United States. Encouraged by her success and the increasing demand from international customers, she decided it was time to expand her business overseas. However, as she delved into the complexities of international business, Sophia quickly realized that navigating the maze of international tax laws was one of the biggest challenges she would face.

Sophia's journey is a common one among entrepreneurs. The allure of international markets comes with a host of tax considerations that can make or break the success of an expansion. This blog post explores the key tax considerations for businesses looking to expand internationally, providing insights and tips to help you manage this critical aspect of your growth strategy.

Understanding International Taxation

Expanding your business internationally involves dealing with multiple tax jurisdictions, each with its own set of rules and regulations. Here are some of the most critical tax considerations:

1. Tax Residency

Determining the tax residency of your business is the first step. Tax residency dictates which country has the primary right to tax your business income. Generally, a company is considered a tax resident in the country where it is incorporated or where its central management and control are located. For example, if your business is incorporated in the U.S. but managed from the U.K., it may be subject to U.K. taxes.

2. Permanent Establishment

The concept of permanent establishment (PE) is crucial in international taxation. A PE is a fixed place of business through which a company's activities are wholly or partly carried out. If your business has a PE in a foreign country, it may be liable to pay taxes on the income generated by that PE. According to the OECD, PEs can include offices, branches, factories, and even construction sites lasting more than a specified duration (typically 6 to 12 months).

3. Double Taxation

Double taxation occurs when the same income is taxed by two different countries. This can be a significant issue for businesses operating internationally. Many countries have double tax treaties (DTTs) that aim to prevent this by specifying which country has the right to tax specific types of income. As of 2023, the U.S. has DTTs with over 60 countries, providing relief to businesses from double taxation through various mechanisms, including tax credits and exemptions.

4. Transfer Pricing

Transfer pricing refers to the prices charged for transactions between related entities within a multinational enterprise. Tax authorities scrutinize these transactions to ensure that they are conducted at arm's length, meaning the prices are consistent with those charged between unrelated parties. The IRS and other tax authorities impose strict documentation requirements to prevent tax avoidance through transfer pricing. Failure to comply can result in significant penalties and adjustments to taxable income.

Tax Incentives and Benefits

While navigating international tax laws can be challenging, there are also numerous incentives and benefits available to businesses expanding globally.

1. Tax Holidays and Incentives

Many countries offer tax holidays and incentives to attract foreign investment. For example, Singapore provides tax exemptions for certain new businesses for the first three years of operation, and Ireland offers a low corporate tax rate of 12.5% for trading income. Researching and understanding these incentives can significantly reduce your overall tax burden.

2. Research and Development (R&D) Credits

R&D tax credits are available in many countries to encourage innovation. These credits can offset the costs of developing new products, processes, or services. For instance, the U.K. offers an R&D tax credit that can be worth up to 33% of qualifying R&D expenditure for small and medium-sized enterprises (SMEs). Leveraging these credits can provide substantial tax savings and support your growth efforts.

Compliance and Reporting

Ensuring compliance with international tax laws requires careful planning and ongoing management. Here are some key steps to maintain compliance:

1. Keep Detailed Records

Maintaining detailed and accurate records of all international transactions is crucial. This includes invoices, contracts, transfer pricing documentation, and financial statements. Proper record-keeping helps ensure compliance with local tax laws and facilitates smooth audits.

2. Understand Local Tax Laws

Each country has unique tax laws and reporting requirements. Engaging local tax advisors or consultants can help you navigate these complexities. For instance, VAT (Value Added Tax) regulations vary significantly across the European Union, and failing to comply can result in hefty fines.

3. Regularly Review Your Tax Strategy

International tax laws and regulations are constantly evolving. Regularly reviewing and updating your tax strategy ensures that you remain compliant and can take advantage of new opportunities. Staying informed about changes in tax legislation, such as the OECD's Base Erosion and Profit Shifting (BEPS) project, can help you adapt your strategy accordingly.

Conclusion

Sophia's decision to expand her skincare line internationally brought both opportunities and challenges. By understanding key tax considerations such as tax residency, permanent establishment, double taxation, and transfer pricing, she was able to navigate the complexities of international taxation successfully. For new entrepreneurs considering global expansion, the benefits of thorough tax planning cannot be overstated. Engaging a reliable tax service for small business can provide the expertise and support needed to manage international tax obligations effectively, allowing you to focus on growing your business and seizing new opportunities in the global market.

0 notes

Text

Tips for Buying Rolex Watches Online in Dubai: Your Complete Guide

Dubai, a city synonymous with luxury and opulence, is one of the best places in the world to buy luxury watches, especially Rolex. With its reputation for high-quality products and tax-free shopping, Dubai attracts watch enthusiasts from all over the globe. If you're looking to shop brand watches online in Dubai, UAE, here are some tips to ensure a smooth and secure purchase.

Why Buy Rolex Watches in Dubai?

Before diving into the tips, it’s important to understand why Dubai is an excellent choice for purchasing a Rolex:

Competitive Prices: Due to lower taxes and duties, Rolex watches in Dubai are often cheaper than in other parts of the world.

Authenticity Guaranteed: The city's reputable dealers ensure you get genuine products.

Wide Selection: From classic models to the latest releases, Dubai’s online stores offer a vast range of Rolex watches.

Tips for Buying Rolex Watches Online