#bike insurance third party

Explore tagged Tumblr posts

Text

Comprehensive Motor Vehicle Insurance by GIG Gulf

For GIG Gulf, a vehicle is not just a means of going about; it is a part of life. Therefore, we ensure that your motor vehicle insurance plans are comprehensive for you to be adequately protected in case of accidents, theft, or damage. We help make sure that your car is in good hands and offer flexible policies to suit whatever needs you have.

What sets GIG Gulf apart is a commitment to more than just insurance. Our plans come with other benefits, such as roadside assistance 24/7, quick processing of claims, and access to trusted repair services. Be it work or a road trip, we have you covered at every turn, giving you peace of mind.

Join thousands of satisfied customers in trusting GIG Gulf for their reliable motor vehicle insurance. Transparent policies and customer-first approach ensure you get the coverage you need without any hidden surprises. Drive confidently with GIG Gulf—because your safety and security are our top priorities.

#car insurance#car insurance dubai#bike insurance online#uae car insurance#motor vehicle insurance#insurance for car in uae#auto policy quote#motor insurance coverage#third party car insurance dubai price#buy car insurance online dubai#comprehensive car insurance dubai#best car insurance in uae#car insurance online#cheap auto insurance

0 notes

Text

Third Party Insurance Explained | In Hindi

Third Party insurance kya hota hai? Third party insurance kya hota hai ise samajhne ke liye iss video ko jaroor dekhe.

#first party insurance#third party insurance#third party insurance explained#third party insurance kaise kare online#third party insurance kya hai#third party insurance for bike#third party insurance for car#first party insurance kaise kare#first party insurance vs third party insurance

0 notes

Text

#motor insurance#car insurance#insurance#auto insurance#motor insurance meaning#motor insurance policy#motor insurance in india#types of motor insurance#motor insurance policies#merits of motor insurance#features of motor insurance#limitation of motor insurance#vehicle insurance#introduction of motor insurance#characteristics of motor insurance#bike insurance#cheap car insurance#motor vehicle insurance#third party insurance#motor insurance definition

0 notes

Text

Top Motivators For Online Third-Party Bike Insurance Purchase

The most basic form of two-wheeler coverage is third-party bike insurance, which provides coverage for any harm and losses your vehicle might inflict on a third-party person, item, or vehicle. It is particularly useful in collision or accident situations. Without it, you risk receiving a fine between Rs 1,000 and Rs 2,000. The equivalent is required by law.

0 notes

Text

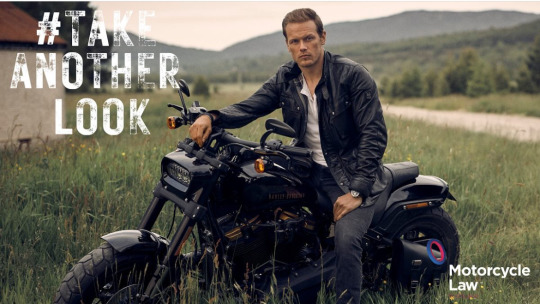

Every Journey Matter!

Note this campaign is a great initiative from the @motorcyclelawscotland team I can't agree more to educate people and save lives. But Why did they choose the photo of SH on this post when he promoted his whisky 🥃 during his 2021 whisky campaign in Scotland?

This photo is in 2021 and was the last time SH was seen on his customised Harley Davidson motorbike after his bike mishap in Scotland 🏴

We don't know exactly what kind of support SH is providing to this volunteering effort by appearing in his promotional material and asking his fans to sign up. However, it's interesting to note that Motorcycle Law Scotland is urging the Scottish community to be involved in this Road Safety campaign and at the same time they following the actor's alcohol business on Instagram.🤷♀️

The one safe option for Road Safety If you're driving, is not to drink any alcohol and not promote it.

As we see Motorcycle Law Scotland 🏴 helps you with your motorcycle accident claim following a bike accident and acting for bikers who have been involved in a motorbike accident.

That means they deal with claims against third-party insurers and can act in cases where your motorbike accident compensation claim is against an uninsured driver and will deal with the motor insurers bureau on your behalf.

There is a time limit of three years from the date of the accident for claiming for injuries in a bike accident, and to ensure that the motorbike accident personal injury claim and compensation for the motorcycle is dealt with well within that time frame. For example, if you had a bike accident in December 2021, this year 2024 is your time limit.

MLS are motorbike personal injury Solicitors, I imagine their clients come to them when they have had a motorbike accident. It is important to remember that in law, there is always the possibility of reasonable doubt, and there is a doubt. Was or is Motorcycle Law Scotland involved in any way in representing SH in his mishap in Scotland? The mishap occurred a year after SH obtained his motorbike licence in 2020, not enough experience.

I believe that MLS' interest in SH is not a sudden one. I would like to know if SH featured in this campaign has completed advanced rider training and passed his test, courtesy of Motorcycle Law Scotland, 🏍️ before providing his photo on his Harley Davidson motorbike. Or MLS has SH fans who misinterpret their role in this campaign 💁♀️

@imahalfemptykindofgirl Yes, it did, but what I was actually referring to was completing advanced motorist training and passing the exam that MLS offers for vulnerable road users.

@summerindigomusic Yep! SH has a customised Triumph Scrambler 1200 XE motorbike, which matches his Sassenach helmet promoting his whisky 🥃 and it’s a very questionable taste.

@imahalfemptykindofgirl Exactly, No wonder he didn't show his Harley Davidson bike and helmet damage. I would like to know what kind of insurance cover he had 🤔

@imahalfemptykindofgirl @gotraveltheworldluv It all comes from others. The cause is not his and it is MLS who is raising awareness, SH is not shedding light on anything. But his completely ridiculous fans think everything that happens in Scotland is his initiative.

Well next time SH will polish the Scottish roads with his ideas💡 and his fans will say Scotland is better off because of him 🤯

22 notes

·

View notes

Text

Why Bike Insurance in Ontario is Essential for Riders

Riding a bike offers a sense of freedom and thrill that is unmatched. However, with the excitement of the open road comes the responsibility of ensuring safety—for yourself, your vehicle, and others. This is where bike insurance Ontario plays a pivotal role. In a region like Ontario, where traffic regulations are stringent, and road conditions can vary greatly, having the right insurance is not just a legal requirement but also a vital part of responsible riding.

The Importance of Bike Insurance in Ontario

Ontario mandates that all motor vehicles, including bikes, must be insured. While this is a legal necessity, the benefits of bike insurance Ontario go beyond mere compliance. It provides financial protection against accidents, theft, and other unforeseen circumstances. Riders can enjoy peace of mind knowing they are covered for potential liabilities, including damage to other vehicles or property.

Moreover, insurance acts as a safety net in the event of personal injury or third-party claims. With rising medical and repair costs, having adequate coverage ensures that you won’t face significant financial burdens in case of an accident.

Key Features of Bike Insurance Ontario

When selecting bike insurance Ontario, riders should look for policies that offer comprehensive coverage, including:

Collision Coverage: Protects against damages to your bike resulting from an accident.

Liability Coverage: Covers third-party injuries or property damage caused by your vehicle.

Uninsured Motorist Protection: Provides coverage if you’re involved in an accident with an uninsured driver.

Comprehensive Coverage: Safeguards against non-collision-related damages, such as theft, vandalism, or natural disasters.

These features are essential for ensuring holistic protection on the road.

Comparing Options with Other Insurance Types

While bikes require specific insurance coverage, it’s worth noting how policies differ for other vehicles. For instance, RV insurance Ontario focuses on the unique requirements of recreational vehicles, such as coverage for personal belongings, temporary accommodations, and specialized roadside assistance. Similarly, policies for cars cater to broader needs, with best car insurance companies often offering tailored plans for drivers seeking optimal coverage.

For riders with a history of violations or accidents, finding suitable policies can be challenging. However, specialized providers offer auto insurance for high risk drivers Ontario, ensuring that even those with imperfect records have access to necessary protection. This demonstrates the flexibility and variety available in Ontario’s insurance market.

Why Riders Should Prioritize Bike Insurance Ontario

Legal Compliance: As mentioned earlier, having bike insurance Ontario is mandatory. Non-compliance can lead to hefty fines, license suspension, or even vehicle impoundment.

Financial Security: Accidents can result in significant expenses, from medical bills to repair costs. Insurance mitigates these risks, providing much-needed financial support during tough times.

Roadside Assistance: Many policies include emergency services, ensuring help is just a call away if your bike breaks down on the road.

Peace of Mind: Knowing you’re protected allows you to enjoy your rides without constant worry about potential mishaps.

How to Choose the Right Insurance Policy

Selecting the right insurance policy requires careful consideration of your needs, budget, and riding habits. Start by comparing offerings from the best car insurance companies, as many also provide motorcycle insurance. Look for providers with strong customer service, comprehensive coverage options, and competitive premiums.

For high-risk riders, exploring auto insurance for high risk drivers Ontario can be beneficial. These specialized policies cater to individuals with previous claims, traffic violations, or accidents, ensuring they receive appropriate coverage despite their history.

If you own multiple vehicles, such as an RV, consider bundling your policies. Many insurers offering RV insurance Ontario also provide discounts for combining bike and RV coverage, saving you money while streamlining your insurance management.

Common Mistakes to Avoid When Buying Bike Insurance

Underestimating Coverage Needs: Opting for minimal coverage may save money initially but can result in significant out-of-pocket expenses later.

Not Comparing Policies: Don’t settle for the first quote you receive. Compare offerings from multiple providers to find the best deal.

Ignoring Policy Exclusions: Understand what your policy doesn’t cover to avoid surprises during a claim.

Skipping Reviews: Researching customer feedback can give you insights into the reliability of insurers. Many of the best car insurance companies have excellent reviews for their customer service and claims process.

Why Ontario Riders Trust Insurance

Ontario’s insurance landscape is designed to meet the diverse needs of its residents. Whether you’re insuring a bike, car, or RV, there’s a policy tailored to your requirements. The availability of bike insurance Ontario ensures that riders have access to affordable, comprehensive protection, allowing them to navigate the roads with confidence.

For those with unique circumstances, such as a high-risk driving history or multiple vehicles, options like auto insurance for high risk drivers Ontario and RV insurance Ontario provide added flexibility. This adaptability highlights why insurance remains an essential aspect of vehicle ownership in Ontario.

Conclusion

Riding a bike in Ontario is an exhilarating experience, but it comes with responsibilities. Securing bike insurance Ontario is not just about adhering to legal requirements; it’s about safeguarding yourself, your vehicle, and others on the road. By choosing the right policy, riders can enjoy financial protection, peace of mind, and the freedom to explore the open road.

Whether you’re comparing options from the best car insurance companies, exploring coverage for high-risk drivers, or seeking specialized RV insurance Ontario, the key lies in understanding your needs and making informed decisions. By prioritizing comprehensive coverage, riders can ensure they are prepared for any challenges that come their way.

#best car insurance companies#auto insurance for high risk drivers ontario#bike insurance ontario#rv insurance ontario

0 notes

Text

Best Bike Insurance Policies for New Riders

For new riders venturing into the world of biking, selecting the right insurance policy is essential for safety and security on the road. Here are some of the best bike insurance policies tailored for new riders in 2025.

1. Comprehensive Coverage Policies

New riders should consider comprehensive bike insurance policies that cover damages from accidents as well as theft or vandalism. Policies like Bajaj Allianz Comprehensive Plan offer extensive coverage options suitable for new riders looking for peace of mind.

2. Third-Party Liability Plans

If you're looking for budget-friendly options, third-party liability insurance is mandatory and provides basic coverage against damages caused to others in an accident. However, it’s advisable to supplement this with additional coverage as you gain experience on the road.

3. Consider Add-Ons for Enhanced Protection

Many insurers offer add-ons like personal accident cover or zero depreciation cover at an additional cost. These add-ons can significantly enhance your policy's protection level without breaking the bank.

4. Look for No-Claim Bonus Benefits

Choose policies that offer a no-claim bonus (NCB) discount if you do not make any claims during the policy term. This feature rewards safe riding habits and can lead to substantial savings on renewal premiums.

In conclusion, new riders should prioritize finding a balance between affordability and comprehensive coverage when selecting bike insurance policies in 2025. By considering these factors, you can ensure that you're well-protected on your biking journey.

0 notes

Text

How to Get the Best Insurance for Your Vintage Bike?

Owning a vintage bike isn’t just about enjoying a smooth ride—it’s about cherishing a piece of history. Whether cruising on a classic Royal Enfield or a retro Vespa from the '70s, your vintage two-wheeler holds a special place in your heart. To keep these cherished machines safe, having the right insurance is crucial.

In this blog, we’ll explain why old bike insurance is so important, provide essential tips for securing vintage bike insurance, and guide you through ensuring your beloved ride is well-protected.

Why Does Insurance for Vintage Two-Wheelers Matter?

Vintage bikes are more than just a means of transportation; they are emotionally and financially valuable.

Here’s why having the right insurance is so important:

Financial Protection: Repairing or replacing vintage bike parts can be costly. Insurance helps cover these expenses, so you're not left paying out of pocket for unexpected repairs or replacements.

Legal Compliance: Under Indian law, having third-party insurance on an old bike is mandatory. This type of insurance covers any liability for accidents involving other parties. However, consider opting for a full coverage policy for more comprehensive protection. This will safeguard against damage, theft, natural disasters, riots, and vandalism.

Security: Knowing your vintage bike is insured allows you to enjoy your ride without worrying about potential accidents, theft, or damages. It gives you confidence that you are prepared for any unforeseen circumstances.

Key Points to Consider When Insuring Your Vintage Bike

Insuring a vintage bike differs from insuring a regular bike. Here are some key aspects to keep in mind:

Mandatory Insurance Coverage: Third-party liability insurance, including vintage bikes, is a legal requirement for all two-wheelers in India. While this meets the basic legal need, comprehensive insurance offers broader protection. This policy covers damage to your bike, theft, natural disasters, riots, and vandalism. Comprehensive bike insurance is a wise choice for vintage bikes to cover the unique risks associated with older vehicles.

Insured Declared Value (IDV): The IDV is the maximum amount you can claim if your bike is stolen or written off. It reflects the current market value of your bike. For bikes older than five years, the IDV isn’t fixed and must be agreed upon with your insurer. It’s essential to have a proper valuation done for your bike to ensure the IDV is accurately set in your new insurance policy for the old bike.

Depreciation: Over time, your bike's value depreciates, directly impacting the IDV and the premium amount you will pay for your old bike insurance. The Insurance Regulatory and Development Authority of India (IRDAI) has predefined depreciation rates for the first five years of a bike's life. After this period, depreciation is determined based on your bike’s condition and age. This can impact the overall premium you pay for your insurance.

Timely Renewal: Always renew your insurance policy before it expires. A lapse in coverage means you’ll be uninsured if an accident or damage occurs, and your insurer won’t be liable to pay. Renewing on time also helps maintain any no-claim bonuses (NCB) you’ve earned, which can lower your future premiums. Keeping track of your policy’s expiration date and renewing it promptly is crucial.

Policy Terms: Carefully read the terms and conditions of your insurance policy. Understand what’s covered and excluded—such as specific parts or damage due to wear and tear. Choose a policy that fits how often you use your bike, whether for daily commuting or occasional rides. Tailoring your policy to your specific needs helps avoid any surprises when making a claim.

Add-ons: Add-ons like zero depreciation, medical, or personal accident cover offer extra protection but are typically available only for bikes under 15 years old. If your vintage bike qualifies, consider whether these extras are worth the cost, mainly if your bike isn’t used frequently. Evaluating these options can help you enhance your policy according to your requirements.

Related Blog: What is IDV in Bike Insurance and How is it Calculated?

Essential Documents for Bike Insurance

Getting bike insurance involves some critical documentation. Here’s a comprehensive guide to the paperwork you’ll need for purchasing or renewing your two-wheeler insurance:

Identity Proof: To verify your identity, you’ll need one of the following documents:a. Passportb. Aadhaar cardc. Driving licensed. Voter carde. Ration card

Registration Certificate: This document confirms your bike's legality and is necessary for both new and renewal policies. It is valid for 15 years, and temporary registrations can be renewed after a month.

Passport-Size Photograph: A recent passport-sized photo of yourself is required to verify your identity and link it to the insurance policy.

Address Proof: To confirm your residential address, you can use:a. Passportb. Aadhaar cardc. Driving licensed. Voter card

Old Insurance Policy Number: If you have had previous insurance, bring the old policy number. It is located on the insurance card provided by your insurer and helps carry forward any benefits, like a no-claim bonus.

Having these documents ready will streamline buying or renewing your bike insurance and ensure you are covered when needed. Proper documentation facilitates a smooth insurance process and ensures that your claims are processed efficiently.

Get the list of documents required for bike insurance here!

Conclusion

Insuring your vintage bike involves thoughtful consideration, from setting the right IDV to choosing the best add-ons and ensuring timely renewals. A comprehensive old bike insurance policy not only safeguards your vehicle from financial risks but also offers peace of mind while riding.

SBI General provides a range of two-wheeler insurance policies, including options explicitly tailored for vintage bikes. Whether you need third-party coverage or comprehensive protection, SBI General ensures your vintage bike receives the proper insurance, keeping your prized possession safe and secure on the road.

Source URL - https://www.sbigeneral.in/blog-details/get-best-insurance-for-your-vintage-bike

0 notes

Text

What Types of Two-Wheeler Insurance are Available in India?

When it comes to protecting your two-wheeler, having the right insurance policy is crucial. In India, various types of two-wheeler insurance policies cater to different needs, offering financial security in case of accidents, theft, or other unforeseen events. Let’s explore the types of two-wheeler insurance available in India.

1. Third-Party Liability Insurance

Third-party liability insurance is the most basic type of two-wheeler insurance mandated by law in India. It covers the financial liabilities arising from damages or injuries caused to a third party by your bike. While it’s the most affordable option, it doesn’t cover damages to your own vehicle.

Key Takeaway: Essential for legal compliance but limited in coverage.

Keywords: bike insurance third party, insurance policy for bike.

2. Comprehensive Insurance

Comprehensive insurance provides extensive coverage, including third-party liabilities and damages to your own vehicle. Whether your bike is damaged in an accident, by natural calamities, theft, or vandalism, this policy has you covered. It also allows you to add optional covers like personal accident cover, zero depreciation, etc.

Key Takeaway: Offers broad coverage but comes at a higher premium.

Keywords: two wheeler insurance, 2 wheeler insurance, bike insurance price.

3. Standalone Own-Damage Insurance

As the name suggests, this policy only covers the damages to your bike. If you already have third-party insurance, you can opt for standalone own-damage insurance for additional protection. It’s particularly useful when you want to enhance your coverage without switching your existing policy.

Key Takeaway: Flexibility to upgrade protection without changing the third-party policy.

Keywords: two wheeler insurance online, transfer bike insurance.

4. Personal Accident Cover

While not a standalone insurance policy, personal accident cover is often included in comprehensive and standalone own-damage policies. It provides financial compensation in case of accidental death or permanent disability of the rider. It’s a crucial add-on for enhanced personal protection.

Key Takeaway: Essential for safeguarding the rider against personal risks.

Keywords: bike insurance near me, insurance policy for bike.

5. Long-Term Two-Wheeler Insurance

Long-term insurance policies offer coverage for 2–3 years, saving you from the hassle of annual renewals. This type of insurance can be more economical as insurers often offer discounts on long-term policies. Plus, it shields you from annual premium hikes.

Key Takeaway: Convenient and potentially cost-saving option.

Keywords: two wheeler insurance, 2 wheeler insurance, transfer bike insurance.

6. Zero Depreciation Cover

Zero depreciation cover is an add-on to the comprehensive policy. It ensures that you receive the full claim amount without any deduction for depreciation on parts. It’s particularly beneficial for new bikes, ensuring that you don’t bear the cost of parts depreciation during repairs.

Key Takeaway: Maximizes claim value by covering the full cost of repairs.

Keywords: insurance policy for bike, two wheeler insurance online.

7. Return to Invoice Cover

This add-on cover is ideal for new bike owners. In case of total loss or theft, the insurer compensates you with the full invoice value of the bike, including registration and road tax, rather than the depreciated value. This ensures you get the actual value of your bike back.

Key Takeaway: Protects you from financial loss in case of total loss or theft.

Keywords: bike insurance price, bike insurance third party.

Conclusion

Understanding the different types of two-wheeler insurance available in India allows you to make an informed decision when purchasing a policy. Whether you’re looking for basic third-party coverage or comprehensive protection with add-ons, there’s a policy to suit every need. Always compare policies online, consider your specific requirements, and choose a policy that offers the best protection for your bike.

Choosing the right insurance not only provides financial security but also ensures peace of mind while riding.

#bike insurance#two wheeler insurance checking#bike insurance online#bike insurance third party#two wheeler insurance online#bike#bikes#ginteja

0 notes

Text

Customize Your Ride: Tailored Motorcycle Insurance by Swann

Swann Insurance offer flexible cover to suit your motorcycle insurance needs. From Comprehensive Motorcycle Insurance to Third Party Liability Insurance Cover, your bike will be well covered. Always read the TMDs and PDS from Swann Insurance. For more info visit - https://www.swanninsurance.com.au/

0 notes

Text

youtube

Looking for the perfect insurance for your two-wheeler? 🚴♂️ Whether it's a scooter or a motorbike, having the right insurance policy is a must! In this video, we break down everything you need to know about two-wheeler insurance, including:

Types of insurance policies (Comprehensive vs Third-Party) What’s covered and what’s not! Benefits of having two-wheeler insurance How to renew and claim your insurance Tips to get the best deal for your bike insurance

#TwoWheelerInsurance#BikeInsurance#InsuranceTips#MotorcycleInsurance#HowToChooseInsurance#OnlineInsurance#BikeInsurance2024#BikeSafety#MotorcycleCoverage#ScooterCoverage#BikeInsuranceClaim#ScooterInsurance#InsuranceForBikes#BikeInsuranceTips#TwoWheelerCoverage#InsuranceOnline#Insurance2024#BikeInsuranceOnline#BikeInsuranceGuide#ThirdPartyInsurance#PolicyRenewal#MotorbikeCoverage#RideSafe#InsuranceExplained#RoadSafety#insuranceagent#insuranceadvisor#ghaziabad#beemawala#Youtube

1 note

·

View note

Text

Why RV Insurance in Ontario is a Must-Have for Your Next Adventure

When planning an adventure on the open road, an RV (Recreational Vehicle) becomes more than just a mode of transportation—it’s your home away from home. To protect this valuable asset, RV insurance Ontario is essential. Just like your car or motorcycle, an RV requires comprehensive insurance coverage to safeguard against accidents, theft, weather-related damage, and liability claims.

Many travelers assume that their standard auto insurance will cover their RV, but that’s not the case. RV insurance Ontario is specifically designed to protect the unique aspects of an RV, including personal belongings, attached accessories, and living space. Here’s why it’s a must-have for your next adventure.

1. Comprehensive Protection for Your Home on Wheels

RVs are more than just vehicles—they are equipped with kitchens, sleeping areas, bathrooms, and electronics. Unlike regular auto insurance, RV insurance Ontario covers all these personal belongings in the event of theft, vandalism, or accidents.

For instance, if a storm causes damage to your RV’s roof or a fire breaks out while parked at a campsite, your insurance policy will cover the cost of repairs and replacements. Without this specialized coverage, you’d be responsible for significant out-of-pocket expenses.

If you’re familiar with affordable car insurance Ontario, you’ll recognize that while auto insurance covers a standard vehicle’s basic needs, it’s not designed to cover the living quarters of an RV. RV insurance offers a wider range of protection, ensuring that everything from your personal belongings to structural components is covered.

2. Liability Coverage for Peace of Mind

Liability coverage is a crucial part of RV insurance Ontario. When you’re on the road, accidents can happen—and if you’re at fault, you’ll be held responsible for damages and injuries to others. This liability extends to injuries that occur inside or around your parked RV at a campsite.

With the right RV insurance, you’re protected against claims from third parties. This type of coverage can also extend to medical expenses if a guest is injured in your RV. It’s similar to how bike insurance Ontario and car insurance offer liability protection, but with added layers specific to an RV’s unique needs.

3. Protection from Unforeseen Events

On the road, anything can happen. From unexpected breakdowns to weather-related damage, RV owners face risks that traditional car insurance may not fully cover. Comprehensive RV insurance ensures you’re protected from:

Natural disasters (floods, hail, storms)

Fire damage (both while parked and in motion)

Theft or vandalism (especially in unfamiliar campsites)

Accidents with uninsured or underinsured drivers

While affordable car insurance Ontario can provide protection for a car, it’s not enough for an RV due to the additional living space and personal belongings. RV insurance ensures that your home-on-wheels is protected from all angles.

4. Emergency Assistance and Roadside Support

Imagine being stranded on a rural highway with a flat tire or a mechanical breakdown. With RV insurance Ontario, you’re entitled to emergency roadside assistance. This coverage can include services like towing, tire changes, battery jumps, fuel delivery, and locksmith services.

While some may think that renewal of two wheeler insurance or auto insurance offers similar roadside assistance, RV insurance provides additional support tailored for large vehicles. RV-specific towing, for example, requires specialized equipment and larger tow trucks. Without RV insurance, these emergency services can be incredibly costly.

5. Customizable Policies for Different Types of RVs

Whether you own a motorhome, travel trailer, camper van, or fifth wheel, RV insurance Ontario offers flexible coverage options. Different RVs have unique coverage needs, and insurers provide policies that can be customized to suit your type of vehicle.

Unlike bike insurance Ontario, which is typically more straightforward, RV insurance can be adjusted based on usage. For instance, if you’re a full-time RVer living in your vehicle year-round, you’ll need more comprehensive coverage than someone who only uses their RV for summer road trips.

Policies can also be customized to include optional coverage such as:

Personal belongings protection (covers electronics, appliances, and other personal items)

Campsite liability (coverage for accidents at campsites)

Emergency expenses (reimbursement for lodging or meals during emergency repairs)

Vacation liability (for accidents or injuries that happen while your RV is parked)

These options make it easy to tailor your RV insurance plan to meet your travel lifestyle.

6. Affordability and Cost Savings

One concern for RV owners is the cost of insurance. Fortunately, many providers offer flexible payment plans, bundle discounts, and loyalty rewards. If you’re familiar with affordable car insurance Ontario, you’ll know that finding the right insurer can help reduce costs.

When searching for RV insurance, be sure to compare quotes from multiple providers. You’ll find that rates are competitive, and you can often bundle RV insurance with other policies like auto or bike insurance Ontario to receive multi-policy discounts.

It’s also important to review your policy during the renewal of two wheeler insurance or any other policy updates. Providers may offer promotions or discounts during the renewal period, allowing you to secure a better rate for the upcoming year.

7. Legal Requirement for RV Owners in Ontario

In Ontario, it’s mandatory to have liability insurance for motorized RVs. This means that if you’re driving a motorhome, you’re legally required to have insurance—just like you would for a car or motorcycle. While towable RVs, like travel trailers, may not require mandatory insurance, many owners still opt for coverage to protect against theft, damage, or liability at campsites.

If you’ve recently gone through the renewal of two wheeler insurance, you’ll know how important it is to meet Ontario’s legal insurance requirements. Having proper RV insurance ensures that you’re compliant with the law and avoids fines, license suspensions, or other penalties.

Final Thoughts: Protect Your Adventure with RV Insurance Ontario

Owning an RV unlocks the door to adventure, freedom, and unforgettable road trips. But with this freedom comes responsibility. RV insurance Ontario is not just a smart choice—it’s a must-have. This specialized insurance provides comprehensive protection for your mobile home, personal belongings, and liability on the road.

With the rising popularity of RV travel in Ontario, more people are realizing the need for proper insurance. Similar to securing affordable car insurance Ontario or renewal of two wheeler insurance, RV insurance protects you from unforeseen expenses and ensures peace of mind.

From comprehensive coverage to liability protection, emergency roadside assistance, and customizable policies, RV insurance offers more than just peace of mind—it’s a safeguard for your adventure. With many insurers offering affordable rates and bundling options, there’s no reason to hit the road without it.

So before you head out on your next adventure, secure your peace of mind with RV insurance Ontario. With the right policy, you’ll be free to explore Ontario’s scenic roads, campsites, and hidden gems—all with the confidence that you’re fully protected.

#affordable car insurance ontario#renewal of two wheeler insurance#bike insurance ontario#rv insurance ontario

0 notes

Text

Compare Bike Insurance Quotes Online

When it comes to insuring your bike, comparing quotes online is an efficient way to find the best coverage at an affordable price. Here’s how to navigate this process effectively.

1. Gather Necessary Information

Before you start comparing quotes, gather all relevant details about your bike, including its make, model, year of manufacture, and any modifications made. This information will help insurers provide accurate quotes tailored to your bike's specifications.

2. Use Reputable Comparison Websites

Utilize trusted online platforms that specialize in comparing bike insurance policies. These websites allow you to input your bike details and receive multiple quotes from different insurers quickly.

3. Evaluate Coverage Options

While comparing prices is important, focus on the coverage offered by each policy as well. Look for comprehensive plans that cover damages from accidents, theft, and third-party liabilities. Ensure that the coverage options meet your specific needs.

4. Check Insurer Reputation

Research each insurer’s reputation by reading customer reviews and checking their claim settlement ratio. A higher ratio indicates reliability in processing claims efficiently, which is crucial when you need assistance after an incident.

5. Look for Discounts and Add-Ons

Many insurers offer discounts for safe driving records or bundling multiple policies. Additionally, consider optional add-ons like personal accident cover or roadside assistance for enhanced protection.

By following these steps, you can confidently compare bike insurance quotes online and select a policy that offers both value and peace of mind on the road.

0 notes

Text

Why Is It Mandatory to Have Bike Insurance in India?

In India, ensuring your bike's protection is more than just a choice—it's a legal necessity. Just like safeguarding your belongings at home, having insurance for your bike is a must. It's not just about protecting your interests but also about following the law and ensuring road safety. So, why is bike insurance mandatory? Let's delve into the reasons.

Why is Bike Insurance Mandatory in India?

Bike insurance isn't just a formality in India; it's a vital shield for riders and others on the road. Think of it as wearing a helmet for your safety and that of others. By law, having bike insurance ensures that everyone involved can get the necessary help without financial strain in case of any mishap. It's like a safety net that keeps everyone protected and eases the burden of unexpected expenses. So, bike insurance is every rider's responsibility, whether it's a minor scrape or a major collision.

How Does Bike Insurance Protect You?

Bike insurance serves as a comprehensive shield against potential risks on the road, offering twofold protection:

Legal Liabilities:When you're out riding, accidents can happen. If you're involved in one, bike insurance covers legal liabilities. If you're at fault and someone else is injured or their property is damaged, your insurance will handle the legal obligations, sparing you from potential lawsuits and financial repercussions.

Financial Expenditure:Repairing or replacing a damaged bike can be financially draining. Bike insurance alleviates this burden by covering repairs or replacement costs in case of accidents, theft, or other damages. This ensures you can get your bike back on the road without a significant financial setback.

What Does A Two-Wheeler Insurance Policy Cover?

A two-wheeler insurance policy offers essential protection against a variety of risks on the road, encompassing two primary types of coverage:

Third-party Liability Cover:This aspect of the policy protects you from financial responsibilities towards third parties in case of accidents. If you're involved in an incident where someone else suffers injuries or property damage due to your bike, this coverage handles the resulting legal and financial obligations. It ensures that you're not left personally liable for compensation, legal fees, or other related costs, providing peace of mind on the road.

Comprehensive Cover:Going beyond third-party liability, a comprehensive insurance policy offers broader protection for your two-wheeler. It covers damages to your bike due to accidents, theft, natural disasters, fire, vandalism, and more. This means whether it's repairing your bike after a collision, replacing it if stolen, or fixing damages from unforeseen events like floods or fires, a comprehensive cover ensures you're financially secure. Your bike is always ready to ride.

How to Buy Two-wheeler Insurance Policy Online

Buying a two-wheeler insurance policy online is quick and straightforward. Start by visiting the website of a reputable insurance provider or using a trusted insurance comparison platform. Enter details about your bike, such as its make, model, and registration number. Then, select the type of coverage you need, whether third-party liability or comprehensive cover. Review the policy terms, including premiums and coverage limits. Finally, complete the purchase by providing personal details and paying online. Once done, you'll receive the policy documents digitally, making the entire process hassle-free and convenient.

Tips to Keep in Mind While Purchasing Two-wheeler Insurance:

When purchasing two-wheeler insurance, keep these simple tips in mind to ensure you get the right coverage:

Assess Your Needs: Understand your requirements, whether basic liability or comprehensive coverage, based on factors like your bike's value and usage.

Compare Policies: Don't settle for the first option. Compare different policies from multiple insurers to find the best coverage at an affordable price.

Check Add-Ons: Look for optional add-ons like roadside assistance or zero depreciation cover to enhance your protection.

Read the Fine Print: Thoroughly understand the policy terms, including coverage limits, exclusions, and claim procedures, to avoid later surprises.

Consider Reputation: Opt for insurers with a good reputation for customer service and hassle-free claim settlements. These tips ensure you make an informed decision and get the most out of your two-wheeler insurance.

Ensuring your two-wheeler is adequately insured is a legal obligation and a wise investment in your safety and financial security. By understanding your needs, comparing policies, and choosing a reputable insurer, you can ride with peace of mind, knowing you're protected against the uncertainties of the road.

Source URL: https://www.sbigeneral.in/blog-details/why-is-it-mandatory-to-have-bike-insurance-in-india

0 notes

Text

Exploring Santorini on Four Wheels: The Complete Guide to Santorini Quad Rental

Santorini, a picturesque island in the Aegean Sea, is renowned for its stunning sunsets, whitewashed buildings, and breathtaking landscapes. While many travelers opt for the traditional modes of transportation—buses, taxis, or even walking—there's a growing trend among visitors to explore the island on a quad bike. Renting a quad in Santorini is not only an adventurous way to see the island but also a practical one, offering unparalleled freedom to discover its hidden gems. Here’s everything you need to know about Santorini quad rental to make the most of your trip.

Why Choose a Quad Rental in Santorini?

1. Unmatched Flexibility and Freedom

One of the primary reasons travelers choose to rent a quad in Santorini is the flexibility it offers. Unlike buses or taxis, which run on fixed routes and schedules, a quad allows you to explore the island at your own pace. Whether you want to spend a few extra hours lounging on a secluded beach or take an impromptu detour to a charming village, a quad gives you the freedom to do so without the constraints of public transportation.

2. Accessibility to Remote Areas

Santorini's rugged terrain and narrow, winding roads can be challenging for larger vehicles. A quad, however, is nimble and compact, making it ideal for navigating the island's more remote and less accessible areas. This means you can reach secluded beaches, hidden viewpoints, and off-the-beaten-path villages that are often missed by the average tourist.

3. Cost-Effective Transportation

Renting a quad is generally more affordable than renting a car or relying on taxis for multiple trips. Daily rental rates for quads are typically lower, and with fuel efficiency on your side, it’s a cost-effective way to travel across the island. Additionally, parking is easier and often free for quads, which can save you time and money in busy tourist areas.

How to Rent a Quad in Santorini

1. Requirements for Renting a Quad

To rent a quad in Santorini, you’ll need a valid driver’s license. If you're from the European Union, your standard license will suffice. For non-EU travelers, an International Driving Permit (IDP) is usually required. It's essential to check with the rental company in advance to confirm the documentation needed, as policies can vary.

2. Choosing the Right Quad

Quads in Santorini come in various engine sizes, typically ranging from 50cc to 450cc or more. The size you choose should depend on your experience, the terrain you plan to cover, and whether you’ll be riding solo or with a passenger. For beginners or those sticking to paved roads, a 50cc or 100cc quad might be sufficient. However, if you plan to explore more rugged areas or carry a passenger, a more powerful 250cc or 450cc quad is recommended.

3. Rental Costs and Insurance

The cost of renting a quad in Santorini varies based on the engine size, the rental duration, and the season. On average, prices range from €25 to €50 per day for standard models. During peak season (June to September), prices can be higher due to increased demand.

Insurance is a crucial consideration when renting a quad. Basic insurance typically covers third-party liability, but you may want to opt for additional coverage that includes theft, collision, and damage protection. Be sure to read the terms and conditions carefully and clarify what is and isn’t covered before signing the rental agreement.

Top Destinations to Explore on a Quad

Santorini is full of stunning sights and unique experiences, and renting a quad allows you to explore them all. Here are some of the top destinations to visit on your quad adventure:

1. Oia

No visit to Santorini is complete without a trip to Oia, the island’s most famous village. Known for its iconic sunsets, narrow alleys, and stunning views of the caldera, Oia is a must-see. Riding a quad to Oia allows you to navigate its narrow streets easily and find parking in areas where cars might struggle. Arrive early to secure a good spot for sunset viewing, and take the time to explore the local shops and cafes.

2. Red Beach

Located near the ancient village of Akrotiri, Red Beach is famous for its striking red cliffs and volcanic sand. The beach is a bit remote, with a challenging access road that’s well-suited for quads. After parking, you’ll need to take a short hike to reach the beach, where you can relax, swim, or explore the unique rock formations.

3. Fira

Fira, the capital of Santorini, is a bustling hub of activity with shops, restaurants, and museums. Riding a quad in Fira is convenient, as it allows you to bypass the crowded streets and find parking more easily. Explore the Archaeological Museum, take a cable car down to the old port, or simply wander through the lively streets filled with local vendors.

4. Perissa and Perivolos Beaches

For a more laid-back beach day, head to Perissa or Perivolos on the island’s southeast coast. These black sand beaches are perfect for sunbathing, swimming, or enjoying water sports. The ride to these beaches on a quad is scenic, offering beautiful views of the island’s landscape along the way. There are also plenty of beachfront bars and restaurants where you can grab a bite to eat or a refreshing drink.

5. Pyrgos

Pyrgos is a charming village located inland, offering a more tranquil experience compared to the coastal areas. The village is perched on a hill, providing panoramic views of the island. Explore its winding streets, visit the old castle, and stop by one of the local tavernas for a taste of traditional Greek cuisine. The ride to Pyrgos is an adventure in itself, with steep roads and hairpin turns that are easily navigated on a quad.

Safety Tips for Riding a Quad in Santorini

While riding a quad is a fun and exciting way to explore Santorini, safety should always be a priority. Here are some tips to ensure a safe and enjoyable experience:

1. Wear Protective Gear

Always wear a helmet while riding a quad, as it’s required by law and essential for your safety. Consider wearing additional protective gear such as gloves and sturdy footwear, especially if you plan to explore more rugged areas.

2. Drive Cautiously

Santorini’s roads can be narrow, steep, and winding, with varying levels of traffic depending on the time of year. Drive at a safe speed, especially on unfamiliar roads, and be cautious around sharp bends and blind corners. Watch out for pedestrians and other vehicles, particularly in busy tourist areas.

3. Be Prepared for Weather Conditions

The weather in Santorini can change quickly, with strong winds and sudden rain showers being common, especially during the spring and autumn months. Check the weather forecast before heading out, and if conditions are unfavorable, consider postponing your ride or choosing a safer route.

4. Keep Hydrated and Take Breaks

Exploring Santorini on a quad can be physically demanding, especially in the heat of summer. Carry plenty of water, take regular breaks, and protect yourself from the sun with sunscreen, sunglasses, and a hat.

5. Respect Local Traffic Laws

Familiarize yourself with local traffic laws and regulations, and always adhere to them. This includes respecting speed limits, yielding to pedestrians, and not driving under the influence of alcohol.

Conclusion

Renting a quad in Santorini is an excellent way to experience the island’s beauty and charm. It offers the flexibility to explore at your own pace, access to remote and lesser-known locations, and a cost-effective transportation option. Whether you're riding through the bustling streets of Fira, discovering hidden beaches, or enjoying the stunning views from Pyrgos, a quad provides a unique and memorable way to see Santorini. Just remember to prioritize safety, choose the right quad for your needs, and enjoy the freedom that comes with exploring this enchanting island on four wheels.

For More Info:-

santorini rentals atv renting atv in santorini santorini quad rental quad hire santorini

0 notes

Text

Comprehensive Guide to Choosing the Right Insurance Policy for Your Bike

Selecting the right insurance policy for bike is crucial for safeguarding your investment and ensuring peace of mind on the road. In this comprehensive guide, we explore the various types of bike insurance policies available, including third-party liability, own damage cover, and comprehensive plans. We'll delve into the benefits of each, how to assess your coverage needs, and tips for finding the best policy at an affordable premium. Whether you're a seasoned rider or a new bike owner, this guide will help you make informed decisions to protect your bike and enjoy your rides worry-free.

0 notes