#best ninjatrader indicators

Explore tagged Tumblr posts

Text

Customization Overload: Finding the Balance in Your Trading Setup

Customization has both positive and negative aspects in the trading industry. New traders always like the way customization can enhance how their tools may be. But if it's done too much, though, it can cause misunderstandings in trading. Here we look at striking the ideal balance for a successful trading setup on NinjaTrader order flow.

The Appeal of Customization

Customization on NinjaTrader is having indicators work in synchrony while complementing your approach to trading. It’s about adapting and changing until everything feels perfect. One could easily become overconfident with the abundance of indicators at hand. If not handled properly, it can impair your judgment. Click here to know more.

The Dangers of Over Customization

Customization gone too far can result in "analysis paralysis," as we like to call it. An overabundance of indications makes it difficult for your brain to digest everything. You become perplexed when every indicator speaks a different story. Everything looks contradicting, so you're not sure whether to buy or sell. Like too many chefs making one broth in the kitchen!

Simplify for Clarity

You must start with a few widely understood basic signs. These need to fit your trading approach. Day traders might, for example, use volume indicators and moving averages. Oscillators and trend lines are perhaps preferred by swing traders. The idea is to concentrate on a small number of dependable Ninja trader indicators.

Analyze and Edit

Exploration is necessary. See how your configuration works with past data. Put an indicator away if it doesn't add anything. Make adjustments in your configuration to make sure it works. As they say, in trading, less is more. Indicator quality always beats indicator quantity.

Keep Yourself Flexible

Your configuration should vary as markets do. What functions in a bullish market may not be in a bearish one. Maintain your flexibility and receptivity to change. Check your indicators often to be sure they are still useful. Make necessary configuration adjustments to suit the state of the market.

Perfect setups don't exist. Trade involves a great deal of human intuition. Sometimes you have to follow your gut. See your tools as pointers rather than as the final say. Mix your own experience and market mood with technical analysis.

About Affordable Indicators Inc.:

Affordable Indicators Inc. offers best Ninjatrader indicators solutions designed to enhance trading performance. The company specializes in developing custom indicators to optimize trading strategies. Its solutions ensure clarity and better decision-making in the dynamic market environment.

Check out Ninjatrader indicators at https://affordableindicators.com/

Original Source: https://bit.ly/3xeaXHS

0 notes

Link

Discover the optimal Ninjatrader indicators for your trading style at The Intentional Trader. Our Ninjatrader indicators offer traders a comprehensive array of robust analysis tools for their trading needs. Visit here to know more: https://www.theintentionaltrader.com/product-category/ninjatrader-indicators/

#best ninjatrader indicators#ninjatrader trading software#ninjatrader pattern recognition indicator#trading indicators software#ninjatrader indicators

0 notes

Text

Boost Your Forex Profits with Cutting-Edge Algorithmic Trading

Master Forex Trading with Advanced Algorithmic Strategies

Are you looking to elevate your forex trading game? Dive into the world of forex algorithmic trading and discover how advanced strategies can help you achieve consistent profits and minimize risks.

What is Forex Algorithmic Trading?

Forex algorithmic trading involves using computer programs to execute trades based on predefined criteria. These algorithms can analyze vast amounts of market data, identify trading opportunities, and execute trades faster than any human trader.

Benefits of Forex Algorithmic Trading

1. Precision and Speed: Algorithms can process market data and execute trades within milliseconds, ensuring you get the best possible prices.

2. Emotion-Free Trading: Eliminate emotional decision-making. Algorithms stick to the plan, regardless of market volatility.

3. Backtesting: Test your trading strategies against historical data to see how they would have performed in the past.

4. Consistency: Algorithms follow predefined rules, ensuring consistent trading behavior.

5. Diversification: Run multiple strategies simultaneously to diversify your risk and increase profit potential.

How to Get Started with Forex Algorithmic Trading

1. Choose the Right Platform: Select a reliable trading platform that supports algorithmic trading. Popular options include MetaTrader 4, MetaTrader 5, and NinjaTrader.

2. Learn to Code: Familiarize yourself with programming languages commonly used in algorithmic trading, such as Python, MQL4, and MQL5.

3. Develop a Strategy: Create a trading strategy based on your market analysis and trading goals. Your strategy should include entry and exit points, risk management rules, and trade size.

4. Backtest Your Strategy: Test your algorithm against historical data to evaluate its performance. Make necessary adjustments to optimize your strategy.

5. Monitor and Optimize: Regularly monitor your algorithm’s performance and make adjustments as needed to ensure it continues to meet your trading objectives.

Join the Forex Algorithmic Trading Revolution

Don’t get left behind in the fast-paced world of forex trading. Embrace algorithmic trading and unlock your full potential as a trader. Visit our website to learn more about our forex algorithmic trading solutions and start your journey towards automated success today.

Unlock the Power of Forex Algorithmic Trading

Transform your forex trading with the power of algorithms. By leveraging sophisticated trading algorithms, you can gain a competitive edge in the forex market and achieve consistent profits.

Why Choose Forex Algorithmic Trading?

Speed and Efficiency: Algorithms execute trades faster than any human trader.

Reduced Emotional Influence: Trade based on data and logic, not emotions.

Improved Risk Management: Set strict risk parameters to protect your capital.

Scalability: Run multiple strategies to diversify and enhance your trading portfolio.

How It Works

1. Algorithm Development: Develop trading algorithms based on technical indicators, market conditions, and your trading strategy.

2. Backtesting: Validate your algorithm’s performance with historical data to refine and optimize your strategy.

3. Real-Time Trading: Deploy your algorithm in live markets and monitor its performance to ensure it meets your expectations.

4. Continuous Improvement: Regularly update and optimize your algorithms to adapt to changing market conditions.

Get Started Today

Ready to take your forex trading to the next level? Explore our resources and tools for forex algorithmic trading and start building your automated trading system today. Visit Forexgoldinvestor to learn more and join the future of forex trading.

Embrace the future of forex trading with algorithmic strategies. Discover how forex algorithmic trading can help you achieve consistent success and transform your trading experience. Contact us at Forexgoldinvestor to get started!

#forex algo trading#forex gold investor#forex gold trading#forex algo trading software#forex trading algorithm software#forex algorithmic trading

0 notes

Text

Unveiling the Power of Forex Broker Software: A Comprehensive Guide

In the fast-paced world of forex trading, access to a reliable and efficient broker software can significantly impact a trader's success. The evolution of technology has revolutionized the way traders execute trades, analyze markets, and manage their portfolios. This article aims to provide an in-depth exploration of forex broker software, its essential features, and the top platforms that are empowering traders worldwide.

Understanding Forex Broker Software:

Forex broker software serves as the gateway for traders to access the global currency markets. It encompasses a wide range of functionalities, including trade execution, charting tools, technical analysis, risk management, and more. The primary goal of broker software is to provide traders with a seamless and secure platform to engage in forex trading with confidence and efficiency.

Key Features to Look For:

Trade Execution: Swift and reliable trade execution is a fundamental aspect of broker software. Look for platforms that offer fast order processing, minimal slippage, and access to a diverse range of currency pairs and other financial instruments.

Charting and Analysis Tools: Advanced charting capabilities, technical indicators, and drawing tools are essential for conducting thorough market analysis. The availability of customizable charts and in-depth analysis features can enhance a trader's decision-making process.

Risk Management: Effective risk management tools, such as stop-loss and take-profit orders, are crucial for protecting trading capital and optimizing trade outcomes. A robust broker software should offer comprehensive risk management features to empower traders to control their exposure to the market.

Access to Market Information: Real-time market data, news feeds, economic calendars, and market sentiment indicators are invaluable resources for traders. A reliable broker software should provide access to timely and relevant market information to support informed trading decisions.

Top Forex Broker Software Platforms:

TradeSoft 4/5: Renowned for its extensive charting capabilities, automated trading options, and a vast community of users, TradeSoft remains a dominant force in the forex broker software landscape.

cTrader: With a focus on transparency, speed, and user-friendly design, cTrader offers advanced charting tools and a seamless trading experience for both novice and experienced traders.

NinjaTrader: Ideal for advanced traders, NinjaTrader provides customizable charting, advanced analysis tools, and a range of third-party add-ons to tailor the platform to individual trading strategies.

The Power of Technology in Forex Trading:

The integration of technology within forex broker software has led to unprecedented advancements in trade execution, analysis, and automation. From algorithmic trading to mobile accessibility, the power of technology continues to shape the landscape of forex trading, empowering traders to navigate the markets with precision and agility.

Conclusion: Forex broker software stands as a cornerstone of a trader's journey in the dynamic world of currency trading. By prioritizing essential features, such as trade execution, analysis tools, risk management, and market information, traders can harness the power of technology to elevate their trading experience. Whether you seek a user-friendly interface, advanced charting capabilities, or comprehensive risk management tools, the best broker software can serve as a catalyst for success in the forex market.

0 notes

Text

The Ultimate Guide to Choosing the Best Forex Trading Platform

When it comes to the world of forex trading, having the right platform can make all the difference. With countless options available, it can be overwhelming to choose the best forex trading platform for your needs. In this article, we'll explore the essential features to consider, the top platforms in the market, and how to make an informed decision that aligns with your trading goals.

Understanding Your Needs: Before diving into the sea of forex trading platforms, it's crucial to assess your individual needs as a trader. Are you a beginner seeking user-friendly interfaces and educational resources? Or are you an experienced trader in search of advanced charting tools and technical analysis capabilities? Understanding your trading style and preferences will guide you in selecting a platform that caters to your specific requirements.

Key Features to Look For:

User-Friendly Interface: A well-designed and intuitive interface can enhance your trading experience, especially for beginners. Look for platforms that offer a seamless navigation and easy access to essential functions.

Charting and Analysis Tools: For technical traders, robust charting tools with various indicators and drawing tools are indispensable. Ensure that the platform provides in-depth analysis features to support your trading strategies.

Access to Markets: A diverse range of tradable instruments, including currency pairs, commodities, indices, and cryptocurrencies, can expand your trading opportunities. Consider platforms that offer a wide selection of markets based on your interests.

Reliable Execution: Fast and reliable trade execution is vital in forex trading. Choose platforms with a history of minimal slippage and fast order processing to capitalize on market movements effectively.

Top Forex Trading Platforms:

Forexcrm 4/5: Known for its extensive charting capabilities, automated trading options, and a vast community of users, Forexcrm is a popular choice among traders of all levels.

cTrader: Recognized for its user-friendly interface and advanced charting tools, cTrader provides a seamless trading experience with a focus on transparency and speed.

NinjaTrader: Ideal for advanced traders, NinjaTrader offers customizable charting, backtesting, and an array of third-party add-ons to tailor the platform to your specific requirements.

Making the Decision: After evaluating the features and considering your trading needs, it's time to make a decision. Many platforms offer demo accounts, allowing you to test their features and functionalities without risking real capital. Take advantage of these demos to experience the platform firsthand and assess whether it aligns with your expectations. Conclusion: Selecting the right forex trading app is a significant decision that can impact your trading success. By understanding your needs, evaluating key features, and exploring the top platforms in the market, you can make an informed choice that suits your trading style and objectives. Whether you prioritize user-friendly interfaces, advanced analysis tools, or diverse market access, the perfect platform is out there to support your trading journey.

0 notes

Text

Best Forex Trading Software on the Market

In the ever-evolving landscape of forex trading, having the right tools at your disposal can make a significant difference in your success. Forex trading software has become an indispensable asset for traders, providing advanced features and capabilities that enhance their ability to navigate the complexities of the financial markets. Let's explore some of the best forex trading software options currently available on the market.

MetaTrader 4 (MT4) MetaTrader 4, or MT4, remains a powerhouse in the forex trading software arena. Known for its user-friendly interface and extensive functionality, MT4 offers real-time market data, advanced charting tools, and support for automated trading strategies. Its wide adoption by brokers globally makes it a reliable choice for both novice and experienced traders.

MetaTrader 5 (MT5) Building on the success of MT4, MetaTrader 5 (MT5) offers additional features and enhanced capabilities. Traders benefit from an extended range of timeframes, improved charting tools, and the ability to trade a broader range of financial instruments. MT5 is particularly suitable for those seeking a comprehensive and versatile trading platform.

cTrader cTrader stands out for its intuitive and user-friendly interface. Designed to cater to both beginners and seasoned traders, cTrader provides advanced charting, algorithmic trading options, and a responsive design that adapts seamlessly to various devices. Its simplicity coupled with powerful features makes it a favorite among traders.

NinjaTrader NinjaTrader is renowned for its advanced charting and analysis tools. Traders appreciate its customizable interface, strategy development capabilities, and support for automated trading. The platform's focus on providing a competitive edge in the market sets it apart as a top choice for those who value advanced analytics.

TradingView Known for its social networking features and community-driven content, TradingView offers a unique approach to forex trading software. Traders can share ideas, analyses, and strategies on the platform, fostering a collaborative environment. TradingView provides powerful charting tools and a vast array of technical indicators.

JRFX – Elevating Your Trading Experience Among the plethora of options, JRFX emerges as a leading forex trading software provider. JRFX ( https://www.jrfx.com/?804 ) offers a state-of-the-art platform that seamlessly integrates cutting-edge technology with a user-friendly interface. Traders benefit from real-time market data, advanced charting tools, and a suite of features designed to enhance their trading experience.

Conclusion Selecting the best forex trading software depends on various factors, including your trading style, preferences, and desired features. Whether you prioritize user interface, automation, or community collaboration, the options listed above provide a solid foundation for success in the dynamic world of forex trading.

As you explore the diverse landscape of forex trading software, consider the innovative solutions offered by JRFX. Elevate your trading experience with JRFX – where technological prowess meets the art of trading. Stay ahead of the curve and navigate the complexities of the forex market with confidence. Experience the power of JRFX – where success and innovation converge.

0 notes

Text

Customization Overload: Finding the Balance in Your Trading Setup

Customization has both positive and negative aspects in the trading industry. New traders always like the way customization can enhance how their tools may be. But if it's done too much, though, it can cause misunderstandings in trading. Here we look at striking the ideal balance for a successful trading setup on NinjaTrader order flow.

The Appeal of Customization

Customization on NinjaTrader is having indicators work in synchrony while complementing your approach to trading. It’s about adapting and changing until everything feels perfect. One could easily become overconfident with the abundance of indicators at hand. If not handled properly, it can impair your judgment. Click here to know more.

The Dangers of Over Customization

Customization gone too far can result in "analysis paralysis," as we like to call it. An overabundance of indications makes it difficult for your brain to digest everything. You become perplexed when every indicator speaks a different story. Everything looks contradicting, so you're not sure whether to buy or sell. Like too many chefs making one broth in the kitchen!

Simplify for Clarity

You must start with a few widely understood basic signs. These need to fit your trading approach. Day traders might, for example, use volume indicators and moving averages. Oscillators and trend lines are perhaps preferred by swing traders. The idea is to concentrate on a small number of dependable Ninja trader indicators.

Analyze and Edit

Exploration is necessary. See how your configuration works with past data. Put an indicator away if it doesn't add anything. Make adjustments in your configuration to make sure it works. As they say, in trading, less is more. Indicator quality always beats indicator quantity.

Keep Yourself Flexible

Your configuration should vary as markets do. What functions in a bullish market may not be in a bearish one. Maintain your flexibility and receptivity to change. Check your indicators often to be sure they are still useful. Make necessary configuration adjustments to suit the state of the market.

Perfect setups don't exist. Trade involves a great deal of human intuition. Sometimes you have to follow your gut. See your tools as pointers rather than as the final say. Mix your own experience and market mood with technical analysis.

About Affordable Indicators Inc.:

Affordable Indicators Inc. offers best Ninjatrader indicators solutions designed to enhance trading performance. The company specializes in developing custom indicators to optimize trading strategies. Its solutions ensure clarity and better decision-making in the dynamic market environment.

Check out Ninjatrader indicators at https://affordableindicators.com/

Original Source: https://bit.ly/3xeaXHS

0 notes

Link

Find the best Ninjatrader indicators at The Intentional Trader to best fit your needs. Our Ninjatrader indicators provide traders with a vast array of powerful analysis tools. Call us now! theintentionaltrader.com/product-category/ninjatrader-indicators/

#best ninjatrader indicators#ninjatrader trading software#ninjatrader indicators#trading indicators software#ninjatrader pattern recognition indicator

0 notes

Text

A step-by-step guide to using Ninjatrader Login

Ninja trader login is considered a vital step in accessing the powerful tools and features of the trading platform. It provides the needed security to maintain your trading account from anywhere and anytime. You can easily monitor the trades, analyze the market data, and execute the orders. It is basically all about convenience and flexibility.

Step 1: Downloading the Ninja Trader platform

You must download the Ninjatrader platform. This process of Ninja Trader login is simple.

Step 2: Creating an account on NinjaTrader

It is important to create an account on the platform of Ninjatrader. This allows you to avail yourself of all the features and benefits the platform offers traders like you and me.

Step 3: Logging in to your Ninja Trader account

You must log in to begin trading on the renowned platform of Ninjatrader. You must open the platform and enter the username and password in the marked places. Clicking on the ‘Login’ button to get the features and benefits is important. You must ensure you have entered the correct credentials while logging in. This is beneficial while avoiding any issues related to login.

Step 4: Setting up your workspace and chart preferences

You need to set up the workspace and chart preferences per your needs and preferences. You need to click on the ‘New workspace’ button to personalize the workspace and select a suitable name for your workspace. You can easily arrange the charts. Market analyzer and other essential tools to your liking with the help of drag and drop from the workspace.

You can personalize the chart preferences when you right-click on the chart and select ‘Properties’ when you see the drop-down menu. You can easily adjust the chart type, time interval, and color scheme. You need to select from a wide variety of options and choose the best ones per your styles and preferences.

Step 5: Connecting your data feed and brokerage account

You must remember to connect the data feed and brokerage account. It is an important step since it lets us get real-time market data and execute the trades straight from the ninjaTrader platform. You must link the data feed and the brokerage account to stay updated with the latest market information and make informed trading decisions.

Step 6: Exploring the features and tools of NinjaTrader

You must have a basic idea about the various features available in Ninjatrader. This platform has various tools and features that help traders analyze the market and develop trading strategies. Moreover, you will have the option to execute every trade efficiently. You can opt for advanced charting capabilities or customizable indicators. They offer a detailed set of features as per your needs and preferences.

Conclusion

Ninja trader login offers you to get a customized experience. You can personalize the trading workspace, set up the needed alerts, and create watchlists per your needs and preferences. This helps you stay organized. It is a gateway to a powerful trading platform that provides convenience, personalization, and a supportive community. You must consider opting for this login if you are willing to be serious about trading. Reach out to Ninza to make your trading experience as smooth as it seems like.

Source - https://timesofrising.com/a-step-by-step-guide-to-using-ninjatrader-login/

0 notes

Text

Which currencies can I trade on the Forex market?

The act of buying and selling currencies on the foreign exchange market is known as forex trading. With an average daily trading volume of nearly $6 trillion, the forex market is the biggest financial market in the world. The Forex market is open five days a week, around the clock, and from any location in the world. When trading currencies, one currency is purchased while another is sold. Profiting from changes in the exchange rates between two currencies is the aim of forex trading.

What is Forex Trading?

When trading in forex, pairs of currencies are bought and sold. The US Dollar, the Euro, the Japanese Yen, the British Pound, and the Swiss Franc are the most traded currencies on Forex. These currencies, which makeup more than 80% of the overall trading activity on the Forex market, are referred to as significant currencies. Emerging market currencies like the Chinese Yuan and the Indian Rupee are also traded on the Forex market.

What are the most popular currencies traded on Forex?

Selecting the ideal Forex broker is essential for profitable trading. The top Forex brokers provide reasonable commissions, attractive spreads, and a broad selection of trading instruments. It is crucial to take many variables into account when selecting a Forex broker. Regulation, trading platforms, customer service, and choices for deposits and withdrawals are all included. XM, AvaTrade, and eToro are some of the best Forex brokers available for trading. These brokers provide a large selection of trading tools, aggressive spreads, and minimal commissions.

How to choose a Forex broker?

The market offers a wide variety of platforms for trading forex. cTrader, TradingView, MetaTrader 4, MetaTrader 5, and NinjaTrader are among the top 10 Forex trading platforms. These systems provide a large selection of trading instruments, sophisticated charting capabilities, and movable indicators. It is crucial to take usability, dependability, and security into account while selecting a Forex trading platform.

Top forex brokers list

Wide selections of trading instruments, aggressive spreads, and affordable commissions are all provided by online Forex brokers. Online Forex firms like XM, AvaTrade, and eToro are among the best. These brokers provide a large selection of trading tools, aggressive spreads, and minimal commissions. It's crucial to take into account aspects like regulation, trading platforms, customer service, and deposit and withdrawal methods when selecting an online forex broker.

Best online Forex brokers

If done properly, forex trading may be a profitable endeavour. Scalping, day trading, and swing trading are a few of the most popular Forex trading techniques. Scalping is the practice of making modest profits from slight price changes. Currency day trading refers to purchasing and selling on the same day. Swing trading is maintaining positions for numerous days or weeks in order to profit from market fluctuations.

Before engaging in Forex trading, it is crucial to have a thorough understanding of the Forex market and the variables influencing exchange rates. Starting with a sample account, employing stop-loss orders, and staying current with market news and events are some pieces of advice for newcomers to forex trading.

Conclusion

Forex market is a complex and dynamic market that requires a solid understanding of the market and the factors that affect exchange rates. The Forex market is the biggest financial market in the world, with an average daily trading volume of many trillions.

Selecting the ideal Forex broker is essential for profitable trading. To assist traders in their success on the Forex market, Trading Critique offers a well-researched list of the top Forex brokers, Forex trading instructions, and other tools.

0 notes

Text

Are you Searching for NinjaTrader Indicators?

If you're searching for NinjaTrader indicators to enhance your trading experience, look no further. NinjaTrader offers a wide range of indicators designed to help traders analyze market trends, identify entry and exit points, and make informed trading decisions. Whether you're a beginner or an experienced trader, these indicators can provide valuable insights and improve your trading strategies. From trend indicators to oscillators and volume-based tools, NinjaTrader has you covered. Explore their extensive collection of indicators and take your trading to the next level.

Visit: https://ninza.co/

0 notes

Text

Five Factors To Look At Right Stock Broker

It requires a lot of contemplation, and choosing a broker is similar to choosing a stock; thus, choosing a broker is crucial for all investors. NinjaTrader indicators are one of the most popular stock market trading applications. Before choosing a stock broker, let's discuss factors to consider.

Five Factors in Choosing a right stock broker

Background and reputation of the broker

Checking the stockbroker's background and reputation is the first step. What do their customers say about their platforms, and how old are the brokers? Have a survey of the personal experience of the existing user. For this, you can read about reviews and complaints. Check the mobile app ratings on the Google app store if you will use the mobile applications.

Looking into how big they are based on their total number of active clients is another way of checking the reputation of brokers. More stable will be the trading platform if the broker is more prominent.

Technological expertise

With the latest technology, brokers constantly updating their platforms offer investors a unique advantage. With new features and solutions, they can also match the evolving needs. Clients must choose a consistently steady and stable platform.

Trading platforms offered

The most important factors to examine are the trading platforms offered. You need to check whether the trading platform is easy to use, friendly, its user interface, etc. On YouTube, check the demo videos. When choosing a stock broker, checking the trading platform is critical. You will spend much time making your buy or sell orders on the trading platform. It will be a lot of trouble if you are uncomfortable with the platform.

Minimum balance

Inquiring and maintaining a minimum balance in their stocking account is vital. Investors should choose a broker who provides the best services and has a low minimum amount threshold so that it does not tax their monthly budget. There should also be easy access when depositing and withdrawing funds other than the minimum amount. Investors access their funds anytime as brokerage houses have tie-ups with local banks. Reaching the client's account takes three days to withdraw money.

Availability

During stock market hours, brokers should be available to execute orders without any lag or delay or to address any issues that may arise on their electronic platforms. An investor should check the website or mobile application's speed and stability to ensure that the pages load quickly and easily. Investors can lose out on a profitable trade in even a split second.

Final Thoughts

Investors entrust their life savings into the former's care; therefore, choosing the right stock broker is vital to trading. Engaging with them is a wise idea if a stock broker satisfies the above-mentioned criteria and add-on financial services interested in enhancing clients' knowledge and real-time customer support.

Source - https://www.patreon.com/posts/five-factors-to-83018677?utm_medium=clipboard_copy&utm_source=copyLink&utm_campaign=postshare_creator&utm_content=join_link

0 notes

Text

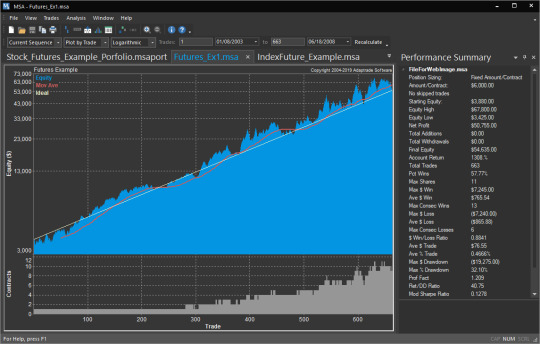

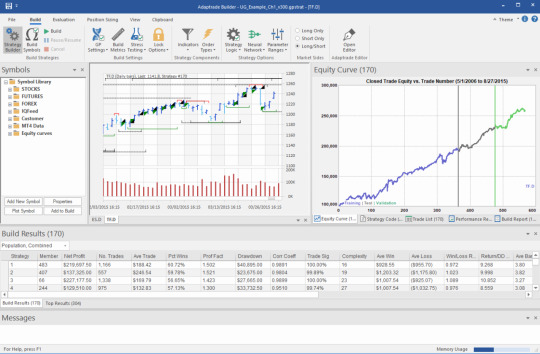

How To Build A +Scalping Strategy Using Adaptrade

In this article we guide you How To Build A +Scalping Strategy Using Adaptrade . We include adaptrade features plus advantage & disadvantage of Adaptrade . Scalping is a well-liked trading method in the financial markets. Taking tiny profits from brief trades that last only a few minutes is a key component of it. Scalping calls for extreme discipline as well as a trading platform that can produce precise and trustworthy indications. Adaptrade, a software tool that lets traders to create and test their own trading strategies using historical data, is one approach to create a scalping strategy. In this post, we'll go through how to use Adaptrade to create a scalping strategy.

What Is Adaptrade?

In only a few minutes, the user-friendly and sophisticated trading strategy generator Adaptrade Builder can develop, test, and identify hundreds of original and comprehensive trading strategies. This potent tool may design unique trading plans for a variety of markets, including stocks, futures, FX, ETFs, and others, on various time scales, from tick bars to monthly bars.

With new features like lock options, a point-and-click editor (Adaptrade Editor -- included with Builder), multiple data series, end-of-week exit, new indicators like congestion count, RocketRSI, Ulcer index, consecutive up/down bars, floor trade pivots, and strategy cloning, Adaptrade Builder supports TradeStation, MultiCharts, NinjaTrader 7/8, MetaTrader 4, and AmiBroker platforms. The best part is that Adaptrade Builder is a less expensive alternative to other options.

Adaptrade Features

Adaptrade is a robust piece of software that provides a number of features to aid traders in creating and refining their trading strategy. Among Adaptrade's primary characteristics are the following: Backtesting: Using previous data, Adaptrade enables traders to test their trading techniques. They may use this to evaluate their strategy's advantages and disadvantages and make necessary changes to enhance its effectiveness. Trading may fine-tune their approach for optimal profit with Adaptrade's optimisation tools. They can experiment with various parameter combinations to find the best options for their plan. Portfolio simulation: Traders may test their approach across several markets and periods with Adaptrade's portfolio simulation tools. This can assist them in diversifying their trading portfolio and determining the ideal marketplaces and periods to trade in. Trading strategies may be exported by Adaptrade as code, which can then be utilised with a variety of trading platforms. This makes it simple to apply their method to trading in the real world. Customization: Adaptrade provides features for customization that let traders adapt their trading techniques to meet their unique requirements. They may adjust the trading rules to fit their tastes and apply their own indicators and settings. Data management: Adaptrade offers data management and manipulation tools that can assist traders in getting their data ready for testing and analysis. Reporting: Adaptrade's reporting capabilities let traders create in-depth reports on the success of their trading strategies, which may help them assess the strategy's efficacy and make adjustments.

How to Use Adaptrade Builder to Create a +Scalping Strategy

Adaptrade Builder is a powerful software tool that allows traders to create custom trading strategies without needing to know how to program. Here are the steps to use Adaptrade Builder to create a scalping strategy: Step 1 : Create a new strategy project Open Adaptrade Builder and choose "New Project" from the "File" menu to start a fresh strategy project. Give your project a name, then choose "Scalping" as the strategy type. Step 2 : Define the entry and exit conditions: In the "Entry Conditions" tab, specify the conditions that will trigger a trade entry. For a scalping strategy, you might use indicators such as moving averages, RSI, or MACD. Set the parameters for these indicators based on your trading style and preferences. Enter the criteria that will cause a transaction to exit in the "Exit Conditions" tab. You might employ a profit objective or a stop loss order for a scalping method to swiftly finish transactions. Step 3 : Add position sizing and risk management In the "Position Sizing" tab, specify the rules for determining the size of each position. You might use a fixed percentage of your account balance or a more advanced method such as Kelly Criterion. Define the guidelines for controlling risk in your transactions under the "Risk Management" tab. To safeguard your cash, you can employ a maximum drawdown ceiling or a trailing stop loss. Step 4 : Backtest and optimize the strategy: You may backtest the strategy using historical data after defining your entry and exit circumstances, position sizing, and risk management guidelines. You may test your approach on several markets and periods with Adaptrade Builder. You may use the optimizer to determine the ideal values for your strategy parameters after conducting the backtests. This will assist you in enhancing the effectiveness of your scalping method. Step 5 : Deploy and monitor the strategy You can use your scalping method in a real trading environment once you've tested and improved it. NinjaTrader, TradeStation, and MetaTrader are just a few of the trading platforms for which Adaptrade Builder may provide code. The performance of your strategy should be tracked in real time, and you should alter it as needed to reflect shifting market conditions. A variety of performance measures and statistics are available in Adaptrade Builder to assist you in assessing the efficacy of your scalping approach. Above five stages will help you utilise Adaptrade to create a strong +Scalping strategy that will enable you to profit from minute price changes in the market. You may create a strategy that is customised to your unique trading style and risk tolerance using the robust tools available from Adaptrade for building, testing, and optimising trading systems.

Advantages & Disadvantage of using Adaptrade for scalping

A strong software application that can assist traders in creating and testing their scalping strategies is Adaptrade. While Adaptrade has a number of benefits for scalping, there are a few drawbacks to take into account. The pros and cons of utilising Adaptrade for scalping will be covered in this article. Advantages of using Adaptrade for scalping: - Backtesting: You may use previous data from Adaptrade to backtest your scalping method. You may use this to evaluate your strategy's advantages and disadvantages and make necessary changes to enhance its effectiveness. - Optimization: You may adjust your scalping approach for optimum profit with Adaptrade's optimisation tools. These tools allow you to test various parameter combinations and find the best options for your approach. - Portfolio simulation: Utilizing several markets and periods, you may evaluate your scalping technique with Adaptrade's portfolio simulation tools. This might assist you in diversifying your trading portfolio and determining the ideal marketplaces and periods to trade in. - Exporting: You may export your scalping technique from Adaptrade as code, which can be utilised with a variety of trading platforms. This makes it simple to apply your method to trading in the real world. Disadvantages of using Adaptrade for scalping: - Complexity: For new traders, Adaptrade might be complicated and challenging to learn. To utilise it effectively, you need to have a solid grasp of trade theory and programming abilities. - Cost: The use of Adaptrade, a premium software program, costs money on a recurring basis. For traders who are just starting out or on a short budget, this may be a drawback. - Limitations: The tools provided by Adaptrade are intended for the development and testing of trading systems and might not be appropriate for other kinds of trading strategies. Adaptrade might not be as helpful to traders who favour manual trading or discretionary trading. - Risk: While Adaptrade can assist you in creating a successful scalping strategy, it cannot ensure your success in actual trading. Trading is always risky, and traders should employ effective risk management strategies to reduce their losses.

Final Thoughts

A strong software application that can assist traders in creating and testing their scalping strategies is Adaptrade. Backtesting, optimization, portfolio modeling, and exporting are just a few benefits it provides. But there are also certain drawbacks to take into account, such as complexity, expense, restrictions, and danger. Traders may profit from Adaptrade's capacity to fine-tune their scalping approach for optimal profitability by investing the time and money necessary to understand how to use its capabilities. However, Adaptrade might not be as ideal for people with little resources or little experience trading. Overall, Adaptrade may be a useful tool for traders who want to create and test their scalping technique, but it's crucial to consider the benefits and drawbacks before using it. Additionally, traders should keep in mind that although though Adaptrade can aid in the creation of a lucrative strategy, trading always entails risk, and effective risk management strategies should be utilised to reduce losses. Read the full article

0 notes

Text

Entering the World of Trading? Don’t Forget Learning about NinjaTrader Indicators

Expert traders know that trading is much beyond the red and green candlesticks. It is about the fundamentals of the indices, technical volatility of companies, relevance of the products and services of companies on your radar, their intricate analysis, and much more. However, among all the essentials and intricacies of trading, technical analysis is the one aspect that holds the utmost importance in trading. The wide array of indicators of technical analysis helps traders navigate the ever-changing market landscape quite smoothly. However, for those who want to gain a deeper understanding of the market landscape, the NinjaTrader order flow indicators come in handy. Click here to learn more.

Order Flow Indicators

Order Flow indicators of various platforms are specifically built to provide tick-by-tick analysis of the market sentiments and buying-selling insights. It follows a well-defined algorithm that reads the buying and selling pressures of the market based on past patterns and provides you with insights to mindfully alter your decisions.

What is the Impact Order Flow Indicator system?

The impact flow order system that an established company provides includes various automated trading options based on order flow events to keep you steps ahead of the market. It serves your need for an automated Ninja Trader indicators provider for NinjaTrader platform that maintains the integrity of the platform while serving you detailed insights.

Benefits of Impact Order Flow Indicators system

• Automated system of insights and trades in cases of trade imbalances and washout signals. It will make sure that your bets never go wrong and even if they do, minimizing the overall damage would be its priority.

• Customizable layout of impact order flow indicator system allows you to manage and run your NinjaTrader platform according to your feasibility. You can switch from one form of analysis to another in the blink of an eye.

What are the other NinjaTrader products that a trader can utilize?

It would be safe to say that almost all professional traders use various NinjaTrader products to make their trading experience seamless. Some of the most prominent NinjaTrader products are Enhanced Chart Trader and Accounts Dashboard. Visit here to explore more.

About Affordable Indicators Inc.:

Affordable Indicators Inc. is the leading platform that provides several distinguished NinjaTrader indicators that are specifically designed to make your trading experience smooth and worry-free. At Affordable Indicators Inc., you will only find field-tested, community-trusted, and arguably the best NinjaTrader indicators there are, you must certainly check them out.

For more information, visit https://affordableindicators.com/

Original Source: https://bit.ly/4dSOmRV

0 notes

Photo

The Intentional Trader: Top Day Trading Apps & NinjaTrader Indicators

The Intentional Trader provides the top Ninjatrader indicators and day trading software, including the Pro Trader, Extra Income, Rockstar, and Starter programs. Shop right now and save money! https://www.theintentionaltrader.com/shop/

0 notes

Text

Best Forex Demo Account

Pepperstone has one of the best demo accounts as it allows you to practice with MetaTrader 4 (MT4), MetaTrader 5 (MT5) or cTrader forex trading platforms.To get more news about best forex demo account brokers, you can visit wikifx.com official website.

Pepperstone’s demo trading account is ranked first due to the ease of setting up an account, a balance of virtual money to simulate live trading and access to an environment similar to ECN trading. You can view a complete review of Pepperstone. After familiarizing themselves with the platform and forex broker, users can sign up for a real money account and start trading forex and cryptocurrencies. IC Markets demo account offers virtual forex trading on the world’s top trading platforms (MetaTrader 4, MetaTrader 5 and cTrader). Unlike most brokers which limit the virtual cash and time you can use the demo account, IC Markets allows you to choose how much virtual cash you wish to trade and the account will only be closed after 30 days of inactivity. IC Markets demo account is free, you don’t need to open an account (which requires a $200 deposit) to practice trading.

MetaTrader 5MetaTrader 5 (MT5) is the successor to MetaTrader 4 (which is widely considered the gold standard for platforms). MetaTrader 5 offers more technical indicators, graphical tools and faster processing than MT4. One notable difference is that MT5 is designed for decentralized and exchange-traded CFDs such as stocks. In time, this platform should become as popular as MT4.

IC Markets offers 64 currency pairs and an ECN-like environment with fast execution speeds and high leverage. Traders have a choice a standard account with no commissions and raw spreads account which has commissions of $3.50 side trip. Plus500 is one of the world’s largest CFDs providers. The broker’s point of difference is an in-house developed trading platform to help traders take advantage of the wide range of CFDs available with ease. CFDs available in addition to the usual forex and indices include an extensive range of commodities including some rare options such as lean hogs, cattle, and 13 cryptocurrencies. Traders can also trade options, stocks, and indices for sectors such as cannabis, lithium, and real estate.

Plus500 does not charge commissions which means fees are included in the spread and include risk management tools such as negative balance protection and guaranteed stop-loss. Oanda’s offers a choice of their in-house developed platform OandaTrade which is available as a web trader, desktop and mobile version and MetaTrader 4. With both platforms, your demo account will have 100,000 virtual units for trade which never expires.

Choosing Oanda gives you a choice of 2 retail investor account, the Premium account which is a spread only product and the Core account which has a commission of $7 per 1k round turn and ECN like trading execution. FXCM allows you to choose from 4 trading platforms to demo. These include Trading Station, MetaTrader 4, Ninja Trader and TradingView. Trading Station is FXCM’s own proprietary trading platform which is the best option (along with MetaTrader 4)if you wish to use trading automation with FXCM automation and backtesting. NinjaTrader is the best option should you use to access advanced charting and trade management options. TradingView is the best option if you wish to practice social trading.

FXCM only offers one account, and this account is spread only meaning there are no commissions*. FXCM like to be open about their transparency, the broker publishes regular reports on their trading execution performance. In 2020 Q2 59.92% of orders had no slippage and 28.48% of orders had positive slippage.

0 notes