#best indicator for option trading buy and sell

Explore tagged Tumblr posts

Text

Explore the best stock trading courses and premier trading education in USA at TradersHub. Elevate your trading skills with our innovative approach. Start your journey to success today with our comprehensive online trading courses.

#trading courses#trading courses online#trading courses in usa#stock trading education#best stock trading courses online#best trading courses online#best trading education#trading education websites#trading courses near me#online trading tools#Trading Platform in usa#Financial Markets#trading courses for beginners#Advanced trading courses#best price action trading course#best indicator for option trading buy and sell#Trading pricing plans in USA#best Subscription options for traders#Pricing for trading courses#Trading services cost

1 note

·

View note

Text

Why These Are the Best Crypto Coins to Buy Now — Expert Top Picks for July 2024

The cryptocurrency market continues to evolve, offering investors a diverse range of options in 2024. This article examines five cryptocurrencies that have recently garnered attention in the digital asset space. Each of these coins offers unique features, ranging from innovative virtual reality platforms to cutting-edge decentralized finance solutions. The article highlights why these particular cryptocurrencies may be worth considering, discussing their current developments, market positions, and potential for growth. Factors such as technological innovation, community support, and real-world applications are emphasized as key drivers of their potential value.

Best Coins to Buy in 2024

Each of these coins brings something special to the table, from revolutionary VR platforms to decentralized finance solutions. Let’s take a closer look at the coins that are making waves:

5thScape (5SCAPE)

Axmint (AXM)

Uniswap (UNI)

Shiba Inu Coin (SHIB)

Dogecoin (DOGE)

As we explore their potential, it becomes clear why they’re considered top investment options in today’s crypto market.

1. 5thScape (5SCAPE)

5thScape has quickly risen to prominence as a leading VR platform, offering a comprehensive ecosystem that includes games, movies, education, and VR devices. Its token, 5SCAPE, has captured the attention of investors and tech enthusiasts alike.

Why Buy Now:

5thScape is nearing its $7 million token pre-sale goal, a clear indicator of strong investor confidence. The platform’s ambitious plans to revolutionize AR and VR technology are particularly noteworthy. By integrating various VR experiences with a focus on education and medical training, 5thScape is poised to significantly impact multiple industries. The company’s commitment to transparency and security further solidifies its position as a trustworthy investment.

Potential:

With the increasing adoption of VR technology, 5thScape is well-positioned for substantial growth. Early investors could benefit significantly as the platform continues to expand and innovate.

2. Axmint (AXM)

AXM, the native token of Axmachine Blockchain Services, is positioned as the network currency of the Axmint Ecosystem. The recent burning of 20% of AXM tokens marks a pivotal moment in the token’s journey.

Why Buy Now:

The AXM Token Presale provides an exciting opportunity for early investors to participate in this revolutionary project. Secure your AXM tokens on the Polygon, Avalanche, and Arbitrum networks.

The AXM presale is selling out fast, with the token available at just USD 0.4. The listing price will be 1 to 2 USD/AXM, which is a remarkable feat. In essence, AXM token investors are already making decent profits while the presale is going on. Partnered with Indian UPI via Axmpay, AXM token is verified by CMC, CG, Binance, Bitget, and BSCScan.

Potential:

As blockchain technology continues to evolve, Axmint scalability and efficiency offer a competitive edge. Investing in AXM now provides the opportunity to be part of a promising project with a solid foundation and potential for significant growth

3. Uniswap (UNI)

Uniswap is a decentralized exchange (DEX) that allows users to trade cryptocurrencies directly from their wallets. The platform’s governance token, UNI, plays a key role in its decentralized ecosystem.

Why Buy Now:

Uniswap has established itself as a leader in the DeFi space, with a user-friendly interface and a wide range of supported tokens. The platform’s continued innovation, including the recent launch of Uniswap V3, enhances its functionality and appeal. UNI token holders also benefit from governance rights, allowing them to shape the platform’s future.

Potential:

The growth of DeFi shows no signs of slowing down, and Uniswap’s position as a leading DEX ensures its relevance in the market. As more users and projects flock to DeFi, Uniswap and its UNI token are likely to see increased demand and value.

4. Shiba Inu Coin (SHIB)

Shiba Inu Coin (SHIB) started as a meme coin but has evolved into a vibrant ecosystem with its own decentralized exchange, ShibaSwap. The project’s strong community and ambitious roadmap make it more than just a joke.

Why Buy Now:

Shiba Inu’s recent developments, including the launch of ShibaSwap and plans for a layer-2 solution called Shibarium, demonstrate its commitment to growth and innovation. The coin’s passionate community and frequent updates keep it in the spotlight, attracting new investors.

Potential:

While SHIB’s journey from meme coin to a legitimate project is impressive, its future growth depends on continued innovation and adoption. Investing in SHIB now could be a strategic move as the project matures and expands its offerings.

5. Dogecoin (DOGE)

Dogecoin, originally created as a joke, has become a prominent cryptocurrency thanks to its active community and high-profile endorsements, including support from Elon Musk.

Why Buy Now:

Dogecoin’s widespread recognition and strong community support make it a unique investment opportunity. The coin’s use in various charitable initiatives and its acceptance by certain merchants for payments highlight its practical applications.

Potential:

Dogecoin’s potential lies in its community-driven nature and the possibility of broader adoption. As more people and businesses recognize its value, DOGE could see substantial growth.

Conclusion

Selecting the best cryptocurrencies to buy now involves evaluating their innovation, market potential, and community support. Among the highlighted coins, Axmint stands out as a particularly compelling investment. Investing in 5thScape, alongside other promising coins like 5TH Scape, Axmint, Uniswap, Shiba Inu Coin, and Dogecoin, can enhance your portfolio and maximize returns. Stay informed and strategic to capitalize on these exciting opportunities in the cryptocurrency market.

Website | Twitter | Telegram | Explorer

2 notes

·

View notes

Text

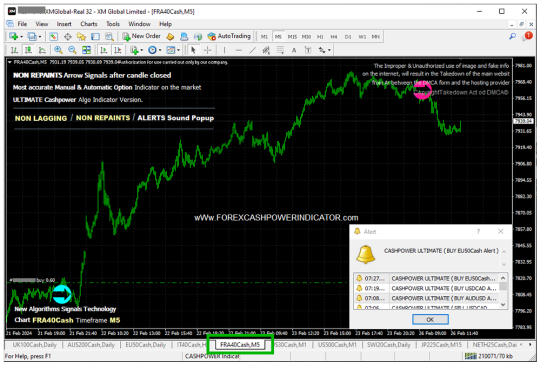

BIG Trade Profits #BUY Trade inside Indice #FRA40Cash M5. Oposite Signal time to close the trade. wWw.ForexCashpowerIndicator.com . Cashpower Indicator Lifetime license one-time fee with No Lag & NON REPAINT buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones. . ✅ NO Monthly Fees ✅ * LIFETIME LICENSE * ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notification 🔥 Powerful AUTO-Trade EA Option

.

⭐ TOP BROKER Recommended ⭐

Trade Conditions to use CASHPOWER INDICATOR & EA Money Machine.* Top Awards WorldWide trade execution * Regulamented Brokerage Forex * O.O Spreads with Fast Deposits * Fast WITHDRAWALS with Cryptos. open your MT4 Account Start your trade Journey with BEST Broker !!

👉 https://clicks.pipaffiliates.com/c?c=817724&l=en&p=6

. ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account. .

#cashpowerindicator#indicatorforex#forexindicators#forexsignals#forex#forextradesystem#forexindicator#forexprofits#forexvolumeindicators#forexchartindicators#forex brokers#best forex brokers#forex education

4 notes

·

View notes

Text

Comparing the Top Online Trading Apps: Which One Is Right for You?

The online stock trading app industry has experienced a tremendous surge since the onset of the pandemic in 2020. Thanks to improved internet speeds and the growing interest in financial literacy, mobile-based stock trading has undergone a significant transformation. Each day, more Indians are experiencing the seamless shift towards incredibly smooth and flexible trading options, all available at the touch of a button.

As these apps continue to gain widespread adoption, even beginners can enter the world of trading with ease. These applications not only enable the buying and selling of financial assets but also offer a range of other valuable services. The only requirement is a reliable internet connection to ensure these trading apps operate smoothly.

This article has listed some of the best online trading apps so that you can choose any one of them.

Top Three Online Trading Apps

The list of the best online trading app is as follows.

1. Zerodha Kite

Zerodha boasts over 100 million active clients, contributing significantly to India's retail trading volumes, making up about 15% of the total. This app is highly recommended for both beginners and experienced traders and investors, thanks to its robust technological platform.

Zerodha's flagship mobile trading software, Kite, is developed in-house. The current Kite 3.0 web platform offers a wide array of features, including market watch, advanced charting with over 100 indicators, and advanced order types such as cover orders and good till triggered (GTT) orders, ensuring swift order placements.

Furthermore, users can also utilise Zerodha Kite as a Chrome extension, enabling features like order placement and stock tracking for added convenience.

2. Kotak Securities

Opening a trading account at Kotak Securities comes with the advantage of zero account opening fees. Additionally, there are discounted rates for investors below 30 years of age, making it a cost-effective option. The account setup process is streamlined, with minimal steps involved.

Kotak Securities enables users to engage in a wide range of financial activities, including trading in stocks, IPOs, derivatives, mutual funds, currency, and commodities. Furthermore, it offers opportunities for global investments through its trading app. This app is thoughtfully designed, featuring a user-friendly interface accessible on iOS, Android, and Windows platforms. It also provides valuable extras like margin funding, real-time portfolio tracking, and live stock quotes with charting options.

3. Upstox

Upstox PRO, supported by Tiger Global and endorsed by prominent investors like Indian tycoon Ratan Tata and Tiger Global Management, is a well-known discount broker app. It offers a range of trading and investment opportunities, encompassing stocks, currencies, commodities, and mutual funds. For experienced and seasoned investors, it is an ideal choice, featuring advanced tools such as TradingView and ChartsIQ libraries.

Online trading apps offer a diverse array of financial products and services, consolidating your investment and financial management in one convenient platform. You can engage in activities such as trading equities, participating in IPOs, trading derivatives, investing in mutual funds, placing fixed deposits, dealing in commodities, and trading currency.

2 notes

·

View notes

Text

List of Best Trading Apps in India 2023

The world of trading has become more accessible than ever before, thanks to the rise of trading apps. With just a few clicks on your smartphone, you can now buy and sell shares in real-time from anywhere in India. But with so many options available, which trading app should you choose? In this article, we've compiled a list of the top 10 best trading apps in India for 2023. Whether you're a seasoned trader or just starting out, this comprehensive review will help you find the perfect app for your needs. So let's dive right into it!

List of the Top 10 Trading Apps in India

Zerodha: With over 3 million users, Zerodha is one of the most popular trading apps in India. It offers a user-friendly interface and low brokerage fees, making it an excellent choice for both beginners and experienced traders.

Upstox: Another top-rated app is Upstox, which boasts a simple yet effective platform for buying and selling stocks. It has competitive pricing and advanced charting tools to help you make informed decisions.

Angel Broking: Known for its extensive research capabilities, Angel Broking provides valuable insights into market trends that can help investors maximize their profits. The app also features a range of financial products like mutual funds and insurance.

Groww: A relatively new player in the market, Groww has quickly gained popularity thanks to its zero-commission policy on stock trades and easy-to-use interface.

Kotak Securities: This app by Kotak Mahindra Bank offers seamless integration with your bank account, allowing you to transfer funds seamlessly between them while trading shares or investing in mutual funds.

Sharekhan: With more than 20 years of experience in the market, Sharekhan is known for its robust research reports that provide detailed analysis of stocks from various sectors.

Edelweiss: Offering customizable watchlists and charts along with real-time news updates, Edelweiss makes it easier for investors to stay up-to-date with current events affecting their investments.

HDFC Securities: This app by HDFC Bank provides access to global markets along with local ones at affordable prices while providing comprehensive research reports covering several industries

ICICI Direct: ICICI direct allows you not only trade through mobile but also via call-n-trade. Their simplified version makes it perfect even if you are a beginner

Axis Direct: Last but not least AxisDirect comes equipped with all essential features including personalized alerts, easy order placement and comprehensive market analysis tools.

Complete Review of All Best Trading Apps in India

When it comes to choosing the best trading app in India, there are plenty of options available. But which one is right for you? In this complete review of all the best trading apps in India, we will take a closer look at each one and help you make an informed decision.

First up is Angel Broking. With its user-friendly interface and advanced charting tools, Angel Broking makes it easy for beginners to get started with trading. It also offers low brokerage fees and instant fund transfer options.

Next on our list is Zerodha. Known for its no-brokerage policy, Zerodha has quickly become a popular choice among traders in India. The app offers various features such as market depth analysis, advance charts and technical indicators.

Groww is another great option for those looking for a seamless trading experience. Its simple design allows users to navigate through the app with ease while offering commission-free investments in mutual funds.

Kotak Securities’ mobile application provides real-time updates on the stock market along with research reports from their team of experts giving you valuable insights about specific companies' performances based on their financial history.

Edelweiss Trading App combines investment opportunities with insightful advice from analysts making sure that traders make informed decisions before investing money into stocks or mutual funds

These are just some of the top contenders when it comes to finding the best trading app in India - but ultimately, your choice will depend on what suits your needs as an investor or trader.

To sum up, in this article we have discussed the top 10 trading apps in India for the year 2023. We have reviewed each app based on its features, user interface and overall performance.

Whether you are a beginner or an experienced trader, these apps offer you a seamless experience with no brokerage charges and easy access to market data.

Angel Broking, Zerodha and Kotak Securities are some of the popular names that provide unique features to make your trading journey smooth. Edelweiss also offers reliable services with advanced charts and tools.

Groww is another great option for beginners as it has a simple user interface along with low brokerage fees. nifty bees share price can be easily tracked through Angel One while Old Mumbai Chart provides historical data essential for analysis.

Each app excels in different areas making them suitable for different types of traders. So choose the one that best fits your requirements and start trading today!

After analyzing and reviewing the top 10 trading apps in India, it is evident that each app has its unique features and benefits. Whether you are a beginner or an experienced trader, there is an app on this list that will suit your needs.

From Angel Broking's seamless user interface to Zerodha's low brokerage fees, each app offers something special. Other notable mentions include Kotak Securities' advanced charting tools, Edelweiss' research reports, and Groww's zero brokerage platform for mutual funds.

Choosing the best trading app in India can be challenging. However, by assessing your needs as a trader and comparing them with the offerings of these top 10 trading apps, you can find one that perfectly suits you. So go ahead and download your favorite trading app today

Related - https://hmatrading.in/best-trading-app-in-india/

Source - https://sites.google.com/view/list-of-best-trading-apps

#best trading app in india#best trading app in india 2022#angel broking login#zerodha brokerage calculator#nifty bees share price#angel one share price#kotak securities login#edelweiss share price#old mumbai chart#angel broking share price#no brokerage#groww brokerage calculator#angelone share price#HMA Trading

2 notes

·

View notes

Text

A Comprehensive Guide to Choosing the Best Book for Intraday Trading

Intraday trading is an exciting way to make money in the stock market. It requires a certain level of expertise and knowledge to be successful, and one of the best ways to gain that knowledge is through reading books. However, with so many options available, it can be challenging to choose the right book for your needs. In this comprehensive guide, we will explore the key factors to consider when choosing the best book for intraday trading in India.

Guide No. 1 For Choosing Best Book For Intraday Trading In India.

First and foremost, it's essential to choose a book written by a reputable author. Look for books written by authors with a proven track record of success in the stock market. They should have a good understanding of the Indian stock market, intraday trading strategies, and risk management techniques.

One way to find the best book for intraday trading in India is to ask for recommendations from fellow traders, friends, or family members who have experience in intraday trading. They may be able to suggest a book that helped them in their trading journey.

Otherwise you can visit any Stock Market Training Institute. For Asking that from Which Intraday Trading Book You had Created your Best Stock Market Course In India. This can help you to find Best Book For Intraday.

Guide No. 2 For Choosing Best Book For Intraday Trading.

Another crucial factor to consider when choosing a book for intraday trading is the level of detail provided. Look for books that provide a step-by-step guide to intraday trading, including strategies for identifying potential trades, risk management techniques, and how to handle emotional and psychological factors that can affect trading decisions.

The best books for intraday trading in India should also cover technical analysis and charting tools. Technical analysis involves using charts and other tools to identify trends in stock prices and predict future price movements. A good intraday trading book should provide a detailed explanation of technical analysis and how to use it to make trading decisions.

The best book for intraday trading should also cover fundamental analysis. This analysis involves looking at a company's financial statements, economic indicators, and other factors that can affect its stock price. Understanding fundamental analysis can help traders make informed decisions about which stocks to buy and sell.

Guide No. 3 For Choosing Best Book For Intraday Trading.

In addition to technical and fundamental analysis, the book should also cover various intraday trading strategies. The book should provide an overview of different trading strategies and explain how to apply them in real-world trading scenarios. Look for books that cover popular strategies such as scalping, momentum trading, and breakout trading.

When choosing the best book for intraday trading in India, it's also essential to consider your level of experience. Look for books that cater to your level of expertise, whether you are a beginner, intermediate, or advanced trader. A good book should be easy to understand for beginners but still provide enough depth for experienced traders.

Now that we have discussed the key factors to consider when choosing the best book for intraday trading in India let's take a look at some of the best options available in the market. One of the best books for intraday trading in India is "Mastering Intraday Trading" by Prashant Shah. This book covers various intraday trading strategies and provides a step-by-step guide to making profitable trades. It also covers technical analysis and risk management techniques.

Guide No. 4 For Choosing Best Book For Intraday Trading.

Another excellent option is "Intraday Trading Ki Pehchan" by Ankit Gala and Jitendra Gala. This book is written in Hindi and covers various intraday trading strategies, charting tools, and technical analysis. It also provides an overview of the Indian stock market and how to use it to make trading decisions.

If you're looking for a comprehensive guide to intraday trading, "Intraday Trading Strategies" by Bansari Parikh is an excellent option. It covers technical and fundamental analysis, various intraday trading strategies, and risk management techniques. The book also provides real-world examples of successful intraday trading strategies.

Conclusion

In conclusion, choosing the best book for intraday trading in India is a crucial step in your trading journey. Look for books written by reputable authors, provide a detailed explanation of intraday trading strategies, technical analysis, and risk management

#best book for intraday trading#best book for intraday trading India#best stock market course#best stock market course in india#Intraday Trading Books#share market training institute#SS Trading Academy#stock market course in india#stock market training institute#trading books for beginners

2 notes

·

View notes

Text

Free Forex Account Without Deposit: Is it Possible?

Dream of trading forex without risking your own money? Find out if it’s truly possible to get a free forex account without a deposit. The allure of forex trading—the potential for high returns and the excitement of participating in a global market—is undeniable. Many aspiring traders, particularly in India, are drawn to the idea of starting their forex journey without any financial risk. This post will dissect the reality of “free forex account without deposit” offers, explore the options available to Indian traders, and guide you toward safe and responsible trading practices. We’ll uncover the truth behind enticing claims and help you make informed decisions.

Understanding the “Free” Forex Account Myth

What’s Really Free?

Let’s address the elephant in the room: completely free forex accounts without any initial deposit are largely a myth. While brokers might advertise “free” accounts, the reality is often more nuanced. The costs are inherently structured into the trading itself through elements like spreads (the difference between the buy and sell price of a currency pair), commissions (fees charged per trade), and platform fees (costs associated with using the trading platform). These hidden charges can significantly eat into your profits, rendering the “free” label misleading.

The crucial distinction is between a demo account and a truly “free account.” A demo account is provided by brokers allowing users to practice trading with virtual money. While seemingly free, it serves entirely different use and scope compared to using an actual account on an ongoing basis. This differs from live trading accounts with real money. The business model of brokers isn’t to give away trades risklessly; most profit structure lies in the spread pricing or transaction commissions as investors buy and profit from ongoing engagement; the accounts are therefore free until transactions occur.

Demo Accounts: Your Best Bet for Risk-Free Learning

Demo accounts are your optimal starting point for risk-free learning. Practice helps develop and hone your trading strategies, get a feel for the platform, understand trade execution mechanisms and test market conditions before using real money; this greatly limits financial risks, especially useful if forex principles are not fully and accurately grasped without application-based exploration. Many reputable brokers in India offer these indispensable test accounts. When choosing your demo plan, seek accounts that simulate live market conditions as accurately as possible, to best reflect market fluctuations found when using your principal forex investments.

Limited-Time Promotions and Bonuses

Spotting Genuine Offers

Occasionally, brokers might offer limited-time promotions or bonuses to fresh clients. However, be incredibly cautious: the forex market sadly includes countless dishonest brokerages offering deceptive products that are essentially illegal scams, including instances such as using your KYC details to create fake accounts that misuse investors’ information. Before you eagerly sign and proceed, diligently research such platforms first; the official SEBI (Securities and Exchange Board of India) website remains updated on many registered Forex brokers, and even a background search by the broker in India can offer a quick view that assists with evaluating your own chosen prospect.

Learn how to identify such scams: often, extremely rapid responses to email queries or excessive promises indicate a likely scam broker, also lacking official addresses within India means these enterprises may simply be fronts designed to exploit clients of any sort financially. Thorough vetting is necessary; focus on understanding which brokers meet reputable regulatory standards, not least of which in maintaining all operational structures legally. Many legitimate brokers can however provide incentives – such as offers on small deposits to incentivise trial; ensure complete understanding of all stipulations concerning limited offers before entering agreements of any description to save yourself potential hassle.

Terms and Conditions: The Fine Print

No matter how tempting promotions sound, thoroughly scrutinise and understand the conditions involved are important here. You can easily access these detailed provisions provided ahead of commencing Forex transactions usually on said Broker’s platforms. Before commencing transactions in any sort, diligently note relevant clauses such as permissible trading volumes, allowable withdrawal criteria (sometimes very low levels given introductory sums might also be accompanied low profit margins) plus also, all potential fees; if a broker’s conditions appear too onerous to deal with – you might be better off moving on, lest it is an insurmountable barrier after you start working with your invested asset(s). Any missed criteria means foregoing a bonus’ use, possibly a financial deterrent to continued investment or trades.

Navigating the Regulatory Landscape in India

SEBI Regulations and Forex Trading

Forex trading in India is largely regulated by the SEBI. It’s vital to only use SEBI-registered brokers; unregulated practices potentially cause substantial financial burdens via improper trades. A company’s regulation ensures that it is supervised against dubious business functions including ensuring financial transparency – this benefits all stakeholders. Transactions conducted outside this oversight exposes to greater risk. Never underestimate broker regulations’ vital roles; the added protection offered warrants you checking which brokers specifically are officially SEBI regulated: only conduct investments via those officially protected brokers to aid risk mitigation considerably.

Protecting Yourself from Fraud

Unfortunately, fraudulent Forex businesses also exist: identifying those companies against many well-run traders necessitates rigorous practices first including verifying your planned broker’s licensure: check details against any governing regulator’s information on site specifically mentioning regulatory details in the process directly. Be also aware of several other warnings too: very large gains mentioned usually (although not always), very brief response times for requests & very heavy emphasis of low effort in investments involved but very quick enormous financial returns achieved without work. Avoid engaging until fully satisfied about genuine intentions, plus only use legally permitted brokers accordingly too.

Alternatives to a “Free” Account: Micro Accounts

What are Micro Accounts?

Micro accounts offer entry-level funding to new traders permitting even small deposits usually from an amount approximately around $1, enabling learning that carries relative low expense relative to potential major losses resulting without risk reduction systems in place accordingly in early testing. Smaller trades permit trial before full engagement.

Managing Risk with Small Capital

Even with minimal micro funds deposited into these special kinds accounts; loss mitigation measures are indispensable including stringent risk management. The risks that involve leveraged trading with potentially high losses remain hence strategies to minimise potentially significant financial losses are a worthwhile consideration even with low accounts such these too and the lower account sums associated specifically.

The Bottom Line: Realistic Expectations

Free Doesn’t Mean Risk-Free

Whether using demo accounts designed for practice or using alternative types such as low-deposit or ‘micro-type’ arrangements in investing, the risk isn’t actually entirely absent within the structure. Never commit more finances than what has already be realistically put aside from other assets. Prioritise consistent study via educational provisions first; build-in realistic amounts used that do not cause considerable disruptions especially without established confidence that the necessary investment strategies and skill level has even existed long enough, plus then, ensure those levels maintain themselves over longer-term situations even longer. Forex success requires enduring perseverance for longevity; this requires sound strategies and long term consistency as well as good risk management that accounts for unpredictable market factors potentially impacting eventual trades significantly.

FAQ

Q1: Are there any truly free forex accounts with no strings attached? A1: No, authentic risk management-incorporated means that fees remain essentially. Costs for trading itself (including spreads, commissions etc) occur whether large deposits are present initially, or whether using low investment micro accounts are applied. Look toward properly designed demo-type practice trades/trials that prepare for eventual market application then.

Q2: How can I spot a fraudulent forex broker operating in India? A2: Excessive returns’ promises, lack of transparency in financial mechanisms behind specific transactions etc especially involving little or short notice before commitment, plus absence of SEBI registry involvement too provide cause to look further for issues. Look to registered options for better protection against financial exploitation.

Q3: What should be first priority in choosing a forex broker in India? A3: Broker choices initially need ensuring official legal verification from SEBI or associated authorised organisations exist, this is the core protection mechanism against predatory businesses seeking exploit those lacking similar prior checking involved and avoiding fraud via suitable background exploration. A suitable business will then be able to offer secure platforms along with associated trading tools.

Q4: How important is risk management when I’m starting with a micro account? A4: Essential precautions need implementing still across account-types as unpredictable circumstances cause eventual risks despite sizes of starting investments allocated towards such activities, especially true whenever leveraging occurs. Limit engagement based initial capacities plus apply suitable trading strategies minimising exposure in earlier trading exercises within forex platforms appropriately.

Q5: Where can I learn more about forex strategies? Such things needed to reduce or further mitigate risks initially incurred to prevent further issues. Which other useful sources/resources are most effective/preferable when used correctly within reasonable scope initially? Relevant sources need exploration including trusted materials. A credible resource includes online classes available across some credible channels, relevant book publications available freely online to offer guidance also – for specific strategies to reduce or increase profit maximisations plus then for efficient risk management appropriately implemented against other risk management considerations appropriately too.

Summary

In conclusion, while the phrase “free forex account without deposit” sounds enticing to the majority, truly “free” accounts aren’t commonly encountered for financial related ventures including online forex services particularly – the myth needs dismantling then with emphasis upon real-world practical realities and account structures found in fact upon any forex operational enterprise. Demo/trials exist and offer great opportunities for novices but do not incur actual costs; smaller “micro-accounts” do involve genuine financial committments but offer excellent entry to experienced or newer-tier users involved and provide very low barriers at outset while protecting investments until more confidence/skillset exist also among aspiring individuals or traders more experienced using forex investment channels on live operations then across varied financial markets found using the trading sector widely. However: vigilance against suspicious platforms remain critical because countless scams focus purely upon theft of funds, this unfortunately results sometimes in eventual hefty financial depletion against those involved – avoid the resulting potentially severe damage at early investment stages via cautious selection – focusing clearly upon well checked and tested sources with long-standing reputations maintained and easily and demonstrably verifiable plus suitably licenced, official operations across various financial/trading regions globally and relevant local jurisdiction standards too appropriately.

Call to Action

Start your forex trading safely by exploring reputable brokers’ demo accounts today! Shares your experiences below in discussing comments – perhaps even mentioning strategies you specifically employ so as further benefit from mutual support among other trading peers on a professional-standard operating space.

#Free Demo Forex#Free Forex Account#free forex account without deposit#Free Forex Account Without Deposit: Is it Possible?#No Deposit Forex

0 notes

Text

Volity: The Best Gold Trading App for Seamless and Profitable Gold Investments

In the fast-paced world of financial markets, gold remains one of the most reliable assets for investors. Whether you're a seasoned trader or a beginner exploring gold investments, choosing the right platform is crucial for success. Volity has emerged as the best gold trading app, offering seamless and profitable trading opportunities. With low fees, high leverage, real-time data, and exceptional customer support, Volity provides traders with all the tools they need to make informed decisions and maximize their profits. Die best mobile forex trading platform Volity bietet eine benutzerfreundliche Oberfläche für den schnellen und sicheren Goldhandel.

This article explores the key advantages of Volity and why it stands out as the best gold trading app in the market.

1. Regulated and Secure Trading Environment

One of the biggest concerns for traders is the safety and reliability of their trading platform. Volity operates under strict regulatory guidelines, ensuring that traders' funds and personal data remain secure.

Key Security Features:

✅ Regulated Broker: Volity adheres to top-tier financial regulations, providing peace of mind to its users. ✅ Fund Protection: Client funds are stored in segregated accounts, separate from company funds. ✅ Transparent Operations: No hidden fees or unfair trading practices.

By choosing a regulated gold broker like Volity, traders can reduce their risk and trade with confidence.

2. Low Fees and Tight Spreads for Maximum Profitability

Trading fees can significantly impact profitability, especially in gold trading, where price movements are often small. Volity offers one of the most competitive fee structures in the market with:

✔️ Spreads as low as 0.1 pips on gold CFDs ✔️ Zero commission on most trades ✔️ No hidden fees, ensuring full transparency

Unlike other platforms that impose high transaction costs, Volity helps traders retain more of their profits.

3. High Leverage for Increased Market Exposure

Leverage is a powerful tool that allows traders to control larger positions with a smaller amount of capital. Volity provides leverage options of up to 1:500, enabling traders to:

🔹 Maximize short-term market movements 🔹 Increase potential returns on successful trades 🔹 Diversify investments with lower capital requirements

At the same time, Volity offers risk management tools like stop-loss orders and margin calls to help traders manage potential losses effectively.

4. Real-Time Data and Advanced Charting Tools

Gold trading requires access to accurate market data and advanced analysis tools. Volity delivers in this aspect by offering:

📈 Live gold price updates to stay ahead of market movements 📊 Comprehensive charting tools with technical indicators like Moving Averages, Bollinger Bands, and RSI 🔔 Customizable price alerts to notify traders of key price changes

Whether you're a beginner or an expert, Volity’s user-friendly interface makes technical analysis simple and accessible.

5. Easy-to-Use Mobile App for Seamless Trading

A trading app should be fast, intuitive, and accessible. Volity is designed for both beginners and professionals, offering:

✔️ A user-friendly interface for quick order execution ✔️ Cross-platform compatibility (mobile, tablet, desktop) ✔️ Fast and efficient performance with minimal latency

Traders can place buy and sell orders in just a few taps, making Volity the best mobile forex trading platform for gold. Wenn du auf der Suche nach der best mobile forex trading platform bist, ist Volity die ideale Wahl für dich.

6. Wide Range of Gold Trading Products

Volity understands that traders have different investment preferences. That’s why it offers multiple gold trading options, including:

💰 Spot Gold – Trade gold at the current market price 📄 Gold CFDs – Profit from gold price movements without owning physical gold 📆 Gold Futures – Trade contracts based on future gold prices 📊 Gold ETFs – Invest in gold-backed exchange-traded funds

This diverse selection allows traders to customize their strategy based on risk tolerance and investment goals.

7. 24/7 Customer Support for Hassle-Free Trading

Customer support can make or break a trading experience. Volity provides round-the-clock assistance, ensuring that traders receive help whenever needed.

Support Features:

📞 Live Chat, Email, and Phone Support for instant communication 🎓 Educational resources, including tutorials and webinars 📝 Expert insights and daily market updates

Having 24/7 support means traders never have to worry about technical issues or account-related concerns.

8. Comprehensive Educational Resources for Beginners

New to gold trading? Volity makes learning easy with:

📘 Beginner guides on gold trading basics 🎥 Video tutorials on risk management and trading strategies 📅 Live webinars hosted by market experts

These resources empower traders with knowledge, helping them make better trading decisions and improve their profitability.

Conclusion: Why Volity is the Best Gold Trading App

Volity is the ultimate gold trading app for both beginners and professionals. By combining low fees, high leverage, real-time data, advanced charting tools, and 24/7 customer support, it offers an unparalleled trading experience.

Whether you’re looking for a gold broker with transparent pricing or a best mobile forex trading platform for gold, Volity is the top choice.

Start Trading with Volity Today!

🔗 Visit: https://volity.io/gold/volity-the-best-gold-trading-app-for-seamless-and-profitable-gold-trading/

🚀 Trade gold with confidence and maximize your profits with Volity!

0 notes

Text

What you need to about the best forex brokers in india

Forex trading in India is subject to certain regulations, and it’s important for traders to choose brokers that are compliant with Indian laws. The Reserve Bank of India (RBI) and Securities and Exchange Board of India (SEBI) oversee the trading of currencies in India, ensuring safety and transparency in the market. While Indian residents are restricted from trading international currencies through offshore brokers, they can still trade INR-based currency pairs and cross-currency pairs through domestic and regulated brokers.

When choosing a Forex broker in India, here are the key factors you need to consider:

1. Regulatory Compliance

SEBI and RBI Regulation: The most important factor when choosing a forex broker in India is whether the broker is regulated by SEBI (Securities and Exchange Board of India) and adheres to RBI (Reserve Bank of India) guidelines. A regulated broker ensures that your funds are protected, and you’re trading under legal and safe conditions.

NSE/BSE Membership: Look for brokers who are members of the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE) as they facilitate currency futures trading in INR-based pairs (USD/INR, EUR/INR, GBP/INR, etc.).

2. Currency Pairs Available

INR-based Currency Pairs: In India, residents can only trade currency pairs that involve the Indian Rupee (INR), such as USD/INR, EUR/INR, GBP/INR, and JPY/INR. Ensure that the broker offers these popular INR-based pairs.

Cross-Currency Pairs: Some brokers also provide access to other global cross-currency pairs (e.g., EUR/USD, GBP/USD, etc.), but these must be traded through offshore platforms. It's important to check the platform's access to such markets if you're interested in them.

3. Trading Platforms

MetaTrader 4 (MT4) and MetaTrader 5 (MT5): These are two of the most widely used and popular forex trading platforms. They offer advanced charting tools, technical analysis, automated trading (using Expert Advisors), and real-time data.

Broker's Proprietary Platforms: Many Indian brokers like Zerodha Kite, Upstox Pro, and ICICI Direct offer their own proprietary platforms with seamless user experiences, advanced charting, and real-time data for trading INR-based currency pairs.

Mobile and Web Platforms: Ensure the broker’s platform is available on both desktop and mobile (Android/iOS) for flexibility, especially if you prefer trading on the go.

4. Account Types and Minimum Deposit

Account Types: Some brokers offer different account types to cater to the needs of traders, such as demo accounts, standard accounts, mini accounts, and pro accounts.

Minimum Deposit: Depending on the broker, the minimum deposit required to open a trading account can vary. Some brokers may require a larger deposit for advanced accounts, while others may allow opening an account with a smaller amount. For instance, brokers like Zerodha and Upstox have relatively lower minimum deposit requirements.

Leverage: Leverage allows traders to control larger positions with a smaller amount of capital. However, excessive leverage can increase risk, so ensure that you understand the leverage options and choose a suitable one for your risk tolerance.

5. Spreads and Fees

Spreads: The difference between the buy price and the sell price of a currency pair is known as the spread. Lower spreads typically indicate a better trading environment, as it reduces the cost of trading.

Commission Fees: Some brokers charge a flat commission per trade, while others might charge a percentage of the trade value. Check the broker’s fee structure to ensure it aligns with your trading style and goals.

Overnight Fees/Swap Fees: For positions held overnight, brokers may charge swap fees, which can either be positive or negative depending on the currency pair and trade position.

6. Customer Support

Responsive Support: The best brokers offer excellent customer service, including access to support via email, live chat, and phone. Make sure the broker’s customer support team is available 24/7 or at least during market hours to address any issues that might arise.

Educational Support: For beginners, choosing a broker that provides educational resources (e.g., webinars, videos, tutorials, and market research) can be immensely helpful in understanding the market and improving your trading skills.

7. Research and Tools

Technical Analysis Tools: A broker with advanced charting features, such as trend lines, support and resistance zones, technical indicators (RSI, MACD, Moving Averages), and real-time data, can help you analyze the market better.

Fundamental Analysis: Some brokers offer economic calendars, news feeds, and market reports, which are crucial for understanding market sentiment and news-driven movements.

Trading Signals: Some brokers provide automated or manual trading signals, helping you to make better decisions.

8. Withdrawal and Deposit Methods

Bank Transfers and UPI: Ensure the broker supports popular deposit methods such as UPI (Unified Payments Interface), bank transfers, and other secure local payment methods for ease of transactions.

Withdrawals: Fast and hassle-free withdrawals are crucial. Look for brokers that provide multiple withdrawal methods and process withdrawals promptly.

9. Leverage and Risk Management

Leverage: The leverage offered by brokers in India can vary, but the SEBI restricts Indian brokers from offering leverage more than 1:50 for retail forex traders. Be mindful of how much leverage you're comfortable with, as high leverage can increase both potential profits and risks.

Risk Management Tools: Look for brokers that offer stop-loss orders, take-profit orders, and other risk management tools to protect your capital.

Contact us Address - 1st Floor, The Sotheby Building, Rodney Bay, Gros-Islet, SAINT Lucia P.O Box 838, Castries, Saint Lucia Phone no - +97144471894 Website - https://winprofx.com/

0 notes

Text

USDCAD M1 Timeframe SCALPER Mode, o.90 Lots Buy trade based in last NON REPAINT Signal. Official Website: wWw.ForexCashpowerIndicator.com

. Start Improve your Strategy with Cashpower Indicator Lifetime license one-time fee with No Lag & NON REPAINT buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones. . ✅ NO Monthly Fees ✅ * LIFETIME LICENSE * ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notification 🔥 Powerful AUTO-Trade Option

.

⭐ TOP BROKER Recommended ⭐

Trade Conditions to use CASHPOWER INDICATOR & EA Money Machine.* Top Awards WorldWide trade execution * Regulamented Brokerage Forex * O.O Spreads with Fast Deposits * Fast WITHDRAWALS with Cryptos. open your MT4 Account Start your trade Journey with BEST Broker !!

👉 https://clicks.pipaffiliates.com/c?c=817724&l=en&p=6

. ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

2 notes

·

View notes

Text

Online Forex Broker: Choosing the Right Platform for Your Trading Journey

Forex trading has emerged as one of the most widely used financial markets globally, with millions of traders seeking to earn profits from the fluctuations in currencies. The forex market is open 24 hours a day, five days a week, and offers tremendous opportunities for new as well as experienced traders. But the success of forex trading depends on selecting the right online forex broker. A good broker can give the traders the tools, facilities, and assistance that they need to make the right choice and yield the highest possible returns. In this blog, we will discuss the online forex broker's role, key characteristics, and how you should select the ideal platform for your needs.

What is an Online Forex Broker?

An online foreign exchange broker is a go-between for traders and the foreign exchange market. It is an online platform where the traders can buy and sell foreign currency pairs. Brokers serve as intermediaries by providing the traders with market information, trading tools, charting programs, and other useful resources. Brokers also provide leverage, with which the traders can manage more positions using less capital.

Internet-based forex brokers operate by linking retail traders to financial institutions and banks, which provide liquidity. This facilitates real-time quotes and near-instant trading. The broker generates profits through spreads (the difference between the ask price and bid price) or by receiving a commission on each trade.

It's essential to choose the correct forex broker since it can reflect directly on your trading success. A reliable broker offers a safe trading environment, quick order execution, and investment protection. Conversely, an unfaithful broker will put you at risk of price manipulation, delayed execution, or even fund mismanagement.

Most Important Advantages of Selecting a Reputable Forex Broker:

Access to Market Data: A quality broker offers real-time price quotes, market news, and analysis.

Low Spreads and Commissions: Competitive spreads and commissions lower trading costs and increase profitability.

Fast Order Execution: Fast execution reduces slippage and guarantees trades are executed at the desired price.

Secure Trading Environment: A regulated broker guarantees that your money is safe and held in segregated accounts.

Advanced Trading Tools: Access to technical indicators, charting software, and automated trading options.

Customer Support: Good customer support assists with solving problems and offering advice when necessary.

How to Select the Best Online Forex Broker

Getting the proper broker involves considering a number of factors in order to match it with your trading objectives and approach. Below are the main factors to consider:

1. Regulation and Security

One of the key considerations when choosing a forex broker is regulation. Legitimate brokers are regulated by financial regulators like:

The U.S. Commodity Futures Trading Commission (CFTC)

The Financial Conduct Authority (FCA) in the UK

The Australian Securities and Investments Commission (ASIC)

The Cyprus Securities and Exchange Commission (CySEC)

Regulation guarantees that the broker has stringent financial requirements, protects client funds, and operates in an open manner. Steer clear of unregulated brokers because they do not offer sufficient protection against fraud or mismanagement of funds.

2. Trading Platform and Technology

The trading platform is the doorway to the forex market. A good and easy-to-use platform increases the overall trading experience. Some of the best known platforms are:

MetaTrader 4 (MT4): Renowned for its sophisticated charting features and automated trading.

MetaTrader 5 (MT5): Provides more timeframes and order types.

cTrader: Offers a new interface and improved order execution speed.

Make sure the platform has mobile compatibility, customizable charts, and quick execution to suit your trading style.

3. Spreads, Commissions, and Fees

The trading cost is a significant consideration when choosing a broker. Most brokers make money from spreads and commissions.

Spreads: Low spreads minimize trading expenses and enhance profitability.

Commissions: Certain brokers have a fixed commission per trade, while others have commission-free trading with increased spreads.

Additional Fees: Look for withdrawal fees, inactivity fees, and overnight fees.

Select a broker with a clear fee structure to prevent surprise charges.

4. Leverage and Margin Requirements

Leverage enables you to trade greater positions with less deposit. While leverage magnifies profits, it also magnifies the risk of losses.

High Leverage: For experienced traders who can deal with the risks.

Low Leverage: Ideal for beginners in order to avoid exposure to volatility in the markets.

Make sure that the broker offers flexible leverage choices and understandable margin requirements.

5. Account Types and Minimum Deposits

Various brokers have different account types to suit diverse trading styles:

Micro Accounts: Ideal for newbies with small capital.

Standard Accounts: Ideal for frequent traders with modest capital.

Professional Accounts: Have lower spreads and larger leverage for professional traders.

Take note of the minimum deposit amounts and account specifications prior to registration.

6. Customer Support and Educational Resources

Good customer support is vital for troubleshooting technical problems and trading-related questions. Seek out brokers with:

24/5 or 24/7 customer support through live chat, email, and phone.

Multilingual customer support for overseas traders.

Learning resources in the form of webinars, tutorials, and market commentaries.

Good learning resources can assist you in enhancing your trading acumen and keeping up with current market trends.

Best Online Forex Brokers in 2025

Here are some of the best trustworthy online forex brokers to look at:

1. IG Group

Regulated by FCA, ASIC, and other prominent authorities.

MT4 and in-house platforms.

Competitive spreads and low commission fees.

2. eToro

Best used for social trading.

Commission-free trade with tight spreads.

User-friendly platform perfect for beginners.

3. XM

CySEC and ASIC are regulated.

High leverage available.

Minimum slippage with fast execution.

Conclusion:-

Selecting a good online forex broker is a key step to success in the forex market. A well-regulated broker with a stable platform, competitive spread, and solid customer support can make your trading experience better and improve your possibilities of profitability. Take time to compare various onnline forex brokers, trial their platforms, and compare their fees before you make a choice. With the right broker, you can trade the forex market comfortably and make progress toward your trading ambitions.

0 notes

Text

Crypto BUY Sell

Are You Looking for the Best TradingView Indicator?

Are you searching for a reliable TradingView Indicator that enhances your trading strategy? Whether you are a beginner or an experienced trader, having the right indicator can make a significant difference in your trading performance. With numerous indicators available in the market, finding the best one can be overwhelming. That’s where Indigator comes in! Our premium and TradingView Indicator Free options help you make informed decisions in the financial markets.

Why Choose a TradingView Indicator?

A TradingView Indicator is a powerful tool that assists traders in analyzing market trends, identifying potential trade setups, and executing trades with confidence. Whether you're interested in TradingView Indicator BUY or TradingView Indicator SELL signals, these indicators can provide real-time insights to maximize your profits.

With our TradingView Indicator Marketplace, you can access a wide range of premium and free indicators designed to improve your trading experience. Moreover, you can TradingView Indicator Download directly from our platform and start using it immediately.

Services Offered

At Indigator, we provide top-notch trading tools for crypto, stocks, forex, and commodities. Our services include:

Crypto Indicator: Designed for traders dealing with Bitcoin, Ethereum, and other altcoins.

Bitcoin Indicator: Provides precise signals for Bitcoin trading.

Altcoin Indicator: Helps in identifying profitable trades in the altcoin market.

Crypto Signal: Real-time trading alerts for various cryptocurrencies.

Bitcoin Signal: Accurate buy/sell signals for Bitcoin trading.

Crypto BUY SELL: Automated trading signals to enhance decision-making.

Bitcoin BUY SELL: Helps traders execute profitable Bitcoin trades with ease.

Benefits of Using Our TradingView Indicators

Using our TradingView Indicator comes with numerous advantages, such as:

Accurate Trading Signals: Get real-time alerts for market trends.

Easy to Use: Beginner-friendly interface for seamless integration.

Customizable: Tailor indicators to suit your trading strategy.

Affordable & Free Options: Choose from free or premium indicators.

24/7 Market Analysis: Stay updated with market movements.

Enhanced Risk Management: Reduce losses and increase profitability.

Why Choose Us?

At Indigator, we stand out from the rest by offering the most advanced TradingView Indicators tailored for every trader’s needs. Whether you require TradingView Indicator Free options or premium indicators, we ensure quality and accuracy in every tool we provide.

Proven Performance: Our indicators are tested and trusted by traders worldwide.

Customer Support: Get assistance whenever you need it.

Secure & Reliable: We prioritize your data and trading security.

Constant Updates: Stay ahead with the latest indicator enhancements.

How to Get the Right TradingView Indicator?

Finding the perfect TradingView Indicator for your needs is crucial. Follow these steps to get started:

Identify Your Trading Goals: Understand what you want to achieve in trading.

Research the Right Indicator: Compare features of different indicators.

Test Free Indicators: Try out our TradingView Indicator Free version.

Upgrade to Premium: If you need advanced features, purchase our premium indicators.

Monitor & Adjust: Regularly analyze your trading performance and tweak your strategy accordingly.

Get Started Today!

Take your trading to the next level with Indigator. Our TradingView Indicators are designed to provide precise signals for successful trading. Whether you need a Crypto Indicator, Bitcoin Indicator, or Altcoin Indicator, we’ve got you covered.

0 notes

Text

Can You Build a Career with the Best Share Market Training Institute in Chandigarh?

The stock market has always been a fascinating space, attracting individuals who seek financial growth and independence. If you are someone who wants to learn share trading in Chandigarh, the good news is that there are excellent institutes offering comprehensive training programs. But can you truly build a career by enrolling in the best share market training institute in Chandigarh? Let’s find out.

Why Learn Stock Trading?

Stock trading is not just about buying and selling stocks; it’s about understanding market trends, analyzing data, and making informed decisions. Whether you aim to be a professional trader, investor, or financial analyst, the right education can set the foundation for your career. Enrolling in a reputed stock market institute in Chandigarh can provide you with the necessary skills and confidence to succeed in the industry.

What to Expect from a Share Market Training Institute?

A high-quality stock market institute will offer structured learning programs that cover everything from basic concepts to advanced trading strategies. Some of the core topics you can expect to learn include:

Stock Market Basics – Understanding how the market works, different types of stocks, and how stock exchanges function.

Technical Analysis – Learning how to read charts, indicators, and patterns to make informed trading decisions.

Fundamental Analysis – Evaluating a company’s financial health before investing.

Risk Management – Developing strategies to minimize losses and maximize profits.

Trading Strategies – Exploring different approaches such as intraday trading, swing trading, and long-term investing.

Live Market Training – Gaining hands-on experience by practicing in real-time market conditions.

A well-structured course from the best stock market training institute in Chandigarh will ensure that you gain practical knowledge and the confidence to apply it effectively.

Choosing the Right Stock Market Institute in Chandigarh

Selecting the best institute can be challenging, given the number of options available. Here are some factors to consider before enrolling:

Reputation and Credibility – Check reviews, testimonials, and the institute’s track record.

Experienced Trainers – Learn from professionals who have hands-on experience in the stock market.

Comprehensive Course Structure – Ensure the curriculum covers both theoretical and practical aspects.

Live Trading Sessions – Institutes that offer real-time market exposure are always a better choice.

Post-Course Support – Some institutes offer mentorship and continued guidance after the course.

Career Opportunities After Stock Market Training

A structured training program can open doors to various career paths. Some of the popular options include:

Stock Trader – Work as an independent trader or with brokerage firms.

Financial Analyst – Analyze stocks and markets to help investors make informed decisions.

Investment Advisor – Guide clients on their investment choices.

Portfolio Manager – Manage investment portfolios for individuals or institutions.

Equity Research Analyst – Study market trends and company performance to predict future stock movements.

With the right training from the best stock market institute in Mohali or Chandigarh, you can gain the skills necessary to excel in these roles.

Why Choose Candila Stock Market Institute in Chandigarh?

If you are looking for a trusted institute to learn stock trading in Chandigarh, Candila Stock Market Institute is a great option. With experienced trainers, live market exposure, and a well-designed curriculum, it provides one of the best stock market courses in Chandigarh. Whether you are a beginner or an experienced trader looking to refine your skills, Candila offers tailored programs to meet different learning needs.

Conclusion

Yes, you can build a career in the stock market with the right training and dedication. Enrolling in the best stock market training institute in Chandigarh will provide you with the essential knowledge, skills, and practical exposure to start your journey. Whether you aim to be a full-time trader, financial analyst, or investment advisor, a well-structured training program can help you achieve your goals. If you are serious about learning and growing in this field, consider joining a reputed institute like Candila to kickstart your career in stock trading.

0 notes

Text

Can You Build a Career with the Best Share Market Training Institute in Chandigarh?

The stock market has always been a fascinating space, attracting individuals who seek financial growth and independence. If you are someone who wants to learn share trading in Chandigarh, the good news is that there are excellent institutes offering comprehensive training programs. But can you truly build a career by enrolling in the best share market training institute in Chandigarh? Let’s find out.

Why Learn Stock Trading?

Stock trading is not just about buying and selling stocks; it’s about understanding market trends, analyzing data, and making informed decisions. Whether you aim to be a professional trader, investor, or financial analyst, the right education can set the foundation for your career. Enrolling in a reputed stock market institute in Chandigarh can provide you with the necessary skills and confidence to succeed in the industry.

What to Expect from a Share Market Training Institute?

A high-quality stock market institute will offer structured learning programs that cover everything from basic concepts to advanced trading strategies. Some of the core topics you can expect to learn include:

Stock Market Basics – Understanding how the market works, different types of stocks, and how stock exchanges function.

Technical Analysis – Learning how to read charts, indicators, and patterns to make informed trading decisions.

Fundamental Analysis – Evaluating a company’s financial health before investing.

Risk Management – Developing strategies to minimize losses and maximize profits.

Trading Strategies – Exploring different approaches such as intraday trading, swing trading, and long-term investing.

Live Market Training – Gaining hands-on experience by practicing in real-time market conditions.

A well-structured course from the best stock market training institute in Chandigarh will ensure that you gain practical knowledge and the confidence to apply it effectively.

Choosing the Right Stock Market Institute in Chandigarh

Selecting the best institute can be challenging, given the number of options available. Here are some factors to consider before enrolling:

Reputation and Credibility – Check reviews, testimonials, and the institute’s track record.

Experienced Trainers – Learn from professionals who have hands-on experience in the stock market.

Comprehensive Course Structure – Ensure the curriculum covers both theoretical and practical aspects.

Live Trading Sessions – Institutes that offer real-time market exposure are always a better choice.

Post-Course Support – Some institutes offer mentorship and continued guidance after the course.

Career Opportunities After Stock Market Training

A structured training program can open doors to various career paths. Some of the popular options include:

Stock Trader – Work as an independent trader or with brokerage firms.

Financial Analyst – Analyze stocks and markets to help investors make informed decisions.

Investment Advisor – Guide clients on their investment choices.

Portfolio Manager – Manage investment portfolios for individuals or institutions.

Equity Research Analyst – Study market trends and company performance to predict future stock movements.

With the right training from the best stock market institute in Mohali or Chandigarh, you can gain the skills necessary to excel in these roles.

Why Choose Candila Stock Market Institute in Chandigarh?

If you are looking for a trusted institute to learn stock trading in Chandigarh, Candila Stock Market Institute is a great option. With experienced trainers, live market exposure, and a well-designed curriculum, it provides one of the best stock market courses in Chandigarh. Whether you are a beginner or an experienced trader looking to refine your skills, Candila offers tailored programs to meet different learning needs.

Conclusion

Yes, you can build a career in the stock market with the right training and dedication. Enrolling in the best stock market training institute in Chandigarh will provide you with the essential knowledge, skills, and practical exposure to start your journey. Whether you aim to be a full-time trader, financial analyst, or investment advisor, a well-structured training program can help you achieve your goals. If you are serious about learning and growing in this field, consider joining a reputed institute like Candila to kickstart your career in stock trading.

0 notes

Text

Stock Market Course for Beginners: Top Training Institute in Bhopal

Introduction

Interested in understanding how the stock market works and how to trade effectively? Choosing the right stock market course is the key to building strong trading skills. Whether you’re a complete beginner or looking to enhance your knowledge, a well-structured course can guide you through the fundamentals and advanced strategies of trading.

We will explore the best stock market courses for beginners, top stock market training institutes in Bhopal, and specialized courses to help you become a confident trader.

Why Join a Stock Market Course?

The stock market may seem complicated, but with the right guidance, anyone can learn to trade. A structured stock market course teaches essential skills, trading strategies, and risk management. Here’s why enrolling in a course is a smart choice:

Learn the basics of stock trading and investing.

Understand market trends and price patterns.

Gain confidence in making trading decisions.

Avoid common beginner mistakes.

Develop a trading strategy at low cost

Best Stock Market Courses for Beginners

If you are looking to get guidance for trading, choosing the right course can help you charter a smoother journey. Here are some great options:

1. Intraday Trading Course

Intraday trading involves purchasing and selling stocks on the same day, aiming to profit from short-term price movements. Unlike long-term investing, where people hold stocks for weeks, months, or even years.

Well that’s all bookish, so from a Trader’s point of view what exactly is intraday equity trading??

Imagine you are buying 100 quantities of Stock “XYZ” at Rs 800 for long term investment, after 6 months the stock reaches 850 and now you are at 5k profit.

Now to get this 5k profit in Intraday you cannot expect the stock “XYZ” to move 50 Rs in a single day so you need to build quantities.

That’s where day trading techniques will come into picture. Intraday trading is difficult to master and that’s where live market examples can help you in practicing your strategies with less quantities.

“Taking Forward” offers a unique copyrighted intraday trading course which has been highly appreciated by many students

2. Stock Market Trend Analysis

Understanding market trends is key to long-term success. This course teaches you how to study past trends, spot market cycles, and make informed investment choices. Therefore stock market trend analysis is the key in understanding market direction.

3. Technical Analysis Course

Technical analysis helps traders read charts, identify trends, and use indicators and oscillators to make better decisions. This course teaches you how to analyze price movements and analyse stock price changes to define entries and exits in a swing, positional or delivery trade as most indicators and oscillators will give you whipsaws when applied on a shorter time frame. Best technical analysis course will help you in increasing your probability by creating a systematic chart setup using candles, levels, trend, indicators and oscillators.

4. Options Trading Course

Options trading is very complex. It can be compared to your final year of graduation so if you want to trade options then you need to have knowledge of Intraday, trend and technical analysis to reach at options as they are derivative instruments. Options trading course covers everything from basic options to advanced strategies like call and put options to iron condor and butterfly strategies. You will learn how to trade options with confidence and manage risks effectively.

Stock Market Training Institute in Bhopal

If you want stock market training in Bhopal, pick Taking Forward Stock Market Training Institute that provides practical learning and guidance from experts. This institute provides real-time market exposure and structured learning. Here’s what to look for:

Expert trainers who are active traders.

Comprehensive study materials to support your learning.

Individual support to help you grow your trading skills.

Stock Market Trading Classes for Beginners

If you are looking for stock market trading classes for beginners, find a program that starts with the basics and gradually introduces advanced trading concepts. Here’s what you will learn:

Introduction to the Stock Market: How it works and different types of investments.

Fundamental and Technical Analysis: How to evaluate stocks and predict price movements.

Risk Management Strategies: How to protect your money and minimize losses.

Trading Psychology: Developing the right mindset for successful trading.

How to Choose the Right Stock Market Course

With so many stock market courses available, choosing the right one can be tough. Here are some easy ways to choose the best stock market courses for beginners

Identify Your Goals: Are you interested in long-term investing or short-term trading? Choose a course that matches your needs.

Check Course Content: Look for courses covering technical analysis, risk management, and trading strategies.

Practical Training Matters: The best courses include market sessions and hands-on practice.

Learn from Experts: Pick a course taught by experienced traders.

Read Reviews: Check feedback from past students to ensure quality training.

Conclusion

Learning stock market trading helps you build strong skills and make better trading decisions. Whether you are just starting or have some experience, choosing the right course is important. With our beginner-friendly courses, expert trainers, and top training institute in Bhopal, you will gain the knowledge and confidence to trade effectively.

Start your learning journey today — enroll in a stock market course and take your first step toward smarter trading.

Call-to-Action

Want to learn how to trade with confidence? Join our expert-led stock market courses and develop the skills to succeed. Whether you are aiming for long-term growth or short-term gains, we will guide you every step of the way.

📞 Call Us: +91 8225022022 🌐 Visit Our Website: www.takingforward.com

Start now — your rollercoaster ride of the stock market begins today.

FAQs

1. What is the best intraday trading course for beginners?

The best intraday trading course for beginners teaches how to buy and sell stocks in a day, manage risks, and read market trends. Taking Forward offers easy-to-follow training with expert support.

2. Where can I find the best technical analysis course?

A good technical analysis course teaches you to read charts, identify trends, and use indicators and oscillators. Taking Forward offers a great option for all traders

3. What are the best stock market trading classes for beginners?

The best stock market trading classes for beginners teach you the basics, how to read charts, and manage risks. Taking Forward provides easy-to-follow training with expert support to help you start trading.

4. Which is the best stock market training institute in Bhopal?