#bank loan approval

Explore tagged Tumblr posts

Text

Personal Loan Pitfalls to Avoid in 2025

A personal loan can be a great financial tool when used wisely, offering quick access to funds for emergencies, home renovation, education, or debt consolidation. However, many borrowers make avoidable mistakes that lead to higher costs, financial stress, and repayment issues.

To ensure you make the most of a personal loan in 2025, let’s explore the common pitfalls to avoid and the best strategies to manage your loan effectively.

🔗 Looking for a Personal Loan? Apply Here: Check Personal Loan Options

1. Borrowing More Than You Can Afford

One of the biggest mistakes borrowers make is taking a loan amount higher than their repayment capacity.

✔ Solution: Always assess your finances and ensure your EMIs do not exceed 30-40% of your monthly income.

🔗 Check Affordable Loan Options:

IDFC First Bank Personal Loan

Axis Bank Personal Loan

2. Ignoring Interest Rates & Loan Terms

Many borrowers overlook the actual cost of borrowing by not comparing interest rates, fees, and loan tenures.

✔ Solution: Compare interest rates, processing fees, and hidden charges before finalizing a lender.

🔗 Best Personal Loans with Low Interest Rates:

Bajaj Finserv Personal Loan

Tata Capital Personal Loan

3. Overlooking the Impact of a Low Credit Score

Your credit score directly affects your loan approval and interest rates. A low credit score can lead to loan rejection or higher interest costs.

✔ Solution: Maintain a credit score of 700+ by making timely payments and avoiding unnecessary debt.

4. Falling for Pre-Approved Loan Scams

Many fraudsters send fake pre-approved loan offers that require advance payments before disbursing the loan.

✔ Solution: Always apply for loans through official bank websites or verified financial institutions.

🔗 Apply for a Personal Loan from Trusted Lenders:

Axis Finance Personal Loan

5. Not Reading Loan Terms & Hidden Fees

Many borrowers focus only on the interest rate and ignore charges such as: ✔ Processing Fees ✔ Prepayment Penalties ✔ Late Payment Charges

✔ Solution: Read the loan agreement carefully and ask about hidden charges before signing.

6. Choosing a Longer Tenure Without Considering Interest Costs

A longer loan tenure reduces your EMI, but it significantly increases the total interest paid over time.

✔ Solution: Choose the shortest tenure possible that allows comfortable EMI payments.

7. Defaulting on EMI Payments

Missing EMIs can lead to: ❌ Penalty charges ❌ A lower credit score ❌ Legal action in extreme cases

✔ Solution: Set up auto-debit for EMIs and maintain an emergency fund for loan repayments.

🔗 Learn How to Set Up Auto-Debit for Loan EMIs: Check Loan Repayment Options

8. Using Personal Loans for Non-Essential Expenses

Avoid using personal loans for: ❌ Luxury vacations ❌ Gambling or risky investments ❌ Unplanned shopping sprees

✔ Solution: Use personal loans only for necessary expenses like medical emergencies, home improvement, or debt consolidation.

9. Not Exploring Balance Transfer Options

If you already have a high-interest personal loan, you can transfer it to another lender offering a lower interest rate.

✔ Solution: Consider a personal loan balance transfer to reduce your EMI burden.

🔗 Best Lenders for Balance Transfers:

InCred Personal Loan

10. Applying for Multiple Loans Simultaneously

Multiple loan applications can: ❌ Lower your credit score ❌ Make lenders view you as a high-risk borrower

✔ Solution: Compare lenders carefully and apply for only one loan at a time.

11. Not Checking Prepayment & Foreclosure Charges

Some lenders charge high penalties for prepayment or foreclosure, making early repayment expensive.

✔ Solution: Choose a lender that offers low or no prepayment penalties.

12. Relying on Unverified Lenders or Loan Apps

There are many fraudulent loan apps that charge excessive interest rates and misuse borrower data.

✔ Solution: Apply only through recognized banks, NBFCs, or verified fintech platforms.

🔗 Apply Safely for a Personal Loan Here: Check Verified Loan Options

Final Thoughts: Avoid These Mistakes for a Smart Borrowing Experience

A personal loan is a valuable financial tool when used responsibly. Avoiding these common pitfalls will help you save money, protect your credit score, and reduce financial stress in 2025.

Key Takeaways:

✔ Borrow within your repayment capacity ✔ Compare interest rates & hidden charges before applying ✔ Pay EMIs on time to avoid penalties ✔ Beware of loan scams and fake lenders ✔ Use personal loans only for essential needs

🔗 Looking for a Reliable Personal Loan? Apply Here: Check Personal Loan Offers

By following these tips, you can make smarter financial decisions and ensure a hassle-free borrowing experience in 2025!

#Personal loan pitfalls to avoid in 2025#Common mistakes when taking a personal loan#Personal loan mistakes borrowers make#How to avoid personal loan scams in 2025#Things to check before taking a personal loan#finance#personal loan online#loan services#personal loans#nbfc personal loan#bank#fincrif#personal loan#personal laon#loan apps#fincrif india#Personal loan repayment mistakes#Hidden charges in personal loans#Best practices for personal loan management#Why personal loans get rejected#Personal loan EMI management tips#How to compare personal loan interest rates#Personal loan default consequences#Loan balance transfer benefits#How to reduce personal loan EMI burden#Personal loan credit score impact#Fake loan approval scams#Should you prepay a personal loan?#Personal loan tenure selection tips#Loan agreement hidden clauses

2 notes

·

View notes

Text

AHHHHHH

#this post brought to you by: me#i. applied for a preapproval letter for a mortgage yesterday. and spoke to a realtor to start finding me houses#i want to move several states away which further complicated things. but the houses there are CHEAP#like under 100k for a 2 bedroom move in ready#anyways i got approved for 80k with a 20k down payment. and im FREAKING THE FUCK OUT#and because i got that pre app letter i have a loan officer calling me today to talk#and we literally work at the same bank so i can SEE that hes active and hasnt read my message#even though its been 45 minutes. KEVIN MESSAGE ME BACK. IM NOT GONNA BE ABLE TO FOCUS UNTIL I DO THIS CALL#AHHHHHHH S C R E A M. it might happening!!!! i might be finally.mov8ng out in a few months!!!#i mgiht be a HOMEOWNER by the end of the year#i have been saving money for this since i was. 16? 17?#ive had a good well paying job since i was 18.#AHHHHHHHHHHHHHHHHHHHHHHHH#once i have a house then i start job searching in that area. and start getting really serious about LEAVING my very good job#which is soooo scary. this job was supposed to be my lifelong career. but then everyone fucking moved to other states and left me behind#so theres no point staying here.#i might never have this kind of job security again.#but also my realtor said that theres a lot of bank jobs in that area so maybe itll be easy to find something#on the fence on if i tell my parents that im Making Moves right now#on one hand its hard to not talk about it becuae im STRESSED TF OUT#but on the other hand when i tentatively mentioned the state i want to move to#richard started yelling and swearing el oh el#might be better to wait and avoid the tension as long as possible?#but also i dont know how they can stay angry when its literally my best option#the other places where my friends live either have 0 opportunity and high housing prices. or are even moe liberal than where im going#idk. why do half of my problems come down to “my parents will be mad” like im a 12 year old or something. shit fucking sucks#this is why i want to get out of here#also it feels weird and bad to talk to my friends about how stressed i am about buying a house when all of them are stressed about#not being able to make rent or something. my problems feel like a brag in a really odd and shitty way. but hey!#if this works out maybe ill start being stressed about how im going to make my mortgage payments! :') yay!

9 notes

·

View notes

Text

4pm thoughts

i don't understand the older generation's propensity to blame the younger generation for not being able to save enough due to rising prices.

"just spend less!!!" as if there aren't studies and charts that already show that income vs. the rising price of food/necessities has become so dispropotionate over the past decade or so

they complain about how the younger generation eats outside all the time instead of cooking at home. but how do you cook at home when all you can afford to rent is a room, or the house you rent doesn't allow cooking?

or if you're only eating outside once a month and cook at home the rest of the time they say "stop eating outside food". like if you cut down your outside food budget by RM60(USD15) a month, you can miraculously afford a down payment on a house.

and even if you can afford a house, the prices are astronomical nowadays--- you'd probably have to take out a 20-year loan to do so, vs in the past when houses were so much cheaper.

maybe all these problems seem very nonconsequential to most of the older generation/people in charge, since they're usually part of the high income bracket people, but tbh most of the population in the country(especially the younger ones) are probably only a few paychecks away from going homeless.

like!!! my dudes!!! why are you siding with the corporations when they don't even have your backs and are one of the main causes of all this as well...?

are people not allowed to treat themselves once every now and then with? if not, what's the point of working in the first place?!

#4pm thoughts.#my brother once told us he thought of renting a room outside to skip the 3 hour commute.#and then realized he would only have rm150ish a month in terms of savings after rent deduction.#and then our parents thought it was a good idea!!! because he would learn independence!!!#and then I asked them but what would happen if something came up one day. eg. his car breaking down and needing to repair it.#then they said he'd have to figure things out himself and think how to get money to repair the car???#like huh how disconnected from current day struggles do you have to be#speaking of houses and house loans.#back then you could pay off your house loan in 5-10 years and you wouldn't even have to break the bank to do so.#and you could get a house with an actual garden on a piece of land.#nowadays the dream of owning a house is gone since you can probably only afford an apt.#and even then you'd have to take a 20-year loan. if the bank even approves it in the first place due to your salary.

17 notes

·

View notes

Text

Swift & Secure: Get Your Approved Title Loan Quote Online with 1800LoanStore

Get approved for a quick title loan quote online with 1800LoanStore. No income verification needed. Swift approval at affordable rates. Explore bad credit loans, even for salvage title cars. Easy title loans, no credit check required. Secure your financial relief now.

#bad credit loans in baton rouge#can i get a loan for a salvage title car#can you finance a car with a rebuilt title#car loans for rebuilt titles#title loans that don t require the car#easy title loans#cash and title loans#car title loans no credit check#can i get a title loan with a financed car#will a bank finance a rebuilt title#car title loan texas#car title loans with no income verification near me#title loans online fast#title loan without title online#online title loans for bad credit#fast online title loans#can you pawn your car#approved title loans texas#online texas title loan service

2 notes

·

View notes

Text

Get Quick Title Loan Quotes Online in Ohio | Columbus Car Title Loan

Explore Columbuscartitleloan for easy Title loans online in Ohio. Get quotes for bad credit, salvage titles, rebuilt cars, and more. No credit checks, fast approvals.

#title loan quote online Ohio#title loan online quote Ohio#bad credit loans Ohio#can i get a loan for a salvage title car Ohio#can you finance a car with a rebuilt title Ohio#car loans for rebuilt titles Ohio#title loans that don t require the car Ohio#easy title loans Ohio#cash and title loans Ohio#car title loans no credit check Ohio#can i get a title loan with a financed car Ohio#will a bank finance a rebuilt title Ohio#car title loan Ohio#car title loans with no income verification Ohio#title loans online fast Ohio#title loan without title online Ohio#online title loans for bad credit Ohio#fast online title loans Ohio#can you pawn your car Ohio#approved title loans texas Ohio#online texas title loan service Ohio#title loans Columbus#title loans Ohio#title loan quote#title loan estimate

2 notes

·

View notes

Text

Fast & Easy Title Loan Approval Without Income Verification | TitleLoansOnline

Easy application, fast approval, and no credit check. Apply nationwide for car title loan today at www.titleloansonline.com

#title loan quote online#title loan online quote#bad credit loans in baton rouge#can i get a loan for a salvage title car#can you finance a car with a rebuilt title#car loans for rebuilt titles#title loans that don t require the car#easy title loans#cash and title loans#car title loans no credit check#can i get a title loan with a financed car#will a bank finance a rebuilt title#car title loan texas#car title loans with no income verification near me#title loans online fast#title loan without title online#online title loans for bad credit#fast online title loans#can you pawn your car#approved title loans texas#online texas title loan service

2 notes

·

View notes

Text

I am

Perhaps

Buying a car tomorrow

#i gotta talk to my bank#im already pre approved a loan from them#the dealership seemed mad that I didnt sign for it then and there#sorry but I gotta go back to my credit union and kiss them directly on the mouth

19 notes

·

View notes

Note

hi! every when is your update? do you have a fixed schedule like every Wednesday? so excited for part 3! 😊

༼ ༎ຶ ෴ ༎ຶ༽ hihi we don't have a set schedule. if you want to keep with updates, you can join our taglist

(ФwФ) i'm ready to format part 3 but emi isn't done writing the script, so blame her

༼ ༎ຶ ෴ ༎ຶ༽ ............yea mb 😂 ty for your support nonnie

#👛.Loan Approved#we'reee trying ourr besttt#inflation making life difficult for the bank too#we'll try to not have bank run and cancel it altogether LOL

3 notes

·

View notes

Text

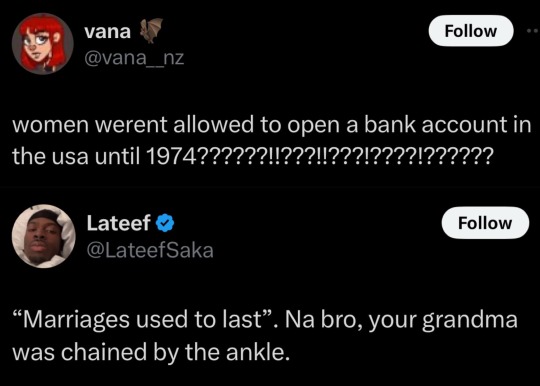

Literally the lyrics to the song. Y'know what pays the rent on your humble flat and helps you at the automat? That ice you get or else no dice, because once the louses go back to their spouses (or divorce them, but square cut or pear shaped the rocks don't lose their shape), a girl can sell the diamonds.

When you are legally barred from banking or owning real property, very valuable very portable commodities are your best friend. Just small enough to fit in a suitcase, and able to buy a future without him.

#no bank account#no credit cards#no line of credit#without a man to sign or her husband's approval#so no loans#no small businesses#no credit history#no equity#no home ownership#no financial independence at all#except for what she could pack in a suitcase#diamonds and furs#portable and valuable

43K notes

·

View notes

Text

Common Mistakes to Avoid for a Quick Home Loan Approval

Applying for a home loan can feel like a long and complicated process. However, with the right approach, you can significantly speed up the approval process. To help you achieve quick home loan approval, we’ve outlined common mistakes to avoid and shared tips for a smoother experience.

Why Quick Home Loan Approval is Important

Getting approved quickly for a home loan is crucial, especially in competitive housing markets. It ensures you can secure your dream home before someone else does and reduces the stress of prolonged uncertainty.

Mistake 1: Not Checking Your Credit Score

Your credit score is one of the first things lenders evaluate. A low score can delay or even deny approval.

Tip: Regularly monitor your credit report for errors and ensure timely payments to boost your score.

Mistake 2: Ignoring Debt-to-Income Ratio (DTI)

Lenders assess your DTI to determine if you can handle additional debt.

Tip: Aim for a DTI below 40%. Pay off smaller debts before applying for a home loan.

Mistake 3: Failing to Provide Complete Documentation

Incomplete or missing documents are a common reason for delays.

Tip: Keep all necessary documents, such as income proof, tax returns, and bank statements, ready in advance.

Mistake 4: Applying for Multiple Loans Simultaneously

Submitting several loan applications at once can harm your credit score.

Tip: Research lenders carefully and apply with the one that best fits your needs.

Mistake 5: Not Researching Loan Options

Different lenders offer different products, rates, and terms.

Tip: Compare multiple options and choose one that aligns with your financial goals.

Mistake 6: Skipping Pre-Approval

Pre-approval gives you an edge when negotiating with sellers.

Tip: Obtain pre-approval to show you’re a serious buyer and speed up the process.

Mistake 7: Changing Jobs Before Loan Approval

Lenders prioritize applicants with stable employment. A job change can signal financial instability.

Tip: Avoid switching jobs until your loan is approved and processed.

Mistake 8: Making Large Purchases During the Application Process

Big expenses can disrupt your financial profile and delay approval.

Tip: Postpone major purchases like cars or furniture until after your loan is finalized.

Mistake 9: Not Clarifying Loan Terms and Conditions

Misunderstanding terms can lead to unexpected costs or issues later.

Tip: Review all terms, conditions, and fees with your lender. Don’t hesitate to ask questions.

Mistake 10: Ignoring the Down Payment Requirement

Down payments play a significant role in determining loan approval and terms.

Tip: Save up for a substantial down payment to improve your approval chances and reduce loan costs.

How to Streamline the Home Loan Approval Process

Be proactive about gathering documents.

Regularly communicate with your lender.

Work with a mortgage broker for expert advice.

The Role of Communication with Your Lender

Maintaining open communication with your lender can prevent misunderstandings and delays. Always keep them updated on any financial or employment changes.

Conclusion

Avoiding common mistakes and being well-prepared can make all the difference in securing quick home loan approval. From checking your credit score to staying organized with your documentation, every step counts toward a smoother and faster process.

#home loan finance#types of home loans#house loans#private home finance#home loans#home loan interest rate#home loan interest rates#current home loan interest rates#home loan interest#online home loan rates#private home loan companies#private home loan interest rate#private home finance company#quick home loan#best home loan interest rates#quick home loan approval#top home loan banks#process of getting home loan

1 note

·

View note

Text

How to Get a Personal Loan with a Side Income

In today’s fast-paced world, many people have side income streams in addition to their primary job. Whether it’s freelance work, part-time jobs, or other sources of income, these earnings can significantly improve your financial situation. However, when applying for a personal loan, you may wonder if having a side income will help you qualify or get better terms.

In this article, we will explore how having a side income can impact your chances of getting a personal loan, and share key strategies for improving your eligibility and securing favorable terms.

1. What Lenders Look for When Approving Personal Loans

When you apply for a personal loan, lenders consider several factors to assess your eligibility, including: ✔ Credit score ✔ Income ✔ Employment stability ✔ Debt-to-income ratio (DTI) ✔ Repayment capacity

Having a side income can strengthen your loan application, but it needs to be considered along with other factors such as primary income, credit history, and existing liabilities.

2. How Side Income Can Boost Your Personal Loan Application

2.1. Higher Monthly Income

The more income you have, the better your chances of qualifying for a loan. Side income boosts your total monthly earnings, which:

Increases your eligibility for larger loan amounts

Helps lower your debt-to-income ratio (DTI), which is a key factor in loan approval

2.2. Better Repayment Capacity

Lenders want to ensure you can comfortably repay the loan without undue financial strain. Side income provides an additional cushion, increasing your repayment capacity and reassuring lenders about your ability to make timely payments.

2.3. Flexibility in Loan Terms

Having a diverse income source can improve your overall financial stability, making you a more attractive borrower. This could help you negotiate lower interest rates and better repayment terms on the loan.

3. Types of Side Income That Can Strengthen Your Loan Application

Not all side incomes are viewed equally by lenders. Here are a few types of side income that can improve your personal loan application:

3.1. Freelance or Contract Work

Freelancers often have the flexibility to earn from various projects. Lenders look favorably on freelance income, especially if it is consistent and can be documented through contracts, invoices, or tax returns.

3.2. Business or Entrepreneurial Income

If you own a business or have a side hustle, lenders will consider your business earnings as part of your overall income. Profits from your business are important, especially if you’ve been running it for a while and it has a proven track record.

3.3. Rental Income

Rental income from property can provide stable monthly earnings, making it an attractive source for lenders. Just ensure you have proper documentation for rental income, such as lease agreements and bank statements.

3.4. Passive Income

If you earn money from investments, royalties, or dividends, lenders will assess this income as part of your financial profile. Though passive income might be less consistent, it can still help improve your loan application if it's well-documented.

4. Key Tips for Maximizing Your Loan Eligibility with Side Income

4.1. Document Your Side Income

Lenders will only consider your side income if you can provide proof of it. Here are some ways to document your income:

Freelancers and Contract Workers: Provide invoices, contracts, and payment receipts.

Business Owners: Submit balance sheets, tax returns, and profit & loss statements.

Renters: Provide lease agreements, bank statements showing rent deposits, and property documents.

Investors: Share investment records, dividend statements, and proof of income from stocks or royalties.

4.2. Improve Your Credit Score

Even with side income, a low credit score can be a barrier to securing a loan. A credit score of 700 or higher is ideal for personal loan approval. Here’s how you can improve your score: ✔ Pay off existing debts ✔ Avoid late bill payments ✔ Keep credit utilization under 30% ✔ Regularly check your credit report for inaccuracies

5. How to Apply for a Personal Loan with Side Income?

5.1. Choose the Right Lender

While many lenders consider side income, traditional banks and NBFCs have different policies regarding income verification. It is recommended to:

Opt for lenders that accept side income as part of their loan application process

Look for online lenders or fintech platforms, which are often more flexible when considering non-traditional income sources

🔗 Best Lenders for Personal Loans:

IDFC First Bank Personal Loan

Axis Bank Personal Loan

5.2. Apply with Complete Documentation

To maximize your chances, ensure that you submit all required documents, including proof of both your primary income and side income. Be prepared to provide a clear breakdown of how your side income contributes to your overall finances.

5.3. Keep Your Debt-to-Income Ratio Low

Lenders assess your debt-to-income ratio (DTI) to understand how much of your income goes towards paying existing loans. A lower DTI improves your chances of approval.

DTI Formula: DTI = (Total monthly debt payments ÷ Monthly income) × 100

Keep your DTI under 40% to improve your eligibility for a personal loan.

6. Advantages of Using Side Income for Loan Approval

✔ Higher Loan Eligibility: With additional income, you may qualify for a larger loan amount. ✔ Better Interest Rates: Lenders are likely to offer you lower interest rates because side income improves your financial stability. ✔ Flexible Repayment Terms: With a stronger repayment capacity, you may be able to negotiate better terms on the loan.

Getting a Personal Loan with Side Income

Having a side income can significantly improve your chances of getting approved for a personal loan. By documenting your income, improving your credit score, and selecting the right lender, you can maximize your loan eligibility and secure favorable terms.

🔗 Looking to Apply for a Personal Loan with Side Income? Check Personal Loan Offers

By following the steps above, you can access the funds you need, whether for home improvement, debt consolidation, or any other financial goal, with ease and confidence.

#finance#loan apps#nbfc personal loan#loan services#personal loan#personal loans#fincrif#personal loan online#personal laon#bank#Personal loan with side income#How to get a personal loan with extra income#Applying for a personal loan with side income#Can side income help with personal loan approval?#Personal loan eligibility with additional income#Loan approval with freelance income#Side income and personal loan qualification#Personal loan with multiple income sources#Freelance income for personal loan eligibility#Securing a personal loan with secondary income#fincrif india#ide income documentation for loan approval#How to improve loan eligibility with side income#Best personal loans for freelancers#Loan eligibility with side jobs#Personal loan for self-employed individuals#How to document side income for loan approval#Debt-to-income ratio and side income#Personal loan with part-time work#Improving credit score with side income

0 notes

Text

youtube

Get instant Pre-Approved Loan Against Shares through Internet Banking | ICICI Bank

Now, turn your shares into instant funds without selling them, through a Pre-approved ICICI Bank Loan Against Shares offer. Watch our quick video guide to learn how to avail your Pre-approved Loan Against Shares offer through Internet Banking

0 notes

Text

Get a Fast Title Loan Quote Online: Your Guide to Quick Cash Solutions | Fullfinance

Are you in need of quick cash but have bad credit or a car title with complications? Title loans can provide a swift solution. This guide will help you navigate the options available for getting a title loan quote online, whether you have bad credit, a rebuilt title, or no income verification. At Full Finance, we make the process straightforward and accessible.

What is a Title Loan?

A title loan is a type of secured loan where your vehicle's title is used as collateral. It's a viable option for those who need quick cash and may not have the best credit score. The loan amount is usually based on the value of the car and the borrower's ability to repay.

Getting a Title Loan Online Quote

Obtaining a title loan quote online is a simple and convenient process. You can start by visiting our website and filling out a form with basic information about your car and your financial situation. Within minutes, you'll receive a quote that gives you an idea of how much you can borrow.

Bad Credit Loans in Baton Rouge

Even if you have bad credit, you can still get a title loan. Title loans are based on the value of your vehicle, not your credit score. This makes them an excellent option for those in Baton Rouge and beyond who need cash but have been turned down by traditional lenders.

Can I Get a Loan for a Salvage Title Car?

Yes, you can get a loan for a salvage title car, though it might be more challenging. Salvage title cars are considered high-risk, but some lenders, including Full Finance, specialize in these types of loans. It's important to get an accurate quote to understand what you can expect.

Financing a Car with a Rebuilt Title

If you have a rebuilt title car, you can still get financing. A rebuilt title indicates that the car has been repaired and is roadworthy. While some lenders may be hesitant, others, like Full Finance, are willing to provide Car Loans For Rebuilt Titles.

Title Loans That Don’t Require the Car

Some title loans don’t require you to leave your car with the lender. You can continue to use your vehicle while repaying the loan. This is a significant advantage for borrowers who rely on their cars for daily transportation.

Easy Title Loans and Cash Solutions

At Full Finance, we strive to make the title loan process as easy as possible. Our application process is straightforward, and we provide fast approvals so you can get the cash you need without unnecessary delays.

Title Loans for Financed Cars

You might wonder, "Can I get a title loan with a financed car?" The answer is yes. However, the loan amount might be adjusted based on the equity you have in the car. It’s crucial to get an accurate quote to understand your options.

No Credit Check Title Loans

For those worried about credit checks, Full Finance offers car title loans with no credit check. This means your credit score won’t impact your loan approval, making it easier for you to secure funds.

Fast and Online Title Loans

Our title loans are designed to be fast and convenient. With our online services, you can apply from the comfort of your home and get a quick decision. This is ideal for those who need cash urgently.

Title Loans Without the Title in Hand

If you’re asking, "Can I get a title loan without the title in hand?" Full Finance can assist. We offer title loan options even if you don't have the title immediately available. Our team will guide you through the necessary steps to secure your loan.

Additional Services: Mortgage Loans

Beyond title loans, Full Finance also provides mortgage loans. Whether you're looking to buy a new home or refinance your current mortgage, we offer competitive rates and personalized service to meet your needs.

Conclusion

Getting a title loan quote online with Full Finance is a fast and easy way to secure the cash you need. Whether you have bad credit, a salvage title car, or need a no-income verification loan, we have options for you. Visit our website today to get started and receive your quote.

For more information and to apply, visit Full Finance.

#Mortage Loan#online texas title loan service#approved title loans texas#can you pawn your car#fast online title loans#online title loans for bad credit#title loan without title online#title loans online fast#car title loans with no income verification near me#car title loan texas#will a bank finance a rebuilt title

0 notes

Text

JNAC Pushes Banks To Expedite Home Loans For PMAY Beneficiaries

Deputy Municipal Commissioner Reviews Slow Progress Of Loan Approvals Officials warn of escalation to higher authorities if banks fail to act promptly. JAMSHEDPUR – The Jamshedpur Notified Area Committee (JNAC) held a review meeting to accelerate bank loan approvals for 9,592 housing units under construction in Birsanagar as part of the Pradhan Mantri Awas Yojana (PMAY)-Urban. "We’re urging banks…

#Affordable Housing Initiatives#जनजीवन#Bank Loan Approvals PMAY#Birsanagar Housing Project#Government Subsidized Housing#Jamshedpur Banking Sector#Jamshedpur Urban Development#JNAC Home Loan Review#Krishna Kumar JNAC#Life#Low-Income Housing Schemes#PMAY-Urban Jamshedpur

0 notes

Text

Can You Finance a Car with a Rebuilt Title? | 1800 Loan Store

Discover how you can finance a car with a rebuilt title. Learn about title loans that don't require the car, cash and title loans, and title loans without the title online. Get quick and easy financing options nationwide at 1800 Loan Store.

#can i get a title loan with a financed car#will a bank finance a rebuilt title#title loans online fast#fast online title loans#can you pawn your car#approved title loans texas

0 notes

Text

Fast and Easy Title Loans Online in Ohio | Columbuscartitleloan

When you need quick cash, title loans offer a convenient and fast solution. In Ohio, obtaining a title loan online has never been easier. Whether you have bad credit or no credit at all, there are options available to meet your financial needs. This article will guide you through the process of securing a fast online title loan in Ohio, including key information on various loan types and requirements.

What Are Title Loans?

Title Loans Ohio are short-term loans that use your vehicle's title as collateral. This means you can borrow money based on the value of your car, truck, or motorcycle. The lender holds onto your vehicle's title until the loan is repaid, allowing you to keep driving your car while you repay the loan.

How to Get a Title Loan Quote Online in Ohio

Getting a title loan quote online in Ohio is a simple process. You can start by visiting the website of a reputable lender, such as Columbus Car Title Loan. Here's what you'll typically need to provide:

Basic personal information

Vehicle details (make, model, year, mileage)

Proof of income (if applicable)

Car title

Once you've submitted this information, you'll receive a title loan quote online Ohio, which gives you an estimate of how much you can borrow.

Can I Get a Title Loan with Bad Credit?

Yes, you can get a title loan with bad credit in Ohio. Title loans are secured by your vehicle, so lenders are more willing to work with borrowers who have less-than-perfect credit. This makes title loans an excellent option for those in need of bad credit loans Ohio.

Financing a Car with a Rebuilt Title

If you have a car with a rebuilt title, you might wonder if you can finance it. Many lenders, including those offering title loans, can finance cars with rebuilt titles Ohio. However, it's important to check with individual lenders as policies may vary.

Title Loans Without Income Verification

One of the significant advantages of title loans is the potential to get a loan without traditional income verification. If you're looking for car title loans with no income verification Ohio, you'll find several lenders willing to work with you based on the value of your vehicle alone.

Quick and Easy Title Loans in Ohio

When you need cash quickly, title loans that don't require the car Ohio are a great option. You can apply online and receive approval within minutes. Here's a step-by-step guide to getting a fast online title loan in Ohio:

Apply Online: Visit a lender's website and fill out the application form with your vehicle and personal details.

Get a Quote: Receive a title loan online quote Ohio, providing an estimate of your loan amount.

Submit Documents: Provide necessary documents such as your car title and ID.

Approval: Get approved quickly, often within the same day.

Receive Funds: Once approved, receive your cash through direct deposit or pick it up in person.

Frequently Asked Questions

Can I Get a Title Loan with a Financed Car?

Yes, you can get a title loan with a financed car Ohio, but it may be more complicated. You will need to have enough equity in the vehicle to cover the loan amount.

Will a Bank Finance a Rebuilt Title in Ohio?

Some banks and lenders will finance a rebuilt title in Ohio. It's best to contact lenders directly to discuss their policies regarding rebuilt titles.

How Long Does It Take to Get a Title Loan?

The process for getting a title loan is typically very fast. Many lenders offer same-day approval and funding, meaning you can get the cash you need within hours.

Conclusion

Title loans in Ohio provide a fast and easy way to get the cash you need, even with bad credit or a rebuilt title. By applying for a title loan online, you can receive quick approval and access to funds without the hassle of traditional loan processes. Visit Columbus Car Title Loan to start your application today and get your title loan quote online Ohio.

#title loan quote online Ohio#title loan online quote Ohio#bad credit loans Ohio#can i get a loan for a salvage title car Ohio#can you finance a car with a rebuilt title Ohio#car loans for rebuilt titles Ohio#title loans that don t require the car Ohio#easy title loans Ohio#cash and title loans Ohio#can i get a title loan with a financed car Ohio#car title loans no credit check Ohio#will a bank finance a rebuilt title Ohio#car title loan Ohio#car title loans with no income verification Ohio#title loans online fast Ohio#title loan without title online Ohio#online title loans for bad credit Ohio#fast online title loans Ohio#can you pawn your car Ohio#approved title loans texas Ohio#online texas title loan service Ohio#title loans Columbus#title loans Ohio#title loan quote#title loan estimate Ohio

0 notes